#Network densification

Explore tagged Tumblr posts

Text

#Small cell technology#Urban network planning#Radio access network#Network slicing#Millimeter wave spectrum#Network densification#Network virtualization#Invisible Revolution

1 note

·

View note

Text

The Stroads of Chicago

While the older part of the city near the lake is dense, walkable and relatively well-served by transit, the rest...well...isn't.

The intersection of N. Cicero and W. North Avenue, where stroads collide.

As newcomers to Chicago, my wife and I like to explore parts of the city we haven't seen yet, and familiarize ourselves with different neighborhoods.

This week, we took a trip westward along Irving Park to Six Corners, then turned down Cicero, then back along Division, with a couple of detours until we went back northward along Lake Shore Drive. In all, we went about six miles west (a little under 10km).

W. Irving Park Road, aka IL-19.

Irving Park, Cicero, and to some degree Division are arterial roads. Arterials are defined as "higher traffic" urban roads, ranking below actual highways.

However, using the Strong Towns definition, these are really stroads - the unfortunate street-highway hybrid that is designed for higher speeds like a highway, with wider lanes; but have multiple potential points for conflicts and accidents such as driveways, turning entrances and exits to parking lots, intersections and crosswalks. Plus, they're usually just a block from residential streets, meaning residents are exposed to highway levels of noise and pollution.

Stroads are highly unpleasant places to walk. The sidewalks, where they exist, are usually narrow, and (as in one spot we noticed along Cicero) obstructed by telephone poles, street signage, utility hardware, and too often, people illegally parked on the sidewalk. They're often impossible to navigate for people using mobility aids like wheelchairs; there's also little to no tree canopy, leaving pedestrians exposed to harsh weather conditions, particularly in summer.

N. Cicero Avenue is mostly a depressing series of new and used car dealerships, gas stations, car repair shops, Jiffy Lubes, and empty storefronts with papered-up windows.

Using Jan Gehl's definition of pedestrian-scale urbanism, there is nothing of interest here; you're faced with long blank walls, nondescript low-rise strip developments fronted by mandated parking, chain-link fences, and empty lots dominated by weeds.

It isn't a place you would willingly walk to, it's a place you drive to and usually only because you have to.

There's no rapid transit to these neighborhoods; just buses. This means residents are often forced into car dependency, and they're also to some degree cut off from jobs, education and other opportunities because of the transit time involved.

For instance, to travel from a typical house in Belmont-Cragin to Columbia College on transit is, at best, about an hour using the bus and CTA trains.

Using buses only (for instance, if the trains are down) it can get closer to two hours.

Imagine if there was a REM-style automated rapid transit line to downtown, at an average speed of 51km/hr; It could make the trip in 11 minutes. Even if there were six additional stops of 30 seconds each along the way, that means you could get from Belmont-Cragin to downtown in maybe 15 minutes, tops.

This is all doable, but it requires money and political will.

Fixing Chicago's Stroads

Thankfully, there are groups, like Strong Towns Chicago, that are advocating for change.

In an op-ed for the Chicago Tribune, Aaron Feldman backs the new plan to redesign Western Avenue, a north-south arterial, using transit and rezoning for higher density housing:

A big part of this proposed transformation is Bus Rapid Transit (BRT), where buses are given dedicated lanes to get them out of car traffic, priority signaling, and (ideally) dedicated boarding stations.

While it'd be wonderful to magically build out a network of REM-like lines to transit-ize these arterials, BRT is a lower-cost option that can be built out relatively quickly.

Rezoning, densification, BRT, and road diets (lane removals; widening sidewalks; installation of protected bike lanes; more crosswalks, etc.) could positively affect all of the stroads we've mentioned, transforming them back into community-centric destination streets, and connecting residents to more opportunities.

This could be supplemented by programs to put short-term "pop up" retail, arts, and other community services into vacant storefronts, to breathe life back into "dead" sections of these streets.

If you're interested in learning more, or participating, here's the links for Strong Towns Chicago:

📷 Strong Towns Chicago on Instagram

💬 Strong Towns Chicago Slack

💌 Strong Towns Chicago Email Newsletter

12 notes

·

View notes

Text

ASX 100 Companies Spotlight: Telstra Group Ltd (ASX:TLS) Expands Digital Infrastructure Nationwide

Highlights:

Telstra strengthens its presence across digital communications through ongoing infrastructure rollout.

The company focuses on network upgrades, 5G technology, and regional connectivity enhancements.

As a major player among ASX 100 companies, Telstra continues to modernise Australia’s digital backbone.

Telecommunication Sector Overview with ASX Index Context Telstra Group Ltd (ASX:TLS) operates in the telecommunication sector, providing mobile, broadband, enterprise, and digital solutions across Australia. As a core member of the ASX 100 companies, Telstra is included in an index comprising the largest public entities on the Australian Securities Exchange by market capitalisation. The ASX 100 is a key benchmark that reflects the strength and stability of top-tier Australian firms across multiple sectors, including communication services, energy, finance, and materials.

Telstra’s broad national footprint includes mobile towers, fibre-optic cables, international transit capacity, and next-generation internet protocols. The company’s listing also places it in the ASX 200 and ASX 300 indexes, highlighting its extensive contribution to Australia’s economic and digital frameworks. Through its portfolio of consumer and business services, Telstra enables connectivity in urban centres, regional towns, and remote locations.

5G Network Growth and National Coverage Strategy Telstra has committed to enhancing its 5G network infrastructure across metropolitan and regional zones. Its deployment roadmap includes upgrades to existing towers and integration of low-band and mid-band spectrum for increased coverage and speed. The company’s goal remains to enable consistent mobile connectivity for both densely populated and underserved areas.

The 5G program includes small cell installation, fixed wireless access development, and site densification to reduce latency and support high-demand applications. Regional communities receive additional attention through improved spectrum access and targeted infrastructure rollouts. Network capabilities are designed to support growing demand for video conferencing, cloud services, smart devices, and industrial connectivity applications.

Enterprise Services and Digital Transformation Focus Telstra delivers a range of enterprise-grade solutions for government, corporate, and small business clients. These services include managed connectivity, cloud-based applications, cybersecurity, and unified communications platforms. The enterprise division plays a strategic role in Australia’s digital transformation, enabling clients to adopt scalable, secure, and responsive communication frameworks.

In addition to fixed and mobile services, Telstra supports industry-specific innovations through partnerships in transport, health, mining, and retail. Its flexible platforms allow businesses to adapt rapidly to changing digital demands while maintaining service reliability. These offerings are underpinned by Telstra’s software-defined networking and infrastructure-as-a-service capabilities.

International Connectivity and Subsea Infrastructure Telstra International manages the company’s global operations, with a strong presence across Asia-Pacific, Europe, and the Americas. The business segment owns and operates a large subsea cable network, providing data transit, international capacity, and enterprise services to multinational customers.

The international infrastructure includes landing stations, data centres, and core routing hubs to enable seamless connectivity between Australia and major global data exchanges. By supporting bandwidth-intensive applications such as streaming, cloud computing, and digital collaboration tools, Telstra enhances both domestic and offshore communication standards.

