Don't wanna be here? Send us removal request.

Text

Understanding Non Banking Financial Company in India

What is a Non-Banking Financial Company (NBFC)?

An NBFC is a company registered under the Companies Act, 2013, that provides financial services but does not hold a banking license. NBFCs operate in various sectors such as loans, asset financing, insurance, leasing, and investments. They are regulated by the Reserve Bank of India (RBI) under the RBI Act, 1934, but do not offer core banking services like accepting demand deposits from the public or issuing checks.

Key Differences Between NBFCs and Banks

While both banks and NBFCs provide financial services, there are some key differences:

1. Deposit Acceptance: Unlike banks, NBFCs cannot accept demand deposits.

2. Payment and Settlement System: NBFCs are not part of the payment and settlement system and cannot issue checks.

3. Deposit Insurance: Deposits with NBFCs are not insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC), unlike those with banks.

Despite these differences, NBFCs are pivotal in delivering financial services across various sectors.

Types of NBFCs

NBFCs in India are categorized based on their activities and types of deposits accepted. Here are the main categories:

1. Asset Finance Company (AFC): Engages in financing physical assets like machinery, automobiles, and equipment used in productive sectors.

2. Loan Company: Primarily focuses on providing loans and advances that do not involve asset financing.

3. Investment Company: Engages in acquiring securities, such as shares, stocks, and bonds.

4. Infrastructure Finance Company (IFC): Specializes in funding infrastructure projects and requires a minimum Net Owned Fund (NOF) of Rs. 300 Crore.

5. Microfinance Institution (MFI): Provides microloans to individuals or small businesses, particularly in rural and semi-urban areas, with a focus on income generation.

6. Core Investment Company (CIC): Holds a minimum of 90% of its total assets as investments in group companies, with 60% of its equity investments in these companies.

7. Infrastructure Debt Fund (IDF): Facilitates long-term debt flow into infrastructure projects by raising resources through bonds.

8. NBFC-Factors: Engaged in the business of factoring, which involves the sale of receivables to improve cash flow.

9. Mortgage Guarantee Companies (MGC): Provides mortgage guarantee services with at least 90% of assets in guarantee business. Visit our website for complete details.

Advantages of NBFCs

NBFCs offer several advantages over traditional banks:

1. Diverse Financial Services: NBFCs can engage in various activities such as loans, leasing, hire-purchase, insurance, and investment management, offering a broad range of financial services.

2. Regulatory Flexibility: Although regulated by the RBI, NBFCs enjoy more flexibility than banks, which allows them to cater to niche markets with innovative financial products.

3. Easier Access to Capital: NBFCs can raise funds through various means, including debentures, bonds, and loans. Some NBFCs are also allowed to accept deposits.

4. Faster Loan Processing: NBFCs often have streamlined loan approval processes, resulting in quicker loan disbursals compared to traditional banks.

Foreign Investment in NBFCs

The Indian government allows 100% Foreign Direct Investment (FDI) in NBFCs under the automatic route, provided they engage in certain specified financial activities such as asset management, stock broking, financial consultancy, and venture capital. NBFCs with foreign investment must comply with minimum capitalization norms as defined by RBI guidelines, depending on the level of foreign ownership.

Registration Process for NBFCs in India

To operate legally, an NBFC must undergo a registration process with the Reserve Bank of India. Below is a step-by-step guide:

1. Incorporate the Company: Register your company under the Companies Act, 2013, ensuring that the primary objective is engaging in financial activities.

2. Meet the Net Owned Fund (NOF) Requirement: Ensure that the company has a minimum NOF of Rs. 200 Lakhs, primarily in equity shares.

3. Prepare a Detailed Business Plan: Draft a comprehensive business plan, including financial projections and operational strategies.

4. Apply Online: Submit an online application to the RBI through its official portal along with required documents such as the Certificate of Incorporation and business plan.

5. Submit Hard Copies: Send a signed hard copy of the application and supporting documents to the regional RBI office.

6. Board Resolutions: Pass board resolutions confirming adherence to RBI’s Fair Practices Code and affirming that the company will not engage in restricted activities.

7. Director Credentials: Ensure that at least one-third of the company’s directors have a minimum of 10 years of experience in finance.

8. Comply with RBI Norms: Meet any additional compliance requirements such as CIBIL ratings and FDI norms, if applicable.

Conclusion

Non-Banking Financial Companies (NBFCs) are integral to the financial system in India, providing essential services that extend beyond the reach of traditional banking institutions. By facilitating access to credit, especially in underserved areas, NBFCs contribute significantly to economic development and financial inclusion. With a thorough understanding of regulatory requirements and a clear registration process, businesses can successfully enter the NBFC sector and thrive in India’s growing financial ecosystem.

#Non Banking Financial Company Registration#Non Banking Financial Company In India#Non Banking Financial Company#NBFC Registration

0 notes

Text

The Comprehensive Guide to Section 8 Company

Introduction to Sector 8 Company

A Section 8 Company, as defined under the Companies Act, 2013, is a non-profit organization established with the purpose of promoting activities that benefit society. These activities can range from commerce, art, science, sports, education, and research, to social welfare, religion, charity, and environmental protection. Unlike other companies, Section 8 Companies are prohibited from distributing profits to their members and must use any income or profits solely for promoting their objectives. This article will delve into the key aspects of Section 8 Company, including their criteria, benefits, formation process, compliance requirements, and how they compare to other non-profit entities.

