#Investment property home loan rates

Text

How to Build a Brighter Future with Home Loan Services in Jaipur?

Are you dreaming of owning your own home in the beautiful city of Jaipur? Well, guess what? You're in luck! Flying Colors is here to help you make that dream a reality with their amazing home loan services in Jaipur.

Why take a home loan in Jaipur?

Jaipur, known for its rich culture and heritage, is a city where many aspire to settle down and build a home. With Flying Colors, applying for a housing loan in Jaipur is now easier than ever. Whether you're a first-time homebuyer or looking to upgrade to a bigger place, Flying Colors has got you covered.

Benefits of Home Loan Services

By availing of home loan services, you can say goodbye to the stress of saving up for years to buy a house outright. With a housing loan, you can spread out the cost over time, making it more manageable for your budget. Plus, you get to enjoy the perks of being a homeowner without waiting for years to save up enough money.

Apply Housing Loan in Jaipur

Flying Colors makes the process of applying for a home loan a breeze. Simply visit their website and fill out the easy online application form. Their team of experts will guide you through the entire process, ensuring that you get the best deal possible.

How to Secure Your Future with a Home Loan?

Investing in a home is one of the best ways to secure your future and build wealth over time. With Flying Colors' home loan services, you can take that first step towards financial stability and independence. Don't let the opportunity slip away – apply for a housing loan today!

In conclusion, if you're looking to build a brighter future for yourself and your family, consider taking advantage of Flying Colors' home loan services. Owning a home is a dream that many aspire to achieve, and with the right support and guidance, you can make it a reality. Visit our website today to learn more about how you can apply for a home loan and start building the future you've always wanted.

#home loan services in jaipur#apply housing loan in jaipur#housing loan in jaipur#investment property loans in jaipur#home loan in jaipur#apply home loan in jaipur#low interest rates home loan in jaipur#easy home loans in jaipur#first time homeowner loan in jaipur#home finance in jaipur#housing finance company in jaipur#home loan agents in jaipur#home loan companies in jaipur#home loan finance company in jaipur#home loan interest rate in jaipur#home loan on society patta in jaipur#housing finance companies in jaipur

0 notes

Text

Conventional Rehab Loan Calculator, Guidelines, Requirements, Limits, Down Payment

Inroduction

With a Conventional Rehab Loan, a homeowner can use a single mortgage to pay for both the purchase of a home and the cost of renovations or repairs. Because it enables borrowers to buy a property that may require significant repairs or improvements and transform it into a livable and desirable home, this loan is also referred to as a "fixer-upper" loan.

Conventional Rehab Loan is not supported by the government and is instead provided by private lenders.

The following is a list of the upcoming events:

Most lenders demand an LTV of 80% or less.

The LTV is calculated as the loan amount divided by the appraised worth of the property.

The borrower may use the loan to refinance an existing mortgage and borrow additional funds for home improvements, or to buy a property in need of repairs or renovations. The loan amount is determined by the property's after-repair value (ARV), which is its estimated worth following any renovations or repairs.

For homeowners looking to buy a home that requires major repairs or upgrades, Conventional Rehab Loan can be a good choice. In contrast to conventional mortgages, however, borrowers should be ready for a more involved application procedure as well as possibly higher interest rates and fees.

Conventional Rehab Loan Definition

A Conventional Rehab Loan is a kind of mortgage that offers funding for both the purchase price and the expenses of house renovation. Based on the expected value of the house following renovations, the loan amount is determined. Homebuyers who want to acquire a property that needs work and make significant renovations or repairs frequently use this type of loan. The borrower usually has up to 12 months to finish the renovations. The money is disbursed in stages as the work advances. Conventional rehab loans are provided by private lenders and backed by Fannie Mae or Freddie Mac.

Conventional Rehab Loan Calculator

You can calculate your monthly mortgage payments for a home renovation job using a Conventional Rehab Loan Calculator.

Here is a straightforward tool you can use:

Establish the overall loan amount required for the renovation project, taking into account both the cost of the property's purchase and the renovations.

Enter the calculator with the loan amount, interest rate, and duration.

A projected monthly mortgage payment for the repair loan will then be produced by the calculator.

Here's an illustration:

Amount borrowed: $200 000

4% interest rate 30

year loan period $954.83 per month is the mortgage payment

Remember that this is only an estimate and that your actual monthly payments may differ based on your credit score, down payment, and the location of the property. To get a more precise estimate of your monthly payments, it is always a good idea to talk with a mortgage expert.

#conventional rehab loan#conventional rehab loan calculator#conventional rehab loan for investment property#conventional rehab loan vs 203k#conventional rehab loan interest rates#conventional rehab loans for manufactured homes#can you get a conventional rehab loan#conventional rehab loan guidelines#rehab loan requirements#fannie mae rehab loan#conventional rehab loan down payment#conventional rehab loan near me#conventional rehab loan limits

1 note

·

View note

Text

Choose the Best Loan for Your Investment Property

When you are thinking about purchasing an investment property, there are a number of different types of loans that you can choose from. Which one is the best for your situation?

Conventional Mortgage

A conventional mortgage is a loan that is not backed by a government agency. Conventional mortgages are available in fixed-rate and adjustable-rate varieties and with a wide range of terms. A conventional mortgage is a good option for investors who have a good credit history and can afford to make a large down payment.

FHA Loan and VA Loan

If you're looking for the best loan for investment on property, an FHA loan may be the best option for you. With low interest rates and flexible terms, an FHA loan can help you get the most out of your investment. There are some restrictions on eligibility, but most FHA loans are available in all 50 states.

If you're a veteran, the VA may be your best option for a loan to buy an investment property. The VA offers low-interest loans that are backed by the government and have some of the lowest down payment requirements in the market. Because these loans are backed by the government, there are some restrictions on eligibility, but most VA loans are available in all 50 states.

Private Mortgage

If you're looking for a private mortgage, you may want to consider a loan from a lending institution that specializes in investments. These types of loans can be harder to get than traditional mortgages, but they offer more flexibility and opportunities for growth.

The VA loan is a great option for investment properties. It offers low interest rates and no down payment, which makes it a great choice for first-time investors. Additionally, the VA loan is backed by the government, so you can be sure that your investment is protected.

Rental Property Loans

If you're looking for a loan to invest in a rental property, there are a few things to keep in mind. First, you'll need to have good credit in order to qualify for the best mortgage rates second home investment. Second, you'll need to have a solid business plan for your rental property in order to convince lenders that it's a good investment. Finally, be prepared to put down a large down payment, as most lenders will require 20-30% for an investment property loan. If you can keep all of these things in mind, you should be able to find a great loan for your rental property.

Avanti Home Equity Line of Credit

Homeowners looking to tap into their equity to fund an investment property may want to consider the Avanti Home Equity Line of Credit. This product offers a competitive interest rate and the flexibility to use the funds for a variety of purposes, making it a good option for those who are looking to finance an investment property.

Peer-to-Peer Lending

Peer-to-peer lending has become a popular option for investment property loans in recent years. This type of lending allows investors to borrow money from individual lenders, rather than banks or other financial institutions.

Peer-to-peer lending offers several advantages for investment property loans, including lower interest rates, more flexible repayment terms, and a quicker approval process. However, it's important to shop around and compare offers from multiple lenders before choosing a loan.

Other Types of Loans

There are other types of loans you can use for investment properties, but the best loan for investment property is typically a conventional mortgage. Other options include FHA loans, VA loans, and portfolio loans

There are many different types of loans available to purchase investment properties. It is important to find the one that best suits your needs and budget

0 notes

Text

What do you need to know about business loan interest rates and best construction loan rates

The bank's opinion of your company will significantly determine the business loan interest rates. Even though every company overestimates its success, entrepreneurs can receive a realistic image of the company's many vital financial indicators by imagining themselves in the roles of the bank's analysts. The most competitive construction loan rates are conditional on some variables. Loan terms, the kind of the building being financed, and the borrower's creditworthiness are only a few of these factors. The average interest of the best construction loan rates is greater than the average interest rate for a mortgage.

Paramount Finance's free financial review can save you hundreds of dollars. First-time homebuyers, those looking to refinance, those looking to consolidate debt, those interested in real estate investment, and business owners can all benefit from our services. At Paramount Finance, we take pride in our impartial assessment of our client's needs and our endorsement of the home loan that best meets those needs.

Companies can get business loan interest rates from a wide variety of banking institutions. When individuals and business owners take the necessary precautions on the strategic and operational sides of their organizations, they are in a position to qualify for the most affordable business loan interest rates. There is a correlation between the frequency of payments made on business loan interest rates.

