#Online Stock Trading in Lowest Cost

Text

Mandot Securities | Lowest Brokerage Company | Open a Trading Account

Mandot Securities provides online share trading in india, lowest brokerage comany, online stock trading in lowest cost and open a trading account.

#Mandot Securities#Online Share Trading in India#Lowest Brokerage Company#Online Stock Trading in Lowest Cost#Open a Trading Account#Open a Demat Account#Trading in Share Market#Best Share Broker

2 notes

·

View notes

Text

Mandot Securities | Lowest Brokerage Company | Open a Trading Account

Mandot Securities provides online share trading in india, lowest brokerage comany, online stock trading in lowest cost and open a trading account.

#Mandot Securities#Online Share Trading in India#Lowest Brokerage Company#Online Stock Trading in Lowest Cost#Open a Trading Account#Open a Demat Account#Trading in Share Market#Best Share Broker

2 notes

·

View notes

Text

the beginner's guide to making money by investing in stocks (hot girl version)

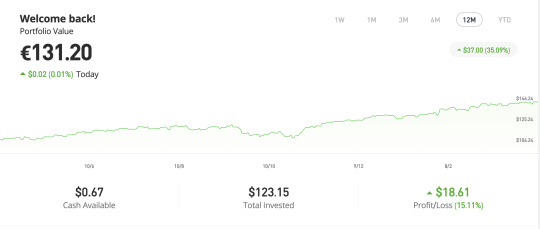

since one of my goals here is to make money i wanted to teach you about what i know about investing in stocks. i use the website etoro to invest, below you can see a picture of my portfolio at the moment. i am by no means an expert but i've found the whole process of investing to be unnecessarily mystified so i thought i'd share what i have learned so far.

what does buying stocks mean?

in simple terms, buying stocks means buying a (tiny) fraction of a company. if the value of the company increases the value of your share goes up, if the company loses money the value goes down.

when should i buy and sell?

ideally, you should buy when you think that the value of a stock will increase in the future and you should sell when you have made a profit. in practice, this means you try to invest when a stock has reached its lowest value and you sell when you think it has reached its peak (but this is, of course, impossible to predict perfectly).

where can i buy stocks?

i would personally recommend going through an online stock trading platform, like etoro. you can look up what the best stock trading platforms are for your country. you should pick one with minimal fees that offers some tutorial or introduction to trading.

you can also go through a stock broker (a person that makes the investments for you) or more broadly your bank - be aware though, that they might take a cut of your profit for their services which is something you need to subtract from your expected profit.

how do i know what to invest in?

There are a few recommendations that I have seen time and time again:

ETFs - exchange-traded funds are bundles of stocks that are traded together. the advantage of ETFs is that they don't rely on a single company making a profit, the companies just need to make a profit overall. they are much less volatile than individual stocks and since economies usually always grow in the long-term, you are very likely to make a profit.

large companies - you can also invest in large, well-established companies that are very likely to make a profit and very unlikely to go bankrupt (e.g., apple, amazon, etc.)

diversify - this means you should invest in a wide variety of companies and industries. even when one of them does really poorly you are likely to make a profit overall.

copy-trading - this means 'copying' the investments of a more experienced trader. so you specify an amount of money and invest it the same way someone who knows what they're doing is.

how much should i invest?

most websites have a minimum amount you need to invest so you could start with that to get a feel for how it works.

as a rule of thumb, they say you should not invest money that you will need within the next 5-10 years. that rule prevents you from having to sell your stock at an unfortunate moment - even if you initially write losses, you can wait for a moment when your stocks have increased in value again.

if you have a fixed income you can commit to investing a part of your income every month. i've seen this referred to as dollar-cost averaging and i have not tried it yet but it is said to be a good way to build wealth in the long term.

how do i actually make money using this knowledge?

simple answer: by selling your stock at the right time and withdrawing the money. investing is a marathon, not a sprint - you should generally give your money some time to make a profit instead of checking every day and panic selling when you see a slight change. for some stocks, the company may also pay dividends. disclaimer: at least where i am from you need to declare what you made from stocks as income and pay taxes on it.

thank you so much for reading!

if you have questions or know more about this and want to add something please leave a comment 💕

#financial freedom#law of assumption#stock trading#financial empowerment#financial education#neville goddard#manifesting money#manifestation#rich girl

19 notes

·

View notes

Text

Investing 101

Part 2 of ?

