Text

The Global Bauxite Mining Market Challenges and Opportunities

Introduction

The global bauxite mining market is experiencing a remarkable surge, driven by the insatiable demand for aluminum products worldwide. As the world progresses towards a more sustainable future, the role of aluminum becomes increasingly crucial, making the bauxite mining market a key player in shaping the global economy. In this comprehensive blog post, we delve into the intricacies of the bauxite mining market, exploring its growth potential, regional dynamics, and the strategies employed by industry leaders to stay ahead of the curve.

Market Overview

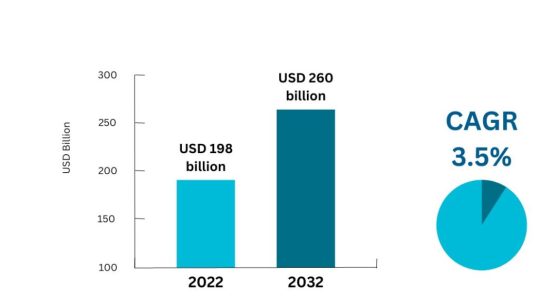

The global Bauxite Mining Market is projected to grow at a CAGR of 6.6% and reach $20,661.9 million by 2026. Another report paints an even brighter picture, forecasting the market to reach a colossal $122.6 billion by 2026, expanding at an impressive CAGR of 4.8% during 2021-2026. This growth trajectory is further supported by industry estimates, which predict the global bauxite production to reach 433 million metric tons by 2025, up from 372 million metric tons in 2020, at a CAGR of 3.5% during 2020-2025.

Regional Dominance

Guinea, Australia, China, Brazil, and India are the world's top five producers of bauxite, collectively accounting for an astounding 87.4% of global production. Australia, the largest producer, generated approximately 86,400 thousand tons of bauxite in 2018. Guinea leads the pack with the largest bauxite reserves, estimated at 7.4 billion metric tons, followed by Australia with 6.2 billion metric tons, China with 2.3 billion metric tons, Brazil with 1.8 billion metric tons, and India with 1.4 billion metric tons.

Key Players and Strategies

The bauxite mining market is characterized by a few key players dominating the industry, including Alcoa Corporation, Rio Tinto Plc, National Aluminium Company Limited, Australian Bauxite Ltd, Gujarat Mineral Development Corporation Ltd, Norsk Hydro ASA, Metro Mining Ltd, ASHAPURA GROUP OF INDUSTRIES, The Aluminium Corporation of China, and United Company Rusal PLC, among others. These industry giants are continuously investing in technology, acquisitions, and R&D activities to maintain their competitive edge and capitalize on the market's growth potential.

Market Segmentation

The bauxite mining market is segmented by application, including the production of alumina, non-metallurgical products like abrasives, refractories, and chemicals. The market is also segmented by region, with Asia Pacific holding the largest share due to China being the world's largest producer and consumer of alumina. The increasing demand for aluminum in various industries, such as transportation, construction, and packaging, is expected to drive the growth of the bauxite mining market.

Challenges and Opportunities

While the bauxite mining market presents immense growth opportunities, it also faces challenges such as stringent government regulations and environmental concerns. For instance, the Malaysian government banned mining in 2015 to control pollution, while community opposition to mining activities can pose obstacles to industry growth. However, the increasing focus on sustainability and the need for lightweight materials in various industries offer promising opportunities for the bauxite mining market to thrive.

Conclusion

The global Bauxite Mining Market is poised for significant growth, driven by the increasing demand for aluminum products and the need for sustainable materials in various industries. Key players in the market are adopting strategies such as technology launches, acquisitions, and R&D activities to stay competitive and capitalize on the market's growth potential. As the world moves towards a more sustainable future, the bauxite mining market will play a crucial role in shaping the global economy and supporting the aluminum revolution.

#Bauxite Mining Industry#Bauxite Mining Market#Bauxite Mining Market Challenges#Bauxite Mining Market Share#Bauxite Mining Market Size#Bauxite Mining Market trends#Global Bauxite Mining Market#Bauxite Mining Market competitors#Bauxite Mining Market outlook#Bauxite Mining Market research reports#Bauxite Mining Industry research reports#Bauxite Mining Market growth#Bauxite Mining Market forecast#Bauxite Mining Market analysis#Bauxite Mining Market top players#Bauxite Mining Market major players

0 notes

Text

Coal Mining Industry Market Size and Projections

Introduction

Coal has long been a cornerstone of the global energy sector, serving as a crucial source of electricity generation and industrial fuel. Despite increasing environmental concerns and the emergence of renewable energy alternatives, the Coal Mining Market continues to demonstrate resilience and sustained growth. In this article, we will explore the factors driving the expansion of the coal mining industry, supported by statistical insights and industry trends.

Future Outlook

The future of the Coal Mining Market is marked by a blend of challenges and opportunities. While the transition towards cleaner energy sources and escalating environmental regulations present hurdles, the persistent demand for coal in emerging economies and industrial sectors offers avenues for growth and innovation. To navigate these dynamics successfully, the coal mining industry must embrace sustainable practices, leverage advanced technologies, and diversify their portfolios to remain competitive in a swiftly evolving energy landscape.

Market Size and Projections

Statistical data underscores a robust growth trajectory for the global Coal Mining Market. In 2020, the market was valued at USD 869.5 billion, with a projected compound annual growth rate CAGR of 2.8% from 2021 to 2027. This growth is fueled by rising energy demand from emerging economies, ongoing industrial development, and the persistent reliance on coal for electricity generation.

Regional Dynamics

The Asia Pacific region stands as the dominant force in the global coal mining market, boasting the largest market share in both production and consumption. Countries like China and India serve as major coal producers and consumers, driven by rapid urbanization, industrialization, and infrastructural expansion. North America and Europe also wield significant influence in the coal mining sector, albeit with a stronger emphasis on environmental regulations and transitioning towards cleaner energy sources.

Key Market Drivers: Several factors propel the growth of the coal mining industry:

Energy Demand: Coal remains a primary energy source for electricity generation, particularly in developing economies with burgeoning populations and expanding industrial sectors. The affordability and reliability of coal-fired power plants sustain its demand.

Industrialization: Coal is integral to industrial processes such as steel production, cement manufacturing, and chemical synthesis, driving demand for coal mining. Industries value coal for its high energy content and cost-effectiveness compared to alternative fuels.

Infrastructure Development: Coal plays a vital role in infrastructure projects like road construction, railway networks, and urban development. As nations invest in infrastructure to support economic growth and urbanization, the demand for coal for construction materials and energy remains strong.

Technological Advancements

The Coal Mining Industry witnesses continuous technological advancements aimed at enhancing efficiency, safety, and environmental sustainability. Innovations such as automated mining equipment, remote monitoring systems, and advanced coal processing technologies bolster productivity and slash operational costs. Furthermore, efforts are underway to develop cleaner coal technologies, including carbon capture and storage (CCS) and coal gasification, to mitigate environmental impacts.

Challenges and Opportunities

Despite promising growth prospects, the coal mining market grapples with environmental concerns, regulatory pressures, and competition from alternative energy sources. Nevertheless, these challenges also foster opportunities for innovation and diversification. Coal mining companies are exploring cleaner coal technologies, expanding into renewable energy sectors, and investing in carbon offset projects to mitigate their environmental footprint and adapt to shifting market dynamics.

