#Plastic Compounding Market Analysis

Explore tagged Tumblr posts

Text

Plastic Compounding Market looks to expand its size in Overseas Market

A Latest intelligence report published by Market Research Forecast with title "Global Plastic Compounding Market Outlook to 2032. A detailed study accumulated to offer Latest insights about acute features of the Plastic Compounding market. This report provides a detailed overview of key factors in the Global Plastic Compounding Market and factors such as driver, restraint, past and current trends, regulatory scenarios and technology development. Definition: The Plastic Compounding Marketsize was valued at USD 52.74 USD million in 2023 and is projected to reach USD 74.71 USD million by 2032, exhibiting a CAGR of 5.1 % during the forecast period. Major Players in This Report Include: Asahi Kasei Corporation, BASF SE",LyondellBasell,SABIC,"Solvay S.A., Celanese Corporation, Covestro AG",DuPont,"LANXESS A.G., Kingfa SCI. & TECH. CO., LTD., Adell Plastics",PolyVisions,"Foster Corporation, RTP Company, KURARAY CO., LTD., MRC Polymers, Kraton Corporation, Aurora Plastics LLC, Other Key Players Free Sample Report + All Related Graphs & Charts @ : https://marketresearchforecast.com/report/plastic-compounding-market-1636/sample-report Global Plastic Compounding the manufacturing cost structure analysis of the market is based on the core chain structure, engineering process, raw materials and suppliers. The manufacturing plant has been developed for market needs and new technology development. In addition, Global Plastic Compounding Market attractiveness according to country, end-user, and other measures is also provided, permitting the reader to gauge the most useful or commercial areas for investments. The study also provides special chapter designed (qualitative) to highlights issues faced by industry players in their production cycle and supply chain. The Global Plastic Compounding Market segments and Market Data Break Down are illuminated below: Type: Polyethylene, Polypropylene, Poly Vinyl Chloride, Polystyrene, Polyethylene, Polybutylene Terephthalate, Polyamide, Polycarbonate, Acrylonitrile Butadiene Styrene, and Others Market Drivers: Increasing Demand for Plastic Compounding from Construction Industry to Drive the Market Market Trend: Adoption of Compounded Plastics to Enhance the Properties of Virgin Plastics Will be a Key Market Trend Restrains: Fluctuations in Prices of Raw Material to Restrict Plastic Compounding Market Growth Enquire for customization in Report @: https://marketresearchforecast.com/report/plastic-compounding-market-1636/enquiry-before-buy Geographically World Global Plastic Compounding markets can be classified as North America, Europe, Asia Pacific (APAC), Middle East and Africa and Latin America. North America has gained a leading position in the global market and is expected to remain in place for years to come. The growing demand for Global Plastic Compounding markets will drive growth in the North American market over the next few years. In the last section of the report, the companies responsible for increasing the sales in the Global Plastic Compounding Market have been presented. These companies have been analyzed in terms of their manufacturing base, basic information, and competitors. In addition, the application and product type introduced by each of these companies also form a key part of this section of the report. The recent enhancements that took place in the global market and their influence on the future growth of the market have also been presented through this study. Report Highlights:

Comprehensive overview of parent market & substitute market

In-depth market segmentation (Trends, Growth with Historical & Forecast Analysis)

Recent industry trends and development activity

Competitive landscape (Heat Map Analysis for Emerging Players & Market Share Analysis for Major Players along with detailed Profiles)

Strategic Points Covered in Table of Content of Global Plastic Compounding Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Plastic Compounding market

Chapter 2: Exclusive Summary – the basic information of the Plastic Compounding Market.

Chapter 3: Changing Impact on Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Plastic Compounding;

Chapter 4: Presenting the Plastic Compounding Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2019-2024

Chapter 6: Evaluating the leading manufacturers of the Plastic Compounding market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2024-2032)

……………. Buy this research @ https://marketresearchforecast.com/report/plastic-compounding-market-1636/checkout?type=corporate Key questions answered

Who are the Leading key players and what are their Key Business plans in the Global Plastic Compounding market?

What are the key concerns of the five forces analysis of the Global Plastic Compounding market?

What are different prospects and threats faced by the dealers in the Global Plastic Compounding market?

What possible measures players are taking to overcome and stabilize the situation?

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Asia. Contact US: Craig Francis (PR & Marketing Manager) Market Research Forecast Unit No. 429, Parsonage Road Edison, NJ New Jersey USA – 08837 Phone: (+1 201 565 3262, +44 161 818 8166) [email protected]

#Global Plastic Compounding Market#Plastic Compounding Market Demand#Plastic Compounding Market Trends#Plastic Compounding Market Analysis#Plastic Compounding Market Growth#Plastic Compounding Market Share#Plastic Compounding Market Forecast#Plastic Compounding Market Challenges

0 notes

Text

Acetic Acid Market - Forecast(2024 - 2030)

Acetic Acid Market Overview

Acetic Acid Market Size is forecast to reach $14978.6 Million by 2030, at a CAGR of 6.50% during forecast period 2024-2030. Acetic acid, also known as ethanoic acid, is a colorless organic liquid with a pungent odor. The functional group of acetic acid is methyl and it is the second simplest carboxylic acid. It is utilized as a chemical reagent in the production of many chemical compounds. The major use of acetic acid is in the manufacturing of vinyl acetate monomer, acetic anhydride, easter and vinegar. It is a significant industrial chemical and chemical reagent used in the production of photographic film, fabrics and synthetic fibers. According to the Ministry of Industry and Information Technology, from January to September 2021, the combined operating revenue of 12,557 major Chinese garment companies was US$163.9 billion, showing a 9% increase. Thus, the growth of the textile industry is propelling the market growth for Acetic Acid.

Report Coverage

The “Acetic Acid Market Report – Forecast (2024-2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Acetic Acid industry.

By Form: Liquid and Solid.

By Grade: Food grade, Industrial grade, pharmaceutical grade and Others.

By Application: Vinyl Acetate Monomer, Purified Terephthalic Acid, Ethyl Acetate, Acetic Anhydride, Cellulose Acetate, Acetic Esters, Dyes, Vinegar, Photochemical and Others

By End-use Industry: Textile, Medical and Pharmaceutical, Oil and Gas, Food and Beverages, Agriculture, Household Cleaning Products, Plastics, Paints & Coating and Others.

By Geography: North America (the USA, Canada and Mexico), Europe (the UK, Germany, France, Italy, Netherlands, Spain, Russia, Belgium and the Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia and New Zealand, Indonesia, Taiwan, Malaysia and the Rest of APAC), South America (Brazil, Argentina, Colombia, Chile and the Rest of South America) and the Rest of the World (the Middle East and Africa).

Request Sample

Key Takeaways

The notable use of Acetic Acid in the food and beverages segment is expected to provide a significant growth opportunity to increase the Acetic Acid Market size in the coming years. As per the US Food and Agriculture Organization, world meat production reached 337 million tonnes in 2019, up by 44% from 2000.

The notable demand for vinyl acetate monomer in a range of industries such as textile finishes, plastics, paints and adhesives is driving the growth of the Acetic Acid Market.

Increase in demand for vinegar in the food industry is expected to provide substantial growth opportunities for the industry players in the near future in the Acetic Acid industry.

Acetic Acid Market Segment Analysis – by Application

The vinyl acetate monomer segment held a massive 44% share of the Acetic Acid Market share in 2021. Acetic acid is an important carboxylic acid and is utilized in the preparation of metal acetates and printing processes, industrially. For industrial purposes, acetic acid is manufactured by air oxidation of acetaldehyde with the oxidation of ethanol, butane and butene. Acetic acid is extensively used to produce vinyl acetate which is further used in formulating polyvinyl acetate. Polyvinyl acetate is employed in the manufacturing of plastics, paints, textile finishes and adhesives. Thus, several benefits associated with the use of vinyl acetate monomer is boosting the growth and is expected to account for a significant share of the Acetic Acid Market.

