#InvoiceManagement

Explore tagged Tumblr posts

Text

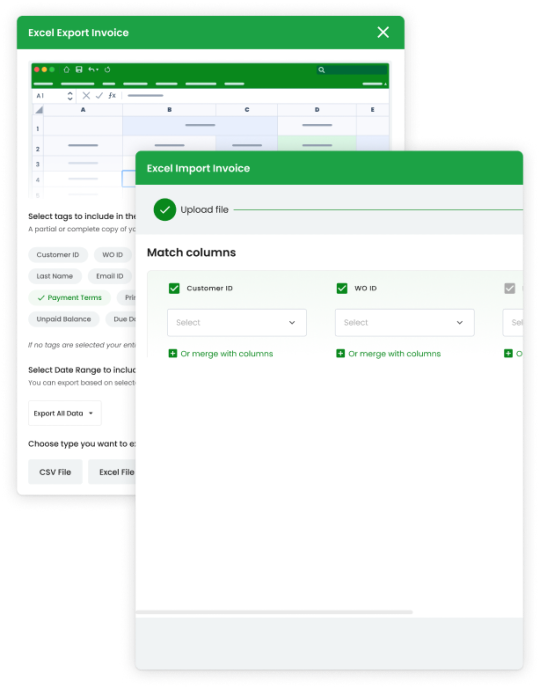

Stay organized and keep track of your payments with TopProz VanLynk's seamless invoice management system. Easy, efficient, and tailored to your business needs.

4 notes

·

View notes

Text

In today’s fast-paced business environment, enhancing productivity is more crucial than ever to successfully accomplish this, one can rely on the power of automation. By automating routine tasks, businesses can save time, reduce errors, and focus on more strategic activities. In this blog post, we will explore essential automation strategies that can help boost productivity in your organization.

Boost productivity with these essential automation strategies. Automation is transforming the way businesses operate, making processes more efficient and streamlined. Implementing the right automation strategies can lead to significant improvements in productivity and overall business performance. In this article, we will discuss several key automation strategies that can help you achieve these goals.

1. Automate Repetitive Tasks

One of the most effective ways to boost productivity is by automating repetitive tasks. These tasks often consume a significant amount of time and can be easily automated using the right tools. For example, you can automate data entry, email responses, and appointment scheduling. By doing so, you free up valuable time for more critical activities.

2. Utilize Workflow Automation

Workflow automation involves creating a series of automated actions that complete a process. This strategy is particularly useful for complex processes that involve multiple steps and departments. Tools like Zapier and Microsoft Power Automate can help you set up automated workflows, ensuring that tasks are completed efficiently and accurately.

3. Implement Marketing Automation

Marketing automation can significantly enhance your marketing efforts by automating tasks such as email marketing, social media posting, and lead nurturing. Platforms like HubSpot and Mail chimp offer comprehensive automation features that can help you reach your target audience more effectively and improve your marketing ROI.

4. Enhance Customer Service with Chatbots

Integrating chatbots into your customer service strategy can greatly improve efficiency and customer satisfaction. Chabot’s can handle a wide range of customer queries, provide instant responses, and escalate issues to human agents when necessary. This not only saves time but also ensures that customers receive timely and accurate support.

5. Streamline Financial Processes

Automation can also be applied to financial processes such as invoicing, expense tracking, and payroll management. Tools like QuickBooks and Xero offer robust automation features that can help you manage your finances more efficiently and reduce the risk of errors.

Boost Productivity with These Essential Automation Strategies. Automation is a powerful tool that can help businesses enhance productivity and efficiency. By implementing the strategies discussed in this article, you can streamline your processes, reduce manual workload, and focus on more strategic activities. Have you tried any of these automation strategies?

