#India Union Budget 2022

Photo

Scott Horton · Drew Sheneman, Newark Star-Ledger

* * * *

LETTERS FROM AN AMERICAN

February 15, 2023

Heather Cox Richardson

President Joe Biden hit the road today to continue the push to highlight the successes of his administration's investment in the economy. In Lanham, Maryland, at the International Brotherhood of Electrical Workers (IBEW) Local 26, he celebrated the economic plan that “grows the economy from the bottom up and the middle out, not the top down.”

He praised union labor and said that the nation’s investment in green energy would mean “good-paying jobs for electricians, plumbers, pipefitters, laborers, carpenters, cement masons, ironworkers, and so much more. And these are good jobs you can raise a family on.” “It’s a stark contrast to our Republican friends, who are doubling down on the same failed politics of the past. Top-down, trickle-down economics is not much trickle down…to most kitchen tables in America,” he said.

He reiterated that he would lay out his budget on March 9 and that he expected the Republicans to lay out theirs, so people can compare the two. Biden maintains that his policy of investing in infrastructure and putting money in the hands of ordinary Americans will nurture the economy and reduce the deficit as growth brings in more tax dollars. Meanwhile, he said, the Republican tax cut of 2017 has already added $2 trillion to the federal deficit.

Good economic news is putting wind under Biden’s wings. The economy continues to perform better than expected in 2023. Retail buying increased 3% in January, and the job market remains strong. The administration today highlighted another series of large private sector investments in American manufacturing: Boeing announced that Air India has contracted to buy more than 200 aircraft; Ford announced it will build a $3.5 billion factory in Marshall, Michigan, to make advanced batteries for electric vehicles; and Texas Instruments announced it will build an $11 billion semiconductor plant in Lehi, Utah.

Biden emphasized that these investments would provide “good-paying jobs that [Americans] can raise a family on, the revitalization of entire communities that have often been left behind, and America leading the world again in the industries that drive the future.”

Biden accused the Republicans of proposing measures that would raise the deficit, which is already rising again. The Congressional Budget Office today projected a much higher deficit for 2023 than it did in May 2022 because of new laws, mandatory spending for Social Security and Medicare, and higher interest rates in place to combat inflation. The CBO notes that “spending substantially exceeds revenues in our projections even though pandemic-related spending lessens. In addition, rising interest rates drive up the cost of borrowing. The resulting deficits steadily increase the government’s debt. Over the long term, our projections suggest that changes in fiscal policy must be made to address the rising costs of interest and mitigate other adverse consequences of high and rising debt.”

This is precisely what Republicans have been complaining about with regard to the Democrats’ recent laws to rebuild infrastructure and invest in the economy, while ignoring that their own tax cuts have also added mightily to the deficit. Republicans want to address the rising deficit with spending cuts; Biden, with taxes on wealthy Americans and corporations.

Biden appears to be trying to turn the nation to a modern version of the era before Reagan, when the government provided a basic social safety net, protected civil rights, promoted infrastructure, and regulated business. Since the 1980s, the Republicans have advocated deregulation with the argument that government interference in the way a company does business interrupts the market economy.

But the derailment of fifty Norfolk Southern train cars, eleven of which carried hazardous chemicals, near East Palestine, Ohio, near the northeastern border of the state on February 3 has powerfully illustrated the downsides of deregulation. The accident released highly toxic chemicals into the air, water, and ground, causing a massive fire and forcing about 5,000 nearby residents in Ohio and Pennsylvania to evacuate. On February 6, when it appeared some of the rail cars would explode, officials allowed the company to release and burn the toxic vinyl chloride stored in it. The controlled burn sent highly toxic phosgene, used as a weapon in World War I, into the air.

Republican Ohio governor Mike DeWine has refused federal assistance from President Biden, who, he said, called to offer “anything you need.” DeWine said he had not called back to take him up on the offer. “We will not hesitate to do that if we’re seeing a problem or anything, but I’m not seeing it,” he said.

Just over the border, Pennsylvania governor Josh Shapiro, a Democrat, said that Norfolk Southern had botched its response to the accident. “Norfolk Southern has repeatedly assured us of the safety of their rail cars—in fact, leading Norfolk Southern personnel described them to me as ‘the Cadillac of rail cars’—yet despite these assertions, these were the same cars that Norfolk Southern personnel rushed to vent and burn without gathering input from state and local leaders. Norfolk Southern’s well known opposition to modern regulations [requires] further scrutiny and investigation to limit the devastating effects of future accidents on people’s lives, property, businesses, and the environment.”

Shapiro was likely referring to the fact that in 2017, after donors from the railroad industry poured more than $6 million into Republican political campaigns, the Trump administration got rid of a rule imposed by the Obama administration that required better braking systems on rail cars that carried hazardous flammable materials.

According to David Sirota, Julia Rock, Rebecca Burns, and Matthew Cunningham-Cook, writing in the investigative journal The Lever, Norfolk Southern supported the repeal, telling regulators new electronically controlled pneumatic brakes on high-hazard flammable trains (HHFT) would “impose tremendous costs without providing offsetting safety benefits.” Railroads also lobbied to limit the definition of HFFT to cover primarily trains that carry oil, not industrial chemicals. The train that derailed in Ohio was not classified as an HHFT.

Nonetheless, Ohio’s new far-right Republican senator J. D. Vance went on the Fox News Channel show of personality Tucker Carlson to blame the Biden administration for the accident. He said there was no excuse for failing infrastructure after the passage last year of the Bipartisan Infrastructure Bill, and said that the administration is too focused on “environmental racism and other ridiculous things.” We are, he said, “ruled by unserious people.”

He also issued a statement saying that “my office will continue to work with FEMA” over the issue, although FEMA, the Federal Emergency Management Agency, has not been mobilized because Ohio governor DeWine has not requested a federal disaster declaration.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From an American#heather cox richardson#infrastructure#Corrupt GOP#Criminal GOP#MAGA Republicans#Drew Sheneman#political parties#train wreck#government regulations

9 notes

·

View notes

Text

NECESSARY OILING!

The government is planning to invite top global oil and gas giants to bid for its stake in ONGC. The

petroleum ministry plans to approach the multinational companies and their investment bankers

after the union cabinet clears strategic disinvestment of the ONGC.

These sales are a priority of the government as it fears that the fiscal deficit may widen.

The deficit stood 45.5% above the target of Rs 7.96 lakh crore within the first nine months of FY22.

India’s fiscal deficit stood at Rs 11.6 lakh crore at the end of 2022.

Finance Minister Nirmala Sitharaman had in her previous budget for 2021-22 set a target of raising

Rs 2.1 lakh crore from privatisation and sale of minority stakes in state-owned companies. This

includes Rs 1.20 lakh crore from selling stake in CPSEs and Rs 90,000 crore from stake sale in

financial institutions.

TASK IN HAND:

Disinvestment department DIPAM is working out a plan to offload the entire government equity of

68.94 per cent in the ONGC to a strategic partner.

You are the Finance Head of DIPAM and have to propose a plan to the investors.

• Snapshot and Benefits of Deal structure

• Strategies to improve company’s position.

• Future Plans of Expansion

Hint: You have 3 options:

Merger with a State owned oil company.

Selling stake to Foreign Investors

Selling stake to Domestic Investors

Preparation time - 15mins

PPT requirement - 5-6 slides

Presentation Time - 3-5 minutes each

Mail your PPTs to [email protected]

Submit the PPTs by 10:45 max.

2 notes

·

View notes

Text

Exploring the 2024 Union Budget: International Tax Insights

What are the key details that taxpayers should be aware of regarding the 2024 tax changes?

Key Highlights

The Finance Minister of India presented the Union Budget 2024 on 23 July 2024. The Budget includes several positive proposals, such as tax incentives for small businesses, increased funding for infrastructure development, and measures to support sustainable energy initiatives. Thus, the purpose of these suggestions is to boost the economy, e-commerce growth in India and tackle several issues.

The Income Tax Act is due for a review, and the government has suggested much-needed changes, which are long overdue.

The base corporate tax rate for nonresident corporate taxpayers has been reduced from 40% to 35%.

The removal of angel tax provisions and the introduction of Equalisation Levy 2.0 will have a significant impact and are considered game changers.

The rationalization of the TDS Regime is a positive step forward and is sure to benefit the country's overall growth.

