#Non Custodial Wallet Crypto

Text

Exploring The Advantages Of A Decentralized Crypto Wallet

Crypto currency has brought about a plethora of options for storing and managing digital assets in the realm of digital finance. Among these options, decentralized crypto wallets have gained significant popularity owing to their unique advantages and user-centric features. In this article, we will explore the advantages of using a decentralized crypto wallet and why it is becoming the preferred choice for many crypto enthusiasts.

What is a Decentralized Crypto Wallet?

A decentralized crypto wallet, also known as a non custodial wallet crypto, is different from traditional online crypto wallets in one fundamental aspect: control. Unlike custodial wallets, where a third party holds the user's private keys and, hence, control over their funds, decentralized wallets empower users with complete control over their digital assets. This means that users are solely responsible for safeguarding their private keys and managing their funds securely.

Advantages of a Decentralized Crypto Wallet:

1. Enhanced Security:

One of the primary advantages of decentralized crypto wallets is enhanced security. As they eliminate the need to entrust private keys to a centralized entity, users mitigate the risk of potential hacks or security breaches. With complete control over their private keys, users can rest assured knowing that their funds are protected against unauthorized access.

2. Sovereignty and Control:

Decentralized wallets embody the core ethos of cryptocurrency - decentralization. Users retain sovereignty and complete control over their funds, free from the constraints of centralized intermediaries. This autonomy aligns with the foundational principles of blockchain technology, fostering trust and transparency within the ecosystem.

3. Flexibility and Compatibility:

Many decentralized wallets, such as The Connecter's Multichain Crypto Wallet, offer support for multiple blockchain networks. This versatility enables users to manage a diverse range of digital assets from a single interface, streamlining the user experience and eliminating the need for multiple wallets.

4. Privacy Protection:

Decentralized wallets prioritize user privacy by minimizing the collection of personal information. Unlike centralized exchanges or custodial wallets that may require extensive KYC (Know Your Customer) verification processes, decentralized wallets offer a level of anonymity that appeals to privacy-conscious users.

5. Access Anytime, Anywhere:

With decentralized wallets, users are not bound by geographical limitations or reliance on third-party services. As long as users have access to the internet, they can manage their digital assets anytime, anywhere, without being subject to downtime or service interruptions.

In conclusion, decentralized crypto wallets offer a host of advantages that cater to the evolving needs of cryptocurrency users. From enhanced security and privacy protection to sovereignty and compatibility, these wallets embody the principles of decentralization while providing a user-friendly experience. As the digital asset landscape continues to evolve, decentralized wallets, such as The Connecter's multichain crypto wallet, stand at the forefront of innovation, empowering users with control, security, and flexibility in managing their digital assets. For more information visit the website: https://www.theconnecter.io/.

#Online Crypto Wallet#Multichain Crypto Wallet#Decentralized Crypto Wallet#Non Custodial Wallet Crypto

2 notes

·

View notes

Text

Get to Know the Crypto Wallets

Hosted Wallets - A hosted crypto wallet is a digital wallet in which your private keys are stored. In exchange, the wallet takes care of the backup and security of your funds.

Non - Custodial Wallets - Non-custodial wallets are Digital Wallets That Enable Users To Take Full Ownership Of Their Assets. The name (non-custodial) comes from the fact that the wallet itself doesn’t have custody of your crypto but rather serves as an interface that enables you to easily conveniently access it while also allowing third-party integrations.

Hardware Wallets - Hardware Wallets keep cryptocurrency in offline or “cold” storage, meaning they’re not connected to the internet. They’re physical devices, typically resembling a USB stick, which function as stripped-down, single-purpose computers.

Final Thoughts

Just as there are many ways to store money (in a bank account, in a safe, under the bed), there are many ways to store crypto. You can keep things simple with a hosted wallet, have complete control over your cryptocurrency with a non-custodial wallet, take extra precautions with a hardware wallet, or even have multiple types of wallets—with cryptocurrencies, the choice is yours. your hand.

