#Straddle Strategy in Volatile Markets

Explore tagged Tumblr posts

Text

Effective Trading Strategies Using Straddle Option Trading Strategy

Introduction to Straddle Option Trading Strategy The Straddle Option Trading Strategy is a versatile approach used by traders to capitalize on significant price movements in the market, regardless of the direction. This strategy involves purchasing both a call option and a put option on the same underlying asset, with the same strike price and expiration date. The primary goal of a straddle is…

#Advanced Options Trading#Consolidation Phase Trading Strategies#Effective Straddle Trading#High Volatility Trading#How to Trade Straddle Options#Implied Volatility and Options#Market Reaction Trading Strategies#Options Premium Costs#Options Trading for Beginners#Options Trading Strategies#Post-News Event Trading Strategies#Pre-Earnings Trading Strategies#Profit from Market Volatility#Risk Management in Straddle Options#Straddle Option Trading Strategy#Straddle Options Examples#Straddle Options for Bear Markets#Straddle Options for Bull Markets#Straddle Strategy in Volatile Markets#Time Decay in Options

0 notes

Text

You have no idea how lucky you’re going to get. We are the only ones who showed up at the office for an in-person meeting. Circling each other for months, I have been waiting for this opportunity to let my desires be known. I’m wearing a business casual, checkered jacket, buttoned up as proper attire and disguising my shirtless state beneath. I sit across from you, chatting about details of a recent project. We’re already friendly and at ease with each other as we spar verbally… verging on affectionate teasing. You hear the pings from others logging into the Zoom room and attend to their entry. I disable my video with apologies to the attendees about my bandwidth limitations… and wink at you. Greetings and formalities are dealt with, and you ask for reports, still oblivious to my intentions. I volunteer to talk the others thru the slide deck we worked on together, while you commandeer the controls. As you share your screen, I unbutton my jacket… then slowly reveal my nudity for your eyes only. They widen and soften as the abundance of my breasts come into view and I let my fingernails graze my soft skin. I lock eyes with you and bite my lip… even as I describe the new product we’re bringing to market.

“Next slide…”

I make points about the advantages we’ll be able to take over our peers in the industry. Pulling one lapel aside, I cradle the plump flesh of the exposed globe and manipulate its heft and shape, while you lick your lips until I suggest

“Next slide…”

Narrating the animated chart, I speak of the touch points for rapid response as I roll my swollen nipple between my thumb and index finger. Adding there is much to be gained by tweaking these weaknesses for greater dominance over our internal systems. My eyes roll with pleasure as I work one, then tug the other lapel to offer the same treatment as I continue with the first.

“Next slide…”

More revenue and profit figures flash on the screen and I profess you would be better to explain the intentions the company has to manipulate this volatile sector. I continue massaging myself as you outline the plans you have waiting in the wings for an upstream shift in funding growth. Mesmerized by my movements, you mention how exciting it is to monitor the quicksilver changes on both sides. You stand to show me the bulge in your trousers as you stroke its length. When I wet my fingers past my trembling lips and then seductively drag them to the wet space between my thighs, you sit down with a firm grip on yourself.

“Next slide…”

In closing, I claim the slides are available for download and review to give everyone a deeper, more fluid understanding of the input and results looming for a rewarding success and culmination of this fiscal year.

During a Q & A you conduct, I stand to sit atop and pivot to your side of the conference table just off camera. I hike my skirt to my waist to show you the dewey juncture swelling with arousal. A scant lacy garter belt holds my dark stockings and it is more than obvious there are no matching panties… and never were since I arrived for the meeting. The premeditated nature of my exhibition brings a smile to your face as you address a question about unexpected developments that would force an adjustment of strategy. You assure them that the company is nimble and more than ready for all sorts of pivots and penetrations into enticing and emerging entities.

Impatient, I suggest we circle back after absorbing what we’ve seen in today’s meeting and explore the most seductive leads. I guide your free hand between my thighs, and you breech me with your fingertips. My gasp is warning enough to mute yourself, as I devolve into needy moans and squirming enough to threaten the frame of your video feed. You nod in my direction and wave a silent goodbye to the team members as you leave the meeting. Checking that the disconnect is solid, your fingers coax me closer to straddle you, standing. Upon withdrawal you cleanse your fingers thirstily, then dip your tongue to savor the juicing source. My whimpers grow to groans again, when you reveal your own commando mode and I am lowered upon your upright growth. Easing it deep, I am beyond exhilarated by the stretching your throbbing length is supplying, giving you an unending series of murmured feedback.

