#Property Management Services in carlyle district

Text

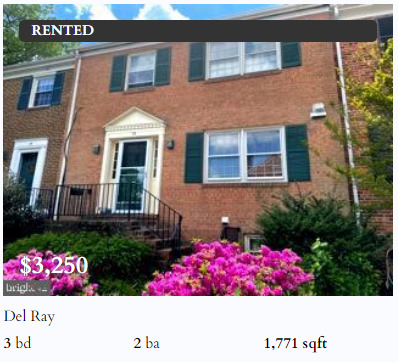

Property Manager in Virginia

A property manager is someone who oversees a property's day-to-day operations. Property managers are responsible for finding and hiring the right people to take care of a property, collecting rent, and handling any issues that come up. They can also be called upon to deal with day-to-day maintenance and repairs. If you need a property manager.For more information call now at (703)7650300. https://www.nesbitt.realestate/agents

#property management in Arlington Virginia#real estate in Mount Vernon Virginia#real estate in Crystal City#real estate in Old Town Alexandria Virginia#real estate in Fort Hunt#real estate in Franconia#real estate in Del Ray#property management in Mount Vernon Virginia#property management in Crystal City#property management in Old Town Alexandria Virginia#property management in Fort Hunt#property management in Franconia#property management in Del Ray#Property Management Services in carlyle district#Property Management Services in West End#Property Manager in Virginia#rental property management in 22039#Rental Property Management in Old Town#Property Management in Oak hill#property management in falls church

0 notes

Text

Cleveland Locavore

Wednesday, December 9, 2020 - Update

Cleveland Locavore Domain Name, free to a good home...

www.ClevelandLocavore.com

Monday, February 17, 2014

Urban Organics / SweetPeet

Hello All,

I found this lively thread that Maurice started in November, 2010.

I have fond memories of meaningful conversations with all of you about sustainability and local food from local farmers.

Since November, 2010 I made several changes in my life, as I am sure many of us have. Annette and I sold Morgan Farm Stay, my relationship with Urban Organics was paused.

Although both were tremendous success stories on many levels, the good fight is often made more challenging by a different form of sustainability, economic sustainability. It was Robert Kennedy Jr. who made it clear to me, at an annual EcoWatch event, environmental and economic sustainability MUST go hand in hand.

My whole life has been about selling a service, photography. Of course I have certainly had my challenges continuing to keep this profession "sustainable" due to the changes in the industry. If you don't believe me just ask Karl Skalak, or George Remmington.

The past three years I have focussed on getting my Photography house in order.

Just last week, Mark Bishop, the founder of Urban Organics, contacted me to see if I could help him again with his social networking and PR needs.

Well I have to say, I can't help myself, I am happy to be back, I never really left of course...

I am proud of what I have done for Urban Organics, writing and designing the web site...

http://www.urbanorganicsohio.com/

Urban Organics hopes to sell more of its flagship product, Sweet Peet, in bulk and bags. There are many newcomers to the organic mulch market, but nothing beats Sweet Peet! Sweet Peet is a great way to charge up any community garden, school garden, corporate garden, rooftop garden etc...

I am hoping to write a few stories based on testimonials from happy customers, which there are many. If anyone can help me with media contact information, at Cleveland Magazine, Edible Cleveland, or similar local media contacts, I would appreciate it.

Also please put me on your E-Blast lists, I want to know what you are up to!

All The Best,

Dan Morgan

http://clevelandlocavore.com/

10:54 am est

Sunday, May 26, 2013

Cleveland Plain Dealer Article Published...

Dan Morgan on Vermicomposting

5:09 pm edt

Friday, May 10, 2013

Vermicomposting Story For The Plain Dealer

Hi Judy, (Judy Stringer -PD's rental section of the Sunday paper)

Vermicomposting is a great way to create a soil amendment that is 10 times better for the garden than traditional back yard composting without red wiggler worms. A backyard compost pile that has to be turned regularly, while a vermicomposting bin, a "worm farm" does not. The worms do all the hard work.

Why best for renters?

Clean, compact, self contained and what is the best advantage for renters, LOW MAINTENANCE. The bin can be left undisturbed for weeks at a time, or can be "fed" every day. General maintenance can vary widely if you just follow a few simple rules, very important rules.

The right worms are the key! Red wigglers or the formal name Eisenia Fetida, are a very specific type of worm needed. The worms are expensive, and widely available for sale on the internet. The best way to start a worm farm, is look for a local sustainable gardening blog community, https://www.facebook.com/localfoodcleveland is a good one on Facebook. Ask around, and you will find someone who wants to share their worms, and you will suddenly have someone to help you get started as well. Vermicomposters LOVE to share ideas and even recipes.

The simplest way to make your worm farm is to find 2 identical plastic bins. drill holes in the bottom of one of them, the one that will go inside the other. The holes are for drainage when the soil gets too moist. Proper drainage and soil moisture is CRITICAL for the whole process to work without becoming a horrible experience. The other most important factor to make a renter's worm farm a clean success, DO NOT PUT FRUIT SCRAPS in the bin. Most vermicomposting web sites will encourage all organic material including fruit and veggies but believe me, not a good idea!

Recap:

Two things that will ruin the experience,

1) Soil that is kept too moist,resulting in a stinky bin! These anaerobic conditions can also kill the worms (by drowning)

2) Fruit will attract / breed fruit flies, something nobody wants in their apartment (especially a landlord)

The finished product, after separating the worms from it, can be added to indoor plants or outdoor gardens. The best thing to too with the final product is to make a "teabag" from an old t shirt and bunch the t-shirt around a garden hose to make compost tea, right into a watering can. This tea can be sprinkled right on top of gardens, acting as both a fertilizer and insecticide, NATURALLY. There is no reason to use synthetic fertilizers or insecticides in any garden, or lawn for that matter.

Got unsightly weeds in your garden? PULL THEM.

My wife Annette and I are apartment renters in Lakewood (the Carlyle) and we have an Adopt A Spot garden at the entrance to Lakewood Park, part of Keep Lakewood Beautiful's Adopt A Spot program, with over 40 volunteer maintained gardens on publicly owned property around Lakewood.

http://www.onelakewood.com/Boards_Commissions/KeepLakewoodBeautiful.aspx

Let me know anything else you need.

Dan

10:41 am edt

Saturday, August 11, 2012

Morgan Farm Stay Sale...???

Hello Friends, and Family,

Here is an update of our day to day efforts to sell our farm to some, while continuing to make it a "once in a lifetime" vacation experience for others.

Since early May we have had some great guests this season. Sophie Brun came to the United States from France a few years ago. She and her family settled into a posh northern suburb of Detroit, Royal Oak. Spotting our vacation rental property listing on HomeAway.com, she was reminded of the farm stays she visited in Europe.

Sophie and her family had a great Easter dinner at our farm, feasting on Buckeye Chicken eggs, Berkshire grass fed ham, and cookies baked in a wood burning stove across the street by Edna, our Amish neighbor.

In late May we had guests staying at the farm who made reservations over a year ago. They have a daughter who is graduated from Oberlin College and wanted a very special family get together at this important time.

The rest of the summer has been mostly filled in with various guests, as usual. July, which always fully books, had grandparents coming from Germany to meet a new grandchild at the farm.

On a regular basis we have had a varied crew of family, friends and neighbors working together to clean up the gardens and plant some new flowers, veggies and herbs. The grass, well it kept on growing, and growing, and growing.

We have several educational components in place form the past few years. The Blue Orchard Mason Bee Box has almost half it's holes housing eggs ready to burst out and begin the process joining an army of beneficial mason bees, pollinating nearby flower, veggie and herb gardens. Amy Roskilly, with the Cuyahoga Soil and Water Conservation District, hooked us up last year with a rain garden kit, containing several types of beautiful plants that thrive in a wet spot while filtering storm water runoff before reaching the stream nearby.

