#Investec Executives

Explore tagged Tumblr posts

Text

Investec Ltd: Executive Leadership Profile

Introduction to Investec Ltd

Investec Ltd is a distinguished financial services company that provides a diverse range of financial products and services to a niche client base in three principal markets: the United Kingdom, South Africa, and Australia. With a commitment to exceptional client service and innovative financial solutions, Investec Ltd has established itself as a prominent player in the global financial sector.

Executive Leadership Team

CEO and Managing Director

Fani Titi Fani Titi is the CEO and Managing Director of Investec Ltd. With extensive experience in finance and business leadership, Titi has been instrumental in driving the company's strategic initiatives and growth. His vision and leadership have focused on fostering a culture of excellence and innovation, ensuring that Investec remains at the forefront of the financial services industry.

Chief Financial Officer

Morne du Plessis Morne du Plessis serves as the Chief Financial Officer (CFO) of Investec Ltd. He oversees the financial operations, including budgeting, financial planning, and reporting. Du Plessis's expertise in financial management and his strategic approach to fiscal discipline have been critical in maintaining the company's financial stability and supporting its growth ambitions.

Chief Operating Officer

Ciaran Whelan Ciaran Whelan is the Chief Operating Officer (COO) at Investec Ltd. He is responsible for overseeing the company's day-to-day operations, ensuring operational efficiency and effectiveness. Whelan's focus on operational excellence and innovation drives the company's efforts to provide top-tier financial services to its clients.

Head of Group Risk

Chris Meyer Chris Meyer holds the position of Head of Group Risk at Investec Ltd. His role involves managing and mitigating the risks that the company faces. Meyer’s comprehensive risk management strategies ensure that Investec operates within its risk appetite while pursuing its business objectives. His expertise is crucial in safeguarding the company's assets and reputation.

Chief Investment Officer

Marc Kahn Marc Kahn serves as the Chief Investment Officer (CIO) of Investec Ltd. He is responsible for the company’s investment strategies and portfolio management. Kahn's deep understanding of investment markets and his strategic insights have been instrumental in achieving favorable investment outcomes for the company and its clients.

Head of Human Resources

Catherine Berman Catherine Berman is the Head of Human Resources (HR) at Investec Ltd. She leads the company's human capital management, focusing on talent acquisition, development, and retention. Berman’s commitment to fostering a positive and inclusive work environment ensures that Investec attracts and retains top talent in the industry.

General Counsel and Company Secretary

Samantha Lee Samantha Lee serves as General Counsel and Company Secretary for Investec Ltd. She oversees the company's legal affairs and provides guidance on corporate governance and compliance matters. Lee's extensive legal expertise ensures that Investec operates with the highest standards of legal integrity and corporate responsibility.

Strategic Vision and Goals

Investec Ltd is committed to delivering exceptional financial services while fostering sustainable growth and innovation. The executive leadership team's strategic vision encompasses several key areas:

Sustainable Finance: Promoting investments and financial products that support environmental sustainability and social responsibility.

Technological Innovation: Leveraging cutting-edge technology to enhance client service and operational efficiency.

Client-Centric Approach: Prioritizing client needs and delivering tailored financial solutions.

Operational Excellence: Continuously improving operational processes to ensure efficiency and effectiveness.

Global Expansion: Expanding the company’s footprint in key international markets to drive growth.

Corporate Governance

Investec Ltd adheres to robust corporate governance practices, ensuring transparency, accountability, and ethical conduct. The board of directors, comprising experienced professionals from diverse backgrounds, plays a critical role in guiding the company's strategic direction and overseeing its governance framework.

Conclusion

Investec Ltd.'s executive leadership team is dedicated to advancing the company's mission of providing superior financial services while fostering innovation and sustainability. Through strategic vision, strong governance, and a client-centric approach, Investec Ltd continues to solidify its position as a leader in the global financial services industry. The leadership's focus on sustainable finance, technological innovation, and operational excellence ensures that Investec is well-positioned to meet the evolving needs of its clients and stakeholders.

0 notes

Text

Stock market today: Suzlon share price rises sixth day in a row. More steam left?

Suzlon share price today opened upside at ₹55.11 apiece on the NSE and touched an intraday high of ₹56.69 per share, logging over 3% rise against Friday's close of ₹54.92 per share

Stock market today: Suzlon Energy share price witnessed strong bulls' interest during the Opening Bell today. Suzlon share price today opened upside at ₹55.11 apiece on the NSE and touched an intraday high of ₹56.69 per share, logging over 3% rise against Friday's close of ₹54.92 per share. Extending its rally for the sixth straight session during Monday morning deals, Suzlon shares registered over 14 per cent rise in the last six successive sessions.

Suzlon Energy share price history As mentioned, Suzlon Energy shares have been on an uptrend for the last six days. After ending at ₹49.71 apiece on the NSE on Friday, 28 February 2025, Suzlon share price has ended higher on all trade sessions in March.

According to stock market experts, Suzlon shares have a strong base at ₹52, and the stock faces resistance at the ₹58 to ₹60 range. If it exceeds this range, the stock may soon touch ₹62 and ₹70 per share mark. On breaching below ₹52, the stock may come under the bear's grip.

Suzlon share price started gaining after the domestic brokerage Investec initiated coverage on the energy stock with a target price of ₹70. The Investec analysts believe Suzlon Energy Ltd is in a strong position to benefit from the revival in the wind energy sector. The renewable energy company has transformed into a net-cash entity with robust return ratios and a growing order book of 5.5 GW. A well-optimized supply chain and a strong pipeline of bids further bolster its outlook.

Suzlon energy share price target Expecting more upside in Suzlon shares, Sumeet Bagadia, Executive Director at Choice Broking, said, “Suzlon share price looks positive on the technical chart. The stock has strong support at ₹52 and on the upper side, it is facing hurdle at ₹58 to ₹60 range. On sustaining above this resistance, Suzlon share price may soon touch ₹62 apiece levels.”

However, Bagadia maintained that Suzlon's share price may become bearish if the renewable energy stock breaks below ₹52 per share.

Profitable trade for smart plan in stock market for best tips provider for nifty option understand exclusive opportunities, seek professional advice, providing 10% discount with intensify research services. Visit- intensifyresearch.com

1 note

·

View note

Text

Today in news every woman already knew

"Mediocre" male managers are blocking women's development in the finance world because they are better at office politics, new research suggests.

Women also said many managers "faked empathy" on diversity, and more direct bosses were easier to work with.

The report, backed by the London School of Economics, called for culture change to improve diversity.

Author Prof Grace Lordan said: "We've made a lot of progress since the overt sexism of the 1980s and 1990s.

"But the problem today is cronyism."

The research, based on interviews with 79 women in the City, was carried out by the LSE and the Women in Banking and Finance campaign group.

Those polled felt they had to show sustained excellence in order to progress and faced more scrutiny than male peers.

The women also reported a tendency for male managers to stand on a platform of diversity while doing little to improve it - in other words "faking empathy".

Most of the women said they preferred harsher managers who lacked empathy because they "knew where they stood".

"A poor manager can derail your entire career. We need a culture change and managers who really understand the benefits for diversity in organisations," said Prof Lordan.

