#Post Office Deposit Schemes

Text

Post Office Scheme 2024: Per month 27,000 in this scheme(couple)

Post Office Scheme 2024: Central Gov. recent announced good news for people. If you are interested in this scheme. Than you can apply this scheme, couple can get the benefit of up to 27000 every month from the account, we have given complete information about Post Office Scheme 2024 interest rate and limit, Benefits, Eligibility.

We are glad to inform you that naukrisambad.com is a free platform…

#mis post office scheme 2024#mis scheme post office 2024#monthly income scheme post office#post office#post office best scheme 2024#post office fixed deposit scheme#post office fixed deposit scheme 2024#post office mis interest rate 2024#post office mis scheme 2024#post office monthly income scheme#post office monthly income scheme 2024#post office new scheme 2024#post office rd scheme 2024#post office scheme

0 notes

Text

Small Savings Schemes 2024-New Interest Rates

Small Savings Schemes 2024

Small Savings Schemes 2024The Inside Scoop on Interest RatesMeet the RatePost Office Plans: What’s Changing?The Money Math: How Rates Are SetPPF Stays Put: No Changes HereBanks vs. Small Savings SchemesSavings Showdown: Big Banks vs. Post Office

Small Savings Schemes 2024- The government just spilled the beans on interest rates for small savings schemes from January…

View On WordPress

#Business news#Changed#fixed deposits#Full#Interest#interest rates#JanMarch#list#nsc#office#post#post office savings schemes#ppf#Public Provident Fund (PPF)#rates#Samriddhi#Savings#schemes#SCSS#senior citizens savings scheme#Small#small savings schemes#Sukanya#sukanya samriddhi

0 notes

Text

Post office schemes in Marathi : पोस्ट ऑफिसची सुपरहिट योजना देणार सुपर रिटर्न - 5 वर्षात देणार 7 लाख 24 हजार 149 रुपये. जाणून घ्या पूर्ण माहिती.

Post office schemes in Marathi : पोस्ट ऑफिस गुंतवणूक योजना त्यांच्या सुरक्षित गुंतवणुकीसाठी गुंतवणुकीचे लोकप्रिय माध्यम आहे. तुम्हाला पोस्ट ऑफिसमध्ये गुंतवणुकीची अनेक साधने मिळतात, जी तुम्हाला बँकेत गुंतवणुकीसाठी मिळतात. पण सरकारी युनिट असल्याने तुम्हाला इथे सुरक्षाही इथे मिळते. पोस्ट ऑफिसने गेल्या महिन्यात आपल्या अनेक योजनांवरील व्याजदरात वाढ केली होती, ज्यामुळे गुंतवणूकदारांना आणखी जास्त परतावा…

View On WordPress

#Government Scheme#investment#Investment Plan#post office#post office scheme#Post Office Scheme 2023#Post office schemes in Marathi#Post Office Time Deposit scheme

0 notes

Text

This is some niche Scottish party politics posting so I’ll try and explain this to everyone who isn’t as familiar.

Scottish Labour are the branch office of the UK Labour Party in Scotland. However, due to the slightly more left-wing nature of Scottish politics - they have to toe a particular line compared to UK Labour who are shifting more and more to the right to appease the right-wing majority in England.

Scottish Land Reform is a really hot issue. The vast majority of Scotland is owned by a handful of people so it could bring about some really positive change if something was done about it.

So Scottish Labour puts something out like this knowing that it’ll speak to the vast majority of people who believe in land reform.

But how it’ll go is the Scottish government (Led by the SNP and the Scottish Greens) will move to do something about it and will pass a bill. Scottish Labour will also support it.

The Scottish Conservatives will oppose it with the backing of the UK Conservatives, and use some UK legal nonsense to block or impede it.

Scottish Labour will then withdraw their support, and then put out a load of press releases about the Scottish government and the UK government needing to work together.

Scottish Labour did this with the Deposit Return Scheme, the Gender Recognition Reform Act and for Low Emission Zones. They will 100% do it with this one.

631 notes

·

View notes

Text

Members of congress have claimed more than $5 million under new expenses rules that allow them to claim back costs without receipts.

The new rules, which have been criticised by transparency campaigners, came into effect last year. Attracting rare bipartisan support, the system relies on members’ honesty and is designed to help with the costs of running homes in both Washington and members’ districts.

A total of 319 of the 435 voting members claimed $5.2 million in expenses under the rules last year, meaning that, on average, each claimed just over $16,300.

The biggest beneficiary of the system was Jack Bergman, 77, a Republican from Michigan, who claimed more than $32,000 for accommodation and another $12,000 for meals, which are also permitted under the programme.

A member of the congressional anti-abortion caucus, Bergman — who was also a candidate to become House speaker in October last year before losing to Mike Johnson — voted to block taxpayer funds that were being used by the US military to pay for abortions for women stationed at bases in states that have outlawed terminations. His office did not respond to a request for comment.

