#LNG Supply Chain

Text

LNG Fuelling Station Market Key Players, End User Demand and Analysis Growth Trends by 2032

The LNG (liquefied natural gas) fueling station market has been experiencing significant growth in recent years. LNG is a cleaner-burning fuel compared to traditional petroleum-based fuels, making it an attractive option for various applications, especially in the transportation sector. Here's an overview of the LNG fueling station market:

Report Description:

Attribute

Description

Market Size

Revenue (USD Billion)

Market size value in 2022

USD 8.1 billion

Market size value in 2032

USD 17.3 billion

CAGR (2023 to 2032)

7.9%

Market Drivers:

Environmental Regulations: Stricter emission standards and regulations to reduce greenhouse gas emissions have driven the adoption of cleaner fuels like LNG.

Cost-Effectiveness: LNG can offer cost advantages over diesel and gasoline, particularly in regions where natural gas is abundant and relatively inexpensive.

Energy Security: LNG provides an alternative fuel source, reducing dependence on imported oil and enhancing energy security.

Technological Advancements: Developments in LNG storage and handling technologies have made the construction and operation of LNG fueling stations more feasible and efficient.

Applications:

Heavy-Duty Vehicles: LNG is commonly used as a fuel for long-haul trucks, buses, and other heavy-duty vehicles, offering extended driving ranges and reduced emissions.

Marine Transportation: LNG is increasingly being used as a fuel for ships, including cargo vessels and ferries, due to its environmental benefits and compliance with stricter marine emission regulations.

Industrial Sector: LNG fueling stations are also utilized in industries where natural gas is a primary energy source, such as mining, manufacturing, and power generation.

Market Outlook:

Growing Infrastructure: Governments and private companies are investing in the development of LNG infrastructure, including fueling stations, to support the expanding demand for LNG as a transportation fuel.

Regional Expansion: LNG fueling stations are being established in various regions globally, with significant growth observed in North America, Europe, and Asia-Pacific.

Collaborations and Partnerships: Energy companies, fuel station operators, and vehicle manufacturers are forming strategic alliances to promote the adoption of LNG and accelerate the expansion of LNG fueling station networks.

Technological Innovations: Ongoing research and development efforts are focused on improving LNG storage and distribution technologies, enhancing station efficiency, and exploring the potential of liquefied biogas (LBG) as a renewable alternative to LNG.

Challenges:

Initial Infrastructure Costs: Establishing LNG fueling stations requires significant upfront investment, including storage tanks, dispensers, and safety measures, which can be a barrier to market entry.

Limited Market Awareness: Despite the environmental and economic advantages, there is still a need for greater awareness and education about LNG as a viable fuel option.

Regulatory Support: Governments can play a crucial role by providing supportive policies, incentives, and regulations that promote the adoption of LNG and facilitate the growth of the fueling station infrastructure.

Several key factors contribute to the growth and development of the LNG fueling station market. These factors include:

1.Environmental Regulations and Policies: Stricter regulations aimed at reducing greenhouse gas emissions and promoting cleaner fuels have been a significant driver for the adoption of LNG as a transportation fuel. Governments and regulatory bodies are implementing policies and incentives to encourage the development of LNG infrastructure, including fueling stations.

2.Cost and Fuel Price Stability: LNG can provide cost advantages over traditional petroleum-based fuels, particularly in regions where natural gas is abundant and competitively priced. The stability of natural gas prices compared to the volatility of oil prices also makes LNG an attractive option for fleet operators and industries seeking fuel cost predictability.

3.Energy Security and Diversification: LNG offers an opportunity for countries to enhance their energy security by diversifying their fuel sources. This is particularly relevant for countries that have significant domestic natural gas resources but rely heavily on imported oil.

4.Advancements in LNG Technology: Technological advancements in LNG storage, transportation, and dispensing have made the construction and operation of fueling stations more efficient and cost-effective. Improved cryogenic storage tanks, vaporization systems, and dispensing equipment have contributed to the expansion of the LNG fueling infrastructure.

5.Increasing Adoption in Transportation Sector: The transportation industry, including heavy-duty vehicles and marine vessels, is increasingly adopting LNG as a fuel due to its lower emissions profile compared to diesel or gasoline. This demand from the transportation sector is driving the need for more LNG fueling stations to support the growing fleet of LNG-powered vehicles.

These key factors, along with ongoing technological advancements and supportive government policies, are expected to continue driving the growth of the LNG fueling station market in the coming years.

We recommend referring our Stringent datalytics firm, industry publications, and websites that specialize in providing market reports. These sources often offer comprehensive analysis, market trends, growth forecasts, competitive landscape, and other valuable insights into this market.

By visiting our website or contacting us directly, you can explore the availability of specific reports related to this market. These reports often require a purchase or subscription, but we provide comprehensive and in-depth information that can be valuable for businesses, investors, and individuals interested in this market.

“Remember to look for recent reports to ensure you have the most current and relevant information.”

Click Here, To Get Free Sample Report: https://stringentdatalytics.com/sample-request/lng-fuelling-station-market/2734/

Market Segmentations:

Global Electrical Bushings Market: By Company

• ABB

• Siemens

• GE

• Eaton

• Nexans

• Bharat Heavy Electricals Limited

• CG Power and Industrial Solutions

• Elliot Industries

• Gamma

• Gipro GmbH

• Hubbell

• Polycast International

• RHM International

• Toshiba

• Webster-Wilkinson

Global Electrical Bushings Market: By Type

• Oil Impregnated Paper (OIP)

• Resin Impregnated Paper (RIP)

• Others

Global Electrical Bushings Market: By Application

• Utilities

• Industries

• Others

Global Electrical Bushings Market: Regional Analysis

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Electrical Bushings market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America

Visit Report Page for More Details: https://stringentdatalytics.com/reports/electrical-bushings-market/2719/

Reasons to Purchase Electrical Bushings Market Report:

• To obtain insights into industry trends and dynamics, including market size, growth rates, and important factors and difficulties. This study offers insightful information on these topics.

• To identify important participants and rivals: This research studies can assist companies in identifying key participants and rivals in their sector, along with their market share, business plans, and strengths and weaknesses.

• To comprehend consumer behaviour: these research studies can offer insightful information about customer behaviour, including preferences, spending patterns, and demographics.

• To assess market opportunities: These research studies can aid companies in assessing market chances, such as prospective new goods or services, fresh markets, and new trends.

• To make well-informed business decisions: These research reports give companies data-driven insights that they may use to plan their strategy, develop new products, and devise marketing and advertising plans.

In general, market research studies offer companies and organisations useful data that can aid in making decisions and maintaining competitiveness in their industry. They can offer a strong basis for decision-making, strategy formulation, and company planning.

Click Here, To Buy Premium Report: https://stringentdatalytics.com/purchase/electrical-bushings-market/2719/?license=single

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs

Contact US:

Stringent Datalytics

Contact No - +1 346 666 6655

Email Id - [email protected]

Web - https://stringentdatalytics.com/

#LNG#Fuelling Station#Natural Gas#Alternative Fuel#LNG Infrastructure#LNG Vehicles#Energy Industry#Transportation#Fueling Infrastructure#LNG Terminal#LNG Storage#LNG Distribution#LNG Supply Chain#LNG Fueling Technology#LNG Fueling Equipment#Environmental Sustainability#Clean Energy#Renewable Energy#Greenhouse Gas Emissions#LNG Market#LNG Demand#LNG Industry#LNG Infrastructure Development.

0 notes

Text

The Dark Passenger - An EZ Reyes/OC Story.

So besties, I have folded spectacularly and decided to post the first chapter, just to see what the reaction is. Cue me sitting here now chewing my nails to bits as I wait to hear if it’s any good! If you enjoy it, please do let me know, and since I haven’t written a full length story for EZ yet, if you want to be helpful and put the word out to any EZ lovers out there who you think might enjoy it too, please feel free!

Oh, and just to reiterate going on from my announcement post, this fic will centre around dark!EZ. He will be manipulative and toxic. The boy scout has died, but eventually, there will be a redemption arc. Until then, though, don’t expect a smooth ride with him!

