#EducationLoanForAbroadStudies

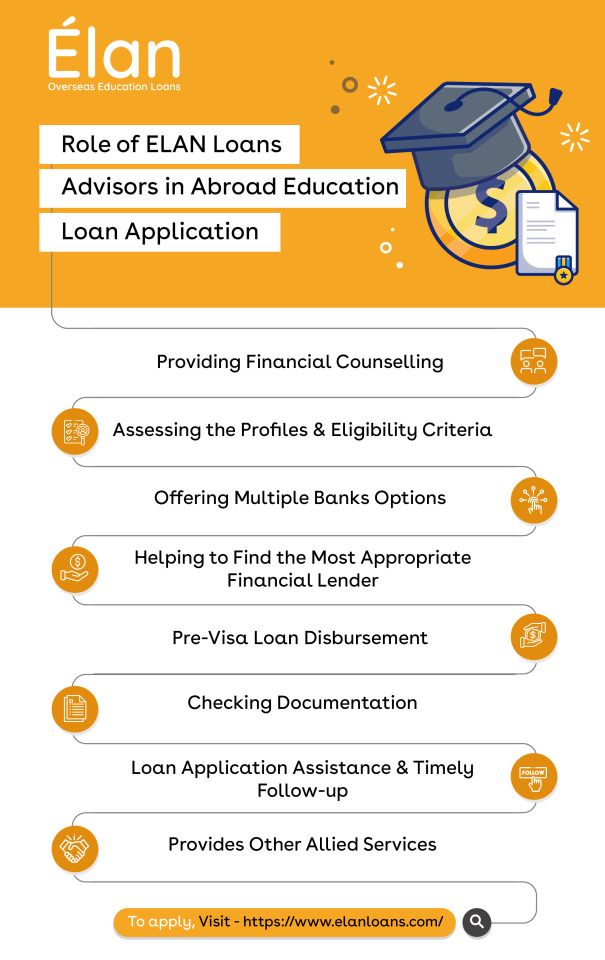

Text

Expert guidance for foreign education loans - ELAN Loan Consultants simplify the application process for aspiring students. Find the best loan options.

#overseaseducationloan#studyabroadloan#educationloanforabroadstudies#student loans for studying abroad

0 notes

Text

Fund For Higher Education

When it comes to higher education many of us know that it’s not cheap. From tuition fees to housing costs, the list of financial obligations for students can be overwhelming. Unfortunately, this means that a lot of potential applicants are unable to pursue further education due to a lack of funds. This blog post will explore the various avenues available for funding student education, from government subsidies and grants to scholarships and loans. We’ll look at how you can access these funds and the best ways to make them stretch as far as possible. Read on to discover how you can get the most out of your higher education experience without breaking the bank!

Grants

There are a number of grants available to students pursuing higher education. The most common type of grant is the federal Pell Grant, which is awarded based on financial need. Other types of grants include state and institutional grants, which are usually awarded based on merit or need. Private scholarships are also available, and these can be found through a variety of sources, including online search engines and private organizations.

Scholarships

Scholarships can be a great way to finance your education, but they can also be a lot of work. The process of finding and applying for scholarships can be time-consuming, but it’s worth it if you can get free money for college.

There are a few different types of scholarships: need-based, merit-based, and student-specific. Need-based scholarships are awarded based on the student’s financial need. Merit-based scholarships are awarded based on the student’s academic achievement or other merits. Student-specific scholarships are awarded to students who meet specific criteria, such as being a member of a certain group or having a certain major.

To find scholarships, you can search online databases, like Fast web or College Board, or check with your school’s financial aid office. Once you find some potential scholarships, you will need to fill out an application and submit any required materials. Make sure you follow all the instructions and deadlines!

If you’re awarded a scholarship, congratulations! Be sure to thank the organization or individual who made it possible.

Loans

There are a variety of loans available to help pay for higher education, including federal and private loans. Federal loans are available through the Department of Education and include Stafford, PLUS, and Perkins loans. Private loans are offered by banks and other lenders and typically have higher interest rates than federal loans. Students should exhaust all federal loan options before considering private loans.

Work-Study Programs

Work-study programs are one way that college students can earn money to help pay for their education. These programs usually involve the student working in a part-time job related to their field of study, and the earnings go towards paying for tuition and other expenses.

There are many benefits to work-study programs beyond just earning money. Students can gain valuable experience in their field, make connections with professionals, and build their resumes. Work-study can also help students stay motivated and on track with their studies, as they are more likely to complete their degree if they have a financial stake in it.