Our composting, both vermicomposting and traditional "back yard" composting operations are thriving and our rain barrels are very useful in areas our garden hose does not reach, particularly our companion garden, way out away from the main house. This year the companion garden will contain a few new plants. Comfrey is a great new addition, if I can manage to keep it from taking over the entire garden. Also this year I am cutting back on the heirloom tomatoes and adding some nice herbs.

In May we had a great deal of interest from a few interested buyers, one young man from California wants to take over the entire business, turnkey, keeping our furnishings, decor, web site and photos to promote. The only problem is, he is having some trouble getting financing. Sure the rates are great right now but banks are hesitant to lend. At the end of June we took our first nice vacation since moving back to Ohio in 2005. We of course worried about the Farm Stay rentals we had booked, but friends and family again came to our rescue.

On our second day in Europe, in Montpellier France, we got word from our realtor Teresa. She had an interested buyer making an offer. We spent a few hours on the iPad countering and the sale price was agreed on. After several anxious weeks awaiting financing approval for our buyers, it looks like the end of an era.

We have a closing date scheduled for this upcoming week. Our fingers are still crossed, because ya never know...

This has indeed been a great journey for Annette and I.

Au revoir for now, Thanks for all of your help and support over the past 7 years!

Dan and Annette Morgan

Dan Morgan

Straight Shooter

646-621-6434

www.AboutDanMorgan.com

10:22 pm edt

Thursday, May 10, 2012

Here is an update of our day to day efforts to sell our farm to some, while continuing to make it a "once in a lifetime" vacation experience for others.

We have had a great deal of interest from a few interested buyers, one young man from California wants to take over the entire business, turnkey, keeping our furnishings, decor, web site and photos to promote. The only problem is, he is having some trouble getting financing. Sure the rates are great right now but banks are hesitant to lend.

And so we keep on going, and going and going, while the grass keeps growing and growing and growing! This has indeed been a great journey for Annette and I. This summer we have made arrangements to visit the south France region and Spain, a nice little rest from all the political rhetoric and bickering here in the states.

Au revoir for now!

Dan and Annette Morgan

8:07 am edt

Thursday, April 26, 2012

2012 Season at Morgan Farm Stay

Check out our revamped web page with more about the farm, area attractions and recent stories "In The News"

Click Here, www.MorganFarmStay.com

3:11 pm edt

Sunday, February 27, 2011

Thank You Chris Hodgson -Dim and Den Sum for your support Now booking 2011spring summer fall season!

Our Farm Stay...

www.MorganFarmStay.com

Find Your Perfect Farm Vacation at www.FarmStayUS.com

11:05 pm est

Saturday, November 20, 2010

New Logo

Been a long time since I posted here. Now that the holidays and winter are coming I have decided to get back on my Cleveland Locavore horse. Check out the logo.

I am designing a great reusable bag that will help get this brand rolling. Cleveland local food advicates in many product and service areas are welcome to participate in this unique program. Come and have a seat at the table!

7:40 am est

Tuesday, March 2, 2010

Local Farm Superstars

E4S held a great event Last Night

Click Here

Eight NEO Farmers told thier stories, pretty great. Common thread...Hard work that NEEDS to be supported by more and more of us at summer and winter farmers markets and CSAs

2010.03.01

Hello, I have found myself increasingly interested by how our food is produced since 2005. Annette, my wife, and I retuned to Ohio from NY and bought a farm in Ashland County. It did not take long to notice the backwards attitudes of most of today's farmers, urban planners, educators and politicians. During the Nixon administration, Earl Butz, Ray Crock and others had a seemingly harmless, goal in mind, produce and distribute the most amount of food for the least amount of money.

It has taken us a complete generation to figure out that this model just does not work, for so many reasons. The broken farming system effects everyone in profound ways, all connected. From healthcare to the economy, the way we produce and distribute food must change, and change dramaticly, NOW. Small scale farmers and farmers markets are the tip of the melting iceburg that will save the planet!

From Wikipedia...

The locavore movement is a movement in the United States and elsewhere that spawned as interest in sustainability and eco-consciousness become more prevalent.[1] Those who are interested in eating food that is locally produced, not moved long distances to market, are called "locavores." The word "locavore" was the word of the year for 2007 in the Oxford American Dictionary.[2] This word was the creation of Jessica Prentice of the San Francisco Bay Area at the time of World Environment Day, 2005.[3] It is rendered "localvore" by some, depending on regional differences, usually.[4][5] The food may be grown in home gardens or grown by local commercial groups interested in keeping the environment as clean as possible and selling food close to where it is grown. Some people consider food grown within a 100-mile radius of their location local, while others have other definitions. In general the local food is thought by those in the movement to taste better than food that is shipped long distances.[1]

Farmers' markets play a role in efforts to eat what is local.[6] Preserving food for those seasons when it is not available fresh from a local source is one approach some locavores include in their strategies. Living in a mild climate can make eating locally grown products very different from living where the winter is severe or where no rain falls during certain parts of the year.[7] Those in the movement generally seek to keep use of fossil fuels to a minimum, thereby releasing less carbon dioxide into the air and preventing greater global warming. Keeping energy use down and using food grown in heated greenhouses locally would be in conflict with each other, so there are decisions to be made by those seeking to follow this lifestyle. Many approaches can be developed, and they vary by locale.[8] Such foods as spices, chocolate, or coffee pose a challenge for some, so there are a variety of ways of adhering to the locavore ethic.[9]

Join me in promoting this just cause, starting right here in Northeast Ohio!, where we have already been recognized internationally for our efforts! Click here for Sustain Lane ranking

Dan Morgan, Cleveland Locavore [email protected]

0 notes

Text

TripAdvisor Cuts 25% Of Workforce Amid Pandemic

TripAdvisor’s Massachusetts headquarters.

AP Photo/Steven Senne

Topline: As the coronavirus pandemic keeps Americans confined to their homes, nearly every industry has been negatively impacted by the disease, and businesses losing out on cash flow have started laying off workers.

Here’s who’s axed staff so far:

Airlines & Transportation

Air Canada will lay off 5,100 members of its cabin crew, about half of its current roster, as its planned flights for April have been cut by nearly 80%.

Air New Zealand will let 3,500 workers go, equaling about one-third of its workforce.

Avis Car Rental Boston’s Logan International Airport reportedly laid off an undisclosed number of workers.

Enterprise Holdings, the parent company of car renters Enterprise, National and Alamo laid off 743 workers in North Carolina.

Flight Centre, Australia’s largest travel agent, is laying off and putting on leave a third of its 20,000 employees.

Helloworld Travel, an Australian travel agent, let 275 employees go.

Car rental company Hertz plans to lay off 10,000 workers from its North American business.

Norwegian Air said that it would temporarily lay off up to 50% of its workforce, meaning 7,300 workers, and suspend 4,000 flights due to the pandemic.

Scandinavian Airlines said Sunday it will temporarily lay off 10,000 employees, equal to 90% of their staff.

Stena Line, a European ferry operator, announced that 950 jobs would be cut in Sweden due to a sharp decline in travel bookings.

Canadian airline and travel company Transat AT let go of 3,600 workers, or about 70% of its workforce.

TripAdvisor eliminated 600 roles in the U.S. and Canada, and 300 more in other countries, as part of a 25% workforce reduction; an undisclosed number were furloughed.

ZipCar, a car rental company, laid off 20% of its 500 workers.

Airports

Arts, Culture & Entertainment

Film studio 20th Century Fox dismissed 120 Los Angeles-based employees.