Inquiry Before Buying

Acetic Acid Market Segment Analysis – by End-use Industry

The food and beverages segment is expected to grow at the fastest CAGR of 7.5% during the forecast period in the Acetic Acid Market. Acetic Acid is also known as ethanoic acid and is most extensively used in the production of vinyl acetate monomer. Vinyl acetate is largely used in the production of cellulose acetate which is further used in several industrial usage such as textiles, photographic films, solvents for resins, paints and organic esters. PET bottles are manufactured using acetic acid and are further utilized as food containers and beverage bottles. In food processing plants, acetic acid is largely used as cleaning and disinfecting products. Acetic acid is extensively used in producing vinegar which is widely used as a food additive in condiments and the pickling of vegetables. According to National Restaurant Association, the foodservice industry is forecasted to reach US$898 billion by 2022. Thus, the advances in the food and beverages industry are boosting the growth of the Acetic Acid Market.

Acetic Acid Market Segment Analysis – by Geography

Asia-Pacific held a massive 41% share of the Acetic Acid Market in 2021. This growth is mainly attributed to the presence of numerous end-use industries such as textile, food and beverages, agriculture, household cleaning products, plastics and paints & coatings. Growth in urbanization and an increase in disposable income in this region have further boosted the industrial growth in this region. Acetic acid is extensively used in the production of metal acetates, vinyl acetate and vinegar which are further utilized in several end-use industries. Also, Asia-Pacific is one of the major regions in the domain of plastic production which provides substantial growth opportunities for the companies in the region. According to Plastic Europe, China accounted for 32% of the world's plastic production. Thus, the significant growth in several end-use industries in this region is also boosting the growth of the Acetic Acid Market.

Acetic Acid Market Drivers

Growth in the textile industry:

Acetic Acid, also known as ethanoic acid, is widely used in the production of metal acetate and vinyl acetate which are further used in the production of chemical reagents in textiles, photographic films, paints and volatile organic esters. In the textile industry, acetic acid is widely used in textile printing and dyes. According to China’s Ministry of Industry and Information Technology, in 2020, textile and garment exports from China increased by 9.6% to US$291.22 billion. Also, according to the U.S. Department of Commerce, from January to September 2021, apparel exports increased by 28.94% to US$4.385 billion, while textile mill products rose by 17.31% to US$12.365 billion. Vinyl acetate monomer is utilized in the textile industry to produce synthetic fibers. Thus, the global growth in demand for textiles is propelling the growth and is expected to account for a significant share of the Acetic Acid Market size.

Schedule a call

Surge in use of vinegar in the food industry:

The rapid surge in population along with the adoption of a healthy and sustainable diet has resulted in an increase in demand for food items, thereby increasing the global production level of food items. As per US Food and Agriculture Organization, in 2019, global fruit production went up to 883 million tonnes, showing an increase of 54% from 2000, while global vegetable production was 1128 million tonnes, showing an increase of 65%. Furthermore, world meat production reached 337 million tonnes in 2019, showing an increase of 44% from 2000. Acetic acid is majorly used in the preparation of vinegar which is further widely utilized as a food ingredient and in personal care products. Vinegar is used in pickling liquids, marinades and salad dressings. It also helps to reduce salmonella contamination in meat and poultry products. Furthermore, acetic acid and its sodium salts are used as a food preservative. Thus, the surge in the use of vinegar in the food industry is boosting the growth of the Acetic Acid Market.

Acetic Acid Market Challenge

Adverse impact of acetic acid on human health:

Acetic Acid is considered a strong irritant to the eye, skin and mucous membrane. Prolong exposure to and inhalation of acetic acid may cause irritation to the nose, eyes and throat and can also damage the lungs. The workers who are exposed to acetic acid for more than two or three years have witnessed upper respiratory tract irritation, conjunctival irritation and hyperkeratotic dermatitis. The Occupational Safety and Health Administration (OSHA) reveals that the standard exposure to airborne acetic acid is eight hours. Furthermore, a common product of acetic acid i.e., vinegar can cause gastrointestinal tract inflammatory conditions such as indigestion on excess consumption. Thus, the adverse impact of Acetic Acid may hamper the market growth.

Buy Now

Acetic Acid Industry Outlook

The top 10 companies in the Acetic Acid Market are:

Celanese Corporation

Eastman Chemical Company

LyondellBasell

British Petroleum

Helm AG

Pentoky Organy

Dow Chemicals

Indian Oil Corporation

Daicel Corporation

Jiangsu Sopo (Group) Co. Ltd.

Recent Developments

In March 2021, Celanese Corporation announced the investment to expand the production facility of vinyl portfolio for the company’s acetyl chain and derivatives in Europe and Asia.

In April 2020, Celanese Corporation delayed the construction of its new acetic acid plant and expansion of its methanol production by 18 months at the Clear Lake site in Texas.

In October 2019, BP and Chian’s Zhejiang Petroleum and Chemical Corporation signed MOU in order to create a joint venture to build a 1 million tonne per annum Acetic Acid plant in eastern China.

Key Market Players:

The Top 5 companies in the Acetic Acid Market are:

Celanese Corporation

Ineos Group Limited

Eastman Chemical Company

LyondellBasell Industries N.V.

Helm AG

For more Chemicals and Materials Market reports, please click here

#Acetic Acid Market#Acetic Acid Market Share#Acetic Acid Market Size#Acetic Acid Market Forecast#Acetic Acid Market Report#Acetic Acid Market Growth

2 notes

·

View notes

Text

"but CACTUS-" cactus """"leather""""" is up to 60% plastic and last time i saw it get tested in a study also contained like 8 federally banned carcinogens.* IT'S ALL FUCKING PLASTIC.

"but tANNING CHEMICALS-" i am holding your face in my hands. your plastic shit production also involves dangerous chemicals. So. Many. Chemicals. and also Continues to release Nasty Shit into the water supply and then landfill after it's made.

you want a textile that doesn't kill an animal? great, we have some! it's FUCKING WOOL. we have literally bred sheep (and goats/alpaca/llamas) for nearly TEN THOUSAND YEARS to harvest their wool in a yearly haircut that leaves them trotting back to the herd in under five minutes with modern tools and a competent shearer. Not shearing these animals is actually detrimental to their welfare!

some of us are allergic to wool though, or can't use it for other reasons. (I will mention though - if you're allergic to sheep's wool specifically I would suggest checking out alpaca fiber if you can, they're different enough many people -though not all- don't have a sensitivity to the material. I have some wonderful dryer balls made of alpaca felt from a local farm and don't have to worry about setting off Mom's allergies with them, and they last for a good while! ours are going on four or five years now.)

look. the cows are going to die. that is a fact of the world we live in right now. do you want their corpses dumped somewhere to rot, or do you want to let someone make use of that massive amount of material to clothes themselves?

*edit: apologies, not 8 but 5 restricted chemicals. study linked here:

All tested materials emitted volatile organic compounds when applied to the thermal desorption screening procedure. Restricted substances were identified in the samples of PUR-coated textile (reference), the similarly constructed materials Desserto®, Appleskin®, and Vegea®, but also in Pinatex®. The PUR-coated textile contained considerable amounts of dimethylformamide (DMFa) and toluene and traces of N,N-dimethylacetamide. In Appleskin®, butanone oxime and traces of DMFa were detected. Desserto® contained the five restricted substances butanone oxime, toluene, free isocyanate, folpet (an organic pesticide), and traces of the plasticizer Diisobutyl phthalate (DIBP). Toluene was detected in the sample of Vegea® and DIBP in that of Pinatex®.

Desserto® and Appleskin® adopt this principle. A part of PUR is replaced by agricultural by-products, which are used as fillers. A detailed analysis of the origin of the natural component and its content in relation to the bulk of the material was not possible, however. Nevertheless, the bulk of the materials remains to consist of polyurethane.

