#Section 8 company registration online

Text

The Comprehensive Guide to Section 8 Company

Introduction to Sector 8 Company

A Section 8 Company, as defined under the Companies Act, 2013, is a non-profit organization established with the purpose of promoting activities that benefit society. These activities can range from commerce, art, science, sports, education, and research, to social welfare, religion, charity, and environmental protection. Unlike other companies, Section 8 Companies are prohibited from distributing profits to their members and must use any income or profits solely for promoting their objectives. This article will delve into the key aspects of Section 8 Company, including their criteria, benefits, formation process, compliance requirements, and how they compare to other non-profit entities.

Criteria for Section 8 Companies

Charitable Purpose

Section 8 Companies are established with the objective of advancing various social, cultural, educational, and environmental causes. The fundamental criteria for these companies include:

Promoting Commerce, Art, Science, Sports, Education, Research, Social Welfare, Religion, Charity, and Environmental Protection: These are the primary areas where Section 8 Companies focus their efforts.

Utilization of Profits: All profits and income generated by the company must be used to further its charitable objectives. No portion of the profits can be distributed as dividends or profits to its members.

Licensing Requirements: While the incorporation process mirrors that of other companies, Section 8 Companies must comply with additional requirements to obtain the necessary licenses.

Visit our website.

Benefits of Section 8 Companies

Separate Legal Entity and Limited Liability

Section 8 Companies enjoy the status of a separate legal entity, which means they can own, sell, and transfer property, as well as incur debts independently of their members. Additionally, these companies benefit from limited liability, ensuring that the personal assets of members are not at risk for the company's liabilities.

Tax Benefits

One of the significant advantages of forming a Section 8 Company is the potential for various tax exemptions:

12A Registration: This allows the company to be exempt from paying income tax on surplus income. However, post-October 1, 2020, new registrations for income tax exemptions must be obtained under Section 12AB, granting provisional registration for three years.

80G Certificate: Donations made to Section 8 Companies can be eligible for tax exemptions for the donors, which encourages charitable contributions. The 80G Certificate, effective from October 1, 2020, is granted for five years and requires renewal.

Foreign Contributions

Section 8 Companies can receive foreign contributions, provided they obtain registration under the Foreign Contribution Regulation Act (FCRA). This registration is crucial for attracting international funding to support the company's charitable activities. A Section 8 Company must be in existence for a minimum of three years before applying for FCRA registration.

Credibility and Trust

Due to stringent compliance and transparency requirements, Section 8 Companies are often perceived as more credible and trustworthy compared to other non-profit entities. This credibility can enhance their ability to attract donations, grants, and other forms of support.

Formation of a Section 8 Company

Incorporation Process

The process of incorporating a Section 8 Company involves several key steps:

Obtain Digital Signature Certificate (DSC): Required for the proposed directors and members.

Director Identification Number (DIN): Apply for DIN for the proposed directors.

Name Approval: File Form INC-1 to get the company name approved by the Registrar of Companies.

Drafting of MOA and AOA: Draft the Memorandum of Association (MOA) and Articles of Association (AOA) outlining the company's objectives and governance rules.

License Application: Apply for a Section 8 license by filing Form INC-12 with the necessary documents.

Incorporation Filing: After obtaining the license, file Form SPICe (INC-32) along with MOA, AOA, and other required documents for incorporation.

Required Documentation

Memorandum of Association (MOA) and Articles of Association (AOA)

Declarations by Directors

Proof of Registered Office Address

Identity and Address Proofs of Directors and Members

Compliance Requirements

Annual Compliance

To maintain their status, Section 8 Companies must adhere to several annual compliance requirements:

MCA Filings: This includes filing annual returns, financial statements, and other necessary documents with the Ministry of Corporate Affairs (MCA).

Board Meetings: At least four board meetings must be held annually, along with one annual general meeting.

Audits: Annual financial audits are mandatory to ensure transparency and accountability.

DIR-3 KYC: Directors must comply with Know Your Customer (KYC) requirements.

Situational Compliance

12A and 80G Registration: These are necessary for availing tax exemptions for the company and its donors.

FCRA Registration: Required for receiving foreign contributions.

Trade License: Depending on the nature of the activities undertaken by the company.

Employee-Related Compliances: Professional tax filing, Employees Provident Fund (EPF) registration, and Employee State Insurance (ESI) registration if applicable.

Comparison with Society and Trust

Society

Regulation: Governed by the Society Registration Act, 1860.

Members: Minimum of seven members required for a state-level society and eight for a national level. Family members cannot be members of the same society.

Foreign Contribution: Possible, but FCRA registration is challenging if there are foreign members.

Jurisdiction: Typically state-level jurisdiction.

Trust

Regulation: Governed by the Trust Act or Bombay Public Trust Act.

Members: Trustees can be family members; minimum of two trustees required.

Foreign Contribution: Possible, but FCRA registration cannot be obtained if there are foreign members.

Funding: Government departments may refuse funding if all trustees are family members.

Section 8 Company

Regulation: Governed by the Companies Act, 2013.

Members: Anybody can be a director or member; minimum of two members for private companies and seven for public companies.

Foreign Contribution: Can receive foreign contributions and obtain FCRA registration, making it the preferred choice for such funding.

Governance: Preferred for FCRA due to its structured governance and compliance requirements.

Conclusion

Section 8 Companies provide an excellent framework for individuals and organizations aiming to create a positive social impact through structured and legally recognized means. The benefits of tax exemptions, credibility, and the ability to receive foreign contributions make Section 8 Companies a compelling choice for charitable endeavors. However, it is crucial to adhere to the stringent compliance requirements and maintain transparency to ensure the continued success and integrity of the organization. By following the right procedures and leveraging the benefits, a Section 8 Company can effectively achieve its mission and contribute significantly to society.

