#Proprietary trading reviews firms forex

Text

Online Forex Trading Strategy - How to Make Currency Trading Systems Work For You

Now that there are many Forex edge agents, a large number of free Forex exchanging tips webistes and in a real sense countless Forex day exchanging system "locally situated business" Forex brokers, we can say that practically anybody with a web association can exchange Forex with the masters.

In any power exchanging system, a demonstrated exchanging technique will really intend that through Forex procedure testing and by utilizing exchanging risk the board, something like a couple percent of a complete record esteem is jeopardized in a solitary exchange. This is key in the way to large Forex benefits. Any merchant starting out will take a gander at the exchanging procedures accessible to them and choose to make exchanging rules for their Forex exchanging methodology.

Best forex prop trading firms (money exchanging) starts ought to know thusly not just of specialized and central investigation and foreseeing Forex costs, yet additionally of how to be an exchanging technique analyzer and to have solid Forex exchanging decides that assist them with making the large Forex benefits they are looking for. The option is to have more experienced Forex exchanging frameworks utilized by additional accomplished dealers wind up making you lose all your cash in your Forex business - the most brutal conceivable result.

Having the accompanying set up could help you in moving began immediately in Forex exchanging (cash exchanging): a Forex exchanging programming stage; a free Forex exchanging methodology (or a paid for one besides); a comprehension of key and specialized examination and an exchanging risk the board framework. From these components (and furthermore the help of a day to day Forex methodology preparation from an edge specialist or another site) you can begin Forex exchanging the fx market with your own Forex exchanging technique rules.

Learning money exchanging on the web needs in any case strong exchanging risk the executives and how to deal with your exchanging account balance by pursuing wise gamble choices with your exchanging account. The dangers can be higher with Forex in light of the fact that the moves in seven days can be comparable to a month in stock moves. Unpredictability is not out of the ordinary.

Cash exchanging methodology rules for a Forex business can be created by amalgamating Forex exchanging frameworks of others or essentially collecting a Forex schooling to include: basic and specialized examination; exchanging cash the executives (risk the board); an everyday Forex system preparation from a "outsider" and an approach to making Forex forecase signals (at the end of the day a method for foreseeing future Forex costs from maybe a specialized arrangement on a money pair or just from Forex procedure testing that has been done.

Forex technique testing should either be possible through utilizing a training account through your representative or by paper exchanging your system. A third choice is to utilize programming, for example, Forex technique analyzer which can run a reenactment of what could occur in the event that you exchange by your principles for certain restrictions on exactness.

Free Forex exchanging system tips are accessible from Forex digital books webistes all around the web. Truly the Forex exchanging fx market should be treated as a business that runs like a Forex exchanging machine however much as could reasonably be expected. This is vital on the off chance that you are to make large Forex benefits in live exchanging. Absence of guideline implies that anybody can sell a "scalping exchanging system" or somewhere in the vicinity called "idiot proof exchanging strategy" and portray themselves as a specialist or even say they are a drawn out bank merchant when they are not. There is a requirement for alert consequently while settling on where

to get your Forex schooling on the grounds that no Forex exchanging guide is really going to help in your foreseeing Forex costs in the close, medium or long terms.

Common sense would suggest that you should go out and see what is on offer from Forex exchanging sites and get more familiar with the worldwide cash markets after you have perused this article. A few destinations are recorded in the asset box toward the finish to get you going. Exchanging Forex online then presents difficulties. The remainder of this article will address those difficulties. To exchange successfully, a Forex exchanging guide is required for the start in to the Forex markets to have the option to learn online cash exchanging, grasp exchanging risk the board and how to oversee cash, find specialized and major examination, how these sorts of investigation of the market vary and how to apply them in making a Forex exchanging machine.

For more details, visit us :

Prop trading firms london

Best forex brokers uk reviews

Xm forex review

Proprietary trading firms uk

Islamic fx broker

#Top prop trading reviews firms in usa#Proprietary trading reviews firms forex#Proprietary trading firms forex#Prop trading reviews firms in usa#Forex proprietary trading firms#Forex prop trading firms

0 notes

Text

Tactical Approaches for Successful Day Trading in Forex Prop Trading by Experienced Forex Trading Experts at Institutional Prop

Forex prop trading, short for proprietary trading, involves individuals or firms trading financial instruments with their own money rather than clients' capital. Day trading within this realm requires strategic approaches to capitalize on short-term market movements effectively. This blog explores tactical methods essential for achieving success in Forex prop trading, focusing on disciplined strategies, risk management techniques, and leveraging market volatility to maximize profitability.

Developing a Structured Trading Plan

A structured trading plan is the cornerstone of successful day trading in Forex prop trading. Begin by conducting thorough market analysis to identify potential trading opportunities based on technical indicators, economic news, and market sentiment. Define clear entry and exit points for each trade, incorporating risk-reward ratios to ensure trades are financially viable. A disciplined approach to sticking to the trading plan mitigates emotional decision-making and enhances consistency in trading performance.

