#Payroll management services

Text

Recruitment Process Outsourcing & Recruitment Services – Mynd

Mynd’s recruitment services help you manage end-to-end recruitment process with the help of effective and efficient recruitment strategy through their recruitment services & automation.

#mynd solution#account payable management#myndsolution#payroll management services#compliance management software#hr outsourcing services#accounts payable services#vendor management software#vendor management system#payroll software

0 notes

Link

#payroll management#payroll management software#payroll management services#Payroll#management services

0 notes

Text

With reliability, efficiency and attention to detail, we give our clients peace of mind knowing their soft services are in good hands.

Experience the difference with Alta Global, where excellence meets innovation in facility management.

With a team of experienced professionals and the latest technology, we offer bespoke solutions for the underlined services, designed to meet your specific needs.

#payroll management services#paycheck companies#employee payroll management system#payroll in india#hr and payroll services#payroll management system#payroll processing companies#payroll agency#payroll service#payroll provider

0 notes

Text

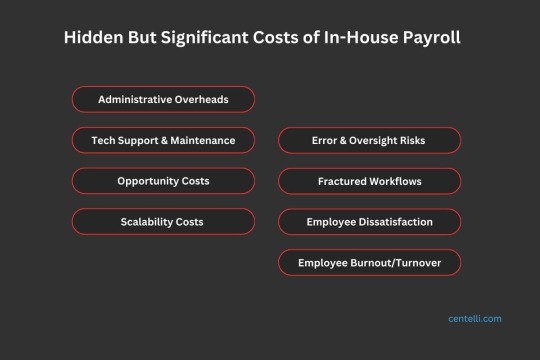

Know the Hidden Cost of Doing Payroll In-House

The cost of doing payroll in-house can be much higher than you might realize. While expenses such as payroll staff salaries, software, and office supplies are apparent, they’re just the top layer!

Beneath this surface, numerous hidden costs—both tangible and intangible—can quickly add up. These can include mounting overheads, inefficient workflows, compliance risks, workload stress leading to employee burnout, and more.

Identifying these hidden costs allows you to accurately assess:

How efficient and effective your payroll department is.

What needs to be improved, and what should your course of action be?

Is it becoming increasingly expensive?

So, should you continue managing payroll in-house or explore outsourced payroll option? Well, it’s entirely up to you, but having the full picture helps!

Continue reading to reveal the hidden layers of in-house payroll management costs…

The True Cost of In-House Payroll Is Higher Than You Think

When managing a payroll process, some costs may not be fully perceived or understood. While these costs might not be immediately obvious, their impact can significantly affect the overall financial and operational health of your business.

Consider these key hidden or less obvious costs for a comprehensive evaluation of what you’re truly spending on your in-house payroll processes:

1. Opportunity Cost of Time Spent on Payroll Tasks

Managing your payroll in-house means dedicating significant time to routine and tedious tasks such as data entry, salary calculations, and tax computation. This diverts your HRM team’s valuable time away from more strategic activities like talent acquisition, employee engagement, and performance optimization.

2. Data Update, Error Correction, and Reconciliation Costs

Payroll errors, such as miscalculated deductions or missed deadlines, can cost you dear. The financial and resource burden of correcting these mistakes and reconciling discrepancies can be significant. Additionally, it is crucial to update your data regularly; otherwise, inefficiencies may disrupt your payroll and cash flow cycle.

3. Payroll Compliance Risk and Regulatory Costs

Keeping up with prevailing payroll compliance requirements and regulations incurs additional costs. You need knowledgeable people to handle your payroll process and internal audits. Failure to ensure compliance can attract inspections from authorities, resulting in penalties and fines.

So, your team must stay updated on compliance to avoid legal troubles.

4. Salary Software/System Maintenance Expenditure

Beyond the initial investment in payroll software and systems, you also face ongoing costs for updates, security measures, and infrastructure support. These expenses are often not anticipated in advance, which can cause discomfort eventually as they quickly accumulate.

