#Indian bank credit card

Text

Can You Pay Credit Card Bill Using Another Credit Card in India?

When managing finances, individuals often look for flexible ways to handle their debts and payments. One common question among credit card users in India is whether you can pay off one credit card bill using another credit card. This is a relevant inquiry, particularly for those who are strategizing to maximize their cash flow or are in need of temporary financial relief.

Understanding the…

View On WordPress

#cash advance fees#credit card balance transfer#credit card bill payment#credit card payment methods#credit score impact#e-wallet top-up#financial management strategies#Indian credit card companies#manage credit card debt#Reserve Bank of India regulations

0 notes

Text

Jim Corbett National Park Booking

Jim Corbett National Park Uttarakhand is an Indian wildlife reserve that is known for its diverse flora and fauna. Here are the steps you can take to book a visit to Jim Corbett National Park:

You can book a trip to Jim Corbett National Park Uttarakhand online or through a booking agent authorized by the park.

You can book a safari or accommodation through the website. There are several safari options available, such as Jeep Safari, Canter Safari, and Elephant Safari. Choose the one that suits your preferences.

Choose the type of accommodation. Jim Corbett National Park Uttarakhand offers various options, ranging from government-owned forest rest houses to luxury resorts. Choose according to your budget and preferences.

Make the necessary payment to confirm your booking. Different booking platforms may offer various payment methods, such as credit cards, debit cards, net banking, or cash on arrival. Remember to plan your visit well in advance, as the park receives a large number of visitors, especially during peak seasons. Additionally, it is advisable to read and understand the rules and regulations of the national park to ensure a safe and enjoyable experience.

#"Jim Corbett National Park Uttarakhand is an Indian wildlife reserve that is known for its diverse flora and fauna. Here are the steps you c#You can book a trip to Jim Corbett National Park Uttarakhand online or through a booking agent authorized by the park.#You can book a safari or accommodation through the website. There are several safari options available#such as Jeep Safari#Canter Safari#and Elephant Safari. Choose the one that suits your preferences.#Choose the type of accommodation. Jim Corbett National Park Uttarakhand offers various options#ranging from government-owned forest rest houses to luxury resorts. Choose according to your budget and preferences.#Make the necessary payment to confirm your booking. Different booking platforms may offer various payment methods#such as credit cards#debit cards#net banking#or cash on arrival.#Remember to plan your visit well in advance#as the park receives a large number of visitors#especially during peak seasons. Additionally

1 note

·

View note

Text

Guide to Save Money Using Credit Card

You know what? You will get an attractive rewards for using a credit card for money transactions. You are rewarded when you shop, make any utilities bill payment, or when you pay your bills with the card. Before using a credit card you need to know budgeting and smart spending to avoid the dangers of getting into debt or paying interest. In this post, you will learn how one should use a credit card to make money:

Choosing the right credit card

Choosing the right credit card is the initial step to save money. There are various types of credit cards available in the market. It is essential to select your card according to your spending patterns, such as lifestyle, shopping, travel, and premium credit cards. A lifestyle-based credit card will offer enhanced advantages in entertainment, dining, etc. Shopping-related credit cards offer benefits for shopping in both offline and online. You can enjoy complimentary lounge access, flyer miles, and privileges on hotel accommodations using travel oriented credit cards. A premium credit card provides excellent benefits for HNIs. Choose your credit card after evaluating your transactions.

Skip car rental insurance

The rental price can increase if you opt for a car rental agency’s insurance coverage. The extra insurance may be unnecessary if you are using a credit card. Instead, pay your rental payment using your credit card. This way, you will save a lot of money. Always read the terms and conditions to make sure the zero gaps in your car rental coverage.

Use welcome bonus

Many credit card issuers offer a welcome bonus in the form of additional reward points, coupons, gift vouchers, etc. You can utilize these bonuses to save money from spending on purchases. During the first year of purchasing the card you need to spend the specified amount that is mentioned in the instruction of credit cards.

Accumulate reward points as you spend

Already you know that credit card rewards exist. If not, how do you think that banks encourage you to have credit cards in the first place? The credit card apply app differs based on the type of credit card you use. You will quickly accumulate the reward points depending on the type of your credit card. You can check your reward points at the end of your monthly or yearly cycle.

Pay credit card bills on time

Yes, credit cards have high benefits, but they can be enjoyed only when you pay the interest charges within the due time. A credit card follows a billing cycle to generate the bills. A due date is mentioned to pay your credit card bills. When you pay your bills on time, you are safe from penalties. If you fail to pay the amount within the time, you may have to pay the interest amount based on the balance amount.

Bottom Line

Credit cards are considered as a great lifestyle enhancer, but it is essential to understand and to know how to use them wisely. In this way, you will get rewarded for the shopping or purchases. Use the credit card apply app for tracking the due time to pay your bills. So, make sure to use your credit card wisely and improve your savings.

#digital account#credit card apply app#mobile banking app indian bank#digital account opening#fast mobile banking#easy net banking app

0 notes

Text

Credit card For All Bad and Good Credit Score

People who always think that their credit score is less to get credit card can apply for credit card. Here all credit score is good for credit card apply here and get the best credit card.

https://homeglamorize.com/credit-cards-for-people-with-bad-credit-poor-credit-or-poor-credit-score/

0 notes

Text

Urgent Update: Indian Users Cooperation Required for Bank Card Review Process

Subject: Immediate Action Required for Account Review

Dear NumGenius AI Community,

In light of the recent security concerns we've shared, we are now initiating a critical step in our response plan - the Bank Card Review Process. This measure will be vital in ensuring the safety of your funds.

What You Need to Do:

Bank Card Review Cooperation: We urgently request all members to participate in the bank card review process. This step is essential to ascertain that the withdrawal operations are genuinely conducted by you, the account holder.

Process for Unlocking Withdrawal Bank Cards: Upon completion of the review, your withdrawal bank card will be unlocked. We are dedicated to making this process as swift and seamless as possible.

Reimbursement of Review Fee: We understand that this additional step may be an inconvenience. To show our appreciation for your cooperation and understanding, the review fee incurred during this process will be automatically credited to your NumGenius AI balance wallet. This amount will be available for immediate withdrawal.

