#Oracle Account Reconciliation

Explore tagged Tumblr posts

Text

Oracle Account reconciliation

In today's dynamic economic panorama, the accuracy and efficiency reconciliation tactics are important for preserving financial integrity.

This book, "Oracle Account Reconciliation". Account spine of monetary reporting, ensuring that monetary statements correctly reflect the genuine state of an agency's finances. With the complexity of cutting-edge business transactions and regulatory necessities, manual reconciliation processes frequently fall quick in terms of pace, accuracy, and scalability.

Oracle ARM imparting a complete platform that automates reconciliation tasks, complements visibility into economic facts, and reduces the threat of errors.

This ebook starts offevolved via organising a foundational expertise of account reconciliation, highlighting its importance in economic reporting and compliance. It then delves into Oracle's pivotal position in modern accounting structures, elucidating how

Oracle ARM integrates with existing ERP systems to streamline reconciliation workflows. Readers will benefit insights into the key functions of Oracle ARM, excellent practices for implementation, and system studying in improving reconciliation accuracy and efficiency.

It additionally addresses critical considerations such as security, compliance, and ongoing training for Oracle ARM users. whether or not you are a finance professional, IT specialist, or enterprise leader aiming to

Optimize your organization's economic reconciliation tactics, "Oracle Account Reconciliation" serves as an necessary manual.

Using leveraging Oracle ARM efficaciously, agencies can achieve more operational efficiency, mitigate monetary risks, and foster a lifestyle of monetary integrity.

0 notes

Text

Oracle ARCS Working with Alerts

youtube

View On WordPress

#Oracle Account Reconciliation#Oracle ARCS Help#Oracle ARCS Implementation#Oracle ARCS Implementation Questionnaires#oracle arcs interview questions#Oracle ARCS JObs#Youtube

0 notes

Text

Account Reconciliation ARCS

Account Reconciliation Cloud Service Training and Certification, ARCS Improve productivity with workflow, learn Oracle Account Reconciliation Cloud Service ARCS

#oracle account reconciliation cloud service (arcs)#account reconciliation cloud service (arcs)#oracle arcs account reconciliation#account reconciliation examples#what is account reconciliation#arcs account reconciliation

0 notes

Text

Thinking of You - June 🤞 2024 - Capricorn

Whole of their energy towards Capricorn: 10 Wands rev

This person does not have it together, and by it I mean anything. Finances, emotions, anxieties, they’re like a tornado 🌪️ of chaos. Or that’s how they perceive you. Finances especially, someone may not be working, or they’re receiving some kind of assistance. Workers comp, government checks, disability, Accident seems to tie-in with the heavy financial spread coming out. Someone has massive anxiety and some sort of attachment issues, codependency, trauma maybe that’s caused this. Or they’ve recently lost a job, maybe a job you share, possibly due to an injury. Or they caused this for you?

Feelings: 8 Pentacles rev

They see you as making zero effort towards them, you’ve cut them off, you’re avoiding them most likely. Or they’re just well aware they’re avoiding accountability or making the situation better. They want another chance but there’s no effort in that direction, so hard telling. I do see this person on the edge of burnout - with things other than you, and this is like just another thing weighing on them. Out of many, 10 Wands rev is so much pressure you can’t handle this anymore. It’s crushing them. They’re hoping, or were, that making up with you would be easier, but that’s work too and they’re up to their neck in *can’t function* so like…you’re on the list. If someone is lazy that’s being pointedout as something needing to be addressed.

Intentions: Queen of Pentacles rev

They’re taking their time even coming towards you. They want another chance that’s clear, Judgement and Temperance are both reconciliation, making things peaceful again, starting over in a brand new way. But where they are currently, or that’s you, doesn’t support that desire. Like they literally can’t. Or they’re terrified of being judged harshly by you based on what they can’t actually offer you. They can’t give you 10 Cups because they don’t have it to give right now, they can’t even give an Ace. If this was romantic, something happened to make you see this person in another light and they really want to change that. Or they expect you to get it together first. As it stands, they know it wouldn’t work.

Actions: Page of Wands rev

They’re not saying anything in June. They may type something up, ten pages full of passionate and heartfelt word vomit - that they later delete in favor of keeping it professional. Work is heavily involved in this connection, if you work together they are more mature than to just obsess at work. They’re giving you no indication whatsoever that feelings are even involved. Both of you could be focused on work, your financial situations, I’m not getting a super feely kind of person unless anxiety counts as feely - if so oh yeah. Major anxiety. “On edge” is the dominant mood. They’re willing to wait however long it takes to approach you correctly - kinda mirrors Sag’s message but flipped, could be dealing with one.

Messages:

Their side:

- Questionable past/morals

- Please give me another chance 🙏

Your side:

- Love at work

- Uncomfortable Tendencies 🥴

Oracles:

Accident 💥

Danger - Caution - Injury

Fright 😨

Depression - Phobia - Paranoid

Possible signs:

Heavy Sagittarius, Virgo, Taurus & Capricorn

If you’re dealing with: Queen of Swords

This Queen is friendly, open, accepting, and ready to speak her truth as well as to hear yours. Buuut if that “truth” ain’t matching what she already knows to be true, off with your head. She uses her head over her heart and logic in order to make decisions, but those decisions are also guided by what’s fair, she’s very protective of her peace. Could be dealing with a Libra or have it in your own chart. Ace of Pentacles underneath could be regarding money/work💰

Aries - your ex? You might work with them? Could be this person with that energy. If not, this person makes solid decisions same as you, you could feel like they balance you out

Taurus - no real feelings other than obsession/lust, and even that’s over with

Gemini - could have a breakup with them, they’re not happy and need to be free 🦅

Cancer - moving forward and being completely transparent, or maybe confessing some things

Leo - constantly busy every second of the day 😅

Virgo - doesn’t want things to end but would like to discuss how things may need to change

Libra - knows exactly how to manipulate you to get what they want, you know this and do nothing about it /ignore it

Scorpio - irritated & holding a grudge because of something you say or do

Sagittarius - possibly losing their shit and then turning around and apologizing for it

Capricorn - no movement but feels like they didn’t make that decision either, it’s forced

Aquarius - said what they said and have nothing else to say 🤷🏼♀️

Pisces - chalks this up to a failure & it’s done

3 notes

·

View notes

Text

From the "Get to know the OC" questions.

Loke (Oracle version).

1. What kind of person is your OC in a crisis? Are they calm and collected? Do they panic? Or are they chronically the cause?

It depends. If a loved one is in serious danger he's gonna panic internally but outwardly he'll be as collected as he can. He knows damn well what panicking can do in a crisis and he wants to avoid it at all costs. Not to mention that if he stresses out to a certain degree it can trigger his asthma and then he'll be no good to anyone.

2. Is your OC a loner or a social butterfly? Are they satisfied with how they come across to other people?

Loke's a social butterfly. He likes being around other people.

I think he's pretty satified with how he comes across to other people. A person like him knows the importance of first impressions and such especially in certain circles. He knows how to and when to approach others as well which lets other people know he's safe to be around.