If you’re interested in applying for a work-study program, talk to your financial aid office or departmental advisor. There are often applications and deadlines involved, so it’s important to start the process early. You may also want to search online or ask around for opportunities – many companies offer work-study positions specifically for college students.

Military Benefits

There are many benefits to joining the military, including the funds available for higher education. The GI Bill is one of the most popular and well-known programs, providing up to 36 months of financial assistance for eligible veterans and their families. Other programs like the Tuition Assistance Program (TAP) and Montgomery GI Bill (MGIB) also offer financial help for those looking to further their education. In addition to monetary assistance, the military also offers other benefits like housing allowances, stipends for books and supplies, and even healthcare coverage. For more information on all the available benefits, be sure to check out the website of your local military branch.

Employer Reimbursement

Employer reimbursement is a great way to ease the financial burden of higher education. Many employers offer some form of tuition reimbursement, whether it’s a set amount per year or a percentage of tuition costs. Check with your human resources department to see if your employer offers any type of tuition assistance program. Even if your employer doesn’t have a formal program in place, they may be willing to negotiate some form of tuition reimbursement as part of your employment contract.

State and Local Funding

State and local funding for higher education has been on the decline in recent years, leading to increases in tuition and a decrease in the quality of education.

In order to address this problem, state and local governments need to increase funding for higher education. This can be done through a variety of methods, such as increasing taxes, cutting spending in other areas, or creating new revenue sources.

Once adequate funding is available, it can be used to improve the quality of education by hiring more faculty, increasing salaries, improving facilities, and providing more financial aid to students.

By making higher education a priority, state and local governments can ensure that their citizens have access to quality education and training that will prepare them for the workforce.

Federal Funding

Federal Funding for higher education comes in many different forms. The most common form of federal funding is through grants and loans. Grants are typically given to students who demonstrate financial need, while loans are given to students who do not demonstrate financial need. Both types of federal funding must be repaid with interest. Other forms of federal funding include work-study programs and federal student aid. Work-study programs provide students with part-time jobs to help pay for their education, while federal student aid can come in the form of grants, loans, or work-study programs.

Private Funding

There are a number of ways to finance your education beyond government loans, grants, and scholarships. You can look into private funding options such as student loans from banks or other lending institutions, lines of credit, or student loan consolidation programs. You can also explore financing options through your parent’s employer, union membership, or professional organizations to which your parents belong.

If you decide to take out a private loan, make sure you compare interest rates and repayment terms before signing on the dotted line. You don’t want to end up with a loan that has an interest rate that’s too high or repayment terms that are too strict.

If you have good credit, you may be able to get a lower interest rate by taking out a private loan. But remember, even if you qualify for a lower interest rate, you’ll still need to make payments on time each month. If you miss a payment or default on your loan, you could damage your credit score.

Conclusion

Funding for higher education is an important factor to consider when planning for college. There are numerous options available such as grants, scholarships, and loans that make it possible for students to cover the cost of college tuition. Researching all available resources is the key to finding the best option that meets your individual needs. With careful planning and hard work, obtaining funds for higher education can be a great way to jumpstart a successful future.

Visit Us : https://www.abroadstudyloan.com/

Email Us : [email protected]

Contact Us : +91 70711 90190

#best education loan for abroad study#educationloanforabroadstudies#studentsloanorstudyingabroad#educationloantostudyabroad#bestbankforabroadeducationloans#topeducationloanprovider

0 notes

Photo

Education Loan For Abroad Studies:- The abroad study loan is here to take care of all your problems related to financing your studies in an overseas university.

0 notes

Photo

Another problem is that students take a loan from the first lender that offers them a plan. This could mean that they are missing out on the numerous other offers that different lenders could be providing them. Never forget to compare a couple of the lenders to be sure you are getting the best study loan plan.

You can find more interesting things on these social sites mentioned below :-

Facebook:-

https://www.facebook.com/AvanseEducationLoan/

Twitter:-

https://twitter.com/avanseeduloan

YouTube:-

https://www.youtube.com/channel/UCcsuUx1EH1C08XmX2embpug

Instagram:-

https://www.instagram.com/avansefinancialservices/

#EducationLoan#StudyLoan#StudentsLoan#OverseasEducationLoan#EducationalLoan#EducationLoanForAbroadStudies

1 note

·

View note

Text

Study Loan Abroad

Study Loan Abroad:-The abroad study loan is here to take care of all your problems related to financing your studies in an overseas university.

