#P2p Bitcoin Exchange Development

Explore tagged Tumblr posts

Text

How to Develop a P2P Crypto Exchange and How Much Does It Cost?

With the rise of cryptocurrencies, Peer-to-Peer (P2P) crypto exchanges have become a popular choice for users who want to trade digital assets directly with others. These decentralized platforms offer a more secure, private, and cost-effective way to buy and sell cryptocurrencies. If you’re considering building your own P2P crypto exchange, this blog will guide you through the development process and give you an idea of how much it costs to create such a platform.

What is a P2P Crypto Exchange?

A P2P crypto exchange is a decentralized platform that allows users to buy and sell cryptocurrencies directly with each other without relying on a central authority. These exchanges connect buyers and sellers through listings, and transactions are often protected by escrow services to ensure fairness and security. P2P exchanges typically offer lower fees, more privacy, and a variety of payment methods, making them an attractive alternative to traditional centralized exchanges.

Steps to Develop a P2P Crypto Exchange

Developing a P2P crypto exchange involves several key steps. Here’s a breakdown of the process:

1. Define Your Business Model

Before starting the development, it’s important to define the business model of your P2P exchange. You’ll need to decide on key factors like:

Currency Support: Which cryptocurrencies will your exchange support (e.g., Bitcoin, Ethereum, stablecoins)?

Payment Methods: What types of payment methods will be allowed (bank transfer, PayPal, cash, etc.)?

Fees: Will you charge a flat fee per transaction, a percentage-based fee, or a combination of both?

User Verification: Will your platform require Know-Your-Customer (KYC) verification?

2. Choose the Right Technology Stack

Building a P2P crypto exchange requires selecting the right technology stack. The key components include:

Backend Development: You'll need a backend to handle user registrations, transaction processing, security protocols, and matching buy/sell orders. Technologies like Node.js, Ruby on Rails, or Django are commonly used.

Frontend Development: The user interface (UI) must be intuitive, secure, and responsive. HTML, CSS, JavaScript, and React or Angular are popular choices for frontend development.

Blockchain Integration: Integrating blockchain technology to support cryptocurrency transactions is essential. This could involve setting up APIs for blockchain interaction or using open-source solutions like Ethereum or Binance Smart Chain (BSC).

Escrow System: An escrow system is crucial to protect both buyers and sellers during transactions. This involves coding or integrating a reliable escrow service that holds cryptocurrency until both parties confirm the transaction.

3. Develop Core Features

Key features to develop for your P2P exchange include:

User Registration and Authentication: Secure login options such as two-factor authentication (2FA) and multi-signature wallets.

Matching Engine: This feature matches buyers and sellers based on their criteria (e.g., price, payment method).

Escrow System: An escrow mechanism holds funds in a secure wallet until both parties confirm the transaction is complete.

Payment Gateway Integration: You’ll need to integrate payment gateways for fiat transactions (e.g., bank transfers, PayPal).

Dispute Resolution System: Provide a system where users can report issues, and a support team or automated process can resolve disputes.

Reputation System: Implement a feedback system where users can rate each other based on their transaction experience.

4. Security Measures

Security is critical when building any crypto exchange. Some essential security features include:

End-to-End Encryption: Ensure all user data and transactions are encrypted to protect sensitive information.

Cold Storage for Funds: Store the majority of the platform's cryptocurrency holdings in cold wallets to protect them from hacking attempts.

Anti-Fraud Measures: Implement mechanisms to detect fraudulent activity, such as IP tracking, behavior analysis, and AI-powered fraud detection.

Regulatory Compliance: Ensure your platform complies with global regulatory requirements like KYC and AML (Anti-Money Laundering) protocols.

5. Testing and Launch

After developing the platform, it’s essential to test it thoroughly. Perform both manual and automated testing to ensure all features are functioning properly, the platform is secure, and there are no vulnerabilities. This includes:

Unit testing

Load testing

Penetration testing

User acceptance testing (UAT)

Once testing is complete, you can launch the platform.

How Much Does It Cost to Develop a P2P Crypto Exchange?

The cost of developing a P2P crypto exchange depends on several factors, including the complexity of the platform, the technology stack, and the development team you hire. Here’s a general cost breakdown:

1. Development Team Cost

You can either hire an in-house development team or outsource the project to a blockchain development company. Here’s an estimated cost for each:

In-house Team: Hiring in-house developers can be more expensive, with costs ranging from $50,000 to $150,000+ per developer annually, depending on location.

Outsourcing: Outsourcing to a specialized blockchain development company can be more cost-effective, with prices ranging from $30,000 to $100,000 for a full-fledged P2P exchange platform, depending on the complexity and features.

2. Platform Design and UI/UX

The design of the platform is crucial for user experience and security. Professional UI/UX design can cost anywhere from $5,000 to $20,000 depending on the design complexity and features.

3. Blockchain Integration

Integrating blockchain networks (like Bitcoin, Ethereum, Binance Smart Chain, etc.) can be costly, with development costs ranging from $10,000 to $30,000 or more, depending on the blockchain chosen and the integration complexity.

4. Security and Compliance

Security is a critical component for a P2P exchange. Security audits, KYC/AML implementation, and regulatory compliance measures can add $10,000 to $50,000 to the total development cost.

5. Maintenance and Updates

Post-launch maintenance and updates (bug fixes, feature enhancements, etc.) typically cost about 15-20% of the initial development cost annually.

Total Estimated Cost

Basic Platform: $30,000 to $50,000

Advanced Platform: $70,000 to $150,000+

Conclusion

Developing a P2P crypto exchange requires careful planning, secure development, and a focus on providing a seamless user experience. The cost of developing a P2P exchange varies depending on factors like platform complexity, team, and security measures, but on average, it can range from $30,000 to $150,000+.

If you're looking to launch your own P2P crypto exchange, it's essential to partner with a reliable blockchain development company to ensure the project’s success and long-term sustainability. By focusing on security, user experience, and regulatory compliance, you can create a platform that meets the growing demand for decentralized crypto trading.

Feel free to adjust or expand on specific details to better suit your target audience!

2 notes

·

View notes

Text

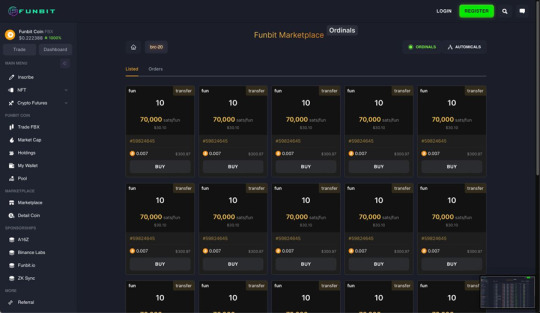

Top 6 Cryptocurrency Exchange Clone Scripts you should know in 2025

In thi Article about Top 6 Cryptocurrency Exchange Clone Scripts you should know in 2025, Read it out.

What is Cryptocurrency Exchange

To purchase, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and Litecoin, you go to an online marketplace called a cryptocurrency exchange. Cryptocurrency exchanges work much like stock exchanges, except instead of issuing or trading stocks, you trade digital currencies.

In simple terms, it’s where Buyers and sellers meet to exchange cryptocurrencies. You can buy cryptocurrency with ordinary money (such as dollars or euros) or swap one cryptocurrency for another. Some exchanges allow you to store your crypto in secure wallets held on the platform.

There are two main types:

Centralized exchanges (CEX)

Decentralized exchanges (DEX)

What is Cryptocurrency Exchange Clone Script

The Cryptocurrency Exchange Clone Script is a ready-made program that simulates the technical features and functionality of popular cryptocurrency exchanges such as Binance, Coinbase, Kraken, or Bitfinex. Compared to developing from scratch, the clone scripts significantly ease and shorten the time required to set up a cryptocurrency exchange network for an aspiring entrepreneur and firms.

These sort of scripts are somewhat equipped with all the basic features to run a cryptocurrency exchange, like user account management, wallet integration, order book, trading engine, liquidity management, and options for secure payment gateways. The whole idea of a clone script is to give you something out-of-the-box that can be customized, thus allowing you to skip the whole painful development process but still be able to modify the script to suit your needs.