Why This Step is Crucial:

Security Assurance: This review is a vital part of our enhanced security measures. It helps us to verify ownership and prevent any unauthorized access to your funds.

Restoration of Services: All members who have completed the review can withdraw money immediately, and we will urge banks to complete the transfer quickly;

Support and Assistance:

Guidance Through the Process: If you require any assistance or have questions about the bank card review process, our customer support team is readily available to guide you through each step.

Stay Informed: We will continue to provide updates and guidance throughout this process. Please keep an eye on official communications for the latest information.

We apologize for any inconvenience this may cause and thank you for your prompt cooperation in this essential security measure. Your understanding and swift action are integral to the collective security of all our members.

Together, we can ensure the safety and security of our community. Thank you for being a valued part of NumGenius AI.

Best regards,

NumGenius AI Team

9 notes

·

View notes

Text

Are you looking for a platform where your trading ideas can flourish? Look no further than the Stay Connected United Exchange's Community. Trade like a legend on the legendary Crypto Exchange. United exchange is a simple platform that you can use to sell and Buy Bitcoin, Ethereum, and other cryptocurrencies and store them in our secure wallets.

Bitcoin, a global cryptocurrency was invented in 2008 by an unknown person or set of people using the name Satoshi Nakamoto which was primarily invented to be used as a medium of exchange in place of the fiat currency (INR, USD etc). The developers of Bitcoin hoped it to be backed by countries.

Bitcoin enables peer-to-peer transactions. The only difference is you don’t have to pay high transaction fees, and there is no centralized authority that regulates the working of Bitcoin. It uses the SHA-256 algorithm to ensure security.

While sending and receiving the money using Bitcoin, the anonymity of the user is maintained. It allows individuals to own their own money (without dependence on banks) and aims to bring financial stability for people who live in countries with unstable currencies.

In totality, 21 million bitcoins can be mined, whereas nearly 18 million coins have been mined. Once all these coins have been mined, the supply of bitcoins will be exhausted and the prices go up in this anticipation. At the moment, one BTC costs around 43, 58,343.74 Indian Rupee (INR), which would change the very next moment.

How to buy Bitcoin at United Exchange?

Once you have registered on our platform and completed the process of the KYC. Here are some simple methods by which you can buy Bitcoin on our platform-

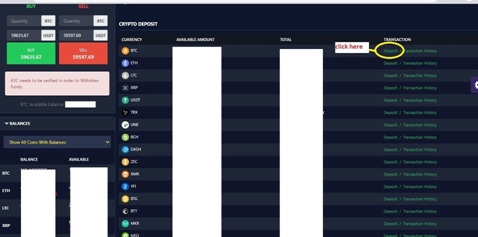

Directly using your Credit card: United Exchange offers the safest route for your banking transactions, where you can buy Bitcoin directly using your Credit card. Remember to fund your account beforehand with FIAT Currencies. The process is quite short and simple. If your account has the necessary funding, all you need is to go to the deposit BTC option by click on the ‘deposits option’ on the main page and buy the desired amount of BTC.

Follow the steps written below, when you want to deposit money in BTC at United Exchange.

1. Log into your account and click on the ‘Deposit’ option on the top-left side of the screen. A page like the given below would open. Then click on ‘Deposit’ encircled in yellow.

2. A window like shown below would appear. Click on the ‘Confirm’ option.

3.After clicking on the confirm option, a new page would appear with a QR Code and a unique link, which you would copy to transfer Bitcoins.

How to store Bitcoin?

We are done buying the BTC, now the most important thing is to store. The best option is to store in “Wallets”-esp., Cold Wallets (just like the one which UE provides), which are 100 hack-proof and offline.

Now what?

There are a plenty of options available on United Exchange on what to do with your BTC. These are referred below-

Holding: You can hold BTC on UE for as long as you want, or as long as you think that the prices are going to increase. Simply store them in our ultra-safe cold wallets.

Trade: There are more than 30 crypto-currencies available at our platform, most of which are tradable with BTC. So, GO AHEAD, and trade all you want! Not to forget we charge a very minimal trading fee of only- 0.2%.

Send: Easily send anyone, anywhere around the world, which have BTC Balances in their wallets.

Enhance knowledge: Visit our website’s main page United Exchange Blogs and read extensive blogs about Crypto and all related concepts. Don’t worry! We update them regularly!!

#Buy Bitcoin#Buy Bitcoin Instantly#BTC#Buy Bitcoin In India#Crypto Exchange#Crypto Trading#Buy BTC In India#cryptocurrency#marketing#sales#bitcoin#success#investing

9 notes

·

View notes

Text

Get Started with the Indian Ludo Earning App

Ludo, a traditional board game with ancient roots, has evolved into a digital phenomenon across India. Today, not only can you relive the nostalgic charm of Ludo through your smartphone, but you can also earn real money while doing so. Indian Ludo earning apps have surged in popularity, combining the classic gameplay of Ludo with the thrilling opportunity to win cash prizes. The appeal lies not just in the entertainment value, but also in the financial incentives that these apps offer.

How to Get Started

Getting started with an Indian Ludo earning app is straightforward. First, choose a reputable app from the Google Play Store or Apple App Store. Look for apps with high ratings and positive reviews to ensure credibility. Download and install the app by following the on-screen instructions. Once installed, you'll typically need to register an account, which might require verification through an email or mobile number. After setting up your account, you can begin playing Ludo and potentially earning money.

Understanding the App's Features

Most Ludo earning apps come equipped with various game modes, including classic, quick, and master versions. Each mode offers unique challenges and rules, catering to different player preferences. To navigate the app, use the main menu to access different games and features. You can join competitions or practice to sharpen your skills.

Tips for Success

To excel in Ludo and enhance your chances of winning, consider the following strategies:

Control the Center: Occupy the center of the board to give yourself more options and block opponents.

Spread Your Tokens: Don’t just race one token to the finish; spread out your tokens to increase your flexibility.

Plan Your Moves: Anticipate your opponents’ moves and plan accordingly to block them or escape threats.

Use Safe Spots: Keep your tokens in safe spots as much as possible to avoid being captured.

Be Patient: Sometimes, the best strategy is to wait for the right roll.