0 notes

Text

Education Loan in Gujarat Apply Online for Interest Subsidy Scheme 2018

Education Loan in Gujarat Apply Online for Interest Subsidy Scheme: Gujarat Government has introduced Education Loan Interest Assistance Plan 2018 for the students covered under the Chief Minister's self-help plan. Under this scheme, all students receive a 100% interest subsidy on education loan for a period of moratorium (1 year in addition to the curriculum). This subsidy will apply to the loan up to a maximum of rupees. 10 lakhs registration is open and interested candidates can apply online at the official website kcg.gujarat.gov.in

The interest subsidy scheme on education loans will benefit all the bright and needy students to continue their studies after the 12th standard. This scheme is applicable for graduate / post graduate / diploma and education courses for higher education in professional courses based on the conditions of the following eligibility.

All applicants must pass class 12 or equivalent with 12 or more percentages. Apart from this, the annual income of the family of all the source candidates is Rs. 6 lakh pay State Government Rs. 500 million crores in Gujarat budget 2017-18

Gujarat Education Loan Interest Subsidy Scheme 2018

Below is the complete procedure to apply online for Interest Subsidy Scheme on Education Loan in Gujarat:-

Visit the official website of Knowledge Consortium Of Gujarat kcg.gujarat.gov.in

On the homepage, click at the “Interest Subsidy Scheme on Education Loan (Registration Open)” link or directly click this link

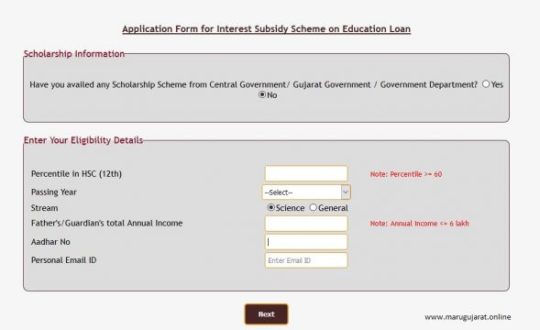

Next click at the “Online Registration Form for Interest Subsidy Scheme on Education Loan“. Afterwards, Gujarat Interest Subsidy Scheme Online Application Form will appear as follows:-

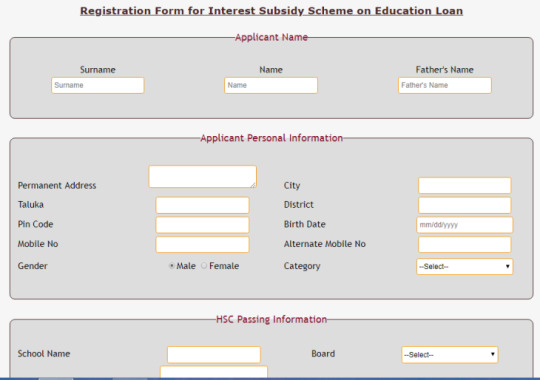

Here candidates can fill their eligibility details accurately and then click at the “Next” button. Afterwards, “Registration Form for Interest Subsidy Scheme on Education Loan” will appear as shown below:-

Enter all your details correctly and "submit" the completed application form. For more details on "How To Apply Online for Education Loan Interest Subsidy Scheme" in Gujarat, see the complete process (along with the document list). Gujarati (PDF), English (PDF)

All students must read the rules and regulations before applying online for the interest subsidy scheme on education loan. Instructions are available in both PDF format and in both English and English languages. Students can click this link directly to read the instructions. Instructions Gujarati (PDF), Instructions English (PDF)

Eligibility for Interest Subsidy Scheme on Education Loan

These applicants must complete the following eligibility criteria to become eligible for this scheme: -

Applicants must pass 12th standard from the Gujarat Higher Secondary Examination Board (GHSB) or the Central Board of Secondary Education (CBSE) and enroll in a recognized university is essential.

The applicant should be secured at least 60% in class 12th examination and after passing 2012, after passing 2012, 12 passes should be passed. If the candidates, who have passed 12th year before 2011, where no percentage is shown in the mark sheet, then such candidates can apply on percentage basis.

Students enrolled in diploma admission after 10 th standard (who do not have 12th matriculation) and can apply for graduation / post graduation can also apply on CGI / CGPA / percentage basis.

Annual Income of the family of the candidates from all sources must not exceed Rs. 6 lakh.

All students who take an academic loan after 4th July 2017 from a scheduled bank for higher education in India and abroad are eligible. Moreover, if the loan for the student is approved before 4th July 2017 and the loan amount withdrawn after 4th July 2017, such students are eligible to apply for this scheme.

This interest on education loan is applicable for subsidy scheme graduation / post-graduation / diploma and other professional courses.