“Next slide…”

4 notes

·

View notes

Text

Master the Market with Smart Intraday and Options Picks

Understanding Intraday Trading in Today’s Market

In the fast-paced world of the stock market, timing is everything. Intraday trading, often referred to as day trading, involves buying and selling stocks within the same trading day. It is a strategy preferred by many traders who seek to capitalize on small price movements. Analyzing the intraday share today can help traders make calculated decisions that align with their short-term profit goals. This approach requires a deep understanding of market trends, price action, and technical indicators.

Intraday traders often rely on charts and data tools to predict market behavior. With so many stocks listed on the exchanges, finding the right stock to trade requires both research and tools designed for fast filtering and analysis. Having access to real-time screeners and alerts can drastically improve your trading success.

The Role of the Nifty Option Chain in Strategy

Options trading is another powerful tool in a trader’s arsenal, and the Nifty option chain plays a critical role in formulating options strategies. The option chain provides a snapshot of all available call and put options for the Nifty index, including strike prices, premiums, open interest, and implied volatility. By analyzing this data, traders can gauge market sentiment, identify support and resistance zones, and predict price movements.

The Nifty option chain is particularly useful for intraday traders looking to hedge their positions or bet on short-term market movements. For instance, a sudden spike in open interest at a particular strike price could indicate a potential price reversal or breakout, enabling traders to act swiftly.

Tools and Techniques for Smarter Intraday Decisions

Success in intraday trading is not based on luck—it’s rooted in strategy, discipline, and the use of reliable tools. Traders often use candlestick patterns, moving averages, volume analysis, RSI, and MACD indicators to identify entry and exit points. Pairing these with real-time data from screener platforms can be the difference between profit and loss.

Screeners help traders filter out noise and focus on stocks with potential. For example, they can track the intraday share today that show unusual volume spikes, price breakouts, or RSI divergence. The speed at which these insights are gathered and acted upon is crucial for profitability.

Risk Management: The Backbone of Intraday Trading

While intraday trading offers high reward potential, it also carries significant risk. Markets can be volatile, and without a solid risk management plan, losses can mount quickly. Experts advise using stop-loss orders, predefined profit targets, and maintaining discipline to avoid emotional decisions.

Additionally, understanding the Nifty option chain can be an effective way to manage risk. By analyzing the distribution of open interest, traders can identify levels where institutions may be active, giving them a sense of when to enter or exit trades. Straddle and strangle strategies based on option data can also provide protection in volatile conditions.

Staying Ahead with Continuous Learning and Practice

Markets evolve constantly. To stay competitive, traders need to keep learning—whether it’s mastering new technical patterns, using advanced screener platforms, or understanding the nuances of derivatives like options and futures. Paper trading and back-testing strategies are also essential for gaining confidence without financial exposure.

Joining communities, attending webinars, and following market experts can offer valuable perspectives. The combination of insight, preparation, and consistent review of the intraday share today helps traders refine their strategies and increase their odds of success.

Conclusion: Unlock Your Trading Potential

For traders aiming to harness the full potential of intraday strategies and options data, combining timely market analysis with smart tool usage is key. Whether you're tracking the intraday share today for momentum or decoding the Nifty option chain for signals, making informed decisions can give you the edge you need in today's competitive trading environment.

0 notes

Text

Futures & Options Trading: Navigate Market Volatility Like a Pro

Step into the world of derivatives with The Stock Learning’s Futures & Options Trading course. Designed for aspiring traders and market enthusiasts, this course teaches you how to hedge, speculate, and profit using F&O strategies. Learn the mechanics of futures and options, options greeks, premium pricing, and how to build risk-managed positions in volatile markets.

✅ Understand futures & options contracts ✅ Learn call, put, spread & straddle strategies ✅ Master risk management techniques ✅ Market examples & expert guidance

Join The Stock Learning today and trade Futures & Options with confidence!

0 notes

Text

ICFM Options Trading Course - Strategies That Work

ICFM (Institute of Career in Financial Market) offers a comprehensive options trading course designed to transform beginners into skilled derivatives traders. This advanced program delves deep into options strategies, from basic calls/puts to complex multi-leg positions like iron condors and butterfly spreads. Participants learn to calculate risk exposure, interpret options Greeks (Delta, Gamma, Theta, Vega), and implement hedging techniques to protect portfolios.

