#Loans and Cards Analyst Program

Explore tagged Tumblr posts

Text

Banking Courses in India That Guarantee Job Placement

A career in banking isn't just prestigious—it’s also one of the most stable and rewarding paths in the financial industry. Yet, in a fiercely competitive job market, qualifications alone are no longer enough. Employers now look for candidates with theoretical knowledge and hands-on, job-ready skills. That’s where certified banking courses with 100% placement come into play.

Across India, many institutes are offering certified bank training programs specifically designed to bridge the gap between education and employment. These programs are ideal for graduate students, early-career professionals, career switchers, and finance enthusiasts who want more than just a certificate—they want a career.

Why Job-Assured Banking Courses Are in High Demand

India’s financial ecosystem has grown beyond traditional banking roles. Fintech, NBFCs, investment firms, and compliance departments now demand professionals with real-world banking skills and domain-specific certifications.

This has created a rising demand for Certified Bank Training Programs that offer:

Practical exposure to core banking operations

Training in modern tools like Excel, CRM systems, and databases

Interview preparation and resume-building sessions

100% placement assistance through corporate tie-ups

For recent graduates, early-career professionals, or job switchers, these banking courses provide a direct path to employment, bypassing the uncertainty of traditional job hunts.

Top Banking Courses in India with 100% Placement

1. Certified Investment Banking Program

The Certified Investment Banking Program is designed for candidates aiming to enter high-value roles in M&A, equity research, and corporate finance. This course includes training in:

Advanced financial modeling courses

Company valuation techniques

Deal structuring and IPO analysis

Pitch deck creation and industry-standard reporting

With placement support into leading investment firms, this course is ideal for finance graduates, engineers, and commerce students with analytical skills.

2. KYC/AML Analyst Program

With rising global compliance standards, the KYC/AML Analyst Program is in high demand. Candidates are trained to:

Understand global AML frameworks and FATF guidelines

Evaluate risk in client onboarding processes

Work with compliance and transaction monitoring tools

Graduates from this program are placed with private banks, fintechs, and global financial service firms in roles like KYC Analyst, AML Officer, and Compliance Associate.

3. Loans & Cards Analyst Program

This is one of the most specialized Certified Bank Training Programs for those interested in retail banking operations. It includes:

Credit underwriting and approval processes

Consumer loans and EMI structures

Risk assessment for unsecured products like credit cards

Regulatory compliance and fraud detection

Graduates are trained to work as Loan processors, Credit Analysts, and Cards Operations executives at leading banks and NBFCs.

Who Should Enroll in These Banking Programs?

These courses are not limited to finance graduates. They’re ideal for:

Commerce or BBA students looking for job-ready skills

Engineering or IT graduates wanting to pivot into banking

Working professionals seeking stable, high-growth roles

Career switchers aiming to enter the financial sector

The key is the practical, employer-aligned approach—delivering exactly what recruiters want in a job-ready candidate.

What Makes These Programs Placement-Assured?

Institutes offering these courses often have dedicated placement cells, corporate partnerships, and a track record of placing students into banks, NBFCs, fintech startups, and MNCs.

The 100% placement guarantee is typically backed by:

Industry-recognized certifications

Real-world projects and simulations

Mock interviews and grooming sessions

Direct recruitment drives

Most importantly, students are mentored through the hiring process, which increases their success rate dramatically compared to self-preparation or generic online courses.

Conclusion: A Smarter Path to a Banking Career

From investment banking courses to financial modeling courses and analyst certifications, the Indian market now offers job assured banking training programs that combine quality education with guaranteed outcomes. These are more than short-term courses—they are career accelerators for anyone serious about making their mark in finance.

#Banking Courses in India#Investment Banking Courses#Certified Bank Training Programs#Banking Courses with Placement#Financial Modeling Courses#Certified Investment Banking Program#KYC/AML Analyst Program#Loans and Cards Analyst Program#Job-Oriented Banking Courses#Banking Career in India#Best Banking Courses for Graduates#Banking Certification with 100% Placement#Career in Investment Banking#Banking Jobs for Freshers#Finance Courses with Job Guarantee

0 notes

Text

tl;dr - i got a promotion, HR sucks and tried to block it/ make me jump through some more hoops, my boss fought for me and it's going forward as originally promised.

i got a promotion last month, but it wasn't starting until next week.. yay!! or maybe not. apparently HR goofed and uploaded the 'wrong' job description in our system for the promotion i received. my boss pre selected me as the candidate. the job posting was JUST for me, no one else would have been selected over me. there are 2 analysts on our team, and last year the senior analyst quit without notice & without me being trained on a lot of things he did, but i took it in stride and reverse engineered a lot of things so there was barely a blip in reporting and did the work for 2 people for half a year.

it was a promotion well deserved, i think. my boss was always happy with my work, never complained. i attended a mentorship program and i feel like I've grown a lot in the last year. she's really proud of me. i try and bring positivity to the team, i always help out when i can, and i do my best to share as many training documents and information as possible to make things easier for everyone.

but, the issue here... because of course something always has to go wrong in my life. the job posting HR loaded was for a senior position, but it was not exactly correct. in the requirements it said I must have a 4 year degree. they did not verify this BEFORE giving me the job offer. they wait less than a week before updating me in the system (my official promotion was supposed to go into effect 6/16), to ask for it.

a couple emails back and forth, and basically HR stated that they would not give me the promotion without the degree, OR my boss would need to submit a service ticket to get the job description updated, reflecting the correct job requirements, and then i would 'reapply'.

my boss showed me the actual job description months ago. it didnt match what was posted on our internal job posting when i applied, but HR has always messed those up so i ignored it. it was wrong when i applied for a buyer role, when i applied for a jr analyst, so no duh when i applied for a sr analyst. the 'real' job description stated that you need a 4 year degree OR (emphasis on or) 5 years or more equivalent analytic experience. which i have, plenty of. i have at least 9 years of analytical experience as a buyer, a sourcing specialist, a materials planner, as a vendor manager. I've done it all basically. i dropped out of college when my mom died, because the FASFA requires 1 parent on the application until you're like 26, even if you have been independent for years and don't speak to your other surviving parent, and i refused to get any loans. a lot of my friends are still paying loans 10+ years later.. every time i try and build up savings, it disappears. car breaking down, hvac or appliances need replaced, lost my job - 3 times in last 6 years. all my savings, bye bye!! no savings, no college. 🤷♀️

anyways.. this stupid lil hiccup in HR went from bottom of the totem pole, to supervisor, to manager, to director. i was absolutely devastated about all of this. i could not concentrate at all in the last few hours of my workday. i have been in the negatives for almost three years now, going paycheck to paycheck and using credit cards to pay for essentials like groceries. my partner lost their job last year and is making half what i make (when we used to make the same). the promotion will give me a couple extra hundred per pay check every 2 weeks. it would help us get out of the red.

i have no idea what my face looked like when i brought my boss into this. i was still copied on the emails back and forth between her arguing with HR, and when I went into her office after their last reply stating i wouldn't get it until some extra BS tickets were submitted.. somehow i didn't cry but it was a close thing. she doesn't like to swear at work but she did say 'what the FUCK?!?!' after i closed her door, in regards to HR.

i have never had a manager fight for me like this before. usually i get unsupportive leadership, who just keep piling more onto me, and make excuses why they can't promote me or give me a raise. or say i wouldn't be a good fit for a higher position and i need to stay where I'm at. my current boss has been amazing. i have no idea what i did to deserve to be treated so well. im going to miss her when she retires in the next year or so.

i left for the day in the worst of moods. about halfway into my drive though, thankfully, she called me to let me know that she spoke with someone higher up in HR and it is being fixed ASAP, that we are going forward with the 6/16 start date with my promotion. and she told me not to worry about a thing.

i was shocked, and nearly side swiped a big ass truck when she told me, but man.. i thanked her and we ended the call but it took hours for my anxiety to go away. i just want to stop being stressed all the time. it was so hard for me to ask for a raise/ promotion as it was (after being told NO so many times, you kind of stop asking), it just feels like another hurdle just as a nice lil 'fuck you'.

anyways. if you read this far, thanks? have a good evening/morning/day

2 notes

·

View notes

Text

‘We’re hemorrhaging money’: US health clinics try to stay open after unprecedented cyberattack

For more than two weeks, a cyberattack has disrupted business at health care providers across the United States, forcing small clinics to scramble to stay in business and exposing the fragility of the billing system that underpins American health care.