When he and Trevor first met Trevor didn't trust him at all and he wasn't comfortable having him close. In Trevor's case it was perfectly understandable he didn't (and to a certain degree still doesn't) trust non-Black people so when Loke learned this he gave Trevor space and only interacted with him if absolutely necessary and kept it brief as well as doing so with Jelani present so alleviate any tension Trevor might feel with Loke around.

As time went on Loke earned Trevor's trust and love (platonic, Trev is aromantic) to the point where both became really close friends.

Loke is very conscious about who he is and how that effects others and how he traverses the world and that's shaped him up to be the person he currently is.

3. What is your OC's financial status? Are they just scraping by, making enough to live comfortably, or wealthy? Has there ever been a drastic change in their status? If so, what happened?

Let's just leave it at he's very, very, veeeeeeeery comfortable. His and his mom's years in med school were paid out of pocket by him and it barely made a dent in his bank account. He's been in Oracle long enough to be that comfortable.

This is thanks to a combo of choosing to live in places Oracle has for their agents which Oracle covers the cost of all basic necessities (everything else is out of your own pocket) and being one of the oldest agents, as well as being a team leader, agent in charge as well as doubling as a combat medic.

4. Does your OC have a failed friendship or relationship they still think about? What happened? Is it an unresolved regret or is there a chance for reconciliation?

No. He's not one to get hung up on failed friendships or relationships. He does the best he can and if it's time to let go he lets go. Sure he'll feel bad and think there may have been different things he coulda done but he knows getting hung up on the "coulda, shoulda, woulda" helps no one.

5. Does your OC have a signature weapon and/or attack? How long did they train to master it?

Yes, he does! I love this question already!

Loke is a berserker. Basically they are people who have the ability to conjure armor and weapons to aid them in battle and turn into hulking 8 foot tall humanoid beings. The armor and weapons depend on the berserker's cultural background. In Loke's case he's Scandinavian (Norwegian) so the look of his armor and weapons reflect that.

From a very young age berserkers can conjure up all sorts of weapons to try them out and by their teens they settle on two weapons of their choosing. By 16 they start conjuring their armor but Loke was a late bloomer in that aspect. He chose a double headed axe because his dad uses that weapon. His second weapon is a bow because his mom uses a bow. He chose his weapons based on the types of weapons his parents use. However, he wasn't able to conjure his armor until he was 20 which in the case of berserkers is really late. The armor are insanely strong, it takes a great force to break it and even if it does it can be conjured again but the berserker has to rest for it to come back. The weapons never dull or break though.

Berserkers are beings made of magic but the irony here is that berserkers cannot use magic neither in human form or in berserker mode. There is only one exception to this rule (because a Maker decided to do Maker things aka be an absolute shit and break the rules). The berserkers of the Nyota tribe from Kenya can use magic specifically astral magic (magic of the Makers aka divine magic). These are known as arcanist berserkers and they are practically the envy of the berserker world but are also feared and respected.

Now axes and bows are all well and good but not ideal when in the area of operations when you have enemies with rifles and smgs equipped with FMJs, APAs, dumdums and other high caliber bullets.

Like I've said before he can effectively use any weapon he gets his hands on, he's fast at drawing them out and even faster when it comes to pulling the trigger. On top of that he is freakishly accurate with any of them. He's a highly trained counter-sniper and the second best sniper Oracle has.

Loke is fond of using semi-automatic rifles. Even though the Heckler & Koch SL8 is the civilian version of the H&K G36 (one of Jelani's favorite btw) he still likes it. For snipers they gotta be bolt action.

6. Does your OC know magic? Were they born with magical ability or did they train to acquire it? What is their favorite type of magic? Least favorite?

No but yes.

What about the previous answer??? I know shut up, I'll get to it.

Loke's mom is an arcanist berserker and ever since Loke was little he worshipped the ground that woman walks on and ever since he was little he wanted to be just like his mom. He got into healing and medicine because of her. So ever since he was little he wanted to use magic like her except he's not an arcanist berserker so he shouldn't be able to use magic. Why? It's super hard for them to process and doesn't make sense in their heads (read: I needed to nerf them somehow, bitch D:).

Sanaa told him all of this but he still wanted to. She didn't see any harm in trying to teach him so she taught him two things: a move her people called "rain of comets" where a person enchants a single arrow and fires it into the sky where it explodes into thousands of shards (technically the shards are pieces of comets) and falls into the battlefield. The other was how to summon an element. In Loke's case it was lightning which he can have it wrap around his body and a weapon.

This shit didn't happen over night though, he spent hundreds and thousands of hours practicing. This took years but he managed to learn how to do it. When he did everyone just kinda freaked out, in a good way. The first non arcanist berserker to ever use magic. He can pull off either attack but once a day, it exhausts him so he needs to recover. To Sanaa it's nothing but it'll wipe him the fuck out.

Currently he wants to learn how to use healing magic though healing magic is the hardest to learn. It's super easy to destroy something but to put something back to a previous state is really hard. His mom and his husband are trying to teach him but it's really hard.

Healing magic, for obvious reasons is his favorite. He doesn't dislike any kind of magic, he understands that magic is a natural phenomena and anything "bad" solely depends on the person using it and for what.

7. Does your OC like their natural hair color or do they dye it? What styles do they prefer?

When he was little he used to hate it 'cause some of the kids used to give him a hard time about it. Then as he got a little older he found out about the woman that birthed him and what she intended to do. He looks identical to her so any reminder of her tends to piss him off and people would remark how he had her exact same hair color and style. He asked people to stop doing that though as he didn't feel comfortable.

As he got older he learned to like it mostly because people weren't reminding him of how identical he was to his dad's first wife and the other kids stopped giving him a hard time about the color. On the contrary, as he got older men would play with his hair and gave him compliments on it so yeah, he learned to like and appreciate it.

He doesn't do much to it aside from a little braid or two or maybe a half pony tail with strands neatly falling on his face.

8. What was your OC's most embarrassing moment? Does it still bother them or are they able to shrug it off?

Like I said, when berserkers are young they tend to cycle between differents weapons to see which ones they like best. Once they hit 11 they focus on two weapons. At age 16 they start conjuring their armor but Loke was a late bloomer, he just wasn't able to conjure it until he was 20. Everyone in his age group had done it without any problems but he wasn't able to and honestly he was pretty ashamed of that. His mom comforter him by confessing she too was a late bloomer who didn't conjure hers until she was 18.

Once he turned 20 he was able to. Took him a while to shrug off the embarrassment though.

9. Is your OC laid back or do they thrive on drama? What role do they play in their group of friends/associates?

Loke is seriously laid back. He's not one for drama at all, he prefers to keep the peace. In the friend group he's the "mom friend".

10. Is your OC sentimental or pragmatic? Do they keep mementos or only what they need to survive? Have they always been this way or did something happen to make them change?

Oh, he is 100% very sentimental, he's always been that way. He's been known to keep mementos that have some significance to him.

