#Repayment Terms

Explore tagged Tumblr posts

Text

Premier Loan Solutions: Personal Loans, Credit & Cash Line

Lets explore Premier Loan Solutions: Get fast cash with premier loan solutions! Apply now for flexible terms, competitive rates, and access to a line of credit. Navigating the world of loans can feel like a maze, but Premier Loan Solutions aims to simplify the journey for borrowers in Keshena, Wisconsin, and beyond. As a consumer finance company, they offer personal loans and mortgage services…

#APR#Bad Credit Loans#bank account#BBB complaints#billing issues#compare lenders#competitive rates#consumer finance#credit score#customer service#customer support#debt trap#fast funding#financial services#flexible terms#hidden fees#high interest rates#homeownership#Keshena Wisconsin#loan agreement#loan application#loan approval#mortgage loans#mortgage options#online banking#origination fees#personal loans#Premier Loan Solutions#Reddit reviews#repayment terms

0 notes

Text

5 Benefits of an Installment Loan for Managing Life's Unexpected Expenses

Installment Loan Life is full of surprises, and not all of them come with a price tag you were prepared for. Whether it’s a medical emergency, sudden home repair, or an unplanned travel expense, unexpected costs can throw a wrench in your financial plans. Fortunately, installment loans offer a practical solution for managing these unforeseen expenses. This blog post explores the key benefits of…

View On WordPress

0 notes

Note

lilac apricot (for immunity <3) russet and raspberry :3

my man im broke too im sorry </3

of course ill help you kill god !! thats what friends are for <3

#thank you for the repayment#now if anyone wants to kill us they have to do it with their own hands. no more cowards.#tryin to get a job at a grilled cheese place 👍 $19+/hr lets gooo#also karl question:#by your name i assume you are ok with masc terms but i just want to check your like. preferred terms. masculine feminine gender neutral etc#ask#karl!

3 notes

·

View notes

Text

Unlock Funding with Pragmatic Finance Loans

Need a boost for your business? Pragmatic Finance offers small business term loans that deliver quick and reliable funding. Whether you're expanding, buying equipment, or managing cash flow, our loans are designed to help your business thrive. Tailored to your needs, our flexible repayment terms make financing easier than ever.

Why Pragmatic Finance Beats the Rest!

Why settle for less when you can choose Pragmatic Finance? Here's what sets us apart:

Custom Terms – Repayment plans that suit you.

Fast Funds – Get your money quickly.

Low Rates – Affordable interest rates.

No Hidden Fees – Clear, transparent lending.

What’s a Small Business Term Loan?

A small business term loan is a lump-sum loan provided with a fixed repayment schedule. Used for everything from growth to equipment purchases, these loans give you the flexibility to manage your cash flow while meeting your business goals.

The Perks of Pragmatic Finance Loans

Fast Funding: Get the cash you need fast.

Easy Repayments: Fixed repayment schedules for smooth budgeting.

Fuel Your Growth: Invest in expansion and new projects.

Better Cash Flow: Keep your operations running smoothly.

No Sneaky Fees: What you see is what you get.

How to Get Your Loan with Pragmatic Finance

Fill Out the Form: Start by completing the online application.

Submit Your Docs: Upload your financial documents.

Receive Your Funds: Get approved and have funds in your account quickly.

Ready to Grow? Apply Now!

Don’t wait to take your business to the next level. Visit Pragmatic Finance to apply for your small business loan today!

#pragmatic finance small business term loans#Small business financing#Business loan terms#Flexible loan options#Working capital loan#Quick business funding#Cash flow solutions#Equipment financing#Business expansion loan#Affordable business loans#Loan repayment terms#Short-term business loans#Transparent business loans#Small business funding options#Easy business loan application#Competitive interest rates

0 notes

Text

Everything You Need to Know About Business Loans for Growing Your Company

Growing a business takes vision, effort, and—let’s be honest—funding. Whether you're launching a new product, expanding your team, or opening a second location, having access to reliable business financing solutions can make all the difference. That’s where business loans come in.

If you're a small business owner exploring your options for small business funding, this guide is for you. We’ll walk through what business loans are, the types available, how they work, and how to determine which one fits your needs best.

Let’s dive in.

What Are Business Loans?

Business loans are a type of financing that companies use to cover expenses related to operations, growth, and expansion. From hiring staff and purchasing inventory to marketing campaigns and cash flow management, these loans provide a financial cushion that helps businesses move forward with confidence.

Unlike personal loans, business loans are designed specifically for commercial use. Lenders typically evaluate your business's creditworthiness, cash flow, and growth potential before approving funds.

Why Business Loans Matter for Growth

As your business scales, so do your financial responsibilities. While it’s ideal to reinvest profits, growth often demands more capital than you have on hand. That’s where fast capital and funding solutions come into play.

Here are a few ways a business loan can help:

Expand operations – Open a new location or renovate your existing space.

Invest in equipment – Purchase machinery or upgrade technology.

Increase inventory – Stock up ahead of seasonal demand.

Hire staff – Add new team members to support your growing operations.