Matt Gaetz, a self-styled firebrand Republican from Florida, has also railed against the wasteful spending of taxpayers’ money. In March he “emphatically” voted against a federal spending bill that, he said, “continues to advance an unconstitutional process” and “unconstitutional agencies”, and would instead fund “all kinds of LGBTQAIXYZ stuff”.

Gaetz, 42, claimed almost $30,000 in accommodation expenses and more than $10,000 for meals in 2023.

A spokesman for Gaetz told the Washington Post that the congressman was reimbursed for accommodation expenses on days when the House was out of session but when he had stayed in Washington on official business for depositions related to his post on the select committee on the “weaponisation” of the federal government.

“Representative Gaetz has always complied with House rules regarding congressional reimbursements,” the newspaper was told.

A number of members did not claim any reimbursements under the new scheme. In all, 153 Democrats and 166 Republicans submitted expenses claims under the new scheme.

“This system is ripe for abuse,” said Craig Holman, a lobbyist for Good Citizen, which advocates for better government. “Many members of congress are not wealthy so a reimbursement system is important, but there should be full transparency and disclosure, and receipts must be produced. The loopholes are ridiculous.”

“Matt Gaetz says he was working on committee business during days the House was not in session, but no other committee members appear to have made similar claims.”

Some of the other claims raised eyebrows after it became apparent that members had claimed for accommodation expenses in Washington despite owning homes in the city.

Nancy Mace, a Republican from South Carolina, owns a townhouse in the capital, but submitted $3,000 for lodgings in Washington.

There are rules dictating what can be claimed, but actual evidence of spending is not required. Instead, the members of the House are “strongly encouraged,” but not required, to keep records of their spending related to their congressional work.

#us politics#news#the times#republicans#conservatives#Democrats#rep. Jack Bergman#rep. Matt Gaetz#rep. Nancy Mace#us congress#financial reimbursement#Congressional rules#us house of representatives#2024

13 notes

·

View notes

Text

Hey hey, if you like my work and also want to help out with our moving fund, don't forget I have a Ko-fi!

We'd appreciate anything rn, but do not worry if you can't help financially (times are tough for all of us rn, I know), you can help by reblogging this post if you want to!

I post updates about our situation on my main, but the tldr of it is we've received another section 21 eviction notice and thus have 2 to 3 months to find a place. The landlord is serious this time.

I've got £100 in savings rn, and while I'm aiming to put another 100 in next month, it just won't be enough (need at least 400 to 500 for a council house) by the time we have to leave.

BUT once we get in touch with a housing officer again, I'm gonna ask if they also pay deposit and first months rent on council houses too, as I'm unsure whether it's just private rented houses that they allow for that scheme.

Anyway, I'll be working on more art, and hopefully have something to show soon in terms of writing.

Thank you for taking the time to read this, hope everyone has a lovely day!!!

#me talking#i am deeply sorry that i have to keep doing this...i know its annoying#but i dont have any other choice#ive exhausted all other financial help

15 notes

·

View notes

Text

Aya & Tristan

A short study in plotting and scheming with someone for centuries.

I realized that I don't mention Tristan's right hand all that frequently, so this is a post offering some appreciation for that connection. Because I do think that they are quite interesting to think about in some respects. In a universe where most of the significant relationships between immortals that we delve into are primary rooted in familiar bonds, profound romance or hate and animosity, these two are part of just a handful of cases where there are different foundations involved.

As cold as the two of them can be, the relationship is always alluded to with certain gravitas by the two of them and by others. equally

This is Elijah talking about Aya in the episode where she is introduced:

ELIJAH: Aya. Let me guess-- Five-foot-seven, built like a goddess, vicious as a viper?

Now this is Elijah talking about Aya in relation to Tristan during the same episode:

ELIJAH: You waltz into my city unannounced with your flock of sycophants flaunting news of a threat. All the while, your little lapdog Aya is conspiring with none other than Marcel Gerard.

A snide description and intended as such, obviously. But it is curious to see Elijah of all people reducing his former romantic partner, and one he does show to have some complicated feelings towards during the season, to Tristan's lapdog as his way of showing his contempt. It legitimizes the significance of that connection as something noticeably more than superficial.

Aya is consistently shown as a paladin and pretty much the greatest defender for Tristan's vision for the Strix:

AYA: The oldest society of vampires this world has ever known. We are called The Strix.

ELIJAH: Quite the prestigious organization! Responsible for countless wars, numerous plagues, assassinations...

AYA: You have to break rules if you want to build a new world.

--

AYA: One of our more famous faces. We count amongst our society celebrated actors, artists, politicians... Of course, most of us prefer to live a life outside of the public eye. That doesn't make our talents any less impressive.