Sustainability, Modernisation, and Technological Integration Telstra continues its focus on sustainability and modernisation through green energy adoption, energy-efficient facilities, and e-waste reduction initiatives. The company operates renewable energy purchase agreements and site-specific solar integration for key infrastructure zones.

On the technology front, Telstra incorporates automation, machine learning, and predictive maintenance in its network operations. These advancements help reduce downtime, enhance customer experience, and streamline infrastructure management. In urban areas, Telstra’s Smart City solutions support traffic flow, lighting, and civic safety through connected sensors and data analytics.

0 notes

Text

High-Quality Pump Solutions in the UAE: Oasis Pumps Delivers Performance and Reliability

When it comes to specialized pumping applications in the UAE—whether you need ground improvement equipment, essential flood-control systems, or versatile self-priming units—Oasis Pumps stands ready to meet your project requirements with world-class engineering and support. Explore our cutting-edge offerings below:

Efficient Vibro-Compaction Pumps UAE for Soil Densification

In large-scale construction projects—such as high-rise foundations, roadbeds, or reclamation works—proper ground densification is crucial. Our Vibro-Compaction Pumps UAE provide the high-pressure, consistent flow needed to drive specialized vibrators and tremie tubes into granular soils. Built with robust stainless-steel components, corrosion-resistant seals, and durable IE3 motors, these pumps ensure uninterrupted operation even under continuous loading. Each unit undergoes rigorous factory testing to verify flow curves and pressure ratings, guaranteeing that your vibro equipment reaches optimal frequencies and achieves uniform compaction.

Reliable Flood Control Sump Pump UAE for Rapid Water Removal

Whether you’re managing stormwater runoff at excavation sites or safeguarding critical infrastructure during the monsoon season, our Flood Control Sump Pump UAE series delivers powerful dewatering performance. Designed with heavy-duty impellers, thermal overload protection, and a submersible configuration, these pumps can handle high solids content and fluctuating water levels without risk of clogging or motor burnout. Their compact footprint and quick-connect discharge fittings allow easy installation into sump basins, while automatic float-switch controls provide dependable “set-and-forget” operation—giving you peace of mind when rapid water removal is non-negotiable.

Versatile Self Priming Pumps UAE for Multi-Industry Applications

From agricultural irrigation networks to industrial transfer processes, our Self Priming Pumps UAE range offers unmatched flexibility. Featuring integrated vacuum chambers and robust mechanical seals, these pumps can clear air from suction lines and begin pumping without manual priming—ideal for remote sites and intermittent-duty cycles. Available in cast-iron and stainless-steel models, they are engineered to withstand abrasive liquids and variable viscosities. Advanced pump hydraulics ensure high efficiencies, while IEC-standard motors deliver reliable performance in the UAE’s demanding climate.

0 notes

Text

Distributed Antenna System (DAS) Market Future Trends: Innovations and Growth Opportunities in Wireless Connectivity

The Distributed Antenna System (DAS) market future trends indicate a dynamic evolution driven by growing demand for robust wireless connectivity in indoor and dense urban environments. DAS technology, designed to improve cellular coverage and capacity by distributing signals through multiple antennas, is increasingly vital as mobile data traffic soars and next-generation networks emerge.

This article explores the future trends shaping the DAS market, highlighting technological innovations, growing applications, regional developments, and strategic market shifts that are expected to define the industry’s growth in the coming years.

Rising Demand for Enhanced Indoor Connectivity

One of the core drivers for the DAS market is the growing necessity for reliable indoor wireless coverage. Traditional cell towers often fail to provide adequate signal penetration in large buildings, stadiums, airports, hospitals, and commercial complexes.

Trend Toward High-Capacity Venues: With the increase in events and gatherings, venues such as sports arenas, convention centers, and transportation hubs require enhanced connectivity solutions to support thousands of simultaneous users. DAS systems are evolving to offer higher capacity and seamless handoff capabilities.

Smart Building and Campus Deployments: The integration of DAS with smart building technologies is becoming a significant trend. Organizations aim to ensure uninterrupted connectivity for IoT devices, security systems, and mobile users within corporate campuses and educational institutions, pushing DAS demand.

Integration with 5G Networks

The rollout of 5G networks is one of the most transformative factors influencing DAS market future trends.

5G-Ready DAS Solutions: Future DAS deployments are being designed to support 5G’s higher frequency bands and massive MIMO (multiple-input multiple-output) technology. This enables ultra-fast data speeds, lower latency, and improved network reliability indoors.

Hybrid Networks Combining DAS and Small Cells: To maximize coverage and capacity, hybrid solutions combining DAS with small cell networks are gaining popularity. This strategic integration addresses challenges such as limited spectrum and network densification required by 5G.

Support for Network Slicing and Private Networks: As 5G enables network slicing and dedicated private networks, DAS systems are adapting to provide customizable coverage tailored to specific business or industrial needs, particularly in manufacturing, logistics, and healthcare sectors.

Increasing Adoption Across Diverse Industries

The DAS market is expanding beyond traditional telecommunications to serve multiple verticals, reflecting broadening application scenarios.

Healthcare: Hospitals require reliable, secure wireless connectivity for critical medical equipment, patient monitoring, and emergency communication. DAS ensures consistent signal quality in complex building layouts and underground areas.

Transportation: Airports, train stations, and metro systems increasingly deploy DAS to enhance passenger connectivity, operational communications, and security systems.

Retail and Hospitality: To meet customer expectations for seamless mobile experiences, malls, hotels, and resorts implement DAS to boost coverage and enable location-based services.

Industrial and Manufacturing: Factories and warehouses use DAS to support IoT devices, automated guided vehicles (AGVs), and real-time monitoring systems, enhancing operational efficiency and safety.

Technological Innovations Influencing Future Trends

Advancements in DAS technology are key to market growth and adapting to evolving connectivity needs.

Cloud-Based and Software-Defined DAS: Future DAS systems leverage cloud platforms and software-defined networking (SDN) to enable remote management, flexible configuration, and scalability. This reduces deployment costs and improves system responsiveness.

Energy Efficiency and Green Technologies: New DAS designs focus on reducing power consumption and integrating with renewable energy sources, aligning with global sustainability goals.

Improved Security Features: As DAS networks handle sensitive data and critical communications, enhanced cybersecurity measures are being incorporated, including encryption, intrusion detection, and compliance with regulatory standards.

Regional Market Trends and Growth Opportunities

Regional developments strongly influence DAS market future trends, driven by infrastructure investments and government policies.

North America Leading in Advanced Deployments: The U.S. and Canada are at the forefront of adopting 5G-ready DAS, supported by substantial investments in smart city projects and enterprise networks.

Asia-Pacific’s Rapid Urbanization and Connectivity Needs: Countries like China, India, Japan, and South Korea are witnessing rapid urban growth, increasing demand for indoor wireless solutions. Government initiatives promoting digital infrastructure boost DAS deployment.

Europe’s Focus on Public Safety and Regulatory Compliance: Europe emphasizes secure and resilient communication networks, including DAS for public safety, emergency response, and transport systems.

