#Risk Management in Straddle Options

Explore tagged Tumblr posts

Text

Effective Trading Strategies Using Straddle Option Trading Strategy

Introduction to Straddle Option Trading Strategy The Straddle Option Trading Strategy is a versatile approach used by traders to capitalize on significant price movements in the market, regardless of the direction. This strategy involves purchasing both a call option and a put option on the same underlying asset, with the same strike price and expiration date. The primary goal of a straddle is…

#Advanced Options Trading#Consolidation Phase Trading Strategies#Effective Straddle Trading#High Volatility Trading#How to Trade Straddle Options#Implied Volatility and Options#Market Reaction Trading Strategies#Options Premium Costs#Options Trading for Beginners#Options Trading Strategies#Post-News Event Trading Strategies#Pre-Earnings Trading Strategies#Profit from Market Volatility#Risk Management in Straddle Options#Straddle Option Trading Strategy#Straddle Options Examples#Straddle Options for Bear Markets#Straddle Options for Bull Markets#Straddle Strategy in Volatile Markets#Time Decay in Options

0 notes

Text

𝐂𝐨𝐧𝐭𝐞𝐧𝐭 𝐖𝐚𝐫𝐧𝐢𝐧𝐠𝐬 | Swearing and smoking.

It was Steve Harrington’s twenty-ninth big birthday palooza.

Well, at least that’s what the giant, colorful banner called it, that hung across the foyer of his home. That’s what happens when Dustin Henderson plans your party. But the kid—who was beyond the definition of a kid now—had told Steve he had no right to complain about it being childish. Steve did shoot down the first option of “Big Birthday Bash,” terribly unaware that palooza was the next best thing for Henderson.

Had he known, he surely would have stuck with the first option.

Steve was correct, though. The banner was childish, and it had garnered all the fascination from the mini Munson that walked in with a gaping mouth of pure awe at the bright sign. At the very least, the actual kid would enjoy it.

And “palooza” was really selling it out. It was merely a group of adult friends simply hanging out like old times. Only the new addition was the three-year-old hanging off your leg, who adorably looked a lot like your husband.

Not fair. You did most of the work.

But it was worth it, staring into those baby cow eyes every time you crouched down to your kid. And once you stood up, you’d find them again from Eddie Munson, himself, who peered at you lovingly.

Of course, you had to show off your baby and bring him to the party. He was already a crowd favorite. Being the first baby born into Hawkins’ infamous clan of misfits gave you that right. And they all loved that tiny Munson.

Especially after that “Happy Birtday, Uncle Steeb!” It was enough to make icebergs melt.

And having a child at an adult hangout wasn’t all bad. Keeping the beers separated from the juice boxes, and having a yard big enough for the child to run was sufficient enough. Bonus points for Steve Harrington’s dog, Rufus, who took up all your kid’s attention.

By the end of the night, the group had naturally separated into two; the men left smoking outside, while the women conversed in the comfort of the living room. This had come after the cake celebration. Once the candles were blown out, Steve had joked that he wished to keep all his hair throughout his thirties. In reality, he’d wished to start a family as loving as the one his friend had.

He would end up confiding this to Eddie during the relaxed smoking session. That he wanted the whole package; a wife and kid. In fact, he dreamed of having many of them. Eddie blew out the smoke from his cigarette and smiled. “It’s the greatest fucking feeling ever, man.”

Because when Eddie looked back through the glass doors of the patio, he saw you. Sitting and chatting, beautiful as ever. But the cherry on top was seeing his tiny kid straddling your lap. His curly head of hair buried into your neck calmly asleep, as Eddie’s leather jacket draped over as a comforting blanket.

“I wouldn’t trade it for the world.” Eddie beamed, as he stomped out his cigarette.

One day Steve would get that. Whether it was with the pretty lady he was currently seeing or a future soulmate, he’d get that.

Eddie had walked in, strutting over to the quarter of cake that was left after everyone had gotten a slice. Not you, though. You were busy cheering on Steve from the couch, as your baby used your chest as a bed. Cutting a slice, and plonking it onto a paper plate, Eddie meandered his way next to you on the couch.