--

AYA: We're the top of the food chain-- the smartest, the strongest. And, we take what we want.

Added to this, she also presents herself as a steadfast advocate for Tristan himself. Both before and after the ocean:

AYA: Tristan has been a collector of extraordinary talent for the better part of a millennium. He chooses the best of the best and helps them evolve.

..

AYA: Tristan de Martel guided this organization for centuries. He was a radical thinker, decisive leader, and, to each of us here tonight, both mentor and friend. He was, in a word, irreplaceable.

--

AYA: But I did not die! Thanks to the efforts of a true nobleman. Tristan saved us! He earned our loyalty.

Tristan, in turn, deposits an intrinsic level of trust in her, not something by any means easily earned from him, even when dangerous circumstances retain him from heading the group:

ELIJAH: The alternative is significantly less pleasant.

TRISTAN: I think I will hold off on any confessions. At least until my Strix arrive to free me and burn your home to the ground...

Holding no shadow of doubt that someone will provide a valiant rescue from the Original family doesn't involve a small degree of trust. And speaking of that episode it does have one of the most important if subtle moments between them.

Tristan spent the episode from torture to torture. Aya spent it trying to make the goal of forcefully saving him from the Mikaelsons not a suicide mission. When she succeeds, he simply looks at her in mild frustration. And goes:

TRISTAN: It took you long enough.

Aya smiles at him. And that is the moment you receive the strangest "another hard Monday at the office uh?" vibe emanating from them. In that moment you fully believe that yes. These two, cold as they may be, have been having adventures together for centuries by this point.

And that is their general impression when they are together. In the little looks they hunt for in the other. In the way they play out of the other as if they were the two on the know whenever they reach the stage.

They are a pretty fun duo.

#Aya Al-Rashid#Tristan de Martel#I'm considering making this into a series going over other connections.#But Lucien is a minefield#Elijah is complicated as well as contradictory#And Aurora would involve me writing at least six or seven novels to discuss all the things I want to talk about.#So I'm unsure at the moment.#If you are reading this for some reason let me know if you would like to read even more of me incoherently rambling about anything specific

8 notes

·

View notes

Text

Savings Plans - Buy Best Saving Plan Online in India 2024

Savings Plan

A savings plan helps you get guaranteed returns against fixed monthly or yearly premiums. Further, these plans also offer a life cover that helps safeguard your family’s financial future.

What are Savings Plan?

An insurance savings plan is a financial tool that combines the benefits of a robust savings strategy with the security of insurance and guaranteed returns. Understanding how an insurance savings plan works can help you build a strong foundation for financial security. The best insurance savings plan offers a systematic approach to consistently setting aside a portion of your income, allowing you to accumulate funds over time. It provides a disciplined framework for allocating resources wisely, managing expenses effectively, and prioritizing your financial goals. By opting for an insurance savings plan, you can also adopt healthy financial habits and be better prepared to handle unexpected challenges and expenses.

Types of Savings Plan

Saving money is ideal for financial planning, ensuring a user has a safety net for emergencies, future expenses, andlong-term plans. Savings plans are tailored to meet different needs and preferences. From traditional options like fixed deposits tomoderninvestment avenues like mutual funds, understand the diverse savings plans available in India.

Fixed Deposits

Fixed deposits are India's most popular andcommonsavings instruments. Banks and financial institutions offer them as a way to allow individuals to deposit an amount for a fixed period at a predecided interest rate. Fixed deposits also provide capital protection and a guaranteed return, making them a secure option for conservative investors.

Recurring Deposits

Recurring Deposits (RDs)are one of the commonfamiliar savings option for people who wish to deposit a fixed amount regularly, often monthly, for a pre-decided period. RDs offer flexibility regarding investment amount and duration, and they are agood optionfor individuals who build savings through disciplined and regularintervals..

Public Provident Fund (PPF)

Public Provident Fund is astableand long-term plan the Government of India offers. PPF accounts have a lock-in period of 15 years, offergoodinterest rates, and offer tax benefits under Section 80C of the Income Tax Act. They also suit people looking for tax-efficient long-term savings with guaranteed returns.

National Savings Certificate

National Savings Certificate is an instrument with a fixed maturity period and interest rates offered by the Government of India. NSC offers tax benefits under Section 80C and can be bought from post offices across India. It also provides a safe and reliable avenue for people looking to accumulate savings over a fixed period.

Sukanya Samriddhi Yojana

SSY (Sukanya Samriddhi Yojana) is a savings plan for girls to promote their education and contribute towards their marriage expenses. It offers impressive interest rates, tax benefits under Section 80C, and partial withdrawal options after the girl child is of a certain age. SSY is a great savings option for parents looking to secure their daughter's tomorrow.