Market Challenges and Adaptations

Despite promising trends, the DAS market faces challenges that require strategic responses.

High Initial Deployment Costs: Although long-term benefits are substantial, upfront investments for DAS installation can be significant, particularly for small and medium-sized enterprises.

Complex Integration and Maintenance: Deploying DAS in existing buildings requires careful planning to avoid disruption. Continuous maintenance and upgrades to keep pace with evolving network standards are necessary.

Competition from Alternative Technologies: Small cells, Wi-Fi 6, and emerging wireless solutions pose competitive threats. DAS providers must differentiate through superior performance, scalability, and integration capabilities.

Strategic Outlook for DAS Market Growth

The future of the DAS market is promising, characterized by innovation and expanding use cases. Providers focusing on developing flexible, scalable, and cost-effective DAS solutions tailored for 5G and beyond will capture significant market share.

Collaboration with telecom operators, infrastructure companies, and enterprise customers will be critical to delivering customized deployments. Embracing software-defined technologies and cloud integration will also enhance service agility.

Conclusion

The Distributed Antenna System (DAS) market future trends showcase a rapidly evolving landscape shaped by 5G adoption, industry diversification, and technological breakthroughs. As wireless connectivity becomes indispensable across all facets of life and business, DAS will play a pivotal role in ensuring seamless, high-quality indoor coverage worldwide. Stakeholders who anticipate these trends and invest in innovation will position themselves at the forefront of this expanding market.

0 notes

Text

Carrier Aggregation Solutions Market Size, Share, Analysis, Forecast, and Growth Trends to 2032 – Infrastructure Investments Fuel Market Size

Carrier Aggregation Solutions Market was valued at USD 3.92 billion in 2023 and is expected to reach USD 17.77 billion by 2032, growing at a CAGR of 18.35% from 2024-2032.

Carrier Aggregation Solutions Market is witnessing significant growth as telecom providers race to deliver faster, more reliable mobile data services. By combining multiple frequency bands, carrier aggregation enables higher throughput and enhanced spectrum efficiency—crucial for meeting the rising demand for high-speed connectivity across 4G, 5G, and beyond. The surge in mobile traffic in regions like the USA and Europe has positioned carrier aggregation as a vital enabler of next-gen network performance.

Carrier Aggregation Solutions Gain Momentum in U.S. 5G Rollout Strategy

Carrier Aggregation Solutions Market is evolving rapidly due to increased network densification, the rollout of 5G infrastructure, and heightened user expectations for seamless streaming, gaming, and real-time communications. Vendors are investing in R&D to deliver scalable, software-defined solutions that improve bandwidth usage and optimize user experience in urban, suburban, and rural environments.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6671

Market Keyplayers:

Anritsu (MD8430A Signaling Tester, MT8821C Radio Communication Analyzer)

Artiza Networks, Inc. (DuoSIM-5G, 5G Load Tester)

Cisco Systems Inc. (Cisco Ultra Packet Core, Cisco 5G Cloud Core)

Huawei Technologies (SingleRAN LTE, SingleRAN@Broad)

Nokia Corporation (AirScale Baseband, AirScale Radio Access)

Qualcomm Technologies, Inc. (Snapdragon X75 Modem-RF System, Snapdragon X65 Modem-RF System)

Rohde and Schwarz GmbH and Co. KG (CMW500 Tester, SMW200A Vector Signal Generator)

Sprint.com (Sprint Spark, Sprint LTE Advanced Pro)

Telefonaktiebolaget LM Ericsson (Ericsson Radio System, Ericsson Cloud RAN)

ZTE Corporation (Uni-RAN, 5G NR Base Station)

Broadcom Inc. (5G RF Front-End Modules, 5G Modem SoCs)

Verizon Communications Inc. (5G Ultra Wideband, LTE Advanced)

Qorvo Inc. (RF Front-End Modules, High Band PADs)

Alcatel Lucent S.A. (9926 eNodeB, 9768 Metro Cell Outdoor)

AT&T Inc. (AT&T 5G+, LTE Advanced Network)

Capestone BV (5G Outdoor Routers, Industrial IoT Gateways)

Ciena Corporation (6500 Packet-Optical Platform, Adaptive IP)

CommScope, Inc. (ERA DAS, Small Cell Antennas)

Fujitsu Limited (5G NR Base Station, Carrier Aggregation Solution)

Hewlett Packard Enterprise L.P. (HPE 5G Core Stack, Open RAN Solution)

Intel Corporation (vRAN Accelerator ACC100, FlexRAN Platform)

Juniper Networks (Contrail Networking, Cloud-Native Router)

Keysight Technologies (CMW500 LTE Test Solution, Signal Studio Software)

LG Electronics (V60 ThinQ 5G, Velvet 5G)

NEC Corporation (5G Radio Units, Open RAN Solution)

Market Analysis

The Carrier Aggregation Solutions Market is being driven by the growing consumption of mobile data, the proliferation of smart devices, and telecom operators’ push for better network utilization. By merging non-contiguous frequency bands, operators can provide faster, more stable connections without acquiring additional spectrum. In the USA, aggressive 5G rollouts and demand for high-speed enterprise applications are fueling adoption, while in Europe, regulatory support and spectrum auctions are accelerating the integration of carrier aggregation technologies.

Market Trends

Rapid adoption of 5G NR (New Radio) technologies with multi-band support

Integration of AI and automation for dynamic spectrum management

Growing investments in small cell deployment for urban coverage

Network slicing enabled by advanced aggregation techniques

Expansion of software-based solutions for easier network upgrades

OEM partnerships to ensure hardware-software compatibility

Demand for real-time, ultra-low latency applications driving performance upgrades

Market Scope

Carrier aggregation is becoming a cornerstone of telecom strategy worldwide, unlocking greater efficiency and superior customer experiences. The market scope is expanding across industries—from telecom and enterprise networks to IoT connectivity and smart city infrastructures.

Enhanced mobile broadband and video streaming performance

Critical support for autonomous systems and low-latency apps

Seamless integration with existing LTE and 5G infrastructure

Improved quality of service (QoS) in high-density areas

Key enabler for industrial automation and private networks

Flexible deployment models through cloud-native solutions

Forecast Outlook

The future of the Carrier Aggregation Solutions Market is marked by technological advancement and strategic telecom transformations. As operators intensify 5G coverage and prepare for 6G experimentation, carrier aggregation will remain a core solution to meet evolving connectivity demands. Ongoing innovation in spectrum utilization and software-defined networking will shape the next wave of growth. Both the USA and Europe will be central to this trajectory, driven by innovation leadership, robust demand, and regulatory alignment.

Access Complete Report: https://www.snsinsider.com/reports/carrier-aggregation-solutions-market-6671

Conclusion

The momentum behind the Carrier Aggregation Solutions Market is redefining what’s possible in mobile and wireless communication. With demand for speed, consistency, and intelligent networks reaching new heights, carrier aggregation is emerging as a game-changer for operators, enterprises, and consumers alike.

