#Online Crypto Wallet

Text

Exploring The Advantages Of A Decentralized Crypto Wallet

Crypto currency has brought about a plethora of options for storing and managing digital assets in the realm of digital finance. Among these options, decentralized crypto wallets have gained significant popularity owing to their unique advantages and user-centric features. In this article, we will explore the advantages of using a decentralized crypto wallet and why it is becoming the preferred choice for many crypto enthusiasts.

What is a Decentralized Crypto Wallet?

A decentralized crypto wallet, also known as a non custodial wallet crypto, is different from traditional online crypto wallets in one fundamental aspect: control. Unlike custodial wallets, where a third party holds the user's private keys and, hence, control over their funds, decentralized wallets empower users with complete control over their digital assets. This means that users are solely responsible for safeguarding their private keys and managing their funds securely.

Advantages of a Decentralized Crypto Wallet:

1. Enhanced Security:

One of the primary advantages of decentralized crypto wallets is enhanced security. As they eliminate the need to entrust private keys to a centralized entity, users mitigate the risk of potential hacks or security breaches. With complete control over their private keys, users can rest assured knowing that their funds are protected against unauthorized access.

2. Sovereignty and Control:

Decentralized wallets embody the core ethos of cryptocurrency - decentralization. Users retain sovereignty and complete control over their funds, free from the constraints of centralized intermediaries. This autonomy aligns with the foundational principles of blockchain technology, fostering trust and transparency within the ecosystem.

3. Flexibility and Compatibility:

Many decentralized wallets, such as The Connecter's Multichain Crypto Wallet, offer support for multiple blockchain networks. This versatility enables users to manage a diverse range of digital assets from a single interface, streamlining the user experience and eliminating the need for multiple wallets.

4. Privacy Protection:

Decentralized wallets prioritize user privacy by minimizing the collection of personal information. Unlike centralized exchanges or custodial wallets that may require extensive KYC (Know Your Customer) verification processes, decentralized wallets offer a level of anonymity that appeals to privacy-conscious users.

5. Access Anytime, Anywhere:

With decentralized wallets, users are not bound by geographical limitations or reliance on third-party services. As long as users have access to the internet, they can manage their digital assets anytime, anywhere, without being subject to downtime or service interruptions.

In conclusion, decentralized crypto wallets offer a host of advantages that cater to the evolving needs of cryptocurrency users. From enhanced security and privacy protection to sovereignty and compatibility, these wallets embody the principles of decentralization while providing a user-friendly experience. As the digital asset landscape continues to evolve, decentralized wallets, such as The Connecter's multichain crypto wallet, stand at the forefront of innovation, empowering users with control, security, and flexibility in managing their digital assets. For more information visit the website: https://www.theconnecter.io/.

#Online Crypto Wallet#Multichain Crypto Wallet#Decentralized Crypto Wallet#Non Custodial Wallet Crypto

2 notes

·

View notes

Text

ATTENTION - Affiliate and network professionals beware!!

The fastest growing network in the crypto industry is starting - don't miss your chance and come with your team -

Start for free, more information in the back office 👉 https://app.robex-ai.com/join/crypto-united/right 👈 YOUR big opportunity 23/24

#bitcoin#wallet#network#cryptocurrency#blockchain#trader#invest#defi#earn money online#profit#income#make money online#trading infra#crypto trading#cryptocurreny trading#trading view#robex#robexai#robex ai

5 notes

·

View notes

Text

Welcome to Payecards CARD

Payecards is a versatile platform offering secure and convenient prepaid card solutions for online and offline transactions. With Payecards, users can easily manage their finances and make purchases with ease. The platform provides a range of prepaid cards that cater to different needs, ensuring safety and flexibility in handling payments. Whether for personal use or business expenses, Payecards aims to simplify financial management with user-friendly features and robust security measures.

#crypto#banking#finance#cards#Open bank account online#digital banking#Bitcoin trading#money transfer#international payments#crypto wallet#cryptocurrency exchange#Payecards Business Account#Payecards UK#Payecards Bank#Payecards Card

1 note

·

View note

Text

Hexacore Gaming | AGO Token Mining

#hexacore#AGO#token mining#crypto currency#crypto wallet#crypto#telegram#tap to earn#hamster kombat#tapswap#bitcoin#earn money online

0 notes

Text

How Regulatory Changes Shape Banking Technology

Banking technology is constantly evolving, driven by rapid advancements in digital tools and a complex regulatory landscape.