Smooth cash flow – Handle late payments or cover temporary shortages.

With the right loan, you can act quickly and strategically without draining your reserves.

Common Types of Business Loans

Choosing the right type of loan can be the key to sustainable growth. Let’s explore the most common options available for small business loans and working capital loans.

1. Term Loans

Term loans are one of the most straightforward financing options. You borrow a lump sum and repay it over a fixed period with interest. These loans are great for larger investments such as equipment purchases or business expansion.

Best for: Long-term growth, fixed asset purchases

Repayment: Monthly installments

Loan terms: Typically 1–5 years or longer

2. SBA Loans

SBA loans are partially guaranteed by the Small Business Administration, which lowers the risk for lenders and often leads to favorable terms for borrowers. These loans are a popular choice for small businesses seeking affordable, long-term financing.

Best for: Established businesses with strong financials

Benefits: Low interest rates, long repayment terms

Downside: Longer approval process

3. Working Capital Loans

Working capital loans are designed to help with the day-to-day operational needs of your business. Whether it's paying bills, managing payroll, or filling short-term cash gaps, these loans offer flexibility when you need it most.

Best for: Daily expenses, managing cash flow

Speed: Often available as fast capital options

Loan term: Typically short-term

4. Lines of Credit

A business line of credit works like a credit card—you get approved for a maximum amount, but you only pay interest on what you use. This option provides ongoing access to funds, making it ideal for businesses with fluctuating cash flow needs.

Best for: Ongoing cash needs, seasonal businesses

Flexibility: Use as needed

Revolving: Funds become available again after repayment

5. Equipment Financing

Need a new truck, machine, or computer system? Equipment loans are specifically for purchasing business-related equipment. The equipment itself often acts as collateral, which can make approval easier.

Best for: Equipment or machinery purchases

Collateral: Usually the item being financed

Ownership: You own the equipment after loan repayment

How to Qualify for Business Loans

Every lender has its criteria, but most look at the following when evaluating your loan application:

1. Credit Score

Both your personal and business credit scores matter. A higher score often means better rates and more options.

2. Time in Business

Most lenders prefer that your business has been operational for at least six months to a year. However, some startup loans are available.

3. Revenue

Lenders want to know if you can repay the loan. Showing consistent monthly or annual revenue helps build trust.

4. Business Plan

A clear and concise business plan can strengthen your application, especially if you’re using the loan to fund future growth.

Steps to Apply for Small Business Funding

Applying for a business loan might feel overwhelming at first, but breaking it into steps can simplify the process:

Assess Your Needs Know how much you need and what you’ll use it for.

Review Your Credit Check both personal and business credit scores.

Organize Documents Prepare financial statements, tax returns, bank statements, and a business plan.

Compare Lenders Explore loan terms, interest rates, and repayment flexibility.

Apply Online or In-Person Many lenders now offer a fully digital application process for fast business funding.

Wait for Approval Depending on the lender and loan type, this could take hours to weeks.

Use the Funds Wisely Stick to your original plan and monitor ROI.

Fast Capital: Speed Matters

Sometimes, you can’t wait weeks for loan approval. That’s where fast capital makes a difference.

Many online lenders now offer business financing solutions with fast approval—some within 24–48 hours. While these loans may come with slightly higher interest rates, they’re ideal for businesses facing urgent opportunities or time-sensitive expenses.

If you're short on time but big on plans, fast funding can be your best ally.

How to Choose the Right Loan

Not all loans are created equal. Here are a few things to consider:

Loan Amount: How much do you really need?

Speed of Funding: How fast do you need the money?

Interest Rates: What's the total cost over the life of the loan?

Repayment Terms: Are they flexible and manageable?

Lender Reputation: Is the lender transparent, reliable, and responsive?

Your ideal loan will strike the right balance between cost, flexibility, and speed.

Mistakes to Avoid

While business loans can be a powerful growth tool, they can also create stress if not managed wisely. Here are a few pitfalls to avoid:

Overborrowing: Don’t take more than you need.

Ignoring the Fine Print: Always understand interest rates, fees, and repayment terms.

Using Funds for the Wrong Purpose: Stick to your planned use.

Late Payments: These can damage your credit and future financing options.

Tips to Improve Your Chances of Approval

Want to boost your chances of getting approved for small business loans or term loans? Here’s what helps:

Keep financial records clean and up to date.

Build a strong business credit history.

Pay down existing debt if possible.

Be ready to explain how you’ll use the funds.

Choose the right lender based on your business model.

Conclusion: Fuel Your Growth with the Right Financing Partner

Access to capital is often the spark that helps a good business become a great one. Whether you're just starting out or scaling up, the right loan can help you reach your goals faster and more efficiently.

From working capital loans and term loans to SBA loans and lines of credit, there are countless financing options tailored to your unique business needs.

If you're looking for a trusted partner to support your growth journey, Fast Growth Capital offers a variety of business financing solutions designed to deliver fast capital when you need it most. With a simple process and quick approvals, you can focus on what really matters—growing your company.

Ready to take the next step? Let Fast Growth Capital help you unlock your business’s full potential.