A borrower who makes many little payments regularly is in excellent financial shape. Ensuring your company's economic outputs are in good condition through rigorous audit processes with reputable third-party experts can significantly impact your interest rates. The goal of the owner, which is to keep the company's finances in good shape, can be accomplished by using an ideal strategy known as a lower interest business loan interest rates A low annual percentage rate (APR) of 7.70% is the beginning of the savings you can make with the best construction loan rates. The most competitive best construction loan rates are typically disbursed in stages. Financing your construction project at a low-interest rate gives you more freedom. A best construction loan rates is the best option for construction financing.

#refinance home improvement loan#home construction loans#investment property loan rates#private loans#small business loans

0 notes

Text

Things Biden and the Democrats did, this week #14

April 12-19 2024

The Department of Commerce announced a deal with Samsung to help bring advanced semiconductor manufacturing and research and development to Texas. The deal will bring 45 billion dollars of investment to Texas to help build a research center in Taylor Texas and expand Samsung's Austin, Texas, semiconductor facility. The Biden Administration estimates this will create 21,000 new jobs. Since 1990 America has fallen from making nearly 40% of the world's semiconductor to just over 10% in 2020.

The Department of Energy announced it granted New York State $158 million to help support people making their homes more energy efficient. This is the first payment out of a $8.8 billion dollar program with 11 other states having already applied. The program will rebate Americans for improvements on their homes to lower energy usage. Americans could get as much as $8,000 off for installing a heat pump, as well as for improvements in insulation, wiring, and electrical panel. The program is expected to help save Americans $1 billion in electoral costs, and help create 50,000 new jobs.

The Department of Education began the formal process to make President Biden's new Student Loan Debt relief plan a reality. The Department published the first set of draft rules for the program. The rules will face 30 days of public comment before a second draft can be released. The Administration hopes the process can be finished by the Fall to bring debt relief to 30 million Americans, and totally eliminate the debt of 4 million former students. The Administration has already wiped out the debt of 4.3 million borrowers so far.

The Department of Agriculture announced a $1 billion dollar collaboration with USAID to buy American grown foods combat global hunger. Most of the money will go to traditional shelf stable goods distributed by USAID, like wheat, rice, sorghum, lentils, chickpeas, dry peas, vegetable oil, cornmeal, navy beans, pinto beans and kidney beans, while $50 million will go to a pilot program to see if USAID can expand what it normally gives to new products. The food aid will help feed people in Bangladesh, Burkina Faso, Burundi, Chad, Democratic Republic of the Congo, Djibouti, Ethiopia, Haiti, Kenya, Madagascar, Mali, Nigeria, Rwanda, South Sudan, Sudan, Tanzania, Uganda, and Yemen.

The Department of the Interior announced it's expanding four national wildlife refuges to protect 1.13 million wildlife habitat. The refuges are in New Mexico, North Carolina, and two in Texas. The Department also signed an order protecting parts of the Placitas area. The land is considered sacred by the Pueblos peoples of the area who have long lobbied for his protection. Security Deb Haaland the first Native American to serve as Interior Secretary and a Pueblo herself signed the order in her native New Mexico.

The Department of Labor announced new work place safety regulations about the safe amount of silica dust mine workers can be exposed to. The dust is known to cause scaring in the lungs often called black lung. It's estimated that the new regulations will save over 1,000 lives a year. The United Mine Workers have long fought for these changes and applauded the Biden Administration's actions.

The Biden Administration announced its progress in closing the racial wealth gap in America. Under President Biden the level of Black Unemployment is the lowest its ever been since it started being tracked in the 1970s, and the gap between white and black unemployment is the smallest its ever been as well. Black wealth is up 60% over where it was in 2019. The share of black owned businesses doubled between 2019 and 2022. New black businesses are being created at the fastest rate in 30 years. The Administration in 2021 Interagency Task Force to combat unfair house appraisals. Black homeowners regularly have their homes undervalued compared to whites who own comparable property. Since the Taskforce started the likelihood of such a gap has dropped by 40% and even disappeared in some states. 2023 represented a record breaking $76.2 billion in federal contracts going to small business owned by members of minority communities. This was 12% of federal contracts and the President aims to make it 15% for 2025.

The EPA announced (just now as I write this) that it plans to add PFAS, known as forever chemicals, to the Superfund law. This would require manufacturers to pay to clean up two PFAS, perfluorooctanoic acid and perfluorooctanesulfonic acid. This move to force manufacturers to cover the costs of PFAS clean up comes after last week's new rule on drinking water which will remove PFAS from the nation's drinking water.

Bonus:

President Biden met a Senior named Bob in Pennsylvania who is personally benefiting from The President's capping the price of insulin for Seniors at $35, and Biden let Bob know about a cap on prosecution drug payments for seniors that will cut Bob's drug bills by more than half.

#Thanks Biden#Joe Biden#jobs#Economy#student loan debt#Environment#PFAS#politics#US politics#health care

755 notes

·

View notes

Text

Oh while I'm on U.S. economics, I have another thing that bugs the hell out of me: the hiking of mortgage interest rates.

For those who don't know, mortgage interest rates dropped low during the pandemic. Which is not all sunshine since it resulted in many bidding wars and a ton of way-over-asking offers in competitive areas, but it put home-ownership way more within reach for a lot of people.

Then the fed started to pee their pants over inflation, and hiked their rates up, prompting mortgage companies to follow.

Here's a chart of mortgage interest rates over the last 4 years

It hit a trough at 2.65% on average in early January 2021, and then you see it hiked itself way back up, now chilling at 6.27%

For context on how different these are: let's use an example of a $400,000 home - someone pays 20% down ($80,000) in cash, and finances the remaining 80% ($320,000).

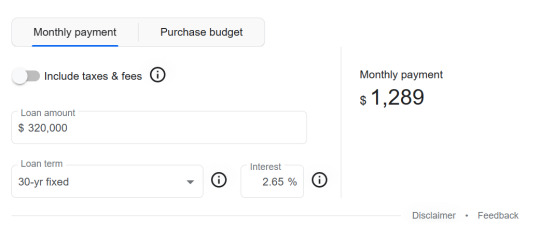

Monthly payments at 2.65%:

This results in paying back, in total, $464,040. You'll notice that's well over the initial $320,000, and that's because of the interest paid over those 30 years.

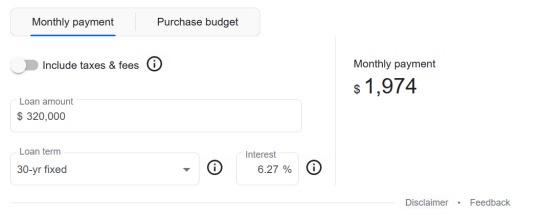

Now, monthly payments at 6.27%:

This results in paying back, in total, $710,640. That's more than twice the initial loan of $320,000.

And, of course, it means the same exact property which could be paid for with a monthly budget of ~$1,300 in early 2021 now requires a monthly budget of ~$2,000 in 2023.

Also, those pandemic lows were an anomaly... Historically, mortgage interest rates were on average HIGHER than 6.27% - but also, historically, wages were much better relative to the prices of homes and people could afford the high interest rates (with the exception of the people who got screwed over in the 2008 housing market meltdown... There's a really good Cold Fusion video on that.)

And because these low interest rates were an anomaly, they may never come back...

So with mortgage interest rates going up, home-buying becomes harder. When home-buying becomes harder, rents increase (because renters have no alternative).

So who DOESN'T get affected?

ENTITIES THAT CAN PAY IN ALL CASH.

They need no mortgage. They pay the sticker price on-spot with no interest applying to them. And I say ENTITIES because, sure, some people can buy their home in all-cash. But a huge number of the entities that can buy in all cash are BIG investment companies--the Blackrocks and the Mega-landlords who scoop up properties to sit on, rent out, and turn for a profit later like it's a piece of stock, and not a habitable property...

Anyway I don't have a conclusion for this. Fix wages, or bring interest rates back down, or kill Blackrock. Preferably all 3.

#Federal Reserve shivering quaking 'but if poor people have disposable income then companies will have no CHOICE but to price-gouge and#turn record profits and fuel inflation... theres no helping it... we have to make#everything harder for poor people...'#gonna start a bingo card if this breaches containment and sparks an argument on libertarian tumblr

279 notes

·

View notes

Text

Investment Property Loans Made Simple

Investing in property holds the promise of financial freedom, yet navigating the world of investment property loans can seem daunting. With NZ Mortgages as your guide, you can embark on this journey with confidence. Let’s delve into the fundamentals of investment property loans, so that you get clarity and insight to get on the path to realising your financial goals.

Understanding Investment Property Loans

Investment property loans differ from traditional home loans in several key aspects. While both involve borrowing money to purchase property, investment loans are specifically tailored for properties that are not occupied by the owner. These loans typically have higher interest rates and stricter eligibility criteria due to the increased risk associated with investment properties.