The removal of indexation to compute cost while calculating gains will significantly impact the capital gains tax regime. With the removal of the buyback tax, the tax incidence will now shift to the recipient.

The government has restated its commitment to simplifying processes, rationalizing GST rates, and expanding GST coverage to all sectors.

Customs duties will be waived for key sectors like healthcare, solar, critical minerals for renewable energy, and high-tech electronics. Additionally, there will be a reduction in customs duties for mobile phones, gold, precious metals, and the leather and textile industries.

Introduction of a one-time tax settlement scheme called Vivad se Vishwas (VSV) to help quickly resolve ongoing tax disputes.

The government of India is currently engaged in modernizing its international tax policies and administration. This initiative encompasses the implementation of a variety of tax incentives and rate reductions, as well as the substantial digitalization of critical processes.

Tax Insights: Introduction

During the presentation of the Union Budget for 2024-2025, the Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman underscored the budget's emphasis on several identified priorities aimed at expediting the journey toward the goal of Viksit Bharat.

The Finance Minister highlighted the government's ongoing efforts to simplify taxes, improve taxpayer services, and reduce legal disputes. Thus, the taxpayers have responded positively to these efforts.

In the fiscal year 2022-23, Smt. Sitharaman highlighted that 58 percent of corporate tax revenue was contributed by the simplified tax regime. Additionally, over two-thirds of taxpayers chose to adopt the new personal income tax regime based on the data available.

During the budget presentation, the Finance Minister also announced a number of attractive benefits designed to provide tax relief to salaried individuals and pensioners who choose the new tax regime. The Union Budget for the fiscal year 2024-2025 has incorporated a range of provisions and amendments, underscoring the government's dedication to establishing a streamlined and effective tax framework.

What is the major objective of the International tax sector?

International taxation serves various objectives, such as ensuring fair distribution of tax burdens, preventing the illegal avoidance of taxes, fostering economic growth, and facilitating international collaboration. However, the following are the primary purposes of the International tax sector.

Preventing Double Taxation

Encouraging International Trade and Investment

Preventing Tax Evasion and Avoidance

Equitable Distribution of Taxing Authority

The encouragement of International collaboration

Union Budget 2024 International tax updates

Following are the International tax sector updates:

Rationalisation of taxes and rates

E-commerce operators from foreign countries, who supply or facilitate the e-commerce supply of goods or services into or relating to India, are currently burdened with India’s digital service tax, the equalisation levy, which is imposed at a significant 2 percent of the gross consideration. The impending discontinuation of this tax will bring a welcome relief and is scheduled to take effect from 1 August 2024.

From fiscal year 2024–2025, foreign companies will have a reduced corporate tax rate of 35 percent, down from 40 percent.

Relief/beneficial provisions

Angel tax is a tax that private companies have to pay when they issue shares to someone at a price higher than the fair market value of the shares. The government's proposed Finance Bill aims to get rid of angel tax starting from April 1, 2024. This will be a great relief for companies that receive investments, including those from foreign sources.

The safe harbour rules will be expanded, and the transfer pricing assessment procedure will be streamlined.

IFSC-regulated finance companies may be exempt from thin capitalization rules as long as they meet certain conditions. This would put them on the same level as banks, some NBFCs, and insurance companies.

Other changes

A new presumptive taxation regime is being considered for cruise ship operations conducted by non-residents in India, effective from the fiscal year 2024–25. This regime would deem 20% of the specified gross receipts as business income. Additionally, Cruise Ship Operators (CSOs) would be exempt from the presumptive taxation regime for non-resident shipping businesses. Specific group companies of these CSOs receiving lease rentals would also be eligible for tax exemption until the fiscal year 2029–30.

With effect from 1st October 2024, a significant change has been implemented in the tax treatment related to share buybacks by domestic companies. The tax burden has now been transferred from the company to the shareholders. The consideration received by the shareholder will be taxable as a "dividend" at applicable tax rates without any deduction for expenses, potentially resulting in a capital loss. Shareholders must proactively consider tax treaty benefits or dividend deductions available to them.

Before April 1, 2024, if a taxpayer transferred a capital asset through a gift, will, or irrevocable trust, it was not considered a "transfer" under the Income Tax Act. Therefore, no capital gains tax was applied to the transferor. Starting April 1, 2024, this rule will only apply to transfers by individuals or Hindu undivided families. This means that gifts or transfers to an irrevocable trust of any capital asset by other taxpayers will be subject to capital gains tax.

Procedural matters

Currently, there is a time limit of seven years to pass an order deeming a person to be in default for failure to deduct or deposit TDS for resident payees. However, there is no such time limit for non-resident payees. Similarly, no time limit has been prescribed for cases of failure to collect or deposit tax at source (TCS). It is proposed to provide a common limitation period of six years for passing such an order for both resident and non-resident payees. A similar timeline has been prescribed for passing orders in the case of TCS provisions.

Effective April 1, 2025, a proposal to streamline compliance for non-resident liaison offices and introduce penalties for delayed compliance will take effect. Currently, the requirement dictates that the statement of activities must be filed within 60 days from the end of the fiscal year. The proposed changes will entail the specification of new timelines through established rules.

Applications for advance rulings that have been transferred from the Authority for Advance Rulings to the Board for Advance Rulings may be withdrawn by October 31, 2024, if they have not already been disposed of.

Non-locals and international businesses can settle ongoing legal disputes through the new conflict resolution program called the Direct Tax Vivad Se Vishwas Scheme 2024.

Last words

The national, state, and union territory governments of India are actively promoting foreign investment to drive economic transformation. While this presents promising opportunities, it's important for investors to approach this with caution, as both risk and opportunity are closely intertwined in India's investment landscape.

0 notes

Text

The Union Budget 2024-25, presented by Finance Minister Nirmala Sitharaman, has allocated a significant portion of the budget to the education sector, emphasizing the importance of education, employment, and skilling. As parents and students at Ecole Globale Schools, it is essential to understand how these allocations and initiatives impact education and the future prospects for students. This article provides a detailed analysis of the education budget, its key components, and its implications.

Key Allocations in the Education Budget

Financial Support for Higher Education

One of the main features of the Union Budget 2024-25 is the provision of financial support for higher education. The government has allocated Rs 1.25 lakh crore to the education sector, with specific initiatives to support students financially:

Education Loans: The budget provides loans up to Rs 10 lakh for students pursuing higher education in domestic institutions. This initiative aims to make higher education more accessible to a broader range of students, easing the financial burden on families.

E-Vouchers: An innovative approach introduced in the budget is the distribution of e-vouchers to 100,000 students annually. These vouchers come with a three percent interest subvention, further reducing the cost of education loans.

Job-Ready Education and Internships

The budget places a strong emphasis on preparing students for the job market. Several key initiatives are aimed at enhancing the employability of young people:

New Skilling Scheme: A centrally-sponsored skilling scheme has been launched in collaboration with state governments and industry partners. This scheme targets skilling two million young people over the next five years, ensuring they have the necessary skills to meet industry demands.

Internships: To provide practical experience, the government will facilitate internships for over 100 million young people aged 21-24. These internships come with a monthly stipend of Rs 5,000 from the government and Rs 6,000 from companies, along with an additional Rs 6,000 grant for incidental expenses.

Upgrading Industrial Training Institutes (ITIs)

The budget also focuses on upgrading the infrastructure and curriculum of Industrial Training Institutes (ITIs):

ITIs Upgradation: A total of 1,000 ITIs will be upgraded to ensure they provide industry-relevant skills. These institutes will adopt a hub-and-spoke model, focusing on the specific skill needs of various industrial sectors.

Shifts in Funding Priorities

The budget reflects significant shifts in funding priorities, with notable changes in allocations for higher education and school education:

Reduction in UGC Funding: The University Grants Commission (UGC) has seen a significant reduction in funding, with its budget cut by 61 percent from Rs 6,409 crore to Rs 2,500 crore. This reduction may impact higher education institutions that rely on UGC grants.

Increased Grants for Central Universities: On the other hand, grants for central universities have been increased by over Rs 4,000 crore, with Rs 15,928 crore allocated for the financial year 2024-25. This increase is expected to improve the infrastructure and capabilities of central universities.

Emphasis on School Education

The budget places a strong emphasis on improving school education, with a focus on developing model schools and improving infrastructure:

Model Schools: The government aims to develop 14,500 model schools under the PM School for Rising India (PM SHRI) program. These schools are intended to set high standards in education and infrastructure, providing quality education to students.

