#InvoiceFactoring

Explore tagged Tumblr posts

Text

Explore the top benefits of using an invoice factoring company for trucking businesses. Learn how factoring improves cash flow, reduces stress from unpaid invoices, and supports business growth by turning outstanding invoices into immediate working capital at SanDiegoNews24.com.

#InvoiceFactoring#TruckingBusiness#CashFlowSolutions#FreightFactoring#TruckingFinance#BusinessGrowth#WorkingCapital#SmallBusinessFinance#AccountsReceivable#SanDiegoNews24

0 notes

Text

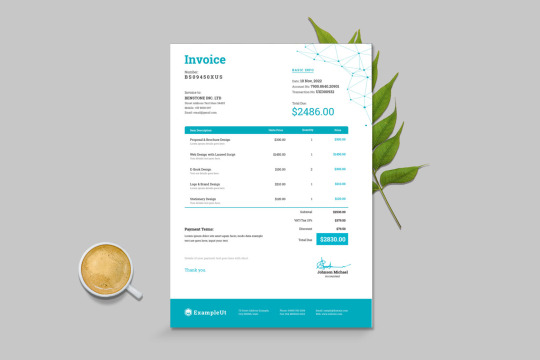

Streamline Your Billing with Creatiya's Simple Invoice Template

In today's fast-paced business environment, efficiency and professionalism are paramount. Creatiya's Simple Invoice Template offers a seamless solution for freelancers, entrepreneurs, and small businesses aiming to present polished invoices effortlessly.

Why Choose Creatiya's Simple Invoice Template?

Designed with user-friendliness in mind, this template is fully editable in Adobe Photoshop, allowing you to tailor every aspect to your brand's identity. Whether it's adjusting colors, inserting your logo, or modifying text, customization is straightforward and intuitive.

Key Features:

Fully Editable PSD Format: Customize text, colors, and layout to align with your branding.

A4 Size (210x297mm) with Bleed: Ensures a professional print-ready format.

CMYK Color Mode: Optimized for high-quality printing results.

Resizable Vector Graphics: Maintain clarity and quality at any size.

Free Font Links Included: Easily access and implement recommended fonts.

Benefits for Your Business:

Implementing this template can significantly enhance your invoicing process. By presenting clear and professional invoices, you not only streamline your billing but also reinforce your brand's credibility. Clients appreciate well-structured invoices, which can lead to faster payments and improved client relationships.

Who Can Benefit?

This template is ideal for:

Freelancers: Simplify billing for various projects.

Small Business Owners: Maintain consistent and professional invoicing.

Consultants: Present detailed service breakdowns with clarity.

Agencies: Ensure brand consistency across all client communications.

Get Started Today

Elevate your invoicing with Creatiya's Simple Invoice Template. Its blend of functionality and design ensures that your billing process is both efficient and reflective of your brand's professionalism.

👉 Download the Simple Invoice Template from Creatiya

#invoice software development bd#free invoice software#invoice generator#invoiceprocessing#invoicefactoring#template

1 note

·

View note

Text

How Receivables Financing Companies Can Help Startups Grow

Receivables financing companies help startups grow by unlocking working capital from unpaid invoices, improving liquidity, and enabling smooth business operations without added debt or dilution.

#accountfactoringcompany#accountsreceivablefactoringcompanies#arfactoringcompanies#bestinvoicefactoringcompanies#commercialfactoringservices#factoringcompaniesinUSA#invoicefactoring#invoicefactoringrates#receivablesfactoringcompanies

0 notes

Text

Fast Business Funding

fast business funding, offering quick access to capital for small businesses. With options like merchant cash advances, small business loans, and invoice factoring, they provide flexible solutions to meet diverse financial needs. Their fast approval process ensures funds are available within 24 to 48 hours, helping businesses seize opportunities and maintain cash flow. Trust GlobalRapidFunding for efficient and rapid financing to support your business growth. Read more

#aesthetic#animals#architecture#art#beauty#GlobalRapidFunding#QuickBusinessLoans#MerchantCashAdvance#InvoiceFactoring#FastFunding#BusinessFinance#SmallBusinessLoans#BusinessFunding#RapidFinancialSolutions#FastCashFlow#QuickApprovalLoans#BusinessGrowthFunding#FinancingOptions#BusinessSupport#CashFlowSolutions