5. Internal Payroll Staffing and Training Expenses

Pre-trained payroll experts come at a high cost due to rising wage demands. On the other hand, training new talent involves additional expenditures, time, and resource allocation. Furthermore, continuously upskilling staff on updates to payroll software, systems, and compliance regulations is both time-consuming and costly.

6. Staff Benefits Administration Expenses

Employee benefits management involves tasks such as handling health insurance, retirement plans, paid time off, and other benefits. Managing all these tasks internally—enrolment, eligibility verification, claims processing, and reporting—is complex and resource-intensive. It requires significant costs for personnel, software, and training.

7. Tax Deduction at Source (TDS) Return Filing Costs

Accurate payroll tax preparation and filing are crucial to avoid significant costs related to errors, penalties, and audits. Payroll taxes involve complex calculations, numerous forms, and strict deadlines. Even minor mistakes can result in hefty fines, interest charges, and the need for costly legal assistance.

8. Spendings on Employee Data Security

This is one painful cost of doing payroll in-house that you would definitely want to avoid, right?

10. Payroll Scalability and Associated Costs

As your business grows, payroll management becomes increasingly complex. Scaling payroll operations demands additional resources, time, and expertise, which can impact operational efficiency. Hiring new employees, expanding to new locations, or adjusting payroll structures also becomes cost intensive.

11. Impact of Payroll Inefficiencies on Business Reputation

Frequent payroll errors or delays can harm employee satisfaction and morale and can also damage your company’s reputation over the long term. This impact extends beyond your employees, potentially tarnishing your brand image with external stakeholders.

The cost of reputational damage can lead to lower employee trust, reduced customer confidence, and a loss of business. No business owner would want this!

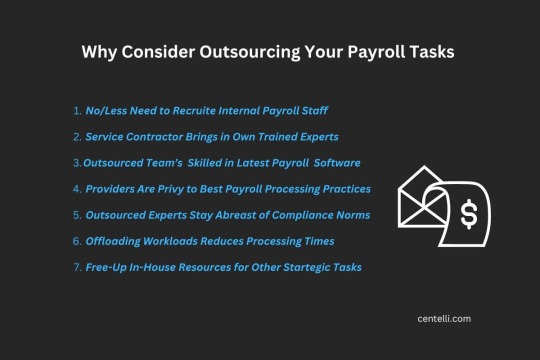

Mitigating the Financial Burdens of In-House Payroll Management Via Outsourcing

While managing payroll in-house offers complete control over data and processes, it requires substantial resources, expertise, and constant maintenance, which means significant capital and costs.

Hiring a professional payroll outsourcing service, in contrast, offers a strategic opportunity to avoid the hassle and mitigate (or even reduce) the hidden costs associated with in-house payroll processes.

Here’s how?

a. Enhance Internal HR Team Efficiency

Or you could even opt for partial outsourcing to relieve your internal payroll team of heavy workloads.

b. Improve Payroll Compliance

Payroll service providers employ experts who are adept at navigating the complex and frequently changing landscape of payroll tax laws and labour regulations. Their expertise helps mitigate compliance issues and avoid costly penalties, enhancing your business’s compliance and reputation.

c. Easily Scale Your Processes

Unlike internal payroll management, which may require additional hires and resources as your company grows, outsourcing offers a highly flexible solution. Most payroll providers can seamlessly adapt to your evolving needs, whether hiring new employees, expanding to new locations, or adjusting payroll structures.

d. Streamline Overall Payroll OPEX

Outsourcing streamlines your payroll operations by eliminating direct expenses, such as salaries and benefits for internal payroll staff. Additionally, it alleviates intangible pressures on internal HR teams, helping prevent burnout. Payroll providers often leverage economies of scale to offer more cost-effective solutions.

End Note on Effective Cost of Doing Payroll In-House

The actual cost of doing payroll internally extends beyond just salaries and infrastructure. Recognizing those hidden and sometimes overlooked expenses is key to understanding how they strain your internal payroll setup.

Outsourcing payroll could be a more cost-effective option. It’s always a great time to review your payroll processes and consider outsourcing to make the most of your resources and cut down on hidden costs.

You can reach out to us to book a free consultation with us to learn how we can help you save up to 35-65% in costs.