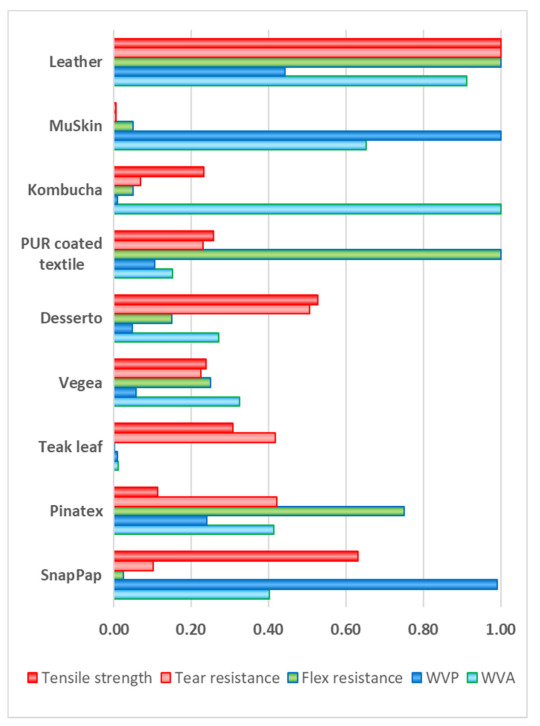

Figure 5 shows impressively the performance of the different materials in comparison to the references. Alternative materials have specific advantages, but none of the materials combines high mechanical strength and flex resistance with high water vapor permeability as in the case of leather. (note: WVP and WVA refer to Water Vapor Permeability and Water Vapor Absorption respectively)

I love leather and I love fur and I don’t mind arguing about it.

#animal welfare#leather#vegan leather#pleather is plastic#vegan leather is plastic#it's all fucking plastic

113K notes

·

View notes

Text

Fast Red B Base: A Key Dye Intermediate Backed by Jay Finechem’s Manufacturing Excellence

Fast Red B Base is a widely used chemical intermediate that plays an essential role in the production of vibrant and durable azo dyes. Known for its reddish-yellow hue and high performance in textile and pigment applications, it is a crucial raw material for industries that rely on color precision and chemical consistency. Chemically identified as 2-Methoxy-4-Nitroaniline with CAS No. 97-52-9, this compound is valued for its high purity, thermal stability, and reliable diazo coupling reactivity.

As global industries push for more dependable and sustainable sources for dye intermediates, selecting a high-quality Fast Red B Base manufacturer becomes vital. This is where Jay Finechem, an established name in India’s specialty chemical landscape, shines. With their focus on purity, compliance, and customer satisfaction, Jay Finechem is the preferred partner for companies sourcing Fast Red B Base for dye and pigment formulations.

Understanding Fast Red B Base: Composition and Utility

Fast Red B Base, or 2-Methoxy-4-Nitroaniline, is part of the aromatic amine family. It contains both nitro and methoxy groups, making it a highly reactive diazo component in the synthesis of azo dyes. It appears as a yellow to reddish crystalline powder and is slightly soluble in water, with better solubility in organic solvents such as acetone and ethanol. Its chemical formula is C7H8N2O3, and it has a molecular weight of 168.15 g/mol.

This compound is essential in producing dyes that offer excellent lightfastness, wash resistance, and color strength, especially on cotton, viscose, and silk fabrics. It is also used in creating organic pigments for plastic coloring, printing inks, and even in coatings used for industrial and road marking purposes. Such diverse applications require the product to be manufactured under strict quality controls, a hallmark of Jay Finechem’s operations.

Industrial Applications of Fast Red B Base

The strength of Fast Red B Base lies in its versatility. It is a core intermediate in the production of:

Azoic dyes for textiles: Known for their deep, rich red and golden yellow tones on cellulose fibers.

Organic pigments: Used in plastics, paints, and coatings for their brightness and heat resistance.

Printing inks: Delivering vivid colors in both water- and solvent-based ink formulations.

Flush colors and highway marking paints: Where durability and resistance to outdoor exposure are essential.

Due to its consistent reactivity and compatibility with various coupling components, Fast Red B Base ensures that end dyes and pigments meet international quality standards. As such, sourcing it from a trusted Fast Red B Base manufacturer like Jay Finechem ensures product performance and formulation reliability.

Product Quality and Technical Specifications

Jay Finechem’s Fast Red B Base is manufactured to meet high-purity specifications, catering to both domestic and export markets. Standard specifications include:

Appearance: Yellow to reddish crystalline powder

Purity: ≥98% (customization available)

Melting Point: 105–110°C

Solubility: Slightly soluble in water, good solubility in acetone and ethanol

Packing: HDPE drums or fiber containers, 25–50 kg standard packaging

Every delivery from Jay Finechem comes with a Certificate of Analysis (COA), Material Safety Data Sheet (MSDS), and full traceability to ensure compliance and customer confidence.

Environment, Safety, and Compliance

Jay Finechem’s commitment extends beyond product quality to include environmental sustainability and workplace safety. Their facility includes:

Effluent Treatment Plants (ETPs)

Zero Liquid Discharge (ZLD) systems

Regular environmental audits

Employee safety training and SOPs

These initiatives reflect Jay Finechem’s vision of being a responsible Fast Red B Base manufacturer that aligns with both regulatory requirements and global sustainability standards. Their export operations are well-versed in handling customs documentation, labeling, and international freight compliance.

Global Supply and Logistics

With a growing presence in Europe, North America, Southeast Asia, and the Middle East, Jay Finechem is well-positioned as a global supplier of Fast Red B Base. Their logistics teams ensure:

On-time delivery with reliable packaging

Custom documentation for each country

Support for small to bulk consignments

Quick responses and transparent communication

This makes them an ideal supplier for both multinational companies and regional dye houses alike, offering consistent service quality and customer-focused solutions.

Conclusion: Fast Red B Base You Can Trust

The dye and pigment industry relies heavily on the quality of its intermediates. Fast Red B Base is a key building block that directly influences color strength, stability, and application performance. Choosing a trusted manufacturer is essential not just for product quality, but also for regulatory compliance and supply chain reliability.

Jay Finechem, as a leading Fast Red B Base manufacturer in India, offers a seamless blend of quality, experience, and customer service. Their focus on technical excellence, sustainable practices, and export readiness make them the preferred choice for companies across the globe. For any business seeking to secure a consistent and compliant source of Fast Red B Base, Jay Finechem delivers unmatched value.

0 notes

Text

Assembly Trays Market Size, Share, Demand, Growth and Global Industry Analysis 2034

Assembly Trays Market is projected to grow from $2.5 billion in 2024 to $4.3 billion by 2034, expanding at a compound annual growth rate (CAGR) of approximately 5.6%. These trays play a vital role in organizing, storing, and transporting components during manufacturing and assembly operations across industries such as electronics, automotive, aerospace, and healthcare. With the rising demand for precision, efficiency, and sustainability in industrial processes, assembly trays have become indispensable in supporting streamlined workflows and protecting sensitive parts.

This market has witnessed strong momentum due to the increased adoption of automation and the rise of lean manufacturing practices. The trays not only enhance operational efficiency but also reduce handling time and minimize errors in production lines. Additionally, companies are increasingly seeking eco-friendly, reusable, and customizable tray solutions that align with sustainability targets while maintaining durability and precision.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS22407

Market Dynamics

The dynamics driving the assembly trays market revolve around technological advancement, evolving material science, and shifting industry needs. A major driver is the growing reliance on automation in sectors like electronics and automotive, where trays enable compatibility with robotic systems and high-speed assembly lines. As industries push for faster turnaround times and greater accuracy, the demand for trays that are ESD-safe, cleanroom compliant, or custom-engineered is growing rapidly.

Plastic continues to dominate the market with a 45% share, valued for its lightweight, moldability, and cost-effectiveness. Metal and composite materials follow, preferred for applications requiring extra strength and temperature resistance. The surge in electric vehicle production, medical device innovation, and semiconductor manufacturing further amplifies tray demand.

However, the market is not without challenges. Volatile raw material prices, especially for polymers and metals, are pressuring margins. Regulatory compliance with safety and environmental standards also adds to operational complexity. Moreover, supply chain disruptions and increasing demand for product customization require manufacturers to remain flexible and innovative to stay competitive.

Key Players Analysis

The competitive landscape of the assembly trays market is shaped by a mix of global giants and emerging specialists. Prominent players such as 3M, Bosch, and Stanley Black & Decker hold significant market shares, benefiting from their strong industrial expertise and continuous investment in product innovation. Bosch’s emphasis on automation integration and 3M’s commitment to sustainable and recyclable tray solutions have set benchmarks for the industry.