'Black women have to outperform'

According to the report, the problem was worse among black women in finance. A quarter of those surveyed were black who described having "more headwinds and less tailwinds than other women".

They said they were held up to higher levels of scrutiny and needed to work harder to receive the same recognition as men and white women.

Dr Shefaly Yogendra, a non-executive director at JP Morgan's US Smaller Companies Investment Trust, told the BBC she struggled to find work in finance when she moved to the UK 20 years ago, despite having run five businesses and having two degrees.

"I would continually not get consideration by boards of those same blue chip companies who like to look at validation of other companies before they allow people like me into boardrooms," she said.

"That systemic exclusion has not ended and it effects a lot of women, especially women of colour."

There has been renewed attention to the lack of female representation on the boards of big companies.

Government guidance states that one-third of board members in the FTSE 350 - the 350 largest companies on the London Stock Exchange - should be women and that target has largely been met.

But new research shows that nearly half of smaller listed firms have only one female director or none at all.

Gender-diversity consultancy the Pipeline slast year found that large UK firms whose executive boards are at least one-third female are 10 times more profitable on average than all-male boards.

The LSE research said rewarding collaborative working and encouraging more flexible working could boost opportunities for overlooked employees in finance, including men who are more introverted, minorities and women.

Laura Lambie, senior investment director at Investec, said that the rise of flexible working in the pandemic could improve diversity.

"If you go back 10 years it's not surprising you don't get the best managers if you're only considering half the population," she said.

180 notes

·

View notes

Text

MEET THE NINE INCREDIBLE WOMEN AT MEGHAN’S BREAKFAST.

(10 if you count the Duchess herself!)

Sophia Williams-De Bruyn is a former anti-apartheid activist and provincial legislator. She was the first recipient of the Women's Award for exceptional national service and is the last living leader of the Women's March.

Dr. Mamphela Ramphele is a former anti-apartheid activist, medical doctor, academic and businesswoman. She was a Managing Director of the World Bank (2000) and former Vice Chancellor at the University of Cape Town.

Professor Mamokgethi Phakeng is the first black woman to get a PhD in mathematics education in South Africa and was appointed the Vice Chancellor of the University of Cape Town in 2018. Previously, she has been the Vice Principal of Research and Innovation at the University of South Africa and acting Executive Dean of the College of Science, Engineering, and Technology at UNISA.

Lindiwe Mazibuko is a South African academic and was the first non-white female Parliamentary Leader for the opposition party, the Democratic Alliance.

Judy Sikuza is the CEO of the Mandela Rhodes Foundation and began her career with Absa Bank, also working with Investec and Reos Partners.

Mbali Ntuli is a South African politician and a member of the Democratic Alliance. She currently serves as a member of the KZN Provincial Legislator. This year, she was awarded the One Young World International Young Politician of the Year award.

Siviwe Gwarube is the Shadow Minister of Health and a Democratic Alliance MP. She was previously head of health department in the Western Cape Government.

Nompendulo Mkhatshwa, an African National Congress MP, is one of the youngest women in Parliament and a well-known gender activist.

Sonja De Bruyn Sebotsais a leading businesswoman in investment banking. She is a former a member of Graca Machel’s Pan African Women’s advocacy initiative, New Faces New Voices, and she is a Young Global Leader of the World Economic Forum.

138 notes

·

View notes

Photo

Fresh New Look for Race to Costa Del Sol

The Race to Costa del Sol is ready to enter the next phase with a new look as part of the Ladies European Tour’s brand refresh pushing towards the future.

The logo includes the LET mark, which represents the ambition of the new LPGA-LET joint venture partnership and a shared desire to elevate women’s professional golf.

The Costa del Sol Tourist Board became a partner of the LET this year by sponsoring the Order of Merit, which is now called the Race to Costa del Sol and rewards the achievements of the players, recognising the hard work, grit and determination that it takes to achieve long-term goals.

Francisco Salado, President of Costa del Sol Tourist Board, said: "The Costa del Sol Tourist Board is proud to be part of this new stage in the history of LET. Women's professional golf will continue to grow in popularity, thanks to the dedication, and mastery, of LET's incredible players and the message that Costa del Sol is a champion of women's golf will be welcomed by golfers throughout the world."

The Race began successfully in February with three first-time winners at the Australian Ladies Classic Bonville, the Women’s New South Wales Open and the Investec Women’s South African Open and the Rankings are currently led by the Women’s New South Wales Open champion, Julia Engström, from Sweden, followed by Belgium’s Manon De Roey in second position and England’s Alice Hewson, the Investec Women’s South African Open winner, in third.

LET Chief Executive Alexandra Armas said: “The Race to Costa del Sol is a huge part of the new LET and our mission to #RaiseOurGame for the female golfers of today and those who will follow. The contribution of the Costa del Sol Tourist Board and their commitment to being a champion of women’s golf is hugely appreciated by our players, who cannot wait to return to the Costa del Sol for our popular season-ending event, the Andalucía Costa del Sol Open de España, in November.”

Follow the Race to Costa del Sol and join the conversation on social using the official hashtag #RaceToCostaDelSol.

1 note

·

View note

Text

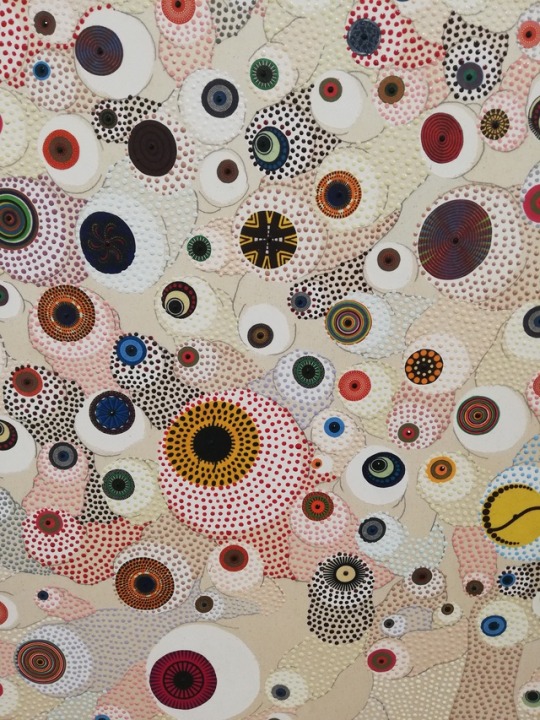

Cape Town Art Fair 2019 Questionnaire

Cape Town Art Fair 2019

1. Blank projects – The curation of the work was very similar to the exhibition in the gallery, it was very minimalistic. However, there was a wider range of variety of different mediums and much more colour.

Stevenson Gallery – They included a lot of paintings and it was curated very similarly to the show room in the gallery. There was lots of colour and included artists Penny Siopis and Zander Blom whose work is present in the show room.

Goodman Gallery – The curation of the work was completely different to that in the gallery. There were a lot more works and they were packed together which is a contrast to the usual curation of shows at the gallery.

2. Works I liked:

Asukra Nirasawa, Cell Division, 952 Cells, 2018

Mixed media on canvas, 150x200 cm

I really enjoy the use of colour, texture and shape in this work. I’m very interested in the subject matter and think the piece is executed really well.