Types of Investment Property Loans

Fixed Rate Loans:

With a fixed-rate loan, the interest rate remains constant throughout the loan term, providing stability and predictability in repayments. This option is ideal for investors seeking protection against potential interest rate fluctuations.

Variable Rate Loans:

Variable rate loans are subject to changes in interest rates, which can either increase or decrease over time. While this option offers flexibility and the potential for lower interest rates, it also carries the risk of higher repayments if rates rise.

Interest-Only Loans:

Interest-only loans allow investors to pay only the interest portion of the loan for a specified period, typically five to 10 years. This can provide short-term cash flow benefits by reducing monthly repayments, but borrowers must be prepared for higher repayments once the interest-only period ends.

Eligibility and Requirements

Before applying for an investment property loan, it's essential to understand the eligibility criteria and requirements set forth by lenders. Key factors that lenders consider include:

Credit Score:

A strong credit score demonstrates a borrower's ability to manage debt responsibly and is a crucial factor in determining eligibility for an investment loan.

Debt-to-Income Ratio:

Lenders assess the borrower's debt-to-income ratio to ensure they have sufficient income to cover loan repayments. Lower ratios indicate less financial strain and may improve loan approval chances.

Loan-to-Value Ratio (LTV):

The LTV ratio compares the loan amount to the property's value, with lower ratios typically resulting in more favourable loan terms. Lenders may require a higher deposit for investment loans to mitigate risk.

Benefits of Investing in Property

Investing in property offers numerous benefits that can contribute to long-term financial stability and growth:

Rental Income:

Investment properties generate rental income, providing a steady stream of cash flow that can be used to cover loan repayments and expenses.

Capital Appreciation:

Over time, property values tend to increase, allowing investors to build equity and potentially realise capital gains on selling the property.

Tax Advantages:

Property investors may benefit from tax deductions on mortgage interest, property depreciation, and other expenses, reducing their overall tax liability.

While investment property loans offer opportunities for wealth creation, it's crucial to be aware of potential risks and considerations:

Market Volatility:

Property markets can be subject to fluctuations in supply and demand, economic conditions, and government policies. Investors should conduct thorough market research and risk assessments to mitigate exposure to volatility.

Vacancy and Cash Flow:

Vacancies in rental properties can disrupt cash flow and impact loan repayments. Investors should budget for potential vacancies and have contingency plans in place to cover expenses during lean periods.

Property Maintenance and Management:

Owning an investment property entails responsibilities such as maintenance, repairs, and tenant management. Investors should budget for these expenses and consider outsourcing property management services if needed.

Interest Rate Risks:

Variable rate loans are susceptible to changes in interest rates, which can affect borrowing costs and cash flow. Investors should assess their risk tolerance and consider strategies such as fixing interest rates or creating buffers to mitigate interest rate risks.

Working with NZ Mortgages

NZ Mortgages specialises in helping investors navigate the complexities of investment property loans. With our expertise and personalised approach, we empower clients to make informed decisions and achieve their financial objectives. Our services include:

Loan Comparison:

We offer a wide range of loan options from various lenders, allowing clients to compare rates, terms, and features to find the best fit for their investment strategy.

Expert Advice:

Our team of mortgage professionals provides personalised guidance and support throughout the loan application process, ensuring a smooth and seamless experience from start to finish.

Ongoing Support:

Beyond securing financing, we remain committed to our clients' success, offering ongoing support and resources to help them maximise the return on their investment property portfolio.

Strategies for Success

To maximise returns and mitigate risks when investing in property, consider the following strategies:

Diversification:

Diversifying your investment portfolio across different property types, locations, and asset classes can help spread risk and enhance long-term returns. Consider investing in residential, commercial, and mixed-use properties to diversify your portfolio.

Research and Due Diligence:

Conduct thorough research and due diligence before investing in a property. Evaluate factors such as location, property condition, rental demand, and potential for capital appreciation to make informed investment decisions.

Financial Planning:

Develop a comprehensive financial plan that accounts for your investment goals, risk tolerance, cash flow projections, and exit strategies. Consider working with financial advisers and mortgage brokers to optimise your investment strategy and financing options.

Regular Review and Monitoring:

Regularly review and monitor your investment portfolio to assess performance, identify opportunities for optimisation, and make necessary adjustments to your strategy. Stay informed about market trends, regulatory changes, and economic developments that may impact your investments.

Conclusion:

Investment property loans represent a gateway to financial freedom, and with NZ Mortgages by your side, the journey becomes simpler and more rewarding. By understanding the nuances of investment lending and leveraging the expertise of our team, you can confidently pursue your investment goals and build a brighter financial future. Contact NZ Mortgages today and unlock the potential of property investment.

10 notes

·

View notes

Text

What Is Best Option? Renting Home Or Buying Home

In Real Estate Mumbai Market Currently Pricing Of Projects Increasing Day By Day, Here People Were Confused About Why They Should Invest So Much Money In House, Instead They Pay Rents To Live In Mumbai. Many Of People Doing This Without Proper Calculation & Planning, At Current Timeline Of Market Phase Real Estate Is One Of The Profitable & Secure Investment. To Compare These Rental & Buying Criteria Of Homes You Must Check Following Facts.

Buying Homes

Interest Rate Of Home Loan Is Low "Better To Pay EMI, Rather Than Rent" #Buying

Freedom Of Rennovation #Buying

Owning A Property Adds to Value Appreciation of Property #Buying

Get A Permanent Live Address To Your Home #Buying

Renting Homes

Trouble For Childrens to Cope in New Schools #Renting

Brokerage & Holding Deposit Has To Paid Everytime #Renting

Burden To Transport & Setup Home Everytime #Renting

Adapting To Frequently Changing Environment & Neighbours #Renting

#Buying Or Renting#Buying Or Renting Homes#Tenants#Owners#real estate Facts#property investing#mumbai homes#realestate#sunblonderealty#mumbai#mumbairealestate#realestateprojects#dreamhome#reality#luxuryliving#propertyfinder#maharera

2 notes

·

View notes

Text

I testified Thursday against the City Council Fair Chance for Housing Act, my second time in Council Chambers. The first was in May 2019 when I spoke personally and passionately about protecting New York City’s specialized high schools.

The bill, also known as Int. 632, is another City Council measure designed to protect lawbreakers at the expense of the law-abiding. It would prohibit criminal background checks on prospective tenants and buyers of residential housing.

After testifying, I left City Hall. It wasn’t until hours later that I heard the racist response to my testimony from Douglas Powell, who spoke on behalf of city-funded nonprofit Vocal-NY. He and his organization want individuals such as Powell, who has a criminal record and is a level 2 registered sex offender, to be able to access housing without criminal background checks.

His testimony laid out his criminal-justice experience and his lived experience of anti-black discrimination at Asian stores — culminating in a racist attack on the Asian community where he lives. In his three-minute tirade, he called Queens’ Rego Park the most racist neighborhood because it is majority Asian. “It’s not their neighborhood — they from China, Hong Kong,” he said. “We from New York.”

Convicted sex offender spews anti-Asian slurs during NYC Council meeting — and pols do nothing to stop him

This anti-Asian, perpetual-foreigner, “You don’t belong here” rhetoric is dangerous hate speech that incites violence. Unprovoked attacks on Asian New Yorkers are on the rise.

Powell’s racist rant was delivered in the presence of three councilmembers without interruption or admonishment. Committee chair Nantasha Williams even thanked Powell for his testimony. It’s as if his anti-Asian hate speech in the chamber was unremarkable white noise. It took hours, after online pressure from constituents, for those present to issue generic disapproval statements, retweeting other electeds’ condemnation, and say “both sides” share blame for systemic racism.

Like many Asian Americans, I am a property owner and small landlord. When I graduated, my parents encouraged me to live at home, pay off my debt and save to buy a property. I lived at home for a few years and paid off my student loans as quickly as I could. Decades later, I bought my first investment property. I rented mostly to young men and women at the start of their careers. As a landlord, I treated my tenants the way I wanted to be treated: fairly and responsively. I’m fortunate real-estate brokers and condo management could conduct criminal and credit checks, not only for my benefit but for the safety of neighbors in the building.

Powell spewed hateful, anti-Asian rhetoric at the council meeting.Stephen Yang

Asian Americans have the highest rate of home ownership in the city, 42%. The stability of owning property as a means of building wealth is deeply rooted in Asian culture. New York’s pro-tenant policies, especially the Emergency Rental Assistance Program, have resulted in heartbreaking stories from small-property landlords. The laws, intended to help tenants, some of whom lost jobs during COVID, disproportionately hurt immigrant landlords. Not only have they not been paid rent for three years; some living in multi-family units are terrorized by tenants who know they can’t evict. Many Asian property owners are working class, and their modest rental income helps pay for the mortgage, property taxes and unit upkeep.