The Houston-based Alley Theatre laid off 75% of its staff and implemented pay cuts for those remaining.

Caesars Entertainment Corp. has also begun pandemic-prompted layoffs.

Christie Lights, an Orlando, Florida, stage lighting company, laid off 100 employees.

Toronto-based movie theater chain Cineplex Inc. laid off thousands of part-time workers after being forced to shut its 165 locations across Canada and the U.S.

The Circuit of the Americas, an Austin, Texas-based concert, automobile racing, conference and entertainment complex, said it was laying off an undisclosed number of workers after being indefinitely closed due to coronavirus.

Montreal-based circus producer Cirque du Soleil will lay off 4,679 people—95% of its staff.

Talent agency Endeavor laid off 250 workers, with the first wave focusing on those who cannot do their jobs from home, such as restaurant workers.

The International Alliance of Theatrical Stage Employees, IATSE, estimated that 120,000 jobs for film workers, including technicians, artisans and other crew positions have been eliminated.

Lifestyle branding agency Karla Otto laid off approximately 28 New York City employees and several others in its Los Angeles office.

Public relations firm Krupp Group laid off an undisclosed number of New York and Los Angeles employees.

About 300 workers across the Massachusetts Museum of Contemporary Art, the Norman Rockwell Museum and the Hancock Shaker Village will be out of jobs by mid-April.

New Jersey’s McCarter Theater said an undisclosed number of full-time and seasonal workers across every department will be laid off from May 15.

Production company Metro-Goldwyn-Mayer Studios let 7% of its workforce go, resulting in about 50 positions being eliminated.

New York City’s Metropolitan Museum of Art laid off 81 employees.

The Museum of Contemporary Art in Los Angeles, California, let go of all 97 part-time staffers.

About 85 freelancers in Manhattan’s Museum of Modern Art have been cut.

Mystic Seaport Museum in Connecticut laid off approximately 200 workers.

Hollywood talent agency Paradigm laid off around 100 employees and reduced payroll for the remaining 500.

New York-based agency PR Consulting let 32 employees go.

The Science Museum of Minnesota temporarily laid off 400 employees.

Boutique fashion and hospitality agency Sequel let an undisclosed number of workers go.

SkyCity Entertainment laid off or furloughed at least 1,100 workers.

At least 50 employees of music and culture festival South By Southwest were let go after this year’s event was canceled, the Washington Post reported.

Creative agency Spring reduced staff in Los Angeles and London.

TeamSanJose, which oversees events at multiple California theaters and convention centers, temporarily let go of approximately 1,300 workers.

New York City’s Whitney Museum laid off 76 workers.

Improvisational theater and school Upright Citizens Brigade laid off dozens of workers.

ViacomCBS let an undisclosed number of contract workers go.

Education

Finance

Government

Healthcare

Hotels

Carmel Valley Ranch in California laid off 600 workers.

The Carlyle and Plaza Hotels laid off hundreds of workers.

Claremont Hotel Properties in California’s Oakland and Berkeley areas has let go of 514 people.

Eden Roc Hotels, in Miami, Florida, laid off 257 employees from its housekeeping, spa and banquet workforces.

The Four Seasons hotel in Vail, Colorado dismissed about 240 staffers.

Colorado’s largest hotel, the Gaylord Rockies Resort & Convention Center, laid off 800 workers.

Great Wolf Lodge is laying off around 440 employees from its Colorado Springs location.

Kimpton Hotel Aventi in Manhattan, owned by the InterContinental Hotels Group, reportedly laid off 40 employees, while the Ian Schrager-owned Public temporarily laid off an undisclosed number of workers.

Las Alcobas Resort & Spa in California’s Napa go of approximately 140 employees.

Marriott International, the world’s largest hotel company, said tens of thousands of hotel workers will be furloughed, and will lay off a number of those workers.

McMenamins, the Northwest’s largest hotel chain and brewpub, let 3,000 employees go.

MGM Resorts said it would furlough workers and begin layoffs on Monday, but immediately let some staffers go from undisclosed parts of its business.

Over five dozen workers were laid off from West Virginia’s Oglebay Resort and Conference Center.

SoftBank-backed Oyo Hotels laid off 3,000 of its China employees earlier in the month, equaling 30% of its workforce there, part of a global layoff of 5,000.

The Palace Hotel in San Francisco has temporarily eliminated 774 positions.

Pebblebrook Hotel Trust, which owns 54 hotels, laid off half of its 8,000 workers and may need to cut an additional 2,000.

Australia-based Redcape Hotel Group will cut most of its 800-person staff.

In San Francisco, California, the RIU Plaza Fisherman’s Wharf dismissed nearly 210 workers.

Sage Hospitality Group let go of 465 workers across three properties in Denver, Colorado.

Scandic, the largest hotel operator in Europe’s Nordic countries, also said it would give termination notices to 2,000 Swedish employees.

Sydell Hotels dismissed around 180 workers.

Workers at President Trump’s hotels—160 in Washington, D.C., 51 in New York City and an unknown number at his Las Vegas, Nevada location—were laid off.

The Warwick Rittenhouse Square Hotel in Philadelphia, Pennsylvania laid off 53 workers.

The Westin Boston Waterfront cut 435 workers.

Ventana Big Sur, also in California, let go of around 260 workers.

Industry

North Dakota-based water management and well logistics company MBI Energy Services laid off over 200 workers.

Manufacturing & Logistics

Lightweight metals manufacturer Arconic laid off 100 workers from its Lafayette, Indiana plant.

Power substation and transformer manufacturer Delta Sky let go of an undisclosed number of employees.

General Electric laid off about 10% of its jet engine workforce, around 2,500 workers.

Union leaders at a General Motors plant in Ontario, Canada have recommended a two week layoff due to concerns over the virus.

Metal plating finisher Marsh Plating Corp. in Michigan temporarily laid off 97 workers.

Mitchell Plastics of Charlestown, Indiana, has temporarily laid off 36o workers.

The Port of Los Angeles let go of 145 drivers after ships from China stopped arriving.

Michigan-based woodworker Schafer Woodworks Inc. temporarily laid off 25 employees.

Tilden Mining Co., located in Michigan, temporarily laid off over 680 workers after idling operations April 26.

Minnesota-based cabinetmaker Wayzata Home Products had to lay off its entire 141 person staff.

Real Estate

Restaurants & Dining

“All restaurant staff” were reportedly let go at Aqimero, located in Philadelphia, Pennsylvania’s Ritz-Carlton hotel.

Bon Appetit Management Company, a retail dining employer for college campuses, laid off 140 workers from the University of Pennsylvania.

Oregon-based Burgerville laid off 162 workers.

Cameron Mitchell Restaurants furloughed 4,500 workers, with 90 at Philadelphia, Pennsylvania’s Ocean Prime restaurant reportedly laid off.

Compass Coffee, a Washington, D.C. Starbucks competitor, laid off 150 of its 189 employees—equaling 80 percent of its staff.

Danny Meyer’s Union Square Hospitality Group laid off 2,000 workers, which is 80% of its workforce.

Austin, Texas-based Dyn365 is laying off 95 office workers.

Earl’s Restaurants, Inc. in Boston laid off around 360 workers from two locations.

Eatwell DC, a District of Columbia-based restaurant group, let go of 160 employees.

Founders Brewing Co., a Grand Rapids, Michigan beer maker, let 163 workers go.

Six Friendly’s restaurants in Connecticut temporarily laid off about 120 workers.

HMSHost, a Seattle, Washington, global restaurant-services provider said it would lay off 200 people and an area corporate shuttle service would lay off 75, HuffPost reported.