Criteria for Section 8 Companies

Charitable Purpose

Section 8 Companies are established with the objective of advancing various social, cultural, educational, and environmental causes. The fundamental criteria for these companies include:

Promoting Commerce, Art, Science, Sports, Education, Research, Social Welfare, Religion, Charity, and Environmental Protection: These are the primary areas where Section 8 Companies focus their efforts.

Utilization of Profits: All profits and income generated by the company must be used to further its charitable objectives. No portion of the profits can be distributed as dividends or profits to its members.

Licensing Requirements: While the incorporation process mirrors that of other companies, Section 8 Companies must comply with additional requirements to obtain the necessary licenses.

Visit our website.

Benefits of Section 8 Companies

Separate Legal Entity and Limited Liability

Section 8 Companies enjoy the status of a separate legal entity, which means they can own, sell, and transfer property, as well as incur debts independently of their members. Additionally, these companies benefit from limited liability, ensuring that the personal assets of members are not at risk for the company's liabilities.

Tax Benefits

One of the significant advantages of forming a Section 8 Company is the potential for various tax exemptions:

12A Registration: This allows the company to be exempt from paying income tax on surplus income. However, post-October 1, 2020, new registrations for income tax exemptions must be obtained under Section 12AB, granting provisional registration for three years.

80G Certificate: Donations made to Section 8 Companies can be eligible for tax exemptions for the donors, which encourages charitable contributions. The 80G Certificate, effective from October 1, 2020, is granted for five years and requires renewal.

Foreign Contributions

Section 8 Companies can receive foreign contributions, provided they obtain registration under the Foreign Contribution Regulation Act (FCRA). This registration is crucial for attracting international funding to support the company's charitable activities. A Section 8 Company must be in existence for a minimum of three years before applying for FCRA registration.

Credibility and Trust

Due to stringent compliance and transparency requirements, Section 8 Companies are often perceived as more credible and trustworthy compared to other non-profit entities. This credibility can enhance their ability to attract donations, grants, and other forms of support.

Formation of a Section 8 Company

Incorporation Process

The process of incorporating a Section 8 Company involves several key steps:

Obtain Digital Signature Certificate (DSC): Required for the proposed directors and members.

Director Identification Number (DIN): Apply for DIN for the proposed directors.

Name Approval: File Form INC-1 to get the company name approved by the Registrar of Companies.

Drafting of MOA and AOA: Draft the Memorandum of Association (MOA) and Articles of Association (AOA) outlining the company's objectives and governance rules.

License Application: Apply for a Section 8 license by filing Form INC-12 with the necessary documents.

Incorporation Filing: After obtaining the license, file Form SPICe (INC-32) along with MOA, AOA, and other required documents for incorporation.

Required Documentation

Memorandum of Association (MOA) and Articles of Association (AOA)

Declarations by Directors

Proof of Registered Office Address

Identity and Address Proofs of Directors and Members

Compliance Requirements

Annual Compliance

To maintain their status, Section 8 Companies must adhere to several annual compliance requirements:

MCA Filings: This includes filing annual returns, financial statements, and other necessary documents with the Ministry of Corporate Affairs (MCA).

Board Meetings: At least four board meetings must be held annually, along with one annual general meeting.

Audits: Annual financial audits are mandatory to ensure transparency and accountability.

DIR-3 KYC: Directors must comply with Know Your Customer (KYC) requirements.

Situational Compliance

12A and 80G Registration: These are necessary for availing tax exemptions for the company and its donors.

FCRA Registration: Required for receiving foreign contributions.

Trade License: Depending on the nature of the activities undertaken by the company.

Employee-Related Compliances: Professional tax filing, Employees Provident Fund (EPF) registration, and Employee State Insurance (ESI) registration if applicable.

Comparison with Society and Trust

Society

Regulation: Governed by the Society Registration Act, 1860.

Members: Minimum of seven members required for a state-level society and eight for a national level. Family members cannot be members of the same society.

Foreign Contribution: Possible, but FCRA registration is challenging if there are foreign members.

Jurisdiction: Typically state-level jurisdiction.

Trust

Regulation: Governed by the Trust Act or Bombay Public Trust Act.

Members: Trustees can be family members; minimum of two trustees required.

Foreign Contribution: Possible, but FCRA registration cannot be obtained if there are foreign members.

Funding: Government departments may refuse funding if all trustees are family members.

Section 8 Company

Regulation: Governed by the Companies Act, 2013.

Members: Anybody can be a director or member; minimum of two members for private companies and seven for public companies.

Foreign Contribution: Can receive foreign contributions and obtain FCRA registration, making it the preferred choice for such funding.

Governance: Preferred for FCRA due to its structured governance and compliance requirements.

Conclusion

Section 8 Companies provide an excellent framework for individuals and organizations aiming to create a positive social impact through structured and legally recognized means. The benefits of tax exemptions, credibility, and the ability to receive foreign contributions make Section 8 Companies a compelling choice for charitable endeavors. However, it is crucial to adhere to the stringent compliance requirements and maintain transparency to ensure the continued success and integrity of the organization. By following the right procedures and leveraging the benefits, a Section 8 Company can effectively achieve its mission and contribute significantly to society.

#section 8 company in india#section 8 company#section 8 company registration#section 8 company registration online

0 notes

Text

Exploring the Advantages and Requirements of Limited Liability Partnership

Overview On Limited Liability Partnership

Limited Liability Partnerships have gained popularity due to their flexible structure and numerous benefits for small and medium-sized enterprises (SMEs). Combining the features of both partnerships and companies, LLPs offer the advantages of limited liability while allowing partners to organize their internal structure like a partnership.

Visit Our Website.