While bad tenants existed before this bill, it would make things worse. Private-property owners should not bear the burden of unknowingly renting to convicted arsonists and murderers and letting them live next door to New Yorkers who want a safe place after a long day braving our unpredictable city streets and subways. We worry about higher insurance, liability in endangering other tenants and frivolous lawsuits in tenant-friendly courts. That becomes a cost-benefit question for owners — whether it’s worth it to rent with little profit.

Like most landlords, I don’t live in the building I rent, but I do worry about the tenants I rent to. I think of the kindhearted young Asian professional who pleaded with me to let her have a Hurricane Sandy rescue dog. I worry about the wheelchair-bound young man grateful to find independence in living in an accessible building and appreciative of me letting him install an automatic door opener for his convenience. I want them to have the peace of mind that when they return to their small haven in the city, they will be safe, among neighbors who won’t pose a risk to them.

The fight to save specialized high schools that brought me to council the first time galvanized many Asian voters who had never been involved in city politics before. I am one of those newly politicized voters. This year, I co-founded Asian Wave Alliance to make sure that Asian-American New Yorkers’ needs are not ignored by the very councilmembers who sat quietly and listened to Powell’s racist attacks.

This time, I went to council to convince the Committee on Human and Civil Rights and the bill’s sponsors that the Fair Chance for Housing Act is not “fair” at all to small landlords and already-existing tenants. Getting rid of reasonable safeguards like criminal background checks is not “fair” to the city’s law-abiding citizens and will put people in danger. True fairness requires listening to all New Yorkers and prioritizing safety and transparency.

42 notes

·

View notes

Text

The days of legally sanctioned race-based housing discrimination may be behind us, but the legacy of attitudes and practices that kept nonwhite citizens out of some neighborhoods and homeownership remains pervasive. Redlining, one of these practices, is especially notorious in U.S. real estate history.

What is redlining? Technically, it refers to lending discrimination that bases decisions on a property’s or individual’s location, without regard to other characteristics or qualifications. In a larger sense, it refers to any form of racial discrimination related to real estate.

America’s discriminatory past can still be present today with nonwhite mortgage borrowers generally getting charged higher interest rates and the persistence of neighborhood segregation. These trends can be traced in part to redlining, an official government policy dating from the 1930s, which codified racist attitudes in real estate finance and investment, and made it more difficult for nonwhites to purchase homes.

Redlining and racism in America have a long, complex and nuanced history. This article serves as a primer on the policy’s background and how it continues to affect real estate and nonwhite homeownership today. It also includes suggestions to reduce redlining’s lingering effect.

Key takeaways

Redlining refers to a real estate practice in which public and private housing industry officials and professionals designated certain neighborhoods as high-risk, largely due to racial demographics, and denied loans or backing for loans on properties in those neighborhoods.

Redlining practices were prevalent from the 1930s to the 1960s.

Ostensibly intended to reduce lender risk, redlining effectively institutionalized racial bias, making it easier to discriminate against and limit homebuying opportunities for people of color. It essentially restricted minority homeownership and investment to “risky” neighborhoods.

Though redlining is now illegal, its legacy persists, with ongoing impact on home values, homeownership and individuals’ net worth. Discrimination and inequities in housing practices and home financing still exist.

What is redlining?

Redlining — both as a term and a practice — is often cited as originating with the Federal Home Owners’ Loan Corporation (HOLC), a government agency created during the 1930s New Deal that aided homeowners who were in default on their mortgages and in foreclosure. HOLC created a system to assess the risk of lending money for mortgage loans within particular neighborhoods in 239 cities.

Color-coded maps were created and used to decide whether properties in that area were good candidates for loans and investment. The colors — from green to blue to yellow to red — indicated the lending risk level for properties. Areas outlined in red were regarded as “hazardous” (that is, high risk) — hence, the term “redlining.”

Redlined areas typically had a high concentration of African-American residents and other minorities. Historians have charged that private mortgage lenders and even the Federal Housing Administration (FHA) — created in 1934 to back, or insure, mortgages — used these maps or developed similar ones to set loan criteria, with properties in those redlined areas incurring higher interest rates or not qualifying at all. Real estate brokers often used them to segregate buyers and sellers.

“This practice was widespread and institutionalized, and it was used to discriminate against minorities and low-income communities,” says Sam Silver, a veteran Santa Clarita, Calif.-based Realtor, real estate investor and commercial lender.

The impact of redlining on the mortgage lending industry

Following World War II, the U.S. had a huge demand for housing, as many returning American servicemen and -women wanted to settle down and begin raising families. Eager to help these veterans, the FHA expanded its financing and loan-insuring efforts, essentially empowering Uncle Sam to back lenders and developers and reducing their risk when offering construction and mortgage loans.

“That lower risk to lenders resulted in lower interest rates, which granted middle-class people the ability to borrow money to purchase homes,” says Rajeh Saadeh, a real estate and civil rights attorney and a former Raritan Valley Community College adjunct professor on real estate law in Bridgewater, New Jersey. “With the new lending policies and larger potential homeowner pool, real estate developers bought huge tracts of land just outside of urban areas and developed them by building numerous homes and turning the areas into today’s suburbs.”

However, many of these new developments had restrictions stated in their covenants that prohibited African-Americans from purchasing within them. Additionally, there were areas within cities, already heavily populated by minorities, that were redlined, making them ineligible for federally backed mortgages (which effectively meant, for affordable mortgages, period). Consequently, people of color could not get loans to buy in the suburbs, nor could they borrow to purchase homes in areas in which they were concentrated.

“Redlining was part of a systemic, codified policy by the government, mortgage lenders, real estate developers and real estate agents as a bloc to deprive Black people of homeownership,” Saadeh continues. “The ramifications of this practice have been generational.”

The (official) end of redlining

During the mid-20th century, redlining predominated along the East Coast, the eastern sections of the South and the Midwest, and several West Coast metropolitan areas. Black neighborhoods and areas adjacent to them were the ones most likely to be redlined.

Redlining as a sanctioned government practice ended with the passage of the Fair Housing Act in 1968, which specifically prohibits racial discrimination in the housing industry and among professionals engaged in renting, buying, selling and financing residential properties. The Act’s protections were extended by the Equal Credit Opportunity Act (1974) and the Community Reinvestment Act (1977).

The Department of Housing and Urban Development (HUD) — specifically, its Office of Fair Housing and Equal Opportunity (FHEO) — investigates reports of redlining. For example, prompted by a complaint filed by the non-profit National Community Reinvestment Coalition, HUD has been examining whether several branches of HSBC Bank USA engaged in discriminatory lending practices in Black and Hispanic neighborhoods in six U.S. metropolitan areas from 2018-2021, HSBC recently disclosed in its Form 10-Q for the second quarter 2023.

Bankrate insights

In October 2021, the Department of Justice announced its Combatting Redlining Initiative, working in partnership with the Consumer Financial Protection Bureau and the Office of the Comptroller of the Currency. It has reached seven major settlements with financial institutions to date, resulting in over $80 million in loans, investments and subsidies to communities of color.

How does redlining affect real estate today?

The practice of redlining has significantly impacted real estate over the decades in several ways:

Redlining has arguably led to continued racial segregation in cities and neighborhoods. Recent research shows that almost all formerly redlined zones in America remain disproportionately Black.

Redlined areas are associated with a long-term decline in homeownership, home values and credit scores among minorities, all of which continue today.

Formerly redlined areas tend to have older housing stock and command lower rents; these less-valuable assets contribute to the racial wealth gap.

Redlining curbed the economic development of minority neighborhoods, miring many of these areas in poverty due to a lack of access to loans for business development. After 30-plus years of underinvestment, many nonwhite neighborhoods continue to be seen as risky for investors and developers.

Other effects of redlining include the exclusion of minority communities from key resources within urban areas, such as health care, educational facilities and employment opportunities.

Today, 11 million Americans live in formerly redlined areas, estimates Kareem Saleh, founder/CEO of FairPlay AI, a Los Angeles-based organization that works to mitigate the effects of algorithmic bias in lending. He says about half of these people reside in 10 cities: Baltimore, Boston, Chicago, Detroit, Los Angeles, Milwaukee, New York City, Philadelphia, San Francisco and San Diego.

“Redlining shut generations of Black and Brown homebuyers out of the market. And when members of these communities did overcome the barriers to purchasing homes, redlining diminished their capacity to generate wealth from the purchase,” says Saleh. “To this day, redlining has depressed property values of homes owned in minority communities. The enduring legacy of redlining is that it has blocked generations of persons of color from accessing a pathway to economic empowerment.”