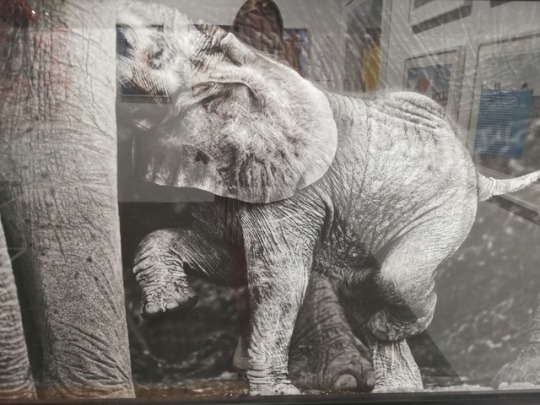

Kim Wolhuter, First Drink

80 x 120 cm, edition 10

I love the emotion this work triggers as it is such a special and vital moment at the start of life. The photograph includes a lot of detail. The use of light and shadow creates a very emotive contrast which I really enjoy.

Stacey Gillian Abe, Seat of Honor #6, #7, #8, 2017

UV digital print on Art Board

Edition 3/5

50 x 50cm

The images are very atmospheric and very powerful. I love the sense of movement within each image and the narrative that continues throughout the series.

Works I disliked:

Chris Soal, The search for meaningfulness in the search for meaning, 2018

Concrete, and birch wood toothpicks held with polyurethane adhesive on ribstop fabric. 130 x 70 x 7cm

The texture of this piece makes me feel very uncomfortable. I am intrigued by the shape and materials, and want to get close but when I do my heart races and I felt extremely unnerved.

Armand Bous, Les Fre Sang (Les Inseparable), 2017

124cm x 90cm

Acrylic and collage on card

I am not excited about this piece and don't enjoy the use of colour.

Kenneth Bakker, Abstract, 1960

68x 129 cm

Oil on board

This piece does not intrigue or inspire me. I could walk past this with out noticing it, nothing grabs my attention. It reminds me of an art work that could be found in a waiting room or hotel reception.

3. I found that painting and photography were predominant mediums present.

4. Most booths had white walls however, a few decided to have colourful walls. Another difference which was present between the booths was the inclusion of furniture, only a couple of booths had small plants whereas most booths had table and chairs.

5. Labels have been written in a variety of ways. There was a selection of; hand written labels on the wall, written labels on the floor and labels written on to masking tape. However, most labels are neatly typed out on to paper and placed on the wall directly next to or underneath the art work. I found the signs for each booth were often too small or located in a place which sometimes made it unclear to which booth I was currently in.

6. The layout of the booths was very simple and linear, making it easy for viewers and employees to move around.

7. The lighting in the convention centre was very bright and natural light. Some works had lights directly above them or pointing on to them which often added to the work. these lights were extremely bright and often much cooler than the other lights used.

8. I noticed that people working at the fair, especially in the booths wore very simple outfits. Most people were wearing black, white or a neutral coloured clothing. They didn’t wear patterned clothing, and nothing blended in with the artworks or distracted from them.

9. Products that were being sold at the fair included, books, tote bags, t-shirts, as well as books, posters and other merchandise of the artist’s and their works. I think the Art Fair is largely aimed people who are interested in art, such as students, lectures’/teachers, practising artists and other people working in the art industry. In addition to this, I feel that the art fair also attracts tourists, who travel from different places in the world to experience and discover the art and artists in Case Town.

10. Athi -Patra Ruga The Ever Promised Erection I, 2019

High-density foam, artificial flowers and jewels

I feel the overall aesthetic and the materials used for this piece really exemplify the spectacle of wealth. Furthermore the style of sculpture exemplifies wealth and power.

11. John Newdigate (In collaboration with Ian Garrett), Flying Ants In Summer Rain, 2018

Hand painted and Glazed Porcelain.

83cm x 52cm

I feel this piece didn’t fit in with the work as the functionality of the pieces is very different from the rest of the work present.

12. It was easy to speak to some staff about the work, in some booths I was approached by members of staff and was asked if I needed help with anything or wanted any information. Other booths were hesitant about sharing prices whereas others had price lists available.

13.The main sponsor of the art fair is Investec.

Investec focus on specialist banking, assest management and wealth and investment divisions. I think the possible clientele of this sponsor are people involved in the art industry such as gallery owners, curators, collectors and people who interested in investment and banking opportunities. I think they chose the art fair as a place to push their product as a place to attract a large audience and to show their interest into an industry that has the ability to create and include a lot of wealth.

14. I think the Cape Town International Convention Centre is a great place for the art fair due to it’s location and accessability. Other commercial events that take place here include; Cape Town International Jazz Festival, FanCon Cape Town Comic Con and Cape Town Homemakers Expo.

15. The oldest work I could find at the fair was Albert Newall’s Untiled. This was a watercolour and ink painting on paper which was made in 1952.

16. The youngest artist at the fair was Talia Ramikillawn who is 23 and recently graduated from Michaelis. Her work was exhibited at Smith.

17.The furniture and painting of the walls of the solo booths relate and compliment the artist work much more than that in the other booths. In a lot of the solo booths the artist’s work was much more spaced out whereas in some of the other booths the work could be quite cramped.

18. Georgina Gratix – Her work has become extremely sought after. Her style of oil painting and using bright colours is intriguing and aesthetically very pleasing.

Igshaan Adams - His use of material and the style of his work holds so much emotion.

19. The trends in subject matter this year included identity and art in the digital age. I believe art in the digital age was a trend and an important subject as the world is constantly looking towards the digital and how we relate to the digital age is constantly changing as technology becomes more advance. Identity is a popular subject matter as many people go through time in their life where they question their identity and it can often be constantly changing. I believe identity is something we are always questioning and discovering.

Materials that were on trend this year included thread, string, beads and pins. I believe this is because many artists were pushing the limit of a canvas and how they can move beyond that.

20. I would love to be represented by Smith as they seem to take a lot of young artist and support them and push them as they grow as artists.

21. I would love to work for Stephenson as I love the wide range of artist they work with and the work that is produced. The subject matter they work with is extremely important and I would love to work with these artists to exhibit their work in the most powerful and meaningful way.

22. How do galleries chose which artists they would like to show at the fair? How many international buyers are usually at the fair? How many people does it take to set up and take down the fair?

23. I would love to show my gallery or institute at the fair, as I think it would be a great way for artist to be seen and a wonderful way to create connections with other galleries. I would like my stall to be quite open to give the viewer a lot of space to walk around and see each art work clearly. I would possibly paint certain walls to relate to the work being shown. I would like to include works that can be hung from the walls as well as sculptures that could be placed on the floor.

2 notes

·

View notes

Text

Investec plc Company Market Analysis Report - Company Market size - Company profile

Investec plc (Investec) is a provider of specialized banking, wealth management, and investment solutions. The company offers a wide range of financial solutions to a select client base. It offers structured products, loans, retirement, and financial planning, portfolio management, research and insights, insurance, and foreign exchange solutions. Investec market analysis Investec Company Profile

The company also offers merger and acquisition solutions, venture capital planning and execution, thematic research, trading recommendation, analysis, and electronic connectivity and efficient settlement. Investec caters to individual, corporate, SME, entrepreneurs, high net worth individuals and wealthy family clients through a network of branch offices, online portals, and financial advisors. It primarily operates in Europe, Asia-Pacific, and Africa. Investec is headquartered in London, the UK.