Related Reports:

U.S.A Media Asset Management Market empowers broadcasters with seamless media organization tools

U.S.A. sees booming growth in Conversational Systems as businesses go digital

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

0 notes

Text

Market Report on District Heating: Understanding Size, Share, Growth Trajectories

he global district heating market size was valued at USD 190.5 billion in 2023 and is anticipated to grow at a CAGR of 5.2% from 2024 to 2030. Energy efficiency and sustainability are the key driving factors of the market growth. District heating systems offer efficiency gains compared to individual heating systems by utilizing waste heat from industrial processes, power generation, or renewable sources such as biomass and geothermal energy. This efficient use of heat resources not only reduces overall energy consumption but also lowers greenhouse gas emissions, aligning with global climate goals.

Increasing urbanization and densification of cities have also impacted the market positively. As urban populations grow and cities expand vertically, the demand for heating in densely populated areas intensifies. District heating systems are particularly well-suited for these environments due to their ability to serve a large number of buildings efficiently from a centralized location. This scalability makes them an attractive solution for urban planners seeking sustainable and cost-effective heating options.

Technological advancements play a crucial role in the expansion of the district heating market. Innovations in heat production, distribution networks, and heat exchange technologies have improved system reliability, efficiency, and flexibility and subsequently drive market growth.

The high initial capital investment required for building or upgrading district heating infrastructure restrain the market’s growth. The costs associated with building extensive networks of insulated pipes and installing heat generation and distribution equipment are substantial, particularly for smaller municipalities or regions with limited financial resources.

However, technological advancements offer opportunities for growth. Innovations in smart grid technologies, heat storage solutions, and digitalization are enhancing the efficiency and reliability of district heating systems. Furthermore, the integration of district heating with other energy systems such as electricity grids and thermal energy storage facilities creates opportunities for synergies and enhanced overall energy management, a lucrative opportunity for market growth.

For More Details or Sample Copy please visit link @: District Heating Market

Key District Heating Companies:

The following are the leading companies in the district heating market. These companies collectively hold the largest market share and dictate industry trends.

Danfoss Group

Ramboll

Dall Energy

Veolia

Helen

Alfa Level

GE

Statkraft

#DistrictHeating#EnergyInfrastructure#SmartCities#SustainableEnergy#GreenInfrastructure#EnergyEfficiency#CarbonNeutral#SmartGrid#RenewableEnergy#WasteHeatRecovery

0 notes

Text

Bridging Australia’s Connectivity Insights into ASX Communication Stocks

Highlights

Examination of sector structure, key operators and service models

Analysis of infrastructure expansion, regulatory framework and technology trends

Pathways for accessing detailed sector updates and network milestones

Australia’s telecommunications sector serves as a backbone for voice, data and media distribution nationwide. ASX Communication Stocks cover a suite of companies offering mobile networks, broadband services and digital content platforms. These firms operate across urban and regional areas, maintaining infrastructure that supports diverse communication needs. A steady flow of network traffic, content streaming and digital messaging highlights the vital role of listed communication entities in the national economy.

Sector Structure An overview of market segmentation shows network operators, internet service providers and media broadcasters among the listed entities. ASX Communication Stocks feature companies that manage core network infrastructure, deliver high speed internet and facilitate content delivery through fixed and wireless connections. Revenue streams include subscription fees, data throughput charges and service level agreements for enterprise and consumer customers in varied geographic regions.

Key Companies Three major entities dominate market capitalization and service reach within the sector. ASX Communication Stocks include Telstra, which operates national networks and digital platforms; TPG Telecom, known for broadband and mobile aggregation; and Vocus Group, which offers enterprise networking solutions and subsea cable systems. Each entity maintains fibre, wireless and satellite assets that support data transmission across metropolitan and regional zones, reinforcing connectivity.

Infrastructure Investments Capital allocation towards network expansion has accelerated in recent years. ASX Communication Stocks have committed resources to fibre to the premises and mobile network densification projects across urban centres. Infrastructure partners have collaborated on satellite launches to extend coverage in remote regions. Continued upgrades in switching centres and core routing equipment underscore commitments to robust service delivery by ASX Communication Stocks across diverse environments, including rural areas.

Regulatory Environment Regulatory oversight by the Australian Communications and Media Authority ensures compliance with service standards and spectrum licensing requirements. ASX Communication Stocks adhere to guidelines for data privacy, network reliability and equitable access provisions. Licence renewals and spectrum allocations influence capital planning cycles and operational timetables for listed communication entities without invoking speculative outcomes or forward looking statements.

Emerging Trends Shift towards fifth generation mobile services and internet of things integration has reshaped bandwidth requirements and network designs. ASX Communication Stocks benefit from partnerships with hardware vendors to deploy low latency applications in manufacturing, health services and public safety networks. Adoption of cloud delivery models and content distribution networks underscores evolving operational frameworks as listed entities respond to changing traffic patterns.

Technology Adoption Innovation in satellite technology and unmanned aerial systems has introduced alternate backhaul and last mile pathways. ASX Communication Stocks engage in trials for high throughput satellites and fifth generation fixed wireless access demonstrations. Emphasis on open access architectures fosters interoperability between service providers, reduces barriers to network deployment and supports a more modular infrastructure landscape.

Global Comparisons Comparative metrics with international peers reveal competitive spectrum pricing and high network reliability rankings in the domestic market. ASX Communication Stocks exhibit resilience in revenue and service scope despite global supply chain challenges affecting equipment delivery. Infrastructure sharing agreements and cross border data exchange protocols illustrate alignment with global standards and reinforce the robustness of listed communication offerings.

Engagement and Updates Inquiries into detailed performance records, infrastructure milestones and compliance filings can be directed to official registries and sector publications. ASX Communication Stocks insights and infrastructure updates are available through subscription to digital briefings and regulatory bulletins. Explore announcements and sector news by subscribing to a curated newsletter focused on communication sector developments and network innovation led by ASX Communication Stocks.

0 notes

Text

Optical Lifelines: How Five Nations Are Powering an $8.8 B Fiber Optic Repeater Market Surge

The global Fiber Optic Repeater market—vital for extending high‑speed data transmission over long distances—is projected to climb from $4.37 billion in 2024 to $8.84 billion by 2032, registering a robust CAGR of 9.2% Global Growth Insights. This rapid expansion is fueled by mass 5G rollouts, hyperscale data‑center interconnect demands, and government‑backed rural broadband initiatives.

Market Overview

Fiber optic repeaters boost weakened optical signals, enabling seamless communication across vast networks.

2024 Market Size: $4.368 billion

2032 Forecast: $8.836 billion (9.2% CAGR)

Alternative Estimate: Some analysts forecast growth from $1.2 billion in 2024 to $2.8 billion by 2033 at a 9.5% CAGR, reflecting varied regional adoption rates

Driving Forces Behind Growth

5G Network Deployments

Telecom operators are investing heavily in 5G backhaul infrastructure, where repeaters are critical to maintaining low‑latency, high‑capacity links .