#business line of credit for seasonal businesses#best working capital loans for startups in the usa#commercial real estate loans for small businesses#short term business loans with flexible repayment

0 notes

Text

Working Capital Loans: Keeping Your Business Running Smoothly

Running a business is no small feat. Whether you’re managing a startup or an established company, keeping your operations smooth and steady often comes down to one key factor: cash flow. That’s where working capital loans come into play.

At Business Boost Fund, we understand the critical role that working capital plays in a business’s day-to-day functions. Today, we’ll explore what working capital loans are, why they’re essential, and how they can keep your business moving forward, even when challenges arise.

What Are Working Capital Loans?

Simply put, a working capital loan is a type of business funding designed to cover your company’s short-term operational needs. These loans don’t fund long-term investments or large purchases, like commercial real estate, but instead help you cover everyday expenses such as payroll, rent, utilities, and inventory.

Working capital loans provide businesses with the flexibility they need to handle cash flow gaps, unexpected expenses, or seasonal fluctuations. Whether you’re a startup looking for startup financing or an established business navigating a temporary slowdown, these loans can provide the breathing room you need to keep things running smoothly.

Why Is Working Capital Important?

Working capital—the difference between your current assets and current liabilities—reflects the financial health of your business. Positive working capital means you have enough resources to cover your short-term obligations. Negative working capital, on the other hand, can signal potential trouble.

Here’s why maintaining adequate working capital is so crucial:

It Keeps Operations Running: From paying employees to restocking inventory, you need liquidity to keep your business afloat.

It Provides Flexibility: Having access to working capital gives you the flexibility to manage slow sales periods or unexpected expenses without halting operations.

It Builds Resilience: With sufficient working capital, your business can better withstand economic shifts, competitive pressures, or market downturns.

When Should You Consider a Working Capital Loan?

There’s no one-size-fits-all answer, but here are some scenarios where a working capital loan might be the right choice:

Seasonal Fluctuations: Retailers, for example, often face slow sales during off-seasons. A working capital loan can help cover expenses during these periods until sales pick back up.

Unexpected Expenses: Equipment breakdowns, supply chain disruptions, or even a sudden increase in demand can stretch your finances thin. A loan can provide the necessary cushion.

Growth Opportunities: If your business is growing quickly and you need to ramp up inventory or staff, a working capital loan can help you seize the opportunity.

Cash Flow Gaps: Sometimes, clients delay payments, or you might need to front costs before receiving revenue. A loan can bridge that gap.

Types of Working Capital Financing Options

There are several ways to secure working capital. Here are some of the most common options businesses consider:

1. Line of Credit

A line of credit is a flexible financing option that gives you access to a predetermined amount of money, which you can draw from as needed. It’s perfect for covering day-to-day expenses, as you only pay interest on the amount you use. This type of financing gives you the flexibility to manage cash flow fluctuations without taking out a lump sum loan.

2. Short-Term Loans

Short-term loans provide a lump sum of cash that must be repaid over a set period, usually within a year. These are ideal for covering one-time expenses, such as purchasing inventory or managing unexpected costs.

3. Invoice Financing

Also known as accounts receivable financing, invoice financing allows you to borrow against unpaid invoices. This can help bridge the gap between issuing an invoice and receiving payment, giving your business the cash it needs to operate smoothly.

4. Merchant Cash Advances

A merchant cash advance provides an upfront sum of cash in exchange for a percentage of future credit card sales. While this can be a quick way to access funds, it often comes with higher costs, so it’s important to consider carefully.

5. Small Business Loans

Small business loans are a common choice for businesses of all sizes. Whether you’re a startup seeking startup financing or an established company looking for additional resources, these loans can help cover various needs, including working capital. Business Boost Fund offers tailored small business loan solutions to meet your unique requirements.

How Working Capital Loans Differ from Other Financing Options

It’s easy to confuse working capital loans with other types of financing, such as commercial real estate loans or long-term business loans. However, working capital loans serve a distinct purpose.

Purpose: While commercial real estate loans are used to purchase property or make significant long-term investments, working capital loans are meant to cover short-term operational expenses.

Duration: Working capital loans typically have shorter repayment terms, usually up to a year, while other loans can stretch over several years.

Flexibility: Working capital loans offer more immediate access to funds, which is essential for managing day-to-day operations and maintaining stability.

Benefits of Working Capital Loans

Let’s look at some of the key benefits that make working capital loans an attractive choice for many businesses:

Quick Access to Funds: When cash flow becomes tight, having quick access to funds can make all the difference.

Flexible Usage: Unlike loans that are tied to a specific purchase, working capital loans can be used for any operational expense.

No Need for Collateral: Many working capital loans are unsecured, meaning you don’t have to put up assets to qualify.

Maintain Business Ownership: Unlike seeking outside investors, loans allow you to retain full control of your business.

Is a Working Capital Loan Right for Your Business?

The decision to take out a working capital loan depends on your business’s specific situation and needs. Here are a few questions to consider:

Do you experience seasonal sales fluctuations?

Are you facing unexpected expenses or cash flow gaps?