Key Benefits of LLPs

Separate Legal Entity: LLPs are distinct legal entities with perpetual existence unless dissolved. They can own, sell, and transfer property and incur debts independently of their partners.

Limited Liability Structure: The liability of each partner is limited to their capital contribution, protecting personal assets from business liabilities.

Easy to Incorporate and Low Maintenance: The process of incorporating an LLP is simpler compared to that of a company. Annual compliance requirements are fewer, resulting in lower maintenance costs.

No Limit on Maximum Number of Partners: While a minimum of two partners is required, there is no upper limit on the number of partners in an LLP.

Transferability: Designated partners can be changed, and partnership ratios can be transferred without disrupting the functioning of the LLP.

Raising Funds: LLPs can raise funds through capital contributions from partners or by taking on debt.

Foreign Direct Investment (FDI): 100% FDI is allowed under the automatic route. LLPs with 100% FDI can also invest in other companies or LLPs where 100% FDI is permitted.

Pros of LLPs

Audit Not Compulsory: Audits are only required if the LLP's contributions exceed Rs. 25 Lakhs or if annual turnover exceeds Rs. 40 Lakhs.

Low Capital Requirement: An LLP can be formed with a minimum capital contribution of Rs. 5,000.

No Tax on Profit Distribution: Unlike private and public companies, LLPs are not required to pay Dividend Distribution Tax (DDT) on the distribution of profits among partners.

Preferred by Small Businesses: LLPs are ideal for small businesses seeking a structured form of organization with low maintenance costs.

Cons of LLPs

Penalties for Non-Compliance: Failure to file annual compliance forms on time incurs a penalty of Rs. 100 per day. Continuous non-compliance can lead to significant penalties, such as Rs. 73,000 for a one-year delay, in addition to regular professional fees.

Limited Fundraising Options: Venture capitalists often avoid LLPs for fundraising. Additionally, LLPs cannot be converted into companies, although the reverse is possible.

Requirements for Forming an LLP

Minimum of 2 Designated Partners

Minimum of 2 Partners who are the owners (similar to shareholders in a company)

Capital Contribution: LLPs can start with a minimum capital of Rs. 5,000

At least 1 Resident Designated Partner

Annual Compliances Post Formation

Compulsory Annual Compliances:

MCA Filing

Income Tax Filing

GST Filing (if applicable)

Situational Compliances:

Trademark Registration: To protect the brand name and logo of the LLP

Audit Requirements: Mandatory once contributions exceed Rs. 25 Lakhs or annual turnover exceeds Rs. 40 Lakhs

GST Registration and Compliance

Trade License: If required

Professional Tax Filing: Applicable if the LLP has employees

Employees Provident Fund Organisation (EPFO) Registration and Compliance: Applicable once the LLP has 20 or more employees

Employee State Insurance Corporation (ESIC) Registration and Compliance: Required once the LLP has 10 or more employees in most states, and 20 in Maharashtra

Conclusion

LLPs offer a balanced structure for businesses looking to benefit from limited liability and the flexibility of a partnership. While they are ideal for SMEs due to their ease of incorporation and low maintenance costs, it is crucial to stay compliant with regulatory requirements to avoid hefty penalties. Understanding the benefits, limitations, and compliance obligations can help businesses decide whether an LLP is the right structure for their needs.

0 notes

Text

Exploring Nidhi Companies in India: A Comprehensive Guide

In Depth Guide On Nidhi Limited Company

Nidhi Compan are a distinct category of non-banking financial companies (NBFCs) in India, established primarily for the mutual benefit of their members. These companies encourage thrift and savings among their members by accepting deposits and lending money exclusively to them, operating on the principle of mutuality.

Formation and Compliance

To form a Nidhi Company, a minimum equity share capital of Rs. 5 Lac is required, and the company's name must end with "Nidhi Limited." They are regulated by Section 406 of the Companies Act, 2013, and the Nidhi Rules, 2014. The primary activities of Nidhi Companies include accepting deposits and providing loans, similar to NBFCs, but they are restricted to transactions involving their members' funds only.

Exemptions and Regulatory Framework

Although Nidhi Company function similarly to NBFCs, they are exempt from the core regulations of the Reserve Bank of India (RBI) that govern NBFCs. Instead, they follow specific guidelines outlined in the Nidhi Rules, 2014, and Section 406 of the Companies Act, 2013.

Accepting Deposits

Nidhi Company are permitted to accept deposits up to 20 times their Net Owned Funds (NOF) as per their latest audited financial statements. The terms and duration for these deposits are as follows:

Recurring Deposits: Minimum duration of 12 months and a maximum of 60 months, with particular conditions for mortgage-related deposits.

Fixed Deposits: Minimum duration of 6 months and a maximum of 60 months.

The interest rate on deposits is regulated, with savings deposits capped at 2% above the rate offered by nationalized banks and fixed and recurring deposits limited to the rate prescribed by the RBI for NBFCs.

Investing Deposits

Nidhi Company must invest at least 10% of their deposits in unencumbered term deposits with scheduled commercial banks or post office deposits.

Loan Provisions

Loans from Nidhi Companies are granted only to their members and must be secured against assets such as gold, silver, jewelry, immovable property, fixed deposit receipts, National Savings Certificates, government securities, and insurance policies. Loan limits are based on the company's total deposits:

Up to Rs. 7.50 Lac if deposits range from Rs. 2 Crore to Rs. 20 Crore.

Up to Rs. 15 Lac if deposits exceed Rs. 50 Crore.

Up to Rs. 2 Lac if deposits are less than Rs. 2 Crore.