Top 6 Cryptocurrency Exchange Clone Scripts

There are many clone scripts for cryptocurrency exchange development, but here are the top 6 of the cryptocurrency exchange clone script.

Binance clone script

Coinbase Clone Script

Kucoin Clone Script

Paxful Clone Script

WazirX clone script

FTX Clone Script

Binance clone script

A Binance clone script is a Pre-made software that is almost ready for use to create your own cryptocurrency exchange platform, along the way simulating Binance, one of the largest and most popular exchanges in the world. This “clone” is a reapplication of some of the features and functionality of Binance, but it can allow for some level of customization depending upon your particular brand and need.

Key Features:

User Registration and Login

Multi-Currency Support

Trading Engine

Multi-Layer Security

Admin Dashboard

Wallet Integration

KYC/AML Compliance

Liquidity Management

Mobile Compatibility

Referral and Affiliate Program

Trading Fees and Commission Management

Live Market Charts and Trading Tools

Coinbase clone script:

The Coinbase clone script is a ready-made solution that allows you to set up a cryptocurrency exchange platform exhibiting features and functionalities similar to the world’s most popular and user-friendly crypto exchange, Coinbase. These scripts are bundled with all the necessary features to run an exchange while still offering ample customization to cater to your branding and business requirements.

Key Features:

User Registration and Account Management

Fiat and Crypto Support

Secure Wallet Integration

Quick Buy/Sell Functionality

Multiple Payment Methods

P2P Trading

Admin Dashboard

Launchpad Functionality

Staking Feature

KYC/AML Compliance

API Integration

Kucoin Clone Script

A KuCoin clone script is a ready-made software solution replicating all functional attributes and operational features of the KuCoin, which can also be customized according to your brand name and business requirement specifications. Fast and feasible for launching your crypto exchange, the idea is to save yourself from the headaches of developing everything from scratch.

Key Features:

Spot trading

Margin trading

Future trading

Crypto derivatives

Advanced security transactions

Escrow protection

User registration

Wallet integration

Advanced analytics

Currency converter

Paxful clone script

A Paxful clone script is a ready-Made platform for opening a peer-to-peer cryptocurrency exchange for users to trade Bitcoin and other cryptocurrencies directly among themselves without any intermediaries. The script replicates the core features of Paxful operated using its server; you can customize it to your brand and business needs.

Key Features:

Secured Escrow Service

Multi Payment Processing

BUY/SELL Ad posting

Real-Time Data

Referrals & Gift Card options

Multi Language Support

Online/Offline Trading

Cold/Offline Wallet Support

FTX Clone Script

An FTX clone script is a ready-made software solution that will allow you to set up your own cryptocurrency exchange like FTX, which was formerly one of the largest crypto exchanges globally before going under in 2022. This script mimics the core features of FTX, such as spot trading, derivatives, margin trading, token offering, etc., so that you can fast-track the launch and operations of your own exchange with customizable branding and features.

Key Features:

Derivatives Trading

Leveraged Tokens

Spot Trading

User-Friendly Interface

KYC/AML Compliance

Staking Functionality

WazirX clone script

A WazirX Clone Script is a pre-made software solution for the creation of your cryptocurrency exchange platform akin to WazirX, one of the top cryptocurrency exchanges in India. The clone script replicating the essential elements, functionality, and WazirX’s user experience enables you to swiftly put together a fully fledged cryptocurrency exchange that would accept a number of digital assets and trading features.

Key Features:

Escrow protection

KYC approval

Trading bots

User-friendly interface

Stunning User Dashboard

SMS Integration

Multiple Payment Methods

Multiple Language Support

Benefits of Using Cryptocurrency Exchange Clone Scripts

The use of a cryptocurrency exchange cloning script entails great advantages, particularly if one is keen on starting an exchange without having to do the full development from scratch. Below, I have listed the primary advantages of using cryptocurrency exchange cloning scripts:

Cost-Effective

Quick and Profitable Launch

Proven Model

Customizable Features

Scalability

Multi-Currency and Multi-Language Support

Low Development Cost

Continuous Support and Updates

Why Choose BlockchainX for Cryptocurrency Exchange clone script

In the opinion of an entrepreneur set to develop a secure, scalable, and feature-loaded cryptocurrency exchange clone script, BlockchainX is the best bet. Since BlockchainX provides a full-fledged solution that replicates the features of flagship cryptocurrency exchanges such as Binance, Coinbase, and WazirX, the entrepreneur gets all the additional features required practically out of the box. With the addition of certain basic offerings such as spot trading, margin trading, and peer-to-peer (P2P) capabilities along with more advanced ones like liquidity management and derivatives trading, BlockchainX provides a holistic set of solutions to carve out an exchange rightly fitted for newbies and pros alike.

Conclusion:

In conclusion, the Top 6 Cryptocurrency Exchange Clone Scripts in 2025 are high-powered and feature-rich solutions which any enterprising spirit would find indispensable if they were to enter the crypto market very quickly and efficiently. Whether it be a Binance clone, Coinbase clone, or WazirX clone-these scripts offer dynamic functionalities that enhance trading engines, wallets, KYC/AML compliance, and various security attributes.

Choosing the right clone script, such as those provided by BlockchainX or other reputable providers, will give you a strong foundation for success in the dynamic world of cryptocurrency exchanges.

#cryptocurrency#cryptocurrency exchange script#exchange clone script#binance clone script#clone script development#blockchainx

2 notes

·

View notes

Text

P2P Crypto Trading: A Decentralized Way to Buy and Sell Bitcoin, Ethereum and Solana

Today we'll explore P2P trading, its mechanisms, advantages, legal aspects, and how to use it to buy cryptocurrencies like Bitcoin, Ethereum, Solana, and more. Additionally, both beginners and advanced traders can try P2P trading on Cryptomus, which makes the overall process even more enjoyable! Join us on this journey!

What is Peer-To-Peer technology?

A P2P network offers direct connections to other computers or users without a centralized server or intermediary. This approach uses resources more efficiently and is less vulnerable to system failures.

In this system, each computer (a peer) has equal status and seamlessly shares resources such as computing power. P2P is widely used in blockchain networks and file-sharing platforms, offering benefits such as reduced reliance on centralized protection.

What is Peer-to-Peer Trading?

Peer-to-peer (P2P) trading is a way of buying and selling cryptocurrencies where traders trade directly with each other on an exchange app or website. P2P technology is established when two or more personal computers connect via a Universal Serial Bus to transfer files. The p2p cryptocurrency exchange development acts as a regulator between both parties to ensure secure transactions. For example, both a beginner and an advanced trader can try P2P trading on BlockchainX. All you need to do is register a wallet, go through the KYC process, fund your wallet with your favorite cryptocurrency, and voila. You can start trading.

P2P trading platforms provide users with a marketplace-like experience, where buyers and merchants list their offers, negotiate terms, and complete transactions. These platforms often include features such as user ratings, escrow services, and dispute resolution to enhance trust and security. This decentralized approach has gained popularity in the cryptocurrency world because it offers greater privacy, lower fees, and fraud prevention.

Main Features of P2P Trading Platforms

Let's take a closer look at the key points of Peer-to-Peer trading:

Wide variety of assets: These platforms support a wide range of cryptocurrencies, allowing users to trade using their preferred cryptocurrencies.

Decentralization: P2P platforms operate without a central authority or server. All users within the network can initiate or complete transactions.

Payment flexibility: Customers choose from multiple payment methods, including bank transfers, cryptocurrency wallets, cash, and more.

Escrow services: They keep assets secure until both parties fulfill their obligations.

User feedback: People leave their comments and ratings in the cryptocurrency community.

Protection: P2P trading often involves fewer identity verification requirements, including KYC (Know Your Customer), compared to centralized exchanges.

How does P2P trading work?

In general terms, a P2P exchange is an online platform or marketplace for trading. When a trader and customer connect and are about to make a deal, the exchange activates the escrow tool. It's a smart contract that holds the cryptocurrency until both parties reach an agreement. Instead of signing a paper contract and trusting a third party to ensure the seller delivers the Bitcoin to you after you pay, the escrow tool does everything for you.

