#Study Montana

Text

Evening on the trail...

Montana

1911

4K notes

·

View notes

Text

old & forgotten

#stumbled on this old drawing i did looking through canvases today#im pretty sure its a study but idk when from#looks like it might be from my trip through montana and wyoming#really not sure but i forgot about it clearly and never finished it#idk what my original intent was for this pic though so i left it simple & cleaned it up a lil#i can tell my past self had a lot of fun with that very tiny truck.#this blog is turning into a second art blog at this point#i think it's just more comfortable to share here with a smaller following

142 notes

·

View notes

Photo

it’s just another day in the hawks party group chat ^-^

[og]

#ryuuji kawara#isa souma#ryouta kawara#hatoful boyfriend#hatoful kareshi#hatokare#ig tohri is there?? POV YOU;RE TOHRI#isa vc: this is a strictly business group chat#baby ryouta is serotonin...my sweet sweet sweet sONNNN A A UU UUUU#illegal how there's no ryuuji and ryouta content out there so i might as well make one myself even if it's this-#THIS TOOK WAY TOO LONG TO MAKE I JUST WANTED TO MAKE A SILLY SHITPOST BUT DECIDED TO DRAW IT AND IF THAT WASNT ENOUGH?? PUT IN MORE EFFORT#THIS IS WHAT HAPPENS WHEN YOU WANNA MAKE A SHITPOST WHILE **ART STUDYING**#i added smthing for tohri's pfp i'm a firm believer he'd marathon hannah montana#FIRM BELIEVER.#i might make this into a silly sticker//tiny print in the future istg :'^)#doveart

147 notes

·

View notes

Text

Full credit to @mistfallenjoyer for doing this with hair thickness

#sso#ssoblr#sso oc#I am genuinely curious bc sometimes artsyles make it hard for me to figure it out#Montana is a 2b btw#fun fact I don't even know what my hair type is x.x#it's somewhere on the 2a to 3a spectrum I genuinely cannot figure it out lol#so since idk mine Montana at least has a defined type#don't mind the sudden activness I am procrastinating studying

7 notes

·

View notes

Text

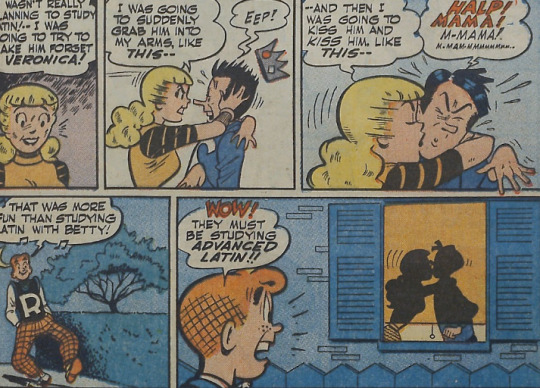

"make love"

The Bob Montana comic strip teases the reader from the jump-go, the comic book story meanders a bit for a set up to the request. There may be a shifting definition of just what is "making love" -- I have never really fixed the vernaculars for "first, second, third base", and am in trouble in speculating if this pushes us back to first when later it suggests further on to third. The closest we will get to the request in later decades gets more chaste.

Run the basic premise -- Betty wants to make Archie jealous through Jughead. Food is exchanged. A set up. Except oddly enough, a third instance of this next visual sequence for this has a different set up where Betty just impulsively starts ... Well... "Making love" to Jughead.

In the 70s Betty does not get to kiss Jughead.

Funny thing here --

The third one is notable as the one where Jughead is walking out satisfied not by food, but from Betty's amorous kisses. Slightly ironic, as it is the one where Betty does not come on to him.

#Archie Comics#Archie Andrews#Betty Cooper#Jughead#“Make love”#Kisses#Study session#Silhouette#Bob Montana#1947#Samm Schwartz#1950#Harry Lucey#1955#Dan Decarlo#1970#Jealousy#Don Waun#Interesting spelling#also note “hy” for “hi”

8 notes

·

View notes

Text

my days consist of ballet, studying and girlblogging on here.

#aesthetic#moodboard#waif chic#words words words#writeblr#academia aesthetic#writing#light academia#study aesthetic#balletcore#luna montana#balletclub#ballet aesthetic#ballet#ballerina#nina sayers#black swan#girlblogging#girl blogger#girl behind the blog

24 notes

·

View notes

Video

Exploration Glacier National Park by Mark Stevens

Via Flickr:

At a roadside pullout along the Going-to-the-Sun Road with a view looking to the East at a mountain goat, wandering around above us. This was around the Mountain Goat Study Area in Glacier National Park.

