#InterestRateForEducationLoan

Photo

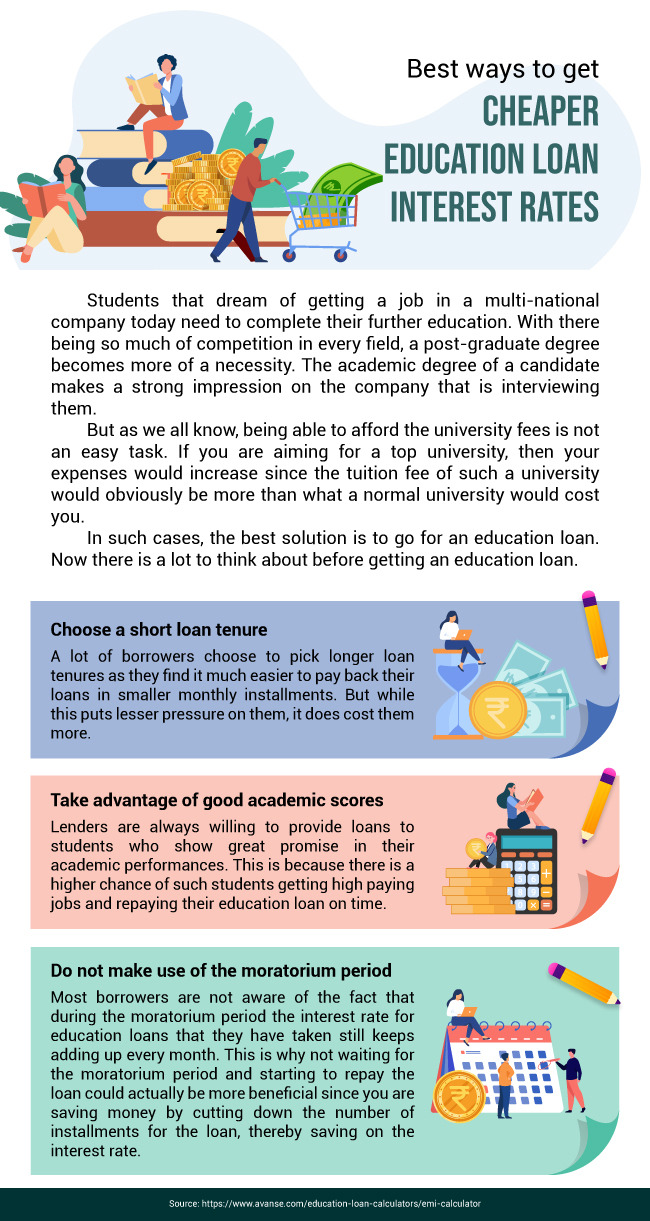

A lot of borrowers choose to pick longer loan tenures as they find it much easier to pay back their loans in smaller monthly installments. But while this puts lesser pressure on them, it does cost them more. This is because the interest rate for education loan plans is added with each installment, hence cutting down the installments to pay back the loan in a shorter loan tenure is actually more beneficial.

You can find more interesting things on these social sites mentioned below :-

Facebook:-

https://www.facebook.com/AvanseEducationLoan/

Twitter:-

https://twitter.com/avanseeduloan

YouTube:-

https://www.youtube.com/channel/UCcsuUx1EH1C08XmX2embpug

Instagram:-

https://www.instagram.com/avansefinancialservices/

#EducationLoan#EducationalLoan#EducationLoans#StudyInIndia#StudyLoan#StudyLoans#OverseasEducationLoan#EducationLoanForAbroadStudies#InterestRateForEducationLoan

1 note

·

View note

Text

Drowning in Educational Loan Debt - Will Loan Consolidation save You?

You've heard about loan consolidation and the idea of making a smaller payment to one lender sounds like a dream compared to your current nightmare of feeding a seemingly endless stream of money to a number of different lenders. No contest--where do you sign up?

Rein yourself in for a moment. Consolidation may be the perfect solution to your financial woes and then again it may not be. So before you jump on the consolidation bandwagon, here are a few things you might want to consider.

Are Lenders Axing Consolidation Loans?

In an effort to remedy some inequities in the federal student aid programs, Congress recently enacted the College Cost Reduction and Access Act of 2007, which among other provisions, cuts lender subsidies that have historically been in place to encourage lenders to participate in the federal education loan programs. This legislation, in concert with the recent subprime mortgage credit crisis, has lenders taking a closer look at whether Emi Calculator Education Loan continues to be profitable for them.

Higher education leaders anticipate that lenders may cut back on the Stafford and PLUS loan incentives and discounts previously offered to attract borrowers--and eliminate them altogether for consolidation loans. Consolidation loans, with the tightest profit margin of all education loans, may even be on the chopping block for some lenders while others may increase the minimum balance that qualifies a borrower for a consolidation loan.

Even if lenders back out of the consolidation loan business, consolidation is still available through the federal Direct Consolidation Loan program, but the government doesn't offer the incentives and discounts that lenders have long been using to attract borrowers.

Are Interest Rates Coming Down?