#Automation#Productivity#BusinessEfficiency#TechTrends#WorkflowAutomation#DigitalTransformation#AutomationTools#SmartBusiness#Innovation#Accomation#BusinessAutomation#InvoiceManagement#EfficiencyTools#AutomationSolutions#SmallBusinessTools#StreamlineOperations#BusinessGrowth#FinancialAutomation

2 notes

·

View notes

Text

No More Billing Stress! Try the best app for invoice making

For small business owners in India, managing invoices and billing can be a challenging and time-consuming task. Without the right tools, creating professional invoices, tracking payments, and managing customer records might feel complicated.

The best app for invoice making simplifies all these tasks and helps small businesses stay organized and get paid faster.

Whether you’re a shop owner, freelancer, or small service provider, this will help you find the perfect invoicing tool for your business needs.

What Is an Invoice Making App?

An invoice making app is a software application designed to help businesses create and send professional invoices to their customers quickly.

Instead of writing bills manually or using spreadsheets, the best app for invoices automates the process, making it faster, error-free, and more professional.

Why Small Businesses Need the Best App for Invoice Making

Small businesses often struggle with billing and invoicing because it requires attention to detail. Using the best app for invoice making can bring many benefits:

Save time by creating invoices quickly with pre-designed templates.

Reduce mistakes by automating tax calculations and totals.

Track payment status to know which invoices are paid or pending.

Improve cash flow by sending timely payment reminders.

Create professional invoices that build customer trust.

Store invoice records digitally, reducing paperwork and clutter.

Key Features to Look for in the Best App for Invoice Making

When choosing the best app for invoice making, keep these features in mind to ensure you pick the right tool for your small business:

1. User-Friendly Interface- The app should be simple to use, even if you are not a pro. Look for apps with easy invoice creation.

2. Customizable Invoice Templates- You should be able to add your business logo, change colors, and customize the invoice format to match your brand.

3. Tax and GST Compliance- Since GST is mandatory in India, the app should support automatic GST calculation and generate GST-compliant invoices.

4. Payment Tracking and Reminders- Good invoicing software tracks whether invoices are paid and sends automatic reminders for overdue payments.

What Makes the Best Billing Software in India?

The best billing software in India should:

Support GST invoicing.

Work smoothly on mobile and desktop.

Offer affordable pricing plans.

How to Choose the Right Billing Software for Small Business

When selecting billing software for small business, consider:

Your budget ��� free or cheap invoicing software.

Features you really need — GST billing, inventory, payment reminders.

Easy to use Ability to scale as your business grows.

Advantages of Using an Invoice Generator for Small Business

An invoice generator for small business automates invoice creation, saving time and effort. You can generate multiple invoices in minutes and avoid manual errors.

Some apps also help with receipts, making them the best receipt app for small business by simplifying your financial records.

Easy Invoicing Software for Small Business

Look for easy invoicing software for small businesses that requires minimal training and lets you focus on your business, not complicated software. It should automate your invoicing and billing processes so you can get paid more quickly.

Simplify Your Billing with Shopaver – Perfect for Small Enterprises

If you are small business owner in India looking for a simple yet powerful invoicing solution, Shopaver is one of the top apps to consider. Designed to meet the unique needs of enterprises, Shopaver allows users to create professional, GST-compliant invoices in just a few taps.

The app supports multiple invoice formats, real-time tax calculations, and easy sharing. For those who need an invoice-making app without complexity, Shopaver offers the perfect balance of functionality and ease of use.

The best app for invoice making helps small businesses in India manage their billing smoothly. Whether you want the best free invoice app for android or are ready to invest in premium features, there are plenty of options designed to fit your budget and needs.

If you are looking for a user-friendly and reliable invoicing solution, Shopaver is a great option to explore.

#InvoiceGenerator#BillingSolutions#InvoiceManagement#GSTBillingApp#MobileInvoicing#InvoiceSoftwareIndia#QuickInvoice#OnlineBillingApp#InvoiceMakerFree#BestInvoiceSoftware2025

0 notes

Text

Streamline Your Finances with Expert Accounts Payable Services

Managing your business finances is easier with professional Accounts Payable Services from Aone Outsourcing. Our experts ensure accurate invoice processing, timely payments, and seamless vendor management. By outsourcing to Aone Outsourcing, you reduce errors, save time, and improve cash flow. Whether you're a small business or a large enterprise, our tailored Accounts Payable Services help you stay organized and efficient. Trust Aone Outsourcing for reliable, cost-effective solutions that streamline your financial operations.

