#Peabody Coal Company

Text

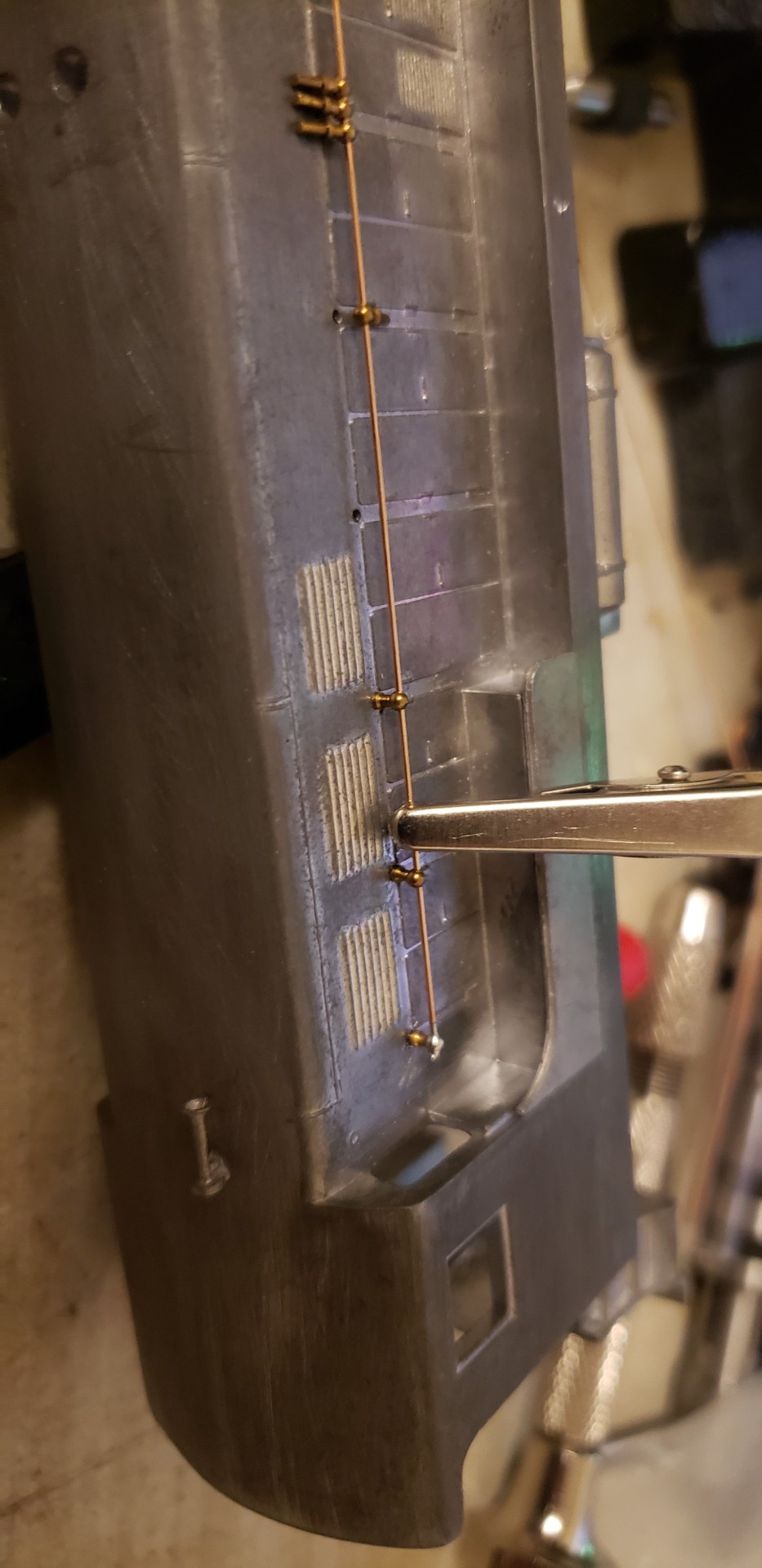

I should post more train stuff.

I'm currently working on building a Fairbanks Morse H10-44 by Cary Locomotive Works for the club I'm in. The shell clocks in at 12oz, and should be around a pound by the time I've added the chassis.