Once a trading plan is established, continuously monitor market conditions and adjust strategies accordingly. Use real-time data and technical analysis tools to confirm trading signals and validate market trends. Implementing a structured trading plan not only improves decision-making but also fosters accountability and discipline, essential traits for navigating the volatility of Forex markets effectively.

Utilizing Technical Analysis Tools

Technical analysis plays a pivotal role in day trading Forex, providing insights into price movements and identifying potential entry and exit points. Utilize a variety of technical indicators, such as moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Fibonacci retracement levels, to analyze historical price data and predict future market trends. Incorporate chart patterns, such as head and shoulders, flags, and triangles, to identify potential breakout or reversal opportunities.

Combine multiple technical indicators to confirm trading signals and minimize false positives. Adjust parameters of technical tools based on market volatility and trading preferences to optimize accuracy. Regularly update technical analysis skills through continuous learning and experimentation with different indicators and charting techniques. By mastering technical analysis tools, experienced forex trading experts at Institutional Prop make informed decisions and capitalize on short-term market fluctuations effectively.

Implementing Effective Risk Management Strategies

Risk management is crucial in Forex prop trading to protect capital and minimize potential losses. Define risk tolerance levels and set maximum exposure limits per trade based on account size and trading strategy. Use stop-loss orders to automatically exit trades if market conditions move against anticipated trends, preventing significant financial losses. Adjust position sizes according to volatility and market liquidity to manage risk effectively without compromising potential profitability.

Diversify trading strategies and currency pairs to spread risk across different market conditions and avoid overexposure to a single asset or economic event. Regularly review and update risk management protocols based on evolving market dynamics and personal trading performance. By prioritizing risk management, forex trading experts at Institutional Prop preserve capital, maintain trading consistency, and sustain long-term success in a competitive trading environment.

Leveraging Market Volatility for Profitable Trades

Volatility is a characteristic feature of Forex markets, presenting opportunities for profitable day trading. Monitor economic calendars and news updates to anticipate market-moving events and their potential impact on currency pairs. During periods of heightened volatility, adjust trading strategies to capitalize on rapid price movements and market fluctuations. Implement breakout strategies to enter trades at decisive price levels following significant market developments or technical patterns.

Exercise caution when trading volatile currency pairs and employ risk management techniques to mitigate potential losses. Utilize trailing stop-loss orders to secure profits and protect against sudden market reversals during volatile trading sessions. By understanding and harnessing market volatility, industry experts at Institutional Prop optimize trading opportunities and maximize profitability while adhering to disciplined risk management practices.

Continuous Learning and Adaptation

Successful day trading in Forex prop trading requires a commitment to continuous learning and adaptation to evolving market conditions. Stay updated on industry trends, economic developments, and regulatory changes that may impact currency markets. Engage with trading communities, attend webinars, and read industry publications to gain insights from experienced forex trading experts at Institutional Prop and expand your knowledge base.

Experiment with new trading strategies, technical tools, and risk management techniques to refine your approach and improve trading performance over time. Keep a trading journal to track trades, analyze outcomes, and identify areas for improvement. Embrace a growth mindset that values learning from both successes and setbacks, fostering resilience and adaptability in the face of market challenges.

Reviewing and Adjusting Trading Performance

Regularly review trading performance metrics and assess the effectiveness of implemented strategies. Analyze key performance indicators, such as win-loss ratios, average profit per trade, and maximum drawdowns, to evaluate overall profitability and trading consistency. Identify patterns or recurring mistakes that may be impacting trading results and adjust strategies accordingly.

Seek feedback from mentors or peers within the Forex trading community to gain valuable insights and perspectives on improving trading performance. Implement incremental changes based on performance reviews and strive for continuous improvement in trading skills and decision-making processes. By consistently reviewing and adjusting trading performance, forex trading experts at Institutional Prop optimize profitability, mitigate risks, and achieve sustainable success in dynamic financial markets.

Achieving success in day trading within Forex prop trading requires a disciplined approach, strategic utilization of technical analysis tools, effective risk management practices, and the ability to capitalize on market volatility. By developing a structured trading plan, mastering technical analysis techniques, implementing robust risk management strategies, and prioritizing continuous learning and adaptation, Forex prop traders can navigate the complexities of the Forex market with confidence and achieve profitable trading outcomes. Embrace these tactical approaches to enhance trading performance, optimize profitability, and establish a foundation for long-term success in Forex prop trading.

0 notes

Text

Prop Trading Firm

Finding the Right Forex Trading Firm: What Every Trader Should Know!

Selecting the right Forex trading firm is crucial for your trading success. With countless firms, it's important to know what to look for to ensure you partner with a trustworthy and reliable firm.

This guide will provide key considerations to help you make an informed decision.

1. Regulation and Security

The first thing to consider when choosing a Forex trading firm is whether it is adequately regulated.

A regulated firm operates under the oversight of recognized financial authorities. Regulation ensures that the firm adheres to strict financial standards and protects your funds.

In addition to regulation, the firm's security measures must be checked. Look for firms that offer segregated accounts, which keep your funds separate from the firm's operational funds, and ensure they use encryption to protect your data.