“You deserve a piece.” He forked a triple chocolate portion into your mouth, where he smiled, as your face contorted into delight. “Good?” He knew it was, he devoured two slices earlier. You could only hum with pleasure, before he leaned in and whispered. “Should we feed the monster?”

It was a risky move. One taste of sugar, and your three-year-old would turn into the Hulk. But it was a risk worth taking, your baby was too cute not to feed treats to.

Eddie managed to slowly insert a small piece between his tiny puckered lips, as he slept. And in true Munson fashion, your baby chewed in his sleep, eyes closed but mouth surely moving.

Then, those baby cow eyes tiredly opened at the sudden sweetness. “Choclat?”

𝐀𝐮𝐭𝐡𝐨𝐫’𝐬 𝐍𝐨𝐭𝐞 | I don’t know why I keep making Dad!Eddie blurbs. It’s an addiction that can’t be stopped.

#stranger things#eddie munson#eddie munson fanfic#eddie munson imagine#eddie munson oneshot#eddie munson blurb#eddie munson fluff#eddie munson x reader#eddie munson x fem!reader#eddie munson x you#dad!eddie x mom!reader#steve harrington

220 notes

·

View notes

Text

ICFM Options Trading Course – Master Strategies

Elevate your trading skills with ICFM's (Institute of Career in Financial Market) Options Trading Course, a comprehensive program designed to transform beginners into confident derivatives traders. This expert-led course demystifies complex options concepts through a structured curriculum that balances theoretical knowledge with practical application, ensuring students develop real-world trading competence.

The program begins with foundational modules covering options terminology, contract specifications, and payoff diagrams. Students progress to advanced strategies like spreads, straddles, and strangles, learning to capitalize on various market conditions. The course emphasizes the "Greeks" - Delta, Gamma, Theta, and Vega - teaching traders to measure and manage risk precisely.

ICFM's unique methodology combines live market simulations with theoretical instruction. Participants practice writing and covering options in a risk-free environment, building confidence before executing real trades. The curriculum includes special sessions on volatility trading, helping students identify profitable opportunities during earnings seasons and market events.

Seasoned options traders lead interactive case studies, revealing how professionals structure trades for consistent returns. Students learn to construct multi-leg strategies, hedge portfolios effectively, and use options for income generation. The course also covers crucial risk management techniques specific to options trading, including position sizing and stop-loss strategies.

Participants gain access to ICFM's proprietary options analytics tools and receive ongoing mentorship even after course completion. The program includes a certification exam that validates skills to potential employers or clients.

Whether you aim to trade options professionally or enhance your investment strategies, ICFM's Options Trading Course provides the complete toolkit for success in the derivatives market. Join India's premier financial education institute and learn to navigate options markets with the confidence of a professional trader.

0 notes

Text

Master the Market with Smart Intraday and Options Picks

Understanding Intraday Trading in Today’s Market

In the fast-paced world of the stock market, timing is everything. Intraday trading, often referred to as day trading, involves buying and selling stocks within the same trading day. It is a strategy preferred by many traders who seek to capitalize on small price movements. Analyzing the intraday share today can help traders make calculated decisions that align with their short-term profit goals. This approach requires a deep understanding of market trends, price action, and technical indicators.

Intraday traders often rely on charts and data tools to predict market behavior. With so many stocks listed on the exchanges, finding the right stock to trade requires both research and tools designed for fast filtering and analysis. Having access to real-time screeners and alerts can drastically improve your trading success.

The Role of the Nifty Option Chain in Strategy

Options trading is another powerful tool in a trader’s arsenal, and the Nifty option chain plays a critical role in formulating options strategies. The option chain provides a snapshot of all available call and put options for the Nifty index, including strike prices, premiums, open interest, and implied volatility. By analyzing this data, traders can gauge market sentiment, identify support and resistance zones, and predict price movements.

The Nifty option chain is particularly useful for intraday traders looking to hedge their positions or bet on short-term market movements. For instance, a sudden spike in open interest at a particular strike price could indicate a potential price reversal or breakout, enabling traders to act swiftly.