#Alberta and Glacier National Park#Azimuth 101#Blue Skies#Boulders#Central Lewis Range#Central Montana Rocky Mountains#Day 8#DxO PhotoLab 6 Edited#Glacier National Park#Glacier National Park Ranges#Going-to-the-Sun Highway#Going-to-the-Sun Road#Landscape#Landscape - Scenery#Lewis Range#Looking East#Mount Oberlin#Mountain Goat#Mountain Goat Study Area#Mountain Peak#Mountains#Mountainside#Nature#Nikon D850#No People#Oreamnos americanus#Outside#Project365#Ridge#Ridgeline

2 notes

·

View notes

Text

Ugh that 80s perm on a white woman...horrific

#just watched Scarface and spent a good 2hrs trying 2 convince myself that thier Spanish accents were passable#watching w a mix of awe and horror as Al Pacino’s Albanian ass tries to speak Spanish#him & Michelle Pfeiffer’s scenes were just 20 mins of back and forth calling each other racial slurs#i feel like the mountain of Cocaine in Tony Montana’s study rn

12 notes

·

View notes

Text

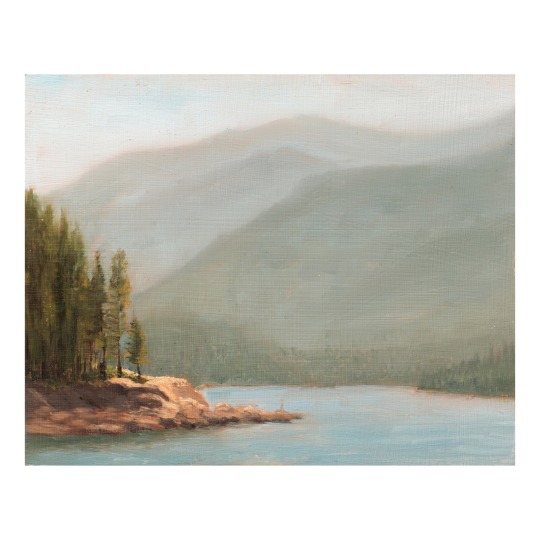

Plein air at hungry horse reservoir, just outside of glacier national park . This was a late morning view

#oil painting#painting#art#fine art#original art#traditional art#art study#pleinair#big sky#montana#glacier national Park#Glacier#lakeside

2 notes

·

View notes

Text

Loaded up and ready to go. Adventure awaits!

Great Falls, Montana

1964

#vintage camping#campfire light#great falls#montana#classic cars#road trips#history#road trip#color study

244 notes

·

View notes

Text

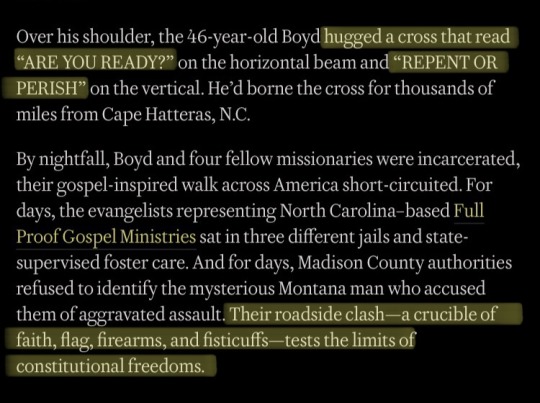

something something life imitating art idek any more, man…

1st source, 2nd source (tho I‘d recommend this article for more info on the situation)

#like what the fuck#the is the reason I wanna study the US under a microscope#local nuts are not enough any more#neither are fictional ones#well…#welcome to Hope County#Freedom. Faith. Firearms.#I guess#Far Cry 5#mine#what do I even tag this as#Montana#?

11 notes

·

View notes

Text

once again looking into moving to montana

#chatter#like think about it...live n work there for a year...get in-state tuition to university of montana...do prelaw studies n law school at um#hike every single day...etc....

2 notes

·

View notes

Text

so my friend and I are miserably failing at studying so I want to know how your oc's would be at it

Montana is like me, she can only study if she's alone, as soon there's someone else she's not doing anything

18 notes

·

View notes

Text

currently having a fig tree moment

#spicy speaks#my Sylvia Plath girlies know#screaming!#I’m a marine studies student right?#fun and games love slay#I realistically want to stay on the East coast for my whole life really#like east coast coastal area#but#I also want to live in the city for a year or two#queens probably#BUT..#I also want to travel#I want to spend a year or more out west more than anything#I need to live in Wyoming like I need oxygen#Wyoming or Montana or something#the horses the mountains everything#I need#I grew up around horses but it’s been many years since I even rode one#I need to reclaim my horse girl heritage#living out west has been my childhood dream#ugh#where do I go to grad school ??#that’s a whole other ball game

0 notes

Text

Retirement Planning: Tips and Tricks

Retirement is that one phase of life that we always anticipate, since we will have time to relax and enjoy the fruits of our labor that we have produced over time. However, to achieve this comfortable retirement, we need to act really fast and understand the need for financial planning in Oregon from a very young age. In this blog post by North Star Reserve, we are going to discuss the tips and tricks for retirement planning to create a solid nest for any individual.