Conclusion

The coal mining market stands as a testament to resilience and growth, buoyed by factors like energy demand, industrialization, and infrastructure development. Despite encountering obstacles from environmental concerns and regulatory pressures, the industry adapts to changing market dynamics through technological innovation and diversification. As the world seeks to harmonize economic growth with environmental sustainability, coal mining companies play a pivotal role in shaping the future of the global energy sector Top of Form

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market challenges#Coal Mining Market in India#Coal Mining Market value#Global Coal Mining Market#Coal Mining Market competitors#Coal mining market analysis#Coal Mining Market Forecast#Coal Mining Market outlook#Coal Mining Industry research reports#Coal Mining Market research reports#Coal Mining Market major players#Coal Mining Market Share

0 notes

Text

Environmental Sustainability in the Gold Mining Industry

Introduction

Environmental sustainability has emerged as a paramount concern in the Gold Mining Market as companies seek to minimize their ecological footprint and address climate change. In this blog, we'll explore the various initiatives and strategies that gold mining companies are implementing to promote environmental stewardship and achieve sustainable operations.

Responsible Mining Practices

Gold mining companies are increasingly adopting responsible mining practices to minimize the environmental impact of their operations. This includes implementing measures to reduce air and water pollution, mitigate habitat destruction, and minimize land disturbance. Companies like AngloGold Ashanti and Kinross Gold have developed comprehensive environmental management plans that incorporate best practices in mine planning, waste management, and rehabilitation to minimize their environmental footprint.

Carbon Emissions Reduction

Reducing greenhouse gas emissions is a key priority for gold mining companies looking to mitigate climate change and comply with regulatory requirements. According to industry data, the gold mining sector emitted approximately 300 million metric tons of CO2 equivalent in 2020. Companies are implementing various measures to reduce their carbon footprint, including investing in energy-efficient equipment, transitioning to renewable energy sources, and implementing carbon offset initiatives. For example, Newmont Corporation has committed to reducing its greenhouse gas emissions by 30% by 2030 through initiatives such as energy efficiency improvements and renewable energy investments.

Biodiversity Conservation

Preserving biodiversity is essential for maintaining ecosystem health and resilience in gold mining regions. According to studies, gold mining activities have led to the degradation of biodiversity in several regions globally. Companies are implementing biodiversity conservation measures, such as habitat restoration, reforestation, and wildlife protection, to mitigate the impacts of mining on local ecosystems. Through partnerships with conservation organizations and indigenous communities, companies like Barrick Gold and Gold Fields are working to protect and restore biodiversity in areas affected by mining activities.

Water Management and Conservation

Water management is a critical aspect of sustainable gold mining, particularly in water-stressed regions. According to industry reports, the gold mining sector consumes significant amounts of water, with estimates suggesting that each ounce of gold produced requires approximately 3,000 to 6,000 gallons of water. Companies are implementing water conservation measures, such as recycling and reusing process water, implementing water-saving technologies, and promoting responsible water use practices among employees and local communities. By minimizing water consumption and reducing water pollution, companies can minimize their environmental impact and ensure the availability of clean water for communities and ecosystems.

Ecosystem Restoration and Rehabilitation

Restoring and rehabilitating mined land is essential for reclaiming disturbed landscapes and promoting ecological recovery. According to industry estimates, approximately 75% of the land disturbed by gold mining activities has not been rehabilitated. Companies are implementing ecosystem restoration and rehabilitation programs to rehabilitate mined land, restore natural habitats, and promote biodiversity conservation. Through initiatives such as land reclamation, revegetation, and soil stabilization, companies like Agnico Eagle Mines and Newmont Corporation are restoring ecosystems and promoting long-term environmental sustainability in mining-affected areas.

Conclusion

Environmental sustainability is a top priority for Gold Mining Companies seeking to minimize their environmental impact and promote responsible mining practices. Through initiatives such as responsible mining practices, carbon emissions reduction, biodiversity conservation, water management, and ecosystem restoration, companies are working to achieve sustainable operations and mitigate their environmental footprint. By embracing environmental stewardship and adopting innovative solutions, the gold mining industry can contribute to a more sustainable future for communities, ecosystems, and the planet as a whole.

#Gold Mining industry overview#Gold mining Industry#Global Gold Mining Market#Global Gold mining Market#Gold Mining Market Analysis#Gold Mining Market Growth#Gold Mining Market Share#Gold Mining Market Size#Gold Mining Market Trends#Gold Mining Market Value#Gold Mining Market in India#Gold Mining Market emerging trends#Gold Mining Market outlook#Gold Mining Market overview#Gold Mining Market Research reports#Gold mining Market Major players

0 notes

Text

Iron Ore Mining Market Trends and Industry Dynamics

Introduction

The Iron Ore Mining Industry operates within a dynamic ecosystem, influenced by a multitude of factors that shape industry trends and market dynamics. This article delves into the prevailing trends in the iron ore mining sector, offering insights into key developments and their implications for industry stakeholders.

Emerging Trends in Iron Ore Mining

Recent trends in the iron ore mining market indicate a notable shift towards sustainable practices, digitalization, and market diversification. According to industry reports, the global iron ore market size was valued at approximately USD 335 billion in 2020, with projections suggesting a CAGR of 5.8% from 2021 to 2028. Companies are increasingly prioritizing initiatives aimed at reducing environmental impact, leveraging advanced technologies to optimize operations, and exploring new markets to mitigate risks and seize opportunities.

Digital Transformation in Iron Ore Mining

The adoption of digital technologies, including artificial intelligence, automation, and predictive analytics, is catalyzing a transformation in iron ore mining operations. Industry data suggests that by 2025, the global mining industry's spending on digital technologies is expected to reach USD 17 billion. These technologies are enhancing operational efficiency, bolstering safety standards, and facilitating data-driven decision-making processes, ultimately enabling companies to optimize production, trim costs, and enhance resource utilization.

Sustainable Mining Practices

Environmental sustainability has ascended to the forefront of priorities for the iron ore mining industry, propelled by regulatory mandates, stakeholder expectations, and evolving market demands. According to a recent survey, 76% of mining executives consider environmental sustainability a strategic priority. Companies are proactively embracing sustainable mining practices such as land reclamation, water conservation, and the integration of renewable energy sources to mitigate their environmental footprint and ensure long-term viability.

Market Diversification Strategies

Against the backdrop of escalating volatility in commodity markets and geopolitical uncertainties, iron ore mining companies are actively diversifying their market portfolios to mitigate dependency risks associated with specific regions or end-users. By venturing into new markets, exploring diverse product segments, and offering value-added services, companies can fortify their resilience and capitalize on emergent opportunities.

Supply Chain Resilience and Risk Management

The disruptive impact of the COVID-19 pandemic underscored vulnerabilities within global supply chains, prompting iron ore mining companies to reevaluate their supply chain strategies and fortify resilience. Investments in supply chain digitization, inventory optimization, and strategic partnerships are instrumental in enhancing supply chain robustness, thereby enabling companies to proactively mitigate risks and navigate disruptions effectively.

Evolving Consumer Preferences

Changing consumer preferences and mounting sustainability concerns are exerting a profound influence on product demand and market dynamics within the Iron Ore Mining Sector. In response, companies are adapting their product offerings and refining marketing strategies to align with consumer preferences for sustainably sourced materials, ethical mining practices, and transparent supply chains.

Conclusion: Navigating the Future of Iron Ore Mining

In navigating the complex terrain of the iron ore mining market, staying attuned to industry trends and market dynamics is paramount for companies aiming to sustain competitiveness and resilience. By embracing digital transformation, embracing sustainable practices, diversifying market outreach, and fortifying supply chain resilience, companies can proactively position themselves to capitalize on opportunities, mitigate risks, and foster sustainable growth in the evolving landscape of the iron ore mining industry.