Tools and Techniques for Smarter Intraday Decisions

Success in intraday trading is not based on luck—it’s rooted in strategy, discipline, and the use of reliable tools. Traders often use candlestick patterns, moving averages, volume analysis, RSI, and MACD indicators to identify entry and exit points. Pairing these with real-time data from screener platforms can be the difference between profit and loss.

Screeners help traders filter out noise and focus on stocks with potential. For example, they can track the intraday share today that show unusual volume spikes, price breakouts, or RSI divergence. The speed at which these insights are gathered and acted upon is crucial for profitability.

Risk Management: The Backbone of Intraday Trading

While intraday trading offers high reward potential, it also carries significant risk. Markets can be volatile, and without a solid risk management plan, losses can mount quickly. Experts advise using stop-loss orders, predefined profit targets, and maintaining discipline to avoid emotional decisions.

Additionally, understanding the Nifty option chain can be an effective way to manage risk. By analyzing the distribution of open interest, traders can identify levels where institutions may be active, giving them a sense of when to enter or exit trades. Straddle and strangle strategies based on option data can also provide protection in volatile conditions.

Staying Ahead with Continuous Learning and Practice

Markets evolve constantly. To stay competitive, traders need to keep learning—whether it’s mastering new technical patterns, using advanced screener platforms, or understanding the nuances of derivatives like options and futures. Paper trading and back-testing strategies are also essential for gaining confidence without financial exposure.

Joining communities, attending webinars, and following market experts can offer valuable perspectives. The combination of insight, preparation, and consistent review of the intraday share today helps traders refine their strategies and increase their odds of success.

Conclusion: Unlock Your Trading Potential

For traders aiming to harness the full potential of intraday strategies and options data, combining timely market analysis with smart tool usage is key. Whether you're tracking the intraday share today for momentum or decoding the Nifty option chain for signals, making informed decisions can give you the edge you need in today's competitive trading environment.

0 notes

Text

Master Options and Futures Trading with Confidence

Explore the world of options and futures trading and learn how to trade smarter with The Stock Learning. Understand how these instruments work, how to apply strategies like hedging, spreads, and straddles, and how to manage risk effectively in changing markets. With expert guidance and practical examples, you’ll build the knowledge and confidence to trade options and futures successfully. Ideal for beginners and those looking to strengthen their skills in derivatives. 🚀 Start your learning journey — visit The Stock Learning and unlock the power of options and futures trading!

0 notes

Text

Futures & Options Trading Strategies (Hindi) – Learn Derivatives Trading in Your Language with Empirical Academy

Empirical Academy’s Futures & Options Trading Strategies (Hindi) course is tailored for Hindi-speaking learners aiming to master derivatives trading. This intermediate-level course covers key strategies like spreads, straddles, strangles, option greeks, and risk management. With real-market examples, live interactive sessions, and lifetime mentorship, you’ll gain the confidence to trade F&O effectively. Whether you’re looking to enhance your existing knowledge or transition into options trading, this course bridges the gap in the most practical way.

👉 Enroll now: https://www.empiricalacademy.net/course-details/futures-and-options-trading-strategies-hindi Trade smart, in your language!

0 notes

Text

Futures and Options Trading Strategies – Learn to Trade Smart with The Stock Learning

Master the most powerful Futures and Options Trading Strategies with The Stock Learning’s expert-led course. Learn how to trade derivatives using real-world techniques like hedging, straddles, strangles, spreads, and option Greeks. Designed for serious learners and traders, this course provides live market practice, strategy building, and risk management skills to help you trade with confidence.

📊 Enroll now at www.thestocklearning.co.in 🎯 Upgrade your trading game – Join The Stock Learning and start applying winning F&O strategies today!

#FuturesAndOptions #TradingStrategies #TheStockLearning #DerivativeTrading #SmartTrading

0 notes

Text

How can I learn options trading and strategies effectively?

