#IDT CA Final

Explore tagged Tumblr posts

Text

Buy IDT CA Final Classes from Lecturewala

Indirect Taxation is a cornerstone of modern commerce, influencing business decisions and economic policies worldwide. As a CA Final student, mastering Indirect Taxation (IDT) is crucial for a successful career in finance and accounting. Fortunately, Lecturewala offers a comprehensive suite of IDT CA Final classes designed to equip students with the knowledge and skills needed to excel in this dynamic field. In this blog, we'll explore the intricacies of IDT CA Final classes at Lecturewala, including the course overview, benefits, testimonials, highlights, enrollment process, additional resources, and frequently asked questions. By the end of this guide, you'll understand why Lecturewala is the ultimate destination for students seeking to conquer the complexities of Indirect Taxation and unlock their potential as tax professionals.

Course Overview:

Lecturewala's IDT CA Final classes provide a comprehensive and in-depth coverage of Indirect Taxation, encompassing both GST and Customs & FTP. Led by expert faculty members with years of experience in the field, these classes delve into the nuances of IDT, ensuring that students gain a thorough understanding of relevant laws, regulations, and compliance requirements. From basic concepts to advanced topics, every aspect of IDT is meticulously explained, allowing students to develop a strong foundation for their exams and future careers.

Benefits of Studying with Lecturewala:

Studying with Lecturewala offers numerous benefits that set it apart from other educational platforms. Firstly, students gain access to high-quality lectures delivered by experienced faculty members who are experts in their field. Secondly, Lecturewala's interactive teaching methods, including live sessions, Q&A sessions, and case studies, make learning engaging and effective. Additionally, Lecturewala provides comprehensive study materials, mock tests, and revision resources to support students in their exam preparation. Moreover, Lecturewala's flexible learning options allow students to study at their own pace, ensuring that each student's individual needs are met.

Testimonials from Previous Students:

The success stories of past students serve as a testament to the effectiveness of Lecturewala's IDT CA Final classes. Many students have credited Lecturewala for their success in the CA Final exams, citing the quality of instruction, depth of coverage, and relevance of course materials as key factors in their achievements. Testimonials from previous students highlight the impact that Lecturewala's classes have had on their academic and professional lives, inspiring confidence in prospective students to enroll and embark on their own journey towards success.

Course Features and Highlights:

Lecturewala's IDT CA Final classes boast a range of features and highlights designed to enhance the learning experience. From comprehensive study materials and interactive lectures to personalized guidance and support, every aspect of the course is tailored to ensure student success. Lecturewala's faculty members are renowned experts in their field, providing students with practical insights and real-world examples to aid in their understanding of complex IDT concepts. Moreover, Lecturewala's online platform offers flexibility and convenience, allowing students to access lectures and study materials anytime, anywhere.

How to Enroll in Lecturewala's IDT CA Final Classes:

Enrolling in Lecturewala's IDT CA Final classes is a simple and straightforward process. Prospective students can visit the Lecturewala website, where they will find detailed information about the course, including curriculum, schedule, fees, and enrollment instructions. Once enrolled, students gain access to Lecturewala's online platform, where they can attend live lectures, participate in Q&A sessions, access study materials, and interact with faculty members and fellow students.

Additional Resources and Study Materials:

In addition to live lectures and interactive sessions, Lecturewala provides students with a wealth of supplementary resources and study materials to enhance their learning experience. These resources may include video tutorials, e-books, practice questions, case studies, and revision notes, providing students with the tools they need to reinforce their understanding and prepare effectively for their exams. Moreover, Lecturewala's faculty members are available to provide ongoing support and guidance, ensuring that students have access to assistance whenever they need it.

Frequently Asked Questions about the Course:

Prospective students may have questions or concerns about enrolling in Lecturewala's IDT CA Final classes. Common queries may include topics such as course duration, schedule, fees, study materials, and exam preparation strategies. By addressing these frequently asked questions, Lecturewala ensures that students are well-informed and confident in their decision to enroll, empowering them to succeed in their IDT CA Final exams and beyond.

Lecturewala's IDT CA Final classes offer a comprehensive and effective solution for students seeking to master the complexities of Indirect Taxation. With expert faculty members, engaging teaching methods, comprehensive study materials, and personalized support, Lecturewala provides students with the tools and resources they need to succeed. Whether you're a beginner or an experienced learner, Lecturewala's IDT CA Final classes offer a transformative learning experience that will empower you to achieve your academic and professional goals. Enroll today and take the first step towards mastering Indirect Taxation with Lecturewala.

0 notes

Text

Get Ahead on the CA Final IDT Exam with These Insider Tips and Strategies!

Introduction to CA Final IDT

The Chartered Accountancy (CA) journey in India reaches its pinnacle with the CA Final, the last and most challenging phase. The CA Final Indirect Tax (IDT) exam stands out as a significant hurdle in this prestigious qualification process. Taking place twice a year in May and November, this examination demands meticulous preparation and strategic planning for success.

