#MCLR

Explore tagged Tumblr posts

Text

RLLR vs MCLR: Which One Impacts Your Loan More?

Understanding how your loan interest rate is calculated can save you thousands over the loan period. If you're confused between RLLR (Repo Linked Lending Rate) and MCLR (Marginal Cost of Funds-Based Lending Rate), this blog by Kogta Financial explains everything in simple terms.

Know the full form, meaning, and impact of each rate before applying for your next loan.

Read now: https://kogta.in/blog/rllr-vs-mclr-full-form-meaning-and-key-differences/

0 notes

Text

another redraw of my old bloodborne fanart euuuiigh. been wanting to do this since i actually solidified my laurence design Q-Q

#i will continue to forget to post after this yes thank you#this one goes out to maria imagine walking in on this stupid shit#my art#bloodborne#micolash host of the nightmare#micolash#laurence the first vicar#laurence bloodborne#micolaur#micolaurence#t4t mclr u will be with me forever in mmy heart. <33#lady maria of the astral clocktower#<--- technically. she makes a cameo.

24 notes

·

View notes

Text

shouldn't have stayed up for this fuck ass shit

7 notes

·

View notes

Text

2 notes

·

View notes

Text

pr cvd t cld mk rm f frshmn lgh wth vd f grffn mclr sn tdd hwrd rptdl. nw y gtt kll smn. Y hv t kll smn.

pre covid you could make a room of freshmen laugh with a video of griffin mcelroy sayin todd howard repeatedly. now you gotta kill someone. You have to kill someone.

62K notes

·

View notes

Text

Major Cheer For SBI Loan Borrowers, Bank Cuts Lending Rates --Check SBI Loan Rate June 2025 | Personal Finance News

New Delhi: In a major relief for borrowers, the State Bank of India (SBI) has slashed loan EMIs linked to benchmarks like the External Benchmark Rate (EBR), External Benchmark Lending Rate (EBLR), and Repo Linked Lending Rate (RLLR) by 50 basis points. The new rates are effective from June 15. SBI MCLR June 2025 SBI’s Marginal Cost of Funds Based Lending Rate (MCLR) though remains unchanged. The…

0 notes

Text

How Investment Banks Are Structuring Deals in a High Inflation Environment

In recent years, global economies have witnessed a resurgence of inflation, fueled by pandemic aftershocks, geopolitical instability, disrupted supply chains, and shifting monetary policies. For investment banks, high inflation isn’t just an economic metric—it's a strategic challenge that redefines how deals are structured, priced, and closed.

From mergers and acquisitions (M&A) to leveraged buyouts (LBOs), every financial deal must now account for elevated interest rates, tighter liquidity, and unpredictable market sentiment. As the landscape shifts, so do the rules of the game.

If you're aiming to navigate this evolving terrain, enrolling in a forward-thinking investment banking course in Delhi that covers inflation-sensitive deal strategies could be your smartest career move.

Understanding the Impact of High Inflation on Deal Structuring

Before diving into the "how," it's essential to understand the "why."

High inflation impacts investment banking activities in multiple ways:

Increased borrowing costs: Central banks raise interest rates to curb inflation, making debt more expensive.

Valuation volatility: Higher inflation reduces future cash flow value, impacting valuation models.

Investor uncertainty: Risk aversion rises, affecting capital markets and deal appetite.

Cost unpredictability: Input and operational costs for companies become harder to forecast, complicating due diligence.

In such an environment, traditional deal-making playbooks must be reimagined.

Key Strategies Investment Banks Are Using to Navigate Inflation

1. Incorporating Inflation Hedges in Deal Structures

Banks are advising clients to build inflation-linked pricing mechanisms and performance metrics into deals.

Example: Earn-out agreements in M&A deals are being linked to revenue growth adjusted for inflation.

Benefit: Protects acquirers from overpaying if inflation erodes real earnings post-acquisition.

2. Stress Testing and Scenario Planning

Financial modeling now includes multiple inflation scenarios, particularly in long-term deals.

Investment banks are running downside cases with higher-than-expected inflation to understand potential risks to EBITDA, IRR, and debt service coverage.

This approach is critical in LBO transactions, where debt repayment timelines are highly sensitive to macro variables.