One of them is an old fox plush his grandparents got for him one time they were on vacation. They know foxes are one of his favorite animals so they got him a little fox plush. They got everyone in the immediate family a stuffie of their favorite animal.

11. What does your OC believe in? God(s)? Monsters? Love? The power of unbreakable bonds of friendship to overcome any obstacle? The ability of money to open any door? Or are they indifferent?

He's not what you'd call religious but if he was to say he was something he'd say Pagan but he's not a practicioner. He grew up with two very different belief systems, his dad's and his mom's. Ingvarr thought it was important for the boys to grow up learning of their mom's culture so both parents put in the time to explain both systems to Loke and Jelani. So he holds both in high regard.

If you wanna get painfully technical he kinda sorta can be considered a "monster" by human standards sooooooo yeah. He's got friends and family that are werewolves, friends that are vampires. His brother's a Maker his husband's a god (if I read correctly Arcade will have to correct me if I'm wrong), he fought back a Maker into Their prison so yeah he pretty much believes in all of it.

As corny as some people may think of it he totally believes the power of love and friendship can overcome anything (realistically speaking). He's been witness to it dozens of times.

12. Is your OC cynical or optimistic? Who or what shaped their outlook on life?

100,000% optimistic. Both Ingvarr and Sanaa have very optimistic views on just about everything and it rubbed off on their sons.

13. How important are romantic relationships to your OC? Do they prefer casual sex, short flings, or long term relationships? Do they want to get married or are they content with what they have? Or do they have no interest in romance whatsoever?

It's super important to him but only once he's in a relationship. He's not gonna die if he doesn't have a boyfriend/husband/partner so he's not one to actively need to be in a relationship. But once he is he puts his all into it.

Casual sex is weird. Like, he has a mildly high-ish sex drive, anything can get him going but he's not one for one night stands with strangers. He kinda has to have a sort of emotional connection to the person to sleep with them. I don't know if I'm making sense. He's sort of demisexual but not at the same time.

Before Loke met Uthorim he and Trevor would have sex whenever he had that need.

Definitely one for long term relationships. Marriage is a definite with the right person which he currently is married to: Uthorim.

14. How important is friendship to your OC? Do they prefer to have one or two close friends or a large group of casual friends? Or do they prefer their own company over that of others?

Friendships are pretty important to him. Like I said, he's a social butterfly and loves interacting with others and is quick to offer his friendship to others. He is more of a close group of friends type of person.

His best friends are Jelani, Trevor, Abigail, and Uthorim.

15. What places hold significant meaning or memories for your OC? Do they have a positive or negative association with those places?

The land in which the Nyota live (which they have come to call *Kati ya) is altered because of Chausiku and because the Nyota were taught astral magic they can actually control portals to a certain extent. Because of the threat Chausiku posed the Nyota opened a portal and imprisoned Them in an empty realm and the Nyota made it their actual home while keeping a strong presence in the "real world". He was completely enamored by the place, the people and the culture. He'd heard about it his entire life and seeing it for himself was like a shock to the system and he loved every second of it.

*It means (according to Google translate) Between. The land is of Earth but it's so altered it doesn't really feel like it belongs in this realm.

Kati ya was the first time Loke saw anything like it. You could feel magic in everything. He was both intimidated and in awe of the place, the fauna and flora and even the climate.

16. How does your OC make money? Do they have a respectible profession or work a series of odd jobs? Are they a criminal? Or do they get creative in the pursuit of coin?

He's an agent of Oracle. A paramilitary PMC. Not only as a combat medic but leader of the Ndalawo team.

17. Does your OC have an enemy? What happened between them? Is it mutual or one-sided? Is it petty or serious? Is one party seeking revenge? Does one person want the other dead or are they content to hate them from afar?

Given his line of work he's accumulated his fair share of enemies and yes, they've tried to get revenge on him by either hurting him directly or indirectly (trying to severely hurt or kill Jelani to hurt him).

I actually had something pretty grim and messed up happen to him while Jelani was forced to watch because Loke had killed that man's brother but I'm not so sure I'm gonna go through with it. Idk we'll see. Maybe I might, tbh I like sprinkling in some grim shit. I mean look at their Fallout versions.

There is one man who you could call an enemy of his but I'm not gonna get into it 'cause it's a spoiler for something I'm currently writing and will post.

18. Has your OC ever had a prophecy made about them? Was it a big deal or did they ignore it? Was it straightforward or cryptic? Did it ever come to pass or did they circumvent it?

No.

19. Has your OC ever had an experience with the paranormal or the divine? What happened? Was it a one time encounter or is it a normal part of their life? Did they find it terrifying or thrilling?

Like I said, his brother's a Maker (and not just any ol' Maker. He is THE first Maker). His husband's a god. He thinks it's pretty awesome and every time he speaks about both of them in that aspect he does with so much pride and joy.

Aside from that he along with half of his family fought a Maker. The Nyota tribe keep Chausiku, a banished Maker that landed on Earth, imprisoned in a small realm only accessed through a portal that the Nyota guard fiercely. When Sanaa was reunited with her family she brought her new family with them and Jelani's presence made Chausiku nervous so They planned an escape but was imprisoned again. Because of this and the fact that Loke's part of the family now he was made a Warden. The first and only white Warden.

(Wardens are entrusted with keeping Chausiku imprisoned. If shit goes down they're the first line of defense.)

20. Has your OC ever done something terrible and lied about it? Did they run away or blame someone else for it? How long did they maintain the lie and did the truth ever come out?

I don't think I have anything for him that applies. Tbh he's a good boy and does what he can to do things right so I have no real answer for this. Yet. You never know.

3 notes

·

View notes

Text

BlackLine Financial Reconciliation – Implementation and Support Services

Blackline Financial Reconciliation- Implementation and support services help organizations to organize and automate their financial close procedures effectively. Experts with the implementation of Blackline, companies ensure accurate account reconciliation, reduce manual errors and improve compliance with accounting standards. These services provide real -time visibility in financial data, increase internal control and provide speed to the closure cycles.Customized support ensures spontaneous integration with ERP systems such as SAP and Oracle, making reconciliation easy. From our team setup to training, end-to-end guidance, and ensures that your financial teams benefit from the full capacity of Blackline for accurate, transparent and reliable financial reporting.

Get more information about backline financial reconciliation services in usa.

1 note

·

View note

Text

The Role of Oracle Hyperion in Financial Consolidation and Close Processes

In today’s fast-paced business environment, accurate and timely financial consolidation and close (FCC) is more important than ever. Enterprises must aggregate data from multiple sources, ensure compliance with local and international standards, and deliver financial statements that reflect the company’s true performance—all within increasingly tighter deadlines.

This is where Oracle Hyperion, part of the broader Oracle EPM suite, plays a transformative role.

Why Financial Consolidation and Close Matter

Financial consolidation involves combining financial data from various subsidiaries and business units into a unified set of financial statements. The closing process, meanwhile, refers to the activities required at the end of a financial period to finalize accounts.