“We’re hemorrhaging money,” said Catherine Reinheimer, practice manager at the Foot and Ankle Specialty Center in the suburbs of Philadelphia. “This will probably be the last week that we can keep everybody on full-time without having to do something,” she told CNN. The center is considering taking out a loan to keep the lights on.

The cyberattack disrupted the computer networks of Change Healthcare, which serves thousands of hospitals, insurers and pharmacies nationwide. It prevented some insurance payments on prescription drugs from processing, leaving many care providers footing the bill up front and hoping to get reimbursed.

Change Healthcare, part of UnitedHealth, is one of handful of companies that make up the central nervous system of the US health care market. Its services allow doctors to look up patients’ insurance, pharmacies to process prescriptions, and health clinics to submit claims so they can get paid.

Health care groups have pleaded with the Department of Health and Human Services (HHS) to offer medical practices a financial lifeline. The department on Tuesday said it was taking extraordinary steps to help get claims processed, but some care providers say it’s not nearly enough.

Mel Davies, chief financial officer of Oregon Oncology Specialists, told CNN she is worried that the private clinic that treats 16,000 cancer patients annually could be forced to close if she doesn’t get financial relief soon.

Cash flow has dropped by 50% in the two weeks since the cyberattack, she said. “The magnitude of this is off the charts for us.”

On Thursday night, half a month since the saga began, Change Healthcare announced plans to have its electronic payment platform back online by March 15 and its network for submitting claims restored the following week.

But the financial wreckage caused by the cyberattack will take a lot longer to clean up, health providers and analysts say.

“The prospect of a month or more without a restored Change Healthcare claims system emphasizes the critical need for economic assistance to physicians, including advancing funds to financially stressed medical practices,” Jesse Ehrenfeld, president of the American Medical Association, said in a statement Friday.

Reinheimer, who works at the foot treatment center, said Change Healthcare’s plan to bringing systems back online was a “light at the end of the tunnel … However, it doesn’t solve the immediate issue, which is lack of money today, tomorrow and next week.”

The chaos caused by the cyberattack is prompting a reckoning for senior US cybersecurity officials about the vulnerabilities in hugely important companies that underpin the health care system.

The Change Healthcare hack “is an evolution beyond” other ransomware attacks on individual hospitals “that shows the entire system is a house of cards,” a senior US cybersecurity official told CNN.

Health care executives have been sounding the alarm for several days that the cyberattack is causing severe financial strain on the sector.

The Medical Group Management Association, which represents 15,000 medical practices, has warned of the “devastating” financial fallout from the hack and of “significant cash flow problems” facing doctors. The ransomware attack has “had a severe ongoing impact on cancer practices and their patients,” the nonprofit Community Oncology Alliance said this week.

A week ago, Change Healthcare announced plans for a temporary loan program to get money flowing to health care providers affected by the outage.

But Richard Pollack, head of the American Hospital Association representing thousands of hospitals nationwide, slammed the proposal as “not even a Band-Aid on the payment problems.”

The cyberattack could end up costing Change Healthcare billions of dollars in lost revenue and clients, said Carter Groome, chief executive of cybersecurity firm First Health Advisory.

“This is a huge, huge moneymaker being essentially the middleman or the intermediary between the insurance companies,” Groome told CNN.

Change Healthcare has blamed the hack on a multinational ransomware gang called ALPHV or BlackCat that the Justice Department says has been responsible for ransomware attacks on victims around the world.

A hacker affiliated with ALPHV this week claimed that the company had paid a $22 million ransom to try to recover data stolen in the hack. Tyler Mason, a spokesperson for Change Healthcare, declined to comment when asked if the company had paid off the hackers.

Private experts who track cryptocurrency payments said the hacking group had received a $22 million payment, but it was unclear who made the payment. “A cryptocurrency account associated with ALPHV received a $22 million payment [on March 1],” Ari Redbord, global head of policy at blockchain-tracing firm TRM Labs, told CNN.

For Joshua Corman, a cybersecurity expert who has focused on the health sector for years, the Change Healthcare cyberattack is clear evidence that the US health sector is not as resilient as it needs to be in a crisis.

Acquisitions that have merged multibillion-dollar healthcare companies have accentuated the problem so that “a single point of failure can have outsized, cascading reach and consequences,” said Corman, who helped lead a federal taskforce to protect coronavirus research from hacking.

If federal officials “don’t identify the systemically important entities proactively, our adversaries will continue to do it for us … while we burn,” he told CNN.

#us medical crisis#cyber crime#cyber security#We’re hemorrhaging money’: US health clinics try to stay open after unprecedented cyberattack

2 notes

·

View notes

Text

How a Certificate Course in Retail Can Open Doors to High-Paying Jobs

In today’s fast-paced and competitive job market, finding a high-paying job right after graduation can be challenging. While academic degrees are essential, they often lack the practical knowledge and industry-specific skills needed to land a lucrative position. This is where short-term, skill-focused programs like a Certificate Course in Retail Lending & Advances or a Certificate Course in Corporate Banking & Finance come into play. These courses are designed to bridge the gap between academic education and real-world application, especially in sectors like banking, finance, and retail.

In this blog, we will explore how enrolling in a certificate course in retail or finance-related programs can significantly improve your chances of securing a high-paying job, especially for freshers and early-career professionals.

Understanding the Scope of the Retail and Banking Sectors

The retail, banking, and finance industries are some of the most dynamic sectors of the global economy. Retail banking, in particular, is undergoing rapid transformation due to digitalization, changing customer preferences, and the growth of fintech companies. These industries require professionals who are not only knowledgeable but also skilled in modern financial tools, customer service, compliance, and risk management.

That’s where specialized, job-oriented courses in banking and finance help students stand out.

What is a Certificate Course in Retail?

A certificate course in retail is a short-term professional course that focuses on the fundamentals and advanced concepts of retail operations, sales, customer relationship management, supply chain, and financial services related to retail banking. This course is suitable for students, fresh graduates, and working professionals who want to upgrade their knowledge and skills in the retail sector.

When extended to financial services, courses such as the Certificate Course in Retail Lending & Advances train candidates in managing personal loans, credit cards, mortgage services, and consumer loans, giving them the expertise needed for roles in banks and financial institutions.

Why Opt for a Certificate Course?

Unlike lengthy degree programs, certificate courses are short, cost-effective, and focused on developing industry-specific skills. Here are some reasons why opting for a certificate course in retail lending and finance can boost your career prospects:

1. Industry-Relevant Curriculum

These programs are designed in consultation with industry professionals. A Banking and Finance Course for Freshers covers practical areas such as:

Loan documentation

Credit appraisal

Risk assessment

KYC norms and regulatory guidelines

Retail financial products

This hands-on knowledge is highly valuable for entry-level roles and gives you an edge over other applicants with only theoretical knowledge.

2. High Demand for Skilled Professionals

With the rise in personal banking, consumer loans, credit card usage, and digital transactions, banks are constantly on the lookout for trained professionals. A job-oriented course in banking and finance makes you an attractive candidate for roles such as:

Retail Banking Officer

Credit Analyst

Loan Processing Executive

Relationship Manager

Corporate Banking Associate

These roles offer not only job security but also attractive compensation packages.