Other key companies like UFP Technologies, Nelipak Healthcare Packaging, and Prent Corporation specialize in custom-engineered trays tailored to niche markets such as healthcare and precision electronics. Emerging players like Tray Tech Innovations, Eco Tray Manufacturing, and Smart Tray Solutions are gaining traction by focusing on sustainability, smart tracking capabilities, and adaptive designs for modern manufacturing environments.

Regional Analysis

Asia Pacific leads the global assembly trays market, fueled by industrial expansion in China, India, and Southeast Asia. These countries are experiencing a manufacturing boom in electronics, automotive, and consumer goods, creating massive demand for efficient and reliable tray systems. The region’s economic growth and emphasis on production scalability contribute significantly to the market’s upward trajectory.

North America follows closely, with the United States at the forefront. Its advanced manufacturing infrastructure and adoption of Industry 4.0 practices have driven demand for smart, reusable, and automation-compatible trays. The strong presence of leading tray manufacturers also supports regional growth.

Europe remains a vital player, particularly Germany and France, where precision engineering and sustainable manufacturing practices dominate. European regulations on material recyclability and worker safety drive innovation in environmentally friendly and ergonomic tray solutions.

Latin America and the Middle East & Africa show steady growth potential. Countries like Brazil and Mexico are investing in automotive and electronics production, while the UAE and South Africa are gradually developing their industrial sectors, increasing the need for high-performance assembly trays.

Recent News & Developments

The market has seen several transformative trends in recent years. Automation and digitalization are leading the way, with trays now being integrated with RFID and barcode tracking to improve inventory visibility and streamline assembly operations. Additionally, many manufacturers are shifting towards biodegradable and recyclable materials in response to growing environmental awareness.

Strategic partnerships are also shaping the landscape. For instance, tray manufacturers are collaborating with robotics and automation companies to co-develop solutions optimized for smart factories. This includes innovations in anti-static materials, heat resistance, and form-fitting compartments that support delicate and irregularly shaped components.

Cost efficiency remains a critical factor. With unit prices ranging from $5 to $50 depending on complexity, many companies are investing in thermoforming and injection molding technologies to scale up production without compromising quality.

Browse Full Report : https://www.globalinsightservices.com/reports/assembly-trays-market/

Scope of the Report

This report offers a comprehensive analysis of the global Assembly Trays Market, covering segmentation by type, product, material, application, technology, and functionality. It provides both qualitative and quantitative insights into current market trends, challenges, and future projections. The report assesses the competitive landscape and profiles major players, highlighting strategies like product innovation, mergers, and geographic expansion.

It also examines regulatory trends, regional market dynamics, and technological advancements shaping the industry. The research supports stakeholders in making informed decisions, identifying growth opportunities, and adapting to evolving customer demands. As industries continue to seek leaner, greener, and smarter solutions, the assembly trays market is well-positioned to deliver value across a broad spectrum of applications.

Discover Additional Market Insights from Global Insight Services:

Cold Forming and Cold Heading Market : https://www.globalinsightservices.com/reports/cold-forming-and-cold-heading-market/

Aviation Crew Management System Market : https://www.globalinsightservices.com/reports/aviation-crew-management-system-market/

Electron Beam Machining Market : https://www.globalinsightservices.com/reports/electron-beam-machining-market/

Ballast Tampers Market : https://www.globalinsightservices.com/reports/ballast-tampers-market/

Spring Energized Seals Market :https://www.globalinsightservices.com/reports/spring-energized-seals-market/

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

Furfurylamine Market Growth Analysis, Market Dynamics, Key Players and Innovations, Outlook and Forecast 2025-2032

The global furfurylamine market was valued at USD 23.2 million in 2024. The market is projected to grow from USD 24.4 million in 2025 to USD 34.3 million by 2032, exhibiting a CAGR of 5.2% during the forecast period.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/1883/furfurylamine-2025-2032-212

Furfurylamine (CAS 617-89-0) is an organic compound derived from furfuryl alcohol, which is produced from renewable agricultural by-products like corncobs and sugarcane bagasse. This colorless to pale yellow liquid with an amine-like odor is primarily used as an intermediate in pharmaceutical synthesis, agrochemical production, and organic chemistry applications. Its versatility in polymerization and condensation reactions also makes it valuable for manufacturing specialty chemicals and corrosion inhibitors.The global furfurylamine market is steadily gaining attention as more industries turn to bio-based alternatives for making everyday products like medicines, crop protection chemicals, and specialty plastics. Made from renewable sources such as furfural, furfurylamine is valued for its versatility and ability to fit into a wide range of chemical processes. As the world moves toward greener and more sustainable practices, this naturally derived compound is becoming an attractive option for manufacturers looking to reduce their dependence on fossil fuels. With innovation in green chemistry and rising environmental awareness, furfurylamine is carving out a stronger role in the future of eco-friendly industrial solutions.

Key manufacturers like Shandong Yuexing Chemical and Alkyl Amines Chemicals Limited are actively supplying high-purity furfurylamine (≥99% and <99% grades) to meet diverse industrial needs across North America, Europe, and Asia-Pacific regions.

MARKET DYNAMICS

MARKET DRIVERS

Expanding Pharmaceutical Applications to Propel Furfurylamine Demand

The pharmaceutical sector's growing reliance on furfurylamine as a key intermediate is significantly driving market expansion. This compound serves as a crucial building block in the synthesis of various active pharmaceutical ingredients (APIs), particularly in cardiovascular and central nervous system drugs. The global pharmaceutical market, valued at over $1.5 trillion, continues to show robust growth with a CAGR of approximately 6%, creating substantial demand for specialized intermediates like furfurylamine. The molecule's unique heterocyclic structure makes it particularly valuable for developing drugs with improved bioavailability and targeted action mechanisms.

Sustainability Trends Boosting Bio-Based Chemical Adoption

The shift toward green chemistry and sustainable production methods is accelerating demand for bio-derived chemicals like furfurylamine. Derived from agricultural byproducts such as corncobs and sugarcane bagasse, furfurylamine offers a renewable alternative to petrochemical-derived amines. The bio-based chemicals market is projected to grow at over 10% annually through 2030, driven by stringent environmental regulations and increasing corporate sustainability commitments. Furfurylamine's production from biomass waste streams aligns perfectly with circular economy principles, making it increasingly attractive across multiple industries.

Furthermore, technological advancements in biomass conversion processes have improved furfurylamine production efficiencies by approximately 15-20% over the past five years, enhancing its commercial viability as a sustainable alternative.

MARKET RESTRAINTS

Stringent Regulatory Compliance Creates Production Challenges

The furfurylamine market faces significant hurdles due to increasingly rigorous safety and environmental regulations. Classified as a hazardous substance in many jurisdictions, furfurylamine requires specialized handling, storage, and transportation protocols that add approximately 20-25% to operational costs. Recent updates to chemical safety regulations, particularly in the EU and North America, have mandated additional toxicity testing and exposure control measures. These requirements can delay product approvals by 6-12 months while significantly increasing compliance expenditures for manufacturers.

Raw Material Price Volatility Impacts Production Stability

Furfurylamine production remains vulnerable to fluctuations in agricultural commodity prices, as its primary feedstock (furfuryl alcohol) is derived from biomass. Over the past three years, raw material costs have shown volatility of ±15-20% annually due to factors like crop yields, weather patterns, and competing demand from other bio-based chemical sectors. This instability makes long-term price forecasting difficult for manufacturers and can negatively impact profit margins, particularly for smaller producers with limited hedging capabilities. Additionally, the seasonal nature of agricultural feedstocks creates periodic supply chain bottlenecks that further challenge production planning.

MARKET CHALLENGES

Technical Limitations in Large-Scale Production

While furfurylamine demonstrates significant potential, the industry faces technical barriers in scaling up production to meet growing demand efficiently. Current production methods often struggle with yield optimization, with typical conversion efficiencies ranging between 65-75%. This limitation stems from complex reaction pathways that can generate unwanted byproducts, requiring expensive purification steps. Small to medium-scale manufacturers particularly struggle with these technical challenges, as they often lack the capital to invest in advanced process optimization technologies that could improve yields by 10-15%.