Learning options trading and strategies effectively requires the right mix of conceptual clarity, hands-on practice, and expert mentorship. At Empirical Academy, we offer a structured Options Trading Course designed to help beginners and intermediate traders master options, from basics like calls and puts to advanced strategies like straddles, strangles, and spreads.

Our course includes NSE certification, live trading sessions, and real-world case studies to help you apply theory in the market. You'll learn to analyze trends, manage risk, and make informed decisions confidently.

📚 Whether you're in India or abroad, our online courses make it easy to start.🎯 Start your learning journey with us at: 🌐 https://www.empiricalacademy.net ✅ Learn Smart. Trade Smart.

0 notes

Text

What is the best course for future and options trading?

The best course for Future & Options trading is one that offers both theoretical knowledge and practical experience. A well-structured Future & Option trading course helps you understand derivatives, hedging, leverage, risk management, and advanced strategies to trade confidently in volatile markets.

Empirical Academy offers one of the most practical and comprehensive Future & Option trading courses, ideal for beginners and intermediate traders looking to upskill.

Course Highlights at Empirical Academy:

Detailed coverage of call/put options and futures contracts

Strategy building: straddle, strangle, spreads, etc.

Live trading sessions with expert guidance

Risk and money management techniques

Real-market case studies and trade setups

This course is perfect for those aiming to trade professionally or generate a second income through derivatives. 🔴 Join Empirical Academy’s Future & Option trading course and trade like a pro! 🔴

0 notes

Text

Mastering Multi-Leg Options Strategies for Advanced Traders

As financial markets are becoming more sophisticated, seasoned traders are looking for the best ways to optimise the returns and manage the risks. Multi-leg options strategies are powerful tools for those who have moved beyond the basic call and put positions. These strategies come up with simultaneous buying and selling of multiple options contracts to take advantage of different market conditions.

Platforms like Tradex.live offer zero brokerage, 24/7 deposit and withdrawal, and more than 500x margin on the Indian and US stocks & commodities. Experienced traders have the needed infrastructure to implement and manage the complex strategies with greater efficiency.

What Are Multi-Leg Options Strategies?

Multi-leg strategies are all about combining two or more options contracts — either of the same type or a mix of calls and puts — across different strike prices and expiry dates. These combinations help traders to distribute the risk, lock in profits, and take benefit from the market-neutral positions.

Some popular multi-leg strategies are:

Straddles and strangles for high-volatility environments

Vertical spreads to limit the risk and define profit zones

Iron condors for market-neutral income generations

Butterfly spreads for targeting specific price outcomes

Calendar spreads to take advantage of time consumption.

These strategies require more precision and timing, which makes access to a fast and flexible platform more essential.

How Tradex.live Empowers Advanced Traders

Seasoned traders focus on precision, speed and strategic complexity. The right platform has the power to make major differences. Tradex.live is designed with advanced traders in mind. It offers powerful tools and unmatched flexibility to execute high-level strategies effectively. Here is how Tradex.live motivates advanced traders:

Zero Brokerage

When executing multiple legs in a strategy, traditional brokers charge a fee for each leg. On the other hand, Tradex.live is all about zero brokerage. Advanced traders can execute complex strategies without any form of worry about the fees which take all your potential returns.

24/7 Deposit and Withdrawal

Capital efficiency is crucial to manage multiple trades. The ability to deposit and withdraw funds irrespective of the time gives traders the flexibility to reallocate the capital as market opportunities arise, without any form of delay.

Up to 500x Margin

Some multi-leg strategies like spreads and condors can be capital intensive. The 500x margin of Tradex.live helps traders to take larger positions with less capital and boost the profit potential, while maintaining the disciplined risk structure.

Access to Indian & US Stocks and Commodities

Multi-leg strategies are not limited to equities. They can be applied to indices, commodities and other fields. Traders can apply their expertise with Indian and US markets with Tradex.live and expand their strategic scope alongside increased diversification.

Risks of Multi-Leg Strategies

Multi-leg strategies offer major potential for returns; they also come up with a unique set of risks which require skills, discipline, and experience to manage them effectively. Tradex.live motivates traders to use the tools to execute the strategies. It is important to be aware of the challenges associated. Some key risks of multi-leg strategies are marked below:

Timing is crucial. A delay or error in executing one leg can affect the entire strategy

Leverage can increase the returns. Poor margin management results in forced liquidations.