Regulatory changes significantly influence the development and implementation of digital banking solutions, ensuring that innovation is balanced with stability and security.

This article explores how these regulatory changes shape banking technology, focusing on key areas such as cybersecurity, open banking, digital lending, and the broader impacts of these regulations.

The Regulatory Landscape: Fostering Innovation and Stability

Understanding the Role of Regulations

Regulatory bodies worldwide play a critical role in shaping the banking technology landscape. Their primary goal is to foster innovation while ensuring financial stability and protecting consumers from potential risks associated with new technologies.

Promoting Innovation

Regulations often encourage innovation by setting clear guidelines that help digital banking solutions companies navigate the complex financial environment.

For instance, regulatory sandboxes allow fintech firms to test new products and services in a controlled environment, helping to refine and improve their offerings before a full market launch.

Key Regulatory Impulses on Banking Technology

Digital Payments and UPI

One of the most significant regulatory impacts has been on digital payments. The introduction of streamlined digital payment frameworks has revolutionised the payment landscape, making transactions faster and more secure.

These frameworks have set a global benchmark for digital payment systems, driving the adoption of next-generation digital banking solutions.

Financial Inclusion Initiatives

Regulations aimed at financial inclusion have driven banks to adopt innovative technologies to reach underserved populations.

Initiatives promoting financial inclusion have leveraged digital banking solutions to provide banking services to millions of unbanked individuals, fostering greater financial inclusion.

Cybersecurity and Data Privacy

Enhancing Security Measures

With the increasing reliance on digital banking solutions, cybersecurity has become a top priority for regulators worldwide.

Regulatory bodies, including the European Central Bank (ECB), the U.S. Federal Reserve, and others, mandate robust cybersecurity frameworks to protect against data breaches and cyber threats.

These regulations ensure that banks implement advanced security measures, such as encryption, multi-factor authentication, and continuous monitoring, to safeguard customer data and maintain the integrity of financial systems.

Data Privacy Regulations

Data privacy is another critical area of focus for global regulators. The implementation of data protection laws, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, requires banks to adopt stringent data handling practices.

These regulations ensure that customer data is processed transparently and securely, enhancing trust in digital banking services across different regions. Adhering to these regulations helps financial institutions maintain customer confidence and comply with international standards.

Open Banking

Facilitating Secure Data Sharing

Open banking regulations enable secure data sharing between financial institutions and third-party providers through APIs.

This fosters innovation by allowing fintech companies to develop personalised banking services, enhancing the customer experience. Various regulatory frameworks worldwide promote secure and efficient open banking practices.

Benefits to Consumers

Open banking gives consumers more control over their financial data and access to a broader range of services.

These regulations facilitate competition and collaboration, driving the development of the best digital banking solutions that cater to diverse customer needs.

Payments and Digital Lending

Streamlining Payment Systems

Regulations have streamlined payment systems, making digital transactions more efficient and secure.

Guidelines on prepaid payment instruments (PPIs) and the interoperability of wallets have enhanced the digital payment ecosystem, providing customers with seamless and convenient payment options.

Enhancing Digital Lending

Digital lending has been significantly impacted by regulatory changes. Guidelines on peer-to-peer lending and digital loan disbursements have facilitated the growth of digital lending platforms.

These platforms leverage technology to provide quick and easy access to credit, especially for underserved segments of the population.

Impact of Regulations: A Balancing Act

Ensuring Consumer Protection

Regulatory changes aim to protect consumers from financial fraud and ensure the security of digital transactions.

Regions create a safe and secure banking environment by setting standards for cybersecurity, data privacy, and consumer grievance redressal.

Encouraging Responsible Innovation

While promoting innovation, regulations also ensure that new technologies are implemented responsibly. This involves setting limits on data usage, ensuring transparency in financial transactions, and requiring regular audits to verify compliance.

The Way Forward: Striking the Right Balance

Future Regulatory Trends

As banking technology continues to evolve, regulators must anticipate and address emerging risks. This involves continuously updating regulatory frameworks to keep pace with technological advancements and ensure they remain effective.

Collaboration Between Stakeholders

Collaboration between regulators, financial institutions, and fintech companies is essential for the sustainable development of digital banking solutions.

By working together, these stakeholders can create an ecosystem that fosters innovation while maintaining financial stability and security.

Beyond the Key Changes: A Deeper Dive into Regulatory Impacts

Impact on Traditional Banking Services

Regulatory changes also affect traditional banking services. Banks must upgrade their legacy systems to comply with new regulations, ensuring that their services remain competitive and secure.