0 notes

Text

Fast Business Funding

fast business funding, offering quick access to capital for small businesses. With options like merchant cash advances, small business loans, and invoice factoring, they provide flexible solutions to meet diverse financial needs. Their fast approval process ensures funds are available within 24 to 48 hours, helping businesses seize opportunities and maintain cash flow. Trust GlobalRapidFunding for efficient and rapid financing to support your business growth. Read more

#GlobalRapidFunding#QuickBusinessLoans#MerchantCashAdvance#InvoiceFactoring#FastFunding#BusinessFinance#SmallBusinessLoans#BusinessFunding#RapidFinancialSolutions#FastCashFlow#QuickApprovalLoans#BusinessGrowthFunding#FinancingOptions#BusinessSupport#CashFlowSolutions

0 notes

Text

A Complete Guide Of Invoice Factoring And Invoice Financing

It's not uncommon for business owners who want to improve cash flow management to ask questions about invoice factoring, but they often overlook an explanation. Here's a quick answer.

What is Invoice Factoring?

Invoice factoring involves invoice sales to a factoring company for fast access to funds. Business owners receive cash for invoice amounts ahead of payment terms, usually less any fees. Invoice amounts are instead paid to the factoring company by the business owner's customer by original payment terms. Accounts receivable factoring and receivable financing are also terms for invoice factoring. It's essential to remember that this is not the same as invoice financing, where a factoring company gives a business owner cash for an invoice. Still, the business owner must pay back the invoice amount. Factoring is more complex than this simple definition implies. It is essential to understand what factoring is, not to know why many businesses use it. A lot of misconceptions have tarnished the reputation of factoring. Factoring isn't a loan, so business owners don't have to worry about paying back the money. Most importantly, factoring in invoices does not imply a business is struggling or cannot reliably serve its customers. It couldn't be further from the truth: invoice factoring is essential to a business's cash flow when it needs to maintain liquidity despite long invoice payment terms. Often, it alleviates a business owner's stress over cash flow. Invoice Factoring: How Does It Work? Invoice factoring is in demand because of long business-to-business (B2B) payment terms that cause cash flow issues. Payment terms are usually between 30 and 120 days in many industries. Rather than receiving payment immediately after delivering goods and services, business owners must wait for their customers to pay. A small business owner with a large customer base is especially vulnerable to this problem. They are excited to close a large contract with a household-name customer, but when they read the payment terms, they realize they won't receive payment for months. As a result, they are unable to maintain positive cash flow, which not only makes it challenging to run a business but also causes them anxiety. Small business owners must receive that money as soon as possible to cover expenses such as: - Making payroll - Buying new equipment - Paying their suppliers - Hiring staff - Fulfilling large orders or projects You might be surprised that these issues are pretty standard. Small businesses with improved cash flow can bid on projects requiring a lot of materials or labor. Companies unable to take on business due to cash flow issues can now accept it. Invoice Factoring vs. Invoice Financing? Many people mistakenly use the terms "invoice factoring" and "invoice financing' as if they meant the same thing. Although both types of invoice funding share some similarities, they also differ. Those who are considering invoice funding solutions should spend some time clarifying the differences between them. Invoice factoring differs from invoice financing (also called invoice discounting), primarily in how the payments are collected. Invoice factoring involves the lender collecting receivables from customers. On the other hand, invoice discounting leaves collection to the borrower. In addition to that, the terms and fees also differ. With invoice factoring, 85% to 90% of the invoice value is upfront, whereas only 80% is typically offered upfront with invoice financing. Similarly, lenders charge different fees based on the level of risk they assume. The monthly payments for invoice factoring generally are higher at around 2% to 4.5%, while the monthly fees for invoice financing are usually lower at about 1% to 3%. Invoice factoring or invoice discounting depends on several factors, such as: - the reliability of your clients when it comes to paying their invoices - the amount of time you have available to chase down your clients - the percentage you are willing to give up in exchange for the loan, etc. Consider those factors carefully before making a decision. Read the full article

0 notes

Text

Factoring Accounts Unveiled: What You Need to Know

Factoring accounts are a popular solution for businesses seeking quick cash flow, but the process is often shrouded in mystery. In this article, we will reveal the true nature of factoring, explaining how it works, what types of businesses benefit from it, and what hidden costs or risks may be involved. With a clear understanding of factoring accounts, you can make informed choices about how to improve your business finances and determine whether factoring is a smart move for your company’s future.

