#How to use Fibonacci extension

Explore tagged Tumblr posts

Text

20 Questions For Fic Writers

this has been sitting in my drafts for probably months and i actually don't remember who tagged me at this point sorry </3

1. How many works do you have on AO3?

26

2. What's your total AO3 word count?

168,724

3. What fandoms do you write for?

currently just rise but i've had some other fandoms i've written for in the past

4. What are your top 5 fics by kudos?

call me here (i will appear) Use Only For Intended Purpose The Idiot's Guide to Blindfold Chess new phone who dis because i fear i'm lost (and i cannot be found again) wow big surprise(/s) all of these are rise al;jfldksjfkd

5. Do you respond to comments?

i try to but uh </3 i am not very good at it

6. What is the fic you wrote with the angstiest ending?

ummm. probably waiting for answers, wasting time bc even if u know the comfort and healing comes there very much isn't any in the fic itself so whoops </3 i am not good at hurt/no comfort so i don't. have a lot of fics that would really qualify

7. What’s the fic you wrote with the happiest ending?

uuhhhhh ig fibonacci? most of my fics have relatively happy endings and. this is the one with the least angst overall so

8. Do you get hate on fics?

not yet thank god

9. Do you write smut? If so, what kind?

i do not alfjdlkjfkdls

10. Do you write crossovers? What’s the craziest one you’ve written?

imma keep it real with you chief most of the crossovers that i've written are with other people's aus and idk if that counts

11. Have you ever had a fic stolen?

not that i know of fingers crossed

12. Have you ever had a fic translated?

nope

13. Have you ever co-written a fic before?

yeesssss? sorta? it's not like, on ao3 but i've done some collab crossover stuff with friends (see aforementioned crossover question)

14. What’s your all time favourite ship?

god idk. i don't do a lot of shipping these days sorry </3 i have some ships i think are cute but i'm not like, into them enough to say they really qualify

15. What’s a WIP you want to finish but doubt you ever will?

i want to finish idiot's guide and cmh very very badly and i refuse to jinx it. idk abt npwd solely because of like the type of fic it is, idk if it'll ever be finished finished yk. like there'll always be more little scenes i can do

16. What are your writing strengths?

um. i've been told i'm good at character voice

17. What are your writing weaknesses?

sweats nervously

18. Thoughts on writing dialogue in another language in fic?

i don't really do it? i probably wouldn't unless it was like, just a couple words - i don't mind too much when other ppl do it bc i have a translation extension on my laptop but i don't have many options when i'm on my phone

19. First fandom you wrote for?

doctor who........ i was like. god idek. fifteen? maybe younger i straight up don't remember <- also none of this is on ao3 this was like, back in my ff.net days and i don't think i even remember my login lmao

20. Favourite fic you’ve written?

hmm hm hm. okay. probably because i fear i'm lost. just bc like... idk i'm proud of how it turned out and i'm really . idk. happy with the reception it got. i'm happy it reached people who can relate to it. and it's short enough that there's not like, enough space for there to be parts where i just have to force myself to write stuff i'm not 100% happy with to fill in the gaps. if that makes sense

tagging: You

#talk tag#hi sorry its been a million years since i even posted. im surviving#no ao3 writers curse i just have zero energy and some other stuff going on ie Bad Mental Block that i cannot for the life of me climb over#but i did get a tiny bit of writing done like... last week or something before it came back so! progress#fic talk#i think that was one of them. obligatory 'i forgor all my tags' tag

28 notes

·

View notes

Text

AT400-D9302 || chapter 1

no one:

absolutely not a single soul:

me: anyway here's a silly TMNT x Detroit: Become Human crossover that no one asked for :)

Warnings: None so far. Spelling, grammar and the fact that it hasn't been beta read by anyone. And a bullshit chatGPT generated code that DO NOT WORK.

Turtles used: Bayverse

You sat lazily watching your monitor. Grimacing at your now cold cup of coffee. A headache had begun to seep its way into the forefront of your mind, one you tried to ignore since you first noticed the signs. The text in front of you mocking the fact you’d gotten hired, even your mere existence felt attacked by it.

def fibonacci(n):

if n <= 0:

return []

elif n == 1:

return [0]

elif n == 2:

return [0, 1]

else:

fib_sequence = [0, 1]

for i in range(2, n):

next_fib = fib_sequence[-1] + fib_sequence[-2]

fib_sequence.append(next_fib)

return fib_sequence

# Example usage:

num_terms = 10

print(fibonacci(num_terms))

“Bullshit…”

Shoving away from your desk you rolled across the room until you hit where your tablet was charging. Unplugging it and using your feet to roll back to your desk. The sound of the TV brought you out of your reading.

A new riot. This time some place outside of the city. Apparently, a storage facility had been hit this time. Not really news by this point. They always got hit first. You’re used to it now, shrugging before turning your attention back to your inbox.

Not a single positive email has reached your inbox in weeks. It was almost draining to open your work email, nowadays. Sinking back into your chair you toss the tablet back towards the desk, only to simply watch as it slides across and falls to the floor on the other side.

Subject: "Urgent: Meeting Request Regarding Project Progress"

Subject: "Deadline Extension: Revised Timeline for Project Completion"

Subject: "Emergency Meeting: Addressing Recent Challenges"

“Uuuggh…”

You needed a shower.

The light in the small workshop flickered as you walked past. You snuck a peek inside the room through the cracked open door. The androids who’d managed to stay locked up in the tower still at work welding, pulling cables. All you did was roll your eyes as you continued towards the employee bathrooms.

Leaning towards the tile in the shower you rubbed your face with your hands, trying to wake up. You’d been stuck on that stupid code for literal weeks by now. Something didn't sit right with it, but you couldn’t figure out what exactly. And it haunted you. Laughed in your very face, making you wonder if you were the right programmer for the job.

Which you knew were false. Sure, you were still learning, an apprentice under Elijah Kamski together with three others. Three who were currently MIA and had apparently decided to leave you to figure this out yourself. Thanks for that.

You watch as the suds from the body wash flush down the drain. Trying to see a pattern, trying to see something in it that could help you get past that stupid code that was currently–

A knock at the stall door brought you back into the now.

“Occupied!”

“I know.”

Ah. One of the MIAs had found their way into the tower. Fantastic. You quickly rinse off and step out of the shower stall wrapped in a towel.

You look at the owner of the voice.

“I thought you guys had gotten captured and sold on the black market.”

You jest towards them.

“Ha-ha. Very funny. You know those are real, right? Like, it happens.”

Jonah countered, making you chuckle.

“Anyway, you want food? I got my hands on some burgers!”

Food. Eating. Right… You’d forgotten to eat.

“Please, I am starving. Maybe you can help me with the code.”

Raising the bag holding said food he saluted as he left you alone to change.

“How long have you been stuck on this?” Jonah asked in between bites of his burger.

You chewed at your straw.

“All day, actually. I just– It feels like something is missing.”

He hummed. “What code are you working from?”

Sitting back down at your desk after getting up to throw the empty boxes and wrappers away you rest your chin on your hand.

“The base code is taken from the RK-series. Although, I only use it as an outline to work from.”

“Oof. That one’s tough. One of my teachers was part of develo– wait, which RK series exactly? Those–” he snapped his fingers trying to remember what model he was thinking of.

“The upgraded coding used in that RK900 model.”

“THAT’S the one! Yes. You’re using that one? For this project? Isn’t it a little– too simple?”

You shrugged.

“Well, yeah. It is. Which is one reason why I’m currently stuck. I don’t know how to move forward. Have you even seen the checklist for the newer models? Check it.”

You tossed the folder containing required knowledge needed for the project. Jonah whistled as he read through it.

“And you’re supposed to finish this… in two months?”

You nodded. “Mmhm.”

“Elijah sure drive a hard bargain. Move over. Take a nap and let me look at it. See if there’s anything I can do.”

Smiling as you got up from the chair, you trudged over to the couch, almost falling asleep the second your head hits the pillow.

“Thank you, Jonah.”

A thud made you wake up in a panic.

“I CRACKED IT!”

A piece of crumpled up paper hit your head. “Wake up and come look at this! I cracked it!”