Employee Provident Fund

Employee Provident Fund is an unavoidable savings scheme after retirement for employees in India. Both the employer and the employee contribute towards the fund, and the amount collated can be withdrawn at retirement or in case of emergency. It also offers tax benefits and is an essential retirement savings tool.

Mutual Funds

MFs are schemes that collect funds from multiple investors to put money into a wide-ranging portfolio. They also offer a range of options catering todifferentrisk management profiles and investment plans. Italso offersprofessional management, liquidity, and a great chance for higher returns over the long-term goals.

Unit-Linked Insurance Plans

ULIPs combine insurance coverage and investment options, allowing policyholders to invest in various fund options basis on the risk appetite and financial goals. Unit-linked Insurance Plans also offer flexibility, and potential for wealth creation, making it a great choice for long-term financial planning.

0 notes

Text

पोस्ट ऑफिस की टर्म डिपॉजिट स्कीम में बैंक एफडी से ज्यादा ब्याज

नई दिल्ली, 4 अगस्त 2024। अगर आप बैंक एफडी ऑप्शन को चुनने की सोच रहे हैं, तो एक बार पोस्ट ऑफिस की टर्म डिपॉजिट स्कीम (post office term deposit scheme) पर भी विचार करें। यह स्कीम बैंक एफडी की तुलना में ज्यादा ब्याज और गारंटी रिटर्न प्रदान करती है।

स्कीम के फायदे

कोई रिस्क नहीं: पोस्ट ऑफिस टर्म डिपॉजिट स्कीम में निवेश पूरी तरह से सुरक्षित होता है।

गारंटी रिटर्न: इस स्कीम में निवेशकों को निश्चित रूप…

0 notes

Text

2 साल रुपए जमा करने पर मिलेंगे 232044, जल्द करे योजना में आवेदन।

Post Office Scheme 2024: https://combonews.in/post-office-scheme-2024-after-depositing-rs-232044-for-2-years-apply-for-the-scheme-soon/

0 notes

Text

Tax Planning & About Tax-Saving Investments in India

Tax-saving investments are essential to personal finance, enabling individuals to reduce their taxable income while simultaneously building a robust investment portfolio. In India, the Income Tax Act of 1961 offers various avenues for tax-saving investments, each catering to different financial goals and risk appetites. This blog delves into tax planning and the top tax-saving investment options available in 2024.

What is Tax Planning?

Tax planning refers to evaluating your financial situation and identifying strategies to minimise your income tax burden. The main objective of tax planning is to find opportunities to save on taxes, thereby reducing your overall tax liability as much as possible. This approach increases your disposable income, enabling you to invest more and work towards achieving your financial goals.

Tax-Saving Investments in India

1. Fixed Deposits (FDs)

Tax-saver Fixed Deposits (FDs) are a popular choice for conservative investors. These FDs offer tax deductions under Section 80C of the Income Tax Act, allowing you to claim a deduction of up to Rs 1.5 lakh. They come with a lock-in period of five years and offer interest rates ranging from 5.5% to 7.75%. However, the interest earned is taxable.

2. Public Provident Fund (PPF)

The Public Provident Fund (PPF) is a long-term savings instrument with a lock-in period of 15 years, making it suitable for long-term financial goals. Contributions to a PPF account earn an assured interest rate, typically higher than that offered by fixed deposits. You can claim tax deductions up to Rs 1.5 lakh per financial year under Section 80C. PPF accounts can be opened at designated branches of public and private sector banks or post offices.

3. Unit Linked Insurance Plans (ULIPs)

ULIPs combine insurance and investment, allowing policyholders to invest in equity funds, debt funds, or a mix of both. They offer the flexibility to switch between funds based on your financial goals. Investments in ULIPs are eligible for tax deductions under Sections 80C and 10(10D). The returns on maturity are tax-free, making ULIPs a dual-benefit product.

4. National Savings Certificate (NSC)

The National Savings Certificate (NSC) is a savings bond primarily aimed at small to mid-income investors. NSCs can be purchased from any post office or via internet banking if you have a savings account with a bank or post office. The investment amount qualifies for tax deductions under Section 80C. NSCs have a fixed maturity period and offer a fixed rate of interest, which is taxable upon maturity.

5. Senior Citizen Savings Scheme (SCSS)

The SCSS is a government-sponsored savings instrument for individuals above 60 years of age, providing a steady and secure income post-retirement. The principal invested in SCSS is eligible for tax deductions up to ₹1.5 lakh as per Section 80C. However, the interest earned is taxable as per the applicable tax slab of the investor. This scheme offers one of the highest interest rates among fixed-income investments, making it attractive for senior citizens.

6. Life Insurance

Life insurance is a critical component of an individual's financial portfolio, providing financial security to the policyholder's family in the event of their untimely demise. Premiums paid for life insurance policies are eligible for tax deductions under Section 80C up to Rs 1.5 lakh. Proceeds received on death or maturity are tax-free under Section 10(10D). Various life insurance plans, including term plans, endowment plans, ULIPs, and money-back plans, offer different benefits tailored to individual needs.

