#Motion Control Software In Robotics Market Trends

Explore tagged Tumblr posts

Text

#Motion Control Software In Robotics Market#Motion Control Software In Robotics Market Share#Motion Control Software In Robotics Market Trends#Motion Control Software In Robotics Market Value

0 notes

Text

Double Motors Market [2025] Size,Trends and Scope till 2033

Global “Double Motors Market” research report is a comprehensive analysis of the current status of the Double Motors industry worldwide. The report categorizes the global Double Motors market by top players/brands, region, type, and end-user. It also examines the competition landscape, market share, growth rate, future trends, market drivers, opportunities, and challenges in the global Double Motors market. The report provides a professional and in-depth study of the industry to help understand its current state and future prospects. What Are The Prominent Key Player Of the Double Motors Market?

Linak

TIMOTION

Jiecang Linear Motion

Zhejiang Ewelift

AMETEK

DewertOkin Technology Group

Qingdao Richmat

Moteck

Zhejiang Xinyi Control System

Lim-Tec

The Primary Objectives in This Report Are:

To determine the size of the total market opportunity of global and key countries

To assess the growth potential for Double Motors

To forecast future growth in each product and end-use market

To assess competitive factors affecting the marketplace

This report also provides key insights about market drivers, restraints, opportunities, new product launches or approvals.

Regional Segment of Double Motors Market:

Geographically, the report includes research on production, consumption, revenue, market share, and growth rate of the following regions:

United States

Europe (Germany, UK, France, Italy, Spain, Russia, Poland)

China

Japan

India

Southeast Asia (Malaysia, Singapore, Philippines, Indonesia, Thailand, Vietnam)

Latin America (Brazil, Mexico, Colombia)

Middle East and Africa (Saudi Arabia, United Arab Emirates, Turkey, Egypt, South Africa, Nigeria)

The global Double Motors Market report answers the following questions:

What are the main drivers of the global Double Motors market? How big will the Double Motors market and growth rate in upcoming years?

What are the major market trends that affecting the growth of the global Double Motors market?

Key trend factors affect market share in the world's top regions?

Who are the most important market participants and what strategies being they pursuing in the global Double Motors market?

What are the market opportunities and threats to which players are exposed in the global Double Motors market?

Which industry trends, drivers and challenges are driving that growth?

Browse More Details On This Report at - https://www.businessresearchinsights.com/market-reports/double-motors-market-104434

Contact Us:

Business Research Insights

Phone:

US: (+1) 424 253 0807

UK: (+44) 203 239 8187

Email: [email protected]

Web: https://www.businessresearchinsights.com

Other Reports Here:

Frisbees Market

CMMS Software Market

Point Machine Market

Canoe and Kayak Market

Grand Piano Market

Thermal Rototiller Market

Concentrated Solar Power (CSP) Market

Vinylene Carbonate Market

Boundary Scan Hardware Market

Ethyl Propenyl Ether Market

Other Reports Here:

Eccentric Press Market

Fluted Plastic Board Market

Instant Coffee Powder Market

B2B Fuel Cards Market

Portable Industrial Platforms Market

Semiconductor Fittings Market

Poultry Market

Semiconductor Wafer Transfer Robotics Market

Linear Alpha Olefins (LAO) Market

Magnetron Market

0 notes

Text

Robotic Platform Market driven by Automation Demand

The Robotic Platform Market encompasses a suite of advanced robotic systems designed to execute tasks ranging from material handling and assembly to inspection and packaging across diverse industries. These platforms integrate cutting-edge hardware components—such as robotic arms, end effectors, and vision systems—with sophisticated software for motion planning, simulation and real-time control. Key advantages include enhanced operational efficiency, improved precision, reduced human error and heightened workplace safety. As industries confront labor shortages and rising production costs, the need for scalable robotic platforms has soared, fueling demand for customizable and modular solutions.

In manufacturing, these systems optimize throughput and facilitate Industry 4.0 initiatives, while in healthcare, they support surgical assistance, telepresence and laboratory automation. Additionally, the ongoing trend toward collaborative robots (cobots) underlines the market’s focus on human-machine interaction and adaptive intelligence. Market research indicates that small and medium enterprises are increasingly adopting robotic solutions to maintain competitive cost structures. Robust market insights point to the pharmaceutical and food & beverage sectors as emerging segments for growth, driven by stringent quality standards and consumer expectations. Overall, continuous innovations in artificial intelligence and machine learning are expected to expand the Robotic Platform Market scope, enabling predictive maintenance and advanced analytics.

The Global Robotic Platform Market is estimated to be valued at USD 11.37 Bn in 2025 and is expected to reach USD 18.62 Bn by 2032, growing at a compound annual growth rate (CAGR) of 7.3% from 2025 to 2032. Key Takeaways Key players operating in the Robotic Platform Market are:

-ABB LTD.

-Amazon.com, Inc.

-Google LLC

-IBM Corporation

-KUKA AG

These market players dominate the industry size and contribute significantly to collectively over 40% of market share, leveraging robust market growth strategies such as strategic partnerships, acquisitions and extensive R&D spending. ABB LTD. continues to enhance its robotics portfolio through modular platforms, focusing on collaborative robots for light-duty tasks. Amazon.com, Inc. integrates robotic platforms in its fulfillment centers for automated order processing, boosting business growth and reducing operational costs. Google LLC and IBM Corporation invest heavily in AI-driven automation, offering cloud-based robotic solutions with advanced analytics and machine vision. Meanwhile, KUKA AG differentiates through high-precision industrial robots tailored for automotive and aerospace segments. Collectively, these leading companies drive market competition, develop new applications and influence market dynamics across global regions.

‣ Get More Insights On: Robotic Platform Market

‣ Get this Report in Japanese Language: ロボ��トプラットフォーム市場

‣ Get this Report in Korean Language: 로봇플랫폼시장

0 notes

Text

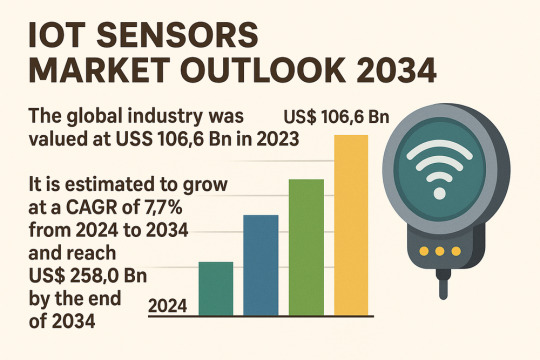

Internet of Things (IoT) Sensors Market to Hit US$ 258 Billion by 2034

The global Internet of Things (IoT) sensors market was valued at US$ 106.6 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 7.7% between 2024 and 2034, reaching US$ 258.0 billion by the end of the forecast period. IoT sensors, which convert physical parameters such as temperature, pressure, humidity, and motion into electrical signals, are key enablers of real-time data analytics across consumer electronics, healthcare, automotive, agriculture, transportation, and industrial sectors.

Market Drivers & Trends

Surge in Demand for Smart Sensors

Smart sensors provide digital data ready for immediate transmission, reducing latency in performance monitoring.

Adoption of automated predictive maintenance in smart factories is accelerating the shift toward intelligent sensor networks to prolong asset life and prevent unplanned downtime.