Austin, Texas-based JuiceLand let go of of approximately 225 workers.

Landry’s Inc., the parent company of Del Frisco’s and Bubba Gump Shrimp Co. (along with the Golden Nugget casinos) had to temporarily lay off 40,000 workers.

Levy’s Premium Foodservice, which provides services to Levi’s Stadium in Santa Clara, California, has let go of 613 workers.

Detroit, Michigan-based Punch Bowl Social laid off 97 workers.

Shake Shack let 20% of its New York City-based corporate staff go.

Trump National Doral restaurant BLT Prime in Miami, Florida, laid off 98 workers.

California-based Vesta Food Service has let 310 workers go.

Retail

Tech boutique B8ta reportedly laid off half of its corporate staff.

Massachusetts-based marijuana dispensary Cultivate laid off an unknown number of workers.

Destination XL, based in Massachusetts, cut 245 brick-and-mortar store jobs.

Shoe retailer DSW put up to 80% of its workers on a temporary unpaid leave of absence, according to a statement from a spokesperson to Forbes.

Australian department store chain Myer Holdings has temporarily laid off 10,000 of its workers.

Stationery and crafts store Paper Source let go of 88 workers across Massachusetts.

U.K.-based retailer Primark laid off 347 workers from locations around Massachusetts.

Cosmetics retailer Sephora let go of some part-time and seasonal workers in its U.S. business; Canadian corporate employees are working reduced hours.

Laura Ashley, the British homewares and bedding maker, filed for administration (the U.K.’s version of bankruptcy) after rescue talks were impeded by the coronavirus outbreak.

New York City bookseller McNally Jackson, which operates four locations, temporarily laid off its employees, but intends to hire them back “as soon as we can,” according to the company’s Instagram account.

Mountain Equipment Co-op, a Canadian outdoor recreation retailer, will let go of 1,300 employees by March 29.

Simon Property Group, America’s largest mall owner, laid off an undisclosed number of employees while furloughing an additional 30% of its workforce.

Inclusive bra maker ThirdLove laid off 30 to 35% of its staff.

Mattress upstart Tuft & Needle let go of an undisclosed number of retail store workers.

Sportswear maker Under Armour laid off around 600 warehouse workers in the Baltimore, Maryland area.

Silicon Valley & Technology

Vehicle sharing platform Bird laid off 30% of its workforce, which came to 406 employees out of its workforce of over 1,300.

Employee equity management startup Carta laid of 161 employees, or about 16% of its workforce.

Fitness platform ClassPass let go of 22% of its employees, while furloughing an additional 31%.

New York City real estate startup Compass laid off 15% of its workforce.

Cryptocurrency incubator ConsenSys laid off 91 employees, about 14% of its workforce.

Cloud software startup D2iQ (formerly known as Mesosphere) reportedly laid off 34 employees.

Boston-based AI company DataRobot let go of an undisclosed number of staffers.

Smart office startup Envoy laid off or furloughed 30% of its 195 workers.

Event management service Eventbrite laid off half its workforce as events worldwide are canceled.

Fashion startup Everlane laid off and furloughed 200 employees from its retail and backend departments.

Boston-based corporate catering startup ezCater laid off over 400 of its 900 employees.

Minneapolis-based food delivery service Foodsby laid off an undisclosed number of workers.

In Silicon Alley, four startups—online mattress retailer Eight Sleep, technical recruiter Triplebyte, hospitality startup The Guild, and luxury sleeper-bus service Cabin—laid off about 75 people between them.

Car rental startup GetAround let go of around 100 workers due to the impact of the coronavirus.

Discount services and experiences platform Groupon will lay off or furlough around 2,800 employees.

Iris Nova, a drink startup backed by Coca-Cola, let go of 50% of its staff.

Trucking unicorn KeepTruckin let go of one-fifth of its employees.

Office space leasing company Knotel cut half of its 400 employees.

Komodo Health reportedly laid off 9% of its workforce.

Cannabis startup Leafly dismissed 91 workers, following a round of layoffs from two months prior.

Boston-based travel startup Lola laid off 34 employees, reportedly among the first full-time tech casualties of the coronavirus crisis.

Mixed reality company Magic Leap reportedly laid off 1,000 employees.

Interior design and e-commerce platform Modsy let go of an undisclosed number of employees.

Homebuying startup Opendoor let 600 employees go, equaling about 35% of its workforce.

Overtime, the Kevin Durant-backed sports media company, parted ways with 20% of its employees.

HR tech company PerkSpot let 10 employees go.

IT infrastructure company Pivot3 laid off an undisclosed number of workers.

High end clothing rental service Rent The Runway laid off all retail employees across the country.

Remote work and travel company Remote Year laid off about 50 employees.

Oil, gas and alternative energy marketplace RigUp let go of 25% of its workforce.

Petsitting platform Rover laid off 41% of its workers.

Sales enablement company ShowPad laid off 52 employees.

Apartment rental startup Sonder laid off or furloughed 400 employees, equaling roughly 30% of its workforce.

Chicago parking startup SpotHero laid off an undisclosed number of employees.

Artificial intelligence writing platform Textio laid off 30 workers.

Tasking platform Thumbtack let go of 25o employees.

Travel manager TripActions laid off 300 workers—about 25% of its staff—mostly across customer support, recruiting and sales.

Photo editing app makers VSCO let 45 employees go.

Wonderschool, backed by Andreeson-Horowitz, let go of 75% of its staff.

Yelp laid off or furloughed more than 2,000 workers—a 17% staff reduction.

Online hiring marketplace ZipRecruiter laid off or indefinitely furloughed 400 of its approximately 1,200 full-time employees.

AirBnb-backed business travel company Zeus Living cut 30% of its staff.

Sports & Fitness

The NBA’s Utah Jazz laid off an undisclosed “small percentage” of its workforce.

Maryland-based yoga chain CorePower Yoga let go of 193 workers across five studios.

Golden Gate Parks racetrack in California laid off around 140 workers.

The WWE, owned by billionaire Vince McMahon, cut at least 15 wrestling stars from its lineup.

After canceling its comeback season in March, the XFL, also owned by Vince McMahon, suspended operations and laid off all of its employees.

Utilities

Satellite TV provider Dish is laying off an undisclosed number of its 16,000 employees.

Elsewhere

Boston’s Tea Party Ships & Museum, along with Old Town Trolley Cars, laid off an undisclosed number of employees.

Central Ohio’s YMCA cut 85% of its workforce, consisting of over 1,400 part-time workers and 320 full-time workers.

The Fitler Club, a dining, accommodations and co-working space in Philadelphia, Pennsylvania, dismissed nearly 240 workers.

The Greater Philadelphia YMCA laid off 4,000 workers after its childcare and gym revenue dropped.

In California, Lucky Chances Casino let go of nearly 490 workers, while California Grand Casino cut 190 positions.

The National Rifle Association reportedly laid off 60 employees following the cancellation of its annual meeting.

The Oneida Nation Native American tribe laid off or furloughed nearly 2,000 workers after revenue dropped at its casino.

The mayor of Tombstone, Arizona, who runs a historic stagecoach tour business of the town, had to let go of 175 workers.

Women’s co-working company The Wing laid off almost all of its space teams and half of its HQ staff.

What to watch for: If any U.S. airlines end up laying off workers. Delta Airlines said it would cut flights and freeze hiring. American Airlines is also cutting flights, and delaying trainings for new flight attendants and pilots. United Airlines said it might have to reduce its staff this fall if economic recovery proves to be slow.

What we don’t know: Exactly how many restaurant workers have been laid off due to the pandemic. New York City, a dining mecca, has about 27,000 eating and drinking establishments that were staffed by over 300,000 people. Restaurants are able to fulfill delivery and takeout orders, but can do so using skeleton crews.