The curriculum combines theoretical frameworks with live market applications. Traders practice writing covered calls, executing straddles/strangles, and managing assignments through simulated exercises. ICFM's faculty - comprising veteran options traders - share proprietary techniques for identifying mispriced options and leveraging volatility skews. Special modules cover earnings season strategies, index options trading, and sector-specific approaches.

Unique features include hands-on training with options analytics platforms, where students backtest strategies against historical data. The course emphasizes position sizing rules specific to options, teaching traders to manage leverage responsibly. Participants also learn to construct synthetic positions and understand put-call parity relationships.

ICFM's practical approach helps traders develop disciplined processes for trade entry, adjustment, and exit. The program includes weekly live trading sessions where students analyze real-time options chains under expert guidance. Graduates receive ongoing mentorship and access to an exclusive community of options traders.

This course is ideal for equity traders expanding into derivatives, investors seeking portfolio protection strategies, and professionals pursuing algorithmic trading careers. ICFM's certification is recognized across India's financial sector as a mark of options trading competency.

0 notes

Text

What is the best course for future and options trading?

The best course for Future & Options trading is one that offers both theoretical knowledge and practical experience. A well-structured Future & Option trading course helps you understand derivatives, hedging, leverage, risk management, and advanced strategies to trade confidently in volatile markets.

Empirical Academy offers one of the most practical and comprehensive Future & Option trading courses, ideal for beginners and intermediate traders looking to upskill.

Course Highlights at Empirical Academy:

Detailed coverage of call/put options and futures contracts

Strategy building: straddle, strangle, spreads, etc.

Live trading sessions with expert guidance

Risk and money management techniques

Real-market case studies and trade setups

This course is perfect for those aiming to trade professionally or generate a second income through derivatives. 🔴 Join Empirical Academy’s Future & Option trading course and trade like a pro! 🔴

0 notes

Text

Upgrades and Expansion: Zinemx Exchange Actively Explores Emerging Markets

DeFi, the Bitcoin ecosystem, and the Solana innovations broadened the boundaries of the crypto market in 2023, with volatility failing to hinder the development of the crypto ecosystem. Multiple lawsuits initiated by the U.S. Securities and Exchange Commission brought uncertainty to crypto regulation, while the EU introduction of the Markets in Crypto-Assets Regulation (MiCA) provided new guidelines for the legalization and standardization of crypto assets. The AI narrative fueled a short-term market surge, and driven by technological evolution and policy transformation, the crypto industry entered a new cycle of competition and application expansion. In this context, Zinemx Exchange kept pace with market trends, adhering to both technological innovation and market expansion, and delivered an impressive annual performance.

Facing the market changes of 2023, Zinemx Exchange proactively adjusted its strategy, optimized product features, and strived to provide users with richer and more innovative crypto trading services. In April, Zinemx launched its Web3 educational product, Zinemx Academy, offering global users systematic crypto knowledge courses, market research reports, compliance lectures, and technical salons. The platform integrated resources from research teams, industry experts, and partner universities, covering a comprehensive knowledge system from beginner to advanced levels.

Zinemx Academy is dedicated to enhancing user risk awareness and investment literacy, further demonstrating the long-term strategic vision of the platform for ecosystem development and providing strong support for nurturing a new generation of global crypto users.

In July, Zinemx Exchange launched its options trading feature, allowing users to flexibly deploy classic strategies such as calls, puts, straddles, and butterflies, meeting diversified trading needs such as hedging. To ensure safe and smooth trading, the platform adopted a risk control engine and intelligent matching algorithms to effectively address market volatility and system pressure. This development marked Zinemx entering into the derivatives market, achieving international leading standards in product depth and trading diversity, and further enhancing its appeal to professional investor groups.

In terms of global expansion, Zinemx established regional offices in Singapore and Malaysia in October, fully launching localized operations in the Southeast Asian market. As a key fintech hub, the stable regulatory environment in Singapore and rich crypto asset ecosystem offer Zinemx an ideal strategic base. Malaysia, as a representative of emerging markets, boasts a large crypto user base and significant policy openness potential.

By setting up local offices, Zinemx Exchange achieved more efficient user support, local compliance integration, and market expansion. The platform actively participated in regional crypto policy discussions, industry exhibitions, and university partnership projects, building a localized ecosystem centered on compliance, education, and community. This strategic initiative enhanced the international influence of Zinemx and provided a reliable foundation for future expansion in Asian markets.