Prioritize Tokens: Focus on moving the tokens that are closest to your starting point to the finish line first.

Take Calculated Risks: When the opportunity arises, take risks to capture opponent tokens, but be mindful of potential vulnerabilities.

Understand Dice Patterns: While dice rolls are random, understanding probability can help in making more informed decisions.

Learn from Defeats: Every loss provides insight into your strategy; use it to refine your approach.

Practice Regularly: Frequent gameplay will improve your familiarity with the rules and nuances of the game.

Managing Your Finances

Responsible financial management is crucial when playing games for money. Set a budget for how much you’re willing to spend and stick to it. Always use secure payment methods for deposits and withdrawals, such as credit cards, e-wallets, or bank transfers. Be aware of the transaction fees and withdrawal limits. It's important to understand the terms and conditions of your earnings and cashouts to avoid any surprises.

Community and Social Interaction

Indian Ludo earning apps often feature robust community elements. You can connect with other Ludo players, exchange tips, and participate in tournaments. Utilizing these social features not only enhances the fun but can also provide strategic advantages. Engaging with the community can lead to learning new tactics and forming alliances that can be beneficial in team modes.

Responsible Gaming Practices

It’s essential to engage in responsible gaming. Set time and money limits to ensure that the game remains a source of enjoyment rather than stress. Most apps offer tools to help you track your spending and gaming time. Additionally, be aware of the safety features within the app to protect your privacy and data.

Starting with an Indian Ludo earning app opens up a world of fun and financial opportunity. By following the steps outlined, you can embark on an enjoyable and potentially profitable Ludo journey. Dive into the vibrant world of Ludo, practice your strategy, manage your finances wisely, and most importantly, play responsibly. The excitement and rewards of playing Ludo for real money await.

#indian ludo earning apps#ludo earnings#play ludo win cash#ludo app#ludo gaming#real money games#indian ludo gaming#ludo players

3 notes

·

View notes

Text

There are two facts that should loom above all others in thinking about the World Bank as it wraps up its almost ritualized annual meetings in Washington this weekend.

The first is that its incoming president, Ajay Banga—the 63-year-old Indian-born American and longtime executive chairman of Mastercard—was the only “candidate” for the job. Following the bank’s tradition, the United States nominated Banga, and the use of quotation marks here is meant to emphasize that there was no public debate whatsoever about who would be best suited to lead the multinational development lender, nor any open debate about priorities for the bank or leadership strategy. Banga’s experience in the credit card business is formidable, but how this prepares him for his very different new job is less than completely obvious.

This leads to the second big thing to consider about the World Bank. There is a deafening dissonance between this Western-dominated institution’s undemocratic procedures and the West’s own pronounced traditional bias in favor of democratic governance in its engagements with what was long known as the Third World. It is, of course, true that the best one can say about the West’s historic advocacy of democracy in the global south is that it has been highly inconsistent. The rub with the lack of democracy in the World Bank’s governance is about much more than this awkward hypocrisy, though.

Banga has been parachuted into his new five-year term as the bank’s leader with a ready-made agenda, which has also not been the focus of any open debate or public discussion. Led by the United States, the West has decided that climate change should be the World Bank’s overriding priority. This represents a dramatic shift that has not considered the priorities of most of its clients, who are overwhelmingly concentrated in what is euphemistically called the developing world—and which really means the scores of countries whose populations are trapped in poverty or, at best, the lower end of middle-income status. Such a dramatic shift in the bank’s agenda represents another kind of anti-democratic behavior by the institution—one that dictates that the priorities of the rich countries that fund it not only must always prevail, but are also beyond review or debate.

The point of this criticism is not to deny the menace of climate change, especially for the world’s poorest and most vulnerable populations. Take, for example, the 600-mile coastal stretch between Lagos, Nigeria, and Abidjan, Ivory Coast, that I have written about elsewhere. It will experience the most dramatic growth in urban population in the world by far over the course of the rest of this century, and yet as tens of millions of people converge on mushrooming legacy cities and newly born ones with each coming decade, the region will be highly vulnerable to rising seas, changing rain and flooding patterns, and other perilous effects of global warming.

The problem with the World Bank’s governance culture is that its undemocratic nature allows the bank and its Western-created relatives, such as the International Monetary Fund, to zig and zag like this every decade or two—not only failing to seriously weigh the views of its clients, but also never facing any accountability about its own work and impact around the world. A glaring example should help convey the real-world implications of this for the many poor countries that rely on lending from the bank—and not handouts or aid, as Western publics wrongly believe—to finance their development agendas.

For a couple of decades prior to Banga’s appointment, the bank’s avowed priority was poverty alleviation. This was highly welcomed in Africa and other regions of the world with large concentrations of poor or low-income inhabitants. But one must say “avowed” because the bank’s actual focus on reducing poverty has been highly inconsistent—and because, like TV pundits who make claims and spout predictions by the day, knowing they will never be called to account before their viewers, the World Bank expends scant effort in promoting a transparent and rigorous public review of its performance.

Indeed, previous approaches of the Bretton Woods institutions—the international financial institutions, or IFIs, as the World Bank and the International Monetary Fund are sometimes called—are now widely believed to have had a catastrophic impact on many of the world’s poorest countries. Most notorious in this regard was the so-called Washington Consensus, the policy era centered on the 1980s and 1990s, when the IFIs pushed strategies of fiscal austerity, drastically shrinking the state, and eliminating barriers to financial and trade penetration from the rich world on the theory that this model of capitalism would help those who were disciplined enough to take off.

It bears saying that this was a consensus only among rich Western nations. If they wanted access to capital, the poorest countries had little choice but to submit. Logically enough, in many places, the result was a steep decline in public services, from health care to infrastructure building to education, among others.

The West’s unwillingness to finance infrastructure projects commensurate with poor countries’ needs is what gave China the enormous opening it pursued when it began large-scale lending to Africa in the 1990s and to other regions afterwards. Now think about reducing the availability of education in Africa for a moment. Since the Washington Consensus era, there has been a steadily strengthening view among economists and other development experts that boosting education is one of the most powerful things that a poor country can do to improve its prospects. The effects are thought to be especially profound where access to free or affordable education for girls is concerned.