The most popular P2P trading platforms accept all popular cryptocurrency pairs, including BTC/ETH, BTC/USDT, and even fiat currency.

Key Steps for successful P2P trading:

To help you with trading, we've compiled all the steps that will fit most P2P exchanges.

Registration: Choose and register on a P2P platform, provide the necessary information, and complete the verification procedures. You can easily create an account that offers P2P trading, such as BlockchainX P2P exchange provides traders with a secure and reliable platform for buying and selling cryptocurrencies.

Establish protection: Consider the security of your assets and apply protection to your user account. Create a strong password and enable two-factor authentication (2FA); a second step in the form of an SMS with a one-time code can increase your confidence in the security of your funds. We recommend not reusing the same passwords across multiple sites and avoiding using personal information when creating passwords.

Create an offer: Once registered, create a trade offer by specifying the cryptocurrency quantity, price, and preferred payment method.

Matching and selection: The platform's algorithm matches your offer with suitable counterparties interested in the same cryptocurrency, ensuring compatibility. Search for the most suitable and profitable offer, then submit a trade request and wait for the trader to contact you.

Negotiation: Communicate with your trading partner through the platform's messaging system to discuss trade terms, preferred payment methods, and additional requirements.

Confirmation and Execution: Both parties confirm the terms of the trade, and the buyer sends payment using the agreed-upon method. Both parties follow through and fulfill the agreement, after which you wait for the funds to arrive in your wallet. Once you've verified that the correct amount has been received, click "Confirm" and release your portion of the payment. In any case, do not finalize the transaction or transfer your money until the cryptocurrency has been credited to you. If the merchant requests otherwise, please contact the support team.

Comments and ratings: Merchants can leave comments and ratings, promoting trust and responsibility within the P2P community.

Advantages of P2P Trading

P2P trading offers users several essential benefits:

Decentralization: As mentioned above, unlike traditional centralized exchanges, P2P trading allows users to directly exchange assets with each other without intermediaries.

Lower costs: By eliminating intermediaries, users often pay lower fees compared to centralized exchanges.

Flexibility: Users have the freedom to choose from a variety of payment methods and transaction terms.

Global access: P2P trading platforms allow users from all over the world to connect and trade without geographical restrictions.

Privacy: Direct interactions and the option for anonymous transactions protect users' identities.

Conclusion:

Peer-to-peer trading represents a powerful shift in the world of cryptocurrency, giving users control, flexibility, and privacy like never before. Whether you're just starting out or already an experienced trader, platforms like Cryptomus and BlockchainX make it easier and safer to engage in P2P trading. By understanding the mechanics, security features, and advantages, you can confidently explore this decentralized method of crypto exchange. Embrace the future of finance—start your P2P trading journey today!

0 notes

Text

Launching Your Own P2P Crypto Exchange: A Step-by-Step Guide

Introduction

The fastest growth of the cryptocurrency market has made peer-to-peer exchange increase in the world of trade. Unlike centralized exchanges, the P2P platforms function the trade or transaction without any third person for communication gap. Everyone has knowledge about exchange but not everyone knows how to develop and implement the crypto exchange. This will guide you to launch your own P2P crypto exchange in a detailed manner from the base to post-launch marketing.

What is P2P Crypto Exchange?

A P2P exchange is a decentralized platform that connects the buyers and sellers without any central authority performing trade. This platform allows users to trade their digital assets. The platform provides tools for trade is listing, price negotiation, payment tracking, and dispute resolution. To create your own p2p crypto exchange platform there are some steps to follow that are given below. The main reason for using the platform does not hold users' funds.

How Does Peer-to-Peer Trading Work ?

The P2P eliminates the third person, enabling users to interact and trade directly. Here are the how P2P is working in trade:

User Registration: Users provide personal information such as name, email, and sometimes phone number for registration.

Posting a Trade Offer: Sellers post offers specifying the cryptocurrency they want to sell, the fixed price, and payment methods they accept

Matching Buyers and Sellers: The platform provides a marketplace where buyers and sellers are matched based on their preferences.

Escrow Service: Once a trade is started, the P2P platform uses an escrow system to protect both users.

Payment and Release: If the buyer completes the payment using some method, the seller withdraws cryptocurrency from escrow to the buyer's wallet.

Dispute Resolution: if any conflicts begin the platform executes dispute resolution. The platform resolves the conflicts.

Steps to Launch Your Own P2P Crypto Exchange

If you want to launch your own P2P crypto exchange there are some steps to follow that are:

Understanding the P2P Exchange Model

Before beginning the development process, It is important to know about the P2P exchange model. Also have knowledge about the match of buyer and sellers, the importance of reputation systems, and the role of escrow services.

Trade facilitation through escrow

Emphasis on user reputation and dispute resolution

Discuss about the importance of a good user experience.

Planning and Conceptualization

It is the initial step that includes the process of defining purpose, target audience, planning a business strategy and also knowing about which theory or strategy you use in your exchange. This phase will give structure for your idea. With the correct planning structure you will create your platform with a strong base.

Define your target audience

Create a detailed business plan including revenue models.

Choosing the Right Tech Stack

The next step is to choose the technology you implement in your platform. Consider before choosing a tech stack with high performance and scalability. That matches your business revenue model for more profit. Also check that it has a proper database, blockchain integration and frameworks.

Frontend: React, Angular

Backend: Django, or Laravel

Blockchain integration: Ethereum, Bitcoin, or other blockchain nodes

Database: PostgreSQL, MongoDB

Implementing Security

In the crypto world security is the most important thing to consider in the creation of crypto exchange. In the platform a transaction begins in between any error occurs the payment is stuck that time the security needs most. There are many ways to secure your platform. Your platform includes two-factor authentication (2FA),Escrow services to protect trades,Encrypted communication,KYC/AML integration. By applying these security methods your platform has strong security measures.

Regulatory Compliance

The next step is a Regulation to follow for your platform. Implement KYC/AML procedures to ensure compliance with relevant regulations in your jurisdiction and the legal and regulatory landscape is essential for long term sustainability. By following these, your regulations go well. You may need:

A money transmitter license

Compliance with local AML and KYC laws

Legal advice to avoid future penalties or shutdowns

Testing & Launching the Platform

After the process the next phase is to test your platform with many of the testing methods. Check if it has any bugs in your platform and rectify it with some tools. Also create your launch strategy that creates many users to access your platform that make more revenues in your platform. In testing methods you include some basic testing like unit testing, integration testing, and user acceptance testing. By following these methods your platform is ready for launch.

Post-Launch Marketing

This is the last stage of launching your own crypto exchange that enhances the user experience. Attract and retain users is major for the success of your P2P exchange. Implement a successive marketing strategy, including social media marketing, content marketing, and community engagement. This gives your platform more users to access and more revenue is generated.

Types of P2P Crypto Exchange

There are several types of P2P exchanges depending on how the platform function trades:

Escrow-Based: Funds are held in escrow until payment confirmation.

Smart Contract-Based: Trustless trades using blockchain smart contracts.

Decentralized P2P DEXs: Fully decentralized, often built on DeFi protocols.

Ad-Based Platforms: Users post trade ads, and the platform helps with discovery.

Hybrid P2P Exchange: Provides P2P security and anonymity along with direct peer-to-peer transactions

Key Features of P2P Crypto Exchange

Here are the key features to make your P2P exchange platform more competitive should include:

Multi-currency wallet support

A successful P2P exchange should support a broad variety of cryptocurrencies and fiat currencies. Fiat support for global currencies to enable seamless local payments. Wallet integration for top cryptocurrencies like Bitcoin, Ethereum, USDT.

Real-time chat between users

Real-time messaging is critical for smooth communication during trades. Features should be secure, in platform chat between buyers and sellers. Attachment support to share payment proofs and screenshots.

Trade history and user ratings

Trust and transparency are the base of P2P trading. A rating system enables users to make informed decisions, visible trade history including number of trades, volume, and success rate. User reviews and ratings after each completed trade and also verified badges for identity verified users to enhance trustability.

