#Mobile Home Repair Winnipeg

Text

Expert Home Technology Device Repair in Winnipeg - Mission Repair Centre

Mission Repair Centre offers professional home repair services for mobile phones, Computer Home Repair Winnipeg. Our experts will fix your devices in the comfort of your home. Don't let technology downtime disrupt your life. Ask about our competitive monthly maintenance contracts. Save big with a 20% discount on repairs for more than three devices. Subscribe to our newsletter for exclusive deals and weekly offers.

1 note

·

View note

Text

Choose Fast, Trusted and Affordable Locksmith Service

If you're looking for a reliable Residential Locksmith Halifax, go no further than Locksmith service. Locksmith specialist offers both routine locksmith services and 24 hour locksmith services in my area in the event of an emergency. Mobile Locksmith Halifax has been serving the area and beyond for over a decade, making them the trusted locksmith of choice for both homes and businesses.

Professional Locksmith Services in

Trustworthiness should be a top priority when selecting a locksmith firm. If you are looking for a reliable locksmith at a fair price, go no further than Locksmith service. The quick response time has made us a household name, which is crucial in times of need.

Contact best Local Locksmith Halifax if you need a reputable and reasonably priced service. Whether you require standard locksmith services or immediate assistance, they are going to be able to meet your needs.

Professional Locksmith Services in

Locksmith is a reputable business that has served the area for more than a decade. As a small, family-run business, we are proud of the excellent reputation they have earned for offering excellent service at reasonable rates. Services for businesses, homes, and cars are all part of our repertoire. We carry extensive insurance coverage and welcome your inquiries at any time. Get in touch with us today for a no-cost initial consultation.

Locksmith is the only locksmith service worthy of your trust in the area. The locksmiths we employ are among the best in the industry. Stuck out of your house or car? No problem. Broken key in the lock? We have got you covered. Our commercial locksmith services cover a wide variety of needs, from installing and repairing security systems and locks to opening and unlocking safes. Call the licensed Locksmith Winnipeg Halifax right now!

Locksmiths with experience in

Locksmith company is an all-inclusive Commercial Locksmith Halifax service based out, professional company that employs a staff of local locksmiths. Our team of professional locksmiths is proud to serve the greater area. Locksmith can take care of all your locksmithing needs.

Do not understand who to call for help when you are stuck out of your car?

You have company. People frequently experience this. It is not a big deal though, because you can just phone Locksmith service professional. Finding a reliable locksmith can be challenging if you are not familiar with the area.

When you need an Emergency Locksmith Halifax, call Locksmith service provider or you can check their website online. There you can find mobile locksmith service, so they can get to you quickly and efficiently, and our technical expertise is top-notch. If you need assistance getting back into your vehicle, they can do it swiftly and safely. Before you hire the service of a locksmith, you should check with your friends or family too. They can suggest you better for the service of a professional. When searching service through online medium, you have to check some reviews and ratings of previous customers.

1 note

·

View note

Text

commercial locksmith - Staso Locksmith Services

Is your door lock broken? Get help from a locksmith at Stasolocksmith who are highly experienced in fixing all the issues. A badly damaged door doesn’t feel safe for a home. Therefore, STASO Locksmith & Data Cabling help rescue you from this trap and sense of insecurity. We’re a team of mobile locksmiths in Winnipeg who are always a call away. You’ll be impressed by how quickly we can show up there.

We run a wide array of locksmith services from lock changes and car lockouts to the installation of master key systems. We have been dedicated to serve both homeowners as well as business owners who are looking to ensure maximum security at their office.

Getting locked out of your home, office, or car is a huge inconvenience. But, we’re here to save you from breaking down your door or smashing your car window.

Our trained Emergency Locksmith in Winnipeg will assess your situation and inform you of the services you need. With the use of quality tools, we ensure to provide exceptional care to keep your property unharmed during the necessary lockout resolution processes.

When a person feels most vulnerable and is in need of an Emergency Locksmith in Winnipeg, calling just anyone is out of the question. This is why choosing a local locksmith with great customer service and experience is a must. This is where STASO Locksmith & Data Cabling comes in.

Moreover, you can have the best commercial locksmith service in Winnipeg from STASO Locksmith & Data Cabling. We have been offering same day commercial locksmithing services ranging from lock repair to key installation, and on-site key cutting and duplication to high security locks and safe & lock.

Get honest advice from the best residential locksmith service in Winnipeg from STASO Locksmith. We have been offering fast response residential locksmith services 24/7/365. We offer free estimates, low service charges in Winnipeg, MB and a personal service at competitive prices.

From key duplication to new lock installations & lock rekeying, our team professionally fixes or replaces your home door locks.

In case you are unable to get inside your car, you can Call our emergency hotline anytime 24/7/365 for Car Lockout in Winnipeg. Our trained automotive locksmith professionals only take approximately 5 minutes to solve the problem. STASO Locksmith & Data Cabling service includes quality and care to assure that your vehicle is unharmed during the necessary processes. Our trained professionals will assure a smooth car lockout process.

So, what are you waiting for, hiring a locksmith near me made it easy.

1 note

·

View note

Text

lost car keys

Locksmiths, without a question, play a vital part in our society through the services they give. Locksmiths are the professionals that install and repair locks on your doors. They also provide a range of other services to help you stay secure and safe. When selecting a locksmith, look to see if they are capable of providing the service you want. There are many Locksmith winnipeg; all of them provide services, but the quality of the services varies. We provide the most straightforward locksmith services in Winnipeg.

Whether you want home locksmith services, commercial locksmith service, or lock change service, we have the most qualified locksmiths to assist you. Our Winnipeg Locksmith are all qualified, so you won't have to worry about the quality of their job. Despite the fact that we have only been in this industry for a short time, our perseverance and attention to the work has made us one of Winnipeg's most well-known locksmith firms. When you choose us, you can rest assured that you will receive simply the most basic of services. We normally provide what we promise, but in the unlikely event that our work does not meet your expectations, we will reimburse your money. So, if you're looking for Locksmith Near Me, we should be your top pick.

Have you had any idea if it's the middle of the night and if any locksmith would be willing to assist you or not? Then you'll be surprised to learn that our business locksmith in Winnipeg also offers mobile locksmith services. Every day is 24 hours long, every week is seven days long, and every year is three hundred and sixty-five days long. So, no matter what hour you need us, simply give us a call and we'll be there for you. If you require our services on a holiday, we are also accessible.

Have you ever locked yourself out of your house or lost car keys? Many individuals have experienced this, and they have had to wait a long time for locksmiths to arrive. If the same thing happens to you then just call us our mobile locksmith Winnipeg will be there at no time possible. Our automobile locksmiths and Winnipeg car locksmith have years of experience. Whether your key fob is broken or you want auto key replacement Winnipeg services, we can help.

Although a homeowner may be able to handle a minor lock problem themselves, serious lock-related difficulties in your house or business require the services of a locksmith. Key cutting, lock picking, vehicle opening, new ignition keys, duplicate keys for your car or home, and key replacement are just a few of the services offered by us. Our skilled locksmiths also help with security challenges that are specific to the sector. They frequently serve as security consultants for businesses and provide a wide variety of security services to the institution. That is why, for any of your lock-related issues, whether at your home, business, or automobile, you should call us.

We recognize that the safety of your family is the most essential thing in the world. And that keeping your valuables safe may save you a lot of time, effort, and aggravation. For residents all throughout Winnipeg, we provide the most dependable and cheap Locksmithing Services.

Our Social Pages:

facebook

twitter

linkedin

0 notes

Video

undefined

tumblr

KUNSHAN CARSAI AUTO PARTS INDUSTRY CO., LTD

https://www.carsai-precisionparts.com/

Whatsapp&WeChat: +8615212743691

email: [email protected]