Rise in Investment in Industry 4.0

Industrial IoT (IIoT) sensors aggregate data centrally and feed it back to optimize processes, critical for factory automation and digital twin implementations.

Growth in collaborative robotics and autonomous guided vehicles has driven demand for Inertial Measurement Units (IMUs) comprising accelerometers, gyroscopes, and magnetometers to enable precise motion control.

Shift Toward Wireless Connectivity

Wireless IoT sensors are rapidly gaining traction due to simpler installation, scalability, and elimination of wiring constraints, essential for real-time asset tracking via GPS and network connectivity.

Latest Market Trends

Industrial IoT (IIoT) Proliferation: Manufacturing companies, post-pandemic, are heavily investing in digital and supply-chain technologies, fueling growth in IIoT sensor deployments for condition monitoring and quality control.

Industry 5.0 Foundations: Emerging trends see humans collaborating with robots, underscoring the need for sensors with embedded AI capabilities to interpret nuanced environmental cues and support safe, efficient cooperation.

Edge Computing Integration: Key players are developing edge-based network architectures that process sensor data locally, minimizing latency and bandwidth usage, and empowering real-time decision-making.

Key Players and Industry Leaders

The competitive landscape is marked by strategic investments and product innovations from leading semiconductor and sensor manufacturers:

Analog Devices, Inc.: Investing €630 million in its Limerick, Ireland facility for advanced semiconductor research in industrial and automotive sensors.

Bosch Sensortec GmbH: Unveiled the BHI380 Smart Connected Sensors platform at CES 2024, enhancing motion-tracking applications with ready-to-use hardware and software reference designs.

Honeywell International Inc.: Expanding its wireless sensor portfolio for building automation and aerospace applications.

Infineon Technologies AG: Focusing on low-power gas and environmental sensors for consumer electronics and healthcare monitoring devices.

Texas Instruments, Murata Manufacturing, STMicroelectronics, and TE Connectivity: Continuously broadening their IoT sensor lines across temperature, pressure, flow, and proximity sensing.

Recent Developments

January 2024: Bosch Sensortec launched the BHI380 platform, addressing wearable and motion-tracking needs with integrated AI support.

2023: ABB Ltd. entered a strategic partnership with Pratexo to co-develop edge-computing solutions for decentralized IoT networks.

2023: Siemens announced a US$ 150 million smart factory in Dallas–Fort Worth, leveraging Siemens-made IoT and AI tools for digital twin and factory automation.

2023: Momenta, backed by the European Commission, launched a US$ 100 million Industry 5.0 fund to support human-robot collaboration technologies.

Market Opportunities

Smart Factory Deployments: As Industry 4.0 adoption deepens, demand for temperature, vibration, and level sensors is set to accelerate, particularly in process-driven verticals like pharmaceuticals and petrochemicals.

Healthcare Monitoring: Wearable IoT sensors for continuous patient vitals tracking present a high-growth avenue amid digital health initiatives.

Agricultural IoT: Precision farming technologies, utilizing soil moisture and ambient condition sensors, offer substantial potential in optimizing crop yields and resource utilization.

Smart Buildings and Cities: Growth in building-management systems and urban infrastructure monitoring will escalate demand for environmental and occupancy sensors.

Future Outlook

Looking ahead to 2034, the IoT sensors market is poised for transformative growth driven by:

Advancements in AI-Embedded Sensors: On-sensor analytics will enable localized anomaly detection and autonomous decision-making.

Expansion of 5G and Beyond: Ultra-low latency networks will unlock new applications, from autonomous vehicles to remote surgery, demanding robust sensor ecosystems.

Sustainability Focus: Energy-harvesting and self-powered sensor technologies will reduce maintenance costs and environmental impact, aligning with corporate ESG objectives.

Market Segmentation

Segment

Sub-Segments

By Type

Temperature, Pressure, Humidity, Flow, Level, Image, Smoke, Hall Effect, Accelerometer, Vibration, Magnetometer, Gyroscope, Light, Gas, Others (Motion, Occupancy)

By Technology

Wired, Wireless

By End-Use Industry

Consumer Electronics, Healthcare, Automotive, Industrial, Building & Construction, Retail, Others (Agriculture, Transportation)

Regional Insights

Asia Pacific: Led the market in 2023, driven by accelerated technology investments in manufacturing. Indian manufacturers allocated 35% of operating budgets to tech investments above global averages to bolster IoT, automation, and AI integration.

North America: Strong uptake in smart building projects and automotive sensor applications, supported by major OEMs and tech giants.

Europe: Growing emphasis on sustainable manufacturing and Industrial Internet Consortium initiatives has catalyzed sensor adoption in Germany, France, and the U.K.

Latin America & MEA: Emerging infrastructure modernization and smart agriculture projects are creating greenfield opportunities for sensor deployment.

Why Buy This Report?

Comprehensive Analysis: Deep-dive quantitative and qualitative assessment covering 2020–2022 historical data and 2024–2034 forecast.

Actionable Insights: Detailed coverage of market drivers, restraints, opportunities, and Porter’s Five Forces to guide strategic decision-making.

Competitive Benchmarking: Profiles of 16 leading companies, including product portfolios, financial metrics, strategic initiatives, and recent developments.

Segmentation & Regional Breakdowns: Granular market sizing across types, technologies, end-use industries, and five key regions plus 12 major countries.

Customizable Format: Delivered in PDF and Excel formats with interactive data dashboards for further analysis.

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Precision in Motion: Machine Control System Market Nears $9B by 2034 🦾📐

Machine control system market is experiencing a dynamic transformation, projected to grow from��$4.2 billion in 2024 to $8.9 billion by 2034, reflecting a strong CAGR of 7.8%. As industries pivot towards automation and precision, machine control systems have become integral to sectors like construction, mining, and agriculture. These systems, which incorporate technologies such as GNSS, GPS, laser scanners, and robotic total stations, are vital in reducing human error, enhancing safety, and optimizing operations.

With the need for real-time decision-making, data integration, and digital transformation, businesses are turning to these technologies to streamline workflows and improve project outcomes. The surge in infrastructure development and the evolution of smart cities are further propelling the demand for intelligent machine control solutions.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS20749

Market Dynamics

The market’s upward trajectory is largely influenced by the rising demand for precision in construction and farming applications, where human oversight alone is insufficient. Automation trends, particularly in heavy equipment, are reducing labor dependency while improving operational accuracy and safety.

At the same time, high initial investment costs and integration complexities act as restraints. Small to mid-sized enterprises often hesitate to adopt due to budget constraints and the steep learning curve. Moreover, the lack of skilled operators and concerns over data security in cloud-based systems also pose notable challenges.

Nevertheless, ongoing technological innovation, increasing government support for infrastructure projects, and the push for sustainability are creating vast opportunities for players in this market.

Key Players Analysis

The competitive landscape of the machine control system market is a blend of well-established giants and emerging innovators. Key market leaders include Topcon Corporation, Trimble Navigation, Leica Geosystems, MOBA Mobile Automation, and Carlson Software. These companies are constantly investing in R&D, forming strategic partnerships, and enhancing their software-hardware integration capabilities to stay ahead.

Emerging players like Geo Dynamics, Terra Track Systems, and Precision Pilot are making waves by offering niche innovations and customizable solutions for specialized applications. The market also sees increasing collaboration between technology developers and equipment manufacturers, allowing for seamless end-to-end solutions.