Up to Rs. 12 Lac if deposits range from Rs. 20 Crore to Rs. 50 Crore.

The interest rate on loans must not exceed 7.5% above the highest rate offered on deposits by the Nidhi Company and is calculated on a reducing balance method.

Branch Operations

Nidhi Company can establish up to three branches within a district if they have earned net profits continuously for the previous three financial years. For additional branches or branches outside the district, prior permission from the Regional Director and notification to the Registrar of Companies (ROC) are necessary. Branch operations are limited to the state where the registered office is located, and financials and returns must be up-to-date.

Basic Requirements

Nidhi Company must fulfill the following criteria:

Investment in unencumbered term deposits of at least 10% of the outstanding deposits.

A Net Owned Funds to deposits ratio of no more than 1:20.

A minimum of 200 members.

Filing a certified return in Form NDH-1 with the ROC within 90 days of the close of the first financial year.

Net Owned Funds of Rs. 10 Lac or more.

If these requirements are not met, an application for extension in Form NDH-2 must be submitted to the Regional Director. Non-compliance can result in restrictions on accepting deposits from the second financial year.

General Restrictions

Nidhi Companies are subject to several operational restrictions, including:

Inability to issue preference shares, debentures, or other debt instruments.

Restriction on opening current accounts with members.

Prohibition on engaging in chit funds, hire purchase, leasing finance, insurance, or acquiring securities.

Prohibition on non-borrowing or lending activities in its own name.

Restriction on advertising for soliciting deposits and paying brokerage or incentives.

Limitations on acquiring other companies or changing management without approval.

Prohibition on admitting bodies corporate, trusts, or minors as members.

Dividend declaration limits, capped at 25% unless approved by the Regional Director.

Conclusion

Nidhi Companies play a crucial role in fostering savings and financial inclusion among their members. By adhering to specific regulations and maintaining compliance, they ensure mutual benefit and contribute to the financial well-being of their communities.

#nidhi company#Nidhi limited company services#nidhi limited company registration#Nidhi limited company in india

0 notes

Text

Mastering Alternative Investment Funds: Key Concepts and Practices

Understanding Alternative Investment Funds (AIFs) in the Indian Context

Alternative Investment Funds (AIFs) represent a distinctive segment within India's investment sphere, structured as trusts, companies, LLPs, or similar entities. These funds aggregate capital from a diverse array of investors, both domestic and foreign, with the aim of deploying it according to a predefined investment strategy for the benefit of investors. Unlike mutual funds or collective investment schemes, AIFs operate outside the ambit of SEBI regulations.

Exemptions and Preferences

Certain entities, such as family trusts, ESOP trusts, employee welfare trusts, holding companies, and securitization trusts, enjoy exemptions from AIF regulations. Among the available structures, opting for a trust structure is often favored, particularly for offshore funds, due to its streamlined incorporation process, operational flexibility, and reduced regulatory disclosure requirements compared to companies or LLPs.

Categorization of AIFs

AIFs are classified into three primary categories:

Category I AIFs: These funds primarily target investments in startups, early-stage ventures, SMEs, social ventures, infrastructure, or other economically desirable sectors. Examples include venture capital funds, SME funds, social venture funds, and infrastructure funds.

Category II AIFs: This category encompasses funds that do not fit into Category I or III. Investments may include private equity, structured credit, debt, or real estate funds.

Category III AIFs: These funds engage in short-term trading or do not receive specific government concessions. Examples include hedge funds, long-only funds, and long-short funds.

Visit our website

Structures and Registration

AIFs can adopt various legal structures, such as trusts, companies, LLPs, or other corporate forms, with trusts being the most prevalent. The sponsor, responsible for establishing the fund, may be an individual or entity. An investment manager oversees investment decisions and fund governance.

Regulatory Compliance

Sponsors and investment managers are required to maintain a minimum interest in the AIF's corpus. Each scheme within the fund must meet specified minimum corpus thresholds. Additionally, AIFs have minimum investment requirements for individual investors.

Tax Implications and Stamp Duty

Category I and II AIFs enjoy pass-through tax benefits, wherein income is taxed at the unit-holder level. However, Category III AIFs do not enjoy this tax status. Stamp duty is applicable on the issuance and transfer of AIF units, with rates specified by SEBI.

Eligibility Criteria for Investing in AIFs

Investors seeking to diversify their portfolios can consider Alternative Investment Funds (AIFs) if they meet the following requirements:

Inclusive Investor Base: AIFs accept investments from Resident Indians, NRIs, and foreign nationals.

Minimum Investment Requirements: General investors must commit at least Rs. 1 crore. For directors, employees, and fund managers, the minimum investment is Rs. 25 lakh.

Mandatory Lock-in Period: AIF investments require a lock-in period of at least three years.

Investor Limits: Each AIF scheme can include up to 1000 investors, except for angel funds, which are limited to 49 investors.

Benefits of Investing in AIFs

There are several advantages to investing in AIFs:

High Return Potential: AIFs often provide higher returns compared to other investment options. The substantial pool of capital allows fund managers to devise flexible strategies aimed at maximizing returns.

Lower Volatility: AIFs are not directly tied to the stock markets, resulting in less volatility. This makes them attractive to risk-averse investors seeking stability.

Enhanced Portfolio Diversification: AIFs improve portfolio diversification, offering a cushion during financial crises or market volatility.

Drawbacks of Investing in AIFs

Investing in AIFs comes with some potential downsides:

Higher Fees and Transaction Costs: AIFs typically have higher fees and transaction costs, which can reduce overall returns.