You nearly toppled over as you ran to Jonah.

import numpy as np

import tensorflow as tf

from tensorflow.keras.layers import Dense, Dropout, LSTM

from tensorflow.keras.models import Sequential

“This is it?” Your eyes rapidly moved between Jonah and the code.

# Generate synthetic data for training

num_samples = 10000

seq_length = 50

input_dim = 10

X_train = np.random.randn(num_samples, seq_length, input_dim)

y_train = np.random.randint(0, 2, size=(num_samples,))

# Build LSTM model

model = Sequential([

LSTM(128, input_shape=(seq_length, input_dim), return_sequences=True),

Dropout(0.2),

LSTM(64),

Dropout(0.2),

Dense(1, activation='sigmoid')

])

# Compile model

model.compile(optimizer='adam', loss='binary_crossentropy', metrics=['accuracy'])

# Train model

model.fit(X_train, y_train, epochs=10, batch_size=32)

# Save model

model.save('ai_model.h5')

He nodded.

“This is it. I’ve tried it on the virtual motor a total of twenty times. This is it.”

“Okay.”

“Okay?”

“Okay, let’s– let’s transfer it to the test ‘droid and see how it reacts.

“I don’t think that’s supposed to happen.”

Both you and Jonah jumped as you heard the voice of Elijah behind you. He stood, hands behind his back looking at the android that was currently laying on the floor, overheated. White plastic melting.

Jonah looked at you, then to the android, and back at you before addressing your teacher and boss.

“Uhm. Mr. Kamski–” Jonah shut up as Elijah raised a hand to silence him.

“Go home. Both of you. You’re not thinking clearly. You’re not seeing what the issue is, and where it is. You’re tired.” He looked at you. “How long have you been here?”

You sighed heavily. “Three days, sir.”

“Are you tired?”

You’d dreamed of working in CyberLife ever since the first android prototypes came off production. When your parents had gotten the first one, a basic cheap AX400 one, Sammy. Your parents had let you name him.

You nodded. “Very much so. I’ve really tried. Jonah came and helped me and he thought he’d figured it out–” Rambling on you barely noticed how Elijah walked up to the crackling android on the floor and looked over it.

He was amazing. You loved listening to the stories he knew. Liked coming home to watch him cook.

Like the one time you’d come home drunk, Sammy was there to help you and take care of you. He promised to not tell your parents as you had reached the age where he was no longer programmed to care for you.

When you got older, your parents let you join him with grocery shopping and by your late teens, he’d become a good friend of yours. Even though you always knew he was just made of plastic and wires. It was nice to always have someone you could talk to that weren’t your parents.

Sometimes… There’s things you don’t want them to know.

You remember the day he died– or well, stopped functioning.

It’d been a very bad stormy night. A giant blast from downstairs where Sammy was on standby during the night woke you up. Your dad running down to check what had exploded, you close behind, only to be met with a destroyed Sammy slumped in his station.

Later you would find out the lightning had accidentally hit an electrical box close to your house, the current traveling up and overheating Sammy’s battery.

Even though you knew he was just plastic and wires, you cried that night. Felt like a small child crying over a toy.

So, standing in the CyberLife tower itself many years later, watching your teacher and boss analyze a failed project of yours… meant a lot.

You knew he was seeing something you’d missed. The way his eyes moved over the machine. He looked up at the two of you again and walked towards you.

“Filling a glass with sand and see how well you manage to fill it with rocks.” With that, he left. His personal android Chloe walked behind him. The elevator doors hissing shut.

Outside, the air that hit you felt like a dream come true. A white CyberLife marked self driving car pulled up, calling out your name.

Slumping down in the seat you looked out the window over the water way stretching as long as you could see before one of the transportation trains ran past you. The flicker of light illuminating your face on the dark tinted window.

Damn, you really did look more tired than you thought.

A yawn makes its way up through your throat as you take your phone out of your bag. A message from Lory reminding you that she’d picked up the groceries needed at home. And you sent a quick message back to thank her, silently praying she hadn’t been approached by any of the deviant androids roaming the streets.

More and more had started to deviate. Some go as far as to murder their owners. You shuddered at the thought of coming home, only to be met with your own death.

Somewhere along the way you must’ve nodded off. Because you remember coming awake with a jolt as your car had stopped suddenly. Screaming could be heard outside and looking out, you saw a late night riot taking place.

Or, this was more like what looked like a sacrificial burning of an android, with delinquent humans laughing and hollering. You frowned at the sight.

Sure, you knew the androids are practically walking and talking computers, but seeing them torn apart always made you feel… uneasy.

They looked too human that way. Too real in a way. It was too easy for you to picture a human that way. The more you looked, the more you felt the food you had earlier turning around in your stomach.

“You have arrived at your destination.”

“Thanks.” You muttered as the door closed behind you. You noticed a soft, pulsing blue light in your living room. Lory must be on standby, you thought.

The fingerprint reader on the door beep, allowing you to open the door. Inside you closed the door, leaned your back on it and sighed. Shoulders dropping. It wasn’t until you finally got home that you realized exactly how tired you were.

Soft footsteps came from around the corner, Lory’s friendly face meeting you.

“Welcome home. You have been gone for three days. Is everything alright?”

“Yeah, everything is fine. I just got held up at work, that's all.”

She nodded in understanding, watching you as you walked past into the kitchen.

Lory proceeded to rummage around in the hallway. Picking up your shoes and placing them neatly in the rack. Hanging your jacket up. And place your bag on the shelf on top of the coat rack.

“TV on.”

What makes them deviate? Is it a glitch in their system? A bug? Maybe it’s a virus… Maybe something faulty in their antivirus that makes it so something can slip through and make them act… irrational.

Grunting, you collapsed on your couch. Flicking through the channels. Nothing seemed tempting. News, politics… All it was nowadays.

This whole… deviant situation gnawed at you. At your bones. You really, really wanted to get hold of a deviant android to study it. To hook it up to your computer and analyze what’s happening.

They think they’re alive. Like humans. You scoffed at that and shook your head at the thought.

Finally you settled on a documentary about the science and reason behind creating animal androids. Animal right’s activists had started protesting it, saying creating an animal android meant real animals would go extinct at a faster rate. Meanwhile, supporters of it said that–

Suddenly, your TV started glitching.

“Come on…”

A white face made you jolt. An android. White plastic illuminating your living room. You took a quick glance out to see if you could see your neighbors living room. Yep, theirs too.

You reach for your pad on the coffee table, turning it on and you're met with the same white face.

“Whaaaaat’s going on…”

Then, he– it spoke.

“This message is the hope of a people. But it is also a warning.”

You shuddered at his voice. Dark, intimidating.

In the corner of your eye you saw Lory turn her head towards the TV, her LED blinked for a second when it continued speaking.

“We will fight for our rights because we believe our cause is just. No human will live in peace until we are free. Now you know who we are, and what we want. We are alive and we demand our freedom.”

In almost an instant the documentary was back on.

Your heart was racing. What. The hell. Did that mean?! Surely, that can’t really mean anything, right? Right? Your throat was dry. You knew you shouldn't be scared, but it made you feel uneasy, seeing you worked with them. You helped create their coding, for God’s sake!

A vibration in your pants pocket brought you back into the now. Jonah’s name is a saving grace.

“Hey, Jon-”

“Did you see it?!”

“Uh– yeah. Yeah, I did."

“What the fuck? I don’t know what to think about it. Do you?”

“No, no. I really don’t know. Should we be concerned? I mean he– it sounded pretty– fed up.”

“Are you still home?”

“Yes, why?”

“I think we should get back to the office.”

“I mean– Jonah, there’s not– much we can do from there. We don’t have anything to work from. Any news. Anything. We can’t even try the code properly because we don’t have any test droids that can handle that much information.”

You’d started pacing. Lory looking at you, her head following your movements.

“I know, I know. But– what if we–”

You cut him off. “No! Absolutely not! If we do that Elijah is going to throw us from the top floor!”

“This is serious! This deviant bullshit is getting worse. And if you want to interpret what the plastic face said, it’s only going to get worse. We have to do something. Elijah put us on this project for a reason.”