Other Challenges

Supply Chain Complexities The specialized nature of furfurylamine logistics presents significant challenges, particularly for international shipments. Many transportation providers impose strict conditions or refuse to handle the chemical due to its classification as a flammable liquid, necessitating premium shipping arrangements that can double logistics costs.

Workforce Expertise Gap The niche nature of furfurylamine chemistry has resulted in a limited pool of experienced process chemists and engineers, particularly in emerging production regions. This talent shortage is expected to persist given the specialized training required, potentially delaying new capacity expansions by 6-18 months in some markets.

MARKET OPPORTUNITIES

Emerging Applications in Advanced Materials Present Growth Potential

Research into novel polymer applications represents a significant growth avenue for furfurylamine, particularly in high-performance composites and adhesives. Recent studies have demonstrated furfurylamine's effectiveness as a crosslinking agent in bio-based epoxy resins, with potential applications in aerospace and automotive components where lightweight, durable materials are increasingly in demand. The advanced materials sector is forecast to grow at 8.5% CAGR through 2030, creating substantial opportunities for specialty chemical intermediates like furfurylamine.

Geographic Expansion in Emerging Markets

Developing regions, particularly in Asia-Pacific, present untapped opportunities for furfurylamine applications. Rapid industrialization and growing pharmaceutical production in countries like India and China are driving demand for specialized chemical intermediates. The Asia-Pacific pharmaceutical chemicals market alone is projected to exceed $120 billion by 2027, with local manufacturers increasingly seeking domestically sourced raw materials to reduce import reliance. This regional shift creates significant potential for furfurylamine producers to establish partnerships with local pharmaceutical and chemical manufacturers. Several leading chemical companies have already announced capacity expansions in Southeast Asia, anticipating 30-40% demand growth for specialty amines in the region over the next five years.

FURFURYLAMINE MARKET TRENDS

Sustainability-Driven Demand for Bio-Based Chemicals

The global shift toward sustainable chemical production has significantly impacted the furfurylamine market, with an estimated 7-9% annual growth in demand for bio-based amine derivatives. Furfurylamine's production from agricultural waste streams like corncobs and sugarcane bagasse positions it favorably in the circular economy model. Major chemical manufacturers are increasingly incorporating green chemistry principles, driving adoption of furfurylamine in pharmaceutical precursors and specialty polymer applications. This aligns with broader industry goals to reduce dependency on petrochemical feedstocks, with bio-based amines projected to capture 25-30% of the specialty amines market by 2030.

Other Trends

Pharmaceutical Intermediate Applications

The pharmaceutical sector's expansion is creating sustained demand for furfurylamine as a key building block in drug synthesis. Its unique heterocyclic structure enables production of anticancer agents, antiviral compounds, and neurological medications. Approximately 40% of current furfurylamine production is directed toward pharmaceutical applications, with growth particularly strong in Asia-Pacific markets where generic drug manufacturing is expanding. Recent clinical pipeline developments suggest increasing utilization in next-generation MAO inhibitors and Parkinson's disease treatments, potentially opening new high-value application segments.

Technological Advancements in Production Processes

Innovations in catalytic hydrogenation and continuous flow chemistry are transforming furfurylamine manufacturing economics. New catalyst systems have improved yield efficiencies from 75% to 88-92% in recent years, while reducing energy consumption by approximately 30%. Leading producers are adopting membrane separation technologies to enhance purity levels above 99.5%, meeting stringent pharmaceutical-grade requirements. These process improvements are critical for maintaining cost competitiveness against petroleum-derived alternatives, particularly in price-sensitive corrosion inhibitor and resin applications.

Furfurylamine Market Competitive Landscape (2024-2032)

Key Industry Players

Strategic Expansions and R&D Investments Define Market Dynamics

The global furfurylamine market, valued at $23.2 million in 2024, features a fragmented competitive landscape with dominant players from Asia Pacific leading production. Shandong Yuexing Chemical and Hubei Jiangyan Tianxiang Chemical collectively account for over 30% of the market share, owing to their vertically integrated supply chains and cost-effective production capabilities in China.

Alkyl Amines Chemicals Limited (AACL) emerges as a significant player, particularly in the pharmaceutical-grade segment (>99% purity), leveraging its expertise in specialty amines. The company's recent capacity expansion in Maharashtra, India, positions it to capitalize on growing API manufacturing demand.

Market participants are actively pursuing three key strategies:

Backward integration to secure furfural supplies

Product purity enhancements for pharmaceutical applications

Geographic expansion into European and North American markets

Notably, Changzhou Huayang Technology recently patented a novel purification process that reduces production costs by 18%, while Jinan Future Chemical formed a strategic alliance with European distributors to penetrate the corrosion inhibitor market.

2025, Hefei TNJ Chemical Industry Co. Ltd. intensified its market outreach across Central Asia and the MENA region, aligning with its export-driven growth strategy. The company participated in Agrofood 2025 in Iran, showcasing its agrochemical portfolio, and conducted business talks in Turkmenistan. These efforts underscore TNJ’s push to strengthen its foothold in agricultural-chemical markets and build long-term regional partnerships.

2023, Alkyl Amines Chemicals Limited significantly ramped up its marketing and expansion initiatives, marked by a twofold increase in digital marketing spend to ₹5 crore. The company enhanced technical outreach and brand visibility through active participation in major global chemical trade shows, webinars, and targeted digital campaigns. This strategic push aims to strengthen its presence in international markets and reinforce its leadership in amine-based specialty chemicals.

List of Key Furfurylamine Manufacturers

Alkyl Amines Chemicals Limited (India)

Shandong Yuexing Chemical (China)

Hubei Jiangyan Tianxiang Chemical (China)

Changzhou Huayang Technology (China)

Jinan Future Chemical (China)

Hefei TNJ Chemical (China)

Liyang Yutian Chemical (China)

Hangzhou Chempro Technology (China)

Shanghai Shenju Chemical (China)

Jinjinle Chemical (China)

Shandong Shenglan Chemical (China)

Segment Analysis:

By Type

Purity ≥99% Segment Leads the Market Due to High Demand in Pharmaceutical Applications

The market is segmented based on type into:

Purity ≥99%

Purity <99%

By Grade

The market is segmented based on grade into:

Industrial Grade Furfurylamine

Pharmaceutical Grade Furfurylamine

Food Grade / Specialty Grade

By Form

The market is segmented based on Form into:

Liquid Furfurylamine

Powder / Solid Form

By Application

Pharmaceutical Segment Dominates Owing to Extensive Use in Drug Synthesis

The market is segmented based on application into:

Pharmaceutical

Agrochemicals

Chemical Intermediates

Resins & Plastics

Corrosion Inhibitors

Dyes & Pigments

Others

By End-Use Industry

Chemical Industry Holds Major Share Due to Wide Usage in Specialty Chemical Production

The market is segmented based on end-use industry into:

Chemical Industry

Pharmaceutical & Healthcare

Oil & Gas / Water Treatment

Agricultural Industry

Others

Regional Analysis: Furfurylamine Market

North America The North American Furfurylamine market is characterized by stringent regulatory frameworks governing chemical production and usage, particularly in pharmaceuticals and agrochemicals. The U.S. dominates due to its well-established pharmaceutical sector, accounting for over 45% of regional demand. However, health and safety concerns related to furfurylamine exposure have led to cautious handling protocols, slightly restraining market growth. Investments in sustainable chemical alternatives are gaining traction, driven by environmental policies, though the adoption remains gradual. Recent regulatory pushes for bio-based chemicals could position Furfurylamine favorably, provided manufacturers address safety concerns while maintaining cost competitiveness.

Europe Europe’s Furfurylamine market is shaped by robust pharmaceutical and agrochemical industries, particularly in Germany and France. Compliance with REACH and CLP regulations has compelled manufacturers to prioritize high-purity (>99%) grades, ensuring safer handling. The region’s strong R&D focus supports niche applications, such as corrosion inhibitors for industrial use. However, higher production costs and competition from alternative amines (e.g., alkylamines) limit expansion. The shift toward green chemistry has spurred interest in furfurylamine’s bio-based origins, though adoption hinges on balancing regulatory compliance with economic feasibility. Market players are increasingly collaborating with research institutes to explore novel applications.