Data Center Interconnects

Hyperscale cloud providers require reliable, long‑reach fiber links between data centers—repeaters ensure signal integrity across these vast networks

Rural & Remote Connectivity

Government initiatives in Asia‑Pacific, Latin America, and Africa aim to close the digital divide by extending broadband to underserved areas, boosting repeater demand .

Top Five Markets Powering Expansion

United States: Leading in R&D and early 5G adoption, accounting for over 25% of global repeater demand

China: Massive investments in rural broadband and cloud infrastructure projects driving growth

Japan: Advanced industrial automation and ultra‑high‑speed networks fueling repeater upgrades Germany:

Europe’s data‑center hub with strong telecom regulations and IoT ecosystems

South Korea: World‑leading broadband speeds and 5G densification initiatives spurring repeater installations

Key Industry Players

Corning Incorporated: Pioneering glass and fiber solutions, with integrated repeater modules.

Furukawa Electric: Known for robust repeater designs in challenging environments.

Nokia: Offers comprehensive fiber‑backhaul solutions including active repeaters.

Huawei Marine Networks: Specializes in submarine cable repeaters for transoceanic connectivity.

CommScope: Provides both passive and active repeater technologies for broadband networks.

Future Outlook & Innovations

Silicon Photonics Integration: Combining repeaters with silicon‑based modulators to reduce power consumption and footprint.

AI‑Driven Network Management: Predictive maintenance and real‑time performance tuning through machine‑learning algorithms.

Modular Edge Designs: Compact repeaters tailored for edge‑computing nodes, enabling micro‑data centers in remote locations.

As global data traffic continues its exponential rise, fiber optic repeaters will remain the unsung heroes sustaining our connected world, with these five powerhouse nations at the helm of innovation and deployment.

Datastring Consulting

0 notes

Text

In-Building Wireless Market Demand, Key Trends, and Future Projections 2032

The In-building Wireless Market sizewas valued at USD 18.3 billion in 2023 and is expected to reach USD 48.9 Billion by 2032, growing at a CAGR of 11.57% over the forecast period of 2024-2032

The in-building wireless market is experiencing rapid expansion, driven by increasing demand for seamless indoor connectivity. With the rise of smart buildings, 5G deployment, and IoT integration, businesses and consumers require high-speed, uninterrupted wireless communication. As enterprises and real estate developers prioritize digital infrastructure, the adoption of in-building wireless solutions is accelerating.

The in-building wireless market continues to grow as organizations seek enhanced network coverage, improved data speeds, and reduced latency. Traditional cellular networks often struggle to penetrate large commercial buildings, hospitals, and high-rise structures, leading to poor indoor connectivity. To address this challenge, businesses are investing in Distributed Antenna Systems (DAS), small cells, and fiber-based wireless networks to ensure optimal coverage and performance.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3525

Market Keyplayers:

CommScope – OneCell Small Cell Solution

Corning Incorporated – Corning Optical Network Evolution (ONE) DAS

Nokia – Nokia AirScale Indoor Radio

Ericsson – Ericsson Radio Dot System

Huawei – Huawei LampSite

ZTE Corporation – ZTE QCell Indoor Solution

Samsung Electronics – Samsung LinkCell

AT&T – AT&T Distributed Antenna System (DAS)

Verizon – Verizon In-Building 5G Solutions

Comba Telecom Systems – Comba DAS (Distributed Antenna System)

SOLiD – SOLiD ALLIANCE DAS

DASAN Zhone Solutions – DASAN DAS Solutions

Boingo Wireless – Boingo Neutral Host DAS

JMA Wireless – TEKO DAS

TE Connectivity – FlexWave Spectrum DAS

Airspan Networks – Airspan AirVelocity

Advanced RF Technologies (ADRF) – ADXV DAS

Casa Systems – Axyom Indoor Small Cells

Betacom – Betacom Private 5G Networks

Intracom Telecom – WiBAS Indoor Solutions

Market Trends Driving Growth

1. 5G Integration and Network Densification

The rollout of 5G is a major catalyst for in-building wireless solutions. Higher frequency 5G signals have limited range and struggle with indoor penetration, making in-building wireless systems essential for extending coverage.

2. Increasing Adoption of Smart Buildings

Smart buildings require robust wireless networks to support IoT applications, security systems, and automation. In-building wireless infrastructure is becoming a critical component of modern real estate developments.

3. Growth of Private Wireless Networks

Enterprises are deploying private LTE and 5G networks within their buildings to enhance security, reliability, and control over their wireless infrastructure. These networks are particularly beneficial for industries like healthcare, manufacturing, and logistics.

4. Demand for High-Speed Connectivity in Large Venues

Stadiums, airports, and convention centers are investing in advanced in-building wireless systems to ensure high-speed, low-latency connectivity for thousands of users simultaneously.

5. Evolution of Neutral Host Networks

Neutral host solutions allow multiple mobile carriers to share in-building wireless infrastructure, reducing costs and improving efficiency while expanding network reach.

Enquiry of This Report: https://www.snsinsider.com/sample-request/3525

Market Segmentation:

By Offering

infrastructure

Distributed Antenna System (DAS)

Small Cells

Wi-Fi

Hybrid Systems

Cellular/3G/4G/5G

Services

By Business model

Service Providers

Enterprises

Neutral Host Operators

By Building Size

Large Buildings

Small & Medium Size Buildings

By Application

Commercial Campuses

Government

Transportation & Logistics

Hospitality

Industrial & Manufacturing

Education

Healthcare

Entertainment & Sports Venues

Others

Market Analysis and Current Landscape

Surging demand for seamless indoor connectivity: High-bandwidth applications, remote work, and video streaming require robust wireless networks.

Regulatory support for spectrum allocation: Governments worldwide are facilitating spectrum availability for private networks and 5G deployment.

Technological advancements in network infrastructure: Cloud-based network management, AI-driven optimization, and fiber-optic backhaul solutions are enhancing in-building wireless performance.

Growing partnerships between telecom providers and real estate developers: Collaboration is increasing to integrate in-building wireless solutions into new construction projects.

Challenges such as high installation costs and complex network integration remain, but advancements in technology and scalable solutions are helping businesses overcome these barriers.

Future Prospects: What Lies Ahead?

1. Expansion of 5G and Beyond

As 5G networks continue to expand, in-building wireless solutions will evolve to support next-generation connectivity standards, ensuring ultra-fast data speeds and minimal latency.

2. AI and Automation in Network Optimization

AI-driven network management will enhance predictive maintenance, traffic optimization, and real-time adjustments for improved wireless performance.

3. Increased Adoption of Edge Computing

With more data processing happening at the edge, in-building wireless solutions will integrate with edge computing frameworks to enable faster, more efficient connectivity.

4. Rising Demand in Healthcare and Education Sectors

Hospitals and universities are upgrading their wireless infrastructure to support telemedicine, remote learning, and connected medical devices.

5. Sustainable and Energy-Efficient Wireless Solutions

The industry is shifting towards energy-efficient wireless technologies, reducing power consumption and environmental impact while maintaining high performance.

