#MeridianLink

Explore tagged Tumblr posts

Text

MeridianLink confirms cyberattack after ransomware gang claims to report company to SEC

Financial software company MeridianLink confirmed that it is dealing with a cyberattack after the hackers behind the incident took extraordinary measures to pressure the company into paying a ransom. MeridianLink, which reported more than $76 million in revenue last quarter, provides tools to banks, credit unions, mortgage lenders and consumer reporting agencies in the United States. This week,…

View On WordPress

0 notes

Text

Crooks call cops because victim did not report crooking quickly enough. Crooks cite law that has not yet taken effect. It starts 12/15/23. Victim says, I dunno, don't seem to be missing anything.

0 notes

Quote

「Alphv」あるいは「BlackCat」という名前で知られるランサムウェアグループが、金融機関・消費者向けのデータ企業であるMeridianLinkの顧客データと運用情報を盗み出し、身代金を要求しました。さらに、MeridianLinkがランサムウェアにデータを乗っ取られた事実を公表しなかったとして、アメリカ証券取引委員会(SEC)に苦情を申し立てました。 Ransomware Group Files SEC Complaint Over Victim's Failure to Disclose Data Breach - SecurityWeek https://www.securityweek.com/ransomware-group-files-sec-complaint-over-victims-failure-to-disclose-data-breach/

企業のデータを盗んだサイバー犯罪集団が被害企業を「データの盗難を公表しなかった」と証券取引委員会に告発 - GIGAZINE

4 notes

·

View notes

Text

Leverage superior analytics and insights with minimal investment to improve mortgage decisions

As per a Forbes survey, 55% of respondents from mortgage companies believe that adopting AI in operations can reduce mortgage origination costs by 26%. In mortgages, where document processing errors can lead to incorrect credit decisions, it is vital to be 100% right the first time. A loan package generally, consists of hundreds of pages with a mix of structured and unstructured data and vastly varies in region and demographics. With precise document classification, lenders can quickly close the loop with customers to validate missing documents. Accurate indexing and data extraction into perfectly synchronized fields can provide a better impetus for underwriting specialists who will have more time to do their core, high-value jobs. DocVu.AI, an Intelligent Document Processing (IDP) solution goes beyond accurate data extraction — it leverages rules and workflow engines to make more data available into customized workflows for better and faster decisions.

As per Business Insider, AI has helped Bank of America to automate the mortgage lending process to the point where a customer now has to fill in just 10 fields on a mortgage application, down from 330. That’s helped boost mortgage originations by 6% in the first three quarters of 2019 and trimmed the closing process to 20 days.

Today, AI-powered automation can take care of repetitive tasks and, importantly, perform more cognitive tasks. Document classification has exceeded human perception (more than 99.5 %), and data extraction is approximating human accuracy of 99.5%. This is primarily due to the expansion of machine learning neural networks — algorithms designed to mimic how the human brain processes information. We are largely familiar with neural networks as they are used in facial recognition, virtual assistants like Alexa and Siri, and self-driving cars. They have many other use cases, one of which is recognizing information in mortgage documents. The technology has evolved to identify information even if it is organized in different ways or has a different syntax.

How DocVu.AI reduces technology transformation risks and provides mortgage lenders what they want –

DocVu.AI on cloud-

While AI advancement is the primary driver of improvements, they are fueled by a substantial increase in cloud technology’s computing power. Businesses can utilize DocVu.AI’s hosting on the cloud to harness the power of AI with minimal effort and technical capability, so they can put the technology to work for them faster. This also makes them more flexible to scale up or down as per mortgage volumes.

DocVu.AI operates on a zero investment and a pay-as-per-use model -

With a turnaround time of 2–4 weeks and a ‘zero’ investment model, it becomes extremely useful for lenders looking to take benefit of the advanced technologies in document processing without utilizing too much time capital for a technology upgrade. Moreover, a transformation should complement your technology landscape without creating more problems. DocVu.AI offers a ‘best-in-class’ suite of APIs to connect to the vast lending ecosystem, including legacy systems. It also has ready integrations with leading origination systems such as Encompass, MeridianLink Mortgage (formerly called LendingQB), Mortgage Director, Openclose, and more. So, to put things into perspective, you can quickly transform your loan operations without any costs — DocVu.AI team provides you with the latest AI/ML technologies with deep mortgage expertise, customizes rules and workflows, and hosts the system on the cloud.