---------------------

China professional oem sheet metal welding fabrication custom made service cheap price

welding welds,e & a welding & oilfield service inc,c-mac welding services,24/7 welding services inc,welding service regina,welding service rates,welding service annapolis,welding equipment service engineer,c welding,welding services leeds,welding service hull,h & h welding services,welding service detroit,j&r welding services,welding service home depot,3 b welding,b.r. welding & industrial services inc,welding repair services austin texas,welding service melbourne,arnold's welding service fayetteville nc,alex o'rourke welding services,service welding newark,todd's welding service kalkaska michigan,welding service bandar lampung,welding service kuala lumpur,welding services gst,welding service of,welding in a factory,welding service gastonia,j.d welding services ltd,a p welding services,welding service winnipeg,s&s welding services carrum downs,welding food service,welding service plano,j&j welding services,d & w underwater welding services,welding service company,welding spec,3 welding types,welding service job,s&h welding services ltd,welding service in dubai,welding service shop near me,welding service electrical engineering,welding service mesa,welding services meaning,what is a class 1 welder,welding service townsville,welding service greenville nc,welding service in singapore,chris welding service odessa tx,united welding service perry florida,welding in a factory,mobile welding service jacksonville fl,welding repair services near me,welding service home,j&w fabrication welding services ltd,welding service napa ca,welding service seattle,welding service dubai,l.n. mobile welding service inc,welding services naics code,welding service perth,welding service austin,welding service agreement,welding service oxnard,a & h welding services ltd redruth,d & e welding services,welding service invoice,g.b. welding services (rutland) limited,a.w.s welding services,welding service in kerrville,g.m welding services artistic ironworks ltd,welding service in las vegas nv,welding for electronics,welding service mobile,class 1 welding services,welding equipment service,welding services near me,welding service birmingham,welding service bedford,welding service malaysia,service welding mount vernon,s & h welding services chatham,s&h welding services,welding services hs code,welding services limited,welding service youngstown ohio,a&f welding services,welding service in vallejo,welding in my area,welding service kota kinabalu,c r welding services,welding services in my area,w.p.s. welding services,welding 7014,welding repair work,s&s welding services,welding service near me,welding services needed,p h welding services,a&b welding & fabrication services,welding equipment service co,o caddick welding services,welding home service karachi,d & k welding services,welding service close to me,b e welding services,welding service at home near me,welding service petaling jaya,welding service charlotte,welding service penang,d welding services,ultrasonic welding service,4 welding types,r.g welding services,j k welding services,welding service center philippines,welding service in mandaluyong,welding services inc,t & o welding services,m hall welding services ltd,welding factories,c & c welding services,welding service fremont ca,welding service galesburg il,universal welding service,d-sol welding services,welding service telford,d welding shop,welding service london,welding service funny video,c welding,welding service cost,welding service fort worth texas,welding 7005,quality welding service,e-beam welding services,welding repair work,welding service providers,welding services hsn code,portable welding service near me,welding service as,welding service yishun,m hall welding services,welding services o'connor,d&z welding services,t r t welding services,service welding and machine co,franklin welding service kingsville,welding service description,dwt welding service westminster md,welding repair,welding service online,24/7 welding services,b&b welding services,welding service body,c barnard welding services,j&s welding services,welding service rockford,welding service highway,welding service dublin,g&s welding services ltd,welding service charge,welding service pueblo colorado,k & s welding roadside service,welding service denver,welding service buda tx,a welding shop,820 welding service,d f w welding services,welding on service truck,r v fabrication welding services limited,welding service co.za,z welding,welding shop supplies,service welding mount vernon ohio,service welding newark ohio,d&k welding services inc,welding service in tallahassee,welding repair work,

0 notes

Text

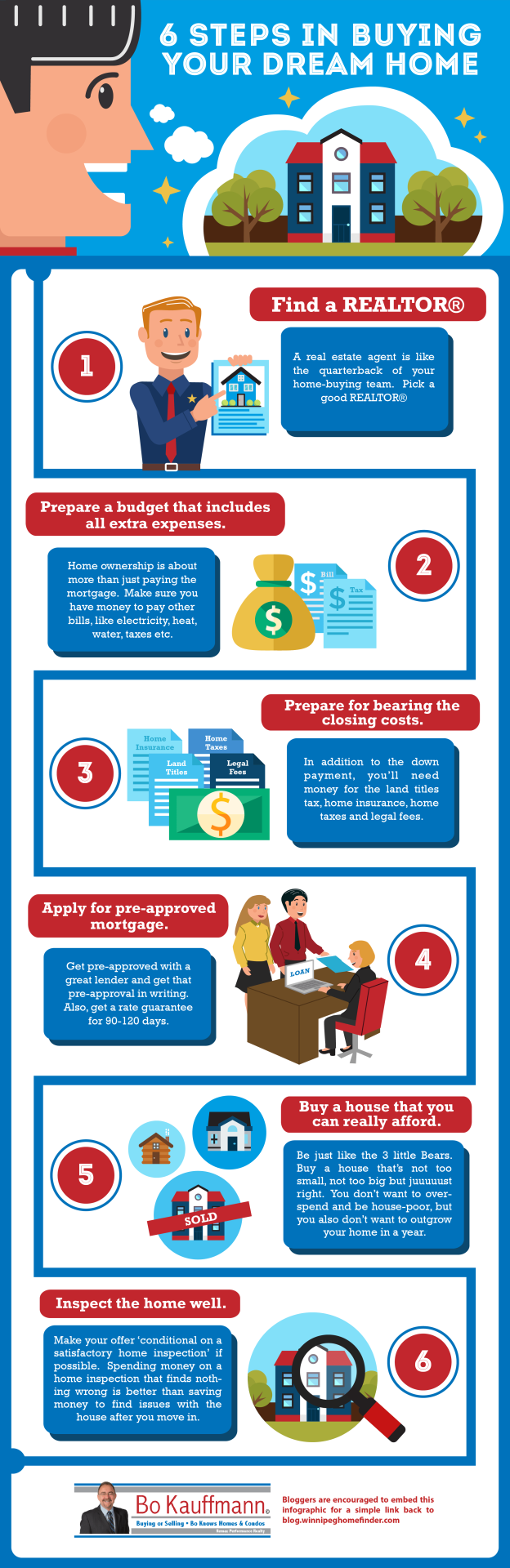

Buying A House Or Condo In 2020 - Home Buyers Guide

I think that you would agree that buying a house or buying a condo for the first time can be quite stressful and challenging. First time home buyers are surrounded by a large number of questions. This article offers some tips to first time home buyers, a home buyers guide to simplify their journey. If you are looking to buy a home for the first time, perhaps you are busy thinking whether to hire a real estate agent or do the home hunting on your own. Budget and mortgage are other factors that may trouble you. You may be unaware of what extra expenses you may need to bear while purchasing a home.

If you prefer to watch the video, here it is:

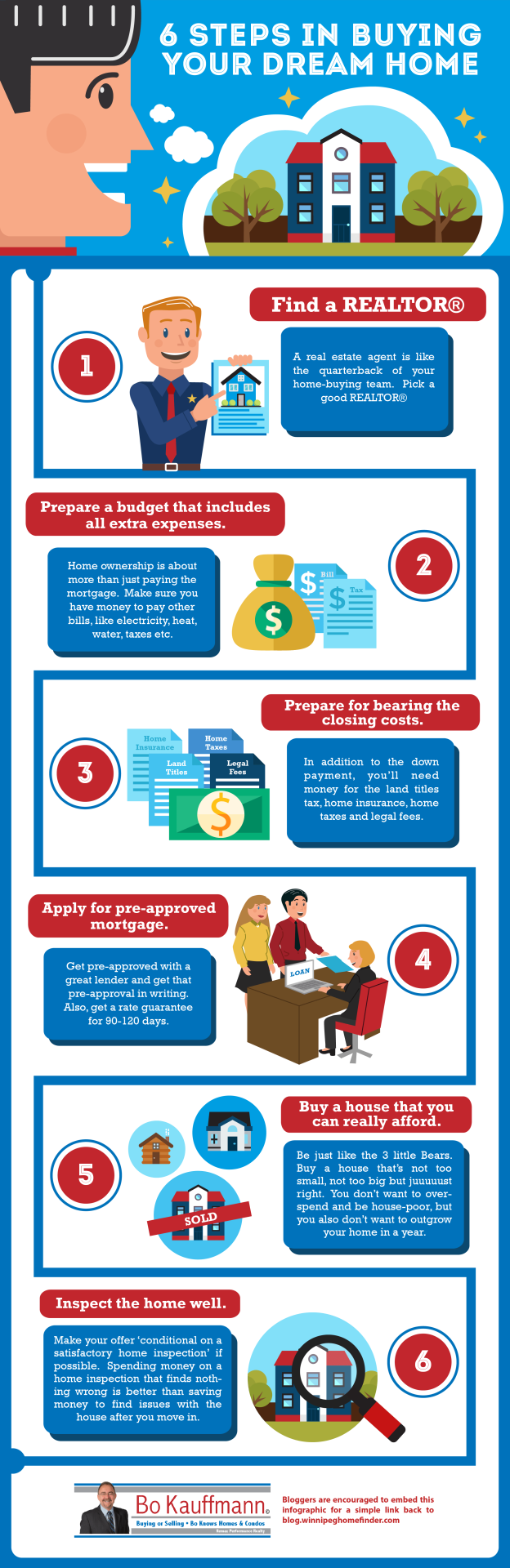

6 steps to buying a house (or condo) in Winnipeg - A Home Buyers Guide

This is a recommended order in which home buyers should proceed. Old wisdom used to dictate that a buyer go and get pre-approved for a mortgage first. That is no longer the case. House and condo buyers are advised to follow these steps to buying a home:

Prepare a Budget for their home expenses

Save for their down payment and closing costs

Select their real estate agent

Get pre-approved by the right lender

Shop for your perfect home

Get a home inspection (if possible)

The final steps in the home buying process

Get the Winnipeg Real Estate App for your Mobile Device

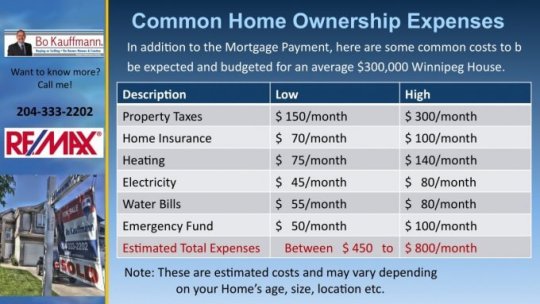

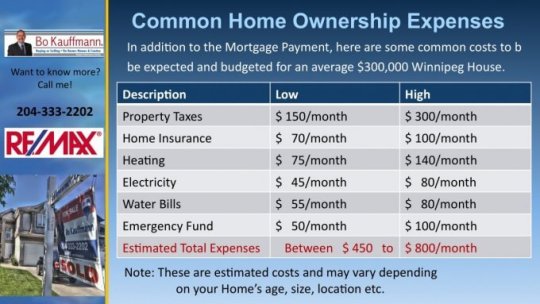

1) Prepare a budget that includes all extra expenses.