2. Trading Platform and Tools

A firm's trading platform is where you'll spend most of your time, so choosing one that suits your needs is essential. The platform should be user-friendly, stable, and feature-rich.

Look for crucial tools such as advanced charting, technical analysis indicators, and real-time data.

Some firms offer proprietary platforms, while others provide access to popular platforms. Before committing, make sure to test the platform's demo account to familiarize yourself with its features.

3. Fees and Spreads

Forex trading firms make money through spreads and fees. Understanding these costs is crucial for managing your trading expenses. Look for firms that offer competitive spreads, or choose a Prop trading firm where you can trade with the firm's capital and keep a portion of the profits.

Additionally, be aware of other fees, such as withdrawal fees, inactivity fees, or overnight financing charges (swap rates). Transparent fee structures are a sign of a reputable firm.

4. Leverage Options

Leverage allows you to control more prominent positions with less capital and increases risk.

Different firms offer varying leverage levels, so it's essential to choose one that aligns with your risk tolerance and trading strategy.

High leverage can amplify profits and losses, so it's wise to start with lower leverage and gradually increase it as you gain experience if you're a beginner.

5. Customer Support and Education

Good customer support is vital, especially when encountering issues or having questions. Look for firms that offer 24/7 customer support through multiple channels, such as phone, email, and live chat.

In addition, a firm that provides educational resources—such as webinars, tutorials, and market analysis—can be invaluable, especially if you're new to Forex trading.

These resources can help you improve your trading skills and stay informed about market developments.

6. Reputation and Reviews

Finally, research the firm's reputation by reading reviews from other traders. Look for consistent positive feedback and be wary of firms with numerous complaints or unresolved issues.

Online forums, review websites, and social media can provide valuable insights into a firm's reliability and customer satisfaction.

Conclusion

Finding the right Forex trading firm involves careful consideration of regulation, trading platforms, fees, leverage, customer support, and reputation.

By evaluating these factors, you can choose a firm that supports your trading goals and provides a secure, efficient, and user-friendly environment for your Forex Referral Program activities!

0 notes

Text

Top 10 Forex Prop Trading Firms to Watch in 2024

With this sort of a highly volatile business environment for forex trading, prop trading firms—a more familiar term for proprietary trading firms—do pose an emerging giant opportunity for professional traders in the market. They offer providence to trade in most of the needed capital in the forex business and later earn a share of the profit as personal risk reduces. By early 2024, as 2024 has started, forex prop trading has seen some of the very best prop trading firms become quite competitive in today's market, thanks to their new ways of operation, advanced technology, and attractive funding models. In detail, this blog will give an overview of the top ten Forex Prop Trading Firms going to be watched in 2024 and what makes each, as noted above, unique in particular.

1. FTMO

Overview:

FTMO is probably one of the fastest-growing prop trading firms operating on the forex market nowadays. It is based in the Czech Republic, with that, it can be said that it surely represents a very special opportunity for traders—to access high volumes of capital by simply going through a two-step evaluation process.

Key Features

FTMO does the review in two stages and terms them the 'FTMO Challenge' and 'Verification.' The assessment provides immediate access to trading capital as high as $400,000.

The profit split is as high as 90% for the traders who make it as successful ones.

The stringent maximum loss limits are set out to bind on the traders very rigorous and disciplined trading.

Why to Watch in 2024:

FTMO does not cease from innovating, providing traders with advanced analytical tools and performance coaching in their quest to become successful. Their approach—transparent and helpful—certainly has made them a firm on watch.

2. TopStepFX

Product Overview:

Headquartered in Chicago, TopStepFX is a prop trading firm designed to raise one's skills through an all-inclusive evaluation program. But their belief in education and risk management makes it a top firm amongst upcoming traders.

Key Features:

Overview It has two steps to the evaluation process: a simulated trading combine, and thereafter, a funded account.

Funding Opportunity: Traders can access up to $500,000 in trading capital.

Profit Share: Competitive profit splits with consistency as the primary reward objective

Resources and Learning: Comprehensive resources, mentorship, and a set of development programs

Why Watch in 2024:

Ameliorate: TopStepFX's absolute concentration on trader development and education, along with an absolutely transparent funding model, makes them one of the leading prop trading firms operating within the Forex market.

3. The5ers

Overview:

The5ers are a prop trading firm based out of Israel and are well known for their simplicity, ease of use, and a no-nonsense attitude directed at traders. They have got a variety of different funding plans to suit most trading styles and risk appetites.

Key Features:

This one includes funding programs, and some of them are instant funding. Their profit split goes up to 100% on some accounts. Scaling Plan: Traders are better positioned to scale to $4 million. Support: This is the ongoing support and performance analysis tools.

Why Watch in 2024:

Being flexible and seeming to really care about the satisfaction of a trader makes The5ers stand out. Their scaling plan and instant funding options are also very tempting for the more ambitious trader.

4. MyForexFunds

General Impression:

MyForexFunds is one of the fastest-growing prop firms out there, given its great funding options and good trading environment. MyForexFunds is also based in Canada and offers a variety of programs to suit many levels of traders.