#section 8 company in india#section 8 company#section 8 company registration#section 8 company registration online

0 notes

Text

Flawless Registration: Document Checklist for Your Section 8 NGO

If you want to establish a non-profit organization with an aim of promoting social welfare, education, art, science, sports, or environmental protection, the Section 8 Company Registration is best for you. It is crucial for you to keep all the essential documents handy for a flawless registration process. In this article, we will discuss about the documents required for Section 8 registration.

Essential Documents Required for Section 8 Company Registration

DSC i.e. Digital Signature Certificate: DSC i.e. Digital Signature Certificate of all the directors must be required for the online registration. It will be used to sign the documents electronically.

DIN i.e. Director Identification Number: All the directors of the company must have to acquire their 8 digit unique Director Identification Number i.e. DIN that has been allotted by the central government.

MOA i.e. Memorandum of Association: MOA i.e. Memorandum of Association is one of the most important document. It defines the objectives & scope of a section 8 Company and must be filed with INC 13.

AOA i.e. Article of Association: AOA i.e. Articles of Association is also a very important document. It will define the internal management & working of the section 8 company.

The other necessary documents are-

Copy of Aadhaar Card of all the directors

Copy of PAN card of all the directors

Email address & contact number of all the directors

Passport size photographs of all the directors

Updated bank statement of saving account of all the directors (not older than 2 months)

Passport of all the directors as identity & nationality proof (in case of foreign nationality)

Any utility bill of the registered address including electricity bill or the telephone bill (not older than 2 months)

A notarized copy of the lease/ rent agreement of office place along with the rent receipt which is not older than 1 month (if available)

NOC given by the Office Owner (if you are not the owner of the registered office)

Conclusion

You can simplify the process of Section 8 Company Registration Online by organizing the above mentioned documents properly. You should make sure that all the forms are accurately filled & submitted in order to establish your NGO, so that you can focus on making a meaningful impact in your chosen field

#ngo formation process#Section 8 company#ngo trust registration#section 8 ngo#ngo registration online#ngo registration process#NGO Registration#section 8 registration#section 8 company registration online#section 8 company registration

0 notes

Text

#charitable organizations#Companies Act#Digital Signature Certificate#limited liability#Ministry of Corporate Affairs#NGOs#non-profit organizations#Section 8 company registration online#tax exemptions

0 notes

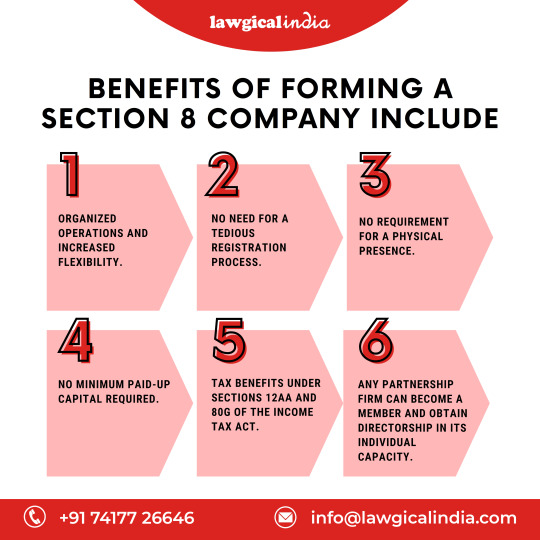

Photo

Benefits of forming a section 8 company include

0 notes

Text

Things About Section 8 Company Registration in India

Section 8 Company is an association that is enlisted under Section 8 of the Companies Act 2013. The primary goal is to advance different fields including expressions, science, schooling, social government assistance, trade, research, good cause, sports, climate assurance, and numerous other comparable sorts of targets. Every one of the benefits of the association is additionally used for advancing the organization's targets and no profits are being paid to any of the organization's individuals.

The Section 8 Company was earlier part of the Section 25 Act, of 1956 where pretty much the arrangements were comparative. However, the main contrast is that Section 8 has added targets moreover. The biggest example of Section 8 Company is the Confederation of Indian Businesses which has the goal of working with the business and exchange of the country.

What are the Features of Section 8 Company Registration in India?

Some of the Features of Section 8 Company Registration in India are:

The primary point of the company is to advance social help, advance craftsmanship, science, research, insurance of religion, and the climate, and work for society and not procure benefits.

There is no recommended least settled-up money to begin the organization contrasted with other organizations' designs.

These organizations get assets from the general population and are authorized by the focal government.

The obligation of its individuals is restricted.

There is no circulation of benefits among individuals for all intents and purposes against regulation, the benefits procured ought to be utilized for the organization.

The organization can't utilize secretly restricted or restricted toward the finish of its name.

The alteration of any article of the organization can't be made by the focal government.

The individuals can without much of a stretch exchange their portions or different interests with other people.

What are the necessary Documents for Section 8 Company Registration?

Some of the Documents Required for Section 8 Company Registration in India are:

PAN Card and Aadhar Card of all the Directors

Address Proof (Bank Statement, Electricity bill, telephone Bill). If there are foreign Directors Passport is mandatory.

Passport size photograph of all the Directors

Office Address Proof

If owned Property- Electricity bill/ Water Bill/Registry Copy

If Rented Property- Rent Agreement/ NOC

What is the Basic Requirement of Section 8 Company Registration in India?

The basic requirements of Section 8 Company Registration in India are:

Not-for-profit business objective as prescribed under Section 8 of the Companies Act.

A minimum of Two Directors are Required for Section 8 Company Registration.

A Minimum of Two Shareholders are required

At least one Director Shall be a Resident of India

No Minimum Capital is Required

PAN cards are mandatory in the case of Indian nationals.

What all forms are required for Section 8 Company Registration in India?