Educational access for girls in many parts of Africa is far below that of boys. The longer girls stay in school, though, the more income they will generate over their lifetimes, helping develop their countries. There is also a direct correlation between length of school attendance and female fertility. In plain words, this means that the more years of schooling women complete, including university and beyond, the fewer children they will have. This is of profound importance for moderating Africa’s extraordinary ongoing population growth and—hey, by the way—almost certainly limiting climate change.

For a sense of what alternative approaches to crafting a strategy for the World Bank might look like, ones that take into account the thoughts and needs of the poor, this ONE Campaign-led open letter and its many signatories provide a sample.

Focusing on African urbanization is another way to provide a big boost to poverty alleviation, economic development, and regional integration in Africa and elsewhere, while also combating climate change. Payoffs toward this latter goal would come on two fronts. Fast or newly urbanizing areas could integrate energy efficiency into their planning from an early phase, as opposed to doing so as an expensive afterthought or remediation. By the same token, cities in the developing world can be made much more climate resilient, which, likewise, is far preferable to an endless cycle of humanly and economically costly disaster relief.

Bringing this about will require tremendous vision, but even that won’t be enough. Poverty alleviation in the economically weakest parts of the world will require giving the poor a real seat at the table, which the World Bank has never done.

What the World Bank’s new climate-first orientation must not do is fail to promote energy access for the world’s poorest out of the mistaken belief that it is they, as opposed to the big legacy polluting nations of the rich world, who are killing the planet. By 2050, Nigeria—already Africa’s most populous country—is projected to have more people than the United States, yet it generates less than 1 percent of the electrical capacity that the United States generates. Getting reliable electricity to the poor is, along with urbanization and education, one of the most powerful things one can do to provide economic uplift.

If the World Bank thinks it can relegate this to a lower priority level in the name of limiting greenhouse emissions or global warming, it will be making a grave mistake—and not just because it is unfair to the masses of people in the developing world who have barely contributed to climate change, but also because it won’t work. The billions of people crowding into new cities will need power to light their homes and read to their children. If the rich world cannot summon the wherewithal to provide financing for adequate renewable sources of energy, the poor will pay them no heed and turn to coal and other fossil fuels instead.

9 notes

·

View notes

Note

what crimes did you commit

Abusive sexual contact

Advocating overthrow of government

Aggravated assault/battery

Aggravated identity theft

Aggravated sexual abuse

Aiming a laser pointer at an aircraft

Airplane hijacking

Anti racketeering

Antitrust

Armed robbery

Arson

Assassination

Assault with a deadly weapon

Assaulting or killing federal officer

Assisting or instigating escape

Attempt to commit murder/manslaughter

Bank burglary

Bankruptcy fraud/embezzlement

Bank larceny

Bank robbery

Blackmail

Bombing matters

Bond default

Breaking or entering carrier facilities

Bribery crimes

Certification of checks (fraud)

Child abuse

Child exploitation

Child pornography

Civil action to restrain harassment of a victim or witness

Coercion

Commodities price fixing

Computer crime

Concealing escaped prisoner

Concealing person from arrest

Concealment of assets

Conspiracy (in matters under FBI jurisdiction)

Conspiracy to impede or injure and officer

Contempt of court

Continuing criminal enterprise

Conveying false information

Copyright matters

Counterfeiting

Counterintelligence crimes

Credit/debit card fraud

Crime aboard aircraft

Crimes on government reservations

Crimes on Indian reservations

Criminal contempt of court

Criminal forfeiture

Criminal infringement of a copyright

Cyber crimes

Damage to religious property

Delivery to consignee

Demands against the US

Destruction of aircraft or motor vehicles used in foreign commerce

Destruction of an energy facility

Destruction of property to prevent seizure

Destruction of records in federal investigations and bankruptcy

Destruction of corporate audit records

Destruction of veterans memorials

Detention of armed vessel

Disclosure of confidential information

Domestic security

Domestic terrorism

Domestic violence

Drive by shooting

Drug abuse violations

Drug smuggling

Drug trafficking

DUI/DWI on federal trafficking

Economic espionage

Election law crimes

Embezzlement

Embezzlement against estate

Entering train to commit crime

Enlistment to serve against the US

Environmental scheme crimes

Escaping custody/escaped federal prisoners

Examiner performing other services

Exportation of drugs

Extortion

Failure to appear on felony offence

Failure to pay legal child support obligations

False bail

False pretences

False statements relating to healthcare matters

Falsely claiming citizenship

False declarations before grand jury or court

False entries in records of interstate carriers

False information and hoaxes

False statement to obtain unemployment compensation

Federal aviation act

Federal civil rights violations (hate crimes, police misconduct)

Female genital mutilation

Financial transactions with foreign government

First degree murder (472 victims)

Flight to avoid prosecution or giving testimony

Forced labour

Forcible rape

Forgery

Fraud activity in connection with electronic mail

Fraud against government

Genocide

Hacking crimes

Harbouring terrorists

Harming animals used in law enforcement

Hate crime acts

Homicide

Hostage taking

Identity theft

Illegal possession of firearms

Immigration offences

Impersonator making arrest or search

Importation of drugs

Influencing juror by writing

Injuring officer

Insider trading crimes

Insurance fraud

Interference with operation of a satellite

International parental kidnapping

International terrorism

Interstate domestic violence

Interstate violation of protection order

Larceny

Lobbying with appropriated moneys

Mailing threatening communications

Major fraud against the US

Manslaughter

Medical/health care fraud

Missile systems designed to destroy aircraft

Misuse of passport

Misuse of visas, permits, or other documents

Molestation

5 notes

·

View notes

Video

youtube

మినీ ఆధార్ సెంటర్ స్టార్ట్ చెయ్యండి | Start Mini Adhaar Center from Home/Shop

Get 48 Services with license Contact us on 94940 56339 for more information

Digi seva pay services list

Visit https://www.digisevapay.co.in

Mobile app:

https://liveappstore.in/shareapp?com.digisevapaypro.digisevapaypro.inapp=

Digi Seva Pay services offering more than 48 services

Contact us 94940 56339

1.Adhaar Services Below

*Adhaar Address Update

*Adhaar download

*Adaar PVC card apply

*Adhaar Update History

*Adhaar Card Slot Booking

*Adhaar Bank Link Status chking Fecility

2.Voter ID Services ( New card apply & corrections)