3. Focus on Defensive and Inflation-Resistant Sectors

In volatile inflationary periods, banks steer clients toward recession-resistant sectors such as:

Consumer staples

Healthcare

Utilities

Renewable energy

These sectors have historically retained pricing power, helping investors preserve returns.

4. Floating-Rate Financing Structures

Rather than fixed-rate debt, investment bankers are recommending floating-rate instruments tied to benchmarks like SOFR or MCLR, especially for short-term financing.

These structures give flexibility to borrowers and lenders in a rising rate environment.

In India, many infrastructure and real estate deals now feature variable interest rates to manage inflationary risk.

5. Revised Discount Rates in Valuations

In high inflation environments, investment bankers adjust discount rates upward in DCF models to reflect the higher cost of capital.

A higher Weighted Average Cost of Capital (WACC) leads to lower present value of future cash flows, making valuations more conservative.

This tactic aligns seller expectations with market realities, avoiding overpriced deals.

6. Repricing & Renegotiation Clauses

Given inflation-related uncertainty, many deals now include repricing or renegotiation triggers.

These clauses allow deal terms to be adjusted if inflation exceeds a predefined threshold.

Especially popular in cross-border M&A deals, where currency depreciation compounds inflation risks.

Case Study: India’s M&A Landscape During Inflation

India, like many emerging economies, has seen inflation fluctuate between 5% to 7% post-2022. Despite this, M&A activity continues to rise, especially in sectors like fintech, logistics, and green energy.

Indian investment banks are leading deals that:

Hedge FX risk and inflation simultaneously in outbound transactions.

Use structured products (like convertible debentures) to delay valuation decisions.

Favor minority investments with step-up rights rather than full acquisitions to reduce inflation exposure.

This adaptability reflects a key insight: It’s not about avoiding inflation—it’s about structuring around it.

How This Affects Careers in Investment Banking

Today’s investment bankers must be economically aware, technically sharp, and creatively strategic. Traditional financial modeling isn’t enough—you must understand:

Interest rate policy impacts on debt structuring

How to price risk in volatile environments

Macroeconomic data interpretation and forecasting

Alternative financing structures (convertibles, mezzanine debt, etc.)

An investment banking course in Delhi that includes real-world case studies, inflation-focused modules, and live market simulations is crucial for preparing professionals for the new normal.

Why Choose an Investment Banking Course in Delhi?

Delhi is not just India’s political capital—it’s a rising financial and education hub with growing access to global markets, top firms, and fintech ecosystems. Here’s why an investment banking course in Delhi is a smart choice:

Macro-Micro Integration: Learn how central bank policies translate into deal-making realities.

Instructor Expertise: Courses often feature investment bankers, economists, and analysts who’ve navigated inflationary cycles.

Real-Time Case Studies: Indian and global examples relevant to the current inflationary environment.

Fintech & Data Exposure: Use Bloomberg terminals, Excel VBA, and Power BI for inflation-adjusted modeling.

Networking Access: Connect with alumni, recruiters, and financial institutions based in Delhi-NCR.

For instance, the Boston Institute of Analytics offers an industry-aligned investment banking course in Delhi that focuses on deal structuring, macroeconomics, and valuation in uncertain economic conditions. With hands-on modules and placement assistance, it’s ideal for those ready to excel in today's challenging financial landscape.

Final Thoughts

High inflation is not a hurdle—it’s a catalyst for innovation in deal structuring. Investment banks are leveraging financial engineering, hedging strategies, and sector insights to not just survive, but thrive.

For finance professionals and students, the message is clear: equip yourself with the right knowledge and tools to participate in this new age of strategic deal-making.

And where better to start than with a leading investment banking course in Delhi that teaches you not just to crunch numbers—but to understand the story the numbers tell in an inflation-driven world?