Regional Analysis

North America leads the global machine control system market, driven by strong technological adoption, robust infrastructure spending, and the presence of major players. The United States remains the largest contributor, thanks to its active smart city initiatives and large-scale construction activities.

Europe follows closely, with Germany and the United Kingdom at the forefront due to their focus on Industry 4.0 and sustainable development. These regions benefit from early adoption and government support for environmentally conscious construction practices.

The Asia-Pacific region is witnessing the fastest growth, led by China and India, where rapid urbanization and industrialization are fueling demand. Local government initiatives aimed at infrastructure modernization and precision agriculture are key market drivers.

Latin America, the Middle East, and Africa are emerging markets, with increasing investments in agriculture, mining, and urban development. Countries like Brazil, Saudi Arabia, and South Africa are investing in smart machinery to boost productivity.

Recent News & Developments

Recent years have seen rapid developments in machine control technology, particularly in GNSS and laser scanning systems. Integration of IoT, AI, and cloud computing into control systems is redefining performance standards. These innovations allow for remote monitoring, predictive maintenance, and data-driven project management.

Additionally, price dynamics remain competitive, with systems ranging from $5,000 to $50,000, depending on complexity and application scope. The increasing ROI and improved system affordability are encouraging broader adoption. Strategic alliances, such as between tech providers and OEMs, are also accelerating global expansion.

Browse Full Report : https://www.globalinsightservices.com/reports/machine-control-system-market/

Scope of the Report

This report provides an in-depth analysis of the machine control system market, spanning from 2018–2034, with a forecast period from 2025–2034. It covers segmentation by type, technology, component, application, end user, and more. Our scope extends to detailed regional forecasts, competitive benchmarking, value chain analysis, and PESTLE assessments.

Additionally, the report evaluates market trends, challenges, and opportunities, equipping stakeholders with the insights necessary to navigate and capitalize on market shifts. Whether you’re an investor, manufacturer, or policymaker, this comprehensive outlook will help align your strategy with emerging global trends.

Discover Additional Market Insights from Global Insight Services:

Printed Circuit Board Market : https://www.globalinsightservices.com/reports/printed-circuit-board-market/

Machine Control System Market : https://www.globalinsightservices.com/reports/machine-control-system-market/

Wires And Cables Market : https://www.globalinsightservices.com/reports/wires-and-cables-market/

Asset Integrity Management Market : https://www.globalinsightservices.com/reports/asset-integrity-management-market/

Gallium Nitride (GaN) Power Devices Market ; https://www.globalinsightservices.com/reports/gallium-nitride-gan-power-devices-market/

#machinecontrolsystems #constructiontech #agtech #smartinfrastructure #automationtechnology #gnss #laserscanning #iotintegration #precisionfarming #constructionautomation #heavyequipmenttech #digitalconstruction #smartfarming #roboticsystems #gpsnavigation #civilengineeringtech #infrastructuregrowth #earthmovingequipment #graderautomation #excavatortechnology #mininginnovation #agriculture4.0 #construction4.0 #geospatialtechnology #industrialautomation #remotesensingtech #lidarsolutions #digitalsite #siteautomation #buildingthefuture #smartcities2025 #jobsiteinnovation #machinelearningtech #constructionequipment #sustainabilitytech #techinconstruction #dataintelligence #fieldautomation #futureofconstruction #gnssapplications #constructionefficiency

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

What Key Factors Should You Consider When Choosing an Automation Products Supplier?

Understanding the Role of an Automation Products Supplier

In today’s fast-paced industrial landscape, businesses depend heavily on reliable Automation Products Supplier in Kuwait partners to streamline operations, improve productivity, and maintain a competitive edge. Automation has become essential across sectors such as manufacturing, logistics, healthcare, and more, driven by the need for efficiency, accuracy, and cost control. The right supplier not only provides advanced products but also delivers technical support, customization, and ongoing services that are crucial for long-term success.

Types of Automation Products Available

Automation products cover a wide range of technologies, each serving specific roles in industrial and commercial applications:

Programmable Logic Controllers (PLCs): These are ruggedized computers designed to control manufacturing processes, offering high reliability and ease of programming for tasks like assembly lines and robotic devices.

Human Machine Interfaces (HMIs): HMIs provide intuitive control panels for operators, enabling easy visualization and management of complex systems through touch screens and multi-touch interfaces.

Motion and Drives: Includes servo motors and stepper motors used for precise control of position, speed, and torque in automated systems.

I/O Systems: Inputs and outputs (I/O) connect various sensors and actuators to central controllers, supporting multiple communication protocols for distributed control.

Sensors and Vision Systems: Photoelectric, proximity sensors, and machine vision cameras are used for detecting objects, monitoring production lines, and ensuring quality control.

Accessories and Connectivity: Products such as cordsets, communication cables, and software for programming and troubleshooting are essential for seamless integration and maintenance of automation systems.

Why Supplier Selection Matters

Choosing the right automation products supplier is a strategic decision that impacts every aspect of your operations. Here are key factors to consider:

Product Range and Innovation: Leading suppliers offer a comprehensive portfolio, including the latest advancements in robotics, artificial intelligence, and IoT-based control systems. This ensures your business can adopt new technologies as they emerge.

Reliability and Support: A reputable supplier provides technical support, training, and after-sales services, helping you maximize the value of your investment and minimize downtime.

Customization and Scalability: As industries evolve, the demand for customized and scalable solutions grows. The best suppliers work closely with clients to tailor products that fit unique operational needs.

Global Reach and Local Presence: Top suppliers often have a global footprint with strong local support, ensuring timely delivery and service regardless of location.

Security and Compliance: With increasing digitalization, security is paramount. Suppliers should offer solutions with robust cybersecurity features and comply with relevant industry standards.

Market Trends and Growth Opportunities

The global industrial automation market is expanding rapidly, with a high growth rate projected for the coming years. This growth is driven by rising labor costs, a shortage of skilled workers, and government initiatives promoting automation for efficiency and sustainability. Companies are investing in technologies such as edge computing, 5G, and digital twin systems, which enable real-time monitoring and predictive maintenance for smarter operations.

Conclusion

Selecting the right Automation Products Supplier in Kuwait is critical for any business aiming to thrive in an increasingly automated world. By evaluating suppliers based on product offerings, innovation, support, and security, companies can ensure they are well-equipped to meet current demands and adapt to future challenges. As automation technology continues to evolve, partnering with a knowledgeable and reliable supplier will help your business achieve greater efficiency, productivity, and long-term growth.

Also Read: Rexroth Pumps and Valves Supplier in Kuwait

0 notes

Text

Motion Control Market: Current Analysis and Forecast (2024-2032)

The motion control market has seen robust growth in the last couple of years due to the improvements in manufacturing processes that are becoming complex, the requirement for accuracy, and the move towards Industry 4.0. Additionally, the integration of advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and machine learning (ML) has further embraced the adoption of motion control systems, which are essential for improving precision, speed, and overall operational efficiency.

Adapting to Evolving Industrial Demands

Automation has become popular in industries to increase production, increase production efficiency, and reduce costs as more consumers demand better products. As these goals are worthwhile, motion control systems are paramount in providing creative handling and positioning of the machines, energy usage, and reliability.