Those students who have left mid-course studies in school curriculum or have been expelled from the organization for some reason are not eligible. For more details about the interest subsidy scheme on education loans in Gujarat, see Bulletin - Info. Booklet Gujarati (PDF), Info. Booklet English (PDF)

References

Self Declaration For Non IT Returns – Click Here

Self Declaration for No Other Scheme Benefit Taken – Click Here

Bank Endorsement Form – Click Here

Government Resolution – Click Here

Circular – Click Here

For complete information, visit the official website http://www.kcg.gujarat.gov.in/Education_loan/index.php

Important Links:

Online Registration Form for Interest Subsidy Scheme on Education Loan

Instructions for Student Gujarati English

How to Apply Gujarati English

Self Declaration for Non IT returns

Self Declaration of No other Scheme Benefit Avail

Bank Endorsement Form

Government Resolution (G.R.)

Interest Subsidy Scheme on Education Loan Booklet Gujarati English

More Detail: https://sarkariyojna.co.in/apply-online-interest-subsidy-scheme-education-loan-gujarat/

Read the full article

#EducationLoan#educationloandetails#educationloaneligibility#educationloanemicalculator#educationloanforabroadstudies#educationloaningujarat#EducationLoaninIndia#educationloaninterest#educationloaninterestrate#gujarat#GujaratEducationLoan#gujaratgovernment#highereducationscholarship#loansforstudents#Marugujarat#obcscholarshipstudentloans#sbieducationloan#scstobcscholarship#scstscholarship#studentloaninindia

0 notes

Link

When intending to study abroad, the education expense is often a major worry for most students. Gratefully there are a lot of education loan lenders like DiFin who will support your studies as long as you are an interested, aspiring and ambitious student. Now, the question arises here is, How would you choose the correct education loan for abroad studies? Before picking, don't just take a gander at the most reduced interest rate, instead, evaluate moratorium period, loan terms and penalty, cost of handling, EMI rates and so on.

Education loans are a friend in need for students who need to finish their education or seek after higher studies however who don't have enough monetary help to do as such. Monetary moneylenders in India like DiFin give education loans to studies in India and in addition overseas. As per UNESCO Foundation for Insights 2016, a sum of 181,872 Indian students sought after their higher education abroad. That is an astounding number of students. Basically, the most extreme vital viewpoint to accomplish the accomplishment of studying overseas is MBA or Vocational Courses. Since the quantity of people studying abroad has been relentlessly expanding, the quantity of banks giving education loan to abroad studies has been expanding as well. On the off chance that you are searching for some assistance on education loan for abroad studies, at that point you are at the perfect place!

Education loan for abroad studies- Instant Assistance by DiFin

Benefits of applying for an education loan:

• Easily accessible

• Repayment tenure more often than not begins a half year after course fruition

• Entire education-related cost coverage – educational cost charge, affirmation expense, everyday costs and so forth.

• Available for an extensive variety of courses.

• Income tax benefits can be claimed

In the event that you are a trying understudy applying for an education loan for abroad studies, you can ask for a callback from DiFin’s expert staff. The professionals will manage you until endorse.

For more information. https://difin.in/

0 notes

Text

HDFC Education Loan: Interest Rates,Student Loan: Apply Online

HDFC Bank Education Loan- Student Loan in India

Eligibility Criteria

You need to be a Indian resident

You should be aged between 16 - 35 years.

If you are taking a loan of more than Rs. 7.5 LakWhy take an Education Loan from HDFC Bank?h, a collateral security will be required.

Co-applicant: A co-applicant is mandatory for all full time programs. Co-applicant could be Parent/ Guardian or Spouse (if married) / Parent-in-law (if married).

Co applicant:

A co-applicant is required for all full time courses. Here are a few points to be noted about co-applicants:

Primary Co-Applicants:

Parents, Spouse, Siblings

Secondary Co-Applicants:

Father-In Law, Mother-In-Law, Brother-In-Law, Paternal / Maternal Uncle / Aunt

Here is an exhaustive list of the documents that you will need for the student loan:

Category Applicant

Student

Academic Institute Admission Letter with Fee break-up

SSC,HSC,Graduation Marksheets

KYC (Know Your Customer)

Age Proof

Signature Proof

Identity Proof

Residence Proof

Income Documents

Salaried

Latest 2 Salary Slips carrying date of joining details

Latest 6 Months Bank Statement of the Salary Account.