“Also, due to redlining, African-Americans who couldn’t qualify for government-backed mortgages were forced to pay higher interest rates. Higher interest rates translate to higher mortgage payments, making it difficult for minorities to afford homes,” Elizabeth Whitman, a real estate attorney and real estate broker in Potomac, Maryland, says. “Since redlining made it more expensive to obtain a mortgage, housing wasn’t as easy to sell and home prices got suppressed in redlined areas.”

Data from FairPlay AI’s recent “State of Mortgage Fairness Report” indicate that equality in mortgage lending is little better today for many nonwhite groups than it was 30 years ago — or it has improved very slowly. For example, in 1990, Black mortgage applicants obtained loan approvals at 78.4 percent of the rate of White applicants; in 2019 that figure remained virtually unchanged — though it did rise to 84.4 percent in 2021.

Although there’s no official federal risk map anymore, most financial institutions do their own risk assessments. Unfortunately, bias can still enter into these assessments.

“Lenders can use algorithms and big data to determine the creditworthiness of a borrower, which can lead to discrimination based on race and ethnicity. Also, some real estate agents may steer clients away from certain neighborhoods based on their racial makeup,” Silver points out.

With the rise of credit rating agencies and their ubiquity, how do we know it’s a fair system? I don’t think, at my core, that African-Americans are predisposed to be poorer and less financially secure.

— Rob Roseformer executive director of the Cook County Land Bank Authority in Chicago

Insurance companies have also used redlining practices to limit access to comprehensive homeowners policies. And the home appraisal industry has also employed redlining maps when valuing properties, which has further repressed housing values in African-American neighborhoods, according to Whitman.

Furthermore, a 2020 National Fair Housing Alliance study revealed that Black and Hispanic/Latino renters were more likely to be shown and offered fewer properties than White renters.

Redlining’s ongoing legacy

Even without conscious bias, the legacy of redlining — and its impact on the accumulation of assets and wealth — can put nonwhite loan applicants at a disadvantage to a disproportionate degree. For example, studies consistently show that Black borrowers generally have lower credit scores today, even when other factors like education and income are controlled for. Credit scores, along with net worth and income, are of course a key factor in determining mortgage eligibility and terms.

As a result, it remains more difficult for Black borrowers to qualify for mortgages — and more expensive for those who do, because they’re usually charged higher interest rates. Other minorities are also much more likely to pay a higher interest rate than their White counterparts.

Because home appraisals look at past property value trends in neighborhoods, they reinforce the discrimination redlining codified by keeping real estate prices lower in historically Black neighborhoods. That, in turn, makes lenders assume they’re taking on more risk when they extend financing in those areas.

“The single-greatest barrier in helping to break out of these neighborhoods is the current appraisal process,” says Rob Rose, former executive director of the Cook County Land Bank Authority in Chicago. “The appraisers are trying to do the best that they can within the parameters that they’re given, but it’s a broken system and industry that’s built on a faulty foundation.”

African-American homeowners pay hundreds of dollars more per year in mortgage interest, mortgage insurance premiums and other fees than White homeowners — amounting to $13,464 over the life of their loan, according to “The Unequal Costs of Black Homeownership,” a 2020 study by MIT’s Golub Center for Finance and Policy.

What can be done to reduce the impact of redlining?

The current housing financing system is built on the foundations that redlining left in place. To decrease the effects of redlining and its legacy, it’s essential to address the underlying biases that led to these practices.

“This can be done through Fair Housing education and training of real estate professionals, increased enforcement of Fair Housing laws, and investment in communities that have been historically redlined,” suggests Silver.

Others insist that the public and private sectors need to play a bigger role in combating prejudice and discrimination.

“Federal regulators likely will continue to put pressure on financial institutions and other stakeholders in the mortgage ecosystem to root out bias,” says Saleh. “The Department of Justice’s Combatting Redlining Initiative shows the government’s commitment to supervisory oversight. There are also policy and regulatory moves, such as the recent push by regulators encouraging lenders to use Special Purpose Credit Programs — lending programs specifically dedicated to remedying past discrimination. Similarly, various federal task forces have been actively addressing historical biases and discriminatory practices in the appraisal industry.”

Also, financial institutions could adjust their underwriting practices and algorithms to better evaluate nonwhite loan applicants, and help level the playing field for them. For example, in late 2022, Fannie Mae announced it had adjusted its automated Desktop Underwriter system — widely used by bank loan officers — to consider bank account balances for applicants who lack credit scores. Fannie and its fellow mortgage-market player, Freddie Mac, now may also consider rent payments as part of borrowers’ credit histories.

Such efforts won’t eradicate the effects of redlining overnight, of course. But they can be a start towards helping more people towards a key piece of the American Dream.

If you believe you are the victim of redlining or another sort of housing discrimination, you have rights under the Fair Housing Act. You can file an online complaint with or phone the U.S. Department of Housing and Urban Development at (800) 669-9777. Additionally, you can report the matter to your local private Fair Housing center or contact the National Fair Housing Alliance.

#What is redlining? A look at the history of racism in American real estate#redlining#Racial disparities in homeownership#white supremacy in banking#american hate

6 notes

·

View notes

Text

Blue Melon Capital Reviews | 5 Key Factors to Consider When Securing Real Estate Financing

Securing financing for real estate investments is a critical aspect of property ownership and development. Whether you're purchasing your dream home or investing in commercial properties, navigating the complex landscape of real estate financing requires careful consideration of several key factors. Blue Melon Capital Reviews shares some essential elements to keep in mind when seeking financing for your real estate ventures.

1. Creditworthiness and Financial Health

One of the foremost factors lenders consider when assessing real estate financing applications is the borrower's creditworthiness and financial health. Your credit score, debt-to-income ratio, and overall financial stability play pivotal roles in determining the terms of your loan, including interest rates and loan amounts. Before applying for financing, it's crucial to review your credit report, address any discrepancies or outstanding debts, and ensure your financial records reflect a favorable picture. Building a strong credit profile not only enhances your chances of securing financing but also opens doors to more competitive loan options with favorable terms.

2. Property Valuation and Collateral

The value of the property you intend to finance serves as collateral for the loan, influencing the lender's risk assessment and loan-to-value (LTV) ratio. Conducting a thorough property valuation, including appraisal and assessment of market trends, is essential to determine its fair market value accurately. Additionally, lenders may impose specific requirements regarding the type, condition, and location of the property, which can affect financing options. Understanding the collateral requirements and ensuring the property meets these criteria is crucial for securing favorable financing terms and minimizing risks for both parties involved.

3. Loan Terms and Structure

Blue Melon Capital Reviews believes real estate financing encompasses a variety of loan options, each with distinct terms, structures, and repayment schedules. From traditional mortgages to commercial loans, bridge financing, and construction loans, selecting the right loan product tailored to your specific needs is vital. Consider factors such as interest rates, loan duration, down payment requirements, and prepayment penalties when evaluating different financing options. Additionally, understanding the implications of fixed-rate versus adjustable-rate mortgages and the impact of market fluctuations on loan payments is essential for making informed decisions about loan terms and structure.

4. Lender Relationships and Options

Building strong relationships with lenders and exploring diverse financing options can provide valuable insights and opportunities for securing favorable terms. Researching reputable lenders, including banks, credit unions, mortgage brokers, and private lenders, allows you to compare rates, fees, and eligibility criteria to find the best fit for your financing needs. Moreover, cultivating open communication and transparency with lenders throughout the application process can strengthen your negotiating position and increase the likelihood of securing financing on favorable terms. By leveraging diverse lender relationships and exploring alternative financing sources, you can optimize your real estate financing strategy and mitigate potential challenges.

5. Regulatory and Legal Considerations

Navigating the regulatory and legal landscape surrounding real estate financing is paramount to ensure compliance and mitigate risks. Familiarize yourself with applicable laws, regulations, and licensing requirements governing real estate transactions and lending practices in your jurisdiction. Additionally, consult legal professionals specializing in real estate law to review loan agreements, contracts, and disclosure documents thoroughly. Understanding your rights and obligations as a borrower, as well as potential legal implications, empowers you to make informed decisions and safeguard your interests throughout the financing process.

In conclusion, securing real estate financing requires careful consideration of various factors, including creditworthiness, property valuation, loan terms, lender relationships, and regulatory compliance. By prioritizing these key elements and conducting thorough due diligence, borrowers can enhance their chances of securing financing on favorable terms while minimizing risks and maximizing returns on their real estate investments. Remember to seek guidance from financial advisors, real estate professionals, and legal experts to navigate the complexities of real estate financing and make informed decisions aligned with your long-term objectives.