Subscribe to access Investec plc interactive dashboard for 12 months get access to premium industry data, predictive signals and more

Subscribe to access Investec plc interactive dashboard for 12 months get access to premium industry data, predictive signals and more

0 notes

Text

Vumile Msweli: ‘We have to break the glass cliff barrier for women’

Vumile Msweli is the Chief Executive Officer of Hesed Consulting, a coaching and consulting firm that specialises in commerce acceleration, career coaching, women empowerment, facilitation and training. The organsation currently has presence in Nigeria, South Africa, Botswana and Rwanda, with affiliates in Namibia, Ghana and Uganda.

Vumile previously worked for reputable multi-national institutions, including Barclays, Investec, Nedbank, First National Bank and Vodafone. An Operations, Finance and Strategy executive with experience in both the telecommunications and finance sectors, she has successfully led global teams in Africa (Nigeria, Kenya, Democratic Republic of Congo, Zambia, Lesotho, Ghana, Tanzania; Mozambique and South Africa); and Europe (Scotland, Isle of Man and England).

As a coach, she has carved a niche for herself in career coaching while also servicing clients in executive, financial, speaking and mentoring coaching. She is also the host of Vumi and Veuve Host Women In Commerce, a career columnist in a leading national newspaper and a career radio host in two radio stations. With degrees from two universities in South Africa, she has an MBA from the University of London and an ongoing Doctorate Applied Leadership from the UGSM, Switzerland.

In this interview with TOBI AWODIPE, she spoke on the importance of career and life coaching for women, breaking glass cliffs and deploying the rule of three in businesses amongst other issues.

You��ve had an interesting career; please take us through your journey so far?

My career journey began in banking from the contact centre and quickly accelerated to an executive role. My journey has been underpinned by education; education has been, for me, the key to the world. I completed my matric at St. Mary’s DSG, did a Bachelor of Accounting Sciences from the University of Pretoria and got a Bachelor of Commerce Financial Planning Honours. I then did my Masters in Business Administration at the University of London, my Executive Education at New York University, my Higher Education Teaching certificate at Harvard University and I am currently studying my Doctorate in Coaching at Switzerland’s Monarch University.

I have spent my career working in the banking and telecommunications sectors and this afforded me the opportunity to work in incredible places such as Singapore, Germany, the Democratic Republic of Congo, Nigeria and South Africa. I always suspected that I would be an entrepreneur, which is how I founded Hesed Consulting, a pan-African coaching and recruitment firm.

You’re also a life and transformational coach among others, what informed your decision to take on these roles?

Becoming a career coach was borne out of my frustration in my corporate career. I was a young executive facing challenges and wanted a coach who looked like me and understood my struggles. Someone who not only empathised but understood what it was like to be an African female pursuing excellence, whilst climbing the corporate ladder. I identified gaps in myself, and I knew coaching could help close those gaps.

A career coach is an expert who has hundreds of hours aiding people to achieve their career goals and gain clarity on their career journey by equipping them with skills that help them overcome obstacles and succeed in their work. So, that is the service I have chosen to dedicate my time to. I support people in their career journey, overcoming obstacles, and having work that fulfills them.

As the head of Hesed Consulting, how are you merging all the things you do successfully?

Hesed Consulting is the channel that enables me to fulfill my life’s calling; to help people have successful and fulfilling careers. We are a pan-African organisation that facilitates the attraction of human capital through recruitment as well as growing and retaining talent through coaching. It keeps me busy, but I truly believe in work-life fluidity, which means I invest in my team, take time to cultivate relationships with my family and friends and get very comfortable on my knees, seeking God for His Will for my life.

There are so many coaches and coaching sessions targeted at women these days. In your opinion, how impactful is this for women?

I believe that a coach is a powerful weapon for women’s careers and life. I personally have three coaches and they have proven invaluable in my growth, both personally and professionally. Unlike a sponsor or mentor, a coach ordinarily has no relationship with you prior to you seeking out their professional services. They are an objective expert in their field who aid people in achieving their goals through psychological techniques, inner reflection and training.

So, a coach has often helped many people in a specific industry or career level, and unlike a mentor, doesn’t solely draw on their experience. A coach, in essence, allows for the sharing of best practices with you as a client and helps you achieve a set goal through a series of coaching sessions.

The theme of this year’s Women’s Month was, Break The Bias, how would you say you are exemplifying this through your work?

In celebrating International Women’s month and reflecting on #BreakingTheBias as a career coach, I naturally consider the workplace. I think of biases like female bosses are terrible or that women have glass ceilings and, at times, even glass cliffs. The use of the phrase ‘she is shattering the glass ceiling’ is a popular term used to describe the pioneering of women and minorities into spheres they historically could not engage in.

However, there is now a new phenomenon called glass cliffs. Glass Cliffs are when women are brought in to save the day when their predecessors have led organisations to dire situations. To break these biases is to make it commonplace to have women in the C-suite, in leadership and executive roles. To break these is for it to be normal to have a board or the African or European Union presidents be predominantly female. So that when we see women in positions of power, we don’t arch our eyebrows in surprise or clap in celebration; it’s another Tuesday because women belong in those seats as much as their male counterparts. That is the reality of our business; our entire board consists of African women from all over the world who help drive African women to shatter glass ceilings and cliffs in whatever career realm they find themselves in.

Having successfully led global teams in Africa and Europe, how would you say we could accelerate and grow women-led SMEs?

I think it’s by creating a culture of leaving the door open in every room you enter to make it easier for other women to come in after you. In essence, it is cultivating a culture of creating opportunities for other women. By intentionally using products and services from women-led SMEs, we help create sustainability for that entrepreneur and increase the opportunities for scalability.

Why are women underrepresented in key leadership positions and how can we change this?

Women historically were not economically liberated and allowed to engage in leadership. This legacy is what results in the disproportionate numbers between men and women at various levels. To change this, we will have to give women the same access, support and privileges that men have enjoyed to get to leadership roles.

To counter this historical advantage bestowed to men, women will need sponsors, mentorship, advocates, coaches and more opportunities that take into account the unique challenges that women face like maternity leave and family responsibilities such as being wives and mothers.

As someone experienced in finances across Africa, what would you say are some of the key issues start-ups face, especially in Nigeria?

Start-ups across the continent have the biggest challenge with access; access to opportunities, finances and investors. Access to markets that can help scale small businesses and access to experts, information and education to help fast track their growth.

The financial institutions we have tend to be archaic in their approach, using models not well suited to the African terrain for start-ups who very rarely have the collateral required to access financing. Furthermore, most entrepreneurs are busy trying to establish their businesses and don’t focus on acquiring financial literacy.

What solutions would you proffer to these problems?

I think creating financial models and products that suit the uniquely African challenges, which the average business will be able to access. This should be underpinned by financial education and literacy.

What five key takeaways would you give a female founder?

The rule of three; however long you think it will take, multiply it by three, how much you think you are going to need, multiply it by three, how many people in your network that you think you need, multiply it by three. So, in essence, think bigger, increase your capacity for patience, stay focused and hold on to your vision even though it may tarry.