Tradex.live provides direct market access but does not offer any advisory and analytical tools. Advanced traders focus on their analysis and experience.

Volatility shifts and unexpected events can quickly turn a well-planned strategy into a losing position.

Tips for Successful Multi-Leg Trading

Each leg must have a purpose to avoid any form of unwanted complexity

Many strategies are impacted because of implied volatility. It is important to keep an eye on the changes.

Traders must start with limited-risk strategies like debit spreads before moving to more aggressive structures.

Use the zero fees of Tradex.live and 24/7 fund access to fine-tune the entry and exit timing.

Final Thoughts

Mastering multi-leg options strategies is a hallmark for a seasoned trader. These strategies offer opportunities to profit in all types of market conditions. They require a deep understanding of option mechanics, market behaviour and risk control. Tradex.live comes up with unique features of zero brokerage, around-the-clock deposit and withdrawal, and 500x leverage on Indian and US assets. Advanced traders can get a strong environment to implement the most intricate strategies. Moreover, success in multi-leg trading focuses on knowledge, discipline and the ability to act swiftly, which are vital qualities that can take your trading experience to the next level with the right platform.

0 notes

Text

Effective Trading Strategies Using Options

Options trading offers a variety of strategies that can be tailored to different market conditions, providing traders with flexibility and opportunities to manage risk. Here, we explore multiple options trading strategies, each designed to capitalize on specific market environments, including volatile markets, bull markets, bear markets, and consolidation phases. 1. Covered Call Overview A…

#Bear Markets#Bear Put Spread#Bull Call Spread#Bull Markets#Butterfly Spread#Calendar Spread#Collar Strategy#Consolidation Phase#Covered Call#Diagonal Spread#Financial Markets#Income Generation#Investment Strategies#Iron Condor#Long Straddle#Long Strangle#Market Conditions#Options Trading#Protective Put#Risk Management#Trading Examples#Trading Strategies#Volatile Markets

3 notes

·

View notes

Text

ICFM Options Trading Course - Strategies That Work

ICFM (Institute of Career in Financial Market) offers a comprehensive options trading course designed to transform beginners into skilled derivatives traders. This advanced program delves deep into options strategies, from basic calls/puts to complex multi-leg positions like iron condors and butterfly spreads. Participants learn to calculate risk exposure, interpret options Greeks (Delta, Gamma, Theta, Vega), and implement hedging techniques to protect portfolios.

The curriculum combines theoretical frameworks with live market applications. Traders practice writing covered calls, executing straddles/strangles, and managing assignments through simulated exercises. ICFM's faculty - comprising veteran options traders - share proprietary techniques for identifying mispriced options and leveraging volatility skews. Special modules cover earnings season strategies, index options trading, and sector-specific approaches.

Unique features include hands-on training with options analytics platforms, where students backtest strategies against historical data. The course emphasizes position sizing rules specific to options, teaching traders to manage leverage responsibly. Participants also learn to construct synthetic positions and understand put-call parity relationships.

ICFM's practical approach helps traders develop disciplined processes for trade entry, adjustment, and exit. The program includes weekly live trading sessions where students analyze real-time options chains under expert guidance. Graduates receive ongoing mentorship and access to an exclusive community of options traders.

This course is ideal for equity traders expanding into derivatives, investors seeking portfolio protection strategies, and professionals pursuing algorithmic trading careers. ICFM's certification is recognized across India's financial sector as a mark of options trading competency.

0 notes

Text

Unveiling 7 Best Option Trading Course in India 2025

Option Trading Tick has emerged as a lucrative avenue for investors seeking to maximize profits and manage risks effectively in the dynamic world of financial markets. In India, the demand for comprehensive options trading courses has surged, catering to both novice traders and seasoned investors. So, Best Option Trading Course in India is comprehensive guide, we delve into the top 7 option trading courses available in India for 2024, offering a detailed analysis of each course’s features, curriculum, and value proposition.