1 note

·

View note

Text

5 Features to Look for in an Invoice Management App

Tired of manual invoicing late payments and billing errors? Then it's time to upgrade to a smart invoice management app — but not all tools are created equal.

Here are 5 must-have features to look for:

Save time and eliminate errors by auto-generating professional invoices based on templates or pre-filled customer data.

Reduce late payments with automated reminders sent to clients before and after due dates.

Give clients the flexibility to pay via credit cards, UPI, net banking or digital wallets — all in one place.

Know when invoices are sent, viewed, and paid — so you stay in control at every stage.

Instantly view summaries, overdue lists and payment trends with built-in reporting dashboards.

Let your invoicing work for you — not the other way around.

#InvoiceManagement#InvoicingApp#Team365#SmartBilling#PaymentAutomation#InvoiceSolutions#BusinessFinance#GetPaidFaster#InvoicingFeatures#FinanceApps#SMBTools#InvoicingSoftware#BillingSolutions#AccountingTech#PaymentTracking#DigitalInvoicing#BusinessTools#InvoiceReports

0 notes

Text

How to Track Your MCA Payment Status Easily

Making payments on the Ministry of Corporate Affairs (MCA) website is a common task for businesses and professionals. But what comes next? You’ve made a payment—how do you know it went through successfully? This article will help you understand how to track your MCA payment status easily in a step-by-step way.

Whether you're paying for company registration, filing forms, or any other mca track payment status-related service, it’s important to confirm that your payment is successful. Let’s walk through the process.

Step 1: Visit the MCA Official Website

To begin, go to the official MCA portal: 👉 https://www.mca.gov.in

Make sure you are on the correct government website. Look for the padlock symbol in the browser to confirm it’s secure.

Step 2: Click on 'MCA Services'

Once you're on the homepage, find the "MCA Services" tab on the top menu. Hover your mouse over it and a dropdown menu will appear.

Step 3: Select 'Track Payment Status'

From the dropdown, look for and click on "Track Payment Status." This is where you can check the status of your payment using your SRN (Service Request Number).

Step 4: Enter the SRN

You must have received an SRN after making the payment. Enter that SRN into the box provided.

👉 Tip: Always note down or save the SRN after making any MCA payment. It is the only way to track your status easily.

After entering the SRN, click Submit.

Step 5: Check the Status

Once you submit, the system will display your MCA payment status. It may show any of the following:

Paid

Pending

Failed

Under Process

If it shows Paid, you're good to go. If it's Pending or Failed, wait a while or try the payment again after confirming from your bank.

What If You Didn't Receive an SRN?

In case you didn’t get an SRN, check your email for a confirmation from MCA or try retrieving the SRN through the “Track Transaction Status” option under MCA Services.

Some Extra Tips:

Always take a screenshot or download the payment receipt after the transaction.

Check your bank or card account to see if the amount was deducted.

If there’s a delay in status update, give it a few hours. Sometimes, bank response times can vary.

Common Issues While Tracking MCA Payment Status

Sometimes, users face issues while trying to track their MCA payment status. Here are a few common problems and how to solve them:

1. Wrong SRN Entered

Make sure you're entering the correct SRN. One small mistake—like a missing letter or number—can lead to an error. Double-check the SRN from your confirmation email or payment receipt.

2. Payment Not Reflected Yet

If your bank has deducted the money but MCA is showing "Payment Failed" or "Pending", wait for a few hours. In most cases, the system updates automatically. If it still doesn't update, you may need to:

Contact MCA helpdesk

Raise a complaint using the 'User Complaint Form' under the 'Help & FAQ' section on the MCA site

3. System Timeout or Error Page

If the page doesn’t load or shows an error while tracking the status, try refreshing your browser or using a different one. Clearing cache or cookies also helps in some cases.