Words - 4,459

Warnings - 18+ content throughout, minors DNI!

Tag list - In the comments. Please DM to be added/removed

Heavy is the head that wears the crown.

Maybe, if Ezekiel Reyes hadn’t been so consumed by an unquenchable thirst for revenge against the Sons of Anarchy, maybe if he hadn’t instigated calling a kill switch vote upon Marcus Alvarez with quite the gusto he had, he perhaps might have left time for El Padrino to warn him of such, before he was ousted from the head of the table.

Heavy is the head that wears the crown. At that moment in time, the crown was a weight upon his head unlike anything he’d previously known, but he would not relent. He would not cease, not until the Sons had been pushed down via the clout of the Mayans, made to fall in line, their necks tethered like fierce guard dogs upon heavy chained leashes, each link a Mayan brother yanking back should they stray too far, ever reminded of the power they had over them.

That power? Heroin.

They now moved huge quantities for the Lobos New Generation cartel, their product giving the Mayans the footing they needed to crush all others beneath their weight. The streets were flooded, the prison supply now pushed exclusively by the MC, the once aptly named poison charter now standing tall and strong above all. Santo Padre led.

The poison still swirled, though. For one man, he was only too happy, it would seem, to let it infect his veins. Yet it did not weaken him, or rather, it did no harm to the man he now was.

The old EZ? It had all but killed him. Poisoned to death by power, greed and bloodlust. It was an opinion shared by everyone who had a seat at the table, as five pairs of dark brown eyes flitted between one another, and the large bag upon the table, placed there by their president. El Rey Oscuro, they called him in the safety of the shadows, out of the reach of his ears. The dark king. There was little light left within EZ, and they all knew it, saw it, felt it. Yes, they were back on top, untouchable, but at what cost?

There upon the table sat the price they knew each of them would likely be set to pay for, sooner or later. The top rung of the ladder they stood upon was not without its complications, of which EZ was attempting to iron out.

“I dunno, man,” Angel began, each other man silently thanking him for being the first to speak. “Heroin is one thing, but getting into this shit? Naw, I ain’t seeing the benefit in moving it.”

EZ rolled his tongue around the inside of his mouth, his forearms flexing as he knitted his fingers together before him. “Fentanyl is more powerful than heroin, many, many times over. We aren’t moving it, per se. We’re cutting our product with it.” He paused, lifting his chin a little more, the dim templo light catching the golden tones of his irises, hues the others were surprised did not burn red. It was as if hell itself had begun to swirl within him at times, after all.

The dark king continued. “Since the unfortunateness of the warehouse fire, our first shipment for the LNG destroyed, forcing us to move an inferior quality replacement as you all know, we need to earn points with our supplier, build further trust, show initiative. We might have the heroin trade sewn up, but it’s with garbage. It’s moving, but not as quickly as the LNG would like. This sets us apart and transforms the product to one of superior quality, if we supply it to them in order to do the cutting. It’ll bring in more cash for us, too.”

Everyone remained quiet, the men shifting uneasily in their seats, their leather kuttes feeling heavy upon them, the hard wood of the chairs stifling, binding, reminding them of their place. Everyone else was held down beneath their force, but them? They were beneath the boot and the unshakable will of one man.

It didn’t mean, however, that they would remain unquestioning in their fealty.

“EZ, while I agree we need to show such, we gotta be careful with this shit,” Bishop began, lighting a cigarette. “That stuff is deadly. If it ain’t cut correctly, it’ll set us apart in the fact that there’ll be a trail of dead bodies all leading back to us, thousands upon thousands of croaked junkies. That’s the kind of shit that gets us watched by certain governmental department eyes more so than we already are.”

The words of his VP were, as usual, steeped in fact and good sense. EZ was, if nothing else though, a man who covered all his bases.

“I have a chemist, one who not only is prepared to work exclusively for us in order to synthesise the fentanyl, but once moved across the border, be there to examine the cutting process and make sure it is precise enough to give the product the correct edge, thus eliminating the overdose danger. If it’s voted in, I will take him to meet with Galindo and Soledad personally, since I already broached the latter with this suggestion. She was keen, of course I told her I would need to take it to a vote, so that is exactly what we are assembled here tonight to accomplish.”

He waited expectantly, his eyes scanning the faces of the five men who sat around the table with him. Bishop spoke first.

“No. It’s too much of a risk, especially with the eyes on us since Creep’s arrest. The heroin is moving, and that’s all we have to worry about, EZ. You’re talking about quality of product like it’s our name on the line, like we’ll be affected by it. We won’t. We’re the mules. Let the LNG worry about whether anyone thinks it’s garbage or not. We still get our cut regardless.”

Hank was next to weigh in. “It’s a no from me, too. It’ll bring too much heat. That chemist might know what he’s doing, but can you really vouch for every single person cutting the heroin to get that kind of delicate balance right, thousands of times over? It’s way too much risk.”

“I think it’s a good idea. I vote yes.” Of course, Nestor would. Angel rolled his eyes, muttering something well under his breath. When it came to their president, the newest member of the club was nothing short of sycophantic in his eyes. Some might disagree, and state that his opinion was tainted by the fact that he disliked him, that Nestor was simply playing safe by showing loyalty during his fledgling months as a newly patched brother.

Gilly and Angel’s votes were both against the idea, EZ’s demeanour changing in a nanosecond as he brought the gavel down, defeated, and extremely displeased by such as they all filed out of templo. The men who had voted against him could only hope that he would see the sense in their reasoning eventually, but until then, they knew El Rey Oscuro would be like a bear with a sore head.

Picking up a beer and a bourbon from the bar, Bishop walked over to join Angel on one of the couches, sitting down with a sigh, handing him the beer. “He’s getting worse.”

Angel’s eyes widened, his jaw twitching as he bit down, grinding his teeth slightly. The VP had noticed him partaking of that a lot of late. “You’re right, Bish. I know we all voted for war, but shit, mano. I live in the biggest fucking regret for voting that kill switch in. He ain’t ready to be at the helm.”

“I’m not gonna sit here and pretend like all of his decisions have been bad, I have to give him a little credit,” Bishop began, his thumb picking at a slight flaw in his bourbon glass. “We’re back on top because of him and his choices, but when he brings ideas like fentanyl to the table, I wonder where the fuck his mind is at. He’s reckless, and you’re right. When he behaves like that, he isn’t ready for it. We gotta try and keep a firm pull on his reins. He might be the head, but us, brother, we’re the neck.”

Angel had heard this before. “And the neck turns the head in whichever direction it wants, right?”

“Right.” His eyebrows fluttered, Bishop taking a deep breath before raising his glass to his mouth. “For as long as we possibly can. The weight of the head can always break the neck.”

That statement didn’t fill Angel with much hope, but he had to hold a belief that somehow, his brother would settle more, and the days of him being labelled El Rey Oscuro would become a thing of the past.

While they sat drinking and discussing, the man himself left a half-drunk beer at the bar, the headache he had coming on only exacerbated by having to share space with the men who had voted against him. He was pissed off, and sought a distraction from it, somewhere where he could feel like he was the one in charge, somewhere he could relax, preferably with something pretty to look at.

Heavy is the head that wears the crown.

Yes, he needed a distraction.

The Luna Lounge was a relatively new enterprise within Santo Padre, the owner of such wanting to offer punters a classier feel to the surroundings in which they viewed the scantily clad women twirling around poles along the long, elevated stage that ran along the back of the bar. It didn’t matter how much he dressed it up, it was still a place to drink beer and see tits and ass. Except the beer was mostly imported and the tits and ass were of superior quality to those within the smaller, grimier establishments dotted around the bleak back streets of the border town, so it had that going for it, at least.

EZ took a seat, a guy who looked like he was all but ready to finish his shift greeting him with a tired smile, taking his drink order. Once furnished with a beer, he moved around to the stage side, scanning what was on offer as women of various appearance clocked him, all brandishing the same warm smiles full of sensual allure, those smiles not quite reaching their eyes.

And then he saw her.