This integration of traditional and digital banking services helps banks offer their customers a comprehensive range of financial products.

Integration with Blockchain Technology

Blockchain technology is increasingly being integrated into banking services, offering enhanced security and transparency.

Regulatory support for blockchain-based solutions, such as crypto banking services and next-gen cross-chain banking, can revolutionise financial transactions by providing a secure and efficient alternative to traditional systems.

Challenges and Opportunities: A Multifaceted Perspective

Overcoming Regulatory Challenges

Banks and fintech companies need help in complying with new regulations, including the cost of implementation and the need for continuous updates.

However, these challenges also present opportunities for innovation and growth as firms develop new solutions to meet regulatory requirements.

Embracing Opportunities

Regulatory changes provide banks with an opportunity to innovate and offer better services to their customers.

By embracing new technologies and adhering to regulatory standards, banks can enhance their competitiveness and build customer trust.

Conclusion

Regulatory changes play a crucial role in shaping the banking technology landscape. These regulations drive the development of next-generation digital banking solutions by fostering innovation, ensuring security, and promoting financial inclusion.

As the banking sector evolves, collaboration between regulators and innovators will be key to striking the right balance between innovation and stability.

How E-Money Network Can Help You with Digital Banking Solutions

E-Money Network provides comprehensive digital banking solutions that comply with regulatory standards. With expertise in implementing advanced security measures, blockchain technology, and personalised banking services.

E-Money Network can help you navigate the regulatory landscape and drive innovation in your banking operations.

FAQs

1. How do regulatory changes impact digital banking solutions?

Regulatory changes drive the adoption of secure, efficient, and innovative digital banking solutions, ensuring consumer protection and financial stability.

2. What role does cybersecurity play in banking regulations?

Cybersecurity is a top priority, with regulations mandating robust security frameworks to protect against cyber threats and ensure data privacy.

3. How does open banking benefit consumers?

Open banking allows secure data sharing with third-party providers, fostering innovation and enabling personalised banking services.

4. What is the impact of regulations on digital lending?

Regulations support digital lending by enabling faster and more efficient loan disbursements, promoting financial inclusion and access to credit.

5. How can banks balance innovation and regulatory compliance?

Banks can balance innovation and compliance by adopting advanced technologies, collaborating with regulators, and continuously updating their systems to meet regulatory standards.

#e- money network#emoney#E Money Network#crypto wallet#defi 2.0#digital currency#digital wallet crypto#top crypto wallets#online bank account#electronic money transfer#digital money transfer#best crypto wallet

0 notes

Text

OOOWELLET Round 2 Airdrop

🙂 Total Airdrop Pool: 500,000 WELLET (~$50,000)

Join Reward $15~ 150 $WELLET:

1) App: https://play.google.com/store/apps/details?id=com.ooo.wellet

2) Reg with REF CODE: >> D8SIERE0 <<

>>> Reg OWEB WALLET to Airdrop

https://owebwallet.online

Enter REFER CODE: >> HHPFBKNF <<

TO GET Received Extra 50 OWEB TOKEN

#coin#coin collecting#crypto news#crypto#make money as an affiliate#make money from home#make money fast#make money tips#make money online#mmo#binance#ooowellet#ooo#point#okx#bybit#wallet

0 notes

Text

AN ADVICE FOR REAL SPARTANS IN AAS

{AN ADVICE FOR REAL SPARTAN’S} By Gods grace, i have been part of AAS right from the days of beta testing and i can attest to the fact that it has never been easy. What drew me to sir Jesam michael is his sincerity. He started with bringing illumination into our lives by teaching us hidden secrets about ponzi and how to identify them. He also thought us allot on how to invest wisely, and all…

View On WordPress

#AAS Blockchain#AAS exchange wallet#AAS token#Arbitrage system#BINANCE#BINANCE COMPETITIVE#Crypto Earning#CRYPTO MINING#CRYPTOCURRENCY#Digital News#Earn money online

0 notes

Text

WOW 🔥🔥🔥

I JUST CLAIMED $500 000 WORTH OF $PLX

Claim :

https://plexus.ink

#airdrop#bitcoin#etherium#crypto#sui#solar plexus chakra#dex#testnet#abu zubaydah#so hot 🔥🔥🔥#litecoin#usdt#metamask#trust wallet clone#web3#web3community#earn money online#money#motivation#how to earn money#earnings#matic#dogecoin

1 note

·

View note

Text

got my exact 0.54BTC recovered and refund to my wallet, AFTER REACHING OUT TO *Hackvoktech* on instagram