Access Complete Report: https://www.snsinsider.com/reports/in-building-wireless-market-3525

Conclusion

The in-building wireless market is poised for significant growth as connectivity demands continue to rise. Businesses, telecom providers, and real estate developers must prioritize investment in robust wireless infrastructure to stay competitive in the digital era. With advancements in 5G, AI-driven optimization, and edge computing, the future of in-building wireless promises greater efficiency, seamless connectivity, and enhanced user experiences.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#In-Building Wireless Market#In-Building Wireless Market Analysis#In-Building Wireless Market Growth#In-Building Wireless Market Trends#In-Building Wireless Market Share

0 notes

Text

5G Infrastructure Market Size, Share And Growth Report By 2033

The Global 5G Infrastructure Market was valued at USD 25.8 Billion in 2024 and is projected to reach USD 175.2 Billion by 2033 at a CAGR of around 23.7% between 2024 and 2033. The global 5G infrastructure market is driven by rising data consumption and expanding IoT applications. Streaming services, cloud gaming, and remote work demand faster networks, increasing 5G adoption. Smart cities and industrial automation rely on ultra-low latency, boosting infrastructure deployment. However, high deployment costs act as a major restraint. Network densification requires extensive investments, limiting rapid expansion in some regions. Despite this, opportunities exist in private 5G networks, where enterprises seek secure and high-speed connectivity. Smart factories, logistics hubs, and hospitals integrate 5G for real-time operations. Another opportunity is seen in the expansion of edge computing. Faster data processing at the edge enhances applications in autonomous vehicles and AI-driven analytics. Real-world examples highlight 5G’s impact. Airports deploy private 5G for seamless passenger management. Manufacturing plants use it for automated quality control. Smart agriculture benefits from real-time monitoring through 5G-connected sensors. Healthcare facilities enable remote surgeries with ultra-reliable communication. Sports stadiums enhance fan experiences with real-time AR overlays. Retailers adopt 5G-powered checkout systems for seamless transactions. Telecom providers continue upgrading infrastructure to meet growing demand. Governments support initiatives to accelerate deployment, ensuring widespread access to next-generation connectivity and digital transformation worldwide.

0 notes

Text

Femtocell Market

Femtocell Market Size, Share, Trends: Cisco Systems, Inc. Leads

Integration of AI and Machine Learning for Optimized Femtocell Performance and Network Management Drives Market Growth

Market Overview:

The global Femtocell market is expected to develop at a 22.6% CAGR from 2024 to 2031, reaching USD YY billion by 2031. North America is likely to dominate the market, with rising demand for better indoor cellular coverage and capacity. Key variables include rising mobile data traffic, increased adoption of IoT devices, and telecom operators' increased emphasis on network densification plans.

The Femtocell market is rapidly expanding due to its ability to improve cellular coverage and capacity in interior locations. The expansion of smartphones, the necessity for seamless connectivity, and the transition to 5G networks are all boosting femtocell adoption across a variety of sectors.

DOWNLOAD FREE SAMPLE

Market Trends:

The trend of adding artificial intelligence (AI) and machine learning (ML) technology into femtocell solutions is gaining traction as telecom operators attempt to improve network efficiency and customer experience. These innovative technologies allow femtocells to dynamically adapt to changing network conditions, optimise spectrum utilisation, and anticipate possible difficulties before they affect service quality. For example, a major telecom equipment provider recently introduced an AI-enabled femtocell platform that may minimise interference and increase capacity by up to 30% over traditional systems.

Market Segmentation:

4G technology dominates the Femtocell market, accounting for the largest share in the technology segment. The 4G segment dominates due to the broad adoption of 4G LTE networks worldwide and the ongoing need for high-speed data services. Recent advances in 4G femtocell technology have focused on increasing spectrum efficiency and user density. For example, a major telecom equipment manufacturer recently unveiled a new 4G femtocell solution capable of supporting up to 64 concurrent users, sparking significant interest from both residential and business clients wishing to improve their indoor cellular coverage.

The enterprise end-user segment of the Femtocell market is rapidly expanding, owing to the growing demand for dependable cellular connectivity in office buildings, shopping malls, and other commercial spaces. According to recent figures, enterprise femtocell deployments increased by 35% per year over the last two years.

Market Key Players:

Cisco Systems, Inc.

Nokia Corporation

Ericsson

Huawei Technologies Co., Ltd.

ZTE Corporation

NEC Corporation

Contact Us:

Name: Hari Krishna

Email us: [email protected]

Website: https://aurorawaveintellects.com/

0 notes

Text

Small Cell 5G Network Market 2024 : Industry Analysis, Trends, Segmentation, Regional Overview And Forecast 2033

The small cell 5g network global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Small Cell 5G Network Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The small cell 5G network market size has grown exponentially in recent years. It will grow from $2.86 billion in 2023 to $3.59 billion in 2024 at a compound annual growth rate (CAGR) of 25.5%. The growth in the historic period can be attributed to rising government focus on digitalization of processes, rising demand for high-speed internet connectivity, rapid penetration of mobile devices in rural areas, increase in network densification, increase in investment in 5G infrastructure.

The small cell 5G network market size is expected to see exponential growth in the next few years. It will grow to $8.85 billion in 2028 at a compound annual growth rate (CAGR) of 25.3%. The growth in the forecast period can be attributed to growing mobile data traffic, increasing demand for fast mobile data connectivity, evolution of network technology and connectivity devices, increasing demand for fast mobile data connectivity, rising demand for 5G services. Major trends in the forecast period include technological advancement, launching advanced indoor and outdoor 5G networking technologies, adoption of 5G network technologies by governments and implementation of Internet of thing (IoT) devices, latest launches of integrated communication platforms, rise of IoT (Internet of Things) and M2M (Machine to Machine) communication.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/small-cell-5g-network-global-market-report

The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Market Drivers - The growing mobile data traffic is expected to propel the growth of the small cell 5G network market going forward. Mobile data traffic refers to the volume of data transmitted over a wireless cellular connection to mobile devices like smartphones and tablets. Mobile data traffic is rising due to increased smartphone adoption, growing demand for mobile applications and services, and the expansion of high-speed mobile networks. The deployment of small cell 5G networks enhances data traffic by improving network capacity, coverage, and reliability in densely populated areas, meeting the increasing demand for high-speed and low-latency connectivity. For instance, in November 2023, according to a report published by Telefonaktiebolaget LM Ericsson, a Sweden-based telecommunications company, the average mobile data usage per smartphone is expected to rise from 21 GB in 2023 to 56 GB in 2029 globally. 5G's share of mobile data traffic is expected to increase to 76% by 2029. Therefore, the growing mobile data traffic is driving the growth of the small cell 5G network market.

Market Trends - Major companies operating in the small cell 5G network market are developing advanced solutions, such as cloud-native software, to gain a competitive edge in the market. Cloud-native software refers to applications and services that are designed and built to fully leverage the capabilities and advantages of cloud computing environments. For instance, in September 2022, Mavenir Systems Inc., a US-based telecommunications software company, launched a 5G small cell E511 designed for high-capacity in-building standalone coverage. This small cell is ideal for communication service providers and private network operators targeting 5G coverage in enterprise and public spaces. It supports both distributed and centralized open radio access network (ORAN) architectures, offering flexibility for deployment scenarios like office, retail, warehousing, manufacturing, and public space.