She was breathtaking, and he could tell as he sat down before where she slowly shimmied around a pole that she had absolutely no idea how stunning she was, but god, how she worked what she had. She should have been on the front of a magazine cover, not swinging around a pole in platform shoes and underwear much too cheap to be befitting of her beauty. She was, as the other girls were too, a little lacking in lustre behind the eyes, likely wondering how life had led to them strutting around a stage for their cash, ones and fives thrown up, tens and twenties from the more generous clientele.

Camille could feel his eyes on her before she even turned around to view him. Tall, dark, handsome. Not many of his type frequented The Luna Lounge. In fact, she wagered he likely didn’t need to pay girls to take their clothes off and dance for him at all, looking the way he did. A mere click of his fingers would be all it took, she thought to herself, sauntering over before any of the other harpies she shared the stage with clocked him.

“Well,” she began, crouching before him, her full lips curving in a way that made something very pleasant run through him, “aren’t you the most handsome thing to walk in here all night.”

Taking a bill from his pocket, he reached for her thong, tucking it into the elastic. “Hmm.” The noise he made confirmed he agreed with her statement; of course, he did. He’d seen himself in a mirror, he knew what he had.

Camille looked down at her hip, seeing the bill was a twenty, turning back to him with a smile full of promise. “That’s very generous of you, handsome.” Running her perfectly manicured nail slowly down his cheek, she felt a little ripple of excitement when he turned and kissed her fingertip, his dark gold eyes focusing in on her. She liked it when they made her feel special.

“How much time does that buy me with you dancing right there in front of me?”

“Just enough to keep you throwing up those bills if you want more.” With a wink, she slowly rose to standing, her feline glide taking her back to the nearby pole, hoisting herself up and locking her legs around it, leaning back gracefully as she slowly turned, her blonde curls tumbling, the shining blue of her eyes fixed upon his.

He watched her intently, focusing on the way the black lace of her underwear accentuated her body, her breasts obviously not her own, but well done enough that they didn’t look ridiculous. Not like the bad boob job currently grinding into the next pole down with the kind of uncouth gusto that didn’t exist in the blonde who was captivating his attentions with her elegance. She’d accentuated her tanned skin with little sparkles, sweeps of glitter highlighting the curves of her hips, the rise of each breast and the lithe muscles in her long, slender legs.

She was immaculate, even down to her matching mani and pedi, glittery black fingers and toes, the sooty smudge of her smoky eye makeup the same, care and effort put into her appearance. Yes, she was most definitely too good for twirling around a pole for a living, but EZ wasn’t about to tell her that. It was her job to make him feel good, after all.

“So,” he asked after a while, Camille returned to right in front of him. “How much to get you by yourself?”

“A standard lap dance will cost you forty. A full nude version, sixty.”

He licked his top lip, nodding. “I think the extra twenty is worth it.”

She smiled, gracefully getting down from the stage. “Give me a couple of minutes, and I’ll meet you just over there by the blue curtains, Mr President.” She winked, running her hand down his arm, her pulse fluttering. God, the muscles. She loved it when they were gorgeous. And he was the president of an MC, too. A man of power, she noted. She liked that even more; it made her feel special that he’d chosen her.

Returning to the dressing room, she changed into a nude-coloured set of lace undies, a matching dress too, leaving on the peach toned sparkly nipple pasties she wore beneath her bra, fluffing her hair, spritzing on her favourite perfume, adding a few more sparkles before changing her shoes to match. Clear lucite with pale peach ribbons tying each one to her delicate feet and ankles.

Leaving his almost finished draught beer on the side of the stage, EZ was on his way over to the curtained area when he saw the shimmering light of the blonde appear, Camille reaching for his hand with a soft smile that was one hundred percent allure, leading him through the curtains and into the private room. It was decorated all in dark blue, with thousands of twinkling lights strewn across the ceiling, looking like a starry sky, small booths dotted around, four other girls present, all in various stages of undress as they worked their charm for the respective men who had paid for their time.

EZ took a seat in the circular booth, Camille leaning forward, resting her hands on his thighs, her lips tickling the outer edge of his ear. “Get comfortable and enjoy, handsome.” She rose slowly, her body beginning to sway softly to the beat of the music, the song unfamiliar to him, but the tones just as sensual and richly delicious as the blonde who danced before him. Her striptease was natural, unhurried and sensually suggestive, enticing him every step by the way she made a show of something as simple as removing a dress.

He tried to fight against the spell he felt himself falling under, the enchantment of her reveal, wanting to remain in control, the one who had others bend to his will, in order to redress the shifted balance that the lack of success at templo had left him feeling. She was here to soothe the stinging within, but he would remain objective, and her his subject.

Perhaps someone should have explained the finer details of the purpose of a lap dance to him. He was the one paying to relinquish control, and let a beautiful woman distract him with fantasy, if only for a short time. His stance over such was certainly telling over where his mind was on the subject of losing even one ounce of control in any aspect of his life, though.

Camille felt it, too. While she didn’t know his inner thoughts, she knew he sat there tense, fighting against himself somewhat. She leaned into him, her bra clad breasts brushing his chest through the grey, long sleeved t shirt he wore, soft meeting hard, hoping to coax a little of the tension out of him. Once again, her body dipped against his, a soft, sweet moan spilling from her lips, turning on her heel and seating herself in his lap, gently rotating her rounded butt against his crotch.

She timed it, waiting for just long enough for his pulse to escalate, standing again, her hands smoothing over her body as she unhooked her bra, the front fastening then secured by her palms as she turned back to look at him over her shoulder, a smouldering pout accentuating her lips. Turning back to him, she moved in a graceful glide to the last bars of the song, the room quiet only for a few moments before a song he recognised instantly began to play.

Venus in Furs was one of Camille’s favourites to strip to, internally beaming to herself as she moved fluidly, her hands working in tease over her breasts before finally revealing them, the glitter of her pasties catching the dim light, sinking to her knees to crawl toward him, hands grasping his thighs and slowly stroking upwards as she brought her body up between them.

Mounting his lap once more, she locked her eyes onto his, gently gyrating against him a few times before bending back fully, her hips rolling slowly, her hands coming up to pull at each pastie, casting them away before she sat back up again, each blush nipple stiffening a little, trailing her fingers down his cheeks as finally, she saw the corners of his mouth upturn.

“Got him.” she thought, watching his shoulders relax, knowing it was only a matter of time. Bare naked tits usually did the trick, though. Continuing to grind herself against him, she felt his breath hit her neck, knowing she was escalating him, giving him a few more seconds before she stood, moving back to her floorshow dance, leaving him feeling as if someone had yanked at the rope of his resolve... and unravelled it completely.

The way she’d just moved against him had utterly blown his mind, ensnared him further than her enchanting display so far, pulled him away from himself and, what he needed most, made him forget. Here, he didn’t need to be in control. Finally, he got it. But fuck, how he wanted more.

And that was exactly her design.

“This no touching rule is getting more difficult to stick to by the moment,” he blurted, not able to prevent the words from leaving his mouth. Her allure, her scent, her moves, her body. Her. She’d got her hooks into him, and he couldn’t help but let the complimentary statements keep on rolling off his tongue. “You’re so fucking beautiful.”

She smiled, smoothing her hands over her breasts, placing a foot up on the back of the booth to the side of his head, her body undulating, EZ inhaling a sharp breath. Oh, the urge to turn his head and skim a lick over her ankle. Camille saw it, too, the state she was working him up into. “I bet it’s the only thing you can think about, isn’t it? Running those big, powerful hands all over me. You have to be good, but me? Mmm, not so much.”

Lowering her leg again, she seated herself in his lap, wiggling against him, her body moving in a serpentine roll, turning her head, her breath fluttering against his cheek as she felt something very big beginning to harden against her butt. A gorgeous, jacked Latino guy with a big dick; he was definitely one hundred percent her taste, but he was work, and she had to remind herself of that.

One more seductive dance before him, this time undoing the ribbon ties of her thong, and she was back astride him, grinding herself into him harder this time, her body pressed tightly against his, EZ physically moving his hands beneath his thighs, the temptation to grasp her almost too much to resist.