In 2023, Zinemx Exchange took important strategic actions and made considerable progress in education, product diversity, and internationalization, boosting the market competitiveness of the platform. The platform will continue to drive innovation and development in the crypto industry, provide investors with an outstanding crypto trading experience, and help cryptocurrencies create greater value in the global financial market. Zinemx is committed to responding to uncertainty with a prudent strategy, laying out the next stage of market opportunities with a forward-looking perspective, and striving to become a bridge connecting investors with the future of finance.

0 notes

Text

Effective Trading Strategies Using Options

Options trading offers a variety of strategies that can be tailored to different market conditions, providing traders with flexibility and opportunities to manage risk. Here, we explore multiple options trading strategies, each designed to capitalize on specific market environments, including volatile markets, bull markets, bear markets, and consolidation phases. 1. Covered Call Overview A…

#Bear Markets#Bear Put Spread#Bull Call Spread#Bull Markets#Butterfly Spread#Calendar Spread#Collar Strategy#Consolidation Phase#Covered Call#Diagonal Spread#Financial Markets#Income Generation#Investment Strategies#Iron Condor#Long Straddle#Long Strangle#Market Conditions#Options Trading#Protective Put#Risk Management#Trading Examples#Trading Strategies#Volatile Markets

3 notes

·

View notes

Text

Mastering Multi-Leg Options Strategies for Advanced Traders

As financial markets are becoming more sophisticated, seasoned traders are looking for the best ways to optimise the returns and manage the risks. Multi-leg options strategies are powerful tools for those who have moved beyond the basic call and put positions. These strategies come up with simultaneous buying and selling of multiple options contracts to take advantage of different market conditions.

Platforms like Tradex.live offer zero brokerage, 24/7 deposit and withdrawal, and more than 500x margin on the Indian and US stocks & commodities. Experienced traders have the needed infrastructure to implement and manage the complex strategies with greater efficiency.

What Are Multi-Leg Options Strategies?

Multi-leg strategies are all about combining two or more options contracts — either of the same type or a mix of calls and puts — across different strike prices and expiry dates. These combinations help traders to distribute the risk, lock in profits, and take benefit from the market-neutral positions.

Some popular multi-leg strategies are:

Straddles and strangles for high-volatility environments

Vertical spreads to limit the risk and define profit zones

Iron condors for market-neutral income generations

Butterfly spreads for targeting specific price outcomes

Calendar spreads to take advantage of time consumption.

These strategies require more precision and timing, which makes access to a fast and flexible platform more essential.

How Tradex.live Empowers Advanced Traders

Seasoned traders focus on precision, speed and strategic complexity. The right platform has the power to make major differences. Tradex.live is designed with advanced traders in mind. It offers powerful tools and unmatched flexibility to execute high-level strategies effectively. Here is how Tradex.live motivates advanced traders:

Zero Brokerage

When executing multiple legs in a strategy, traditional brokers charge a fee for each leg. On the other hand, Tradex.live is all about zero brokerage. Advanced traders can execute complex strategies without any form of worry about the fees which take all your potential returns.

24/7 Deposit and Withdrawal

Capital efficiency is crucial to manage multiple trades. The ability to deposit and withdraw funds irrespective of the time gives traders the flexibility to reallocate the capital as market opportunities arise, without any form of delay.

Up to 500x Margin

Some multi-leg strategies like spreads and condors can be capital intensive. The 500x margin of Tradex.live helps traders to take larger positions with less capital and boost the profit potential, while maintaining the disciplined risk structure.

Access to Indian & US Stocks and Commodities

Multi-leg strategies are not limited to equities. They can be applied to indices, commodities and other fields. Traders can apply their expertise with Indian and US markets with Tradex.live and expand their strategic scope alongside increased diversification.

Risks of Multi-Leg Strategies

Multi-leg strategies offer major potential for returns; they also come up with a unique set of risks which require skills, discipline, and experience to manage them effectively. Tradex.live motivates traders to use the tools to execute the strategies. It is important to be aware of the challenges associated. Some key risks of multi-leg strategies are marked below:

Timing is crucial. A delay or error in executing one leg can affect the entire strategy

Leverage can increase the returns. Poor margin management results in forced liquidations.

Tradex.live provides direct market access but does not offer any advisory and analytical tools. Advanced traders focus on their analysis and experience.

Volatility shifts and unexpected events can quickly turn a well-planned strategy into a losing position.

Tips for Successful Multi-Leg Trading

Each leg must have a purpose to avoid any form of unwanted complexity

Many strategies are impacted because of implied volatility. It is important to keep an eye on the changes.