7. Pension Plans

Pension plans, also known as retirement plans, help individuals accumulate a corpus for their post-retirement life. Contributions to pension plans are covered under Section 80CCC, a subsection of Section 80C, with a combined maximum deduction limit of Rs 1.5 lakh. On maturity, one-third of the stocked pension amount is tax-free, while the remaining two-thirds is taxed as per the individual's tax slab. The amount is tax-free upon the death of the beneficiary.

8. Health Insurance (Mediclaim)

Health insurance policies, commonly known as Mediclaim, cover medical expenses incurred due to accidents or hospitalisation. Premiums paid for health insurance qualify for tax deductions under Section 80D. You can claim up to Rs 25,000 for yourself and your family and an additional Rs 50,000 for senior citizen parents. The maturity value received under critical illness insurance policies is tax-free.

9. National Pension System (NPS)

The National Pension System (NPS) is a government-backed retirement savings scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA). It allows individuals to invest in equity, corporate bonds, and government securities. Contributions to NPS qualify for tax deductions under Section 80CCD, with an additional deduction of Rs 50,000 as per Section 80CCD(1B), over and above the Rs 1.5 lakh limit under Section 80C. NPS offers a flexible and low-cost way to save for retirement.

10. Tax-Saving Mutual Funds (ELSS)

Equity-Linked Savings Schemes (ELSS) invest primarily in equities, offering tax benefits as per Section 80C. ELSS funds come with a lock-in period of 3 years. It is the briefest among all tax-saving investments. They are suitable for investors with a medium to high-risk appetite. The returns on ELSS are linked to market performance, offering the potential for higher returns compared to traditional fixed-income instruments.

Conclusion

Choosing the right tax saving investments can significantly impact your financial health and future security. From conservative options like fixed deposits and PPF to market-linked instruments like ULIPs and ELSS, each investment avenue offers unique benefits and caters to different financial goals and risk profiles. By strategically investing in these options, you can save on taxes and build a diversified and robust investment portfolio.

1 note

·

View note

Text

TDS under GST: Everything You Need to Know

In terms of indirect taxation, the advent of Goods and Services Tax (GST) in India has substantially modified the earlier tax machine Tax deduction at supply (TDS) gadget which has provisions of Under GST plays an essential position in tax compliance and greater transparency Understanding the filing of TDS returns and the method is important to live compliant and keep away from penalties. This article delves into the complexities of TDS below GST, together with who has to claim TDS, truthful price, and most importantly, the way to report a TDS return

What is TDS under GST?

Under GST, tax deduction at supply (TDS) is a method of deducting a positive percent of tax from payments made to providers of taxable items or offerings The principal goal of this scheme in and to make sure timely collection of profits taxes and increase the tax base by means of tracking big groups and authorities entities

Who should deduct TDS under GST?

The following companies are mandatory to deduct TDS under GST:

government departments or offices.

Local Government.

Creation of public offices.

Institutions notified by the Government.

These companies are required to deduct TDS when the total value of the goods supplied exceeds Rs. 2.5 lakh (inclusive of GST).

Valid prices for TDS under GST

The rate of TDS under GST is 2%, which is broken down as follows.

1% CGST (Central Goods and Services Tax) .

In case of intra-State transactions, 1% SGST (State Goods and Services Tax) or 1% UTGST (Under Territory Goods and Services Tax).

2% IGST (Integrated Goods and Services Tax) on inter-State transactions.

Steps for TDS Return Filing

Under GST, filing of TDS return is a mandatory action to be taken through the deductor. Here is the step by step guide on a way to record TDS go back:

Registration: Ensure that the withdrawer is registered below GST and has a legitimate GSTIN.

Form GSTR-7: Those who've deducted TDS need to document their returns thru Form GSTR-7.

Deduction Details: Provide information of providers (deductees) from whom TDS has been deducted.

TDS Certificate: Submit Form GSTR-7A for TDS certificates for deductions.

Due date: Submit your TDS go back by the 10th of the subsequent month.

Comprehensive process for filing TDS return

Step 1: Go to GST Portal

Apply your credentials to the GST portal (www.Gst.Gov.In).

Go to the ‘Services’ tab, then visit ‘Returns’ and pick ‘Returns Dashboard’.

Step 2: Select the ideal monetary 12 months and time

Select the proper financial 12 months and go back length (month) from the drop-down menus.

Step 3: Fill GSTR-7 form

Click on ‘Prepare Online’ under the GSTR-7 tile.

Enter the required details like GSTIN deduction, deduction payment, amount of TDS deduction.

Be sure to be consistent to avoid contradictions.

Step 4: Check before you can submit

Fill in all of the info and test the shape before making sure all the information are correct.