Tell us something you do/did that has influenced your career positively today?

I think getting coaches to help me grow in my career set me apart from my competitors. I think investing in coaching helped me to better articulate my ideas and better position myself. I also think intentionally giving myself exposure through education and travel has served me in good stead enabling me to work all over the world and thus gather global best practices.

Going beyond the usual rhetoric, how can we truly empower today’s woman so she can compete internationally?

To be successful globally, you must give yourself exposure to the world. The world is bigger than your city, country and continent. You are competing with other women sitting in Kuala Lumpur, Toronto, Sao Paulo, Mombasa, Durban… what you bring to the table must have local relevance, but be able to impact the international arena. Knowing how to effectively position yourself and articulate the value you bring whilst respecting the nuances of your diversity will empower you to be globally competitive.

Doing business across different African countries isn’t without its challenges, how are you surmounting these issues?

The biggest misconception is that Africa is the same; we may have the same hue, but are far from homogenous. Walking into a meeting in Lagos versus Kigali versus Gaborone is fundamentally different. I tend to immerse myself in the culture, studying the people, understanding the value system, working with local experts to help guide me and then investing in building those relationships. I like to be clear in the value I can add and the unique service I bring as a career coach and recruiter.

What are five little known facts about you?

I have travelled to over 55 countries in the world. I tasted ‘dodo’ for the first time in my twenties. I am doing my doctorate in applied leadership and coaching. My absolute favourite colour is yellow; it just feels like sunshine and happiness to me. I find my peace in my village; something about the rolling green hills gorgeous rivers allows me to connect with God.

How do you de-stress and unwind from your busy schedule?

I thoroughly enjoy travelling to explore the world; something about immersing myself in a new world piques my curiosity and makes me feel like a child once again. I thoroughly enjoy the simple pleasure of playing with my dog. I also find journaling a good way to release the pressure, fear and anxiety. I also find playing with adult colouring-in books help me to decompress.

What changes would you like to see happen for women if you could make them?

I would love to be able to acquire for women sponsors and advocates for their careers than their male counterparts access with such ease. This, I think, is a simple change that could catapult the careers of women across industries and help close the gender gap.

You seem to have many friends in Nigeria, how’s your personal relationship with Nigerians and the Nigeria-South Africa relationship in general?

I recall studying in Ghana and coming to visit Nigeria for the first time; it began a love affair that has stood the test of time. Nigeria is filled with African excellence, ambitious, hardworking people who strive to embody the African dream. I admire the fast-paced and energetic can-do attitude of Lagosians and have seen this city as the Mecca for my own ambition, refuelling my passion and drive.

South Africa and Nigeria have the biggest economies in Africa, but I think both countries are yet to fully step into their true leadership roles in the continent.

0 notes

Text

Office and retail sparkle in South Africa, Investec says

Office and retail sparkle in South Africa, Investec says

South Africa’s office and retail property market is gaining a second wind after years of being unloved, according to Investec Property Fund Ltd. Half of the firm’s 77 new leases signed with clients in the year through March were in those sectors, creating an opportunity to dive back in after a period of disposals, co-chief executive Officer Andrew Wooler said in an interview. The fund, which has…

View On WordPress

1 note

·

View note

Photo

Race to Costa Del Sol Starts in Australia

New season-long race commences this week, with the Geoff King Motors Australian Ladies Classic, the first of 25 LET tournaments in 18 countries this year A new Ladies European Tour season starts on Thursday with the Geoff King Motors Australian Ladies Classic at Bonville Golf Resort in New South Wales, the first event on the 2020 Race to Costa del Sol.

The Race to Costa del Sol, which is the official LET ranking from 2020, offers a €250,000 bonus pool to the top three finishers. The Race begins in Australia with the first of 25 LET tournaments spanning 18 countries in a greatly enhanced 2020 LET schedule and concludes with the Andalucía Costa del Sol Open de España Femenino in Spain in late November.

The new era begins at Bonville Golf Resort, situated halfway between Sydney and Brisbane on the beautiful Coffs Coast, where an international field of 151 competitors will play on “Australia’s Favourite Golf Course” 2016-2019, according to Golf Australia Magazine’s Favourite Golf Courses poll. The defending champion, Marianne Skarpnord, will be joined by fellow 2019 tournament winners Diksha Dagar, Annabel Dimmock, Esther Henseleit, Nuria Iturrioz, Céline Herbin, Meghan MacLaren, Christine Wolf and Anne van Dam as well as many of the LET’s rising stars from Q-School.

It will tee up a fortnight of competition Down Under, with the Women’s New South Wales Open taking place at Dubbo Golf Club the following week.

The action then moves to the other side of the Indian Ocean for the Investec South African Women’s Open at Westlake Golf Club, followed by the Saudi Ladies Championship at Royal Greens Golf and Country Club.

The main European leg of the schedule begins with the Jabra Ladies Open at Evian Resort Golf Club, in early May, followed by the La Reserva de Sotogrande Invitational at La Reserva Club de Sotogrande and then the Mithra Belgian Ladies Open in Naxhelet.

The Lalla Meryem Cup, which is co-located with the men’s Hassan Trophy at Royal Golf Dar Es Salam, will be followed by an innovative mixed field event, the Scandinavian Mixed Hosted by Henrik & Annika at Bro Hoff Slott Golf Club, where European Tour and Ladies European Tour members will go head-to-head for the first time on the same course, competing for one prize fund and one trophy.

The players will remain in Europe for the Dutch Ladies Open at Rosendaelsche Golfclub and the Estrella Damm Mediterranean Ladies Open at Club de Golf Terramar.

The Evian Championship, which has been played as the fifth major since 2013, will take place in mid-July. After everyone catches their breath for a week, a new event, to be revealed soon, will be played in the United Kingdom in early August, alongside the Tokyo 2020 women’s Olympic Golf Competition.

The UK swing continues with a fortnight in Scotland and the Aberdeen Standard Investments Ladies Scottish Open at The Renaissance Club, followed by the AIG Women’s British Open, the final major of the year, at Royal Troon.

The European odyssey continues with the TIPSPORT Czech Ladies Open at Golf Course Karlstejn, the Creekhouse Ladies Open at Kristianstads Golfklubb, the VP Bank Swiss Ladies Open at Golfpark Holzhäusern and the Lacoste Ladies Open de France at Golf du Médoc.

The action then moves to Asia for the Ladies European Thailand Championship at Phoenix Gold Golf and Country Club, the Hero Women’s Indian Open at DLF Golf and Country Club and a new event in the Philippines, before moving on to the Middle East for the Omega Dubai Moonlight Classic at Emirates Golf Club and then to Africa, for the Magical Kenya Ladies Open, at Vipingo Ridge.

The LET then returns to Europe for the season finale at the Andalucía Costa del Sol Open de España Femenino, one of the most popular stops of the year, where the winner of the season-long competition will be crowned.

The Race to Costa Del Sol begins this week… join the conversation at @LETgolf using the hashtag #RaceToCostaDelSol.