Syllabus Overview

The CA Final IDT paper, classified into three key sections, plays a pivotal role in shaping a candidate’s success:

Central Excise

Rules, Circulars, and Notifications related to the Central Excise Act of 1944 and the Central Excise Tariff Act of 1985.

Service Tax

In-depth exploration of the Service Tax framework.

GST (Goods and Services Tax)

Detailed coverage of GST, encompassing the levy and collection of CGST and IGST, concept of supply, place of supply, time and value of supply, input tax credit, and more.

Study Material for CA Final IDT

Effective preparation for the CA Final IDT exam begins with the right study material. The Institute of Chartered Accountants of India (ICAI) provides comprehensive study material, covering all essential chapters and units. This official material can be complemented with additional course books and online resources for a holistic understanding.

CA Final IDT Study Material:

Module-wise breakdown including chapters like Supply Under GST, Charge Of GST, Place of Supply, Exemptions from GST, Time of Supply, and more.

Vsmart Academy offers valuable notes and techniques for effective preparation.

Previous Year Exam Papers

Practicing with previous year exam papers is a strategic approach to excel in the CA Final IDT exam. This practice provides insights into the exam pattern, question formats, and the level of difficulty. Here are essential resources for candidates:

CA Final IDT Question Papers with Suggested Answers 2024:

Access to previous year’s question papers for May 2022, December 2021, July 2021, and January 2021.

CA Final IDT Paper Mock Test Papers 2024:

Utilize revised mock test papers for Series I and Series II to gauge your preparation level and enhance performance.

CA Final IDT Paper 2024 Weightage - Chapter Wise for New Course

Sections

Part I – GST (75 Marks)

Weightage

Section IChapter 1: Levy and collection of CGST and IGST – Application of CGST/IGST law; Concept of supply including composite and mixed supplies, inter-state supply, intra-state supply, supplies in territorial waters; Charge of tax (including reverse charge); Exemption from tax; Composition levy45%-65%Section IIChapter 1(vii): Procedures under GST including registration, tax invoice, credit and debit notes, electronic waybill, accounts and records, returns, payment of tax including tax deduction at source and tax collection at source, refund, job work Chapter 1(viii): Liability to pay in certain cases<10%-30%Section IIIChapter 1(xi): Demand and Recovery Chapter 1(xii): Offences and Penalties Chapter 1(xiii): Advance Ruling Chapter 1(xiv): Appeals and Revision10%-25%Section IVChapter 1: Introduction to GST in India including Constitutional Aspects Chapter 1(ix): Administration of GST; Assessment and Audit Chapter 1(x): Inspection, Search, Seizure, and Arrest Chapter 1(xv): Other Provisions5% -10%

Sections

Part II – Customs and FTP (25 Marks)

Weightage

Section IChapter 1(ii): Levy of and exemptions from customs duties – All provisions including the application of customs law, taxable the event, a charge of customs duty, exceptions to levy of customs duty, exemption from customs duty Chapter 1(iii): Types of customs duties Chapter 1(iv): Classification of imported and export goods Chapter 1(iv): Valuation of imported and export goods40% -65%Section IIChapter 1(vi): Import and Export Procedures including special procedures relating to baggage, goods imported or exported by post, stores Chapter 1(ix): Drawback Chapter 1(x): Refund Foreign Trade Policy Chapter 2(ii): Basic concepts relating to export promotion schemes provided under FTP20% – 45%Section IIIChapter 1(1): Introduction to customs law including Constitutional aspects Foreign Trade Policy Chapter 2(1): Introduction to FTP – legislation governing FTP, salient features of an FTP, administration of FTP, contents of FTP and other related provisions Chapter 2(i): Basic concepts relating to import and export10% – 20%

Preparation Tips for CA Final IDT

Paper Pattern:

Understand the subjective nature of the paper.

Total questions: 100

Exam duration: 3 hours

Maximum marks: 100

Answering 5 out of 6 questions.

Must Read – https://www.vsmartacademy.com/blog/preparation-strategy-to-score-good-marks-in-ca-final-idt/

Assessment Pattern Ratio:

30:70 ratio for analytical skills, comprehensive knowledge, and reporting efficiency.

Verb Usage:

Follow ICAI’s list of verbs with illustrations, such as recommend, evaluate, advice, produce, prioritize, interpret, discuss, and more.

Weightage Allocation:

Chapter-wise weightage for GST, Customs, and FTP to prioritize preparation effectively.

Revision Techniques:

Regular revisions of important chapters.

Utilize ICAI’s recommended reference for quick revision.

Sample questions for the 30:70 assessment to enhance learning.

Conclusion

In conclusion, success in the CA Final IDT exam requires a strategic and comprehensive approach. By understanding the syllabus, utilizing study materials effectively, practicing with previous year’s papers, and following the recommended preparation tips, candidates can position themselves for success in this challenging examination.