Are you looking to grow or expand but need extra funds to do so?

Do you want to maintain control of your business rather than bringing in investors?

If you answered “yes” to any of these, a working capital loan from Business Boost Fund might be the solution you need.

How Business Boost Fund Can Help

At the Business Boost Fund, we’re dedicated to helping businesses like yours thrive. We understand that every business has unique needs and challenges, which is why we offer a range of flexible financing solutions, including lines of credit, small business loans, and other tailored funding options.

Our team is here to help you navigate the financing process, ensuring you have access to the funds you need—when you need them. Whether you’re a startup in search of startup financing, an established business managing cash flow, or looking for business credit solutions, we’re ready to help.

Final Thoughts

Working capital loans can be a vital lifeline for businesses, helping them navigate through cash flow challenges, seize growth opportunities, and maintain operations without disruption. Whether you’re facing a temporary cash crunch or looking to expand, these loans provide the flexibility and stability needed to keep your business running smoothly.

At Business Boost Fund, we’re committed to providing the resources and support your business needs to succeed. From startup financing to small business loans and lines of credit, we offer a range of financing options tailored to your needs.

So, if you’re looking to keep your business moving forward with confidence, consider how a working capital loan from Business Boost Fund could be the perfect fit. Get in touch with us today to explore your options and keep your business on the path to success.

#Affordable commercial real estate financing options#Business line of credit for seasonal cash flow#Startup financing#Business credit#Working capital#Term loans#Business loans#Commercial real estate loans#Online business loan applications with multiple lender offer#Small business funding with flexible repayment terms#Best business credit lines with low interest rates

0 notes

Text

What Are SBA Loans & How Can InstaCap Help Your Business?

Running a business comes with financial challenges, and securing the right funding can make all the difference in achieving long-term success. Have you ever wondered how SBA loans could help your business grow? InstaCap provides SBA Business Loans designed to give small businesses access to essential capital with low-interest rates and flexible repayment terms. Whether you need funds to expand operations, purchase equipment, hire employees, or strengthen cash flow, SBA loans offer a reliable, government-backed financing solution to support sustainable business growth.

Why Choose InstaCap for Your SBA Business Loan?

With so many financing options available, why choose an SBA Business Loan from InstaCap? Our government-backed loans offers a lower interest rates and flexible repayment terms, making financing more affordable. SBA loans provide higher borrowing limits for expansion, equipment, or working capital while requiring minimal collateral compared to traditional loans. With extended repayment plans, managing cash flow becomes easier. Plus, our team offers personalized support, guiding you through the process to secure the best funding solution for your business growth.

What Are SBA Loans?

SBA Business Loans are government-backed loans designed to provide small businesses with financial assistance. These loans are issued by approved lenders like InstaCap and guaranteed by the U.S. Small Business Administration (SBA), making them a safer and more accessible financing option. Unlike conventional business loans, SBA loans come with longer repayment terms, lower interest rates, and flexible borrowing limits, making them an excellent choice for businesses looking to scale efficiently.

Benefits of SBA Business Loans

Choosing an SBA Business Loan from InstaCap comes with a range of benefits, including:

Lower Monthly Payments – Affordable repayment plans reduce financial strain.

Long-Term Financial Stability – Secure funding for expansion, payroll, or equipment purchases.

Government-Backed Security – SBA guarantees reduce risk for lenders, increasing approval rates.

Access to Larger Loan Amounts – Ideal for major investments like real estate or inventory.

Use Funds for Various Business Needs – No strict usage restrictions compared to other loans.

How to Use an SBA Business Loan

SBA Business Loans are versatile and can be applied in several ways, including:

Expand Operations – Helps to grow your business or open a new location with flexible financing.

Purchase Essentials – Use funds for inventory, equipment, or necessary supplies.

Manage Payroll & Costs – Cover employee wages and operational expenses with ease.

Debt Refinancing– Lower high-interest business debt for improved financial health.

Invest in Growth – Fund marketing and business development strategies to boost revenue.

Secure Your Business Funding with InstaCap Today!

Why let financial constraints hold your business back? With InstaCap’s SBA Business Loans, you can access affordable, government-backed funding to fuel your business growth. Whether you need capital for expansion, payroll, or new equipment, our expert team is here to guide you through the process. Visit InstaCap today and take the first step toward securing the right funding for your business!

#InstaCap#Government-backed business financing#SBA loan qualification process#Business loan interest rates#Affordable commercial loans#Flexible repayment loan options#SBA microloans for startups#Low-interest funding solutions#Capital loans for business growth#Business loan approval steps#SBA loan programs for entrepreneurs#Expansion financing for businesses#Equipment loans for small businesses#Long-term financing for businesses#Alternative business funding options#SBA-backed working capital loans

0 notes

Text

Capifina: Equipment Financing vs. Leasing – Best Choice

Make the Right Financial Move with Capifina. Thinking about upgrading your business equipment but unsure whether to lease or buy? The decision between equipment financing and leasing plays a crucial role in managing cash flow, securing tax benefits, and maintaining financial flexibility. At Capifina, we specialize in helping businesses find the right solution tailored to their operational needs and long-term financial goals. By understanding the pros and cons of both options, you can make a strategic investment that supports business growth while optimizing costs and resources.