How to Contact MCA Support

If you are still facing issues, you can contact MCA customer support for help. Here's how:

Call the MCA Helpdesk at 0120-4832500 (available during working hours)

Email them at [email protected]

Use the 'Contact Us' page on the MCA portal for more support options

Make sure you mention your SRN, date of payment, and any error messages you received while tracking the status. This will help the support team assist you faster.

Why It's Important to Track MCA Payment Status

Tracking your payment helps ensure that your business filings or services are not delayed. For example:

If you're registering a new company, any delay in payment confirmation can push your approval back.

If you’re filing annual returns or documents, a failed payment could lead to penalties or compliance issues.

Having a record of successful payment ensures you're safe during any audits or legal checks.

So, always make it a habit to check your payment status soon after completing any transaction on the MCA portal.

Final Thoughts

Tracking your payment doesn’t have to be stressful. By following these simple steps, you can easily keep an eye on your transactions with the MCA. Always remember to save your SRN and payment receipts for future reference.

Keyword Reminder: If you're searching online, you can use phrases like mca track payment status to find the exact page quickly.

#POManagement#InvoiceManagement#PaymentTracking#MCAPaymentStatus#BusinessAutomation#FinanceManagement#TrackPayments#BillingSoftware

0 notes

Text

Speed Up Your Payments with Zoho Books Invoicing

Still creating invoices manually? It’s time to level up. With Zoho Books, sending professional, GST-compliant invoices takes just minutes. Improve cash flow, reduce errors, and give your clients the clarity they deserve.

Try Zoho Books invoicing with SNS System and get paid faster. Learn more: https://www.snssystem.com/.../bookkeeping-services-for... https://snssystem.com Contact us: +1 214-494-0908 Mail: [email protected]

#ZohoBooks#OnlineInvoicing#SNSSystem#DigitalPayments#AccountingSolutions#GetPaidFaster#AutomatedInvoices#InvoicingMadeEasy#GSTCompliant#BusinessAutomation#InvoiceManagement#CashFlowImprovement#ZohoInvoicing#BusinessEfficiency#ProfessionalInvoices#SaveTime#PaymentReminders#CustomInvoices#OnlinePayments#SmallBusinessAccounting#AccountingAutomation#SNSSystemServices

0 notes

Text

Top 15 Accounts Receivable KPIs & Metrics You Need to Track

Track the top 15 accounts receivable KPIs & metrics to enhance collections, reduce outstanding balances, and improve cash flow efficiency. Stay ahead with data-driven AR management strategies today.

#accountsreceivablefinancingcompany#AccountsReceivableKPIs#AccountsReceivableTips#ARfactoring#ARManagement#BusinessFinance#BusinessMetrics#cashflowmanagement#FinanceMetrics#FinancialAnalysis#FinancialKPIs#FinancialMetrics#FinancialPerformance#InvoiceManagement#ReceivablesManagement

0 notes

Text

What Happens If You Want to Change Your NDIS Plan Midway?

The National Disability Insurance Scheme (NDIS) is designed to be flexible, but what happens if your needs change before your plan ends? If you find that your current NDIS plan no longer meets your needs, you may be able to request a plan change. Understanding the process and how plan management can help is essential for a smooth transition.

When Can You Request a Change to Your NDIS Plan?

You may want to change your NDIS plan midway for several reasons:

Changes in Your Support Needs: If your condition improves or worsens, you might need different types of support.

New Goals or Priorities: You may want to adjust your plan to better align with your personal and developmental goals.

Problems with Current Supports: If your current providers are not meeting your needs, you may wish to explore other options.

Unspent or Insufficient Funds: If you are not using your funding effectively or running out of funds too soon, adjustments may be needed.

Steps to Changing Your NDIS Plan

Contact the NDIS: You can request a plan review by calling the NDIS or speaking to your Local Area Coordinator (LAC) or Support Coordinator.

Provide Justification: Be prepared to explain why you need the change, including supporting documents from healthcare providers or service providers.

