#Public adjuster FAQs

Text

Public Adjuster in Westchester

Public Adjuster in Westchester is a professional who specializes in insurance claims. They are hired by people who have suffered damage to their property due to an accident or natural disaster. The adjuster will then work with the insurance company on behalf of the victim, to make sure that they are compensated for the damage done.

Public Adjusters are not lawyers and they do not provide legal advice. They help you negotiate with your insurance company and make sure that you get what you need in order to recover from the damages done to your property.

Common insurance claims to hire a public adjuster

While there may be many reasons to hire a public adjuster, the most common insurance claims that public adjusters can help with are natural disasters. These include flooding, fire, theft, water damage, and mold.

Some other types of insurance claims are cyber security issues, business interruption (for business owners), and theft. If any of these happened to you, and you’re not sure what step to take to ensure that you’re fully compensated, call Crestview Public Adjusters today for a free consultation.

Not from Westchester county? We manage claims across New York, including New Rochelle and Bronx.

Crestview can manage your NY insurance claim

Searching for the best public adjuster in New York can be overwhelming. You probably already recognize that not all public adjusters are equal. Make sure you find an experienced public adjuster who has specific experience in the area that you’re seeking assistance with.

It is also necessary for the Best public adjuster to be available at all hours of the day because natural disasters can happen at any time. Crestview Public Adjusters has recovered millions of dollars for its clients and may be able to help you do the same. Call today for a free consultation.

About Westchester County, NY

Westchester County is located in the southern portion of New York State, just north of the Bronx. It is home to nearly one million residents spread out across 45 communities. The county is known for its affluence, excellent schools, and sprawling suburban landscape. In recent years, more young families have been moving into the county as they are priced out of NYC. This has led to an increase in cultural offerings and a more vibrant nightlife. There are plenty of things to do in Westchester County, making it an ideal place to call home.

There are many things to do in Westchester. One can go hiking at any of the many parks, such as Croton Gorge Park or Mohegan Park. There are also many historic sites to visit, such as the Philipsburg Manor or the Kykuit Estate. For those who enjoy the arts, the Performing Arts Center at Purchase College offers many shows and events. There are also many restaurants and shops to enjoy in Westchester County.

0 notes

Text

Good Omens graphic novel update: April 2024

Admin & updates

PledgeManager

Earlier this month, we launched the PledgeManager, where shipping is being facilitated. If you missed it, you can read the initial announcement here. We have been adapting the FAQ page to add further recurring asks, so please do visit there if you have a particular query as a starting point. You can view this here. We are working through all queries received - some are taking a bit longer than others, as they need to be raised with PledgeManager, or others involved, so we appreciate your patience in these instances where we are yet to get back. The most common question, which we include here, is the sock sizes:

If you need to change your size, you have the ability to self-unlock your order and make any adjustments you need to. For socks that are part of a tier, there is a button to unlock and modify on the bottom of your receipt where you can alter your choice. If they were an add on, PledgeManager recommends that you remove the item from your cart and add it again with the correct size selected and complete their order to finalize the change.

Shipping

We are also aware of queries arising about the shipping rates themselves. While we have been open from the start of the project that shipping will be charged at a later date, we understand that the resultant cost has come as a surprise to some and that some prices are higher than expected. We want to be transparent on this: we have been working with our fulfillment partners on confirming product weights and the rates for shipping globally during the months since the project’s completion. The cost of doing this ethically - ensuring that everyone involved in the process from creators to those packing boxes is paid fairly, as well as ensuring the packaging is robust at this scale - is substantial.

We’ve done our best to minimise extra costs around shipping, while also not cutting any corners – we want your pledge rewards to reach you safe and sound. We have also subsidised costs across a number of territories, but costs for shipping to many locations remain high. The final thing we’ve done is lock in shipping costs now, a year out from fulfillment. We expect third party shipping costs to increase over the coming year, following the upwards trends across the board so far, but we will continue to absorb any subsequent rises.

We want to assure backers that the shipping does not include a profit margin for us, and every charge to our backers is something we’ve tried to minimise.

We absolutely understand that this is disappointing to many, and we endeavour to keep making the surrounding campaign the best it can be.

The timeline

The PledgeManager will run across 2024, and close at some point ahead of publication date (Spring 2025). When that date has been decided, we will give everyone as much notice as possible.

FAQ

As above, here is the centralised FAQ page. This will be updated over the coming year.

Cameos

Prior updates had noted the deadline for this has passed, however given the new publication date of the graphic novel, this has been extended slightly for God Tier and Archangel Tier backers. Please check your messages and emails if you backed either of these tiers and have not submitted your likeness.

Merch and more

Things are ramping up at Good Omens HQ, first of all with this delivery of one or two mugs at the warehouse:

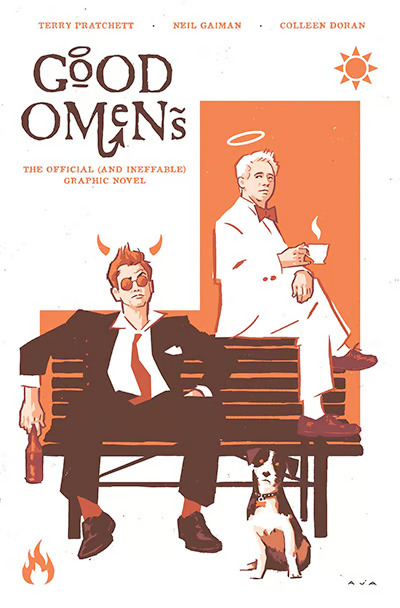

We’ve also got David Aja’s print featuring Aziraphale, Crowley and Dog, in their glorious orangey hues which will appear in Serpent Tier+:

The trading cards are at the testing stage for game mechanics, while some of the early design prototypes are in for artist variants and we really can’t wait to start sharing these with you when they’re a bit further down the road. Almost there.

For those ready to capture your inner Pratchett and Gaiman on the page (Demon+), we have your notebooks:

More from Colleen…

We’ve continued to see gorgeous artwork arrive from Colleen and here’s one that slipped into our inbox this week:

And we thought we’d sign off this month with a glimpse at our favourite antiquarian bookshop:

737 notes

·

View notes

Text

Patch 1.103

🌞 Most affected mods are updated for patch 1.103. All my other mods and traits are cleared for the patch.

Some minor adjustments to autonomy are required for Less Obsession (still safe to use) and I will update it ASAP. After updating it, I will update other mods to add compatibility to the new packs' traits.

📌First round of updates for patch 1.103

UPDATE: Age Up add Preferences V11

Updated main module for patch 1.103

UPDATE: Blue Fear V4

Updated to add Fear of Eviction from For Rent pack

UPDATE: Custom Traits in Club Filter v23

Updated to include all traits from For Rent pack

UPDATE: Introduction Hider/ No Autonomy V5

Added Tomarani Introduction from For Rent Pack

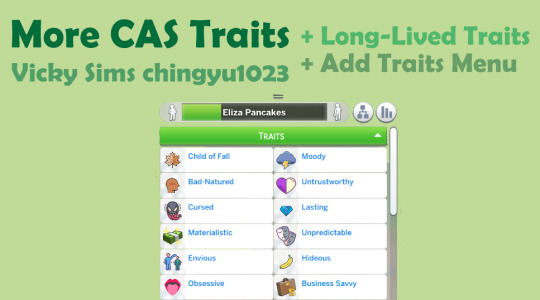

UPDATE: More CAS Traits for Sims and/or Pets (Dec 2023)

Updated all MoreTraits_Options for patch 1.103

I did an overhaul of the options for new NPCs' trait spawning. Some options' trait numbers are changed.

NPC Sims newly generated now should get assigned the correct number of traits when using any of the Options 01~28

If you prefer NPC Sims not getting generated with extra traits, you may choose Option 29 or 30.

I noticed EA fixed a UI glitch when editing Sims with more than 3 traits in CAS! HURRAY!

No changes to the Add Traits Menu or Long-Lived Traits.