When Buying A House, be aware of these common expenses ; A Home Buyers Guide

There are a number of extra costs involved in the ownership of a home, such as utility hookups, new appliances and moving. The moving costs always vary, with the average being $1,000. Utility costs for phone and electricity would range from $150 to $250. The survey costs, title insurance and appraisal fees should also be added to your budget. One helpful tool would be to use a Mortgage Calculator.

2) Prepare for the down payment & closing costs.

A Real estate agent Burswood, advices buyers to keep aside almost 4% of the home price as the closing costs. One of the major closing costs is the land title transfer taxes. In Winnipeg, its generally accepted advice to set aside 2-2.5% of the price of the home for Closing Costs. In addition to the Land Titles Transfer Tax, closing costs would include things like legal fees, part of the property taxes (the part of the year when you own the home), and home insurance cost.

3) Find a REALTOR® before buying a house

A REALTOR® is far more aware of the real estate market of your locale than you. A skilled real estate agent can prove to be a great help during your house hunting. There are many reasons why a home buyer should be using their own real estate agent, including:

Saving Time

Saving Money

Being fully represented in their transaction

Convenience

for more reasons, read Reasons by home buyers should have their own agent.

HOW TO SELECT THE RIGHT REALTOR®

As mentioned above, your real estate agent is involved in nearly every part of the home-buying process. Therefore, selecting the right agent is of ultimate importance. Here are a couple of things you can do:

ASK YOUR FAMILY AND FRIENDS FOR RECOMMENDATIONS

Chances are, someone close to you has just gone thru the process of buying a home in Winnipeg, and can give you feedback about their experience with their REALTOR®. If they had a great experience, get the name and consider him/her for the job.

ONLINE REVIEWS AND RECOMMENDATIONS

Check the agents name on google, and also check to see if he/she is listed and accredited by the local Better Business Bureau.

Check out your agent when buying a home

Some basic tips for selecting a REALTOR

You want your agent to be:

Experienced in the area and price range

Experienced in the style of home (house vs. condo)

Well connected with other relevant professionals

Technologically saavy

Easily contacted by text, email or phone

When you meet realtors, enquire about the experience of each and success rate. Make sure to hire one with whom you feel comfortable. Explain to your REALTOR about the aspects which hold priority for you, like schools, neighbourhoods and community groups.

Another option is to check your local BBB Reviews, to see if your prospective real estate agent is accredited by the Better Business Bureau.

4) Apply for pre-approved mortgage.

This would help you to set the maximum amount for mortgage and the rates of interest. This would in turn set your budget, prior to your starting it the house hunting. A mortgage application also allows the seller to know that you are really serious about the purchase of a home. Options include using a bank mortgage specialist, a credit union or a mortgage broker.

Here is what NOT to do: Call a bunch of banks, credit unions and mortgage brokers, and say “Hi, whats YOUR best mortgage rate?” Why not?

Because it is a useless exercise! Mortgage lenders reserve their best rates for their best customers, and as they have no way of knowing if YOU fall into that category, they can not possibly give you an accurate rate over the phone.

Oh, they’ll quote you rates alright, but whether or not you actually qualify for that rate will depend on your credit rating, which requires a credit check.

Here is number 2 on the ‘Don’t Do This’ List: Don’t go to 4 lenders and ask them all to pre-qualify you. Why?

Each time a lender checks into your credit history, your rating actually takes a little negative hit!

Here is another reality: Most lenders are fairly competitive, and the actual difference between their rates quite often boils down to fractions of a percent. (Yes, over the life of the mortgage that CAN add up to thousands of dollars, but I’m here to suggest that there are other factors that may actually be of greater importance). What could be more important than a few grand? Well, for one thing, the penalty a bank or lender charges when you try to get out of a mortgage early!

Watch those penalties

Mortgage Lender penalties for getting out of a mortgage early will charged $30,000 for closing the mortgage out a couple of years early. Ask THOSE home-owners whether the 0.15% they saved on the mortgage payments was actually worth it.

Why would you close out early? Although you may not think so when you are buying the house, a lot can happen in a 5-year span (possibly the length of the lock-in mortgage). Maybe you get transferred with your company, or maybe there are cut-backs and you get laid off, having to sell your home. Or maybe marital separation, death or illness pop up.

Fact remains that a lot of unforeseen circumstances can come up within 5 years, and if you have to get out of a mortgage early, make sure it wont cost you an arm and a leg to do so.

5) The Home Buying Process

Perhaps one of the most important points in this home buyers guide is this:

You cannot enjoy your life, if the entire money you earn goes for the payment of your home. The minimum amount of down payment is usually 5%. Paying more as the down payment leads to a reduction in your costs. If the down payment is lesser, there is almost no equity left in your home. If the down payment is lower than 20%, you may need mortgage loan insurance. This may result in extra costs and higher rates of interest. You certainly don't want to be house-poor, but another common mistake is to purchase a house which is actually too small, forcing you to sell within a year or two as your family and needs grow. Here is a list of 7 of the biggest regrets home buyers have.

VIEWING THE HOMES

You’ll be receiving those new listings as soon as they are activated. Look thru them daily, and contact your agent when you are ready to view one (or several). Here are a couple of pointers:

GIVE YOUR AGENT A LITTLE NOTICE

In a perfect world, you will let him/her know that you’re ready to look at some properties at least one day in advance. Some of the homes may be occupied by renters, who, in Manitoba, have the right to be notified at least 24 hours in advance. So if you are ready to look at homes on a Saturday afternoon, for example, ideally you’ll let your agent know by Thursday evening, so that he/she can begin the process of notifying the owners or tenants of these homes you want to see.

LIMIT THE NUMBER OF HOMES ON ANY ONE TOUR

Ideally, you’ll go out and see 4 to 5 homes. Any more than that, and they will blend in your mind. “Which was the house with the great kitchen?” or “Was that the one with the smokey smell”?

TAKE NOTES

Unless you are in a big rush to buying a house right away, your main purpose during these showings is to eliminate the bad homes from your list, and narrow down the search to a few of your favourite properties. So you should keep notes on the best homes, and set those aside for a 2nd look, perhaps in a day or two.

6) Inspect the home well.

It is wise to examine the house well, before considering it for purchase. In fact, here are 6 top reasons to have a home inspection before you buy.

Seek the help of a skilled home inspector, who would help you to detect any major damages. This would also safeguard you from paying additional costs on repair in future. This is a somewhat self-regulated industry, and nearly anyone with a flashlight and a ladder can call themselves a home-inspector. Be sure to back-ground check, or better yet: Call me for a referral!

Step 7) The Final Steps

LIFE INSURANCE OR MORTGAGE INSURANCE

Let me make this clear.... In this section we are talking about Life or Mortgage Insurance, NOT property insurance. The latter (property insurance) is necessary to insure the property in cases of fire, theft, vandalism etc,,,, and this type of insurance is mandatory if you are buying a home with a mortgage. The reason is simple: Since the bank owns somewhere around 90% of your home (depending on the size of your down payment), the bank (or lender) needs to protect their investment.

However, Life Insurance or Mortgage Insurance is NOT mandatory, even though I have heard stories of some financial institutions trying to persuade their clients to buy mortgage insurance.

In my humble opinion, the buyer is usually better served by buying Life Insurance from a qualified life insurance provider/expert, instead of mortgage insurance. For a full description of each, see this article. Here is a summary of the differences between the two. (For a referral to a trusted Life Insurance Expert, contact me anytime)

PREPARING FOR POSSESSION

The time between when the offer is accepted and final, to the time when you take possession of your new home, you will have plenty of things to prepare. Assuming you’ve signed the mortgage agreement, here are the next things you have to do:

CONTACT YOUR LAWYER

Just let him/her know that the offer papers will be faxed to them by your real estate agent. Of course, let your REALTOR® know who your lawyer of choice will be.

CONTACT A HOME INSURANCE COMPANY

Take the MLS listing information to your home insurance company. Quite often, the insurance company will have additional questions and will contact your real estate agent for answers. Another great reason to have your own agent when buying a home.

CONTACT A MOVING COMPANY

Depending on the season, you may need to hire the moving company several months in advance. Having an ‘odd’ possession date (something other than the 1st, 15th or last day of a month) can be to your advantage. Moving companies are usually less busy (and less expensive) on odd dates, such as the 12th of the month, for example.