Click the ‘Submit’ button to post the shape.

Step five: Payment of TDS

Use the to be had fee strategies (Net Banking, NEFT, RTGS) to pay the TDS quantity.

Once the charge is made, the GSTR-7 fame may be updated.

Step 6: To publish TDS certificates

Generate TDS certificates (Form GSTR-7A) from GST portal.

For deductees, these certificates ought to be submitted as evidence of TDS deduction.

Consequences of noncompliance

Failure to conform with the TDS regime beneath GST may additionally bring about consequences and interest. Here are the principle results:

Late Fee: Late fee is Rs. 200 per day (Rs. A hundred for CGST and SGST) may be charged for overdue submitting, as much as a most of Rs. 5,000 rectangular feet.

Benefits: Interest is charged on late TDS at 18% consistent with annum.

Credit disallowance: If the drawee fails to deposit TDS on time, the deductees might also face disallowance of Investment Tax Credit (ITC).

Key points to consider

TDS applies to supplies of goods or services for which the contract price exceeds Rs. 2.Five lakhs is available.

The TDS ought to be submitted to the authorities through the tenth of the following month.

The deductors have to difficulty TDS certificates to the deductees inside five days of depositing the TDS.

Deductibles should document GSTR-7 every month, and deductibles can declare TDS income in their electronic earnings library.

Benefits of TDS beneath GST

Ensures compliance: Helps manage high-price transactions and ensures compliance with tax laws.

Reduces Tax Evasion: Reduces tax evasion by using keeping records of transactions.

Improves transparency: Improves transparency in transactions and decreases the chances of disputes.

The demanding situations they confronted

Despite the advantages, corporations generally tend to stand numerous demanding situations associated with TDS under GST:

Complexity: Understanding the provisions and efficiently implementing TDS may be hard for corporations.

Compliance burden: The burden of clearing TDS, issuing returns and certificate will increase the compliance burden.

Technical Issues: Navigating the GST portal and troubleshooting technical challenges may be tough.

Conclusion

Under GST, TDS is one of the most crucial measures geared toward increasing tax compliance and transparency. Understanding the provisions, prices and manner for submitting TDS returns is vital for agencies to avoid penalties and make certain easy operations. By following the noted steps and staying abreast of the cutting-edge information, corporations can manage their TDS legal responsibility below GST efficaciously. Remember, timely and accurate filing of TDS returns no longer best guarantees compliance however also creates a subculture of transparency and responsibility in the business environment also.

0 notes

Text

Comparative Analysis: Estimating Returns from Post Office RD vs. EPF Investments

When it comes to secure investment options in India, both Post Office Recurring Deposits (RD) and the Employee Provident Fund (EPF) stand out as popular choices. Each investment avenue offers distinct advantages and suitability depending on the investor's profile and goals. By employing tools like the post office RD calculator, investors can easily forecast the returns on their monthly contributions to a Post Office RD, which is known for its stability and government backing.

On the other hand, the EPF, primarily designed for the salaried workforce, offers a retirement savings plan that not only helps in building a substantial retirement corpus but also provides tax benefits. To estimate the growth of their EPF contributions, investors can use an EPF calculator. This calculator takes into account variables such as the current EPF balance, employer’s contribution, employee’s contribution, and the current interest rate, which is revised annually by the government.

The key difference between these two investment options lies in their nature and the returns they offer. Post Office RDs allow for a fixed monthly deposit into an account, which earns interest at a rate determined by the prevailing government guidelines. The simplicity of the RD scheme makes it an attractive option for individuals with consistent but limited investing capacity. On the other hand, the EPF is not only a savings tool but also a vital component of India’s social security system, offering interest rates generally higher than those of RDs, which makes it highly beneficial for long-term growth.

Moreover, while the returns on RDs are taxed according to the individual's income tax slab, the interest earned and the maturity amount of the EPF are tax-free under certain conditions, making EPF a more tax-efficient investment in the long run. This distinction is crucial for investors when planning their tax liabilities.

For potential investors, understanding these nuances is vital. Using a post office Recurring Deposits calculator helps in setting realistic expectations on the returns from RDs, providing a clear picture of what the maturity amount will be at the end of the investment period. Similarly, the Employee Provident Fund calculator aids in comprehending how one's money grows over time with the added interest, especially with the compound interest feature that EPF offers.

When comparing both, it’s important to consider factors like investment tenure, risk appetite, liquidity needs, and tax implications. Post Office RDs are typically preferred by those who seek less risky avenues and may need to withdraw their investment relatively sooner. In contrast, EPF is ideal for individuals with a longer investment horizon, primarily due to its focus on retirement savings.

While both Post Office RD and EPF are solid investments, they serve different purposes and offer different benefits. The post office Recurring Deposits calculator and Employee Provident Fund calculator help investors make informed investment decisions that match their financial goals and retirement plans. By carefully analysing and comparing these options, investors can optimise their portfolios for long-term financial goals.

