#RDMaturityCalculator

Explore tagged Tumblr posts

Text

RD Interest Calculator: Maximize Your Returns with Smart RD Planning

Are you looking for a safe and effective way to grow your savings? A Recurring Deposit (RD) is a fantastic option for individuals who want disciplined savings with guaranteed returns. But how do you know how much you will earn at the end of your RD tenure? That’s where an RD Interest Calculator comes in handy.

In this guide, we’ll answer all your questions about RDs and how to use an RD maturity calculator to plan your investments wisely.

What is a Recurring Deposit (RD)?

A Recurring Deposit (RD) is a fixed-income investment option where you deposit a fixed amount every month for a pre-defined period. At maturity, you receive the total savings along with the accumulated interest.

RDs are popular among individuals looking for risk-free savings with assured returns. However, calculating the maturity amount manually can be challenging. This is where an RD calculator simplifies things for you.

How is RD Interest Calculated?

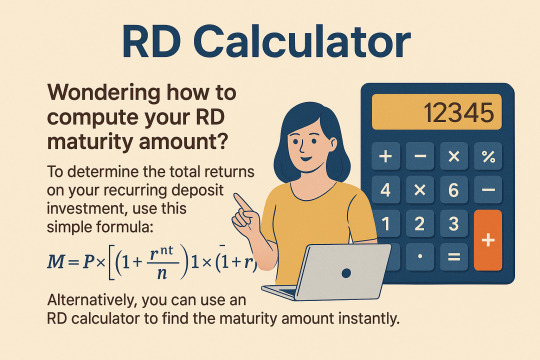

Banks and financial institutions use a standard recurring deposit formula to determine the maturity amount:

Where:

M = Maturity Amount

P = Monthly Deposit

r = Annual Interest Rate (in decimal form)

n = Number of times interest is compounded in a year

t = Tenure in years

Manually solving this formula can be complex, but an RD interest calculator instantly computes the exact amount you will receive at maturity.

Why Should You Use an RD Interest Calculator?

Many investors ask: Why use an online RD calculator when I can calculate it manually? Here’s why:

Saves Time: Manual calculations are time-consuming and prone to errors.

Accurate Results: An RD calculator provides precise results without mistakes.

Easy Comparisons: You can compare different RD plans from various banks instantly.

Financial Planning: Helps you strategize your savings based on expected returns.

Instant Maturity Calculation: Get to know the exact amount you will receive at the end of the tenure.

How to Use an RD Maturity Calculator?

Using an RD maturity calculator is super simple. Just follow these steps:

Enter Monthly Deposit Amount – The fixed amount you will invest each month.

Choose the Interest Rate – Input the applicable interest rate offered by the bank.

Select the Tenure – Choose the duration (e.g., 6 months, 1 year, 5 years, etc.).

Compounding Frequency – Select whether the interest is compounded quarterly, half-yearly, or annually.

Click Calculate – The tool will instantly show your total maturity amount along with the interest earned.

RD vs. Fixed Deposit (FD): Which One is Better?

RD vs. Fixed Deposit (FD): Which One is Better?

A common question among investors is: Should I go for an RD or an FD?

Deposit Type:

RD: Monthly Contributions

FD: One-time Lump Sum

Interest Calculation:

RD: Compound Interest

FD: Compound Interest

Flexibility:

RD: Higher (Monthly Investments)

FD: Less Flexible

Best For:

RD: Salaried Individuals

FD: Individuals with a Lump Sum

If you prefer monthly savings, an RD is a great choice. But if you have a lump sum, Fixed Deposits (FDs) may offer slightly better interest rates.

FAQs on Recurring Deposit Interest Calculator

1. Can I use an RD calculator for any bank?

Yes! An RD interest calculator works for all banks, including SBI, HDFC, ICICI, and more. Just enter the bank’s applicable interest rate to get accurate results.

2. Does RD have a lock-in period?

Most banks allow premature withdrawal, but a penalty may apply. The lock-in period varies from bank to bank.

3. Is RD better than SIP?

RD is a safer option as it offers fixed returns, whereas Systematic Investment Plans (SIPs) are linked to market fluctuations. Choose RD if you prefer stability, and SIP if you seek higher but uncertain returns.

4. How does compounding work in RD?

Interest in RD is compounded quarterly. This means every three months, your interest is added to the principal, helping your money grow faster.

Conclusion: Plan Your RD Wisely!

A Recurring Deposit Calculator is an essential tool to maximize your RD returns smartly. Whether you’re planning for a short-term goal or a long-term financial strategy, an RD is a secure way to grow your savings steadily.

Ready to invest? Use an RD maturity calculator today and take control of your financial future!

#RecurringDeposit#RDCalculator#RDMaturityCalculator#InvestmentPlanning#CompoundInterest#MoneyManagement#WealthBuilding#SmartInvesting#BankingTips#SecureInvestments

0 notes