“Yeah, do you want me, gorgeous? I can feel that you do. God, it’s so big,” she purred, her hand gently grasping his jaw as she rotated against him, EZ feeling himself spinning. There they were, client and lap dancer, and the heat that escalated between them was very, very real. More potent than either of them could have anticipated. There it was, the first thread of connection linking between them, and it crackled like a live wire.

“You could pull my cock out and get on it right now, and I wouldn’t stop you, and no one would know. You want it, don’t you? Yeah, you wanna fuck me.”

And god, how she did. It was unmistakable, the heat of her want as he watched the fire of it dance in her eyes, a blaze of lust that was unmistakable, that wasn’t an amped up bluff performance for the purposes of allure. However, she was in control, and she remained that way, working him up, and up... and up, until he felt his cock twitching against her, hot and hard, dying for release, tingling violently until... no she wasn't going to make him... fuck. Yes, she was. She’d actually made him cum in his pants, while staring him right in the eye entire time.

God... fucking... damn.

He certainly hadn’t expected that, Camille climbing off him, picking up her underwear and sliding them back on, her dress following. He took her money from his pocket as he stood somewhat uneasily, adjusting his jeans, tucking the bills into the corner of her bra, eyeing her appreciatively. “What time do you finish?”

“1am,” she confirmed, fluffing her hair, resting her hands to her hips.

“Good, I’ll wait,” he spoke, leaning to her ear. “Because the next time you make me blow my load, I want to actually be inside of you.”

She smirked, running her fingernails down his chest, her face nearing his, still teasing him with the allure, the promise of more, until it ground to an abrupt halt. “I’m not that easy, big fella.”

As she sauntered away, for the second time that night, EZ felt frustrated at not being able to attain the goal of having others to bend to his chosen will. While he knew the table vote would remain resolute, the same would not be said for the blonde stripper.

He’d make her comply, because he knew she wanted him just as much as he did her. It was only a matter of wearing her down, but he would. Being on top of everything in his world was the only acceptable place for Ezekiel Reyes, and before the week was out, he very much intended to be on top of her.

Exiting the private room, he walked back to the bar while Camille headed for the dressing room, sitting down in front of a pale beauty, with long black hair and a plentiful collection of tattoos.

“Evening, sexy,” she purred, sinking to her knees and leaning close to him in brazen fashion.

He replicated the lean, looking her up and down. “How’d you like to earn a hundred dollars?”

The corners of her mouth tilted. “You just came out from a private dance, and you want another? Shit, Camille must be slipping.”

“No,” he confirmed. “That girl I came out with, Camille, you say? I wanna know when she’s working this week. You tell me what hours, and the hundred is yours, babe.” To show he wasn’t bluffing, he pulled the bill from his wallet, sliding it across the shiny surface, his finger remaining. Raven looked down at it and back up at him, figuring it to be the easiest hundred she’d make that night.

“Wednesday, seven ‘till two, Friday and Saturday, six ‘till one.”

His finger left the top of the bill, using it to tickle under her chin with a wink. “Thanks, gorgeous.” Armed with the information he needed, he left, all the while planning his return.

Ezekiel Reyes; he was a man who got what he wanted in the end. And damn, he wanted Camille. Meanwhile, the lady herself sat in her chair in front of her makeup mirror, sinking a shot of tequila from the bottle she always had stashed in her bag for emergencies. The owner didn’t allow the girls to drink while they worked, but in this case, she needed a little jolt of strong alcohol.

God, the way he’d looked at her. Sure, she was in the business of having men look at her like that, especially when she was grinding herself into their lap, but there was an intensity to the man with a chest about as wide as the hood of her car, and a cock that felt so big, it likely had its own zip code. The intensity of that stare, though, a stare she knew she’d reciprocated with honest intent, it was burned into her mind. There’d been a connection there, and suddenly, Camille cursed herself for not being quite as easy as he presumed her to be.

Because of her profession, she’d always been a little uptight about the speed with which she had sex with a guy, though. Two hours later, while she was alone in her house watching a pan of pasta bubble, she closed her eyes and saw him there, the dark, sexy man whose name she didn’t even know.

What she did know, though? He’d be back.

#ez reyes#ez reyes fanfiction#ez reyes smut#ez reyes imagine#ez reyes x ofc#ez reyes fanfic#ez reyes fic#ezekiel reyes fanfiction#ezekiel reyes imagine#ezekiel reyes smut#mayans mc#mayans mc fanfiction#mayans mc smut#mayans mc imagine#mayans mc fanfic#mayans mc fic

87 notes

·

View notes

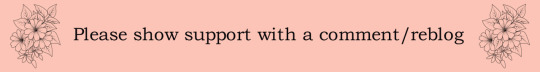

Photo

Field Notes - Supply Chain / Government Oversight: The White House blocked the permit issuance for at least six (possibly 12) proposed liquefied natural gas (LNG) export terminals. In a statement, the Biden Administration said they have imposed a "pause on pending applications for exports of U.S. natural gas as LNG to non-free trade agreement countries until the department can update the underlying analyses for authorizations". The...(CLASSIFIED, see full brief at www.graymanbriefing.com by joining our intel service via Telegram, Signal, or Email delivery)

2 notes

·

View notes

Text

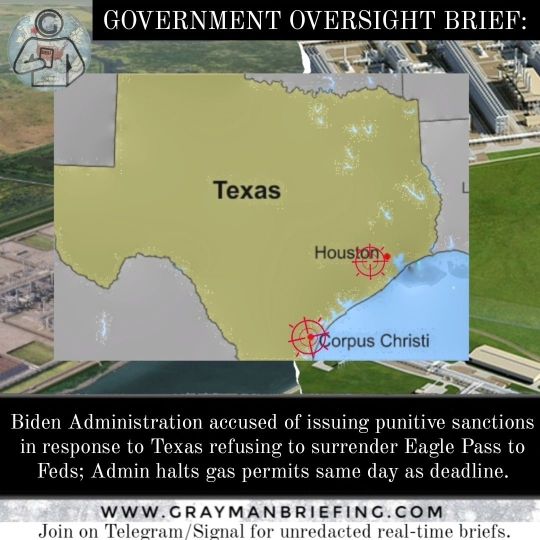

Renewable Energy M&A hits a record high of $100bn!

The global deal value surged by 48% y/y to $108bn in 2022; transacted capacity more than doubled to 740 GW. Corporate consolidations in the US and acquisitions of offshore wind assets in Europe were the major contributors to this rise.

Enerdatics has published its annual analysis of renewable energy transactions, globally. To access the full copy of this report, kindly visit enerdatics.com.

In the US, large, integrated power producers and oil majors expanded their presence in the onshore wind, solar and biofuels segments, fueled by incentives offered under the Inflation Reduction Act (IRA). The Biden administration’s waiver of import tariffs on solar panels from certain Southeast Asian countries improved the outlook for the US’s solar sector, contributing to a 309% y/y rise solar deal value during the year. Meanwhile, clean fuel tax credits and the rising demand to decarbonize domestic heating and power spurred billion-dollar investments in renewable natural gas (RNG) and alcohol fuels assets by bp and Chevron.

In Europe, private equity (PE)-led farm-ins in offshore wind assets, primarily in the UK and Germany accounted for ~40% of the region's transaction value. Ambitious government targets and supportive legislation, such as Germany’s Easter Package, drove deal activity. Further, the EU's plan to offset 3.5 billion cubic metres of Russian gas annually and efforts to decarbonize fossil fuel-based power and heating is spurring investments in renewable natural gas and energy-from-waste platforms. Shell and KKR led activity in the sector during the year.

APAC accounted for $19bn of transactions during the year, with India emerging as the premier market in the region. Onshore wind M&A activity surged by 69% y/y, as countries in the region overcame supply chain bottlenecks due to proximity to steel and equipment manufacturing hubs. Additionally, continued elevated prices of oil, coal, and LNG drove C&I customers to turn to corporate power purchase agreements, leading to a surge in interest for assets backed by bilateral contracts

LatAm deal value surged by 314% y/y, with Brazil accounting for 84% of the region’s transaction value. A 2021 regulation that allows companies to sign dollar-denominated PPAs incentivized foreign investment in Brazil's renewables sector by reducing forex risk. Meanwhile, Chile recorded $1bn of deals in 2022, however, transmission bottlenecks continue to impact investor appetite in the country.