2 notes

·

View notes

Text

Investments in place matter. Public spaces such as parks and community centers as well as businesses such as restaurants and bars signal local prosperity, add a richness to the neighborhood, and enhance community wealth by attracting further investment.

Grocery stores are a crucial component of this ecosystem. And premium grocery chains focused on natural, organic, and specialty foods (commonly referred to as “fresh format” stores) such as Whole Foods and Trader Joe’s[1] not only provide healthy shopping options for residents, but also serve as markers of high-income, desirable areas, which contributes to increased property values and an image of security and stability. Conversely, the lack of these assets—or the proliferation of chains associated with poverty, such as dollar stores—can indicate to investors and developers that a community is struggling or lacks a clientele that would make investing profitable. These patterns can drive an upward or downward spiral of investment, concentrating wealth in already-wealthy areas while diverting it from struggling ones.

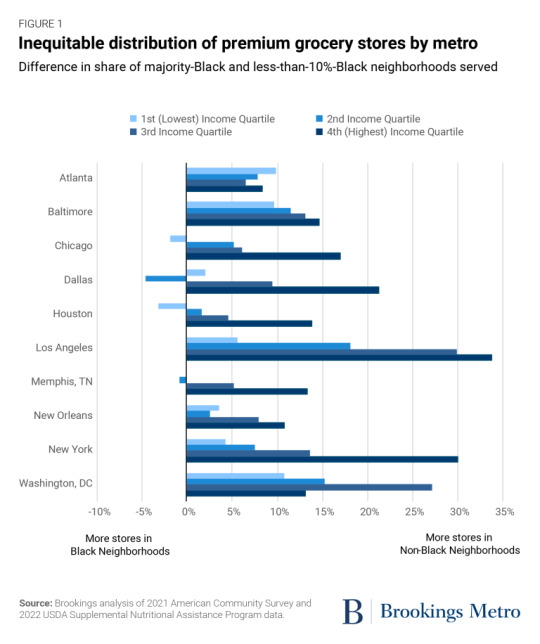

Community investment patterns are often influenced by race as well as wealth. Analyzing the distribution of grocery stores in several large U.S. cities, we find that premium grocery stores are less likely to be located in Black-majority neighborhoods, regardless of the average household income of those neighborhoods, and are substantially more likely to be located in neighborhoods where the Black population share is less than 10%.

In other words, businesses and the broader real estate and financing sectors are not investing even in prospering Black-majority neighborhoods, which devalues these communities and hinders opportunities for growth.

Devaluation of Black communities has led to disparities in food access

Uneven food systems across neighborhoods of varying racial compositions reveal ways that American society signals the value it places on the people in those communities.

The devaluation of Black neighborhoods is linked with redlining and mid-20th century “urban renewal” projects that labeled many Black neighborhoods as “slums” and demolished them. Meanwhile, federal, state, and local leaders invested in infrastructure that brought suburban white residents to and from urban cores, signaling the higher intrinsic value of white communities. These policies acted on the presumed lower value of people and assets in Black communities, which shows up in the kinds of amenities a community offers.

Federal Housing Finance Agency appraisal reports have allowed researchers to confirm that homes in Black neighborhoods are valued roughly 20% lower than equivalent homes in non-Black neighborhoods, and are nearly twice as likely to appraise below the contracted selling price. Similar devaluation patterns have been found in commercial real estate in Black-majority neighborhoods, which makes it difficult for Black entrepreneurs to get loans to start new businesses or invest in existing ones. Customer-facing businesses that do establish themselves in Black-majority neighborhoods face lower customer ratings and less revenue.

One part of the larger structure of business and commercial real estate devaluation in Black-majority communities is “food apartheid,” or disparities in access to food that have been produced by structural racism in residential and investment patterns, such as supermarket redlining. Though differences in food access are often blamed for elevated food insecurity and worse nutritional outcomes in Black communities, the relationship may not be as strong as is often believed, as our Brookings Metro colleagues pointed out in a 2021 report. They found that while there has been a tendency to frame the problem of food insecurity and poor nutrition in low-income neighborhoods as one of “food deserts” (areas with limited access to affordable and nutritious food), a number of recent studies have shown that greater access to food retailers does not correlate to reduced food insecurity, and that shoppers, even those without vehicles, do not necessarily choose to shop at the nearest supermarket.

Furthermore, the rise of food delivery services during the COVID-19 pandemic has resulted in greater access to grocery delivery services for most Americans living in traditionally defined “food deserts.” While financial insecurity and the higher cost of healthier food play a bigger role in food insecurity and nutritional deficits among low-income Americans, segregation and differing retail options in Black-majority neighborhoods still matter, because they are symptoms of a broader problem of devaluation and underinvestment in Black communities, which has real consequences for local wealth retention and development.

Beyond issues of access, this report presumes that store type is an economic statement of value that can spur or throttle investment in an area. The store types present in a community are a judgement of the level of investment a community is worthy of.

Premium grocery stores are absent from wealthy Black-majority communities

We analyzed the locations of premium grocery retailers in 10 U.S. metro areas with populations over 1 million and substantial numbers of high-income, non-rural census block groups with Black-majority populations.[2] We found strong evidence for underinvestment across all 10 metro areas.

As seen in Table 1, in seven of the 10 metro areas studied, none of the Black-majority, non-rural block groups in the top quartile for household income were located within 1 mile of a premium grocery store and only in one metro area—Washington, D.C.—was the percentage above 5%. For block groups in the same income brackets but with less than a 10% share of Black residents, the percentage that were located within 1 mile of a premium grocery store ranged from 10% in Atlanta to 34% in Los Angeles. Furthermore, Black-majority block groups in each income quartile of all the metro areas studied had a lower chance of being within 1 mile of a premium grocery store than block groups in that metro area overall.[3]

While we see the same pattern of underinvestment in wealthy Black communities across all 10 cities in our sample, there are significant differences between metro areas as well. Figure 1 highlights the difference in the shares of Black and non-Black neighborhoods near premium grocery stores. The differences in premium grocery store prevalence in wealthy neighborhoods are lowest in the low-income metro areas (New Orleans and Memphis, Tenn., which have median household incomes below $60,000), and largest in Washington, D.C., New York, and Los Angeles (which are among the wealthiest metro areas in our sample).

Another difference appears when we look at low-income block groups. In some metro areas (Atlanta and Baltimore in particular), the deficit of premium grocery stores is similar across low-income and high-income Black neighborhoods. However, in two metro areas (Houston and Chicago), Black-majority communities in the bottom income quartile were actually more likely to be located near a premium grocery store than low-income communities with few Black residents. In both cases, the differences are small, and the low-income Black neighborhoods in question are in relatively dense urban areas adjacent to higher-income neighborhoods.

Comparing premium grocery store locations in the Washington, D.C. and Atlanta metro areas

The Washington, D.C. metro area is the highest-income metro area that we studied, with a median household income of $111,000 according to 2021 American Community Survey (ACS) 5-year estimates. It is also home to Prince George’s County and Charles County in Maryland, the second-highest and highest-income Black-majority counties in the country. Still, our analysis demonstrates the differences in investment distributions between Black-majority and predominantly white neighborhoods. For example, the absence of high-end retailers, including premium grocery outlets, in Prince George’s County has been a point of concern in those high-income Black communities for decades.

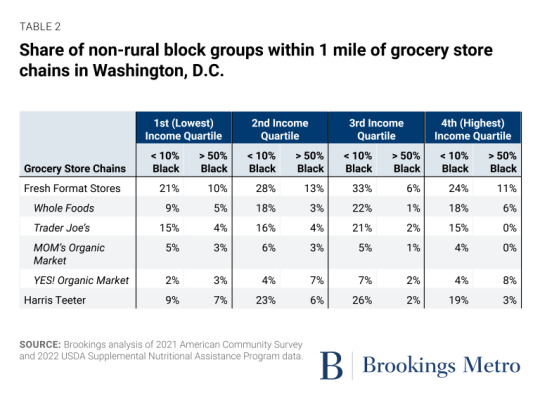

The Washington, D.C. area is home to roughly 20 Trader Joe’s and Whole Foods locations each, as well as two local organic chains: MOM’s Organic Market and Yes! Organic Market. The national chains are much more likely to be located in neighborhoods with few Black residents across the income spectrum, while the two local chains show a much smaller racial disparity. In the case of Yes! Organic Market, this is partly a consequence of the fact that all of their stores are located in the urban core—often in gentrifying areas—and thus close to historically Black communities. However, it may also be evidence that locally owned stores are less likely to undervalue Black neighborhoods than national chains with less familiarity with the areas where they operate.