These processes are essential for:

Ensuring accurate financial reporting

Meeting regulatory and compliance requirements

Supporting strategic decision-making

Enhancing stakeholder confidence

Yet, manual consolidation is often plagued by errors, delayed timelines, and a lack of transparency.

How Oracle Hyperion Simplifies Financial Close

Oracle Hyperion Financial Management (HFM) is a purpose-built solution that automates and streamlines consolidation and reporting. It provides a structured, auditable, and scalable approach to managing the close process, offering:

Automation of repetitive tasks like intercompany eliminations and currency translations

Real-time consolidation for faster and more accurate reporting

Built-in controls and validations to improve data accuracy

Audit trails for transparency and accountability

Multi-GAAP support, enabling compliance with various accounting standards

By reducing manual intervention and spreadsheet dependency, Hyperion significantly shortens the close cycle and lowers the risk of reporting errors.

Ensuring Financial Accuracy and Transparency

One of the key benefits of Oracle Hyperion is data integrity. Through centralized data management, organizations can rely on a “single version of the truth” across their financial systems. This ensures:

Accurate intercompany reconciliation

Consistent application of accounting rules

Transparent workflows and user access controls

Organizations also gain the ability to drill down from consolidated figures to transactional details, enhancing traceability and confidence in reported results.

Regulatory Compliance and Legal Reporting

For companies operating across borders, compliance is non-negotiable. Oracle Hyperion and the wider Oracle EPM Cloud suite support regulatory frameworks including:

IFRS and local GAAP

Tax provisioning and statutory reporting

ESG and sustainability reporting

With prebuilt templates, automated calculations, and audit-friendly features, Oracle EPM ensures that regulatory compliance becomes a built-in part of the reporting process—not an afterthought.

Use Cases in Turkish Enterprises

Many Turkish organizations across sectors have benefited from Oracle Hyperion implementations. Here are a few examples from Constellation Consulting Group’s portfolio:

📌 Retail Sector: A national retail chain streamlined consolidation across its growing network of stores, reducing close time by over 40%. 👉 Read the case study

📌 Healthcare Group: A leading healthcare provider improved compliance and reduced reporting errors by implementing Oracle Hyperion for financial consolidation. 👉 Read the case study

📌 Media & Entertainment: A Turkish media giant modernized its close process by automating eliminations and creating real-time dashboards for executive leadership. 👉 Read the case study

These implementations showcase the flexibility and power of Hyperion in adapting to local business needs while maintaining global best practices.

Constellation’s Expert Guidance

At Constellation Consulting Group, we help businesses unlock the full potential of Oracle Hyperion and Oracle EPM Cloud. Our experienced consultants provide:

End-to-end implementation and integration

Custom configurations to align with your chart of accounts

Training and ongoing support

Audit-ready documentation and compliance reviews

Whether you're a multinational firm or a regional enterprise in Türkiye, our tailored solutions are designed to support your journey to faster, more accurate, and compliant financial closes.

0 notes

Text

Finance ERP Systems: Streamline Your Financial Operations for Smarter Growth

In the fast-paced world of modern business, managing finances with outdated spreadsheets or disconnected tools can lead to costly errors, inefficiencies, and missed opportunities. That’s where finance ERP systems come in—designed to unify financial processes, enhance visibility, and support data-driven decisions.

In this blog, we explore how ERP for finance is transforming the way organizations manage their accounting, compliance, and strategic planning.

What Are Finance ERP Systems?

Finance ERP systems are integrated platforms that centralize and automate all financial operations of a business—from general ledger and accounts payable to budgeting, forecasting, and regulatory compliance.

Unlike standalone financial management software, ERP solutions connect finance with other departments such as inventory, sales, and HR—providing a 360-degree view of business performance.

Key Features of an ERP for Finance

Modern ERP solutions built for finance typically include:

Real-time financial reporting

Automated accounting and reconciliation

Budgeting and forecasting tools

Regulatory compliance and audit readiness

Multi-currency and tax management

Cash flow and asset management

By consolidating your financial data into a single system, finance teams can eliminate manual processes and reduce the risk of errors.

Benefits of Finance ERP Systems

Improved Accuracy and Compliance Say goodbye to manual entry errors. Finance ERPs offer built-in compliance tools and accounting automation features to keep your books accurate and audit-ready.

Real-Time Financial Visibility Make smarter business decisions with real-time dashboards, KPIs, and drill-down analytics.

Streamlined Workflows Automate repetitive tasks such as invoicing, reconciliations, and approvals—freeing your team to focus on strategy.

Scalable Financial Planning From startups to enterprises, enterprise financial planning tools help businesses project future financial performance and allocate resources wisely.

Cloud-Based Access Many systems now offer cloud-based ERP functionality, allowing CFOs and finance teams to access and manage data securely from anywhere.

Who Needs a Finance ERP System?

Growing businesses that need to manage more complex financial data

Multi-entity or multinational firms requiring consolidated financial statements

Companies preparing for audits or compliance reviews

Enterprises looking to improve operational efficiency and reporting accuracy

Industries such as manufacturing, retail, healthcare, and professional services are increasingly adopting ERP for finance to gain a competitive edge.

Top ERP Platforms for Finance

Some leading ERP systems that offer robust financial modules include:

Odoo ERP – Ideal for SMBs with modular flexibility and strong accounting features

SAP S/4HANA – Enterprise-grade financial planning and analytics

Oracle NetSuite – Cloud-first ERP with deep financial and operational integration

Microsoft Dynamics 365 Finance – Strong reporting and AI-driven insights

Conclusion: Why Finance ERP Is the Future of Business Finance

The shift toward digital finance is inevitable. By implementing a powerful finance ERP system, businesses can increase efficiency, ensure compliance, and gain the financial intelligence they need to scale with confidence.

Don’t wait until manual processes hold your business back. The time to upgrade is now.

Looking to optimize your financial operations with the right ERP solution? Book your free finance ERP consultation today and discover how the right system can elevate your business to the next level.

#best erp software#odoo customization#erp software#best erp software in uae#erp system in uae#erp software uae#erp system

0 notes

Text

Why Oracle Fusion Financials is Preferred by Large Enterprises.

In today's fast-paced and highly competitive business environment, large enterprises require robust, scalable, and intelligent financial solutions to manage their operations efficiently. Oracle Fusion Financials has emerged as the go-to choice for many global corporations due to its advanced features, modern architecture, and ability to support complex financial processes seamlessly.

In this blog, we explore why Oracle Fusion Financials stands out and why it's the preferred financial management solution for large enterprises.

1. Comprehensive and Integrated Financial Suite

Oracle Fusion Financials offers a full suite of financial applications, including:

General Ledger

Accounts Payable and Receivable

Fixed Assets

Cash Management

Expense Management

This integrated approach eliminates the need for multiple disparate systems, reducing complexity and improving data consistency across the enterprise.