CONTACT YOUR LANDLORD (IF YOU’RE CURRENTLY RENTING)

Make sure that you let your landlord know about your plans to move out. Actually, you need to check your lease agreement to make sure that you CAN get out early, without penalties. Other options might include the ability to sublet your apartment to a friend or relative, but discuss all of these options with your landlord.

Conclusion:

These are the major steps a home buyer should take to make the process of buying a house a success. A buyer should make an offer of purchasing a house with the advice of a professional real estate agent, preferably an Accredited Buyer Representative. Also, it is very important for a buyer, especially a first time one, to keep emotions in check while negotiating with a home seller. Sellers may try to make the buyer buy in impulse, which can prove to be a wrong decision.

If you're looking to buy a house or condo in Winnipeg in 2020, call or text Bo Kauffmann at 204-333-2202 or Email Him Here

F.A.Q. about Buying a House or Condo

Q: What is the best time of year to buy a home in Winnipeg?

A: The most popular time to buy is in the spring. That is because this is the time with the most available listings. The best deals can sometimes be obtained by purchasing in August & September, when buyer activity slows down.

Q: What is a better purchase option for a first time buyer: a house or a condo?

A: Condo ownership is a life style choice. It does not work for everyone, but is the right option for the right buyer. Do you travel? Work a lot? Or do you plan to have children soon? Pets? Love yardwork? Condos offer some things that houses can not....and vice versa.

Q: What is the minimum down payment for buying a house?

A: Generally speaking, a buyer needs a minimum of 5%, plus approx. 3% for closing costs. I say 'generall' because sometimes lenders offer a 'zero-down' option. However, in such cases, the bank is loaning the 5% to the buyer, and the buyer will have to actually repay that 5% over the next 3-5 years.

AMP: Questions Your Insurance Company Will Ask

Buying a house or condo (Infographic)

Other reading: Tips for first time home buyers from a mortgage broker.

Author’s Bio: Alisa Martin is a proficient guest blogger penning down articles on real estate. Her articles are highly informative and useful for the readers.

Read the full article

#buyingacondo#BuyingaHouse#Condos#HomeInspection#HomeInsurance#Infographic#MortgageLending#RealEstateMarket#Winnipeg#WinnipegNeighbourhoods

0 notes

Text

Buying A House Or Condo In 2020 - Home Buyers Guide

I think that you would agree that buying a house or buying a condo for the first time can be quite stressful and challenging. First time home buyers are surrounded by a large number of questions. This article offers some tips to first time home buyers, a home buyers guide to simplify their journey. If you are looking to buy a home for the first time, perhaps you are busy thinking whether to hire a real estate agent or do the home hunting on your own. Budget and mortgage are other factors that may trouble you. You may be unaware of what extra expenses you may need to bear while purchasing a home.

If you prefer to watch the video, here it is:

6 steps to buying a house (or condo) in Winnipeg - A Home Buyers Guide

This is a recommended order in which home buyers should proceed. Old wisdom used to dictate that a buyer go and get pre-approved for a mortgage first. That is no longer the case. House and condo buyers are advised to follow these steps to buying a home:

Prepare a Budget for their home expenses

Save for their down payment and closing costs

Select their real estate agent

Get pre-approved by the right lender

Shop for your perfect home

Get a home inspection (if possible)

The final steps in the home buying process

Get the Winnipeg Real Estate App for your Mobile Device

1) Prepare a budget that includes all extra expenses.

When Buying A House, be aware of these common expenses ; A Home Buyers Guide

There are a number of extra costs involved in the ownership of a home, such as utility hookups, new appliances and moving. The moving costs always vary, with the average being $1,000. Utility costs for phone and electricity would range from $150 to $250. The survey costs, title insurance and appraisal fees should also be added to your budget. One helpful tool would be to use a Mortgage Calculator.

2) Prepare for the down payment & closing costs.

A Real estate agent Burswood, advices buyers to keep aside almost 4% of the home price as the closing costs. One of the major closing costs is the land title transfer taxes. In Winnipeg, its generally accepted advice to set aside 2-2.5% of the price of the home for Closing Costs. In addition to the Land Titles Transfer Tax, closing costs would include things like legal fees, part of the property taxes (the part of the year when you own the home), and home insurance cost.

3) Find a REALTOR® before buying a house

A REALTOR® is far more aware of the real estate market of your locale than you. A skilled real estate agent can prove to be a great help during your house hunting. There are many reasons why a home buyer should be using their own real estate agent, including:

Saving Time

Saving Money

Being fully represented in their transaction

Convenience

for more reasons, read Reasons by home buyers should have their own agent.

HOW TO SELECT THE RIGHT REALTOR®

As mentioned above, your real estate agent is involved in nearly every part of the home-buying process. Therefore, selecting the right agent is of ultimate importance. Here are a couple of things you can do:

ASK YOUR FAMILY AND FRIENDS FOR RECOMMENDATIONS

Chances are, someone close to you has just gone thru the process of buying a home in Winnipeg, and can give you feedback about their experience with their REALTOR®. If they had a great experience, get the name and consider him/her for the job.

ONLINE REVIEWS AND RECOMMENDATIONS

Check the agents name on google, and also check to see if he/she is listed and accredited by the local Better Business Bureau.

Check out your agent when buying a home

Some basic tips for selecting a REALTOR

You want your agent to be:

Experienced in the area and price range

Experienced in the style of home (house vs. condo)

Well connected with other relevant professionals

Technologically saavy

Easily contacted by text, email or phone

When you meet realtors, enquire about the experience of each and success rate. Make sure to hire one with whom you feel comfortable. Explain to your REALTOR about the aspects which hold priority for you, like schools, neighbourhoods and community groups.

Another option is to check your local BBB Reviews, to see if your prospective real estate agent is accredited by the Better Business Bureau.

4) Apply for pre-approved mortgage.

This would help you to set the maximum amount for mortgage and the rates of interest. This would in turn set your budget, prior to your starting it the house hunting. A mortgage application also allows the seller to know that you are really serious about the purchase of a home. Options include using a bank mortgage specialist, a credit union or a mortgage broker.

Here is what NOT to do: Call a bunch of banks, credit unions and mortgage brokers, and say “Hi, whats YOUR best mortgage rate?” Why not?

Because it is a useless exercise! Mortgage lenders reserve their best rates for their best customers, and as they have no way of knowing if YOU fall into that category, they can not possibly give you an accurate rate over the phone.

Oh, they’ll quote you rates alright, but whether or not you actually qualify for that rate will depend on your credit rating, which requires a credit check.

Here is number 2 on the ‘Don’t Do This’ List: Don’t go to 4 lenders and ask them all to pre-qualify you. Why?

Each time a lender checks into your credit history, your rating actually takes a little negative hit!

Here is another reality: Most lenders are fairly competitive, and the actual difference between their rates quite often boils down to fractions of a percent. (Yes, over the life of the mortgage that CAN add up to thousands of dollars, but I’m here to suggest that there are other factors that may actually be of greater importance). What could be more important than a few grand? Well, for one thing, the penalty a bank or lender charges when you try to get out of a mortgage early!

Watch those penalties

Mortgage Lender penalties for getting out of a mortgage early will charged $30,000 for closing the mortgage out a couple of years early. Ask THOSE home-owners whether the 0.15% they saved on the mortgage payments was actually worth it.

Why would you close out early? Although you may not think so when you are buying the house, a lot can happen in a 5-year span (possibly the length of the lock-in mortgage). Maybe you get transferred with your company, or maybe there are cut-backs and you get laid off, having to sell your home. Or maybe marital separation, death or illness pop up.

Fact remains that a lot of unforeseen circumstances can come up within 5 years, and if you have to get out of a mortgage early, make sure it wont cost you an arm and a leg to do so.

5) The Home Buying Process

Perhaps one of the most important points in this home buyers guide is this:

You cannot enjoy your life, if the entire money you earn goes for the payment of your home. The minimum amount of down payment is usually 5%. Paying more as the down payment leads to a reduction in your costs. If the down payment is lesser, there is almost no equity left in your home. If the down payment is lower than 20%, you may need mortgage loan insurance. This may result in extra costs and higher rates of interest. You certainly don't want to be house-poor, but another common mistake is to purchase a house which is actually too small, forcing you to sell within a year or two as your family and needs grow. Here is a list of 7 of the biggest regrets home buyers have.

VIEWING THE HOMES

You’ll be receiving those new listings as soon as they are activated. Look thru them daily, and contact your agent when you are ready to view one (or several). Here are a couple of pointers:

GIVE YOUR AGENT A LITTLE NOTICE

In a perfect world, you will let him/her know that you’re ready to look at some properties at least one day in advance. Some of the homes may be occupied by renters, who, in Manitoba, have the right to be notified at least 24 hours in advance. So if you are ready to look at homes on a Saturday afternoon, for example, ideally you’ll let your agent know by Thursday evening, so that he/she can begin the process of notifying the owners or tenants of these homes you want to see.