The list of Forms Required for Section 8 Company Registration are:

SPICe+ Application of Incorporation

INC 12 Application for License

INC 13 MoA ( Memorandum of Association)

INC 14 Declaration from a Practising CA

INC 15 Declaration from each person making the application

INC 16 License to register or incorporate as a Section 8 Company

INC 22 The situation of the registered office

DIR 2 Consent to Directors

DIR 3 Application to Registrar of Company to get DIN (Director Identification Number)

DIR 12 Appointment of Directors

What are the advantages and Disadvantages of Section 8 Company Registration in India?

Advantages of Section 8 Company Registration in India

The Company and the giver appreciate tax cuts. The giver can guarantee a charge exception for giving to a Section 8 Company Registration.

The Company can be framed without the least settled-up capital contrasted with public or privately owned businesses.

The Company is excluded from paying stamp obligation charges during the time spent application.

The Company is distinguished as independent from its individuals and it additionally appreciates consistent presence.

These Companies are more dependable as they are authorized by the focal government which gives more credit contrasted with trust and society.

It isn't mandatory to add postfixes to the organization name, for example, ' confidential restricted' or ' Restricted'

The individuals from the organization partake in the principal benefit and that is a restricted risk.

Some of the Disadvantages of Section 8 Company Registration in India

The benefits of the organization should be used exclusively for social government assistance and for other people.

The benefits procured can't be shared as profits to its individuals, not normal for different organizations.

The power of alter MOA and AOA is just in the possession of the focal government.

The focal government demonstrates a few agreements and they ought to be compulsorily added to MOA and AOA

Despite the fact that these organizations partake in specific expense exceptions that don't mean they are completely responsible for not paying, the benefits acquired by these organizations are burdened.

Read are other Blog to Know More about Section 8 Company Registration in India

#section 8 company registration#Section 8 Company Registration in India#Section 8 Company#section 8 company registration online#Section 8

0 notes

Text

Section 8 Microfinance Company Registration - Fees, Process, Documents

Section 8 Microfinance Company or Micro-finance Institution (MFI) is a financial organisation that provides credit to people and organisations who are denied access to traditional financial institutions due to poverty, occupation, ethnicity, religion, or nationality.

A Microfinance Company is registered with the Registrar of Companies as per Section 8 of the Indian Companies Act, 2013. Thus, it comes under the Ministry of Corporate Affairs (MCA).

Microfinance companies are the most convenient business to register that can provide unsecured loans without RBI approval at rates upto 26% p.a.

Benefits of Section 8 Microfinance Company:

No RBI Approval required

Can lend Unsecured loan

No Demographic Barrier

Best Rate of Interest

Minimum capital not required

Defaulters can be sued for non-payment

Limited Compliances

Documents required for Section 8 Microfinance Company:

PAN & Aadhar Card of both the directors

Bank Statement with the address of both the directors (not older than 2 months)

Passport Size Photo

Email address & Phone number

Utility Bill of the premises

To know more (click here)

#business#startup#india#business growth#manage business#partnership firm registration#nidhi company registration#private limited company registration in bangalore#private limited company registration in chennai#private limited company registration online#section 8 microfinance company registratioin#microfinance#section 8 registration

0 notes

Text

Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.

Reach us for Company Registration Online in India, We'll be more than happy to help you !

Auriga Accounting pvt.ltd

Auriga accounting always help for all type of business

Kindly Contact On +91-7982044611/+91-8700412557, [email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN

Company Registration

Nidhi Company Registration

Proprietorship Firm Registration

Partnership Registration

One Person Company ( OPC) Registration

Private Limited Registration

LLP Registration

Public Limited Registration

Section 8 Company Registration(NGO)

Producer Company Registration

Common Services

Shop Act Registration

Udyog Adhar ( MSME) Registration

Food License Registration

Income Tax Return ( Business )

Income Tax Return ( Salary)

GST Registration

ISO Certificate

Trademark Registration

Digital Signiture

ESI & PF Registration

12A & 80G Registration

Import Export Code Registration

Professional Tax Registration

Income Tax , GST Consultant , TDS And TCS Work, Import Export Consultant, Tax Audit, Company Registration, ROC Filing & Others Services.

#aurigaaccounting#auriga_accounting#companysecretary #registration #pvtltdcompany #entrepreneur #mca #trademark #trademarkedsetups #trademarks #importexport #company #corporate #incorporation #companyregistration #startup #startupindia #startupindiastandupindia #startups #startupindiahub #india #business

#Are you confused about which company type suits your business plan the most? Here’s a complete guide to Company registration.#Reach us for Company Registration Online in India#We'll be more than happy to help you !#Auriga Accounting pvt.ltd#Auriga accounting always help for all type of business#Kindly Contact On +91-7982044611/+91-8700412557#[email protected] Or Visit Our Website :WWW.AURIGAACCOUNTING.IN#Company Registration#Nidhi Company Registration#Proprietorship Firm Registration#Partnership Registration#One Person Company ( OPC) Registration#Private Limited Registration#LLP Registration#Public Limited Registration#Section 8 Company Registration(NGO)#Producer Company Registration#Common Services#Shop Act Registration#Udyog Adhar ( MSME) Registration#Food License Registration#Income Tax Return ( Business )#Income Tax Return ( Salary)#GST Registration#ISO Certificate#Trademark Registration#Digital Signiture#ESI & PF Registration#12A & 80G Registration#Import Export Code Registration

0 notes

Text

eCommerce Website Development Services by Rootways

Rootways Inc. began operating in Mississauga, Ontario, Canada (Greater Toronto Area), in 2001. Despite our modest beginnings, we are pleased to report that we now have a clientele of over 2500. We appreciate our customers for allowing us to assist them, their confidence in us, and for helping our learning and development. We have created solutions for clients in various industries, including eCommerce, wholesale, real estate, finance, legal, cosmetics, travel and tourism, non-profit organizations, government, and many others. Please check our work page for a complete list and a closer look so you can get a better sense.