Certificate Course in Retail Lending & Advances – A Gateway to Growth

This course focuses specifically on retail lending, which is a core function of banking institutions. The curriculum typically includes:

Types of retail loans and advances

Lending procedures

Legal documentation and compliance

Credit risk and underwriting

Customer acquisition and servicing strategies

Upon completion, students are equipped to handle real-time banking operations and are ready for high-paying roles in both private and public sector banks.

Certificate Course in Corporate Banking & Finance – Scaling the Ladder

If you are looking to explore corporate roles in banking, then the Certificate Course in Corporate Banking & Finance is the right choice. It covers:

Corporate lending

Trade finance

Project finance

Treasury operations

Risk management in large accounts

The complexity of corporate accounts means that professionals trained in this niche can command significantly higher salaries due to their expertise and the responsibility involved.

Banking and Finance Course for Freshers – A Smart First Step

For those just stepping into the professional world, a Banking and Finance Course for Freshers serves as an excellent platform. These programs introduce candidates to:

Banking fundamentals

Financial products and services

Customer engagement and service ethics

Soft skills and communication

Sales and marketing strategies for banking services

This all-rounded training not only builds technical proficiency but also focuses on personality development, making freshers job-ready from day one.

Real Career Benefits of Certificate Courses

Let’s take a look at some tangible benefits of completing a certificate course in retail and banking:

1. Better Job Opportunities

Employers prefer candidates who require less training. Certified professionals fit this criterion perfectly and are often prioritized for recruitment.

2. Higher Starting Salaries

Certified individuals often start with higher pay packages than their non-certified counterparts. For example, a fresher with a certificate in retail lending might start at ₹3–5 LPA, while others may begin at ₹2–3 LPA.

3. Faster Career Growth

With specialized knowledge, promotions and appraisals come faster. Many professionals with certifications move into managerial roles within 2–3 years of employment.

4. Job Flexibility and Security

Certified professionals are not limited to one job role or company. Their skills are transferable across various organizations—banks, NBFCs, fintech companies, and retail chains.

Who Should Enroll?

These certificate programs are ideal for:

Graduates in commerce, economics, or management

Freshers aiming to enter the banking and finance sector

Working professionals looking to switch to high-paying finance roles

Employees in retail or customer service who want growth in financial services

How to Choose the Right Course?

When choosing a certificate course, ensure the following:

The course is recognized by industry bodies or reputed institutes.

It offers real-world case studies and practical training.

Placement support or internship opportunities are provided.

The course duration and fees align with your goals.

Many reputed institutions and training academies now offer online, hybrid, and classroom-based job-oriented courses in banking and finance, making it easier for learners to upskill at their convenience.

Final Words

In a world where competition for every job is high, a Certificate Course in Retail Lending & Advances or Certificate Course in Corporate Banking & Finance can be your key to success. These specialized, job-oriented courses in banking and finance prepare you for high-paying roles, give you real-world skills, and ensure you're industry-ready from day one.

Whether you’re a fresher seeking your first break or a professional looking to upgrade, a certificate course in retail or banking is a smart investment in your future.

0 notes

Text

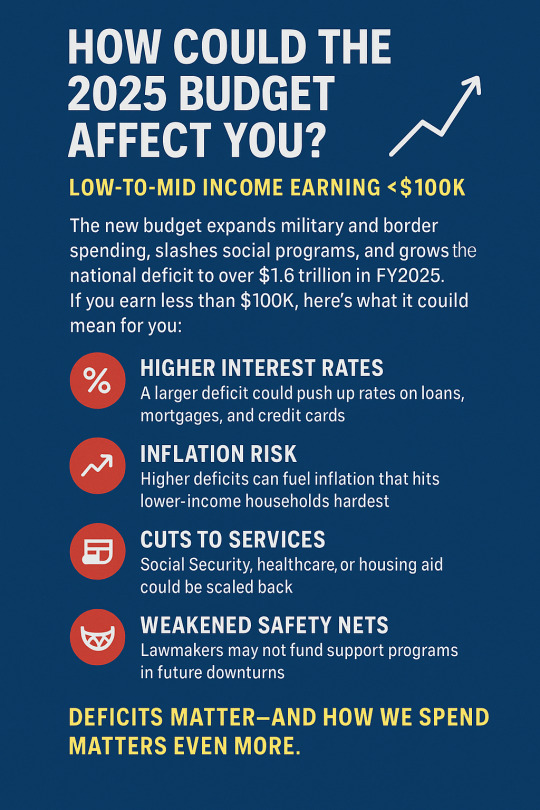

🔍 What is the Deficit, and how does it affect you?

The deficit is the amount the government spends beyond what it collects in revenue (taxes) in a given year.

📈 How Does the 2025 Budget Increase the Deficit?

Massive tax cuts for high-income earners and corporations were extended.

Military and border spending were significantly increased (e.g., $79 billion for border enhancements).

Discretionary domestic spending, especially for social programs and the arts, was cut—but not enough to offset the revenue shortfall and defense increases.

As a result, the Congressional Budget Office and independent analysts expect a substantial increase in the annual deficit, possibly surpassing $1.6 trillion in FY2025.

💥 How Does This Impact Low-to-Mid Income Citizens?

Higher Interest Rates

The government borrows more by issuing Treasury bonds.

This can push up interest rates on loans, mortgages, and credit cards, making it harder for families to afford big purchases or repay debt.

Cuts to Services

To eventually "balance the books," lawmakers may push for future cuts to Social Security, Medicare, housing aid, or education programs—all of which disproportionately benefit people earning under $100K.

Inflation Risk

While not guaranteed, a higher deficit can stoke inflation, especially if borrowing increases faster than economic growth. Inflation hits lower-income households hardest, as a larger portion of their income goes toward food, gas, and rent.

Weakened Safety Nets

If federal debt becomes politically controversial, future Congresses may refuse to fund or expand support programs, even during economic downturns—again hurting lower-income citizens most.

✅ Summary for Facebook:

💸 The new 2025 budget expands military and border spending while slashing support for the arts and education—and it's set to grow the national deficit by over $1.6 trillion.

📉 If you earn under $100K, here's what it could mean for you: higher interest rates, more inflation, and possible cuts to Social Security, healthcare, and housing programs down the road.

💬 Deficits matter—and how we spend matters even more.

#Budget2025 #FederalDeficit #EconomicJustice #Under100k #FinancialAwareness #USBudget #WorkingClassVoices #SocialProgramsMatter #CostOfLivingCrisis #MiddleClassStruggles #DebtAndDeficits #PolicyMatters #TruthInNumbers #EconFacts #PeopleOverPolitics

0 notes

Text

FRM Salary in India 2025 | Scope, Jobs, Growth

Thinking about a career in finance that’s challenging and well-paid? Financial Risk Management might be the perfect fit. FRMs (Financial Risk Managers) are the professionals who help organisations safeguard their assets and maintain stability in an unpredictable financial world. Whether it’s banking, trading, loan origination, or even marketing — FRMs are in demand across industries.

According to Glassdoor, the average salary of an FRM in India is ₹9 LPA. With experience, that can go as high as ₹33 LPA. On a monthly scale, expect somewhere between ₹66,130 and ₹77,821, depending on your role and experience.

Who is a Financial Risk Manager?

Financial Risk Managers are the people companies trust to keep their money safe. They use a mix of strategy, analysis, and financial tools to reduce exposure to risk like credit defaults, market crashes, or operational hiccups.

An FRM’s job is to anticipate what could go wrong and put systems in place to handle it be it low contingency reserves, poor resource management, or risky financial decisions.