#recovery#hacked#hackers#hacking#crypto scams#pls help#refund#wallet#coinbase#scammed#scam email#scam exposed#online scam#online services#discord server#bitcoin scam bitcoin crash bakkt xrp cardano ripple bitcoin bottom bull run should i buy bitcoin digibyte binance basic attention token btc#banned#crypto

0 notes

Text

Read More

Get $1 to sign up with Airtm

0 notes

Text

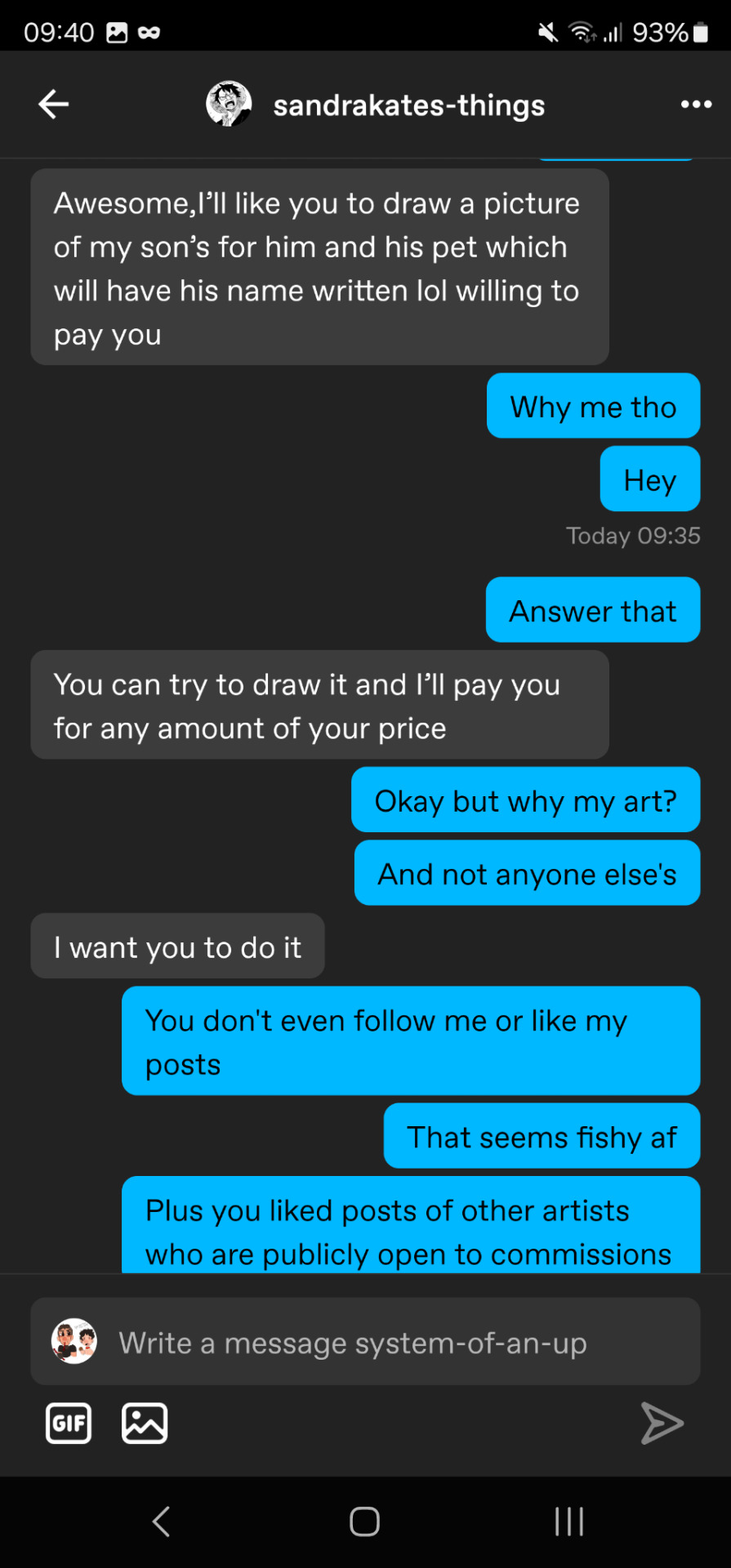

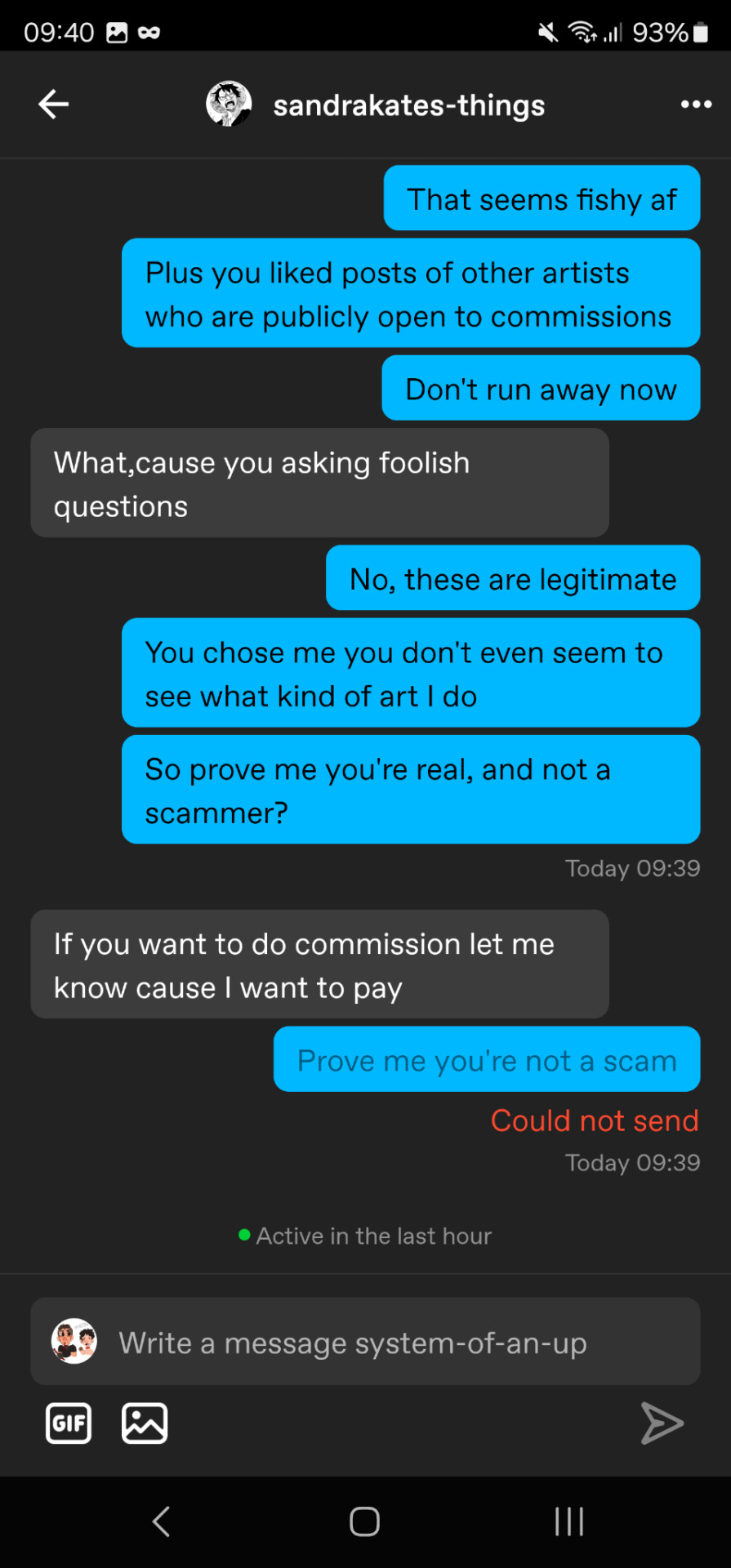

I'm so clever

Stay safe artists.

How to recognize an art scam?

1. Hi can you draw a picture of my son and his pet? I'll pay you anything what are your prices?

That's the most common question I got several times on other websites. Whether you gave prices or not they won't look into it. They never looked at your account, in fact. They pish you into making high prices for them to get refunded later.

2. They don't follow you, or they didn't like your art a while ago.

When you're commissioning an artist, it's because you enjoy their art. The least you'd normally do is give their art likes, comments, or follow you.

3. Just do it

A normal client would totally understand your suspicions and would prove they're not a scammer by explaining what they like in your art. For example, the choice of color palette, the graphic paw (funny way to say signature style), etc. They can also make you feel guilty about your questions. Don't.

4. They'll insist on a certain payment method that could give them advantages, and/or pay you AFTER.

Okay, let's say you're gonna buy bread. The baker hands you your baguette. You are right in front of them, so it's okay to pay after.