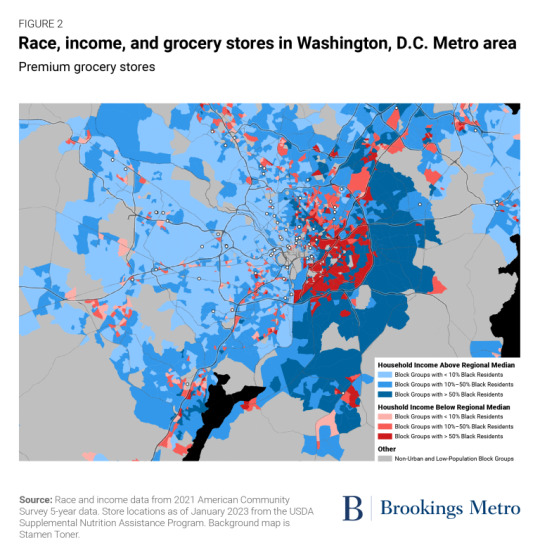

As seen in Figure 2, a belt of high-income block groups with Black-majority populations wraps roughly a third of the way around the Capital Beltway in the District’s eastern and southern suburbs. However, while high-income areas in other parts of the Washington, D.C. suburbs are scattered with Whole Foods, Trader Joe’s, and MOM’s Organic Market locations, the two MOM’s locations in the belt are near its ends, in areas with less predominately Black populations, and neither of the national chains has any locations in the belt. In fact, while each of the chains has a single location in Prince George’s County and none in Charles County, these stores are located within a mile of each other, and very near the University of Maryland’s flagship campus, in a part of the county that is not majority-Black.

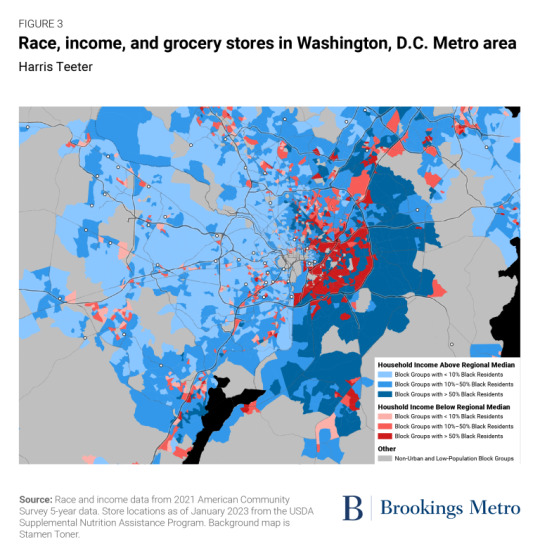

A similar pattern is seen in the locations chosen by the Kroger-owned conventional grocery retailer Harris Teeter (Figure 3), which began to move into the Washington, D.C. area in the early 2000s and has focused its expansion on upscale markets. Although Harris Teeter is now the third-largest grocery chain in the region with 44 stores, it has no stores in Charles County and only two in Prince George’s County—neither in a Black-majority neighborhood and both near the county’s border with majority-white Baltimore suburbs.

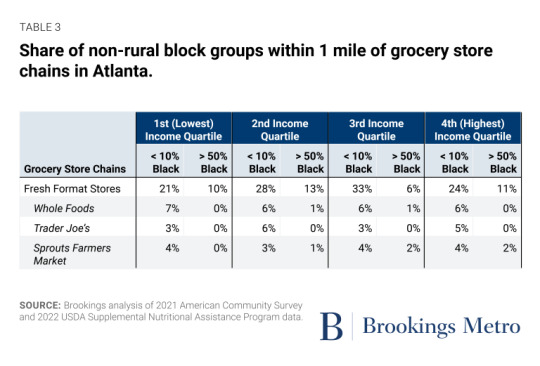

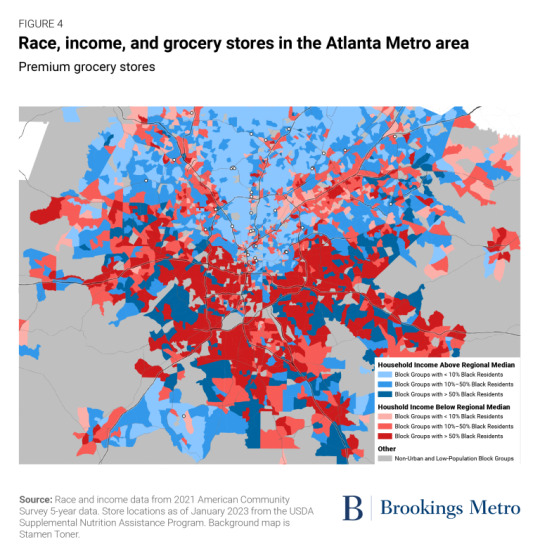

The distribution of premium grocery chains in Atlanta, shown in Table 3 and Figure 4, provides a good comparison to Washington, D.C., since Atlanta has the smallest percentage of top-quartile block groups within 1 mile of a premium grocery store among the metro areas we studied. While relatively few block groups in the Atlanta area are located near premium grocery stores, nearly all of those that are have few Black residents.

Premium grocery stores are rare overall in the Atlanta area, but the ones that are present are nearly all confined to a corridor running north of downtown that has some of the region’s smallest shares of Black residents. The major suburban “edge city” job clusters of Buckhead and Perimeter Center are also home to pairs of premium grocery stores.

Dollar stores are more common in Black-majority communities at all income levels

The absence of premium grocers from even high-income Black-majority communities is an example of the disinvestment side of food apartheid. However, there is a second component to the different food retail ecosystems in Black and non-Black (especially white) neighborhoods: the prevalence of less-desirable food options. Studies have shown that the prevalence of fast-food restaurants is positively correlated with the percentage of Black residents in urban neighborhoods in the U.S. Similar trends have been found for liquor stores.

Chain dollar stores are one example of food retailers that have targeted Black-majority urban neighborhoods for store locations, often saturating these communities with outlets and making it more difficult for local businesses and other grocery chains to become established. While dollar stores can fill a need in low-income neighborhoods, they are often regarded as predatory businesses that harm communities more than they benefit them, due to very low wages, displacing other grocery options while failing to sell fresh food, store design that increases the rate of armed robberies, and OSHA and FDA violations that put customers and employees at risk.

As shown in Table 4, in every metro area in our cohort except Washington, D.C. (where dollar stores are less prevalent overall, likely due to the metro area’s substantially higher incomes), Black-majority neighborhoods in the top income quartile were more likely to have a dollar store within 1 mile than high-income neighborhoods with a share of Black residents lower than 10%. Furthermore, in six of the 10 metro areas (New York, Los Angeles, Chicago, Houston, New Orleans, and Memphis), most Black-majority neighborhoods in the top income quartile were within 1 mile of a dollar store. In fact, in New York and Chicago, Black-majority neighborhoods in the top income quartile were more likely to be near a dollar store than non-majority-Black neighborhoods in any income quartile.

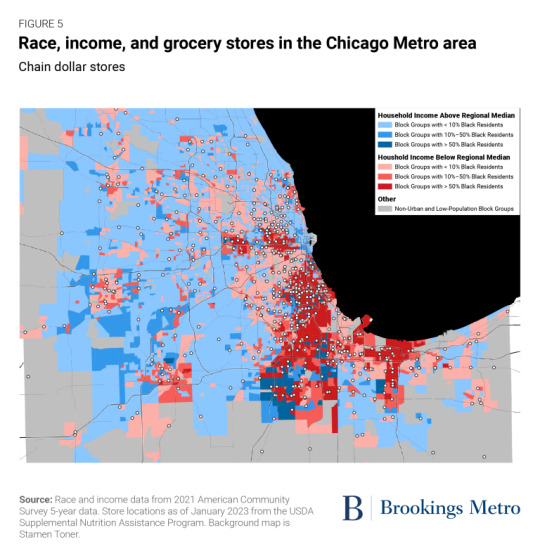

Figure 5 shows the situation in Chicago, where dollar stores are concentrated in and near Black-majority areas, including the higher-income ones south of the city. Dollar stores are significantly less common in areas with few Black residents. While chain dollar stores are much more numerous than fresh-format grocery stores, they still concentrate in neighborhoods with lower incomes and higher shares of Black residents. Many of these neighborhoods have not just one, but a cluster of several dollar stores—making it especially hard for businesses that compete with them to become established.

