#RecurringDeposit

Explore tagged Tumblr posts

Text

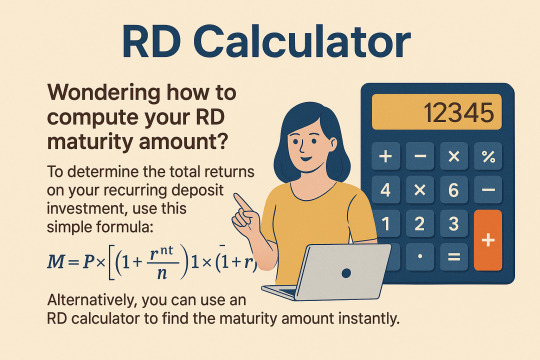

RD Calculator: Plan Your Savings with a Recurring Deposit Calculator

An rd calculator is your personal savings companion. In just a few taps, this tool shows exactly how much your monthly deposits will grow, taking the guesswork out of planning. A good recurring deposit calculator helps you see your total contributions, interest earned, and final payout—all without confusing formulas. Whether you’re building an emergency fund or saving for a dream trip, an rd calculator puts you in control from day one.

How Does an RD Calculator Work?

Let’s break down the magic:

Monthly Instalment (P): You enter how much you’ll save each month.

Interest Rate (R): Add the annual rate your bank or post office offers.

Tenure (t): Choose how many months or years you’ll keep saving.

Hit “Calculate,” and your rd calculator uses a built‑in rd calculator formula to deliver:

Total Deposits you’ve made

Interest Earned over time

Maturity Amount you’ll receive

No more paper calculations—this recurring deposit calculator does the math for you in seconds.

Why Use a Recurring Deposit Calculator?

An rd interest calculator feature brings extra clarity:

Instant Insights: See your maturity amount right away.

Error‑Free Answers: Avoid mistakes that cost you money.

Side‑by‑Side Comparison: Plug in different rates or tenures to find the best deal.

Goal Tracking: Match your monthly instalment to your savings target.

Pairing this recurring deposit calculator with smart planning helps you stay on track and worry‑free.

Understanding the RD Calculator Formula

Behind every rd calculator is a simple compound interest model. Here’s the rd calculator formula.

A = P × (1 + R/N)^(N × t)

A = Final maturity amount

P = Monthly instalment

R = Annual interest rate (in decimal form)

N = Number of compounding periods per year (usually 4)

t = Time in years

This rd calculator formula multiplies each instalment by compound growth, giving you an accurate result every time.

Top Benefits of an RD Maturity Calculator

A dedicated RD maturity calculator offers powerful perks:

Time‑Saver: No manual math—get results in a flash.

Accurate Results: Relies on the proven rd calculator formula for precision.

Flexible Planning: Experiment with instalments or tenure until your plan fits.

Visual Breakdown: Some tools show charts or tables to track principal vs. interest.

Mobile Access: Use your RD maturity calculator on any device for on‑the‑go planning.

With an RD maturity calculator, you make savings decisions confidently and quickly.

Simple Steps to Plan with Your RD Calculator

Step 1: Open the rd calculator on your device.

Step 2: Enter your monthly savings (P).

Step 3: Input the interest rate (R) and choose compounding frequency.

Step 4: Set your tenure (t) in months or years.

Step 5: View your maturity amount plus total interest earned.

Use this rd calculator anytime you want to compare new rates or update your goals.

FAQs

Q1: What makes an rd calculator different from an FD calculator? An rd calculator handles fixed monthly instalments, while an FD calculator works with a one‑time lump sum.

Q2: How often should I use the rd interest calculator? Re‑run it whenever interest rates change or you adjust your deposits or tenure.

Q3: Can I compare multiple plans with a recurring deposit calculator? Yes! Simply enter different rates or tenures to see which option gives you the best maturity amount.

Q4: Do I need to know the rd calculator formula? No. The formula runs in the background—you just enter numbers and get instant, accurate results.

Conclusion

An RD calculator is a simple online tool that estimates your recurring deposit maturity amount in seconds. Just enter your monthly instalment, interest rate, and tenure, and the recurring deposit calculator shows your total deposits, interest earned, and final payout. It uses a compound-interest formula behind the scenes, eliminating manual errors and saving time. You can adjust rates and tenures to compare different plans and match your savings goals. Many tools even provide an amortization breakdown and mobile access. By using an RD calculator, you gain clarity, choose the best option, and confidently track your progress toward a secure financial future.