Read more about Crypto wallets here: https://www.cryptorial.co/tech/understanding-crypto-wallets-and-its-importance/

0 notes

Text

Notcoin – How to Earn Crypto in Telegram

Let's face it: trends have a habit of fizzling out quickly. We've seen this play out time and time again. If we're being honest, probably 95% of Telegram games are just riding the hype train, offering little to no real value.

But Notcoin? That's a whole different ball game. NOT isn't just a game; it's a philosophy. The developers realized that a simple clicker game wouldn't cut it long-term. So they used that viral mechanic merely as a way to distribute coins. The real challenge was to offer users something more substantial, something truly valuable.

No sooner had the clicker craze cooled off than Notcoin launched the next big thing: Explore-to-Earn. This is uncharted territory in the crypto world. After a successful beta run, they finally dropped the full release on July 11th.

Let's dive deep into what this project looks like today, who might benefit from it, and most importantly - how to make some money.

Getting Started with Explore-to-Earn

Jumping in couldn't be easier. All you need to do is hop into the Telegram bot.

Next up - and we can't stress this enough - link your crypto wallet to the app. Don't sweat it; it's completely safe. Notcoin can't touch your funds without your say-so. It's just requesting info. Any non-custodial wallet will do the trick. The crowd favorites? TON Space and TON Keeper.

And that's it!

The Essence of Explore-to-Earn: A Triple Win

In the crypto world, you'll often hear the phrase "win-win" - a situation where both parties come out on top. But Notcoin? They've upped the ante with a "win-win-win" system. Let's break down how this clever setup works.

The Notcoin ecosystem brings together three key players: Notcoin itself, other Web 3.0 developers, and you, the users. Notcoin's user base has already blown past an eye-popping 40 million. Let's be real - what project wouldn't jump at the chance to showcase their product to such a massive audience?

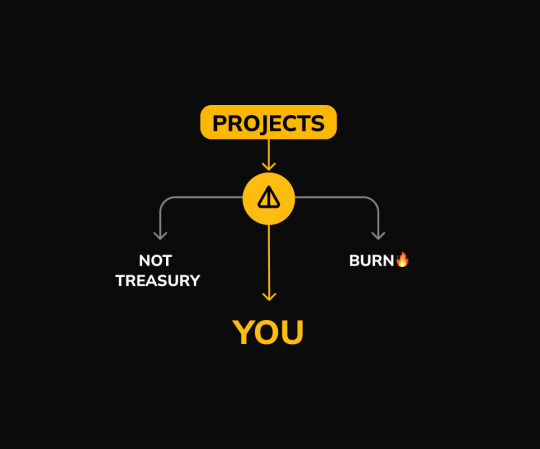

Here's how the mechanism works in practice:

A crypto project buys a chunk of NOT tokens from the market (usually around 1 million coins). Think of this as their advertising budget.

You, as a user, go through an onboarding process - getting to know their product, following their channels and social media, and completing various tasks. For your efforts, you pocket the lion's share of these tokens.

A smaller portion goes to the Notcoin team. This is how they monetize the project and fund further development of the app.

The third, also small, portion gets burned. This reduces the total supply of coins, potentially driving up the value of NOT tokens.

In the end, everyone comes out ahead:

You pocket tokens for checking out new projects.

Crypto projects tap into a massive audience.

Notcoin turns a profit from their platform.

NOT holders benefit from the token's rising value.

Simple, yet brilliant...

Let's dive deeper into how this mechanism ticks.

Pools

When a new project drops into Notcoin, they kick off what's called a "pool". Think of it as a reservoir of NOT tokens, with two key features:

Pool Size: This is the total number of NOT tokens up for grabs, waiting to be divvied up among users.

Campaign: This is your to-do list - a series of tasks you need to knock out to get your slice of the pool.

Here's how the process of participating unfolds:

You spot a new pool and decide to jump in.

You work your way through the campaign tasks. This could involve following the project's channels, getting acquainted with their product, performing specific actions on their platform, and so on.

Once you've successfully completed all the tasks, you become a full-fledged pool participant.