Ladies European Tour Partner

Costa Del Sol Tourist Board

In 2020 the Costa Del Sol Tourist Board became a partner of the Ladies European Tour by sponsoring the Order of Merit, which will be called the Race to Costa del Sol.

Costa del Sol Tourist Board is dedicated to the promotion of Costa del Golf and provides advice and support to its partners throughout the golf industry. The Costa del Sol has been recognised as a top European Golf Destination by IAGTO (International Association of Golf Tour Operators) and is the exclusive destination in continental Europe of PGA Germany.

The Costa del Sol is the leading destination for golfers who seek a wide variety of quality golf courses and ideal golfing weather through 12 months of the year. With over seventy golf courses, many of which were conceived by masters of golf course design, the Costa del Sol enjoys worldwide prestige. Many top-level championships have provided unforgettable days of competition on its courses: the Ryder Cup, the World Golf Championship, the Estrella Damm Masters and the Ladies European Tour Andalucia Costa del Sol Open de España.

Golfers of all levels visit this unique destination, year after year, to enjoy the golf, and explore all that this unique destination offers including top class restaurants, a vibrant nightlife, great shopping and a wide range of hotels, apartments and villas with an astounding array of services, combined with the legendary sights of Andalusia.

Race to Costa Del Sol

In 2020 the Costa del Sol Tourist Board will sponsor the Ladies European Tour Order of Merit, which will be called the ‘Race to Costa del Sol’ and will offer an additional bonus pool of €250,000, split between the top three finishers.

The player who tops the Race to Costa del Sol rankings will receive an additional €125,000, with the second highest finisher receiving €75,000 and €50,000 for the third placed player following the season-long race. The winner will also receive a 7-year exemption under category 2A regulations.

The Race to Costa del Sol tees off in Australia in February with the Australian Ladies Classic Bonville and will culminate at the Andalucía Costa del Sol Open de España Femenino in November.

The Race to Costa del Sol will showcase the tourism excellence of both the Costa del Sol and Andalusia whilst providing a tremendous incentive for Ladies European Tour members.

An image of the Costa del Sol can be downloaded here.

About the Ladies European Tour

Ladies European Golf Venture Limited, the company which operates the Ladies European Tour, is a joint venture collaboration between Ladies European Tour and the Ladies Professional Golf Association, which started on 8 January 2020 and was formed to increase playing opportunities for female golfers in Europe. Its board comprises 12 directors, including LPGA Commissioner Mike Whan, European Tour Chief Executive Keith Pelley, The R&A’s Chief Executive Martin Slumbers and the Chair of the LET, Marta Figueras Dotti. The entity will be led by CEO Alexandra Armas.

The 2020 LET season is the 42nd series of golf tournaments since the professional tour was founded in 1978 and marks the first edition of the Race to Costa del Sol. The LET Access Series is the official development tour of the LET, formed to give players an opportunity to compete and progress onto the LET and achieve their dreams in professional golf.

Follow the LET at www.ladieseuropeantour.com and join the social conversation on https://twitter.com/LETgolf, www.facebook.com/LadiesEuropeanTour, Instagram @LETgolf, www.youtube.com/user/ladieseuropeantour and www.flickr.com/photos/ladieseuropeantour/.

2 notes

·

View notes

Text

Investec announces Board member Philip Hourquebie as next Chairman of the Board of Directors

Investec announces Board member Philip Hourquebie as next Chairman of the Board of Directors

By Debbie Wright June 22, 2021 by Olivier Dellacherie – Talent4Boards – UK, London – Investec PLC (LON: INVP | JSE: INP) today announced the selection of Non-Executive Director Philip Hourquebie to succeed Perry Crosthwaite as the Group Chair, effective on 5 August 2021. For more information: https://www.investec.com/ Source:: NEDworks News

View On WordPress

0 notes

Text

Investec announces Board member Philip Hourquebie as next Chairman of the Board of Directors

Investec announces Board member Philip Hourquebie as next Chairman of the Board of Directors

June 22, 2021 by Olivier Dellacherie – Talent4Boards – UK, London – Investec PLC (LON: INVP | JSE: INP) today announced the selection of Non-Executive Director Philip Hourquebie to succeed Perry Crosthwaite as the Group Chair, effective on 5 August 2021. For more information: https://www.investec.com/

View On WordPress

0 notes

Photo

New Post has been published on https://freenews.today/2021/01/25/jd-sports-fashion-plots-400m-share-sale-to-bolster-deals-war-chest/

JD Sports Fashion plots £400m share sale to bolster deals war chest

JD Sports Fashion is in talks about a £400m share sale as it eyes further opportunities to expand in a global retail industry rocked by seismic change wrought by the coronavirus pandemic.

Sky News has learnt that the board of Manchester-based JD Sports is considering launching an equity placing as soon as this week.

Its size has yet to be determined but would be in the region of £400m, according to one insider.

Image: Peter Cowgill is executive chairman of JD Sports

If it gets the green light, the funds would be used to bolster a takeover warchest depleted by last month’s $681m (£491m) acquisition of Shoe Palace, a retailer based on the US west coast.

Roughly half of that sum was paid by JD Sports in cash, with the remainder handed to Shoe Palace’s shareholders as an equity stake in the FTSE-100 company’s US subsidiary.

City sources cautioned on Monday night that the capital-raising was by no means certain to proceed, and that JD Sports’ directors retained the option of calling a halt to their deliberations.

Confirmation of the plan, however, would come within days of two significant deals in the UK retail sector in which JD Sports considered participating.

The company, run by executive chairman Peter Cowgill, pulled out of a deal to buy Debenhams last month, a move that would probably have saved some of the department store chain’s 118 outlets.

Instead, Debenhams’ brand and website were sold on Monday to Boohoo Group, the online fashion retailer, potentially spelling the end of its centuries-long presence on UK high streets.

Please use Chrome browser for a more accessible video player

December 2020: Retailers hope for seasonal rush

JD Sports also held talks with Authentic Brands Group, the US-based retailer, about a takeover of TopShop that would have involved the British company operating the jewel in Sir Philip Green’s former retail empire.

On Monday, Asos, the online clothing platform, confirmed a Sky News report that it was the frontrunner to buy TopShop from administrators to Arcadia Group.

Although Asos is in exclusive talks about that deal, analysts expect ABG and JD Sports to make a fresh approach if a transaction cannot be concluded.

Nevertheless, there is unlikely to be a shortage of plausible acquisition targets for Mr Cowgill given JD Sports’ growing international reach.

The company is also likely to enjoy strong backing from its shareholders if it proceeds with an equity-raise.

JD Sports has seen its shares trade broadly flat over the last year, a stark contrast with those of most non-food retailers, many of which have been plunged into crisis by the enforced closure of their stores.

The company has a market value of just over £8bn, making it the London stock market’s biggest athleisure retailer.

Frasers Group, which owns the Sports Direct chain as well as House of Fraser, has a market value of just £2.26bn.

Earlier this month, JD Sports hiked its full-year profit forecast, saying earnings would exceed £400m, compared with previous market expectations of just under £300m.

Investec and Peel Hunt, JD Sports’ brokers, are understood to be working on the prospective cash call.

A JD Sports Fashion spokesman declined to comment on Monday.