#Iron ore mining market#Iron ore mining Industry#Iron Ore Mining Market Overview#Iron Ore Mining Market Size#Iron Ore Mining Market Share#Iron Ore Mining Market Trends#Global Iron ore Mining Market#Iron Ore Mining Market Growth#Iron Ore Mining Market Report#Iron Ore Mining Industry Analysis

0 notes

Text

Trends Impacting the Bauxite Mining Industry

The Bauxite Mining Market is currently experiencing a surge in growth, primarily driven by the escalating demand for aluminum. This versatile metal finds extensive applications across various sectors, from construction to aerospace. This article aims to dissect the pivotal trends shaping the bauxite mining industry, shedding light on both the opportunities and challenges that lie ahead.

Riding the Aluminum Wave: A Thriving Demand Driver

At the heart of the Bauxite Mining Market lies the flourishing aluminum industry. Aluminum's exceptional combination of lightweight and strength renders it a preferred choice across diverse sectors:

Construction: The high strength-to-weight ratio of aluminum makes it an ideal material for construction purposes, contributing significantly to the ongoing construction boom worldwide.

Transportation: Both the automotive and aerospace industries heavily rely on aluminum for manufacturing lightweight components, thus fueling the demand for bauxite to meet production requirements.

Packaging: Aluminum's recyclability and excellent barrier properties have made it a staple in beverage cans and food packaging, further bolstering bauxite mining endeavors.

As the demand for aluminum continues its upward trajectory in these sectors, the demand for bauxite, the indispensable raw material for alumina production (a crucial step in aluminum manufacturing), is expected to follow suit.

Regional Powerhouses: A Diverse Geographical Landscape

While the bauxite mining market demonstrates global growth, certain regions emerge as frontrunners:

Asia-Pacific: This region boasts the largest share of bauxite reserves, exceeding 60%. Economic powerhouses like China and India are experiencing significant growth, translating to heightened aluminum demand and, consequently, increased bauxite mining activities.

Africa: Guinea, a West African nation, emerges as a major bauxite producer with substantial potential for future expansion. With estimated bauxite reserves of approximately 7.4 billion tonnes, Guinea emerges as a significant player in the global market.

Beyond Demand: Additional Growth Catalysts

Several other trends contribute to the optimistic outlook for the bauxite mining market:

Urbanization: The rapid urbanization sweeping across the globe fuels the demand for construction materials, including aluminum.

Infrastructure Development: Investments in infrastructure projects such as bridges and transportation networks drive up aluminum consumption, thereby increasing bauxite demand.

The Sustainability Challenge: Balancing Growth and Responsibility

Despite the promising outlook, the bauxite mining market encounters significant challenges:

Environmental Concerns: Mining operations can adversely impact the environment, leading to issues like deforestation and water pollution. Embracing sustainable practices and adhering to stricter regulations are imperative for sustained growth.

Geopolitical Tensions: Political instability in regions abundant in bauxite resources can disrupt mining operations and disrupt global supply chains. Companies must be prepared to navigate such potential disruptions.

Technological Advancements: A Driver of Efficiency and Sustainability

Innovation plays a pivotal role in propelling the Bauxite Mining Industry forward:

Automation and Data Analytics: Incorporating automation and data analytics into mining processes can enhance efficiency, safety, and environmental sustainability.

Focus on Rehabilitation: Advancements in rehabilitation techniques can mitigate the long-term environmental impact caused by mining activities.

The Road Ahead: Towards a Sustainable and Resourceful Future

The future of bauxite mining is likely to be shaped by several key trends:

Sustainable Practices: Companies that prioritize environmentally friendly practices and invest in rehabilitation efforts are poised for long-term success.

Exploration for New Resources: Identifying and exploring untapped bauxite reserves in new regions will be critical for maintaining a stable supply and reducing reliance on existing reserves.

Responsible Mining: Implementing responsible mining practices that consider the social and environmental well-being of local communities is essential for earning social license to operate.

Conclusion: A Dynamic Market with Far-Reaching Implications

The Bauxite Mining Market stands as a dynamic and multifaceted landscape. Understanding the trends that shape this industry is imperative for stakeholders, including mining companies, policymakers, and consumers. By embracing sustainability, innovation, and responsible resource management, the bauxite mining industry can pave the way for a brighter future for both itself and the environment.

#Bauxite Mining Industry#Bauxite Mining Market#Bauxite Mining Market Challenges#Bauxite Mining Market Share#Bauxite Mining Market Size#Bauxite Mining Market trends#Global Bauxite Mining Market#Bauxite Mining Market competitors#Bauxite Mining Market outlook#Bauxite Mining Market research reports#Bauxite Mining Industry research reports#Bauxite Mining Market growth#Bauxite Mining Market forecast#Bauxite Mining Market analysis#Bauxite Mining Market top players#Bauxite Mining Market major players

0 notes

Text

Exploring the Growth Trajectory of the Coal Mining Industry by 2027

Coal has long stood as a cornerstone of the global energy sector, serving as a primary source for electricity generation and industrial fuel. Despite mounting concerns about environmental impacts and the emergence of renewable energy alternatives, the coal mining market continues to demonstrate resilience and steady growth. In this blog, we will delve into the factors propelling the growth of the coal mining market, supported by statistical insights and industry trends.

Market Size and Projections:

Statistical data unveils a robust growth trajectory for the global Coal Mining Market. In 2020, the market size was estimated at USD 869.5 billion, with a projected compound annual growth rate (CAGR) of 2.8% from 2021 to 2027. This growth is underpinned by increasing energy demand from emerging economies, industrial expansion, and the persistent reliance on coal for electricity generation.

Regional Dynamics:

The Asia Pacific region dominates the global coal mining market, boasting the largest market share in both production and consumption. Nations like China and India emerge as major coal producers and consumers, fueled by rapid urbanization, industrial growth, and infrastructure development. North America and Europe also wield significant influence in the coal mining market, albeit with a stronger emphasis on environmental regulations and transitioning to cleaner energy sources.

Key Market Drivers:

Several factors are steering the growth of the coal mining market:

Energy Demand: Coal remains a primary energy source for electricity generation, particularly in developing economies with burgeoning populations and expanding industrial sectors. The affordability and reliability of coal-fired power plants sustain its demand.

Industrialization: Coal finds extensive use in industrial processes such as steel production, cement manufacturing, and chemical synthesis, driving demand for coal mining. Industries leverage coal for its high energy content and cost-effectiveness compared to alternative fuels.

Infrastructure Development: Coal plays an indispensable role in infrastructure endeavors, including road construction, railway networks, and urban expansion. As countries invest in infrastructure to bolster economic growth and urbanization, the demand for coal for construction materials and energy remains robust.

Technological Advancements:

The coal mining industry is witnessing technological innovations aimed at enhancing efficiency, safety, and environmental sustainability. Innovations such as automated mining equipment, remote monitoring systems, and advanced coal processing technologies bolster productivity and curtail operational costs. Moreover, endeavors are underway to develop cleaner coal technologies like carbon capture and storage (CCS) and coal gasification to mitigate environmental impacts.

Challenges and Opportunities:

Despite its growth potential, the coal mining market grapples with challenges such as environmental concerns, regulatory pressures, and competition from alternative energy sources. Nevertheless, these challenges also present avenues for innovation and diversification. Coal mining entities are exploring cleaner coal technologies, diversifying into renewable energy sectors, and investing in carbon offset initiatives to mitigate their environmental footprint and adapt to evolving market dynamics.

Future Outlook:

The future of the Coal Mining Market is characterized by a blend of challenges and opportunities. While the transition towards cleaner energy sources and escalating environmental regulations pose hurdles, the sustained demand for coal in emerging economies and industrial domains offers avenues for expansion and innovation. The coal mining industry must navigate these dynamics by embracing sustainable practices, adopting advanced technologies, and diversifying portfolios to maintain competitiveness in a swiftly evolving energy landscape.