In my last post I explained what stocks are, why companies might want to issue shares and some of the types of stocks. I also explained dividends and why some stocks are called Growth and others called Value stocks. The next logical question is, "How do I buy stocks?"

For most beginning investors, their 401K or IRA is their first opportunity to purchase stock. My recommendation to my kids (which I followed myself) is to set your 401K withholding at least high enough to earn the maximum employer match. Most employers will match a fixed percentage of an employee's 401K withholdings up to a maximum amount. Not withholding at least enough to get the maximum employer match is like taking a salary cut. This is 'free money' from your employer but only you save enough to take advantage of it. 401K plans are almost always administered by a large brokerage firm and through that firm participants are offered a variety of investment options, some more limited than others. I will talk a bit more about the various investments options later.

If you're already investing in your 401K and you still have after-tax funds you'd like to invest (in stocks or other investments), there are a few options.

The simplest, lowest cost option is a direct stock purchase plan (DSPP) which enables individual investors to purchase stock directly from the issuing company without a broker. I've never done this, but it's possible and if you're a big fan of a company and want to be a long term investor, you may want to consider it.

The more common approach is to open an account with a Broker. From Investopedia, "Brokerage firms are licensed to act as a middleman who connects buyers and sellers to complete a transaction for stock shares, bonds, options, and other financial instruments. Brokers are compensated in commissions or fees that are charged once the transaction has been completed." When you open an account with a broker, they take care of all trading paperwork and send you investment reports and tax forms.

ETrade and RobinHood are examples of Discount Brokers (low cost, self-service). They execute your trades (buying and selling) for very low fees and include online resources for the investor to research investments. It is easy to set an up account online and start trading using their mobile apps.

Full Service Brokers like Morgan Stanley, Ameriprise, Edward Jones, etc. operate on the other end of the spectrum. These firms execute trades like the self-service brokers but their account relationships include the services of a Financial Advisor. Ostensibly, the Financial Advisor is periodically meeting with you to review your portfolio, rebalancing your investments to ensure continued alignment with your goals and risk tolerance and recommending investments to buy and sell. Financial advisors generally charge an annual fee of 1% or more of the value of your portfolio. These brokerage firms also have online investment research materials, but the idea is that the Financial Advisor is actively helping you steer the ship.

Alternatively, you can consult a Certified Financial Planner (CFP). These individuals can help manage your broader financial life (including investments, budgeting, insurance needs assessment, estate planning), though CFPs generally aren't brokers (i.e. they don't execute stock trades). Rather than charging a percentage of your portfolio as a fee, CFPs generally have a fixed hourly rate. That hourly rate might seem steep, but it is almost always less than the fee of a full service broker/Financial Advisor.

Assuming you're already investing enough in your 401K to get your employer match, which investing/broker relationship should you pursue? Because full service Financial Advisor fees are a % of your portfolio, these advisors tend to pursue relationships with wealthier clients. If you don't have a large portfolio, it can be difficult get the time/attention of a full service broker. (True story, 30 years ago a friend who was also our financial advisor fired Beth and I as clients when his firm raised its minimum portfolio threshold to exclusively service wealthy clients. I'd like to think he regrets that decision now.) A caveat to this is if your parents have an established relationship with a broker/advisor - then that advisor may be more enthusiastic about managing the adult child's portfolio. (Yes, this is an example of white privilege.)

If you're just starting out (ex <$100K portfolio), I think engaging a fee-based CFP 2-3x a year and opening a Discount Brokerage account is the way to go.

I know several investors with large portfolios who also prefer the Discount Broker strategy, however, because they loathe the idea of paying 1% of their portfolio every year to a financial advisor. There is plenty of research supporting this strategy for large portfolios... after all 1% every year really adds up. Over 20-30 years the 1% annual fee can be very expensive. Despite this, Beth and I have always used a Full Service Advisor.