Automated dispute resolution

Error can occur, so the platform must be ready to manage them efficiently by smart automation to flag common dispute triggers., AI powered defect to analyze chat logs and proof of payment and also manual moderator override for edge cases or complex issues.

Mobile app support

A well designed app increases engagement and ensures users can trade anytime, anywhere. So some features include android and iOS apps with full platform functionality, push notifications for trade updates and messages and optimized UX for on the go trading, verification, and wallet access.

Conclusion

Launching a successful Crypto Exchange platform requires best planning, expertise in technical and a strong commitment to security and legal compliance. By following these methods and steps you will launch your own crypto exchange platform in an excellence way also that is excellence in user experience, safety, compliance and growth. Now you are ready to launch your own Crypto Exchange development platform with a clear vision and mission.

0 notes

Text

Cryptocurrency Exchange Development: How to Start & Scale Your Platform

Cryptocurrency exchanges play a crucial role in the digital asset ecosystem, providing a platform for users to buy, sell, and trade cryptocurrencies. As blockchain technology advances, the demand for secure and efficient crypto trading platforms continues to rise. This article explores the essential steps to develop and scale a cryptocurrency exchange successfully.

Understanding Cryptocurrency Exchanges

What is a Cryptocurrency Exchange?

A cryptocurrency exchange is an online platform that enables users to trade digital assets such as Bitcoin, Ethereum, and other altcoins. These exchanges act as intermediaries, facilitating transactions between buyers and sellers while ensuring security and liquidity.

Types of Cryptocurrency Exchanges

Centralized Exchanges (CEX): Operated by a central authority, these platforms offer high liquidity and user-friendly interfaces but require KYC compliance.

Decentralized Exchanges (DEX): Peer-to-peer platforms without intermediaries, providing enhanced security and privacy but lower liquidity.

Hybrid Exchanges: Combining features of both CEX and DEX, offering security and liquidity benefits.

P2P Exchanges: Allow direct trading between users with minimal involvement from the platform.

Key Components of an Exchange Platform

Trading engine for order matching

Multi-currency wallet integration

Secure user authentication system

Liquidity management tools

Admin panel for monitoring and compliance

Market Research and Planning

Analyzing Crypto Market Trends

Before launching an exchange, conducting thorough market research is essential. Understanding market demand, user preferences, and competition will help design a successful platform.

Identifying Target Audience

Different users have varying needs, from institutional investors to retail traders. Identifying the target audience helps tailor the platform’s features and services.

Regulatory Compliance and Legal Considerations

Each country has unique regulations governing cryptocurrency exchanges. Researching legal requirements ensures compliance and prevents potential legal issues.

Business Model Selection

Revenue Models for Crypto Exchanges

Trading Fees: Percentage-based fees on trades.

Withdrawal Fees: Fees charged when users withdraw funds.

Listing Fees: Fees for adding new cryptocurrencies.

Subscription Plans: Premium features for paid users.

Market Making and Staking Services: Earning from liquidity provision and staking rewards.

Choosing the Right Business Model

A successful exchange should adopt a model that balances profitability and user experience. Analyzing competitors and user expectations will help in selecting the best strategy.

Legal and Regulatory Compliance

Importance of Compliance

Adhering to financial regulations prevents legal complications and enhances user trust. Exchanges must implement robust compliance measures.

Licensing Requirements

Different jurisdictions have varying licensing requirements, such as:

USA: Registration with the Financial Crimes Enforcement Network (FinCEN)

EU: Compliance with the General Data Protection Regulation (GDPR)

Asia: Country-specific regulations in China, Japan, and Singapore

AML and KYC Procedures

To prevent money laundering and fraud, exchanges must implement AML and KYC policies, requiring users to verify their identities before trading.

Technical Development of a Cryptocurrency Exchange

Choosing the Right Technology Stack

The technology stack determines the platform's efficiency and security. Popular technologies include:

Backend: Node.js, Python, or Golang

Frontend: React, Vue.js, or Angular

Database: PostgreSQL, MongoDB, or MySQL

Blockchain Integration: Ethereum, Binance Smart Chain, or custom blockchain solutions

Security Measures

Security is critical in exchange development. Best practices include:

Two-Factor Authentication (2FA) for user accounts

Cold Wallet Storage for securing funds

SSL Encryption for data protection

DDoS Protection to prevent attacks

Essential Features of a Crypto Exchange

User Registration and Authentication: Secure onboarding process with KYC verification

Multi-Currency Wallets: Supporting various cryptocurrencies

Trading Engine: Fast order matching and execution

Liquidity Management: Ensuring seamless trading experience

Payment Gateway Integration: Enabling fiat-to-crypto transactions

Admin Dashboard: Tools for monitoring and risk management

Liquidity Management

Liquidity is a key factor in an exchange’s success. Strategies to improve liquidity include:

Partnering with liquidity providers

Implementing market-making services

Offering incentives to traders

UI/UX Design Considerations

An intuitive design enhances user experience. Best practices include:

Simple navigation

Responsive mobile design

Customizable dashboards

Cryptocurrency Exchange Software Solutions

Custom vs. White-Label Solutions

Custom Development: High customization but costly

White-Label Software: Faster deployment with ready-made features

Blockchain Integration and Smart Contracts

Integrating blockchain enhances transparency and security. Smart contracts automate trading and eliminate third-party risks.

Payment Gateway and Fiat Integration

Offering fiat support increases accessibility. Compliance with banking regulations is necessary for smooth fiat transactions.

Marketing and User Acquisition Strategies

SEO Optimization for organic traffic

Social Media Campaigns to attract users

Referral Programs for community engagement

Customer Support and Community Management

Providing 24/7 support builds trust. Managing an active community through forums and social media enhances user engagement.

Scaling Your Cryptocurrency Exchange

Expansion strategies include:

Adding new trading pairs

Partnering with global crypto projects

Entering international markets

Challenges and Risks in Crypto Exchange Development

Regulatory uncertainties requiring constant updates

Security threats from hackers

Market volatility affecting liquidity

Future Trends in Cryptocurrency Exchanges

Growth of DeFi Exchanges

Rise of NFT trading platforms

Adoption of Layer-2 Scaling Solutions

Conclusion

Developing a cryptocurrency exchange requires careful planning, robust security, and a scalable strategy. Entrepreneurs entering this market must stay ahead of trends and regulations to succeed.

0 notes

Text

Cryptocurrency exchange development company

Dappfort is a leading cryptocurrency exchange development company committed to delivering high-quality, secure, and scalable trading platforms. With a strong focus on customer satisfaction, we have successfully developed and deployed various types of crypto exchanges tailored to our clients unique requirements. Our expert team ensures top-tier security, privacy, and reliability, fostering trust between business owners and their users. By leveraging our advanced cryptocurrency exchange solutions, including P2P trading and Bitcoin exchange systems, businesses can offer a seamless and highly secure trading experience. To explore how Dappfort can help you build a robust crypto exchange, schedule a consultation with our blockchain experts today.

Contact : +91 8838534884 Mail : [email protected]

#blockchain#cryptocurrency#web3community#cryptonews#crypto investors#web3 development#business#crypto#crypto traders#cryptocurrency exchange development#usa news#usa#uk#russia#spain#australia

1 note

·

View note

Text

How Smart Contracts Are Changing Cryptocurrency Development

Cryptocurrency development has come a long way since Bitcoin’s inception in 2009. While Bitcoin introduced the concept of decentralized digital money, it was the advent of smart contracts that revolutionized how blockchain technology is used today. Smart contracts enable the creation of decentralized applications (dApps), automate financial transactions, and power entire ecosystems like decentralized finance (DeFi) and non-fungible tokens (NFTs).

In this blog, we’ll explore how smart contracts are reshaping cryptocurrency development, their advantages, use cases, and what the future holds for this transformative technology.

What Are Smart Contracts?

Smart contracts are self-executing agreements stored on a blockchain, where the terms are directly written into code. Unlike traditional contracts that require intermediaries like lawyers or banks, smart contracts automate transactions based on predefined conditions.