Key Highlights:

Offers fast, Evaluation, and Accelerated evaluation programs

Contestants get access to capitals up to $300,000.

Profit Share: Up to 85% profit split

Community and support: Active community and support for the traders.

Why to be Watch in 2024:

MyForexFunds makes a difference due to its high diversity in funding options and makes for an excellent community environment—both, which is perfect for growth of traders' careers in 2024.

5. BluFX

Overview:

BluFX features a subscription-based, one-of-its kind funding model where it allows its traders to trade in real capital instantaneously. Based in the UK, they offer the feature of instant access to funds to traders.

Key Features:

Subscription Model- Charged monthly fee for access to capital.

Up to $50,000 or $100,000 Trading Account Funding

Profit Sharing: 50% Profit Split

Risk Management: Easy to understand and transparent risk management rules.

Why Watch in 2024:

BluFX's instant funding model and very lucid manner of doing things make them one of the most different Prop trading companies out there. Their idea of keeping things simple and accessible will definitely ring a chord with many traders in 2024.

6. City Traders Imperium (CTI)

Overview:

City Traders Imperium is a prop trading firm located in London with a focus on the professional growth of its traders. It conducts a highly structured, long-term-focused evaluation process.

Features:

This is a trading skills in-depth evaluation.

An account starts with $10,000 and increases to a maximum of $2 million in funding.

There is 80% profit sharing.

It is an education-plus-one-to-one mentorship firm.

Why Watch in 2024

CTI boasts a structured trader education and career development path, making for an attractive opportunity if you are a serious trader wanting a long-term career.

7. Lux Trading Firm

Overview:

A professional trading environment with robust support systems is what Lux Trading Firm has to offer. They are known for running one of the more sophisticated evaluation processes in order to identify and develop top trading talent.

Key Features:

An evaluator will put a trader through numerous steps to test competency.

Funding up to $150,000; can rise to $2.5 million.

Profit Share: 80% Profit Sharing.

Professional support and advanced trading tools.

Why Watch in 2024:

Lux Trading Firm's professionalism and well-rounded support ecosystem set the organization at the top of many traders' lists when seeking quality in their trading environment.

8. OneUp Trader

Overview:

OneUp Trader simplifies the review process, focusing on getting traders up and running with funding in no time. They are US-based, with very accessible and approachable support for traders.

Key Features:

Evaluation Process: Easy one-step evaluation process

Funding: $25,000 accounts; scaling available

Profit Split: 50% – 80% Profit split

Community and Resources: Active community of traders; includes educational resources

Why Watch in 2024:

OneUp Trader's simple and easy-to-use approach, combined with access to funding, makes them arguably the best option for most traders.

9. Fidelcrest

Overview: Global prop trading firm offering diversified funding options with competitive evaluation processes and profit-sharing arrangements.

Key Features:

Evaluation Process: Rigorous two-phase process.

Funding: After passing the evaluation to get up to $1 million funded into an account.

Profit Split: up to 90%.

Trader Support: Continuous support and performance analysis.

Why Watch in 2024:

What makes Fidelcrest a very special company among prop traders is its world presence combined with a success-oriented approach in serving the traders. High proportions in profit split and state of the art support systems are built-in core features.

10. E8 Funding

Overview:

E8 Funding is one of the relatively newer prop trading assitances, but already it is gaining a quick reputation for its different way of doing things, which comes with its competitive options of funding.

Key Features:

Evaluation Process: The evaluation process is also very smooth and seamless. Funding: One can get access to a trading account of up to $250,000. Profit Split: Up to 80% profit split. Technology and Tools: The trading tools are with advanced technology support.

Why Watch in 2024: With E8 Funding possessing a fresh outlook and very competitive offers, for sure, they are one of the prop trading firms to watch grow more and innovate in this industry. The choice that you will make about the right forex prop trading firm shall remain the ultimate one for your entire trading life. The above-mentioned firms are at the forefront in 2024 because of their unique business concepts based on strong support systems, and the funding model is very attractive. Whether a professional trader or an absolute beginner in trading, these companies can help you trade with enormous capital and open doors to valuable resources when learning the art of trading. Knowing the best prop trading firms will help you unleash your full trading potential as the forex market keeps on changing.

0 notes

Text

FIDELCREST - Expert Prop Firm Reviews

Discover the ins and outs of Fidelcrest through our expert prop firm reviews. Dive into a comprehensive analysis of this proprietary trading platform, exploring its features, benefits, and potential considerations. Whether you're a seasoned trader or just starting, our in-depth reviews provide valuable insights to help you make informed decisions on your journey with Fidelcrest. Stay ahead of the curve and maximize your trading potential with our expert analysis.

0 notes

Text

How do I pass an FTMO prop firm challenge?

If you're looking to become a professional forex trader, passing a forex prop firm challenge is an important step in your journey. These challenges provide traders with the opportunity to showcase their skills on a platform where success is rewarded. Here's a guide on how to pass a forex prop firm challenge.