#Payroll Management Services#Payroll Services#payroll tax services#Tax services#Online tax services#Payroll tax Preperations

0 notes

Text

What is Management Payroll?

In the business world, efficient management of payroll is crucial to ensuring the smooth operation of any organization. But what exactly is management payroll? This blog aims to demystify the concept, explaining its components, benefits, and the best practices for handling payroll effectively.

Understanding Management Payroll

Management payroll refers to the systematic process of administering and overseeing employee compensation, which includes wages, salaries, bonuses, deductions, and other financial aspects related to employment. It encompasses a range of tasks that ensure employees are paid accurately and on time, adhering to both company policies and regulatory requirements.

Key Components of Management Payroll

Salary and Wages Calculation:

Base Pay: This is the fixed amount of money an employee earns, usually determined by their job role, experience, and industry standards.

Overtime Pay: Additional compensation for hours worked beyond the regular working hours.

Bonuses and Incentives: Extra earnings are provided based on performance or achieving certain targets.

Deductions:

Taxes: Federal, state, and local taxes that need to be withheld from employee paychecks.

Benefits: Contributions towards health insurance, retirement plans, and other employee benefits.

Garnishments: Court-ordered deductions for debts such as child support or loan repayments.

Payroll Taxes and Compliance:

Employer Contributions: Payments made by employers towards Social Security, Medicare, unemployment insurance, and other mandatory contributions.

Compliance: Ensuring adherence to employment laws and regulations, including minimum wage, overtime pay, and tax filing requirements.

Record Keeping:

Maintaining accurate records of all payroll transactions, employee hours, and compensation details for auditing and reporting purposes.

Benefits of Effective Payroll Management

Accuracy and Timeliness:

Ensures employees are paid accurately and on time, which boosts morale and trust in the organization.

Reduces errors that could lead to financial discrepancies and legal issues.

Regulatory Compliance:

Helps the organization comply with various labour laws and tax regulations, avoiding penalties and legal complications.

Employee Satisfaction:

Transparent and fair payroll practices enhance employee satisfaction and retention.

Efficient payroll management can lead to better financial planning and benefits utilization by employees.

Operational Efficiency:

Streamlined payroll processes save time and reduce administrative burdens, allowing HR and finance teams to focus on strategic initiatives.

Best Practices for Managing Payroll

Invest in Payroll Software:

Using reliable payroll software automates calculations, tax filings, and record-keeping, reducing the likelihood of errors.

Stay Updated on Laws and Regulations:

Regularly update payroll policies to comply with changing labour laws and tax codes.

Attend workshops or training sessions to stay informed about payroll management trends and best practices.

Conduct Regular Audits:

Periodically review payroll processes and records to identify discrepancies and areas for improvement.

Implement internal controls to prevent fraud and ensure accuracy.

Communicate with Employees:

Provide clear information about payroll policies, deductions, and benefits.

Establish a channel for employees to address payroll-related queries and concerns.

Maintain Confidentiality:

Ensure sensitive payroll information is securely stored and only accessible to authorized personnel.

Implement data protection measures to prevent breaches and unauthorized access.

Conclusion

Management payroll is a critical aspect of running a successful business. By understanding its components and implementing effective practices, organizations can ensure smooth payroll operations, maintain compliance, and enhance employee satisfaction. Investing in robust payroll systems and staying informed about regulatory changes are key steps towards achieving efficient payroll management.

0 notes

Text

0 notes

Text

0 notes

Text

youtube

#employee tracking app#payroll management software#payroll software#payroll software india#payroll management systems#payroll management services#Youtube

0 notes

Text

The Essential Guide to Payroll Processing and Management Services

In today's fast-paced business world, efficient payroll processing and management are critical to the smooth operation of any company. Whether you're a small business owner or managing a large enterprise, understanding payroll management services can save you time, reduce errors, and ensure compliance with tax regulations. This guide will explore the key aspects of payroll management services, their benefits, and how to choose the right provider for your business.

What is Payroll Processing?

Payroll processing involves the administration of an employee's financial records, including the calculation of wages, tax deductions, and the issuance of payments. It also includes the preparation of various reports and compliance with legal requirements. The main steps in payroll processing include:

Collecting Employee Information: Gathering data such as hours worked, salaries, and benefits.