0 notes

Text

Understanding How Time Frames Affect Passive Income: Three Examples

Passive income is often touted as the ideal way to earn money with minimal effort. However, the time frame over which one invests can significantly impact the potential returns. Here are three examples of how different time frames can affect passive income streams:

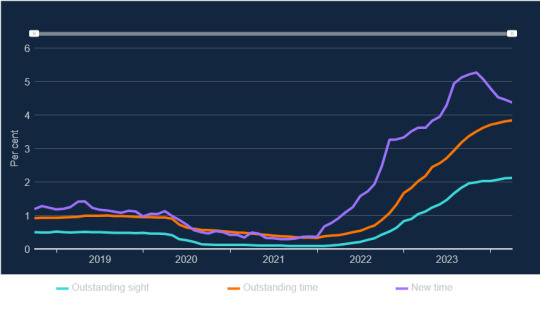

High-Interest Savings Accounts: In the short term, high-interest savings accounts can provide a reliable source of passive income. With interest rates having risen sharply since December 2021, savers can now enjoy more substantial returns on their deposits. For instance, moving your money to a high-interest account like the Post Office, which offers a 5.06% rate, can yield a decent income stream without much effort. However, it's crucial to monitor these rates regularly, as they can fluctuate.

Effective interest rates on individual deposits: source—Bank of England

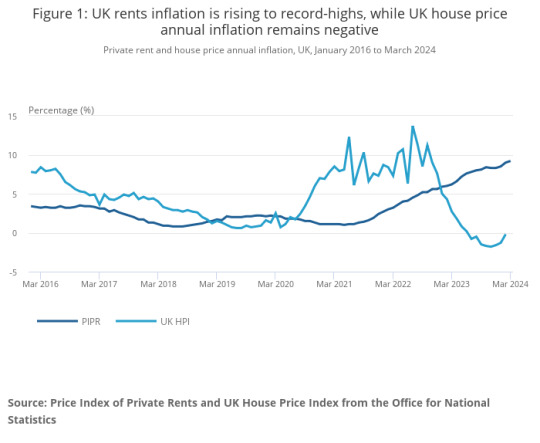

Renting Out Property: Medium-term passive income can be generated by renting out property. Whether it's a spare room through the government's Rent a Room Scheme or a parking space via platforms like JustPark, this method can provide a steady income stream. The key here is the balance between the initial investment and the ongoing passive returns. Over time, as the mortgage is paid down, the income can become more passive and potentially increase if property values rise.

Creating Online Courses: From a long-term perspective, creating and selling online courses can be a lucrative source of passive income. Once the initial work of recording and uploading the course is done, the creator can earn money each time someone enrols. Platforms like Skillshare or Udemy host such courses and handle the distribution, making it a potentially evergreen source of income as long as the content remains relevant and in demand.

Renting Out Property: Medium-term passive income can be generated by renting out property. Whether it's a spare room through the government's Rent a Room Scheme or a parking space via platforms like JustPark, this method can provide a steady income stream. The key here is the balance between the initial investment and the ongoing passive returns. Over time, as the mortgage is paid down, the income can become more passive and potentially increase if property values rise.

Creating Online Courses: From a long-term perspective, creating and selling online courses can be a lucrative source of passive income. Once the initial work of recording and uploading the course is done, the creator can earn money each time someone enrols. Platforms like Skillshare or Udemy host such courses and handle the distribution, making it a potentially evergreen source of income as long as the content remains relevant and in demand.

In conclusion, the impact of time frames on passive income can vary greatly depending on the type of investment and the effort involved. Short-term methods may require more frequent attention to rates and terms, while long-term strategies could yield higher returns with less ongoing effort. It's essential to consider your financial goals and the level of engagement you're willing to commit to when choosing the right passive income strategy for you.

0 notes

Text

In a concerning development, a Denver resident became the latest victim of an elaborate cryptocurrency scam, losing a whopping $14,000. Denver Police are urging the public to be vigilant after the individual was tricked into sending money through a cryptocurrency ATM under false pretenses. This incident highlights the growing trend of sophisticated scams targeting digital currency users. Authorities are now investigating the case, warning others to exercise caution and verify all transactions thoroughly to avoid falling prey to similar fraudulent schemes.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

In recent developments coming out of Denver, a warning has been issued by the local police department highlighting a worrying scam trend involving cryptocurrency ATMs. This new scam strategy has already led to a person losing a staggering $14,000. The manner in which these scammers operate isn't entirely new, but their method of collecting money has taken a digital turn, using the allure of cryptocurrency as their tool.