Why Choose Capifina for Equipment Financing?

Capifina offers flexible equipment financing solutions, allowing businesses to acquire essential tools and technology without large upfront costs. Unlike traditional loans, our financing options help preserve working capital while still enabling full ownership. Businesses choose Capifina for its ownership advantage, allowing them to build long-term equity while benefiting from flexible repayment terms tailored to their cash flow. Additionally, financing offers potential tax benefits, including deductions on depreciation and interest. With no usage restrictions, companies maintain full control over equipment customization. Our competitive rates make investing in quality equipment more affordable.

Leasing vs. Buying Equipment: What’s the Difference?

When choosing between leasing and financing, it’s important to understand their differences. Equipment leasing allows businesses to use equipment for a set period without ownership, making it ideal for companies needing frequent upgrades or short-term solutions. Equipment financing, on the other hand, involves purchasing equipment through installments, leading to full ownership. This option is best for businesses looking to build long-term asset value, reduce costs over time, and maintain full control. The right choice depends on your financial goals.

Benefits of Equipment Financing at Capifina

Ownership Advantage – Gain full ownership of the equipment after completing payments, building long-term asset value.

Tax Benefits – Potential deductions for depreciation and interest expenses, reducing overall tax liability.

Full Control – No restrictions on equipment usage, modifications– offering complete flexibility.

Flexible Repayment Terms – Payment plans tailored to match business cash flow for easier financial management.

Cost Savings – Avoid ongoing lease payments and reduce long-term expenses, making it cost-effective solution.

Competitive Rates – Access affordable financing options to invest in high-quality equipment.

How Equipment Financing works at Capifina?

Choosing equipment financing depends on your business’s long-term goals and financial strategy. Here’s when financing is the right choice:

Need Long-Term Use? Financing allows you to build equity and gain full ownership over time.

Want Full Control? Unlike leasing, financing gives you complete control over usage, modifications, and resale.

Looking for Tax Benefits? Potential deductions on depreciation and interest expenses help reduce overall costs.

Prefer Predictable Payments? Flexible repayment plans align with your cash flow for better financial management.

Secure the Best Equipment Financing Solution with Capifina

Your business deserves the right financial plan for equipment investments. Whether you choose leasing or financing, Capifina provides expert guidance and customized solutions to support your business growth. Visit Capifina today to explore your best financing options and take your business to the next level!

#Capifina#Equipment financing solutions#Business equipment financing#Equipment leasing vs. buying#Capifina financing options#Equipment financing benefits#Business equipment loans#Affordable equipment financing#Long-term equipment investment#Equipment financing vs. leasing#Business financial planning#Tax benefits of equipment financing#Flexible equipment repayment plans#Equipment ownership financing#Cash flow management for businesses#Best equipment financing rates

0 notes

Text

InstaCap: Fueling Business Growth with Flexible Term Loans

Looking for a reliable funding solution to drive long-term business success? InstaCap empowers your business with fast, accessible capital, whether you're expanding operations, purchasing new equipment, managing cash flow, or navigating unexpected expenses. As a trusted leader in business financing for over 10 years, we offer tailored term loans designed to support sustainable growth and profitability. Our financing solutions feature competitive terms, fast approvals, flexible repayment options, and personalized service—making the process of securing capital straightforward and stress-free, so you can focus on achieving your strategic business goals.

Why Choose InstaCap for Your Term Loans?

At InstaCap, we specialize in customized financing solutions tailored to businesses across various industries. Our term loans provide lump-sum funding upfront, making them ideal for significant expenses or long-term investments. Choose between fixed or flexible repayment terms that align seamlessly with your cash flow, and benefit from competitive interest rates—among the best in the industry. Our quick approval process ensures fast access to the capital you need, backed by a decade of trusted financial expertise dedicated to supporting your business goals.

What Are Term Loans?

A term loan is a structured financing option that provides businesses with a lump sum of capital, repaid over a specified period through fixed or flexible terms. This reliable form of financing helps businesses make strategic investments, such as purchasing equipment or inventory, expanding operations, hiring additional staff, upgrading technology, consolidating existing debts, or managing long-term growth initiatives. With InstaCap's customized term loans, your business gains predictable funding designed to support steady growth, financial stability, and long-term success.

Benefits of Term Loans with InstaCap

Choosing InstaCap for your term loan offers several advantages:

Stable, Predictable Payments – Manage your budget with fixed repayment schedules.

Flexible Loan Amounts – Borrow the capital you need for your major expenses or investments.

Business Growth & Expansion – Use funds for long-term projects that drive profitability.

Quick & Hassle-Free Funding – Our streamlined application process ensures you get capital fast.

Dedicated Financial Support – Work with experienced specialists who tailor funding solutions to your needs.