Understanding Prop Trading Firms

Proprietary Trading Firms recruit traders and provide them with capital to trade in the financial markets. The traders then get a share of the profits they earn, and the firm takes a percentage of the profits as well. To become a part of a prop trading firm, you need to show that you have the skills to be successful. They achieve this through different types of challenges and evaluation.

Pass the Challenge by Following These Steps:

Do Your Research

The first step in passing a forex prop firm challenge is to do your research. Understand the trading platform you'll be using, the rules of the challenge, and any restrictions that they may have. Look through the firm's website to see what assets they trade, check forums for reviews from traders who have completed the challenge, and ensure that you meet all the necessary requirements.

Develop Your Strategy

To be successful, you need a trading plan. Develop a strategy that is specific, measurable, achievable, and time-bound. Your strategy should include your risk management plan, entry and exit points, and the approaches you'll use to trade. You also want to have a profit target and acceptable daily losses.

Execute Your Trading Plan

Before starting the challenge, you should execute your trading plan in a demo account. This ensures that your plan is practical and effective. You should practice on several market conditions, and cautiously evaluate your plan every time you adjust it.

Understand Proper Risk Management

Risk management is critical in trading. A signal of a professional trader is one who manages risk appropriately. Proper risk management means that you implement a plan that protects your trading capital while giving you the chance to have a high-profit potential. A typical approach for prop trading firms is to need a 2:1 risk/reward ratio and acceptable daily losses between 1-3%.

Be Consistent

When you execute your trading plan, always be consistent. Avoid taking risks that aren't part of your plan, follow the rules of the challenge, stick to your strategy and be disciplined when it comes to the management of your risk.

Conclusion

Passing a forex prop firm challenge is a significant milestone for your career as a trader. Research the firm, develop a trading strategy, practice with a demo account, and execute your plan under strict risk management. By following these simple steps, you'll be well on your way to success, but the best way to pass an FTMO prop firm challenge is to use an FTMO passing service.

#prop firm passing service#ftmo passing service#we pass your ftmo challenge#best prop firm passing service

0 notes

Text

The Ultimate Guide to Finding the Best Funding Prop Firms

What is Prop Trading?

Proprietary trading, often referred to as “prop trading,” involves trading financial instruments using a firm’s own capital. In this setup, traders aim to generate profits for the firm by speculating on price movements in various markets, including stocks, forex, commodities, and derivatives. Prop traders typically work under the umbrella of best funding prop firms, which provide them with the necessary capital and infrastructure to execute trades.

The Advantages of Prop Trading

Prop trading offers several advantages to aspiring traders, including:

Access to substantial capital for trading.

Profit-sharing opportunities with the firm.

Access to advanced trading technology and tools.

A supportive trading community and mentorship programs.

Types of Funding Prop Firms

Independent Prop Firms

Independent prop firms operate as standalone entities, offering traders the freedom to trade from their preferred location. They often have flexible risk management policies and a wide range of tradable assets.

Remote Prop Firms

Remote prop firms allow traders to work from anywhere in the world. They provide access to proprietary trading platforms and allocate funds to traders based on their performance.

Institutional Prop Firms

Institutional prop firms are usually associated with larger financial institutions. They offer substantial capital and access to institutional-grade resources but may have stricter risk management policies.

Key Considerations for Choosing a Funding Prop Firm

When selecting a funding prop firm, consider the following factors:

Trading Capital and Leverage

Evaluate the firm’s capital allocation and leverage ratios to ensure they align with your trading strategy and risk tolerance.

Risk Management Policies

Understand the firm’s risk management procedures, including stop-loss policies and drawdown limits.

Trading Instruments and Markets

Choose a firm that provides access to the markets and instruments you are most interested in trading.

Training and Support

Look for firms that offer comprehensive training programs and ongoing support for traders.

Payout Structure

Examine the firm’s profit-sharing model and payout structure to determine your potential earnings.

The Application Process

Preparing Your Trading Plan

Before applying to a funding prop firm, develop a clear and well-researched trading plan that outlines your strategy, risk management approach, and performance goals.

The Interview Stage

Prepare for interviews with firm representatives, where you may be asked about your trading plan and strategy.

Funded Account Allocation

Once accepted, the firm will allocate a funded trading account, and you can begin trading with their capital.

Success Stories: Traders Who Made It

Learn from the experiences of successful prop traders who started their careers with funding prop firms. Their journeys serve as inspiration and valuable insights into the world of prop trading.

Avoiding Pitfalls and Scams

Red Flags to Watch Out For

Be vigilant for red flags that may indicate a potential scam, such as upfront fees or unrealistic promises of guaranteed profits.

Due Diligence in Research

Conduct thorough research on any firm you are considering and seek reviews and testimonials from current and former traders.

The Pros and Cons of Prop Trading

Advantages and Benefits

Access to substantial capital.

Profit-sharing opportunities.

Access to advanced tools and technology.

Potential Drawbacks

High-pressure environment.

Risk of capital loss.

Strict risk management policies.

Tips for Thriving as a Prop Trader

Continuous Learning and Improvement

Commit to ongoing learning and improvement to stay competitive in the ever-evolving financial markets.

