#Lordstown Motors

Text

#mo#moto#motor#motorbike#motorcycle#motorhome#motorious#motoriousTV#motorcars#dude where’s my car?#1. cuci bersih dan keringkan permukaan plastik & trim motor mobil#motorcity#motor vehicle accident attorneys#dc motors#lordstown motors corp#kia motors#electric motors#tata motors#motors#w motors#tesla motors#auto motor und sport#I am motorious#are you motorious?#i am mclovin#motorious concierge#motorious motors#motorious motorsports#motorious.eu#motorious.nyc

1 note

·

View note

Photo

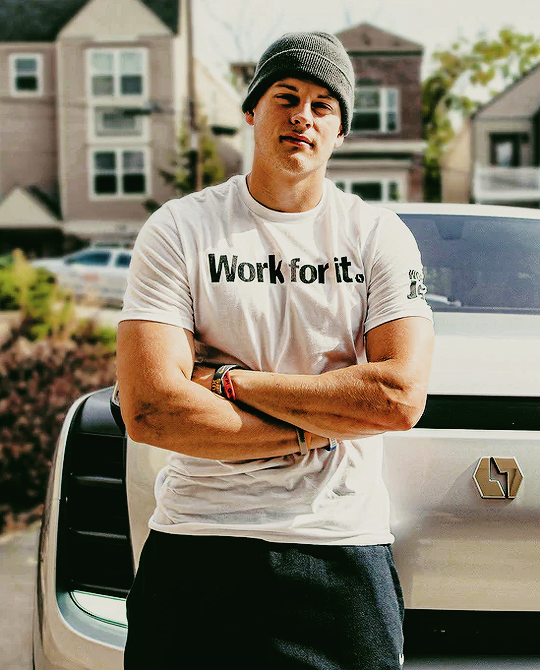

JOE BURROW

[20221124] Joe Burrow Answers your Fleet of Questions | Lordstown Motors

562 notes

·

View notes

Text

JOE BURROW for LORDSTOWN MOTORS

February 27, 2022

152 notes

·

View notes

Photo

On this day, 4 March 1972, thousands of autoworkers in the Lordstown General Motors plant walked out on strike over numerous grievances. The walkout occurred amidst a widespread unofficial campaign of sabotage and absenteeism. For example, to slow down the inhumanly fast production line, workers would often just fail to perform their designated task. The plant manager told the Cleveland Plain Dealer: "we've had cases of engine blocks passing 40 men without them doing their work." Other workers slashed upholstery, scratched paint and bent metal parts. Management responded by disciplining and suspending 1,200 workers and laying off nearly 700. Staying solid for 22 days, concessions were won, including cancellation of most of the layoffs and disciplinaries. The United Auto Workers union declared a complete victory despite management not conceding on speed-up and workloads which were the main problem for workers. One worker's subsequent complaint outlined the feelings of the rank and file: "Before the strike the union local was in favour of not working faster than you could. Now people are afraid not to work. The union and the Company say everything's settled." The dispute was a lesson to some radical workers that it showed the importance of strikers themselves running disputes rather than leaving it to union leaderships. More: https://stories.workingclasshistory.com/article/10455/lordstown-gm-plant-strike https://www.facebook.com/workingclasshistory/photos/a.294735704044920/2223170111201460/?type=3

92 notes

·

View notes

Text

Joe speaks to Lordstown Motors about his nicknames.

My fav one is the classic Joe Shiesty, what about you guys?

160 notes

·

View notes

Text

The Feds Have Been Suspicious of Lordstown Motors for Weeks

10 notes

·

View notes

Text

Anchor Motor Freight Chevy C90 haulaway rig with lift centre axle and 43-foot Bankhead auto rack. The Vega cargo this one is carrying at Lordstown, Ohio , one of some 1,500 contracted to General Motors in the early 1970s and carrying new new Vegas at Lordstown, Ohio

Image by Dick Copello via hemmings.com

2 notes

·

View notes

Note

As a person on the spectrum as well, you handled that question so well. I've also wondered about Joe Burrow being neurodivergent, I saw it the most when he was saying hi to people on the opposing team during the super bowl and in the interviews with Lordstown Motors when he was talking about tiger king and even in some of the LSU interviews he had like when he was talking cartoons all happily and got asked what cartoon character he was most like and he said squidward and his demeanor changed immediately right after. It's little things like that where people might wonder if he is.