Calculating Pay: Determining gross pay, deductions (taxes, insurance, retirement contributions), and net pay.

Issuing Payments: Disbursing salaries through direct deposit, checks, or other methods.

Reporting and Compliance: Preparing tax forms, compliance reports, and other documentation required by law.

The Role of Payroll Management Services

Payroll management services go beyond the basic payroll processing tasks to offer a comprehensive solution for handling all aspects of payroll. These services can include:

Tax Compliance: Ensuring that all payroll tax obligations are met accurately and on time.

Benefits Administration: Managing employee benefits such as health insurance, retirement plans, and other perks.

Time and Attendance Tracking: Automating the tracking of employee work hours and attendance.

Employee Self-Service: Providing online portals for employees to access pay stubs, tax documents, and other payroll-related information.

Reporting and Analytics: Offering detailed reports and analytics to help businesses make informed decisions.

Benefits of Outsourcing Payroll Management

Accuracy and Compliance: Professional payroll services ensure accurate calculations and compliance with ever-changing tax laws and regulations.

Time Savings: Outsourcing payroll frees up time for business owners and HR staff to focus on core business activities.

Cost Efficiency: Reduces the need for in-house payroll staff and infrastructure, leading to cost savings.

Security: Protects sensitive employee data with advanced security measures.

Scalability: Easily scales with your business as it grows, accommodating changes in workforce size and complexity.

How to Choose the Right Payroll Management Service Provider

Selecting the right payroll management services provider is crucial for ensuring a seamless payroll process. Here are some factors to consider:

Reputation and Experience: Look for providers with a proven track record and experience in your industry.

Range of Services: Ensure the provider offers all the services you need, from basic payroll processing to comprehensive management solutions.

Technology and Integration: Choose a provider with modern, user-friendly technology that can integrate with your existing HR and accounting systems.

Customer Support: Assess the quality of customer support, including availability, responsiveness, and expertise.

Pricing: Compare pricing models and ensure there are no hidden fees.

Conclusion

Effective payroll processing and management are vital for the success of any business. By outsourcing these tasks to a reliable payroll management service provider like Capleo Global, a leading staffing and payroll company, you can ensure accuracy, compliance, and efficiency, allowing you to focus on growing your business. Take the time to evaluate your needs and choose a provider that aligns with your goals and values. With the right partner, such as Capleo Global, payroll management can become a seamless and stress-free part of your business operations.

0 notes

Text

Streamline Payroll with MYND Solution’s Intelligent Software

Experience streamlined payroll with MYND Solution’s Enterprise Payroll System. MyPay centralizes and standardizes payroll processes, offering comprehensive features for calculating salaries, managing taxes across multiple countries, and planning employee benefits. With high configurability, MyPay adapts to unique requirements, providing a unified solution without the need for different versions. Simplify and optimize your payroll management with MYND’s intelligent, adaptable software.

#Payroll Management Services#Payroll Management Solution#payroll management software#Finance and Accounting#MYND Solution

0 notes

Text

Payroll Management Services | Ma Foi

Looking for payroll compliance solutions for your organization? Ma Foi's Payroll Services in India ensures statutory and legal compliance when it comes to managing your employees payroll.

0 notes

Text

Soft Services

Focused on reliability, efficiency, and attention to detail, we bring peace of mind to our clients, knowing that their soft service needs are in capable hands. Experience the difference with Alta Global, where excellence meets innovation in facility management.

With a team of seasoned experts and state-of-the-art technology, we offer customized solutions covering underlined services, designed to precisely address your unique needs.