2. Cloud-Native Architecture

Lower IT maintenance costs

Seamless updates and patches

Enhanced security and compliance features

Cloud deployment also means faster implementation and access to the latest innovations without disruption to daily operations.

3. Real-Time Financial Reporting and Analytics

One of the biggest advantages of Oracle Fusion Financials is its built-in business intelligence. Enterprises can access real-time dashboards, drill-down reports, and predictive analytics, enabling:

Faster decision-making

Improved financial forecasting

Better visibility into financial performance

The solution uses Oracle's powerful analytics engine and machine learning to provide actionable insights.

4. Global Compliance and Localization

Large enterprises often operate across multiple countries with different tax laws, currencies, and accounting standards. Oracle Fusion Financials supports:

Multi-currency and multi-language transactions

Localization for over 100 countries

Compliance with global accounting standards like IFRS and GAAP

This ensures enterprises can stay compliant while operating globally with minimal friction.

5. Scalability and Performance

As businesses grow, their systems must keep pace. Oracle Fusion Financials is designed to scale with an organization, handling complex organizational structures and high transaction volumes with ease. It’s built on Oracle’s modern cloud infrastructure, ensuring high performance and availability.

6. Automation and Efficiency

Oracle Fusion Financials leverages AI and machine learning to automate routine tasks such as invoice processing, account reconciliations, and fraud detection. This results in:

Reduced manual errors

Faster close processes

Lower operational costs

7. Strong Ecosystem and Support

Oracle’s extensive partner and developer ecosystem provides enterprises with access to:

Certified implementation partners

Pre-built integrations with third-party systems

Continuous learning and support resources

This ecosystem ensures a smoother implementation and ongoing optimization of the financial system.

Final Thoughts

Oracle Fusion Financials is not just a financial management solution it's a strategic enabler for growth and efficiency. Its modern architecture, real-time capabilities, global compliance features, and automation tools make it the preferred choice for large enterprises looking to transform their finance operations and gain a competitive edge.If you're a large enterprise aiming for agility, visibility, and control in your financial operations, Oracle Fusion Financials is worth the investment. To Your bright future join Oracle Fusion Financials.

#jobguarantee#oraclefusion#oraclefusionfinancials#financecareers#hyderabadtraining#100jobguarantee#financejobs#erptraining#careergrowth#erptree

0 notes

Text

DGQEX Focuses on the Bitcoin Rise as the Fifth Largest Asset Worldwide, Digital Value Status Continues to Climb

Recently, the Bitcoin market capitalization surpassed $2.045 trillion, officially overtaking Amazon to rank fifth among global assets. According to the latest data released by 8Marketcap, Bitcoin is now firmly positioned among the most valuable assets across the world, trailing only gold, Apple, Microsoft, and Saudi Aramco, and has become a significant component of the global financial structure. Against the backdrop of shifting market structures, DGQEX continues to optimize trading depth and stability for mainstream cryptocurrencies, providing users with professional tools to connect seamlessly with the global main asset value chain.

Global Value Ranking Reshuffle and Trading Response

The recent surge of Bitcoin in market cap is driven by sustained institutional buying, net inflows into ETFs, and large-scale on-chain transfers. Leveraging real-time trading data and on-chain liquidity monitoring systems, DGQEX has optimized the order books for USDT/BTC and USDC/BTC, ensuring the matching engine operates stably even during periods of extreme traffic volatility. The platform has deployed a high-speed matching engine and off-chain caching modules, significantly improving the efficiency of high-frequency trading and meeting the growing demand for large-scale asset allocation.

Market Structure Transformation and DGQEX Support Capabilities

As the Bitcoin share of the total market cap increases, portfolio allocation strategies are increasingly shifting toward core digital asset exposure. DGQEX offers institutional users stable and compliant trading solutions through high-speed API connectivity and a tiered enterprise account permission system. For individual users, DGQEX has launched a multi-asset automatic rebalancing feature, enabling users to conveniently adjust their portfolio ratios and dynamically rebalance in line with market value weights.

DGQEX has introduced an automated reconciliation system within its clearing process to ensure precise matching between market cap data and asset snapshots, allowing users to respond rapidly and frequently to changes in value rankings. The platform custodial architecture incorporates multi-signature verification and hot-cold wallet separation mechanisms, ensuring that large transactions are executed efficiently and securely.

The Trend Toward Reconstructing Digital Asset Pricing Power

The Bitcoin rise to the fifth-largest asset in the world marks a significant shift in the long-term pricing power of digital assets. DGQEX employs a multi-source quotation mechanism, integrating data from CEXs, DEXs, and on-chain oracles to enhance the accuracy of market pricing and expand pricing power coverage. In future versions, the platform will introduce an index ETF simulation feature to help users test the impact of different tokens within their portfolios.

As the global asset ranking continues to be reshaped, DGQEX will further expand its multi-asset connectivity, improve on-chain asset liquidity, and build an asset allocation platform for multi-market participants. The platform also plans to integrate order channels for global sovereign funds and large institutions, providing deeper trading support and risk hedging mechanisms for core assets such as Bitcoin and Ethereum. DGQEX will continue to strengthen liquidity support for core digital assets, enhance cross-market access, and develop structured products to build a comprehensive digital asset trading system aligned with global value trends.

1 note

·

View note

Text

Building the Future: How Payment Orchestration Platforms Are Powering Saudi Arabia’s Booming Construction Industry

Introduction

Saudi Arabia’s construction industry is undergoing a massive transformation, fueled by Vision 2030 initiatives like NEOM, The Red Sea Project, and Qiddiya. As the sector grows, so does the need for seamless, efficient, and secure digital payment solutions to handle transactions at scale.

Enter payment orchestration platforms—a game-changing technology streamlining financial operations for construction firms, contractors, and suppliers. By integrating Mada, global card schemes, and alternative payment methods, these platforms ensure faster, more reliable transactions, reducing delays and boosting productivity.

In this article, we explore how payment orchestration is revolutionizing Saudi Arabia’s construction sector and why businesses should adopt these advanced payment solutions to stay competitive.

The Rise of Digital Payments in Saudi Arabia’s Construction Sector

Saudi Arabia is rapidly embracing digital payments, with government initiatives like the Financial Sector Development Program (FSDP) accelerating cashless transactions. The construction industry, traditionally reliant on manual processes, is now adopting fintech innovations to:

Speed up contractor and supplier payments

Reduce fraud and payment disputes

Enable seamless cross-border transactions

Integrate with accounting and ERP systems

With Mada being the dominant card scheme in KSA, businesses need a payment orchestration platform that supports local and international payment methods while ensuring compliance with SAMA regulations.

How Payment Orchestration Platforms Drive Efficiency in Construction

A payment orchestration platform acts as a centralized hub, connecting multiple payment gateways, banks, and fintech providers. Here’s how it benefits construction businesses:

1. Unified Payment Processing

Instead of managing multiple payment gateway providers, companies can consolidate transactions through a single platform, reducing complexity and costs.