Traditionally, scams have taken many forms, but this particular scam involves a caller impersonating a Denver Police Department officer. The victim is falsely informed of a missed court appearance resulting in an outstanding warrant. To make matters more convincing, the scammer directs the victim to deposit what they claim is "bail" money through a cryptocurrency option available at a kiosk in a local laundromat.

Unsuspecting individuals are coerced into transferring an initial sum of money under the pretense of avoiding jail time. However, the demands don't stop there; more requests for money follow. In one devastating instance, a victim ended up transferring a total of $14,000 before realizing it was all a scam.

The Denver Police Department has emphasized that they would never initiate contact with individuals to inform them about an outstanding warrant or demand money over the phone. They are strongly advising the public to be vigilant and disconnect any such calls immediately. Victims or individuals who encounter such incidents are encouraged to report these scams to the local law enforcement at 720-913-2000 and press 2 or take a step further by filing a complaint with the Colorado Attorney General’s Office online.

This alarming trend underscores the evolving landscape of scams and the importance of staying informed about the tactics used by scammers. The use of cryptocurrency in scams adds a layer of complexity and anonymity, making it crucial for individuals to exercise caution and skepticism when approached with such demands. The Denver Police Department's warning serves as a timely reminder to remain alert and protect oneself from becoming a victim of such deceitful schemes.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. **What happened in the cryptocurrency ATM scheme in Denver?**

A victim lost $14,000 in a scheme involving a cryptocurrency ATM, as reported by the Denver police.

2. **How did the victim lose money in this scheme?**

The victim was tricked into sending money through a cryptocurrency ATM, leading to a loss of $14,000.

3. **Are the police investigating the cryptocurrency ATM scheme?**

Yes, the Denver police are actively investigating the case to find the perpetrators behind the scheme.

4. **What can people do to avoid falling victim to such schemes?**

It's important to be cautious and skeptical about unsolicited requests for money transfers, even if they appear legitimate, and to consult with trusted financial advisors or the police before making such transactions.

5. **Will the victim get their money back?**

Recovering money from cryptocurrency scams can be challenging, but the authorities are working on the case. The victim's ability to get their money back will depend on the investigation's outcome and the possibility of tracing the stolen funds.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes

Text

Best Investment Plans in India To Invest in 2024 For High Returns | Kotak Life

Investment Plans

Investment plans offer a structured approach to wealth accumulation and preservation, tailored to meet a variety of financial goals and risk preferences. The best investment plans in India are essential for achieving financial security and reaching long-term objectives. They act as strategic roadmaps, guiding individuals in making informed decisions about where to allocate resources, how much to invest, and the optimal duration for investment.

These plans serve as blueprints for informed financial decisions, helping you determine where to invest your money, how much to invest, and the time horizon needed for growth. The process typically starts with setting clear, measurable goals—whether it's saving for retirement, purchasing a home, funding education, or simply building wealth over time. By providing structure and direction, the best investment plans in India empower individuals to navigate the complexities of financial markets with confidence, ultimately working towards a secure and prosperous financial future.

What is an Investment Plan?

An investment plan is a strategic roadmap designed to help individuals or organizations achieve financial goals by allocating resources to various assets or securities. It involves assessing financial objectives, risk tolerance, and time horizon to create a personalized wealth accumulation or preservation strategy.

Types of Investment Plans in India

An investment plan considers risk management. It evaluates the balance between potential returns and the level of risk one is willing to tolerate. Several investment plans in India cater to different risk profiles and financial goals.

Low-risk Investment

Low-risk investment options provide varying degrees of returns and liquidity, allowing investors to choose based on their risk tolerance and financial objectives. Here are some of the popular low-risk investment options:

Guaranteed Savings Plan

Guaranteed Savings Plans are low-risk investment plans offering guaranteed returns and life insurance coverage. Insurance companies typically offer them and are designed to help individuals build savings over a specified period while providing financial protection to their loved ones.

Tax Saving Fixed Deposits

Fixed deposits with banks or post offices that offer tax benefits under Section 80C of the Income Tax Act, with the principal amount locked in for a specified period.

Sukanya Samriddhi Yojana (SSY)

Sukanya Samriddhi Yojana, or SSY, is a government-backed savings scheme designed to secure the financial security of the girl child. It offers attractive interest rates and tax benefits to the policyholder.

Public Provident Fund (PPF)

This is a long-term savings scheme with tax benefits. It offers a fixed interest rate and partial withdrawal options after a specified period. Currently, this scheme offers an attractive interest rate of 7.1% per annum.

Senior Citizen Savings Scheme (SCSS)

The Senior Citizen Savings Scheme is exclusively for senior citizens. It offers regular income and tax benefits, with a fixed interest rate of 8.2% per annum.

Retirement Plans

Retirement plans are designed to help individuals accumulate savings and generate income during their retirement years. These plans aim to ensure financial security and independence post-retirement when individuals no longer receive regular employment income.

0 notes