Traders must start with limited-risk strategies like debit spreads before moving to more aggressive structures.

Use the zero fees of Tradex.live and 24/7 fund access to fine-tune the entry and exit timing.

Final Thoughts

Mastering multi-leg options strategies is a hallmark for a seasoned trader. These strategies offer opportunities to profit in all types of market conditions. They require a deep understanding of option mechanics, market behaviour and risk control. Tradex.live comes up with unique features of zero brokerage, around-the-clock deposit and withdrawal, and 500x leverage on Indian and US assets. Advanced traders can get a strong environment to implement the most intricate strategies. Moreover, success in multi-leg trading focuses on knowledge, discipline and the ability to act swiftly, which are vital qualities that can take your trading experience to the next level with the right platform.

0 notes

Text

Unveiling 7 Best Option Trading Course in India 2025

Option Trading Tick has emerged as a lucrative avenue for investors seeking to maximize profits and manage risks effectively in the dynamic world of financial markets. In India, the demand for comprehensive options trading courses has surged, catering to both novice traders and seasoned investors. So, Best Option Trading Course in India is comprehensive guide, we delve into the top 7 option trading courses available in India for 2024, offering a detailed analysis of each course’s features, curriculum, and value proposition.

What Is Option Trading?

Option trading refers to the buying and selling of options contracts, which give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (known as the strike price) within a predetermined time frame. Option trading allows investors to profit from price movements in the underlying asset without having to own the asset itself, offering flexibility and leverage in their investment strategies.

7 Best Option Trading Course in India:

1. Advanced Options Trading Mastery

Option trading course offers a deep dive into advanced option trading strategies, focusing on complex concepts such as butterfly spreads, iron condors, and straddles. With a blend of theoretical insights and practical application, students gain a comprehensive understanding of risk management and profit generation in volatile market conditions. One of 7 best option trading course in India.

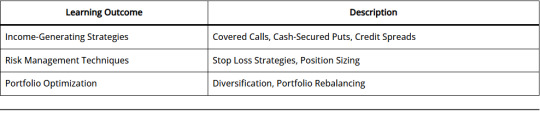

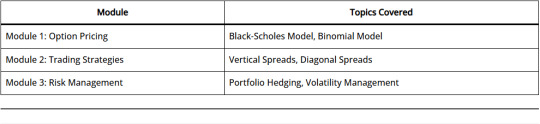

Table: Sample Curriculum Overview

2. Options Trading Bootcamp

Geared towards beginners, option trading course provides a foundational understanding of options trading, covering essential topics such as option pricing, strategies for income generation, and risk mitigation techniques. Through interactive sessions and real-life case studies, participants gain the confidence to execute trades effectively in diverse market conditions. Second best option trading course in India.

Table: Key Learning Objectives

3. Technical Analysis for Options Trading

Best Option Trading course in India focuses on leveraging technical analysis techniques to identify profitable options trading opportunities. Through in-depth chart analysis and trend identification, participants learn to make informed decisions while executing option trades, enhancing their probability of success in the market. Third and best option trading course in India.

Table: Sample Course Modules

4. Options Trading Fundamentals

Option trading course are designed for beginners and intermediate traders, this course provides a comprehensive overview of options trading fundamentals, including option pricing models, volatility analysis, and popular trading strategies. With a focus on practical application, participants develop a strong foundation to navigate the complexities of the options market confidently. Fourth best option trading course in India.

Table: Curriculum Highlights

5. Options Trading Masterclass

Option trading course with comprehensive masterclass covers a wide range of topics, including advanced options trading strategies, risk management techniques, and portfolio optimization strategies. With personalized coaching and interactive sessions, participants gain practical insights into executing profitable trades in the options market. Fifth best option trading course in India.

Table: Course Overview

6. Options Trading for Income

Option trading course are targeted towards investors seeking to generate consistent income through options trading, this course explores various income-generating strategies such as covered calls, cash-secured puts, and credit spreads. Participants learn to capitalize on market volatility while minimizing downside risks, thereby enhancing their overall portfolio returns. Sixth best option trading course in India.

Table: Key Takeaways

7. Options Trading Certification Program

Option trading course are comprehensive certification program covers a wide spectrum of topics, including option pricing models, advanced trading strategies, and risk management techniques. With a focus on hands-on learning and practical application, participants develop the skills and expertise required to navigate the complexities of the options market confidently. Seventh best option trading course in India.