PS: The above analysis is proprietary to Enerdatics’ energy analytics team, based on the current understanding of the available data. The information is subject to change and should not be taken to constitute professional advice or a recommendation.

12 notes

·

View notes

Text

Right now, the sobering truth is that the future of Europe hinges on the weather. It seems absurd. But whether the winter ahead is cold or warm will determine if Europe gets through the next six months without major economic, political, and social stress.

We are in this situation because, thanks to the clash with Russia over Ukraine, Europe has lost roughly a third of its regular gas supply. Much of Europe, particularly in the former Soviet bloc, relied on Russian gas for electricity generation, home heating, cooking, and industrial purposes. Germany and Italy, the largest and third-largest economies in the Eurozone, were also heavily dependent on Russian gas.

Since the spring, as the scale of the conflict became clear, Europe has been bracing for the worst. While buying as much Russian gas as it can, Europe has been scrambling to sign new gas deals and make up the impending shortfall by buying up cargos of liquefied natural gas, or LNG. Over the summer, as Russia’s situation became more dire, deliveries of Russian gas slowed to a fraction of their normal level. Europe’s purchasing went into overdrive, pushing gas prices to extraordinary levels—equivalent to roughly $400 per barrel of oil or more. As a result, the gas storage facilities are now full. Gas prices, at least for the next few months, have plunged. There is simply nowhere to put more of the stuff. It’s now the daily charges for LNG tankers that have gone through the roof, as shippers wait offshore for European demand to return. It is only a matter of time. The gas storage facilities are sufficient to cover no more than a few months. Gas prices for next year and for the foreseeable future remain severely elevated—in the $200-per-barrel range, around 8 times their precrisis levels. With no prospect of a resumption of Russian gas deliveries in sight, the outlook is grim—unless, that is, the weather stays warm.

Weather has mattered in modern European history before. A freezing winter in 1946-47 brought Europe to a standstill and helped to trigger Washington into launching the Marshall Plan. But that was in the immediate aftermath of World War II, when the continent was in ruins. For Europe in the third decade of the 21st century to find itself at the mercy of the weather truly comes as a shock.

Of course, as the saying goes, Europe is forged in crisis and consists largely of the sum of the solutions found to those crises. But when Jean Monnet, one of the architects of European integration, made that famous declaration in 1976, he can hardly have expected a severe cold snap or an unusual warm spell to swing the history of the continent. Even former European Commission President Jean-Claude Juncker, when he used the term “polycrisis” to describe Europe’s situation in 2016, cannot have imagined a moment as precarious as this. He was thinking of the Syrian refugee crisis, the Eurozone debt crisis, and the Russian annexation of Crimea. The difference is that throughout the first clash over Ukraine, Russian gas continued to flow.

In the worst-case scenario, if the thermometer plunges in the next few months, several European countries could be forced to impose gas rationing. Even with good weather, the outlook for next year is alarming. The concerns are not merely prospective. With energy prices currently hovering around five times their precrisis levels, energy-intensive industries such as fertilizer and aluminum are already shutting down. Under the pressure of the shock, the energy supply chain in Europe is fracturing. Energy supply companies have found themselves caught between fixed-price contracts with their customers and soaring gas and power costs. It turns out that there is maturity mismatch, one of the boogeymen of the financial crisis of 2008, at the heart of the energy supply system. Either supply companies breach their contracts, or they pile up gigantic losses that bring them to the brink of bankruptcy—or a bailout. The nationalization of Germany’s Uniper has already cost the taxpayers billions of euros.

To mitigate the damage to households and businesses, Europe’s governments have launched a variety of programs to stabilize prices. The details are mind-bogglingly complex and contentious. Germany agreed, only very reluctantly, to the idea of a maximum price for European gas purchases. As its government points out, it will work only if demand does not surge elsewhere. With Italy, France, and Spain taking the initiative early in the crisis to introduce national support programs, and Germany following suit with its own gigantic energy package, there has been little European coordination. The only thing that is clear is that effective programs are going to be very expensive. The German package is touted as costing 200 billion euros. On top of earlier German support programs, the total bill could run to 5 percent to 6 percent of its GDP—a lot even for a country of Germany’s fiscal capacity.

Europe has a track record of big crises with big bills. But this one is particularly tricky to handle. After the banking crises of the late 2000s, Germany did not want to foot the bill for a common bank insurance fund to support weaker banks in Italy and Spain. But at least those countries’ efforts to support their own ailing banks made Germany’s banks more, rather than less, safe. The opposite is precisely the situation regarding energy subsidies. Uncoordinated gas stockpiling by the richest consumers prices poorer consumers out of the market to the benefit of speculators. In this regard, the measures taken so far to meet the crisis are akin to vaccine nationalism or protectionist policies to horde limited supplies of personal protective equipment.

Back in 2020, in the first months of the COVID-19 pandemic, it seemed as though Europe might fail to agree to a common pandemic plan. French President Emmanuel Macron spoke of a “moment of truth” for the EU. A deal was done for common borrowing to fund national government spending. Europe also adopted an impressively coordinated approach to vaccine procurement and distribution. It was cumbersome but addressed basic issues of equity. More than eight months on from the start of Russia’s attack on Ukraine, the prospects for a similar deal to face the energy crisis are very uncertain.

Crucially, the common response to the COVID crisis depended on an agreement between France and Germany. With the help of their finance ministries, then-German Chancellor Angela Merkel and Macron reached a deal on EU borrowing. Today, relations between France and Germany are at their lowest in recent memory. German Chancellor Olaf Scholz and Macron have a frosty working relationship. They are split over the gas-price-cap proposal, with France favoring more dramatic measures. They are split over the proposal for a gas pipeline to connect the Spanish and Portuguese LNG gasification terminals with the rest of Europe. France has effectively vetoed the plan. In February, when Germany announced its much-heralded defense-spending package, Paris was dismayed by the fact that the first big-ticket purchase went on U.S. F-35s, rather than a European alternative. More recently, Germany launched a new missile and air defense program without prior consultation with France, which left Paris fearing that Berlin now sees its future as the protector and patron of its Eastern European neighbors.

Most fundamentally, to address the escalating costs of the energy crisis and the financial legacies of COVID, Paris would like to renegotiate Europe’s fiscal architecture, including the question of common European borrowing. Scholz initially gave some indication that he was open to this discussion, only for Germany’s finance minister, Christian Lindner, of the Free Democratic party, to issue a firm “Nein,” both on common borrowing and on any fundamental redesign of the Stability and Growth Pact, the agreement that disciplines national fiscal policy in the Eurozone.

As Lindner points out, France can currently borrow at more attractive interest rates than Brussels. However, as everyone knows, that is not the point. The countries that need the protection of a common-borrowing scheme are Greece, Spain, and above all, Italy.

For a long time, liberals and progressives have worried about the rightward drift of Italian politics. Now, following the September 2022 elections, Rome has seen the inauguration of a far-right government headed by Giorgia Meloni of the Fratelli d’Italia, a party descended from a post-fascist lineage. By bitter coincidence, they took office just as Italy’s most diehard post-fascists have been celebrating the centennial of Mussolini’s march on Rome.

In choosing her ministerial team, Meloni seems to have been at pains to avoid provocation on economic and financial affairs. The finance minister, Giancarlo Giorgetti, is from the business wing of the Lega. He is the only holdover from the Draghi cabinet and more pro-European and pragmatic than Matteo Salvini, his party boss. But, for all his alleged moderation, a showdown with an outspoken German finance minister is red meat for any Italian nationalist. It would also suit Lindner, whose party is under pressure in the polls. If Scholz does not take charge of the issue, a clash between Italian and German finance ministers could spiral into the crisis that the rest of Europe fears. Even if the financial issue can be settled, Meloni’s picks for the rest of the cabinet are much less conciliatory. The stage seems set for clashes between Rome and Brussels over issues including immigration, climate change, and reproductive rights.