Increased Risk: Compared to traditional investments, AIFs generally carry higher levels of risk, requiring careful consideration by investors.

Transparency and Regulatory Challenges: AIFs may offer less transparency and be subject to reduced regulation, posing challenges for investors seeking clear oversight.

Complexity and Suitability: The complexity of AIFs might not suit novice investors who may find them difficult to understand and manage.

Liquidity Constraints: AIFs can be illiquid, making it challenging for investors to access their capital quickly when needed.

Methods of Investing in Alternative Assets

Starting to invest in various alternative assets varies significantly based on the type of asset:

Private Equity Investments: These involve buying shares in private companies or groups of companies. Investors can engage through private equity firms, venture capital funds, or crowdfunding platforms.

Real Estate Investments: Investors can enter the real estate market by purchasing rental properties, investing in Real Estate Investment Trusts (REITs), or using real estate crowdfunding platforms.

Hedge Funds: Hedge funds are typically reserved for accredited investors with high net worth and substantial investment capital. Access is usually through hedge fund managers or brokers.

Commodity Investments: Investing in commodities involves purchasing physical assets like gold, silver, oil, or agricultural products. Participation can also be through commodity trading platforms, exchange-traded funds (ETFs), or mutual funds.

Art and Collectibles: Investing in art and collectibles can be done through art dealers, auction houses, or online marketplaces. Given the unique nature of these items, it's essential to verify the dealer's reputation.

Cryptocurrency Investments: Cryptocurrency investments are made through cryptocurrency exchanges, brokers, or online platforms. Investors typically deposit domestic currency into a digital wallet to manage their private keys and digital currencies.

Conclusion

Understanding the nuances of AIF structures, categories, and regulatory obligations is crucial for stakeholders navigating the alternative investment landscape in India.

0 notes

Text

Essential Steps to Set Up a Producer Limited Company in 2024

Introduction to Producer Limited Companies

Producer companies in India represent distinct corporate entities established under the Companies Act of 2013. These entities focus on enhancing the well-being of their members, typically individuals engaged in agriculture, rural entrepreneurship, or primary goods production. They aim to foster collaboration, pool resources, and offer various benefits in agriculture and rural development.

Tax Benefits & Support for Farmer Producers

Farmer Producer Companies primarily serve Farmer Producer Members and offer them tax advantages:

While the Income Tax Act of 1961 exempts agricultural income under Section 10(1), specific tax exemptions for Producer Companies are not outlined.

Farmers can establish Producer Companies in alignment with the main objectives specified under the Companies Act, 2013, to avail tax benefits and exemptions.

Income generated from the sale of grown produce is considered agricultural income under the Income Tax Act, 1961, and is entirely tax-free. However, any further processing incurs taxation on 60% of the income.

Reduced customs duty on agricultural equipment and parts imports benefits Producer Companies engaged in agricultural activities.

Financial Assistance

Farmer Producers can access support from the Small Farmers Agribusiness Consortium (SFAC), including:

A Credit Guarantee Fund to mitigate credit risks for financial institutions lending to Farmer Producer Companies.

Matching equity grants of up to Rs. 10 Lac to augment borrowing capacity.

Additionally, NABARD provides credit support for business operations and technical and managerial support.

Check out our website.

Primary Objectives of Producer Companies

As per the Companies Act, 2013, Producer Companies focus on the following objectives:

Production, harvesting, procurement, and marketing of primary produce.

Processing, manufacturing, and supplying machinery or equipment to members.

Providing education, technical services, and welfare measures to promote member interests.

Generation and distribution of power, conservation of resources, and insurance services.

Financing and other ancillary activities related to procurement and marketing.

Additional Requirements

Limited by Shares:

Producer Companies operate as companies limited by shares.

Membership & Quorum in General Meetings:

Formed by 10 or more individuals or a combination of producer institutions and individuals.

A quorum for General Meetings is set at 1/4th of the total members.

Number of Directors & Minimum Quorum in Board Meetings:

Requires a minimum of 5 and a maximum of 15 directors.

Board Meeting quorum is 1/3rd of the total strength, with a minimum of 3 directors.

Company Secretary:

Companies with an average annual turnover exceeding Rs. 5 crore must appoint a full-time Company Secretary.

Conversion:

Inter-state Co-operative Societies have the option to convert into a Producer Company.

Voting Rights:

Each member has one vote, with the Chairman having a casting vote in case of a tie.

Payment to Producer Company Limited Members

Producer Company members are compensated in the following ways:

a) Value for Produce: Determined by the Board and disbursed in cash, kind, or equity shares.

b) Limited Return: Members receive bonus shares based on their share capital contribution.

c) Patronage Bonus: Surplus funds are distributed among members based on their participation in business activities.

Post-Registration Compliances for "Producer Company Limited"

Statutory Audit

Tax Audit

Income Tax Returns Filing

Annual ROC Compliances

Ongoing Corporate Secretarial Compliances

Fulfillment of any other Compliances or Returns mandated by relevant Competent Authorities, if applicable

#Producer limited company in india#legal services#structuredbiiz#Producer limited company#Producer limited company services#Producer Company Limited Registration

0 notes

Text

In Depth Guide on Public Limited Company

What is Public Limited Company

A Public Limited Company, also known as a PLC, is like a big family of investors and entrepreneurs coming together to achieve their financial goals. It's a special type of business that offers its shares to the public on stock exchanges, inviting anyone interested to become a part-owner by buying shares.