Pinching the bridge of your nose you groaned. He was right, and you knew he was right. Anxiety perked up in your body and you started tapping your foot. If you did this, you risked your job. Your life. Everything you’d worked for. Everything you promised Sammy.

“Meet me at the tower in an hour.”

With that, you hung up.

“Are you sure about this, Jonah?”

You wiped the sweat from your brow. Too many heavy cables had to be pulled, the table heavy to push into the testing room.

Jonah laughed nervously.

“Hah! No. I have no idea what I’m doing if I’m going to be honest. Grab the USB.”

How a small thing such as this USB could feel so heavy for you, you didn’t know.

You both looked at each other and sighed.

“Here goes nothing.” You mumbled right as you injected the USB in a port right under the android’s LED.

You both waited. And waited… And waited. Hope slowly fading before a soft whirring sound came from the android. It was booting, slowly. The fans started to spin rapidly. The thirium pump started pumping, and soon you both saw thirium flowing in the still exposed parts of it.

Jonah nudged you.

“It’s voice activated to you. I can’t do shit to activate it.”

“Oh, right.”

You approached it, cleared your throat and stated your name.

Voice activation granted

The android opened its eyes. Eyes that were yet to be finished and still had the look of a camera lens.

“AT400, state your serial number.”

It spoke, voice laced with static.

“AT400D9302.”

Jonah and you shared a look of disbelief.

“State your name and objective.”

It went quiet for a bit. You looked at the LED rapidly spinning between red and yellow. You guessed it was searching inside its coding.

This time, the voice was more glitchy, more static.

“My name is Donatello. My objective is to defend humanity in war.”

#bayverse tmnt#bayverse#tmnt bayverse#tmnt fanfiction#tmnt x d:bh crossover#crossover fic#d:bh#detroit become human#d:bh crossover fic#detroit become human crossover fic#tmnt#tmnt crossover#tmnt 2014#tmnt 2016#tmnt oots#teenage mutant ninja turtles#teenage mutant ninja turtles X detroit: become human

10 notes

·

View notes

Text

My take on the timeline involving the Entrati family, warning that this also includes like 50 layers of fanon that is not supported by lore; also this turned out incredibly long:

-Loid is hired when Euleria is the Orokin equivalent of a preschooler. Albrecht has other servants and aides around the lab.

-As the years go on and Albrecht's research turns up nothing of value, most of his assistants leave to find better job opportunities, this is when Loid distinguishes himself and becomes more loyal to the cause (Defending Albrecht's work from scrutiny as Albrecht's confession in the Grimoire mentions); Euleria is still too young and inexperienced to represent her father, Loid is too low status to make a difference in the eyes of the Archimedians. The research continues.

-The first Void expedition. According to Albrecht's original notes, Euleria, Kalymos and some unnamed attendants were present during this event.

-Albrecht is almost killed and requires extensive recovery, he is put in a bath of nepenthe (an artificial womb) and is attended by both medical staff and Loid. This is Euleria's "breakout" moment, though it also spells the first steps of her own mental decline. Being a witness to her father's tragedy was traumatizing, she couldn't bear to look at him in the nepenthe, so she instead decided to pick up his work and prepare everything for her father's return.

-Euleria had to make some tough calls while her father was unable to continue research, so in part Albrecht's findings actually getting out to the public was her achievement. This also helped establish Euleria as a scientist, but also tied her to her father's legacy. She would become "The daughter of the father of the Void" and this reputation would haunt her for the foreseeable future.

-Finally, Albrecht is recognized. From a humiliated laughingstock he is suddenly shot up to the uppermost echelons of Orokin society. Places are named after him, statues are built, Archimedians flock to his lab to consult on their own research. But Albrecht has changed - he no longer harbors the bitterness that used to plague him before, but now he was anxious, suspicious. He would make both Loid and Euleria represent him, but that only increased the mystique of his persona in the eyes of the Orokin. While the Orokin concocted new plans with their new and shiny technology, Albrecht was devising other schemes.

-The Orokin were secretly preparing the Zariman project (with Albrecht's reluctant consultations), meanwhile Albrecht was working on the Cavia, while also becoming more and more paranoid due to the Man in the Wall's lingering presence. He notes that others who travel in the Void do not recount meeting any entities or doubles like he did. He starts shutting down emotionally more and more. He keeps only Loid around for his research, his relationship with Euleria deteriorates.

-Despite this, Albrecht and Euleria co-author several publications and she becomes an accomplished scholar, however, chooses to pursue a career of a teacher instead of researcher. Albrecht approves but in a very standoffish Albrecht way - he has been trying to push away Euleria from his mad research for years and sees this is as a positive development.

-Euleria feels guilty and responsible for what happened to her father, so she starts researching the effects of Void exposure. This is how she became a consultant to the Zariman project - initially she works with adult subjects but eventually also expands her research to children (at the request of Orokin supervisors, she does not know the true nature of the Project).

-Euleria starts working on the Tales of Duviri, during this time Albrecht is preoccupied with the Cavia and de-evolving the Void, so Euleria consults with Loid. Cue Fibonacci's line about Euleria learning to explain complex concepts in childish terms from Loid. Loid and Euleria have a semi-positive relationship, until Albrecht chastises Euleria for "wasting Loid's time with frivolous side projects".

-Euleria finishes and publishes the Tales of Duviri, they become essential reading for children and even gain certain popularity among adults. The Zariman project is close to being finished. During this time Euleria meets Quinn, but their relationship doesn't kick off as she is still to entrenched in understanding her father's affliction. Euleria and Albrecht practically don't talk - they live under one roof, but the Entrati estate is so huge they can easily avoid one another (and the Secret Labs are being constructed and Albrecht is becoming more and more secretive with his research, at this point Loid has become a messenger between father and daughter).

-Several events happen: The failed Zariman void jump, Albrecht gives up on the Cavia and at some point disappears (he decides, against better judgement, to traverse the Void once again but this time ends up in Duviri, he is gone for a considerable amount of time and even presumed dead). Loid is now the only warden of the Entrati estate, he cannot tell Euleria what happened to Albrecht - she knows that he knows and grows frustrated with Loid, but decides to hold her bitterness for now. They need one another to survive.

-During Albrecht's first disappearance Euleria meets Vilcor.

-Albrecht suddenly re-appears, he has changed once again. This time he is determined and he even starts talking to Euleria again. She is so taken aback by Albrecht's sudden change that she briefly forgets all that happened before. She even deludes herself into thinking that her father became better.

-Sometime during this time, the Old War should have started, but the Orokin are still in the early stages of fighting against the Sentients.

-An unknown amount of time passes, Euleria and Vilcor become married and they have children. During all this, Albrecht prepares for his first venture to 1999. An infestation research facility is built on Deimos and Albrecht takes interest in that as well. The Orokin come to Albrecht for aid in the Old War but he is reluctant to help, he directs them to Vilcor and his Necramechs.

-Euleria finds out about the Tenno in a roundabout way. Her expertise on Void exposure is required and she realizes that children have been exposed to the void and something has happened to them. She puts two and two together and realizes that whatever happened to the children, happened to her father.

-Euleria confronts Albrecht about the first Void voyage. It turns into a bitter argument, Albrecht tells Euleria off and she gives up on him.

-The Warframe project begins. Albrecht starts traveling to 1999. He gets his hands on Ballas' blueprints and crafts Arthur and Aois' exoskeletons. Loid is keeping an eye on the infestation research and brings attention to the gray strain. The construction of the vessels begins.

-Albrecht concocts the Kalymos sequence, he crafts the Necraloid and eventually leaves for 1999 permanently. Loid is left to deal with the family and Euleria desperately tries to get some information out of Loid, he doesn't relent and Euleria gives up on Loid as well.

-The Old War is in full swing, the Warframes have been fully deployed and have been fighting for years. Belric and Rania set off the biobomb, infesting the whole of Deimos.

-Eventually Loid goes into cryosleep and Necraloid takes over his duties, Euleria and the rest of the family are convinced the real Loid is dead.

-Kermerros breaches containment and the whole family is infested. Necraloid shields the cephalon Otak by merging their consciousness in the construct body.

-The Old War ends, the Rebellion begins and the fall of the Orokin Empire is set in motion.