Salary by Job Roles in Financial Risk Management

Here’s a look at common FRM job titles and what you can expect to earn:

1. Risk Qualification Manager

Manages a company’s insurance and risk programs, flagging anything that could threaten financial stability. Salary: ₹3 LPA — ₹30 LPA

2. Credit Risk Analyst

Works with banks, credit card companies, and rating agencies to assess consumer credit risk. Salary: ₹2.4 LPA — ₹21 LPA

3. Operational Risk Analyst

Identifies internal risks caused by weak controls or staffing issues, and reports them to management. Salary: ₹3 LPA — ₹20 LPA

4. Operational Risk Manager

Ensures all potential and existing risks are proactively managed to stay compliant with regulations. Salary: ₹5.5 LPA — ₹30 LPA

FRM Salary in India by Experience

As you’d expect, the more experience you gain, the higher your salary. Certifications like the CFA can also give your resume a serious boost.

Here’s a breakdown based on years of experience:

Years of ExperienceAverage Salary2–3 years₹8.0 LPA3–4 years₹9.0 LPA4–5 years₹10.7 LPA5–6 years₹11.6 LPA6–7 years₹12.0 LPA7–8 years₹9.7 LPA8–9 years₹13.7 LPA9–10 years₹10.5 LPA10–11 years₹14.7 LPA11–12 years₹15.2 LPA

Note: Salaries can vary based on the company, your credentials, and market demand.

Top Companies Hiring FRMs

FRMs are needed just about everywhere money is involved — which is pretty much every business. Here are some top companies actively hiring Financial Risk Managers:

PwC

KPMG

Amazon

EY

HSBC

Deloitte

J.P. Morgan

PayPal

ANZ

Wells Fargo

Goldman Sachs

Axis Bank

Bank of India

Reserve Bank of India

The starting salary for freshers may not blow your mind, but it grows quickly with experience and the right certifications. Pursuing a CFA (Chartered Financial Analyst) alongside your FRM can give your career an extra edge.

Got Questions About the FRM Course?

Conclusion

The demand for Financial Risk Managers is only going up. Companies are constantly on the lookout for professionals who can manage uncertainty and protect their bottom line. If you’re serious about making a career in this field, pairing your FRM certification with a CFA can unlock even better opportunities.

At Zell Education, we guide you through everything you need to become a successful FRM. Get in touch today to explore the course and see how we can help boost your career.

FAQ — Financial Risk Manager Salary

Q. What is the salary of an FRM in India? FRM salaries in India range from ₹3.0 LPA to ₹24.0 LPA, with an average of ₹9.1 LPA.

Q. Does having an FRM certification increase your salary? Absolutely. Certified FRMs are in high demand, and companies are willing to pay more for that expertise.

Q. Is FRM better than CFA? Not better — just different. CFA focuses more on investment and portfolio management, while FRM dives deeper into financial risk. You can even pursue both for a broader skillset.

Q. Are FRMs in demand in India? Yes! As the financial industry grows, more organisations are hiring FRMs to help manage risk and remain compliant.

0 notes

Text

Become the Data Scientist Every Company Wants to Hire

Today, a great deal of information surrounds people and businesses, and companies are constantly under pressure to leverage it well. Data can be used for sales forecasting, detecting credit card fraud, tracking epidemics, marketing promotions, and even predicting your next power outage. However, what makes a data scientist most beneficial? Which factors make an average analyst a desired employee on the list of recruiters?

The answer is going to be skills, skills acquired through experience and a deep understanding of business. However, if you are serious about building this winning combination, then a data science certification in Pune can be your foundation for success.

Why the Demand for Data Scientists Is So High

It has become a trend for every industry to become data-driven. No matter whether it is related to the healthcare sector, finance, e-commerce, or even sports, everyone desires data insights. And that is why many organizations in the international market have hired data scientists as never before.

Pune city in India has become one of the preferred destinations for seekers in data science. For all these reasons, starting your journey with a data science course in Pune is a wise choice because the city houses numerous growing IT companies and boasts a start-up, as well as an academic culture.

What Makes a Data Scientist Truly Employable?

Thus, to become the kind of data scientist every company would like to have on their team, one has to step beyond theory and know how to apply it. This is the reason. The following are the top things or qualities, or job requirements that employers are looking for:

1. A Solid Educational Foundation

Gaining structured knowledge through a data science certification in Pune is quite beneficial for the learners. From Python coding to machine learning and other statistical learning, an accreditation guarantees that the data scientist has mastery of the foundational practices of the trade.

Example: Meera completed her graduation in computer science and then took a certification course to enter data science. She could soon get a job at a Pune-based fintech firm, where she develops machine learning models to decrease the loan default percentage by 20%.

2. Hands-On Training with Real Projects

Theoretical learning isn't enough. Companies want professionals who can handle real-world challenges. That’s where data science training in Pune makes a difference—it often includes projects like:

Customer segmentation for retail chains

Predictive modelling for stock prices

Churn prediction for telecom companies

These are the kinds of experiences that make your resume stand out.

Key Skills Every Great Data Scientist Must Have

Whether you're just starting or upgrading your current skills, here's what you must focus on:

● Programming Languages

Proficiency in Python or R is non-negotiable. You'll need them for data wrangling, model building, and automation.

● Statistics and Machine Learning

A deep understanding of algorithms like linear regression, decision trees, and neural networks is crucial. These skills are typically part of every data science course in Pune, helping you build intelligent models.

● Data Visualization Tools

Tools like Tableau, Power BI, or even Matplotlib help convert raw numbers into business-ready insights.

● Business Acumen

You need to understand the “why” behind the data. That's what turns a technical solution into a business success.

Real-Life Scenario: A student from a local data science training in Pune worked with a Pune-based logistics firm. Using clustering models, they optimised delivery routes and saved the company over ₹15 lakhs in a year.

How Pune Helps You Build the Right Career

Choosing Pune isn't just about affordability or convenience. The city is a growing tech ecosystem filled with data-driven companies. Pursuing a data science certification in Pune means:

Access to live projects with local businesses

Mentorship opportunities from professionals already working in the field

A strong community of learners and industry experts

Plus, most data science courses in Pune include career guidance and placement support, which increases your chances of landing your dream role.

Create a Portfolio That Gets You Noticed

A well-structured GitHub portfolio can be more powerful than a resume. Include projects that highlight:

Your data cleaning and analysis skills

Your ability to apply machine learning models

Your storytelling through dashboards and visuals

If you're learning through a data science course in Pune, make sure your course includes project-based assessments that can be showcased to potential employers.

Don't Ignore Soft Skills

Technical skills may get you an interview, but soft skills will help you get the job—and keep it. Companies look for data scientists who are:

Great communicators

Problem solvers

Team players with an analytical mindset

Example: Ravi, a data science professional based in Pune, impressed his hiring team not just with his technical skills but also with his ability to explain model outcomes in layman’s terms. He now leads a team in a major analytics firm.

Career Growth and Earning Potential

Once you've completed your data science certification in Pune, the career path is quite promising. Here's what the industry looks like:

Entry-Level: ₹6–₹10 LPA

Mid-Level (3–5 years): ₹12–₹20 LPA

Senior Roles: ₹25+ LPA depending on leadership and domain expertise

These figures show why more and more people are signing up for data science training in Pune—the ROI is hard to ignore.

The Road Ahead: What You Should Do Next

To become the data scientist every company dreams of hiring:

Choose a hands-on, industry-focused data science certification in Pune

Practice consistently with real-world data.

Build a portfolio that tells your data story.

Stay curious and keep learning.g

The correct data science course in Pune can be your stepping stone to a rewarding and future-proof career. Whether you're switching fields or just starting, Pune offers the tools, network, and opportunities to help you thrive.

Conclusion: Become Unstoppable

In the end, it's not about having a fancy title—it's about making an impact with data. With the right mindset and the proper data science training in Pune, you can become that rare kind of data scientist who doesn't just get hired, but gets remembered.

Your future in data starts now. Are you ready to leap?

0 notes

Text

Tips for Younger Homebuyers: How To Make Your Dream a Reality

If you’re a member of a younger generation, like Gen Z, you may be asking the question: will I ever be able to buy a home? And chances are, you’re worried that’s not going to be in the cards with inflation, rising home prices, mortgage rates, and more seemingly stacked against you.