Beth and I are both CPAs and financially literate, why would we pay the higher fees for a Full Service Advisor? We pay an advisor so we can sleep at night. When I was still working I checked my portfolio balance no more than once or twice a month. I check it more often now, but that's mostly because I simply have more free time. I've never spent any mental energy trying to research good investments. Most importantly, I've never had any emotional attachment to an investment. Every quarter or so we will meet with our advisor and he recommends investments we should sell, either because they haven't performed well or sometimes because they have performed well and have 'topped out'. I never feel any guilt or blame for investments that haven't done well because I didn't originate the investment idea when we bought it. I don't feel tempted to hang on to the investment in hopes that it will rebound and I will be proven right. I can be completely objective and devoid of emotion. And that's one of the reasons I've never lost any sleep over our investments.

Next installment - what to buy.

23 notes

·

View notes

Text

Mandot Securities | Lowest Brokerage Company | Open a Trading Account

Mandot Securities provides online share trading in India, lowest brokerage company, online stock trading in lowest cost and open a trading account.

#lowest brokerage company#mandotsecurities#onlinesharetradinginindia#lowestbrokeragecompany#onlinestocktradinginlowestcost#openatradingaccount#openademataccount#TradingInShareMarket#BestShareBroker

2 notes

·

View notes

Text

Bullion Coins vs Bars: Which Buy is better for you?

Around the globe, gold is considered a go-to investment. Bullion dealers in Canada and nearby areas thus support the above fact by acknowledging us with the same. Gold is thus refined in every form such as jewelry, coins, biscuits, and many times, a special occasion is marked with the purchase of gold. However, this article here by 24 Gold Group Ltd is made to discuss Bullion Coins and Gold Bars and which one will be the best to buy.

What are Bullion Coins?

A bullion coin is made by a precious metal company that is entirely made out of gold. Bullion coins have been minted since 1800, and are approximately 90-92% gold. However, most of today’s bullion coins are pure gold. Also, bullion coins have an extra premium attached to them. This is due to the fact that they can be used as legal tender. Furthermore, many people are sentimental about the historical value that a bullion coin may hold or represent. For many investors, buying precious metals in Canada, like bullion coins can be easier when it is compared to jewelry. Also, there are different channels where investors can purchase these coins from local jewelers, authentic online sellers, Stock Holding Corporations, and many more. Moreover, a bullion coin purchased from one source should be sold back to the same source, as sometimes it might return a lower resale value depending on the market price.

What are Bullion Bars?

Bullion bars are precious refined gold that is made by meeting the standard conditions of manufacturing and labeling by both government and private authorities. Also, bullion bars are also called gold bars or sometimes, gold ingots. The large bullion bars are made by pouring molten gold into the molds. However, the smaller bullion bars are made by minting or stamping the rolled gold sheets. The Central ministry holds the bullion bar reserves.

Gold bars are produced in pure gold and come with a certificate that guarantees their weight, purity, and the requirements of Gold Standards. Moreover, investors with large budgets prefer bullion coins because of their low premiums.

In the past few years, in countries like Canada gold bar prices have been favorable, hence allowing more individuals to buy gold at the lowest price per gram. Hence, bullion bars are one of the most cost-effective ways to invest in gold.

Advantages of buying bullion coins

Bullion coins come in various sizes, finishing, designs, prices, grades, and origins. Investors hence can purchase them on the basis of their budget and personal preference.

Many bullion coins are minted by the government that safely guarantees the gold content, purity, and design.

Bullion coins also offer liquidity as they can easily be traded. However, investors do have to wait for a buyer. They are also universally recognized and easy to sell.

Investors who purchase bullion coins need not worry about inflation or pay capital gains tax until they sell it.

Advantages of buying bullion bars

Bullion bars are available in various sizes ranging from 1gram to 1kg. Therefore, they are rightly suitable for any investor’s budget.

A bullion bar is a standard for gold investment because they are exchangeable worldwide to any bullion dealer.