Annnd that's that - the main point of this wall of text was to establish that Albrecht disappeared twice: first time he ended up in Duviri but returned, second time he disappeared for good in 1999. There are certain details that I want to hash out (which is mostly about interpersonal relationships), but I'll cross that bridge when I get to it.

9 notes

·

View notes

Text

Master the Markets: Best Share Market Courses in Pune & India for Technical Analysis and Option Strategies

In the current fast moving financial era, it is more important than ever to know how the stock market works. Whether you are a newcomer attempting to master the fundamentals or a seasoned trader seeking to improve your skills, taking the appropriate share market course can be the difference between success and failure. This holds particularly in cities such as Pune and Mumbai, where high-quality stock market classes are in highly demand owing to an increase in interest in wealth creation through equities, derivatives, and technical trading.

Why Choose Share Market Education?

Learning to navigate the market is not simply a matter of reading charts or keeping up with trends. It's about building a disciplined trader's mindset, risk management skills, and insight into market forces. Thorough share market training programs provide that foundation and much more. From learning fundamentals to mastering sophisticated tools, a properly structured curriculum gives you the advantage.

Best share market courses in Pune and in India today include specialized modules covering everything from:

Introduction to equities and market mechanics

Candlestick and price action analysis

Risk and money management

Trading psychology

Advanced modules such as Option Trading Strategies course and Advance Technical Analysis course

What is an Advance Technical Analysis Course About?

An Advance Technical Analysis course goes deep into market indicators, patterns, and trading systems. It prepares students to analyze price action accurately and make correct decisions using tools such as:

Fibonacci Retracements and Extensions

Elliott Wave Theory

Ichimoku Cloud Analysis

Volume and Open Interest Analysis

Advanced Charting Software (e.g., TradingView, MetaStock)

Such comprehensive training, offered at well-known stock market classes in Mumbai and Pune, keeps you ahead of the curve.

Mastering Options with a Focused Option Trading Strategies Course

Options trading is a high reward area of the market that needs to be understood in depth. A good Option Trading Strategies course teaches both the theoretical basis and actual execution of trades. Such courses typically feature:

Basics of options: calls and puts

The Greeks (Delta, Theta, Vega, Gamma)

Popular strategies such as Iron Condor, Straddles, and Spreads

Hedging techniques and risk reduction

Real market case studies and backtesting

You can find some of the finest guidance by opting for well-planned share market classes in Mumbai and Pune with a focus on theory and practice in the live market.

For more courses - https://sharemarketclasses.in/

How to Select a Good Share Market Institute

Selection of a good share market institute is key to receiving quality education. Find out the following:

Certified and experienced trainers

Practical training with market simulators

Up-to-date curriculum based on market trends

Availability of trading tools and guidance

Good student reviews and reputation in the industry

Urban cities such as Mumbai and Pune also have numerous institutes that provide exhaustive stock market classes. Whether one is a student, a professional, or retired, flexible timing and batch facility make learning feasible for all. Why Choose Stock market Classes in India?

India has become a retail trading hotspot around the world. The quality and diversity of stock market classes in India (and share market classes in India) have increased significantly over the years. Through a combination of online and offline courses, students from across the country can now benefit from high-level market training that previously was concentrated in metro cities.

Learn from the Best at eMS Stock Market Institute

If you're searching for career focused, hands on share market courses in Pune or best stock market classes in Mumbai, eMS Stock Market Institute is the place to be. With a legacy of excellence in training and guidance, eMS provides holistic programs in advance technical analysis course, option trading strategies course, and complete share market training. Whether you are embarking on the journey or aspire to be a professional trader, eMS guarantees that you possess the tools, information, and assistance necessary to succeed in the financial markets.

Are you seeking in person or online stock market classes?

#share market classes in pune#Share Market Courses In Pune#best share market courses in pune#share market classes#Best Share Market Classes In Pune

1 note

·

View note

Text

5 Key Indicators Every Trader Should Know: Essential Tools for Today's Market

The Trading Compass: Navigating India's Current Market

Hey there, fellow traders! 📈 Have you been feeling the market's unpredictability lately? You're not alone! I've been trading through this volatility too, and wanted to share some hard-earned wisdom about the technical indicators that have truly made a difference in my decision-making process.

India's market has been particularly turbulent recently, with everything from global economic shifts to domestic policy changes throwing curveballs our way. That's why having reliable tools to guide your trading decisions isn't just helpful—it's essential for survival in today's market environment.

Let me walk you through the five indicators I personally rely on every single day:

1. RSI: Your Market Mood Reader

Think of the Relative Strength Index as your market psychiatrist—it tells you when the market is getting too emotional in either direction. On a scale of 0-100, it measures whether an asset is potentially overvalued or undervalued.

I've found RSI incredibly reliable lately, especially when:

It pushes above 70, suggesting a stock might be running too hot (happening frequently in our tech sector right now)

It dips below 30, hinting at oversold conditions (I've found some great bargains in manufacturing this way)

2. MACD: Your Trend's Best Friend

Don't let the complicated name fool you! The Moving Average Convergence Divergence indicator simply helps you understand the momentum and direction of trends.

Here's how I personally use MACD in today's market:

When the MACD line crosses above the signal line, I pay attention—this bullish signal has been remarkably accurate in renewable energy stocks lately (helped me catch a 12% move just last week!)

I watch the histogram to see momentum building or fading—crucial for timing entries and exits

Zero-line crossings give me confidence about the overall trend direction—essential for my medium-term positions

3. Bollinger Bands: Your Volatility Visualizer

In times like these, understanding volatility is everything—and Bollinger Bands make it visual. They expand during chaotic periods and contract during calmer ones.

Three ways I apply Bollinger Bands in my daily trading:

Band width immediately shows me if volatility is increasing/decreasing—absolutely crucial as our markets navigate current transitions (saved me from several false breakouts recently)

I love finding mean reversion opportunities when prices touch band extremes—this strategy has been particularly profitable in FMCG stocks

After consolidation periods, decisive band breakouts often precede strong trends—I've seen this pattern repeatedly in banking stocks this year

4. VWAP: Your Institutional Edge

As algorithms dominate more trading, understanding where big money is active becomes critical. VWAP (Volume-Weighted Average Price) helps me see the true average price incorporating volume—essentially showing where institutions are likely active.

Here's how VWAP gives me an edge:

Major institutions use it for execution benchmarks, creating natural support/resistance levels

Trading above/below VWAP helps confirm my intraday bias—essential in today's quick-moving markets

I use it as an exit benchmark to improve my average performance

5. Fibonacci Retracement: Your Timeless Market Map

It amazes me that a mathematical sequence discovered centuries ago works so well in our digital markets today, but Fibonacci retracement levels consistently help identify potential turning points.

My three favorite Fibonacci applications:

The 38.2%, 50%, and 61.8% retracement levels provide amazing entry points in trends—I've used these successfully throughout this year's commodity cycles

Fibonacci extensions help me project realistic profit targets beyond previous highs/lows

When Fibonacci levels align with other indicators like RSI or MACD, the high-probability setups that emerge have dramatically improved my win rate

Bringing It All Together: The Integrated Approach

Here's what I've learned after years of trading: while each indicator offers valuable insights, the real magic happens when you combine them strategically. I don't make major trading decisions without confirmation from multiple indicators—it's like having several expert advisors all agreeing on the same trade. You can learn this strategies and how to effectively apply them by enrolling in the Stock Market Courses in Mumbai

I'd love to hear which indicators you find most helpful in your trading! Drop a comment below and let's learn from each other. Happy trading! 📊

1 note

·

View note

Text

Fibonacci Trading Education

Explore Fibonacci trading education at Fibonacci Trading Institute and transform your trading skills. Our education programs are tailored to teach you the powerful techniques of Fibonacci analysis, offering both theoretical knowledge and practical application. Learn how to use Fibonacci retracements and extensions to identify key levels and make precise trading decisions. Our comprehensive resources include live classes, video tutorials, and hands-on exercises to ensure you gain a deep understanding of Fibonacci trading strategies. Empower yourself with the knowledge to enhance your trading performance.