#accountsreceivablefactoring#accountfactoringcompany#ARfactoring#accountsreceivable#businessfinancing#factoringaccounts#invoicefactoring

0 notes

Text

Investigating Invoice Discounting: Lowest Expense and Maximum Profit

Invoice discounting stands out as one of the best alternative investment options in India. It offers investors low-risk, short-term investment cycles (30-180 days) and attractive returns (12%-22%). With minimum investments starting as low as INR 25,000 on leading alternative investment platforms, it provides an accessible entry point for a wide range of investors.

Visit :https://www.falconsgrup.com/

#alternativeinvestment#billdiscounting#business#cashflow#falconinvoicediscounting#finance#investment#investors#invoicefactoring#invoicefinancing

0 notes

Text

#invoice#marathistatuaking#aayushyacha_pariksharthi#invoicedesign#marathisanman#f4flike#tfgcrowdinvesting#invoicetemplate#tfgcrowd#invoicefinancing#invoicefinanceforbusiness#crowdinvestment#invoicefinance#seting#bavfaktor#voucherdesign#arttemplate#kwitansi#lebakbanten#infolebak#tshirtorder#letterheaddesign#invoices#crowdinvesting#inforangkasbitung#undanganblangko#designandprint#invoicefactoring#invoiceorder

0 notes

Text

Recognizing India's Minimum Investment Needs for Invoice Discounting

Invoice discounting involves selling outstanding invoices to a financial institution or a discounting platform in exchange for immediate cash. Instead of waiting for customers to pay their invoices, businesses can access a percentage of the invoice value upfront. The lender then collects the payment from the customer on the due date. This method helps businesses manage their cash flow more effectively and address short-term financial needs.

For More Details :https://www.falconsgrup.com/

#business#finance#investment#investors#falconinvoicediscounting#invoicediscounting#invoicefinancing#invoicefactoring#shortterminvestment#alternativeinvestment

0 notes

Text

Use Fracxn to Increase Your Cash Flow! 🚀

Say goodbye to slow payments 🐢 and hello to fast cash flow 🚀 with Fracxn! Our solution helps SMEs get paid quicker, improving your business's financial health and stability.

𝗕𝗲𝗳𝗼𝗿𝗲 𝗙𝗿𝗮𝗰𝘅𝗻: Slow payments, delayed growth.

𝗔𝗳𝘁𝗲𝗿 𝗙𝗿𝗮𝗰𝘅𝗻: Fast payments, rapid growth.

Learn more at www.fracxn.com or contact us at [email protected].

𝗥𝗲𝗮𝗱 𝗼𝘂𝗿 𝗯𝗹𝗼𝗴 𝗵𝗲𝗿𝗲: https://cutt.ly/yetqtMzx

Fracxn #CashFlow #SMEs #BusinessGrowth #Fintech #PaymentSolutions #SmartFinancing #InstantSettlement #DubaiBusiness #Innovation #BusinessSuccess #Dubai #UAE #UK

𝐖𝐞 𝐀𝐫𝐞 𝐀𝐥𝐬𝐨 𝐀𝐯𝐚𝐢𝐥𝐚𝐛𝐥𝐞 𝐎𝐧: 𝐋𝐢𝐧𝐤𝐞𝐝𝐢𝐧:- https://lnkd.in/gqqPPkJa 𝐈𝐧𝐬𝐭𝐚𝐠𝐫𝐚𝐦:- https://lnkd.in/gtBpR8mm 𝐅𝐚𝐜𝐞𝐛𝐨𝐨𝐤:- https://shorturl.at/nrLT4 𝐓𝐰𝐢𝐭𝐭𝐞𝐫:- https://lnkd.in/gxyVaUUW

UnpaidInvoices #CashFlow #InvoiceFactoring 💼💰 #Finance #BusinessGrowth #WorkingCapital #BusinessFinance, #InvoiceManagement, #FinancialStrategy, #WorkingCapitalBoost, #CashFlowSolutions, #FinanceOptimization, #FinancialHealthCheck, #InvoiceHandling, #CashFlowEfficiency, #InvoicePayments, #FinanceManagement, #CapitalFlow, #PaymentSolutions, #FinancialWellbeing, #CashFlowInsights, #InvoiceProcessing, #FundsManagement, #PaymentEfficiency, #FinancialStability, #CashFlowPlanning

0 notes

Text

Which Statements Are True About Factoring Accounts?