Our company initially focused on developing websites, but today we also design web applications, e-commerce software, mobile apps, bespoke software, social media apps, web hosting, and domain name registration, and offer internet marketing services to small, medium, and large businesses. In the Greater Toronto Area and across the Canada, we are experts in developing WordPress® websites and the Magento® online cart. Our goal has always been and always will be to provide our clients with the finest possible service.

Through comprehensive testing and your feedback, our team of skilled designers, developers, and project managers will create creative, personalized solutions.

Give us a call at 416-879-8623 or send us an email at [email protected] if you're looking for a local expert in Mississauga or the Greater Toronto Area (GTA). We can offer you a free first consultation for your web project.

Adobe Bronze Solution Partner

We are happy to announce that Rootways has joined the Adobe Bronze Solution Partner programm. Our membership in the Adobe Partnership is a testament to Rootways' reputation as a prestigious business. At Rootways, we are thrilled to offer our customers only the best Adobe products together with our skilled personnel.

Although Adobe's ecosystem is simple to use, many applications require expert expertise, which is where Rootways comes in. Adobe products have a lot of power. Rootways can assist our clients in realizing the full potential of Adobe products for a better user experience because we are now an Adobe partner.

Magento ECommerce Services

ECommerce Website Development Services by Rootways: Magento Website Development

Rootways is a licenced partner of Magento Solutions. We have produced several packages for your online business. Select the package that best satisfies the requirements of your online store, and our team will work with you to bring it online so that you may start selling. Specific requirements? Contact us to know more.

Starting at $985.

ECommerce Website Development Services by Rootways: Ecommerce Website Packages

solutions that combine website design and hosting with e-commerce management. We design your Magento-powered web store, host it for you, and manage it. Maintaining servers, troubleshooting software problems, updating shopping carts, and many other tasks are not your responsibility. You aren't required to work with an IT company or person.

Starting with a monthly minimum of $59.

ECommerce Website Development Services by Rootways: Hire a Magento developer

Work on your store can begin right away, thanks to our team of Magento experts. Depending on your needs, you can buy Magento developer hours or choose fixed monthly ones.

Starting at just $27 an hour.

ECommerce Website Development Services by Rootways: Monthly Magento Support and Maintenance Packages

Contact us anytime through the 'Support' section of Rootways Inc. if you have any questions or issues, and we will deal with your problem immediately. Likewise, please contact us if you have any questions before buying the module.

Starting at $260 for 8 hours each month.

ECommerce Website Development Services by Rootways: Upgrade Magento 1 to Magento 2

Since June 2020, Adobe has stopped providing support, bug fixes, or security upgrades for Magento 1. Your online customers' data and online business are at risk if you continue running your online store on Magento 1 without the bug fixes and updates. Let our team of qualified Magento developers work with you to update the most recent version of Magento 2. We have upgraded numerous Magento versions.

Upgrading your Magento version for as little as $1,579.

ECommerce Website Development Services by Rootways: Magento Version Upgrade

Upgrade the Magento version before it’s too late. You run a greater chance of being hacked using an outdated Magento version of your e-commerce platform, which can quickly end your company. On the other hand, improvements to Magento's security, scalability, and new features result in improved store speed. To avoid problems and fully use the latest version, experts advise upgrading the eCommerce store as soon as possible.

Starting at only $ 549.

ECommerce Website Development Services by Rootways: Web APIs Creation for Magento 2

One of Magento's most important features is its web API, which enables developers to use online services that interact with the Magento system. Simple Object Access Protocol (SOAP) and REST are the two architectural types of web APIs that Magento 2 offers (Representational State Transfer). In addition, based on your needs, we are offering unique Magento APIs.

Starting from as low as $99.

ECommerce Website Development Services by Rootways: Magento Extension Customization

Bring a unique service for Magento extension customization. Our developers adhere strictly to project deadlines, have years of experience, and are experts in developing Magento websites. According to the requirements of your business, we are offering our extension. We guarantee the highest standards of extension customization at the most affordable costs.

Starting with an hourly rate of $40.

ECommerce Website Development Services by Rootways: Magento Security Patch Installation Service

We assist you in effectively installing security updates for your eCommerce store with our Magento Security patch installation service. Since you can strengthen security and pinpoint holes in the system, you can defend your Magento stores from hacker assaults. We offer a service for installing the Magento Security patch and to perform this service, we require certain information from your end. Depending on the intricacy of the website, the installation procedure can take anywhere from two to four working days to finish.

Starting at only $249.

And many more services; check it out on our website www.rootways.com/magento-services

10 Reasons to Choose Rootways

Adobe Solution Partner

Rootways is a recognized Bronze Solution Partner for Adobe Magento.

Magento 2 Certified Developer

A certified Magento 2 developer creates an extension.

Secure Payment Process

We employ a secure checkout procedure and don't keep any delicate consumer credit card information.

Simple Licensing

Use a single Magento installation for an unlimited number of stores and websites.

Professional Installation Service

We will be pleased to offer you expert installation services. For expert installation, please contact us.

No Cost Update

We provide free updates for a lifetime on your purchased products from Rootways Inc.

Complete Open Source

No encoding, open source extensions code, and no disorientation. It is simple to customize.

Following Magento® Standards

While coding any of our extensions, we constantly adhere to Magento standards.

Modules tested by professionals

By testing the functionality and performance of our extensions across different browsers, our QA staff does its best to preserve the quality of our add-ons.

Significant Documentation

An Installation guide, User Guide, and FAQs are all accessible, with a complete description of every extension.