Asia-Pacific Asia-Pacific is the fastest-growing Furfurylamine market, propelled by China and India’s expanding pharmaceutical and agrochemical sectors. China alone contributes nearly 60% of regional consumption, leveraging its cost-efficient production capabilities. The region benefits from abundant agricultural by-products (e.g., corncobs), which serve as low-cost raw materials. However, price sensitivity has led to a preference for <99% purity grades in non-critical applications. While environmental regulations are less stringent than in the West, increasing awareness of sustainable practices is gradually shifting demand toward bio-based alternatives. Emerging agrochemical needs in Southeast Asia further bolster growth, albeit with challenges around inconsistent supply chains.

South America South America’s market is nascent but shows promise due to Brazil's agrochemical demands and Argentina’s growing pharmaceutical industry. Regional production is limited, relying heavily on imports from Asia and North America. Economic volatility has hindered investment in local Furfurylamine manufacturing, leading to inconsistent supply. Nevertheless, the agrochemical sector’s reliance on cost-effective intermediates offers growth potential if stability improves. Regulatory frameworks are evolving but lack enforcement, creating ambiguity for manufacturers. Strategic partnerships with global suppliers could bridge gaps, though infrastructure deficits remain a hurdle.

Middle East & Africa The MEA market is underdeveloped but exhibits slow growth in pharmaceutical applications, particularly in Turkey and Saudi Arabia. Limited local production and reliance on imports constrain market expansion. While furfurylamine’s use in corrosion inhibitors aligns with the region’s oil & gas industry, adoption is hampered by low awareness and fragmented regulations. Investments in diversifying economies (e.g., UAE’s focus on pharmaceuticals) could spur demand, but progress is uneven. Long-term growth hinges on regional stability and the prioritization of specialty chemical sectors in industrial policies.

Report Scope

This market research report offers a holistic overview of global and regional markets for the forecast period 2025–2032. It presents accurate and actionable insights based on a blend of primary and secondary research.

Key Coverage Areas:

✅ Market Overview

Global and regional market size (historical & forecast)

Growth trends and value/volume projections

✅ Segmentation Analysis

By product type or category

By application or usage area

By end-user industry

By distribution channel (if applicable)

✅ Regional Insights

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country-level data for key markets

✅ Competitive Landscape

Company profiles and market share analysis

Key strategies: M&A, partnerships, expansions

Product portfolio and pricing strategies

✅ Technology & Innovation

Emerging technologies and R&D trends

Automation, digitalization, sustainability initiatives

Impact of AI, IoT, or other disruptors (where applicable)

✅ Market Dynamics

Key drivers supporting market growth

Restraints and potential risk factors

Supply chain trends and challenges

✅ Opportunities & Recommendations

High-growth segments

Investment hotspots

Strategic suggestions for stakeholders

✅ Stakeholder Insights

Target audience includes manufacturers, suppliers, distributors, investors, regulators, and policymakers

FREQUENTLY ASKED QUESTIONS:

▶ What is the current market size of Global Furfurylamine Market?

The global furfurylamine market was valued at USD 23.2 million in 2024 and is expected to reach USD 34.3 million by 2032.

▶ Which key companies operate in Global Furfurylamine Market?

Key players include Shandong Yuexing Chemical, Hubei Jiangyan Tianxiang Chemical, Alkyl Amines Chemicals Limited (AACL), Changzhou Huayang Technology, and Jinan Future Chemical, among others.

▶ What are the key growth drivers?

Key growth drivers include growing demand for biobased chemicals, applications in pharmaceuticals and agrochemicals, and versatility in chemical synthesis.

▶ Which region dominates the market?

Asia-Pacific is the fastest-growing region, driven by expanding pharmaceutical and agrochemical industries.

▶ What are the emerging trends?

Emerging trends include increased R&D for new applications, sustainable production methods, and technological advancements in chemical synthesis.

Get free sample of this report at : https://www.intelmarketresearch.com/download-free-sample/1883/furfurylamine-2025-2032-212

https://chatterchat.com/read-blog/7088

https://chatterchat.com/read-blog/7090

0 notes

Text

The Role of Textile Testing in Automotive Interior Manufacturing

In the world of modern automotive design, vehicle interiors have evolved from purely functional elements to luxurious, performance-enhancing spaces. One key driver behind this transformation is the increasing use of advanced textiles and fabrics in car interiors. From seat upholstery and headliners to door panels and carpeting, textiles now define much of the vehicle’s aesthetic and comfort. However, behind the stylish appearance and tactile comfort lies a critical process—Textiles and Fabrics Testing.

Textiles and Fabrics Testing in the automotive industry ensures that interior materials meet performance, safety, and regulatory standards required for modern vehicles. As automotive manufacturers strive to deliver top-tier products to global markets, rigorous testing of interior fabrics becomes indispensable for quality assurance, customer satisfaction, and compliance.

Why Textiles and Fabrics Matter in Automotive Interiors

Automotive interiors are subjected to unique stressors not found in other textile applications. These materials must withstand high temperatures, UV exposure, friction, spills, and wear from daily use. Additionally, vehicle manufacturers must meet stringent safety and flammability standards, making textile testing a foundational step in the manufacturing process.

Common Textile Applications in Automotive Interiors:

Seat covers and backrests

Headliners and sun visors

Floor carpeting and mats

Door trim fabrics

Pillar covers

Cargo liners and trunk covers

Importance of Textiles and Fabrics Testing in the Automotive Industry

1. Ensuring Durability and Longevity

One of the core purposes of fabric testing in automotive applications is to ensure that materials can withstand long-term use without degradation. Lab tests simulate wear and tear conditions such as abrasion, fading, and temperature fluctuation to predict real-world performance.

2. Meeting Safety Regulations

Automotive textiles must comply with safety standards, especially flammability regulations. Unchecked, interior fabrics can become ignition points in accidents. Testing ensures that materials meet legal requirements like FMVSS 302, ECE R118, and other global standards.

3. Enhancing Aesthetic and Functional Quality

Fabrics used in vehicle interiors must maintain colorfastness, dimensional stability, and tactile feel over time. Testing ensures that color does not bleed, materials do not shrink or stretch excessively, and surfaces remain smooth and attractive.

4. Reducing Environmental and Chemical Risks

With growing attention to VOC emissions, odor, and chemical residue, automotive textile testing includes chemical analyses to detect formaldehyde, heavy metals, and other harmful substances, helping manufacturers meet environmental benchmarks like REACH and RoHS.

Key Tests Performed in Automotive Textile Testing Labs

1. Abrasion Resistance Testing

Tests like the Martindale or Taber methods are used to simulate fabric wear caused by repeated rubbing or friction. This determines the fabric's ability to endure long-term use without visible degradation.

2. Colorfastness Testing

Automotive interiors are exposed to sunlight and human interaction. Labs assess:

Colorfastness to light (UV resistance)

Colorfastness to rubbing (crocking)

Colorfastness to perspiration and water

3. Flammability Testing

One of the most critical safety evaluations:

FMVSS 302: Measures burn rate of interior materials.

ECE R118: Required for buses and commercial vehicles in Europe.

4. Tensile and Tear Strength

This test ensures materials won’t rip or stretch easily under pressure—essential for seat covers, which face daily stress from passengers.

5. Chemical Testing

Fabric testing labs analyze textile composition for harmful substances and odors:

Formaldehyde content

Volatile Organic Compounds (VOCs)

Phthalates and plasticizers

Heavy metal analysis

6. Thermal Aging and UV Resistance

Testing how materials hold up to prolonged heat and UV exposure is key, especially for vehicles used in hot climates.

7. Dimensional Stability and Shrinkage

Ensures fabric maintains shape after exposure to heat or humidity, preventing sagging headliners or wrinkled seat covers.

Role of Accredited Testing Labs in Automotive Compliance

To meet international quality benchmarks, automotive OEMs rely on ISO 17025 accredited textile labs. These labs offer validated procedures, traceable test results, and certification that complies with:

Automotive OEM specifications

International safety regulations

REACH and RoHS directives

Customer-specific quality requirements

Using a certified Textiles and Fabrics Testing lab ensures that materials will not just pass internal audits but also satisfy regulatory inspections across North America, Europe, Asia, and the Middle East.

