#FinancialMetrics

Explore tagged Tumblr posts

Text

Top 15 Accounts Receivable KPIs & Metrics You Need to Track

Track the top 15 accounts receivable KPIs & metrics to enhance collections, reduce outstanding balances, and improve cash flow efficiency. Stay ahead with data-driven AR management strategies today.

#accountsreceivablefinancingcompany#AccountsReceivableKPIs#AccountsReceivableTips#ARfactoring#ARManagement#BusinessFinance#BusinessMetrics#cashflowmanagement#FinanceMetrics#FinancialAnalysis#FinancialKPIs#FinancialMetrics#FinancialPerformance#InvoiceManagement#ReceivablesManagement

0 notes

Text

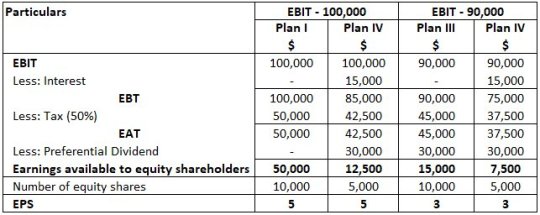

Mastering EBIT and EPS Analysis: Unveiling Financial Insights

View On WordPress

0 notes

Text

Profit Margin:100 Complete Guide to Profit Margin Calculation

Understanding your profit margins is not only crucial in the business world; it is necessary. Profit margins are a crucial measure of a company's financial stability, effectiveness, and potential for expansion. How do you, however, calculate profit margin? What elements must you take into account? This comprehensive guide will provide the information you need to understand profit margins, answering these and other related questions.

Profit Margins: An Overview

Profit Margins: An Overview Profit refers to a company's financial gain after deducting all its expenses, including employee salaries and benefits. They reveal how well a business profits from its sales and operational operations. Profit Margins: Their Importance Profit margins are significant to firms because they show how well they run their operations. A corporation with a high-profit margin typically indicates successful operations and effective cost management compared to its competitors. Essential Phrases to Understand: Gross Profit, Net Profit, and More Before learning how to calculate profit margins, it's crucial to comprehend the following terms: The remaining profit is known as gross profit after subtracting the expenses involved in producing and offering a company's goods or services. The difference between the gross profit and all other operational costs, such as taxes and interest, is the net profit, also known as net income. The term "profit" refers to the amount of money that may be made from selling a product. It displays the proportion of sales that have generated profits.

The Basics of Profit Margin Calculation

The Basics Of Profit Margin Calculation Calculating the profit margin is more superficial than it might seem, requiring understanding your business's financials and basic arithmetic. A Deep Dive Into The Profit Margin Formula The profit margin formula is straightforward: (Net Profit / Revenue) * 100 = Profit Margin What is the best formula for profit margins? It is generally agreed that the formula given above is the best and most straightforward technique to calculate profit margin. It provides a percentage that illustrates the real profit as a percentage of each sales dollar. Learning About Gross Profit Margin A particular kind of profit margin called a gross profit margin, concentrates on gross profit. The following is how to calculate it: (Gross Profit / Revenue) * 100 = Gross Profit Margin Gross Profit Margin Calculation You need to know your gross profit and sales to calculate the gross profit margin. To calculate your gross profit, deduct your cost of goods sold (COGS) from your revenue. To calculate the gross profit margin percentage, divide the gross profit by the total revenue and multiply the result by 100. Net Profit Margin: An Overview

Net Profit Margin: An Overview Another crucial indicator of profitability is the net profit margin. The following is how to calculate it: (Net Profit / Revenue) * 100 = Net Profit Margin. Net Profit Margin Calculation You need to know your net profit and sales to calculate the net profit margin. To calculate your net profit, deduct all operational costs from your gross profit, including taxes and interest. To calculate the net profit margin percentage, divide the net profit by the total revenue and multiply the result by 100. The Function of Cost of Goods Sold (COGS) in Calculating Profit Margin One crucial component in determining profit margins is the cost of goods sold (COGS). It includes the total cost of producing the goods or services a business sells. The Importance of Sales Revenue in Calculating Profit Margin Sales revenue is the sum of the money from selling goods or services. It serves as the foundation for figuring out profit margins. More sales revenue may translate into larger profit margins if expenses are successfully managed.