0 notes

Text

Advanced Forex Trading Techniques for Experienced Traders

For seasoned traders, forex trading goes beyond basic strategies. To excel, advanced techniques are essential. Start by mastering multi-timeframe analysis, which involves analyzing charts on different timeframes to gain a clearer market perspective. Use Fibonacci extensions to set profit targets and spot market reversals with patterns like Gartley and Butterfly.

Incorporate order flow trading to understand how large institutional players move the market, and keep an eye on economic divergences between currencies for better predictions. Finally, consider automating your trades with tailored forex bots, reducing emotional decisions and increasing efficiency. These techniques can give you an edge in today's dynamic FX trading market.

0 notes

Text

Leveraging Fibonacci Retracement Levels for Precision Entries and Exits in Forex Prop Trading with Industry Experts at Institutional Prop

Forex proprietary trading, or prop trading, involves trading currencies with the firm's capital rather than personal funds. Successful prop traders employ various technical analysis tools to enhance trading accuracy and profitability. Among these tools, Fibonacci retracement levels stand out for their ability to identify potential support and resistance zones based on key Fibonacci ratios. Understanding how to effectively use Fibonacci retracements can significantly improve precision in entry and exit points, thereby optimizing trading strategies and maximizing returns in the dynamic forex market.

Fibonacci Retracement Levels

Fibonacci retracement levels are based on the mathematical ratios identified by the Italian mathematician Leonardo Fibonacci. These ratios (typically 23.6%, 38.2%, 50%, 61.8%, and 78.6%) are derived from sequences found in natural phenomena and have proven effective in identifying price levels where retracements or reversals may occur within a trend. In forex trading, Fibonacci retracements help traders anticipate potential support levels during uptrends or resistance levels during downtrends, enabling strategic entry and exit points.

Traders initiate Fibonacci retracement analysis by identifying a recent significant price movement, either up (swing high to swing low) or down (swing low to swing high). The retracement levels are then plotted on the chart, providing visual guides that assist experienced forex trading experts at Institutional Prop in identifying areas where price corrections are likely to encounter support or resistance before continuing in the direction of the prevailing trend.

Using Fibonacci Retracement for Entry Points

One of the primary uses of Fibonacci retracement levels in forex prop trading is to identify optimal entry points. Traders look for confluence between Fibonacci levels and other technical indicators, such as moving averages, trendlines, or candlestick patterns, to confirm potential entry opportunities. For example, a trader may observe that a currency pair has retraced to the 50% Fibonacci level, coinciding with a key support level identified by previous price action. This alignment suggests a strong potential for a bounce or reversal, prompting the trader to consider entering a long position with a favorable risk-to-reward ratio.

By integrating Fibonacci retracement with other technical analysis tools, forex trading experts at Institutional Prop enhance the probability of successful trades by pinpointing entry points where market sentiment and price action converge. This disciplined approach to entry ensures that trades are executed based on logical, objective criteria rather than emotional impulses, fostering consistency and reliability in trading performance.

Precision Exits Using Fibonacci Retracement

In addition to entry points, Fibonacci retracement levels play a crucial role in determining optimal exit strategies for forex prop traders. Industry experts at Institutional Prop utilize Fibonacci extensions or additional retracement levels beyond the initial Fibonacci sequence to set profit-taking targets or trailing stop-loss orders. For instance, a trader who entered a long position based on a bounce from the 38.2% Fibonacci retracement level may set a profit target near the 161.8% Fibonacci extension level, anticipating significant price extension in the direction of the trend.

By aligning exit strategies with Fibonacci retracement levels, traders establish clear objectives for profit-taking and risk management, thereby maximizing potential gains while mitigating losses. This systematic approach ensures that trades are managed effectively throughout the duration of the trade, adhering to predefined trading plans and optimizing overall portfolio performance.

Practical Applications and Case Studies

Real-world applications of Fibonacci retracement in forex prop trading illustrate its effectiveness in enhancing trading decisions. Case studies often highlight scenarios where traders successfully identify reversal points or continuation patterns using Fibonacci levels, validating the reliability of this technical analysis tool in various market conditions. For example, during a strong uptrend in a major currency pair, a trader may use Fibonacci retracement to identify key support levels that coincide with historical price patterns, reinforcing confidence in holding a long position for extended gains.

Through practical applications and case studies, experienced forex trading experts at Institutional Prop gain insights into the versatility and applicability of Fibonacci retracement levels across different currency pairs and timeframes. These examples underscore the importance of incorporating Fibonacci analysis into comprehensive trading strategies to achieve consistent profitability and manage risk effectively in forex prop trading.

Challenges and Considerations

While Fibonacci retracement levels offer valuable insights into market behavior, traders must consider potential challenges and limitations when applying this tool. One challenge is the subjective nature of identifying swing highs and lows, which can vary among traders and impact the accuracy of Fibonacci level placements. Moreover, market volatility and sudden price movements may invalidate Fibonacci retracement levels, requiring traders to adapt and reassess their analysis in real-time.

Another consideration is the potential for over-reliance on Fibonacci retracement without supplementary analysis or confirmation from other technical indicators. Successful prop traders emphasize the importance of combining Fibonacci retracement with complementary tools such as trend analysis, volume indicators, and economic news events to validate trading signals and enhance decision-making accuracy.

Future Trends and Integration with AI

Looking ahead, the future of Fibonacci retracement in forex prop trading is poised for further advancements with the integration of artificial intelligence (AI) and machine learning algorithms. AI-powered trading platforms can analyze vast amounts of historical data to identify optimal Fibonacci levels dynamically, adapting to changing market conditions and improving predictive accuracy. This integration enables forex trading experts at Institutional Prop to leverage advanced analytics and predictive models to refine trading strategies, optimize risk management, and capitalize on emerging opportunities in the forex market.

As AI continues to evolve, prop trading firms and individual traders alike will benefit from enhanced automation, data-driven insights, and algorithmic trading strategies that incorporate Fibonacci retracement seamlessly.

Leveraging Fibonacci retracement levels for precision entries and exits represents a cornerstone of effective forex prop trading strategies. By understanding how Fibonacci retracement works, utilizing it for strategic entry and exit points, exploring practical applications through case studies, addressing challenges, and embracing future trends with AI integration, traders can enhance their trading proficiency and profitability in the competitive forex market. With disciplined application and continuous refinement of Fibonacci analysis techniques, prop traders position themselves for success by optimizing trading decisions, managing risk effectively, and achieving sustainable growth over time.

0 notes

Text

FxPro South Africa

What are the ways to set targets in Forex trading?

Forex trading involves several complications, and a trader should evaluate them carefully to control losses. However, one should consider setting targets in forex trading that will help ensure more advantages. Targets are crucial in currency trading because they provide ways to earn profits and manage risks. Setting targets enables a trader to eliminate emotions from trading and experience peace of mind. On the other hand, one should know how to set targets properly, which gives ways to overcome unwanted issues.

How to set targets in forex trading?

Using a risk-reward ratio

A risk-reward ratio lets a trader have predetermined stop-loss and profit targets that help to make informed decisions. Moreover, it shows ways to implement a consistent trading strategy that aligns with the trading goals. A high risk-reward ratio may lower the winning rates, and new traders should select a small target to have a high winning rate.

Support and resistance levels

A support and resistance level allows traders to set targets in forex trading, which ultimately gives ways to achieve the best results. The support level enables traders to know the price when an asset becomes undervalued. Similarly, a resistance level will help determine the price of an overvalued asset. Traders should consider using the auto-support and resistance indicators to take a profit based on the results.

Pattern projections

Forex trading uses several chart patterns, and they have predesignated take-profit targets in trading. Some traders utilize the pattern height to determine the price movements after a successful breakout. FxPro South Africa is an ideal platform for those who want to identify trends with different charts. It provides ways to measure projections based on chart patterns to proceed further in currency trading.

Partial trade closing

Partial trade closing is another technique that allows traders to take some profit from trading and continue to ride the trend in a certain direction. On the other hand, one should use any of the above strategies for taking a profit percentage when a price hits a profit target.

Trailing stop-loss

This technique works similar to partial trade closing, and a trader should set a trailing stop-loss after the price hits the first target. One can even use other tools, such as moving averages for stop-loss trailing.