Thank you. This is so interesting, thank you for sharing and showing insight on why people might say this about him.

14 notes

·

View notes

Link

0 notes

Link

Steve Burns, the ousted founder, chairman and CEO of bankrupt EV startup Lordstown Motors, has settled with the U.S. Securities and Exchange Commission over misleading investors about demand for the company’s flagship all-electric Endurance pickup truck. Burns was ordered to pay a civil fine of $175,000 and cannot serve as an officer or director of […] © 2024 TechCrunch. All rights reserved. For personal use only.

0 notes

Text

What are the popular vehicles and services that begin trading below IPO prices?

Trading below their initial public offering (IPO) prices is not uncommon for vehicles and services, particularly in the volatile and competitive market of transportation and technology. Several factors, such as market conditions, investor sentiment, and company performance, can contribute to a stock trading below its IPO price. Here are some popular vehicles and services that have experienced this phenomenon and Crypto News

Ride-Hailing Services: Ride-hailing companies like Uber and Lyft have faced challenges in the public market, with their stocks trading below their IPO prices at various points since going public. Both companies experienced high levels of investor scrutiny due to concerns about profitability, regulatory issues, and competition from other transportation services and technologies and Big Data

Electric Vehicle (EV) Manufacturers: Electric vehicle manufacturers have garnered significant attention in recent years, but some have struggled to maintain their IPO prices in the public market. Companies like Nikola Corporation and Lordstown Motors have faced skepticism from investors and analysts, leading to their stocks trading below their IPO prices amid concerns about production delays, management changes, and regulatory scrutiny.

Food Delivery Services: Food delivery services have become increasingly popular, especially during the COVID-19 pandemic, but some companies in this space have faced challenges in the public market. DoorDash, for example, saw its stock drop below its IPO price shortly after going public, as investors questioned its valuation and long-term profitability in a competitive and low-margin industry.

Shared Mobility Companies: Shared mobility companies, which offer services like bike-sharing and scooter-sharing, have faced difficulties in maintaining their IPO prices amid regulatory challenges and concerns about profitability. Companies like Lime and Bird have seen their stock prices decline below their IPO prices, reflecting investor skepticism about their business models and growth prospects.

Tech Startups: Tech startups often face pressure to deliver strong financial results and demonstrate sustainable growth after going public. Some companies in sectors like autonomous vehicles, artificial intelligence, and augmented reality have struggled to meet these expectations, leading to their stocks trading below their IPO prices as investors reassess their future potential and market positioning.

Travel and Hospitality Services: Travel and hospitality services have been heavily impacted by the COVID-19 pandemic, leading to volatility in the public market for companies in this sector. Online travel agencies, hotel chains, and vacation rental platforms have seen their stocks fluctuate below their IPO prices as investors weigh the long-term effects of the pandemic on travel demand and consumer behavior.

Subscription-Based Services: Subscription-based services in industries such as entertainment, fitness, and software have also experienced fluctuations in their stock prices relative to their IPO prices. Companies like Peloton, Spotify, and Zoom have faced challenges in sustaining investor interest and confidence amid changing market conditions and competitive pressures.

Healthcare Technology Companies: Healthcare technology companies developing innovative solutions for diagnostics, telemedicine, and digital health have attracted investor attention, but some have struggled to maintain their IPO prices in the public market. Companies like Clover Health and Babylon Health have faced scrutiny over their business models and growth prospects, leading to their stocks trading below their IPO prices.

Real Estate Technology (PropTech) Companies: Real estate technology companies offering services such as online property listings, virtual tours, and property management software have experienced mixed results in the public market. While some companies have seen their stocks perform well post-IPO, others have faced challenges in maintaining their IPO prices amid concerns about market saturation and competitive dynamics.

Cryptocurrency and Blockchain Companies: Cryptocurrency and blockchain companies have attracted significant investor interest in recent years, but many have experienced volatility in their stock prices relative to their IPO prices. Companies in this space, including cryptocurrency exchanges, blockchain technology providers, and digital asset management firms, have faced regulatory uncertainty and market speculation, leading to fluctuations in their stock prices.