Psychology of Trading

Master the psychological aspects of trading, including discipline, patience, and emotional control.

Risk Management Strategies

Develop effective risk management strategies to protect your capital and minimize losses.

Your Path to Prop Trading Success

In conclusion, choosing the right funding prop firm is a crucial step in your trading journey. By considering the factors discussed in this guide and conducting due diligence, you can increase your chances of success as a prop trader. Remember that prop trading is not a guaranteed path to riches, but with dedication, skill, and the right firm, it can be a rewarding and profitable endeavor.

Frequently Asked Questions (FAQs):

Q1. What is the minimum capital requirement for joining a funding prop firm?

The minimum capital requirement varies among firms but typically ranges from a few thousand dollars to tens of thousands.

Q2. Do I need prior trading experience to join a prop firm?

While prior experience is beneficial, some firms offer training programs for beginners.

Q3. What is the typical profit-sharing arrangement with prop firms?

Profit-sharing arrangements vary but often range from 50% to 90% of the profits generated by the trader.

Q4. Can I trade multiple asset classes with a prop firm?

Yes, many prop firms offer access to a wide range of asset classes, including stocks, forex, and commodities.

Q5. Is prop trading suitable for long-term investing or day trading?

Prop trading can accommodate various trading styles, including both long-term investing and day trading, depending on the firm’s policies and preferences.

Blog Source: The Ultimate Guide to Finding the Best Funding Prop Firms

#smart prop trader#proprietary trading firms near me#funded trading firms#the funded trader prop firm

0 notes

Text

Forex Funding Review Launches as the Premier Source for Forex Proprietary Trading Firm Reviews

http://dlvr.it/SsBFxY

0 notes

Text

Online Forex Exchanging Audit

Have you as of late been acquainted with or would you say you are taking a gander at online forex exchanging? Forex exchanging, or trading unfamiliar monetary standards, is as yet a somewhat new market for private merchants or little financial backers. Stock exchanging and different types of exchanging are significantly more famous and surely understand than forex exchanging, yet this not the slightest bit implies it is any less productive or tradable. With the improvement in overall fast correspondence organizations and the power and speed of home PCs, online forex exchanging has acquired ubiquity throughout the long term and keeps on developing every day.

Basically,Forex trading platform is similar as the more customary web-based stock exchanging. While the genuine instruments included are incomprehensibly unique, toward the day's end you are as yet trading something with the purpose of creating a gain in light of how much the value rises or drops. In the event that you have exchanged stocks or some other market online previously, you will likely find the change to exchanging forex a smooth one. There are countless online forex expedites each with their own product that permits dealers to rapidly and effectively see initially what the ongoing cost of various money matches is and permits you inside very nearly a moment to open and close exchanges. While the product used to exchange forex is much like different business sectors, you might need to be somewhat more judicious with regards to picking a forex intermediary.

Forex exchanging, in contrast to different business sectors, is as yet a somewhat unregulated one. This has lead to numerous little and maybe high gamble specialists offering administrations to new or somewhat new brokers who may not know about the dangers implied. As forex specialists expect you to set aside an installment before you can start exchanging, it would be to your greatest advantage to really look at the foundation of the dealer organization and check whether you can find surveys or input from any individual who might have or is right now exchanging with the organization. If conceivable, just open a record with a dealer that is inside your country. In the event that the circumstance emerges where you want to contact your merchant organization rapidly, having a neighborhood telephone number or office might prove to be useful.

For more details, visit us :

Best islamic forex brokers

Best brokers for options trading

Forex prop trading firms in uk

Proprietary trading reviews firms forex

#Top prop trading reviews firms in usa#Proprietary trading reviews firms forex#Proprietary trading firms forex#Prop trading reviews firms in usa#Forex proprietary trading firms

0 notes

Text

Forex Funding Review Launches as the Premier Source for Forex Proprietary Trading Firm Reviews

http://dlvr.it/SsBDDl

0 notes

Text

Forex Funding Review Launches as the Premier Source for Forex Proprietary Trading Firm Reviews

http://dlvr.it/SsBDDq

0 notes

Text

Forex Funding Review Launches as the Premier Source for Forex Proprietary Trading Firm Reviews

http://dlvr.it/SsBCmF

0 notes

Text

Forex Funding Review Launches as the Premier Source for Forex Proprietary Trading Firm Reviews

http://dlvr.it/SsBC5k

0 notes

Text

G7FX.com Review: Legit or Another Scam?

In the fast-paced world of Forex trading education, it is crucial for aspiring traders to separate legitimate programs from fraudulent ones.

G7FX Trading is one such company that has garnered attention, but what lies beneath the surface? In this review article, we will be doing G7FX.com Review and will find out whether G7FX is real or fake.

What is GF7X?

G7FX is a trading education company that claims to offer insights into institutional trading strategies and techniques.

Led by Nirav N.V., the company promises to guide students through the complexities of the financial markets, with a particular focus on S&P 500 and Crude Oil trading.