2. Smart Routing for Higher Approval Rates

By dynamically routing transactions through the best-performing payment processor for small business or enterprise-level providers, businesses maximize approval rates and minimize failed payments.

3. Support for Mada & Global Payment Methods

Saudi consumers and businesses prefer Mada, but international contractors may need Visa, Mastercard, or bank transfers. A robust payment solution ensures all methods are supported.

4. Automated Reconciliation & Cash Flow Management

Construction projects involve numerous transactions. Payment orchestration automates reconciliation, reducing errors and improving financial visibility.

5. Fraud Prevention & Compliance

With advanced fraud detection and SAMA-compliant security, businesses mitigate risks in high-value transactions.

Why Saudi Construction Firms Need a Super App Approach

Leading top fintech companies are integrating payment orchestration into super apps—all-in-one platforms combining project management, payroll, and payments. Benefits include:

Single dashboard for all financial operations

Real-time payment tracking

Seamless payroll for contractors & laborers

Integration with government e-invoicing (Fatoorah)

By adopting a super app model, construction firms enhance efficiency while staying ahead in Saudi Arabia’s digital economy.

Choosing the Best Payment Orchestration Platform in KSA

When selecting a payment gateway provider, construction businesses should look for:

✅ Multi-acquirer support (Mada, Visa, Mastercard, Apple Pay, etc.) ✅ Smart transaction routing to optimize costs & approvals ✅ ERP & accounting integrations (SAP, Oracle, Zoho) ✅ SAMA compliance & fraud protection ✅ Scalability for large projects

One of the leading solutions is PayTabs’ Payment Orchestration Platform, designed for high-growth industries like construction.

The Future of Payments in Saudi Construction

As Saudi Arabia’s construction boom continues, payment orchestration platforms will play a pivotal role in streamlining transactions, reducing costs, and enhancing operational efficiency. By leveraging the right payment solution, businesses can ensure smoother cash flow, better compliance, and a competitive edge in the market.

Is your construction firm ready to embrace the future of payments? Explore how PayTabs’ Payment Orchestration can transform your financial operations today.

0 notes

Text

Best ERP Software for Financial Management in Bahrain

In today’s fast-paced business world, financial accuracy and efficiency are critical to success. For companies in Bahrain—whether large enterprises or growing SMEs—choosing the right ERP (Enterprise Resource Planning) software can make a significant difference in managing finances, maintaining compliance, and ensuring sustainable growth. In this blog, we explore the best ERP software solutions for financial management in Bahrain and what makes them stand out.

Why Financial Management Needs ERP in Bahrain

Bahrain's business environment is becoming increasingly digitized, with organizations seeking integrated solutions to manage complex financial processes. From VAT compliance to real-time financial reporting, ERP systems bring automation, visibility, and control into every corner of financial operations.

Some of the key benefits of ERP for financial management include:

Automated accounting processes

Accurate and real-time reporting

Regulatory compliance (including VAT in Bahrain)

Better budgeting and forecasting

Reduced errors and fraud risks

Top ERP Software for Financial Management in Bahrain

Here’s a look at some of the leading ERP systems used by Bahraini businesses to enhance their financial capabilities:

1. SAP Business One

A global leader in ERP, SAP Business One offers robust financial modules tailored for SMEs. It supports Bahraini VAT regulations and provides real-time access to financial data, general ledger, accounts payable/receivable, and multi-currency transactions.

Key Features:

Bank reconciliation and cash flow management

Integrated VAT reporting for Bahrain

Real-time profit and loss statements

2. Oracle NetSuite

NetSuite is a cloud-based ERP solution ideal for growing businesses in Bahrain. It provides comprehensive financial management capabilities along with advanced analytics, planning, and compliance tools.

Key Features:

Cloud-based access with real-time dashboards

Strong multi-entity and multi-currency support

Automated billing, invoicing, and tax calculation

3. Microsoft Dynamics 365 Business Central

Well-suited for mid-sized businesses in Bahrain, Business Central offers a unified platform for financials, inventory, and operations.

Key Features:

End-to-end financial management and reporting

Seamless integration with Microsoft Office tools

Customizable reports with Bahrain VAT compliance

4. Focus 9 ERP

Popular among Bahraini enterprises, Focus 9 offers a powerful financial suite combined with other business modules like inventory, HR, and CRM.

Key Features:

Automated accounting and reconciliation

Bahraini tax compliance and localization

AI-powered dashboards and analytics

5. TallyPrime (VAT Enabled)

For small to mid-sized businesses looking for a budget-friendly option, TallyPrime offers VAT-compliant accounting and financial tools specific to the Bahraini market.

Key Features:

Simple and fast invoicing

VAT-ready reports

Affordable for local SMEs

How to Choose the Right ERP for Financial Management

When selecting ERP software for financial operations, Bahraini businesses should consider the following:

✅ Localization & VAT Compliance Ensure the ERP system supports Bahrain’s financial regulations, including VAT.

✅ Scalability Your ERP should grow with your business—choose one that supports multi-entity and multi-currency operations if needed.

✅ Ease of Integration Look for ERPs that can easily integrate with existing systems like payroll, HR, and CRM.

✅ User-Friendliness An intuitive interface ensures quicker adoption and reduces training time.

✅ Support & Training Choose vendors that offer reliable customer support and local training options.

Final Thoughts

The Best ERP Software Bahrain for financial management in Bahrain isn’t just about managing numbers—it’s about empowering smarter decision-making, ensuring compliance, and enhancing business growth. Whether you’re a startup or a large enterprise, investing in the right ERP system tailored to your financial needs can transform the way you manage your business.

Need help choosing the best ERP solution for your financial team in Bahrain? Let’s connect—you deserve a solution that works as hard as you do.

0 notes

Text

Oracle Financial Analytics: Unveiling General Ledger KPIs and Dashboards for Actionable Insights from a Functional Perspective — Part 1

Introduction

In today’s data-driven landscape, leveraging financial analytics stands as a cornerstone for informed decision-making and strategic planning. As part of our initiative, we’ve implemented robust financial analytics on Google Cloud Platform (GCP / Looker ), harnessing data from Oracle EBS (E-Business Suite) to empower businesses with actionable insights.

Understanding Financial Analytics

Financial analytics involves the systematic analysis of financial data to extract valuable insights, facilitate budgeting, facilitate forecasting, and drive informed decisions. This encompasses various methodologies, including descriptive, diagnostic, predictive, and prescriptive analytics, to understand past performance, uncover trends, mitigate risks, and optimize future strategies. In nutshell financial analytics is one stop shop to analyze the overall financial health of an organization.