Conclusion:

The coal mining market continues to showcase resilience and growth, propelled by factors like energy demand, industrialization, and infrastructure development. Despite confronting challenges from environmental and regulatory fronts, the industry is adapting to shifting market dynamics through technological innovation and diversification. As the world endeavors to strike a balance between economic prosperity and environmental sustainability, coal mining entities play a pivotal role in shaping the trajectory of the global energy sector.

#Coal Mining Industry#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market#Coal Mining Market Demand#Coal Mining Market challenges#Coal Mining Market in India#Coal Mining Market value#Global Coal Mining Market#Coal Mining Market competitors#Coal mining market analysis#Coal Mining Market Forecast#Coal Mining Market outlook#Coal Mining Industry research reports#Coal Mining Market research reports#Coal Mining Market major players#Coal Mining Market Share

0 notes

Text

Exploring the Dynamics of the Copper Mining Sector

Introduction:

The Copper Mining Market is a dynamic sector that plays a crucial role in powering various industries, from electronics to renewable energy. In this article, we delve into the intricate workings of the copper mining industry, examining key trends, challenges, and opportunities shaping its trajectory.

Market Overview:

Copper mining is a global industry with significant contributions from regions such as Latin America, Asia Pacific, and North America. The market is driven by the growing demand for copper across diverse end-use sectors, including construction, transportation, and telecommunications. As economies continue to develop and urbanize, the need for copper as a vital conductor of electricity and heat remains paramount.

Market Trends:

Several trends are reshaping the copper mining landscape. These include advancements in extraction technologies, increased emphasis on sustainable practices, and the rise of electric vehicles and renewable energy sources. Furthermore, geopolitical tensions, trade dynamics, and environmental regulations influence market sentiment and pricing trends, impacting the profitability of mining operations.

Production Landscape:

Leading copper-producing countries such as Chile, Peru, and China dominate global copper output. However, the industry faces challenges such as declining ore grades, resource depletion, and operational inefficiencies. To address these challenges, mining companies are investing in exploration activities, adopting innovative technologies, and pursuing strategic partnerships to enhance production capabilities.

Price Dynamics:

Copper prices are influenced by a myriad of factors, including supply-demand dynamics, macroeconomic indicators, and market speculation. Price volatility is inherent in the copper market, with fluctuations driven by factors such as trade tensions, currency movements, and inventory levels. Despite short-term fluctuations, the long-term outlook for copper remains positive, supported by its essential role in infrastructure development and technological innovation.

Environmental Considerations:

Environmental sustainability is increasingly becoming a focal point for Copper Mining Companies. Concerns regarding water usage, energy consumption, and greenhouse gas emissions have prompted industry players to adopt cleaner production methods, invest in renewable energy infrastructure, and engage with local communities to mitigate environmental impacts.

Technological Advancements:

Technological innovation is revolutionizing the copper mining sector, enabling companies to improve operational efficiency, reduce costs, and minimize environmental footprints. Automation, data analytics, and remote monitoring systems are being deployed to optimize mining processes, enhance safety standards, and maximize resource recovery rates.

Investment Opportunities:

Despite challenges, the copper mining market presents lucrative investment opportunities for stakeholders seeking exposure to the commodities sector. Strategic investments in exploration, infrastructure upgrades, and sustainable practices can drive long-term value creation and position companies for success in a competitive market environment.

Conclusion:

The copper mining market is characterized by its resilience, adaptability, and strategic importance to the global economy. While challenges persist, including geopolitical uncertainties and environmental concerns, the industry remains well-positioned to capitalize on emerging opportunities driven by technological innovation and sustainable development. By embracing innovation, fostering collaboration, and prioritizing environmental stewardship, copper mining companies can navigate market dynamics and contribute to the sustainable growth of this vital sector.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Global Copper Mining Market#Copper Mining Market Analysis#Copper Mining Market Outlook#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Research Reports#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Top Players

0 notes

Text

The Evolution of Gold Mining Market Trends and Innovations

Introduction

The Gold Mining Industry has undergone significant evolution in recent years, driven by technological advancements, changing market dynamics, and evolving consumer preferences. In this blog, we explore the latest trends and innovations shaping the future of gold mining and their implications for stakeholders.

Technological Advancements

Technological innovation has revolutionized gold mining operations, enabling companies to extract gold more efficiently and sustainably. Advanced mining techniques, such as heap leaching, bioleaching, and in-situ leaching, have minimized environmental impact and reduced production costs. Additionally, the integration of automation, robotics, and artificial intelligence (AI) has optimized mining processes, enhanced safety, and increased productivity.

Sustainable Practices

Environmental sustainability has become a top priority for gold mining companies, driven by regulatory requirements and stakeholder expectations. Companies are implementing eco-friendly mining practices, such as reclamation and rehabilitation of mine sites, water recycling, and energy efficiency measures. Moreover, the adoption of renewable energy sources, such as solar and wind power, is reducing carbon emissions and lowering operational costs.

Market Dynamics

The gold market is influenced by various factors, including economic trends, geopolitical tensions, and currency fluctuations. Investors often turn to gold as a safe haven asset during times of uncertainty, driving demand and influencing prices. Additionally, changing consumer preferences, such as the rise of ethical consumerism and sustainable investing, are shaping demand patterns in the gold market.

Emerging Trends: Several emerging trends are shaping the future of gold mining:

Digital Transformation: The digitization of mining operations, through the use of data analytics, Internet of Things (IoT) sensors, and cloud computing, is improving efficiency and decision-making processes. Companies are leveraging big data analytics to optimize mine planning, resource allocation, and predictive maintenance.

Responsible Sourcing: Ethical sourcing and responsible mining practices are gaining traction in the gold industry. Consumers are increasingly demanding transparency and accountability in the supply chain, prompting companies to implement traceability measures and adhere to responsible sourcing standards.

Innovation Investment

To stay competitive in the evolving market landscape, Gold Mining Companies must continue to invest in innovation. Research and development initiatives are essential for developing new technologies, improving operational efficiency, and unlocking new reserves. Collaboration with industry partners, research institutions, and government agencies can accelerate innovation and drive industry-wide progress.

Conclusion

The future of gold mining is characterized by innovation, sustainability, and adaptability. As technological advancements continue to reshape the industry, companies must embrace change, invest in innovation, and adopt sustainable practices to thrive in the evolving market environment. By staying ahead of emerging trends and leveraging new opportunities, gold mining companies can position themselves for long-term success and contribute to a sustainable future.

#Gold Mining industry overview#Gold mining Industry#Global Gold Mining Market#Global Gold mining Market#Gold Mining Market Analysis#Gold Mining Market Growth#Gold Mining Market Share#Gold Mining Market Size#Gold Mining Market Trends#Gold Mining Market Value#Gold Mining Market in India#Gold Mining Market emerging trends#Gold Mining Market outlook#Gold Mining Market overview#Gold Mining Market Research reports#Gold mining Market Major players

0 notes

Text

Exploring the Copper Mining Market Research Reports

Introduction

Copper mining serves as a cornerstone of the global economy, providing a vital raw material for numerous sectors including construction, electronics, and transportation. This article examines the dynamics of the copper mining market, encompassing its prospects, research findings, market share, trends, size, challenges, key players, and competitors.

Copper Mining Market Outlook

The outlook for the Copper Mining Market appears promising, fueled by escalating demand for copper in infrastructure development, renewable energy initiatives, and electric vehicles. Analysts anticipate sustained growth in the forthcoming years, bolstered by factors like urbanization, industrialization, and technological innovations.

Copper Mining Market Research Reports

Market research reports furnish valuable insights into the copper mining sector, offering comprehensive analyses of market dynamics, production figures, consumption trends, and trade patterns. These reports serve as indispensable resources for investors, mining entities, and policymakers to comprehend market trends and make informed decisions.