While there’s no arguing this housing market is challenging for first-time homebuyers, it is still achievable, especially if you have professionals on your side.

Here are some helpful tips you may get from a pro.

1. Explore Your Options for a Down Payment

If a down payment is your #1 hurdle, you may have options to give your savings a boost. There are over 2,000 down payment assistance programs designed to make homeownership more achievable. And, that’s not the only place you may be able to get a helping hand. While it may not be an option for everyone, 49% of Gen Z homebuyers got money from loved ones that they used toward a down payment, according to LendingTree.

And chances are you won’t need to put 20% down (unless specified by your loan type or lender). So be sure to work with a trusted mortgage professional to explore your options, find out how much you’ll really need, and learn about any guidelines on getting a gift from loved ones.

2. Live with Loved Ones To Boost Your Savings

Another thing a number of Gen Z buyers are doing is ditching their rental and moving back in with friends or family. This can help cut down your housing costs so you can build your savings a whole lot faster. As Bankrate explains:

“. . . many have opted to stop renting and live with family in order to boost their savings. Thirty percent of Gen Z homebuyers move directly from their family member’s home to a home of their own, according to NAR.”

3. Cast a Broad Net for Your Search

When you’ve saved up enough, here’s how a pro will help you approach your search. Since the supply of homes for sale is still low and affordability is tight, they’ll give you strategies and avenues you may not have considered to open up your pool of options.

For example, it’s usually more affordable if you consider a rural or suburban area versus an urban one. So, while the city may be livelier and more energetic, the cost of living may be reason enough to look at something further out. And if you consider smaller homes and condos or townhouses, you’ll give yourself even more ways to break into the market. As Colby Stout, Research Analyst at Bright MLS, explains:

“Being flexible on the types of home (e.g., a condo or townhome versus a single-family home) and exploring more affordable neighborhoods is important for first-time buyers.”

4. Take a Close Look at Your Wants and Needs

And lastly, an agent can help you really think about your must-have’s and nice-to-have’s. Remember, your first home doesn’t have to be your forever home. You just need to get your foot in the door to start building equity. If you want to buy, you may find making some compromises is worth it. As Chase says:

“An open-minded approach to house-hunting may be one way for Gen Z homebuyers to maintain some edge. This could mean buying in areas that are less expensive. Differentiating needs vs. wants may help in this area as well.”

An agent will help you prioritize your list of home features and find houses that can deliver on the top ones. And they’ll be able to explain how equity can benefit you in the long run and make it possible to move into that dream home down the line.

Bottom Line

Real estate professionals have expertise on what’s working for other buyers like you. Lean on them for tips and advice along the way. As Directors Mortgage says, with that support you can make it happen:

“The path to homeownership may not be a straightforward one for Gen Z, but it’s undoubtedly within reach. By adopting the right strategies, like exploring down payment assistance programs and sharing living costs with relatives, you can bring your dream of owning a home closer to reality.”

Let’s connect to get you set up for long-term success.

0 notes

Text

Tips for Younger Homebuyers: How To Make Your Dream a Reality

If you’re a member of a younger generation, like Gen Z, you may be asking the question: will I ever be able to buy a home? And chances are, you’re worried that’s not going to be in the cards with inflation, rising home prices, mortgage rates, and more seemingly stacked against you.

While there’s no arguing this housing market is challenging for first-time homebuyers, it is still achievable, especially if you have professionals on your side.

Here are some helpful tips you may get from a pro.

1. Explore Your Options for a Down Payment

If a down payment is your #1 hurdle, you may have options to give your savings a boost. There are over 2,000 down payment assistance programs designed to make homeownership more achievable. And, that’s not the only place you may be able to get a helping hand. While it may not be an option for everyone, 49% of Gen Z homebuyers got money from loved ones that they used toward a down payment, according to LendingTree.

And chances are you won’t need to put 20% down (unless specified by your loan type or lender). So be sure to work with a trusted mortgage professional to explore your options, find out how much you’ll really need, and learn about any guidelines on getting a gift from loved ones.

2. Live with Loved Ones To Boost Your Savings

Another thing a number of Gen Z buyers are doing is ditching their rental and moving back in with friends or family. This can help cut down your housing costs so you can build your savings a whole lot faster. As Bankrate explains:

“. . . many have opted to stop renting and live with family in order to boost their savings. Thirty percent of Gen Z homebuyers move directly from their family member’s home to a home of their own, according to NAR.”

3. Cast a Broad Net for Your Search

When you’ve saved up enough, here’s how a pro will help you approach your search. Since the supply of homes for sale is still low and affordability is tight, they’ll give you strategies and avenues you may not have considered to open up your pool of options.

For example, it’s usually more affordable if you consider a rural or suburban area versus an urban one. So, while the city may be livelier and more energetic, the cost of living may be reason enough to look at something further out. And if you consider smaller homes and condos or townhouses, you’ll give yourself even more ways to break into the market. As Colby Stout, Research Analyst at Bright MLS, explains:

“Being flexible on the types of home (e.g., a condo or townhome versus a single-family home) and exploring more affordable neighborhoods is important for first-time buyers.”

4. Take a Close Look at Your Wants and Needs

And lastly, an agent can help you really think about your must-have’s and nice-to-have’s. Remember, your first home doesn’t have to be your forever home. You just need to get your foot in the door to start building equity. If you want to buy, you may find making some compromises is worth it. As Chase says:

“An open-minded approach to house-hunting may be one way for Gen Z homebuyers to maintain some edge. This could mean buying in areas that are less expensive. Differentiating needs vs. wants may help in this area as well.”

An agent will help you prioritize your list of home features and find houses that can deliver on the top ones. And they’ll be able to explain how equity can benefit you in the long run and make it possible to move into that dream home down the line.

Bottom Line

Real estate professionals have expertise on what’s working for other buyers like you. Lean on them for tips and advice along the way. As Directors Mortgage says, with that support you can make it happen:

“The path to homeownership may not be a straightforward one for Gen Z, but it’s undoubtedly within reach. By adopting the right strategies, like exploring down payment assistance programs and sharing living costs with relatives, you can bring your dream of owning a home closer to reality.”

Let’s connect to get you set up for long-term success.

#exprealty#losangeles#neilsingerman#homebuying#homeownership#mortgageapplication#interest rates#homesforsale

0 notes

Text

Investment Banking Courses for Career Growth

Investment banking demands sharp analytical skills, regulatory understanding, and deep product knowledge. Certifications tailored to these requirements can bridge the gap between academic learning and professional readiness. The following courses are structured to help individuals build expertise and gain a competitive edge in diverse banking functions.

Certified Investment Banking Program – Core Training for Front-Office Roles

The Certified Investment Banking Program provides intensive training in financial modeling, valuation, and deal structuring. Key components include:

Building financial models from scratch

Performing company valuation using DCF, LBO, and comparable company analysis

Understanding M&A transactions and capital raising processes

Creating investment pitchbooks and deal presentations

The program is built for professionals aiming to work in mergers & acquisitions, equity research, private equity, or corporate finance teams. It emphasizes practical application through Excel-based assignments and real transaction case studies.

KYC/AML Analyst Program Training – Specialized Skills in Compliance and Risk

The KYC/AML Analyst Program focuses on financial crime prevention, client onboarding, and regulatory reporting. Core learning modules include:

Customer due diligence (CDD) and enhanced due diligence (EDD)

Anti-Money Laundering (AML) compliance frameworks

Risk scoring models and transaction monitoring techniques

Understanding global standards like FATF, OFAC, and FinCEN

The course prepares candidates for operational and compliance roles within investment banks, helping institutions adhere to international regulatory standards.

Certified Bank Training Programs – Foundational Knowledge Across Banking Functions

Certified Bank Training Programs cover a broad scope of banking operations, from retail banking to corporate services. Modules typically include:

Credit analysis and loan structuring

Retail and corporate product portfolios

Trade finance instruments and documentation

Banking regulations and risk management practices

These programs are ideal for professionals transitioning into investment banking from other domains or for those seeking a comprehensive understanding of the financial sector before choosing a specialization.