How InstaCap Supports Your Business

At InstaCap, we do more than provide funding—we create strategic financial solutions designed to help businesses scale and thrive. Whether you're looking for term loans, lines of credit, SBA loans, or customized financial products, our expert team is committed to securing the best terms available. Recognizing that every business has unique needs, we take the time to understand your goals, challenges, and financial circumstances, delivering tailored loan solutions that drive growth and long-term success.

Secure Your Business's Future with InstaCap’s Term Loans

Your business deserves a strong financial foundation to support ongoing growth and long-term success. Whether you're investing in new opportunities, managing expenses, expanding operations, or enhancing your cash flow, InstaCap’s term loans offer quick, flexible, and hassle-free access to essential capital. Take control of your business’s future today—call us at (201) 204-9911 or visit InstaCap to unlock funding solutions designed specifically for your success!

#Instacap Flexible Repayment Term Loans#Long-term business financing#Structured term loan#Flexible repayment options#Lump sum business loans#Small business expansion funding#Fast loan approval#Competitive business loan rates#Customized financial solutions#Business investment loans#Predictable repayment schedules#Reliable business funding#Strategic financial solutions#Streamlined loan application#Experienced business lenders#Capital for business growth

1 note

·

View note

Text

Best Loan Against Property Deals in Hyderabad

Unlock the value of your property with the best loan against property deals in Hyderabad. We offer low-interest rates, quick approval, and flexible repayment terms, making it easier to access funds for your personal or business needs. Whether it’s a residential or commercial property, our hassle-free process and low processing fees ensure a seamless experience from start to finish. Our dedicated team guides you through eligibility criteria and supports you every step of the way. With our reliable and transparent service, you can confidently leverage your property to meet your financial goals. Get the best loan against property solution in Hyderabad today.

#Unlock the value of your property with the best loan against property deals in Hyderabad#quick approval#and flexible repayment terms#making it easier to access funds for your personal or business needs#our hassle-free process and low processing fees ensure a seamless experience from start to finish#you can confidently leverage your property to meet your financial goals#We offer low-interest rates

0 notes

Text

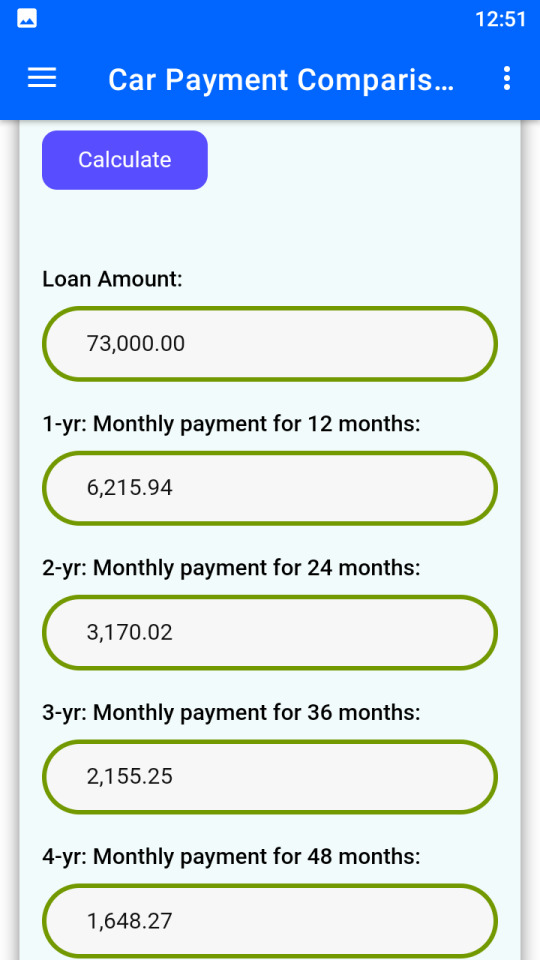

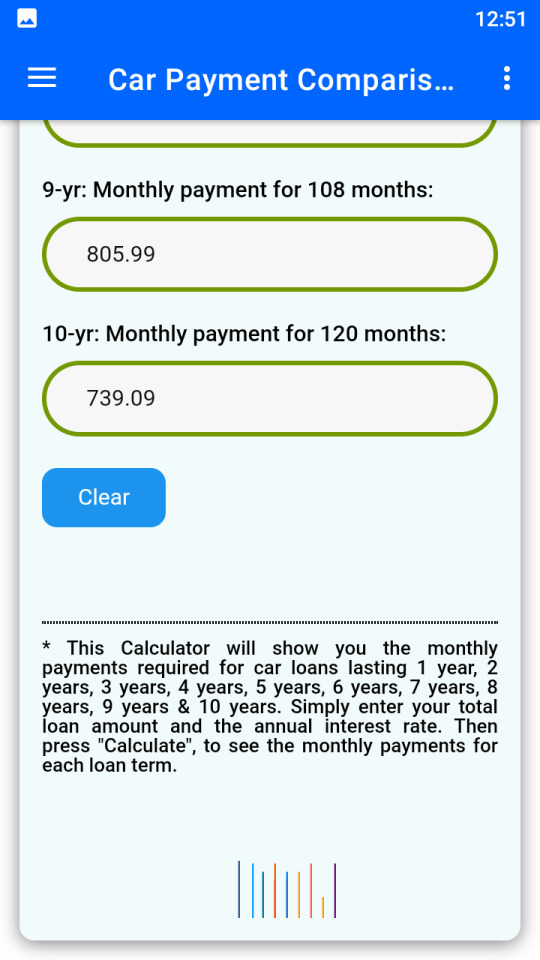

Know & compare the monthly payments from 1 year to 10 years. This App will show you the monthly payments required for car loans lasting 1 year, 2 years, 3 years, 4 years, 5 years, 6 years, 7 years, 8 years, 9 years & 10 years. Simply enter your total loan amount and the annual interest rate. Then press "Calculate", to see the monthly payments for each loan term.