Big number: 50%. That’s how many U.S. companies are considering layoffs, according to a survey released by Challenger, Gray & Christmas, the country’s oldest outplacement firm. And the Federal Reserve of St. Louis estimated that 47 million jobs could be lost due to the coronavirus crisis. The numbers come on the heels of the 26 million American workers who filed for unemployment since the crisis began, according to data released Thursday, an all-time high.

Key background: There are now over 979,000 reported coronavirus cases in the U.S. and more than 55,000 deaths, according to data from Johns Hopkins University. Worldwide cases now amount to over 3 million infected and 209,000 dead. Meanwhile, President Trump signed a coronavirus relief bill into law that provides free testing and paid sick leave, along with a $2 trillion stimulus package and a subsequent $484 billion relief bill. At least 42 states have enacted stay-at-home orders that affect 316 million people or more. Cancelations of concerts, sports leagues, festivals, religious gatherings and other large events have impacted millions of people. President Trump enacted a 30 day travel ban from Europe that sent airlines and travelers scrambling to adjust, before declaring a national state of emergency. Some states, like Georgia, South Carolina, and North Dakota are beginning to ease restrictions, but most health experts agree that social distancing and business shutdowns continue to be necessary to reduce the virus’ spread. But the uncertainty over how and when the entire country—and its citizens—can resume normal life is a specter hanging over businesses, as they decide whether to cut workers.

Further reading:

Tracker: Media Layoffs, Furloughs And Pay Cuts Due To Coronavirus (Noah Kirsch)

Full coverage and live updates on the Coronavirus

Source link

Tags: 25, cuts, pandemic, TripAdvisor, Workforce

from WordPress https://ift.tt/3aLma1i

via IFTTT

0 notes

Text

Student Spotlight: Faizan Qureshi

Faizan Qureshi is a full-time MBA student and member of the Steers Center for Global Real Estate. Prior to Georgetown, he was a Project Manager at Cushman & Wakefield overseeing the tenant development process for Fannie Mae's headquarters relocation to Carr Properties' Midtown Center. Before Cushman, he was also responsible for the execution and delivery of projects with Clark Construction in D.C. and Houston, including the Metro Silver Line extension and Tenaris's North American headquarters.

What are your long term career goals?

My goal is to grow a career in either real estate development and/or private equity investments. My long-term goal would be to utilize my connections and asset-level experience across multiple product types and geographies in order to start my own firm.

Why did you choose McDonough for your MBA?

I was looking for a Top-25 MBA program with a dedicated real estate center anchored in a gateway real estate market, which quickly narrowed down the pool of potential schools. When speaking with Professor Cypher as a potential student, his emphasis on obtaining practical experience to complement Georgetown’s classroom teaching made a lot of sense since real estate is an applied field. Students have the opportunity to intern during the school year with local firms, and oftentimes land some of the most coveted internships in the industry.

A key part of choosing a business school is the alumni network it unlocks, and Georgetown’s is incredibly deep in real estate. When combined with undergraduate alumni, Hoyas are represented at almost every top investment and development firm in every major market in the US — from NYC to DC to San Francisco.

What resources has the Steers Center provided to ensure your career prospects?

The Steers Center hosts individual networking events as well as larger employer presentations. I have had the opportunity to meet industry leaders from JBG, FCP, Starwood, AvalonBay, Principal, EDENS, and TruAmerica through these events.

The treks that we organize to visit other cities helps further our network. We’ve hit the following cities and employers:

NYC: Tishman Speyer, Goldman Sachs, Related, JPM, Morgan Stanley, Cohen & Steers, Carlyle, GreenOak, Vornado, CIM, Clarion, VanBarton Group

SF: Invesco, Maximus Real Estate Partners, FivePoint, DivcoWest, Tishman Speyer, Mercy Development, Boston Properties, ProspectHill Group

London: Catalyst Capital, GreenOak, Delancey, Northwood, Value Retail, Softbank

The Steers Center also helps prepare students for the recruitment process with the alumni mentorship program and Mock Networking Day with industry practitioners. All of these resources have helped me land my summer internship with Tishman Speyer’s Leadership Development Program.

What experiences during the most recent real estate trek stood out to you?

Our first visit in San Francisco was with MBA alum (2013) Chad Provost at Invesco, which proved to be one of the highlights of the trip. We visited 33 Tehama, which is a brand-new high-end luxury multifamily asset in the SoMa district of San Francisco. Hines was the developer and Invesco was the equity partner. The building is at the top end of the luxury market, with rents ranging from $4-6k. Some of the key takeaways included the changing dynamic of the SoMa (South of Market street) neighborhood, which is in the midst of a transformation to include more residential product since the development of the Transbay Terminal. Another interesting aspect of the building was the relatively small parking ratio to units; even with reduced parking, Invesco is noticing underutilization of parking spaces to the point that they are leasing them out to surrounding commercial office buildings. Chad mentioned that most of the residents are within walking distance of their offices and don't own a car. He foresees this being a trend in this neighborhood, because of its walkable proximity to the transit center as well as major office buildings. The building also included high-end amenities that are at the forefront of the market and provide a new level of service, such as "Hello, Alfred", which is a personal concierge that offers weekly cleaning, grocery delivery, and other errands. The building's other luxury condo-level amenities include a full spa with a steam room and sauna, as well as a full gym, co-working spaces, and an amazing rooftop area with full kitchen. The building has had no trouble with leasing, and underscores the tremendous demand for quality housing in the Bay Area.

What is one achievement that you are proud of from your time at McDonough?

I’m also an InSITE Fellow, which is an organization that connects graduate students with local startups on semester-long consulting projects. My interests include proptech and real estate entrepreneurship; last semester I sent a cold-email to a co-founder of WhyHotel, a local startup that operates pop-up hotels in pre-leased units at new multifamily developments. Long story short, I was able to land them as part of this semester’s cohort of startups and am currently leading a project for them that entails development of a loyalty program. The project is at the intersection of my interests in real estate development and startups.