In January 2024, Siemens enhances the Sinamics S210 servo drive system in terms of new hardware and software for even broader application areas. Some of the latest features in the new V6 software generation include a single positioner that lightens the load of the controller as well as an EtherNet/IP interface for integration of third-party controllers. The servo drive system is especially suitable for applications with high dynamics in the power range between 50 W and 7 kW: For example, packaging machines, pick and place machines, digital printers, or any automated device.

Emphasis on Sustainability and Industry 4.0 Adoption

In the context of promoting sustainable business and adopting Industry 4.0 principles, motion control systems become the enablers of manufacturing process efficiency through precise control of energy consumption. There is a shift to smart motion control as a system where the smart motion control systems are compatible with larger industrial automation systems with the IoT and AI systems to improve real-time data processing and machine learning capabilities.

In April 2024, Rockwell Automation announced the FLEXLINE 3500 motor control center (MCC) that has been developed to meet electrical engineers’ needs. This LMV motor control solution is aimed at increasing production, reducing mean time, and improving power utilization among manufacturing industries. The system incorporates intelligent motor control devices to provide direct in-line data on operations and the status of the system to reduce downtime and maintenance expenses and increase efficiency. The FLEXLINE 3500 is designed for various industries including food and beverage, oil and gas industries, and complies with global standards of IEC 61439-1&2.

Regulatory Compliance and Safety Enhancements

With enhanced safety measures being adopted in industries, motion control systems are gradually being developed to meet the safety requirements that are being set by various standards, thus improving functional safety in industrial automation. This trend is particularly prominent in industries like automotive, pharmaceuticals, and food & beverage, where precision and safety are critical. For example, Bosch Rexroth launched a new line of motion control solutions that meet the latest ISO 13849-1 safety standards, offering enhanced safety features such as safe torque off (STO) and safe limited speed (SLS). These solutions are designed for use in applications requiring high levels of safety, such as collaborative robotics and automated manufacturing lines.

Access sample report (including graphs, charts, and figures): https://univdatos.com/get-a-free-sample-form-php/?product_id=67665

Conclusion

Currently, the global motion control market is experiencing a major shift due to the rising need for automation and energy-saving solutions globally. Since companies are not ceasing to experiment with solutions and introducing smart technologies such as AI, IoT, and machine learning, the market is set to grow steadily. Manufacturers are becoming innovative, creating radical innovations, and ensuring compliance with guidelines that are today’s needs for industries. The appeal to accuracy, non-risky performance, sustainability as well and improvement in smart manufacturing techniques make the motion control market predisposed to a path that constitutes robust growth as well as incremental innovation.

Contact Us:

UnivDatos Market Insights

Contact Number - +1 9782263411

Email - [email protected]

Website - www.univdatos.com

Linkedin- https://www.linkedin.com/company/univ-datos-market-insight/mycompany/

Related Electronic & Semiconductor Research Industy Report:-

Chip On Board LED Market: Current Analysis and Forecast (2024-2032)

Foldable Display Market: Current Analysis and Forecast (2024-2032)

0 notes

Text

Collaborative Robots Market Size, Share, Growth and Industry Trends, 2030

The global collaborative robots market size is anticipated to reach USD 11.04 billion by 2030, exhibiting a CAGR of 32.0% over the forecast period, according to a new report published by Grand View Research, Inc. The growth can be credited to the growing inclination of industries toward collaborative robots or cobots to automate manufacturing processes.

Over the past few years, the growing interest in robot technology across various industries has positively impacted the collaborative robots industry. Unlike conventional industrial robots, cobots are developed to operate at par with their human counterparts. They are mobile and can be easily moved from one area of a manufacturing facility to another. Moreover, they can be programmed with ease, are more cost-effective than their fixed counterparts, and can be used in a wide range of low-speed, repetitive applications.

The increasing need for highly efficient and user-friendly robots that do not require highly skilled experts for deployment and functioning has created a significant demand for software platforms. These platforms allow the integration of robots, motion control, and the generation of an interface that enables the programming of such robots. For instance, Mitsubishi Electric Corporation has launched a cobot named MELFA ASSISTA equipped with RT VisualBox, the company’s engineering software. This software allows the intuitive creation of operating sequences by connecting block diagrams in a chain of events, including linking with other devices, such as cameras and the hands of the robot.

Gather more insights about the market drivers, restrains and growth of the Collaborative Robots Market

Detailed Segmentation:

Application Insights

The gluing & welding segment is expected to witness the highest CAGR over the forecast period, which can be attributed to various benefits offered by cobots such as reduced waste, increased consistency, quality, and output product gaining attention from marketers. The assembly application segment captured a sizeable revenue share of around 23.0% across the collaborative robots market in 2022, owing to the increased usage of cobots for combining easy and repetitive tasks and supporting complex assembly processes.

Payload Capacity Insights

The up to 5kg payload capacity segment held a revenue share of more than 44% in 2022 and is anticipated to show remarkable growth in the future owing to its wide range of attributes. They are light in weight and offer flexibility while optimizing low-weight collaborative processes such as picking, placing, and testing. The launch of advanced cobots in this payload capacity range is opening new growth opportunities for the market. For instance, in March 2021, Comau S.p.A. launched a cost-effective cobot named Racer-5 suitable for packaging and warehousing. This advanced cobot works at an industrial speed of up to 6 m/s and has a 5kg payload capacity which facilitates seamless operations.

Vertical Insights

The automotive segment accounted for a revenue share of more than 24% in 2022 and is expected to grow substantially over the forecast period. The growth can be largely attributed to the increased adoption of collaborative robots owing to their ability to reduce floor space and the cost of production downtime. In addition to this, they find important usage in spot and arc welding, assembling parts, painting, coating, etc. Furthermore, the implementation of collaborative robots helps the automotive industry to increase productivity, resulting in increased demand over the forecast period.

Regional Insights

Europe is a remunerative hub for collaborative robots and captured a significant revenue share of more than 30.0% in 2022. This can be chiefly credited to the enormous application of collaborative robots across various verticals, including logistics, electronics, and inspection. Moreover, various advantages such as efficient manufacturing optimization solutions and increased collaboration offered by automation at the workplace are also expected to support the market expansion.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global robotic platform market size was estimated at USD 9.97 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030.

• The global drone charging station market size was estimated at USD 0.43 billion in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030.

Key Companies & Market Share Insights

The major companies operating in the collaborative robots industry are inclined to introduce innovative offerings to gain a competitive edge in the market. For instance, in February 2021, ABB Group expanded its collaborative robot portfolio with the introduction of the SWIFTI and GoFa cobot range, delivering higher speeds and payloads. This new range complements ABB’s cobot line-up of YuMi and Single Arm YuMi and is faster, stronger, and more capable.

It has been designed to support high-growth segments such as consumer goods, electronics, healthcare, logistics, food, and beverage, etc. Additionally, in November 2022, Epson America, Inc. announced the expansion of the VT6L-Series through the launch of the VT6L-DC All-in-One 6-Axis Robot. The newly launched product is ideal for mobile solutions and delivers next-level technology that helps to improve operational efficiency.