It is also ideal for long-term investment if the investor has no intention to sell bullion bars from your investment portfolio.

Bullion bars are cheaper than bullion coins as they are cheaper to manufacture. For instance, a larger bullion bar will have a lower manufacturing cost than a smaller bullion bar.

Key Takeaway:

Based on the above information, 24 Gold Group Ltd suggests that investment in gold offers the best value of return for investors. Investors can choose to buy gold coins in Canada or bullion bars based on their situation and it all depends on their personal preferences and circumstances and all the considered factors. There is no right or wrong answer between buying bullion coins or bars. It is all about personal choices and the risk of tolerance level one can handle as an investor.

For more insightful details and advice, feel free to reach out to one of our expert consultants and get started with a better approach to inventing bullion coins and bars.

2 notes

·

View notes

Text

Best Trading Platform UK for Beginners: Straddleco

In the fast-paced world of online trading, choosing the right platform is key to a successful start, especially for beginners. In the UK, one platform stands out from the rest: Straddleco. Tailored to meet the needs of novice traders, Straddleco combines ease of use, extensive educational resources, and robust support to provide the ideal environment for anyone just starting out. In this blog, we’ll explore why Straddleco is the best trading platform for beginners in the UK and how it can help you navigate the complex world of stock trading.

Why Choosing the Right Platform Matters for Beginners

When stepping into the stock market for the first time, the learning curve can be steep. New traders are often overwhelmed by the wide range of tools, charts, and market information available. The wrong platform can add unnecessary complexity, making the process more confusing and frustrating. That's where Straddleco comes in—it is specifically designed to simplify stock trading for beginners, ensuring that users can focus on learning and making informed decisions rather than struggling with a clunky or confusing interface.

User-Friendly Interface

One of the standout features of Straddleco is its intuitive and user-friendly interface. For beginners, this is crucial. A platform that is overly complicated can deter new traders from learning and experimenting with trading strategies. Straddleco ensures that from the moment users log in, they are greeted with a clean, well-organized dashboard. The layout is simple, with easy access to essential tools like market data, trade execution, and portfolio tracking.

The trading interface is designed to be straightforward, allowing new users to execute trades without confusion. You won’t be overwhelmed by unnecessary features, but you'll still have access to powerful tools that help you grow as a trader.

Educational Resources and Tutorials

For beginners, education is one of the most important aspects of trading. Straddleco excels in this area by providing a wealth of educational resources that are easily accessible on its platform. These resources include video tutorials, eBooks, and articles designed to help new traders understand market dynamics, different types of investments, and basic trading strategies.

Straddleco’s educational center walks users through everything from setting up their first trade to understanding complex topics like risk management and technical analysis. The platform also offers live webinars and interactive Q&A sessions with experienced traders, helping beginners sharpen their skills and gain valuable insights.

Low Fees and Commissions

New traders often have limited capital and are looking for ways to maximize their returns. High fees and commissions can quickly eat into profits, especially for beginners who may not be making large trades initially. Straddleco understands this, offering some of the lowest fees and commissions in the market, making it accessible for traders with smaller budgets.

Whether you're trading stocks, ETFs, or other assets, Straddleco's competitive fee structure ensures that more of your money stays invested, where it belongs. This feature alone makes it a top choice for beginners in the UK, who are looking for a cost-effective way to start trading.

Advanced Tools Made Simple

While Straddleco is designed with beginners in mind, it doesn't sacrifice powerful trading tools. As you gain confidence and experience, Straddleco grows with you, offering advanced tools like real-time market data, customizable charts, and technical indicators. These features allow you to develop your skills and take your trading to the next level.

However, the platform ensures that these advanced tools are not overwhelming for new users. Detailed explanations and tutorials are provided for each tool, ensuring that beginners can experiment without fear of making costly mistakes. The platform also offers demo accounts, allowing users to practice trades without risking real money.

Responsive Customer Support

One of the major concerns for beginners is having reliable customer support. Straddleco shines in this area, offering 24/7 customer service via live chat, email, and phone. If a user encounters any issues or has questions about how to execute trades, the support team is readily available to assist.