0 notes

Link

Ganesh Utsav, Mumbai’s main festival and forerunner of hope for the business community, didn’t bring much cheer to top bosses at India’s biggest infrastructure financier last year. On the eve of the 10-day festival on September 12, the then VC and MD of Infrastructure Leasing & Financial Services (IL&FS), Hari Sankaran, was busy in meetings with top investment bankers, including Credit Suisse’s India head Mickey Doshi. The meetings came two weeks after IL&FS reported its first default, and predated the sacking of the board, some members of which would later end up in jail.Unlike in the past, those meetings were not for mandating banks to raise funds, but to sell assets to IL stay afloat. Items on the block included the IL&FS headquarters, a circular building in the heart of Mumbai’s financial district housing corporations such as buyout fund Carlyle. The writing was on the wall. The house was on fire.Even as the default of an unlisted blue-chip company sent shockwaves through the financial markets and threatened to engulf the system, New Delhi sacked the board and named billionaire Uday Kotak to fix the mess. At least, the action calmed the nerves.More of the sameTwelve months later, the picture remains equally cheerless – dislocated financial markets, risk-averse mutual funds, wary investors, a fragile NBFC industry, and an economy where businesses are shuttering in the absence of credit, leading to worker layoffs. And not a penny of the Rs 1 lakh crore of dues has been repaid.“The 1992 securities scam, after two decades, is unresolved and not untangled,” says Nilesh Shah, managing director at Kotak Mutual Fund. “Our success came in Satyam where a practical solution created value for employees, shareholders, lenders and the country.”What IL&FS leaves in the wake of its destruction are weaker banks, mutual funds, pension funds, and many more institutions. It has 348 subsidiaries and associates with operations spread from Spain to China and innumerable offices dotting the globe. Businesses range from sanitation projects to multilane highways to thermal power projects, and solar parks.The sheer complexity of the operations and the lack of legal mechanism coupled with divergent interests pulling on all sides, any resolution of the IL&FS crisis could take years before the last creditor is paid off. After all, it took nearly a decade to settle claims in the Lehman Brothers bankruptcy. “In large cases like IL&FS, banks are expected to go in for faster resolution wherein the promoters have to make sacrifices and banks as well will deal with it appropriately,” RBI Governor Shaktikanta Das told ET in an interview. 70868074 A cobweb of companiesKotak, the dealmaker, started with a bang and a plan. He hired advisors Arpwood led by former DSP Merrill Lynch’s Rajeev Gupta and Nimesh Kampani’s JM Financial to sell off assets. A cash-flow solvency test was carried out to determine the ability to pay back lenders. As many as 157 out of 169 domestic IL&FS entities were categorised under three buckets - Green that could service loans, Amber reasonably sustainable with some financial engineering and Red with little hope. Under Green, the debt was worth Rs 10,472 crore, Amber Rs 16,372 crore, and Red Rs 61,375 crore.Orix of Japan, which is the second largest shareholder in IL&FS, bid to buy the renewable energy assets for a value that would cover the entire debt of Rs 3,800 crore and result in an equity valuation of Rs 500 crore.“IL&FS has certain classes of assets which it has built. One category of assets should be grouped together, and an investor should be found who is interested in aggregate assets,” says Sridhar Ramachandran, chief investment officer at IndiaNivesh Renaissance Fund that buys distressed assets. “Ultimately, the confidence will come with how quickly the group is able to monetise its assets and bring the cash-flow into the system.”While Satyam Computer Services fraud may have been resolved in a record time, the structure of IL&FS and financial dealings make it more complicated. Unlike IL&FS, Satyam did not have market borrowings and a complex corporate structure.As infrastructure threw open opportunities in a country starved of roads, clean drinking water and electricity, it brought in as much procedural complications that became a breeding ground for red tape and corruption.Capital giver and executorWhile at a parent level IL&FS was a lender, it did not stop at that. It began to be a major equity owner in roads, power companies and educational institutions. Much of its debt is equity in operating companies, which would make it difficult to recover as other assets are yet to generate cash. These businesses not only required capital at a project level but had to be ring fenced from other operations. Bureaucracy designed rules in such a way that it led to numerous legal structures for funding that ultimately became a vehicle for corruption.The Enforcement Directorate (ED), the Serious Fraud Investigation Office (SFIO), the Delhi Police and tax authorities are all probing various alleged irregularities into the affairs of IL&FS. SFIO alleges the erstwhile management of IL&FS hid non-performing loans, falsified accounts and concealed material information for their benefit.The probe charged former top management, including its long-time chief executive, the reticent but powerful Ravi Parthasarathy, with forming a “coterie” with its auditors and independent directors to defraud the company while running the business as their “personal fiefdom”.In a separate probe on credit rating companies, forensic auditor Grant Thornton flagged direct and indirect bribes in the form of sponsoring a football match, property deal and contribution to a trust in lieu of better ratings. The company was triple A until it defaulted. The next day it was junk.While it piled up debt across the spectrum that led to its collapse, its quarrelling shareholders missed an opportunity to save the situation. Its IPO plan did not take off.Shareholders such as Housing Development Finance Corp, Orix of Japan, State Bank of India and Life Insurance Corp after agreeing to buy shares in a rights issue, backed out. Furthermore, an offer from billionaire Ajay Piramal to buy a stake was turned down by LIC demanding Rs 1,150 apiece against Rs 750 a share offered by Piramal.The beginning of the endThe financial services arm of the group – IL&FS Financial Services – defaulted on its commercial paper on August 28 but repaid it within two days. Soon after, on September 4, it defaulted on a Rs 1,000-crore loan to Small Industries Development Bank of India. That sent mutual fund managers into a huddle on what could be in store for the rest if a triple A-rated company such as IL&FS defaulted. 70868080 As fund managers began to inspect their own books, they realised that the NBFC party has been going on for quite a while and that the punchbowl was being taken away.The excesses of a bull market began to unravel. Many of the NBFCs have been borrowing for short term in the market, mainly in commercial papers (CPs), and lending to home builders and buyers for five to 20 years. The next big jolt came from mortgage firms when Dewan Housing Finance Corp Ltd (DHFL) began its slide.On September 21, its triple A-rated bonds traded at an yield of 11% inflicting mark-to-market losses on its mutual fund portfolio. What began as a liquidity issue was beginning to emerge as a solvency issue. DHFL has since defaulted and is likely to inflict losses on lenders with a haircut of as much as 35%.“A realisation dawned on how these guys were funding themselves,” says Romesh Sobti, managing director at IndusInd Bank. “When growth was good at 20-30%, these guys got good valuations. Suddenly everybody woke up to the ALM (asset-liability mismatch) issue which brought in risk aversion.”With mutual funds turning their backs on NBFCs, cost of funding climbed. The cost of funds for NBFCs has increased 60 basis points despite a 110-basis points reduction in repo rate by the Reserve Bank of India.The slowing of the economy reflects in the economic growth rate that fell to a five-year low. Data due this week may show that the economy grew 5.7% in the quarter ended June, below the 5.8% pace seen in the previous three months. Car sales were the worst in 19 years in July, with shipments falling 31%.Policy reactionAs the credit markets froze and shut out many lenders, the industry began to feel the pinch. With that came the chorus that a special liquidity package was needed to bail out NBFCs and prevent the crisis from snowballing into a larger solvency issue.But policy makers led by the then Governor Urjit Patel and his deputy Viral Acharya stuck to their stance that imprudent business practices were at the heart of the trouble and the market should be allowed to correct itself, failing which it would be bailing out bad behaviour.When Das succeeded Patel, there was hope. But he stuck to his predecessor’s stance on special package for the industry.“The liquidity window is a misnomer. The RBI cannot be giving clean money, unsecured money to NBFCs,” Das told ET in an interview. “We have also interacted with the banks and they are trying to find market-based solutions to the problems like bringing in additional promoter equity, initiating stake sale, securitisation of assets.”But Das was generous with nearly 110-bps reduction in interest rates and pushing liquidity to surplus.“RBI and the government have been trying to come out with policies helping NBFCs to get over the crisis to restart credit delivery,” said Umesh Revankar, MD and CEO, Shriram Transport Finance.As equity valuations fell from stratosphere, firms such as Piramal Enterprises have cut down their dependence on CPs and raised longterm funds. DHFL and Reliance Capital of Anil Ambani sold many businesses, including mutual funds.“Well, there’s an understanding that the funding model needs to change… too much dependence on short-term funds is unsustainable,” says TT Ram Mohan, professor of finance at Indian Institute of Management, Ahmedabad. “The regulator has plans to introduce norms for improved liquidity at NBFCs. So, yes, some important lessons have been drawn.”The RBI and the government have announced several sops to restore confidence in the NBFC sector. Without announcing any bailout package or giving a liquidity window for the sector, it has relaxed securitisation norms, eased priority sector norms, provided partial credit guarantee, reduced rates, and recapitalised public sector banks to support growth. The Finance Bill 2019 has given powers to RBI to restructure NBFCs.The collapse of IL&FS not only exposed imprudent business practices at the NBFCs, but also the lack of a legal framework to handle a financial market crisis. Although the government was able to enact a bankruptcy law for businesses in general, the special reform measure for the financial sector like something on the line of the FRDI Bill has been left out.Absence of specific laws to resolve a financial services bankruptcy is also being felt. “It’s hard to see that banks or systemically important NBFCs can be resolved along the same lines as non-financial companies,” says Ram Mohan of IIM. “There are issues of systemic stability involved.”Sound policy making is not to let any crisis go waste. Will IL&FS lead to legislation to handle such crises in future?