For example, in a decentralized exchange (DEX), a smart contract can facilitate a trade between two parties without requiring a middleman. The transaction only executes when both parties meet their agreed-upon conditions.

Key Features of Smart Contracts:

Automation: Transactions execute automatically when conditions are met.

Transparency: The code is visible on the blockchain, ensuring trust.

Security: Data stored on the blockchain is immutable and tamper-proof.

Efficiency: Removes the need for manual verification, reducing time and costs.

How Smart Contracts Are Transforming Cryptocurrency Development

1. Enabling Decentralized Finance (DeFi)

Smart contracts have fueled the growth of DeFi, an ecosystem that eliminates traditional financial intermediaries. Developers are using smart contracts to build:

Decentralized Exchanges (DEXs): Platforms like Uniswap and PancakeSwap allow users to trade crypto assets directly.

Lending & Borrowing Protocols: Platforms like Aave and Compound let users lend or borrow crypto without a bank.

Yield Farming & Staking: Users can earn rewards by locking their assets in smart contract-based pools.

DeFi applications use smart contracts to automate transactions, ensuring trust and efficiency while reducing costs associated with traditional banking.

2. Powering Token Development and ICOs

Smart contracts have revolutionized token development by enabling the creation of custom cryptocurrencies. Using standards like ERC-20 (Ethereum) or BEP-20 (Binance Smart Chain), developers can launch tokens with predefined rules such as supply, transfer conditions, and burn mechanisms.

Additionally, smart contracts have made Initial Coin Offerings (ICOs) and Initial DEX Offerings (IDOs) more transparent and automated. Investors can send funds to a smart contract that automatically distributes tokens, reducing fraud and ensuring fairness.

3. Enforcing Security and Trust in Transactions

One of the biggest challenges in the cryptocurrency development is trust. Smart contracts solve this by enforcing rules programmatically. Unlike traditional financial agreements that require trust in a third party, smart contracts ensure that no transaction occurs unless all predefined conditions are met.

For example, in a peer-to-peer (P2P) marketplace, a smart contract can act as an escrow service, holding funds until both parties fulfill their obligations. This eliminates fraud and disputes.

4. Automating NFT Marketplaces

Smart contracts have fueled the rise of NFTs (non-fungible tokens), which represent ownership of digital or real-world assets like art, music, and real estate.

NFT marketplaces like OpenSea and Rarible rely on smart contracts to:

Mint NFTs with unique attributes.

Automate royalty payments for artists every time an NFT is resold.

Securely transfer ownership without intermediaries.

Without smart contracts, NFT transactions would require trust in centralized platforms, increasing risks of fraud and manipulation.

5. Streamlining Cross-Border Payments

Traditional cross-border transactions involve multiple intermediaries, resulting in high fees and long processing times. Smart contracts eliminate these inefficiencies by enabling:

Instant Settlements: Transactions settle within minutes rather than days.

Lower Costs: No need for banks, reducing transaction fees.

Transparency: Every transaction is recorded on a blockchain, preventing disputes.

Cryptocurrencies like XRP (Ripple) and Stellar (XLM) leverage smart contracts to provide efficient payment solutions for global remittances.

6. Enabling Decentralized Autonomous Organizations (DAOs)

Smart contracts are also driving the emergence of DAOs (Decentralized Autonomous Organizations)—communities governed by code instead of traditional management.

DAOs use smart contracts to automate decision-making and voting processes.

Members vote on proposals, and the smart contract executes actions based on the majority decision.

This creates transparent, democratic governance without centralized control.

Notable DAOs like MakerDAO and Aragon use smart contracts to manage decentralized governance efficiently.

Challenges of Smart Contract-Based Cryptocurrency Development

Despite their benefits, smart contracts come with challenges:

1. Coding Vulnerabilities

Poorly written smart contracts can have bugs or security loopholes. The DAO hack (2016) resulted in a $60 million loss due to a vulnerability in the contract’s code. Developers must rigorously audit their contracts to prevent exploits.

2. Scalability Issues

Smart contracts, especially on Ethereum, face high gas fees and slow transaction speeds during network congestion. Solutions like Layer 2 scaling (Optimistic Rollups, zk-Rollups) and alternative blockchains (Solana, Polygon) help mitigate this issue.

3. Regulatory Uncertainty

Smart contract-based applications operate in a gray legal area. Governments worldwide are still figuring out how to regulate DeFi, DAOs, and crypto tokens. Developers must ensure compliance to avoid legal risks.

4. Limited Flexibility

Once deployed, smart contracts are immutable, meaning bugs cannot be fixed easily. This makes rigorous testing crucial before deployment. Some projects use upgradeable contracts, but these come with their own security trade-offs.

The Future of Smart Contracts in Cryptocurrency Development

Smart contracts continue to evolve, and their future looks promising with several advancements:

1. AI-Powered Smart Contracts

AI integration could make smart contracts more dynamic, allowing them to analyze real-world data and adjust conditions autonomously.

2. Cross-Chain Compatibility

Current smart contracts are limited to individual blockchains. Technologies like Polkadot, Cosmos, and Chainlink’s CCIP enable interoperability between different blockchains, making smart contracts more versatile.

3. Zero-Knowledge Proofs (ZKPs) for Privacy

Smart contracts currently operate transparently, but ZKPs can enable private transactions, making DeFi and crypto payments more confidential.

4. Enhanced Security Measures

As smart contract adoption grows, more formal verification and AI-based auditing tools will emerge, making smart contracts even more secure.

Conclusion

Smart contracts have fundamentally changed cryptocurrency development by enabling automation, decentralization, and trustless transactions. From DeFi and NFT marketplaces to DAOs and cross-border payments, smart contracts are shaping the next era of blockchain applications.

Despite some challenges, innovations in scalability, AI integration, and cross-chain solutions are paving the way for smarter, more secure blockchain ecosystems. As cryptocurrency adoption continues to rise, smart contracts will remain at the heart of innovation, driving the industry towards a more efficient and decentralized future.

0 notes

Text

Navigating the Crypto Landscape: News, Trends, and Investment Strategies for 2025

Since its inception in 2009, Bitcoin has revolutionized how we perceive money and financial transactions. The cryptocurrency market is constantly evolving, with Bitcoin news emerging every second, influencing Bitcoin prices and mining activities. Staying informed is crucial, whether you're a seasoned investor or just starting. This article provides a comprehensive guide to navigating the crypto landscape, covering the latest news, emerging trends, and investment strategies for success in 2025.

Latest Crypto News and Market Trends

Bitcoin (BTC): As of February 2, 2025, Bitcoin is trading at approximately $99,383.00. Bitcoin price hit an all-time high of over $69,000 in November 2021. Analysts believe that Bitcoin’s bull market could extend past 2025 with institutional involvement and shifting market dynamics. Be aware of potential bear traps, which are coordinated selling efforts that cause temporary price dips in a long-term uptrend.

Ethereum (ETH): Ethereum is trading at approximately $3,096.90. Ethereum's dominance in fee earnings remained unchallenged in 2024, with a total of almost $2.5 billion, more than double that of TRON. Analysts are closely watching if Solana can compete with Ethereum to be the top Layer 1 blockchain. Ethereum faces significant resistance at $3,400, with over $1 billion worth of cumulative leveraged shorts set to be liquidated.

Altcoins: Litecoin (LTC) and Mantra (OM) are showing potential for gains. Solana (SOL) is trading at approximately $213.44. Solana is gaining traction with significantly higher daily transactions compared to Ethereum. XRP (XRP) is trading at approximately $2.84. Dogecoin (DOGE) is in focus with Grayscale launching a DOGE trust.

Stablecoins: Tether (USDT) reported net profits of $13 billion in 2024. Kraken is delisting Tether (USDT) and other stablecoins in Europe to comply with MiCA regulations.

Other News: Trump's tariffs may impact the crypto market. North Dakota introduces a bill to uphold Bitcoin mining rights. El Salvador ends mandatory Bitcoin acceptance for merchants. Malaysia is leveraging Blockchain and AI to fight fraud.