Some prominent players in the global collaborative robots market include:

• ABB Group

• DENSO Robotics

• Epson Robots

• Energid Technologies Corporation

• F&P Robotics AG

• Fanuc Corporation

• KUKA AG

• MRK-Systeme GmbH

• Precise Automation, Inc

• Rethink Robotics, Inc

• Robert Bosch GmbH

• Universal Robots A/S

• Yaskawa Electric Corporation

• MABI Robotic AG

• Techman Robot Inc.

• Franks Emika Gmbh

• AUBO Robotics

• Comau S.p.A.

Collaborative Robots Market Segmentation

Grand View Research has segmented the global collaborative robots market based on payload capacity, application, vertical, and region:

Collaborative Robots Payload Capacity Outlook (Revenue, USD Billion, 2018 - 2030)

• Upto 5kg

• Upto 10kg

• Above 10kg

Collaborative Robots Application Outlook (Revenue, USD Billion, 2018 - 2030)

• Assembly

• Pick & Place

• Handling

• Packaging

• Quality Testing

• Machine Tending

• Gluing & Welding

• Others

Collaborative Robots Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

• Automotive

• Food & Beverage

• Furniture & Equipment

• Plastic & Polymers

• Metal & Machinery

• Electronics

• Pharma

• Others

Collaborative Robots Regional Scope (Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o U.K.

o France

• Asia Pacific

o China

o Japan

o India

• South America

o Brazil

• Middle East and Africa

Order a free sample PDF of the Collaborative Robots Market Intelligence Study, published by Grand View Research.

#Collaborative Robots Market#Collaborative Robots Market size#Collaborative Robots Market share#Collaborative Robots Market analysis#Collaborative Robots Industry

0 notes

Text

Motion Control Market : By Industry Trends, Leading Players, Size, Share, Growth, Opportunity And Forecast 2024-2033

The motion control global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Motion Control Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The motion control market size has grown strongly in recent years. It will grow from $15.91 billion in 2023 to $16.82 billion in 2024 at a compound annual growth rate (CAGR) of 5.7%. The growth in the historic period can be attributed to innovation in entertainment and gaming, industrial automation growth , demand for robotics , increase in manufacturing activities, emphasis on precision and efficiency .

The motion control market size is expected to see strong growth in the next few years. It will grow to $20.99 billion in 2028 at a compound annual growth rate (CAGR) of 5.7%.The growth in the forecast period can be attributed to industry 4.0 and smart manufacturing, rise in robotics and automation, expansion in industrial iot , demand for precision engineering, energy efficiency focus. Major trends in the forecast period include safety innovations, expansion in electric vehicles , healthcare automation, food processing automation, entertainment and gaming integration .

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/motion-control-global-market-report

The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Market Drivers - The surging adoption of automation in manufacturing facilities is expected to propel the growth of the motion control market going forward. Automation refers to the use of technology such as robots to automate tasks without manual intervention. Many industries are adopting motion-control robots to achieve maximum automation and efficiency in operations. Integration of motion control robots in manufacturing industries provides the advantage of improving productivity, quality, and safety of workers by reducing errors and waste and adding flexibility to the manufacturing process. For instance, in March 2022, according to the Manufacturing India article, an India-based agency that provides new related information to various industries, including production, automation updates, manufacturing, and automation updates, reported that wide adoption of automation had been seen in Indian manufacturing industries, and it was estimated that by 2050, approximately 85–90% of manufacturing firms in India will have adopted automation in operations. Therefore, the surging adoption of automation in manufacturing facilities is driving the growth of the motion control market.

Market Trends - Product innovation is the key trend that is gaining popularity in the motion control market. Major companies operating in the motion control market are focused on developing new technological solutions to strengthen their position in the market. For instance, in May 2021, Performance Motion Devices, Inc., a US-based company operating in high-performance motion control, launched its advanced motion controller known as the ION/CME N-Series digital drive with intelligent motion control amplifiers to meet high-end motion control needs in manufacturing. Intelligent motion control is a high-performance motor control drive that can control multi-phase motors such as AC and DC induction motors for sophisticated control features. The ION/CME N-Series Digital Drive provides a complete control solution with advanced features such as a flexible connection option, 1 KW output capacity, support for quadrature, a communication interface, sin/cost, and BiSS-C encoders, among others.

The motion control market covered in this report is segmented –

1) By Type: Computerized Numeric Control, General Motion Control, Servo drives, Position control hardware 2) By Component: Actuators and Mechanical Systems, Motion Controllers, Electric Drives, Ac Motors, Sensors and Feedback Devices 3) By Application: Metal Cutting, Metal Forming, Material Handling Equipment, Robotics, Semiconductor Machinery, Rubber and Plastics, Machinery, Other Applications 4) By Industry: Aerospace and Defense, Automotive, Semiconductor and Electronics, Metals and Machinery Manufacturing, Food and Beverages, Medical, Printing and Paper, Pharmaceuticals and Cosmetics, Other Industry

Get an inside scoop of the motion control market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=8344&type=smp

Regional Insights - Asia-Pacific was the largest region in the motion control market share in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the motion control market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the motion control market report are ABB Ltd., Fanuc Corporation, Mitsubishi Electric Corporation, Siemens AG, Yaskawa Electric Corporation, Altra Industrial Motion, Parker Hannifin Corporation, Rockwell Automation Inc., Robert Bosch GmbH, Dover Motion, Omron Corporation, Novanta Inc., AMETEK Advanced Motion Solutions, Galil Motion Control, Schneider Electric SE, Emerson Electric Co., STM Microelectronics, Bosch Rexroth AG, Kollmorgen, Moog Inc., Aerotech Inc., Delta Electronics, Advanced Motion Controls, Copley Controls, Elmo Motion Control, Faulhaber Group, Harmonic Drive LLC, KEB America, LinMot USA, Maxon Motor AG

Table of Contents 1. Executive Summary 2. Motion Control Market Report Structure 3. Motion Control Market Trends And Strategies 4. Motion Control Market – Macro Economic Scenario 5. Motion Control Market Size And Growth ….. 27. Motion Control Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

Why Siemens is a Leader in Industrial Automation

Siemens, a global powerhouse in automation technology, has long been recognized as a leader in industrial automation. With its extensive range of products and solutions designed to enhance factory operations, Siemens is at the forefront of revolutionizing manufacturing and production processes. This leadership stems from a combination of innovative technologies, a commitment to research and development, and a deep understanding of industrial needs.

Pioneering Automation Technology

Siemens’ automation technology portfolio is comprehensive and versatile, addressing the diverse needs of modern factories. Central to this portfolio is the Siemens Simatic line, which includes programmable logic controllers (PLCs), human-machine interfaces (HMIs), and industrial software. These tools are the backbone of automated manufacturing systems, enabling precise control and monitoring of production processes.

Simatic PLCs, for example, are renowned for their reliability and performance. They provide robust solutions for automating complex tasks, reducing manual intervention, and enhancing operational efficiency. Siemens HMIs offer intuitive interfaces for operators, ensuring seamless interaction with automated systems. Together, these components create a cohesive and powerful automation environment.

Advanced Motion Control Solutions

Siemens’ Motion Control technology is another critical component of its industrial automation leadership. Motion Control systems are essential for applications that require precise movements, such as robotics, CNC machines, and high-speed production lines. Siemens provides a range of Motion Control products, including servo drives and motors, that deliver exceptional accuracy and responsiveness.