How Fabric Testing Affects the Supply Chain

Textile testing impacts every stage of the automotive manufacturing supply chain:

For Material Suppliers:

Verifies compliance with OEM technical data sheets

Provides test reports for raw fabric certification

For Tier-1 and Tier-2 Suppliers:

Ensures intermediate parts (e.g., pre-stitched seat covers) meet end-use specifications

Supports quality audits and sampling procedures

For OEMs:

Prevents costly recalls due to material failure

Enhances consumer trust and brand value

Simplifies import/export through valid testing documentation

Advancements in Automotive Textile Testing

As materials science evolves, fabric testing labs have adopted advanced tools like:

Infrared Spectroscopy (FTIR): For polymer and fiber identification

Gas Chromatography (GC-MS): For VOC detection

Digital Microscopy and Surface Analysis

AI-driven test automation for faster results

These advancements allow for more precise, repeatable testing that accelerates product development without sacrificing quality.

The Future of Textile Testing in Automotive Interiors

With the rise of electric vehicles, sustainable materials, and smart fabrics, the importance of textile testing will only grow. Labs will increasingly need to:

Validate recycled and biodegradable textiles

Assess thermal and electrical conductivity in smart textiles

Ensure compatibility with sensors and electronics

As innovation in automotive interiors continues, Textiles and Fabrics Testing will remain the gatekeeper for quality, safety, and compliance.

Final Thoughts

The integration of high-performance fabrics into vehicle interiors has revolutionized automotive design. But without proper Textiles and Fabrics Testing, these innovations carry risks—from durability issues to safety violations. That’s why fabric testing labs are more than quality control checkpoints—they’re strategic partners that ensure global compliance, reduce recalls, and deliver the excellence today’s automotive market demands.

Whether you're an OEM, a component supplier, or a textile manufacturer, partnering with a competent, accredited fabric testing lab is not just recommended—it’s essential to your success in the global automotive sector.

#Textiles and Fabrics Testing#Textiles Testing#Fabrics Testing#Testing Lab near me#Testing Lab in Delhi

0 notes

Text

Urea Price Trend: Global Market Insights, Analysis, and Forecast

Urea, a nitrogen-rich compound, plays a vital role in the global agricultural and industrial sectors. As the most widely used nitrogen fertilizer, fluctuations in the urea price chart have a direct impact on food security, crop productivity, and the global supply chain. Its usage in resins, adhesives, and plastics also amplifies its importance across industries beyond agriculture.

Understanding urea pricing requires a comprehensive view of market dynamics, historical trends, production regions, trade policies, and evolving demand patterns. This article offers detailed insights into the latest urea prices, historical data, market analysis, forecasts, and procurement strategies.

Urea Price Trend Overview

The urea price trend has witnessed considerable volatility in recent years, driven by multiple intersecting factors such as raw material availability, energy costs, logistics constraints, and global demand fluctuations.

Key Drivers Affecting Urea Prices:

Natural Gas Prices: Urea is synthesized from ammonia, which is produced using natural gas. Any spike in gas prices significantly increases urea production costs.

Seasonal Agricultural Demand: Peak planting seasons in major agrarian economies like India, Brazil, and the U.S. cause demand surges and impact prices regionally and globally.

Export Policies: Export bans or duties from top urea producers like China, Russia, and Egypt can restrict global availability and sharply influence market prices.

Supply Chain Disruptions: Maritime transport issues, geopolitical tensions, or local regulatory changes can lead to price spikes or dips based on shipment delays.

Latest News and Global Market Developments

Recent developments in the fertilizer and chemical markets are reshaping the urea supply-demand equilibrium. Key highlights include:

Export Restrictions from Major Producers: Nations like China have periodically restricted urea exports to safeguard domestic agriculture, influencing international prices.

Energy Crisis Impact: The European energy crisis led to a reduction in ammonia output, pushing up the cost of nitrogen fertilizers across the EU and beyond.

Sustainability Trends: Increasing focus on eco-friendly fertilizers and controlled-release urea is shifting procurement and production strategies across global markets.

Monitoring these changes via a reliable source such as Procurement Resource helps businesses stay informed and agile in their sourcing and budgeting decisions.

Historical Urea Price Trends and Chart Analysis

Analyzing historical price data is crucial for understanding market behavior, planning procurement, and forecasting future movements. Over the past decade, urea prices have fluctuated sharply during periods of energy shortages, supply chain breakdowns, and agricultural booms.

Historical Patterns:

2011–2014: High price volatility due to energy cost surges and increased demand from emerging markets.

2015–2019: Moderate pricing trend as global production increased, particularly from the Middle East and North Africa.

2020–2023: Unprecedented price increases driven by post-pandemic recovery, global inflation, and natural gas shortages.

Data Visualization:

An interactive urea price chart displaying multi-year trends, monthly averages, and year-over-year comparisons provides a clear picture of market movements.

Forecast: Outlook for Urea Prices

The outlook for urea prices over the next 3–5 years is influenced by global agricultural trends, energy transitions, and regulatory pressures. Analysts expect moderate to high pricing, particularly if natural gas remains volatile and agricultural demand continues to grow.

Forecast Considerations:

Rising Food Demand: With global population growth, food security has become critical, increasing fertilizer consumption.

Green Ammonia and Decarbonization: As industries move toward low-carbon production, green ammonia could reshape urea manufacturing and impact cost structures.

Government Subsidies: Countries like India may continue to subsidize urea for domestic farmers, distorting market dynamics and influencing global trade.

Procurement teams should closely monitor these factors to anticipate future urea price trend shifts and make timely sourcing decisions.

Regional Insights and Market Analysis

Asia-Pacific

Asia-Pacific remains the largest consumer and producer of urea. India and China dominate consumption, while countries like Qatar and Saudi Arabia serve as significant exporters. Subsidy policies and import dependency in countries like India can lead to seasonal price volatility.

Middle East & North Africa (MENA)

MENA countries have a strategic advantage due to abundant natural gas, making them key urea exporters. Expansion projects and free trade agreements in this region are improving market access and supply reliability.

Europe

European producers have faced challenges due to high natural gas prices, forcing temporary plant shutdowns. This has shifted Europe into a net importer of urea, especially during peak agricultural demand.

North America

The U.S. maintains a mix of domestic production and imports, with steady demand from the corn and soybean sectors. Environmental regulations and logistics efficiency also shape procurement strategies.

Procurement Strategy: Market Intelligence for Buyers

As global markets grow increasingly volatile, strategic procurement of urea demands accurate market intelligence, supplier analysis, and dynamic price modeling. Here’s how businesses can stay ahead:

Benchmarking Tools: Compare current prices with historical averages to evaluate procurement timing.

Supplier Risk Assessment: Identify geopolitical risks in sourcing countries to avoid unexpected supply disruptions.

Inventory Optimization: Align purchase cycles with seasonal demand and pricing patterns using forecast tools.

Platforms like Procurement Resource provide customized dashboards, procurement strategies, and market insights tailored for fertilizer buyers across sectors.

Request for the Real Time Prices : https://www.procurementresource.com/resource-center/urea-price-trends/pricerequest

Access to Urea Price Database and Forecast Models

An extensive urea price database is essential for procurement teams, market analysts, and industrial buyers to stay informed and plan strategically.

What’s Included:

Historical Data: Comprehensive pricing history segmented by region, grade, and application.

Forecast Models: AI-powered prediction models for accurate short- and long-term forecasts.

Trade Insights: Import/export trends, tariff updates, and supplier country analysis.

Professionals use data from platforms like Procurement Resource to build robust sourcing strategies, track supplier reliability, and reduce cost exposure.

Why Monitoring the Urea Price Trend Matters

Staying ahead of the urea price trend allows businesses to:

Improve Procurement Timing: Purchase during favorable price windows to reduce costs.

Avoid Stockouts: Predict demand spikes and supply issues to ensure consistent availability.

Maintain Competitive Pricing: Use market intelligence to negotiate better terms with suppliers.

Given urea’s importance in both agriculture and industrial sectors, monitoring price trends isn’t just beneficial — it’s essential.