#investing#calculator#rd calculator#recurringdeposit#recurringrevenue#recurring income#recurring payments#investsmart#investment

0 notes

Text

RD Interest Calculator: Maximize Your Returns with Smart RD Planning

Are you looking for a safe and effective way to grow your savings? A Recurring Deposit (RD) is a fantastic option for individuals who want disciplined savings with guaranteed returns. But how do you know how much you will earn at the end of your RD tenure? That’s where an RD Interest Calculator comes in handy.

In this guide, we’ll answer all your questions about RDs and how to use an RD maturity calculator to plan your investments wisely.

What is a Recurring Deposit (RD)?

A Recurring Deposit (RD) is a fixed-income investment option where you deposit a fixed amount every month for a pre-defined period. At maturity, you receive the total savings along with the accumulated interest.

RDs are popular among individuals looking for risk-free savings with assured returns. However, calculating the maturity amount manually can be challenging. This is where an RD calculator simplifies things for you.

How is RD Interest Calculated?

Banks and financial institutions use a standard recurring deposit formula to determine the maturity amount:

Where:

M = Maturity Amount

P = Monthly Deposit

r = Annual Interest Rate (in decimal form)

n = Number of times interest is compounded in a year

t = Tenure in years

Manually solving this formula can be complex, but an RD interest calculator instantly computes the exact amount you will receive at maturity.

Why Should You Use an RD Interest Calculator?

Many investors ask: Why use an online RD calculator when I can calculate it manually? Here’s why:

Saves Time: Manual calculations are time-consuming and prone to errors.

Accurate Results: An RD calculator provides precise results without mistakes.

Easy Comparisons: You can compare different RD plans from various banks instantly.

Financial Planning: Helps you strategize your savings based on expected returns.

Instant Maturity Calculation: Get to know the exact amount you will receive at the end of the tenure.

How to Use an RD Maturity Calculator?

Using an RD maturity calculator is super simple. Just follow these steps:

Enter Monthly Deposit Amount – The fixed amount you will invest each month.

Choose the Interest Rate – Input the applicable interest rate offered by the bank.

Select the Tenure – Choose the duration (e.g., 6 months, 1 year, 5 years, etc.).

Compounding Frequency – Select whether the interest is compounded quarterly, half-yearly, or annually.

Click Calculate – The tool will instantly show your total maturity amount along with the interest earned.

RD vs. Fixed Deposit (FD): Which One is Better?

RD vs. Fixed Deposit (FD): Which One is Better?

A common question among investors is: Should I go for an RD or an FD?

Deposit Type:

RD: Monthly Contributions

FD: One-time Lump Sum

Interest Calculation:

RD: Compound Interest

FD: Compound Interest

Flexibility:

RD: Higher (Monthly Investments)

FD: Less Flexible

Best For:

RD: Salaried Individuals

FD: Individuals with a Lump Sum

If you prefer monthly savings, an RD is a great choice. But if you have a lump sum, Fixed Deposits (FDs) may offer slightly better interest rates.

FAQs on Recurring Deposit Interest Calculator

1. Can I use an RD calculator for any bank?

Yes! An RD interest calculator works for all banks, including SBI, HDFC, ICICI, and more. Just enter the bank’s applicable interest rate to get accurate results.

2. Does RD have a lock-in period?

Most banks allow premature withdrawal, but a penalty may apply. The lock-in period varies from bank to bank.

3. Is RD better than SIP?

RD is a safer option as it offers fixed returns, whereas Systematic Investment Plans (SIPs) are linked to market fluctuations. Choose RD if you prefer stability, and SIP if you seek higher but uncertain returns.

4. How does compounding work in RD?

Interest in RD is compounded quarterly. This means every three months, your interest is added to the principal, helping your money grow faster.

Conclusion: Plan Your RD Wisely!

A Recurring Deposit Calculator is an essential tool to maximize your RD returns smartly. Whether you’re planning for a short-term goal or a long-term financial strategy, an RD is a secure way to grow your savings steadily.

Ready to invest? Use an RD maturity calculator today and take control of your financial future!

#RecurringDeposit#RDCalculator#RDMaturityCalculator#InvestmentPlanning#CompoundInterest#MoneyManagement#WealthBuilding#SmartInvesting#BankingTips#SecureInvestments

0 notes

Text

Are you preparing for a banking interview? Then you must know the difference between Recurring Deposit (RD) & Fixed Deposit (FD)!

Both are great saving options, but which one is better? It depends on financial goals, tenure, and liquidity.