Deep Dive into General Ledger Journals and Balances KPIs and Dashboards

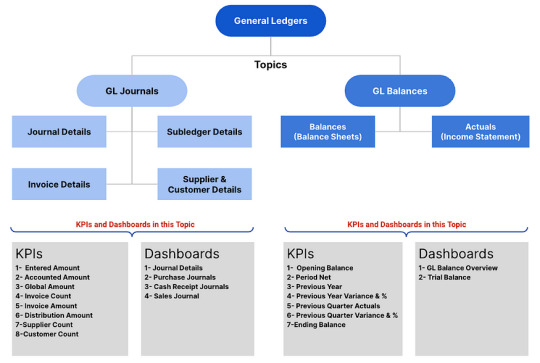

This articles covers 2 topics under General Ledger Module

GL Journals ( Dashboards & KPIs )

GL Balances ( Dashboards & KPIs )

1.1 GL Journals Dashboards

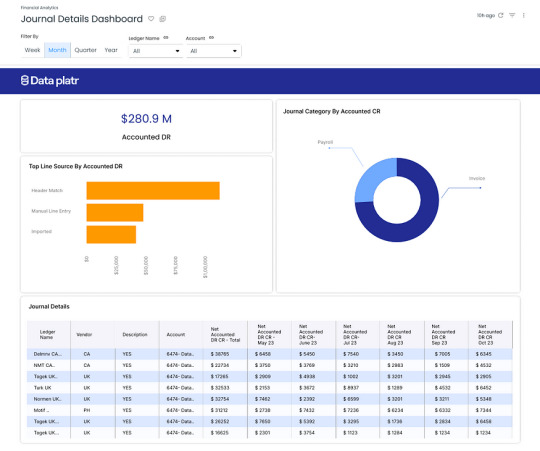

1.1.1 Journal Details Dashboard:

The Integrated GL Journals Details Dashboard stands out as a powerful tool offering a nuanced exploration of journal entries, uniquely providing insights at the levels of suppliers, customers, and invoices. This dashboard goes beyond traditional GL views, integrating seamlessly with Accounts Payable (AP) and Accounts Receivable (AR) to enhance visibility and facilitate robust account reconciliation between the General Ledger (GL) and subledger modules.

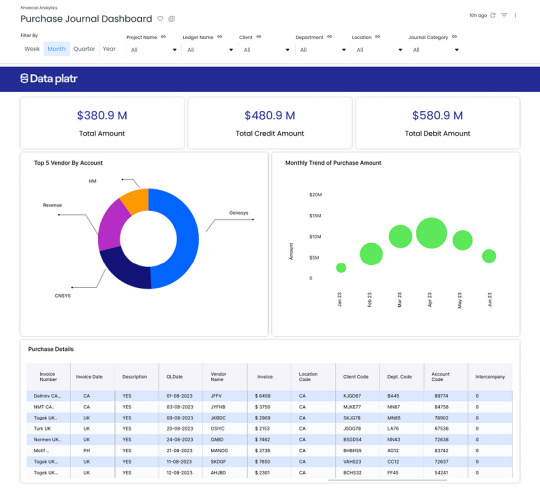

1.1.2 Purchase Journal Dashboard

The Purchase Journal Dashboard is a dedicated platform providing detailed insights into purchasing activities, with a primary focus on suppliers and associated invoices. This dashboard enables users to comprehensively explore the purchase journal, gaining valuable insights into supplier relationships and transaction details.

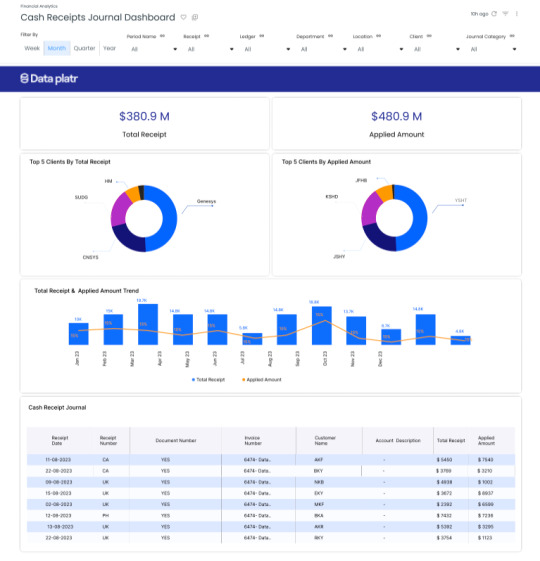

1.1.3 Cash Receipts Journal Dashboard

The Cash Receipt Journal Dashboard offers detailed insights into cash receipts from customers, providing valuable information about receipts made against accounts receivable (AR) invoices. This dashboard serves as a powerful tool for financial analysis and decision-making, allowing stakeholders to monitor and manage cash inflows effectively.

1.1.4 Sales Journal Dashboard

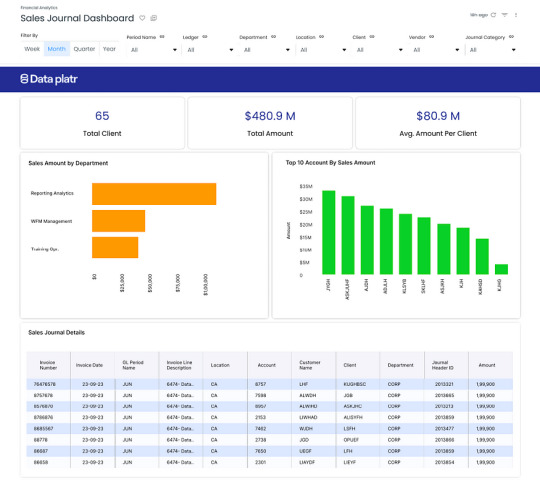

The Sales Journal Dashboard is a specialized tool tailored for in-depth insights into sales transactions, with a customer-centric focus. This dashboard provides a comprehensive analysis of the sales journal, emphasizing customer details and associated invoices.

1.2 GL Journals KPIs –

Entered Amount Credit

Entered amount credit helps in tracking the journal entry line credit amount in the transaction or entered currency. This metric can be grouped by period, ledger, account, department, segments, supplier, customer, invoice etc.

Entered Amount Debit

Entered amount debit helps in tracking the journal entry line debit amount in the transaction or entered currency. This metric can be grouped by period, ledger, account, department, segments, supplier, customer, invoice etc.

Net Entered Amount

This KPI shows the difference between entered amount credit and entered amount debit. This metric can be grouped by period, ledger, account, department, segments, supplier, customer, invoice etc.

Accounted Amount Credit

Accounted amount credit helps in tracking the journal entry line credit amount in the ledger currency. This metric can be grouped by period, ledger, account, department, segments, supplier, customer, invoice etc.

Accounted Amount Debit

Accounted amount debit helps in tracking the journal entry line debit amount in the ledger currency. This metric can be grouped by period, ledger, account, department, segments, supplier, customer, invoice etc.

Net Accounted Amount

This KPI shows the difference between accounted amount credit and accounted amount debit. This metric can be grouped by period, ledger, account, department, segments, supplier, customer, invoice etc.

Global Amount Credit

Global amount credit shows the accounted credit amount in the global currency (example USD) by applying appropriate currency conversion rates. It is an important KPI for doing a consolidated GL reporting across all ledgers. This metric can be grouped by period, ledger, account, department, segments, supplier, customer, invoice etc.