Investment Strategies and Tips

Diversification: Consider diversifying your crypto portfolio to mitigate risk. Investing in a mix of Bitcoin, Ethereum, and promising altcoins can provide a balanced approach.

Stay Informed: Keeping a close eye on BTC prices and Bitcoin news is essential due to the cryptocurrency market's volatility.

Utilize Crypto Exchanges: Use cryptocurrency exchanges, Bitcoin ATMs, or P2P marketplaces to buy Bitcoin.

Monitor Market Sentiment: Pay attention to where investment capital is flowing to gauge market sentiment and identify potential high-growth areas.

Be Aware of Regulatory Changes: Stay informed about regulatory developments, such as India's tax penalties on undisclosed crypto gains and Europe's MiCA regulations affecting stablecoins.

Long-Term Holding (HODL): Consider a long-term holding strategy, as demonstrated by Illinois' proposed state-run Bitcoin reserve with a five-year holding period.

Assess Risk Tolerance: Understand the risks associated with cryptocurrency investments and carefully consider your risk tolerance before investing.

Follow Expert Analysis: Look to crypto analysts for insights on market trends, potential breakouts, and future price targets.

Guides

How to Buy Bitcoin: Cryptocurrency Exchange: Use reputable exchanges like Coinbase to purchase Bitcoin. Bitcoin ATMs: Utilize Bitcoin ATMs for quick purchases. P2P Marketplace: Engage in peer-to-peer transactions for potentially better rates.

How to Stay Safe from Crypto Scams: Be wary of "pump-and-dump" schemes: Chainalysis reports that nearly 5% of all tokens launched in 2024 had patterns similar to pump-and-dump schemes. Beware of Telegram scams: Crypto scammers are increasingly using Telegram to target victims. Adjust slippage tolerance: When trading, adjust slippage tolerance to protect your crypto trades from being exploited by sandwich attacks.

How to Earn Free Bitcoin: Bitcoin Faucets: Explore opportunities to earn free Bitcoin through various Bitcoin faucets.

Examples of Successful Crypto Investments

Ethereum Trader: Some cryptocurrency traders are profiting millions from Ether’s downtrend through leveraged trading.

Thumzup Media Corporation: Doubled its Bitcoin holdings to 19.106 BTC, increasing its investment in digital assets to $2 million.

MicroStrategy: MicroStrategy’s stock offering was oversubscribed 3x due to the "Bitcoin Effect".

Tether: Reported net profits of $13 billion during 2024.

The cryptocurrency market offers exciting opportunities, but it also demands vigilance and informed decision-making. By staying updated on the latest news, understanding market trends, and employing sound investment strategies, you can navigate the crypto landscape successfully in 2025.

0 notes

Text

Best Decentralized Exchange in India: Why is it gaining Popularity and How to get started

It has been two years since the earth of cryptocurrencies experienced an evolution. More people entered this digital asset sphere and with that, the demand for more secure, efficient, and user-friendly platforms. While CEX has dominated for so long, recent trends show how fastly DEX is becoming an alternative option for many crypto traders and enthusiasts. Coming as a newcomer to this world of crypto trading in India, you would have definitely wondered, "What is the best decentralized exchange in India, and what do so many users prefer DEX over CEX?

We are going to venture into decentralized exchanges, the key advantages that they have, and why choosing the best decentralized exchange in India is important for your crypto journey in this blog.

What is a Decentralized Exchange (DEX)?

A decentralized trade is one kind of bitcoin exchanging stage that works without a go between or central specialist. While central exchanges depend on some sort of central server processing trades, DEXs rely upon block chain technology to enable peer-to-peer trading among users. Because a P2P model eliminates the need for a third party, users may keep complete control over their money.

They have developed as one of the foremost broadly utilized DEXs like Uniswap, SushiSwap, PancakeSwap, among numerous others. Most of them are savvy contract-based and utilize the blockchain organize either through Ethereum, Binance Savvy Chain, or Polygon for consistent exchanges.

Key Benefits of Decentralized Exchange

More Secure and Self-governance

The major advantage of using a decentralized exchange in India is that it gives you security and control. In central exchanges, you let a central entity handle your money and store them on their servers. In case the entity is hacked, you can lose your assets.

On the contrary, DEXs allow you to trade directly from your wallet. Since funds cannot be stolen from users in a centralized hack since control over private keys is maintained, as long as you keep your private keys and wallet safe, your funds are entirely under your control.

Privacy and Anonymity

Decentralized exchanges have generally included privacy upgrades. Most of the centralized platforms will require users to undergo KYC verifications where personal documents and sensitive information will be required. DEXs usually do not request such verification so that users can trade under pseudonyms.

Most traders in crypto, especially in a country like India where privacy of central platforms is of major concern, prefer DEXs due to private and anonymous trading.

Lower Fees and No Intermediaries

Decentralized exchanges also cost less. Most centralized exchanges tend to charge for trading, withdrawal, and other forms of service fees. Although DEXs do incur transaction fees-mostly in the form of gas fees when using blockchain networks such as Ethereum or Binance Smart Chain-it has fewer overhead costs; in most instances, such platforms will charge a small fee for trading or for providing liquidity.

In addition, lacking a central authority, it has no middlemen, hence the lesser overhead cost is passed on to the user. The DEX solutions are cost-efficient to traders in pursuit of maximum gains.

Diversity of tokens and assets

Decentralized exchanges support a large number of cryptocurrencies, including small-cap and niche tokens with a very slight probability of trading on centralized exchanges. This enables more extensive options for Indian traders to diversify the variety of their assets and trading pairs, allowing for room for diversification and investment diversity.

With DEXs, it is possible to swap tokens and other activities, like liquidity pools and yield farming-not always found within the confines of traditional exchanges.

Problems on Decentralized Exchanges

While decentralized exchanges go a long way toward representing many advantages, they also share a problem set of their own. A major challenge when it comes to user experience involves DEX platforms that often lack user-friendliness people get accustomed to with their centralized equivalents, especially for those new to exchanges. Learning curves are often steep, and users will need to work with wallets, smart contracts, and blockchain networks.

Another example is slippage, the price at which the trade is entered versus the price it is executed at. DEX's tend to be less liquid than CEX's so the price differences tend to be larger, especially on smaller trades.

To obtain the best decentralized exchange in India, some factors might be taken into account such as security, usability, access to tokens, and fees. Though there is no one-size-fits-all, below are some of the most popular decentralized exchanges that became popular in India among traders:

Uniswap (Ethereum Network)

Uniswap, perhaps one of the widely used DEXs in the world, carries an extensive user base within India as well. As it is based on Ethereum blockchain, its ability to allow an assortment of ERC-20 tokens to be traded in a very decentralized manner further strengthens its users' choice. Simple interface, high liquidity, and much more makes Uniswap remain one of the first alternatives for traders looking for low slippage as well as a safe trade experience.

SushiSwap (Ethereum and Polygon)

Another prevalent DEX that works on a few blockchain systems, such as Ethereum, Binance Savvy Chain, and Polygon, is SushiSwap. The platform offers yield farming, staking, and providing liquidity in addition to the other features. This is one of the alternatives through which the user can engage with an advanced interface for trading in India.

Pancake Swap (Binance Smart Chain)

This DEX is one of the top-performing ones on the Binance Canny Chain (BSC). It offers instant transactions with fees that are very low. Therefore, it should be a good platform for trading in India since one will not experience high gas fees, as happens when one uses Ethereum-based platforms. Pancake Swap further supports multiple tokens, such as most of the altcoins-small, and offers various DeFi services.

1inch (Ethereum and Polygon)

1inch is a decentralized exchange aggregator for a particular transaction, aggregating the best price across multiple DEXs. This minimizes slippage when trading on the platform while ensuring the best possible price to users. With hundreds of tokens it supports and available on both Ethereum and Polygon, it has made this a feasible option for Indian crypto traders.

How to set up decentralized exchange in India Setting up a decentralized exchange in India is not at all burdensome, even though some basic understanding of crypto-wallets and blockchain technology is required. Here is the simple guide to get started.