Watch the latest episode of Common Banking Interview Questions and master this concept in seconds!

💡 Pro Tip: Know the pros and cons of both and be ready to explain their best use cases!

Want us to cover another topic? Let us know in the comments!

#BankingInterview#FinanceEducation#BankingBasics#InterviewPrep#MoneyManagement#IPB#RDvsFD#FixedDeposit#RecurringDeposit#InterviewPreparation#BankingJobs#FinanceTips#BankExam#bankinterview#InstituteofProfessionalBanking#SmartSavings#CareerInBanking#BankingAwareness#BankingConcepts#1lakhbankersby2030

0 notes

Text

In the domain of secure investments, Fixed Deposits (FD) and Recurring Deposits (RD) stand apart as tried and true monetary instruments. This article intends to give a complete manual for FD and RD, revealing insight into what they are, the manner by which they work, and the factors to consider while investigating the best FD rates, especially from presumed banks like SBI.

Know More: https://shorturl.at/aepM8

0 notes

Text

Secure your financial future with Recurring Deposits—a simple, disciplined savings option. Enjoy fixed returns, flexibility, and automation for hassle-free wealth accumulation. Start building your financial foundation today.

Visit Us: https://www.mcfinserve.com/ Download Our Application: https://play.google.com/store/apps/details?id=com.mcfinancial

#recurringdeposit#mcfinancialservices#recurring#finance#savings#rd#investments#moneytransfer#gold#money#investment#financialfreedom#business#loan#financialplanning#businessloan

0 notes

Text

Recurring Deposit Interest Rates:৫ বছরের রেকারিং ডিপোজিটে পোস্ট অফিস, SBI, HDFC Bank এর মধ্যে কোথায় বেশি টাকা পাবেন? - TAKAPOYSANEWS

0 notes

Text

Looking for reliable financial solutions in Mettupalayam? Chit funds are a secure and flexible option for individuals and businesses seeking disciplined savings and quick financial support. With trusted chit fund companies in Mettupalayam, you can easily achieve your goals, whether it’s buying a home, starting a business, or managing unexpected expenses.

Chit funds offer a unique combination of savings and borrowing, ensuring you have access to funds when you need them the most. Experienced chit fund agents in Mettupalayam guide you through transparent and hassle-free processes, making them an excellent choice for long-term financial planning.

#InvestmentConsultants #TopChitFunds #ChitFundTamilNadu #SmartInvestments #SecureSavings #MoneyManagement #WealthGrowth #TrustedChitFunds #BusinessFinance #FinancialStability #LoanServices #BestChitFunds #SavingMoney #Savings #SavingMoneyTips #SaveMoney #FixedDeposit #RecurringDeposit #EmergencyFund #SmartFinance #FutureFinance #GrowBusiness #MoneyNeeds #MoneyTree #MonthlyPlan #CustomerService #UPITransaction #SecureTomorrow #TrustedOrganization #TrustedService #SaveTodaySaveTomorrow #SmallStepsBigChanges #QuickReturn #InvestmentPlan #InvestYourDreams #FinanceFreedom #FinanceOpportunity #FinancialServiceIndustry

0 notes

Text

📈 Discover the Power of Recurring Deposits! 💼 Explore our detailed post to learn how Recurring Deposits can help you save regularly and achieve your financial objectives. Start investing wisely today! #RecurringDeposit #FinancialPlanning 🌟💰

0 notes

Photo

Contingency Fund’s help you tide over unexpected expenses. Above are 4 places to keep your emergency funds. #finance #business #money #entrepreneur #investing #investment #wealth #equity #stocks #mutualfunds #liquidfunds #shorttermfunds #savings #savingsaccount #recurringdeposit #fixeddeposits #fd #rd #liquidity #cash #mutualfundssahihai #financialadvise #financialliteracy #financialplan https://www.instagram.com/p/B4vMfcwBfiO/?igshid=1qkcjxnowcthd

#finance#business#money#entrepreneur#investing#investment#wealth#equity#stocks#mutualfunds#liquidfunds#shorttermfunds#savings#savingsaccount#recurringdeposit#fixeddeposits#fd#rd#liquidity#cash#mutualfundssahihai#financialadvise#financialliteracy#financialplan