Self Employed

Last 2 Year ITR with Computation of Income

Last 2 Years Audited Balance Sheet

Last 6 Months Bank Statement

Proof of Turnover (Latest Sales / Service Tax Return)

Self Employed - Professional

Last 2 Year ITR with Computation of Income

Last 2 Years Audited Balance Sheet / P& L

Last 6 Months Bank Statement

Proof of Qualification

Others Completed Application Form

Latest Photograph (Signed Across)

If appointment letter does not mention Joining Details, then applicant has to submit appointment letter of the current employer.

Proof of continuity from previous employer is required if co-applicant is in current job for less than 1 year at the time of loan application

Documentation (Post Sanction).

Benefits of Educational Loan In India

Avail tax benefits under section 80(E) of income tax Act 1961

Flexible repayment options

Option to avail insurance cover for your loan

Why take an Education Loan from HDFC Bank?

Whatever be your need we have a loan for you. Over the years we have won the trust of our customers and have become market leader in loan products.

Enjoy triple benefits when you take an Education Loan from HDFC Bank:

Faster loan - Our loan sanction and disbursal is one of the quickest with easy documentation and doorstep service.

Competitive pricing – Our loan rates and charges are very attractive

Transparency – All charges are communicated up front in writing along with the loan quotation

Education Loan for Indian Education Interest Rates & Charges

Enclosed below are HDFC Bank Education Loan for Indian Education Interest Rates & Charges Here is an exhaustive list of all the fees and charges to be paid for the education loan:

Description of Charges

Education Loan

Loan Processing Charges

Maximum up to 1% of the loan amount as applicable.

Pre-payment charges

Upto 4% of the Outstanding Balance prepaid, if loan is foreclosed/ part perpaid during Moratorium (along with and in addition to due/accrued interest, if any, and other amounts due and/or payable by the Borrower to the Bank). No prepayment charges will be charged if loan is foreclosed / part prepaid any time after expiry of the Moratorium.

No Due Certificate / No Objection Certificate (NOC)

Nil

Duplicate of No Dues Certificate/NOC

Nil

Solvency Certificate

Not applicable

Charges for late payment of EMI

@ 24 % p.a. on overdue/unpaid EMI amount outstanding from EMI due date

Credit assessment charges

Not applicable

Non standard repayment charges

Not applicable

Cheque / ECS swapping charges

Rs. 500/- per instance

Duplicate Repayment Schedule Charges

Rs. 200/-

Loan Re-Booking/Re-Scheduling Charges

Upto Rs. 1000/-

EMI Return Charges*

Rs.550/- per instance

Legal / incidental charges

At actual

Loan Cancellation Charges

Nil cancellation charges. However, interest for the interim period (date of disbursement to date of cancellation), CBC/LPP charges as applicable would be charged and Stamp duty will be retained

*Terms & conditions apply

Rates offered to customer during the period of Oct'15 to Dec'15

Min IRR

Max IRR

Avg IRR

10.10%

15.50%

12.64%

Annual Percentage Rate offered to customer during the period of Oct'15 to Dec'15

Min IRR

Max IRR

Avg IRR

10.10%

15.94%

12.70%

Read the full article

#BestBankForEducationLoan#CredilaEducationLoanInterestRate#EducationLoanForAbroadStudies#EducationLoan-HDFCBankInterestRates#Eligibility&Application#EligibilityandDocuments#HDFCBankEducationLoan|InterestRates|Information#HDFCBankEducationLoan-StudentLoaninIndia#HDFCBankEducationLoan:InterestRate#HdfcEducationLoanForAbroad#HdfcEducationLoanInterestRate2017#HdfcEducationLoanReview#HDFCEducationLoan:InterestRates#HowToGetEducationLoanFromBank#IciciEducationLoan#StudentLoan:ApplyOnline

0 notes

Photo

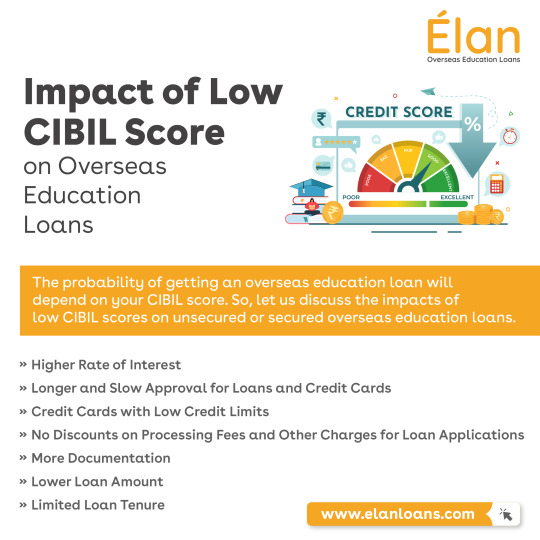

Discover Your Path to Studying Abroad!