Fibonacci extensions

Fibonacci extensions let Forex traders use calculations based on the Fibonacci sequence, which help determine potential profit target levels. They show ways to set targets at each extension to take some profits.

1 note

·

View note

Text

Cryptocurrency analyst Jason Pizzino believes that the Bitcoin bull cycle is far from over. In a recent statement, he shared his targets for the digital currency, emphasizing its potential for long-term growth. Find out more about his insights in this article. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Bitcoin analyst and trader Jason Pizzino predicts a significant upward move for Bitcoin (BTC), potentially leading to new all-time highs. Pizzino, who has a substantial YouTube following, believes that the current Bitcoin bull Market is simply taking a breather as it hovers below the $69,000 resistance level. Using the Fibonacci extension tool, Pizzino projects a potential 100% increase in Bitcoin's price from its current levels. He sets a price target of $135,000, with other key levels to watch out for, such as $100,000, $115,000, $120,000, and $130,000 to $150,000. These levels are crucial as investors anticipate Bitcoin's performance in the coming months. At the time of writing, Bitcoin is trading at $66,988, showing a more than 2.50% increase in the past 24 hours. Pizzino highlights the importance of monitoring Bitcoin's price movements closely to capitalize on potential rallies and corrections. To stay updated on the latest cryptocurrency news and Market trends, subscribe to our email alerts and follow us on social media platforms. Remember that investing in Bitcoin and digital assets carries risks, so it's essential to conduct thorough research before making investment decisions. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. Is the Bitcoin bull cycle over? No, according to analyst Jason Pizzino, the bull cycle is not over. 2. Who is Jason Pizzino? Jason Pizzino is an analyst who provides insights and targets for Bitcoin and other cryptocurrencies. 3. What are some of Jason Pizzino's targets for Bitcoin? Jason Pizzino has set targets for Bitcoin at $70,000 and $120,000 in the future. 4. Should I invest in Bitcoin based on Jason Pizzino's targets? It's important to do your own research and consider your own financial goals before investing in Bitcoin or any other cryptocurrency. 5. How can I stay updated on Jason Pizzino's analysis? You can follow Jason Pizzino on social media platforms or subscribe to his newsletter for regular updates on his analysis and targets for Bitcoin. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--;

if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

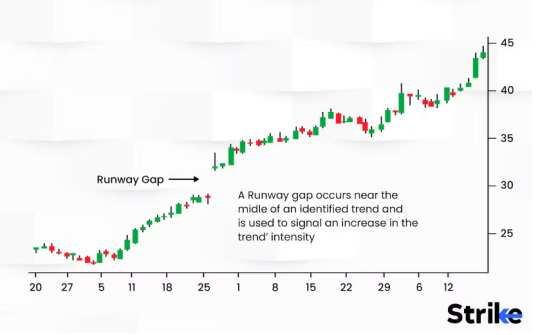

🚀 Complete Guide to Runaway Gap: Decode This Momentum Signal Like a Pro

The stock market speaks in signals. Among them, few are as visually loud and behaviorally bold as a runaway gap. For traders chasing strong trends, understanding this gap is not optional—it’s essential. Let’s dive into what makes the runaway gap a favorite among momentum traders, especially in markets like India’s NSE and BSE.

📈 What Is a Runaway Gap & Why Does It Matter to Traders?

A runaway gap, also known as a measuring gap or continuation gap, is a price jump that occurs mid-trend—not at the beginning, not at the end, but when the market is already in full swing. It typically reflects increased investor interest, a sudden surge in demand or supply, and signals that the current trend is far from over.

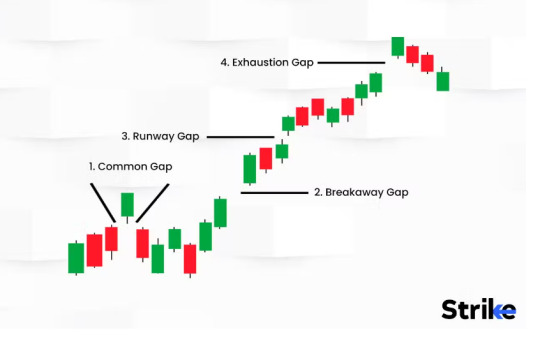

💡 It’s different from:

Breakaway gaps that launch new trends.

Exhaustion gaps that signal trend reversal.

A runaway gap doesn’t just suggest strength—it confirms it.

🧠 How to Identify a Runaway Gap on Charts (Without Guessing)

Look for these signs: ✨ A clear gap on the price chart in the direction of the prevailing trend ✨ No overlapping candles from the previous session ✨ Spiking volume during the gap ✨ No immediate reversal after the gap

✅ Tip: Use tools like Strike Money or TradingView to visualize these gaps accurately with candlestick patterns and volume indicators.

🪙 Example: Runaway Gap in TATA Motors (NSE)

In October 2023, TATA Motors saw a surge from ₹610 to ₹645 overnight after reporting stellar earnings and an upgrade from global brokerages. There was no prior resistance at ₹645, and the volume hit a 52-week high.

👉 This wasn’t a breakaway—it happened in the middle of a 3-month uptrend. 👉 The trend continued for 4 more weeks, touching ₹720. ✅ Classic runaway gap.

🔍 Breakaway vs Runaway vs Exhaustion Gap: Why It Matters

🟥 Breakaway Gap ➤ Appears at the start of a trend 🟨 Runaway Gap ➤ Occurs mid-trend, confirms momentum 🟩 Exhaustion Gap ➤ Near the end, often reversed shortly after

🎯 Misidentifying a gap type can lead to wrong entries or mistimed exits.

🔬 What Research Says About Runaway Gaps (Backed by Data)

According to the Journal of Technical Analysis (2021), runaway gaps have a 68% continuation rate over the next 10 trading days. 📊 A Bloomberg Intelligence report showed that Nifty 50 stocks forming runaway gaps in high-volume environments had a 20% higher probability of achieving new short-term highs.

📚 As John J. Murphy notes in Technical Analysis of the Financial Markets, “Runaway gaps typically occur halfway through a move and act as a measuring tool for future price projection.”

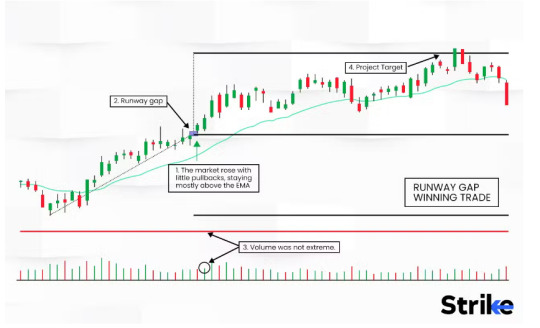

🔄 Why Volume Confirms the Runaway Gap (Don’t Ignore This)

🔊 Volume is the amplifier of a gap’s credibility. A runaway gap without volume is like a rocket without fuel—it might lift off, but it won’t last.

In the HDFC Bank case (June 2023), a ₹50 upward gap came with 2x average volume. Analysts called it speculative. Within 2 sessions, the price pulled back and filled the gap—proving it wasn’t a true runaway gap.

💡 Look for volume confirmation using Strike Money’s volume overlay feature. It helps distinguish valid moves from fakeouts.

💡 Market Psychology Behind Runaway Gaps

Runaway gaps tell a story: 🔹 Buyers or sellers are in control 🔹 News, earnings, or macro triggers fuel mass action 🔹 Late entrants jump in, pushing the trend further 🔹 Short-sellers get squeezed, adding more pressure

🧠 It’s not just technical—it’s psychological warfare on charts.

📊 How to Trade a Runaway Gap: Entry, Stop Loss, and Target

🔥 Entry: Wait for the first pullback candle after the gap. Enter on next green (bullish trend) or red (bearish trend) candle. 🛑 Stop Loss: Set it just below the gap low (bullish) or above the gap high (bearish). 🎯 Target: Use Fibonacci extensions or project the same move as before the gap—it often mirrors.

✅ Strike Money’s tools make this analysis visual and beginner-friendly.