UPDATE: No Mopping in Bad Weather/ Outdoors V2

Updated for patch 1.103

In case you missed it, two new mods have already been available to the public!

NEW: Blush Mod

NEW: Friendly Neighborhood (Sharing is Caring Replacement)

🔆 Changelog in December 2023 HERE

🔹 Links to ALL My Traits, Game Mods, and CCs

🔹List of IDs for creators who want to refer my traits to their own mods

🔹 List of Chingyu’s CC Traits Name and Descriptions for mod users

🔹 Check Mod Status after a patch & Compatibilities

👁🗨 Learn how to install a mod & FAQs

👁🗨 Terms of Use

👁🗨 Ask Questions/ Suggestions/ Bug Reports on Discord

▶ I need to see a screenshot or LE report to help you figure out what’s wrong!

👁🗨 Download on my Patreon

👁🗨 Follow me on Twitter

#sims 4 for rent#for rent#sims 4#ts4 gameplay#ts4cc#s4cc#sims#s4cc download#sims 4 cc#ts4 download#game mod#sims4#ts4 news#ts4 cc#ts4#the sims community#the sims 4#the sims#sims community#ts4 finds#s4cc finds#cc finds#ts4 cc download#sims 4 download#s4 download#sims 4 gameplay#ccfinds#custom content#the sims cc#my cc

521 notes

·

View notes

Text

FAQ & Important Info

About me:

bday: march 30th

lgbt?: im bi

What can we call you?

Seraphont is fine, its supposed to be a play on of Seraph and Serif Font, you can call me Seraph!

What pronouns do you use?

I'd prefer They/Them, but you can use She/Her.

Whats your Main blog?

not posting it publically for now.

Dying and Getting Over It (DaGOI au) Related:

Where can I read DaGOI?

It will be uploaded to my Ao3. its currently being written, so there is no link to the fic yet.

When will you post the fic?

short answer: I'm not sure, possibly by early october.

its my first time writing a fic, so I ask you to be patient with me!

the outline is written and being tweaked, and its going through adjustments now that MD ep 8 is out. Im also moving across the world, so I'm a tad bit busy rn.

Will you include MD ep8 into the canon of your fic?

at first I was on the fence, but its grown on me, its being integrated now.

Will you be drawing all of DaGOI in comic form?

if I was a stronger man I would. I'll mostly be drawing key story moments.

making comics is an aid to helping me write. so I'll be making a lot, but I may not be posting them until the chapters start coming out (trying not to spoil everything). to give you an idea, as of writing this, I have 6 comics on the backburner lol.

Art Related:

What art program(s) do you use?

Procreate -Brushes: Shiyoon Kims Wet Brush pack (X) (everything you see on this blog is made with this brushpack) and several Max Packs (X) for procreate

How long have you been drawing?

I've always drawn, but I started getting really serious at 14, around the same time I first made my main blog. I was self taught up until I got into animation school.

What do you do as a career?

I'm currently doing Freelance work for publishers and individuals. I was previously an animator, I'm making the move to storyboarding

Do you take requests/commissions?

I do have commissions open. only lineart, and flat colours are available. if you want a rendered piece: slots are closed, but you can dm me for interest.

Asks and Messaging:

Rules for asks/tagging?

Anyone can send me an Ask, Mutuals, Anons or not!

Dont send discourse or anything explicitly NSFW. you'll be blocked lol. I'd prefer if you didnt send suggestive. if you send me triggering content I’ll mind blast you into dust. (block).

Do not send and DNI's?

Transphobia, Homophobia, Acephobia. All the obvious bigot contenders.

SA, pdfilia and incest are absolute no goes.

are you okay with me direct messaging you?

only if we have spoken before/ you're giving me a headsup about something/ I've prompted you to send me one.

***minors: please refrain from dming me to chit chat, im not down to.***

Why don’t you answer my asks/dms?

my main has 1000+ asks and my other side blog is pushing 250+, sometimes the ask's get lost in the sauce.

that being said, some ask's go unaswered because:

1. it might spoil too much if I were to answer.

2. I simply have to think hard to reply.

3. its super nice and im hoarding it all for myself.

Misc

Can you reblog my donation posts?

no. too many scams.

76 notes

·

View notes

Text

Federal Corporate Tax in UAE – Published Official CT Legislation

After the announcement by the government regarding the benefits of Corporate Tax in UAE (CT) and the frequently asked questions (FAQs) on January 31, 2022, as well as the publication of the Public Consultation Document in April 2022, the Federal Decree-Law no. 47 of 2022 regarding the Taxation of Corporations and Businesses UAE Corporate Tax Law has been released on December 9, 2022.

The UAE Corporate Tax Law is Federal Decree-Law No. 47 of 2022, enacted on October 3, 2022, and will be in force 15 days following its public publication by the Official Gazette. The UAE Corporate Tax law applies to profits from businesses in financial years beginning on or after June 1, 2023.

This article offers brief highlights of the new rules which were made public by The Ministry of Finance (“MoF”) and the Federal Tax Authority (“FTA”). It is important to note that the rules closely match those in the Public Consultation Document.

Additional details will be deferred to Cabinet and Tax Authority Decisions. Further guidance is expected to be issued to finalize all UAE Corporate Tax Legislation in areas such as the Free Zone and Director compensation guidelines. Following the publication of Corporate Tax Legislation, the MoF has confirmed that the implementation is scheduled for June 2023.

Scope of Corporate Tax in UAE

Corporate Tax in UAE will be applied to the adjusted net profit of the worldwide accounting of the company.

The UAE Corporate Tax regime has two rates of different types:

A tax-free rate will be applied to tax-paying earnings up to a certain amount that is to be set in the Cabinet Decision (the FAQs relate to the threshold of AED 375,000)

The tax statutory standard rate is 9 percent.

The relative minimal tax burden of just 9% aims to ensure that the UAE has a competitive tax rate in the global marketplace.

The UAE Corporate Tax Law is silent in Article 3 on aspects governing the global minimum of 15% tax rate. That applies to MNEs that fall within the scope of Pillar Two, which is part of BEPS Pillar 2. OECD BEPS project and applies to multinational corporations (MNCs) that have consolidated worldwide revenues exceeding EUR 750 million (c. 3.15 billion AED) 3.15 billion) at any time in two of the preceding four years. The FAQs address the possibility of adopting within the UAE of BEPS Pillar 2.

Individuals:

Individuals also are affected by corporate taxation if they engage in business activities and are in line with general VAT rules of business activities. The Cabinet is expected to decide how to apply Corporate Tax in UAE to natural individuals. Thus, Corporate Tax in UAE does not apply to a person’s salary and other earnings earned through employment.

However, those who are earning income through an enterprise activity will be covered by Corporate Tax in UAE.

Free Zones

A clearly defined and specific policy (subject to a further Cabinet decision) is set out for companies established in UAE-free zones. These zones:

Maintain sufficient substance and

Earn qualifying income.

What exactly is a sufficient income will be defined by a Cabinet decision. The Public Consultation Document could refer to the requirement to not do business with the mainland UAE. It is stated that Free Zone businesses can choose to be taxed as a corporation at a rate of 9 percent.

The extensive UAE rules for sourcing are in force and essential for the Free zone companies seeking to comply with the substance requirements.

Withholding Tax

There is a possibility of a zero-withholding tax on specific categories in the UAE State Sourced income produced by a non-resident. In turn, foreign investors who do not conduct any activities in the UAE won’t be taxed within the UAE.

Foreign Entities

Foreign entities can be considered residents in the UAE if they are managed and controlled by the UAE. In the case of foreign companies that aren’t recognized as residents of the UAE and who possess a permanent establishment in the UAE, The Definitions of Permanent Establishment have been clarified as fixed PE as well as the term “agency PE. Further details on PEs will be subject to a Ministerial decision.

Exempt Entities

The UAE Corporate Tax Law has retained the exemption for Investment Managers of the Public Consultation Document. Specific rules apply to Partnerships as well, as Family Foundations can also use to increase tax transparency

Government entities and government-controlled entities as well as qualifying public benefit entities and qualifying investment funds will be exempt from the UAE Corporate Tax Law.