0 notes

Text

SBI trims FD rates by 10bps after RBI cut

MUMBAI: State Bank of India (SBI), the country’s largest lender, has cut its deposit rates following a 25 basis-point reduction in the Reserve Bank of India’s benchmark rate last week. Lending rates linked to the marginal cost of funds-based lending rate (MCLR), however, remain unchanged, as the bank’s cost of funds has yet to decline meaningfully.The bank has reduced its external benchmark…

0 notes

Text

#interest rate on used car loan#used car loan rate#second hand car loan interest rate#best interest rate for used car loan

0 notes

Text

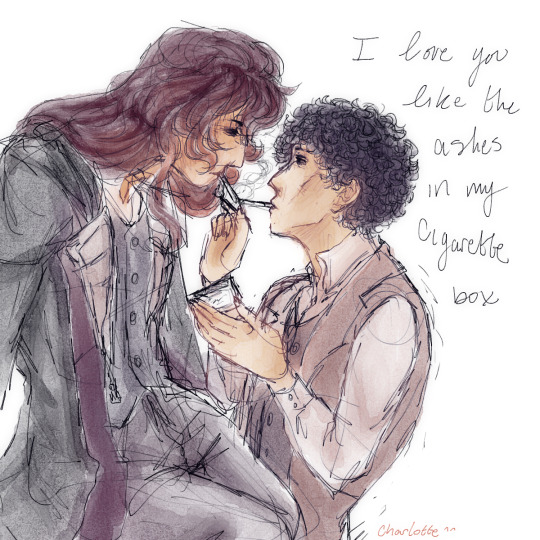

figuring out my new drawing program with micolaurence

#my art#laurence the first vicar#micolash host of the nightmare#micolaur#micolaurence#the lyrics are from one of the songs in my mclr playlist#no real connection to the drawing i just wanted 2 fill empty space and those were the most fitting i cld find i thiiiink#style subject to change esp rendering style bcuz im still working things out w this new program theres a lot more freedom#To Me at least#i hate drawing micolash's hair btw i might change how i do it i might not

56 notes

·

View notes

Text

Vidyalakshmi Portal - Education Loan & Application Process

1 note

·

View note

Text

SBI trims FD rates by 10bps after RBI cut

MUMBAI: State Bank of India (SBI), the country’s largest lender, has cut its deposit rates following a 25 basis-point reduction in the Reserve Bank of India’s benchmark rate last week. Lending rates linked to the marginal cost of funds-based lending rate (MCLR), however, remain unchanged, as the bank’s cost of funds has yet to decline meaningfully.The bank has reduced its external benchmark…

0 notes

Text

youtube

RBI Cuts Repo Rate! Will Loan EMIs Reduce? 🔥 Home & Personal Loan Interest Rate Explained! The Reserve Bank of India (RBI) has cut the repo rate by 25 basis points to 6.25%—the first rate cut in nearly 5 years! But what does this mean for home loans, personal loans, and car loans? Will EMIs reduce for existing borrowers? Watch Now: https://www.youtube.com/watch?v=YYSd6kw_Jyc 💰 In this video, we break down: ✔️ How the repo rate impacts loan interest rates ✔️ The difference between floating rate and fixed rate loans ✔️ When banks will pass the benefits to borrowers ✔️ Expert insights on MCLR-based lending rates ✔️ The best time to take a new personal or home loan 📊 Watch till the end to know if your EMIs will get cheaper! 🔔 Subscribe for more finance & loan updates! 👍 Like, Share, & Comment on your thoughts below!

0 notes

Text

Bank Loan: Availing Loan From HDFC Bank Becomes Cheaper

Bank Loan: Availing Loan From HDFC Bank Becomes Cheaper Bank Loan: HDFC Bank has announced a cut in interest rates. Based on the information given by the bank, the bank has reduced its MCLR by up to 5 basis points (BPS) on selected periods. After this cut, HDFC Bank’s MCLR now ranges from 9.15% to 9.45%. The new rates have come into effect from today i.e. January 7, 2025. The reduction in MCLR…

0 notes

Text

Fixed vs. Floating Housing Loan Interest Rates: Which One Should You Choose?

Choosing a housing loan is one of the most significant financial decisions you will make, especially for first-time homeowners in India. One of the crucial factors that can influence your financial journey is the type of housing loan interest rate you choose. The two primary options are fixed and floating interest rates. Each comes with its own set of advantages and disadvantages, making it essential to weigh your options carefully. In this blog, we’ll dive deep into fixed vs. floating housing loan interest rates to help you make an informed decision.

Understanding Fixed Interest Rates

A fixed interest rate remains constant throughout the loan tenure. This means that your monthly EMI (Equated Monthly Installment) will not change, regardless of market fluctuations.