Stafford Loan and PLUS variable interest rates, which are based on a formula that includes the interest rate of the most recent 91-day T bill, change every July 1; rates are expected to drop significantly on July 1, 2008. This decrease should make the educational loan variable interest rates very attractive. Because the interest rate for a consolidation loan is calculated using a weighted average of all interest rates for all of the loans you would include in consolidation, you may want to wait until after July 1 to make a more informed decision.

Consolidation: Thumbs Up or Down?

To consolidate or not to consolidate: that is the question. But there's no easy answer.

Consolidation may be a good idea if:

· You have a variable interest rate and would rather have a fixed rate. This may be a good idea but you might want to wait and consider it only if interest rates start going back up. And, what happens if variable interest rates stay down or drop below your fixed rate?

· You have a variety of loans and lenders and would like to have only one lender. One problem--you may have to 'pay' for the convenience by accepting a higher interest rate on some of your loans.

· You need more flexible repayment options. Repayment options available through consolidation are:

Standard - fixed monthly payments.

Graduated - start out with low payments and increase every 2 years.

Extended - for amounts greater than $30,000, either a fixed or graduated option.

Income contingent - based on annual income and total loan debt, with a payment adjustment every year as income changes. The FFEL program offers income sensitive repayment, which bases monthly payments on a percentage of income.

Although the Stafford Loan programs offer flexible repayment options, the Perkins Loan program currently does not. Note: An income-based repayment option will become available for FFEL and Direct Stafford, Perkins, Grad PLUS, and Federal Consolidation (less undergrad PLUS) loan borrowers on July 1, 2009.

· You absolutely need to ease up on your monthly payments. Beware of this option. A lower payment generally means a longer repayment period and paying more interest over time.

· Consolidation may not be a good idea if:

· Any of the loans you plan to include have cancellation or forgiveness options that may be lost if you consolidate.

· The Perkins Loan Program, for example, has a cancellation option if you teach in certain public school service professions or subject areas or in certain designated low income schools.

· Portions of a Stafford Loan may be eligible for cancellation if you teach full time for five consecutive years in a low income school. (Under certain circumstances, this option may also be available for consolidation loans.)

· Your current lender offers rebates (such as an annual reduction in your interest rate) for successive on-time payments. You would lose this option if you consolidate and, as previously mentioned, lenders may be phasing out incentives for consolidation loans.

· You consolidate during your grace period(s). The remainder of your grace period is lost.

· You've already substantially reduced the amount you owe. Because consolidation generally extends your repayment period, often with an increased interest rate, you may ultimately end up paying more.

Research and Conquer

Unfortunately the answer to whether or not consolidation is right for you is..."it depends." To find out, collect information about what federal loans you have (Perkins, FFEL, PLUS, and Direct Loan programs) by accessing the National Student Loan Data System (nslds.ed.gov). Collect information about any private educational loans you have directly from your lender(s). Take the loan information and find an online consolidation loan calculator to help you determine how your loan repayments may change through consolidation.

Then ask yourself the following questions:

· Am I willing to pay higher interest or extend my repayment period and pay more interest over time?

· Am I going to lose any loan cancellation options or incentives for which I'm currently eligible?

· Can I afford my current payments without consolidating?

· Would consolidation actually make my payments significantly more affordable?

· Does the 'lower payment now' benefit offset the 'pay more for longer' downside of consolidation?

You can see that the decision whether or not to consolidate is not black and white. It is an individual decision--it may work for some and not for others. Because there are long term implications to consolidation, do your research and weigh the pros and cons carefully. When all of the evidence is in, you should be able to decide whether or not a consolidation loan is the answer for you.

#educationloaninterest#educationloaninterestrates#educationalloaninterestrate#educationalloanemicalculator#interestrateforeducationloan#educationalloaninterest#educationalloancalculator

0 notes

Text

Personal Education Loans - Choose the Best and Learn the Best

Loans are helping people in each and every step of life. Education too is one sector that has now been made available to all by the loans. In this context the personal education loans are worth mentioning. It is because of the help of these loans that students of any financial status can now dream of acquiring the best education and then be successful. Any amount, that is required for higher studies and for other courses is delivered by these loans.

As these are available in two forms, you will be able to take up any one from these. It will depend on your capacity mainly, while you decide to choose one from these loans. The secured loans can be adopted by only those who pledge their valuable assets as collateral. Hence, this Education Loan Interest mainly is for the homeowners. However, for the unsecured loans it is not necessary for you to be a homeowner. No collateral is asked here and therefore, anyone can get it. Even the property owners too can get it if they want smaller amount for their studies. The rate of interest in both these loans differs. In the secured loans the rate of interest is low and vice versa, because it depends on the risk factor being suffered by the lender. The risk of the lender in the unsecured loans is more and therefore, the rate of interest too is higher.

These loans will help you in affording lots of things like:

- Taking admission in college

- Paying class fees and examination fees

- Making projects

- Going in excursions

- Paying for room and food

- Medical treatments

- Travel expenses

- And other miscellaneous activities

For repaying the personal education loans you will be given certain good facilities. You can pay it off six months after you finish your course or after getting employed in a job.

#educationloaninterest#educationloaninterestrates#educationalloaninterestrate#educationalloanemicalculator#interestrateforeducationloan#educationalloaninterest#educationalloancalculator

0 notes