Extractive companies (upstream oil and gas companies) are exempt if they earn revenue from the extraction business.

Bank operations will be restricted to Corporate Tax in UAE (unless your institution operates in a Free Zone and is eligible for the zero-interest rate).

Implementation Date

Article 69 of the UAE Corporate Tax Law provides that the Law applies to Tax Periods that begin on or after June 1, 2023.

Companies with a fiscal year that begins on January 1 are subject to CIT beginning 1. January 2024.

Financial records & Requirement to Maintain Audited Statements

Taxpayers must prepare and maintain financial statements backed by all records and documents to support UAE Corporate Tax returns. The forms should be kept for a minimum of seven years.

That will apply to every UAE entity (unless included in the Corporate Tax Group). Every entity must make separate financial statements. However, all entities will not be audited for financial information. Subsequent Cabinet Decision(s) will outline the tax-paying categories required to keep audited or certified accounts.

Small Business Tax Relief

The possibility of relief for small-sized businesses with gross or revenue less than the threshold of a specific amount is made. Qualifying businesses will be considered not to have tax-deductible income and must comply with a simplified set of requirements.

Revenues and not tax-deductible income determine the threshold. It is likely to be confirmed by an upcoming Cabinet Decision.

Deductible / Non-Deductible Expenses

The expenses incurred solely and exclusively to serve business needs (and which are not to be capitalized) can be deducted.

Deductions are not allowed for expenditures incurred to generate tax-free income. Deductibility is only permitted in the case of any price with a mixed purpose. Interest expense is deductible subject to a maximum of 30% of EBITDA.

Financial assistance rules have been implemented to prevent businesses from getting funding to pay dividends or distribute profits.

Entertainment costs are limited to 50 percent.

Non-deductible expenses include contributions to a non-qualifying Public Benefit Entity and bribes, fines, and dividends.

Importantly, amounts taken from the business by an individual who is a tax-deductible individual are not deductible.

Exempt Income & Relief

The following income categories are exempt from Corporate Tax in UAE (Article 22 of the UAE Corporate Tax Law):

Capital Gains and Dividends, and other profits distributions from a Resident

Capital Gains or Dividends, as well as other profits distributions from Qualifying shareholding in a legal entity of a foreign country with a holding time of 12 months and a minimum contribution of 5 percent, and at an absolute minimum of 9 percent CIT for the source country. From which they originate.

The income from a foreign PE is subject to the conditions & an option to use an exemption (rather than credit)

The income earned by an individual, not a country resident, comes from the operation of ships or aircraft involved in international transport.

These transactions can be subjected to a specific reduction, i.e., it is essentially an exemption from taxation:

Restructurings and intragroup transactions that qualify as qualifying entities are eligible when they hold 75 percent common ownership

Restructuring of businesses is a relief from the government with specific conditions.

Transfer Pricing

Related parties’ transactions should be carried out under the arm’s-length arms-length principle outlined in Section 34 of the UAE Corporate Tax Law. It also states that the five standard OECD transfer pricing techniques are suitable to help support the arm’s-length arms-length nature of arrangements with related parties and allow alternative methods if needed.

Article 34 states that should there be an adjustment by a tax authority from a foreign country that affects a UAE entity, the application must be submitted to the FTA to request a similar adjustment that allows the UAE firm to be exempt against double taxation. The resulting adjustments relating to domestic transactions do not require an application.

The requirements for documentation on transfer pricing are covered by Article 55. UAE businesses must follow the transfer pricing regulations and the documentation requirements set by references to the Transfer Price Guidelines.

These lead to three-tier reports, i.e., master file, local file, and country-by-country reporting. The connection to a controlled transactions disclosure form is provided (details of which are to be determined).

It is important to note that no thresholds of materiality are provided. Separate legislation will be announced shortly. Advance pricing plans will become made available via the normal clarification process currently in place.

UAE has introduced provisions requiring the payment and benefits given to persons connected to be tax-deductible in the market value. The same rules are followed in section 34 of UAE CIT Law for applying this principle.

Administration & Enforcement

The MoF is the sole authority for multilateral or bilateral agreements and the exchange of information between countries.

The FTA is responsible for the corporate tax system’s administration, collection, and application. The Tax Procedures Law sets fines and penalties.

Companies will require an FTA VAT Registration UAE.

Companies affected by Corporate Tax in UAE must submit a CT report electronically for each period of financial activity within nine months from the close of that Financial Period. (A financial period generally refers to any financial period that is 12 months long)

Free Zone companies that are which are subject to CIT at 0 percent CIT must also submit a Corporate Tax Return.

Foreign Tax Credits

Tax credits for foreign taxation are allowed for UAE corporate tax due as per the Public Consultation Document. Businesses are entitled to claim the lesser amount of corporate tax due and the sum of withholding tax that is effectively taken out. There is no carrying forward. There will be no credit for taxes paid to an individual Emirate.

Tax Grouping

Fiscal unity or Tax Group: UAE companies can create a “fiscal unity” or Tax Group to serve UAE purposes. The primary requirement for the formation of a Tax Group is to comply with an (in)direct minimum shareholding of 95 percent.

Free zone entities subject to zero percentage shareholding are not eligible to join the Tax Group. Furthermore, the parent (which may be intermediate) is required to be a UAE company.

Losses

By article 37 of the UAE Corporate Tax Law, losses can be carried forward for up 75 percent of taxable income. Losses can be transferred between members of the same group of corporations if they are 75 percent direct or indirectly owned. Losses cannot be transferred from exempt people or entities in the free zone. The loss offset is subject to the cap of 75 when it comes to businesses that roll forward losses.

Tax-deductible losses may be lost in the event of an ownership change (50 percent or more); however, the new owner is operating the same or similar business. The requirements to be considered for this have been established.

Anti-Abuse

UAE will implement an Anti-Abuse General Rule known as “GAAR”. The GAAR applies to cases where one of the principal reasons for a transaction is to gain an advantage in taxation for corporations that is not in line with the intent, intent, or purpose of UAE Corporate Tax Law.

The FTA will be able to address and adjust or counteract the transaction. The GAAR only applies to arrangements or transactions made after the UAE Corporate Tax Law is published in the UAE Official Gazette on October 10, 2022, in issue #737.

Summary

The publication of UAE Corporate Tax Law and confirmation of a rate of 9 The UAE have established a global affordable Corporate Tax rate and confirmed their intention to implement Corporate Tax in June 2023.

The information to be released in the next few months will be fleshed out and provide a greater understanding of the implementation process. Nevertheless, several key elements are already confirmed, including introducing compulsory transfer pricing rules.

2 notes

·

View notes

Text

Federal Corporate Tax in UAE – Published Official CT Legislation

In the wake of the public announcement regarding the benefits of Corporate Tax in UAE (CT) and the frequently asked questions (FAQs) on January 31, 2022, as well as the publication of the Public Consultation Document in April 2022, the Federal Decree-Law no. 47 of 2022 regarding the Taxation of Corporations and Businesses Corporate Tax Law has been released on December 9, 2022.

The UAE Corporate Tax Law is Federal Decree-Law No. 47 of 2022, issued on October 3, 2022, and becomes effective 15 days following its announcement in the Official Gazette. The Corporate Tax law applies to the profits of businesses for fiscal years that begin on or after June 1, 2023.

This article gives brief highlights of the new rules, which were it was announced by The Ministry of Finance (“MoF”) and the Federal Tax Authority (“FTA”). It is important to note that the new rules align with the Public Consultation Document.

More details are awaiting Cabinet and Tax Authority Decisions, and further guidelines are expected to be issued to finalize all Corporate Tax Legislation in areas such as the Free Zone and Director compensation guidelines. Following the publication of Corporate Tax Legislation, the MoF has confirmed that its introduction is scheduled for June 2023.