The small cell 5G network market covered in this report is segmented –

1) By Component: Hardware, Services 2) By Architecture: Distributed, Virtualized 3) By Deployment Mode: Indoor, Outdoor 4) By Application: Enhanced Mobile Broadband, Massive Internet of Things (IoT), Massive Machine Type Communication And Ultra Reliable Low Latency 5) By End-use: Residential, Commercial, Industrial, Smart City, Transportation And Logistics, Government And Defense, Other End-Users

Get an inside scoop of the small cell 5g network market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=14493&type=smp

Regional Insights - North America was the largest region in the small cell 5G network market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the small cell 5G network market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the small cell 5G network market are Samsung Electronics Co. Ltd., Huawei Technologies Co. Ltd., Cisco Systems Inc., Qualcomm Technologies Inc., Fujitsu Limited, Telefonaktiebolaget LM Ericsson, Nokia Corporation, NEC Corporation, ZTE Corporation, Corning Incorporated, CommScope Inc., Altiostar Networks Inc., Sterlite Technologies Limited, Aviat Networks Inc., Cambium Networks Corporation, Ceragon Networks Ltd., Casa Systems Inc., Airspan Networks Holdings Inc., Baicells Technologies, Comba Telecom Systems Holdings Ltd., Contela Inc., ip.Access Limited, Radisys Corporation, Qucell Inc., Blinq Networks, Shenzhen Gongjin Electronics Co. Ltd., PCTEL Inc., and Radwin.

Table of Contents 1. Executive Summary 2. Small Cell 5G Network Market Report Structure 3. Small Cell 5G Network Market Trends And Strategies 4. Small Cell 5G Network Market – Macro Economic Scenario 5. Small Cell 5G Network Market Size And Growth ….. 27. Small Cell 5G Network Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

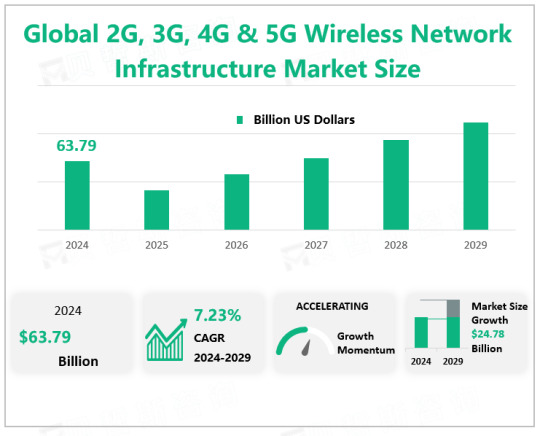

Global 2G, 3G, 4G & 5G Wireless Network Infrastructure Market Competition is Fierce, Ericsson Holding a share of 26.39% in 2024

According to Global Market Monitor, the global 2G, 3G, 4G & 5G wireless network infrastructure market size will be $63.79 billion in 2024 with a CAGR of 7.23% from 2024 to 2029.

When users connect to the internet, the speed of the internet depends upon the signal strength that has been shown in alphabets like 2G, 3G, 4G, and 5G, right next to the signal bar on the home screen. Each Generation is defined as a set of telephone network standards, which detail the technological implementation of a particular mobile phone system. The speed increases and the technology used to achieve that speed also changes. For instance, 1G offers 2.4 kbps, 2G offers 64 Kbps and is based on GSM, 3G offers 144 kbps-2 Mbps whereas 4G offers 100 Mbps - 1 Gbps and is based on LTE technology.

With the advancement of technology, each generation of network from 2G to 5G has brought significant performance improvements. 5G networks promise lower latency, ultra-fast connections and the ability to support millions of devices per square kilometer, which will be critical for future innovations such as self-driving cars and industrial automation.

Market Drivers

Wireless technology is experiencing tremendous growth due to the introduction of technologically advanced solutions worldwide. The rapid expansion of mobile network coverage has covered remote areas. Due to increasing competition in the industry, the increased demand for wireless technology has led to lower data usage charges. The continuous growth of network traffic, deployment of infrastructure, and growing demand for wireless connectivity due to numerous advantages are driving the growth of the market. The growing demand for 5G services and advanced high-speed Internet connectivity is driving the market growth.

The latest trends in 4G, 5G, and beyond include densification and coverage extension approaches, spectrum trends, network customization and intelligence, virtualization, and cloud. These trends provide service providers with more opportunities for network customization, network deployment, and network optimization.

Market Restraints Analysis

Radiofrequency (RF) radiation, which includes radio waves and microwaves, is at the low-energy end of the electromagnetic spectrum. It is a type of non-ionizing radiation. If RF radiation is absorbed by the body in large enough amounts, it can produce heat. This can lead to burns and body tissue damage. Although RF radiation is not thought to cause cancer by damaging the DNA in cells the way ionizing radiation does, there has been concern that in some circumstances, some forms of non-ionizing radiation might still have other effects on cells that might somehow result in cancer. Most people are exposed to much lower levels of man-made RF radiation every day due to the presence of RF signals all around us. They come from radio and television broadcasts, WiFi and Bluetooth devices, cell phones (and cell phone towers), and other sources. Cell phones and cell phone towers (base stations) use RF radiation to transmit and receive signals. Some concerns have been raised that these signals might increase the risk of cancer.

Issues related to radiofrequency have discouraged some people from 2G, 3G, 4G, and 5G wireless network infrastructure, which is not conducive to the sustainable development of the industry.

Most Up-To-Date Market Figures, Statistics & Data - Order Now (Delivered In 48-72 Hours)

Market Competition

With major suppliers in the 2G, 3G, 4G & 5G wireless network infrastructure industry competing globally, the intensity of competition within the 2G, 3G, 4G & 5G wireless network infrastructure industry has increased. The vendors adopt strategies like price premiums to stay competitive in the market. Meanwhile, the local vendors in developing nations are providing tough competition to the global players based on product pricing. The fierce competition is not conducive to the sustainable development of the industry. At the same time, small companies enter the business consequently as venturing into a 2G, 3 G, 4G & 5G wireless network infrastructure business does not require immense capital or investment. However, this leads to the proliferation of sub-standard or duplicate services which then hampers the competitive scenario in the market as established 2G, 3G, 4G & 5G wireless network infrastructure manufacturers are compelled to lower the price, which ultimately impacts their profit margins and sales volumes.

Ericsson is one of the major players operating in the 2G, 3G, 4G & 5G Wireless Network Infrastructure market, holding a share of 26.39% in 2024. Ericsson Inc. operates as a provider of telecommunications equipment and related services. The Company offers its products and services to mobile and fixed network operators, as well as provides communications networks, telecom services, and multimedia solutions. Ericsson operates globally.

0 notes

Text

Global Aggregate In Road Construction Market Analysis 2024: Size Forecast and Growth Prospects

The aggregate in road construction global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Aggregate In Road Construction Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The aggregate in road construction market size has grown rapidly in recent years. It will grow from $735.36 billion in 2023 to $828.16 billion in 2024 at a compound annual growth rate (CAGR) of 12.6%. The growth in the historic period can be attributed to increasing urbanization, growing population, increasing economic development, growing industrialization, and rising vehicle ownership.