· Select a Crypto Wallet: Trading on a DEX requires a compatible wallet; you can use Meta Mask, Trust Wallet, or Coin base Wallet. These will allow you to store your private keys securely and help you interact with DEXs.

· Buy Cryptocurrency: Because a trader needs to have his or her cryptocurrency to begin trading, buying it will be the very first thing to do before transferring it to a wallet. This can be done through an easier method in a centralized exchange by purchasing coins, for example, Bitcoins or Ethers.

· Connect wallet to DEX: When you have a setup and funded wallet, connect it to your chosen DEX, Uniswap, Sushi Swap, or Pancake Swap using the interface of the platform.

· Trade: At this point, you can trade directly from your wallet, swap tokens, provide liquidity in pools, or even stake tokens to collect rewards.

Conclusion

It indicates that the increase in demand for more decentralized, privacy-based, and secure cryptocurrency trading is also the resultant increase of best decentralized exchanges in India. More Indian traders find an importance in DEXs, leading to the very popular platforms such as Uni swap, Sushi Swap, Pancake Swap, and 1inch. DEXs are revolutionizing crypto trading practices in ways that would not have been possible otherwise-superior security, more accessible fee, and wider availability of tokens.

#tonbigbull#Web3#decentralizedsocialnetworks#TheFutureIsNow#Cryptocurrency#Crypto#Bitcoin#Ethereum#Blockchain#cryptotrading#cryptonews

1 note

·

View note

Text

What is the P2P cryptocurrency exchange script? How does it benefit businesses?

A P2P (Peer-to-Peer) Cryptocurrency Exchange Script is a software platform that enables users to trade cryptocurrencies directly with each other without the need for a central authority or intermediary. This is a ready-to-use solution that businesses can tailor to launch their own P2P crypto exchanges.

Key Features of a P2P Cryptocurrency Exchange Script:

Multicurrency: The script could be incorporated to include multi-cryptocurrencies: Bitcoin, Ethereum and all other coins onward.

User-Friendly Interface: It features an easily navigated interface where users can browse offers, buy-and-sell orders, and other transactions.

Security Features: Protected by secure user authentication, data protection encryption and fraud prevention.

Business Benefits

Cost-Efficient

It will be really expensive and time-consuming to create a self-developed P2P exchange. However, the readily available script reduces this cost significantly for businesses to launch the exchange platform in no time and with minimum efforts.

Revenue Generation

P2P exchanges charge a fee for each transaction executed on the platform. This fee model gives businesses a regular income stream.

Market Growth

Enables the market to grow as the cryptocurrency adoption is increasing by allowing the business to offer a P2P platform as a space to enter this growing market.

Scalability

The script can be customized and scaled as and when required as the number of users increases on the platform.

Regulatory Compliance

It may be made regulatory compliant to suit the local culture requirements thereby making the use of it secure and trustworthy in users' perspectives.

In summary, a P2P Cryptocurrency Exchange Script provides a quick, cost-effective way for businesses to launch and manage their crypto exchange platform, offering both security and scalability.

0 notes

Text

How to Create a Binance Clone: A Comprehensive Guide for Developers

Binance is one of the world's leading cryptocurrency exchanges, providing a platform to buy, sell, and trade a wide variety of cryptocurrencies. creating a binance clone is an ambitious project that involves understanding both the core features of the exchange and the complex technologies required to manage secure financial transactions.

This guide will cover the features, technology stack, and step-by-step process required to develop a Binance clone.

1. Understanding the main features of Binance

Before diving into development, it is important to identify the key features of Binance that make it popular:

spot trading: The main feature of Binance where users can buy and sell cryptocurrencies.

Forward trading: Allows users to trade contracts based on the price of the cryptocurrency rather than the asset.

expressed: Users can lock their cryptocurrencies in exchange for rewards.

Peer-to-Peer (P2P) Trading: Binance allows users to buy and sell directly with each other.

wallet management: A secure and easy way for users to store and withdraw cryptocurrencies.

security features: Includes two-factor authentication (2FA), cold storage, and encryption to ensure secure transactions.

market data: Real-time updates on cryptocurrency prices, trading volumes and other market analysis.

API for trading:For advanced users to automate their trading strategies and integrate with third-party platforms.

2. Technology Stack to Build a Binance Clone

Building a Binance clone requires a strong technology stack, as the platform needs to handle millions of transactions, provide real-time market data, and ensure high-level security. Here is a recommended stack:

front end: React or Angular for building the user interface, ensuring it is interactive and responsive.

backend: Node.js with Express to handle user authentication, transaction management, and API requests. Alternatively, Python can be used with Django or Flask for better management of numerical data.

database: PostgreSQL or MySQL for relational data storage (user data, transaction logs, etc.). For cryptocurrency data, consider using a NoSQL database like MongoDB.

blockchain integration: Integrate with blockchain networks, like Bitcoin, Ethereum, and others, to handle cryptocurrency transactions.

websocket: To provide real-time updates on cryptocurrency prices and trades.

cloud storage: AWS, Google Cloud, or Microsoft Azure for secure file storage, especially for KYC documents or transaction logs.

payment gateway: Integrate with payment gateways like Stripe or PayPal to allow fiat currency deposits and withdrawals.

Security: SSL encryption, 2FA (Google Authenticator or SMS-based), IP whitelisting, and cold wallet for cryptocurrency storage.

Containerization and Scaling: Use Docker for containerization, Kubernetes for orchestration, and microservices to scale and handle traffic spikes.

crypto api: For real-time market data, price alerts and order book management. APIs like CoinGecko or CoinMarketCap can be integrated.

3. Designing the User Interface (UI)

The UI of a cryptocurrency exchange should be user-friendly, easy to navigate, and visually appealing. Here are the key components to focus on:

dashboard: A simple yet informative dashboard where users can view their portfolio, balance, recent transactions and price trends.

trading screen: An advanced trading view with options for spot trading, futures trading, limit orders, market orders and more. Include charts, graphs and candlestick patterns for real-time tracking.

account settings: Allow users to manage their personal information, KYC documents, two-factor authentication, and security settings.

Deposit/Withdrawal Screen: An interface for users to deposit and withdraw both fiat and cryptocurrencies.

Transaction History: A comprehensive history page where users can track all their deposits, withdrawals, trades and account activities.

Order Book and Market Data: Display buy/sell orders, trading volume and price charts in real time.

4. Key Features for Implementation

The key features that need to be implemented in your Binance clone include:

User Registration and Authentication: Users should be able to sign up via email or social login (Google, Facebook). Implement two-factor authentication (2FA) for added security.

KYC (Know Your Customer): Verify the identity of users before allowing them to trade or withdraw large amounts. You can integrate KYC services using third-party providers like Jumio or Onfido.

spot and futures trading: Implement spot and futures trading functionality where users can buy, sell or trade cryptocurrencies.

Order Types: Include different order types such as market orders, limit orders and stop-limit orders for advanced trading features.

real time data feed: Use WebSockets to provide real-time market data including price updates, order book and trade history.

wallet management: Create secure wallet for users to store their cryptocurrencies. You can use hot wallets for frequent transactions and cold wallets for long-term storage.

deposit and withdrawal system: Allow users to deposit and withdraw both fiat and cryptocurrencies. Make sure you integrate with a trusted third-party payment processor for fiat withdrawals.

Security: Implement multi-layered security measures like encryption, IP whitelisting, and DDoS protection. Cold storage for large amounts of cryptocurrencies and real-time fraud monitoring should also be prioritized.

5. Blockchain Integration

One of the most important aspects of building a Binance clone is integrating the right blockchain network for transaction processing. You will need to implement the following:

blockchain nodes: Set up nodes for popular cryptocurrencies like Bitcoin, Ethereum, Litecoin, etc. to process transactions and verify blocks.

smart contracts: Use smart contracts for secure transactions, especially for tokenized assets or ICOs (Initial Coin Offerings).

cryptocurrency wallet: Develop wallet solutions supporting major cryptocurrencies. Make sure wallets are secure and easy to use for transactions.