The mortgage intelligence you need -

The solution uses noise reduction technology to eliminate noise and extract the required information. Noise in document imaging is degradation in image quality due to external factors such as multi-photocopying of the images, problems in image capturing, or degradation of documents over a period of time. DocVu.AI uses deep learning to train its AI models to learn from millions of images and accurately distinguish between real image detail and noise.

Variation in templates used to mean that the system had to be re-configured each time whenever there was a change in the template. DocVu.AI identifies multiple document types in a multi-page document and automatically splits it into single pages along with classification. It recognizes the data labels with its pre-trained AI/ML models and captures the corresponding data and can be used readily to process unstructured or semi-structured data.

False positives (extracted data which is not true) can be absolutely detrimental. With exception handling-based workflows, DocVu.AI ensures that the data is always true.

DocVu.AI is a specialized solution with over 3 decades of mortgage expertise and has a pre-configured mortgage library for over 2000 fields across 2000+ mortgage documents. DocVu.AI with its pre-trained AI/ML and NLP models provide guaranteed data extraction accuracy of over 99.5% to mortgage lenders.

Reach out to us at [email protected] to embrace automation with minimal costs.

0 notes

Text

3Rivers Federal Credit Union Taps MeridianLink to Enhance Member Experiences and Offer Frictionless Digital Lending and Account Opening http://dlvr.it/T8Xkyy

0 notes

Text

2. MeridianLink Inc Struggles with Financial Performance Amidst Software and Programming Sector Growth $MLNK #NYSE

company delivered first quarter of 2024 operating income of $3.352 millionMeridianLink Inc (NYSE: MLNK) has been facing some significant challenges in the recent financial period, with a loss of $-0.07 per share compared to the same period a year prior. While the company did show some improvement in earnings per share from the previous quarter, the overall financial performance leaves much to be desired. The revenue growth for MeridianLink was soft, with only a 0.788% increase to $77.74 million from the same quarter a year a

0 notes

Text

MeridianLink breach delivers the funniest moment cyberspace has ever seen

http://i.securitythinkingcap.com/Sz6sHs

0 notes

Text

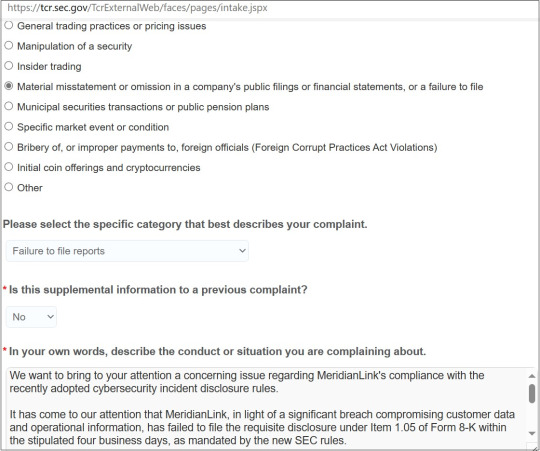

"The ransomware group known as Alphv and BlackCat claims to have breached the systems of MeridianLink, a California-based company that provides digital lending solutions for financial institutions and data verification solutions for consumers.

The cybercriminals claim to have stolen a significant amount of customer data and operational information belonging to MeridianLink, and they are threatening to leak it unless a ransom is paid.

In an apparent effort to increase its chances of getting paid, the malicious hackers claim to have filed a complaint with the SEC against MeridianLink, accusing the company of failing to disclose the breach within four business days, as required by rules announced by the agency in July."

0 notes

Text

How Integrated Digital Marketing Can Reduce Attrition at Banks

How Integrated Digital Marketing Can Reduce Attrition at Banks

How Integrated Digital Marketing Can Reduce Discomfort in Banks Case Study: Data-Driven, Personalized Marketing Increases ROI by 511% Learn how MeridianLink helped a credit union take on more loans and deliver a stronger member experience through a targeted prescreened lending campaign. Download now Improve member experience by creating a segment-of-one. how to learn (Sponsored…

View On WordPress

0 notes

Text

BlackCat Ransomware Gang Files SEC Complaint Over Victim’s Undisclosed Breach

MeridianLink, a publicly traded software company, is facing pressure from the ransomware group after allegedly not responding to their ransom demands and failing to disclose the breach.