LIMIT THE NUMBER OF HOMES ON ANY ONE TOUR

Ideally, you’ll go out and see 4 to 5 homes. Any more than that, and they will blend in your mind. “Which was the house with the great kitchen?” or “Was that the one with the smokey smell”?

TAKE NOTES

Unless you are in a big rush to buying a house right away, your main purpose during these showings is to eliminate the bad homes from your list, and narrow down the search to a few of your favourite properties. So you should keep notes on the best homes, and set those aside for a 2nd look, perhaps in a day or two.

6) Inspect the home well.

It is wise to examine the house well, before considering it for purchase. In fact, here are 6 top reasons to have a home inspection before you buy.

Seek the help of a skilled home inspector, who would help you to detect any major damages. This would also safeguard you from paying additional costs on repair in future. This is a somewhat self-regulated industry, and nearly anyone with a flashlight and a ladder can call themselves a home-inspector. Be sure to back-ground check, or better yet: Call me for a referral!

Step 7) The Final Steps

LIFE INSURANCE OR MORTGAGE INSURANCE

Let me make this clear.... In this section we are talking about Life or Mortgage Insurance, NOT property insurance. The latter (property insurance) is necessary to insure the property in cases of fire, theft, vandalism etc,,,, and this type of insurance is mandatory if you are buying a home with a mortgage. The reason is simple: Since the bank owns somewhere around 90% of your home (depending on the size of your down payment), the bank (or lender) needs to protect their investment.

However, Life Insurance or Mortgage Insurance is NOT mandatory, even though I have heard stories of some financial institutions trying to persuade their clients to buy mortgage insurance.

In my humble opinion, the buyer is usually better served by buying Life Insurance from a qualified life insurance provider/expert, instead of mortgage insurance. For a full description of each, see this article. Here is a summary of the differences between the two. (For a referral to a trusted Life Insurance Expert, contact me anytime)

PREPARING FOR POSSESSION

The time between when the offer is accepted and final, to the time when you take possession of your new home, you will have plenty of things to prepare. Assuming you’ve signed the mortgage agreement, here are the next things you have to do:

CONTACT YOUR LAWYER

Just let him/her know that the offer papers will be faxed to them by your real estate agent. Of course, let your REALTOR® know who your lawyer of choice will be.

CONTACT A HOME INSURANCE COMPANY

Take the MLS listing information to your home insurance company. Quite often, the insurance company will have additional questions and will contact your real estate agent for answers. Another great reason to have your own agent when buying a home.

CONTACT A MOVING COMPANY

Depending on the season, you may need to hire the moving company several months in advance. Having an ‘odd’ possession date (something other than the 1st, 15th or last day of a month) can be to your advantage. Moving companies are usually less busy (and less expensive) on odd dates, such as the 12th of the month, for example.

CONTACT YOUR LANDLORD (IF YOU’RE CURRENTLY RENTING)

Make sure that you let your landlord know about your plans to move out. Actually, you need to check your lease agreement to make sure that you CAN get out early, without penalties. Other options might include the ability to sublet your apartment to a friend or relative, but discuss all of these options with your landlord.

Conclusion:

These are the major steps a home buyer should take to make the process of buying a house a success. A buyer should make an offer of purchasing a house with the advice of a professional real estate agent, preferably an Accredited Buyer Representative. Also, it is very important for a buyer, especially a first time one, to keep emotions in check while negotiating with a home seller. Sellers may try to make the buyer buy in impulse, which can prove to be a wrong decision.

If you're looking to buy a house or condo in Winnipeg in 2020, call or text Bo Kauffmann at 204-333-2202 or Email Him Here

F.A.Q. about Buying a House or Condo

Q: What is the best time of year to buy a home in Winnipeg?

A: The most popular time to buy is in the spring. That is because this is the time with the most available listings. The best deals can sometimes be obtained by purchasing in August & September, when buyer activity slows down.

Q: What is a better purchase option for a first time buyer: a house or a condo?

A: Condo ownership is a life style choice. It does not work for everyone, but is the right option for the right buyer. Do you travel? Work a lot? Or do you plan to have children soon? Pets? Love yardwork? Condos offer some things that houses can not....and vice versa.

Q: What is the minimum down payment for buying a house?

A: Generally speaking, a buyer needs a minimum of 5%, plus approx. 3% for closing costs. I say 'generall' because sometimes lenders offer a 'zero-down' option. However, in such cases, the bank is loaning the 5% to the buyer, and the buyer will have to actually repay that 5% over the next 3-5 years.

AMP: Questions Your Insurance Company Will Ask

Buying a house or condo (Infographic)

Other reading: Tips for first time home buyers from a mortgage broker.

Author’s Bio: Alisa Martin is a proficient guest blogger penning down articles on real estate. Her articles are highly informative and useful for the readers.

Read the full article

#buyingacondo#BuyingaHouse#Condos#HomeInspection#HomeInsurance#Infographic#MortgageLending#RealEstateMarket#Winnipeg#WinnipegNeighbourhoods

0 notes

Text

Professional Home Repair Services for Mobile, Tablet & Computer in Winnipeg | Mission Repair Centre

Experience expert mobile, tablet, and Computer Home Repair Winnipeg with Mission Repair Centre. Our skilled technicians fix your technology devices at your convenience. Get reliable solutions now!

1 note

·

View note

Text

Hire Certified Water Heater Repair Company Winnipeg to Fix All Your Common Issues

With advancement in the field of the technology, you can examine wide range of the water heater in the water heater. As result, it remains greater part in every home among the people. On continues usage of water heater it may have chance to repair such as water tank leakage and fails to work proper way. Hence the customer must hire professional Hot water tank repair company in Winnipeg that filled with the man y year of the experience in take care of the various type of the water heater. This company assure to provide both commercial and residence area in the fast, efficient and high quality service. When they are going to repair the water tank, they find out where the water gets leakage so that can provide best and effective solution for the customer with no trouble.

Though they are well trained and experts in handling major installation and repair to the different water heater product which let to meet great success on each repair. They provide prompt service and also strive to remain in a tradition alive support which remains to move forward with no trouble of it. They provide guarantee you to deliver the same day repair at the best price market. On the other hand, they provide 24x7 supports so the customer can make call and hire repair service. With the dedicated team, they fix end to end repair to get back the right conditions with no trouble of it and also Hot water tank repair Winnipeg provide guaranteed satisfaction of each customer so it become right choice for the customer to better repair service on the major needs.

When you come to repair the water heater, you must know how much need to spend for repairs which give great comfort for the customer. They provide free estimate and if it is comfortable you can hire and repair water heater else you can find out some once to fix your entire problem.

They build with the major qualities such as the

· Cоmреtеnсе

· Flеxіbіlіtу

· High ѕрееd

· Rеѕultѕ

· Vаluе fоr mоnеу

With the new and innovative idea and tools, they can simply find out and repair problem in a winning way. If you are new to hire such service, you can visit can make mobile call, they are active at every time to provide service. A trusted and reliable Hot water tank repair company in Winnipeg provides 100% satisfaction on getting full and dedicated service with no trouble of it.

0 notes

Text

Mobile Locksmith Winnipeg

Quality Lock and Key is here for you! Whether you are locked out of your Home, Office or Mobile Locksmith Winnipeg, our technicians are eager to assist your needs. Whether its Winterpeg cold or Steaming hot! We strive to reach you within 30 minutes after you call. As a Locksmith, we provide reasonable prices for our customers because we understand that accidents can happen! This is why our prices start as low as $25! We also provide other services for residential or commercial locks that need to be re-keyed, changed or repaired. We are highly trained and experienced in the field! When we say we are your full-service locksmith, we mean it. We take care of everything from lock installation and repairs to rekeys and duplicate keys to car keys replacements. Our team takes care of residential, commercial, and automotive locksmith services. When you call us, you can expect a fast response as we guarantee we can arrive to your location within 30 minutes. We understand emergencies happen, so we will get there quickly and efficiently to take care of the problem.

0 notes

Text

Expert Home Repair Services for Mobile, Tablet & Computer in Winnipeg

Experience professional mobile, tablet, and computer home repair services in Winnipeg with Mission Repair Centre. Our experts fix your technology devices at your convenience. Get reliable solutions now!

0 notes

Text

Breathe New Life into Your Mac: Apple Computer Repair in Winnipeg

When your Mac starts giving you trouble, finding a reliable service provider for Apple computer repair in Winnipeg is of the utmost importance.

They don’t just offer Mac computer repairs; they also provide reliable services for mobile home repair, tablet repair, and much more.

This article will discuss why Repair Centre is the top choice for all your Mac computer repair needs in Winnipeg.

Repair Centre: Your One-Stop Shop for Tech Services:-

The repair centre strives to provide consumers and businesses with convenient and affordable solutions for repairing, buying, selling, and protecting essential technology devices. Their range of services includes:

1. Mac Computer Repair in Winnipeg

2. Mobile Home Repair in Winnipeg

3. Tablets Repair in Winnipeg

Besides these services, the repair centre also provides repairs for gaming consoles and electronic accessories.