Copper Mining Market Size

The global copper mining market holds significant prominence, with substantial investments channeled annually into exploration, development, and production endeavors. Recent data indicates that the global copper market reached a valuation of around USD 150 billion in 2020. Concurrently, copper production surpassed 20 million metric tons during the same period, with notable copper-producing nations encompassing Chile, Peru, China, and the United States. The market size is projected to exhibit steady expansion in the ensuing years, propelled by escalating demand for copper in infrastructure ventures, electrical installations, and consumer electronics.

Copper Mining Market Share

The copper mining market is characterized by several prominent players, each wielding substantial market shares. Key participants include multinational mining conglomerates, state-owned enterprises, and junior mining firms, collectively contributing to the global copper supply chain.

Copper Mining Market Trends: Numerous trends are reshaping the copper mining landscape, including:

Technological Advancements: Ongoing advancements in mining technologies, such as automation, remote sensing, and data analytics, are enhancing operational efficiency, safety standards, and productivity in copper mining operations. Concurrent innovations in extraction methodologies and processing techniques are augmenting resource retrieval rates and curtailing environmental footprints.

Sustainable Practices: There is a burgeoning emphasis on sustainability within copper mining, with entities embracing eco-friendly technologies, deploying energy-efficient processes, and engaging with local communities to mitigate environmental impacts and foster responsible mining practices.

Supply Chain Resilience: The copper mining industry is adapting to evolving supply chain dynamics, including disruptions precipitated by geopolitical tensions, trade regulations, and the COVID-19 pandemic. Companies are diversifying their supply chains, investing in inventory management, and fortifying logistics capabilities to ensure resilience and operational continuity.

Copper Mining Market Challenges: Despite its growth trajectory, the copper mining sector grapples with several challenges, encompassing:

Resource Depletion: The diminishing ore grades and escalating extraction costs present formidable challenges for copper mining enterprises, necessitating investments in exploration endeavors and technological innovations to sustain production levels and reserves.

Environmental Regulations: Copper mining operations exert substantial environmental pressures, encompassing water contamination, habitat degradation, and greenhouse gas emissions. Stringent regulatory mandates pertaining to environmental compliance, mine closure protocols, and community engagement are escalating compliance costs and operational risks.

Market Volatility: Copper prices are susceptible to volatility, influenced by factors like supply-demand dynamics, macroeconomic conditions, and geopolitical upheavals. Fluctuations in copper prices can impact the profitability and investment decisions of mining entities, necessitating robust risk management strategies and financial planning.

Copper Mining Market Major Players

Key entities in the Copper Mining Market include:

Codelco

BHP Group

Rio Tinto

Glencore

Freeport-McMoRan

Conclusion

The copper mining market presents compelling growth prospects and investment opportunities, driven by escalating demand for copper across diverse industries. Despite encountering challenges such as resource depletion and environmental regulations, the industry is poised for sustained expansion, buoyed by technological innovations, sustainability initiatives, and market resilience. Collaborative endeavors, innovation, and conscientious mining practices are imperative for ensuring the enduring sustainability and prosperity of the copper mining sector.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Research Reports#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Outlook#Copper Mining Market Top Players#Global Copper Mining Market#Copper Mining Market Analysis

0 notes

Text

The Challenges of the Coal Mining Market

The Coal Mining Industry has been a fundamental pillar of global energy production for centuries, powering economies, fueling industries, and providing livelihoods to millions. However, in recent years, the industry has encountered numerous challenges that have tested its resilience and viability. In this blog, we'll delve into some of the key challenges facing the coal mining market and explore potential solutions to address them.

Environmental Concerns:

Perhaps the most prominent challenge facing the coal mining industry is its environmental impact. Coal extraction, processing, and combustion emit greenhouse gases, particulate matter, sulfur dioxide, and other pollutants, contributing to air and water pollution, deforestation, habitat destruction, and climate change. According to the International Energy Agency (IEA), coal-fired power plants are responsible for approximately 30% of global carbon dioxide emissions. As the world strives to reduce its carbon footprint and transition to cleaner energy sources, coal mining companies face mounting pressure to mitigate their environmental impact and adopt sustainable practices.

Regulatory Compliance:

The coal mining industry operates in a heavily regulated environment, subject to stringent environmental, health, and safety regulations imposed by governments and regulatory bodies worldwide. Compliance with these regulations entails substantial costs, including investments in pollution control technologies, mine safety measures, land reclamation efforts, and emission reduction initiatives. Failure to comply with regulatory requirements can result in fines, lawsuits, and reputational damage, posing significant challenges to coal mining companies' financial viability and operational sustainability.

Market Volatility:

The coal mining market is inherently volatile, susceptible to fluctuations in supply and demand, geopolitical tensions, economic conditions, and energy market dynamics. Changes in government policies, technological advancements, and shifts in consumer preferences also influence coal prices and market trends. Volatility in coal prices can affect the profitability of coal mining operations, disrupt investment plans, and create uncertainties for industry stakeholders. Moreover, competition from alternative energy sources, such as natural gas, renewables, and nuclear power, further exacerbates market volatility and challenges the long-term viability of coal as an energy source.

Declining Demand and Market Shifts:

The coal mining industry is facing declining demand for coal, driven by several factors, including the growing adoption of renewable energy sources, energy efficiency measures, and environmental regulations aimed at reducing greenhouse gas emissions. As countries strive to meet their climate goals under the Paris Agreement and transition to low-carbon economies, the demand for coal is expected to continue declining, particularly in developed nations. This shift in energy consumption patterns poses significant challenges to coal mining companies, necessitating diversification strategies and adaptation to changing market conditions.

Social Impacts and Community Relations:

Coal mining operations often have profound social impacts on local communities, including disruptions to land use, displacement of indigenous peoples, health and safety risks for workers, and socio-economic inequalities. Community opposition to coal mining projects, driven by concerns over environmental degradation, health hazards, and loss of livelihoods, can hinder project approvals, delay development timelines, and escalate project costs. Building and maintaining positive relationships with local communities, engaging in meaningful consultation and dialogue, and addressing socio-economic concerns are essential for mitigating social risks and securing social license to operate.

Conclusion

The Coal Mining Industry faces a myriad of challenges that require proactive and collaborative efforts from industry stakeholders, governments, and civil society to address effectively. Embracing sustainable practices, investing in clean technologies, diversifying energy portfolios, and fostering dialogue and engagement with communities are critical for navigating the challenges and ensuring the long-term viability and sustainability of the coal mining market.

#Coal Mining#Coal Mining Germany#Coal Mining India#Coal Mining Indonesia#Coal Mining Market#Coal Mining Industry#Coal Mining Companies#Global Coal Mining#Coal Mining Industry Reports#Coal Mining Market Growth#Coal Mining Market Size#Coal Mining Market Challenges#Coal Mining Market in India#Coal Mining Market Competitors#Coal Mining Market Outlook#Coal Mining Industry Research Reports#Coal Mining Market Research Reports#Coal Mining Market Major Players#Coal Mining Market Share

0 notes

Text

Iron Ore Mining Market Players and Industry Participants

Introduction: Overview of Iron Ore Mining Market Players

The Iron Ore Mining Market is characterized by a diverse array of industry participants, ranging from global mining giants to regional players. This article provides insights into the major companies driving the iron ore mining sector, highlighting their operations, market strategies, and contributions to industry dynamics.

Rio Tinto: A Global Mining Powerhouse

Rio Tinto is one of the world's largest diversified mining companies, with extensive iron ore mining operations across Australia and North America. The company boasts a strong portfolio of high-quality iron ore assets, including the Pilbara iron ore mines in Western Australia, which are among the largest and most efficient in the world. Rio Tinto's commitment to innovation, operational excellence, and sustainability positions it as a key player in the global iron ore market.