Integrated Facility Management

Housekeeping & Cleaning Services

Pantry / Cafeteria Services

Gardening / Horticulture Services

Specialized Services

Pest Control Services

Deep Cleaning Services

Upholstery Cleaning

Facade Cleaning

#payroll management services#employee payroll management system#paycheck companies#payroll agency#payroll in india#payroll processing companies#hr and payroll services#payroll provider#payroll management system#payroll service

0 notes

Text

Reasons Why Companies Choose Payroll Outsourcing Services

Say Goodbye to Payroll Headaches: Discover the Top Reasons Why Companies Choose Payroll Outsourcing Services

As a business owner, one of the most time-consuming and complex tasks you have to deal with is payroll management. From calculating salaries to deducting taxes and ensuring compliance with legal regulations, it can be a daunting process that often results in headaches. But what if there was a way to eliminate these payroll headaches and free up your time for more important tasks? That’s where payroll outsourcing services come in.

Payroll outsourcing services entail giving a third-party provider control over your company’s payroll administration. These service providers are experts in managing every facet of payroll, including filing taxes, processing payments, and creating reports. Through the utilization of their specialized knowledge, companies may optimize their payroll procedures and concentrate on their primary tasks, thus increasing productivity and cutting expenses.

Benefits of Payroll Outsourcing Services

Making the choice to outsource payroll can help your company in a number of ways. It saves you time, to start. Payroll outsourcing services eliminate the need for you to spend hours every month on payroll-related documentation and salary calculations. Alternatively, you could concentrate on calculated plans that increase revenue and profitability.

The second benefit of outsourcing payroll is compliance and accuracy. Payroll providers ensure that your firm stays up to speed and avoids costly mistakes by being well-versed in the constantly changing tax laws and regulations. They also handle all the paperwork, which includes filling out tax returns and preparing W-2 forms, to further reduce your stress.

Payroll outsourcing services are also scalable. Payroll management gets more complicated as your company expands. You won’t need to buy pricey software or hire and train more employees to handle the extra workload if you engage with a payroll management business.

Common Payroll Headaches Faced by Businesses

It’s crucial to comprehend the typical payroll issues that firms have before diving into the reasons behind their decision to use payroll outsourcing services. The difficulty of payroll computations is among the most common problems. Time-consuming and error-prone computations are required, ranging from subtracting taxes and employee benefits to factoring in overtime and incentives.

Ensuring compliance with constantly evolving tax legislation presents another challenge. Small businesses, in particular, often find it challenging to stay updated on tax laws. Penalties and fines may be imposed for breaking these rules, which will increase the payroll load.

Lastly, payroll administration requires significant documentation and paperwork. From maintaining employee records to generating reports, the administrative tasks can quickly become overwhelming, especially for small businesses with limited administrative staff.

Top Reasons Why Companies Choose Payroll Outsourcing Services

Having discussed the common payroll problems faced by organizations, let’s now explore the key factors that affect their choice to opt for payroll outsourcing services.

Expertise and Accuracy: Access to a group of professionals with payroll management expertise is made possible by payroll outsourcing services. These experts guarantee accuracy and compliance since they are knowledgeable about the intricacies of tax laws and payroll computations.

Time and Cost Savings: By outsourcing your payroll, you save valuable time that can be redirected toward core business activities. Furthermore, payroll administration firms frequently provide affordable options that do away with the requirement for pricey software and lower the possibility of costly mistakes.

Enhanced Data Security: Payroll outsourcing services prioritize data security. They employ robust security measures to protect sensitive employee information, reducing the risk of data breaches and identity theft.

Improved Efficiency: With payroll outsourcing, you no longer have to worry about manual calculations and paperwork. Automation streamlines the process, reducing the chances of errors and allowing for smoother payroll management.

Scalability and Flexibility: As your business grows, your payroll requirements will evolve. Payroll outsourcing services offer scalability, allowing you to easily accommodate changing needs without the hassle of additional staffing or software upgrades.

How Payroll Outsourcing Services Work

Having persuaded you of the advantages of payroll outsourcing, let’s examine these services’ operation in more detail.

Initial Consultation: The first step is to consult with a payroll management company to discuss your specific requirements. This includes the number of employees, pay frequency, and any unique payroll needs your business may have.

Data Collection: You have to grant the chosen payroll provider access to the necessary payroll and employee data after choosing them. This usually contains details regarding the identities, hours worked, and any benefits or deductions received by the employees.

Payroll Processing: The payroll management company takes care of all the calculations, including gross wages, taxes, and deductions. They generate paychecks or direct deposits for your employees, ensuring accuracy and compliance.