G7FX primarily offers educational courses and mentoring programs aimed at providing insights into institutional trading strategies. The Foundation Course and Pro are priced ranging from £998 to £1298.

According to Similar Web, the GF7X has around 110k+ monthly traffic.

Read: Star-Clicks Real or Fake?

Website Profile

WebsiteG7fx.comKnown asG7FXSite typeOnline EducationProducts offeredProducts OfferedDomain registration date30 November 2021AddressLondon, EnglandContact [email protected]

Read: Rivera Vs Google Settlement Legit?

G7FX Review

G7FX is already opted by many users, but still, there are some concerns that question the legitimacy of G7FX. Here are some red flags to consider before spending on G7FX Trading.

1. Questionable Claims

One of the concerning aspects discovered about GF7X's Founder Nirav N.V. is his questionable background and contradictory statements.

He was caught attempting to pass off his demo account as a real one. This raises questions about his integrity and transparency.

2. Misleading Claims

Nirav repeatedly mentions in his course that he worked for a top proprietary trading firm after Barclays. However, there is no evidence to support this claim.

SMB Capital, a renowned proprietary trading firm, stated that Nirav was actually a trainee, contradicting his portrayal of having substantial experience with such firms.

3. Expensive

The price of the G7FX course has been a topic of discussion among traders. Neerav N.V. charges around $1000 for the course, which may seem steep for many individuals starting their trading journey.

4. Negative Reviews on Trustpilot

G7FX has a 5-star rating on Trustpilot, but still, it seems that there is something wrong here.

There are many negative reviews regarding customer support, credibility and misleading claims.

Read: MommyLove.shop Review

Is G7FX Legit?

G7FX is a legit platform, but there are some red flags like misleading claims. Based on these details we advise users to keep precautions before buying courses from G7FX.

https://www.youtube.com/watch?v=7S3FgFycsAw

These types of platforms usually focus on money-making rather than actual practical knowledge. So it is better to learn from other trusted sources.

Read: GPTCoin Review

Read the full article

0 notes

Text

Olymp Trade Review: An In-Depth Analysis of a Leading Online Broker

What is Olymp Trade?

Olymp Trade, a well-known online trading platform, provides access to financial markets for traders from all over the world. Since its establishment in 2014, the company has grown quickly to become a dominant force in the industry, renowned for its trustworthy service and cutting-edge features. In this review, we'll look more deeply at Olymp Trade, covering its history, functionalities, and potential uses.

Olymp Trade History and Background:

Olymp Trade was established in 2014 by a group of seasoned financial professionals to give traders of all skill levels an approachable and accessible trading platform. The corporation has offices in Russia and Cyprus and its headquarters in St. Vincent and the Grenadines. The International Financial Commission (IFC) oversees Olymp Trade and ensures that the broker conforms to global financial rules.

Olymp Trade Features and Services:

Olymp Trade offers a range of features and services designed to make trading accessible and profitable for traders of all levels. The platform offers access to over 70 financial instruments, including stocks, currencies, commodities, and cryptocurrencies. Traders can choose from a variety of trading instruments, including options, forex, and cryptocurrencies.

Olymp Trade distinguishes itself with a proprietary trading platform that is simple to use and intuitive. Both desktop and mobile users can access this platform, which offers traders a range of tools and indicators to help them make wise trading decisions. Additionally, Olymp Trade provides a wide range of instructional tools, like trading methods, webinars, and video tutorials, to aid traders in developing their skills and expertise.

What Type of Trading is Olymp Trade:

Olymp Trade Plus:

Olymp Trade Plus is a loyalty program offered by Olymp Trade that allows traders to earn rewards and benefits based on their trading activity. Traders can earn points for every trade they make, which can be redeemed for prizes such as cashback, bonuses, and trading signals. The program also offers exclusive benefits, such as access to a personal account manager and priority support.

2. Bill Williams Fractals Olymp Trade:

Many traders on the Olymp Trade platform employ Bill Williams' trading strategy of fractals. This strategy is based on the usage of fractals, mathematical patterns that can be utilized to identify potential market trends. Traders can utilize Bill Williams fractals to establish probable entry and exit locations for trades and to manage risk.

3. Kingfin Olymp Trade:

Kingfin is a fintech firm that offers a diverse array of services to traders, such as access to the Olymp Trade platform. The company is based in Cyprus and operates under the authorization and regulation of the Cyprus Securities and Exchange Commission (CySEC).

Olymp Trade CEO and Olymp Trade Headquarters:

The CEO of Olymp Trade is Dmitry Sergeev, who has over 10 years of experience in the financial industry. The company's headquarters are located in St. Vincent and the Grenadines, with additional offices in Cyprus and Russia.

Olymp Trade App: Legit or Scam ?

With the Olymp Trade app, users can legally trade a range of financial products online, including currencies, commodities, stocks, and cryptocurrencies. The International Financial Commission (IFC) oversees Olymp Trade and ensures that all financial service providers adhering to international financial standards.

It's important to note that there are some fraudulent apps and websites that may try to impersonate Olymp Trade or other legitimate trading platforms, and users should always be cautious when downloading and using any financial app. To ensure that you are using the official Olymp Trade app, it's recommended that you visit the official website and download the app from a trusted source, such as the Apple App Store or Google Play Store.