Among Europe’s nightmares is now the prospect that Italy under Meloni could become a second Poland, challenging the cohesive value system of the EU precisely at the moment that Brussels is seeking to consolidate a solid front against Russian President Vladimir Putin.

Poland, as a nonmember of the Eurozone, is not integral to the functioning of the EU in the way that Italy is. But Warsaw has acquired huge new significance as a frontline state in the confrontation with Russia. It is positioning itself to take full advantage of this leverage by dramatically raising its defense spending and cultivating its role as one of the United States’ most active allies within NATO. Despite Brexit and the shambles in London, Putin has helped to forge a new axis that runs from Washington via London to Warsaw. As if to emphasize the historic resonances of this axis, Poland’s nationalist parliamentarians have picked this moment to reopen the issue of reparations for the genocidal atrocities perpetrated by Germany in World War II.

Europe is embroiled in an ongoing and unpredictable war in which Putin’s Russia must not be allowed to prevail. Its basic energy supply is in doubt. In Germany, Italy, and Poland, the issues at stake are as much political as diplomatic, technical, or economic. This makes the resolution of the current crisis far more intractable. When Monnet declared that Europe would be forged in crisis, he not only assumed that there were, in fact, solutions to be forged, but he also assumed that those forging the European answers would be its civil servants and elite decision-makers. Operating independently of popular politics, they would find their way toward satisfying the functional imperatives of the moment. That model of European institution-building has been in doubt arguably since the French and Dutch referenda of 2005 shot down the proposal for a European constitution. This does not mean that progress toward “ever greater union” is impossible. 2020 proved the contrary. But it requires complex intergovernmental bargains. As winter approaches, the signs for such a deal in the present crisis seem anything but good.

It is not for nothing that Europe’s governments are looking to the weather.

The one bit of good news is that the long-range forecasts look favorable. Perhaps unseasonable warmth will buy Europe’s politicians the time they need. If the thermometer drops, however, the pressure on Europe’s capitals will become intense.

16 notes

·

View notes

Text

Global Industrial Truck Market Trend, Impact of Covid-19, In-depth Insights by Top Manufacturers and Forecast to 2029

Global Industrial Truck Market: is expected to grow at a CAGR of 3.02% throughout the forecast period, to reach US$ 36.66 Bn. by 2027.

Global Industrial Truck Market Overview:

The Global Industrial Truck Market report includes New recent developments, trade rules, import-export assessment, business model, value chain optimization, market share, the impact of domestic and localized market participants, evaluates opportunity in terms of emerging income pockets, shifts in market restrictions, tactical market growth analysis, sales volume, segment’s market growths, application niches and dominance, product approvals, product releases, geographic regions, etc.

To Get A Copy Of The Sample of the Global Industrial Truck Market, Click Here: https://www.maximizemarketresearch.com/request-sample/89961

Global Industrial Truck Market Dynamic:

Rapid digitalization in e-commerce sector and supply chain sector is expected to drive the growth of Industrial truck market. These sectors mainly invest in logistic and warehouses, which in return is expanding the industrial truck market across the globe due to easy transport and efficiency.

Industries nowadays are facing problems in increasing high yield and production, accuracy, labor scarcity. This in turn is expected to accelerate the growth of the industrial truck market across the world. Apart from that manufacturing industry, mining industry, railway and shipping industry demands for industrial truck due to its fast and easy way of equipment handling, which leads to the growth of industrial truck market in near future.

Market Scope:

A competitor's information is provided in the highly competitive environment for the Global Industrial Truck market. The information includes a business overview, financials, revenue generated, market potential, research and development investment, new market efforts, geographical presence, firm advantages and disadvantages, product introduction, and application dominance. The information shown above is only related to the businesses' focus on the Global Industrial Truck industry.

Global Industrial Truck Market Segmentation:

In urban areas, Industrial truck has limited access as they are diesel operated and led to CO2 emissions. Thus, there is need to use alternative drive system, such as LNG or CNG operated engines and electrical engines that bring higher torque, high horse power and emit lesser emissions in order to control air pollution.

Therefore, in order to sustain the environment, global leaders have implemented EURO 6, EPA 10, JP09, and BS-VI India, in order to reduce air pollution.

Governments of developing countries are providing incentives with programs and schemes for manufacturing of battery electric trucks, which in turn are expected to boost the growth of the electric truck market.

Get Free inquiry of the Global Industrial Truck Market: https://www.maximizemarketresearch.com/request-sample/89961

Global Industrial Truck Market Key Players:

• Combilift Material Handling Solutions

• Doosan Corporation

• Crown Equipment Corporation

• Godrej & Boyce Mfg. Co. Ltd.

• Caterpillar

• Kion Group AG

• SANY Group

• Toyota Industries Corporation

• Mitsubishi Nichiyu Forklift Co. Ltd.

• Clark Material Handling Co. Ltd.

• Hangcha Group Co. Ltd.

• Anhui Heli Co. Ltd.

• Hyster-Yale Materials Handling Inc.

• Jungheinrich AG

• Lonking Forklift Company Ltd.

• Komatsu Ltd.

• EP Equipment Ltd.

• Mitsubishi Logisnext Co., Ltd.

The major players covered in the Global Industrial Truck market report are

Regional Analysis:

The causes for the global Global Industrial Truck market's rise, and the industry's numerous users, are explored. Market participants, geographies, and special requirements all give data. This study proposal is ready for the market and offers a full evaluation of all important advancements that are now prevalent in all market sectors. Statistics, infographics, and demonstrations have been used to provide key data analysis.

COVID-19 Impact Analysis on Global Industrial Truck Market:

The COVID-19 pandemic resulted in a severe and prolonged decline in production utilization, while travel bans and facility closures kept people away from their facilities, leading the Global Industrial Truck market to slow in 2020. The new research features COVID 19's impact on the Global Industrial Truck# market, as well as insights, analysis, estimations, and projections.

Key Questions Answered in the Global Industrial Truck Market Report are:

Which segment was responsible for the largest share in the Global Industrial Truck market?

How was the competitive scenario of the Global Industrial Truck market in 2020?

Which are the key factors responsible for the Global Industrial Truck market growth?

Which region held the maximum share in the Global Industrial Truck market in 2020?

To Request Customization of the Global Industrial Truck Market Report, Click Here: https://www.maximizemarketresearch.com/request-customization/89961

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 96071 95908, +91 9607365656

2 notes

·

View notes

Text

Energy Security: U.S.-Korea Partnerships

In an era of geopolitical tensions and climate urgency, the United States is doubling down on strengthening energy partnerships with its allies to accelerate the global clean energy transition, according to a senior State Department official.

At a briefing this week, Assistant Secretary for Energy Resources Geoffrey R. Pyatt provided an inside look at the 10th annual U.S.-Republic of Korea Energy Security Dialogue held in Houston.

The high-level talks focused on deepening cooperation across three key fronts:

Wind turbine farm. Photo by World Bank Photo Collection. Flickr.

Forging Resilient Supply Chains

To power the energy revolution, both nations are collaborating to diversify sources for critical minerals and materials like:

Solar panels and batteries

Wind turbine components

Electric vehicle parts

"Korea has been one of the most active partners in securing these supply chains away from reliance on China,"

said Pyatt, highlighting ROK investments in U.S. manufacturing under the Inflation Reduction Act.

Korean Energy Footprint in U.S.

Billions invested in secure solar supply chains

New battery, EV component plants

Offshore wind power projects

Ford - Powered by Hydrogen. Photo by Ian Muttoo. Flickr.

Unleashing Clean Tech's Potential

Beyond traditional fossil fuels, the dialogue spotlighted joint public-private efforts to scale up emerging clean technologies like:

Green hydrogen produced from renewable energy

Carbon capture for heavy industries

Next-generation solar and geothermal

With Korea a "world leader" in energy storage, Pyatt said cooperation could "decarbonize hard-to-abate sectors requiring high temperatures" for steel, chemicals and more.