Scope of Corporate Tax in UAE

Corporate Tax in UAE applies to the adjusted net profit of the worldwide accounting of the company.

The Corporate Tax in UAE Regime has two rates of different types:

A tax-free rate applies to tax-deductible earnings up to a certain amount that is to be set in a Cabinet Decision (the FAQs relate to the threshold of AED 375,000)

The tax standard for the statutory rate is 9 percent.

Confirming the minimal tax burden of just 9% aims to ensure that the UAE has a competitive tax rate worldwide.

The Corporate Tax Law is silent in Article 3 on aspects governing the global minimum of 15% tax rate. That applies to MNEs that fall within the definition of Pillar Two, which is part of BEPS Pillar 2. OECD BEPS project and applies to multinational corporations (MNCs) that have consolidated worldwide revenues exceeding EUR 750 million (c. the equivalent of AED 3.15 billion) at any time in two of the last four years. The FAQs address the possibility of adopting within the UAE of BEPS Pillar 2.

Individuals:

Individuals are affected by corporate taxation if they engage in business activities that are in line with an overall VAT concept for business activities. A Cabinet decision is anticipated regarding how to apply Corporate Tax in UAE to natural people. That means that Corporate Tax does not apply to a person’s salary and other earnings earned through employment. However, those earning income through part of a business venture would be covered by Corporate Tax in UAE.

Free Zones

A specific and defined regime (subject to a further Cabinet decision) is provided for all businesses in UAE-free zones. These zones:

Maintain sufficient substance and

Earn qualifying income.

What is a sufficient income will be defined by a Cabinet decision. According to the Public Consultation Document, this could refer to the requirement not to do Business with the mainland UAE. It is stated that Free Zone companies can choose to be taxed as a corporation at a rate of 9 percent.

A wide range of UAE rules for sourcing is in force and essential for businesses in the Free zone who want to satisfy the requirements of substance.

Withholding Tax

There will be no withholding tax on specific categories of UAE State Sourced income produced by a non-resident. In turn, foreign investors who don’t carry any businesses in the UAE, in general, will not be taxed within the UAE.

Foreign Entities

Foreign entities can be residents of the UAE if they are operated and controlled in the UAE. Foreign entities who aren’t considered to be residents in the UAE, however, may have a permanent establishment in the UAE. The Definitions of Permanent Establishment have been clarified as fixed PE and the term “agency PE. Further details on PEs will be subject to a Ministerial decision.

Exempt Entities

The UAE Corporate Tax Law retains the exemption for Investment Managers exempted from Public Consultation Documents. Rules apply to Partnerships, and Family Foundations can also use to increase tax transparency.

Government entities and government-controlled entities, as well as qualifying public benefit entities and investment funds, will be exempt from the UAE Corporate Tax Law. Extractive companies (upstream oil and gas companies) are exempt if they earn revenue from their extractive businesses.

Banking operations are affected by Corporate Tax in UAE (unless an institution falls located in a Free Zone and is eligible for the zero-interest rate).

Implementation Date

Article 69 of the UAE Corporate Tax Law provides that the Law will apply to Tax Periods that begin on or after June 1, 2023.

Businesses with a financial year that begins on January 1 are subject to CIT starting on January 1, 2024.

Financial records & Requirement to Maintain Audited Statements

Taxpayers must create and keep financial statements backed by all records and documents to support Corporate tax returns. The forms must be kept for a minimum of seven years.

This obligation will apply to every UAE entity (unless included in the Corporate Tax Group).

Every entity must create its financial statements. However, only some entities may be audited for financial information. A subsequent Cabinet Decision(s) will define the types of tax-paying individuals that must keep certified or audited accounting statements.

Small Business Tax Relief

Reliefs for small-scale businesses with revenues or gross income below the threshold of a specific amount are made. Qualifying businesses will be considered to have no tax-deductible income and must comply with a simplified set of requirements.

The threshold is determined by the revenue, not the earnings or taxable income. That is likely to be confirmed by an upcoming Cabinet Decision.

Deductible / Non-Deductible Expenses

The expenses incurred solely and exclusively for business reasons (and which are not to be capitalized) can be deducted.

Deductions are not allowed when expenses are incurred to earn tax-free income. In the case of any expenditure with a mixed purpose, removal is not permitted. Interest expense is deductible subject to a limit of 30% of EBITDA.

Financial assistance rules are in effect and prevent companies from getting funding to pay dividends or distribute profits.

Entertainment costs are set at 50 percent.

Donations not tax-deductible include those made to a non-Qualifying Public Benefit Entity and bribes, fines, and dividends.

Notably, the amounts withdrawn from the Business by any natural person who is a tax-deductible individual are not deductible.

Exempt Income & Relief

The following income categories will be exempted from Corporate Tax in UAE (Article 22 of the UAE Corporate Tax Law):

Capital Gains and Dividends, and other distributions of profits from a Resident

Capital Gains such as dividends, capital gains, and other distributions from Qualifying shareholding in a legal entity of a foreign country that is subject to a hold duration of 12 months, the minimum contribution of 5 percent, and at the minimum, subject to 9 percent CIT for the source country. From which they originate.

The income from a foreign PE is subject to certain conditions and the option to apply an exemption (rather than credit)

Earnings of an individual who is not a resident of the country come from operating ships or aircraft involved in international transport.

These transactions can be subjected to a specific reduction, i.e., effectively an exemption from taxation:

Restructurings and intragroup transactions that qualify as qualifying Entities will be eligible when they hold 75 percent common ownership.

Restructuring relief for businesses under specific conditions.

Transfer Pricing

Related party’s transactions should be carried out under the arm’s-length principle as outlined in Section 34 under the UAE Corporate Tax Law. In addition, it states that the five conventional OECD Transfer Pricing strategies are suitable to help support the arm’s length character of arrangements with related parties and allows the use of alternative methods when needed.

Article 34 provides that when a tax authority adjusts to a foreign country that affects the tax structure of a UAE entity, the application must be submitted to the FTA to request a similar adjustment that allows the UAE firm to be exempt against double taxation. Any adjustments that result from domestic transactions do not require an application.

The requirements for documentation on transfer pricing are covered in Article 55. UAE businesses will have to follow the rules for transfer pricing and the documentation requirements set by OECD Transfer Price Guidelines, which lead to three-tier reports, i.e., master file, local file, and country-by-country reporting. A reference to a controlled transaction disclosure form is provided (details of which are still to be determined).

It should be noted that no thresholds for the materiality of the product are provided. Separate legislation will be released later. Advance pricing plans will become made available via the normal clarification process currently in place.

UAE has introduced provisions requiring the payment and benefits given to persons connected to be tax-deductible in their market value. The same rules are followed in Article 34 of the UAE CIT Law.

Administration & Enforcement

The MoF is the sole authority for purposes of multilateral bilateral or multilateral agreements as well as for the exchange of information between countries.

The FTA is accountable for the corporate tax system’s administration, collection, and application. Fines and penalties are governed under a law known as the Tax Procedures Law.

Companies will require a VAT Registration UAE from the FTA.

Companies that are required to comply with UAE Corporate Tax are required to submit the Corporate Tax return online for every financial year within nine months from the date of the end of that Financial Period. (A financial period generally refers to any financial period that is 12 months long)

Free Zone companies that are subject to CIT at 0 percent CIT must also submit a CT Return.

Foreign Tax Credits

Tax credits for foreign taxation are allowed for Corporate Tax in UAE due as per the Public Consultation Document. Businesses can claim less corporate tax owing and the sum of tax withholding effectively removed. There is no way to carry forward. There will be no credit for taxes paid to the individual Emirate.

Tax Grouping

Fiscal unity or Tax Group: UAE companies can form a “fiscal unity” or Tax Group to serve UAE purposes. The main requirement for a Tax Group is to comply with the (in)direct sharing requirement, which is 95 percent. Free zone entities subject to zero percent cannot join the Tax Group. Additionally, the parent (which may be intermediate) must be a UAE company.