The kit was new old stock, unassembled, so I'm putting in the effort to build and solder the hand rails using Tichy wire. It didn't include enough stanchions to complete the wrap around nose hand rail, so I bent one around before learning I could get more.

I'll need about 10 more stanchions to complete the hand rails and add the coupler lift bar. It looks like I can just buy pre bent bars, so I'll get that instead of bending it myself.

Then I just need to finish the end rails and figure out how I want to build the add on rails from the prototype.

This FM is planned to be stationed at our future coal mine, which will be running heavy live loads. The heavy shell will boost the pulling power, as the Walthers model I have was incapable of pulling our existing fake load coal train on flat table.

The real locomotive that inspired the build is the only H10-44 Peabody Coal Company owned. PCCX 274 was purchased from the Frisco, where it was assigned the same number. I plan to paint this unit to match the mixed scheme Peabody gave 274 during their ownership, then patch cab numbers, and possibly hood lettering, using the club's shade of blue as backing. It will be as though our railroad purchased it from Peabody after the 70s.

It's going to be a real ugly duckling, but it'll pull a house down and put history into the scenes on the layout, while also calling out to my contribution and choice of railroad.

#model railroading#model trains#model railroad#ho scale#frisco#Peabody Coal Company#Fairbanks Morse#cary locomotive works

4 notes

·

View notes

Note

holy shit new music !! may i ask which man the new song is about 👁

Out With A Bang is a work of fiction and any similarity to actual persons, living or dead, is purely coincidental. On a completely unrelated note, here is a list of interesting actual persons who are alive today and have real names and addresses:

Patrick Pouyanné, Chairman and CEO, TotalEnergies

Helge Lund, Chairman, BP

Bernard Looney, CEO, BP

Amin H. Nasser, CEO, Saudi Aramco

Yasir Al-Rumayyan, Chairman, Saudi Aramco

Zhang Yuzhuou, Chairman, China Petrochemical

Mike Wirth, CEO, Chevron

Viktor Zubkov, Chairman, Gazprom

Alexey Miller, CEO, Gazprom

Javad Owji, Chairman, National Iranian Oil Company

Ken Mackenzie, Chairperson, BHP Billiton

Mike Henry, CEO, BHP Billiton

PM Prasad, Chairman, Coal India

Octavio Romero Oropeza, CEO, Pemex

Jim Grech, CEO, Peabody Energy

Ryan Lance, CEO, ConocoPhillips

Sultan Al Jaber, CEO, ADNOC

Jean Paul Prates, CEO, Petrobras

Nawaf Saud Nasser Al-Sabah, CEO, Kuwait Petroleum Corp.

Toufik Hakkar, CEO, Sonatrach

John P Surma, CEO, Marathon Petroleum

Joseph Gorder, CEO, Valero

Greg Garland, CEO, Phillips 66

Basuki Tjahaja Purnama, President, Pertamina

19 notes

·

View notes

Text

handler's intro page absolutely delights me ....

Daniel Handler is the author of seven novels, including Why We Broke Up, We Are Pirates, All The Dirty Parts and, most recently, Bottle Grove.

As Lemony Snicket, he is responsible for numerous books for children, including the thirteen-volume A Series of Unfortunate Events, the four-volume All the Wrong Questions, and The Dark, which won the Charlotte Zolotow Award.

Mr. Snicket’s first book for readers of all ages, Poison for Breakfast, was published by Liveright/W.W. Norton in 2021.

Handler has received commissions from the San Francisco Symphony, Berkeley Reperatory Theater and the Royal Shakespeare Company, and has collaborated with artist Maira Kalman on a series of books for the Museum of Modern Art in New York, and with musicians Stephin Merritt (of the Magnetic Fields), Benjamin Gibbard (of Death Cab for Cutie), Colin Meloy (of the Decemberists) and Torquil Campbell (of Stars).

His books have sold more than 70 million copies and have been translated into 40 languages, and have been adapted for film, stage and television, including the recent adaptation of A Series of Unfortunate Events for which he was awarded both the Peabody and the Writers Guild of America awards.

He lives in San Francisco with the illustrator Lisa Brown, to whom he is married and with whom he has collaborated on several books and one son.

books page:

Daniel Handler Writes novels.