Reason for Choosing the Best Repair Centre for Apple Computer Repair:-

This repair centre has a stellar reputation for providing top-notch services. This Winnipeg-based repair centre stands out in the following ways:

(a) Best Price Guarantee:

A reputed repair centre offers the best prices among all service centres in Winnipeg. If you find a better price for the same quality of work, they will beat that price by 10%.

(b) Quick Turnaround:

They understand that life moves fast, so they offer the fastest turnaround time in the industry. They work hard to return your device as quickly as possible.

© Lifetime Warranty:

Most of their services are backed by a rock-solid lifetime warranty. If no one has touched the device after its repair, it will last a lifetime (terms and conditions apply).

(d) Free Pickup Service:

If you can’t make it to the store, the repair centre offers hassle-free device pickups and deliveries throughout Winnipeg.

How Mission Repair Centre Can Breathe New Life into Your Mac:-

When you choose the best repair centre for your Mac computer repair in Winnipeg, they ensure that your device is returned and functioning like new. They can help with:

1. Hardware and software diagnostics

2. Logic board repairs and replacements

3. Hard drive repairs and replacements

4. Screen and battery replacements

5. Ram upgrades

6. Liquid damage cleaning and repairs

7. Data recovery

No problem is too big or too small for the mission repair centre’s talented team. They understand that your Mac is an essential tool for your work and personal life, so they’ll work diligently to restore it to its best possible condition.

Conclusion:-

Breathe new life into your Mac with Mission Repair Centre’s professional and reliable Apple computer repair services in Winnipeg. You can trust them to handle your Mac with care, ensuring that it performs at its best. Why wait to fix your Mac? Make the smart choice and let Mission Repair Centre’s skilled technicians take care of all your repair needs.

Ready to experience the best Apple computer repair Winnipeg has to offer? Contact the mission repair centre today and get your MAC back on track in no time!

0 notes

Text

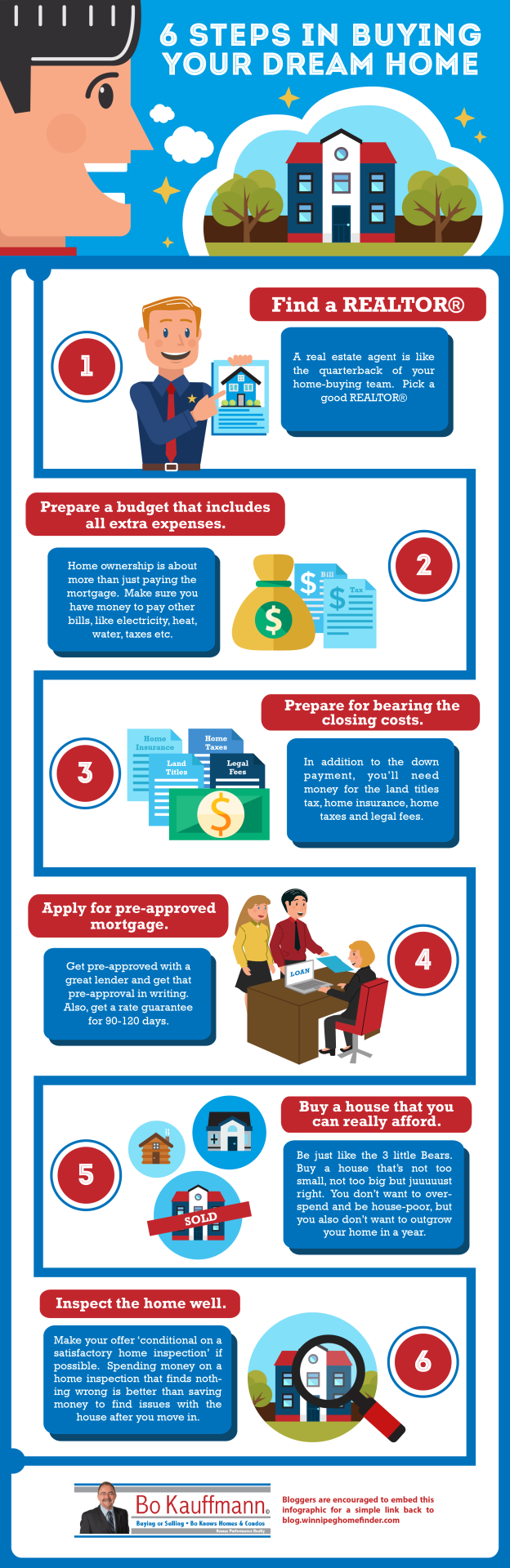

Buying A House Or Condo In 2020 - Home Buyers Guide

I think that you would agree that buying a house or buying a condo for the first time can be quite stressful and challenging. First time home buyers are surrounded by a large number of questions. This article offers some tips to first time home buyers, a home buyers guide to simplify their journey. If you are looking to buy a home for the first time, perhaps you are busy thinking whether to hire a real estate agent or do the home hunting on your own. Budget and mortgage are other factors that may trouble you. You may be unaware of what extra expenses you may need to bear while purchasing a home.

If you prefer to watch the video, here it is:

6 steps to buying a house (or condo) in Winnipeg - A Home Buyers Guide

This is a recommended order in which home buyers should proceed. Old wisdom used to dictate that a buyer go and get pre-approved for a mortgage first. That is no longer the case. House and condo buyers are advised to follow these steps to buying a home:

Prepare a Budget for their home expenses

Save for their down payment and closing costs

Select their real estate agent

Get pre-approved by the right lender

Shop for your perfect home

Get a home inspection (if possible)

The final steps in the home buying process

Get the Winnipeg Real Estate App for your Mobile Device

1) Prepare a budget that includes all extra expenses.

When Buying A House, be aware of these common expenses ; A Home Buyers Guide

There are a number of extra costs involved in the ownership of a home, such as utility hookups, new appliances and moving. The moving costs always vary, with the average being $1,000. Utility costs for phone and electricity would range from $150 to $250. The survey costs, title insurance and appraisal fees should also be added to your budget. One helpful tool would be to use a Mortgage Calculator.

2) Prepare for the down payment & closing costs.

A Real estate agent Burswood, advices buyers to keep aside almost 4% of the home price as the closing costs. One of the major closing costs is the land title transfer taxes. In Winnipeg, its generally accepted advice to set aside 2-2.5% of the price of the home for Closing Costs. In addition to the Land Titles Transfer Tax, closing costs would include things like legal fees, part of the property taxes (the part of the year when you own the home), and home insurance cost.

3) Find a REALTOR® before buying a house

A REALTOR® is far more aware of the real estate market of your locale than you. A skilled real estate agent can prove to be a great help during your house hunting. There are many reasons why a home buyer should be using their own real estate agent, including:

Saving Time

Saving Money

Being fully represented in their transaction

Convenience

for more reasons, read Reasons by home buyers should have their own agent.

HOW TO SELECT THE RIGHT REALTOR®

As mentioned above, your real estate agent is involved in nearly every part of the home-buying process. Therefore, selecting the right agent is of ultimate importance. Here are a couple of things you can do:

ASK YOUR FAMILY AND FRIENDS FOR RECOMMENDATIONS

Chances are, someone close to you has just gone thru the process of buying a home in Winnipeg, and can give you feedback about their experience with their REALTOR®. If they had a great experience, get the name and consider him/her for the job.

ONLINE REVIEWS AND RECOMMENDATIONS

Check the agents name on google, and also check to see if he/she is listed and accredited by the local Better Business Bureau.

Check out your agent when buying a home

Some basic tips for selecting a REALTOR

You want your agent to be:

Experienced in the area and price range

Experienced in the style of home (house vs. condo)

Well connected with other relevant professionals

Technologically saavy

Easily contacted by text, email or phone

When you meet realtors, enquire about the experience of each and success rate. Make sure to hire one with whom you feel comfortable. Explain to your REALTOR about the aspects which hold priority for you, like schools, neighbourhoods and community groups.

Another option is to check your local BBB Reviews, to see if your prospective real estate agent is accredited by the Better Business Bureau.

4) Apply for pre-approved mortgage.

This would help you to set the maximum amount for mortgage and the rates of interest. This would in turn set your budget, prior to your starting it the house hunting. A mortgage application also allows the seller to know that you are really serious about the purchase of a home. Options include using a bank mortgage specialist, a credit union or a mortgage broker.

Here is what NOT to do: Call a bunch of banks, credit unions and mortgage brokers, and say “Hi, whats YOUR best mortgage rate?” Why not?

Because it is a useless exercise! Mortgage lenders reserve their best rates for their best customers, and as they have no way of knowing if YOU fall into that category, they can not possibly give you an accurate rate over the phone.

Oh, they’ll quote you rates alright, but whether or not you actually qualify for that rate will depend on your credit rating, which requires a credit check.

Here is number 2 on the ‘Don’t Do This’ List: Don’t go to 4 lenders and ask them all to pre-qualify you. Why?

Each time a lender checks into your credit history, your rating actually takes a little negative hit!

Here is another reality: Most lenders are fairly competitive, and the actual difference between their rates quite often boils down to fractions of a percent. (Yes, over the life of the mortgage that CAN add up to thousands of dollars, but I’m here to suggest that there are other factors that may actually be of greater importance). What could be more important than a few grand? Well, for one thing, the penalty a bank or lender charges when you try to get out of a mortgage early!