BHP: Leading the Way in Iron Ore Production

BHP, formerly known as BHP Billiton, is another major player in the iron ore mining industry, with significant operations in Australia and Brazil. The company operates the world's largest integrated iron ore mining and processing facilities in the Pilbara region of Western Australia, producing a diverse range of iron ore products for domestic and international markets. BHP's focus on operational efficiency, cost optimization, and technological innovation has cemented its position as a leader in the iron ore sector.

Vale: A Brazilian Mining Giant

Vale is a leading global mining company based in Brazil, with extensive iron ore mining operations in the Carajás region of the Brazilian Amazon. The company is one of the largest producers and exporters of iron ore in the world, leveraging its vast reserves and integrated supply chain to meet global demand for iron ore products. Vale's commitment to environmental stewardship, community engagement, and innovation underscores its role as a key player in the iron ore mining market.

Fortescue Metals Group: Driving Growth in Australia

Fortescue Metals Group is an Australian mining company that has rapidly emerged as a major player in the Iron Ore Mining Sector. The company operates a portfolio of iron ore mines in the Pilbara region of Western Australia, with a focus on low-cost production and operational efficiency. Fortescue's strategic investments in infrastructure, technology, and sustainability initiatives have positioned it as a key contributor to Australia's iron ore industry and a significant player in the global market.

Anglo American: A Diversified Mining Conglomerate

Anglo American is a multinational mining company with diverse interests in various commodities, including iron ore. The company's iron ore operations are primarily located in South Africa and Brazil, where it operates mines and processing facilities to produce high-quality iron ore products for global markets. Anglo American's commitment to safety, sustainability, and responsible mining practices underscores its contribution to the iron ore mining sector.

Conclusion: Driving Innovation and Growth

The major players in the iron ore mining market play a pivotal role in shaping industry dynamics, driving innovation, and fueling economic growth. Through their extensive operations, technological advancements, and commitment to sustainability, these companies contribute significantly to meeting global demand for iron ore products and driving value across the supply chain. As the industry continues to evolve, collaboration, innovation, and strategic investments will be key to unlocking new opportunities and driving sustainable growth in the iron ore mining sector.

#Iron Ore Mines#Global Iron Ore Mining Market#Iron Ore Mining Market Growth#Iron Ore Mining Market Report#Iron Ore Mining Market Share#Iron Ore Mining Market Size#Iron Ore Mining Market Trends#Iron Ore Mining Market#Iron Ore Mining Market Research Reports#Iron Ore Mining Market Players#Iron Ore Mining Market Top Companies#Iron Ore Mining Industry

0 notes

Text

Bauxite Mining Market Top Contenders in the Mining Ring

The bauxite mining market is a battleground where industrial giants clash for the precious ore that fuels the aluminum industry. This resource-rich arena is not a free-for-all, however. Established players dominate the scene, wielding their experience, global reach, and strategic prowess. Let's meet the reigning champions and rising stars of bauxite mining:

The Big Three: Unquestionable Powerhouses

Rio Tinto: This Anglo-Australian titan is a force to be reckoned with. With extensive bauxite mining operations in Australia and Guinea, Rio Tinto controls a significant portion of the global market. Their dominance is further solidified by their vast experience and established infrastructure.

Alcoa Corporation: This American giant isn't just a mining champion; they're an integrated aluminum powerhouse. Alcoa not only extracts bauxite but also refines alumina and produces aluminum. This vertical integration gives them a strategic edge, allowing them to control the entire aluminum value chain.

National Aluminium Company Limited (NALCO): As India's undisputed bauxite king, NALCO is a major player in the Asia-Pacific region, a significant bauxite producer. Their dominance stems from their control over India's rich bauxite reserves and their role in fulfilling the country's growing aluminum demand.

Beyond the Triumvirate: Regional Players and Future Aspirants

The bauxite mining ring isn't a closed circuit. Several regional heavyweights and aspiring companies are making their mark:

Rusal: The Russian aluminum giant, Rusal, throws its weight around, particularly with its significant bauxite mining operations in Guinea. Their presence adds another layer of complexity to the global market dynamics.

Norsk Hydro ASA: This Norwegian powerhouse isn't just a hydropower champion; they're a bauxite and alumina producer too. Their strong presence in Europe makes them a crucial player in the regional market.

Emirates Global Aluminium PJSC (EGA): This Dubai-based company is a strategic player in the Middle East. Located near booming aluminum consumption regions, EGA is well-positioned to capitalize on future market growth.

South32: Watch out for this rising Australian star! South32's bauxite mining projects in Worsley, Western Australia, have them challenging the established order. Their innovative approach and focus on efficiency could see them climb the ranks in the coming years.

The Asian Advantage: A Resourceful Region on the Rise

The Asia-Pacific region is a bauxite powerhouse, boasting over 60% of the world's total reserves. This abundance fuels the dominance of companies like NALCO and positions China and Australia as major players. The region's economic growth, particularly in China and India, further fuels the bauxite mining fire as aluminum demand skyrockets.

The Future of the Bauxite Brawl: More Than Just Muscle

The Bauxite Mining arena isn't just about brute force and resource control. The future demands a more nuanced approach, with sustainability becoming a key battleground:

Sustainable Practices: Companies that prioritize environmentally friendly practices and invest in rehabilitation efforts will gain a competitive edge. Consumers and regulators are increasingly demanding responsible mining, making sustainability a strategic imperative.

Technological Advancements: Innovation is key to staying ahead of the curve. Advancements in mining technologies can improve efficiency, reduce environmental impact, and enhance worker safety. Companies that embrace automation and data-driven solutions will likely be the future victors.

Conclusion: A Fight for Resources, a Race for Innovation

The bauxite mining market is a fascinating battleground where established players and aspiring companies vie for dominance. While Asia's resource wealth and economic growth play a significant role, the future demands a focus on sustainability and technological innovation. The companies that can navigate this complex landscape and adapt to changing market dynamics will be the ultimate champions in the bauxite brawl.

#Bauxite Mining#Bauxite Mining in Guinea#Bauxite Mining Companies in USA#Bauxite Mining Industry#Bauxite Mining Market#Bauxite Mining Market Challenges#Bauxite Mining Market Share#Bauxite Mining Market Size#Bauxite Mining Market Trends#Global Bauxite Mining Market#Bauxite Mining Market Competitors#Bauxite Mining Market Outlook#Bauxite Mining Market Research Reports#Bauxite Mining Industry Research Reports#Bauxite Mining Market Growth#Bauxite Mining Market Analysis#Bauxite Mining Market Top Players#Bauxite Mining Market Major Players

0 notes

Text

Exploring the Iron Ore Mining Market Trends, Growth, and Major Players

Introduction

The iron ore mining industry plays a crucial role in global economic development, serving as the primary source of iron, a key ingredient in steel production. This article delves into the iron ore mining market, examining its growth, market share, size, trends, and major players, while also providing valuable insights into the market's current status and future outlook.

Iron Ore Mining Market Research Reports

Iron Ore Market research reports offer comprehensive analyses of the iron ore mining industry, providing valuable insights into market trends, growth drivers, challenges, and opportunities. Recent reports indicate a positive outlook for the global iron ore mining market, with steady growth projected in the coming years.

Iron Ore Mining Market Growth

The iron ore mining market has experienced moderate growth in recent years, with a compound annual growth rate CAGR of 1.6% over the past five years (2018-2023). Market analysts forecast continued growth, with the market expected to reach an estimated value of USD 299.1 billion in 2024 and projected to grow at a CAGR of 7.10% to reach USD 4,922.48 million by 2030.

Iron Ore Mining Market Report

Market reports provide detailed insights into the iron ore mining industry, offering comprehensive analyses of market size, growth, trends, and key players. The market size was estimated at USD 299.1 billion in 2023, with steady growth anticipated in the coming years.