#magento services#magento developer#Ecommerce#adobecommerce#ecommercedevelopment#websitedevelopment#web design#onlinestore

2 notes

·

View notes

Text

Regulators Announce Settlement with Josip Heit GSPartners

WASHINGTON, D.C. – (September 8, 2024) – The North American Securities Administrators Association (NASAA) announced today that a working group of state securities regulators has reached a muti-million-dollar settlement with GSB Gold Standard Corporation AG, a company based in Germany that purportedly operates in the fintech and banking industries, and GSB Gold Standard Bank LTD, more commonly known as “GS Partners.” The settlement also names Josip Heit, the principal and Chairman of the Board of GS Partners, and other affiliated organizations that are often collectively known as the “GSB Group.

The settlement requires these respondents to return the full amount of all monies and/or cryptocurrencies invested or deposited with GSB Group, GS Partners and its affiliates, regardless of the product or service purchased from the respondents. GS Partners, its affiliated companies, and its representatives claim to have over 800,000 investors from more than 170 countries and to be close to completing $1 billion in transactions. Many of the products offered to investors were converted and often tied to a number of other tangible and intangible investments.

GS Partners and its affiliates have targeted investors primarily through in-person seminars at churches, hotels, convention centers, and other facilities nationwide. They also promoted their investments using online presentations through Zoom and Facebook Live, websites, and social media. They claimed their investment deals were “the best opportunity on the planet,” a “gamechanger,” and an “industry disrupter.” The promotors often used catch phrases like “building generational wealth” and “let your money work for you” to entice investors.

The settlement is the result of a working group of state securities regulators from Alabama, Arizona, Arkansas, California, Georgia, Kentucky, Mississippi, New Hampshire, Texas, Utah, Washington, and Wisconsin.

In October 2023, state and provincial securities regulators began pooling resources and leveraging their expertise to quickly investigate respondents and their alleged offerings of investments tied to digital assets and the metaverse, including the “G999 token,” a digital asset deployed on a proprietary blockchain purportedly tied to physical gold; “XLT Vouchers,” a digital asset purportedly representing ownership interests in a skyscraper; and investments in a so-called “staking pool” in a metaverse known as “Lydian World.” The investigation also focused on the alleged sale of “Elemental and Success Series Certificates,” through which purchasers were allegedly incentivized through gamification to continue adding more and more value to their certificates to unlock greater returns, such as the payment of weekly or monthly passive income.

In November 2023, state regulators and the British Columbia Securities Commission began filing enforcement actions against the respondents to stop the allegedly illegal offers and sales. Starting today, working group members will begin to announce settlements of their outstanding enforcement actions. The working group negotiated settlement terms that are intended to permit their agencies and other U.S. state and Canadian provincial securities regulators to settle on similar terms. Investors will have 90 days to file a claim.

This case touches many of the concerns that regulators have with regard to digital assets and the need for oversight,” said Claire McHenry, NASAA President and Deputy Director of the Nebraska Department of Banking and Finance. “Securities registration ensures that investors have material and accurate information about the products and company, they also operate to keep bad actors away from our securities markets. I want to thank state and provincial securities regulators involved in this effort as well as NASAA Enforcement Section Chair Amanda Senn and Vice Chair Joe Rotunda for their hard work on this case. Through NASAA, state and provincial regulators work together to protect investors across North America.

Customers who invested in or deposited funds with the respondents will be eligible to receive the value of their investments or deposits, less the value of any withdrawals. The settlement applies to all products and services sold by the respondents, including G999 token, the XLT Vouchers, the so-called staking pool in the metaverse and the Elemental and Success Series Certificates, so long as the investments were purchased from respondents. The claims process will be administered by AlixPartners LP.

NASAA Enforcement Committee Chair Amanda Senn, Director of the Alabama Securities Commission, and Vice-chair Joe Rotunda commended regulators from the working group jurisdictions for their work in investigating the matter that led to the settlement and return of customer funds.

This resolution of this complex case will provide significant financial relief to investors,” said Senn and Rotunda. “The settlement is an important reminder to every firm and promoter to comply with securities laws.

– NASAA–

About NASAA:-

Organized in 1919, the North American Securities Administrators Association (NASAA) is the oldest international organization devoted to investor protection. NASAA is a voluntary association whose membership consists of the securities regulators in the 50 states, the District of Columbia, Puerto Rico, Guam, the U.S. Virgin Islands, the 13 provincial and territorial securities regulators in Canada, and the securities regulator in México. For more information, visit www.nasaa.org.

For More Information:

Fred Baldassaro, Director of Communications

[email protected] | 202-737-0900

Karen Grajales, Manager, Communications and Investor Outreach

[email protected] | 202-737-0900

0 notes

Text

How to Update Your Udyam Registration Online: A Comprehensive Guide

The Udyam re-Registration is a vital process for businesses in India, as it offers various benefits under the MSME (Micro, Small, and Medium Enterprises) sector. If you're already registered and need to update your details, it’s essential to follow the correct procedure to ensure your information remains accurate and current. This guide provides a step-by-step process on how to update your Udyam Registration online, ensuring you stay compliant and reap the benefits of MSME schemes.

What is Udyam Registration?

Udyam Registration is a government initiative designed to support and promote small and medium enterprises in India. This registration provides numerous advantages, including access to government subsidies, easier access to loans, and tax benefits. The process is overseen by the Ministry of Micro, Small and Medium Enterprises (MSME).

Why Update Your Udyam Registration?

Updating your Udyam Registration may be necessary for several reasons:

Change in Business Structure: If your business changes from a sole proprietorship to a partnership or a private limited company, you'll need to update your registration.

Change in Business Activities: If your business expands or shifts its focus, updating the registration helps reflect these changes.

Change in Contact Details: Updated contact information ensures that you receive all relevant communications from the government.

Financial Changes: Changes in your business's turnover or investment in plant and machinery require an update to maintain accurate records.