For beginners, having access to responsive support can make the difference between a positive and negative trading experience. Straddleco ensures that help is always just a click or a call away, providing peace of mind to new traders navigating the stock market for the first time.

Mobile Trading on the Go

In today’s fast-paced world, having access to your trading account on the go is essential. Straddleco’s mobile app offers full functionality, allowing you to execute trades, track your portfolio, and access educational resources from anywhere. The app is designed to be just as user-friendly as the web platform, with a sleek interface that makes mobile trading simple and accessible.

This feature is particularly beneficial for beginners who may not have the time to sit at a desktop computer all day. The ability to trade and monitor your portfolio on the go means you can stay informed and react quickly to market changes, no matter where you are.

Conclusion

For beginners in the UK looking to start their trading journey, Straddleco is the ideal platform. Its combination of a user-friendly interface, low fees, extensive educational resources, and responsive customer support makes it the best trading platform for those just starting out. Whether you’re looking to trade stocks, ETFs, or other assets, Straddleco offers a seamless experience tailored to the needs of novice traders.

With Straddleco, you’ll have the tools, knowledge, and support needed to succeed in the stock market—making it the best trading platform for beginners in the UK.

0 notes

Photo

Low Brokerage Charges for Online Trading: What to Know - Lowest Brokerage Charges in India (on Wattpad) https://www.wattpad.com/1451819742-low-brokerage-charges-for-online-trading-what-to?utm_source=web&utm_medium=tumblr&utm_content=share_reading&wp_uname=hmatrading Are you ready to dive into the world of online trading and maximize your investment potential? One crucial aspect to consider when choosing a brokerage platform is the brokerage charges. Understanding how these fees work can make a significant difference in your overall returns. Let's explore everything you need to know about <a href="https://hmatrading.in/lowest-brokerage-charges/">low brokerage charges for online trading</a> and how to find the best options available! What are Brokerage Charges? Brokerage charges are fees that investors pay to brokerage firms for executing trades on their behalf in the financial markets. These charges are essential for the services provided, such as facilitating buying and selling of securities like stocks, bonds, or commodities. When you place a trade through a brokerage platform, they act as intermediaries between you and the market. The brokerage charges cover their operational costs, research facilities, trading platforms, and expertise in executing your orders efficiently. The amount of brokerage fee can vary depending on factors like the type of asset being traded, the size of the trade, and the specific broker's fee structure. It is crucial to understand how these charges are calculated to make informed decisions about your investments. Calculation Methods for Brokerage Fees Understanding how brokerage fees are calculated is essential for online traders looking to minimize costs. The most common method used by brokers is the percentage-based model, where a percentage of the total transaction value is charged as a fee. For example, if the brokerage fee is 0.1%, a Rs.10,000 trade would incur a Rs.10 fee. Another calculation method is the flat fee model, where a fixed amount is charged per trade regardless of its size. This can be beneficial for large trades as it offers cost predictability.

0 notes

Text

Mandot Securities | Lowest Brokerage Company | Open a Trading Account

Mandot Securities provides online share trading in india, lowest brokerage comany, online stock trading in lowest cost and open a trading account.

#OnlineShareTradinginIndia#LowestBrokerageCompany#OnlineStockTradinginLowestCost#OpenaTradingAccount#OpenaDematAccount#TradinginShareMarket#BestShareBroker

1 note

·

View note

Text

Unveiling the Best: Navigating the Landscape of Lowest Brokerage Charges in India

In the realm of stock trading, where every penny counts, finding the right brokerage with the lowest charges can make a significant impact on your bottom line. As a world-renowned stock trader, I bring forth a comprehensive exploration of the lowest brokerage charges in India, unraveling the offerings of renowned platforms like ICICI Direct, Zerodha, Angel Broking, Upstox, Kotak Securities, SAS Online, HDFC Securities, SBI Securities, m.Stock, and 5 Paisa.