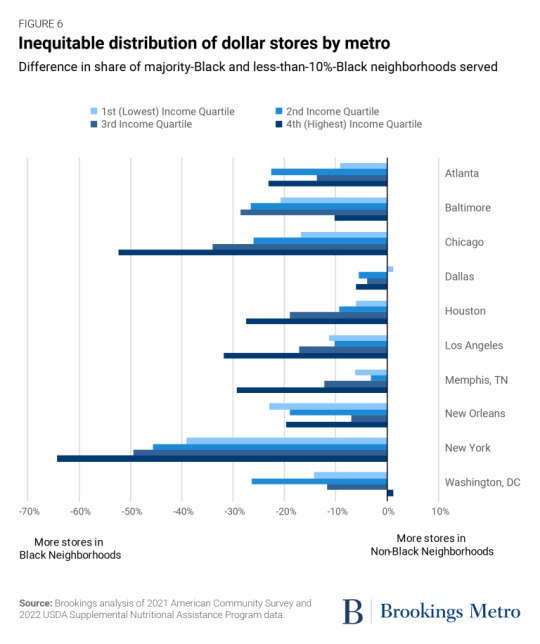

As shown in Figure 6, Black-majority block groups were more likely than block groups with a share of Black residents lower than 10% to be within 1 mile of a dollar store for each income quartile in each metro area, with two exceptions: the highest quartile in Washington, D.C. (where dollar stores are especially rare) and the lowest quartile in Dallas (where the racial differences in dollar store locations are smallest overall). And while there is an overall trend toward more dollar stores in Black-majority neighborhoods, the patterns in each metro area are very different.

Dallas has especially small differences—never more than 7 percentage points—in dollar store prevalence between Black-majority block groups and those with Black population shares lower than 10%, while there is a very large variation in dollar store prevalence by income, with roughly 85% of lowest-quartile and 30% of highest-quartile block groups within 1 mile of a dollar store. And among cities with substantial racial disparities, these disparities follow different patterns with income. In Washington, D.C., dollar stores are most over-represented in low-income Black neighborhoods, while the difference is smaller in third-quartile neighborhoods and negative in neighborhoods in the fourth income quartile. On the other hand, Atlanta, Baltimore, and New Orleans show similar disparities across income quartiles, while Houston, Los Angeles, Memphis, Chicago, and New York show the biggest disparities in high-income neighborhoods, which have few dollar stores when they have few Black residents but far more when they are majority-Black.

Like other local assets, grocery stores influence investment decisions

No single asset type alone determines the value of a place or the willingness of entrepreneurs, businesses, developers, and private individuals to invest in it. Rather, community, consumption, institutional, and other asset types are all part of a unified ecosystem that creates value and indicates potential investment opportunities.

The decisions food retailers make have obvious direct impacts on residents, such as the length of a trip to their preferred store. But their indirect impacts can be even more important. The presence of premium (or discount) retail in a community can drive the decisions of other retailers to locate in or avoid the community, thus strengthening or weakening the tax base. Furthermore, the presence of premium amenities in a community makes it more appealing to wealthier residents, which raises home values and potentially contributes to firms’ decisions on where to locate offices.

The less obvious outcomes of these choices—including their implications for place-based, racialized wealth divides—are no less important. Local assets and infrastructure matter to community well-being and development, and the differences in grocery store chains indicate a broader structural issue of financing practices and corporate underinvestment in Black communities. The tendency to frame this solely as a problem of access has led to suggestions that delivery services can bring about equality between communities. However, disparities in access were always just a symptom of a deeper and more fundamental problem of devaluation and divestment that need to be directly addressed.

12 notes

·

View notes

Text

When i’ve bought or sold a home the mortgage companies have always looked at three documents:

A. The appraisal,

B. The seller’s disclosure statement,

C. The buyer’s statement of financial condition

Any factual misstatements or material omissions on B or C can result in a conviction for fraud for the signee(s)

https://www.federalcriminaldefenseadvocates.com/mortgage-fraud

[From the Article]

Some common types of mortgage fraud are: [I’ve added the numbering]

Intentionally providing false financial statements;

lying about income (income fraud);

providing false tax returns;

overvaluing a property's value (appraisal fraud);

providing fake employment verification;

manipulated credit scores/reports;

stating that the property acquired is for residential purposes but in actuality is for investment purposes which gives lower interest rates (occupancy fraud)…

In United States federal courts, mortgage fraud is prosecuted as wire fraud, real estate fraud, bank fraud, mail fraud and money laundering, and you may face a maximum of 30 years in prison and up to a $1 million fine.

•••••••••••••••••••••••••••••••••

Donald Trump, his sons, his companies and other of his executives have been found liable for fraud in the on going civil trial.

Just as you or I would be if we did ANY of the above.

The State had demonstrated that the Trump Organization committed repeatedly 1, 2, 4, 6, 7 plus others not listed above

Judge Engoron’s ruling on the State’s Motion for Summary Judgment noted that the State compared documents in the Trump Organizations records which at odds with the Statements of Financial Conditions subpoenaed from banks which had provided Trump loans.

Donald Trump’s attorneys filed three motions against the State; were rejected three times by the Judge; then appealed three times and were rejected three times.

•••••••••••••••••••••••••••••

Lead attorney Kise has argued before the US Supreme Court and won his cases

If he had any any any other legal arguments howler specious or nebulous for an appeals court he would have made that appeal before the train wreck of testimony by Trump and Sons.

Undoubtedly Trump, who considered himself smarter than the Judge, opposing counsel, and his own $3million retainer attorney, paid close to ZERO attention to Kise’s attempt to prep him as a witness.

2 notes

·

View notes

Text

Mortgage Brokers in Pimpama A Must Home Review

Pimpama, a picturesque suburb in Queensland, has witnessed a surge in the real estate market, attracting homebuyers from all walks of life. Navigating the complexities of mortgages in such a thriving market can be daunting. That’s where Must Home, the leading mortgage broker in Pimpama, steps in to simplify the process.

What Sets Must Home Apart

1. Tailored Financial Solutions: Must Home prides itself on offering personalized mortgage solutions tailored to individual needs and financial situations. Their expert brokers meticulously analyze your requirements, ensuring you get the best-suited mortgage plan.

2. Comprehensive Market Knowledge: With an in-depth understanding of the local real estate landscape, Must Home brokers provide valuable insights. They help clients make informed decisions, ensuring they secure the most advantageous mortgage deals available.

3. Streamlined Application Process: Must Home simplifies the often labyrinthine mortgage application process. Their team guides you through every step, from document preparation to submission, making the journey seamless and stress-free.

4. Competitive Interest Rates: Must Home collaborates with various lenders, granting access to an array of mortgage products at competitive interest rates. This ensures clients not only find a suitable mortgage but also save significantly over the loan term.

5. Exceptional Customer Service: Beyond securing mortgages, Must Home excels in customer service. Their dedicated brokers provide ongoing support, addressing queries and concerns promptly. This commitment to client satisfaction sets them apart in the industry.

How Must Home Can Help You

Whether you’re a first-time homebuyer, looking to refinance, or investing in property, Must Home offers a diverse range of services.

First Home Buyer Loans: Must Home assists newcomers in navigating the complexities of securing their first home, ensuring they benefit from government incentives and affordable repayment plans.

Refinancing Solutions: For existing homeowners, Must Home evaluates your current mortgage, exploring opportunities for refinancing that could lead to substantial savings over time.

Investment Property Loans: Investors receive tailored financial guidance, helping them expand their real estate portfolios strategically.

Conclusion —

In conclusion, Must Home stands out as a reliable and client-focused mortgage broker in Pimpama. Their commitment to personalized service, market expertise, and exceptional customer care makes them the go-to choice for anyone seeking a mortgage solution in this vibrant suburb.

Connect with us now on +61 468 784 663 and step ahead to a wise decision .

2 notes

·

View notes

Text

Exploring Boston, Massachusetts Real Estate: A Strategic Investment Landscape with Hard Money Loans

Introduction

Boston’s Proximity and Climate

Proximity to Nearby Cities: Boston’s strategic location offers easy access to neighboring thriving New England cities such as Cambridge, Somerville, and Quincy. This geographical advantage expands the scope of investment opportunities for discerning investors.

Climate Diversity: Boston experiences a diverse range of seasons. From warm and humid summers to snowy and picturesque winters, the city’s climate caters to a variety of lifestyles, adding to its overall allure.

Major Employers in Boston

Boston’s economic landscape is characterized by a diverse array of major employers across various sectors:

Harvard University: As one of the world’s most esteemed educational institutions, Harvard University significantly contributes to the local education sector by employing a diverse range of faculty and staff.

Massachusetts General Hospital: This prominent healthcare institution plays a pivotal role in the healthcare sector, offering an extensive array of medical services.

State Street Corporation: A leading financial institution, State Street Corporation, provides numerous employment opportunities within the financial services sector.

Biogen: Headquartered in nearby Cambridge, Biogen, a renowned biotechnology company, has a significant presence in the Boston area, contributing significantly to the biotech and life sciences industry.