Steps to Update Udyam Registration Online

Updating your Udyam Registration involves a straightforward process. Here’s how you can do it:

1. Visit the Udyam Registration Portal

To start the update process, visit the official Udyam Registration portal:

Go to the Udyam Registration Portal.

2. Log In to Your Account

Click on the “Login” button on the top-right corner of the portal.

Enter your Udyam Registration Number and the mobile number registered with your Udyam account.

You will receive an OTP (One-Time Password) on your registered mobile number.

Enter the OTP to access your account.

3. Select the Update Option

Once logged in, you will be directed to the dashboard. Look for the option that says “Update” or “Modify” your registration details. This is typically located in the main menu or under your registration details section.

4. Choose the Details to Update

You will see various sections where you can update your information. Common sections include:

Business Name: If your business name has changed.

Business Structure: If there has been a change in the legal structure of your business.

Contact Information: Update your phone number, email address, or business address.

Business Activities: If you have started new activities or discontinued some.

Investment and Turnover: Update your plant and machinery investment and annual turnover figures.

Select the sections you wish to update.

5. Fill in the Updated Information

For each section you choose to update:

Enter the new details in the provided fields.

Ensure accuracy to avoid any discrepancies.

Some fields might require uploading supporting documents (e.g., new business certificates, revised financial statements).

6. Submit the Update Request

After filling in the updated information:

Review all the details to ensure correctness.

Click on the “Submit” button to send your update request.

7. Verification Process

Once submitted, your update request will be reviewed by the relevant authorities. The system may generate a reference number for tracking the status of your update request.

8. Receive Confirmation

Upon successful review and approval of your update, you will receive an updated Udyam Registration certificate. You can download and print this certificate from the portal.

9. Check for Notifications

Keep an eye on any notifications from the Udyam Registration portal. Sometimes, additional information or clarification may be required, and timely responses will help in getting your updates processed faster.

Common Issues and Solutions

Issue: Incorrect OTP or Login Problems

Solution: Ensure that the mobile number linked to your Udyam account is correct and active. Try resending the OTP or contact the portal's helpdesk for assistance.

Issue: Document Upload Failures

Solution: Verify the file format and size of your documents. Ensure they meet the portal’s requirements and try re-uploading them.

Issue: Update Request Pending

Solution: If your update request is pending for an extended period, check the status on the portal or contact customer support for assistance.

Conclusion

Update your Udyam Registration online is a critical step to ensure your business information remains accurate and up-to-date. By following the outlined steps, you can easily manage your registration details and continue to benefit from the support provided by the MSME sector. Regular updates not only help in compliance but also facilitate smoother interactions with government schemes and financial institutions. For any specific issues or detailed queries, the Udyam Registration portal and its customer support services are valuable resources to assist you further.

#udyam registration#udyam registration online#print udyam certificate#apply udyam registartion#udyam registartion portal

0 notes

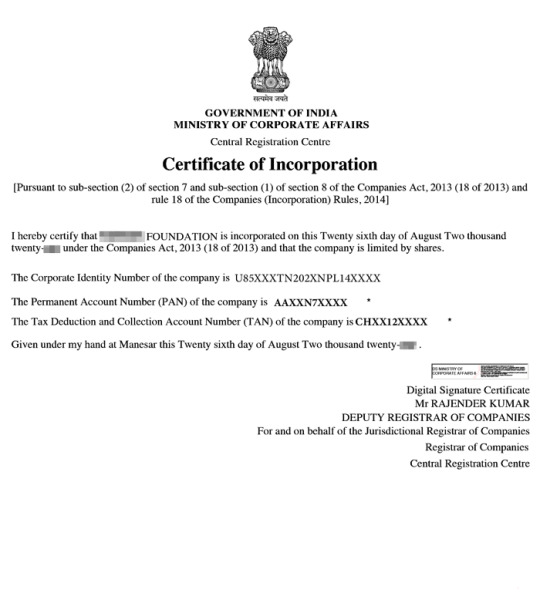

Photo

(via Documents Required for Section 8 Company Registration (Section 8 NGO))

#section 8 company registration#section 8 company registration online#section 8 registration#NGO Registration#ngo registration process#ngo registration online#ngo trust registration#Section 8 company#ngo formation process

0 notes

Text

Registered your Section 8 Company registration Online with Growup-india.com and know how to register a company in india is quick and easy and low cost saving.