Unmasking the Players: A Closer Look at Platforms

ICICI Direct: The Balance of Quality and Affordability

ICICI Direct has carved its niche by striking a balance between service quality and cost-effectiveness. Its user-friendly interface combined with moderate fee structures makes it an attractive option for those seeking reliable services without breaking the bank.

Zerodha: Pioneering the Low-Cost Revolution

Zerodha, a pioneer in low-cost trading, has disrupted the market with its user-friendly platform and competitive pricing. It caters to traders who prioritize efficiency and seek to minimize transaction costs.

Angel Broking: Affordable Choices for Diverse Traders

Angel Broking provides affordable choices for traders with diverse needs. Its transparent fee structure and a range of services make it an appealing option for both beginners and seasoned traders.

Upstox: Empowering Traders with Cost-Effective Solutions

Upstox empowers traders with cost-effective solutions. With a commitment to transparency and low brokerage charges, it attracts those who value efficient trading without compromising on quality.

Kotak Securities: Striking the Right Balance

Kotak Securities strikes the right balance between comprehensive services and competitive charges. Traders looking for a blend of quality research and cost-effectiveness find Kotak Securities to be a reliable choice.

SAS Online: Catering to the Budget-Conscious Traders

SAS Online caters to the budget-conscious traders with its minimalistic approach to brokerage charges. It's an ideal choice for those who prioritize cost savings and straightforward pricing.

HDFC Securities: Bridging Trust and Affordability

HDFC Securities bridges trust and affordability, offering a moderate fee structure alongside comprehensive service. It appeals to traders seeking a combination of reliability and cost-effectiveness.

SBI Securities: The Credibility Advantage

SBI Securities leverages the credibility of the State Bank of India. With a commitment to trust and affordability, it caters to traders seeking a reliable and cost-effective trading experience.

Unraveling the Factors: What Matters in Brokerage Charges

Transparency and Hidden Costs

Transparency in fee structures is vital. Traders should be cautious of hidden costs that might include account maintenance fees, withdrawal charges, or specific conditions that could impact the overall cost of trading.

Negotiating Brokerage Charges

Traders, especially those with substantial trading volumes, can explore the possibility of negotiating brokerage charges with their chosen platform. This is often viable for high-frequency traders and can result in a more tailored and cost-effective pricing structure.

Additional Services and Support

While low brokerage charges are a crucial factor, traders shouldn't overlook the importance of additional services and customer support. A broker that offers a comprehensive suite of services, educational resources, and responsive customer support can enhance the overall trading experience.

Real-Life Success: Case Studies

Case Study 1: Maximizing Profits with Zerodha

Explore how a trader maximized profits by leveraging Zerodha's low-cost model. This case study provides a real-life example of how choosing the right brokerage can significantly impact your trading outcomes.

Case Study 2: Navigating Markets with HDFC Securities

Delve into the journey of a trader who found the perfect balance of trust and affordability with HDFC Securities. This case study showcases the practical benefits of selecting a broker that bridges credibility and cost-effectiveness.

Brokerage charges may undergo changes. Stay informed about any modifications in the fee structure of your chosen platform to make timely adjustments to your trading strategy.

Navigating the Future: A Summary

Selecting the right brokerage with the lowest charges is a strategic decision that can significantly impact your trading journey. From transparent fee structures to a commitment to quality services, each platform has its unique offerings.

The journey to success begins with understanding the intricacies of brokerage charges, negotiating when possible, and prioritizing a comprehensive trading experience.

1 note

·

View note

Text

crypto and stocks

Working with an online stockbroker makes investing and managing your portfolio much easier. However, different stockbrokers are better at different things. Additionally, each broker can charge differing fees and offer contrasting user experiences. If you’re trying to choose the best stockbroker to work with, here are some of the best brokers we recommend.

Trading platforms form the crucial bridge between you and your chosen financial market. As such, whether you’re interested in crypto and stocks, forex, commodities, the best trading platforms, the best trading tools, or cryptocurrencies – you need to find a suitable free trading platform that meets your needs.

Here at Trading Platforms, we strive to bring you the very best trading platforms of 2023 and beyond. This includes trading platforms that offer the best fees and commissions, the most diverse asset classes, and of course – the strongest regulatory standing.