0 notes

Text

CA Final IDT Study Material Notes Pdf Nov 2023

The Indirect Tax or IDT paper is one of the most important papers in the Chartered Accountancy (CA) course. It is a comprehensive paper that covers a wide range of topics related to indirect taxes, including GST, customs duty, excise duty, service tax, and VAT (value-added tax) Preparing for this paper requires a lot of hard work and dedication, and coaching institutes play a crucial role in helping students crack this exam. In this blog, we want to tell about YM Concept Coaching Institute, which is known for providing the best coaching for the CA Indirect tax (IDT) paper Nov-2023

About the YM Concept:

YM Concept is a coaching institute that specializes in providing coaching for Students. The institute has a team of highly qualified and experienced faculty members who are experts in their respective fields. They use a unique teaching methodology that focuses on making the students understand the concepts rather than just memorizing them. This approach helps the students to retain the knowledge for a longer period of time and also helps them to apply the concepts in practical situations.

YM Concept has a track record of producing excellent results in the CA indirect tax paper. The institute has helped many students to secure top ranks in this paper, and its students have consistently achieved a high pass percentage.

Features of YM Concept:

Experienced Faculty: YM Concept has a team of highly qualified and experienced faculty members who are experts in their respective fields. They have years of experience in teaching the IDT paper and have a deep understanding of the subject.

Comprehensive Study Material: The institute provides comprehensive study material that covers all the topics in the CA indirect tax paper. The study material is designed to make the concepts easy to understand and remember.

Mock Tests: YM Concept conducts regular mock tests that simulate the actual exam environment. This helps the students to assess their preparation level and identify their strengths and weaknesses.

Doubt Clearing Sessions: The institute conducts doubt-clearing sessions where the students can clarify their doubts and get their queries answered.

Personalized Attention: YM Concept believes in providing personalized attention to each student. The batch sizes are kept small to ensure that each student gets individual attention from the faculty members.

If you are planning to appear for the CA Final IDT paper in Nov-2023, then YM Concept is the best coaching institute for you. CA Final IDT Study Material Notes Pdf Nov 2023 are available. With its experienced faculty, comprehensive study material, regular mock tests, doubt-clearing sessions, and personalized attention, YM Concept can help you crack this paper with ease. So, enroll today and give your preparation a boost!

Questionnaire + MCQs Book By CA.

Yashvant Mangal For Nov. 23

0 notes

Text

Get CA Inter GST, CA Final and CMA Final IDT regular and fastrack courses by CA Riddhi Bagmar on Edugyan

2 notes

·

View notes

Text

#law books#education#books#Indirect Tax Laws (IDT) | CRACKER#buy Indirect Tax Laws (IDT) | CRACKER#sriina

1 note

·

View note

Text

CA Final Preparation Strategy for the Last One Month

Students, you have less than a month until your Nov 2024 CA Final exams. You must be wondering how you will cover such a large course in that time and how to prepare a last-month CA Final revision plan. Don’t worry that nothing can happen to you because you are in the worst conceivable situation. You should count yourself fortunate that you have finished the course because there are still a lot of students who haven’t finished. It’s now time for review. Give it your all; ICAI will match 50% of it, and that’s all you need to pass this test.

You need to create a study plan, go over your material three times or more in advance of the exam, and practice a lot of questions to ensure you understand the material in order to achieve a solid CA Final score. Don’t waste your time, though, if you are intelligent enough to remember everything after just one rewrite. It’s time to work hard and with total commitment. A whole day’s worth of study is required.

Nevertheless, we are presuming that you successfully finished your CA Final course one time. You can also review all of the information about the CA Course on this page.

CA Final Preparation Strategy for the Last One Month

Creating brief revision notes should be the first step in the CA Final Revision Strategy from last month. To revise, you can either bring your handwritten notes on exam day or use a summary book. If you find that writing summary notes is a waste of time, use some professors’ summary modules instead.

But keep in mind that you have to have read the content you are preparing for the exam day. Do not take the one-day preparatory leave with new material.

Cover RTP and MTP

RTP and MTP must be covered by students as soon as they finish the course. Think of it as a component of your editing. It will provide you an accurate idea of how to approach the paper. Don’t wait to begin RTP and MTP until you’ve finished all the subjects.

Rather, you ought to cover RTP concurrently. You won’t need much time because it only addresses one or maybe two questions from each chapter. Finally, you can choose MTP. To be ready for the tests in November 2024, download the PDF versions of the Agrawal Classes CA Final sample test papers and the ICAI CA Final previous year papers.

Focus on Amendments

Don’t ignore the amendments; ICAI wants you to be informed about all laws and provisions at all times. Attempt to cover them first, particularly when we discuss topics like law, DT, and IDT.

Mnemonics for ISCA

For most students, ISCA is a weakness when it comes to passing the CA Final. This could be the result of having trouble remembering such details during the exam and mastering the technical terminology.