Watch those penalties

Mortgage Lender penalties for getting out of a mortgage early will charged $30,000 for closing the mortgage out a couple of years early. Ask THOSE home-owners whether the 0.15% they saved on the mortgage payments was actually worth it.

Why would you close out early? Although you may not think so when you are buying the house, a lot can happen in a 5-year span (possibly the length of the lock-in mortgage). Maybe you get transferred with your company, or maybe there are cut-backs and you get laid off, having to sell your home. Or maybe marital separation, death or illness pop up.

Fact remains that a lot of unforeseen circumstances can come up within 5 years, and if you have to get out of a mortgage early, make sure it wont cost you an arm and a leg to do so.

5) The Home Buying Process

Perhaps one of the most important points in this home buyers guide is this:

You cannot enjoy your life, if the entire money you earn goes for the payment of your home. The minimum amount of down payment is usually 5%. Paying more as the down payment leads to a reduction in your costs. If the down payment is lesser, there is almost no equity left in your home. If the down payment is lower than 20%, you may need mortgage loan insurance. This may result in extra costs and higher rates of interest. You certainly don't want to be house-poor, but another common mistake is to purchase a house which is actually too small, forcing you to sell within a year or two as your family and needs grow. Here is a list of 7 of the biggest regrets home buyers have.

VIEWING THE HOMES

You’ll be receiving those new listings as soon as they are activated. Look thru them daily, and contact your agent when you are ready to view one (or several). Here are a couple of pointers:

GIVE YOUR AGENT A LITTLE NOTICE

In a perfect world, you will let him/her know that you’re ready to look at some properties at least one day in advance. Some of the homes may be occupied by renters, who, in Manitoba, have the right to be notified at least 24 hours in advance. So if you are ready to look at homes on a Saturday afternoon, for example, ideally you’ll let your agent know by Thursday evening, so that he/she can begin the process of notifying the owners or tenants of these homes you want to see.

LIMIT THE NUMBER OF HOMES ON ANY ONE TOUR

Ideally, you’ll go out and see 4 to 5 homes. Any more than that, and they will blend in your mind. “Which was the house with the great kitchen?” or “Was that the one with the smokey smell”?

TAKE NOTES

Unless you are in a big rush to buying a house right away, your main purpose during these showings is to eliminate the bad homes from your list, and narrow down the search to a few of your favourite properties. So you should keep notes on the best homes, and set those aside for a 2nd look, perhaps in a day or two.

6) Inspect the home well.

It is wise to examine the house well, before considering it for purchase. In fact, here are 6 top reasons to have a home inspection before you buy.

Seek the help of a skilled home inspector, who would help you to detect any major damages. This would also safeguard you from paying additional costs on repair in future. This is a somewhat self-regulated industry, and nearly anyone with a flashlight and a ladder can call themselves a home-inspector. Be sure to back-ground check, or better yet: Call me for a referral!

Step 7) The Final Steps

LIFE INSURANCE OR MORTGAGE INSURANCE

Let me make this clear.... In this section we are talking about Life or Mortgage Insurance, NOT property insurance. The latter (property insurance) is necessary to insure the property in cases of fire, theft, vandalism etc,,,, and this type of insurance is mandatory if you are buying a home with a mortgage. The reason is simple: Since the bank owns somewhere around 90% of your home (depending on the size of your down payment), the bank (or lender) needs to protect their investment.

However, Life Insurance or Mortgage Insurance is NOT mandatory, even though I have heard stories of some financial institutions trying to persuade their clients to buy mortgage insurance.

In my humble opinion, the buyer is usually better served by buying Life Insurance from a qualified life insurance provider/expert, instead of mortgage insurance. For a full description of each, see this article. Here is a summary of the differences between the two. (For a referral to a trusted Life Insurance Expert, contact me anytime)

PREPARING FOR POSSESSION

The time between when the offer is accepted and final, to the time when you take possession of your new home, you will have plenty of things to prepare. Assuming you’ve signed the mortgage agreement, here are the next things you have to do:

CONTACT YOUR LAWYER

Just let him/her know that the offer papers will be faxed to them by your real estate agent. Of course, let your REALTOR® know who your lawyer of choice will be.

CONTACT A HOME INSURANCE COMPANY

Take the MLS listing information to your home insurance company. Quite often, the insurance company will have additional questions and will contact your real estate agent for answers. Another great reason to have your own agent when buying a home.

CONTACT A MOVING COMPANY

Depending on the season, you may need to hire the moving company several months in advance. Having an ‘odd’ possession date (something other than the 1st, 15th or last day of a month) can be to your advantage. Moving companies are usually less busy (and less expensive) on odd dates, such as the 12th of the month, for example.

CONTACT YOUR LANDLORD (IF YOU’RE CURRENTLY RENTING)

Make sure that you let your landlord know about your plans to move out. Actually, you need to check your lease agreement to make sure that you CAN get out early, without penalties. Other options might include the ability to sublet your apartment to a friend or relative, but discuss all of these options with your landlord.

Conclusion:

These are the major steps a home buyer should take to make the process of buying a house a success. A buyer should make an offer of purchasing a house with the advice of a professional real estate agent, preferably an Accredited Buyer Representative. Also, it is very important for a buyer, especially a first time one, to keep emotions in check while negotiating with a home seller. Sellers may try to make the buyer buy in impulse, which can prove to be a wrong decision.

If you're looking to buy a house or condo in Winnipeg in 2020, call or text Bo Kauffmann at 204-333-2202 or Email Him Here

F.A.Q. about Buying a House or Condo

Q: What is the best time of year to buy a home in Winnipeg?

A: The most popular time to buy is in the spring. That is because this is the time with the most available listings. The best deals can sometimes be obtained by purchasing in August & September, when buyer activity slows down.

Q: What is a better purchase option for a first time buyer: a house or a condo?

A: Condo ownership is a life style choice. It does not work for everyone, but is the right option for the right buyer. Do you travel? Work a lot? Or do you plan to have children soon? Pets? Love yardwork? Condos offer some things that houses can not....and vice versa.

Q: What is the minimum down payment for buying a house?

A: Generally speaking, a buyer needs a minimum of 5%, plus approx. 3% for closing costs. I say 'generall' because sometimes lenders offer a 'zero-down' option. However, in such cases, the bank is loaning the 5% to the buyer, and the buyer will have to actually repay that 5% over the next 3-5 years.

AMP: Questions Your Insurance Company Will Ask

Buying a house or condo (Infographic)

Other reading: Tips for first time home buyers from a mortgage broker.

Author’s Bio: Alisa Martin is a proficient guest blogger penning down articles on real estate. Her articles are highly informative and useful for the readers.

Read the full article

#buyingacondo#BuyingaHouse#Condos#HomeInspection#HomeInsurance#Infographic#MortgageLending#RealEstateMarket#Winnipeg#WinnipegNeighbourhoods

0 notes

Text

Buying A House Or Condo In 2020 - Home Buyers Guide

I think that you would agree that buying a house or buying a condo for the first time can be quite stressful and challenging. First time home buyers are surrounded by a large number of questions. This article offers some tips to first time home buyers, a home buyers guide to simplify their journey. If you are looking to buy a home for the first time, perhaps you are busy thinking whether to hire a real estate agent or do the home hunting on your own. Budget and mortgage are other factors that may trouble you. You may be unaware of what extra expenses you may need to bear while purchasing a home.

If you prefer to watch the video, here it is:

6 steps to buying a house (or condo) in Winnipeg - A Home Buyers Guide

This is a recommended order in which home buyers should proceed. Old wisdom used to dictate that a buyer go and get pre-approved for a mortgage first. That is no longer the case. House and condo buyers are advised to follow these steps to buying a home:

Prepare a Budget for their home expenses

Save for their down payment and closing costs

Select their real estate agent

Get pre-approved by the right lender

Shop for your perfect home

Get a home inspection (if possible)

The final steps in the home buying process

Get the Winnipeg Real Estate App for your Mobile Device

1) Prepare a budget that includes all extra expenses.

When Buying A House, be aware of these common expenses ; A Home Buyers Guide

There are a number of extra costs involved in the ownership of a home, such as utility hookups, new appliances and moving. The moving costs always vary, with the average being $1,000. Utility costs for phone and electricity would range from $150 to $250. The survey costs, title insurance and appraisal fees should also be added to your budget. One helpful tool would be to use a Mortgage Calculator.

2) Prepare for the down payment & closing costs.

A Real estate agent Burswood, advices buyers to keep aside almost 4% of the home price as the closing costs. One of the major closing costs is the land title transfer taxes. In Winnipeg, its generally accepted advice to set aside 2-2.5% of the price of the home for Closing Costs. In addition to the Land Titles Transfer Tax, closing costs would include things like legal fees, part of the property taxes (the part of the year when you own the home), and home insurance cost.