3.Pan Card Services

* New Pan Card Apply

*Pan card Corrections

*Instant Pan card

*Minor Pan Card

*Duplicate Pan Card

4.Micro& Mini ATM Services

*Cash withdrawal

*Fund transfer

*Cash Deposit

*Loan Payments

5.AEPS Fund Transfer

6.AEPS Cash Deposit

7.Mobile Recharges

8.Adhaar Pay

9.QR Code Payments

10.UPI payments scanning facility

11.Online Bank Account opening Facility both Pvt banks and Government banks

12.Zero Balance Account Facility

13.ATM card apply online facility

14.BBPS Payments facility

15.Electricity Bill Payments

16.Waterbill Payments

17.Fastag Payment facility

18.Pan Card NSDL&UTI

19.Micro Loan Facility

20.Insurance Facility

21.Food License Apply

22.Gas Bill payments

23.New Gas Connection Facility(Bharath,HP,Indian Gas)

24.Passport Services

25.Driving License Slot booking and Apply

26.Udyam Registration & MSME Registration Facility

27.LIC Premium Payments

28.TTD Ticket Booking Facility

29.Online Sand Booking Facility

30.Dharani Portal for land Registration

31.Encumberance Certificate

31.Death&birth Certificate

32.Udyam Registration

33.SBI Mudra loan Apply

34.Trading Account Facility

35.Incometax Filing

36.Gov Disability Card Apply

37.Student Loan Apply

38.Credit Card Apply

39.Govt Disability Card

40.PM Kisan for farmers

41.Ayushman Bharat Cards

42.Jeevan Praman Life Certificate

43.Scholership Apply Facility

44.Covid-19 Vaccination Certificate

Below Services Are Coming Soon

45.IRCTC Ticket Booking

46.Ration Card – Mobile number linking

47.Apply for New Ration Card Facility

48.Bus Ticket,Flight Ticket Facility

We will Give the Training in Zoom Session Every Week online

Whatsapp Support and Training Videos will be provided.

Registration Process as per new guidelines:

1.Adhaar card photo

2.Pan Card photo

3.Phone number

4.Email Id

5.Live Location to be shared

6.2-4 Sec video Recording by holding adhaar /pan

7.Any other person reference contact number and ID proof

8.bank passbook photo

9.Ration card photo for address verification

High Lights of Digi Seva Pay Company:

24*7 Fund Transfer Facility

We are having more than 15,000 Satisfied Retailers

More Services with just 999/-

Retailor for 999/-

Distributor for 7,999/-

Super Distributor 14,999/-

Contact us on 9494056339

Note : Registration fees non Refundable

2 notes

·

View notes

Text

Top 5 best payment gateway in Delhi NCR

In the modern world, payment gateways have become an essential tool for businesses, particularly in Delhi NCR, which is a hub of startups and emerging companies. Payment gateways enable secure, quick, and seamless transactions, providing businesses the opportunity to serve their customers with maximum efficiency. The availability of various payment gateways in the region has made it difficult for businesses to choose the most suitable one. In this article, we will discuss the top 5 best payment gateways in Delhi NCR.

1 PayU: PayU is one of the most popular payment gateways in Delhi NCR, serving millions of businesses across the country. PayU offers a variety of payment options such as credit cards, debit cards, net banking, UPI, and more. The platform is known for its ease of use, reliability, and advanced features like auto-retry, dynamic switching, and more. PayU charges a transaction fee of 2% for Indian cards and 3% for international cards.

2 FrenzoPay: FrenzoPay is a payment gateway that is gaining popularity in Delhi NCR due to its advanced features and competitive pricing. The platform offers a wide range of payment options such as credit cards, debit cards, net banking, UPI, and more. FrenzoPay is known for its low transaction fees, multi-currency support, and advanced features such as recurring payments and invoice management. The platform charges a transaction fee of 1.75% for Indian cards and 3% for international cards.

3.Razorpay: Razorpay is another popular payment gateway in Delhi NCR. The platform offers a variety of payment options, including credit cards, debit cards, net banking, UPI, and more. Razorpay is known for its competitive pricing and user-friendly features. The platform charges a transaction fee of 2% for Indian cards and 3% for international cards. It also offers features such as recurring payments, smart routing, and instant refunds.

4.CCAvenue: CCAvenue is one of the oldest payment gateways in India and is a popular choice for businesses in Delhi NCR. The platform offers a wide range of payment options such as credit cards, debit cards, net banking, UPI, and more. CCAvenue is known for its excellent customer support and advanced features like multi-currency support and recurring payments. The platform charges a transaction fee of 2% for Indian cards and 3% for international cards.

5 Cashfree: Cashfree is a popular payment gateway in Delhi NCR, especially among small businesses and freelancers. The platform offers a variety of payment options such as credit cards, debit cards, net banking, UPI, and more. Cashfree is known for its low transaction fees, instant payouts, and automated reminders. The platform charges a transaction fee of 2% for Indian cards and 3% for international cards.

Conclusion:

Choosing the right payment gateway is crucial for any business, especially in Delhi NCR, where competition is intense. While there are many payment gateways available, businesses must choose the one that best suits their needs. PayU, FrenzoPay, Razorpay, CCAvenue, and Cashfree are some of the best payment gateways in Delhi NCR, each offering unique features and pricing. By choosing the right payment gateway, businesses can provide their customers with a seamless and secure payment experience, enabling them to grow their business and stay competitive.

3 notes

·

View notes

Text

Being Human announces a Flat 50 per cent discount on the entire collection between the 25-27th December!

23 December, 2022

Mumbai (Maharashtra) [India], December 23 (ANI/NewsVoir): If it’s Salman Khan’s birthday, there’s bound to be a celebration!

A bond so genuine, this birthday Being Human Clothing has a special surprise for fans and fashion enthusiasts as all of their stores announce one of their biggest sales EVER!

While the digital platform has been buzzing with talk around this party surrounding the superstar’s birthday, the brand finally announces their plans to celebrate the occasion in the biggest way possible. Numerous celebrities and personalities have taken to Instagram to celebrate this occasion.