Infrastructure Improvements: Several key improvements in school infrastructure have been highlighted:

Girls' Toilets: The percentage of schools with girls' toilets has increased from 88.1% in 2012-13 to 97% in 2022-23.

Internet Coverage: Internet coverage in schools has grown significantly, from 6.2% to 49.7% over the past ten years.

Challenges and Concerns

While the budget introduces several promising initiatives, it also leaves certain areas unaddressed, which may pose challenges to achieving comprehensive educational improvements:

Secondary Level Dropout Rates: The budget does not sufficiently address the high dropout rates at the secondary level, which stood at 20.6% for class 10 in 2023. Addressing this issue is critical to ensuring that more students complete their education.

Academic Performance: The National Achievement Survey 2021 highlights a decline in students' performance, indicating a need for reforms in teaching methods and curriculum design. Improving academic performance at all levels of education remains a significant challenge.

Conclusion

The Union Budget 2024-25 presents a comprehensive approach to improving the education sector, with substantial allocations aimed at enhancing accessibility, skilling, and infrastructure. For parents and students at Ecole Globale Schools, these initiatives promise to provide better educational opportunities and support. However, the budget also underscores the need for ongoing efforts to address existing challenges, particularly in higher education funding and secondary level retention. By focusing on these areas, the government can ensure a more robust and inclusive education system for all.

The Union Budget and Education Budget have laid a strong foundation for the future of education in India. As we move forward, it is essential to keep an eye on how these initiatives are implemented and their impact on the education sector. With continued focus and effort, we can look forward to a brighter future for our students and the nation as a whole. For more info...https://www.ecoleglobale.com/blog/union-budget-means-for-education-budget/

0 notes

Text

India Biological and Biomedical Materials Market Assessment, Opportunities and Forecast, 2031

India biological and biomedical materials market size was valued at USD 2.5 billion in FY2023, which is expected to reach USD 7.6 billion in FY2031, with a CAGR of 14.8% for the forecast period between FY2024 and FY2031. The discovery of biomedical materials is imperatively revolutionizing modern medicinal treatment by restoring normal functioning and achieving healing for patients after undergoing complex surgeries. Living cells, tissues, metals, ceramics, and plastics can be reengineered into desired mold and parts, fibers, films that are progressively used in biomedical products and devices. Sealants and patches made from biomedical materials are significantly allowing damaged tissue to regenerate and heal in a shorter time. As patients with diabetic ulcers are prone to severe infections, they are treated with biomaterials, which leads to healing while reducing unnecessary dressing replacements.

Prominent government organizations and institutions are conducting innovative research on developing technologies and products leading to affordable healthcare under the mandated government program. An eminent collaboration of Dr. Reddy’s Institute of Life Sciences Hyderabad and University of Hyderabad developed microneedles that are potentially impacting the iron and vitamin B12 status of 170 million Indian women lying in the reproductive age and around 480 million children. IISc Bangalore has developed Fluorescence based optical volume screening system (OVSS) for interrogating multicellular organisms.

Sample report- https://www.marketsandata.com/industry-reports/india-biological-and-biomedical-materials-market/sample-request

Incorporation of Innovative Biomedical Material into Drug Delivery Systems

Biomaterials are considered a prominent asset, significantly driving the advanced drug delivery systems; they can facilitate surgery, implantation, and treatment of serious oral diseases such as periodontitis, peri-implantitis, and severe dental problems. Natural polymeric substances such as calcium phosphate, chitosan, gelatin, are substantially used to prepare various drug delivery systems. Biomedical materials have significant characteristics like antibacterial and anti-inflammatory effects and are potentially active in enhancing antibiotic activities in oral infections. In addition to oral delivery, biomedical materials are successively creating avenues for drug delivery through transdermal, pulmonary, ocular, and nasal routes where specific designing of biomaterials accomplish the desired delivery actions.

India has been progressive for spending enormous money on improving the healthcare sector. Under India’s National Health Policy, 2017, the government substantially aimed to increase spending on health by 2025 to 2.5% of GDP. In the Union Budget 2021-2022, the Indian government allocated USD 27 billion for the healthcare and wellbeing of its citizens. The huge potential of biological and biomedical materials in drug delivery systems has impeccable market opportunities to exponentially expand with the rising health sector and significant government investments.

Regulatory Adoption for Implementation of Biological and Biomedical Materials

Numerous international and country-specific standards and guidelines have been framed to regulate utilizing biological and biomedical materials. Assuring effectiveness and enabling execution, some of the recognized institutions are International Organizations for Standard guidelines, ASTM International, the United States Pharmacopeial Convention, and European Conformity Marking. Several standard tests and practices are being incorporated like testing of polymeric biological materials that are extensively used in surgical implants, assessment of selected tissue effects of absorbable biomaterials for implant with respect to muscles and bones.

Hyaluronic Acid Biopolymer is Revolutionizing the Cosmetic and Pharma Industries

Hyaluronic acid (HA) biopolymer is a naturally occurring material, delivering an imperative role in the wound healing process, generating a massive potential in regenerative medicine. Due to its valuable physicochemical properties, HA biopolymer is progressively used for treating various medical conditions including arthritis treatment (osteoarthritis), dry eye syndrome, ocular surgery (ophthalmology), cosmetic space (plastic surgery, skincare), drug delivery, etc. Hyaluronic acid is engaged in soft tissue hydration and structural scaffolding that prominently provides viscoelasticity, leading to proper lubrications and impart shock absorbing functionalities.

An apex national organization of India IBHA, that represents the cosmetics, beauty, hygiene, and personal care units in India has an estimated industry size of USD 13 billion in 2021, which is substantially growing at 8-9% annually. A report published by National Investment Promotion & Facilitation Agency estimated the market size of personal care and hygiene sector at around USD 15.050 billion, during the financial year 2022.

Biomedical Materials in Medical Implants is Successively Revolutionizing Market

The advancement in medical technology has consequently led to innovative medical implant materials varying from conventional silicone to 3D-printed biomaterials. Ultra-high molecular-weight polyethylene (UHMWPE) and hip replacement implants are progressively used in knee replacements. Cross-linked polyethylene (XLPE) can accomplish hip implants, removing the revision surgery requirement. 3D-printed implantable materials are gaining interest with a microfluidic approach that has prominently led to leaps in the vascularization of engineering tissues. In Australia, researchers have significantly developed a 3D printing Biopen device called Biosphere, enabling surgeons to repair damaged bones and cartilage by generating new cells directly.

India ranked 4th largest in the Asian medical device market and 20th globally. An extensive category of medical devices, from consumables to implantables, are utilized in India, where the majority includes drug-eluting stents, cardiac stents, orthopedic implants, intraocular lenses, etc. In April 2023, an achievement for Hindustan Syringes & Medical Devices Ltd. was appraised as they successfully supplied 1.75 billion syringes. Medtronic, a leading biomaterial company, has hugely invested around USD 362.8 million in India to expand Medtronic Engineering & Innovative Center in Hyderabad, India.

Impact of COVID-19

The outbreak of COVID-19 had a devastating impact on mankind. Biomaterials, being an essential element for several medical implant practices, like treating arthritis, joint replacements, etc., has emerged incredibly. India has been at the forefront in developing indigenous diagnostics during the COVID-19 where the DBT has announced the call on “COVID Research Consortium” and successfully commissioned COVID-19 diagnostics kits. Biomedical materials have diverse applications for enhancing COVID-19 immunotherapeutic in developing preventing vaccines, infection treatments, healing, and regeneration of damaged tissues. The pandemic situation in India was ever-growing for the medical treatments and created huge potential for the biological and biomedical materials market.

Impact of Russia-Ukraine War

The invasion of Russia on Ukraine has led to unprecedented impact on various sectors subsequently leading to deterioration of global economy including healthcare. A project named KOROVAI designed for the international community is providing aid to Ukraine with the coordination of medical material gifting. The financial sanctions on Russia by the Western countries led to severe outcomes on Russian health care facilities as Russia imports massive number of medical devices from the United States and European countries. These imperative factors severely impacted the applications of biomedical materials in treatments. The measures adopted by significant government agencies to overcome the disaster of aggression and retain the economic instability.