Tax Filing and Compliance: Tax-related duties including W-2 form preparation, tax return filing, and guaranteeing adherence to local, state, and federal regulations are handled by payroll outsourcing companies.

Reporting and Analytics: These services handle payroll processing as well as provide comprehensive reporting and analytics to assist you in understanding your labor expenses, employee patterns, and other payroll-related information.

Considerations for Selecting a Payroll Management Firm

Reputation and Experience: Select a payroll provider that has a solid reputation and many years of experience. To assess a company’s credibility and expertise level, look for testimonials and recommendations from previous clients.

Services Offered: Assess the range of services offered by the payroll management company. Ensure they can handle your specific payroll needs, such as tax filing, benefits administration, and timekeeping.

Technology and Integration: Consider the payroll provider’s technology infrastructure and integration capabilities. Ensure they offer user-friendly software that can seamlessly integrate with your existing systems.

Compliance and Security: Payroll providers must prioritize compliance and data security. Inquire about their security protocols, data backup procedures, and compliance with relevant regulations.

Customer Support: Excellent customer support is essential when it comes to payroll outsourcing. Ensure the payroll management company offers responsive and knowledgeable support to address any issues or concerns.

Cost Savings and ROI of Payroll Outsourcing Services

Even while it might not be the main incentive, saving money is a significant advantage of adopting payroll outsourcing services. You can cut expenses on payroll personnel recruiting and training, software and hardware purchases, and potential fines for payroll errors by outsourcing your payroll.

The affordable packages that payroll management companies usually offer can be advantageous to businesses of all sizes. These packages can be tailored to your requirements by only charging for the services you use. This flexibility guarantees a healthy return on investment and prudent use of your funds.

Payroll outsourcing services not only reduce direct costs but also free up time and resources, which results in indirect savings. You can concentrate on projects that generate income and strategic plans that advance the expansion of your company when you have more free time.

Tips for a Smooth Transition to Payroll Outsourcing Services

Making the move to payroll outsourcing services may seem overwhelming, but it can go more smoothly if you prepare ahead of time and take the right steps. You can make the move with the following advice:

Evaluate Your Current Payroll Processes: Before outsourcing, assess your existing payroll processes and identify areas that need improvement. This will help you communicate your requirements effectively to the payroll management company.

Choose the Right Provider: Spend some time finding and evaluating payroll management providers that fit your company’s requirements. Take into account elements like experience, reputation, and the variety of services provided.

Communicate with Your Employees: Inform your employees about the transition to payroll outsourcing services. Address any concerns they may have and provide them with the necessary information regarding their paychecks and benefits.

Collaborate with the Provider: Work closely with the payroll management company during the transition phase. Provide them with accurate and up-to-date employee data to ensure a seamless payroll processing experience.

Monitor the Transition: Keep a close eye on the transition process and communicate regularly with the payroll management company. Address any issues or concerns promptly to minimize disruptions to your payroll operations.

Case Studies: Success Stories of Companies Using Payroll Outsourcing Services

Let’s examine a few businesses that use payroll outsourcing to give a more pronounced illustration of these advantages.

Company A: A small manufacturing business struggling with payroll calculations and compliance decided to outsource their payroll to a reputable payroll management company. The company experienced significant time savings, allowing their HR team to focus on employee development and strategic initiatives. Additionally, the payroll provider’s expertise in tax regulations ensured compliance and reduced the risk of costly penalties.

Company B: A rapidly growing technology startup faced challenges in managing payroll as its workforce expanded. By outsourcing their payroll, they were able to seamlessly handle the increased workload without the need to hire additional staff. The payroll management company’s scalable solutions provided the flexibility they needed to accommodate their growing business.

Conclusion: Is Payroll Outsourcing Right for Your Business?

In conclusion, payroll outsourcing services offer numerous benefits that can alleviate the headaches associated with payroll management. From time and cost savings to enhanced accuracy and compliance, these services streamline your payroll processes and allow you to focus on what matters most – growing your business.