What Does Profit Margin Percentage Mean, and How Is It Calculated

The profit margin percentage is a helpful indicator displaying the good sales proportion. It's an excellent technique to contrast the profitability of various businesses and sectors. The Profit Margin Percentage Concept By dividing net profit by sales and multiplying the result by 100, one may calculate profit margin %. It gives a precise picture of the profitability and effectiveness of a business. A profit margin percentage is what? The net income made for every dollar of sales produced is measured by the profitability ratio known as the profit margin percentage. It's a vital performance indicator that sheds light on how profitable a business is. Making a Profit Margin Calculation Divide your net profit margin by your sales and multiply the result by 100 to calculate your profit margin percentage. Doing this lets you determine what proportion of each sales dollar is profit. Examples of Real-World Profit Margin Calculations Suppose your business makes a $50,000 net profit on $20,000 in sales. Your profit margin would be (50,000 / 200,000) * 100 = 25% using the formula for profit margin percentage. Accordingly, 25 cents of every dollar of revenue are profits. What does a 20% profit margin mean? If your profit margin A 20% profit margin means you make $0.20 for every $1. Many sectors see this as a good profit margin. The Effect of Variable Costs on Profit Margin Percentage: Understanding Costs that vary concerning the quantity of goods or services a business generates are known as variable costs. Materials, direct labor expenses, and credit card processing fees are a few examples of them. It's critical to efficiently control these expenditures since high variable costs might lower your profit margin percentage. The Function of Fixed Costs in Calculating Profit Margin Percentage Costs that remain constant regardless of how many goods or services are produced are known as fixed costs. These might consist of rent, wages, and insurance. The overall amount of profit that may be earned is impacted by these expenses, even if they have no direct influence on the profit margin %.

Calculating Advanced Profit Margin

After fully grasping the fundamentals, you may explore more complex profit margin calculations. The more you invest in your business, the higher the potential returns. A 30% Margin Calculation It would be best to determine your cost of goods sold (COGS) to calculate a 30% margin. When you have it, use the formula below: COGS / (1 - 0.30) = Selling Price You may use this to determine the selling price you should choose to generate a 30% profit margin. Examples of 30% Margin Calculations in Practice Suppose your COGS is $70. your selling price would be $70 / (1 - 0.30) = $100. It indicates that to have a profit margin of 30%. You must offer your goods for $100. Using Margin Calculators to Calculate Profit Margin A simple tool that might make calculating profit margins easier is a margin calculator. They are available online and often cost nothing to use. The Advantages of Margin Calculators Using a margin calculator may save time and effort, mainly if working with complex numbers. They may also assist you in avoiding mistakes and guaranteeing the accuracy of your estimates for the profit margin. Operating Expenses' Function in Complex Profit Margin Calculations In addition to the cost of goods sold, operating expenditures include all other costs related to running your business. These range from utilities to rent and other costs. These expenses must be considered while calculating profit margins. As Total Revenue Increases, So Does Your Potential Profit Margin

As Total Revenue Increases, So Does Your Potential Profit Margin Total revenue, the sum of all a company's earnings, is significant in determining profit margin. As your revenue increases, your potential profit margin rises.

Analysis of profit margins is essential for business success.

You may better understand the financial health of your business and pinpoint opportunities for development using profit margin analysis, a potent tool. What Business Decisions Can Benefit from Profit Margin Analysis? Analysis of profit margins may provide insightful information that helps guide strategic choices. Concentrating your efforts in these areas could assist you in determining which goods or services are more lucrative. Business Analysis Using Profit Margin Ratios Profit margin ratios, including gross profit margin and net profit margin, may provide you with a more in-depth picture of how profitable your business is. You can see patterns and make wise judgments by comparing these ratios over time or to industry standards. What the Profit Margin Ratio Means The term "profitable" describes a company's capacity to generate income. A firm with a high-profit margin ratio is likely very lucrative, whereas a low ratio may point to inefficiencies or possible financial problems. The Function of Profit Margin in Evaluating a Company's Financial Health A business's profit margin is a vital sign of its financial health. While a low-profit margin may portend possible financial challenges, a large profit margin signals a prosperous business successfully controlling its expenses. How to Improve Profit Margins by Increasing Efficiency Enhancing productivity may have a significant influence on your profit margins. It may include optimizing processes, cutting waste, raising productivity, etc.