Loans & Cards Analyst Program – Practical Insights into Lending and Credit Products

The Loans & Cards Analyst Program delivers functional knowledge relevant to the lending and consumer finance segments of banking. Key focus areas:

Credit card operations and lifecycle management

Retail loan underwriting and credit risk modeling

Portfolio analysis and delinquency tracking

Regulatory compliance in consumer lending

This course supports roles in credit analytics, lending operations, and retail product strategy teams within both investment and commercial banks.

Aligning the Right Course with Long-Term Career Objectives

Selecting a training path depends on the specific career track within investment banking:

Roles in corporate finance and M&A require technical depth from the Certified Investment Banking Program.

Regulatory and operations teams benefit from the structured learning in the KYC/AML Analyst Program.

Broader roles in banking functions or transitions from traditional banking are supported by Certified Bank Training Programs.

Lending-focused analysts gain domain knowledge through the Loans & Cards Analyst Program.

Final Thought

Structured, role-specific certification programs not only build capability but also enhance employability in the investment banking sector. Whether targeting analytical roles, compliance functions, or credit operations, these courses act as career accelerators backed by practical training and industry relevance.

Website https://psib.co.in/

0 notes

Text

Paloma, Part I

Series Masterlist - Part I - Part II

Word count: 4100+

Rating: mature, 18+ only

Outline: Statesman!Frankie "Catfish" Morales, Agent Jack “Whiskey” Daniels, and "You" (OC cis/het female reader, Statesman research analyst, code name “Paloma”; age 26; reader is “blank canvas”/no physical description/no use of “Y/N”)

Warnings: fully legal age gap; curse words; references to M/F sex; lots of yearning; a little sprinkling of angst; American readers, please be warned that this piece features the absolutely filthy fantasy of Statesman paying off your student loans in full

You left Kentucky on a sunny June morning with a rolling suitcase, six cardboard boxes, and a heart full of golden light. You were ready for the new challenges of your promotion and the move to New York, but it was still hard to quell the little butterflies that insisted on dancing and twirling in your gut. Statesman HQ was like a beacon that had been calling to you for the last three years, and you were half-convinced that the promotion and the move were a daydream; something that would be snatched out of your hands if you thought about it too much.

It was strange to leave Kentucky, your home since you were four years old. You had been raised in a small town about an hour south of Louisville, and you hadn't had the opportunity to leave until college. Even then you didn't travel very far, just to a dorm room at the University of Louisville, going back to your hometown for every vacation instead of flying off to California or Europe like some of your more glamorous friends.

You had put your time to good use, though. You busted your ass and completed an accelerated program in Criminal Justice that earned you both a Bachelor's and a Master's in one go, with a minor in statistics and data science. The result was a deep and abiding love of research and analysis, with the burning desire to do good in the world.

---

The Friday morning of your graduation ceremony, you emerged from your apartment fresh-faced and giddy, ready to walk the stage and start the next phase: adult life in the "real world." You knew that your life was about to change, but as you juggled the garment bag with your cap and gown and tried to lock your door, you had no idea just how much. You heard a soft voice say your name behind you, and it made you jump and drop your purse, spilling the contents across your doorstep. You turned to see a woman of about 40, with flawless terra-cotta skin and an adorable mop of chestnut hair. Black horn-rimmed glasses framed bright, inquisitive eyes. She immediately bent to help you retrieve your belongings, stammering gentle apologies.

"I'm so sorry! Let me help you get your things. I didn't mean to scare you." She smiled sweetly at you and handed you back your sunglasses and lip gloss.

"No! It's fine, I'm sorry I'm so preoccupied." You lifted the garment bag by way of explanation. "Graduation day! Um, how can I help you?"

"You don't know me, but my name is Ginger. I work for an organization that recruits bright young minds like yours. It's a lot to explain, but if you're interested in a job interview next week, we'd love to talk with you." She handed you a creamy white business card with a Louisville address.

You frowned. "Statesman Distillery? I don't have any experience with alcohol production or marketing. I do data analysis and my degrees are in criminal justice."

"We know. We've been following your research and your schooling for a while." She gave you a mischievous smile, and it looked for all the world like she was hiding something fun behind it, something secretive and intriguing that made you want to know more.

"Please, just give me an hour of your time next week? When you have some time to pay us a visit, just call that number and ask for me. I'm really looking forward to chatting with you."

You thanked her and promised you would call, and then you tucked the card into your bag and forgot all about it for nearly a week. Graduation day was hectic, with lots of relatives visiting and interrogating you about your career plans, and the days afterward were spent attending parties and saying goodbye to friends who were scattering to far-flung places. After you had finished the last of your university-related errands like returning a few library books and picking up your official transcript, there wasn't much left to do except putter around your apartment and take a few days off before beginning a job search. Those student loans weren't going to pay themselves off.

You found Ginger's card in your purse on Wednesday morning and put it on the fridge with a magnet. On Thursday you were so hungover you didn't want to make any calls. On Friday you found yourself at loose ends with nothing planned, so you picked up the phone and dialed. When you reached the switchboard you gave your name and asked for Ginger, and they put you right through. She picked up after one ring, as if she had been waiting for your call.

"Hi! I'm so glad you called me! Can you come by today?" Ginger sounded genuinely excited to talk to you, not smarmy or fake like other corporate recruiters you had spoken with.

"Oh, uh, yeah. I mean, yes, thank you. Are you sure today's okay? I can come next week if that's better."

"No! Please come whenever you're ready. I'm really hoping you'll like what you see."

"Okay, will I need to dress up? Will I be meeting with anyone for an interview? Should I bring copies of my resume?" You wanted to make a good impression, but you weren't sure if this was just something the distillery did casually, like a winery tour, or if you would need to be ready for a formal interview.

"Nope! Just bring yourself! We already know everything we need to know about your qualifications."

"Ah... okay. I'm all yours. I'll see you in about an hour?"

"Perfect! I'll leave your name at the front gate with the guard. Just show them your ID and they'll wave you through."

You said your goodbyes and put the phone down. What kind of data analysis job was even available at a distillery? Market trends? Did they need a criminal justice major for tracking down rip-offs, like people counterfeiting their product? But wait, didn't the government do that kind of thing? The ATF? You shook your head clear of questions and hopped in the shower. You could ask Ginger all of your questions, since she seemed to be so happy to talk with you.

When you arrived at the Statesman Distillery an hour later, you were impressed at the size of the facility. Distilleries were pretty common in the state of Kentucky, with lots of little family companies sprinkled around. But Statesman rivaled the big names for sheer square footage.

Ginger met you in a conference room and offered you coffee, and then asked you to sign a non-disclosure agreement. You didn't think twice about it. NDAs were common in lots of industries, and you guessed that it had something to do with trade secrets, Statesman not wanting to leak information about their whiskey production details. When Ginger began the tour and you walked down a long hallway with multiple sparkling white laboratories behind thick glass, you found it unusual, but not alarming. Cleanrooms, maybe? Something to do with alcohol distillation formulas, probably.

When she ushered you into a large wood-paneled office and introduced you to Champ, the head of Statesman, you thought it was odd. Companies didn't normally introduce new college graduates to executives during tours. Based on the size of the organization, you thought you might meet the CEO or President once or twice a year, maybe at a holiday party or a company retreat. But he was friendly, and he seemed to have already heard of you; his eyebrows raised an inch at Ginger when she gave him your name. He also seemed far more interested in criminal justice and data analysis than you expected for a distillery executive, but you shook hands and answered all of his questions politely.