Fidelity Investments is well known for being the lowest-costing online brokerage. They provide great market intelligence resources, and numerous broker tools and you won’t have to pay a single cent for commission fees for stocks and ETF trades! Clients have rated their trade executions and accuracy to be excellent, alongside being the perfect platform for beginners. This is mainly due to the fact that Fidelity Investments has a very detailed research system that will support beginners by providing all the market knowledge needed.

Furthermore, while it is true that Fidelity Investments is only open to US citizens and that these US customers have to sign onto multiple platforms just to gain access to the different trading tools, clients won’t need to hassle about requiring an account minimum. So, if you’re a US citizen looking to gain an easy and safe entry into the online trading market, Fidelity will be the best platform for you to set up your own portfolio — you’ll get to focus on building up your skillsets without having to worry about any bank fees!

0 notes

Text

In the fast-paced world of online trading, securing the lowest brokerage charges in India is a top priority for investors. Whether you're a seasoned trader or just dipping your toes into the stock market, minimizing your trading costs is crucial for maximizing your profits. The key to achieving this financial efficiency lies in finding the lowest brokerage demat account in India, which will significantly reduce your trading expenses.

0 notes

Text

Zinc Prices, Pricing, Demand & Supply, Market Analysis | ChemAnalyst

For the Quarter Ending June 2023

North America

The Zinc powder market in North America experienced a relatively stable price trend during the second quarter of 2023. Prices in CFR California saw a slight decrease from $4280 per metric tonne in April to $4250 per metric tonne in June, resulting in a decline of -0.7% over the quarter. The United States initially showed positive signs as the economy improved, with inflation dropping by nearly 5%, reaching its lowest level in two years. However, the economy started slowing down significantly in the latter half of the year. The demand for pharmaceutical-grade Zinc Powder in the USA declined as nutraceutical and pharmaceutical companies stocked up. Meanwhile, the Nutra sector experienced a fluctuating market due to differing opinions on supplement costs. Despite improvements in market conditions and trading dynamics, weaker demand for zinc across the country led distributors to offer it at lower prices. Inflationary pressures and China's sluggish recovery also impacted confidence and dampened zinc demand in the US, as stated by an industry source. They added that the industry did not anticipate such a significant drop in zinc prices that would lead to mine closures this year.

Asia Pacific

The Zinc powder market in the Asia-Pacific region witnessed mixed price movements throughout the second quarter of 2023. Prices in EXW Shanghai initially increased from $3870/t in April to $3920/t in May but subsequently declined to $3790/t in June. This downward trend began in late May and intensified as demand for zinc powder from the pharmaceutical and nutraceutical sectors decreased both globally and domestically. Chinese zinc powder producers had to sell their products at narrower profit margins due to weakened demand and consumer inquiries. According to statistics, China's manufacturing activity contracted for the third consecutive month in June, albeit at a slower rate. The June PMI indicated various imbalances and weaknesses, including ongoing losses in domestic and foreign demand, accelerated declines in business activity, and mounting pressure on the pharmaceutical and nutraceutical industries. Given the state of the Chinese economy, manufacturers and sellers remained cautious and adjusted production based on demand.

Get Real Time Prices of Zinc: https://www.chemanalyst.com/Pricing-data/zinc-1260

Europe

In Europe, the zinc powder market experienced a stagnant second quarter, with prices initially rising in the first half and subsequently declining in the latter half. Reduced demand from downstream industries, coupled with significant supplier inventories, contributed to price decreases in the German domestic market during the second half of the quarter. In April, gas prices for power generation in Europe hit their lowest level since the start of the crisis. However, the market environment was severely impacted by an unexpected rise in the unemployment rate in Germany in June. Retailers stockpiled zinc powder to mitigate potential future shortages, which later prompted them to lower their profit margins to clear their inventories. In June, German inflation rose by over 6%, but the country's Zinc Powder industry remained unaffected. Similar to other regions, market participants in Europe adopted a wait-and-see approach and remained skeptical about the economic situation in the country.