Attend a Plan Review Meeting: The NDIS may schedule a review meeting to assess your request and discuss the necessary adjustments.

Wait for Approval: If your request is approved, you will receive a new plan reflecting the changes. If denied, you may have the option to appeal the decision.

How Plan Management Helps with Midway Plan Changes

Plan managers assist in several ways when you need to change your plan:

Budget Monitoring: They track your spending and can alert you if funds are running low or not being used effectively.

Guidance on Available Supports: They help you understand if other support options are better suited to your needs.

Invoice Management: Ensuring payments are processed correctly so you can transition smoothly into a new plan.

Assistance in Documentation: Plan managers can help gather financial records and expenditure reports that may support your request for a plan change.

What to Do If Your Request Is Denied

If the NDIS does not approve your request to change your plan, you can:

Request an Internal Review: This allows you to appeal the decision within the NDIS.

Seek External Review: If needed, you can take your case to the Administrative Appeals Tribunal (AAT).

Work with Your Plan Manager: They can help explore alternative solutions to ensure you receive the necessary support.

Conclusion

Your NDIS plan should reflect your needs and goals. If circumstances change, you have options to request modifications. Having a plan manager can simplify the process, helping you track expenses, gather required documentation, and navigate plan reviews. If you need assistance with your NDIS funding, contact Life Balance NDIS Plan Management for expert support.

#NDIS#PlanReview#PlanChange#SupportNeeds#NDISPlan#GoalsAdjustment#BudgetMonitoring#UnspentFunds#ProviderIssues#NDISReview#NDISSupport#PlanManager#NDISFunding#PlanManagement#HealthSupport#NDISAppeal#SupportCoordinator#LocalAreaCoordinator#NDISDocumentation#InvoiceManagement#LifeBalanceNDIS#MidwayPlanChange

0 notes

Text

Leading the Way: The Future of Invoice Processing and Vee Technologies’ Innovative Solutions

Business ecosystem is growing faster, and the importance of efficient invoice processing is rising more than ever. Logistics industries have high transactional volumes, which allow them to gain a lot from innovative solutions. Vee Technologies has the best team for logistics invoice process management to run smoothly.

Why Go for Vee Technologies?

Logistics invoice processing services provided by Vee Technologies help in reducing cycle times and increasing accuracy and scalability. Here are some other ways by which we stand out:

Customizable Solutions: We provide curated services according to diverse business requirements, making us one of the best logistics invoice processing companies.

Information Security and Compliance: Encrypting information is the need of the hour in this data-driven era. Data security is ensured by us and the maintenance of compliance with local and international regulations.

Automation and AI Integration: Automation of repetitive tasks can be done using advanced tools like Artificial Intelligence (AI) and Machine Learning (ML) to help reduce errors and improve the overall turnaround times. Vee Technologies is quite good at this.

Cost Efficiency: Through the optimization of workflows and reduction of manual interventions, Vee Technologies makes businesses lower their operational costs, so that they can free up resources to focus on core competencies.

What Does the Future of Invoice Processing Hold?

With the continuous growth of technologies, the future of logistics invoice processing will be transformed into a cutting-edge technology. The industry will be taken to new heights using predictive analytics, blockchain technology, and other enhanced AI capabilities to improve precision and efficiency. Vee Technologies is a reputed invoicing company in the USA by leveraging all the innovative technologies and years of process expertise.

As more businesses are opting for the best logistics invoice processing companies in USA to streamline their operations, Vee Technologies’ expertise is achieving remarkable efficiencies with the right approach to invoice processing.

#InvoiceProcessing#InvoiceAutomation#BillingSolutions#InvoiceManagement#AccountsPayable#InvoiceWorkflow#StreamlinedBilling#InvoiceSolutions#LogisticServices

0 notes

Text

Invoice Processing Services for Logistics Operations

If you’re searching for reliable invoice process for logistics operations, we, as one of the renowned invoice processing services companies, can help you runyour operations smoothly.