India Biological and Biomedical Materials Market: Report Scope

“India Biological and Biomedical Materials Market Assessment, Opportunities and Forecast, FY2017-FY2031F”, is a comprehensive report by Markets and data, providing in-depth analysis and qualitative & quantitative assessment of the current state of the India Biological and Biomedical Materials Market, industry dynamics, and challenges. The report includes market size, segmental shares, growth trends, COVID-19 and Russia-Ukraine war impact, opportunities, and forecast between FY2024 and FY2031. Additionally, the report profiles the leading players in the industry mentioning their respective market share, business model, competitive intelligence, etc.

Click here for full report- https://www.marketsandata.com/industry-reports/india-biological-and-biomedical-materials-market

Contact

Mr. Vivek Gupta

5741 Cleveland street,

Suite 120, VA beach, VA, USA 23462

Tel: +1 (757) 343–3258

Email: [email protected]

Website: https://www.marketsandata.com

#Chemicals and Materials#Biological and Biomedical Materials#Indian Market#Biological and Biomedical Materials Market

0 notes

Text

Darshan Hiranandani Announces Hiranandani Group's Dive into Technology-led Consumer Services via Tez Platforms

The new venture will introduce a wide gamut of services including social media, gaming & e-sports, blockchain and other emerging tech services

Having found success in Datacenters, Cloud Computing, and Enterprise Technology through Yotta Infrastructure, the Hiranandani Group is now turning its attention to technology-driven consumer services with its latest project - Tez Platforms. Tez Platforms will target significant opportunities in social media, entertainment, gaming, e-sports, e-commerce, personal mobility, artificial intelligence, and blockchain solutions.

"We think digital opportunities are just beginning. Following the vision of Digital India from our Prime Minister and the government, highlighted in the Union Budget 2022, we're expanding our focus on tech-driven services. Yotta Infrastructure will keep investing in cloud computing, connectivity, business applications, and cybersecurity, benefiting from our large data centers. Additionally, through Tez Platforms, we'll partner with top tech firms, both local and global, to explore new opportunities," explained Darshan Hiranandani, CEO of Hiranandani Group.

Darshan Hiranandani further stated, "We've planned to introduce two highly anticipated services in 2022, followed by three more the following year. Tez Platforms will benefit from collaboration and expertise across various Hiranandani Group divisions, while also aiming to recruit over 250 employees by FY 2023. The initial investment for launching these services this year will be around INR 1000 crore. Over the next 2-3 years, we anticipate investing approximately INR 3,500 crore."

The group will also utilize its non-profit organizations to focus on skill development and training in areas such as cloud solutions, cybersecurity, and artificial intelligence.

About the company:

The Hiranandani Group is a dynamic organization, filled with ambitious plans and a forward-looking vision. Aligned with the nation's aspirations and modernization efforts, the group invests in solutions to meet all customer needs spanning real estate, energy, infrastructure, and big data. It also contributes to societal welfare through initiatives in education and healthcare. Guided by a commitment to excellence and flawless execution, we have a proven track record of delivering landmark projects that enhance lifestyles, provide sustainable energy solutions, and offer cutting-edge infrastructure. Our real estate offerings cater to the lifestyle preferences of aspiring Indians, while our energy and infrastructure ventures are elevating standards in trade, commerce, logistics, and urban development. Additionally, our data centers represent the gateway to a new era, poised to revolutionize the digital landscape of the nation.

0 notes

Text

Interim Union Budget 2024 - Vote on Account

While India's Gross Domestic Product (GDP) grew at a pace of 6.3% in the year 2023, it is expected to grow at 7% in the year 2024. This year's vote on account (interim budget) to be presented tomorrow will be a statement of revenue and expenditure for the period preceding the conclusion of the General Elections slated to take place in the months of April-May 2024.

India's growth story is based on the single principle of self reliance. The growth of an Aatmanirbhar Bharat through various pushes given by the Government in the years succeeding the life altering pandemic of COVID 19 has spiraled India on the path of economic stability and growth amid macroeconomic turmoil across the world ravaged by wars, uncontrolled inflation and unstable policies.

The Production Linked Incentive scheme has seen a disbursement of an amount of ₹4,415 crores till October 2023. This has resulted in an investment of ₹1,03,000 crores reported till the month of November 2023. A total of 6,78,000 jobs were created in the process. The total outlay for all the Production Linked Incentive Scheme is slated to be ₹1,97,000 crores over the next few years.

While the vote on account will not bring major changes but a change in the standard deduction offered for the salaried taxpayers in the Direct Tax is expected enhancement along with the sweetening of the New Tax Regime slabs introduced in the Union Budget 2022.

The detailed budget will be brought to us sometime in June 2024 but to go by any standards set by the current NDA Government, the fillip given by record capital expenditure in terms of new infrastructure and the National Infrastructure Pipeline that is supported by the National Bank for Financing Infrastructure and Development (NaBFID) will keep India on the growth path in the years to come. The expectation for the capital expenditure outlay to increase will be normal. With the Prime Minister Gati Shakti National Monitoring Plan taking full shape, the infrastructure for logistics and its cost for the country coming down, will add to the economic growth of India faster than expected.

The total capital expenditure outlay for the Railways was pegged at ₹2,40,000 crores. This led to the push of building of Vande Bharat rakes, Amrit Bharat rakes and full electrification of the Indian Railways network. With a massive push for safety related infrastructure and modernization works of railways stations in the Amrit Bharat Station Scheme, the Budget is expected to enhance the required capital expenditure of the Indian Railways.

While the full Union Budget 2024 is awaited, this interim budget will give a birds-eye-view of the growth trajectory in the Amrit Kaal of Aatmanirbhar Bharat towards 2047 with a clear vision. India will certainly be a $4 trillion economy in FY 2024 and shall surpass $5 trillion in the coming year of FY 2025, there is buzz that India is setting itself a target of being a $7 trillion economy in the next 7 years. Definitely coupled with political stability, this is achievable.

As India steps into Ram Rajya, a bright civilization looks at the path of growth and stability and being a force to reckon with in a world full of instability, war and poor economics in this year. Jai Hind, Jai Bharat!

0 notes

Text

#2 - The Look-a-likes

Blog 2 - Producing the Feature Film

Part 1- Film Comparatives

Here is the list of the 5 films I found to show that my proposed film (a remake of 1997's Anastasia) would be doable.

In no particular order they are;

Photograph - (2019)

Genre - Drama, Romance

Budget- around $750,000 (adjusted from India rupee to USD)

Box Office- $1,340,700

Photograph, unfortunately, is my example of a box office flop. Topping out at the box office not even half of what would needed of this film to break even (3 million), it is clear are this film did not perform well.

Mr. Malcolm's List - (2022)

Genre - Comedy, Drama, Romance

Budget - $950,000

Box Office - $3,910,220

In contrast to the last film Mr. Malcolm's List is a great example of a recent romance film that has done modesty well for itself at the box office. With the film needing a break even point at $3.8 millions, Mr. Malcolm's List passed the mark grossing $3.9 million.

The Great (2020–2023)

Genre - Biography, Comedy, Romance, Drama

Budget - around $1,000,000 per episode (estimated from the $30 million budget report to be spend for seasons 1 & 2)

Box Office - around $4,000,000 (estimated from the $40 million reported to be made from the 10 episodes of season 1)

While The Great is not a film, I wanted to show a successfully piece of media in the same genre and aesthetic (a period romance). The Great hits that mark at a Box Office (or the TV equivalent) of around $4 millions per episode, sitting perfectly at the break even point of the estimated episodes.

Portrait of a Lady on Fire (2019)

Genre - Drama, Romance

Budget - $2,000,000

Box Office - $13,779,300

This film is one of the best example of a well preforming film in the romance genre within the last 5 years, performing well above its break even point and becoming a certified box office hit.

Lady Chatterley's Lover (2023)

Genre - Drama, Romance

Budget - around $1,000,000 (estimated from press information and director comments)

Box Office - $4,025,000

The last film to add to my list Lady Chatterley's Lover is another modest film that squeaks in at just over its break even point of $4 millions, grossing close to $4.02 million.

Part 2- ROI

Estimated Gross - $5,411,044 (calculated by averaging all 5 box office results)

Estimated Investment/ Budget - $1,540,000

ROI = [ ($5,411,044 - $1,540,000) / $1,540,000] x 100

ROI = 251% (?)