Don't Let a Low CIBIL Score Hinder Your Study Abroad Loan!

Check out the impact of a low CIBIL score, so that student must stay informed, prepared, and find effective solutions to ensure nothing stands in the way of their study abroad ambitions.

0 notes

Text

Funds for higher education

When it comes to higher education, many of us know that it’s not cheap. From tuition fees to housing costs, the list of financial obligations for students can be overwhelming. Unfortunately, this means that a lot of potential applicants are unable to pursue further education due to a lack of funds. This blog post will explore the various avenues available for funding student education, from government subsidies and grants to scholarships and loans. We’ll look at how you can access these funds and the best ways to make them stretch as far as possible. Read on to discover how you can get the most out of your higher education experience without breaking the bank!

#Education loan to study abroad#Education loan for abroad studies#educationloantostudyabroad#educationloanforabroadstudies#bestbankforabroadeducationloans#top education loan provider#education loan for abroad studies

0 notes

Text

#Educationloantostudyabroad#Educationloanforabroadstudies#TopEducationloanprovider#Bestbankforabroadeducationloans#Besteducationloansforabroadstudies#Studentsloanorstudyingabroad#Topeducationloanprovider

0 notes

Text

#Educationloantostudyabroad#Educationloanforabroadstudies#TopEducationloanprovider#Bestbankforabroadeducationloans#Besteducationloansforabroadstudies#Studentsloanorstudyingabroad#Topeducationloanprovider

0 notes

Text

Student loan for studying abroad

Studying abroad can be a truly life-changing experience; it's an opportunity to explore a new culture, make new friends, and gain valuable skills that could help you in your future career.

But for most people, affording the cost of studying abroad is not possible without taking out student loans. Student loans are not always easy to come by either. There are many factors to consider such as interest rates, repayment plans, and loan forgiveness programs that can make the process confusing and overwhelming.

In this blog post, we will explore the various options available for student loans when it comes to studying abroad. We'll look at some of the pros and cons of each option and how you can make sure you are making the best decision for your specific needs.

UK

If you're a UK student looking to study abroad, there are a few things you need to know about your student loans. The first thing is that you can apply for a loan from the UK government to help cover the cost of your studies. The second thing is that you'll need to repay this loan once you've finished your studies and returned to the UK. And finally, you should be aware of the interest rates on these loans, which can vary depending on the country you're studying in.

So, if you're planning on studying abroad, be sure to research all of your options for funding your education, including student loans from the UK government. And remember to factor in the repayment terms and interest rates when making your decision.

US

There are many options for financing your education when you study abroad. The US government offers several programs that can help you with your expenses, including the Federal Direct Loan Program and the Perkins Loan Program. You can also apply for private loans from banks and other financial institutions.

If you're a US citizen or permanent resident, you may be eligible for federal student loans. The Federal Direct Loan Program offers both subsidized and unsubsidized loans, as well as PLUS loans for graduate and professional students. All of these loans are backed by the US government and have fixed interest rates.

The Perkins Loan Program is another option for US students studying abroad. This program offers low-interest loans to students with financial need. If you're interested in this program, you should contact your school's financial aid office to see if they participate in it.

You may also be able to get private loans from banks or other financial institutions. These loans typically have variable interest rates, so it's important to compare different lenders before deciding on one. Be sure to read the terms and conditions carefully before taking out a private loan.

Canada

If you're looking to study abroad in Canada, you'll need to take out a student loan. Here's everything you need to know about getting a student loan for studying in Canada.

The first step is to fill out the Free Application for Federal Student Aid (FAFSA). You'll need to provide information about your financial situation, including your family's income and assets. The FAFSA is used to determine your eligibility for federal student aid, which can be used to cover the cost of tuition, room and board, books, and other expenses.

Once you've completed the FAFSA, you'll need to apply for a student loan from a Canadian bank or financial institution. There are two types of student loans available in Canada: government-backed loans and private loans. Government-backed loans are typically offered at lower interest rates and have more flexible repayment terms than private loans. Private loans may be an option if you don't qualify for a government-backed loan or if you need additional funding.

Before taking out a loan, be sure to compare interest rates, repayment terms, and fees from multiple lenders. Once you've found the right loan for you, be sure to keep up with your payments and make all required payments on time.

Australia

Australia is a popular destination for students seeking to study abroad. The cost of living and tuition in Australia are both relatively high when compared to other countries, but there are a number of financial aid options available to help offset these costs.