In conclusion, trading below IPO prices is a common occurrence for vehicles and services in various industries, driven by factors such as market dynamics, investor sentiment, and company performance. While some companies may eventually recover and thrive in the public market, others may continue to face challenges in meeting investor expectations and achieving sustainable growth. Investors should carefully evaluate the fundamentals and prospects of companies trading below their IPO prices before making investment decisions and Stock Prices and News

Read more Blogs:

Record Outflows for Grayscale Bitcoin ETF as BTC Dips

DeepMind Co-Founder Joins Microsoft AI Team

Groups Seek SEC Clarity on Crypto Amid Coinbase Case

0 notes

Text

Lordstown Motors to pay $25M in SEC settlement over misleading investor claims

http://securitytc.com/T3Tl0H

0 notes

Text

The Unadvertised Details Into Gold Bars For Sale That Most Individuals Don't Know about

Silver and gold mining stock costs are inclined to rise sooner than the actual spot worth of silver and gold when the prices are rising. Fashionable gold bullion coins include the American Gold Eagle, Canadian Maple Leaf, South African Krugerrand, and Chinese Panda. As soon as economies may count on important annual development, although, a nation’s productive capability rapidly started to outstrip its supply of treasured metals, and due to this fact its cash supply. When investing in precious metals, safeguarding your valuables is a crucial factor. That's because it has extra industrial makes use of, and when the economic system expands and contracts, so does the demand, says Doug Eberhardt, writer of Buy Gold and Silver Safely. Shares of electric automobile (EV) stocks Nio (NYSE: NIO), Lucid Group (NASDAQ: LCID), and Lordstown Motors (NASDAQ: Ride) fell on Wednesday, down 5.1%, 3.6%, and 4.9%, respectively, as of 2:17 p.m. Two of the most prominent mortgage actual property investment trusts (REITs), Annaly Capital Management (NYSE: NLY) and AGNC Funding (NASDAQ: AGNC), have been down sharply throughout buying and selling on Wednesday.

Annaly Capital was down as a lot as 9% on the day at round noon ET, while AGNC fell as far as 9.7% on the day at around the identical time. As each Annaly Capital and AGNC Investment are mortgage REITs, they have been each negatively affected by the latest information from the housing trade. If you'd like the safety that an enormous reputation can carry, and you’re hoping to set your self up with an funding opportunity, then Harrods Financial institution may be simply what you need. Everyone needs to own their very own gold bars and coins. While best place to buy bullion online are obscured in the underside image, we're instructed they are often seen clearly from different viewing factors. 20 years. The S&P 500 alone has climbed from round 1,000 factors within the early 2000s to highs over 4,600 in 2022. Gold costs have skilled a similarly rapid growth. This metal does not tarnish or put on out the best way that most metals, similar to silver, do; a gold brick from 1,000 years ago may be dusty, however it is going to be just as luminous because the day it was minted. They give you the prospect to purchase virtual gold or silver, which is backed by real bullion, with over 34 tons of gold allotted for buyer purchases.

World recognised gold refiner, Metalor now produce their large gold bar with a QR code, allowing the purchaser to scan the bar with a smart phone to take the customer to an internet web page to indicate the bar’s product particulars to show the bar is real. The fact that it's important to take delivery of your order, with no storage options and no method to instantly purchase or promote, means that your margins are all the time a little bit smaller and your input is at all times a bit better. The final massive run-up occurred through the latest Great Recession and the monetary crisis of 2008. That 12 months, credit froze, the Dow Jones industrial average misplaced 778 factors in a single day, and Wall Street icons Bear Stearns and Lehman Brothers collapsed whereas the nation nervously waited to find out who was subsequent. Silver and gold ETFs do not track the performance of single corporations. If the enterprise has had a protracted track file of being available in the market, they are more likely to have several prospects who've posted reviews online.

0 notes

Photo

Lordstown Motors founder launches new EV startup with trucks we've seen before

0 notes

Text

0 notes

Text

The Road Not Taken | The New Republic

https://newrepublic.com/article/154129/general-motors-plant-closed-lordstown-ohio-road-not-taken?fbclid=IwAR3U8d-FFRksBuOVnPhDs0MGQtxmgWB0yy8ESFQcCgRU2eI1XvdkGezyd4k

View On WordPress

0 notes