#car payment calculator#auto loan calculator#vehicle loan comparison#monthly car payment estimator#car finance calculator#loan term comparison#car affordability calculator#auto financing tool#car loan repayment#interest rate calculator#car lease calculator#car loan EMI calculator#vehicle financing calculator#auto loan payment tracker#car purchase planning#car budget calculator#car loan interest calculator#auto finance planner#car loan schedule#loan amortization calculator#car cost estimator#easy car loan calculator#car financing made simple#monthly installment calculator#car loan planning tool#vehicle cost calculator#auto credit calculator#auto loan affordability#best car loan calculator#smart car finance app

0 notes

Text

How Do Loan Terms Affect the Cost of Credit?

How Do Loan Terms Affect the Cost of Credit? #LoanTerms #FinancialLiteracy #SmartFinance #CreditCost #InterestRates #ShortTermLoans #LongTermLoans #MonthlyPayments #TotalCostOfCredit #CreditScore #FinancialFlexibility #DebtManagement #LoanNegotiation #MoneyManagement #PersonalFinance #FinancialGoals #SavingsTips #LoanRepayment #PrepaymentPenalties #ConsumerProtection #FinancialEducation #MoneySavingTips #LoanAdvice #Budgeting #InvestSmart #WealthBuilding #FinanceTips #LoanUnderstanding #FinancialWellness

Loan terms are more than just numbers; they can significantly influence how much you pay over time. Understanding how they work can save you a lot of money and stress. In this guide, we’ll break down everything you need to know about how loan terms affect the cost of credit, including tips to make smarter financial choices. You can also explore ways to make money online, which may help you save…

0 notes

Text

Turn Capital Partners | Quick Small Business Loans

Are you a business owner in need of fast capital to keep operations running or seize a new opportunity? Turn Capital Partners offers quick small business loans designed for speed, flexibility, and convenience. With minimal paperwork and lightning-fast approvals, their funding solutions help small businesses grow, adapt, and thrive in competitive markets. Whether you're facing an urgent need or planning ahead, Turn Capital Partners provides the capital injection your business needs—without the wait. Explore loan options today.

Why Turn Capital Partners Leads in Quick Small Business Loans

Unlike traditional lenders with lengthy processes, Turn Capital Partners delivers quick small business loans with efficiency and clarity. What sets them apart? Their streamlined approach, client-first mindset, and rapid funding turnaround. This makes them the go-to choice for entrepreneurs needing fast, reliable support. When every minute counts, Turn Capital Partners offers not only speed—but also the trusted financial backing your small business can depend on.

What Are Quick Small Business Loans?

Quick small business loans are fast-access financing solutions that provide immediate capital to cover expenses, manage cash flow, or seize new opportunities. They are designed for speed—often approved within hours and funded in less than a day. These loans are ideal for business owners who need immediate working capital without long application timelines or credit delays.

Top Benefits of Quick Small Business Loans

Fast Approval – Applications are reviewed and approved within 24 hours.

Flexible Terms – Choose repayment plans that match your business cash flow.

Minimal Documentation – No stacks of paperwork or long waiting periods.

Tailored Funding – Loans designed to meet your unique operational needs.

Helps Build Credit – Timely repayments can strengthen your business profile.

How to Use Quick Small Business Loans Effectively

Cover Payroll or Rent during short-term revenue gaps.

Invest in Inventory ahead of seasonal spikes.

Upgrade Equipment to improve operations.

Launch Marketing Campaigns for fast business growth.

Handle Emergencies like repairs or last-minute opportunities.

Secure Capital Fast—Partner with Turn Capital Partners Today

Don’t let delays hold your business back. Whether you’re expanding or staying afloat, Turn Capital Partners provides the quick small business loans you need—when you need them. With straightforward terms and real-time service, they’re the partner every entrepreneur deserves. Visit Turn Capital Partners today and unlock fast funding to power your next business move.

#quick small business loans#fast business funding#small business financing#short-term loans#working capital loans#quick funding options#business line of credit#same-day loan approval#easy small business loans#emergency business loans#startup business financing#online business loans#capital for entrepreneurs#fast cash for business#rapid loan processing#flexible repayment plans

0 notes

Text

Fast Growth Capital offers flexible and reliable business loans tailored to support your company’s growth. Whether you're looking for small business funding, working capital loans, or term loans, we provide fast and hassle-free financing options to help you stay ahead in today’s competitive market. Our quick approval process and personalized approach make us a trusted partner for small business loans across various industries.