About Us:

ChemAnalyst is an online platform offering a comprehensive range of market analysis and pricing services, as well as up-to-date news and deals from the chemical and petrochemical industry, globally.

Being awarded ‘The Product Innovator of the Year, 2023’, ChemAnalyst is an indispensable tool for navigating the risks of today's ever-changing chemicals market.

The platform helps companies strategize and formulate their chemical procurement by tracking real time prices of more than 400 chemicals in more than 25 countries.

ChemAnalyst also provides market analysis for more than 1000 chemical commodities covering multifaceted parameters including Production, Demand, Supply, Plant Operating Rate, Imports, Exports, and much more. The users will not only be able to analyse historical data but will also get to inspect detailed forecasts for upto 10 years. With access to local field teams, the company provides high-quality, reliable market analysis data for more than 40 countries.

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

Tradingo: Low-Cost Online Stock Trading & Zero Brokerage Investments

Experience seamless online stock trading with Tradingo! Boasting the industry's lowest brokerage rates on futures, options, commodities, and mutual funds, we make your trading journey effortless. Dive into the world of online stock market investments with zero delivery charges.

0 notes

Text

Technical advantages of ON Semiconductor's new ElitePower simulation tool and PLECS model self-service generation tool

【Lansheng Technology Information】ON Semiconductor recently released the Elite Power simulation tool and the PLECS model self-service generation tool (SSPMG). The Elite Power simulation tool is paired with PLECS to provide customers with a convenient online environment. Elite Power simulation tools bring several new features and advantages over the current state of the art. SSPMG is a breakthrough tool that increases the flexibility and accuracy of models used in PLECS simulations.

The PLECS model contains loss look-up tables (based on manufacturer data sheets) and thermal chains in the form of Cauer or Foster equivalent networks. During simulation, PLECS uses loss tables to interpolate and/or extrapolate to obtain bias point conduction and switching losses for circuit operation.

The most common method for measuring switching losses is the double pulse tester. ON Semiconductor's advanced dual-pulse testers are valuable for measuring lowest (or device) losses with negligible effect on parasitic elements, allowing comparisons across die sizes, RDS(ON) values and packages. However, data sheet loss values will not reflect the observed losses when customers evaluate losses in their actual applications. After further analysis, it became clear that the datasheet based PLECS model was not representative of the end user's application. Customers had to make a trade-off between cost and performance, so the inductors and capacitors chosen were not as ideal as those found in ON Semiconductor's double-pulse tester. Only if the user's application has the same parasitic environment as the manufacturer's datasheet double-pulse test environment, the simulation can be performed using the standard manufacturer-supplied PLECS model.

A better way to evaluate the customer's actual losses is to introduce the customer's real board and component (such as inductors and capacitors) parasitic elements into the dual pulse tester setup and adapt it to the specific customer application. Since this can be a very difficult measurement task, ON Semiconductor has launched SSPMG for this purpose, enabling customers to design PLECS models according to their application environment in a virtual prototyping environment. While all simulation-based virtual environments are only as good as the underlying model, ON Semiconductor's highly accurate physics-based models are the SSPMG engine customers can rely on to achieve high-fidelity PLECS models.

Lansheng Technology Limited, which is a spot stock distributor of many well-known brands, we have price advantage of the first-hand spot channel, and have technical supports.

Our main brands: STMicroelectronics, Toshiba, Microchip, Vishay, Marvell, ON Semiconductor, AOS, DIODES, Murata, Samsung, Hyundai/Hynix, Xilinx, Micron, Infinone, Texas Instruments, ADI, Maxim Integrated, NXP, etc

To learn more about our products, services, and capabilities, please visit our website at http://www.lanshengic.com

0 notes

Text

"Mandot Securities provides online share trading in india, lowest brokerage comany, online stock trading in lowest cost and open a trading account."

Mandot Securities

#stock market#finance#investing#startup#mandotsecurities#OnlineShareTrading#LowestBrokerage#OnlineStockTrading#OpenaTrading

1 note

·

View note