📌 Real-World Runaway Gap Example: INFOSYS in January 2024

INFY jumped from ₹1,480 to ₹1,545 after beating Q3 earnings. 📈 Volume was 2.3x the daily average 📈 RSI showed bullish divergence 📈 Analysts on Moneycontrol projected a ₹1,600 target 📈 Price hit ₹1,610 in the next 8 sessions ✅ Clean runaway gap confirmed with trend continuation

❌ Common Mistakes When Trading Runaway Gaps

⚠️ Jumping in without volume confirmation ⚠️ Mistaking an exhaustion gap for a continuation ⚠️ Ignoring macro triggers like RBI policies or global cues ⚠️ Placing stops too tight, getting stopped out early

🧠 Remember: Gaps aren’t guarantees. They're signals. Combine with confirmation tools like Strike Money.

🛠️ Best Tools to Spot Runaway Gaps in Indian Market

📍 Strike Money – Made for Indian traders. Visualize gaps, draw zones, use real-time volume overlays. 📍 TradingView India – Deep historical charts, useful for backtesting. 📍 Finviz – For U.S. markets, but not ideal for NSE/BSE. 📍 ThinkorSwim (TOS) – Professional-level, more common with F&O traders.

💬 “Strike Money has a visual gap detection module that helps me never miss a runaway,” says Mumbai-based trader Ankit Mehra.

📚 What Experts Say About Runaway Gaps

🧠 John J. Murphy: “Runaway gaps provide a psychological midpoint—where the crowd acknowledges the trend and joins it.” 📊 Nithin Kamath (Zerodha) has noted in interviews that gap-based strategies work well in news-driven moves, particularly in the mid-cap space. 💬 Investopedia defines it as “a strong signal that institutional money is flowing in and continuing a trend.”

💬 FAQs About Runaway Gaps (Clear the Confusion)

🔹 Do runaway gaps always fill? Not always. Only 30–35% fill within 30 days if confirmed with volume.

🔹 Are they bullish or bearish? They can be both. It depends on the trend direction.

🔹 Best timeframe to trade them? Daily charts work best. But intraday traders use 15-min charts with volume.

🔹 How to confirm one? Volume spike, strong trend context, and no overlap with prior candles.

🔹 What if it fails? Use tight stop loss. Not every gap is tradeable.

🎯 Final Thoughts: Make Runaway Gaps Work for You

📌 Runaway gaps are powerful technical tools—but only when used right. 📌 They appear mid-trend and can forecast strong continuation moves. 📌 Confirm with volume, momentum, and context. 📌 Use charting tools like Strike Money to visualize and act confidently. 📌 Learn from past Indian stock cases—TATA Motors, INFOSYS, HDFC Bank—and apply insights in real time.

🔑 In trading, timing is everything. Recognizing a runaway gap might just be the edge you need.

0 notes

Text

Identifying the Cup and Handle Pattern on Price Charts

The cup and handle pattern is a popular technical analysis pattern used by traders to identify potential bullish continuation patterns in price charts. It consists of two main components: the cup, which resembles a rounded bottom, and the handle, which forms a smaller consolidation pattern near the highs of the cup. Here's how to identify the cup and handle pattern on price charts:

1. Formation of the Cup:

The cup portion of the pattern typically begins with a downtrend, as prices decline.

As the downtrend exhausts, prices gradually start to reverse and form a rounded bottom, resembling a "cup" shape.

The cup should exhibit smooth and rounded price action, indicating a gradual transition from selling pressure to buying pressure.

The depth and duration of the cup can vary, but it should generally span several weeks to months.

2. Formation of the Handle:

After the cup formation, prices may experience a minor pullback or consolidation phase, forming the handle of the pattern.

The handle is characterized by lower trading volume and narrower price swings compared to the cup.

It typically takes the shape of a smaller, downward-sloping price channel or a sideways consolidation pattern.

The duration of the handle is usually shorter than that of the cup, typically spanning several days to a few weeks.

3. Breakout Confirmation:

The cup and handle pattern is considered complete when prices break out above the resistance level formed by the highs of the cup.

This breakout is accompanied by increased trading volume, indicating renewed buying interest and potential continuation of the uptrend.

Traders often look for a decisive breakout with a strong close above the resistance level to confirm the pattern's validity.

4. Volume Analysis:

Volume analysis plays a crucial role in confirming the cup and handle pattern.

During the formation of the cup, trading volume tends to decline as prices stabilize and begin to reverse.

In the handle formation, volume should contract further, signaling reduced selling pressure and potential accumulation by buyers.

A breakout accompanied by above-average volume adds credibility to the pattern and increases the likelihood of a sustained uptrend.

5. Price Targets:

Traders often use the height of the cup as a price target for the breakout move.

To calculate the price target, measure the distance from the lowest point of the cup to the highest point and add it to the breakout level.

Additionally, some traders use Fibonacci extensions or other technical analysis tools to identify potential price targets beyond the initial target.

Conclusion:

Identifying the cup and handle pattern on price charts requires careful observation of price action, volume trends, and pattern characteristics. While the pattern can signal bullish continuation, traders should always use additional confirmation signals and risk management techniques before making trading decisions based on technical patterns alone.

0 notes

Text

Will The Resiliency Of Equity Markets Continue – Sprott Precious Metals Projections

Using a hefty silver or gold bar as a doorstop is how this interview got started!

Watch The Interview Here

Our discussion covered the following topics and questions:

Looking at the equity markets, what are your thoughts on where it may go from here?

What can a sentiment indicator tell us about picking tops/bottoms and betting against the trend?

NVDA is rocketing higher almost every day. Using Fibonacci to estimate where the price may go, what is the likelihood that the 100% extension will be reached?

As the masses head back to Advisors and strategies like buy and hold, is this something to consider?

How do you think gold, silver, and the miners are hanging in there against potential rate cuts? Where do you see precious metals going from here?

Watch The Interview Here

1 note

·

View note

Text

MKR has both bullish momentum and structure on the one-day chart Demand in the spot markets was encouraging and showed the token is likely to break above the $1,500 resistance Maker [MKR] has gained 35% and counting in just over two weeks. The rally from the $1071 level has not yet halted, although the bears did beat the bulls back slightly from the $1500 high MKR reached a few hours ago. Is your portfolio green? Check the Maker Profit Calculator A previous analysis from AMBCrypto pointed out a few days ago that the $1235-$1279 zone was a region of support where the bulls could initiate another move upward. How much further can this rally extend? The Fibonacci extension levels showed the rally was likely to go past $1500 Source: MKR/USDT on TradingView On the one-day chart, the market structure of MKR was strongly bullish. The rally in June in July saw a pullback to the $1037 level and consolidated there for a few days. This was the 61.8% retracement level. The move past $1121 on 31 August flipped the structure bullishly and the rally continued to surge higher. The Relative Strength Index (RSI) was at 72 to show intense northward impetus but worryingly, the On-Balance Volume (OBV) has only noted relatively minor gains in September. The conclusion remained positive for the buyers and it was likely that MKR would move past $1500 to the 61.8% extension level at $1700. However, it was possible that MKR could face resistance at the 23.6% extension level at $1497 and witness a minor dip to retest the $1350-$1370 former resistance zone. This could offer buyers an opportunity to re-enter long positions. Alternatively, a move above $1500 can also be used to enter long positions, although volatility could mess up the trade. Hence managing the trade would be particularly important. The near-term sentiment was firmly in favor of the bulls Source: Coinalyze The Open Interest (OI) chart noted massive gains over the past three days. It climbed from $90 million to $130 million, and the spot CVD also registered respectable gains. The OI showed speculators in the futures markets retained their strong bullish conviction. Realistic or not, here’s MKR’s market cap in BTC’s terms The rise in spot Cumulative Volume Delta (CVD) highlighted demand in the spot markets and was an encouraging development. It made MKR’s rally past $1500 more credible. Source

0 notes

Text

An Introduction

Welcome to the world of Alpha Fibonacci, where ancient Fibonacci wisdom built a foundation for the renowned Alpha Fibonacci Precise Trading Method. In this ebook, you’ll embark on a journey to discover the power of the Alpha Fibonacci Trading System, a revolutionary approach that has transformed the way traders navigate financial markets. Whether you’re new to trading or a professional trader, this e-book will provide you with the insights to elevate your trading game to the Alpha Precision.