The Basic Eight

Watch Your Mouth

Adverbs

Why We Broke Up

We Are Pirates

All the Dirty Parts

Bottle Grove

Poison for Breakfast

And not novels.

Weather, Weather

Girls Standing on Lawns

Hurry Up and Wait

Books for the Holidays.

The Baby In The Manger

The Lump of Coal

The Latke Who Couldn’t Stop Screaming

Assorted and sundry.

Goldfish Ghost

The Bad Mood and The Stick

Horseradish: Bitter Truths You Can’t Avoid

The Composer Is Dead

13 Words

The Dark

Swarm of Bees

And one as the Pope.

How To Dress For Every Occasion

All while penning children’s books as Lemony Snicket.

A Series Of Unfortunate Events

All the Wrong Questions

16 notes

·

View notes

Text

youtube

Today the new John Prine Memorial Park will be dedicated on the Green River in Muhlenberg County, Kentucky. So here are Jamey Johnson and Kelsey Waldon covering Prine’s song “Paradise”. I have previously posted Prine’s performance of “Paradise”.

__________________________

Paradise

Songwriter: John Prine

When I was a child, my family would travel

Down to Western Kentucky where my parents were born

And there’s a backwards old town that’s often remembered

So many times that my memories are worn

And daddy won’t you take me back to Muhlenberg County

Down by the Green River where paradise lay?

Well, I’m sorry, my son, but you’re too late in asking

Mister Peabody’s coal train has hauled it away

Well, sometimes we’d travel right down the Green River

To the abandoned old prison down by Adrie Hill

Where the air smelled like snakes and we’d shoot with our pistols

But empty pop bottles was all we would kill

And daddy won’t you take me back to Muhlenberg County

Down by the green river where paradise lay?

Well, I’m sorry, my son, but you’re too late in asking

Mister Peabody’s coal train has hauled it away

Then the coal company came with the world’s largest shovel

And they tortured the timber and stripped all the land

Well, they dug for their coal till the land was forsaken

Then they wrote it all down as the progress of man

And daddy won’t you take me back to Muhlenberg County

Down by the Green River where paradise lay?

Well, I’m sorry, my son, but you’re too late in asking

Mister Peabody’s coal train has hauled it away

When I die let my ashes float down the Green River

Let my soul roll on up to the Rochester dam

I’ll be halfway to Heaven with paradise waitin’

Just five miles away from wherever I am

And daddy won’t you take me back to Muhlenberg County

Down by the green river where paradise lay?

Well, I’m sorry my son, but you’re too late in asking

Mister Peabody’s coal train has hauled it away

11 notes

·

View notes

Text

Peabody'Energy'Corp'Unveils'Comprehensive'Analysis'of'Q'''''''Performance $BTU #spx #NYSE

BTUs Reports Key Metrics and Insights Driving Growth in the Energy Sector,In the ever-changing landscape of the coal market, Peabody Energy Corp, a prominent player in the industry, is currently experiencing a challenging period. Despite the company's efforts, its shares have been trailing the overall performance of the market in recent times. Looking at the year-to-date performance, Peabody Energy Corp shares have lagged behind the market by 12.58%. This trend has also been observed over the past 90 days, indicating a consistent underperformance comp

0 notes

Text

Exploring the Global Coal Mining Market: Share and Trends

Introduction

Coal mining is a fundamental pillar of the global energy sector, supplying a significant portion of the world's energy needs. This article provides a comprehensive overview of the coal mining market, including its size, growth, challenges, and key players.

Understanding the Coal Mining Market

Coal mining involves the extraction of coal from underground or surface mines. It serves as a vital source of energy for electricity generation, industrial processes, and heating worldwide. Despite increasing concerns about environmental impacts, coal remains a prominent energy source, particularly in countries with abundant coal reserves.

Coal Mining Market Research Reports

Coal Mining Market research reports offer invaluable insights into the coal mining industry, providing detailed analyses of market trends, demand-supply dynamics, regulatory developments, and competitive landscapes. These reports aid industry stakeholders, investors, and policymakers in making informed decisions regarding investment, regulation, and strategic planning.

Coal Mining Market Share

The coal mining market is characterized by several major players dominating significant shares of the global market. According to recent data:

BHP Billiton accounts for approximately 7% of global coal production.