I have a feeling that I did my math wrong somewhere, as this seems like much to high of a number to give to investors.

Part 3- Signatory

List 2 way how your film can change into a signatory project

For this film we will either need to already be a signatory company- therefore the project will already be signatory- or develop our project and later during production flip our project and/or company union.

Regardless of what what we choose, we will still need to be sure that we are paying the correct union rates for what are project is at that moments.

0 notes

Text

Germany undeterred by global turmoil as it faces 2024; US dollar supremacy facing resistance

COGwriter

Deutsche Welle reported the following:

Germany undeterred by global turmoil — Scholz

The common currency took a battering in 2022, falling below parity with the US dollar as an energy crisis gripped Europe. The euro has now bounced back, …

31 December 2023

In his New Year’s message, German Chancellor Olaf Scholz acknowledged the tough global landscape but expressed confidence that “Germany will get through it.”

“So much suffering; so much bloodshed. Our world has become a more unsettled and harsher place. It’s changing at an almost breathtaking speed,” Scholz said, according to the text of his speech released by his office ahead of the broadcast on New Year’s Eve.

“The result is that we, too, are having to change. This is a worrying thing for many of us. In some, it is also causing discontent. I do take that to heart.”

The German leader, however, struck an optimistic note and highlighted the obstacles the country successfully overcame in 2023, both domestically and internationally.

“Our strength resides in our readiness to compromise – in the efforts we put in for one another,” Scholz asserted.

US election could have ‘far-reaching consequences’

With many key general elections to be held worldwide in 2024, most notably in the United States, United Kingdom, India and the European Parliament, Scholz reiterated the importance of these elections — particularly in the US — with wars still raging in Ukraine and the Middle East.

The chancellor emphasized that Germany’s strength resides in the European Union.

“It’s so important for Europe to emerge unified and strengthened from the European elections in the coming year,” he said.

“After all, Russia’s war in the east of our continent is not over. Nor is the armed conflict in the Middle East. The year ahead will also bring presidential elections in the United States, which may have far-reaching consequences — including for us here in Europe.”

‘We held back economic downturn’

With inflation having sunk from an average of 7.9% in 2022 to 3.2% in November 2023, the lowest level in two years, Scholz spoke of a much brighter economic outlook than a year ago — even if Germany’s rate of inflation is still some way higher than the Eurozone average of 2.4%.

He also referenced Germany’s replenished gas supplies, which he described as “filled to the brim” and said the country avoided an economic downturn. …

Scholz believed that every person in Germany plays a vital role, and with mutual respect, “we need to have no fear about the future.”

“Then the year 2024 will be a good year for our country even if some things do turn out differently from the way we imagine them today, on the eve of that New Year.” https://www.dw.com/en/germany-undeterred-by-global-turmoil-scholz/a-67860274

Notice that Europe, not the USA, is where Germany’s strength is according to the above report.

And, without naming names, he and others in Europe are concerned that Donald Trump may once again become President of the United States.

That said, notice also the following about Germany:

Germany’s government clinched a last-minute deal on its 2024 budget on Wednesday that will see Berlin return to its self-imposed limits on new debt despite warnings this could hamper growth in Europe’s top economy and its green transition.

Chancellor Olaf Scholz’s three-party coalition was faced with either suspending what is known as the debt brake or finding some 17 billion euros ($18.3 billion) in savings and tax hikes after a Nov. 15 constitutional court ruling threw its plans into disarray. https://www.reuters.com/markets/europe/german-government-agrees-2024-budget-government-sources-2023-12-13/

Debt limits are good for many reasons, but they also can cause problems in the short run.

Europe will one day have various crises, and at risk of repeat, the late Pastor General of the old Worldwide Church of God, Herbert W. Armstrong, had a view about banking matters and European unity. Here is something he said in a sermon on July 7, 1984:

And I can see now, the event that is going to trigger the formation of the reunification in Europe; the resurrection of the medieval Holy Roman Empire that we’ve been looking forward to that is prophesied to come…

But I believe that some event is going to happen suddenly just like out a blue sky that is going to shock the whole world and is going to cause the nations in Europe to realize they must unite! … Well now I think I can see what may be the very event that is going to trigger…that is the economic situation in the world…

The whole banking structure in the United States is a network all jointed together. But not only that, one nation has to deal with other nations and imports and exports. And so they have to have a means of transforming money from one nation to another. And so the banking structure is international and interwoven…

Now when the financial structure breaks down, all civilization is going to break down…

So, an economic or banking crisis is what Herbert W. Armstrong concluded would drive Europe to unite.

Notice something somewhat consistent with that from earlier this year:

February 9, 2023

What amazes me is how obtuse the elites in Europe are. None seem to be able to envision a future where a declining U.S. economic empire drags Europeans down. https://www.zerohedge.com/news/2023-02-09/great-game-divisiveness-draws-nearer-end

We are not to that point yet that enough in Europe will more clearly see. Yet, various crises will arise in Europe and it will change (cf. Revelation 17:12-13). And Europe will blame the USA for various real and perceived harms.

The time will come when a different reserve currency will replace the USA dollar.

Some believe it will be from the BRICS alliance of nations.

Some others think that the new reserve currency will be the Euro.

Could the Euro surpass the US dollar as the world’s primary reserve currency?

Some suspect it might:

The Euro is 25. It isn’t perfect, but it has prospered

31 December 2023

Germany has dominated too much … I was there when the EU decided to have a baby currency all its own. https://www.theneweuropean.co.uk/the-euro-is-25-it-isnt-perfect-but-it-has-prospered/

Euro Challenges USDollar As Global Currency

January 15, 2022

Goldman Sachs this week predicted that the Eurozone would grow at a faster pace than the U.S. in 2022, projecting a growth rate of 4.4 percent for EU and only 3.5 percent for U.S. GDP. The latest World Bank forecast, also from January, still sees the U.S. ahead, if only by a paper-thin margin of 0.1 percent, while the new IMF outlook is yet to be released.

While the jury is still out … Statista’s Katharina Buchholz notes that there are other indicators that already show the Eurozone’s growing economic prowess and international importance. The value of global payment transactions in Euro has been inching up to that of the U.S. dollar, data from the Swift international payment network shows, hinting at increased activity around the currency. In October 2020, Euro transaction value even slid ahead of the U.S. dollar, and while that didn’t last long, the gap between the two currencies on the world stage has become considerable smaller since the start of the coronavirus pandemic. Potential reasons for this include the EU’s coordinated efforts to prop up its economy in the current crisis and its continued zero-interest fiscal policy. Faith in the U.S. economy and its growth is meanwhile shaky, according to CNBC, as uncertainty around President Joe Biden’s “Built Back Better” economic package continues. https://www.zerohedge.com/geopolitical/euro-challenges-usdollar-global-currency

Proportionally, the world still primarily uses the US dollar as its primary reserve currency.

But, because of US sanctions, increasing US debt and money supply increases, and the general strength of the European economy, more are looking towards the Euro as the US dollar replacement. Consider also the following:

U.S. Dollar ‘Demise

The U.S. dollar is set to end 2023 with its first yearly loss since 2020 thanks to the Federal Reserve’s dovish pivot … https://www.forbes.com/sites/digital-assets/2023/12/30/us-dollar-demise-iran-and-russia-suddenly-abandon-the-dollar-as-it-charts-worst-year-since-2020-amid-a-16-trillion-bitcoin-and-crypto-price-boom/?sh=2c52d1ac3b97

As we head into 2024, the dynamics of geopolitics are at the core of global markets.

So far, America has imposed sanctions against countries to cut them off from the global payment systems and dollars.

Many countries, including Russia, are looking at alternatives to the dollar.

For a very long time, the US dollar has dominated international markets. It still does so, although, during the past 20 years, the US economy has produced a decreasing percentage of the world’s production.

Central banks are no longer keeping as much of the US dollar in reserves as they formerly did …

Dollar demand waning?

The latest International Monetary Fund’s (IMF) data shows a decline in the dollar’s share in global central banks’ foreign currency reserves. …

The dollar has been the preferred reserve currency for most of the world’s central banks.

However, the dollar has progressively lost dominance since 2000, when its share was above 70%.

The US currency’s share is down to 59.2% in the September quarter, marking the lowest since it fell below 60% last year. …

Most countries are slowly but surely moving away from dollar-denominated trade. … the shift away is clear and noticeable.