Different Industries' Profit Margin

Due to factors like rivalry, market circumstances, and cost structures, profit margins may change dramatically across various sectors. Create realistic profit margin goals for your business by being aware of these distinctions. E-commerce Industry Profit Margin Considerations Competition, client acquisition expenses, and transportation costs are just a few examples of variables that affect profit margins in the e-commerce sector. When calculating and examining profit margins, it's critical to consider these elements. Understanding Wholesale Business Profit Margins Due to the wholesale business's large volume and low-margin characteristics, profit margins are often smaller. However, effective inventory management and solid connections with suppliers may increase profit margins.

Investigating Profit Margin in Various Business Models

The business model may have a substantial impact on the profit margin. Let's examine the methods used to calculate and analyze profit margins by various categories of enterprises. Service-Based Businesses' Profit Margin Compared to product-based organizations, service-based enterprises often have distinct cost structures. Instead of tangible goods, labor and time are the primary expenditures in this situation. The Effect of Labor Costs on Profit Margins in the Service Sector Labor expenditures have a significant influence on service-based enterprises' profit margins. Increased profit margins may result from effective labor cost management techniques, such as productivity upgrades or tactical scheduling. Manufacturing Businesses' Profit Margin Raw materials, labor, and manufacturing overheads are just a few expenditures that manufacturing enterprises often have to cope with. These elements have a significant influence on profit margins. Retail Businesses' Profit Margin Buy-and-sell models are expected in retail organizations, and elements, including inventory turnover, operational expenses, and pricing strategy, often impact these firms' profit margins. Inventory Turnover's Effect on Retail Profit Margins The primary determinant of retail profit margins is inventory turnover. A retailer's profit margin is more likely to increase the quicker it can sell its product. Gaining control of your inventory may increase your profit margins.

Profit Margin's Function in Business Strategy

Profit Margin's Function In Business Strategy Profit margin is a strategic instrument that may help businesses make choices and spur development, not merely a financial number. Pricing Strategy Determined by Profit Margin In deciding on a price plan, profit margin is a crucial component. You may establish pricing that assures profitability while being competitive by being aware of your profit margins. Benchmarking business performance using profit margin A benchmark for business success might be profit margin. You may assess your business's financial health and competitive position by comparing your profit margins to those of significant rivals or industry averages. Profit Margin's Impact on Investment Decisions For investors, the profit margin is a crucial factor. A business with a large profit margin may be successful and operate well, making it a desirable investment.

A Tool for Growth and Sustainability: Profit Margin

A measure of profitability, the profit margin is more than that. It's a tool that may support firms in identifying prospects for expansion and sustainability. Business Growth and Profit Margin Knowing your profit margin might help you identify possible opportunities for business expansion. For instance, a high-profit margin on a certain product line may indicate a market need you may satisfy by stepping up production or marketing initiatives. The Impact of Profit Margin on Decisions Regarding Expansion The decision to introduce a new product or enter a new market is made after thoroughly examining the market. A large profit margin in your existing activities may indicate that you have a solid financial base to expand. Sustainability of the business and profit margin In the long term, a high-profit margin is essential to the viability of a business. The Role of Profit Margin in Financial Resilience A healthy profit margin supports financial resilience by acting as a safety net against unforeseen expenses or declines in income. Additionally, it offers the financial means for investing in crucial long-term business viability areas, including innovation, employee development, and market growth.

Gaining a Competitive Advantage Through Profit Margin

Understanding your profit margin might give you a significant advantage in today's cutthroat business world. Measurement of Operational Efficiency Using Profit Margin A large profit margin may indicate operational effectiveness, which is crucial for gaining a competitive edge. A company must first determine its target market to enhance the likelihood of a successful outcome in its operations. Making Strategic Decisions Using Profit Margin Profit margin is a strategic tool as well as a financial statistic. Knowing your profit margin, you can improve your competitive position by making strategic pricing, cost control, and investment decisions. Profit Margin's Function in Pricing Strategy Pricing strategy heavily depends on profit margin. Knowing your product's profit margin can enable you to establish pricing that will draw buyers while maintaining profitability.