When you plan for retirement, it is not like any other investment decision; it is a commitment that you have to uphold for a really long time and cannot afford to take chances. So let's start early to understand how to plan for your retirement

Understanding Your Retirement Needs

When you plan your retirement, it is very important for you to understand your financial needs, goals, and expectations for life after you retire. You should always take into account inflation and potential healthcare costs, which will significantly impact your retirement savings over time as you age. Additionally, consider local government lifestyle and expenses while planning for your retirement, including additional costs that you may encounter in retirement, such as healthcare or travel expenses.

Start Early, Save Wisely

It is crucial to start your retirement plan early, as time is the most valuable aspect here. The earlier you start your retirement plan, the more time your investment has to grow. Even if you make a retirement plan of a very small amount consistently, you will be able to accumulate substantial revenue with the power of compounding. You should start exploring your options early so that you have enough time to decide in which option you want to invest.

Diversify Your Investments

It is very important for you to diversify your investments when planning for your retirement or making a retirement portfolio. You can invest in different aspects such as stocks, bonds, and real estate in order to minimize the impact of fluctuations in the market. You should always consider your risk tolerance and investment horizon when you allocate your assets within your portfolio. Additionally, you should always rebalance your profile to maintain the desired asset allocation and adjust your investment strategy accordingly and as you get closer to retirement, you may want to shift towards more conservative investments to protect your principal. Alternatively, you can simply have a top financial plan by North Star Reserve in Utah.

Consider Longevity and Healthcare Costs

As medical science is evolving, we receive high-class medical treatment, which is also increasing our life expectancies. Thus, you should always plan for a longer retirement than your previous generation. Your longevity risk will help you estimate your retirement needs and ensure your savings will last throughout these years.

You should even consider healthcare costs, which will be another significant consideration need for financial planning in Oregon as you grow old after your retirement. You should invest in different kinds of health insurance that will supplement your Medicare options and cover medical expenses not included in your basic Medicare coverage. Long-term care insurance will also provide financial protection against potential long-term care expenses in the future.

Create a Budget and Stick to It

Creating a practical budget is crucial need for financial planning in Oregon. Monitor your income and spending, identifying opportunities to trim expenses or redirect funds to savings. Explore options like downsizing or cutting discretionary costs to boost cash flow for retirement savings. Adhere to your budget, steering clear of unnecessary splurges that may deplete your retirement funds prematurely. Prioritize financial goals and make informed choices aligned with long-term objectives, ensuring a secure and comfortable retirement.

Plan for Multiple Sources of Income

Depending solely on retirement savings might not sustain your lifestyle throughout retirement. Seek additional income from part-time work, rental properties, or passive investments you can even make a solid financial plan for your business in Washington. Diversifying income can buffer against unexpected expenses or market changes. Delay retirement to maximize Social Security benefits, increasing monthly payouts. Explore pension benefits or other retirement income streams based on employment history.

Review and Adjust Your Plan Regularly

Retirement planning demands continuous review and adaptation due to life events like marriage, divorce, childbirth, or career shifts, impacting financial standing and retirement aspirations. Regularly evaluate and tweak your retirement plan to align with evolving circumstances and market dynamics. Engage a financial advisor or retirement planner or best hoa reserve study companies in Utah to guide you through complex financial decisions and enhance your retirement approach. Their expertise offers tailored insights and recommendations attuned to your unique goals and requirements, ensuring a more robust and personalized retirement strategy.

Conclusion

Retirement planning necessitates foresight, disciplined savings, and strategic decisions. Start early, diversify investments, and create a viable budget for a secure financial base. Be proactive in understanding the need for financial planning in Oregon managing retirement funds, stay informed about options, and seek expert advice when needed. Through meticulous planning, envision a comfortable, worry-free retirement. Commence today and invest in your future welfare.

#condo reserve study company in washington#best condominium reserve study in montana#best hoa reserve study companies in utah#top reserve study companies in idaho#need for financial planning in oregon

0 notes