6. Security measures

Security is paramount when building a cryptocurrency exchange, and it is important to ensure that your platform is protected from potential threats. Here are the key security measures to implement:

ssl encryption: Encrypt all data exchanged between the server and the user's device.

Two-Factor Authentication (2FA): Implement Google Authenticator or SMS-based 2FA for user login and transaction verification.

Cold room: Store most user funds in cold storage wallets to reduce the risk of hacks.

anti phishing: Implement anti-phishing features to protect users from fraudulent websites and attacks.

audit trails: Keep detailed logs of all transactions and account activities for transparency and security audits.

7. Monetization Strategies for Your Binance Clone

There are several ways to earn from Binance clone:

trading fees: Charge a small fee (either fixed or percentage-based) for each trade made on the platform.

withdrawal fee: Charge a fee for cryptocurrency withdrawals or fiat withdrawals from bank accounts.

margin trading: Provide margin trading services for advanced users and charge interest on borrowed funds.

token lists: Charge projects a fee for listing their tokens on their platform.

Affiliate Program: Provide referral links for users to invite others to join the platform, thereby earning a percentage of their trading fees.

8. Challenges in creating a Binance clone

Creating a Binance clone is not without challenges:

Security: Handling the security of users' funds and data is important, as crypto exchanges are prime targets for cyber attacks.

rules: Depending on your target sector, you will need to comply with various financial and crypto regulations (e.g., AML/KYC regulations).

scalability: The platform must be able to handle millions of transactions, especially during market surges.

real time data: Handling real-time market data and ensuring low latency is crucial for a trading platform.

conclusion

Creating a Binance clone is a complex but rewarding project that requires advanced technical skills in blockchain integration, secure payment processing, and real-time data management. By focusing on key features, choosing the right tech stack, and implementing strong security measures, you can build a secure and feature-rich cryptocurrency exchange.

If you are involved in web development with WordPress and want to add a crypto payment system to your site, or if you want to integrate cryptocurrency features, feel free to get in touch! I will be happy to guide you in this.

0 notes

Text

A Comprehensive Guide to Cryptocurrency Exchanges, 2025

Since its start, the cryptocurrency exchange industry has seen significant developments. Founded in 2010, the first cryptocurrency exchange, "BitcoinMarket," only allows trading in Bitcoin. Cryptocurrency exchanges have so far only been a "revelation" and provide traders with an excellent platform for making quick profits.

Numerous cryptocurrencies, such as Bitcoin, have gained popularity, and their values fluctuate every second. When traders invest in them, price volatility is a crucial factor. In February 2024, the price of Bitcoin was $61,000; by March 2024, it had risen to $73,000. In just one month, the traders who had made Bitcoin investments in February made close to $12,000.

However, users or traders must contact cryptocurrency exchanges in order to generate all of these gains. These cryptocurrency exchange development company give traders the convenience of buying or selling Bitcoin. Understanding the fundamentals of cryptocurrency exchanges, their varieties, and the most successful ones is essential before delving deeply into it. In this tutorial to cryptocurrency exchanges, we have covered everything, starting with the fundamentals.

What Is A Cryptocurrency Exchange?

A website called Cryptocurrency Exchange makes it easier for buyers and sellers to safely trade cryptocurrencies like Bitcoin or Ethereum. To put it simply, a cryptocurrency exchange platform links two or more people who want to purchase or sell cryptocurrency. With this platform, any user can quickly convert their fiat money into a cryptocurrency asset or vice versa. These platforms also offer a number of features to aid traders and improve the process.

Generally speaking, an ideal cryptocurrency exchange's growth is determined by two factors: the trading fees it receives and the security measures it has. Digital trading systems frequently face security concerns, therefore traders should seek out a highly secure exchange. But the bigger the security, the higher the exchange's trading cost will be.

The amount that cryptocurrency exchanges take in order to track or monitor a user's cryptocurrency trade is known as the trading fee. The exchange makes money by charging traders a nominal commission fee in order to maintain security. By providing distinctive and varied trading choices, exchanges have recently increased the number of ways that users can profit from their transactions. Notably, cryptocurrency exchanges function similarly to stock exchanges, except they charge far greater trading costs.

Now that we know what a cryptocurrency exchange is, let's discuss the different kinds of cryptocurrency exchanges.

Types of Cryptocurrency Exchanges

Depending on their functionality and trading preferences, cryptocurrency exchanges can be divided into a variety of forms. This is the diversification of cryptocurrency exchanges as a result.

Centralized Cryptocurrency Exchanges (CEX): A middleman or other third party oversees and controls the trading activities on centralized exchanges. Centralized exchanges can be categorized according to their mode of operation as

P2P (Peer to Peer Ad based & Order Book-based) cryptocurrency exchanges

OTC (Over the Counter) cryptocurrency exchanges

Derivative trading cryptocurrency exchanges

Margin trading cryptocurrency exchanges

Leverage trading cryptocurrency exchanges

Decentralized Cryptocurrency Exchanges (DEX): Direct trading is possible on decentralized cryptocurrency exchanges (DEX) without the requirement for outside oversight. One way to explicitly arrange the DEX exchanges is as follows:

Orderbook based DEX

DEX with AMM feature

DEX aggregator

Hybrid Cryptocurrency Exchanges: For optimal performance, hybrid exchanges combine the benefits of decentralized and controlled exchanges. The user experience, speed, privacy, and liquidity of these exchanges are all superior.

In the cryptocurrency ecosystem, these are the most prevalent kinds of exchanges. Every kind of trading has advantages and disadvantages. Let's now examine how Crypto Exchange operates.

How Do Cryptocurrency Exchanges Work?

Crypto exchanges operate differently depending on whether they are decentralized or centralized. Crypto buyers use advertisements and an escrow wallet to connect with the appropriate sellers in P2P ad-based centralized exchanges. The user can conveniently purchase or sell cryptocurrency on a P2P ads-based exchange after completing KYC and linking a wallet. The two most notable instances of a P2P exchange based on advertisements are LocalBitcoins and Remitano.

After completing KYC, individuals can convert their fiat money into cryptocurrencies immediately on P2P order-based exchanges, which also offer live prices and charts. An order will be executed according to the trader's specifications (such as a market order, limit order, or stop order) and all they need is a cryptocurrency wallet. To complete the order and receive the cryptocurrency in their wallet, users will need to pay a minor trading fee. Binance is the best illustration of how trade occurs on a centralized exchange that uses order books.

This is a broad summary of how order book-based centralized exchanges operate.

Before using a cryptocurrency exchange, both the buyer and the seller should have a working trading account.

Enough money should be placed into the wallet to start trading.

The buyer can place an order after selecting their desired trading option (such as spot, margin, future derivatives, etc.). He or she can also choose to screen the trade execution using tools like a market order, limit order, or stop order.

Order matching will be processed by the trade engine in accordance with the specified parameters.

The buyer's account will be debited with the fiat amount that corresponds to the asset purchase and trading fees.

The cryptocurrency assets will go into the buyer's wallet, and the money will go into the seller's wallet.

Regarding decentralized exchanges, customers can begin trading as soon as they link their wallet to the platform. One significant benefit of these exchanges is that KYC is not required. In this case, cryptocurrencies can be exchanged for one another and fiat money is not used. The site collects a slippage fee and a minor trading cost in order to facilitate switching. Decentralized exchanges offer other revenue streams, such as yield farming and staking, in addition to the trading option. Pancakeswap is the best illustration of how trade occurs in a decentralized exchange based on AMM.

Popular Cryptocurrency Exchanges

Here is the list of the top 10 cryptocurrency exchanges with a significant user base and massive daily trading volume.

Binance

Coinbase

Kraken

Bybit

OKX

KuCoin

CoinDCX

Bitstamp

Huobi

WazirX

Popularity, user count, and average trade volume are used to construct the ranking of the top cryptocurrency exchanges. Crypto exchanges typically keep their credibility by providing an easy-to-use trading interface. They also carry advances that allow them to stay ahead of the competition. Crypto exchanges may have streamlined growth in the future and in the present with these crucial elements.