The Strategic Influence of Profit Margin

Business success depends on understanding and controlling profit margins. It is a strategic instrument that may promote development, sustainability, and competitive advantage rather than only serving as a measure of profitability. Wrapping Up: The Power of Profit Margin In the hands of business owners, the profit margin is a potent instrument. You may obtain critical insights into the financial health of your business, spot areas for improvement in efficiency and growth, and make successful strategic choices by learning how to calculate and evaluate profit margins. Conclusion: Recognize the Influence of Profit Margin Profit margin is crucial to successful businesses, not merely a financial number. So, recognize the influence of profit margin. Recognize, examine, and utilize it as the foundation for your strategic choices. Your bank account will be grateful. Read the full article

#BusinessExpansion#BusinessGrowth#BusinessPerformance#BusinessResilience#BusinessStrategy#BusinessSuccess#BusinessTransformation#CostManagement#EconomicUncertainty#FinancialMetric#PricingStrategy#ProfitMargin#ProfitMarginCalculation#ProfitMarginOptimization#SustainableBusinessPractices

0 notes

Text

Prabhu Mahalaxmi Life Insurance (PMLI) h... #businessperformance #Catastrophicfund #Claimpayments #declines #EPS #EPSdecline #equity #expenseincrease #financialhighlights #financialmetrics #FinancialPerformance #financialreportanalysis #FinancialStability #fiscalyear #increases #insurance #insurancecompany #insurancepremium #Insurancesector #life #lifeinsuranceindustry #Mahalaxmi #Marketposition #Net #netprofit #networth #PEratio #PaidupCapital #PMLI #Prabhu #PrabhuMahalaxmiLifeInsurance #premiumgrowth #profit #Retainedearnings #sharepremiumfund #thirdquarterfinancialreport #totalincome

0 notes

Text

Low Price-to-Book (P/B) Ratio:

Compares market value to book value.

Suggests undervaluation if low.

Not always accurate for companies with significant intangible assets.

#StockAnalysis #Investing #ValueInvesting #Finance #Stocks #PEratio #PBratio #DividendYield #FinancialMetrics #InvestmentStrategy #MarketAnalysis #UndervaluedStocks #IncomeInvesting #FinancialAnalysis

0 notes

Text

youtube

EBITDA and its Importance in a Business

Contact 👉 1300 049 534 Address:🏪 Reliable Melbourne Accountants 1/3 Westside Avenue Port Melbourne VIC 3207 Australia Mail📩 [email protected]

#EBITDA#BusinessFinance#FinancialMetrics#Profitability#CashFlow#FinancialAnalysis#BusinessPerformance#ManagementMetrics#EBITDADefinition#FinancialHealth#BusinessGrowth#FinancialManagement#EBITDAImportance#BusinessSuccess#ProfitMargin#InvestmentMetrics#FinancialReporting#BusinessStrategy#EBITDAFormula#FinancialDecisionMaking#Youtube

0 notes

Text

More Financial Clarity & Insights with Cutting-Edge Financial Automation Strategy

Get more financial clarity and insights with cutting-edge financial automation strategy. Integrate your business with smarter tools & boost progressions & productivity with faster TAT. Improve profitability with Park Intelli Solutions Financial Automation Solutions. https://bit.ly/2SVyypl

#Insights#BusinessIntelligence#KPI#FinancialGuidance#PerformanceManagement#FinancialMetrics#CovidRecovery#FinancialReporting#OperationExcellence#Profitability#FinancialClarity#Productivity#FinancialAutomation

1 note

·

View note

Text

"Investors, are you curious about a company's profitability before making an investment? Earnings per Share (EPS) is a critical financial metric that provides insight into a company's financial performance. In this article, we dive into the world of EPS, including the difference between Basic EPS and Diluted EPS, and how to use EPS in stock market analysis. Whether you're a beginner or a seasoned investor, understanding EPS is an important step in making informed investment decisions. #EPS #Investment #StockMarket #FinancialMetrics #InvestorEducation"

0 notes

Photo

Did you know: You can create your own KPIs in FinAlyzer?