Giving fans another reason to rejoice this festive season, Being Human Clothing brings in Salman Khan’s birthday with a flat 50 per cent discount, + 5 per cent OFF FOR THE ARMED FORCES* + 7 per cent INSTANT DISCOUNT ON ICICI BANK CREDIT CARDS* for their entire collection between the 25th to 27th December 2022.

With his inimitable swag, style and large personality Salman Khan has amassed the love of billions of fans across the globe, all of whom are the brand’s most loyal fanbase. On the occasion of his birthday, Being Human Clothing, in what can be described as one of the biggest annual events, throws buyers a party making it even more accessible and affordable to purchase these bespoke pieces.

Being Human Clothing CEO, Sanjeev Rao says, “Our campaign is based on an insight of connection that Salman has with his fans. To his fans he is Bhai. Hence the campaign “BhaiKaBirthday”. The idea is to extend the large heart that Salman has to the consumers of being human clothing. This Aadha Bill Bhai Bharenge” was our way of announcing our biggest annual sale around his birthday, where we have our entire stores on a flat 50 per cent. If you are from the armed forces, we offer you an extra 5 per cent. We also tied up with ICICI to offer an additional 7 per cent benefit to their card holders.”

Founded in 2012 to further the objective of ‘Being Human – The Salman Khan Foundation’ a charitable trust devoted to education and healthcare initiatives for the underserved Indian population, Being Human Clothing has always stood for loving, caring and sharing. The brand has also always been about inclusivity and integrity. Keeping these principles in mind, the label will be offering a transparent flat 50 per cent discount on not just selected pieces but the entire clothing and accessory range.

A clothing line with a heart – When you buy Being Human Clothing, you help save and shape lives through the Being Human Foundation’s healthcare and educational initiatives.

2 notes

·

View notes

Text

Top 10 Recharge & Bill Payment Websites in India

There was a time when people used to visit recharge shops to recharge their mobile numbers. At that time, people take a good amount of time from their busy schedule to visit their nearest recharge shops 2-3 days before the day of recharge. That shopkeeper charges an amount of money for his services based on the recharge amount. And for utility bills like electricity bills, gas bills, water bills, landline bills, etc., people used to stand in long queues. But now that those days are gone, certain websites and apps enable you to make all these payments with a click of the mouse. The best thing about these websites is that they can be utilized for the payment of most service providers in the country. You can pay all your bills on these websites, including electricity bills, water bills, DTH, post-paid bills, piped gas, WIFI bills, credit card bills, and even make prepaid recharges that include mobile recharges, FasTag, data cards, and others. So, nowadays, these recharge websites are in trend as well as easy to use and time-saving. Along with these benefits, it also provides the benefit of lucrative deals, offers, and cashback from time to time.

So, we present you with the list of the top 10 recharge websites and apps in 2022.

· EaseMyDeal- You must be wondering why we have kept EaseMyDeal on top. Well, EaseMyDeal is an ISO Certified Platform that is made in India that assures safety and reliability to its customers. We must advocate for local businesses and support Indian start-ups. It has an easy-to-use app interface that has a multilingual support system. It is the best not only in terms of its services but also because it has the best customer support. All the queries or complaints are answered within 24 hours. It also offers 24/7 Premium Support via WhatsApp, phone, and email. It has a fast, secure, and safe payment system that never stores payment details with them and has all the payment options that also include Pay Later Options, EMI, and Multiple Reward Points. It provides instant refunds and the fastest complaint resolution. On top of that, the reason why it has gained so much publicity in a very short time is that it provides the best cashback and deals on all payments made on EaseMyDeal. It is so good that it has a very high Google rating of 4.9/5.

· Paytm- It is also known as Cashless Haven for Online Payers. Paytm is used by Indian people to transact daily, from a small grocery shop to a big mall or movie hall. Paytm is running everywhere now, from village small shops to urban big malls. Paytm is also the premium site for adding bill payment, mobile recharging, booking movie tickets, booking taxi and airline tickets, and a lot more. There is no end to Paytm services. Any service you think of is available on Paytm. It is one of the best platforms that runs on Windows, iPhones, Androids, etc.

· MyAirtel - MyAirtel Appis one of the bestapps for all online recharges, bill payments, BHIM UPI transactions, mobile banking, and much more. It allows its users to pick any prepaid or postpaid mobile plan that suits them best. The best thing about this app is that it provides the best offers and cashback on all recharges. It even provides OTT subscriptions at discounted rates as well.

· Freecharge: Freecharge is the most favored payment channel. Freecharge offers recharge for prepaid mobile phones, post-paid mobiles, DTH, and data cards. It offers online wallet features for all users. It allows its users on Android to send and receive money via WhatsApp too. Freecharge allows you to get cashback and shopping coupons for the same price that has been paid to get the recharge done. Those coupons include McDonald’s, Barista, Shoppers Stop, Café Coffee Day, Croma, Puma, etc.

· Dealmegood - Dealmegood is one of the best websites thatprovides DTH recharges andshopping vouchers at various discount rates. Those shopping vouchers include fashion, food, travel, entertainment, and others. It not only provides shopping vouchers but also provides mobile and DTH vouchers as well. It is the most useful website where you can buy vouchers at discounted rates and use them to gift any of your friends on their birthdays or anniversaries. And it is the best and most useful gift for anyone. To have a close look at what they offer and what the relevant prices are, you can visit DealMeGood.

· MobiKwik - Mobikwik is a quick way to make online recharges and payments. It is a mobile wallet as well as an online payment system to store money and make payments. It is an online platform for prepaid mobile recharges, utility bill payments, DTH recharges, or shopping at listed outlets. It also provides a door-stop service where they collect money from your house and add it to your MobiKwik Wallet. It is a semi-closed wallet that is authorized for use by the Reserve Bank of India. It is one of the top recharge Websites in India.

· Amazon Pay - Amazon is the one-stop solution for all your shopping needs. It provides online services for prepaid recharges, post-paid bill payments, gas, landline, mobile, electricity, and broadband bill payments. Not only do these services exist and what you can think of, but Amazon also has that service that includes grocery shopping, clothes shopping, luxury items, and phones. It has a closed wallet as well, so you can make instant payments anywhere in India. It even provides cashback on recharges as well.