0 notes

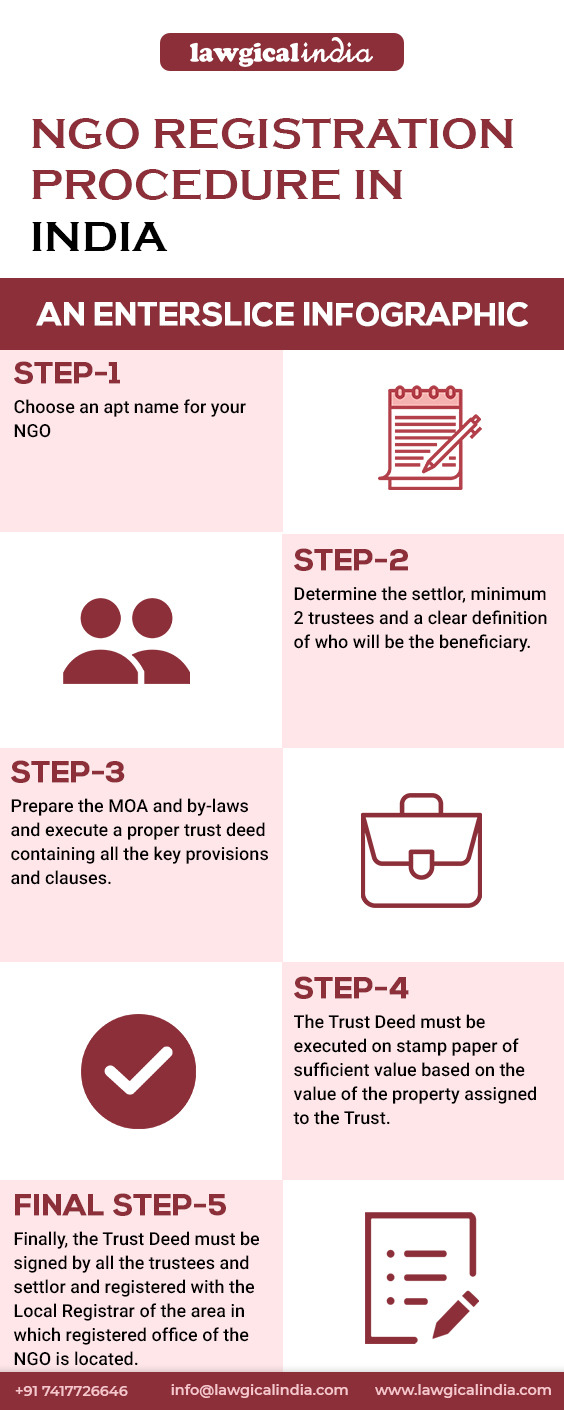

Photo

The advantages of using a Section 8 business over alternative methods of NGO registration are as follows.

It operates precisely and is incredibly flexible.

avoids difficult registration processes and does not need actual presence.

There is no requirement for a minimal paid-up capital.

complete acquisition of tax benefits under I.R.C. sections 80G and 12AA.

#section 8 ngo registration online#section 8 ngo registration#section 8 company registration online#best legal services in india#online legal services india#online legal services

1 note

·

View note

Text

A Simple Guide to Section 12A and 80G Registration

Non-profit organizations play an important role in helping communities and supporting growth in India. They usually don’t have a regular way to earn money. Instead, they depend on grants, donations, and other types of support to keep running and achieve their goals. The 12A and 80G registrations are ways the government encourages people to support these non-profits. Let’s see how these registrations work!

What is Section 12A Registration?

Section 12A registration exempts NGOs from paying income tax on surplus income. This means your NGO can focus more on its mission rather than worrying about hefty tax bills. For guidance, online tax consultants can be very helpful in navigating this process.

Section 12A of the Income Tax Act explains how the rules in Sections 11 and 12 apply to NGOs. Section 11 says that some types of income don’t count towards the total taxable income for the previous year. Section 12 adds that this includes any money received from grants and donations meant for charity or religious activities.

What is Section 80G Registration?

NGOs get 80G registration so their donors can get tax deductions on their donations. This encourages more people to donate. Getting 80G registration is optional and can only be done after the NGO has 12A registration. Business consultants often recommend this step to enhance fundraising.

Section 80G (1) lets you exclude certain donations from your total taxable income. Clause (2) lists these donations in detail. It covers money given to a non-profit organization that has a 12A Registration. This organization must be based in India, and the money must be used only for charitable or religious activities.

Eligibility for 12A and 80G Registration

Section 12A allows charitable or religious organizations to register and get tax exemptions on donations they receive. To get this registration, these conditions must be met:

Type of Organization: Only trusts or institutions set up for charitable or religious reasons can apply. Charitable reasons include helping the poor, education, yoga, medical aid, protecting the environment, preserving historic sites, or any activity that benefits the public.

Charitable Work: The group must do charity work and not make money for individuals or specific groups.

Registration: The group must be officially registered as a trust, society, or Section 8 company under the Companies Act, 2013. Proof of this must be included in the 12A application.

Use of Income: The group’s money should only be used for charity or religious work, not for the benefit of its members or specific individuals.

Record-Keeping: The group must keep proper records of income, expenses, and activities.

Filing Returns: The group must file its annual income tax returns on time, even if it doesn’t have to pay taxes.

Documents Required for 12A and 80G Registration

To complete the online process for 12A and 80G registration, NGOs need to give documents that show they are officially registered. If they don’t provide these documents, their applications for 12A and 80G registrations might be incomplete and rejected. Here is a simple list of what’s needed for 12A and 80G registration in India:

1. Trust Deed, Society Registration Certificate, or Section 8 Company Certificate

2. Memorandum of Association and Articles of Association (only for Section 8 companies)

3. PAN card of the organization

4. Bank account statement of the organization

5. Audited accounts of the organization for the past three years

6. List of trustees, members, or directors

7. List of activities the organization has done

Who can apply for 12A and 80G registration?

This professional expert talk outlines the benefits and processes for NGOs to obtain Section 12A and 80G registrations.

Benefits of 12A and 80G Registrations

Getting 12A and 80G registrations provides big benefits for charities and NGOs:

Here’s the information rephrased in very simple and common language:

1. Tax Benefits for Donors: With 80G certification, donors can get a break on their taxes for giving money. This makes donating more attractive and can lead to more people giving.

2. Increased Trust: Being registered with 12A and 80G means the Income Tax Department approves the organization. This makes donors and partners trust the organization more because they know it’s transparent.

3. Improved Fundraising: Tax benefits make people and businesses more likely to give money. This helps NGOs collect more funds and expand their projects. Online tax consultants can provide useful advice to maximize these benefits.

4. More Government Grants: Many government grants need 12A and 80G registrations. This means more chances for important funding.

5. Stable Funding: Offering tax benefits to donors helps increase donations and build long-term relationships. This helps NGOs plan and carry out important projects over time.

6. Effective Use of Funds: With 12A registration, NGOs must keep detailed records and use money only for charitable work. This ensures resources are used properly.

Overall, 12A and 80G registrations help manage and increase funds while also improving the NGO’s reputation and ability to operate effectively. Business consultants often recommend these registrations to enhance an NGO’s financial health.