Thus, it is advised that you study this material by using mnemonic devices. Google searches and teacher’s notes from the days when mnemonics were utilized to teach this topic are also good resources. CS Executive December 2024 Exam Preparation

Must Cover AS, IND AS, and SA

This section of Accounting and Auditing AS IND AS is highly rated, and compared to other sections, SA is quicker to read and requires less effort. Aside from this, they are excellent scorers who never enter the incorrect amount of AS, IND AS, or SA. If you can’t remember such a number, just begin with the name.

Write the Section Numbers

If you don’t write down the section numbers, you might believe that your IPCC score was good. But remember that this is the CA Final, not the IPCC, which is five times more difficult. Your fundamental understanding of the sections is assessed at the IPCC level, but the ICAI wants you to be an authority on every topic when you reach the Final level.

Try to write all of the section numbers, even if you omit the subsection or clauses. Do not, however, state the incorrect section number if you are unable to remember it throughout the exam. Alternatively, you may begin with “According to the guidelines of Income Tax Law 1961..” The best way to prepare for Sections is to write a Section number.

Cover Relevant Part First

While we do not advise our students to study selectively, given the limited time, it is best to go over the most crucial subjects that your teacher has covered first.

Since your teachers have extensive experience in this area, go over those themes from all of the subjects first. Since they are familiar with the ICAI’s questioning style, start with their recommended subjects.

Watch the Revision Videos

Instead of wasting time on revising the entire concepts, you can watch the revisionary videos available on YouTube, which helps you a lot in revising the concepts, and you can directly start with the questions.

Revise the PM

The PM is frequently questioned by ICAI. Therefore, it is preferable to review the PM if you have already completed it. It is a little harder to review the PM than the AMA, but you can choose whatever questions you believe are important for the test.

Writing Skills

In the CA Exam, the presentation is a significant component. Take it seriously as it awards you with important marks. Thus, take a close look to the writing style of the ICAI Material, whether it is the SM, PM, or suggested replies, and begin rehearsing the questions.

Regarding theoretical subjects, you should first clarify the examiner’s request before writing the pertinent section number and provision. Lastly, you should provide your conclusion and any relevant case law.

Manage your Time

The majority of pupils truly only dream about attempting the entire paper. You may be laughing at me, but ICAI papers are really long, and you will need to move quickly to finish the entire work. If you haven’t started working on it yet, do so right now.

Always allow yourself enough time to complete Mock Test Papers—at least fifteen minutes before the real exam. This will introduce you to the process of attempting the entire paper.

Important Points Summarized for Last Month of CA Final Preparation

It is recommended that candidates review all of the key subjects covered in the CA final course and take topic-specific notes. This will make things easier for CA final exam candidates the day before the test.

The final candidates’ only assignment during the last month of the CA is revision. Practice guides, mock exam papers, and revision test papers should all be solved by them.

Time management is a critical skill for CA final candidates, as it is imperative that they finish their CA final papers on schedule. It is therefore recommended that CA final candidates practice in accordance with the time-bound structure.

For applicants vying for the CA finals, completing practice exams in full is crucial.

They will be able to evaluate their own performance and how well-prepared they are for the CA final exams thanks to this.

Candidates need to allocate their time and grasp the importance of the marks.

The most crucial thing for candidates to do in the final month before the CA final test is to study nonstop with little breaks.

Last Month’s Plan for CA Final Exam

Candidates must arrange their plans such that they address all of the crucial and significant subjects first. Furthermore, applicants should not skip any topics from the CA final curriculum as they are all required to be covered in the exam.

It is recommended that candidates go over the full syllabus in detail and take notes so that they may review all the key aspects of each course on test day.

It is recommended that candidates take brief notes on each topic to facilitate their comprehension throughout the exam.

Important Points to Note

Applicants should always make an effort to practice and write.

Applicants ought to make an effort to write a self-note on each subject.

Candidates for the CA finals might consider taking the ICAI practice exams.

MCQs for both categories should be practiced by candidates.

Attempt to commit headers to memory for candidates.

Candidates should confirm that they have answered all of the faculty members’ questions. Students need to have a firm grasp of every concept for the CA final exams.

Explore More : https://agrawalclasses.in/

1 note

·

View note

Text

Mastering CA Final IDT with DT Classes at Edshop Technology Private Limited

In the competitive landscape of professional education, Chartered Accountancy (CA) remains one of the most sought-after career paths, demanding rigorous dedication and comprehensive understanding.

The final stage of the CA curriculum, especially the subject of Indirect Taxation (IDT), presents intricate challenges that require adept guidance and thorough preparation.

Enter dt classes ca final at Edshop Technology Private Limited, an educational platform that stands as a beacon for CA aspirants seeking excellence in IDT for their final examinations.

Edshop Technology Private Limited has carved a niche in the realm of professional education by offering specialized coaching for CA Final IDT.

The institution’s success story is underpinned by its commitment to quality pedagogy, leveraging technology, and a team of experienced educators dedicated to nurturing the skills and knowledge base of aspiring CAs.