Table: Program Highlights

Option Trading Books:

Some best option trading course books in India that are certainly highly regarded:

“Option Trading: Bear Market Strategies” by Ajay Jain: This book focuses on strategies specifically designed for bearish market conditions, which can be particularly useful in volatile markets like those often found in India.

“Options as a Strategic Investment” by Lawrence G. McMillan: This is often considered the bible of options trading. It covers a wide range of strategies and provides comprehensive insights into the world of options.

“Option Volatility and Pricing: Advanced Trading Strategies and Techniques” by Sheldon Natenberg: This book is great for understanding the theoretical aspects of options pricing and volatility. It’s well-regarded for its clear explanations and practical examples.

“Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits” by Dan Passarelli: This book focuses on understanding the Greeks (Delta, Gamma, Theta, Vega) and how they affect option pricing and trading strategies.

“The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies” by Guy Cohen: This book offers a wide array of strategies, ranging from basic to advanced, with detailed explanations and real-world examples.

“Options Trading: The Hidden Reality” by Charles M. Cottle: Cottle, also known as Risk Doctor, provides insights into the realities of options trading, emphasizing risk management and practical strategies.

“A Beginner’s Guide to Options Trading: Unlocking the Secrets of the World’s Most Versatile Investment Strategy” by Matthew R. Kratter: As the title suggests, this book is great for beginners, offering a straightforward introduction to options trading concepts and strategies.

Remember, while books are excellent resources, practical experience and ongoing learning are key to mastering options trading. It’s also advisable to complement book knowledge with real-world trading experience and staying updated with market trends and developments.

Option Trading Strategies:

Option trading strategies encompass a wide range of approaches aimed at achieving specific investment objectives while managing risk effectively. Some popular strategies include:

Covered Call Strategy: Involves selling call options on a stock while simultaneously holding a long position in the underlying asset.

Protective Put Strategy: Involves purchasing put options to hedge against potential downside risk in an existing stock position.

Bullish Spread Strategies: Include strategies such as bull call spreads and bull put spreads, designed to profit from upward price movements in the underlying asset.

Bearish Spread Strategies: Include strategies such as bear call spreads and bear put spreads, aimed at profiting from downward price movements in the underlying asset.

Straddle and Strangle Strategies: Involve purchasing both call and put options simultaneously to profit from significant price movements in either direction.

CONCLUSION:

In conclusion, mastering best option trading course in India requires a combination of theoretical knowledge, practical skills, and hands-on experience. By enrolling in one of the top 7 option trading courses outlined above, investors and traders in India can gain the expertise and confidence needed to navigate the complexities of the options market successfully. Whether you’re a beginner looking to build a strong foundation or an experienced trader seeking for best option trading course in India must join ISMT.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#optiontrading#stockmarketindia#tradingcourse#learntrading#indiainvesting#financialliteracy#tradingtips#investmenteducation#stocktradingcourse#optionsstrategies#learnfromismt#ismtinstitute

0 notes

Text

Best Options Trading Course - Learn Strategies

Take your trading skills to the next level with a comprehensive options trading course from the Institute of Career in Financial Markets (ICFM). Designed for both beginners and experienced traders, this program provides in-depth knowledge about options strategies, Greeks, volatility analysis, and risk management techniques. ICFM's practical approach ensures you learn not just theory but gain hands-on experience in live market conditions.

The options trading course at ICFM stands out for its industry-relevant curriculum taught by market experts. You'll master complex concepts like straddles, strangles, spreads, and hedging strategies through real-world examples and simulated trading exercises. The course emphasizes the importance of position sizing, trade adjustments, and developing a disciplined trading mindset crucial for options market success.

ICFM's training methodology focuses on helping students understand both the profit potential and risks involved in options trading. You'll learn to analyze market trends, identify trading opportunities, and implement strategies across different market conditions. The institute's personalized attention ensures each participant develops confidence in executing trades and managing portfolios effectively.

Located in Delhi with flexible learning options, ICFM's options trading course provides the perfect environment to enhance your derivatives expertise. Whether you aim to become a professional trader or want to supplement your investment knowledge, this course offers valuable insights into one of the most dynamic segments of financial markets. Enroll today to unlock advanced trading strategies and gain a competitive edge in the options market.

ICFM's alumni have successfully applied these skills in various market scenarios, proving the effectiveness of this practical-oriented program. Start your journey towards becoming an options trading expert with guidance from seasoned professionals at one of India's premier financial education institutes.