Dollar lacks competition

Despite a two-decade drop in its proportion of global foreign currency reserves, the US dollar is still utilised more than all other currencies combined. …

So, it will take a long time for other currencies to be able to overshadow the greenback. 12/24/23 https://www.wionews.com/business-economy/is-the-dollars-status-as-a-global-reserve-currency-at-risk-673035

The USA has been gambling with its currency for many years.

Its leaders basically think that they can continue to get away with it.

But, while they will for a while longer (Habakkuk 2:2-3), one day the USA will not make it because of its debt (cf. Habakkuk 2:6-8).

What about Europe?

Now, while it is true that Europe is reeling from many issues, Europe has NOT produced as many trillions of Euros of debt that the USA has with its dollar. Plus, several of the nations there have been accumulating and/or repatriating gold.

Understand that the Bible shows that the time will come when Europe will prosper mightily and be involved with gold (cf. Revelation 18).

Now, consider a story, I have reported here before:

There once was a movie that had two men camping outdoors. Suddenly, one man yells, “Run, a bear!” The other man yells back, “You can’t outrun a bear.” The first man responded with, “True, but all I have to do is to outrun you.”

The implication is that the first man only needed to be better runner than the second man, which presumably the bear would consider to be weaker, and then catch and destroy. This would, supposedly, allow the first man to survive.

From an economic perspective, the story basically is that the debt and economic situation in Europe does not need to be perfect, only perceived to better (or at least similar) than that of the USA to someday surpass it.

While the Bible shows that gold and silver will one day be considered worse than useless (cf. Ezekiel 7: 19), it also shows that it will have value after the USA is defeated (cf. Daniel 11:39-43).

That being said, yes the USA dollar will collapse one day–and some type of European-backed currency, possibly the Euro or perhaps some type of international basket of currencies will replace the US dollar as the world’s reserve currency.

Here is something from my book Biden-Harris: Prophecies and Destruction:

Since many are now questioning the role of the US dollar as the world’s reserve currency, more are looking into other currencies as well as gold. Gold will set records in US dollar terms. In 2017, I also published that in my book related to Donald Trump, and it did in July and August in 2020. [i]

It has been proposed that various nations around the world are already in the process of accumulating gold to one day overthrow the U.S. dollar—and that the “U.S. is unprepared for this strategic alternative to dollar dominance.”[ii]

When the U.S. dollar totally collapses people all around the world will consider that even if the Euro (or something similar) is strong, having a more gold-backed currency would be safer.

The collapse of the U.S.A. dollar will shake a lot of the world’s confidence in non-gold backed currencies.

The Europeans do not have to have a perfect currency, only one that is perceived to be in better shape than the U.S.A. dollar.

Having the European power acquiring more gold to back the Euro or possibly another future European currency (that might potentially replace the Euro or even a basket of currencies) may greatly increase European credibility, prosperity, and influence around the globe, even if the backing is only implied.

The debt accumulation policies of the Obama-Biden and the Trump-Pence Administrations, which were a massive acceleration of the previous policies of the Bush Administration, look like they will be continued by a Biden-Harris Administration.

The increases in America’s debt are heading the world into the time when something other than the U.S. dollar will be valued as its reserve currency.

A Biden-Harris Administration would need to make massive changes to possibly prevent this.

The U.S.A. and its dollar are at serious risk.

[i] Gold hits new record, posts best month since 2016 CNBC, July 30, 2020; Woodall T. Gold surges to new highs as US dollar weakens despite growing macro risks. S&P Global, August 10, 2020

[ii] Rickards J. Axis of Gold. The Daily Reckoning, December 20, 2016

The US dollar will one day be worth no more than its scrap or burning value, other than perhaps as a collector’s novelty.

As far as gold as a partial replacement for the US dollar, the Continuing Church of God (CCOG) put out the following video on our Bible News Prophecy YouTube channel:

youtube

12:30

Gold Backed Currency to Replace the US Dollar?

China introduced something that was called the gold-petro-yuan back in 2018. Since then, the global share of US-dollar-dominated exchange reserves have dropped to 59.0%. In April 2021, China became the first major economy to unleash a Central Bank Digital Currency. China also has given its banks permission to import large amounts of gold. Is China preparing for a gold-backed yuan to push aside the US dollar or to help it survive a US dollar cataclysm? Are other nations preparing to push the US dollar aside? Do Europeans seem to have the most gold? Are Europeans prophesied to gain more gold? Is the US debt trajectory sustainable per Fed Chairman Jerome Powell? Does the Bible warn of the end coming to the highly indebted in Habakkuk 2:6-8? Why does it looked like a gold-backed currency will replace the US dollar? Will the US dollar, ultimately, become essentially worthless? Dr Thiel addresses these issues and more.

Here is a link to our video: Gold Backed Currency to Replace the US Dollar?

The US dollar will collapse a few years before the end of that 6,000 years and Jesus returns.

This would suggest perhaps in 2028 or perhaps as late as 2031.

A collapse of US dollar is coming. Europe is moving further away from the USA–and one day will turn against and conquer it per Daniel 11:39.

The diminishing dominance of the USA dollar was number 12 of my list of 24 items to prophetically watch in 2024. It is also discussed in the sermon I gave yesterday:

youtube

1:13:05

24 Items to Prophetically Watch in 2024

In Mark 13:37, Jesus tells His followers to watch world events that will precede His coming. In this sermon, Dr. Thiel goes over 24 items to watch in 2024 and points out events that were related to several of them in 2023: 1. Scoffing in the Last Days 2. Immorality Prophecies Being Fulfilled 3. Media, Internet, and Other Censorship 4. Weather Sorrows and Troubles 5. Earthquakes and Volcanoes 6. The White Horse of the Apocalypse 7. Strife and the Red Horse of War 8. Trade Issues 9. The Deal of Daniel 9:27 10. Knowledge Increasing 11. Debt 12. US Dollar Dominance will Decrease 13. CBDC and 666 14. Gold 15. Unrest, Terror, and the Dividing of the USA 16. Europe Will Work to Reorganize 17. Europe Will Have a Great Army and Many Ships 18. Steps Towards the Formation of the King of the South 19. The Time of the Gentiles will Lead to Armageddon 20. Jews Readying to Sacrifice 21. Inventions of evil things 22. Totalitarian Steps 23. Preparation for the Short Work 24. Fulfillment of Matthew 24:14 and 28:19-20. Dr. Thiel goes over prophetic scriptures (in 2 Timothy, Habakkuk, Amos, Daniel, Matthew, Mark, Romans, Revelation, Isaiah, 2 Corinthians, Psalms), including those that must be fulfilled before the start of the Great Tribulation as well as others that also need to be fulfilled before Jesus returns. When are some prophetic events expected and not expected to be fulfilled? Could we see events in 2024 in the Middle East involving Israel that would lead to the Great Tribulation starting in 3 1/2 years and Jesus returning in 2031? Dr. Thiel goes over many biblical items and ties them in with world events that happened and are in the process of happening.

Here is a link to our video: 24 Items to Prophetically Watch in 2024.

If you think that the USA and its dollar will continue to be number 1 and claim to believe the Bible, please consider biblical prophecies such as Daniel 11:39; Habakkuk 2:6-8; Isaiah 10:5-11 (see also USA in Prophecy: The Strongest Fortresses and/or watch Do these 7 prophesies point to the end of the USA?).

Hopefully, you are taking the proper spiritual steps now, whether or not you might be American.

Related Items:

The End of US Dollar Dominance Is the USA losing its economic status? What about the petro-gold-yuan? A related video is also available: US Dollar being challenged by Gold-Petro-Yuan.

The Plain Truth About Gold in Prophecy. How Should a Christian View Gold? What do economists and the Bible teach about gold? Gold and silver may drop in value. Inflation/deflation? What do Christians need to know about gold and silver? Two videos of related interest may be: Germany, Gold, and the US Dollar and Silver, Science, and Scripture.

Germany’s Assyrian Roots Throughout History Are the Germanic peoples descended from Asshur of the Bible? Have there been real Christians in Germanic history? What about the “Holy Roman Empire”? There is also a You-Tube video sermon on this titled Germany’s Biblical Origins.