Imagine it as a bustling marketplace where shares of the company are up for grabs, and anyone with a little extra cash can join the club. But don't worry, joining this club comes with a safety net – the "Limited" part means that your financial responsibility is only as much as the money you put in. So, if things don't go as planned, your personal assets are safe and sound.

In simpler terms, a Public Limited Company is like a well-organised team where everyone chips in some money to make things happen, and in return, they get a slice of the company's success.

Importance of Establishing a Public Limited Company

1. Broadening Investment Horizons

Public Limited Companies (PLCs) have a unique advantage – the ability to attract capital from a diverse pool of investors. By offering shares to the public on recognized stock exchanges, PLCs can tap into a vast market of potential investors, allowing them to raise substantial capital compared to private entities.

2. Spreading Risk, Sharing Rewards

One of the key benefits of going public is the opportunity to diversify ownership and spread risk among a large base of shareholders. This not only reduces the financial burden on individual investors but also allows early backers of the company to cash in on their investments while still retaining a significant stake.

3. Access to Varied Financing Options

Beyond share capital, PLCs often enjoy better access to alternative sources of funding. Maintaining a stock exchange listing imposes additional compliance requirements, enhancing the company's creditworthiness when issuing corporate debt. This, in turn, makes it easier to negotiate favourable terms with banks and financial institutions for loans and financing.

4. Fueling Growth and Expansion

The influx of capital provides PLCs with ample opportunities for growth and expansion. Whether it's venturing into new markets, investing in research and development, or making strategic acquisitions, the additional financial resources enable PLCs to pursue ambitious projects and capitalise on emerging opportunities.

5. Enhancing Reputation and Visibility

The "plc" tag adds prestige and credibility to a company's name, bolstering its reputation in the eyes of stakeholders and investors. Publicly listed companies often command greater attention from the media and investment professionals, leading to increased brand recognition and visibility in the marketplace.

6. Facilitating Share Transferability

Unlike their private counterparts, shares of PLCs are more readily transferable, providing shareholders with greater liquidity. Quoted on stock exchanges, these shares are easier to buy and sell, offering investors flexibility and peace of mind.

7. Strategic Exit Opportunities

Going public opens up new avenues for founders to exit the business when the time is right. Higher share transferability and heightened visibility increase the likelihood of attracting potential buyers, providing founders with viable exit strategies for the future.

Visit our website for more information.

Cons of a Public Limited Company

Compulsory Regulatory Procedures Public Limited Companies (PLCs) are subject to mandatory audit, tax filing, and secretarial compliance filings. These legal obligations are non-negotiable and require meticulous attention to ensure adherence to regulatory standards.

Annual Compliance Obligations are obligated to fulfill annual compliance requirements stipulated by the Registrar of Companies. Failure to comply can lead to severe penalties and consequences. Directors risk disqualification for up to five years if financial statements or returns are not filed for three consecutive financial years. Additionally, delays in filing annual compliance forms incur penalty fees of Rs. 100 per day.

Navigating Complex Procedures Raising funds in PLCs involves navigating complex procedural aspects and taxation considerations. It is essential to analyze and follow these procedures meticulously to avoid repercussions. Non-compliance with the Companies Act, 2013, and SEBI guidelines for listing shares can have serious ramifications.

Challenges of Dissolution Dissolving a PLC is a complex and costly process, often more challenging than its formation. Entrepreneurs must carefully evaluate the implications before initiating the dissolution process to mitigate potential challenges and expenses.

Criteria for Establishment of Public Limited Company

At least 3 Directors are required.

A minimum of 7 shareholders/subscribers, referred to as Owners of the Company, is mandatory.

The Authorised Capital must be a minimum of Rs. 10 lakh.

The Paid-Up Capital must be a minimum of Rs. 5 lakh.

At least 1 director must be a resident.

Compulsory Annual Compliances:

MCA Filings (Required):

Compliance regarding the Commencement Certificate post formation of the Company.

Compliance regarding the appointment of Auditors of the Company.

DIR-3 KYC of Directors.

Return of Deposits, if any obtained.

Appointment of CS or CFO or CEO.

Preparation of Statutory Register.

Issuance of Share Certificates.

Printing & Payment of Stamp Duty on Share Certificates.

Conducting the First Board Meeting within 30 days of incorporation.

Conducting 4 Board Meetings in a year and 1 Annual General Meeting.

Annual Disclosures of interest/non-disqualification by Directors.

Filing of Financial Statements & Returns.

Accounting & Auditing (Required)

IT Filing (Required)

GST Compliances (Required), if registration already obtained

Additional Compliances as Needed:

Trademark Registration: Registering the Brand name and logo of the Company.

GST Registration & Compliances: Ensuring compliance with Goods and Services Tax regulations.

Trade License: Obtaining a license if required by local authorities.

Professional Tax Filing: Filing taxes if the Company has hired any employees.

Employees Provident Fund Organization (EPFO) Registration/Compliances: Required once the Company surpasses the threshold number of employees, i.e., 20 employees.

Employee State Insurance Corporation (ESIC) Registration/Compliances: Applicable once the Company exceeds the threshold number of employees, i.e., 10 employees in states other than Maharashtra, and 20 in Maharashtra.

Secretarial Audit: Mandatory once the Public Company exceeds the paid-up capital limit of Rs. 50 Crore or more, or turnover of Rs. 250 Crore or more.

#legal services#structuredbiiz#public limited company services#public limited company#public limited company registration#public limited company in india#legal

0 notes

Text

The Advantages, Disadvantages, and Requirements of a Private Limited Company

Choosing the right business structure is pivotal for entrepreneurs, and the Private Limited Company model offers distinct advantages and challenges. Let's explore its features, benefits, drawbacks, and the essential requirements for establishment and operation.