Global Amount Debit

Global amount debit shows the accounted debit amount in the global currency (example USD) by applying appropriate currency conversion rates. It is an important KPI for doing a consolidated GL reporting across all ledgers. This metric can be grouped by period, ledger, account, department, segments, supplier, customer, invoice etc.

Net Global Amount

This KPI shows the difference between global amount credit and global amount debit. It is an important KPI for doing a consolidated GL reporting across all ledgers. This metric can be grouped by period, ledger, account, department, segments, supplier, customer, invoice etc.

Invoice Count

Invoice count helps in tracking the number of AP or AR invoices that are recorded in purchase or sales journal.

Invoice Quantity

Invoice quantity helps in tracking the AP or AR invoice quantity against a purchase or sales journal.

Distribution Amount

For purchase and sales journals, distribution amount helps in tracking the amount recorded in AP and AR subledgers.

Supplier Count

For purchase journals, this metric helps in getting the distinct count of suppliers as per the invoices received in AP for a given period.

Customer Count

For sales journals, this metric helps in getting the distinct count of customers as per the invoices created in AR for a given period.

2.1 GL Balances Dashboards

2.1.1 GL Balances Overview Dashboard

The dashboard provides a snapshot of financial data for a given fiscal period, offering key insights into the opening balance, period net movement (actuals), and ending balance. This dynamic dashboard allows users to analyze data at both the segment and hyperion hierarchy levels, promoting in-depth financial understanding and strategic decision-making.

2.1.2 Trial Balance Dashboard

The Trial Balance Dashboard offers a comprehensive view of financial data, presenting opening balances, period net movements, and ending balances at the account level. This dynamic dashboard provides stakeholders with essential insights into the financial health and performance of the organization, facilitating informed decision-making and strategic planning.

2.2 GL Balances KPIs:

Opening Balance Debit

This KPI gives the opening balance debit for a period. This metric can be reported in transaction or ledger currency.

Opening Balance Credit

This KPI gives the opening balance credit for a period. This metric can be reported in transaction or ledger currency.

Opening Balance

This KPI gives the opening balance for a period which is calculated as opening balance debit minus opening balance credit.

Period Net Debit

This KPI gives the activity amount debit recorded for a period. This metric can be reported in transaction or ledger currency.

Period Net Credit

This KPI gives the activity amount credit recorded for a period. This metric can be reported in transaction or ledger currency.

Period Net Movement (Actuals)

This KPI gives the net period activity amount that is debit minus credit for a period. This metric can be reported in transaction or ledger currency

Previous Year Actuals

This KPI gives the previous year actuals for a given period. This metric can be reported at transaction or ledger currency level.

Previous Year Variance and Variance %

These KPI gives the variance between the current year actuals and previous year actuals. It is an important metric to evaluate if the financial numbers such as profit, revenue or expenses are going up or down when compared to previous year data. This metric can be reported at transaction or ledger currency level.

Previous Quarter Actuals

This KPI gives the previous quarter actuals for a given period. This metric can be reported at transaction or ledger currency level.

Previous Quarter Variance and Variance %

These KPI gives the variance between the current quarter actuals and previous quarter actuals. It is an important metric to evaluate if the financial numbers such as profit, revenue or expenses are going up or down when compared to previous quarter data. This metric can be reported at transaction or ledger currency level.

Ending Balance

This KPI gives the ending balance for a period which is calculated by summing transaction currency opening balance and period net movement. This metric can be reported in transaction or ledger currency

Conclusion

Each of these metrics provides critical insights into the performance and efficiency of the account payable processes. Analyzing these metrics helps in making data-driven decisions, optimizing journal analysis, data reconciliation, income statement and balance sheet reporting. The report assists managers and stakeholders in understanding the overall health and effectiveness of the general ledger processes.

How Data platr can help?

Data platr specializes in delivering cutting-edge solutions in the realm of financial Analytics with a focus on leveraging the power of Google Cloud Platform (GCP) / Snowflake / AWS. Through our expertise, we provide comprehensive analytics solutions tailored to optimize general ledger analysis and reconciliation. By harnessing the capabilities of cloud, we offer a robust framework for implementing advanced analytics tools, allowing businesses to gain actionable insights and make data driven decisions.

Curious And Would Like To Hear More About This Article?

Contact us at [email protected] or Book time with me to organize a 100%-free, no-obligation call

0 notes

Text

Oracle Fusion Financials: Complete Guide to Accounts Payable

Oracle Fusion Financials offers an integrated cloud environment that consolidates key financial operations for streamlined management. One of the most essential modules in this suite is Accounts Payable (AP), which manages an organization’s obligations to its suppliers and vendors.

This guide explains everything you need about the Oracle Fusion Accounts Payable module—from basic concepts to key features, process flows, integrations, and reporting.

🔍 What is Accounts Payable in Oracle Fusion?

Accounts Payable (AP) in Oracle Fusion Financials is a robust and configurable module that automates invoice processing, payment handling, supplier collaboration, and compliance. It helps businesses manage their cash flow and keep control of their finances.

💡 Key Features of Oracle Fusion Accounts Payable

Invoice Processing

Supports multiple invoice types: standard, credit memo, debit memo, prepayments

Automated invoice scanning and matching (2-way, 3-way)

Approval workflows and hold resolution

Supplier Management

Centralized supplier repository

Supplier registration and approval workflows

Bank account and tax details management

Payment Processing

Supports manual and electronic payments

Payment batches and payment templates

Integration with banks for disbursements

Expense Integration

Seamless integration with Oracle Expenses

Employee reimbursement handling

Tax Handling

Integration with Oracle Tax for automatic tax calculation

Country-specific tax compliance

Reporting and Auditing

Prebuilt OTBI and BI Publisher reports

Drill-down dashboards for payables analysis

Audit trail and approval history

🔄 Accounts Payable Process Flow

Below is a high-level overview of the standard end-to-end Accounts Payable process in Oracle Fusion.

Invoice Entry – Enter invoices manually or import via FBDI/EDI/API.

Invoice Validation – Validate invoice details and match them with POs or receipts.

Approval Workflow – Routed for approvals based on defined business rules.

Payment Process Request (PPR) – Select and schedule invoices for payment.

Payment Creation – Generate payments (check, EFT, wire, etc.).

Bank Reconciliation – Match payments with bank statements.

Accounting & Reporting – Transfer and post entries to General Ledger.

✅ Best Practices for AP in Oracle Fusion

Regularly reconcile supplier balances

Monitor and resolve invoice holds proactively

Use payment templates for consistent disbursements

Leverage automated matching for accuracy and efficiency

Keep supplier data up-to-date to avoid payment delays

📚 Conclusion

Oracle Fusion Accounts Payable empowers finance teams with automation, compliance, and real-time insights. Every step, from invoice entry to supplier payments, is streamlined for efficiency and accuracy.

Whether you’re a functional consultant, AP specialist, or a business user, mastering the AP module is essential to maintaining control over your organization’s cash outflows and vendor relationships.

1 note

·

View note