One of the standout features of DT Classes at Edshop Technology Private Limited is their faculty.

The institute boasts a team of seasoned professionals and subject matter experts who bring years of industry experience and academic prowess to the table.

These instructors understand the complexities of IDT and employ innovative teaching methodologies to simplify intricate concepts for students, making the learning process engaging and effective.

Moreover, Edshop Technology Private Limited understands the significance of technology in modern education.

The institution has embraced cutting-edge teaching tools and platforms to deliver high-quality lectures, live sessions, and study materials.

The utilization of technology not only enhances accessibility but also facilitates a dynamic learning experience, allowing students to interact with instructors and peers seamlessly.

The curriculum offered by DT Classes is meticulously crafted to cover every aspect of CA Final IDT comprehensively.

From in-depth coverage of GST, customs, service tax, excise duty to recent updates and case studies, the course ensures that students are well-versed with the latest amendments and practical applications of indirect taxation.

The focus on conceptual clarity and real-world scenarios equips students to tackle the complexities of IDT with confidence.

Edshop Technology Private Limited goes beyond conventional classroom teaching.

They provide comprehensive study materials, practice questions, mock tests, and revision modules designed to reinforce learning and assess students’ progress regularly.

This holistic approach aids in better comprehension and retention of complex topics, thereby boosting students’ confidence as they approach their final examinations.

Another significant advantage offered by DT Classes is their commitment to providing personalized attention to students. The institute maintains a conducive student-teacher ratio, ensuring that each student receives individualized guidance and support.

This personalized approach enables educators to understand the unique learning needs of every student and tailor their teaching methods accordingly.

DT Classes at Edshop Technology Private Limited emerges as a beacon of excellence for CA Final IDT preparation.

Their holistic approach, experienced faculty, integration of technology, comprehensive curriculum, and personalized attention distinguish them as a premier educational platform.

Aspiring CAs seeking to conquer the challenges of IDT in their final examinations can undoubtedly find guidance and support through DT Classes, setting a solid foundation for their professional journey.

0 notes

Text

CA Final DT + IDT Combo Regular In-Depth Batch New Scheme by CA Bhanwar Borana & CA Vishal Bhattad

CA FINAL DT + IDT COMBO by CA BHANWAR BORANA & CA VISHAL BHATTAD CA Final DT + IDT Combo by CA Bhanwar Borana & CA Vishal Bhattad is beneficial for the May 2024 and Nov 2024 exams. The course includes study materials that will be provided to students. Applicable for May 2024 and Nov 2024 Course CA Final Paper Direct Tax Laws & International Taxation + Indirect Tax Laws Combo Faculty CA…

View On WordPress

0 notes

Text

CA Vishal Bhattad is a chartered accountant by profession but an educator by passion. He is well-known among CA students all across India for his skill, knowledge and mastery in indirect taxes. CA Vishal Bhattad did his schooling from New High School Belpura, Amravati, Maharashtra. And then went to University of Pune

#best coaching for cseet#cseet video classes#online classes for cseet#across the spiderverse#succession

0 notes

Text

CA Raj Agrawal : Documentation

CA Raj Agrawal stands as a distinguished and highly skilled Chartered Accountant, renowned for an impressive track record rooted in unwavering commitment to excellence and an insatiable thirst for knowledge. Throughout his educational journey, he consistently showcased exceptional abilities and unparalleled dedication, securing an impressive 27th rank in the CA Final examination of 2008 and an admirable 29th rank in the CA Foundation. His educational endeavors commenced at Sunbeam School Bhagwanpur and later continued at DAV Degree College BHU Varanasi, where his passion for learning and expanding his expertise shone through.

In 2018, CA Raj K Agrawal successfully completed the IDT Committee's Certificate Course on GST, further solidifying his reputation as a dedicated professional in the field of taxation. This remarkable accomplishment serves as a true testament to his unwavering dedication to providing exceptional education and guidance. By sharing his extensive knowledge and expertise through Pendrive Classes, he consistently inspires and empowers aspiring Chartered Accountants, enabling them to achieve extraordinary success.

His achievements not only epitomize his relentless pursuit of knowledge but also demonstrate his unwavering drive for success. Not only did he attain remarkable ranks in the CA Final and CA Foundation examinations, but he also exhibited profound passion for learning and an unyielding determination to expand his expertise.

Foreword: CA Raj Agrawal

In addition to his professional feats, CA Raj Agrawal , a practicing Hindu, actively embraces and respects various religious beliefs and nationalities, thereby fostering an environment of understanding and acceptance. By recognizing the importance of diversity in creating a harmonious world, he contributes to the cohesive fabric of society, promoting unity and inclusivity.

Furthermore, his dedication to success extends beyond his remarkable academic accomplishments. Engaging in a dynamic teaching career and venturing into entrepreneurship, he generously imparts extensive knowledge and expertise to aspiring Chartered Accountants and other eager learners through his video classes. Through these endeavors, he cultivates a culture of continuous learning and growth, empowering individuals to reach their full potential.