Factoring accounts demystified! Discover how this financing solution accelerates cash flow, reduces waiting time for payments, and supports business expansion. Learn key benefits and strategies to maximize success!

#accountfactoringcompany#accountsreceivable#accountsreceivablefactoring#ARfactoring#assetbasedlending#businessfinancing#cashflowmanagement#factoringaccounts#factoringaccountsreceivablecompany#invoicefactoring#receivablesfactoringcompanies

0 notes

Text

Global Rapid Funding

GlobalRapidFunding offers fast financial solutions, including small business loans, merchant cash advances, and invoice factoring. With a quick approval process, typically within 24 to 48 hours, businesses can access funds swiftly. Their simple online application ensures rapid disbursement, helping businesses tackle cash flow challenges, expand, or cover operational costs. Visit GlobalRapidFunding today to get the support you need, fast. Read more

#aesthetic#animals#architecture#art#beauty#finance#rapidfunding#GlobalRapidFunding#QuickBusinessLoans#MerchantCashAdvance#InvoiceFactoring#FastFunding#BusinessFinance#SmallBusinessLoans#BusinessFunding#RapidFinancialSolutions#FastCashFlow#QuickApprovalLoans#BusinessGrowthFunding#FinancingOptions#BusinessSupport#CashFlowSolutions

1 note

·

View note

Text

Global Rapid Funding

GlobalRapidFunding offers fast financial solutions, including small business loans, merchant cash advances, and invoice factoring. With a quick approval process, typically within 24 to 48 hours, businesses can access funds swiftly. Their simple online application ensures rapid disbursement, helping businesses tackle cash flow challenges, expand, or cover operational costs. Visit GlobalRapidFunding today to get the support you need, fast. Read more

#finance#rapidfunding#GlobalRapidFunding#QuickBusinessLoans#MerchantCashAdvance#InvoiceFactoring#FastFunding#BusinessFinance#SmallBusinessLoans#BusinessFunding#RapidFinancialSolutions#FastCashFlow#QuickApprovalLoans#BusinessGrowthFunding#FinancingOptions#BusinessSupport#CashFlowSolutions

1 note

·

View note

Text

What is AR Factoring? Simplifying Accounts Receivable Financing

AR factoring is a straightforward financial solution that allows businesses to convert their unpaid invoices into immediate cash. When your customers have outstanding invoices, it can cause delays in your cash flow, but factoring gives you the flexibility to get paid faster. The factoring company purchases your receivables and provides quick funds, which you can use for payroll, operations, or growth initiatives. Read More: https://medium.com/@statefinancialcorp/what-is-ar-factoring-a-comprehensive-guide-for-business-owners-7917303f1faa

#arfactoringcompanies#AccountsReceivableFinancing#InvoiceFactoring#ReceivablesFactoring#AccountsReceivableManagement#FactoringServicesforSMEs#AccountsReceivableLoans

0 notes

Text

How Falcon Invoice Discounting Platforms Can Increase the Productivity of Your Company

In today’s competitive business environment, managing cash flow efficiently is essential for maintaining smooth operations and fostering growth. One effective strategy that many businesses are adopting is invoice discounting. This financial solution involves selling your outstanding invoices to a third party at a discount in exchange for immediate cash. Leveraging invoice discounting platforms can significantly boost your business efficiency by improving cash flow, reducing financial stress, and enhancing operational agility. In this article, we’ll explore how invoice discounting platforms can transform your business and the key benefits they offer.

#alternativeinvestment#billdiscounting#business#cashflow#falconinvoicediscounting#finance#investment#investors#invoicefactoring#invoicefinancing

0 notes