By integrating Motion Control with automation systems, Siemens ensures that manufacturing processes are not only efficient but also highly precise. This precision is vital for industries such as automotive, aerospace, and electronics, where even minor deviations can lead to significant quality issues.

Innovation through Simatic and Beyond

The Simatic brand represents Siemens’ commitment to innovation in industrial automation. Beyond traditional PLCs and HMIs, Simatic encompasses a wide range of advanced automation solutions, including edge computing devices, industrial IoT gateways, and cloud-based analytics platforms. These technologies enable factories to harness the power of data, driving insights that lead to continuous improvement.

Edge computing devices, for instance, allow real-time processing of data at the factory floor level, reducing latency and improving decision-making. Industrial IoT gateways connect machines and systems, facilitating seamless data exchange and enabling predictive maintenance and remote monitoring. Cloud-based analytics platforms provide powerful tools for analyzing production data, uncovering trends, and optimizing processes.

Comprehensive Industrial Solutions

Siemens offers end-to-end solutions for industrial automation, from design and engineering to implementation and maintenance. Their portfolio includes software tools for simulation and digital twin modeling, which help manufacturers design and optimize production systems before physical implementation. This approach reduces time-to-market and minimizes the risk of costly errors.

Furthermore, Siemens’ commitment to open standards ensures that their automation solutions are compatible with a wide range of third-party systems. This interoperability is crucial for modern factories, which often rely on equipment from multiple vendors. By providing seamless integration, Siemens helps manufacturers create cohesive and efficient production environments.

Commitment to Research and Development

One of the key reasons Siemens remains a leader in industrial automation is its unwavering commitment to research and development. Siemens invests heavily in developing new technologies and enhancing existing ones. This investment ensures that Siemens stays ahead of industry trends and continues to provide cutting-edge solutions.

Siemens’ R&D efforts focus on several key areas, including artificial intelligence (AI), machine learning (ML), and digitalization. By incorporating AI and ML into their automation systems, Siemens enables smarter and more adaptive manufacturing processes. Digitalization efforts, such as the development of digital twins and advanced analytics, empower manufacturers to optimize their operations and make data-driven decisions.

Real-World Impact

Siemens’ leadership in industrial automation is evident in its extensive track record of successful implementations across various industries. In automotive manufacturing, for instance, Siemens’ automation solutions have streamlined assembly lines, improved quality control, and increased production rates. In the food and beverage industry, Siemens’ technologies have enhanced processing and packaging efficiency, ensuring high standards of hygiene and product quality.

Future of Manufacturing

Looking ahead, Siemens is poised to continue leading the industrial automation sector. The company’s focus on integrating emerging technologies, such as AI, IoT, and 5G, will drive the next wave of innovation. These advancements will enable even greater levels of automation, connectivity, and flexibility in manufacturing.

The future of factory automation will be characterized by smart, self-optimizing systems that can adapt to changing conditions and demands. Siemens is at the forefront of this transformation, providing the tools and technologies that will define the factories of tomorrow.

Conclusion

Siemens’ leadership in industrial automation is the result of decades of innovation, a comprehensive portfolio of automation technology, and a deep commitment to advancing manufacturing processes. Through products like Simatic and advanced Motion Control systems, Siemens has set the standard for efficiency, precision, and reliability in industrial operations. As the industry continues to evolve, Siemens is well-positioned to remain a driving force in shaping the future of factory automation.

#automation#simatic#motion control#automation technology#industrial#manufacturing#factory#production#siemens

0 notes

Text

Robotic Camera Modules Market Analysis, Size, Share, Growth, Trends, and Forecasts 2023-2030

The Robotic Camera Modules market caters to the growing demand for automated, robotics-enabled cameras across consumer electronics, industrial inspection, healthcare and automotive sectors. With AI and robotics advancing considerably, robotic camera modules have emerged as key enablers for dynamic vision capabilities in smart devices and machines.

Robotic camera modules typically feature multi-axis motion actuators to facilitate pan, tilt and swivel functionality. This allows real-time alignment of the visual field with the target object or scene as per requirement. Control and integration electronics along with embedded software and machine learning further empower autonomous viewing capability tailored for specific use cases.

Get a Free Sample Report:https://www.metastatinsight.com/request-sample/2521

Who are the largest manufacturers of the Robotic Camera Modules Market worldwide?

ams

e-con Systems

CM Technology Company

LG Innotek

Luxvision Innovation

OFILM Group

Nidec

D3 Engineering

Unispectral

InfiRay

However, within challenges lie opportunities. The market has the potential to overcome these hurdles and thrive. For instance, addressing cost concerns through more cost-effective solutions or innovative pricing models could broaden the market's appeal. Similarly, actively engaging with regulatory bodies to streamline compliance processes can pave the way for smoother market penetration.

Looking ahead, the future holds promising opportunities for the Robotic Camera Modules Market. The rising adoption of these modules in diverse applications, from surveillance to industrial automation, opens new avenues for growth. The advent of smart cities, with an increased focus on surveillance and security, further accentuates the demand for advanced robotic camera modules.

Access Full Report@https://www.metastatinsight.com/report/robotic-camera-modules-market

Moreover, the growing inclination toward smart homes and the Internet of Things (IoT) presents a lucrative opportunity. Robotic camera modules, integrated into smart home systems, contribute to enhanced security and monitoring capabilities. The expanding scope of applications signifies a broader market reach and sustained growth potential.

While technological advancements and the increasing demand for automation propel the Robotic Camera Modules Market forward, challenges such as cost constraints and regulatory complexities warrant careful consideration. However, these challenges are not roadblocks but opportunities in disguise. The market, with its innovative capacities, can leverage these challenges to carve out new avenues for growth, ensuring a promising trajectory in the years to come.

Contact Us:

+1 214 613 5758

#RoboticCameraModul#RoboticCameraModulesMarket#RoboticCameraModulindustry#marketsize#marketgrowth#marketforecast#marketanalysis#marketdemand#marketreport#marketresearch

0 notes

Text

Global Top 7 Companies Accounted for 16% of total Vtuber (Virtual YouTuber) market (QYResearch, 2021)

A VTuber, or virtual YouTuber, is an online entertainer who uses a virtual model generated using computer graphics. Real-time motion capture software or technology are often—but not always—used to capture movement. A digital trend that originated in Japan in the mid-2010s and, since the early 2020s, has become an international online phenomenon. A majority of VTubers are English and Japanese-speaking YouTubers or live streamers who use model designs. By 2020, there were more than 10,000 active VTubers. Although the term is an allusion to the video platform YouTube, they also use websites such as Niconico, Twitch, and Bilibili.

The first entertainer to use the phrase "virtual YouTuber", Kizuna AI, began creating content on YouTube in late 2016. Her popularity sparked a VTuber trend in Japan, and spurred the establishment of specialized agencies to promote them, including major ones such as Hololive Production (Cover), AnyColor, etc. Fan translations and foreign-language VTubers have marked a rise in the trend's international popularity. Virtual YouTubers have appeared in domestic advertising campaigns, and have broken livestream-related world records.

According to the new market research report “Global Vtuber (Virtual YouTuber) Market Report 2023-2029”, published by QYResearch, the global Vtuber (Virtual YouTuber) market size is projected to reach USD 23.28 billion by 2029, at a CAGR of 31.8% during the forecast period.