Now, here's where it gets exciting: As a pool participant, you start "draining" NOT tokens from it. This happens automatically, every hour. You and other participants gradually claim tokens until the pool is completely emptied.

Levels

Your farming speed in the pool depends on your level. There are three levels: Bronze, Gold, and Platinum. During the beta, your level was determined by how many NOT tokens you staked. Now, things have changed.

Those who staked their NOT tokens early (before May 16th) and haven't withdrawn them yet have been granted a permanent level (as long as they keep their coins staked).

For everyone else, it's now subscription-based. You can pay through Telegram Stars, or use your NOT tokens already in the app.

Will the subscription pay off? That's the million-dollar question. For example, over 2 months of farming at the Platinum level, we managed to mine about 10,000 NOTs. Currently, a 3-month subscription costs 9,990. It's a decision you'll have to weigh carefully.

The Evolution of Notcoin

We envision Notcoin evolving into something akin to Steam - a platform connecting products with end-users. This is the unique value Notcoin offers, setting it apart from most of its clones and imitators.

Looking Ahead:

Temper Expectations: While the potential is there, it's clear that initial promises haven't fully materialized yet. Be patient and realistic.

Stay Active: With future airdrops planned, maintaining activity in the ecosystem could pay off.

Watch the Tokenomics: The limited supply and burn mechanism could lead to price appreciation over time, but it's not guaranteed.

Keep an Eye on New Features: The trading bot and NFTs could add new dimensions to the platform's utility and value.

Platform Potential: If Notcoin successfully positions itself as a go-to platform for crypto projects to reach users, it could become a significant player in the space.

Diversify: While Notcoin shows promise, remember it's just one project in a vast crypto ecosystem. Don't put all your eggs in one basket.

The team's focus on creating a unique value proposition - being the bridge between crypto projects and users - is a smart move. If executed well, this could indeed make Notcoin a "Steam for crypto", providing lasting value beyond the initial hype.

As always in crypto, there are no guarantees. The project shows promise, but also faces challenges and competition. Stay informed, engage wisely, and as they say, DYOR (Do Your Own Research).

Good luck!

2 notes

·

View notes

Text

SOURCE PROTOCOL

SOURCE is building limitless enterprise applications on a secure and sustainable global network. Defi white-labelled services, NFT markets, RWA tokenization, play-to-earn gaming, Internet of Things, data management and more. SOURCE is providing blockchain solutions to the real world and leveraging the power of interoperability.

SOURCE competitive advantages over other blockchain projects

For builders & developers — Source Chain’s extremely high speeds (2500–10000+ tx / per second), low cost / gas fees ($0.01 average per tx), and scalability (developers can deploy apps in multiple coding languages using CosmWasm smart contract framework), set it apart as a blockchain built to handle mass adopted applications and tools. Not to mention, it’s interoperable with the entire Cosmos ecosystem.

For users — Source Protocol’s DeFi suite is Solvent and Sustainable (Automated liquidity mechanisms create a continuously self-funded, solvent and liquid network), Reduces Complexity (we’re making Web 3.0 easy to use with tools like Source Token which automate DeFi market rewards), and we’ve implemented Enhanced Security and Governance systems (like Guardian Nodes), which help us track malicious attacks and proposals to create a safer user environment.

For Enterprises — Source Protocol is one of the first to introduce DeFi-as-a-Service (DaaS) in order for existing online banking and fintech solutions to adopt blockchain technology with ease, and source also provides Enterprise Programs which are complete with a partner network of OTC brokerages, crypto exchanges, and neobanks that create a seamless corporate DeFi experience (fiat onboarding, offboarding, and mutli-sig managed wallets)

Why Source Protocol

Firstly, many protocols are reliant on centralized exchanges for liquidity, limiting their ability to scale independently. This creates a lot of the same issues traditional finance has been plagued with for decades.

Next — slow tx speeds, high costs, limited scalability, and inability to collaborate with other chains, has created severe limitations in Gen 2 blockchain infrastructure.

Lastly, there still exists a level of complexity in blockchain applications that remains a barrier to entry for the average user, and there is not enough focus on building “bridges” for the enterprise to adopt this technology easily and quickly.