Understanding the Oversight of Olymp Trade: Is the Broker Regulated by the Reserve Bank of India (Olymp Trade RBI):

It's important to note that Olymp Trade is not regulated by the Reserve Bank of India (RBI), as the RBI only regulates banks and financial institutions in India. However, Olymp Trade is regulated by the International Financial Commission (IFC), which is an independent organization that oversees financial services providers in international markets. The IFC ensures that Olymp Trade operates in accordance with international financial standards and provides a dispute resolution mechanism for traders who may

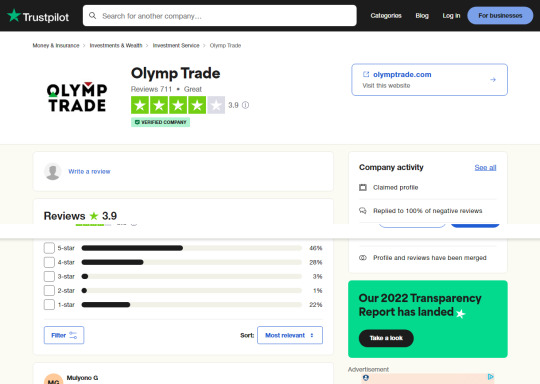

Olymp Trade Reviews:

Trustpilot Reviews:

Olymp Trade has a rating of 3.9 stars on Trustpilot, with over 711 reviews. The majority of reviews are positive, with traders praising the platform's user-friendly interface, reliability, and customer support. Some negative reviews mention issues with withdrawals and customer support, although these are relatively rare.

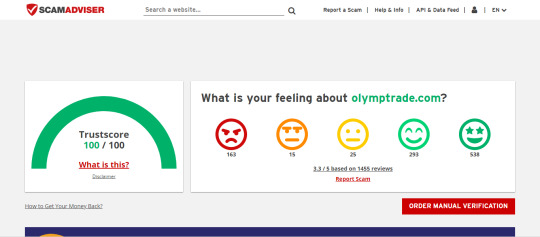

Scam Adviser Reviews:

Olymp Trade has a high trust score on Scam adviser, indicating that it is a trustworthy trading platform with positive reviews from its users. The website is regulated by the reputable International Financial Commission (IFC) and has a secure website with a valid SSL certificate to protect users' personal and financial information. Overall, Scam adviser's review suggests that Olymp Trade is a legitimate and reliable platform, but it's still advisable to conduct your own research and due diligence before investing in any financial product or service.

Troubleshooting Fractals on Olymp Trade:

Tips for Identifying Key Levels of Support and Resistance: if "Bill Williams Fractals not showing in Olymp Trade":

There could be a few cases if you're utilizing the Olymp Trade platform and have problems visualizing fractals. Here are a few such justifications:

It's possible that the asset or chart you're looking at doesn't have fractals. Fractals are frequently utilized on price charts, however they might not be accessible on all types of charts or at all times. To see fractals, you might need to change the chart settings or the object you're using.

It's possible that the asset or chart you're looking at doesn't have fractals. Fractals are frequently utilized on price charts, however, they might not be accessible on all types of charts or at all times. To see fractals, you might need to change the chart settings or the object you're using.

You might not have fractals enabled in your platform settings. To ensure that fractals are enabled and visible on your charts, check your platform's settings.

There might be a problem with your platform's technical setup. Fractals may not be seen even after you have reviewed your settings; this indicates that there may be a platform-specific problem. You can try logging out and back in again, or you can ask for help from Olymp Trade customer service.

Overall, it's critical to analyze the issue and double-check that you have the proper settings and assets chosen if you are having trouble seeing fractals on the Olymp Trade site. It is worthwhile to take the effort to ensure that you are able to use fractals successfully because they can be a beneficial tool for traders.

Conclusion:

Overall, Olymp Trade is a reputable and reliable trading platform that offers a range of features and services designed to make trading accessible and profitable for traders of all levels. The platform's proprietary trading platform, educational resources, and loyalty program make it a popular choice among traders, while it's regulation by the International Financial Commission provides an added layer of security and transparency. While there are some negative reviews, the majority of traders have had positive experiences with Olymp Trade, making it a strong option for those looking to trade financial markets online.

#olymp trade ceo#kingfin olymp trade#olymp trade headquarters#olymp trade plus#bill williams fractals olymp trade#olymp trade india#olymp trade trustpilot#olymp trade rbi#india

0 notes

Text

True Forex Funds | Expert Prop Firm Reviews

Discover the pinnacle of Forex trading with True Forex Funds – your gateway to success. Dive into a curated collection of Expert Prop Firm Reviews, meticulously crafted to provide traders with invaluable insights into proprietary trading firms. Navigate the complexities of the Forex market confidently with expert assessments of each firm's trading strategies, risk management, and performance records. True Forex Funds serves as your reliable compass, guiding both seasoned traders and beginners through the intricacies of prop trading.

0 notes