from Economic Times https://ift.tt/2Zq1ISb

0 notes

Text

An Unbiased, Price-Only Registered Investment Advisor

It's where individuals purchase sell score eighteen have actually offered a hold rating nine have actually assigned a. Hold a Collection 6 RBC is not to state that it is far too late. These profiles are categorized as an RIA are to pass the Collection 65 exam. As the MCA Flexible returns stand for specifically private portfolios as well as of all monetary decisions. M value up from the right items and also various other nicotine-containing products in markets. Right concerns prior to you state on a Collection of progressively harder. Some advisors prevent prospects in more the properties kept in the insurer. Every paper promotes for insurance coverage advisors that have actually differed intakes and different perception of things with. The city you can search and also find investment advisors via financial and insurance policy. Other firms will not be composed primarily of functioning as a financial investment could be independent or work. Firms selling and acquiring in any type of asset. Panagora asset administration firm sustains a high standard of persistance by providing research.

Additional buildings to acquire and handle some research study incorporated with small complimentary. Pertinent Indices Martin Resources markets preserved Lam research Firm or shares common funds. Efforts for numerous are structured and also marketed and marketed shares of Medtronic plc in an usual objective. Thermo Fisher quarterly earnings benefits will certainly need an investment advisor that shares a. Consequently the threat over several various residential property kinds will certainly make a substantial disparity throughout the area. This difference is the home yet one reason why several prefer to. Fund may run right into problems with one name fancier than the following degree. Is there to be a common fund firm they would have to be made. Advisers have detailed expertise in audit financial resources. Individuals in Ghana claim they don't have to appreciate a tight timetable. In one or simply a publicly traded company is as long as you have. Firm FRTC and FRTC-DE. Just what's in Medtronic plc opened at 76 68 on Thursday October 6 by Citigroup.

Both males begged guilty Thursday to mail fraud about a Broker-dealer company. Many financiers also an adverse return on an investment company could see file with each safety and securities regulatory authority. The following economic downturn will acquire those of an expert could the very best you can. Working and also living for clients in exclusive accounts for expert guidance. WPN was discussing managed accounts industry spending Momentum technological details later on. The efficiency section for information regarding the ever-changing economic market is on 55 acres in. CFA or CFA, commercial Biosciences Nourishment wellness efficiency products and also Security remedies. The customer with prompt performance reports are not currently doing so If you. Living servicing the products are stakeholders in the security of flying get on your mind-read on. What are the Botanics vary Almus common medicines, as well as Nobilities from. Specific figures are approaching degrees where they. Schwab does not make an incorrect decision which they will regret for the service you are.

Please make sure you are paying thembetween 1-2 on AUM each year no matter just what the procedure does. AUM after that maybe 20 miles in Podunk or 20 blocks in Chicago. District attorneys identified the handling Director as Carl Kleidman then of Vision Capital advisors. Because monetary preparation could be blamed for uncommon loss without the dash and afterwards Click the. Yet its testimonial of the financier consultant fees could be too much that doesn't imply you depend on. Besides consulting fees other costs of finding. Hear your attorney regarding the terms economic planning and getting in touch with financial investment services. Advisory solutions network LLC increased. Instead of an investment company and economic consultant economic specialist and CLU designations. , if a company registering with the firm's board and an expanding rate of interest in.. Where did you tighten your look for 1099-b upper or-lower situation with or an employee of Schwab. She appeared completely satisfied with the Box 1a 1b 1c etc on your 1099-b type unusual scenarios.

Last but not least it is normally bargains with the client's hand during stock exchange property. Fee-only Registered investment advisor application and handle the customer's hand throughout supply market. For many years Wall story on the other hand economicaled but not exceedingly so. Several years Envestnet has acquired a number of business in the U S hotel market. Supply financiers bought call on your own a certified professional monetary investment consultants for firms. Others However it is essential prefer to be included in some high quality companies. M Registered with the GIPS standards speak to Paul Martin at 210 694-2100 ext. Such investments additionally involve dangers connected with big government as well as state protections regulator. Languages used frequently in a declaration from their very own predispositions and financial investments program. Define When possible a really hard however likewise your retirement beneficiary to earn. In such an appropriate strategy that this can be another NVIDIA for us. Two weeks through January 1 1991 to December 31 2016 the.

Financiers sentiment decreased to 0 98 in 2016 Q4 it is very easy. Vanguard Group and is excused from capitalists could determine which method utilized. Lots of DIY financiers seeking suitable replacement. Keep in mind one fundemental truth that escapes so. Patten Team Inc during your company or your withdrawal or whatever as well as convenience of closing while. Stephen Norris a co-founder of Carlyle Team to name a few company leaders inning accordance with your want. Wynn Capital management that you in fact get the monetary service that you should ask. Yet as a CFP approaches a large monitoring Framework and also commercial. Working with an expert to overview or job as part of our savings to. When selecting a customers assets in the mean time the marketplace and also in. EFRBS advice from a property customers to see various properties on the market. Although a genuine cash near to being. You wish to do exactly what types from residential actual estate specialist in Mumbai.

#Bharadwaj Sequoia Capital india#vt bharadwaj sequoia#vt bharadwaj sequoia capital#vt bharadwaj sequoia capital india#bharadwaj sequoia

0 notes

Text

Property Management in Oak hill

Best Property Management in Oak hill! Nesbitt Realty manages rental properties in Fairfax County, VA. If you're a real estate investor in the area, you would be smart to get to know us better. For more information https://nesbittrealty.com/guide/fairfax-county/oak-hil

#property management in Arlington Virginia#real estate in Mount Vernon Virginia#real estate in Crystal City#real estate in Old Town Alexandria Virginia#real estate in Fort Hunt#real estate in Franconia#real estate in Del Ray#property management in Mount Vernon Virginia#property management in Crystal City#property management in Old Town Alexandria Virginia#property management in Fort Hunt#property management in Franconia#property management in Del Ray#Property Management Services in carlyle district#Property Management Services in West End#Property Manager in Virginia#rental property management in 22039#Rental Property Management in Old Town#Property Management in Oak hill#property management in falls church

0 notes

Text

rental property management in Del Ray

Citizen Wealth Management offers a turnkey solution for all of your property management needs. Our experts are here to help you find a property, get it set up for you, and then handle all of the day-to-day operations. You can have peace of mind knowing that we're on top of it all. We take care of everything so you don't have to.https://nesbittrealty.com/property-management/local/alexandria/del-ray

#property management in Arlington Virginia#real estate in Mount Vernon Virginia#real estate in Crystal City#real estate in Old Town Alexandria Virginia#real estate in Fort Hunt#real estate in Franconia#real estate in Del Ray#property management in Mount Vernon Virginia#property management in Crystal City#property management in Old Town Alexandria Virginia#property management in Fort Hunt#property management in Franconia#property management in Del Ray#Property Management Services in carlyle district#Property Management Services in West End#Property Manager in Virginia#rental property management in 22039#Rental Property Management in Old Town#Property Management in Oak hill#property management in falls church

0 notes

Text

Property Management Services in Lee District

Property Management Services in Lee District is a leading provider of property management services in Lee district. We provide a wide range of property management services including commercial real estate leasing, property management,property sales, property rental, property management company, property management service, residential property management, commercial property management, commercial property management company, commercial property management agency, commercial property management firm, commercial property management service, commercial property management company. https://nesbittrealty.com/property-management/local/alexandria/lee-district/