Figure. Global Vtuber (Virtual YouTuber) Market Size (US$ Million), 2018-2029

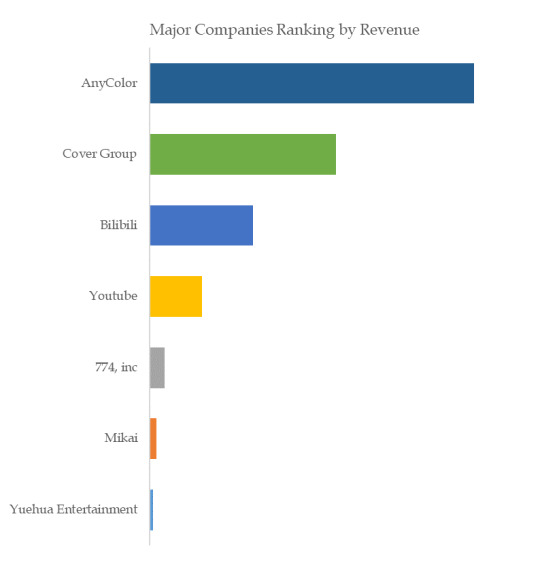

Figure. Global Vtuber (Virtual YouTuber) Top 7 Players Ranking and Market Share (Ranking is based on the revenue of 2022, continually updated)

The global key manufacturers of Vtuber (Virtual YouTuber) include AnyColor, Cover Group, Bilibili, Youtube, 774, inc, etc. In 2021, the global top four players had a share approximately 27.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

Motion Control Industry worth USD 21.6 billion by 2029

The report "Motion Control Market by Offering (Actuators & Mechanical Systems, Drives, Motors, Motion Controllers, Sensors & Feedback Services, Software & Services), System (Open-loop, Closed-loop), End-user Industry and Region - Global Forecast to 2029" The motion control market is expected to reach USD 21.6 billion by 2029 from USD 16.5 billion in 2024, at a CAGR of 5.5% during the 2024–2029 period.

The Motion Control Market is experiencing growth driven by various factors, with the widespread adoption of automation being a significant contributor across global industries. As businesses pursue operational efficiency, the utilization of motion control systems becomes crucial in optimizing manufacturing processes. These systems play a key role in ensuring precise control over the movement of machinery and robotic systems. Market expansion is further fueled by technological advancements, such as the incorporation of advanced sensors and communication protocols, enhancing the sophistication of motion control solutions. The emergence of smart factories, Industry 4.0 initiatives, and the demand for enhanced production quality and accuracy also contribute to this upward trend. Additionally, the increasing applications of motion control in diverse sectors, including automotive, aerospace, electronics, and healthcare, underscore its pivotal role as a fundamental facilitator of modern industrial automation.

The closed-loop system is expected to account for the largest share of the motion control market during the forecast period.

The closed-loop systems provide a continuous feedback loop to regulate and adjust the performance of motion control components. This feedback mechanism allows for real-time monitoring and correction, ensuring precise and accurate control over the movement of machinery and automated systems. As industries increasingly prioritize efficiency and precision in their operations, the closed-loop system's capability to deliver reliable and stable performance positions it as a leading choice in the motion control market, contributing significantly to its overall market share.

The automotive industry is projected to account for the largest share of the motion control market during the forecast period.

Motion control assumes a crucial role in the manufacturing processes of the automotive industry, providing precise oversight of machinery and robotic systems. This precision is pivotal in improving production accuracy, minimizing cycle times, and optimizing the overall efficiency of operations. The automotive sector's growing emphasis on automation, smart manufacturing practices, and the implementation of Industry 4.0 initiatives further fuels the demand for advanced motion control solutions. With automotive manufacturers consistently integrating motion control technologies to streamline their production lines, the industry is positioned to sustain its leadership, playing a key role in propelling the overall growth and dominance of the motion control market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=98406125

Asia Pacific is expected to register the highest CAGR during the forecast period.

The growth in Asia Pacific is rooted in the region's dynamic industrial landscape, characterized by a surge in manufacturing activities and rapid technological advancements. As countries in the Asia Pacific region, particularly China and India, continue to witness substantial industrialization and automation across diverse sectors, the demand for motion control solutions is on the rise. The burgeoning adoption of Industry 4.0 practices, coupled with a focus on enhancing manufacturing efficiency, contributes to the increased deployment of motion control systems in the region. Additionally, the expansion of key industries such as automotive, electronics, and machinery manufacturing further propels the demand for motion control technologies. With these factors in play, the Asia Pacific region is positioned to lead in registering substantial growth in the Motion Control Market, reflecting its pivotal role in the global industrial automation landscape.

Key Players

The report profiles key players such ABB (Switzerland), FANUC Corporation (Japan), Siemens (Germany), Yaskawa Electric Corporation (Japan), and Mitsubishi Electric Corporation (Japan).

About MarketsandMarkets™

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem.Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research.The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook.

0 notes

Text

The Evolution of Warehousing: Navigating the World of Smart Warehouses

In the digitally-charged world of today, we're accustomed to the term "smart" permeating every aspect of our lives - smartphones, smart homes, smart cities. Now, it's time to familiarize ourselves with another addition to this repertoire - Smart Warehouses. So, what sets them apart in the vast realm of logistics?

The Blueprint of a Smart Warehouse:

Traditional warehouses store products. Smart Warehouses? They incorporate the magic of technology to reimagine the existing storage and distribution processes. We're talking about state-of-the-art robots working seamlessly alongside humans, intricate networks of sensors, the incredible capabilities of artificial intelligence, the omnipresent Internet of Things (IoT), and game-changing software systems.

Why Go Smart?

Automation: It’s the bedrock of any Smart Warehouse. Using SaaS tools and robots, business owners can now reduce human interventions and fast-track operations. No more manually picking, packing, or storing - robots have got your back!

Connectivity: Envision a unified platform where all your devices converge. With SaaS solutions, that vision becomes reality. Now, you can have real-time visibility and control over your networks, inventory, vehicles, and more.

Data Accessibility and Analytics: Being limited to on-site systems? A thing of the past. Advanced analytics not only facilitates strategic, data-driven decisions but also offers real-time insights, accessible from anywhere.

Security: We've progressed from simply employing guards to utilizing state-of-the-art security measures. Motion-tracking cameras, firewalls, biometrics – all these work in harmony to ensure both physical and digital security.

But, What’s in It for Me?

For those in the e-commerce realm, this isn't just about keeping up with the trends. It’s about survival and thriving. Here are the wins you can expect:

Cost Efficiency: The upfront costs may be daunting, but in the long run, the savings, from reducing manual labor and minimizing errors, can be substantial.

Bolstered Efficiency: Tasks that once took hours are now completed in mere minutes.

Pinpoint Accuracy: Say goodbye to inventory mismatches or out-of-stock scenarios.

Enhanced Customer Service: Faster processing, real-time tracking, and fewer errors translate to happier customers.

Safety First: No more fretting about accidents or cyber threats. Smart Warehouses are equipped to tackle both.

Tech to Look Out For:

From collaborative robots (hello, cobots!) to Automated Guided Vehicles and the widely celebrated Warehouse Management Systems (like ERP software), the tech tools available today are pushing the boundaries of what's possible in warehousing.