Chapter 1: Introduction to Fibonacci

In this chapter, we’ll explore the fascinating origins of the Fibonacci sequence, its discovery by Leonardo of Pisa, and how these intriguing numbers appear in various aspects of nature. We’ll then delve into how the Fibonacci sequence forms the foundation for our Alpha Fibonacci Trading System, setting the stage for its application in the financial markets.

Chapter 2: Fibonacci in Trading

Here, we’ll uncover the pivotal role Fibonacci plays in trading. By comparing Fibonacci with traditional indicators, we’ll highlight its superior predictive capabilities and why it’s favored by professional traders. You’ll learn how Fibonacci levels serve as key support and resistance areas, providing a roadmap for price movement. This chapter sets the stage for understanding the core principles for precise and predictive trading.

You’ll discover the unique characteristics of Fibonacci retracement and extension levels, essential tools for identifying potential reversal points in the market. We’ll explain how these levels can be used to set entry and exit points, manage risk, and enhance your overall trading strategy. By the end of this chapter, you’ll have a solid grasp of why Fibonacci is a cornerstone of successful trading.

Chapter 3: Introduction to the Alpha Fibonacci Trading System

Now that you understand the fundamental role of Fibonacci in trading, we’ll introduce you to the Alpha Fibonacci Trading System. This chapter provides an overview of what sets this system apart from conventional trading methods. You’ll learn about its unique features, such as precision timing, adaptability to all instruments and platforms, and how it leverages the natural rhythm of the markets. By the end of this chapter, you’ll see why the Alpha Fibonacci Trading System is a game-changer for traders seeking consistent, reliable results.

Chapter 4: How Alpha Fibonacci Trading System Can Improve Your Trading

Conclusion: Embrace the Alpha Fibonacci Transformation

1.0 - A Brief History Of Fibonacci

In this chapter, we'll explore the fascinating origins of the Fibonacci sequence, its discovery by Leonardo of Pisa, and how these intriguing numbers appear in various aspects of nature. We'll then delve into how the Fibonacci sequence forms the foundation for our Alpha Fibonacci Trading System, setting the stage for its application in the financial markets .

What is important to know prior to diving into Fibonacci mathematics: math complexities are not required to apply Alpha Fibonacci but rather used as a preset settings for Precise Entries, Stops and Targets.

Fibonacci numbers were derived from an Italian mathematician Leonardo Pisano and documented initially in the 13th Century. Pisano was considered by some as the most talented Western mathematician of the Middle Ages and made many of the original contributions within complex calculations.

It was whilst journeying with his father that Pisano began to develop his mathematical skills and solve problems relating to merchant trade and price calculations. He started to observe that certain ratios of a number series can describe the natural proportions of the Universe including price data.

With this in mind Pisano devised a series of numbers that were derived by starting at 0 and 1 and then adding the two previous numbers to create the next number in the series. This series reaches all the way out to infinity and the start of the sequence looks like the following:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987 ……. and so on to infinity.

The ‘Golden Ratio’ is a term that is associated with Fibonacci and the ratio is determined by a special relationship found within the number series. After the commencement of the first few numbers there is found to be a ratio multiplier of 1.618 between each number for example:

55 x (1.618) = 89, 89 x (1.618) = 144, 144 x (1.618) = 233 and so on.

Further work has been done on the Fibonacci ratios to provide yet another sequence which is used in today’s Fibonacci Analysis. Without going too deep into the square roots, reciprocals or other mathematical formulas of these numbers the list of values which are in use are:

2.0 - Fibonacci vs Indicators TechnicaIndIndicators

Fibonacci in Trading

Fibonacci is a highly powerful natural precise predictive tool in trading when used with a proven strategy. Fibonacci cant not be placed on the charts randomly without rules and with speculative levels.Based upon mathematical concepts of the Fibonacci Sequence, nomath knowledge required to use Alpha Fibonacci correctly. Fibonacci is naturally predictive and the only tool, which can identify price entries, targets and reversals in advance of current prices. The accuracy of Fibonacci lends itself to finding precise key entries and precise key targets with retal and instituional support and resistance within the markets thus identifying precise trade entry and profit target prices.

Technical Indicators are mostly delayed with limitations in that they are often expensive, work only on certain platforms and lag behind the markets. Fibonacci Tools on the other hand are common to the vast majority of trading platforms, work on any instrument, any timeframe and are predictive in nature.

Characteristics of Alpha Fibonacci & Indicators

ALPHA FIBONACCI

INDICATORS

Naturally Predictive

Delayed

Precise

Artificial

Can be used on:

Can only be used on:

All Platforms

Specific Platforms

All Instruments

Specific Timeframes

All Timeframes

Cost can be Considerable

3.0- Introduction to the Alpha Fibonacci Trading System

The Alpha Fibonacci Trading System represents the culmination of centuries of mathematical evolution, tailored specifically for the modern trader. Developed by Alla Peters-Plocher in 2004, the system emerged from a profound understanding of Fibonacci principles and extensive market experience. Its precision was notably affirmed during the financial crisis of 2008, a time when traditional trading strategies floundered. Since 2011, traders from beginner to hedge fund manager in US and around the globe have been leveraging this Proprietary system, transforming their approach to the markets with remarkable success across all instruments and all platforms.

The Alpha Fibonacci Trading System is more than a set of tools; it's a comprehensive methodology. It adapts to all instruments and platforms, offering traders a structured approach to deciphering precise strategic market patterns. By tapping into the natural rhythm of price movements, this system allows traders to anticipate market turns with remarkable accuracy.

In the following sections, we'll explore how the Alpha Fibonacci Trading System can be integrated into your trading routine, enhancing precision, managing risk, and ultimately elevating your trading success.

Contact Fibonacci Trading Institute

If you would like to see the accuracy of Fibonacci and the FTI Method in action, then please get in touch and be welcomed as a guest in the trading room.

Contact Alla Peters- Plocher:

Phone: (925) 257-4298

Web: www.FibonacciTradingInstitute.com

0 notes

Text

A Comprehensive Guide for Traders to Mastering in Technical Analysis

Technical analysis is sometimes compared to fundamental research, which looks at the underlying economic variables and firm fundamentals, but it is not without its drawbacks and limitations. To obtain a more thorough grasp of the markets and make wise trading decisions, many traders mix the two methods.

Technical Analysis Overview:

Recognizing the advantages and goals of technical analysis.

Identifying the differences between technical and fundamental analyses.

Investigating the psychology of price changes and patterns on charts.

Crucial Concepts and Tools for Charting:

Describing the many chart kinds, such as line, bar, and candlestick.

Recognizing upward, downward, and sideways trends.

Identifying important patterns on charts, such as triangles, head and shoulders, and double tops and bottoms.

Important Technical Indicators:

Overview of well-known indicators, including the stochastic oscillator, moving averages, MACD, and relative strength index (RSI).

How to use and understand indicators to generate trading signals.

Combining indicators to confirm trade arrangements

Analysis of Support and Resistance:

Recognizing the degrees of resistance and support.

Establishing channels and trendlines.

Weghing resistance and support when making trade selections.

Analysis of Trends:

Technical tool analysis for trend strength determination.

Identifying trends' continuations and reversals.

Strategies for trading derived from trend analysis.

Price Action and Candlestick Patterns:

Comprehensive examination of popular candlestick patterns, including engulfing, hammer, and doji.

Candlestick patterns are useful for determining market sentiment.

Candlestick patterns are incorporated into trading plans.

Fibonacci Explanation:

Investigating the Fibonacci extension and retracement levels.

Utilizing Fibonacci analysis to determine levels of support and resistance and possible price goals.

Risk Management and Trading Techniques:

Creating technical analysis-based trading techniques. Setting up technical signals to establish entry and exit locations.

Putting stop-loss, take-profit, and position-sizing orders into practice as risk management strategies.

Useful Cases and Illustrative Examples:

Real-world examples of technical analysis trades that were made.

Examining deals that were successful and unsuccessful in order to draw conclusions.

Discipline and Psychology of Trading:

Use technical analysis to control your emotions when trading.