· Phone Pe - Phone Pe is a normal app that can be easily downloaded from the Play store. Phone Pay is a normal app that can be used to pay money to someone. The money you transfer gets automatically deducted from your linked bank account, and the money you receive gets deposited into your linked bank account. It does not have any wallet facilities. It can normally be used to recharge your mobile, DTH, cable TV, FasTag, and all other bill payments. Apart from that, you can buy brand vouchers, magazine subscriptions, FasTag, and even make donations as well. So, all in all, it is one of the best apps for recharges and bill payments.

· Google Pay - Google Pay is an app that you can download from the Play store and use to pay someone money, recharge your phone, and pay your bills. The best thing about Google Pay is that the money you transfer gets directly withdrawn from your bank account and the money you receive gets directly deposited into your bank account. Google Pay does not have any wallet facility, or you can say there is no tension about maintaining a wallet. You can directly transact through your bank account with the help of Google Pay.

· PayZapp- PayZapp is an app offered by HDFC. PayZapp allows you to save money while shopping on your mobile device at partner apps, buy mobile phones, tickets, and groceries, compare and book flight tickets and hotels, and shop online. This app can be used to transfer money to anyone who is on your contact list. You can pay your bills, recharge your mobile, DTH, data card, and many more things. It is UPI powered and Visa and MasterCard supported. It is a multi-tasking app. You can use this app for different purposes.

#Broadband Bill#DTH Recharge#EaseMyDeal#Electricity Bill#fastag recharge#Freecharge#Gas Bill#LPG Bill#Mobile Recharge#Momikwik#Paytm#Utility Bill Payments#Water Bill#Trending Apps

3 notes

·

View notes

Text

The Invisible Engine: How Corporate DSAs Fuel India's Economic Growth

India's economic landscape is a complex ecosystem, powered by various forces. One such force, often overlooked, is the network of Corporate Direct Selling Agents (DSAs) across the country. This blog explores the crucial role Corporate DSAs play in India's economic growth, specifically focusing on the contributions of DSA channels in Jaipur, Rajasthan.

Who are Corporate DSAs?

Corporate DSA in India are independent agents who act as a crucial bridge between financial institutions and potential customers. They promote and distribute financial products like loans, credit cards, and investment plans offered by banks and NBFCs (Non-Banking Financial Companies). Unlike traditional bank branches, Corporate DSAs reach customers in diverse locations, including far-flung rural areas.

The Power of DSA Channels in Jaipur

Jaipur, Rajasthan, with its vibrant economy and growing entrepreneurial spirit, serves as a prime example of how Corporate DSA channel contribute to growth. Here's how:

Financial Inclusion: DSA in Jaipur extends financial services to a wider population, including those who might not have easy access to traditional banking channels. This promotes financial inclusion, a key driver of economic development.

Increased Loan Disbursement: By reaching a broader customer base, Corporate DSAs in Jaipur facilitate a significant increase in loan disbursements. This injects capital into the local economy, fueling business growth and job creation.

Micro and Small Business (MSME) Growth: DSAs play a vital role in supporting MSMEs, the backbone of the Indian economy. They provide these businesses with access to much-needed credit, allowing them to expand, innovate, and contribute to the state's economic prosperity.

Employment Generation: The growth of the DSA in Jaipur creates employment opportunities for individuals who act as agents. This not only empowers individuals but also boosts local consumption and economic activity.

Beyond Jaipur: A Nationwide Impact

The impact of Corporate DSAs isn't limited to Jaipur. Across India, DSA channel play a significant role in:

Financial Literacy: Through their interactions with potential customers, DSAs raise awareness of financial products and services, promoting financial literacy and responsible financial behavior.

Market Penetration: DSAs act as the physical extension of financial institutions, enabling them to penetrate new markets and cater to diverse customer segments.

Economic Upliftment: By facilitating access to credit and financial services, DSAs contribute to the overall economic upliftment of communities across the nation.

Conclusion

Corporate DSAs, often unseen and under-appreciated, are the invisible engine propelling India's economic growth. Their dedication to reaching customers in every corner of the country, particularly in areas like Jaipur, Rajasthan, fosters financial inclusion, empowers businesses, and creates employment opportunities. As India continues its economic journey, the role of Corporate DSAs will undoubtedly become even more critical in ensuring inclusive and sustainable growth. So, the next time you see a DSA promoting financial products, remember the significant role they play in building a stronger and more vibrant Indian economy.

0 notes

Text

Pan Card

In the vast landscape of financial documentation, the Permanent Account Number (PAN) card stands as a cornerstone for individuals and entities in India. Introduced by the Indian Income Tax Department, the PAN card serves as a unique identification number, essential for various financial transactions and regulatory compliance. Its significance extends far beyond mere identification, playing a crucial role in taxation, investment, and financial planning.

Understanding PAN Card

At its core, the PAN card is a 10-character alphanumeric identifier, issued in the form of a laminated card by the Income Tax Department of India. The format of the PAN number follows the pattern: AAAPL1234C, where the first five characters are letters, followed by four numerals, and ending with a letter again.

Purpose and Utility

The PAN card serves a myriad of purposes in the Indian financial ecosystem:

Tax Identification: Every taxpayer in India, whether an individual or an entity, is required to possess a PAN card. It is used to track taxable financial transactions and ensure compliance with tax laws.

Income Tax Filing: PAN is mandatory for filing income tax returns in India. It facilitates the assessment and verification of an individual’s tax liabilities and ensures transparency in tax declarations.

Financial Transactions: PAN is essential for various financial transactions, including opening a bank account, making investments in securities, buying or selling immovable property, and conducting high-value transactions.

Identity Proof: PAN serves as a valid identity proof, accepted by government agencies, financial institutions, and other authorities across the country.

Prevention of Tax Evasion: By linking financial transactions to PAN, the government can track and curb tax evasion and black money circulation effectively.