Advantages of a Private Limited Company Structure:

Separate Legal Entity: A Private Limited Company enjoys the status of a distinct legal entity with perpetual existence. It can hold property, enter contracts, and incur debts independently of its owners.

Limited Liability Structure: Owners benefit from limited liability, safeguarding personal assets against business liabilities. This separation ensures that individual finances remain unaffected by the company's obligations.

Fundraising Opportunities: Private Limited Companies have various avenues for raising capital:

Debt instruments like Convertible Notes, Compulsorily Convertible Debentures, and Preference Shares offer flexible financing options.

Venture capital investors prefer this structure due to its suitability for diverse investment instruments.

Potential for conversion into a Public Limited Company enables access to public funding through stock exchanges.

Foreign Direct Investment (FDI): Private Limited Companies facilitate FDI, with 100% FDI permitted in many sectors. This allows seamless investment in other companies or LLPs where FDI is allowed.

Judicial Authority: Specialized judicial authorities, such as the National Company Law Tribunal under the Companies Act, 2013, provide a structured framework for dispute resolution.

Transparency & Transferability:

The company's operations are transparent, with major decisions made collectively in board meetings and documented minutes.

Directors can be changed, and share ownership can be transferred with board approval, ensuring continuity and flexibility.

Read In detail article on our offical website.

Disadvantages of a Private Limited Company Structure:

Compliance Obligations: Mandatory audits, tax filings, and secretarial compliance add administrative burdens.

Failure to meet annual compliance deadlines can lead to penalties or director disqualification.

Complex Procedures: Navigating procedural and tax requirements for fundraising can be intricate, demanding thorough analysis.

Issuing debt and equity instruments entails compliance with regulatory frameworks, which can be complex.

Dissolution Complexity: Dissolving a Private Limited Company involves complex procedures and costs, necessitating careful consideration before establishment.

Requirements for Establishing and Operating a Private Limited Company:

Minimum of 2 directors and shareholders.

No mandatory authorized capital requirement.

At least one resident director.

Compliance with annual filing requirements, including MCA filings, accounting, auditing, and IT filings.

Adherence to GST compliance if registered.

Additional compliances as per business needs, such as trademark registration, professional tax filing, and employee-related registrations based on employee count.

Conclusion: The Private Limited Company structure offers a blend of advantages and challenges. Understanding its features, compliance obligations, and operational requirements is crucial for entrepreneurs embarking on this journey. By navigating these intricacies effectively, businesses can harness the benefits while mitigating potential pitfalls, ensuring sustainable growth, and compliance with regulatory standards.

#private limited company registration in india#company registration#StructuredBiiz#legal services#for legal reasons this is a joke#legal advice#legal advisory in malaysia

0 notes

Text

Understanding SEBI Registered Portfolio Managers: Roles, Benefits, and Regulations

What is a Portfolio Manager?

A portfolio manager is a professional who manages, advises, and supervises a client's portfolio of securities, goods, or funds. Holding a fiduciary duty, the portfolio manager aims to optimize returns based on the client's needs and investment goals, within the framework of a signed agreement. The role of a portfolio manager is governed by SEBI (Portfolio Management) Regulations, 2020, requiring mandatory registration with SEBI.

Benefits of Creating a Portfolio

Creating a portfolio offers numerous advantages for investors:

Diversification: A well-balanced and diversified portfolio spreads risk across different investments.

Long-term Goals: It helps in achieving long-term financial aims.

Risk Reduction: By diversifying, the portfolio reduces the risk factor.

Loss Recovery: Effective management can help recover losses over time.

Informed Decisions: Portfolio managers make strategic decisions on shuffling investments, enhancing safety and returns.

Visit Us: https://structuredbiiz.com/sebi-registered-portfolio-managers/

Types of Portfolio Management Services

1. Discretionary Portfolio Management

Under discretionary management, the portfolio manager independently manages the client's funds and securities, making all buy or sell decisions. This strategy is typically executed by individuals with extensive stock market knowledge.

Advantages:

Expertise of an investment professional.

No stress for the client in making decisions.

Smooth management process if client and manager agree on investment strategies.

Disadvantage:

Higher fee costs.

2. Non-Discretionary Portfolio Management

In non-discretionary management, the portfolio manager acts as a financial advisor, making suggestions while the client retains the final decision-making authority.

Advantages:

Client retains control over investment decisions.

Access to professional financial advice without giving up control.

SEBI Registration Process for Portfolio Managers

To act as a portfolio manager, obtaining a SEBI registration is mandatory. The process includes:

Application Submission: Apply to SEBI in Form A of Schedule I with a non-refundable fee of Rs. 1 lakh.

Qualifications: Minimum net worth of Rs. 5 crores and a finance degree with 10 years of stock market experience.

Application Review: SEBI reviews the application, providing an opportunity to correct any deficiencies.

Registration Fee: Upon approval, a registration fee of Rs. 10 lakhs is required.

Renewal Fee: Rs. 5 lakhs every three years to keep the registration active.

SEBI Regulations for Portfolio Managers

Key regulations include:

Minimum Net Worth: Rs. 5 crores.

Detailed Contracts: Comprehensive contracts between investors and managers detailing services and fees.

Minimum Investment: Increased to Rs. 50 lakhs.

Performance Reports: Provided every three months or on client request.

Responsibilities of Portfolio Managers

According to Regulation 23, portfolio managers must:

Manage funds based on client needs (discretionary) or client directions (non-discretionary).