1 note

·

View note

Text

Ru Ru Jalvidhyut Project (RURU) has rele... #businessearnings #Businessgrowth #businessperformance #energyindustry #energysector #EPS #Financialanalysis #Financialexpenses #financialhighlights #financialmetrics #Financialoutlook #FinancialPerformance #financialreportanalysis #FinancialStability #financialstatement #fiscalyear #growth #hydroelectricpower #hydroelectricproject #incomestatement #Jalvidhyut #marketperformance #netprofit #networthpershare #PEratio #PaidupCapital #plain #profitgrowth #Profitabilityanalysis #records #reservefund #revenuedecline #RuRuJalvidhyutProject #RURU #salesincome #thirdquarterreport

0 notes

Text

High Dividend Yields: 1. Compares dividend income to stock price. 2. Attracts income-seeking investors. 3. High yields can indicate financial strength but may also signal risks if unsustainable.

#StockAnalysis #Investing #ValueInvesting #Finance #Stocks #PEratio #PBratio #DividendYield #FinancialMetrics #InvestmentStrategy #MarketAnalysis #UndervaluedStocks #IncomeInvesting #FinancialAnalysis

0 notes

Text

Here are the 33 ultimate financial KPIs CFO's watch in current trend. Predict risks and capitalize on growth with all 33 financial metrics during economic downturn. https://bit.ly/3cwqnaN

#financialmetrics#kpis#uncertainty#ebitdac#finance#customerprofitabilityanalysis#profit#sales#metrics#financialdata#KPI#operatingprofit#financialclarity#financialvisibility#financialguidance#financialplanning#CFOGuidance#Financialanalytics#Financialforecast#Financialintelligence#FinancialAudit

0 notes

Text

Taragaun Regency Hotels (TRH) has releas... #1Bn #businessearnings #Businessgrowth #businessperformance #EPS #exceeds #Financialanalysis #financialhighlights #financialmetrics #Financialoutlook #FinancialPerformance #financialreportanalysis #financialstatement #fiscalyear #fiscalyearreview #hospitalityindustry #hospitalitysector #hotel #hotelindustry #hotelmanagement #hoteloperations #income #incomestatement #marketperformance #netprofit #networthpershare #Operating #operatingincome #operatingincomegrowth #PEratio #Profitabilityanalysis #Regency #Revenuegeneration #RevenueGrowth #Taragaun #TaragaunRegencyHotel #thirdquarterfinancialreport #TRH

0 notes

Text

Nerude Mirmire Laghubitta Bittiya Sansth... #Borrowings #Businessnews #Companyperformance #Corelendingactivities #depositcollection #distributableloss #Economicactivities #Economicoverview #EPS #Falgun30 #financial #financialinclusion #financialmetrics #financialreport #financialresults #FinancialStability #Financialstanding #Fiscalanalysis #Fiscalperformance #Fiscalupdate #fiscalyear #Grassrootslevel #growth #Jointtransaction #Laghubitta #loanextension #marketconditions #marketfluctuations #marketperformance #merger #Mergerimpact #Microfinanceinstitutions #Microfinancesector #Mirmire #Nepalifinance #Nerude #NerudeMirmireLaghubittaBittiyaSanstha #Netfeeandcommissionincome #netinterestincome #netprofit #networthpershare #NLBBL #operatingincome #operatingprofit #Operationalexpenses #PaidupCapital #profitability #reservefund #revenuestreams #Stakeholders #standing #Strategicpositioning #sustainability #thirdquarterreport #Valuecreation

0 notes

Text

Super Madi Hydropower (SMHL) has release... #Businessresilience #Businesssuccess #CorporateGovernance #Corporatesuccess #Currentfiscalyear #earningspershare #Economicviability #Financialexpenses #Financialmanagement #financialmetrics #FinancialPerformance #Financialresilience #financialresults #Financialstrength #Financialturnaround #Fiscalchallenges #Fiscalstability #Futuregrowth #Growthopportunities #growthpotential #Hydropower #Hydropowersector #increases #Industryperformance #Madi #marketdynamics #Marketleadership #Marketmomentum #marketperformance #marketpresence #Marketresilience #markettrends #networthpershare #PaidupCapital #Performanceindicators #Positiveoutlook #profit #Profitrecord #Profitabilityimprovement #records #reservefund #Revenuesurge #sales #Salesgrowth #Salesincrease #Sectoralgrowth #Shareholdervalue #Shareholderwealth #SMHL #Stakeholdervalue #Strategicmanagement #Strategicvision #Super #SuperMadiHydropower #Sustainablegrowth #thirdquarterreport #Valuecreation

0 notes