Source

0 notes

Text

Brokerages cut Insurance Share Target Prices

Brokerage cut Insurance focus on, the dealer organizations hope to see long haul negative consequences for insurance agencies on the most recent recommendations in Union spending plan concerning annual duty. In the mean time, the safety net provider said it would cut the objective offer costs. In any case, a few financiers said that it would affect Insurance organizations.

Investec said a 7-13 percent fall in the objective cost for portions of the protection division because of long haul vulnerability. The reasonable estimation of HDFC life diminished from Rs 615 to Rs 590 in Kotak Institutional Equities. Similarly, the ICICI Prudential Value at Rs 610 to Rs 580 and SBI Life esteem decreased from Rs 1030 to Rs 1010.

Moreover, Foreign goliath Morgan Stanley additionally cut costs by 2-9% on SBI Life, ICICI Prudential Life, and HDFC Life.

Investec:

Investec sees the chance of protection de-appraisals because of part development vulnerability and rich evaluations. The high estimation of the offers is the purpose behind the segment's vulnerability. Despite the fact that the revisions to annual duty have an insignificant momentary impact, the expulsion of specific exclusions would affect contrarily in the long haul. So that Investec decreased 7-13% for protection stocks.

Jefferies:

Jefferies expressed that the last change to personal duty would negatively affect protection items. Individuals acquiring Rs 15 lakh or getting full exclusions won't advantage from this. It is accepted that the abrogation of profit dissemination charge (DDT) will affect insurance agencies' edges.

Kotak Institutional Equities:

Kotak Institutional Equities said that the current proposed charge rates could prompt the value of a new business (VNB) edge of 100–150 premise focuses for the protection part. It cuts 3-5% in value-of-in-force business (VIF). The effect on ICICI Life, HDFC Life, SBI Life, and Max Life will be high.

Motilal Oswal:

Motilal Oswal expressed that expelling the duty system would decrease protection deals. In the interim, the people moving to new approaches will lose charge conclusions on protection buys. Truth be told, the new strategy could raise charges. In this way, a high level of new recommendations probably won't be associated with new arrangements. This may have no significant effect on new protection business deals. Be that as it may, transient stock execution might be unpredictable.

Morgan Stanley:

Insurance agencies must compensation charge on pay from their profits. So the business expressed, this would affect charge rates. Likewise, there are no imaginable negative effects on the new proposition. Additionally, conversations on disposing of exclusions could be another shade over the long haul. The HDFC Lie and ICICI Prudential are correspondingly high regarding business intrigue, and SBI Life is its relative overweight. The SBI Life, ICICI Prudential Life, and HDFC Life target rates have been decreased by 2-9% by Morgan Stanley.

0 notes

Text

Joao Felix & Antoine Griezmann: Meet the lender behind the some of football's biggest transfers

New Post has been published on https://thebiafrastar.com/joao-felix-antoine-griezmann-meet-the-lender-behind-the-some-of-footballs-biggest-transfers/

Joao Felix & Antoine Griezmann: Meet the lender behind the some of football's biggest transfers

Joao Felix has been called the most exciting Portuguese player since Cristiano Ronaldo

A few steps from London’s West End, and just a couple of miles from the capital’s financial district, is a company helping football’s elite seal some of the world’s biggest transfers.

Joao Felix moved from Benfica in Portugal to Spain’s Atletico Madrid as the world’s second-most expensive teenager, thanks to a loan processed in trendy Fitzrovia.

Less than a fortnight after making that £113m deal a reality last July, 23 Capital were helping Barcelona meet Atletico’s £107m buyout clause for Antoine Griezmann.

“It was a strong summer for us, we were involved in some of the biggest and best moves,” chief executive and co-founder Jason Traub told BBC Sport.

“We call ourselves a capital and solutions company for sport, music and entertainment – a sports bank, for lack of a better term.

“We help affect deals but we are not changing the way deals are done, or whether they do or don’t ultimately happen. But we are certainly helping.”

Traub, who spent 13 years with Investec Bank, and partner Stephen Duval, an Australian who previously worked with the Olympic Games and sports management company IMG, have made an impact.

Last summer’s window saw a record £5bn spent across Europe’s top five leagues, and they were involved in two of the biggest moves.

Atletico broke their transfer record for Felix just two years after moving into their £220m Metropolitano home.

Going to a lending company was an alternative way to fund his arrival without having to raise money by offloading French World Cup-winning forward Griezmann first.

‘Distilling transfer-market pressure’

Antoine Griezmann’s move to Barcelona from Atletico Madrid was regarded the worst-kept secret in Spanish football last summer

Barcelona took out a bridging loan to ensure they landed Griezmann in time for a money-spinning pre-season tour of Japan and the United States after their request for more funding from Spanish banks was reportedly turned down, having already borrowed more than £500m for stadium renovations.

“In truth, the real pressure at that time, for that transfer, was the start of pre-season, flying off to the Far East and the knock-on effects of not being able to unveil a superstar signing for the year as you land and what that would mean for exposure and sales. That impact was a factor for them,” Traub said.

“We don’t love being asked to make sense of transactions within a short timeline, particularly for those amounts, but for very good clubs that we know intimately and understand their credit strengths, if it makes sense we can move quickly.”

Neither transfer was dependent on the other and so the domino effect which can often define a transfer window was reduced.

“In the old days you would have some of these deals happening in the last five days or even last five hours of the transfer window,” Traub said.

“Don’t get me wrong, we’ve all been glued to the TV watching the reporter in a car park waiting for that first deadline day move to happen and loved it.

“But it is not helpful or good for the game to rely on that first shot across the bow. So now clubs have a better means to a credible finance partner and are not as reliant on waiting for a Real Madrid, Barcelona or Manchester United to make that first payment to allow the rest to follow.

“We have distilled down the pressures that used to exist. Taking away some of that pressure in negotiations is much healthier in any event.”

‘Boutique lenders’

Helping clubs finance transfers or stadium improvements by lending against future broadcast income and the value of players as intangible assets is nothing new, and there are a number of lenders to whom clubs can turn.

Traub says an already established relationship with Benfica, having helped restructure their balance sheet, played a part in their involvement in the Felix transfer ahead of others “desperate to try to help because it was an opportunistic transaction”.

He continued: “In this market place there are a number of brokers and banking groups that see this as a quick way to make money because they see these deals as being very visible and you might not need a world of credit expertise to understand that Barcelona or Real Madrid, at face value, will pay you back next year for a transfer.”

Football finance expert Kieran Maguire, of the University of Liverpool, describes the firm as a “boutique” lender that has spotted a gap in the industry.

“They have realised that the transfer market and the club transaction market is unregulated, often unprofessional and contains people who see football as an opportunity for an easy profit. If anyone can then come in and run a professional service and effectively provide a one-stop shop, then there is a gap in the market,” he said.

“Whether that will be successful in generating the level of income they are looking for, I’m not so certain because football is a very insular industry and there are unusually close relationships between agents, management and clubs, and that particular dynamic will be difficult to break.

“But for clubs that do operate with integrity and do things by the books, then there is potential for a company like 23 Capital to be involved.

“A boutique operation, and that is what they are, don’t have to go through so many layers of approval, don’t have to go through governance rules you may see at JP Morgan, where a bank of that nature is very risk concerned and will have a compliance department, which to a certain extent is the tail wagging the dog in corporate lending.”