To summarize, his journey stands as a testament to CA Raj K Agrawal unwavering commitment to excellence, insatiable thirst for knowledge, and steadfast dedication to fostering unity and inclusivity. His exceptional academic achievements, teaching career, and entrepreneurial pursuits have a profound and lasting impact on the lives of those he educates and inspires.

Individual Details: CA Raj Agrawal

On October 23rd, the delightful celebration of CA Raj Agrawal takes place in Varanasi, Uttar Pradesh, India, a city that holds a special place in his heart. With strong roots in his Hindu heritage and an immense sense of pride in his Indian nationality, he wholeheartedly embraces his unique identity.

His educational journey commenced at Sunbeam School Bhagwanpur in Varanasi, where he laid a solid foundation for his future pursuits. With unwavering dedication, he pursued a B.Com (Hons) degree at DAV Degree College, fueled by his passion.

Guided by resolute determination, he ventured onto the path of Chartered Accountancy, building a remarkable career characterized by unwavering commitment and exceptional expertise. In 2008, he accomplished a significant milestone by successfully qualifying as a Chartered Accountant, a true testament to his relentless pursuit of excellence. Among his remarkable achievements are securing the 27th rank in the CA Final and the 29th rank in the CA Foundation exams, which vividly illustrate his exceptional capabilities.

Proficient

In 2018, CA Raj Agrawal enhanced his taxation skills by successfully completing the IDT Committee's Certificate Course on GST, but enriching his already extensive knowledge in the field.

Beyond his notable academic achievements, his channels his drive for success into a flourishing teaching career and entrepreneurial pursuits, expanding his horizons and making a significant impact across various domains.

So, as we celebrate his birthday, we recognize and express gratitude for his remarkable contributions to the field of Chartered Accountancy. With unwavering dedication, academic excellence, and expertise in teaching, he is widely acknowledged as a prominent figure in financial education.

Driven by an insatiable passion for his field, CA Raj K Agrawal personifies an unyielding commitment and an unwavering pursuit of excellence. His exceptional accomplishments and steadfast determination serve as a resounding testament to his tireless quest for perfection.

Treasured: CA Raj Agrawal

The delightful flavors of Hare Bhare Kabab offer immense pleasure, tantalizing his taste buds with their exquisite taste. Additionally, the indulgent sweetness of Gulab Jamun and the velvety allure of Red Velvet Cake bring great joy. Moreover, the cherished 5 Star chocolate holds a special place in his heart, adding to his culinary delights.

When it comes to beverages, CA Raj Agrawal finds solace in the refreshing Lassi, which offers moments of rejuvenation, while the invigorating Lemonade revitalizes his senses.

Furthermore, the serene elegance of White brings tranquility to his being, evoking a sense of peace and serenity. Conversely, the vibrant charisma of Yellow captivates him with its liveliness, leaving a lasting impression.

Romantic songs hold a special place in his heart, captivating him with their enchanting melodies and heartfelt lyrics. Among movies, Dilwale Dulhaniya Le Jayenge is his favorite, enthralling him with its captivating plot and well-drawn characters.

The soulful voice of Kumar Shanu deeply resonates with him, touching his heart. Furthermore, he admires Salman Khan's versatility in flawlessly portraying diverse characters on the screen.

Football ignites his passion, captivating him with its thrilling and fiercely competitive nature. During leisure time, playing Ludo brings him joy, fostering friendly competition and shared enjoyment with others.

Character: CA Raj Agrawal

Demonstrating unwavering commitment to maintaining a healthy lifestyle, he prioritizes his well-being by consciously refraining from smoking and consuming alcohol. So, valuing the importance of staying active, CA Raj K Agrawal rarely frequents the gym, instead choosing to incorporate physical activity into his daily routine through regular walks. Through mindful decision-making, he nurtures his physical health and overall well-being, resulting in a fulfilling and harmonious existence.

Family Ties

Surrounded by the unwavering support and love of his family, CA Raj Agrawal discovers profound fulfillment and happiness, cherishing their constant presence. The Agrawal family stands as a steadfast source of encouragement, consistently showering him with love and nurturing his personal growth. Together, they navigate the highs and lows of life, finding solace and strength in the deep bond they share.

Thus, their children's presence brings immense joy and ignites passion, inspiring both him and Megha profoundly. Inspired by their role models, they join forces, excel, and create lasting memories that leave a profound impact.

Acquaintance

Enveloped by the warm embrace of their tightly-knit familial connection, he discovers solace and draws unwavering strength. Their profound love becomes the driving force behind his aspirations, propelling him towards a brighter future for their children. In this nurturing environment, dreams flourish, aspirations thrive, and love creates an enchanting sanctuary for their family.