Accept funds or securities worth a minimum of Rs. 50 lakhs.

Act in a fiduciary capacity with the client's funds.

Maintain separate accounts for each client’s holdings.

Keep client funds in a separate account at a Scheduled Commercial Bank.

Transact within client limitations under RBI regulations.

Avoid deriving direct or indirect benefits from client funds or securities.

Not borrow funds or securities on behalf of the client.

Not lend client securities except as allowed by regulations.

Handle client complaints promptly and appropriately.

Ensure compliance with regulations in service distribution activities.

Actions for Contraventions

Portfolio managers violating regulations face actions under SEBI rules, including:

Disposal of proceedings without adverse action.

Cancellation or suspension of registration.

Prohibition from taking new assignments.

Debarment of officers from securities market activities.

Regulatory censure, with potential cancellation after multiple censures.

Understanding the roles, benefits, and regulations of SEBI registered portfolio managers is crucial for investors seeking professional management of their portfolios. This ensures informed decision-making, adherence to regulations, and optimized returns on investments.

0 notes

Text

In-depth Guide on One Person Company

An One Person Company (OPC) is legally constituted with only one shareholder, who is acknowledged as the company’s sole member. OPCs typically emerge when there is a single founder or promoter involved in the company. Because of the numerous advantages they offer, entrepreneurs and businessmen launching a new venture often opt for this business structure instead of sole proprietorships.

If you want to register your One Person Company you can visit our official website https://structuredbiiz.com/

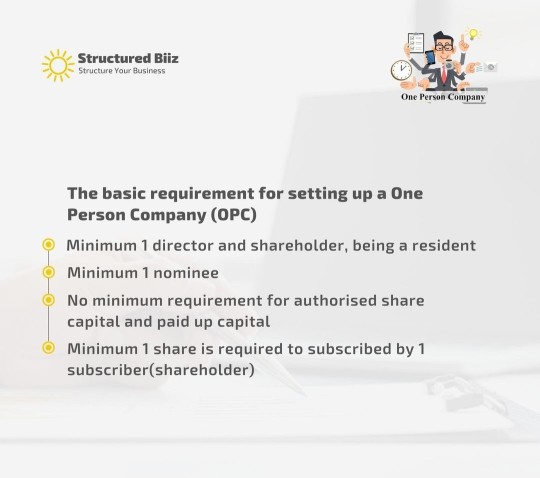

Requirements for One Person Company (OPC) Formation

At least one director and shareholder must be a resident.

Minimum one nominee is required.

The authorized capital should be a minimum of 1 lakh.

There is no minimum requirement for paid-up capital.

Features of One Person Company (OPC)

Distinct Legal Identity: An OPC possesses a distinct legal identity, separate from its owner. This autonomy enables the company to engage in contracts, own assets, and assume liabilities under its own name.

Mandatory Incorporation: Unlike other business structures, OPC formation is mandatory and governed by the Companies Act. This formal process ensures adherence to legal standards, enhancing transparency and accountability.

Single Ownership: A defining characteristic of OPCs is their single-member ownership structure. This arrangement allows a sole entrepreneur to own and manage the entire business, facilitating efficient decision-making without the complexities of a multi-member board.

Indian Ownership: OPCs mandate Indian ownership, restricting establishment and operation to Indian citizens and residents. This requirement ensures the business remains firmly rooted within the country's jurisdiction.

Limited Liability Protection: OPCs offer limited liability protection, a significant draw for entrepreneurs. This safeguard shields the owner's personal assets, limiting their liability to the extent of their investment in the company. Such financial insulation is a valuable advantage for individual business owners.

Requirements for One Person Company

Unique and Meaningful Name: A company's name is its primary identifier, crucial for building brand value. It must be distinctive yet indicative of the company's purpose.

Registered Office Address: An OPC must have a designated office for conducting business and official correspondence. The location, whether rented or owned, must be secure and lockable to safeguard important documents.

Adequate Capital Investment: Capital investment is essential for the smooth operation of an OPC. Since there's only one shareholder, the invested amount must be sufficient to sustain business operations effectively.

Single Shareholder Ownership: OPCs are characterized by a single shareholder who holds 100% ownership of the company. The shareholder, an Indian citizen, whether resident or non-resident, is entitled to all profits earned by the company.

Directorship Requirement: While the sole owner doesn't manage the company directly, they must appoint at least one director. An OPC can have up to 15 directors, with at least one being a resident in India for more than 120 days during the previous financial year.

Limitations of One Person Company (OPC)

1. Ineligibility for Certain Conversions: OPCs cannot be converted into Section 8 Companies (Not for Profit) or Non-Banking Financial Companies (NBFCs).

2. Resident Shareholder Requirement: Only residents of India, who have stayed in the country for 182 days or more in a year, are permitted to be shareholders of OPCs. Non-residents are not allowed to establish OPCs.

3. Restriction on Multiple OPCs: Each individual is limited to either owning one OPC or being nominated as a nominee in one OPC. Consequently, one person cannot simultaneously hold shareholder or nominee positions in multiple OPCs.

4. Conversion Limitation Period: An OPC cannot be converted into a regular company until two years have elapsed from the date of incorporation, except under specific circumstances. These exceptions include instances where the paid-up capital exceeds Rs. 50 lakh or the average annual turnover for the immediately preceding three consecutive financial years exceeds Rs. 2 crore.

5. Unsuitability for Investor Funding: OPCs are not recommended for entrepreneurs seeking investment from external investors.

1 note

·

View note