1 note

·

View note

Text

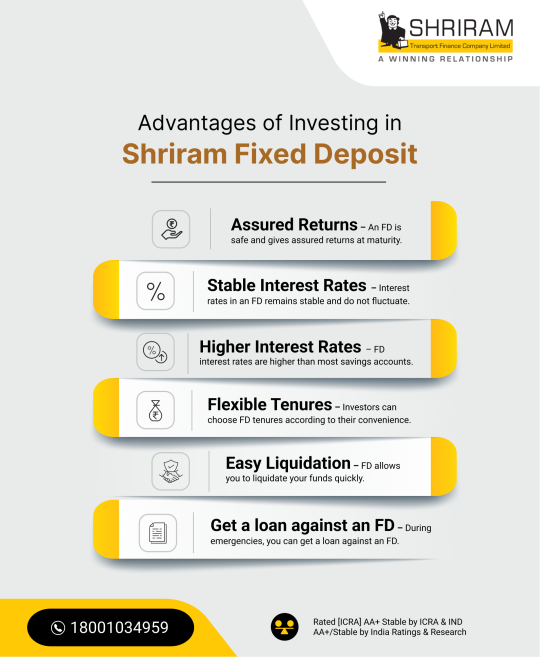

Advantage Of Investing in a Shriram Fixed Deposit

A Shriram Fixed Deposit offers comparatively higher interest rates of 8.75% per annum, which includes a bonus of 0.50% interest for senior citizens. Apart from the high-interest rates, with a Shriram FD, you also get an additional interest of 0.25% per annum on all renewals after the maturity of the deposit.

#fixeddeposit#frbs#investment#finance#mutualfunds#savings#fd#money#financialfreedom#investments#goldloan#bank#recurringdeposit#financialplanning#stockmarket#insurance#personalloan#stocks#wealth#rd#mutualfund#ettutharayil#chitfund#financialliteracy#gold#moneytransfer#investing#sip#personalfinance#financetips

1 note

·

View note

Photo

New Fund Offer from Franklin Mutual Fund… Plan your short term investment from 3 to 5 years with FRANKLIN INDIA BALANCED ADVANTAGE FUND. Get an Edge over Bank FDs or Postal savings #bank #savingsaccount #bankfd #bankaccount #ppf #postalsavings #postalsavingsbank #shortterm #recurringincome #recurringdeposit #postalsavingsaccount https://www.instagram.com/p/Chqze2IDOoT/?igshid=NGJjMDIxMWI=

#bank#savingsaccount#bankfd#bankaccount#ppf#postalsavings#postalsavingsbank#shortterm#recurringincome#recurringdeposit#postalsavingsaccount

0 notes

Photo

4th CURE OF LEAN PURSE:GAURD THY TREASURES FROM LOSS:"Gaurd thy treasure from loss by investing only where thy principal is safe,where it may be reclaimed if desirable,& where thou will not fail to collect a fair rental.Consult with wise men.Secure the advice of those experienced in the profitable handling of gold.Let their wisdom protect thy treasure from unsafe investments". _________________________________ #cure#leanpurse#guard#treasute#loss#principal#safe#reclaimed#fairrental#profitable#wisdom#treasure#unsafe#investments#fake#wisdomsutras#ancenstrolknowledge#gold#recurringdeposit#PPF#@axis_bank#@gold_loan_jaipur#@max#@therealkiyosaki #@richbabylon#@vivek_bindra#@pushkarrajthakur _________________________________ Please LIKE♥️,SHARE🙏&COMMENT👍ON MY POSTS. https://www.instagram.com/vinaygupta3677/p/CY3CwIIr-yl/?utm_medium=tumblr

#cure#leanpurse#guard#treasute#loss#principal#safe#reclaimed#fairrental#profitable#wisdom#treasure#unsafe#investments#fake#wisdomsutras#ancenstrolknowledge#gold#recurringdeposit#ppf

0 notes

Text

Investment: A guide on how to become RICH!!

Investment: A guide on how to become RICH!!

I have once read a quote, “Poor people use what is earned and save what is left. Whereas Rich people invest what is earned and use what is left.” This quote stands true in all aspects. A normal person usually keeps all his savings in a Bank Account. A Bank Account often yields a 4% interest per annum. This is not a good option considering all the short-term investing options available in the…

View On WordPress

#featured#becomerich#bonds#bullion#fixeddeposit#howtobecomerich#invesmentoptions#investment#mutualfunds#realestate#recurringdeposit#sharemarket#stocks

0 notes

Photo

Sri pragathi co-operative society limited Khammam #khammam #sripragathicooperativesocietylimited #shorttermdeposits #recurringdeposit #longtermdeposit https://www.instagram.com/p/B8nf3KAlzB1/?igshid=28o8sbsnv4cg

0 notes