Anglo American holds a market share of around 6% in the global coal mining industry.

Glencore contributes approximately 5% of the world's coal production.

Peabody Energy is responsible for around 4% of global coal output.

Together, these companies and others collectively account for the majority of coal production worldwide, leveraging their extensive operations and infrastructure to meet global demand for coal.

Coal Mining Market Growth

Despite facing challenges such as environmental regulations and competition from alternative energy sources, the coal mining market continues to experience growth in certain regions. According to industry forecasts, the coal mining market is projected to grow at a compound annual growth rate (CAGR) of 2.8% from 2021 to 2026.

Coal Mining Market Size

The global coal mining market is sizable, with billions of tons of coal extracted annually to meet various energy and industrial needs. In 2021, the global coal production stood at approximately 7.4 billion metric tons, with significant contributions from countries like China, India, the United States, and Australia. The market size is expected to remain substantial in the foreseeable future, albeit with fluctuations influenced by market dynamics and regulatory changes.

Coal Mining Market Challenges

The coal mining industry faces several challenges, including:

Environmental Concerns: Coal mining operations have significant environmental impacts, including habitat destruction, water pollution, and greenhouse gas emissions. As governments and society increasingly prioritize environmental sustainability, coal mining companies must navigate stricter regulations and adopt cleaner technologies.

Market Volatility: The coal market is subject to price volatility influenced by factors such as geopolitical tensions, supply-demand dynamics, and shifts in energy policies. Fluctuating coal prices can impact the profitability of coal mining companies and deter investment in new projects.

Competition from Renewables: The rise of renewable energy sources, such as solar, wind, and hydroelectric power, poses a competitive challenge to the coal mining industry. As renewable technologies become more cost-effective and accessible, coal's share in the energy mix may decline, affecting coal demand and market dynamics.

Coal Mining Market in India

India is one of the largest coal-producing and consuming countries globally, with a significant portion of its energy derived from coal. According to recent statistics, India produced approximately 955 million metric tons of coal in 2020, making it the second-largest coal producer after China. Coal accounts for around 70% of India's electricity generation, highlighting its crucial role in the country's energy mix.

The Indian Coal Mining Market is characterized by large state-owned coal companies like Coal India Limited (CIL) and Singareni Collieries Company Limited (SCCL), as well as private players operating in the sector. Despite efforts to diversify the energy mix and promote renewable energy, coal continues to play a vital role in India's energy security and economic development.

Coal Mining Market Competitors

In addition to major players like BHP Billiton and Anglo American, the coal mining market features various competitors, including:

Shenhua Group (China)

China Coal Energy Company Limited

Yanzhou Coal Mining Company Limited (China)

Glencore plc (Switzerland)

Peabody Energy Corporation (USA)

Conclusion

The global coal mining market remains a significant component of the energy landscape, despite facing challenges and evolving market dynamics. As the world transitions towards cleaner energy sources, coal mining companies must adapt to changing demands, embrace sustainable practices, and innovate to remain competitive in a rapidly evolving industry.

#Coal Mining#Coal Mining Germany#Coal Mining India#Coal Mining Indonesia#Coal Mining Market#Coal Mining Industry#Coal Mining Companies#Global Coal Mining#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market Challenges#Coal Mining Market in India#Coal Mining Market Competitors#Coal Mining Market Outlook#Coal Mining Industry Research Reports#Coal Mining Market Research Reports#Coal Mining Market Major Players#Coal Mining Market Share

0 notes

Text

Stock markets experience twists and turns throughout the year. The volatility makes them risky and rewarding at the same time. However, that does not mean that stock predictions don’t work. By doing meticulous technical and fundamental analysis, experts are able to precisely tell you the future of all stocks. They may not get it right every time, but they’re correct mostly.

Those who’ve read a bit about trading have probably come across “the September effect”. Historically, markets have shown the worst performance in this month. While most people have their beliefs and reasons, nothing is 100% true.

Nevertheless, investors need to be extra careful this month. Considering all the risks, analysts have picked the best options.

Best Picks For Traders This September

These stocks have been picked on the basis of their performance. In all likelihood, they’ll help you beat the jinx of September.