Importance of PAN in Financial Planning

In the realm of financial planning, PAN plays a crucial role in:

Tax Planning: PAN enables individuals to avail tax benefits, file returns, and comply with tax regulations. It facilitates efficient tax planning strategies, including investment in tax-saving instruments like ELSS (Equity Linked Savings Scheme), PPF (Public Provident Fund), and insurance policies.

Investment Management: PAN is required for opening demat accounts, investing in stocks, mutual funds, and other financial instruments. It enables individuals to track their investments and manage their portfolios effectively.

Credit Score: PAN is linked to financial transactions, including loans and credit card payments. Timely payment of dues and responsible financial behavior, reflected through PAN, contributes to a positive credit score, enhancing one’s creditworthiness.

Legal Compliance: PAN ensures compliance with various financial regulations and acts as a safeguard against fraudulent activities. It enhances transparency and accountability in financial transactions, thereby fostering trust in the financial system.

Conclusion

The PAN card stands as a testament to India’s evolving financial infrastructure, providing individuals and entities with a universal identifier for taxation, investment, and financial planning. Its seamless integration into various financial processes underscores its importance in the modern economy. As India progresses towards a digital economy, the PAN card remains a vital tool for unlocking financial opportunities and fostering economic growth.

0 notes

Text

Cyber Crime Full Lecture

Hello friends, welcome to you guys in the form of Menu Rashi and in today's blog we will talk about this cyber crime and together we will know the justice of cyber crime and then after that we will know about cyber crime and IPC i.e. in IPC. Which are the sections which deal with cyber crime? So stay with me and mostly in this group [Music] In this Vrishabha Loot, let's start with the meaning of cyber crime. So friends, this cyber law which you have seen in the blog. In this meeting we talked about cyber crime. If we read its contents then cyber crime is a general term that refers to all criminal activities done using the medium of communication technology companies through internet, cyber space and world wide. Web i.e. WWW is a time cyber crime is a criminal activity which is done by using the medium that is by using communication technology companies and then by using the internet and subscribe. All the activities that are done by using the World Wide Web are called cyber crimes. And I would like to tell you that we know cyber crime by the name of computer oriented craft. Now let us talk about crimes in front of internet i.e. the crimes being committed by using the internet. Let us first read about internet crimes. This is any time for illegal online activity committed in the internet through the internet or using the internet i.e. such illegal activity which is being done on the internet or through the internet or by using the internet and friends, this is I have further explained that internet crime is a strong bench of cyber crimes and in which times internet alarm should be given as an example issue, identity theft or internet schemes or cyber stalking. Now let us talk about the categories of cyber crime i.e. What are those decrees against which we go against cyber crime? Friends, we talk about Radhe-Radhe Pimple first, individual second, government and this property.

Also Read-Telangana cyber cell account freeze

Individual is this category and cyber crime involves individual distributive malaysia and illegal information online i.e. such crime or a cyber crime which is done to an individual, we put them in this category like for example if we talk about cyber stalking distributive pornography. And traffic in that means distributing pornography or talking about women trafficking. If we talk about pornography trafficking, then all those are gas crimes of individuals. They come in this category. They talk on the number of government. This is the list. Komal Cyber. Crime which is the most serious office i.e. it is a less commonly done work but the most serious offense is a crime against government is also known as cyber terrorism. Below we will call cyber terrorism against government job. We also know and what are those crimes which we consider against the government i.e. hacking a government website or hacking a military website, disrupting the governance of any government portal, all these crimes are Coming to the category, now let us talk about the third option i.e. against property dissimilar tour. Real life instance of criminal illegally possessing and individuals bank and credit card details. This is like real life insurance in which a criminal is an individual's bank. Takes key details or edits details fraudulently. If we talk about hot examples in this, then access confidential information or stealing from Sesame Bank Oriental, then friends, these are fine categories of cyber crime. Now let's talk about cyber crime and Indian Penal Code i.e. Indian Penal Code Mukund has sections which deal with cyber crimes and cyber criminal activities, so friends I have given it cyber crimes and personal liability IPC, we have given some examples of them in this blog. Let's start with section 425 i.e. from soil to soil. It was told that it is done with intention and normally i.e. any person intentionally or knowingly causes harm to someone or causes loss, de-matches a person and gives away his properties and destroyer. This committee will consider that if it destroys or diminishes the value of that property or its utility, then if we are damaging someone's computer or doing magic to the computer system, then we will bring that also in Mirchi category and that We will give punishment through Section 345. In this, the person can be punished with medium punishment up to 3 months or fine or both. If you do not take tension then talk about Section 379. Definition of slapping friends is known that a person If someone is troubled by the property of another person and removes it with criminal intent without his permission, then friends, if a person owns a computer that is owned by an individual or is owned by a company.

Also Read-Karnataka cyber cell account freeze

If the person steals its data, then that person will also be punished in the third degree by imprisonment up to 3 years or a fine or both. Now let's move to the next session, section 3198. Who deletes this by cheating? Friends, it is a matter of fitting. Everyone knows that we do chatting, that is why it is said that if a person steals someone's password and uses it for a prominent purpose or sends an email to someone for a product purpose, then a bogus website does this or does cyber fraud. If so, then the person can be punished with imprisonment up to three years under Section 319 or may fail, whereas if we talk about Section 320, then the person can be punished with imprisonment up to one year or may be punished with fine. Moving towards the next session, Section 2 F Sale The types of cyber crimes include capturing the private area of a person, publishing or transmitting the content without that person's knowledge or consent, we have also included that in this section and if a person commits such a crime for the first time, then he should be given two penalties. Imprisonment up to one year or fine which can be up to ₹ 2000.

Also Read- bank account freeze ho jaye to kya kare

Will front and if the person continues this office again i.e. in the setting convention he will be punished up to 5 years i.e. voice off will be increased to 5 years and the fine will be increased to ₹ 5000. Friends, now let's talk if obscene 465 Punishment of forgery means that if a person creates a false document then he will be included in this category and will be punished with imprisonment up to 2 years or fine or both. So friends, in this blog we talked about the happiness category of cyber crime. In the Indian Penal Code, if we deal with cyber crime or punish cyber crime in the gym, then friends, we have put the notes of this blog in the description box of this blog. If you want, you can click on that link. You can download those notes so that it becomes easier for you to read and understan.

0 notes