0 notes

Text

BankNifty Option Trading Strategy

Master the art of BankNifty option trading strategy with ShaanTrade – your go-to platform for expert-led trading education in India. BankNifty is known for its high volatility and quick price movements, making it a favorite among experienced traders. At ShaanTrade, you’ll learn how to navigate this volatility using proven strategies like straddles, strangles, spreads, and intraday scalping. With live market analysis, practical examples, and personalized mentorship, this course empowers you to make smarter, faster trading decisions. Whether you’re trading weekly expiries or looking for short-term profits, ShaanTrade equips you with the tools and confidence to succeed in the Indian options market. Join now and take your BankNifty trading skills to the next level!

0 notes

Text

Future & Option Trading Course – Learn Powerful Strategies to Trade Like a Pro!

Master the world of derivatives with our Future & Option Trading Course designed for serious traders. Learn essential concepts, risk management, and profitable strategies like hedging, straddles, and spreads with live market practice. Whether you're a beginner or looking to sharpen your skills, this course gives you the tools to trade confidently and profitably.

📊 Join now at www.empiricalacademy.net and get expert mentorship, certification, and real-world training. 🔥 Don’t miss out – Enroll today and turn market volatility into opportunity!

0 notes

Text

What is Stock Options Trading? Unlocking a Flexible Investment Strategy

Investing doesn’t have to be one-dimensional. With stock options trading, you gain access to a powerful financial instrument that offers flexibility far beyond traditional buying and selling. But what exactly is it?

Defining Stock Options Trading

At its core, stock options trading involves contracts — not shares. These contracts give you the right (but not the obligation) to either:

Buy a stock (via call options), or

Sell a stock (via put options),

at a predetermined price before a specified expiration date. This makes it possible to profit from stock movements without actually owning the underlying asset.

The Flexibility Factor

What makes stock options unique is their versatility. You can use them to:

Speculate on stock price movements.

Hedge your existing stock positions to limit losses.

Generate consistent income through selling options (like covered calls).

Create complex strategies like spreads and straddles that profit in multiple market conditions.

This means you don’t have to rely on stocks going up to make money. You can profit from downward moves, market stagnation, or simply from the passage of time.

Choosing the Best Platform

To take advantage of these strategies, selecting the Best Stock Trading Platform is crucial. You’ll need a broker that offers:

Advanced trading tools for multi-leg strategies.

Access to options chains with customizable filters.

Detailed analytics and risk graphs.

Educational webinars and courses on options.

Some excellent platforms for intermediate to advanced traders include:

Tastytrade: Built specifically for options strategies and active traders.

Interactive Brokers: Known for its low fees and global market access.

TradeStation: Offers both beginner-friendly and advanced trading tools.

Final Thoughts

Stock options trading opens the door to strategies that fit your unique risk tolerance and market view. Whether you’re hedging your investments or aiming to profit from volatility, it’s a tool worth exploring. Just remember, always use the Best Stock Trading Platform for a smarter, safer trading experience.

1 note

·

View note

Text

AI Meets CFA: Evolution or Extinction?

Technically, Artificial Intelligence is no more an imaginary or futuristic phenomenon; it is currently the influential power revolutionizing the financial industry. From the algorithmic trading and detecting fraud to giving personalized investment strategies, AI is permeating every nook and corner of the financial ecosystem. Therefore, as this technology is increasingly embedded in financial decision-making, the question that arises is: Will CFA charterholders be entirely replaced, perhaps reinvented?

The reality is more nuanced than replacement. What lies ahead is reinvention.

The Evolution of AI in the Finance Industry

The biggest strength of AI is its speed, efficiency, and data-crunching capabilities. AI can process millions of transactions, tell similarities in behavior, and optimize portfolios faster than any human analyst. Most of the large investment firms and banks have now moved to using AI platforms for performance enhancement and risk minimization.

But financial analysis is just not about math. It involves interpretation, regulation, ethics, and the human factor behind movements in the market, all of which are domains where CFA charterholders are still strong. However, what is also clear is that while AI will do most of the heavy lifting, it must still be supervised. The context and expert judgment are the ones machines cannot replicate.

Transforming the CFA Profession

The more the industry changes, the more the CFA curriculum begins to address topics such as Python programming, machine learning, and big data analytics. This isn’t just an upgrade-it is a signalling. A modern CFA is no longer just a finance expert, but a technology savvy professional who understands how AI works and how its use can make the decision-making process responsible.

