#South African Revenue Service (SARS) - www.sars.gov.za

Text

How Do I Register for Tax? See Methods

How Do I Register for Tax? See Methods

There are three ways to register for tax:

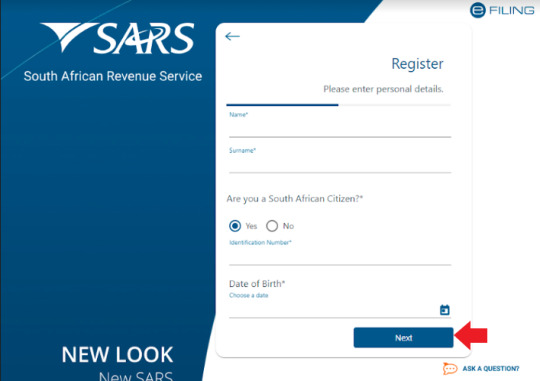

– Auto registration for Personal Income Tax

When you register for SARS eFiling for the first time and you do not yet have a personal income tax number, SARS will automatically register you and issue a tax reference number. Note that you must have a valid South African ID.

Easy Steps:

Go to http://www.sars.gov.za

Select ‘Register Now’

Follow the…

View On WordPress

0 notes

Text

SARS Vacancies 2022 Apply Online – www.sars.gov.za Recruitment Portal

SARS Vacancies 2022 Apply Online – www.sars.gov.za Recruitment Portal

South African Revenue Service (SARS) Vacancies 2022 | http://www.sars.gov.za Recruitment Portal

South African Revenue Service (SARS) Vacancies 2022 | http://www.sars.gov.za Recruitment Portal The South African Revenue Service (SARS) http://www.sars.gov.za Invites south African Energetic Youth to Apply for Announced job Vacancies to fill Different positons.

SARS OVERVIEW

What SARS does

The…

View On WordPress

0 notes

Text

Who and or what is a Tax Practitioner?

For one, it most certainly is not your bookkeeper, broker, financial advisor or financial planner.

Yes, yes, I know they have been doing your returns for years, but…did you know that their actions are illegal? The question is not whether they have the requisite knowledge.

The question you should be asking is, “Are you a registered Tax Practitioner?” If that answer is “No”, then I wish you the best of luck allowing that person to continue preparing, calculating and or submitting your tax returns.

The fact that someone has been doing your returns in the past is irrelevant these days. You, and by inclusion, they need to comply to the Tax Administration Act(TAA) of 2011.

The question still begs, so…what is a Tax Practitioner?

The term means a person who is: “A Member of a South African recognised controlling body(RCB)”.

Let us investigate further, so… what is an RCB and who are they?

An RCB is an organization who is either:

Listed in Section 240A of the TAA; or

Recognised by the South African Revenue Services(SARS).

Those are the only two options to be an RCB.

The Commissioner of SARS may grant an organization RCB status if they meet the below criteria:

All persons(“members”) registered with the organization shall adhere and maintain:

Minimum qualification and experience requirements;

Continuing professional education requirements;

Codes of ethics and conduct;

Tax compliance; an

Disciplinary processes and procedures.

Further, the organization must have a minimum of 1,000 members upon registration, or have a reasonable expectation of reaching 1,000 members by the end of the first year of registration.

The below organizations are the only organizations who are currently permitted as an RCB:

Chartered Institute of Management Accountants (CIMA)

Chartered Secretaries Southern Africa (CSSA)

Institute of Accounting and Commerce (IAC)

South African Institute of Chartered Accountants (SAICA)

South African Institute of Professional Accountants (SAIPA)

South African Institute of Tax Practitioners (SAIT)

The Association of Chartered Certified Accountants (ACCA)

Association of Accounting Technicians Southern Africa (AAT(SA))

Independent Regulatory Board for Auditors (IRBA)

Law Society of South Africa

General Council of the Bar of South Africa, Bar Councils and Societies of Advocates

It is obviously clear from the above that your financial planner, financial advisor, broker or bookkeeper may not register as a Tax Practitioner. Even if they are members of the above RCB’s, they still need to apply with SARS to become a Tax Practitioner.

What if they said “Yes, I am a Tax Practitioner”? Simple, ask them to provide you with their Tax Practitioner certificate, or their Tax Practitioner registration number. The Tax Practitioner number starts with “PR-“ and is followed by 7 numbers. You can always log on to SARS and verify whether a person claiming to be a Tax Practitioner is registered and active.

Why all this hassle, why should I not just continue with my existing arrangement? Firstly, it is against the law, secondly, you are the one who will be responsible regardless of who calculated, prepared or submitted that return to SARS. Even if your bookkeeper submitted that return, you will ultimately remain responsible for any errors, omissions and or faults. The penalties and interest alone is enough reason not to risk going this route, but there is always jail time if you need more reason.

What will a Tax Practitioner benefit me then? The Tax Practitioner was implemented to ensure that there is a framework available which ensures that the person(s) who gives advice or submits information to SARS, are properly qualified and that there are mechanisms in place, for both taxpayers and SARS, to address misconduct.

The bottom-line then is, should you continue to allow your bookkeeper, financial advisor, financial planner or broker to submit your returns on your behalf, you will ultimately remain responsible for whatever information they submitted to SARS. Now, SARS is really clever these days, and it will not be long before you will be found out for erroneous information submitted to them.

I am not saying that your bookkeeper, financial advisor, financial planner or broker will intentionally submit faulty information to SARS, what I am saying is that there is a good chance that they probably do not possess the most recent information or relevant knowledge in relation to changes in tax laws or changes made to SARS’s systems, as they do not deal with these matters daily.

Should you be found out for faulty information submitted to SARS, the penalties are harsh, and because the person who submitted the return on your behalf are not members of an RCB, the only remedy at your disposal is a civil law suit, which by the way, may take several years and turn out costing you much more than settling your account with SARS.

In comparison, if your Tax Practitioner submitted the return, and was found guilty of misconduct, then not only will your penalties and interest be remitted, the error will be corrected, and you will be compensated for any losses you incurred, without going the legal route. Thus, moving the onus form you, to your tax practitioner.

References:

1. http://www.sars.gov.za/ClientSegments/Tax-Practitioners/Pages/Controlling-Bodies-for-Tax-Practitioners.aspx

2. http://www.acts.co.za/tax/240a__recognition_of_controlli

P.S. – The withholding of information from your Tax Practitioner does not constitute misconduct on his behalf.

Until next time , Chiefcook

Copyright:

Copyright reserved by the writer hereof. No part of this article/guide may be reproduced, without prior written permission of the author.

The content of this article is intended to be general in substance and nature; to provide commentary on contemporary issues and where appropriate constitutes a general guide to the subject matter. Specialist advice should be sought about the reader’s specific circumstances.

The commentary or opinions expressed within is that of the writer and not that of any professional organisation or entity with which the writer may be associated with.

0 notes

Text

My SARS Notice Of Registration - How To Get Document

My SARS Notice Of Registration – How To Get Document

SARS notice of registration: If you have lost your Notice of registration and you are wondering how to get your notice of registration back, it’s as easy as one, two, three steps.

How To Get My SARS Notice Of Registration Document

The Notice of Registration for Individuals (IT150) can be obtained via different channels, you just have to choose the most comfortable method for you and follow the…

View On WordPress

0 notes