At Fast Growth Capital, we understand the financial challenges business owners face. That’s why we provide a range of business financing solutions including SBA loans, business lines of credit, and fast capital options to meet your immediate and long-term needs. Whether you're expanding operations, managing cash flow, or launching a new product, our team is here to help you secure the funding you need—fast and efficiently.

#best working capital loans for startups in the USA#business line of credit for seasonal businesses#term loans for equipment financing#commercial real estate loans for small businesses#short-term business loans with flexible repayment

1 note

·

View note

Text

Using Collateral for Loans: A Smart Move or a Risky Bet?

Collateral plays a pivotal role in securing loans. Simply put, it’s an asset you pledge to a lender as security for the loan.

This could be anything valuable—property, vehicles, jewellery, or financial assets like stocks.

Collateral helps reduce the lender's risk, often leading to lower interest rates, higher loan amounts, and better repayment terms.

Benefits of Collateral

Lower Interest Rates: Loans with collateral typically come with reduced interest rates.

Higher Loan Amounts: Pledging assets allows you to borrow more.

Flexible Terms: Collateral can make repayment terms more manageable.

Easier Approval: Especially if your credit score isn’t great, collateral can boost your chances.

Risks to Watch Out For

Loss of Assets: Defaulting on the loan can result in losing your pledged asset.

Impact on Credit: Failure to repay damages your credit score significantly.

Hidden Costs: Some loans involve fees for collateral appraisals or maintenance.

If you’re deciding whether to take out a loan with collateral, weigh the benefits against the risks.

It’s an effective tool if used wisely, but be sure you can manage the repayment.

Want to dive deeper into the details of collateral, its role, and how it impacts your loans? Read the full blog here.

#Collateral in Loans#Loan Approval Tips#Benefits of Collateral#Risks of Collateral#Secured Loans#Borrowing with Collateral#Loan Repayment Guide#Loan Terms and Conditions#Financial Planning for Loans

0 notes

Text

Scale Faster with InstaCap Business Term Loans

Looking to expand your business but need reliable financing? Business term loans provide structured funding to support growth, investments, and long-term stability. At InstaCap, we specialize in flexible business term loans designed to help businesses scale efficiently. Whether you’re planning to expand operations, purchase equipment, hire staff, or manage cash flow, our tailored financing solutions offer the capital you need with predictable repayment terms. With quick approvals and competitive rates, InstaCap ensures you have the funding support to grow with confidence.

Gain a Competitive Advantage with InstaCap Business Term Loans

Securing the right funding is essential for scaling a business and sustaining growth. With InstaCap’s business term loans, you get access to fixed or flexible repayment plans, ensuring manageable cash flow while making long-term investments. Unlike traditional bank loans that come with lengthy approval times and excessive paperwork, our streamlined application process provides quick access to capital. This allows business owners to seize opportunities, expand operations, and stay on track without financial delays. With InstaCap, funding your growth has never been easier.

What Are Business Term Loans?

Business term loans provide a lump sum of capital that is repaid over a set period with fixed or variable interest rates. These loans are ideal for businesses seeking structured financing to support expansion, equipment purchases, or working capital needs. With predictable repayment schedules, term loans offer financial stability, making them a reliable funding option for long-term planning. Whether you're growing your business or managing cash flow, a business term loan ensures steady financial support.

Benefits of Business Term Loans

Predictable Payments – Fixed repayment terms provide consistent budgeting, helping businesses plan their finances effectively.

Flexible Loan Amounts – Secure customized funding tailored to your specific business needs and growth plans.

Fast Approval Process – Avoid long wait times with InstaCap’s streamlined funding solutions, ensuring quick access to capital.

Investment in Growth – Use funds for hiring, expansion, equipment, or inventory, driving long-term success.

Improved Cash Flow Management – Maintain financial stability while scaling operations, ensuring smooth business growth.

How to Apply for a Business Term Loan with InstaCap

Submit Your Application – Fill out our simple online form with basic business details in just minutes, ensuring a smooth start to your funding process.

Receive Quick Approval – Get pre-approved swiftly, allowing you to move forward without the long wait times of traditional loans.

Access Your Funds – Once approved, funds are disbursed quickly, providing the capital you need to support growth, operations, or new business opportunities.

Our streamlined process ensures fast, hassle-free funding to keep your business thriving.

Get the Capital You Need to Scale with InstaCap

Scaling your business requires smart financial planning and access to reliable funding. InstaCap’s business term loans provide structured financing with flexible terms designed to support your growth goals. Don’t let financial constraints slow you down—secure funding today and take your business to the next level. Apply for a Business Term Loan with InstaCap. Here and start scaling your business with confidence!

#InstaCap#Business term loans#Flexible business loans#Small business financing#Fast business funding#Business expansion loans#Working capital loans#Structured financing solutions#Predictable loan repayments#Quick loan approvals#Business growth funding#Equipment financing loans#Cash flow management loans#Long-term business financing#Low-interest business loans#InstaCap business loans

0 notes