‘Blue-chip focus’

Grammy-award-winning rapper Childish Gambino, also known as Donald Glover, has a publishing deal with the Kobalt Music Group

When Traub and Duval went about founding a business that could work as effectively in football as it could in Formula 1 and tennis or the music industry and in Hollywood, they did so with a ‘high end’ focus.

Traub says more than £2.3bn has been provided by 23 Capital since its inception, evenly split between sport and the entertainment industry – in which they have provided finance for the Kobalt Music Group, which has Childish Gambino and the Red Hot Chili Peppers on its roster, and holds publishing rights to the late Elvis Presley’s recorded work.

Since its beginnings in London in 2014, the company has expanded to open offices in Barcelona, New York and Los Angeles.

“We have always wanted to position ourselves very much in the blue chip,” Traub explained.

“We have been able to get great traction at the very top and a profile with industry leaders in the three sectors.

“A real challenge was how we saw ourselves. We wanted to be principle lenders, we wanted to build our own balance sheet, we didn’t want to be brokers or fund managers for other people – we effectively wanted to set up a banking model so that we could own that risk.”

With backing from billionaire philanthropist George Soros, Traub and Duval got the business up, running and positioned where they wanted.

Ensuring they made a success of it took a considered approach to recruiting in an effort to become “pure play” or specialist lenders across sport, music and entertainment.

“We have pulled individuals from places like Universal Music, people who have worked in football, within the business as much as pulled credit specialists,” Traub added.

“We are a business, not unlike a bank in some ways. But an individual at a bank may get a deal done because they can get a bonus at the end of the year or maybe go to a different bank if it doesn’t work out – but this is our livelihood.

“We are truly aligned to our clients, the football industry, to drive value for them in a symbiotic relationship, and that is what credit should be.”

Read More

0 notes

Text

Banks fail to account for Nigeria’s $7bn reserves

By Tony Ademiluyi There are strong indications that a huge chunk of the $7bn reserves which the Central Bank of Nigeria under a former Governor Charles Soludo gave to 14 banks had yet to be repaid 13 years after it was collected. The CBN had in 2006 apportioned $7bn out of the nation’s external reserves, which stood at $38.07bn then to 14 global asset managers and their 14 Nigerian banks local partners, to manage. The amount given to the asset managers represented about 18.39 per cent of the total external reserves, which was hitherto kept with foreign banks. The 14 global asset managers and their local counterparts were Black Rock and Union Bank of Nigeria Plc; J.P. Morgan Chase and Zenith Bank Plc; H.S.B.C and First Bank of Nigeria Plc; BNP Paribas and Intercontinental Bank Plc; UBS and United Bank for Africa Plc; Credit Suisse and IBTC Chartered Bank Plc. Others were Morgan Stanley and Guaranty Trust Bank Plc; Fortis and Bank PHB Plc; Investec and Fidelity Bank Plc; ABN Amro and Access Bank Plc; Cominvest and Oceanic Bank Plc; ING and Ecobank Plc; Bank of New York and Stanbic Bank Plc; and Crown Agents and Diamond Bank Plc. The CBN gave each asset manager $500m of the external reserves to manage. Sources in the banking industry confided in our correspondent that the global financial crisis of 2008 and the capital market meltdown of 2009 affected some of the banks. It was gathered that some of the banks took the fund and in a bid to boost profitability invested massively in capital market instruments through margin loans. The drive to remain bullish amidst threat of economic meltdown also propelled some of the banks to channel funds to oil marketers for petroleum products importation without due diligence. A former Managing Director of a Deposit Money Bank who spoke to our correspondent in confidence said the global financial crisis of 2008 dealt a heavy blow on the balance sheets of many of the banks. He said some of the banks that collected the $7bn reserves to manage on behalf of the country never recovered from the crisis, a situation that made repayment difficult. Some of the banks that were taken over by the apex bank after the stress test of 2009 were Oceanic Bank, Intercontinental Bank Plc, Platinum Habib Bank, FinBank, Afribank, Union Bank Plc. Out of these banks, three of them namely Bank PHB, Oceanic Bank and Intercontinental Bank benefitted from the management of the $7bn reserves. The bank boss said, “The banks collected the reserves and some of them such as Intercontinental Bank, Oceanic Bank, Platinum Habib Bank, could not repay because at the dying days of Soludo’s tenure, we even had to create a window which is called Standing Loan Facility. “This allows banks to access this window and borrow against their assets like treasury bills when they want to address issues relating to liquidity. “But normally, no bank access SLF unless they have liquidity issues and so any bank you see accessing SLF and staying there means there is a need for a searchlight on that bank. Maybe they have endemic crisis. “Those banks became permanent tenants at the SLF – Intercontinental, Oceanic, Habib and others were always there. “It (SLF) is a very high interest rate that is prohibitive and if you see any bank going there, it’s out of desperation because they have no alternatives. “So they were all there up to the time (former CBN Governor Lamido) Sanusi took over and conducted that stress test. “They borrowed money, they raised capital, they took CBN money, they took foreign money and there was pressure for profits and so they became so bullish. “They invested in capital market, petroleum importation business and when you invest in petroleum without collateral, if the PPPRA (Petroleum Products Pricing Regulatory Authority) does not pay, then you don’t have money.” The source added, “They invested in margin loans and the stock market collapsed in 2008. They invested in housing and housing market collapsed after the 2008 financial crisis. “So everything went negative for them. They got into crisis and Soludo who was trying to manage them left. “Sanusi had no sentiment for them and he ordered for a stress test and the stress test was very clear and it found them wanting.” Another top bank executive told our correspondent that after the stress test of 2010, some of the banks were taken over by the CBN and their toxic assets transferred to the Asset Management Corporation of Nigeria for recovery. The source said the unpaid portion of the reserves constituted the over N5tn debt currently being recovered by AMCON. He said some of the debt might not be recovered because the funds were borrowed with fraudulent intentions. He said, “This money we are talking about constitutes part of the loans inherited by AMCON “Someone took N1bn from Intercontinental Bank at that time and the name he gave does not exist. It was fake and that facility was used to import petroleum products. The guarantee they gave was fake because the address was invalid, everything was forged. “So that entire $7bn may never be recovered, Nigerians have paid the price. We took the heat of over N5tn because of the recklessness of few people and some of them are political actors.” The circumstance surrounding the management of the $7bn is currently being investigated by the Economic and Financial Crimes Commission, it was learnt. In January, a former Deputy Governor of the CBN and then Presidential candidate of the Action Democratic Party, Dr Obadiah Mailafia, was reportedly arrested by security operatives and questioned over the $7bn. He had said, “They said there was a policy on CBN in 2006 that some foreign exchanges were given to the banks to manage and the banks now turned around and said the money was a bailout and I should come and explain. “I told them the policy was made around 2006 October and I left CBN in March 2007 and within that four months, I don’t know what happened. Even my department didn’t handle cash. Those who are managing this department have not been questioned. It is only me.” Attempts to get comments from the CBN on the status of the $7bn reserves were not successful as the Director Corporate Communications Department, Isaac Okorafor, had yet to respond to enquiries on the issue. Read the full article

0 notes