Losses

By article 37 of the UAE Corporate Tax Law, losses can be carried forward for up 75 percent of taxable income. Losses can be transferred between members of the same group of corporations if those entities have 75 percent direct or indirectly owned. Losses cannot be transferred from exempt individuals or entities that are free zone. Loss offsets are also subject to the cap of 75 for businesses that roll forward losses.

Tax-deductible losses may be lost in the event of an ownership change (50 percent or more) if the new owner runs the same or similar Business. The criteria to be considered for this have been established.

Anti-Abuse

UAE will adopt an Anti-Abuse General Rule, also known as “GAAR.” The GAAR applies to cases where one of the primary reasons for a transaction is to gain an income tax benefit for the corporation that is incompatible with the purpose or intent of the UAE Corporate Tax Law.

The FTA will deal with and alter or counteract the transaction. The GAAR only applies to agreements or transactions entered after the UAE Corporate Tax Law is published in the UAE Official Gazette on October 10, 2022, in issue #737.

Summary

With the publication of the UAE Corporate Tax Law and confirmation of a 9% tax rate and a 9% rate, UAE has established a globally competitive rate for Corporate Tax in UAE and confirmed its intention to implement Corporate Tax in June 2023.

It is expected that additional information to be released over the coming months to be fleshed out and provide more excellent knowledge of its implementation. Nevertheless, several key elements are already confirmed, including introducing compulsory transfer pricing rules.

4 notes

·

View notes

Text

**Check Your Plagiarism : Best Plagiarism Services In Ranchi**

In the vibrant academic and professional landscape of Ranchi, maintaining the integrity and originality of work is paramount. “Check Your Plagiarism” offers top-tier plagiarism detection services that ensure your content is authentic and meets the highest standards. This blog delves into the various ways this service helps confirm and preserve originality.

#### Confirm Originality With Reliable Tools

Ensuring originality is essential in academic and professional writing. “Check Your Plagiarism” provides reliable tools that scan your text for any potential overlaps with existing sources. These tools utilize extensive databases to cross-reference your content, confirming its originality. By using advanced technology, you can be confident that your work is free from plagiarism and meets the required standards.

#### Apply Tools For Thorough Research

Thorough research is critical to producing high-quality work. “Check Your Plagiarism” offers tools designed to support comprehensive research efforts. These tools help in detecting any potential similarities or unintentional copying by comparing your content against a wide range of sources. This ensures that your research is thorough, authentic, and free from inadvertent plagiarism.

#### Authenticate Scholarly Work’s Originality Accurately

Academic integrity is crucial in scholarly work. “Check Your Plagiarism” provides accurate tools to authenticate the originality of scholarly texts. By analyzing your work against extensive databases, the tool identifies any potential issues, allowing you to make necessary adjustments. This accuracy is vital for maintaining the credibility of academic submissions and ensuring that all work is genuinely original.

#### Rely On Tools For Publishing

Publishing content requires rigorous checks for originality. “Check Your Plagiarism” supports this process by offering tools that ensure your content is free from plagiarism before submission. These tools provide detailed reports on any detected similarities, helping you address potential issues and ensure that your work is publish-ready and meets the highest standards of originality.

#### Preserve Originality Throughout Research Process

Maintaining originality throughout the research process is essential. “Check Your Plagiarism” helps preserve this by providing tools that monitor and analyze your content for any potential overlaps. By regularly checking your work, you can ensure that all stages of your research are original and free from unintentional plagiarism, contributing to the overall integrity of your research.

#### Boost Scholarly Integrity Using Tools

Scholarly integrity is a cornerstone of academic success. “Check Your Plagiarism” boosts this integrity by offering advanced tools that ensure your work is original and properly cited. These tools help in detecting any potential issues and providing guidance on how to address them, thus enhancing the overall credibility and quality of your scholarly work.

#### Facilitate Rigorous Research With Technology

Technology plays a vital role in facilitating rigorous research. “Check Your Plagiarism” leverages advanced technology to support detailed research efforts. By using state-of-the-art tools, researchers can detect and address any potential plagiarism issues, ensuring that their work is thorough, accurate, and maintains high standards of originality.

#### Ensure Reliable Originality In Publications

Reliable originality is crucial for successful publications. “Check Your Plagiarism” ensures this by offering tools that provide detailed analyses of your content. These tools compare your work against an extensive database to detect any similarities, helping you make necessary revisions before publication. This ensures that your published work is authentic and maintains its credibility.

/media/ce3c92a9f93e124c4aac522b125bd7ef

### FAQs

**1. How does “Check Your Plagiarism” confirm the originality of my work?**

“Check Your Plagiarism” confirms originality by using reliable tools that compare your text against an extensive database of sources. The tool scans for any similarities or overlaps, ensuring that your content is unique. This thorough analysis helps confirm the originality of your work and prevents issues related to plagiarism.

**2. What tools does “Check Your Plagiarism” provide for thorough research?**

“Check Your Plagiarism” offers advanced tools designed for thorough research. These tools compare your content with a wide range of sources, identifying any potential similarities or unintentional copying. By using these tools, you can ensure that your research is comprehensive and that your work is free from inadvertent plagiarism.

**3. How does “Check Your Plagiarism” ensure the accuracy of scholarly work?**

The accuracy of scholarly work is ensured through detailed analysis provided by “Check Your Plagiarism.” The tool compares your text against extensive databases to detect any potential issues. This accurate analysis helps in authenticating the originality of your scholarly work, ensuring that it adheres to academic standards.

**4. Why is it important to rely on “Check Your Plagiarism” tools for publishing?**

Relying on “Check Your Plagiarism” tools for publishing is important because these tools ensure that your content is free from plagiarism before submission. They provide detailed reports on any detected similarities, allowing you to address issues and submit publish-ready, original work that meets the highest standards.

**5. How does “Check Your Plagiarism” help preserve originality throughout the research process?**

“Check Your Plagiarism” helps preserve originality by providing tools that monitor and analyze your work at various stages of the research process. By regularly checking your content for potential overlaps, these tools ensure that your research remains original and free from unintentional plagiarism, contributing to the integrity of your work.

### Conclusion

“Check Your Plagiarism” offers premier plagiarism detection services in Ranchi, supporting the creation of original, high-quality work. With its advanced tools for confirming originality, thorough research, and publishing, this service ensures that your work maintains high standards of integrity and credibility. For reliable plagiarism prevention and to enhance your research and writing, consider using “Check Your Plagiarism.”

“Like, Share, Subscribe for Plagiarism Solutions.”

Check Your Plagiarism Youtube channel offers valuable insights, tutorials, and expert advice on preventing plagiarism, enhancing manuscript quality, and protecting your reputation in academic and professional circles. By subscribing, you’ll gain access to tips on how to use “Check Your Plagiarism” effectively, updates on new features, and strategies for maintaining originality in your writing. Don’t miss out — join our community of dedicated writers, researchers, and professionals committed to producing high-quality, plagiarism-free content!

0 notes

Text

Navigating Social Media Algorithms: Tips for Better Marketing Outcomes

Better marketing results in digital marketing depend on knowing and adjusting to social media algorithms. Social media algorithms are the unseen forces guiding users' view, access frequency, and interaction with material. Learning these algorithms can help social media marketing firms like Digital Cappuccino distinguish between a campaign that soars and one that fails. Here's how you properly negotiate these algorithms.

Prioritise Engagement

Content that encourages user participation takes the stage on social networking sites. Content is more likely to be pushed to a larger audience the more likes, comments, shares, and saves it earns. To increase significant involvement, Digital Cappuccino promotes producing interactive materials like competitions, quizzes, and polls for viewers.

Optimise Posting Time

In social media marketing, timing rules everything. Since algorithms often favor recent postings, providing material when your audience is most engaged is essential. Using sophisticated analytics techniques, Digital Cappuccino finds periods of most activity for your target market and plans postings in the queue. This approach raises your chances of quick participation, thereby improving the exposure of your material.