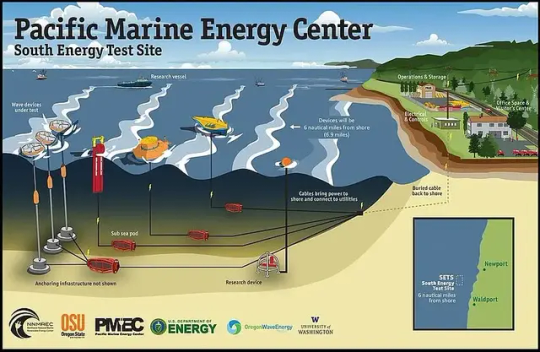

Wave energy test site in Oregon. Photo by Oregon State University. Flickr.

Shores of Energy Security

Undergirding these efforts is a shared commitment to enhancing energy security across the Indo-Pacific amid Russian disruptions.

Pyatt revealed Korean firms are supplying transformers and equipment to "keep the lights on in Ukraine" following Moscow's attacks on infrastructure there. Both countries are also exploring ways to reduce reliance on Russian LNG exports to the ROK.

"This is not an area of tension," Pyatt stated. "We find our Korean allies very attentive to the threat Russia's invasion poses."

Widening Circle of Collaboration

Looking ahead, the official left the door open to potentially expanding future energy dialogues to include other regional partners like Japan, Australia and New Zealand.

"We're not quite there yet, But this is very much on the agenda as we look to deliver more value through multilateral cooperation."

As the world races to avert climate catastrophe while bolstering economic resilience, the U.S. is banking on deepening ties with its friends to help power that dual-track transition.

For the latest on America's global energy diplomacy, visit www.state.gov/energy

Sources: THX News & US Department of State.

Read the full article

#cleanenergy#cleantechcooperation#energypartnership#energyresilience#energytransition#globalenergydiplomacy#Indo-Pacificenergy#Renewableenergy#ResilientSupplyChain#U.S.-Koreadialogue

0 notes

Text

LNG Liquefaction Equipment market Market Insights: Evaluating Growth Opportunities till 2032

New Research Report on “LNG Liquefaction Equipment market Market” provide insightful data on the main market segments, dynamics, growth potentials and future prospects of industry. The study covers complete analysis on changing market trends for industry. The report shows the year-on-year growth of each segment and touches upon the different factors that are likely to impact the growth of each market segment. Each segment has analyzed completely on the basis of its production, consumption as well as revenue. And also offers LNG Liquefaction Equipment market market size and share of each separate segment in the industry.

Get a Sample Copy of the Report at - https://www.proficientmarketinsights.com/enquiry/request-sample/1474

The global LNG Liquefaction Equipment market size was USD 794.3 million in 2024 and the market is projected to touch USD 1107.2 million by 2031, exhibiting a CAGR of 4.8% during the forecast period.

Top Key Players in the LNG Liquefaction Equipment market Market:

Air products and chemicals (U.S.)

Linde group (Germany)

Conoco Philips company (U.S.)

Atlas copco (Sweden)

Kobelco compressors (Japan)

Request Sample for Covid-19 Impact Analysis - https://www.proficientmarketinsights.com/enquiry/request-covid19/1474

The LNG Liquefaction Equipment market market research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

Market split by Type, can be divided into:

Heat Exchanger

Compressor

LNG Pump

Others

Market split by Application, can be divided into:

Small LNG Plants (Below 0.25 MTPA)

Mid-Scale LNG Plants (0.25 to 2.0 MTPA)

Large LNG Plants (Above 2.0 MTPA)

Report presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources by an analysis of key parameters. Our LNG Liquefaction Equipment market market covers the following areas:

LNG Liquefaction Equipment market market sizing

LNG Liquefaction Equipment market market forecast

LNG Liquefaction Equipment market market industry analysis

Inquire or Share Your Questions If Any Before the Purchasing This Report -https://www.proficientmarketinsights.com/enquiry/pre-order-enquiry/1474

What Global LNG Liquefaction Equipment market Market Report Offers?

Provides strategic profiling of key players in the LNG Liquefaction Equipment market market.

Drawing a competitive landscape for the world LNG Liquefaction Equipment market industry.

Describes insights about factors affecting the LNG Liquefaction Equipment market market growth.

Analyze the LNG Liquefaction Equipment market industry share based on various factors- price analysis, supply chain analysis etc.

Extensive analysis of the industry structure along with LNG Liquefaction Equipment market market forecast 2020-2024.

Granular Analysis with respect to the current LNG Liquefaction Equipment market industry size and future perspective.

Regions Covered in LNG Liquefaction Equipment market Market Report:

North America (United States, Canada and Mexico)

Europe (Germany, UK, France, Italy, Russia and Turkey etc.)

Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia and Vietnam)

South America (Brazil etc.)

Middle East and Africa (Egypt and GCC Countries)

Purchase this Report (Price 2900 USD for a Single-User License) - https://www.proficientmarketinsights.com/purchase/1474

0 notes

Text

Cryogenic Equipment Market Dynamics: Size, Share, Trends, Growth And Forecast

Increasing demand for LNG and rising need for clean energy sources are likely to drive the market in the forecast period

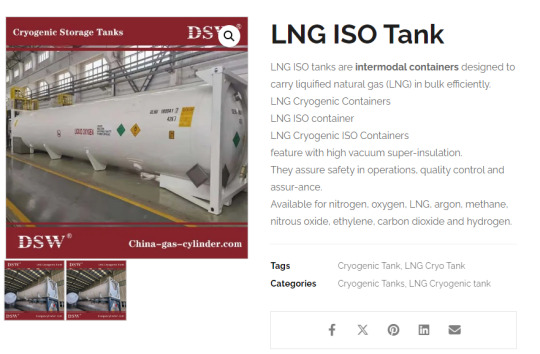

According to TechSci Research report, “Cryogenic Equipment Market – Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2029”, the Global Cryogenic Equipment Market is experiencing a surge in demand in the forecast period. One primary driver propelling the global cryogenic equipment market is the escalating demand for Liquefied Natural Gas (LNG). As the world transitions towards cleaner energy sources, LNG has emerged as a pivotal component in the global energy mix. Cryogenic equipment, such as LNG storage tanks and vaporization systems, plays a critical role in the liquefaction, transportation, and regasification of natural gas.

The rise in demand for LNG is attributed to its environmental benefits, as it produces fewer greenhouse gas emissions compared to traditional fossil fuels. This shift towards LNG is particularly notable in the transportation and power generation sectors. The construction of new LNG terminals, coupled with expansion projects, is fueling the need for advanced cryogenic equipment. As countries invest in enhancing their LNG infrastructure to meet growing energy demands, the cryogenic equipment market is experiencing a substantial boost, reflecting the industry's integral role in supporting the global adoption of cleaner energy alternatives.

Significant driver steering the global cryogenic equipment market is the expanding range of applications in healthcare and biotechnology. Cryogenic equipment, including cryogenic storage tanks and freezers, is instrumental in preserving and storing biological materials, pharmaceuticals, and medical gases at ultra-low temperatures.

In the healthcare sector, cryogenic applications are indispensable for the storage of stem cells, tissues, and organs, facilitating advancements in regenerative medicine and organ transplantation. Also, the biotechnology industry relies heavily on cryogenic solutions for the preservation of research materials, vaccines, and biomolecules. As medical and biotechnological research and development continue to advance, the demand for cryogenic equipment is witnessing a surge.

The precision and reliability of cryogenic systems in maintaining the integrity of biological samples make them indispensable in laboratories, hospitals, and biorepositories. Consequently, the expansion of healthcare infrastructure and ongoing developments in biotechnology drive the growth of the cryogenic equipment market, positioning it as a critical enabler of breakthroughs in medical science and biopharmaceutical innovation.

Browse over XX Market data Figures spread through XX Pages and an in-depth TOC on "Global Cryogenic Equipment Market.”

https://www.techsciresearch.com/report/cryogenic-equipment-market/20008.html

The Global Cryogenic Equipment Market is segmented into product type, cryogen type, end user and region.