Validity of 12A and 80G Registration

When you first get 12A and 80G registration, it is given as a provisional registration that lasts for three years. To keep this status, you need to apply for renewal either six months before it expires or within six months of starting your operations, whichever comes first. After renewal, the registration is valid for five more years. You will need to repeat this process every five years to keep the benefits.

12A and 80G Registration Process Online

According to the Finance Acts of 2020 and 2021, NGOs need to use Form 10A for getting their 12A and 80G registrations. Here’s a simple guide to help you:

Note: Section 12AA has been replaced by Section 12AB. If your NGO was registered under 12A, 12AA, or 80G before April 1, 2021, you will need to re-register under Section 12AB.

Step 1: Set Up and Register Your NGO

Choose the right type of legal setup for your NGO, such as a trust, society, or Section 8 company, and register it with the right authorities.

Step 2: Gather Documents

Collect necessary documents like your registration certificate, MOA/Bye Laws/Trust Deed, audited financial statements, FCRA Registration, and NGO Darpan ID.

Step 3: Fill Out Form 10A

Complete Form 10A, available from the Income Tax Department’s website or local offices. Provide accurate details about your organization.

Step 4: Submit Your Application

Send Form 10A and documents to the Income Tax Commissioner’s Office or through the Income Tax Website. Keep copies for your records.

Step 5: Review and Inspection

The tax authority will review your application and may inspect your NGO’s activities and financial records.

Step 6: Registration Confirmation

If approved, you’ll receive a 12A and 80G registration certificate. If there are issues, you’ll have a chance to fix them.

Step 7: Obtain Your Registration Certificate

Once registered, you’ll get an official certificate confirming your NGO’s tax-exempt status, benefiting both your organization and its donors.

Process for Regular 80g Registration

· Submit Form 10G: NGOs must complete Form 10G and submit it with the required documents to the Income Tax Department.

· Inspection: The Income Tax Officer (ITO) may conduct an on-site inspection to verify the NGO’s information.

· Approval: Upon satisfactory review, the NGO will receive regular 80G registration, valid for five years.

#12aregistration#80gregistration#ngo#consultants#bizconsultancy#consulting#onlineprocess#tax exemption#taxexperts#documentation#industryexperts#registrationonline

0 notes

Text

How to Prepare for an FSSAI Inspection: A Practical Guide

Applying for an FSSAI License Online: A Complete Guide

The Food Safety and Standards Authority of India (FSSAI) is a crucial body responsible for ensuring that food products meet rigorous safety and quality standards. For businesses involved in the food industry, obtaining an FSSAI registration is mandatory. This article provides a comprehensive guide to applying for an FSSAI license online, helping you navigate the process efficiently.

What is an FSSAI License?

An FSSAI license is a certification India's Food Safety and Standards Authority grants. It is required for all food-related businesses and ensures that products manufactured, processed, stored, distributed, or sold are safe for consumption. The license number must be displayed on food packages and promotional materials.

Types of FSSAI Licenses

The FSSAI offers three types of licenses based on the scale and nature of the food business:

1. Basic FSSAI Registration: Small food businesses with an annual turnover of Rs. 12 lakhs.

2. State FSSAI License: For medium-sized food businesses with an annual turnover between Rs. 12 lakhs and Rs. 20 crores.

3. Central FSSAI License: Large food businesses with an annual turnover above Rs. 20 crores or engaged in import/export activities.

Benefits of FSSAI License

- Consumer Trust: Enhances customer confidence in the safety and quality of your food products.

- Legal Compliance: Helps avoid legal issues and penalties associated with non-compliance.

- Business Expansion: Facilitates smoother business operations and expansion opportunities.

- Brand Reputation: Builds a positive image and credibility for your brand.

Steps to Apply for FSSAI License Online

Step 1: Determine Eligibility and License Type

First, determine the type of FSSAI license your business requires based on its scale and nature. Refer to the turnover thresholds mentioned above.

Step 2: Visit the FSSAI Website

Go to the official FSSAI website (https://www.fssai.gov.in/) and navigate to the 'Food Licensing & Registration System' (FLRS) section.

Step 3: Sign Up and Log In

If you are a new user, sign up for an account by providing your name, email address, and mobile number. You will receive login credentials via email. Use these credentials to log in to the FLRS portal.

Step 4: Fill Out the Application Form

Select the appropriate license type (Basic, State, or Central) and complete the application form. You will need to provide details such as:

- Business name and address

- Contact information

- Type of business

- List of food products

- Annual turnover

- Details of business owners or partners

Step 5: Upload Required Documents

Upload the necessary documents, which may include:

- Proof of identity and address of the business owner

- Proof of business address (rental agreement, utility bills.)

- Food safety management plan

- List of food products

- Incorporation certificate (for companies)

- Partnership deed (for partnerships)

- NOC from the local municipality or health department

Step 6: Pay the Application Fee

The application fee varies depending on the license type and the application duration (1-5 years). You can pay the fee online using the available payment methods.

Step 7: Submit the Application

Review all the details and documents before applying. Once submitted, you will receive an acknowledgement receipt with a unique reference number.

Step 8: Inspection and Approval

The FSSAI authorities will review your application and may inspect your business premises. If everything is in order, your license will be approved and issued.

Step 9: Download the FSSAI License

Once approved, you can download your FSSAI license from the FLRS portal. Display this license at your business premises and on food product packaging.

Conclusion

Applying for an FSSAI registration license online is a streamlined process that ensures your food business complies with the necessary safety and quality standards. Following the steps outlined in this guide, you can obtain your FSSAI license efficiently, enhancing your business's credibility and operational legality. Consider consulting with a professional or contacting the FSSAI helpline for any assistance.

0 notes