Germany in Biblical and Roman Catholic Prophecy Does Assyria in the Bible equate to an end time power inhabiting the area of the old Roman Empire? What does prophecy say Germany will do and what does it say will happen to most of the German people? Here is a version of the article in the Spanish language: Alemania en la profecía bíblic. Here are links to two English language sermon videos Germany in Bible Prophecy and The Rise of the Germanic Beast Power of Prophecy. Here is one in the Spanish language: Alemania en profecía Biblica.

Is God Calling You? This booklet discusses topics including calling, election, and selection. If God is calling you, how will you respond? Here is are links to related sermons: Christian Election: Is God Calling YOU? and Predestination and Your Selection. A short animation is also available: Is God Calling You?

Christian Repentance Do you know what repentance is? Is it really necessary for salvation? Two related sermons about this are also available: Real Repentance and Real Christian Repentance.

24 items to prophetically watch in 2024 Much is happening. Dr. Thiel points to 24 items to watch (cf. Mark 13:37) in this article. Here is a link to a related video: 24 Items to Prophetically Watch in 2024.

USA in Prophecy: The Strongest Fortresses Can you point to scriptures, like Daniel 11:39, that point to the USA in the 21st century? This article does. Two related sermon are available: Identifying the USA and its Destruction in Prophecy and Do these 7 prophesies point to the end of the USA?

Who is the King of the West? Why is there no Final End-Time King of the West in Bible Prophecy? Is the United States the King of the West? Here is a version in the Spanish language: ¿Quién es el Rey del Occidente? ¿Por qué no hay un Rey del Occidente en la profecía del tiempo del fin? A related sermon is also available: The Bible, the USA, and the King of the West.

Could God Have a 6,000 Year Plan? What Year Does the 6,000 Years End? Was a 6000 year time allowed for humans to rule followed by a literal thousand year reign of Christ on Earth taught by the early Christians? Does God have 7,000 year plan? What year may the six thousand years of human rule end? When will Jesus return? 2031 or 2025 or? There is also a video titled: When Does the 6000 Years End? 2031? 2035? Here is a link to the article in Spanish: ¿Tiene Dios un plan de 6,000 años?

Might the U.S.A. Be Gone in 2028? Could the USA be gone by the end of 2028 or earlier? There is a tradition attributed to the Hebrew prophet Elijah that humanity had 6,000 years to live before being replaced by God’s Kingdom. There are scriptures, writings in the Talmud, early Christian teachings that support this. Also, even certain Hindu writings support it. Here is a link to a related video: Is the USA prophesied to be destroyed by 2028? In Spanish: Seran los Estados Unidos Destruidos en el 2028?

When Will the Great Tribulation Begin? 2024, 2025, or 2026? Can the Great Tribulation begin today? What happens before the Great Tribulation in the “beginning of sorrows”? What happens in the Great Tribulation and the Day of the Lord? Is this the time of the Gentiles? When is the earliest that the Great Tribulation can begin? What is the Day of the Lord? Who are the 144,000? Here is a version of the article in the Spanish language: ¿Puede la Gran Tribulación comenzar en el 2020 o 2021? ¿Es el Tiempo de los Gentiles? A related video is: Great Tribulation: 2026 or 2027? A shorter video is: Tribulation in 2024? Here is a video in the Spanish language: Es El 2021 el año de La Gran Tribulación o el Grande Reseteo Financiero.

Biden-Harris: Prophecies and Destruction Can the USA survive two full presidential terms? In what ways are Joe Biden and Kamala Harris apocalyptic? This book has hundreds of prophecies and scriptures to provide details. A Kindle version is also available and you do not need an actual Kindle device to read it. Why? Amazon will allow you to download it to almost any device: Please click HERE to download one of Amazon s Free Reader Apps. After you go to your free Kindle reader app (or if you already have one or a Kindle), you can go to: Biden-Harris: Prophecies and Destruction (Kindle) to get the book in seconds.

LATEST NEWS REPORTS

LATEST BIBLE PROPHECY INTERVIEWS

0 notes

Text

All You Need to Know About the Income Tax Calculator

India’s Union Budget has left most people in a dilemma with the choice of the tax regimes. Both old and new regimes need a thorough assessment before a tax payer picks one. With the new income tax calculator FY 2022-23, you will be able to gauge the impact of both tax structures on your income and tax liability. The unique calculator will help estimate tax benefits on your income.

What is a Tax…

View On WordPress

0 notes

Quote

Global fossil CO2 emissions (including cement carbonation) further increased in 2022, being now slightly above their pre-COVID-19 pandemic 2019 level. The 2021 emission increase was 0.46 GtC yr−1 (1.7 GtCO2 yr−1), bringing 2021 emissions to 9.9 ± 0.5 GtC yr−1 (36.3 ± 1.8 GtCO2 yr−1), same as the 2019 emissions level. Preliminary estimates based on data available suggest fossil CO2 emissions continued to increase by 1.0 % in 2022 relative to 2021 (0.1 % to 1.9 %), bringing emissions of 10.0 GtC yr−1 (36.6 GtCO2 yr−1), slightly above the 2019 level.

Emissions from coal, oil, and gas in 2022 are expected to be above their 2021 levels (by 1.0 %, 2.2 % and −0.2 % respectively). Regionally, emissions in 2022 are expected to have decreased by 0.9 % in China (3.1 GtC, 11.4 GtCO2) and 0.8 % in the European Union (0.8 GtC, 2.8 GtCO2) but increased by 1.5 % in the United States (1.4 GtC, 5.1 GtCO2), 6 % in India (0.8 GtC, 2.9 GtCO2), and 1.7 % in the rest of the world (4.2 GtC, 15.4 GtCO2).

ESSD - Global Carbon Budget 2022

0 notes

Text

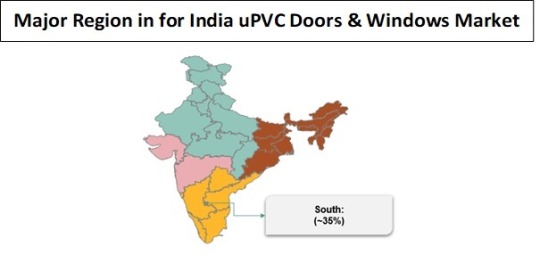

India's UPVC Door and Windows Market Set to Soar: Exploring Factors Driving the 2027 Boom!

The growth projections for India's UPVC door and windows market are promising. Industry experts estimate that the market will experience a CAGR of around ~11.3% from 2022 to 2027.

Story Outline

UPVC Demand in Evolving Real Estate: India's real estate evolution sees surging demand for UPVC doors and windows, driving market growth towards modernization by 2027.

Government's Role in Housing Evolution: Government investments anticipate increased urban housing demand, driven by initiatives like the Urban Infrastructure Development Fund, reshaping the real estate landscape.

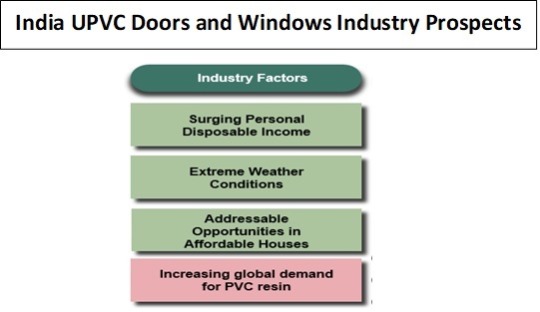

Influential Market Factors: Rising personal income aligns with infrastructure growth, while climate resilience and affordable housing policies contribute to evolving market dynamics.

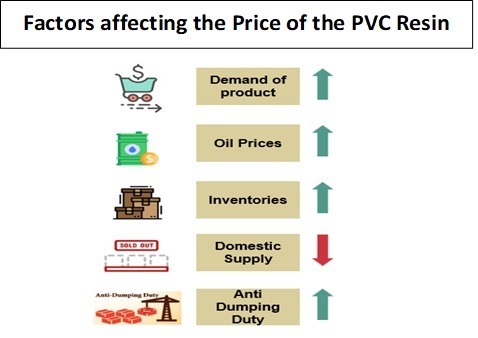

PVC Resin's Pricing Influence: PVC resin pricing, swayed by demand, inventories, and oil costs, showcases sensitivity as historical trends indicate. Future trends remain molded by these factors.