Use Video Material

Social media algorithms favour video content more because of its better engagement rates. Video content that retains people on platforms like Instagram, Facebook, and TikHub is a top priority for these platforms. Digital Cappuccino shines in producing engaging, shareable films that appeal to viewers, including instructional, behind-the-scenes footage and live streaming, therefore fostering engagement.

Apply Hashtags Deliberately.

One very effective strategy for raising content discoverability is hashtags. To increase the reach of your material, Digital Cappuccino advocates combining popular and specific hashtags pertinent to your company. Still, the emphasis should be on a few properly selected hashtags that fit the interests of your target audience, therefore avoiding the dangers of stuffing posts with too many hashtags.

Stay Consistent.

Developing a great social media profile calls for consistency. Frequent publication of high-quality material indicates to algorithms that your profile is active and relevant, therefore raising the possibility of your posts being seen by more people. Digital Cappuccino helps companies create a content schedule to guarantee a consistent supply of exciting ideas.

Adjust for Algorithm Changes

Social media algorithms are constantly changing. Hence, it is essential to be current on the most recent developments. By tracking industry news, platform upgrades, and insights, Digital Cappuccino remains ahead of the curve and can rapidly modify plans for more significant outcomes. For example, Digital Cappuccino changed its strategy quickly to keep ahead when Instagram turned to give original content priority.

Review and hone your plan.

Understanding what works and what doesn't depends on routinely reviewing your social media metrics. Digital Cappuccino specialises in spotting excellent material and honing techniques based on thorough study. Different post forms, captions, and images in A/B testing offer insightful analysis that helps to continuously optimise.

In summary,

Navigating social media algorithms calls for a combination of strategic preparation, inventiveness, and flexibility. Digital Cappuccino's knowledge helps social media marketing firms prioritise interaction, optimise posting schedules, use video content, and keep updated about algorithm changes, thus optimising content reach and obtaining better marketing results. The secret is to be adaptive and sensitive to the constantly shifting digital terrain.

FAQs

1.How can I stay updated with regular algorithm updates on social networking sites?

Following professional advice from organisations like Digital Cappuccino and being updated via industry news and platform upgrades will enable you to react fast to algorithm changes.

2.How does content quality help one negotiate social media algorithms?

Good content is essential as it not only motivates interaction but also tells algorithms that your material is worth advertising to a larger audience.

3.Does succeeding with social media algorithms require using sponsored promotions?

Although organic reach is conceivable, combining it with sponsored campaigns can improve awareness, particularly when aiming for certain groups or increasing very successful material.

4.What differences exist between the algorithms of many social media platforms?

Every network has different algorithmic priorities; for example, Instagram could give visual materials like images and videos top priority, while Twitter might concentrate more on real-time interaction with retweets and comments.

#digital cappuccino canada#social media marketing agency Canada#social media marketing company Canada#social media marketing company in Canada

0 notes

Text

0 notes

Text

#Sense Of Cents#Personal Finance#Investing#Side Hustle#Budgeting#Finance#Savings#Retirement#Retirement Planning

0 notes

Text

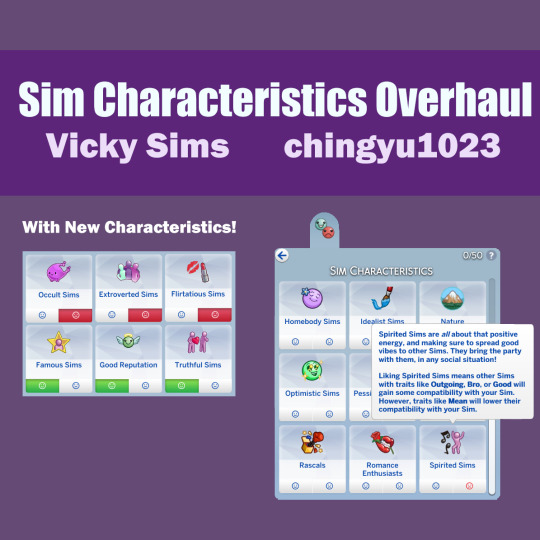

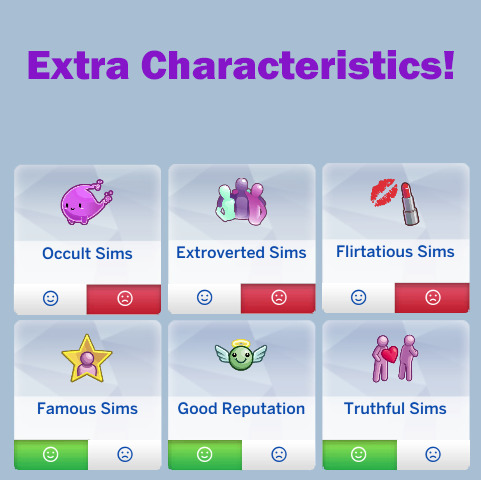

Sim Characteristics Overhaul

👥 This brings New Sim Characteristics and overrides how EA's Sim Characteristics are impacted by traits from the Growing Together pack.

Extra Custom Characteristics of Occults, Fame, Reputation, Extroverted, Flirtatious, and Truthful Sims.

The "Original" version adjusts how much each trait impacts characteristics, and added my custom traits and some missing EA traits, lifestyles, and preferences

The "Conflict Overhaul" version includes all the above PLUS removes some strange conflict choices by EA. This removes conflicts between Creative & Genius in Cerebral Sims & Idealist Sims, removes Lazy from Nature Enthusiasts, Evil from Pet Enthusiasts, Cheerful from Egotistical Sims, etc.

It is not a requirement to use this mod with my custom traits, but Sim Characteristics are now also impacted by the following traits pack if you installed them:

100 Base-Game Traits

Absent Emotion Traits

Faithfulness Traits

Seasons Traits

Sims Qualities

Supernatural Traits

Traits Remade In CAS

EA Traits As Reward

Pet Enthusiasts also include all negative Cats & Dogs Traits from ilkavelle.

👑 Mod Info (Read about each sim characteristic)

🧡 Download HERE Now!

Public Access: May 20

🔆 CHANGELOG IN APRIL 2023 HERE

🔹 Links to ALL My Traits, Game Mods, and CCs

🔹List of IDs for creators who want to refer my traits to their own mods

🔹 List of Chingyu’s CC Traits Name and Descriptions for mod users

🔹 Check Mod Status after a patch & Compatibilities

👁🗨 Learn how to install a mod & FAQs

👁🗨 Terms of Use

👁🗨 Ask Questions/ Suggestions/ Bug Reports on Discord

▶ I need to see a screenshot or LE report to help you figure out what’s wrong!

👁🗨 Download on my Patreon

👁🗨 Follow me on Twitter

#growing together#the sims 4 growing together#ts4 infants#the sims 4 infants#sims 4 infants#ts4 download#ts4 finds#s4cc finds#cc finds#ts4ccfinds#s4ccfinds#s4cc download#sims 4 download#ts4 cc download#s4 download#ts4 cc#ts4cc#traits#ts4 news#sims 4 traits#trait#ts4 gameplay#the sims 4 news#thesims4#the sims 4#the sims cc#sims 4#sims community#s4cc#game mod

678 notes

·

View notes

Text

NAVIGATING NEW TAX LEGISLATION: YOUR PATH TO CLARITY AND OPPORTUNITY

The tax landscape is constantly evolving, and keeping up with new legislation can feel like a daunting task. But fear not! This blog post serves as your guide to navigating the latest tax changes, helping you achieve clarity and uncover potential opportunities.

Understanding the New Landscape:

The first step is to gain a clear understanding of the recently introduced tax laws. Here are some key points to consider:

Effective Dates: Identify the starting point for the new legislation. Are the changes retroactive, or do they apply to future tax years?

Eligibility: Determine who is affected by the changes. Does the new legislation apply to individuals, businesses, or both? Are there specific income thresholds or business types to consider?

Impact on Filings: Explore how the new legislation might affect your tax return or business filings. Are there new forms to complete or deductions/credits to be aware of?