In summary, consumers are eager for a blockchain ecosystem that can securely and sustainably support mass adopted applications. That’s why we’ve built Source!

Source Protocol’s ecosystem

Source Protocol’s ecosystem includes a full DeFi Suite, a members rewards program and white-label integration capabilities with existing online Web 2.0 enterprises:

Source Swap — An Interchain DEX & AMM built on Source Chain for permission-less listing of $SOURCE-based tokens, native Cosmos SDK assets, cw-20’s, and wrapped Binance Smart Chain (BEP-20) assets.

Source One Market — A peer to peer, non-custodial DeFi marketplace for borrowing, lending, staking, and more. Built on Binance Smart Chain with bridging to Source Chain & native Cosmos SDK assets.

Source Token $SRCX (BEP-20) — the first automated liquidity acquisition and DeFi market participation token built on Binance Smart Chain.

Source One Token $SRC1 (BEP-20) — a governance and incentivized earnings token that powers Source One Market.

Source USX $USX (BEP-20) — Source One Market stablecoin backed and over collateralized by a hierarchy of blue chip crypto assets and stablecoins.

Source Launch Pad — Empowering projects to seamlessly distribute tokens and raise liquidity. ERC-20 and BEP-20 capable.

Source One Card & Members Rewards Program — users can earn from a robust suite of perks and rewards. In the future, Source One Card will enable users to swipe with their crypto assets online and at retail locations in real time.

DeFi-as-a-Service (DaaS) — Seamless white-label integration of Source One Market, Source Swap, Source Launch Pad, and/or Source One Card with existing online banking and financial applications, allowing businesses to bring their customers DeFi capabilities.

Source Protocol Key Components

Sustainable Growth model built for enterprise involvement and mass application adoption

Guardian Validator Nodes for enhanced network security

Integration with Source Protocol’s Binance Smart Chain Ecosystem and Decentralized Money Market, Source One Market

Source-Drop (Fair community airdrop and asset distribution for ATOM stakers and SRCX holders)

Interoperable smart contracts (IBC)

High speed transaction finality

Affordable gas fees (average of $0.01 per transaction)

Highly scalable infrastructure

Open-source

Permission-less Modular Wasm + (EVM)

Secured on-chain governance

Ease of use for developers

conclusion

SOURCE is a comprehensive blockchain technology suite for individuals, enterprises and developers to easily use, integrate and build web3.0 applications. It is a broad-spectrum technology ecosystem that transforms centralized web tools and financial instruments into decentralized ones. Powering the future of web3,

Next — slow tx speeds, high costs, limited scalability, and inability to collaborate with other chains, has created severe limitations in Gen 2 blockchain infrastructure.

Lastly, there still exists a level of complexity in blockchain applications that remains a barrier to entry for the average user, and there is not enough focus on building “bridges” for the enterprise to adopt this technology easily and quickly.

In summary, consumers are eager for a blockchain ecosystem that can securely and sustainably support mass adopted applications. That’s why we’ve built Source!

For More Information about Source Protocol

Website: https://www.sourceprotocol.io

Documents: https://docs.sourceprotocol.io

Twitter: https://www.twitter.com/sourceprotocol_

Instagram: https://www.instagram.com/sourceprotocol

Telegram: https://t.me/sourceprotocol

Discord: https://discord.gg/zj8xxUCeZQ

Author

Forum Username: Java22

Forum Profile Link: https://bitcointalk.org/index.php?action=profile;u=3443255

SOURCE Wallet Address: source1svnzfy5fafuskeaxmf2sgvgcn6k3sggmssl8d7

2 notes

·

View notes

Text

📢💤It is time to take back the ownership and control of your 💥Crypto & put it to real use.

𝐏𝐥𝐮𝐭𝐨𝐏𝐞 ,A😎 non-custodial wallet has all this to offer & more.