Parting Thoughts:

The verdict is clear. As we hurtle towards a future defined by technology, smart warehouses are not just an option; they're the inevitable next step. With a forecasted market value of a whopping $54.60 billion by 2030, it's a shift that promises rewards for those ready to embrace it. If you're an e-commerce business, the future beckons. Are you ready?

0 notes

Text

Global Linear Motion System Market Is Estimated To Witness High Growth Owing To Increasing Demand in Automation and Robotics

The global Linear Motion System Market is estimated to be valued at US$ 9.38 Bn in 2021 and is expected to exhibit a CAGR of 8.1% over the forecast period 2022-2030, as highlighted in a new report published by Coherent Market Insights. A) Market Overview: Linear motion systems are essential components used in various industries such as manufacturing, packaging, healthcare, automotive, and others. These systems provide smooth and accurate movement along a linear path, enabling efficient transportation of goods or components. The advantages of linear motion systems include high precision, improved productivity, reduced downtime, and increased efficiency. The growing demand for automation and robotics in industries is driving the market for linear motion systems. B) Market Key Trends: One key trend observed in the global linear motion system market is the increasing demand for miniaturized linear motion systems. Miniaturization is a significant trend observed across various industries, driven by the demand for compact and lightweight solutions. Miniaturized linear motion systems offer precise movement in restricted spaces and are widely used in applications such as medical devices, microelectronics, and laboratory automation. For example, THK Co. Ltd offers miniature linear motion systems that are compact, lightweight, and provide high rigidity and accuracy. C) PEST Analysis: - Political: The political stability of a country affects the growth of the linear motion system market. Government policies supporting industrial automation and technological advancements play a crucial role in the market growth. - Economic: The economic conditions of a country influence the demand for linear motion systems. Growing economies and rising disposable incomes drive the adoption of advanced automation solutions. - Social: The increasing need for improved efficiency, productivity, and safety in industries is driving the adoption of linear motion systems. The shift towards Industry 4.0 and the growing demand for smart manufacturing further contribute to the market growth. - Technological: Technological advancements such as the integration of sensors, controllers, and software with linear motion systems enhance their capabilities and enable precise control and monitoring of movement. D) Key Takeaways: 1: The global Linear Motion System Market Growth is expected to witness high growth, exhibiting a CAGR of 8.1% over the forecast period, due to increasing demand for automation and robotics in industries. With the growing focus on productivity and efficiency, the adoption of linear motion systems is expected to increase. 2: The Asia Pacific region is expected to be the fastest-growing and dominating region in the global linear motion system market. Factors such as rapid industrialization, increasing investments in the manufacturing sector, and the presence of key market players contribute to the market growth in this region. 3: Key players operating in the global linear motion system market include Hiwin Corporation, Bosch Rexroth AG, The Timken Company, Schneeberger Group, Rockwell Automation Inc., Ewellix AB, THK Co. Ltd, Thomson Industries Inc., Parker Hannifin Corporation, Nippon Bearing Co. Ltd, HepcoMotion Inc., Lintech Corporation, and NSK Ltd. These players focus on product innovation, partnerships, and strategic collaborations to stay competitive in the market.

#Information and Communication Technology#ICT Industry#Linear Motion System#Linear Motion System Market

0 notes

Text

Industrial Robots

Robot sales to automotive producers increased by 22 p.c to a brand new peak of almost a hundred twenty five,seven hundred models. Carmakers remained the biggest prospects for industrial robots last year – just – with a one-third share of the total supply. Innovators have created robots that mimic the movements of dogs, cats, insects, and people with eerie precision. In industrial settings, these advances are letting firms transfer a few of the most tough, harmful, and time-consuming duties from workers to robots. As this trend accelerates, each traders and robotic-component manufacturers are in strong positions to entry profit swimming pools.

Collaborative industrial robots are designed to carry out duties in collaboration with employees in industrial sectors. The International Federation of Robotics defines two forms of industrial robots designed for collaborative use. The different group covers robots designed for collaborative use that do not satisfy the requirements of ISO.

Since grippers and EOATs account for around 3 p.c of the total price of automation, the selection of a high-priced supplier could have relatively little impact on a company’s manufacturing-line prices. As China builds its robotic installed base, it's going to see a 25 % annual increase in demand for end effectors from 2018 by way of 2023. That determine represents about 45 % of the whole market growth expected over those years, and it’s greater than the mixed contribution of Europe and North America. Of the $5.1 billion in market worth for grippers and EOATs in 2023, greater than $1 billion will come from China. If your business isn’t listed on this listing, it doesn’t imply that you can’t use robots in your business. In reality, lots of the hottest robotic functions are applicable to almost any business.

Increased use of robots can be enabling firms in high value nations to ‘re-shore’ or bring again to their home base components of the supply chain that they have beforehand outsourced to sources of cheaper labor. This implies that even small-quantity productions can effectively be automated in areas similar to components welding and slicing, versatile assembly and packaging and palletizing. Robot investments have gotten more and more worthwhile and hence turn out to be increasingly widespread within business. The robotic’s actions are directed by a mixture of programming software and controls. Their automated performance allows them to function around the clock and on weekends—in addition to with hazardous supplies and in difficult environments—releasing personnel to carry out other duties.

The International Federation of Robotics has predicted a worldwide enhance in adoption of industrial robots and so they estimated 1.7 million new robot installations in factories worldwide by 2020 . Using knowledge from the Bureau of Labor Statistics, NIOSH and its state companions have investigated four robot-associated fatalities beneath the Fatality Assessment and Control Evaluation Program. In addition the Occupational Safety and Health Administration has investigated dozens of robot-associated deaths and accidents, which could be reviewed at OSHA Accident Search page. Injuries and fatalities could increase over time because of the rising number of collaborative and co-existing robots, powered exoskeletons, and autonomous automobiles into the work environment.

ISO 9283 specifies that accuracy and repeatability should be measured at most velocity and at maximum payload. But this ends in pessimistic values whereas the robot could be rather more accurate and repeatable at gentle loads and speeds. Repeatability in an industrial process is also topic to the accuracy of the end effector, for instance a gripper, and even to the design of the 'fingers' that match the gripper to the item being grasped. For instance, if a robot picks a screw by its head, the screw might be at a random angle. A subsequent try and insert the screw into a gap could simply fail.

In the year 2020, an estimated 1.64 million industrial robots have been in operation worldwide according to International Federation of Robotics . Industrial robots are automated, programmable and capable of motion on three or more axes. The most commonly used robot configurations for industrial automation, include articulated robots, SCARA robots and gantry robots. The IFR forecasts continued annual industrial robot growth of 5 percent in Germany over the subsequent three years. IFR forecast US industrial robot development of 5 percent this year, rising to 10 percent between 2019 and 2021.

The enthusiasm and funding weren't at all times matched with understanding. General Motors Corporation spent greater than $40 billion on new technology in the 1980's, but a lack of know-how led to expensive robotic fiascos. In 1988, robots at the Hamtramck Michigan plant wreaked havoc - smashing home windows andpaintingone one other. Unfortunately, the premature introduction of robotics began to create monetary instability. The Silver Arm was created by MIT's David Silver to perform exact meeting using touch and pressure sensors and a microcomputer.