Iron Ore Mining Market Share

The iron ore mining market is dominated by a few key players, with Australia and Brazil leading global production. In 2022, global iron ore production reached an estimated 2.42 billion tonnes, with Australia accounting for 880 million tonnes and Brazil producing 410 million tonnes.

Iron Ore Mining Market Size

The global iron ore mining market is substantial, with a market size estimated at USD 299.1 billion in 2023. Steady growth is expected in the coming years, driven by increasing demand for iron ore from steel production industries worldwide.

Iron Ore Mining Market Trends

Several trends are shaping the iron ore mining market, including:

Price Fluctuations: Iron ore prices have experienced fluctuations, with average prices around USD 9,500 per tonne in 2023. Fluctuations in prices can be influenced by factors such as supply and demand dynamics, geopolitical tensions, and environmental considerations.

Demand Drivers: Rising demand for steel production, particularly in developing economies like China, is driving demand for iron ore. Steel is a crucial material in infrastructure development, automotive manufacturing, and construction projects, driving demand for iron ore.

Supply Constraints: Limited readily available, high-grade iron ore deposits pose a challenge for the industry. As existing reserves are depleted, mining companies are exploring new technologies and methods to extract iron ore from lower-grade deposits, increasing production costs and timelines.

Iron Ore Mining Market Players

Key players in the Iron Ore Mining Market include:

Vale S.A. (Brazil): One of the largest iron ore producers globally, Vale S.A. operates extensive mining operations in Brazil, with a focus on sustainable mining practices and environmental stewardship.

Rio Tinto (Australia): A leading global mining company, Rio Tinto is a major player in the iron ore mining sector, with significant operations in Australia. The company is known for its technological innovation and commitment to operational excellence.

BHP Group (Australia): BHP Group is another prominent player in the iron ore mining industry, with extensive mining operations in Australia. The company focuses on maximizing value for shareholders while prioritizing safety, sustainability, and community engagement.

Conclusion

The iron ore mining market presents significant opportunities for growth and investment, driven by steady demand for iron ore from steel production industries worldwide. Despite challenges such as supply constraints and price fluctuations, the industry remains resilient, with key players leveraging technology, innovation, and sustainable practices to ensure long-term success and profitability.

#Iron Ore Mines#Global Iron Ore Mining Market#Iron Ore Mining Market Growth#Iron Ore Mining Market Report#Iron Ore Mining Market Share#Iron Ore Mining Market Size#Iron Ore Mining Market Trends#Iron Ore Mining Market#Iron Ore Mining Market Research Reports#Iron Ore Mining Market Players#Iron Ore Mining Market Top Companies#Iron Ore Mining Industry

0 notes

Text

Exploring the Bauxite Mining Market Challenges, Trends, and Outlook

Introduction

Bauxite mining is a critical industry that serves as the primary source of aluminum ore, essential for various sectors such as automotive, aerospace, and construction. This article provides an in-depth analysis of the bauxite mining market, including its challenges, market share, size, trends, global outlook, competitors, and future prospects.

Bauxite Mining Market Research Reports

Bauxite Mining Market Research Reports offer valuable insights into the bauxite mining industry, providing detailed analyses of market trends, growth drivers, challenges, and opportunities. Recent studies indicate that the global bauxite mining market is poised for steady growth, driven by increasing demand for aluminum across industries worldwide.

Bauxite Mining Market Outlook

The outlook for the Bauxite Mining Market is optimistic, driven by sustained demand for aluminum products and ongoing infrastructure development projects worldwide. However, mining companies must navigate challenges such as resource depletion, regulatory compliance, and community engagement to ensure sustainable growth and long-term profitability.

Bauxite Mining Market Challenges

The bauxite mining sector faces numerous challenges, including environmental concerns, regulatory complexities, and geopolitical risks. Environmental impacts such as deforestation, biodiversity loss, and water pollution pose significant challenges that mining companies must address through sustainable mining practices and environmental stewardship.

Bauxite Mining Market Share

Leading mining companies dominate the bauxite mining market, commanding a significant share of global bauxite production. According to industry data, major players such as Rio Tinto, Alcoa Corporation, and Guinea Alumina Corporation collectively account for a substantial portion of the global bauxite market share.

Bauxite Mining Market Size

The global bauxite mining market is substantial in size, driven by the growing demand for aluminum products worldwide. Market statistics indicate that the global bauxite market was valued at approximately USD 13.8 billion in 2021, with a projected compound annual growth rate (CAGR) of 3.4% from 2022 to 2028.

Bauxite Mining Market Trends

Several key trends are reshaping the bauxite mining market, including:

Sustainable Mining Practices: Mining companies are increasingly embracing sustainable practices to minimize environmental impact and promote responsible resource extraction. Initiatives such as reforestation, land rehabilitation, and water conservation are becoming integral parts of bauxite mining operations.

Digitalization and Automation: The adoption of digital technologies and automation is revolutionizing bauxite mining operations, enhancing efficiency, productivity, and safety. Technologies such as autonomous vehicles, remote monitoring systems, and predictive analytics are transforming the way bauxite is extracted and processed.

Global Bauxite Mining Market

The global bauxite mining market is influenced by various factors, including economic trends, trade policies, and technological advancements. Emerging economies in Asia-Pacific, particularly China and India, are significant consumers of bauxite, driving demand and shaping market dynamics in the region.

Bauxite Mining Market Competitors

Key competitors in the bauxite mining market include:

Rio Tinto: With extensive bauxite mining operations in Australia, Guinea, and Brazil, Rio Tinto is one of the largest producers of bauxite globally. The company's commitment to sustainable mining practices and innovation has positioned it as a leader in the industry.

Alcoa Corporation: Alcoa is a prominent player in the bauxite mining sector, with operations in several countries, including Australia, Brazil, and Jamaica. The company's focus on operational excellence and technological innovation has enabled it to maintain a competitive edge in the market.

Guinea Alumina Corporation (GAC): GAC is a key player in the bauxite mining industry, with significant operations in Guinea, one of the world's largest bauxite-producing countries. The company's strategic investments in infrastructure and resource development have positioned it for future growth and expansion.

Conclusion

The bauxite mining market presents significant opportunities for industry participants, but also poses challenges that must be addressed proactively. By embracing sustainability, innovation, and collaboration, mining companies can navigate market dynamics and capitalize on emerging opportunities in the global bauxite mining industry.

#Bauxite Mining#Bauxite Mining in Guinea#Bauxite Mining Companies in USA#Bauxite Mining Industry#Bauxite Mining Market#Bauxite Mining Market Challenges#Bauxite Mining Market Share#Bauxite Mining Market Size#Bauxite Mining Market Trends#Global Bauxite Mining Market#Bauxite Mining Market Competitors#Bauxite Mining Market Outlook#Bauxite Mining Market Research Reports#Bauxite Mining Industry Research Reports#Bauxite Mining Market Growth#Bauxite Mining Market Analysis#Bauxite Mining Market Top Players#Bauxite Mining Market Major Players

0 notes

Text

The Copper Mining Market Size, Trends, and Top Players

Introduction

Copper mining is a fundamental sector in the global economy, providing the essential raw material for a wide range of industries, including construction, electronics, and transportation. This article explores the dynamics of the copper mining market, examining its outlook, research reports, market share, trends, size, challenges, major players, and competitors.

Copper Mining Market Outlook

The outlook for the Copper Mining Market is promising, driven by the increasing demand for copper in infrastructure development, renewable energy projects, and electric vehicles. Market analysts project steady growth in the coming years, supported by factors such as urbanization, industrialization, and technological advancements.

Copper Mining Market Research Reports

Market research reports offer valuable insights into the copper mining industry, providing in-depth analyses of market dynamics, production statistics, consumption patterns, and trade flows. These reports serve as essential tools for investors, mining companies, and policymakers to understand market trends and make informed decisions.