What Is Option Trading?

Option trading refers to the buying and selling of options contracts, which give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (known as the strike price) within a predetermined time frame. Option trading allows investors to profit from price movements in the underlying asset without having to own the asset itself, offering flexibility and leverage in their investment strategies.

7 Best Option Trading Course in India:

1. Advanced Options Trading Mastery

Option trading course offers a deep dive into advanced option trading strategies, focusing on complex concepts such as butterfly spreads, iron condors, and straddles. With a blend of theoretical insights and practical application, students gain a comprehensive understanding of risk management and profit generation in volatile market conditions. One of 7 best option trading course in India.

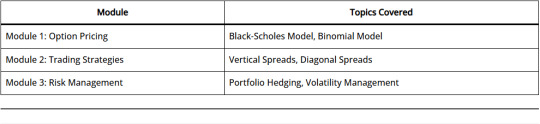

Table: Sample Curriculum Overview

2. Options Trading Bootcamp

Geared towards beginners, option trading course provides a foundational understanding of options trading, covering essential topics such as option pricing, strategies for income generation, and risk mitigation techniques. Through interactive sessions and real-life case studies, participants gain the confidence to execute trades effectively in diverse market conditions. Second best option trading course in India.

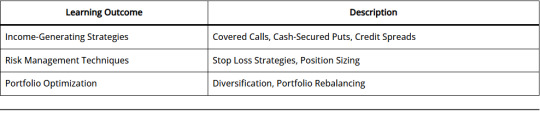

Table: Key Learning Objectives

3. Technical Analysis for Options Trading

Best Option Trading course in India focuses on leveraging technical analysis techniques to identify profitable options trading opportunities. Through in-depth chart analysis and trend identification, participants learn to make informed decisions while executing option trades, enhancing their probability of success in the market. Third and best option trading course in India.

Table: Sample Course Modules

4. Options Trading Fundamentals

Option trading course are designed for beginners and intermediate traders, this course provides a comprehensive overview of options trading fundamentals, including option pricing models, volatility analysis, and popular trading strategies. With a focus on practical application, participants develop a strong foundation to navigate the complexities of the options market confidently. Fourth best option trading course in India.

Table: Curriculum Highlights

5. Options Trading Masterclass

Option trading course with comprehensive masterclass covers a wide range of topics, including advanced options trading strategies, risk management techniques, and portfolio optimization strategies. With personalized coaching and interactive sessions, participants gain practical insights into executing profitable trades in the options market. Fifth best option trading course in India.

Table: Course Overview

6. Options Trading for Income

Option trading course are targeted towards investors seeking to generate consistent income through options trading, this course explores various income-generating strategies such as covered calls, cash-secured puts, and credit spreads. Participants learn to capitalize on market volatility while minimizing downside risks, thereby enhancing their overall portfolio returns. Sixth best option trading course in India.

Table: Key Takeaways

7. Options Trading Certification Program

Option trading course are comprehensive certification program covers a wide spectrum of topics, including option pricing models, advanced trading strategies, and risk management techniques. With a focus on hands-on learning and practical application, participants develop the skills and expertise required to navigate the complexities of the options market confidently. Seventh best option trading course in India.

Table: Program Highlights

Option Trading Books:

Some best option trading course books in India that are certainly highly regarded:

“Option Trading: Bear Market Strategies” by Ajay Jain: This book focuses on strategies specifically designed for bearish market conditions, which can be particularly useful in volatile markets like those often found in India.

“Options as a Strategic Investment” by Lawrence G. McMillan: This is often considered the bible of options trading. It covers a wide range of strategies and provides comprehensive insights into the world of options.

“Option Volatility and Pricing: Advanced Trading Strategies and Techniques” by Sheldon Natenberg: This book is great for understanding the theoretical aspects of options pricing and volatility. It’s well-regarded for its clear explanations and practical examples.

“Trading Options Greeks: How Time, Volatility, and Other Pricing Factors Drive Profits” by Dan Passarelli: This book focuses on understanding the Greeks (Delta, Gamma, Theta, Vega) and how they affect option pricing and trading strategies.