One option for funding your studies in Australia is through a student loan. Student loans can be taken out from both the Australian government and private lenders, and can cover the cost of tuition as well as living expenses.

Another option for funding your studies is through scholarships. There are a number of scholarships available to students studying in Australia, from both the Australian government and private organizations. These scholarships can help cover the cost of tuition, travel, and other associated expenses.

Finally, another way to finance your studies in Australia is through personal savings or family support. If you have the means to do so, self-funding your studies can be a great way to avoid accumulating debt.

No matter how you choose to finance your studies in Australia, be sure to research all of your options carefully before making any decisions.

How to get a student loan for studying abroad

If you're planning to study abroad, you may be wondering how to finance your education. One option is to take out a student loan. Here's what you need to know about getting a student loan for studying abroad:

First, research the different types of loans available. There are federal loans, private loans, and loans from international organizations. Each type of loan has its own eligibility requirements, interest rates, and repayment terms.

Next, compare the costs of attendance at different schools. Make sure to factor in all expenses, including tuition, room and board, travel costs, and living expenses.

Once you've decided on a school, contact the financial aid office to inquire about loan options. They can help you determine if you're eligible for federal or private loans, or for scholarships or grants that could cover some of your costs.

If you decide to take out a loan, be sure to understand the terms and conditions before signing anything. Read over the fine print carefully so that you know exactly what you're responsible for and when repayment is due. And remember: taking out a loan is a serious responsibility. Make sure you can afford the monthly payments before committing to anything.

Repayment options

There are a few repayment options available for students who have taken out loans to study abroad. The first option is to repay the loan in full as soon as possible. This option is the best way to save on interest and get out of debt quickly.

The second option is to make minimum payments on the loan while you are still in school. This option can help you keep your debt manageable while you finish your studies.

The third option is to defer your payments until after you graduate. This can be a good option if you need time to find a job or get your finances in order before starting to repay your loan.

Whatever repayment option you choose, it is important to stay on top of your payments and make sure you are making progress towards paying off your debt.

Visit Us: https://www.abroadstudyloan.com/

Email Us: [email protected]

Contact Us: +91 70711 90190

Conclusion

Studying abroad is a life-changing experience that can open up vast new opportunities for learning and personal growth. However, financing this kind of venture can be difficult, especially if you’re relying on student loans to cover the cost. As we have seen, there are ways to access funding for study abroad programs but it’s important to do your research before committing yourself. With the proper planning and preparation, however, you can make sure that your adventure overseas is both enjoyable and affordable!

#Educationloantostudyabroad#Educationloanforabroadstudies#TopEducationloanprovider#Bestbankforabroadeducationloans#Besteducationloansforabroadstudies#Studentsloanorstudyingabroad#Topeducationloanprovider

0 notes

Text

Student loan for studying abroad

Studying abroad can be a truly life-changing experience; it's an opportunity to explore a new culture, make new friends, and gain valuable skills that could help you in your future career.

But for most people, affording the cost of studying abroad is not possible without taking out student loans. Student loans are not always easy to come by either. There are many factors to consider such as interest rates, repayment plans, and loan forgiveness programs that can make the process confusing and overwhelming.

In this blog post, we will explore the various options available for student loans when it comes to studying abroad. We'll look at some of the pros and cons of each option and how you can make sure you are making the best decision for your specific needs.

UK

If you're a UK student looking to study abroad, there are a few things you need to know about your student loans. The first thing is that you can apply for a loan from the UK government to help cover the cost of your studies. The second thing is that you'll need to repay this loan once you've finished your studies and returned to the UK. And finally, you should be aware of the interest rates on these loans, which can vary depending on the country you're studying in.

So, if you're planning on studying abroad, be sure to research all of your options for funding your education, including student loans from the UK government. And remember to factor in the repayment terms and interest rates when making your decision.

US

There are many options for financing your education when you study abroad. The US government offers several programs that can help you with your expenses, including the Federal Direct Loan Program and the Perkins Loan Program. You can also apply for private loans from banks and other financial institutions.

If you're a US citizen or permanent resident, you may be eligible for federal student loans. The Federal Direct Loan Program offers both subsidized and unsubsidized loans, as well as PLUS loans for graduate and professional students. All of these loans are backed by the US government and have fixed interest rates.

The Perkins Loan Program is another option for US students studying abroad. This program offers low-interest loans to students with financial need. If you're interested in this program, you should contact your school's financial aid office to see if they participate in it.

You may also be able to get private loans from banks or other financial institutions. These loans typically have variable interest rates, so it's important to compare different lenders before deciding on one. Be sure to read the terms and conditions carefully before taking out a private loan.