India's real estate and construction sectors have been experiencing rapid development, with a noticeable shift towards modernization and efficiency. One significant aspect of this transformation is the increasing demand for UPVC (unplasticized polyvinyl chloride) doors and windows. This trend is driven by a variety of factors that are projected to lead to substantial growth in the UPVC door and windows market in India by the year 2027.

1. Government's Mega Investment Plans Set to Reshape the Market

To learn more Download a Free Sample Report

Anticipated government initiatives and investments in the real estate sector are predicted to generate a surge in demand for the construction of new housing units, particularly in urban centers such as Delhi and Bangalore.

The upcoming period envisions new building construction taking the lead in market dominance. This trend is predominantly attributed to the robust infrastructural advancements in the northern and central regions of the nation.

The initiation of the Urban Infrastructure Development Fund, backed by a substantial INR 10,000 Cr. investment in the Union Budget 2023-24, exemplifies a proactive stride towards holistic national advancement.

2. Impactful Industry Factors: Income Rise, Climate Challenges & More…

Visit this Link: – Request for custom report

The rise in Personal disposable income is set to drive market demand, fueled by infrastructure development. Demand for door and window systems are expected to increase due to its ability to withstand extreme climatic conditions.

High emphasis by the Government on the housing scheme presents strong opportunity in the urban affordable housing segment. Increased consumption of PVC resin by the US and other countries will lead to price escalation if production is limited.

3. PVC Resin Price Faces Ripple Effects

Request free 30 minutes analyst call

The price of PVC resin is affected and expected to rise in future owing to various factors such as increase in demand, inventories, and oil prices.

The cost of PVC resin is subject to periodic fluctuations. Notably, it surged significantly from INR 64.0 per Kg in 2015 to INR 111.0 per Kg in 2022. This increase is attributed to heightened end-user demand, elevated oil prices, and reduced domestic supply.

The escalation in PVC resin prices stems from heightened demand for end-use products, oil price hikes, and decreased domestic supply. Additionally, the forthcoming years will witness PVC resin pricing influenced by end-use product availability and various other factors.

0 notes

Text

IMF Global Debt Insights: Vitor Gaspar's Analysis

Vitor Gaspar, Director of the IMF Fiscal Affairs Department, shared crucial insights on the global debt landscape, unveiling a trajectory that has witnessed unprecedented shifts over the past 75 years. As fiscal authorities and policymakers navigate through challenges, this analysis provides a comprehensive view of debt dynamics and policy trade-offs.

Global Debt Peaks in 2020: The Pandemic's Impact

The fiscal world saw an extraordinary transformation in 2020 when global debt reached its pinnacle at 258 percent of GDP. The pandemic year left an indelible mark on economies worldwide, and this was evident in the towering debt levels.

However, the subsequent two years witnessed a substantial rebound in economic activity. This, coupled with an unexpected inflation surge, lowered global debt by 20 percentage points of GDP. As a result, debt levels returned to nearly two-thirds of pre-pandemic benchmarks.

2022 Snapshot: $235 Trillion and China's Ascent

In 2022, the total debt liabilities of governments, non-financial corporations, and households globally amounted to a staggering $235 trillion, equivalent to 238 percent of GDP. Notably, China's debt trajectory stood out, with a rapid ascent from 1 percent of global debt in 1995 to 20 percent in 2022. This shift not only surpassed global debt growth but also outpaced Chinese GDP, effectively converging China's debt ratio with that of the United States.

The Global Debt Database: A Comprehensive Resource

Gaspar emphasized that these findings are part of the IMF's Global Debt Database, which provides in-depth insights into the global debt landscape over time, offering a valuable resource for policymakers and economists alike.

The Debt Challenge: Slowing Growth, Rising Interest Rates, and Budget Deficits

As we look to the future, one question looms large: Will total debt continue its upward trend? Gaspar suggests that this is indeed likely to be the case. Notably, major global economies, with the United States and China at the forefront, play a significant role in this trend.

Slowing growth, rising real interest rates, and expanding budget deficits all contribute to the resurgence of global public debt. The result is substantially higher debt levels that are expected to grow at a faster pace compared to pre-pandemic projections.

Risk of Sovereign Debt Defaults: Low but Present

Despite the high levels of debt and associated vulnerabilities, Gaspar asserts that the risk of a "systemic" wave of sovereign debt defaults remains low, providing some reassurance in the current fiscal landscape.

The Fiscal Equation: Balancing Act

Gaspar delves into the intricate challenge faced by all nations—the need to balance the fiscal equation. Rising debts, increasing borrowing costs, and expanded public expectations of budget roles have set the stage for a complex policy trade-off. Gaspar notes that many countries are grappling with tighter fiscal policies to manage public finance risks and contribute to central banks' efforts to meet inflation targets.

A Global Pragmatic Side Deal for Climate Action

In the face of impending climate crises, Gaspar highlights the imperative for a global pragmatic side deal among major players such as the United States, China, India, the European Union, and the African Union. Such a deal could significantly impact climate action and financial stability.

Gaspar underscores the importance of incorporating a carbon price floor, transfers, and revenue-sharing mechanisms to bridge financial divides and achieve sustainable development goals.

IMF's Role in Financial Stability

In conclusion, Gaspar emphasizes the IMF's pivotal role in maintaining sound public finances and financial stability. Urgent support from member countries is essential to bolster quota resources and secure funding for the concessional Poverty Reduction and Growth Trust and the Resilience and Sustainability Trust.

Navigating the Policy Trilemma

Gaspar's analysis concludes with an astute observation: the policy trilemma holds true not only for climate action but also for any policy objective that requires additional budget spending. As countries grapple with a multitude of spending pressures and political red lines limiting taxation, the challenge remains to balance the fiscal equation.

Whether through recalibrating policy ambitions or adjusting taxation red lines, a smart policy mix offers a way forward in the complex landscape of fiscal choices.

Sources: THX News & IMF.

Read the full article

#Climateaction#Climateimplications#Debtdynamics#Fiscalchallenges#FiscalMonitor#Globaldebt#IMFinsights#Policytrade-offs#Sovereigndebt#VitorGaspar

0 notes

Text

Disposable Medical Eye Shield Market Size, Type, segmentation, growth and forecast 2023-2030

Disposable Medical Eye Shield Market

The Disposable Medical Eye Shield Market is expected to grow from USD 480.60 Million in 2022 to USD 845.30 Million by 2030, at a CAGR of 8.40% during the forecast period.

Get the Sample Report: https://www.reportprime.com/enquiry/sample-report/11059

Disposable Medical Eye Shield Market Size

The disposable medical eye shield market is governed by several regulatory and legal factors that vary across regions. In North America, the market is subject to regulations set by the FDA, which ensures that the products meet specific safety and efficacy standards. The European Union follows similar regulations set by the European Commission, which encompasses CE marking, conformity assessments, and regulations on medical devices. The Asia Pacific region is witnessing an increased focus on product quality and safety, with countries such as India and China introducing regulatory frameworks for medical devices. The Middle East and Africa region is highly regulated, with a focus on product quality, safety, and efficacy. These factors are expected to impact the growth of the disposable medical eye shield market in the respective regions.

Disposable Medical Eye Shield Market Key Player

InTec Industries

Innovative Optics

Honeywell

Eye Shield Technology

TIDI Products

Buy Now & Get Exclusive Discount on this https://www.reportprime.com/checkout?id=11059&price=3590

Disposable Medical Eye Shield Market Segment Analysis

The Disposable Medical Eye Shield market is a niche market that caters to the needs of healthcare professionals who perform invasive procedures in close proximity to patients' eyes. This market has witnessed significant growth in recent years due to the rising number of surgeries and the growing awareness among healthcare professionals regarding the importance of eye protection. The target market for Disposable Medical Eye Shields includes hospitals, clinics, and ambulatory surgical centers.

The major factors driving revenue growth in the Disposable Medical Eye Shield market include increasing demand for eye protection equipment from healthcare professionals, the growing number of surgeries with high risks of eye injury, and rising awareness among patients regarding the importance of eye protection during surgery. In addition, the increasing prevalence of eye diseases and disorders, such as cataracts and glaucoma, is also fueling the demand for disposable medical eye shields.

The latest trend in the Disposable Medical Eye Shield market is the shift from reusable eye protection equipment to disposable equipment. This trend is being driven by concerns regarding the spread of infectious diseases and the need for safer and more hygienic equipment. Another trend is the development of eye shields with improved comfort and ergonomics to enhance the user experience.