Finding Reliable Resources:

Navigating new tax laws requires access to accurate and reliable information. Here are some valuable resources to get you started:

Government Websites: The IRS website for the US or your local tax authority website often provide detailed explanations and FAQs about new legislation.

Tax Professionals: Consulting a tax professional experienced in the recent changes can offer personalized guidance and ensure you take advantage of all applicable benefits.

News and Industry Publications: Stay informed by following reputable news outlets and industry publications that cover tax law updates.

Turning Change into Opportunity:

New tax legislation can sometimes present unexpected opportunities for tax savings or strategic planning. Consider the following:

Deductions and Credits: Explore any new deductions or credits introduced by the legislation. Could you benefit from these tax breaks for business expenses, charitable donations, or other categories?

Investment Strategies: Certain tax changes might incentivize specific investment strategies. Research any new investment opportunities that could align with your financial goals.

Tax Planning Adjustments: Review your existing tax plan and adapt it based on the changes. Consulting a tax professional can help you tailor your strategy for optimal tax efficiency.

Embrace Clarity and Move Forward:

By taking the time to understand and navigate new tax legislation, you empower yourself to make informed financial decisions. Remember, knowledge is power! Don't let tax changes create confusion or missed opportunities.

Take Action:

Bookmark the websites of reliable tax resources.

Schedule a consultation with a tax professional to discuss your specific situation.

Start researching potential deductions, credits, or investment strategies related to the new legislation.

By putting these steps into action, you can confidently navigate the new tax landscape and pave your path to clarity and opportunity.

visit our site : https://gns-cpas.com/navigating-new-tax-legislation-your-path-to-clarity-and-opportunity/

0 notes

Text

Reasons Why Our English School in Los Angeles Stands Out

Our English school in Los Angeles is dedicated to providing an outstanding educational experience for students from all over the world. Here are the key reasons why our school stands out:

Expert Faculty and Personalized Instruction

Our faculty members are highly qualified, with advanced degrees in education and linguistics, and extensive experience in teaching English as a Second Language (ESL). They use innovative teaching methods tailored to meet the individual needs of our students, ensuring each learner receives personalized attention and support. Small class sizes allow for a more interactive and engaging learning environment, where instructors can focus on each student's progress and address their unique challenges.

Comprehensive and Dynamic Curriculum

Our curriculum is meticulously designed to cover all aspects of the English language, including speaking, listening, reading, and writing. We offer a wide range of courses from beginner to advanced levels, ensuring that students can find programs that match their proficiency and learning goals. The curriculum is dynamic and updated regularly to incorporate the latest trends and methodologies in language teaching. We also provide specialized courses, such as business English and test preparation, to cater to specific needs and objectives.

State-of-the-Art Facilities and Resources

Our school boasts state-of-the-art facilities that enhance the learning experience. Classrooms are equipped with the latest technology to support interactive learning, including smart boards, multimedia projectors, and computer labs. Our library and resource centers offer a vast collection of books, journals, and digital resources, providing students with ample materials for further study. Additionally, we have comfortable study areas and common spaces where students can collaborate and practice their language skills in a relaxed setting.

Supportive and Inclusive Community

We pride ourselves on fostering a supportive and inclusive community where students from diverse cultural backgrounds feel welcomed and valued. Our staff and instructors are dedicated to creating a positive and encouraging environment that promotes mutual respect and understanding. We offer various support services, including academic advising, counseling, and extracurricular activities, to help students adjust to life in Los Angeles and succeed in their studies. Our community activities, such as cultural events, language exchange programs, and social gatherings, provide students with opportunities to practice their English skills and build lasting friendships.

Prime Location in Los Angeles

Our school is strategically located in the heart of Los Angeles, offering students easy access to a vibrant, multicultural city. Los Angeles is known for its diverse population, rich cultural scene, and numerous educational and recreational opportunities. Students can immerse themselves in the city's dynamic environment, practice their English in real-life settings, and explore world-renowned attractions. The city's extensive public transportation network also makes it convenient for students to commute and explore different neighborhoods.

Strong Alumni Network and Career Support

Our alumni network is a testament to the success of our programs. Many of our former students have gone on to achieve their academic and professional goals, and they often return to share their experiences and mentor current students. This network provides valuable connections and support for students during and after their studies. We also offer career support services, including resume workshops, interview preparation, and job placement assistance, to help students transition smoothly from education to employment.

Frequently Asked Questions (FAQs)

What levels of English courses do you offer?

We offer a wide range of courses from beginner to advanced levels. Our curriculum is designed to cater to the needs of all students, regardless of their initial proficiency in English. Specialized courses such as business English and test preparation are also available.

How do you support students who are new to Los Angeles?

We provide a variety of support services to help students adjust to life in Los Angeles, including orientation sessions, housing assistance, and cultural adjustment workshops. Our staff is dedicated to helping students feel comfortable and make the most of their time in the city.

What kind of extracurricular activities do you offer?

We offer a range of extracurricular activities, including cultural outings, language exchange programs, and clubs. These activities provide students with opportunities to practice their English skills in informal settings, build friendships, and experience the local culture.

What are the qualifications of your instructors?

Our instructors are highly qualified, holding advanced degrees in education and linguistics. They have extensive experience in teaching English as a Second Language and are committed to continuous professional development to stay current with the latest teaching methodologies.

conclusion

In conclusion, our English school in Los Angeles stands out due to its expert faculty, comprehensive curriculum, modern facilities, supportive community, prime location, and strong alumni network. We are committed to providing our students with the best possible education and support to help them achieve their language learning goals and succeed in their personal and professional lives.

Twitter Pinterest Youtube

Facebook Instagram

0 notes

Note

Your answer on 10/11 got me thinking. How often does the math change on an ability or combat? Will some sort of adjustment be made every patch or is it accumulated into a major patch or expansion pack?

We won't change every aspect of the formula every update, but it's uncommon for us not to touch or tweak anything at all between updates. This is, in part, because we need to tune the new content for the update, which often has interactions with older content. Some new piece of gear with a cool new ability might have a synergistic interaction with an older piece of gear, so we may need to put in safeguards around that interaction to prevent players breaking the power curve. We won't always tell you about these kind of changes in the patch notes either - we usually want players to discover these new interactions, rather than get spoiled on them.

We usually save balance changes for regular content updates. That's usually once every month for mobile, or once every three months for console/PC. This way we have enough time to design, build, and test the changes before they reach the public. Stability is the most important thing to maintain near launch. If a feature or a particular change is deemed dangerous or unstable, it's not uncommon for production to pull those features or changes from the update and bump it to the next instead. This last-minute scope change is often what makes some content patches lighter and others heavier.

[Join us on Discord] and/or [Support us on Patreon]

Got a burning question you want answered?

Short questions: Ask a Game Dev on Twitter

Long questions: Ask a Game Dev on Tumblr

Frequent Questions: The FAQ

11 notes

·

View notes

Text

Why Choose Butt Buddy? A Closer Look at Their Top Bidet Products

In the quest for a more comfortable and hygienic bathroom experience, Butt Buddy products stand out as a top choice. From bidet attachments to toilet seat covers, these innovative solutions cater to a variety of needs, ensuring cleanliness and convenience. Let's dive into the different products Butt Buddy offers and see how they can transform your bathroom routine.

Bidet Attachments for Toilet with Warm Water

The bidet attachment for toilet warm water is a game-changer. It provides a soothing and effective cleaning experience, ensuring that you feel fresh and clean every time you use the bathroom. The warm water feature adds an extra level of comfort, especially during colder months.

Heated Bidet Attachment

Taking comfort to the next level, the heated bidet attachment ensures that the water temperature is just right. No more cold surprises during your cleaning routine! This attachment offers adjustable settings, allowing you to customize the temperature to your preference.

Toilet Seat Cover

The toilet seat covers from Butt Buddy are made with comfort and hygienic design in mind. These covers guarantee a clean surface every time since they are simple to apply and create a barrier between you and the toilet seat. They are ideal for bathrooms, both private and public.