When Ginger asked you to step into an elevator and it dropped 10 floors, you started to wonder a little. When the doors opened and she walked you to a room with a huge bank of monitors, with screens showing all kinds of maps and security video feeds, you were downright confused. But when she revealed the cherry on top, the fact that Statesman was not in the business you thought they were? That was too shocking. You were sure she was joking. You turned behind you to look for hidden cameras, expecting a prank show host to come jumping out at you.

"This is a joke, right?"

Ginger smiled that sweet, warm smile at you. "No joke. We want you to join the Research Unit, working in the Data Analysis section. You would be keeping our agents safe, helping them make the best decisions possible. And in turn your work could save lives, hundreds of them. Maybe even thousands. What do you say?"

"I... uh... I still think you’re joking. I’ve never heard of anything like this. I… are you sure you want me?"

"Yes, if you're interested. We could use you on the team." She pushed a little slip of paper into your hand, and when you saw the annual salary that was listed, you almost fainted.

"Ginger, this is way too much. I just graduated and this is, like... this is a senior analyst's salary. I'd be able to pay off my student loans in like three years!"

"Actually, we would be paying your student loans off before you start work. If you have financial burdens hanging over your head you could be vulnerable to bribes or extortion attempts from foreign governments or bad actors. We want you clear before you start with us. Think of it as a signing bonus."

"Holy shit! Sorry, I mean... I... Jesus." You looked at her in confusion. "Y'all really want me?"

She smiled and nodded. "Yes, we really do."

"Okay, when do I start?"

And that had been it, your first "big girl" job out of college. You were welcomed warmly to the Statesman team, and you loved the fact that you did interesting work that had a real impact. The hardest part had been telling your friends and family the required cover story, saying you were doing market analysis until you could find a job in criminal justice somewhere. But since you were happy with your new job and it paid well, none of them pressured you to move on.

During your first two years with Statesman you climbed the ranks, earning promotions and new responsibilities that eventually put you in the seat of Assistant Director of Data Analysis. You had risen high enough in Statesman that your work required a code name, and you chose “Paloma,” a nod to your favorite grapefruit cocktail. You answered directly to the head of the Research Unit, and every report that your team produced was vital. You weren't wasting your talent in some corporate hole, enriching the CEO's salary at the expense of your sanity. You were saving lives, making a difference. Your reports had even been sent to the New York headquarters, where they used them as a model for operations.

And the job had brought you romance, too. One day not long after your promotion to Assistant Director, you were walking out of the conference room, so focused on your phone that you didn't see where you were going. You bumped into something large and solid in a denim shirt, and a pair of warm, calloused hands held your shoulders to steady you. You cursed softly to yourself and then looked up into the most gorgeous pair of brown eyes that you had ever seen. A man with patchy stubble and a well-worn baseball cap smiled at you, eyes crinkling with warmth.

"Whoa! Are you okay?" His eyes looked concerned as they searched your face. You looked at him with wonder. He was so, so beautiful. The smile dropped, and then his brows knitted together into a slight frown. "I said, are you okay?"

You realized you were staring with your mouth half open like some lovestruck teenager, and that an embarrassing amount of time had passed since you first met his eyes.

"Yes!" Your voice was louder than you intended. "Yes, I'm sorry. Sorry I bumped into you. I should have watched where I was going. I'm sorry."

"That's okay. Did I hurt you?"

"Ah, no. No, I'm fine. Sorry. Just distracted today."

"That's okay. Sorry I startled you." He smiled again and squeezed your upper arm.

You could have stayed there forever, leaning into his touch. He let go, much to your chagrin, and then went into the conference room. You made a note to ask someone who he was, to see if you could find out more about him. He wasn't being escorted by a staff member, so he was obviously part of the Statesman organization somehow. Someone would know who he was.

You went into the ladies room, running into Ginger at the sinks. "Oh, Paloma! I'm so glad I saw you. I need to steal your boss for an urgent matter. Can you run his 11:00 meeting in the conference room? I know it's last minute, but I'll buy you lunch later."

Your brain flickered out for a nanosecond. The 11:00 meeting? The conference room? The handsome man? You recovered your composure and smiled at Ginger. "Yeah, no problem at all. Tell him to drop his notes off in the conference room and I'll be there in just a moment."

Ginger smiled and punched your shoulder softly. "Thanks, Pal. I owe you one."

You washed your hands in a trance. Oh lord, this was going to be interesting. You squared your shoulders and met your own eyes in the mirror. You looked exactly like you had this morning, just your normal self. Most of the time that was fine, but right now you wanted to be more glamorous, more devastating. You wanted to absolutely bewitch the handsome mystery man in the meeting. In the absence of some kind of last-minute emergency Hollywood makeup team, you would have to settle for a fresh application of lip balm and a quick scrub of your teeth with a damp paper towel. You flicked a stray eyebrow hair into place, sighed, and headed back to the conference room. Looks weren't important anyway, right? Statesman had hired you for your brain, not your face. And really, you were more interested in showing your boss that you could do well in your new role. So you banished your insecurities from your mind and breezed into the meeting.

"Good morning everyone." You studiously chose not to look at the handsome man you had run into, keeping your eyes on your notes for the time being. You were afraid that if you looked at him you wouldn't be able to tear your gaze away. "The Director has been called away for an urgent matter, so I'll be leading today’s operational planning meeting. For those of you who don't know me, I'm Paloma."

You risked a glance at the handsome stranger, relieved to see that his eyes were on his notepad and not on you. You let out a breath and found your stride, walking the group through the team's findings, the data, the implications, and the desired outcome for the mission. Agent Tequila asked a few cocky, half-assed questions, probing you for weaknesses. Normally that would have irritated you, but today it was a welcome focus that took your mind off the butterflies. You knocked Tequila back in place with a few well-chosen words, and then opened up the floor for questions.

The handsome man raised his hand, and your eyes fixed on how large and thick his fingers were. Oh God, this was torture. "Yes, Mr...?"

"Catfish. Um, can you tell me more about the extraction plan?"

"Yes, absolutely." You went over that phase of the mission, giving all the details your team had gathered about the terrain and the timing. When you were done, Catfish smiled at you, and your knees went weak at the sight of the dimple that appeared. No one else had questions, so you closed the meeting and stood to leave.

Suddenly there was a warm wall of denim at your elbow. "Hey, that was really detailed information. Thank you so much for walking me through everything."

You turned and smiled. "You're welcome. Glad I could help." You fumbled for something to say, trying to extend the conversation and keep him in your orbit for however long you could while everyone else filed out of the room.

"So, um, you go by 'Catfish.' Can I ask why? That's your code name, right? There's not some kind of hidden tragedy where that's the name your parents actually wrote on your birth certificate?"

He chuckled, throwing his head back. The expanse of his thick neck and bobbing Adam's apple did nothing to improve the butterflies. They only fluttered harder, rising higher in your chest.

"It's an old Army nickname, I was Special Forces about a million years ago. Now I'm here on the transport team. I'm a helicopter pilot. When we're not working you can just call me Frankie."

"Ah." You bit your lip and nodded. Why couldn't you think of something else to say? Fortunately, Frankie continued the conversation.

"And you're Paloma around here? I love that drink. Am I allowed to know your real name, or is that classified?"

You grinned and shook his hand, giving him your name. When it rolled off his lips in that deep voice it sounded like heaven to you. You didn't want anyone else to say your name ever again. Just him.

He leaned closer, like he was sharing a secret. “Can I ask you a question? Top secret.” He winked, and you nodded.

“Can I take you to lunch?”

Your heart dropped into your pelvis, and you gulped, hard. “Y-yes. Yes, that would be great. I’d love to.”

---

When Ginger found you in your office at 2:00 p.m. you were staring off into space, smiling blissfully.

“Hey, Paloma. Why did you blow me off for lunch? I came by at 12:30, I was going to take you out.”

“Oh! Oh my god, Ginger, I’m so sorry! I had a date.”

She raised her eyebrows at you, settling down in one of your visitors chairs. “A date?”