We deliver solutions curated for your authentic needs, which can simplify the logistics invoice process using our expertise in invoice processing in USA to ensure accuracy, speed, and compliance.

If you're looking for services that can provide you with better efficiency, on-time deliveries, and fast processing, connect with us today.

#InvoiceProcessing#InvoiceAutomation#BillingSolutions#InvoiceManagement#AccountsPayable#InvoiceWorkflow#StreamlinedBilling#InvoiceSolutions#LogisticServices

0 notes

Text

Accounting Record for Sales and Distribution

Accurate accounting records are the backbone of effective sales and distribution (SD) management in any organization. These records ensure that all financial transactions related to sales, distribution, and customer management are well-documented, transparent, and compliant with regulatory standards. read more

#AccountingRecords#VendorInvoiceVerification#InvoiceManagement#AccountsPayable#FinancialRecords#InvoiceVerification#BusinessAccounting#AuditTrail#InvoiceProcessing#AccountingTips#VendorManagement#FinancialAccuracy

0 notes

Text

How to Use Quick Bill Software for Efficient Billing 🧾💼

In today’s fast-paced business world, managing invoices and billing efficiently is crucial—especially for small businesses.

Quick Bill Software offers a powerful, user-friendly solution to streamline your billing process and improve cash flow.

What is Quick Bill Software? 🖥️

It is a modern billing and invoicing software designed to simplify billing for small and medium-sized businesses. Whether you're a freelancer or run a retail shop, this tool helps you create, send, and manage invoices with ease.

Unlike complicated platforms, Quick Bill stands out as an easy bill software that even non-tech-savvy users can navigate without a steep learning curve.

Key Features of Easy Bill Software 🔍

Automated Invoicing: Generate GST-compliant invoices in seconds.

Customer Management: Store client details for faster billing.

Inventory Tracking: Keep your stock updated in real-time.

Multi-device Access: Use it from desktop, tablet, or mobile.

As a billing software for small business, Quick Bill ensures accuracy and professionalism, improving both internal efficiency and customer satisfaction.

How to Get Started 📋

Sign Up & Setup: Create an account and configure your company profile.

Add Products/Services: List items with pricing and tax details.

Create Your First Invoice: Use the built-in invoice system to generate professional-looking bills.

Track & Manage: Monitor pending and paid invoices effortlessly.

With this, best invoicing software for small business, you can manage your billing without spending hours on manual paperwork.

Why Choose Quick Bill Software? 🤔

If you're searching for the best invoice software that’s simple, fast, and efficient, look no further. From GST billing software compliance to automated follow-ups, Quick Bill has you covered. Compared to other quick billing software, it’s both cost-effective and reliable.

Final Thoughts 💬

Don’t let inefficient invoicing slow your business down. Switch to Quick Bill Software—the smart choice for those who value time, accuracy, and professionalism in billing.

#QuickBillSoftware#BillingSoftwareForSmallBusiness#GSTBillingSoftware#InvoiceManagement#InvoicingSoftware

0 notes

Text

Zoho Invoice: Effortless Invoicing and Payment Tracking"

Discover Zoho Invoice to create customized invoices, automate billing, and track payments with ease. Enhance your business’s financial management with this powerful, user-friendly tool

#ZohoInvoice#InvoicingSolutions#BusinessAutomation#BillingSoftware#FinanceManagement#SmallBusinessTools#ZohoSuite#InvoiceManagement

0 notes

Text

💼 Simplify your business billing with Nammabilling! 🧾 Perfect for all industries, easy to use, and efficient. Manage invoices, GST, and more in one place! 🚀 #BillingSoftware #BusinessTool For more information, please visit our website: https://www.nammabilling.com

#BillingSoftware#BusinessTool#NammaBilling#InvoiceManagement#GSTBilling#BusinessGrowth#EasyBilling#SmallBusiness#BillingMadeEasy#BusinessSolutions#SoftwareForBusiness

0 notes

Text

Vendor Onboarding: Building Strong Partnerships

In today’s fast-moving business world, vendor onboarding is more than just a process – it’s the start of a strong and long-lasting partnership. Whether you run a small business or a large company, working with reliable vendors is important. But how you begin that relationship can make all the difference.