💥Join it's waitlist Now to get early access to the wallet 😎 experience

4 notes

·

View notes

Text

#PlutoPe is a non-custodial wallet. Using PlutoPe we can take control of our own digital assets and be the real owner of our #Cryptos . Join the waitlist right now to get early access to #PlutoPe

Link below, don't forget to join it 😇

2 notes

·

View notes

Link

0 notes

Text

Crypto Wallets 101: How to Choose and Use the Right One for You

In the rapidly evolving world of cryptocurrency, securely storing your digital assets is essential. Crypto wallets serve as the gateway to managing your cryptocurrency holdings, allowing you to send, receive, and store your assets safely. This guide provides essential cryptocurrency information to help you navigate the different types of wallets, their features, and how to choose the best one for your needs.

Understanding Crypto Wallets

A crypto wallet is a digital tool that allows you to interact with blockchain networks. It stores your public and private keys, which are necessary for accessing and managing your cryptocurrency. Importantly, wallets don’t store your cryptocurrency itself; instead, they provide the means to access your assets on the blockchain, where they are recorded.

Types of Crypto Wallets

There are several types of crypto wallets, each with its own advantages and disadvantages. Understanding these can help you make an informed decision based on your needs.

Hot Wallets

Hot wallets are connected to the internet and are typically used for everyday transactions. They include mobile wallets, desktop wallets, and web wallets. While hot wallets are convenient for quick access, they are more vulnerable to hacking and phishing attacks.

Cold Wallets

Cold wallets are offline storage options that provide enhanced security for your cryptocurrency. Hardware wallets (like Ledger and Trezor) and paper wallets fall into this category. Cold wallets are ideal for long-term storage of large amounts of cryptocurrency, as they are less susceptible to online risks.

Custodial Wallets

Custodial wallets are managed by third-party services, such as exchanges. While custodial wallets are user-friendly and accessible for beginners, they require you to trust the service provider with your private keys.

Non-Custodial Wallets

Non-custodial wallets give you full control over your private keys and funds. This type of wallet is recommended for those who prioritize security and want to take responsibility for their assets.

Choosing the Right Wallet for You

When selecting a crypto wallet, consider the following factors:

Security

Security should be your top priority when choosing a crypto wallet. Cold wallets offer the highest level of security, while hot wallets are more convenient but come with higher risks. If you plan to hold significant amounts of cryptocurrency, consider investing in a hardware wallet.

Usability

Choose a wallet that is user-friendly and matches your level of expertise. Beginners may prefer a custodial wallet or a simple mobile wallet, while experienced users might opt for a more complex desktop wallet that offers advanced features.

Compatibility

Ensure that the wallet you choose supports the cryptocurrencies you plan to hold. Some wallets are designed for specific cryptocurrencies, while others can manage multiple assets.

Backup and Recovery Options

Look for wallets that offer robust backup and recovery options. This is vital in case you lose access to your wallet. Most wallets provide a seed phrase that you can use to recover your funds.

Best Practices for Using Crypto Wallets

Once you have chosen a wallet, follow these best practices to ensure the security of your cryptocurrency:

Enable Two-Factor Authentication (2FA)

For wallets that support it, enabling 2FA adds an extra layer of security by requiring a second form of verification when logging in.

Keep Your Software Updated

Regularly update your wallet software to protect against vulnerabilities and security risks. This applies to both hot and cold wallets.

Use Strong Passwords

Create strong, unique passwords for your wallets and accounts. Consider using a password manager to help you manage your passwords securely.

Be Cautious of Phishing Attacks

Always verify the authenticity of websites and emails related to your wallet. Phishing attacks are common in the crypto space, and attackers often impersonate legitimate services to steal your credentials.

Store Your Seed Phrase Securely

Your seed phrase is the key to recovering your wallet. Store it offline in a secure location, and never share it with anyone.

Cryptocurrency Research and Staying Informed

To make informed decisions about your crypto investments, engage in ongoing cryptocurrency research. Follow reputable sources of cryptocurrency information, such as news websites, forums, and social media channels. Keeping up with trending cryptocurrency projects can help you identify potential investment opportunities and stay ahead of market trends.