Peabody Energy (NYSE: BTU)

Investing in coal might seem an odd choice when the whole world is talking about sustainable energy resources. But rising oil prices and the Russia-Ukraine war have made coal more valuable than ever. Peabody Energy is a coal mining company with an impressive track record. Moreover, its stock recently spiked by 136% with more than 400% EBITDA.

Grocery Outlet (NYSE: GO)

Focusing on closeouts, Grocery Outlet has been able to eke profits even in a high-inflation environment. It obtains supplies from other retailers and wholesalers at a very cheap price, which helps, as people are trying to save money by cutting down on grocery expenses.

Cal-Maine Foods (NASDAQ: CALM)

Cal-Maine is the biggest egg producer in the US and a favorite of investors. One of the reasons is that it pays dividends along with the quarterly profits. Lately, egg prices have increased due to avian flu scares. Cal-Maine registered a 29% hike in profits this quarter amid the price rise.

Funko (NASDAQ: FNKO)

Two things helped FNKO stock recently. First, JPMorgan Chase did an endorsement saying that the company is recession-resistant. Second, it acquired Mondo, a staffing agency with multi-pronged operations. The first quarter showed a jump of 63% in its stock price.

Marathon Oil (NYSE: MRO)

Many oil companies are making more profits ever since the Russia-Ukraine war began. Marathon Oil is one of them. And its purple patch will continue as long as the war goes on. It is selling crude oil at an all-time high. Furthermore, it has the lowest cost structure which allows it to make more profits.

Conclusion

With the help of these stocks, traders can certainly feel more confident in their investments. These are companies that have managed to create and distribute profits consistently. Still, when money is involved, one has to examine every step with a pinch of salt.

Source

0 notes

Text

Peabody Energy: Shackles Coming Off, But Will They Reoffend? (NYSE:BTU)

Peabody Energy: Shackles Coming Off, But Will They Reoffend? (NYSE:BTU)

Gearstd/iStock via Getty Images

Introduction

Following the tragic Russia-Ukraine war in 2022, the operating conditions for the coal industry have never been as strong with these once-hated companies enjoying massive cash windfalls. Despite their bumpy start to the year, this marks a day and night difference from two years ago during 2020 for Peabody Energy (NYSE:BTU) who at the time was fighting…

View On WordPress

0 notes

Text

Peabody Energy: Shackles Coming Off, But Will They Reoffend? (NYSE:BTU)

Peabody Energy: Shackles Coming Off, But Will They Reoffend? (NYSE:BTU)

Gearstd/iStock via Getty Images

Introduction

Following the tragic Russia-Ukraine war in 2022, the operating conditions for the coal industry have never been as strong with these once-hated companies enjoying massive cash windfalls. Despite their bumpy start to the year, this marks a day and night difference from two years ago during 2020 for Peabody Energy (NYSE:BTU) who at the time was fighting…

View On WordPress

0 notes

Text

Dow Jones Newswires: Peabody, Australia’s Coronado end talks over potential merger

Dow Jones Newswires: Peabody, Australia’s Coronado end talks over potential merger

SYDNEY — Coronado Global Resources Inc. and Peabody Energy Corp. mutually agreed to end talks over combining to create a new global coal giant.

Australia-listed Coronado CRN, -6.61%, which also has operations in the U.S., and Peabody BTU, +13.21% on Monday both said they had ended discussions over a combination that would have created a company worth about $6 billion.

Neither company gave a…

View On WordPress

0 notes

Text

Peabody Energy’s third-quarter results report showed that its third-quarter revenue exceeded $900 million

Peabody Energy’s third-quarter results report showed that its third-quarter revenue exceeded $900 million, the highest level in the past seven quarters; EBITDA was $280 million to $290 million, the highest level of last year. three times the same period. Shares of Peabody Energy jumped 23% on Oct. 25, the biggest gain since July 7. Shares of the company have risen 568.71% this year. In addition, the US coal company Consol Energy (CEIX) shares rose 9.31% that day, Alliance Resources (ARLP) shares rose 6.98%, and Arch Resource (ARCH) shares rose 6.23%.