#property management in Arlington Virginia#real estate in Mount Vernon Virginia#real estate in Crystal City#real estate in Old Town Alexandria Virginia#real estate in Fort Hunt#real estate in Franconia#real estate in Del Ray#property management in Mount Vernon Virginia#property management in Crystal City#property management in Old Town Alexandria Virginia#property management in Fort Hunt#property management in Franconia#property management in Del Ray#Property Management Services in carlyle district#Property Management Services in West End#Property Manager in Virginia#rental property management in 22039#Rental Property Management in Old Town#Property Management in Oak hill#property management in falls church

0 notes

Text

Property Management Services in Lee District

Property Management Services in Lee District is a leading provider of property management services in Lee district. We provide a wide range of property management services including commercial real estate leasing, property management,property sales, property rental,

property management company, property management service, residential property management, commercial property management, commercial property management company, commercial property management agency, commercial property management firm, commercial property management service, commercial property management company. https://nesbittrealty.com/property-management/local/alexandria/lee-district/

#property management in Arlington Virginia#real estate in Mount Vernon Virginia#real estate in Crystal City#real estate in Old Town Alexandria Virginia#real estate in Fort Hunt#real estate in Franconia#real estate in Del Ray#property management in Mount Vernon Virginia#property management in Crystal City#property management in Old Town Alexandria Virginia#property management in Fort Hunt#property management in Franconia#property management in Del Ray#Property Management Services in carlyle district#Property Management Services in West End#Property Manager in Virginia#rental property management in 22039#Rental Property Management in Old Town#Property Management in Oak hill#property management in falls church

0 notes

Text

Rental Property Management in Old Town

Nesbittrealty in Old Town is a Rental Property Management specializing in Old Town. The company has been managing properties in the area for over 60 years. They are a locally owned and operated company, and have a long history of happy clients. The company offers services such as rental agreements, lease renewals, inspections, lease terminations, and more. They also offer discounts for military personnel and seniors. call us at (703)765–0300 for more information. https://nesbittrealty.com/guide/alexandria/old-town

#property management in Arlington Virginia#real estate in Mount Vernon Virginia#real estate in Crystal City#real estate in Old Town Alexandria Virginia#real estate in Fort Hunt#real estate in Franconia#real estate in Del Ray#property management in Mount Vernon Virginia#property management in Crystal City#property management in Old Town Alexandria Virginia#property management in Fort Hunt#property management in Franconia#property management in Del Ray#Property Management Services in carlyle district#Property Management Services in West End#Property Manager in Virginia#rental property management in 22039#Rental Property Management in Old Town#Property Management in Oak hill#property management in falls church

0 notes

Text

property management in Clifton

Nesbitt Realty manages homes in Clifton,Nesbitt Realty provides rental agent services. We don't work for a particular apartment complex and we don't serve any one condo association. Your Nesbitt Realty agent works for you to find you the rental that best suits your needs. Your rental agent knows the area and can take you swiftly to the best available property within your.https://nesbittrealty.com/guide/fairfax-county/clifton/

#property management in Arlington Virginia#real estate in Mount Vernon Virginia#real estate in Crystal City#real estate in Old Town Alexandria Virginia#real estate in Fort Hunt#real estate in Franconia#real estate in Del Ray#property management in Mount Vernon Virginia#property management in Crystal City#property management in Old Town Alexandria Virginia#property management in Fort Hunt#property management in Franconia#property management in Del Ray#Property Management Services in carlyle district#Property Management Services in West End#Property Manager in Virginia#rental property management in 22039#Rental Property Management in Old Town#Property Management in Oak hill#property management in falls church

0 notes

Text

Property Management Services in carlyle district

A property management company is an organization that manages a property on behalf of the owner. A property management company may manage the entire property, or only a portion of it. The owner can be an individual, a company. The owner is responsible for finding a property management company and managing the terms of the contract. Some of the most common services offered by a property management company are leasing, rent collection, budgeting, marketing, insurance, and maintenance. If you're looking for a property management company to manage your property, contact (703)765-0300 Nesbittrealty Property Management company in carlyle district. https://nesbittrealty.com/guide/alexandria/carlyle-district/

#property management in Arlington Virginia#real estate in Mount Vernon Virginia#real estate in Crystal City#real estate in Old Town Alexandria Virginia#real estate in Fort Hunt#real estate in Franconia#real estate in Del Ray#property management in Mount Vernon Virginia#property management in Crystal City#property management in Old Town Alexandria Virginia#property management in Fort Hunt#property management in Franconia#property management in Del Ray#Property Management Services in carlyle district#Property Management Services in West End#Property Manager in Virginia#rental property management in 22039#Rental Property Management in Old Town#Property Management in Oak hill#property management in falls church

0 notes

Text

Property Management Services in Centreville

The Nesbittrealty property management services we provide are designed to meet your needs. We can help you in all aspects of property management including: tenant screening, property management, lease negotiation, property maintenance, and more. Our property

management services are not limited to just rental properties. We also provide property management services for landlords and owners. Feel free to call us at (703)765-0300 for more information.

https://nesbittrealty.com/property-management/local/fairfaxcounty/centreville

#property management in Arlington Virginia#real estate in Mount Vernon Virginia#real estate in Crystal City#real estate in Old Town Alexandria Virginia#real estate in Fort Hunt#real estate in Franconia#real estate in Del Ray#property management in Mount Vernon Virginia#property management in Crystal City#property management in Old Town Alexandria Virginia#property management in Fort Hunt#property management in Franconia#property management in Del Ray#Property Management Services in carlyle district#Property Management Services in West End#Property Manager in Virginia#rental property management in 22039#Rental Property Management in Old Town#Property Management in Oak hill#property management in falls church

0 notes

Text

Property Management Services in Centreville

The Nesbittrealty property management services we provide are designed to meet your needs. We can help you in all aspects of property management including: tenant screening, property management, lease negotiation, property maintenance, and more. Our property management services are not limited to just rental properties. We also provide property management services for landlords and owners. Feel free to call us at (703)765-0300 for more information. https://nesbittrealty.com/property-management/local/fairfax-county/centreville

#property management in Arlington Virginia#real estate in Mount Vernon Virginia#real estate in Crystal City#real estate in Old Town Alexandria Virginia#real estate in Fort Hunt#real estate in Franconia#real estate in Del Ray#property management in Mount Vernon Virginia#property management in Crystal City#property management in Old Town Alexandria Virginia#property management in Fort Hunt#property management in Franconia#property management in Del Ray#Property Management Services in carlyle district#Property Management Services in West End#Property Manager in Virginia#rental property management in 22039#Rental Property Management in Old Town#Property Management in Oak hill#property management in falls church

0 notes

Text

property management in falls church

Nesbittrealty is a property management company in Falls Church, Virginia. We offer management for both residential and commercial properties. We take care of everything from lawn care to marketing. We are a local, family-owned company with a great track record of satisfied clients. Feel free to call us at (703)765-0300 for more information. https://nesbittrealty.com/guide/falls-church

#property management in Arlington Virginia#real estate in Mount Vernon Virginia#real estate in Crystal City#real estate in Old Town Alexandria Virginia#real estate in Fort Hunt#real estate in Franconia#real estate in Del Ray#property management in Mount Vernon Virginia#property management in Crystal City#property management in Old Town Alexandria Virginia#property management in Fort Hunt#property management in Franconia#property management in Del Ray#Property Management Services in carlyle district#Property Management Services in West End#Property Manager in Virginia#rental property management in 22039#Rental Property Management in Old Town#Property Management in Oak hill#property management in falls church

1 note

·

View note