Conclusion

Choosing the right crypto wallet is essential for managing your cryptocurrency assets securely. By understanding the different types of wallets and their features, you can select one that aligns with your needs and preferences. Remember to prioritize security, usability, and compatibility when making your choice.

Stay informed, follow best practices, and you’ll be well-equipped to navigate the exciting world of cryptocurrency with confidence!

0 notes

Text

Carta di debito in cryprovalute di mastercard

Mastercard lancia carta di debito crypto denominata in euro, in collaborazione con Mercuryo. La nuova carta permette agli utenti di spendere le criptovalute presenti nel loro wallet self-custodial presso gli oltre 100 milioni di esercenti della rete Mastercard.

Il colosso dei pagamenti Mastercard sta espandendo il suo supporto per i wallet di criptovalute non-custodial, grazie a una nuova collaborazione che consente agli utenti di spendere asset digitali "come se fossero la propria banca."

Dopo aver condotto ad agosto un programma pilota per una carta di debito crypto in collaborazione con MetaMask, la nuova partnership di Mastercard con Mercuryo – fornitore europeo di infrastrutture di pagamento per crypto – connetterà ulteriormente la finanza tradizionale e le criptovalute.

Nell'ambito della collaborazione, Mastercard ha attivato una nuova carta di debito denominata in euro che consente agli utenti di spendere le criptovalute presenti nei loro wallet presso gli oltre 100 milioni di esercenti della rete Mastercard.

Mastercard mira a guidare l'adozione dei wallet self-custodial

L'autocustodia – ovvero detenere i propri asset in maniera indipendente, senza il supporto di una piattaforma centralizzata come una banca o un exchange – è uno dei concetti fondamentali delle criptovalute.

A differenza dei wallet cosiddetti "custodial," ovvero gestiti da un'autorità centrale, i wallet "non-custodial" richiedono che sia l'utente stesso ad assumersi la piena responsabilità dei propri fondi, essendo l'unico conoscitore della chiave privata che consente di accedere al portafoglio.

Fonte: Tastycrypto

Christian Rau, vicepresidente senior della divisione Crypto and Fintech Enablement di Mastercard, ha commentato:

"Mastercard lavora a stretto contatto con i partner per innovare e migliorare l'esperienza dei wallet self-custodial. Grazie alla collaborazione con Mercuryo, stiamo eliminando le tradizionali barriere tra la blockchain e i pagamenti convenzionali, offrendo ai consumatori che desiderano spendere i propri asset digitali un modo facile, affidabile e sicuro per farlo, ovunque sia accettata Mastercard."

Perché Mastercard desidera supportare i wallet non-custodial?

Mastercard ha annunciato il supporto per le criptovalute sulla sua rete nel febbraio del 2021, citando il ruolo crescente degli asset digitali nel mondo dei pagamenti.

Da quando è entrata nel mondo delle criptovalute, ormai oltre tre anni fa, Mastercard ha stretto collaborazioni con nomi molto importanti del settore, tra cui Circle, Coinbase, Metamask e tanti altri.

I partner di Mastercard nel settore crypto. Fonte: Mastercard

Secondo Raj Dhamodharan, responsabile di Mastercard per la blockchain e gli asset digitali, l'azienda mira a risolvere le complessità associate all'acquisto e alla vendita di criptovalute. A suo parere, anche gli exchange centralizzati tendono ad essere troppo complessi per una grande fascia di utenti.

"Le complessità di questo processo sono state un ostacolo sia per gli acquirenti che per i venditori, in quanto limitano sia la scelta che il potere d'acquisto delle criptovalute custodite," ha dichiarato Dhamodharan ad agosto.

Ma i servizi di Mastercard nel settore delle criptovalute non sono gratuiti. La nuova carta Spend di Mercuryo, a marchio Mastercard, comporta infatti una commissione di emissione di 1,60€ e una commissione di mantenimento mensile di 1€, oltre a una commissione aggiuntiva dello 0,95% applicata da Mercuryo.