What is Vendor Onboarding?

Vendor onboarding is the process of bringing a new vendor into your system. This means collecting their company details, verifying documents, agreeing on payment terms, and making sure both sides understand how to work together.

It may sound simple, but a smooth onboarding process helps avoid problems later and builds a good foundation for trust and collaboration.

Why is Vendor Onboarding Important?

Here are a few reasons why vendor onboarding matters:

Saves Time and Reduces Mistakes By setting clear expectations and providing the right information from the start, you reduce the chances of miscommunication or errors later on.

Improves Compliance When you collect the necessary documents early (like tax info, business licenses, etc.), you ensure your business stays compliant with local laws and policies.

Builds Trust A well-structured onboarding process shows vendors that you are serious and professional. This encourages them to deliver better service.

Better Relationships Good onboarding helps vendors feel like a part of your team, not just another supplier. This creates strong and more committed partnerships.

Steps for Effective Vendor Onboarding

Let’s look at the basic steps to onboard a vendor the right way:

1. Collect Basic Information

Get the vendor’s business details like company name, address, bank info, tax documents, and certifications.

2. Review and Approve Documents

Make sure all legal documents are valid. Double-check for errors or missing information.

3. Agree on Terms

Clearly define payment terms, delivery schedules, return policies, and expectations. Put everything in writing.

4. System Setup

Add the vendor to your company’s systems. This includes accounting, inventory, or any platforms you use to manage vendors.

5. Provide Training or Guidance

If your company uses special tools or follows certain procedures, share that information with the vendor. This helps them align with your way of working.

6. Stay in Touch

Even after onboarding, keep the communication open. Regular check-ins can help solve small issues before they turn into big ones.

Tips to Improve Your Vendor Onboarding Process

Use simple forms and checklists

Automate where possible, but keep a human touch

Make the process fast and easy

Be available to answer vendor questions

Ask for feedback to improve the experience

Common Challenges in Vendor Onboarding

Even though vendor onboarding is important, many businesses face challenges during the process. Here are a few common ones — and how to handle them.

1. Incomplete Documentation

Sometimes, vendors may miss out on submitting key documents. This can slow things down.

Tip: Share a clear checklist with all required documents at the beginning. Follow up regularly to make sure nothing is left out.

2. Poor Communication

Lack of communication can lead to confusion, delays, or misunderstandings.

Tip: Set up one main point of contact from your team who handles vendor communication. Also, make sure instructions are simple and clear.

3. Manual Processes

Doing everything manually can take time and lead to human errors.

Tip: Use digital tools or vendor management software. Even a basic spreadsheet system or online form can help keep things organized.

4. One-Size-Fits-All Approach

Not all vendors are the same. Some may need more help or details than others.

Tip: Customize the onboarding process based on the type of vendor, product, or service. A little flexibility goes a long way.

Benefits of a Smooth Vendor Onboarding Process

When you invest time in improving your onboarding, you’ll see benefits across your entire business:

Faster Start Times Vendors can begin work quicker when everything is sorted in advance.

Stronger Vendor Loyalty A good first impression creates a lasting relationship.

Fewer Disputes Clear terms from the start mean fewer disagreements about pricing, payments, or delivery timelines.

Better Quality Control When vendors understand your standards clearly, it leads to better results.

Final Thoughts

Vendor onboarding is not just paperwork — it’s the first step in a business relationship that can grow and benefit both sides. By making the process clear, simple, and respectful, you show your vendors that you value their time and effort.

Remember, the stronger your onboarding process, the stronger your partnerships will be. And in business, strong partnerships often lead to better growth, smoother operations, and long-term success.

#POManagement#InvoiceManagement#PaymentTracking#MCAPaymentStatus#BusinessAutomation#FinanceManagement#TrackPayments

0 notes