Canada

If you're looking to study abroad in Canada, you'll need to take out a student loan. Here's everything you need to know about getting a student loan for studying in Canada.

The first step is to fill out the Free Application for Federal Student Aid (FAFSA). You'll need to provide information about your financial situation, including your family's income and assets. The FAFSA is used to determine your eligibility for federal student aid, which can be used to cover the cost of tuition, room and board, books, and other expenses.

Once you've completed the FAFSA, you'll need to apply for a student loan from a Canadian bank or financial institution. There are two types of student loans available in Canada: government-backed loans and private loans. Government-backed loans are typically offered at lower interest rates and have more flexible repayment terms than private loans. Private loans may be an option if you don't qualify for a government-backed loan or if you need additional funding.

Before taking out a loan, be sure to compare interest rates, repayment terms, and fees from multiple lenders. Once you've found the right loan for you, be sure to keep up with your payments and make all required payments on time.

Australia

Australia is a popular destination for students seeking to study abroad. The cost of living and tuition in Australia are both relatively high when compared to other countries, but there are a number of financial aid options available to help offset these costs.

One option for funding your studies in Australia is through a student loan. Student loans can be taken out from both the Australian government and private lenders, and can cover the cost of tuition as well as living expenses.

Another option for funding your studies is through scholarships. There are a number of scholarships available to students studying in Australia, from both the Australian government and private organizations. These scholarships can help cover the cost of tuition, travel, and other associated expenses.

Finally, another way to finance your studies in Australia is through personal savings or family support. If you have the means to do so, self-funding your studies can be a great way to avoid accumulating debt.

No matter how you choose to finance your studies in Australia, be sure to research all of your options carefully before making any decisions.

How to get a student loan for studying abroad

If you're planning to study abroad, you may be wondering how to finance your education. One option is to take out a student loan. Here's what you need to know about getting a student loan for studying abroad:

First, research the different types of loans available. There are federal loans, private loans, and loans from international organizations. Each type of loan has its own eligibility requirements, interest rates, and repayment terms.

Next, compare the costs of attendance at different schools. Make sure to factor in all expenses, including tuition, room and board, travel costs, and living expenses.

Once you've decided on a school, contact the financial aid office to inquire about loan options. They can help you determine if you're eligible for federal or private loans, or for scholarships or grants that could cover some of your costs.

If you decide to take out a loan, be sure to understand the terms and conditions before signing anything. Read over the fine print carefully so that you know exactly what you're responsible for and when repayment is due. And remember: taking out a loan is a serious responsibility. Make sure you can afford the monthly payments before committing to anything.

Repayment options

There are a few repayment options available for students who have taken out loans to study abroad. The first option is to repay the loan in full as soon as possible. This option is the best way to save on interest and get out of debt quickly.

The second option is to make minimum payments on the loan while you are still in school. This option can help you keep your debt manageable while you finish your studies.

The third option is to defer your payments until after you graduate. This can be a good option if you need time to find a job or get your finances in order before starting to repay your loan.

Whatever repayment option you choose, it is important to stay on top of your payments and make sure you are making progress towards paying off your debt.

Visit Us: https://www.abroadstudyloan.com/

Email Us: [email protected]

Contact Us: +91 70711 90190

Conclusion

Studying abroad is a life-changing experience that can open up vast new opportunities for learning and personal growth. However, financing this kind of venture can be difficult, especially if you’re relying on student loans to cover the cost. As we have seen, there are ways to access funding for study abroad programs but it’s important to do your research before committing yourself. With the proper planning and preparation, however, you can make sure that your adventure overseas is both enjoyable and affordable!

#Educationloantostudyabroad#Educationloanforabroadstudies#TopEducationloanprovider#Bestbankforabroadeducationloans#Besteducationloansforabroadstudies#Studentsloanorstudyingabroad#Topeducationloanprovider

0 notes

Text

Student loan for studying abroad

Studying abroad can be a truly life-changing experience; it's an opportunity to explore a new culture, make new friends, and gain valuable skills that could help you in your future career.

But for most people, affording the cost of studying abroad is not possible without taking out student loans. Student loans are not always easy to come by either. There are many factors to consider such as interest rates, repayment plans, and loan forgiveness programs that can make the process confusing and overwhelming.

#Educationloantostudyabroad#Educationloanforabroadstudies#TopEducationloanprovider#Bestbankforabroadeducationloans#Besteducationloansforabroadstudies#Studentsloanorstudyingabroad#Topeducationloanprovider

0 notes