Now, you are asking for a developer to make you a script. They have no guarantee that you are real, nor that you are honest. It's normal for them to ask you to pay them first. Or 50% before 50% in the middle.

If you take PayPal, don't. They have a 180d refund policy, and even if the client was hobest at first, PayPal is by the buyer's side and not yours. It doesn't matter if you did the commission, the buyer CAN be refunded.

Solutions?

KYC. Know Your Customer. Sniff shady customers. But it's not really 100% working.

Use a middleman. This one decreases trust from the buyer's side but someone who has seen your commissions before and trusts you from the beginning wouldn't be too affected.

Make them sign an online contract before the commission. A lawyer can make you one or you can make one yourself. Email them, and if they're not a scammer they would sign it. Then you could contact PayPal in case of refund with this contract that person signed with their REAL information + their username and PayPal acc.

Ask for CRYPTOCURRENCY or set up a private XMR <your crypto currency> wallet. Few people really use crypto though.

DMCA them in case they use your art after refusing to pay you. Keep reverse-searching (Google Lens/Images) your art after getting scammed. As long as you have screenshots of the conversation with the client, you have all rights to do so.

13 notes

·

View notes

Text

Donald Trump’s youngest son, and his only child shared with Melania Trump, has largely remained out of the public eye to the degree any former president’s child could. Well, until recently. Newly 18, Barron Trump is now a freshman at NYU and a burgeoning political adviser to his father.

For the past two weeks, my TikTok For You page has been filled with posts from New York University students posting clips of Barron Trump attending classes as if he were Sasquatch: the videos are all blurry and taken hurriedly, and mostly feature fellow students trying to track down the once-elusive Trump. These cryptic videos, complete with shaky camera angles set to songs like Chamillionaire’s “Ridin,’” are all over, taken from “day in my life”-style student videos and reposted to the dozens of Barron stan accounts across TikTok and Instagram.

These posts have garnered millions of views and look like paparazzi shots. You can tell from the camera angle that the people filming are trying to hide their cameras under backpacks or sweaters. New genres of Barron memes have flourished.

“I feel like Barron could’ve gone to any school, but the fact that he chose one of the most liberal schools in the country speaks volumes,” Grace Rowley, an NYU student who posted about Barron on TikTok, told me. “I was shocked and super intrigued that he would choose NYU. Would love to speak with him and would love to read his ‘why NYU’ essay.”

This kind of projection has been part of Barron’s story for years.

Before September, Barron was an enigma. He had no social media accounts and rarely made public appearances. For eight years, his personal life and interests were left to the public’s imagination. In 2020, rumors spread on TikTok that his then classmates had identified his Roblox username, “JumpyTurtlee.” The account’s bio said that the user was a fan of anime and K-pop and supported LGBTQ+ rights. While the rumor was never confirmed, it became part of Barron’s online mythos. Users would grab clips of him looking glum and make it sound as if he were miserable and despised his father, and then post them under the hashtag #savebarron2020.

Barron was the subject of dozens of pieces of fan fiction on sites like Archive of Our Own and Wattpad, and on fan accounts that recycle the same few clips and images over and over again. As Slate writer Luke Winkie noted earlier this year, Barron became a blank canvas for anyone even somewhat interested in the Trump family to project their own “fantasies” on to.

As Winkie also noted, the weird Greco-Roman antiquity-obsessed wing of the conservative base has obsessed over Barron as well, comparing his jawline to that of Alexander the Great and referring to him as America’s Caesar. Earlier this week, someone made an account seemingly impersonating Barron, making it appear as though he were making misogynistic comments about Kamala Harris. That account has since been suspended.

But fans of Barron won’t need to make up their own personal headcanons any longer, especially as it looks like Barron is beginning to take on a more public-facing role supporting his father. He made an X account on Monday to join a Space hosted by Trump to announce the former president’s new crypto venture. “He talks about his wallet, he’s got four wallets or something, and I’ll say, ‘What is a wallet?” the former president said. When Trump sat for an interview with Kick streamer Adin Ross earlier this year, he said that Barron was a fan of Ross. “My son’s told me about you,” Trump told him.

Time will tell, but for now, I'm not sure the internet can assume Barron is merely a weeb anymore. At least we'll probably find out on TikTok soon.