Read the full article

0 notes

Text

Best non kyc defi development

Here is a concise answer to your query about the best non-KYC DeFi wallets for crypto investors, based on the provided search results:

Top Non-KYC DeFi Wallets

Electrum - An open-source Bitcoin wallet that offers complete control over private keys without KYC. It supports hardware wallet integration and multi-signature functionality for enhanced security.

Ledger Nano X - A hardware wallet supporting over 5,000 cryptocurrencies including NFTs. It operates offline for maximum security and allows frequent IP and device changes during transactions to maintain anonymity. The wallet is accessed via PIN code and secure element chip.

Zengo - A mobile-based wallet with advanced security features like annual software audits. It has over 1 million users with no reported hacks so far. Zengo supports a wide range of cryptocurrencies and includes features like in-app purchases and staking.

Coinomi - Doesn't track IP addresses which are anonymized in real-time. Coinomi supports your own Bitcoin node and has a built-in exchange for easy crypto swaps, making it a good choice for privacy-focused investors.

Best Wallet - Available on Android and iOS, Best Wallet is self-custodial so you own the private keys. It has robust security with PIN/fingerprint access and email recovery. The wallet is compatible with Ethereum, Binance Smart Chain and plans to add staking, NFTs and DeFi features.

These non-KYC wallets prioritize user privacy and security while providing a range of DeFi features like staking, swaps and dApp integration. They are a good choice for crypto investors looking to manage their assets without revealing personal information.

Looking for the best in non-KYC DeFi development?

Explore solutions that prioritize privacy and decentralization without compromising security. These platforms enable seamless and anonymous transactions while offering cutting-edge DeFi features.

Dive into the world of non-KYC DeFi to unlock financial freedom and innovation!

#cryptocurrency#defiwallet#blockchain#cryptonews#crypto investors#cybersecurity#DeFiWallet#DecentralizedFinance#BlockchainWallet#DeFiSolutions

0 notes

Text

Mastercard's Latest Partnership Allows Crypto to Be Used as Cash

Want to spend your crypto on everyday items? Mastercard has got you covered with its newest partnership.

In recent crypto news, Mastercard is enhancing its support for non-custodial cryptocurrency wallets through a fresh collaboration that allows users to manage and utilize their crypto assets while retaining full control over them.

0 notes

Text

Mastercard Launches Euro Denominated Non-Custodial Bitcoin Debit Card

New Post has been published on Sa7ab News

Mastercard Launches Euro Denominated Non-Custodial Bitcoin Debit Card

Mastercard has launched a euro debit card enabling direct spending of Bitcoin and crypto from non-custodial wallets at its over 100 million merchants. The move reflects Mastercard’s expanding efforts to bridge Bitcoin with its traditional payments network.

... read more !

0 notes

Text

Tonhub Wallet extension

Tonhub Wallet | Storing and using your Toncoins

In the continuously growing sector of blockchain technology, several developers have introduced us to numerous secure and user-friendly wallets so that we can seamlessly and safely keep or manage our crypto assets.

Nowadays, Tonhub wallet emerges as a front-runner for users seeking to interact with The Open Network (TON), a layer 1 decentralized blockchain platform. If you search for Tonhub, its features, or how to set it up, this article below will familiarize you with everything you must know before getting started with Tonhub wallet and exploring The Open Network blockchain.

Understanding TON and Ton Coin:

The Open Network, TON, is a layer 1 blockchain decentralized computer network with various components. It was initially developed by Nikolai Durov and the team behind the popular messaging app Telegram to integrate cryptocurrency and blockchain functionality into the Telegram ecosystem.

The native cryptocurrency of TON is Toncoin (TON). It is utilized for gas payments (i.e., smart-contract message processing fees), transaction fees, network development decisions, staking to secure the blockchain, and payment settlement.

TON serves various purposes within the network, including:

Transaction fees: Users can pay TON Coins to interact with the network, such as sending and receiving cryptocurrency or executing smart contracts.

Staking: Users can also stake their TON Coins to participate in network development and earn rewards.

Governance: TON Coin token holders are now able to vote on a few decisions across all projects on the network.

What is Tonhub wallet?