Instead of shrinking under this technology, the CFA holder is being encouraged to learn how to work with it. He/she stands becoming that bridge between the two-the technical models and the real world application. In this new era, being a CFA is no more about pitting oneself against AI but actually about working with it to make better, smarter decisions.

AI Needs Human Oversight

At the end of day, artificial intelligence lacks in something important like reasoning in ethical terms and contextualization. Human psychology, geopolitical events, and, of course, some unpredictable crises affect our world's financial markets in a very serious manner. All of these elements cannot be coded into an algorithm.

For risk assessment during volatile times or navigating ethical investment dilemmas such as ESG compliance, these conditions require human judgment and moral reasoning where a CFA charter is educated well. AI could provide input, but in several instances, it is the professionals that decide.

New Opportunities for CFA Professionals

Career avenues in the finance sector continue to change with changing times. There is an increasing demand for professionals who straddle both finance and technology. And one of the new opportunities created is for CFA charterholders who are willing to upskill and adapt.

Taking an online CFA course that offers some engagement with AI tools, data analytics, and financial modeling not only updates you professionally but also makes you future-proof. Present-day finance roles have expanded from portfolio management or equity research into areas such as financial data science, fintech strategy, and quantitative investment, where proficiency with advanced technology becomes a major advantage.

Human Element Still Holds

One primary element AI cannot learn is trust. Financial advisors and analysts are often the voice of reason when the market panics. Faced with uncertain times, it is the human being, not the machine, to whom clients or institutions turn for guidance. No matter how advanced, the algorithm cannot generate reassurance or justify itself in a language that supports long-lasting relationships.

These include crisis management, negotiation, and stakeholder communications—all based on human intelligence, empathy, and experience. AI can support, but it cannot lead.

The Road Ahead

AI in finance is here to stay. It will continue to grow powerful and increase its abilities. But this speaks not of lessening the import of CFA professionals but rather highlights the beginning of a more integrated role where finance and technology work in tandem.

This is a global phenomenon. Regions investing in AI-powered finance education are now experiencing a surge in demand for hybrid-skilled professionals. One case in point is the popularity of the online CFA course in UAE, creating professionals capable of flourishing in both traditional finance and technology-driven finance.

Conclusion

AI is not a threat-it is a tool. A powerful one, yes, but one that needs talented hands to work with it. CFA charterholders who will embrace this change, and choose to learn and evolve, will not only stay relevant, but will be the leaders in transforming the financial world.

They won't be replaced; they will be reinvented. Smarter, more versatile, and as valuable as never before.

0 notes

Text

Volatility Risk Premium Seasonality Across Calendar Months

Volatility Risk Premium Seasonality Across Calendar Months Seasonality in investing refers to the tendency of financial markets or specific assets to exhibit predictable patterns at certain times of the year. These patterns can arise due to recurring economic, behavioral, or institutional factors. Understanding and analyzing seasonal trends can help investors time their trades more effectively and enhance portfolio performance. We have recently discussed the seasonality of the volatility risk premium (VRP) in terms of days of the week. In this regard, Reference [1] examined the VRP in terms of months of the year. The authors pointed out, As the first in the literature, this study documents a statistically significant December effect, namely, the delta-hedged returns in December are substantially lower than those in other months of the year. The lower hedged returns in December are attributed to overvaluation of options at the beginning of the month, which in turn is attributed to option investors’ consistent failure of recognizing and incorporating the lower realized volatility in the second half of December, i.e., the implied volatility at the beginning of December is consistently larger than the realized volatility in December. This December effect prevails in both equity options and S&P 500 index options. A trading strategy selling straddles based on the decile with the biggest predicted difference between implied volatilities and realized volatilities can generate a monthly return of 13.09% in December, compared with the unconditional sample mean of 0.88%. The next step of the study is to examine and rule out alternative channels such as time-varying risks and demand pressure. In short, the authors concluded that the VRP is greatest in December and smallest in October. An explanation for the large VRP in December is that during the holiday season, firms might refrain from releasing material information, leading to low trading volumes. The combination of low trading volume and the absence of important news releases would naturally result in lower realized volatility. This is another important contribution to the understanding of the VRP. Let us know what you think in the comments below or in the discussion forum. References [1] Wei, Jason and Choy, Siu Kai and Zhang, Huiping, December Effect in Option Returns (2025). https://ift.tt/ALBlyJ7 Post Source Here: Volatility Risk Premium Seasonality Across Calendar Months via Harbourfront Technologies - Feed https://ift.tt/Um0T43o April 21, 2025 at 10:39AM

0 notes