Pros of Fixed Interest Rates

Predictability: With a fixed interest rate, budgeting becomes simpler. You know exactly how much you need to pay each month, making it easier to manage your finances.

Protection from Market Fluctuations: If interest rates rise in the future, you are shielded from increased costs. This can be particularly beneficial in a volatile economic environment.

Ideal for Long-term Loans: For long-term loans, fixed rates can offer stability and peace of mind, especially for first-time homeowners loan who may be cautious about fluctuating expenses.

Cons of Fixed Interest Rates

Higher Initial Rates: Fixed interest rates are often higher than floating rates at the outset. This can lead to larger EMIs initially.

Less Flexibility: If interest rates fall after you’ve locked in your rate, you won’t benefit from the reduced payments. You could miss out on potential savings.

Prepayment Penalties: Many lenders impose penalties for prepaying a fixed-rate loan, limiting your options if your financial situation changes.

Understanding Floating Interest Rates

Floating interest rates, on the other hand, are tied to market rates, usually linked to an index such as the MCLR (Marginal Cost of Funds based Lending Rate) or the Repo Rate. As these rates fluctuate, so do your EMIs.

Pros of Floating Interest Rates

Lower Initial Rates: Floating rates typically start lower than fixed rates, meaning lower initial EMIs and more affordability for first-time homeowners.

Potential Savings: If interest rates decrease, your EMIs will reduce, providing significant savings over time.

Flexibility in Prepayment: Floating loans usually come with fewer restrictions on prepayments, allowing you to pay off the loan more easily without hefty penalties.

Cons of Floating Interest Rates

Uncertainty: The biggest drawback is the unpredictability. Your EMIs can increase if market rates rise, leading to budget strain.

Budgeting Challenges: Since the EMI can change, planning your monthly expenses becomes more complicated.

Long-term Costs: Over a long tenure, if rates rise significantly, you may end up paying more in interest compared to a fixed-rate loan.

Which One Should You Choose?

Choosing between fixed and floating interest rates depends largely on your financial situation and personal preferences. Here are some factors to consider:

Financial Stability: If you have a steady income and prefer predictability, a fixed rate might be more suitable. Conversely, if you can manage fluctuations and prefer initial lower payments, a floating rate could be a better option.

Loan Tenure: For long-term loans, many borrowers lean towards fixed rates for stability. However, if you're looking at a shorter tenure, a floating rate might yield more savings.

Market Trends: Keep an eye on the economic landscape. If interest rates are expected to rise, locking in a fixed rate could save you money in the long run.

Personal Risk Appetite: Consider how comfortable you are with risk. If you prefer stability, go for fixed. If you’re okay with some uncertainty for potential savings, floating might work for you.

Making the Right Choice

Ultimately, your choice between fixed and floating housing loan interest rates should align with your financial goals and risk tolerance. For first-time home buyers, understanding these nuances can help you make a more informed decision that fits your needs.

How Loan Bazaar Financial Services Can Help

At Loan Bazaar Financial Services, we understand that selecting the right housing loan can be overwhelming, especially for first-time homeowners. Our expert team is here to guide you through the entire process, helping you understand the different types of housing loan interest rates available. We offer personalized services to match your unique financial situation and preferences.

If you’re unsure about whether a fixed or floating rate is right for you, Contact Us Today for expert advice tailored to your needs.

Conclusion

In the end, both fixed and floating housing loan interest rates have their merits and challenges. The right choice depends on your financial situation, risk tolerance, and future market predictions. Whether you opt for the security of a fixed rate or the flexibility of a floating rate, understanding your options is key to making a smart financial decision.

At Loan Bazaar Financial Services, we are committed to helping you navigate the complexities of housing loans. With our expertise, you can confidently choose the best financing option for your dream home. Don’t hesitate to reach out and Get Started Now on your journey toward homeownership!

0 notes

Text

The Bank of India (BOI) offers education loan refinancing at competitive interest rates that enable students to transfer their existing education loans for more favourable terms. Bank of Indian refinance interest rates are linked to the bank's MCLR, and students can benefit from lower rates and flexible repayment options. BOI allows refinancing for loans taken from other banks or financial institutions, helping students reduce their overall loan costs. The refinancing process includes an evaluation of the borrower's financial profile and the terms of the current loan. It's a useful option for students looking to ease their repayment burden.

0 notes