Based on end user, The Energy & Power segment held the largest Market share in 2023. The Energy & Power sector, particularly the LNG industry, is a major consumer of cryogenic equipment. LNG, which is natural gas cooled to cryogenic temperatures for storage and transportation, is becoming increasingly important as a cleaner and more versatile energy source.

The demand for LNG is growing globally, driven by factors such as the transition to cleaner fuels, increased energy consumption, and the rise in international LNG trade.

Cryogenic storage tanks and transportation systems are integral components of the LNG supply chain. Cryogenic conditions are necessary to keep natural gas in a liquid state, reducing its volume for more efficient storage and transport.

The construction and expansion of LNG infrastructure, including liquefaction plants, storage terminals, and LNG carriers, contribute significantly to the demand for cryogenic equipment.

The Energy & Power sector is undergoing a transition toward cleaner energy alternatives, and LNG is positioned as a key player in this shift. LNG is considered a cleaner-burning fuel compared to traditional fossil fuels, contributing to reduced greenhouse gas emissions.

Governments and industries worldwide are increasingly adopting LNG as a cleaner energy source for power generation, industrial processes, and transportation, further driving the demand for cryogenic equipment.

Cryogenic technologies are essential for the production and storage of hydrogen, which is gaining prominence as a clean and sustainable energy carrier. Cryogenic storage is particularly effective in maintaining hydrogen at extremely low temperatures, allowing for denser storage.

The increasing focus on green hydrogen and the development of hydrogen-based energy systems contribute to the demand for cryogenic equipment in the Energy & Power sector.

Cryogenic technologies play a crucial role in enhancing the efficiency and reliability of power plants. For example, cryogenic air separation units are used to produce industrial gases like oxygen and nitrogen, which find applications in combustion processes for power generation.

The overall growth in global energy demand, coupled with the need for cleaner and more efficient energy sources, drives investments in energy infrastructure. Cryogenic equipment supports the development and operation of advanced energy systems.

The strategic importance of LNG in global energy trade makes the Energy & Power sector a key driver of the cryogenic equipment market. LNG terminals and facilities, equipped with cryogenic technology, facilitate international energy trade and distribution.

Major companies operating in the Global Cryogenic Equipment Market are:

Air Liquide S.A.

Linde Plc

Emerson Electric Co.

Chart Industries Inc.

Baker Hughes Company

IHI Corporation

Kawasaki Heavy Industries Ltd

Mitsubishi Heavy Industries Ltd

Howden Broking Group Limited

Burckhardt Compression AG

Download Free Sample Report:

https://www.techsciresearch.com/sample-report.aspx?cid=20008

Customers can also request for 10% free customization on this report.

“The Global Cryogenic Equipment Market is expected to rise in the upcoming years and register a significant CAGR during the forecast period. This growth is being driven by a number of factors, including the increasing demand for liquefied natural gas (LNG), the rising need for clean energy sources, and the growing use of cryogenic equipment in the healthcare, food processing, and electronics industries. For instance, LNG is a clean and efficient energy source that is becoming increasingly popular around the world. This is leading to an increase in demand for cryogenic equipment, which is used to store and transport LNG.

Additionally, The world is moving away from fossil fuels and towards cleaner energy sources such as solar, wind, and geothermal power. Cryogenic equipment is used to store and transport these renewable energy sources. Therefore, the Market of Cryogenic Equipment is expected to boost in the upcoming years.,” said Mr. Karan Chechi, Research Director of TechSci Research, a research-based management consulting firm.

“Cryogenic Equipment Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, 2019-2029 Segmented By Product Type (Valve, Tank, Vaporizer, Pump, and Others), By Cryogen Type (Nitrogen, Oxygen, Argon, Liquefied Natural Gas, and Others), By End User (Energy & Power, Chemical, Electronics, Shipping, Metallurgical, and Others), By Region, By Competition”, has evaluated the future growth potential of Global Cryogenic Equipment Market and provides statistics & information on Market size, structure and future Market growth. The report intends to provide cutting-edge Market intelligence and help decision-makers make sound investment decisions., The report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in the Global Cryogenic Equipment Market.

Browse Related Reports:

Saudi Arabia Solar Assisted Heat Pump Market:

https://www.techsciresearch.com/report/saudi-arabia-solar-assisted-heat-pump-market/21690.html

Saudi Arabia Wind Power Generator Market

https://www.techsciresearch.com/report/saudi-arabia-wind-power-generator-market/21832.html

Saudi Arabia LNG Engine Market

https://www.techsciresearch.com/report/saudi-arabia-lng-engine-market/21276.html

Saudi Arabia Onshore Floating Solar Market

https://www.techsciresearch.com/report/saudi-arabia-onshore-floating-solar-market/21291.html

Contact

Techsci Research LLC

420 Lexington Avenue,

Suite 300, New York,

United States- 10170

Tel: +13322586602

Email: [email protected]

Website: www.techsciresearch.com

#Cryogenic Equipment Market#Cryogenic Equipment Market Size#Cryogenic Equipment Market Share#Cryogenic Equipment Market Trends#Cryogenic Equipment Market Growth

0 notes

Text

Low-Carbon Propulsion Market Research & Forecast till 2033

Low-Carbon Propulsion Market is expected to grow at a CAGR of 21.5% during the forecasting period 2024-2033.

The competitive analysis of the Low-Carbon Propulsion Market offers a comprehensive examination of key market players. It encompasses detailed company profiles, insights into revenue distribution, innovations within their product portfolios, regional market presence, strategic development plans, pricing strategies, identified target markets, and immediate future initiatives of industry leaders. This section serves as a valuable resource for readers to understand the driving forces behind competition and what strategies can set them apart in capturing new target markets.

Market projections and forecasts are underpinned by extensive primary research, further validated through precise secondary research specific to the Low-Carbon Propulsion Market. Our research analysts have dedicated substantial time and effort to curate essential industry insights from key industry participants, including Original Equipment Manufacturers (OEMs), top-tier suppliers, distributors, and relevant government entities.

Receive the FREE Sample Report of Low-Carbon Propulsion Market Research Insights @ https://stringentdatalytics.com/sample-request/low-carbon-propulsion-market/13361/

Market Segmentations:

Global Low-Carbon Propulsion Market: By Company

• Tesla

• BYD Company Ltd.

• YUTONG

• Nissan

• Bombardier

• Siemens

• Alstom

• Toyota

• Honda Motor Co. Ltd.

• Hyundai Motor Group

Global Low-Carbon Propulsion Market: By Type

• Heavy-Duty Vehicle

• Light-Duty Vehicle

Global Low-Carbon Propulsion Market: By Fuel Type

• Compressed Natural Gas (CNG)

• Liquefied Natural Gas (LNG)

• Ethanol

• Hydrogen

• Electric

Regional Analysis of Global Low-Carbon Propulsion Market

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Low-Carbon Propulsion market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Click to Purchase Low-Carbon Propulsion Market Research Report @ https://stringentdatalytics.com/purchase/low-carbon-propulsion-market/13361/?license=single

Key Report Highlights:

Key Market Participants: The report delves into the major stakeholders in the market, encompassing market players, suppliers of raw materials and equipment, end-users, traders, distributors, and more.

Comprehensive Company Profiles: Detailed company profiles are provided, offering insights into various aspects including production capacity, pricing, revenue, costs, gross margin, sales volume, sales revenue, consumption patterns, growth rates, import-export dynamics, supply chains, future strategic plans, and technological advancements. This comprehensive analysis draws from a dataset spanning 12 years and includes forecasts.

Market Growth Drivers: The report extensively examines the factors contributing to market growth, with a specific focus on elucidating the diverse categories of end-users within the market.

Data Segmentation: The data and information are presented in a structured manner, allowing for easy access by market player, geographical region, product type, application, and more. Furthermore, the report can be tailored to accommodate specific research requirements.

SWOT Analysis: A SWOT analysis of the market is included, offering an insightful evaluation of its Strengths, Weaknesses, Opportunities, and Threats.