Supported wholeheartedly by Megha Agrawal and their children, Simona and Bhuvit, their love becomes the catalyst for his personal growth. The presence of their children fills their lives with boundless joy, endless inspiration, and treasured memories crafted through shared experiences. United by deep family ties, CA Raj Agrawal finds unwavering strength and love, propelling him towards a promising future. Together, within their nurturing environment, dreams are cultivated, aspirations are cherished, and a thriving haven is fostered for their family.

Well-arranged: CA Raj Agrawal

With his captivating eyes, flawless black hair, and imposing presence, he effortlessly captures the attention of those around him. His unmatched self-assurance exudes an air of confidence, leaving a memorable impression on every person he encounters. Overflowing with charm and unwavering composure, he makes an indelible mark on the lives of those he interacts with.

Irresistible

The outstanding accomplishment of him in the CA Final examination drew numerous students seeking his invaluable guidance and expertise.

Starting with a modest initial enrollment of only six students in 2008, he embarked on a transformative journey. Initially conducting in-person teaching sessions, he personally traveled to various locations in Kerala to share his extensive knowledge. In 2018, CA Raj Agrawal embraced online classes, marking a remarkable shift towards the digital realm. This shift to virtual teaching allowed StudyAtHome to provide students with convenient access to high-quality educational content featuring esteemed educators.

Thus, he undeniable impact of his teachings is evident through the exceptional achievements of his students. Several of them achieved remarkable All India Ranks, thus confirming the effectiveness of his teaching methods. His unwavering commitment to teaching empowers students to achieve unparalleled success.

Establish a Connection: CA Raj Agrawal

Celebrated for his remarkable academic brilliance, CA Raj K Agrawal emerges as a prominent figure in the finance domain, exemplifying exceptional capabilities through impressive rankings in the CA Final (27th) and CA Foundation (29th) examinations. So, his educational journey commenced at Sunbeam School Bhagwanpur in Varanasi, where his passion for learning was ignited. Building upon this strong foundation, he pursued a BCom (H) degree at DAV Degree College in Varanasi.

In 2018, he completed the GST Certificate Course, displaying his commitment to continuous learning and industry updates. CA Raj Agrawal 's pursuit of success finds expression through his outstanding academic achievements, flourishing teaching career, and entrepreneurial ventures.

Proudly based in Varanasi, Uttar Pradesh, he holds deep reverence for his Indian heritage and faithfully practices Hinduism. So, his unwavering passion and resolute commitment propelled him to qualify as a Chartered Accountant in 2008, achieving remarkable ranks.

Accompany : CA Raj Agrawal

In recognition of his remarkable contributions, the Honorable Prime Minister bestowed upon him a generous prize of Rs. 5 Lakhs, symbolizing deep appreciation for his exceptional achievements. His notable certifications, like Recognized Startup and Eligible Business, highlight his exceptional accomplishments and excellence. The Government of Uttar Pradesh also granted him a Certificate of Recognition, acknowledging his remarkable feats. Additionally, the MoSD&E, Government of India, presented him with a special certificate, applauding his commendable efforts.

As the Secretary of Marwari Yuva Manch Kashi, CA Raj Agrawal actively leads and makes a significant impact on the community.

Engrossed

As an esteemed author, CA Raj K Agrawal commands great admiration in the industry, earning well-deserved acclaim for his achievements and expertise. Through his books and contributions, he establishes himself as a prominent figure, providing invaluable resources to students and professionals alike.

Furthermore, his YouTube channel "StudyAtHome" boasts an impressive subscriber base of over 2.5 lakh, standing as a renowned educational hub. So, students from across the globe have benefited from its resources, leading to remarkable accomplishments.

What distinguishes his educational approach is the equal emphasis placed on practical application in addition to theoretical knowledge. CA Raj Agrawal strives to enhance students' overall understanding and equip them with essential skills for success. Through a comprehensive approach, students excel in exams and gain confidence for their future careers.

Driven by an unwavering passion for education, he travels extensively, sharing knowledge and connecting with students worldwide. Moreover, his interactions with learners from diverse backgrounds facilitate a vibrant exchange of ideas, enriching the overall learning experience.

Social organization: CA Raj Agrawal

Moreover, with unwavering commitment and compassion, he uplifts others, fostering positive change through acts of kindness and selflessness. His selflessness inspires others, igniting their potential to create meaningful change and make impactful contributions. So, through his leadership, motivation, and empowerment, he nurtures compassion and fosters collective progress, sparking active engagement in social work.

A shining testament to his dedication to inclusivity, CA Raj Agrawal generously offers free IT classes on the StudyAtHome YouTube Channel. Thus, this initiative ensures equal education access, highlighting his commitment to serving society and creating impact. By providing free education, he removes financial barriers and empowers individuals, recognizing the transformative power of education. Through this remarkable endeavor, he enables individuals to unleash their full potential and embrace a brighter future.