Contact Information

Company Name: Procurement Resource Contact Person: Ashish Sharma (Sales Representative) Email: [email protected] Location: 30 North Gould Street, Sheridan, WY 82801, USA Phone: UK: +44 7537171117 USA: +1 307 363 1045 Asia-Pacific (APAC): +91 8850629517

0 notes

Text

Tetrahydrophthalic Anhydride Market Set for Moderate Growth by 2037

The Tetrahydrophthalic Anhydride (THPA) Market has been steadily expanding, reflecting growing industrial demand and diverse applications. Valued at approximately USD 636.61 million in 2024, the market is projected to reach around USD 1.02 billion by 2037. This growth represents a Compound Annual Growth Rate (CAGR) of about 3.7% over the forecast period from 2025 to 2037. The steady increase in demand for high-performance resins and plasticizers in various industries is a key factor contributing to the market’s expansion.

Tetrahydrophthalic Anhydride Industry Demand

Tetrahydrophthalic Anhydride is a vital chemical intermediate widely used in the synthesis of polyesters, alkyd resins, and plasticizers. It plays a crucial role in enhancing the mechanical and thermal properties of polymeric materials, thereby improving product performance. Its chemical stability and reactive nature make it an essential ingredient in industrial manufacturing processes.

The rising demand for THPA products is driven by several factors. Primarily, THPA offers cost-effectiveness compared to alternative chemical intermediates, making it an attractive choice for manufacturers seeking efficient raw materials. Additionally, its ease of administration in production environments facilitates smoother manufacturing workflows and reduced processing times. The long shelf life of THPA further supports its widespread adoption, allowing industries to maintain inventory without rapid degradation, thereby ensuring consistent supply chain efficiency.

Request Sample@ https://www.researchnester.com/sample-request-7669

Tetrahydrophthalic Anhydride Market: Growth Drivers & Key Restraint

Key Growth Drivers:

Technological Advancements: Continuous innovation in polymer and resin technologies is driving the need for specialized anhydrides like THPA to meet enhanced performance requirements, especially in coatings, adhesives, and composites.

Expanding Application Base: Growth in end-use industries such as automotive, construction, and electronics increases the demand for THPA, particularly for producing durable and high-quality resins and plasticizers.

Cost-Effectiveness and Efficiency: The affordability and operational benefits of THPA encourage manufacturers to adopt it over other chemical intermediates, stimulating market growth.

Market Restraint:

Raw Material Volatility: Fluctuations in the availability and cost of raw materials used in THPA production can impact pricing and supply stability, posing challenges for consistent market growth.

Tetrahydrophthalic Anhydride Market: Segment Analysis

By Application:

Polyester: THPA is extensively used in the production of polyester resins, valued for imparting flexibility and chemical resistance. This segment experiences steady demand fueled by growth in packaging, textiles, and coatings industries.

Alkyd Resins: The alkyd resin application segment benefits from THPA’s ability to improve drying times and durability, particularly in paints and varnishes, contributing to robust market growth.

Plasticizers: As a raw material in plasticizer production, THPA enhances the flexibility and longevity of plastics, supporting expanding demand in flexible packaging and consumer goods.

Others: This includes specialized applications such as adhesives and composites, which are emerging areas contributing to incremental market expansion.

By Form:

Liquid: The liquid form of THPA is favored for its ease of handling and integration into chemical processes, making it popular in large-scale industrial applications.

Powder: Powdered THPA offers advantages in terms of storage stability and transport efficiency, appealing to manufacturers prioritizing logistical convenience.

By Distribution Channel:

Direct: Direct distribution channels involve manufacturers supplying THPA straight to end users, ensuring better control over product quality and customization options.

Indirect: Indirect channels include distributors and agents who enhance market reach, particularly in regions where direct supply chains are less developed, thus supporting market penetration and accessibility.

Tetrahydrophthalic Anhydride Market: Regional Insights

North America: The North American market benefits from advanced industrial infrastructure and stringent environmental regulations promoting the use of high-performance resins derived from THPA. Growth drivers include demand from automotive, aerospace, and construction sectors, with increasing investments in research and development enhancing product innovation.

Europe: Europe holds significant market share owing to the presence of established chemical manufacturing hubs and progressive policies on sustainable materials. Demand is bolstered by the paint and coatings industry, along with rising consumer awareness about product quality and environmental impact.

Asia-Pacific (APAC): APAC is the fastest-growing region for THPA consumption, driven by rapid industrialization, expanding manufacturing bases, and increasing end-use industries such as electronics, automotive, and construction. Government initiatives to upgrade infrastructure and rising exports also propel demand, making APAC a focal point for market growth.

Top Players in the Tetrahydrophthalic Anhydride Market

The Tetrahydrophthalic Anhydride Market features several prominent players known for their extensive product portfolios and strong regional presence. Key companies include ANHUI MEISENBAO TECHNOLOGY CO., LTD., Dixie Chemical Co., Hanyong Co., Ltd., NAN YA PLASTICS CORPORATION, PENPET Petrochemical Trading GmbH, Puyang Huicheng Electronic Material Co., Ltd., Woowon Sea & Air Co., Ltd., Xiamen Ditai Chemicals Co., Ltd., BASF SE, Evonik Industries AG, and others. These organizations focus on product innovation, sustainability, and strategic collaborations to strengthen their foothold in the global market.

Access Detailed Report@ https://www.researchnester.com/reports/Tetrahydrophthalic Anhydride--market/7699

Contact for more Info:

AJ Daniel

Email: [email protected]

U.S. Phone: +1 646 586 9123

U.K. Phone: +44 203 608 5919

#Tetrahydrophthalic Anhydride Market#Tetrahydrophthalic Anhydride Market share#Tetrahydrophthalic Anhydride Market growth

0 notes

Text

Convenience and Sustainability Drive Disposable Tabletop Product Growth

The North American tabletop kitchen products market which includes both disposable and reusable dinnerware, drinkware, and flatware is undergoing steady growth due to changing lifestyle habits, hospitality expansion, and increasing focus on sustainability. From a market size of USD 10.47 billion in 2023, it is forecast to reach USD 14.56 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.8%.

To Get Sample Report: https://www.datamintelligence.com/download-sample/disposable-and-re-usable-tabletop-kitchen-products-market

Key Market Drivers and Opportunities

1. Growth in Foodservice and Hospitality Sectors Restaurants, catering services, cafes, and hotels are significantly boosting demand for high-quality tabletop products. The commercial sector remains the largest consumer of both durable and single-use products.

2. Convenience-Focused Disposable Solutions With increasing time constraints and a booming takeout culture, disposable tableware and flatware are gaining popularity. Households and event organizers increasingly prefer single-use items for their convenience and hygiene.

3. Rising Preference for Premium Reusable Products Reusable kitchen products made from porcelain, metal, and glass are gaining traction, especially in commercial environments. In the U.S. commercial sector, the porcelain dinnerware segment is expected to grow at a CAGR of 7.9% between 2021 and 2028, outpacing other segments.

4. Evolving Consumer Behavior Post-Pandemic The pandemic has changed how people eat and entertain. More people now invest in better quality kitchenware for home dining and entertaining, contributing to the expansion of both disposable and durable product segments.

5. Retail and E-Commerce Distribution Boom Major retailers and online platforms have broadened their offerings, allowing consumers to access a variety of affordable and premium tabletop products. This accessibility has contributed to higher demand in both the commercial and residential sectors.

Segment Analysis

By Product: Dinnerware remains the largest category, accounting for over 35% of market revenue. Flatware, drinkware, and associated products like table linens follow closely.

By End User: The commercial segment (restaurants, hotels, catering) is the largest user base. However, the residential segment is growing due to trends like home gatherings and hybrid dining habits.

By Material: Porcelain and metal dominate the reusable segment, while plastic and biodegradable materials lead the disposable segment. Premium ceramic and sustainable bamboo products are also gaining popularity.

Regional Performance

The U.S. leads the North American market, with a major share in both commercial and residential consumption. In 2022, the U.S. tabletop market alone was valued at over USD 12.2 billion. The market is projected to exceed USD 14.6 billion by 2030, aligning with strong economic recovery and consumer spending in food services and home decor.

Market Challenges