9 notes

·

View notes

Text

.

i try not to talk about this kind of thing here because i like to keep them separate but doing sw shit again has had the unintentional effect of reminding me that i actually kinda do and have done a bunch of stuff in my life. even if i'm a jack-off of all trades and master of absolutely none, ive still dabbled in djing, sculpting, metalwork, jewelrymaking, painting, ink illustration, web and graphic design, can read japanese kana and slowly fumbling my way through spanish, have traveled at least a little bit, organized events both online and in person, i'm literate and decently well-read with a proficient grasp of the english language and grammar... yet my """"clients"""" are guys who own ferraris and have several crypto wallets and say that i am 'perfect' and want to literally own me [he has not commissioned anything yet so please do not think i have gotten any of that money because i have not], or theyre submissive furries writing shit like 'your so sexy' and mansplain my own smut to me. like surely i must deserve better than this. surely im at least worth employment at pizza hut or stocking shelves overnight at target. but maybe not.

13 notes

·

View notes

Text

GEMZ Token mining on telegram

#earn money online#crptocurrency#crypto mining#telegram#referral link#hamster kombat#tap swap#boon#ton#solana#binance#bybit#trust wallet

1 note

·

View note

Text

Security Features of Cryptocurrency Wallet Apps

As the world embraces digital currencies, ensuring the security of cryptocurrency wallet apps becomes paramount. These wallets are essential tools for managing digital assets, and understanding their security features is crucial for safeguarding your investments.

This article explores the various security features that make a blockchain wallet app secure and reliable.

What is a Crypto Wallet?

Definition and Functionality

A cryptocurrency wallet, a blockchain wallet, is a software application or hardware device that stores your private and public keys, interacts with various blockchains, and enables users to send and receive digital currencies.

Unlike traditional wallets holding physical money, crypto wallets store keys to access blockchain addresses and sign transactions digitally, making it possible to manage and trade digital assets securely.

Importance of Security

The security of a cryptocurrency wallet is paramount as it directly impacts the safety of your digital assets. A secure wallet ensures that only authorised users can access and control the funds, protecting them from theft, fraud, and hacking.

Types of Crypto Wallets

Hardware Wallets

Hardware wallets are physical devices that store private keys offline, providing a high level of security against online threats. Examples include Ledger Nano S and Trezor. Due to their robust security features, these wallets are ideal for long-term storage of large amounts of cryptocurrency.

Software Wallets

Software wallets are applications installed on computers or smartphones. They include:

Desktop Wallets: These are installed on a personal computer and provide control over the private keys.

Mobile Wallets: These are installed on smartphones and offer convenience and mobility.

Web Wallets: Accessed through a web browser, offering ease of access but potentially higher vulnerability to hacking.

Paper Wallets

Paper wallets are physical documents containing private and public keys, often represented by QR codes. They provide offline storage but are less convenient for regular use due to the difficulty of accessing funds quickly.

Online Wallets

Online wallets, also known as web wallets, are accessible via a web browser. They offer convenience but can be vulnerable to hacking. To protect your assets, choosing an online wallet with strong security measures is crucial.

Crypto Wallet App Development

Security Features in Development

When developing a cryptocurrency wallet app, incorporating robust security features is essential to protect user assets. Key security features include:

Two-Factor Authentication (2FA): Adds an extra layer of security by requiring two forms of identification before accessing the wallet.

Encryption: This process ensures that private keys and sensitive data are converted into code that can only be deciphered with the correct decryption key.

Multi-Signature Support: Multiple private keys are required to authorize a transaction, reducing the risk of fraud and enhancing security.

Cold Storage: Keeps private keys offline, away from potential online threats.

User Experience and Interface

Any crypto wallet app must have a user-friendly interface. The best apps offer intuitive designs, easy navigation, and clear instructions, making it easy for users to manage their digital assets securely.

Essential Components for Your Cryptocurrency Wallet App

Backup and Recovery Options

Robust backup and recovery options are essential for safeguarding your crypto wallet. Wallets that provide seed phrases or recovery keys allow users to restore their wallets in case of device loss or failure. It is crucial to store these recovery options securely, as they are the key to regaining access to funds.

Biometric Authentication

Biometric authentication, such as fingerprint or facial recognition, provides additional security for accessing your wallet account. This feature leverages unique physical characteristics to verify identity, making it difficult for unauthorised users to gain access.

Regular Updates and Support

Regular updates and support from the wallet provider are essential to ensure ongoing security and functionality. Updates often include security patches and new features that enhance the wallet’s performance and protect against emerging threats.

Customer Support

Reliable customer support is essential for resolving users' issues or queries. Check whether the wallet provider offers timely and effective customer support through multiple channels like email, chat, or phone.