Tonhub wallet is a popular and reputed non-custodial wallet that allows users to store, send, and receive TON coins and NFTs. Unlike custodial wallets, where a third party controls your secret recovery phrase or private keys, Tonhub provides you with complete control over your private keys and crypto assets. This increases security and offers financial independence among its users.

Tonhub wallet is available across multiple platforms, offering users flexibility in how they manage their TON:

Mobile App: Tonhub wallet is available as a Mobile App that can be downloaded on iOS and Android devices. This app enables users to manage their TON coins with a few taps conveniently.

Key Points of Tonhub wallet

Several features of TON Wallet attract a large user base. Here are some of its highlights.

User-Friendliness: Tonhub prioritizes user-friendliness. Therefore, its interface is easy to navigate, whether you are an existing user or a beginner and unfamiliar with using cryptocurrency wallets.

Security: In terms of security, Tonhub wallet’s second feature is providing a non-custodial wallet experience. A non-custodial crypto wallet allows its users to maintain complete control over their assets and private keys. Your seed phrase will never be stored on Tonhub wallet’s servers.

Seed Phrase: Upon wallet account creation, Tonhub wallet generates a unique 24-word seed phrase, a series of random words. This seed phrase acts as the key to your wallet that will allow you to unlock your wallet when you lose your account login credentials.

Multiple Crypto Assets: In addition to Ton Coins, Tonhub also allows you to store and manage other digital assets built on the TON network.

In-built Decentralized EXCH: Tonhub offers an In-built decentralized exchange, allowing users to swap TON for other cryptocurrencies directly within the wallet.

How to get started with Tonhub wallet?

Upon reading the aforementioned write-ups, if you are now interested to know the step-by-step process for setting up your Tonhub wallet. Then, navigate through the steps below-

Step 1: Download the Tonhub wallet:

First, visit the official Tonhub wallet website to download it.

If you are an Android user, you can find it on Google Play Store.

If you are an iOS user, you can find it in an app store.

Make sure to download and install the latest version on your iOS or Android devices or your computer’s web browser.

Step 2: Create a New Wallet:

Launch the app on your preferred device.

Opt for the “Create a New Wallet” option.

Follow the on-screen prompts and set a PIN Code.

Make sure to set a PIN code that you can remember as you’ll need it for confirming transactions.

Step 3: Backup Your Secret Key

Now, you can see the 24-word secret seed phrase on your screen.

Write down the 24-word seed phrase in the correct order and store it in a safe place.

Now, verify your 24-word seed phrase by entering it in the correct sequence.

Step 4: Set Up a Passcode:

Lastly, follow the on-screen prompts.

Create and confirm a passcode.

This passcode will be used for accessing the app.

Final Words

Congrats!! Your wallet is now ready to use. Now, you can securely send and receive Toncoin and other assets, interact with dApps (decentralized applications), store and transfer NFTs, stake Toncoin, and exchange cryptocurrencies. Now that we have reached the end of this article, we hope that you are ready to begin using the Tonhub wallet Extension. After completing the above-described procedures, you will be able to easily configure your Tonhub and begin exploring the Ton network.

0 notes

Text

keplrwalletapp

keplr wallet. Keplr is a secure, non-custodial crypto wallet for the Cosmos ecosystem. Download the Keplr extension to manage your digital assets and interact with dApps. website: https://keplrwallet.app #keplr, #keplr wallet , #keplr wallet download, #keplr Extension

1 note

·

View note

Text

💥Plutope is a non-custodial #DeFi wallet,that enables Multi-Coin lightning fast:-) #crypto payments. ✅

💥 Join waitlist☝️today for Early updates,rewards and access 💰.

👉 #Fast

👉 #Frictionless

👉#Decentralized

👉#Secure

👉 #Cost_Effective

2 notes

·

View notes

Text

#PlutoPe is a non-custodial wallet. Using PlutoPe we can take control of our own digital assets and be the real owner of our #Cryptos . Join the waitlist right now to get early access to #PlutoPe

Link below, don't forget to join it 😇

2 notes

·

View notes