0 notes

Text

#bucyrus erie 2570w#peabody coal company#bear run#walking drag line#michael davis photo#mining photography archive

12 notes

·

View notes

Photo

1966 Peabody Coal Company ad

#peabody#coal#1966#1960s#vintage#ad#vintage ad#advertisement#vintage advertisement#advertising#vintage advertising

40 notes

·

View notes

Text

Peabody Energy Corp. Reports Sharp Decline in Income, Plummets by -82.74% for Fiscal Year Ending March 31, 2024 $BTU #Coal Mining #NYSE

Peabody Energy Corp's Fiscal Quarter Results Show Revenue Demise Impacting Company's Bottom Line Author: Publication: The CSIMarket.com St. Louis, April 11, 2024 - Peabody Energy Corp (NYSE: BTU) released their preliminary unaudited financial results for the first quarter of 2024. The report reveals a significant decrease in revenue, which ultimately resulted in a substantial fall in income for the quarter. The company reported revenue of $983.60 million, a decline of 27.889% compared to the previous yea

0 notes

Link

Excerpt from this story from Grist:

Over the years, Horseherder has attended public hearings and testified in front of lawmakers, from the reservation to Washington, D.C., advocating for an end to extractive energy economies. She’s often been the lone voice in the room — confronting not only the coal companies and private interests, but also her own neighbors and tribal government. Now that the Navajo Generating Station has closed and other power plants in the region are soon to follow, her vision of a more sustainable energy economy — one powered by wind and solar — is coming more clearly into view. “No matter how frustrated I get, sometimes with the way tribal government works or with how hard it is sometimes to educate people and the community — still, it’s the right thing to do,” Horseherder told me. “And it’s a worthwhile thing to do.”

Though some states like New Mexico and Colorado have recently passed laws that together provide millions of dollars for workforce training and economic support for coal-dependent communities, other states, including Arizona and Nevada, have not. Horseherder is demanding support directly from utilities and industry. It’s a moral imperative, she says. “We’re trying to compel them to provide some kind of transition support for the Navajo Nation instead of just walking away and leaving — leaving the NGS plant and leaving the communities behind,” Horseherder said.

The demolition of the Navajo Generating Station marks the decline of coal in the West. And, if Horseherder is successful in her work, it will also symbolize the beginning of what she calls “a just transition”: a new, more equitable relationship with the energy economy — “one in which there is mutual benefit between the Navajo Nation and its partners,” Horseherder said.

With NGS shuttered, Horseherder is focusing on clean energy for the Navajo Nation by building support for renewable energy projects. Her organization and other grassroots groups, including the Black Mesa Water Coalition and Diné CARE, have pushed the Navajo Nation to develop a more progressive energy policy in recent years. “They’ve succeeded in making the conversation about transition,” said Andrew Curley, a Diné scholar and assistant professor at the University of Arizona who studies the relationship between coal and the Navajo Nation. “There was even reluctance about that initially. There was a perspective that coal doesn’t need to transition.”

That transition has been painful. The Navajo Generating Station and Peabody paid approximately $40 million in the 2019 fiscal year to the Navajo Nation and millions more to the Hopi. (In 2016, money from the industry accounted for nearly 80% of the tribe’s budget.) These royalties and leasing income funded essential government services like education and health care. “Everybody wants to talk in the language of economics,” Curley said. But it’s more than that; people forge identities around coal. “The dynamics that are often underappreciated are the social (and) political dynamics.”

50 notes

·

View notes

Photo

Idling Alligator

Here we see a former Santa Fe Alco RSD15; I believe it was owned by the Squaw Creek Coal Company at the time I ran across it. I have some history of this very distinctive unit here...

9842 RSD15, was built by Alco in June 1960, #83578, as Atchison, Topeka & Santa Fe 842. It was renumbered 9842 Class 9800, in 1970, and sold to Precision National Corp in 1975. They sold it to Squaw Creek Coal Company as 9842 in 1975. It later became Peabody Coal Company 9842 and then was sold to Indiana Hi-Rail as 9842 in 1988. It was soon renumbered 442. It was sold to Austin & Texas Central as 442 in 2000 (source).

I’m not sure where I was when I saw this locomotive: Boonville or Yankeetown, Indiana, perhaps. [Someone of FB has since told me this is two or three miles north of Boonville.]

Two images by Richard Koenig; taken November 1977.

#railroadhistory#railwayhistory#squawcreekcoal#boonville#yankeetown#indianacoal#alco#rsd15#alcorsd15

50 notes

·

View notes