“The Bible of Options Strategies: The Definitive Guide for Practical Trading Strategies” by Guy Cohen: This book offers a wide array of strategies, ranging from basic to advanced, with detailed explanations and real-world examples.

“Options Trading: The Hidden Reality” by Charles M. Cottle: Cottle, also known as Risk Doctor, provides insights into the realities of options trading, emphasizing risk management and practical strategies.

“A Beginner’s Guide to Options Trading: Unlocking the Secrets of the World’s Most Versatile Investment Strategy” by Matthew R. Kratter: As the title suggests, this book is great for beginners, offering a straightforward introduction to options trading concepts and strategies.

Remember, while books are excellent resources, practical experience and ongoing learning are key to mastering options trading. It’s also advisable to complement book knowledge with real-world trading experience and staying updated with market trends and developments.

Option Trading Strategies:

Option trading strategies encompass a wide range of approaches aimed at achieving specific investment objectives while managing risk effectively. Some popular strategies include:

Covered Call Strategy: Involves selling call options on a stock while simultaneously holding a long position in the underlying asset.

Protective Put Strategy: Involves purchasing put options to hedge against potential downside risk in an existing stock position.

Bullish Spread Strategies: Include strategies such as bull call spreads and bull put spreads, designed to profit from upward price movements in the underlying asset.

Bearish Spread Strategies: Include strategies such as bear call spreads and bear put spreads, aimed at profiting from downward price movements in the underlying asset.

Straddle and Strangle Strategies: Involve purchasing both call and put options simultaneously to profit from significant price movements in either direction.

CONCLUSION:

In conclusion, mastering best option trading course in India requires a combination of theoretical knowledge, practical skills, and hands-on experience. By enrolling in one of the top 7 option trading courses outlined above, investors and traders in India can gain the expertise and confidence needed to navigate the complexities of the options market successfully. Whether you’re a beginner looking to build a strong foundation or an experienced trader seeking for best option trading course in India must join ISMT.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#optiontrading#stockmarketindia#tradingcourse#learntrading#indiainvesting#financialliteracy#tradingtips#investmenteducation#stocktradingcourse#optionsstrategies#learnfromismt#ismtinstitute

0 notes

Text

Future & Option Trading Strategies Made Simple — The Stock Learning

Learn how to trade smartly with The Stock Learning’s practical guide to Future & Option Trading Strategies. This program helps you understand how futures and options work, and how to use strategies like hedging, spreads, and straddles to manage risk and profit in different market conditions. With easy-to-follow lessons and real market examples, you’ll gain the confidence to apply these techniques in your trading journey. Ideal for both beginners and traders looking to sharpen their skills.

Start trading smarter—visit The Stock Learning today and explore powerful F&O strategies!

0 notes

Text

Intermediate Futures & Options Trading Strategies – Enhance Your Derivatives Trading with Empirical Academy

Take your F&O trading to the next level with Empirical Academy’s Intermediate Futures & Options Trading Strategies course. This program dives deep into practical strategies like spreads, straddles, strangles, hedging techniques, and market sentiment analysis. Learn how to manage risk, identify profitable setups, and apply strategies in real-time market conditions. With live sessions, expert mentorship, and lifetime access, this course is ideal for traders ready to go beyond the basics and build consistency.

👉 Enroll now: https://www.empiricalacademy.net/course-details/futures-and-options-trading-strategies Start trading smarter today!

0 notes

Text

Future & Option Trading Course – Learn Powerful Strategies to Trade Like a Pro!

Master the world of derivatives with our Future & Option Trading Course designed for serious traders. Learn essential concepts, risk management, and profitable strategies like hedging, straddles, and spreads with live market practice. Whether you're a beginner or looking to sharpen your skills, this course gives you the tools to trade confidently and profitably.

📊 Join now at www.empiricalacademy.net and get expert mentorship, certification, and real-world training. 🔥 Don’t miss out – Enroll today and turn market volatility into opportunity!

0 notes