Bidet Bottle

For those who prefer a portable solution, the bidet bottle is an excellent choice. This handy tool is perfect for travel or when you're on the go, ensuring that you can maintain your hygiene standards no matter where you are.

Paper Toilet Seat Cover

Paper toilet seat covers are a practical and throwaway way to keep public restrooms hygienic. They offer a barrier between you and the toilet seat that is easy to carry and use.

Bidet Attachment with Warm Water

Similar to the warm water bidet attachment, this product offers the added benefit of adjustable water temperature. It ensures a comfortable and effective cleaning experience, making your bathroom routine more enjoyable.

Bidet Seat Attachment

The bidet seat attachment combines the features of a bidet and a toilet seat. It offers a comprehensive cleaning solution with the added comfort of a specially designed seat. This attachment is easy to install and provides an enhanced bathroom experience.

Bidet Toilet Attachment

The bidet toilet attachment is a simple yet effective solution for improving bathroom hygiene. It can be easily installed on most standard toilets and provides a refreshing clean with every use.

Warm Water Bidet Attachment

This attachment focuses on delivering a warm water cleaning experience. It is perfect for those who want to avoid the discomfort of cold water, especially during colder seasons.

Enhance your bathroom experience with Butt Buddy products and enjoy the comfort, cleanliness, and convenience they bring to your daily routine. Whether you're looking for a basic bidet attachment or a luxurious heated option, Butt Buddy has you covered.

Frequently Asked Questions (FAQ)

Q: How do I install a bidet attachment on my toilet?

A: Installation is straightforward and usually involves connecting the attachment to your existing water supply and securing it to the toilet seat. Most products come with detailed instructions and all necessary hardware.

Q: Are Butt Buddy products compatible with all toilet models?

A: Butt Buddy products are designed to be compatible with most standard toilet models. However, it's always a good idea to check the specifications before purchasing.

Q: Can I adjust the water temperature on the warm water bidet attachments?

A: Yes, many of the warm water bidet attachments come with adjustable settings, allowing you to control the water temperature for a comfortable experience.

Q: Are the toilet seat covers reusable?

A: Butt Buddy offers both reusable and disposable toilet seat covers. The reusable covers are easy to clean and maintain, while the disposable ones are convenient for single use, especially in public restrooms.

Q: Is the bidet bottle suitable for travel?

A: Absolutely! The bidet bottle is designed to be portable and is perfect for maintaining hygiene while traveling.

Q: How do I maintain and clean my bidet attachment?

A: Generally, regular cleaning with a light soap and water is adequate.. Avoid using harsh chemicals that could damage the attachment.

Q: Do heated bidet attachments consume a lot of electricity?

A: Heated bidet attachments are designed to be energy-efficient. They only use electricity when the heating function is active and often come with energy-saving features.

1 note

·

View note

Text

Why Choose the Cheapest Countries to Live In?

Choosing to reside in one of the cheapest countries to live in is about enhancing your life without emptying your money, not only about cost-saving. These nations may provide shockingly high standards of living, which lets you savour a way of life full of travel, cultural immersion, and unusual events that may be beyond reach in more costly countries. These places enable you to live more for less, from enjoying great local food without a big price tag to getting healthcare and education at a fraction of the cost.

Discover and flourish: The Top 10 Cheapest Countries to Live and Work from

1. Vietnam

Accept the vivid culture and breathtaking surroundings of Vietnam. Apart from being reasonably priced, the nation provides expats with a low cost of living and a great standard of living. Either working in tourism or teaching English might offer a nice way of life here.

2. Costa Rica.

Experience the real Costa Rica has to offer, with welcoming locals and affordable, basic living. This is a great option for people seeking warm temperatures and biodiversity because of the balance between slightly higher costs and pay.

3. Bulgaria

Bulgaria is one of Europe's economic jewels; it provides the old continent's appeal at far less expense. History lovers and urban adventurers seeking a low-cost lifestyle will find the nation ideal.

4. Mexico

From busy markets to peaceful beaches, Mexico presents a varied way of life with plenty of cultural value at reasonably priced rates. Living here lets you have a good quality of life for little money spent.

5. South Africa:

Affordable English-speaking South Africa provides a smooth adjustment for ex-pats, filled with breathtaking scenery and a cosmopolitan environment fit for both budget-conscious and energizing.

6: China

China's fast-growing economy presents many chances for foreigners to work, particularly in technology and education, all while appreciating the low cost of living away from the main cities.

7. South Korea

Renowned for its technological innovations and vibrant culture, South Korea is where modern conveniences meet history at a reasonable cost, with many jobs having housing allowances.

8. Thailand

Because of its varied selection of experiences—from vibrant city life to breathtaking natural landscapes—and its incomparable rates, Thailand continues to be a popular destination for budget visitors. Apply Now

9. Peru

With its diverse economy and vibrant culture, Peru offers a wealth of options to its citizens and workers, while also being one of the most cheap South American countries.

10. Poland

With the extra advantage of being within travel distance of several European nations, Poland presents a far lower cost of living than Western Europe, despite being a quite popular destination within Europe.

Visa Collect: Your Global Relocation Partner

VisaCollect streamlines the visa application procedure, therefore improving your path to residing in one of the cheapest countries to live in. From thorough advice on particular visa requirements for your selected location to help with document preparation and application submission, VisaCollect is committed to making your change as seamless and stress-free as it can be. Supported by VisaCollect's experience, embrace overseas living with confidence.

Living Abroad Made Simple

With some planning, adjusting to living in a foreign nation can be easy.

Live like a local: Live like a local to save money; use public transport, eat locally grown food, and shop where residents shop.

Join groups of expatriates: Gain great help navigating your new home from the shared knowledge and experience of expat groups.

Plan Economically: To guarantee a worry-free stay, track spending, and make emergency plans.

With the correct planning and a VisaCollect partner, you could enjoy the positive aspects of living abroad.

FAQs

What kind of visa is required to work in the cheapest countries to live in?

The destination country will determine the kind of visa needed. Usually, one needs either specific work permission or a working holiday visa. VisaCollect can offer particular advice depending on the nation you decide to relocate to.

In these countries, how do I approach healthcare?

Healthcare rules differ nationally. Generally speaking, expats may find local healthcare insufficient or inaccessible. Hence, you will most likely need foreign health insurance. For every one of the top 10 cheapest countries to live in, VisaCollect can recommend the best insurance policies.

Can a foreign visitor open a bank account here?

Yes, most of the time, opening a bank account as a foreigner is allowed. Usually needing proof of address, a passport, and occasionally a minimum payment, requirements differ.

How does one find accommodation in these nations?

Finding a place might range from looking on internet sites to working with local real estate brokers. Local contacts and expat groups can also supply insightful information and leads in nations such as Vietnam and Thailand.

For those looking to live abroad, are these nations safe?

Although these nations are generally secure for foreigners, as elsewhere on the globe, it's still wise to follow basic safety guidelines.

How can I guarantee seamless cultural blending?

Interact with nearby towns, pick up the fundamental local language skills, and grasp local cultural standards and expectations. VisaCollect can make arrangements for advantageous attendance at cultural orientation events or intercultural communication training.

How can I be ready for the typical difficulties expats in these nations experience?

Common difficulties include language limitations, cultural changes, and legal and financial matters under bureaucratic procedures. Researching thoroughly and consulting businesses like VisaCollect helps one prepare by overcoming these obstacles.

Under a working holiday visa, could I bring my family?

This relies on the particular country's rules and visa. While some nations allow dependents on a working holiday visa, others do not. VisaCollect can offer comprehensive information, depending on your particular circumstances.

Expatriates in these nations have what type of support system at hand?

Most of these nations have strong expat populations, and frequent meetings, internet forums, and social events combined with VisaCollect can assist you in linking yourself to these networks so that, upon arrival, you have support.

Could you please tell me how long it takes to get a visa for these countries?

The particular visa type and the nation will substantially affect the visa processing periods. It could last a few weeks to several months. VisaCollect offers estimations depending on your selected destination and current schedules and helps to simplify this process.

0 notes