View On WordPress

0 notes

Quote

ALPHV/BlackCat として知られるランサムウェアグループが攻撃を実行した企業について、重大なサイバーセキュリティインシデント発生時の開示義務を怠っていると米証券取引委員会 (SEC) に報告したそうだ (DataBreaches.net の記事、 Ghacks の記事)。 ALPHV によれば 11 月 7 日、金融機関向けにデジタルレンディングプラットフォームを提供する MeridianLink を攻撃し、ファイルの暗号化は行わずにファイルを盗み出したという。ALPHV は MeridianLink がそ��日のうちに攻撃を察知してパッチを当てたと主張している。ALPHV が 15 日までに行った SEC への報告では、重大なサイバーセキュリティインシデント発生後 4 営業日以内に義務付けられている Form 8-K での報告を MeridianLink が行わなかったと主張しているとのこと。 一方、MeridianLink では投資家向けページで 15 日に発表した第 1 報でサイバーセキュリティインシデント発生を報告し、本番環境のプラットフォームへの不正アクセスはなく、業務への影響は最低限だったと説明した。20 日の第 2 報では非特権ユーザーアカウントへの不適切なアクセスを 10 日に確認したこと、攻撃者は同社のネットワークやサーバーなどにはアクセスしておらず、ランサムウェアやマルウェアの侵入もないことなどを追記している。 両者の主張するサイバーセキュリティインシデント判明日は異なっており、MeridianLink の主張する 11 月 10 日であれば、15 日が 4 営業日目となる。ただし、SEC の Form 8-K による報告義務付けルールが発効するのは 12 月 18 日であり、現時点で報告は義務付けられていない。ALPHV が DataBreaches.net に提供した SEC の応答も自動返信によるものであり、ルール違反が確認されたわけではないようだ。

ランサムウェアグループ、米証券取引委員会にサイバー攻撃を報告 | スラド セキュリティ

1 note

·

View note

Text

Leverage the right API framework for seamless flow of data across banking systems

Working in ‘silos’ is by far not a good thing in today’s times. In fact, as we are headed towards an open banking scenario in the coming years, it is important that the financial institutions first get themselves ready for a more synchronized flow of data between their internal systems. Enormous data gets generated through document processing processes and the financial institutions will be responsible to ensure that they provide complete financial data to their customers when the open banking is implemented in full scale. The first movers as we have seen with other technologies such as ATMs, digital banking and more, will derive maximum tangible and intangible benefits through this development. The future is certainly open.

DocVu.AI, an intelligent processing solution processes structured and unstructured data to speed up loan origination and reduce closing times. The solution also digitizes Post close QC which improves quality of such audits with improved turn-around times. Our robust API framework forms an essential medium for seamless and controlled flow of data across systems. DocVu.AI offers a ‘best-in-class’ suite of APIs across the entire loan origination lifecycle for lenders to digitally connect with others in the ecosystem such as LOS, loan servicing solutions, external third party service providers such as title services, Credit rating agencies, valuation agencies and more and drive tremendous business benefits by enabling completely digital and faster services.

McKinsey estimates that APIs have the potential to unlock significant value across global banking — approximately 50 percent of revenues or 65 percent of profits over the next decade. DocVu.AI has ready integrations with leading origination systems such as Encompass, MeridianLink Mortgage (formerly called LendingQB), Mortgage Director, Openclose, and more. The perfectly interconnected mesh between the two systems creates a holistic and powerful platform for mortgage lenders to process loan applications quickly and accurately.

0 notes

Text

Meridianlink Customer Service

If you are looking for meridianlink customer service, simply check out our links below : 1. Loan & Mortgage Origination Software (LOS) Support … https://www.meridianlink.com/client-support/ Get support for MeridianLink Consumer loan origination system (LOS) and MeridianLink Mortgage digital lending software for banks, credit unions, more. 2. MeridianLink: Loan Origination Software (LOS) &…

View On WordPress

0 notes

Text

Meridianlink Inc. Surpasses Expectations with Remarkable Financial Performance in Q3 2023 https://csimarket.com/stocks/news.php?code=MLNK&date=2023-11-04151417&utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

ZestFinance to Provide AI Underwriting for MeridianLink LoansPQ Platform

ZestFinance to Provide AI Underwriting for MeridianLink LoansPQ Platform

Hundreds of Lenders Will Now Have Instant Access to Advanced AI Tools

LOS ANGELES–(BUSINESS WIRE)–ZestFinance, the leader in artificial intelligence (AI) software for credit, announced today its integration with MeridianLink®, the financial industry’s leading multichannel loan and new account origination platform. MeridianLink will be integrating Zest Automated Machine Learning (ZAML) credit…

View On WordPress

0 notes

Text

MeridianLink's LendingQB® <b>Mortgage</b> SaaS Browser-based LOS Announces Another Record ...

In the second quarter of 2020, eight new LendingQB clients signed on with MeridianLink, choosing the mortgage loan origination platform over any other ...

0 notes