Your business must conduct a thorough needs analysis and consider factors like payroll complexity, staff size, and budget before making a decision. Subsequently, you can determine whether outsourcing payroll is the optimal approach for your business.

So, say goodbye to payroll headaches and explore the world of payroll outsourcing services. Free up your time, improve efficiency, and ensure accurate and compliant payroll management. Your business deserves it.

0 notes

Text

India's Leading Payroll Management Consultants and Outsourcing Company in India. Simplify Your Payroll with Trusted Services and Expertise at affordable cost.

#Payroll Management Services#Payroll Management outsourcing#Payroll Management outsourcing India#Payroll management Consultants#Payroll Outsourcing Company India

1 note

·

View note

Text

Beyond the Pay-check How ADP Payroll Services Can Help You Manage Your Workforce

In the complex landscape of modern business, managing a workforce goes far beyond just issuing pay checks. It involves navigating through intricate payroll processes, ensuring compliance with regulations, and optimizing operational efficiency. This is where Ignite HCM's comprehensive payroll services, powered by ADP Payroll Processing Services, come into play. Let's delve into how Ignite HCM can empower your organization to effectively manage your workforce beyond mere payroll transactions.

Streamlined Payroll Processing

Seamless Integration with ADP Payroll Processing Services

Ignite HCM offers seamless integration with ADP Payroll Processing Services, allowing for efficient and accurate payroll processing. With automated systems and advanced technology, manual errors are minimised, ensuring payroll is processed swiftly and accurately. This integration streamlines the entire payroll process, from time tracking to tax calculations, saving time and resources for your organization.

Customized Payroll Solutions

Ignite HCM understands that every business is unique, with its own set of payroll requirements. Therefore, it provides customisable payroll solutions tailored to meet the specific needs of your organization. Whether you're dealing with complex payroll structures, multiple pay rates, or varying employee benefits, Ignite HCM's flexible platform, backed by ADP Payroll Processing Services, can accommodate your needs, ensuring accuracy and compliance at every step.

Compliance Management

Adherence to Regulatory Requirements

Navigating through the ever-evolving landscape of employment regulations can be daunting for businesses. Ignite HCM alleviates this burden by ensuring compliance with all federal, state, and local payroll regulations. Through continuous monitoring and updates provided by ADP Payroll Processing Services, Ignite HCM helps your organization stay compliant with changing laws and regulations, reducing the risk of penalties and fines.

Tax Filing and Reporting

One of the most complex aspects of payroll management is tax filing and reporting. Ignite HCM simplifies this process by leveraging the expertise of ADP Payroll Processing Services. From accurate tax calculations to timely filings and reporting, Ignite HCM ensures that your organization remains compliant with tax laws, minimizing the risk of costly mistakes and audits.

Enhanced Workforce Management

Time and Attendance Tracking

Efficient workforce management begins with accurate time and attendance tracking. Ignite HCM's integrated platform, powered by ADP Payroll Processing Services, offers advanced time tracking features, allowing you to monitor employee hours, track overtime, and manage schedules effectively. This not only improves payroll accuracy but also enhances productivity by optimizing workforce utilization.

Employee Self-Service

Empowering employees with self-service capabilities is key to enhancing workforce management. Ignite HCM provides a user-friendly self-service portal, enabling employees to access their pay stubs, update personal information, and request time off seamlessly. By reducing administrative overhead and empowering employees to manage their own information, Ignite HCM improves employee satisfaction and engagement.

Conclusion

Managing a workforce goes far beyond issuing pay checks. It requires comprehensive solutions that address payroll processing, compliance management, and workforce optimization. Ignite HCM, in partnership with ADP Payroll Processing Services, offers a suite of integrated solutions designed to streamline payroll processes, ensure regulatory compliance, and enhance workforce management. By leveraging Ignite HCM's expertise and technology, your organization can focus on driving growth and success while leaving the complexities of workforce management to the experts.

for more info : https://www.ignitehcm.com/solutions/payroll-processing

Contact : +1 301-674-8033

#ADP Payroll Solutions#Payroll Management Services#ADP Payroll Software#Employee Payment Processing#Payroll Outsourcing#Automated Payroll Systems

0 notes