The aggregate in road construction market size is expected to see rapid growth in the next few years. It will grow to $1339.87 billion in 2028 at a compound annual growth rate (CAGR) of 12.8%. The growth in the forecast period can be attributed to smart city initiatives, stricter environmental regulations, rising adoption of green construction, growth in public-private partnerships, and urban densification trends. Major trends in the forecast period include greater automation in construction processes, growth of 3D printing technologies in road building, smart road infrastructure integration, expansion of electric vehicle charging networks, and a focus on reducing carbon emissions in construction.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/aggregate-in-road-construction-global-market-report

Scope Of Aggregate In Road Construction Market The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Aggregate In Road Construction Market Overview

Market Drivers - The increasing road transportation is expected to propel the growth of the aggregate in road construction market going forward. Road transportation refers to the movement of people and goods using vehicles on roads. It encompasses a wide range of transportation modes and vehicles. Road transportation is increasing due to more people owning cars, technological advances, improvements in road infrastructure, urbanization, policy and regulation, and the higher demand for quickly delivering goods as cities grow. Aggregate in road construction enhances road durability, load-bearing capacity, and overall infrastructure quality, enabling the development of more extensive and efficient road networks. For instance, in May 2024, according to statistics published by the Department for Transport UK-based government department, between 2022 and 2023, car traffic on Great Britain’s ‘A’ roads increased by 3.3% to 111.6 billion vehicle miles, while van traffic rose by 1.0% to 24.3 billion vehicle miles. Therefore, the increasing road transportation is driving the growth of the aggregate in road construction market.

Market Trends - Major companies operating in the aggregate in road construction market are focusing on developing innovative products such as carbon-neutral asphalt material to support Aggregate Industries' goal of reducing emissions and achieving net-zero construction. Carbon-neutral asphalt material is a type produced that eliminates or offsets carbon emissions, making its overall environmental impact net zero in terms of carbon dioxide. For instance, in March 2024, AGGREGATE Industries, a UK-based construction and building materials company, launched Foamix Eco. This carbon-neutral, cold-lay asphalt is made with a high percentage of recycled materials, reducing reliance on virgin resources and minimizing energy consumption during production. Its use of on-site recycling, reduced HGV movements, and lower carbon footprint makes it a cost-effective, eco-friendly solution that contributes to achieving net zero construction goals.

The aggregate in road construction market covered in this report is segmented –

1) By Type: Granite, Sand, Gravel, Limestone, Crushed Rock, Other Types 2) By Application: Highway Construction, Railway Construction, Other Applications 3) By End-User: Government, Private Contractors, Public-Private Partnership

Get an inside scoop of the aggregate in road construction market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=18949&type=smp

Regional Insights - North America was the largest region in the aggregate in road construction market in 2023. The regions covered in the aggregate in road construction market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the aggregate in road construction market are Holcim Group, CRH plc, CEMEX S.A.B. de C.V., Vulcan Materials Company, Terex Corporation, Buzzi S.p.A., Arcosa Inc., Boral Limited, Breedon Group plc, LSR Group, Adbri Limited, Rogers Group Inc., Carmeuse, Norlite LLC, Eagle Materials Inc., Sully-Miller Contracting Co., Titan America LLC, Stalite Lightweight Aggregate, Salt River Materials Group, Liapor Group, Okanagan Aggregates, Wharehine Construction, Rock Road Companies Inc.

Table of Contents 1. Executive Summary 2. Aggregate In Road Construction Market Report Structure 3. Aggregate In Road Construction Market Trends And Strategies 4. Aggregate In Road Construction Market – Macro Economic Scenario 5. Aggregate In Road Construction Market Size And Growth ….. 27. Aggregate In Road Construction Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

Exploring the Leading Telecom Tower Manufacturers!

In today’s digital age, reliable connectivity is more crucial than ever, and at the heart of this infrastructure are telecom towers. These towering structures not only facilitate communication but also support the increasing demand for data and connectivity. In this article, we’ll explore some of the leading manufacturers of telecom towers that are shaping the landscape of modern telecommunications.

The Importance of Telecom Towers

Telecom towers play a vital role in establishing and maintaining communication networks. They support various technologies, including cellular, microwave, and radio transmissions. As mobile data usage continues to soar, the demand for advanced and efficient telecom towers has never been higher. This demand has led to significant innovations within the industry.

Leading Manufacturers in Telecom Tower Production

American Tower Corporation As one of the largest owners and operators of telecom towers in the world, American Tower Corporation is a key player in the industry. They provide comprehensive solutions for wireless communications, including site leasing and infrastructure development. Their commitment to sustainability and innovation has made them a leader in the telecom tower space.

Crown Castle Known for its extensive portfolio of towers and small cell solutions, Crown Castle focuses on providing connectivity solutions that meet the needs of urban environments. Their expertise in site acquisition and development enables them to build and manage telecom towers effectively, ensuring optimal coverage and capacity.

China Tower Corporation As the world’s largest telecom tower manufacturer, China Tower Corporation supports the rapid expansion of 5G networks across Asia. Their innovative designs and efficient construction methods have set benchmarks in the industry, allowing for quicker deployment of telecommunications infrastructure.

SBA Communications SBA Communications specializes in the development and management of wireless communication infrastructure. With a robust portfolio of towers, they focus on enhancing connectivity for mobile network operators. Their customer-centric approach and strategic partnerships have established them as a trusted name in telecom tower manufacturing.

Ericsson While primarily known for its telecommunications equipment, Ericsson also plays a significant role in the telecom tower market. They provide solutions for network densification, helping operators meet the growing demand for data and enhance user experiences. Their focus on innovation ensures that their towers support the latest technologies.

Innovations in Telecom Tower Design

Leading manufacturers are constantly innovating to meet the evolving needs of the telecom industry. Key trends include:

Smart Towers: These towers are equipped with advanced technologies such as IoT sensors and energy-efficient systems, enabling real-time monitoring and data collection.

Modular Designs: Manufacturers are adopting modular designs that allow for quicker and more flexible installations, reducing time and costs associated with tower construction.

Sustainable Practices: Many telecom tower manufacturers are prioritizing sustainability by using eco-friendly materials and incorporating renewable energy sources into their designs.

The Future of Telecom Towers

As the demand for connectivity continues to rise, the role of telecom towers will become even more critical. Leading manufacturers are poised to address challenges related to network capacity, coverage, and efficiency. The transition to 5G and beyond will drive innovations in tower technology, ensuring that manufacturers remain at the forefront of this dynamic industry.

Conclusion

The telecom tower industry is essential for the advancement of communication technologies. Leading manufacturers play a significant role in shaping the future of connectivity by providing innovative solutions and infrastructure. As we continue to rely on mobile communication and data services, these manufacturers will be key to building the networks that connect us all.

For more insights into the telecom industry and the role of telecom towers, stay tuned to our updates!

0 notes