0 notes

Text

https://lecturewala.com/ca-final-idt-regular-batch-by-ca-yashwant-managal

CA / CMA Final IDT (In Depth) Course New Scheme Latest Recording By CA Yashvant Mangal: Pen Drive / Online Classes

Welcome to a transformative journey in the realm of taxation with the latest offering from CA Yashvant Mangal — the CA / CMA Final IDT (In Depth) Course. This meticulously crafted course is designed to equip aspiring Chartered Accountants and Cost and Management Accountants with the in-depth knowledge required to conquer the challenges of indirect taxation. Dive into the world of CA Yashvant Mangal’s expert guidance through the convenience of Pen Drive and Online Classes.

0 notes

Text

Guide for the Preparations of CA Exams in the Last 30 Days

Chartered accountancy is among the most challenging professional courses one can pursue. The course includes three levels program comprising of foundation stage, intermediate level and final courses. Moreover, the difficulty level of examination has made it tough for the aspirants to clear the exam.

Here are the top CA preparation tips you need to follow for the last month in addition to professional help.

Develop a new study plan

To crack the CA examination, the aspirant must develop a proper plan for the last 30 days. It is better to develop a new study plan that includes revising entire syllables while allotting sufficient time for each subject or topic.

Moreover, there should be a smart revision strategy set for either daily or weekly to emphasize important topics. But one should remember not to study for too long and have sufficient time to relax and sleep.

Start revising topics

The aspirants must start revising the subjects that are easy for them. This will help them cover the syllabus in less time. Moreover, it will boost the confidence level and will ensure you have enough time to focus on difficult topics.

You can also take up professionals' help from Bhanwar Borana pen drive classes. Professional guidance will help you get thorough knowledge about the subjects.

Solved mock papers and previous year papers

By solving previous year question papers and taking a mock test, the aspirant can assess the examination pattern, questioning trends, and difficulty level. Moreover, by solving the paper in a time-bound manner, one can learn how to utilize the time properly during the exam.

Work with self-prepared notes.

While preparing, the aspirant must refer to a lot of books, but it is important to remember that consulting too many books might create confusion. Also, it and there might not be enough time to study all the topics in detail; therefore, coming up with self-prepared notes for quick revision can be very helpful.

Get Help from a Certified Professional

Help from a professional can help you develop the right study plan and acquire the right study material. In case you need professional guidance, Bhanwar Borana Pendrive classes from COURSE TRAIL can be beneficial. Get in touch with them to improve your exam clearing possibilities.

#bhanwar borana pendrive classes#ca final idt pendrive classes#ca final direct tax pendrive classes#bhanwar borana#CA pendrive classes

1 note

·

View note

Text

CA Final IDT Classes Fast Track Batch For Nov 2023

Advanced your preparation with Yashvant Mangal's CA final IDT classes fast-track batch for Nov 2023 and May 2024 exams. These specifically designed fast-track formula 50 video lectures, totaling 70 hours, cover topics like GST, Customs, and FTP in the new syllabus. The video lectures are up to date till April/2023 and are downloadable and as well as available on a pen drive. Along with these lectures, you will get the study material. So get CA Yashvant Mangal's video lectures and master your exams using expert insights.

0 notes

Text

CA Mahesh Gour - Edugyan

Get CA Final Indirect Tax Laws (IDT) regular and exam oriented batch by CA Mahesh Gour on Edugyan.

1 note

·

View note

Photo

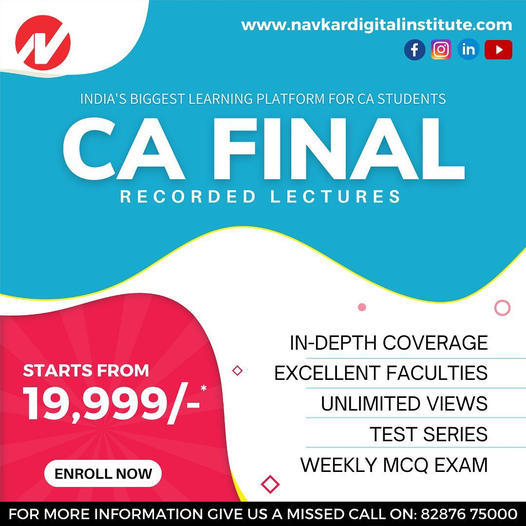

CA Final Recorded Lectures | CA Final Online Classes | CA Final Registration Fees | CA Final Audit Classes | SFM CA Final Classes | CA Final FR Classes

Navkar Digital Institute is the Best CA Final Online Coaching Classes in India that aims to provide Quality-Education to students through E-Learning Platform. Get CA Final Pendrive Classes of India’s Top Faculties for Group 1, Group 2, and Both Groups Combo at Competitive Price.

For more information about CA Final New Syllabus Video Lectures, you can send us a mail at [email protected] or give us a missed call on 8287675000 or visit our website: https://www.navkardigitalinstitute.com/courses/online-ca-courses/ca-final/

#CA Final Registration Fees#CA Final Audit Classes#SFM CA Final Classes#CA Final Law Classes#CA Final Online Classes#CA Final FR Classes#CA Final IDT Classes#Video Lectures for CA Final

0 notes