Copper Mining Market Size

The global copper mining market is significant, with billions of dollars invested annually in exploration, development, and production. According to recent data, the global copper market was valued at approximately USD 150 billion in 2020. Copper production totaled over 20 million metric tons in the same year, with major copper-producing countries including Chile, Peru, China, and the United States.

The market size is expected to grow steadily in the coming years, driven by increasing demand for copper in infrastructure projects, electrical wiring, and consumer electronics.

Copper Mining Market Share

The copper mining market is characterized by several major players who command significant market shares. Key players include multinational mining corporations, state-owned enterprises, and junior mining companies, each contributing to the global copper supply chain.

Copper Mining Market Trends

Several trends are shaping the copper mining market, including:

Technological Advancements: Advances in mining technologies, such as automation, remote sensing, and data analytics, are improving operational efficiency, safety, and productivity in copper mining operations. Innovations in extraction methods and processing techniques are also enhancing resource recovery and reducing environmental impacts.

Sustainable Practices: There is a growing emphasis on sustainability in copper mining, with companies adopting eco-friendly technologies, implementing energy-efficient processes, and engaging with local communities to minimize environmental impacts and promote responsible mining practices.

Supply Chain Resilience: The copper mining industry is adapting to evolving supply chain dynamics, including disruptions caused by geopolitical tensions, trade policies, and the COVID-19 pandemic. Companies are diversifying their supply chains, investing in inventory management, and enhancing logistics capabilities to ensure resilience and continuity of operations.

Copper Mining Market Challenges

Despite its growth prospects, the copper mining industry faces several challenges, including:

Resource Depletion: Declining ore grades and increasing extraction costs pose challenges for copper mining companies, necessitating investments in exploration and technology to maintain production levels and reserves.

Environmental Regulations: Copper mining operations have significant environmental impacts, including water pollution, habitat destruction, and greenhouse gas emissions. Regulatory requirements related to environmental compliance, mine closure, and community engagement are becoming increasingly stringent, driving up compliance costs and operational risks.

Market Volatility: Copper prices are subject to volatility due to factors such as supply-demand dynamics, macroeconomic conditions, and geopolitical tensions. Fluctuations in copper prices can impact the profitability and investment decisions of mining companies, requiring robust risk management strategies and financial planning.

Copper Mining Market Major Players

Leading companies in the Copper Mining Market include:

Codelco: Codelco is the world's largest copper producer, with operations in Chile and international exploration projects.

BHP Group: BHP is a global mining company with significant copper assets, including mines in Chile, Peru, and Australia.

Rio Tinto: Rio Tinto is a diversified mining company with copper operations in Mongolia, the United States, and Australia.

Glencore: Glencore is a major copper producer with assets in Zambia, the Democratic Republic of Congo, and Peru.

Freeport-McMoRan: Freeport-McMoRan operates copper mines in the United States, Indonesia, and South America.

Conclusion

The copper mining market presents significant opportunities for growth and investment, driven by increasing demand for copper in various industries. Despite facing challenges such as resource depletion and environmental regulations, the industry is poised for steady expansion, supported by technological innovation, sustainability initiatives, and market resilience. Collaboration, innovation, and responsible mining practices will be essential for ensuring the long-term sustainability and success of the copper mining sector.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Research Reports#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Outlook#Copper Mining Market Top Players#Global Copper Mining Market#Copper Mining Market Analysis

0 notes

Text

Unveiling The Gold Mining Market: Trends, Insights, And Key Players

Introduction

Gold mining is a critical sector in the global economy, driven by the enduring value and demand for gold as a precious metal. This article delves into the dynamics of the Gold Mining Market, exploring its trends, growth drivers, challenges, and key players shaping the industry landscape.

Understanding the Gold Mining Market

Gold mining involves the extraction of gold from the earth's crust through various methods, including surface mining, underground mining, and placer mining. Gold has been prized for centuries for its intrinsic value, serving as a store of wealth, a hedge against economic uncertainty, and a component of luxury goods and jewelry.

Gold Mining Market Research Reports

Market research reports provide valuable insights into the gold mining industry, offering analyses of market trends, production statistics, exploration activities, and regulatory developments. These reports assist investors, mining companies, and policymakers in making informed decisions regarding investment, expansion, and policy formulation.

Gold Mining Market Size

The global gold mining market is substantial, with billions of dollars invested annually in exploration, development, and production. According to recent data, The global gold mining industry was valued at approximately USD 353 billion in 2020. Gold production totaled over 3,000 metric tons in the same year, with major gold-producing countries including China, Australia, Russia, and the United States.

The market size is expected to grow steadily in the coming years, driven by factors such as increasing demand for gold in jewelry, investment, and technology sectors.

Gold Mining Market Trends

Several trends are shaping the gold mining market, including:

Technological Innovation: Advances in mining technologies, such as automation, artificial intelligence, and data analytics, are enhancing efficiency, safety, and productivity in gold mining operations. Innovative extraction methods and processing techniques are also improving recovery rates and reducing environmental impacts.

Sustainable Practices: There is a growing emphasis on sustainable mining practices in the gold mining industry. Companies are increasingly adopting eco-friendly technologies, implementing biodiversity conservation measures, and engaging with local communities to ensure responsible mining operations.

Exploration and Discovery: Despite being a mature industry, gold mining continues to benefit from ongoing exploration efforts aimed at discovering new gold deposits. Remote sensing technologies, geological modeling, and geochemical analysis are facilitating the identification of prospective areas for gold exploration.

Gold Mining Market Growth

The gold mining market is experiencing steady growth, driven by factors such as:

Safe-Haven Demand: Gold is often perceived as a safe-haven asset during times of economic uncertainty, geopolitical tensions, and currency fluctuations. As a result, demand for gold tends to increase during periods of market volatility, supporting the growth of the gold mining industry.

Investment Demand: Gold serves as an attractive investment option, offering diversification benefits and hedging against inflation and currency devaluation. Institutional investors, central banks, and retail investors allocate significant capital to gold-backed exchange-traded funds (ETFs), physical gold holdings, and gold mining equities, driving demand for gold and stimulating mining activities.

Gold Mining Market Challenges

Despite its growth prospects, the gold mining industry faces several challenges, including:

Environmental Regulations: Gold mining operations have significant environmental impacts, including habitat destruction, water pollution, and land degradation. Regulatory requirements related to environmental protection, biodiversity conservation, and mine closure are becoming increasingly stringent, posing compliance challenges and increasing operational costs for mining companies.

Cost Pressures: Rising production costs, labor shortages, and fluctuations in energy and commodity prices can exert pressure on the profitability of gold mining operations. Companies must optimize their operations, implement cost-saving measures, and invest in technological innovation to remain competitive in a challenging operating environment.

Social License to Operate: Community relations and stakeholder engagement are critical for obtaining and maintaining a social license to operate in the gold mining industry. Companies must address social and cultural concerns, respect indigenous rights, and mitigate social and environmental impacts to secure community support and regulatory approvals for their mining projects.

Key Players in the Gold Mining Market

The Gold Mining Market is dominated by several major players, including:

Newmont Corporation: Newmont is one of the world's largest gold mining companies, with operations in multiple countries and a diverse portfolio of gold assets.

Barrick Gold Corporation: Barrick Gold is a leading gold producer, with mines located in North and South America, Africa, and the Asia-Pacific region.

AngloGold Ashanti Limited: AngloGold Ashanti is a global gold mining company, with operations in Africa, the Americas, and Australia.

Polyus PJSC: Polyus is the largest gold producer in Russia and one of the top gold mining companies globally, with significant reserves and production capacity.

Kinross Gold Corporation: Kinross Gold operates mines in North and South America, West Africa, and Russia, producing gold and silver.