“No! Not a date. A, um…” You burst into husky giggles, and then confessed everything to her: the handsome man, the crinkles around his eyes, his dimples and his silly code name, the easy conversation over lunch, and the fact that he had scribbled his phone number down on a sticky note that was now burning a hole in your pocket. You felt like you were 12 again, confiding in your girlfriend about crushes and cute boys.

Ginger laughed and gave your hand a squeeze. “No wonder you forgot about me. I can’t compete with a handsome helicopter pilot!”

“Oh, I’m so sorry, Ginger. I really didn’t mean to forget.”

“No, it’s okay. But definitely call him this weekend and make a real date. I’ll want details when you take me out for an apology lunch on Monday.” She winked and left your office.

You sat back in your chair and tilted back to look at the ceiling while you considered it. Was it too soon to call him and make a date? Ugh, this was agony. You decided that going by conventional rules hadn’t really mattered to you at any point in your life until now, so why the hell not?

You took a deep breath, trying to puff up your confidence. When he answered the phone on the second ring, you dove right in. “Hi, Catfish? It’s Paloma. Listen, I had a really good time at lunch, and I’d like to see you this weekend if you’re free.”

---

On Monday, you had a whole lot to report to Ginger.

Frankie took you up for a sightseeing flight on your date, and you loved the way he controlled everything; making sure he warned you before any sudden movements, and checking that you weren’t getting airsick or anxious. When the rotors were stilled and you were back on the ground, Frankie reached over to help you unbuckle your harness. Something got stuck, and the agonizing extra seconds of feeling him jostle the strap near your hip made you bold. When it was finally free and he was about to pull his hand away, you grabbed his wrist. He looked at you, alarmed that something was wrong, and you crashed your lips against his, all teeth and tongue and wanting. Frankie was as good a kisser as he was a pilot, and you spent the rest of the date making out in his truck.

The next weekend, you found out that his warm, work-worn hands were also magic in the bedroom. Frankie was adept at tweaking your sensitive spots as gently as the little buttons and switches of the flight panel, bringing you to thrumming heights the same way he did his helicopter.

The rest of the summer passed in heady, humid days and nights like a dream. You loved Frankie’s easy sense of humor and his confidence in the cockpit. But Frankie was less confident about your relationship, voicing concerns about the decade-plus that separated your ages, and whether he was keeping you from dating men your own age. He made self-deprecating comments about being an “old man,” and you reassured him that there was no one you’d rather be with, no one who could sway your attention. You loved using your hands and arms and lips and tongue to reassure him, finding that he had his own sensitive spots that you could manipulate. You loved sending him to sleep with a smile on his face.

But as much as you and Frankie enjoyed the relationship, the nature of his work with the transportation team meant that he was never in town for very long. At the same time, your job was getting more complex, requiring late nights at the office that interfered with your time together. You refused to dwell too much on the fact that you were torn, that you loved your work as equally as you wanted to spend those nights with Frankie.

By the end of the summer, you both came to the realization that it was nobody’s fault, simply a case of poor circumstances, and you decided to end things and remain friends. In October Frankie left Statesman to take a job that relocated him to Florida. You were wistful, and you missed him, but at least it had been an amicable split. At least friends was something. And as sometimes happens even with the best of intentions, the time in between each phone call grew longer, and you eventually lost touch. Last you heard he was spending weekends with his old Army buddies who all lived nearby, and he had a new girlfriend. By February the ache was starting to subside, and by April you were nearly ready to date again.

In May, almost three years to the day after Ginger’s visit to your apartment had changed your life, you were offered the position to lead the Data Analysis team in New York. You jumped at the chance. Statesman located an apartment for you, and from the pictures you were already in love with it. Huge windows looked out over the city, and it was within walking distance of Statesman HQ. Your farewell party was bittersweet. Ginger offered to come visit you, and promised that New York would be everything you hoped it would be. Your team gave you such high praises that you joked that if that’s what it took to hear accolades, you would have left ages ago.

---

Your first few days in New York were spent acclimating to the Statesman HQ, and getting to know your neighborhood. It was strange to find that you could walk or take the subway for whatever you needed, compared to the Midwest where a car was required for everything. Your new team was welcoming, and you enjoyed your new duties immensely. Your first two weeks on the job passed in no time, and you went home every night feeling like you could fly.

And then you hit a wall, in the form of Jack Daniels, a.k.a. “Senior Agent Whiskey.” You knew him by reputation, of course. Ginger had filled you in on his exploits, his overbearing charm, his smarmy flirtations. You had seen him once or twice in passing when he had visited Champ’s office, but you hadn’t actually met him in person.

When you finally did, you almost asked for an immediate transfer back to Louisville. --- "Paloma" Series Masterlist Just-here-for-the-moment’s masterlist

Tag list: @honeymandos @driedgreentomatoes @silverwolf319 @mourningbirds1 @honestly-shite @anaaaispunk @greeneyedblondie44 @spacedilf @maxwell–lord @nicolethered @dihra-vesa @the-queen-of-fools @juletheghoul @anxiousandboujee

#frankie morales x reader#frankie morales#Statesman!Frankie Morales#Statesman!Frankie Morales x you#agent whiskey x reader#agent whiskey#agent whiskey x you#jack daniels x reader#jack daniels x you#jack whiskey daniels

65 notes

·

View notes

Text

Financial Education Service For Military

There are many sources of financial education service for military personnel. The U.S. Department of Defense is one such source, however that service is limited to providing financial education to enlisted personnel and their spouses. All other financial services are available to retired military personnel through a variety of different outlets. They include banks, credit unions, mortgage companies, employers, consumer credit counseling agencies, nonprofit organizations and military financial aid programs. Find out for further details right here activedutypassiveincome.com.

Military members that have completed their service in the military and wish to continue their education with a college degree can contact their local branch or base of the armed forces to find out what financial aid resources they may have available. Financial education is available for active duty and retired military personnel who wish to pursue higher education. A number of colleges and universities across the country offer this type of financial education service for military personnel. For those who serve in the Armed Forces there are a variety of programs that can be found at different branches' websites. Many colleges even offer financial assistance for single parents, enabling them to send their children to school without worrying about how they will support them. You can click for more info here.

Many colleges also offer credit or debit cards that can be used on campus and at other participating institutions. There are also loan programs offered for military members that are based on certain criteria. The most common loan program for military financial education services for military personnel is the Direct Loan Consolidation Loan Program. This program provides an education service provider with both a loan and a debit card, allowing members to consolidate all their debt into one easy to manage loan.

Military personnel that wish to complete a masters degree in financial education often must first complete a bachelor's degree. Those wishing to pursue further financial education often take additional courses and increase their grade point averages. Depending on where a student is in their career or their grade point average, a student may be able to pursue additional graduate courses or take general education courses as well. As part of a financial education service for military personnel, some colleges offer internship programs that give students the chance to gain valuable experience while gaining a relevant skill. This experience can be invaluable when applying for jobs or when trying to secure raises and promotions in the military.

In order to start a program in financial education for military personnel, a college should first contact the armed forces office. Usually, you can use your existing benefits to pay for your education. However, it is important to realize that these funding programs are only available to those willing to work in the field. Individuals who want to pursue a higher education have to demonstrate their interest in such fields through a college application. After completing an education service for military members program, you can look forward to receiving an education that can lead to a rewarding career in the future. Take a look at this link https://en.wikipedia.org/wiki/Passive_income for more information.

Armed Services Vocational Aptitude Disorder (ASVAD) applies to all members of the military including those in the navy, air force, and Marine Corps. The goal of this educational service is to teach those with physical disabilities how to adapt to life as a member of the armed forces. Those accepted into such a financial education program can look forward to an education that will prepare them for careers as financial managers, information technology specialists, and budget analysts. This type of education can be very beneficial to the thousands of military personnel who are currently seeking advancement in their careers and those on the fringes of the service who are looking for a more flexible career.

1 note

·

View note

Text

Improve your credit score in Chula Vista, CA