Conclusion

Ensuring the security of your cryptocurrency wallet app involves understanding and utilising various security features such as two-factor authentication, encryption, multi-signature support, and cold storage.

By selecting a wallet with robust security measures and essential components, you can protect your digital assets from potential threats and enjoy peace of mind.

How E Money Network Can Help You with Cryptocurrency Wallet App

E Money Network offers expert services in developing secure and user-friendly cryptocurrency wallet apps. Our team specialises in creating custom wallet solutions that meet your needs, incorporating advanced security features, multi-currency support, and seamless user experiences.

Whether you're looking to develop a new wallet app or enhance an existing one, E-Money Network is here to assist you in navigating the complexities of the cryptocurrency landscape.

FAQs

1. What is the most secure type of cryptocurrency wallet?

Hardware wallets are generally considered the most secure due to their offline storage capabilities, which protect them from online threats.

2. Can a cryptocurrency wallet be hacked?

While no system is immune to hacking, wallets with strong security features such as 2FA, encryption, and multi-sig support significantly reduce the risk.

3. How can I recover my cryptocurrency wallet if I lose my device?

Most wallets provide backup and recovery options, such as seed phrases or recovery keys, which can be used to restore your wallet on a new device.

4. Are online wallets safe to use?

Online wallets offer convenience but can be more vulnerable to hacking. Strong security measures are essential, and hardware wallets for long-term storage should be considered.

5. What should I do if I suspect my wallet has been compromised?

If you suspect your wallet has been compromised, immediately transfer your funds to a secure wallet and contact the wallet provider's customer support for further assistance.

6. Which of the Following Features is Important for the Security of a Cryptocurrency Wallet?

Several features are crucial for the security of a cryptocurrency wallet:

Two-Factor Authentication (2FA): This adds an extra layer of security by requiring two forms of identification before accessing the wallet.

Encryption: Ensures that private keys and sensitive data are converted into a code that can only be deciphered with the correct decryption key.

Multi-Signature Support (Multi-Sig): Requires multiple private keys to authorize a transaction, enhancing security and reducing the risk of fraud.

Cold Storage: Keeps private keys offline, away from potential online threats, which is ideal for long-term storage.

Backup and Recovery Options: Allows users to restore their wallet in case of device loss or failure using seed phrases or recovery keys.

Biometric Authentication: Utilizes unique physical characteristics such as fingerprint or facial recognition to verify identity and enhance security.

7. What Makes a Crypto Wallet Secure?

A secure crypto wallet typically includes the following features:

Private Key Control: Ensures that only the wallet owner has access to the private keys, which are necessary to sign transactions.

Advanced Encryption: Protects private keys and sensitive data from unauthorized access.

Regular Software Updates: Keeps the wallet secure against new threats and vulnerabilities by regularly updating the software with security patches.

Secure User Interface: Provides a user-friendly and secure interface that minimizes the risk of user errors that could lead to security breaches.

Hardware Security Modules (HSM): For hardware wallets, using dedicated hardware that securely stores private keys and performs cryptographic operations.

8. What is the Security Key in a Crypto Wallet?

The security key in a crypto wallet refers to the private key, which is a secret alphanumeric code used to authorize transactions and access the digital assets stored in the wallet.

The private key must be kept confidential and secure because anyone with access to it can control the funds associated with the wallet.

Additionally, some wallets use public keys and seed phrases as part of their security infrastructure:

Public Key: Used to generate wallet addresses that others can use to send cryptocurrency to the wallet.

Seed Phrase: A series of words generated by the wallet that can be used to recover the private key and access the wallet if the original device is lost or compromised.

#cryptocurrency wallet#blockchain wallet#e-wallet account#wallet account#online wallet crypto#best crypto wallet#blockchain wallet app#crypto wallet#crypto wallet app#cryptocurrency wallet app#online wallet#online wallet apps

0 notes

Note

Oooh ok like where this is going but the question is how did Luke manage to bypass Aemond to invest in Aegon’s startup

luke doesn’t understand what crypto is at all — he learned all about economics and finance from corlys and his grandpa was always like “i don’t bother with that millennial garbage”

aegon, in snake oil con man fashion, info dumps on luke until all luke can pick out is “future” “high returns” “tendies” “r/wallstreetbets”. he lets aegon open a crypto wallet using aemond’s information thinking it’s a cute fun little online game thing and next thing anyone knows, aemond is on his way to murder his brother for bamboozling his pookie

45 notes

·

View notes