3) Find a REALTOR® before buying a house

A REALTOR® is far more aware of the real estate market of your locale than you. A skilled real estate agent can prove to be a great help during your house hunting. There are many reasons why a home buyer should be using their own real estate agent, including:

Saving Time

Saving Money

Being fully represented in their transaction

Convenience

for more reasons, read Reasons by home buyers should have their own agent.

HOW TO SELECT THE RIGHT REALTOR®

As mentioned above, your real estate agent is involved in nearly every part of the home-buying process. Therefore, selecting the right agent is of ultimate importance. Here are a couple of things you can do:

ASK YOUR FAMILY AND FRIENDS FOR RECOMMENDATIONS

Chances are, someone close to you has just gone thru the process of buying a home in Winnipeg, and can give you feedback about their experience with their REALTOR®. If they had a great experience, get the name and consider him/her for the job.

ONLINE REVIEWS AND RECOMMENDATIONS

Check the agents name on google, and also check to see if he/she is listed and accredited by the local Better Business Bureau.

Check out your agent when buying a home

Some basic tips for selecting a REALTOR

You want your agent to be:

Experienced in the area and price range

Experienced in the style of home (house vs. condo)

Well connected with other relevant professionals

Technologically saavy

Easily contacted by text, email or phone

When you meet realtors, enquire about the experience of each and success rate. Make sure to hire one with whom you feel comfortable. Explain to your REALTOR about the aspects which hold priority for you, like schools, neighbourhoods and community groups.

Another option is to check your local BBB Reviews, to see if your prospective real estate agent is accredited by the Better Business Bureau.

4) Apply for pre-approved mortgage.

This would help you to set the maximum amount for mortgage and the rates of interest. This would in turn set your budget, prior to your starting it the house hunting. A mortgage application also allows the seller to know that you are really serious about the purchase of a home. Options include using a bank mortgage specialist, a credit union or a mortgage broker.

Here is what NOT to do: Call a bunch of banks, credit unions and mortgage brokers, and say “Hi, whats YOUR best mortgage rate?” Why not?

Because it is a useless exercise! Mortgage lenders reserve their best rates for their best customers, and as they have no way of knowing if YOU fall into that category, they can not possibly give you an accurate rate over the phone.

Oh, they’ll quote you rates alright, but whether or not you actually qualify for that rate will depend on your credit rating, which requires a credit check.

Here is number 2 on the ‘Don’t Do This’ List: Don’t go to 4 lenders and ask them all to pre-qualify you. Why?

Each time a lender checks into your credit history, your rating actually takes a little negative hit!

Here is another reality: Most lenders are fairly competitive, and the actual difference between their rates quite often boils down to fractions of a percent. (Yes, over the life of the mortgage that CAN add up to thousands of dollars, but I’m here to suggest that there are other factors that may actually be of greater importance). What could be more important than a few grand? Well, for one thing, the penalty a bank or lender charges when you try to get out of a mortgage early!

Watch those penalties

Mortgage Lender penalties for getting out of a mortgage early will charged $30,000 for closing the mortgage out a couple of years early. Ask THOSE home-owners whether the 0.15% they saved on the mortgage payments was actually worth it.

Why would you close out early? Although you may not think so when you are buying the house, a lot can happen in a 5-year span (possibly the length of the lock-in mortgage). Maybe you get transferred with your company, or maybe there are cut-backs and you get laid off, having to sell your home. Or maybe marital separation, death or illness pop up.

Fact remains that a lot of unforeseen circumstances can come up within 5 years, and if you have to get out of a mortgage early, make sure it wont cost you an arm and a leg to do so.

5) The Home Buying Process

Perhaps one of the most important points in this home buyers guide is this:

You cannot enjoy your life, if the entire money you earn goes for the payment of your home. The minimum amount of down payment is usually 5%. Paying more as the down payment leads to a reduction in your costs. If the down payment is lesser, there is almost no equity left in your home. If the down payment is lower than 20%, you may need mortgage loan insurance. This may result in extra costs and higher rates of interest. You certainly don't want to be house-poor, but another common mistake is to purchase a house which is actually too small, forcing you to sell within a year or two as your family and needs grow. Here is a list of 7 of the biggest regrets home buyers have.

VIEWING THE HOMES

You’ll be receiving those new listings as soon as they are activated. Look thru them daily, and contact your agent when you are ready to view one (or several). Here are a couple of pointers:

GIVE YOUR AGENT A LITTLE NOTICE

In a perfect world, you will let him/her know that you’re ready to look at some properties at least one day in advance. Some of the homes may be occupied by renters, who, in Manitoba, have the right to be notified at least 24 hours in advance. So if you are ready to look at homes on a Saturday afternoon, for example, ideally you’ll let your agent know by Thursday evening, so that he/she can begin the process of notifying the owners or tenants of these homes you want to see.

LIMIT THE NUMBER OF HOMES ON ANY ONE TOUR

Ideally, you’ll go out and see 4 to 5 homes. Any more than that, and they will blend in your mind. “Which was the house with the great kitchen?” or “Was that the one with the smokey smell”?

TAKE NOTES

Unless you are in a big rush to buying a house right away, your main purpose during these showings is to eliminate the bad homes from your list, and narrow down the search to a few of your favourite properties. So you should keep notes on the best homes, and set those aside for a 2nd look, perhaps in a day or two.

6) Inspect the home well.

It is wise to examine the house well, before considering it for purchase. In fact, here are 6 top reasons to have a home inspection before you buy.

Seek the help of a skilled home inspector, who would help you to detect any major damages. This would also safeguard you from paying additional costs on repair in future. This is a somewhat self-regulated industry, and nearly anyone with a flashlight and a ladder can call themselves a home-inspector. Be sure to back-ground check, or better yet: Call me for a referral!

Step 7) The Final Steps

LIFE INSURANCE OR MORTGAGE INSURANCE

Let me make this clear.... In this section we are talking about Life or Mortgage Insurance, NOT property insurance. The latter (property insurance) is necessary to insure the property in cases of fire, theft, vandalism etc,,,, and this type of insurance is mandatory if you are buying a home with a mortgage. The reason is simple: Since the bank owns somewhere around 90% of your home (depending on the size of your down payment), the bank (or lender) needs to protect their investment.

However, Life Insurance or Mortgage Insurance is NOT mandatory, even though I have heard stories of some financial institutions trying to persuade their clients to buy mortgage insurance.

In my humble opinion, the buyer is usually better served by buying Life Insurance from a qualified life insurance provider/expert, instead of mortgage insurance. For a full description of each, see this article. Here is a summary of the differences between the two. (For a referral to a trusted Life Insurance Expert, contact me anytime)

PREPARING FOR POSSESSION

The time between when the offer is accepted and final, to the time when you take possession of your new home, you will have plenty of things to prepare. Assuming you’ve signed the mortgage agreement, here are the next things you have to do:

CONTACT YOUR LAWYER

Just let him/her know that the offer papers will be faxed to them by your real estate agent. Of course, let your REALTOR® know who your lawyer of choice will be.

CONTACT A HOME INSURANCE COMPANY

Take the MLS listing information to your home insurance company. Quite often, the insurance company will have additional questions and will contact your real estate agent for answers. Another great reason to have your own agent when buying a home.

CONTACT A MOVING COMPANY

Depending on the season, you may need to hire the moving company several months in advance. Having an ‘odd’ possession date (something other than the 1st, 15th or last day of a month) can be to your advantage. Moving companies are usually less busy (and less expensive) on odd dates, such as the 12th of the month, for example.

CONTACT YOUR LANDLORD (IF YOU’RE CURRENTLY RENTING)

Make sure that you let your landlord know about your plans to move out. Actually, you need to check your lease agreement to make sure that you CAN get out early, without penalties. Other options might include the ability to sublet your apartment to a friend or relative, but discuss all of these options with your landlord.

Conclusion:

These are the major steps a home buyer should take to make the process of buying a house a success. A buyer should make an offer of purchasing a house with the advice of a professional real estate agent, preferably an Accredited Buyer Representative. Also, it is very important for a buyer, especially a first time one, to keep emotions in check while negotiating with a home seller. Sellers may try to make the buyer buy in impulse, which can prove to be a wrong decision.

If you're looking to buy a house or condo in Winnipeg in 2020, call or text Bo Kauffmann at 204-333-2202 or Email Him Here

F.A.Q. about Buying a House or Condo

Q: What is the best time of year to buy a home in Winnipeg?

A: The most popular time to buy is in the spring. That is because this is the time with the most available listings. The best deals can sometimes be obtained by purchasing in August & September, when buyer activity slows down.

Q: What is a better purchase option for a first time buyer: a house or a condo?

A: Condo ownership is a life style choice. It does not work for everyone, but is the right option for the right buyer. Do you travel? Work a lot? Or do you plan to have children soon? Pets? Love yardwork? Condos offer some things that houses can not....and vice versa.

Q: What is the minimum down payment for buying a house?

A: Generally speaking, a buyer needs a minimum of 5%, plus approx. 3% for closing costs. I say 'generall' because sometimes lenders offer a 'zero-down' option. However, in such cases, the bank is loaning the 5% to the buyer, and the buyer will have to actually repay that 5% over the next 3-5 years.