#Subscription Billing software provider

Explore tagged Tumblr posts

Text

Streamlining NetSuite Subscription Billing with SuiteWorks Tech: Enhancing NetSuite’s Capabilities

In today’s fast-paced business environment, managing subscriptions efficiently is crucial for success. NetSuite Subscription Billing is a powerful tool that can help businesses streamline their billing processes. However, to unlock its full potential, integrating it with a robust solution like SuiteWorks Tech is essential. This blog will explore how SuiteWorks Tech enhances NetSuite’s capabilities, providing a comprehensive subscription billing solution that not only automates processes but also elevates customer satisfaction.

The Need for Efficient Subscription Billing

As businesses transition to subscription-based models, the complexity of billing can increase exponentially. Manual processes can lead to errors, missed payments, and ultimately, dissatisfied customers. The NetSuite Subscription Billing solution addresses these challenges by automating recurring billing, but integrating it with SuiteWorks Tech takes this automation to the next level.

Understanding SuiteWorks Tech Subscription Billing Solution

Comprehensive Automation

SuiteWorks Tech subscription billing solution is natively built on the NetSuite platform, ensuring seamless integration into your existing ERP environment. This powerful billing engine automates the creation of recurring invoices, significantly reducing manual intervention. By automating these processes, businesses can focus on growth and customer service rather than getting bogged down in administrative tasks.

Key Features of SuiteWorks Tech Subscription Billing

For full blog click the below link

#Leading Subscription Billing Software for NetSuite#Best Subscription Billing Software for NetSuite#Top Subscription Billing Software for NetSuite#Subscription Billing Software for NetSuite#Subscription Billing Suiteapp#Subscription Billing solutions provider#Subscription Billing software provider#NetSuite Subscription Billing Solution#Subscription Billing solutions provider in india#Subscription Billing solutions provider in hyderabad

0 notes

Text

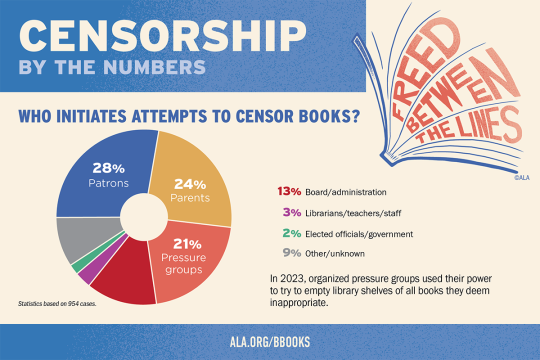

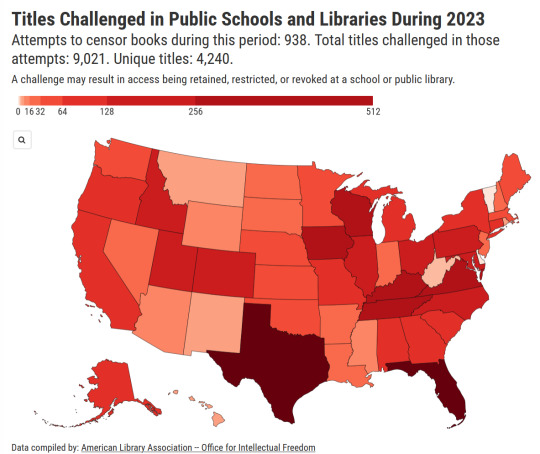

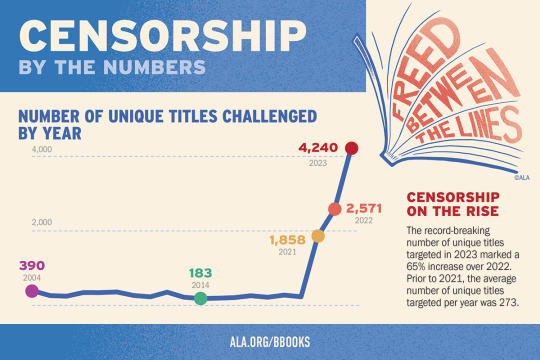

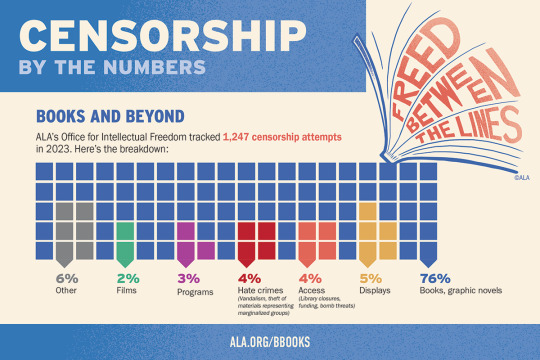

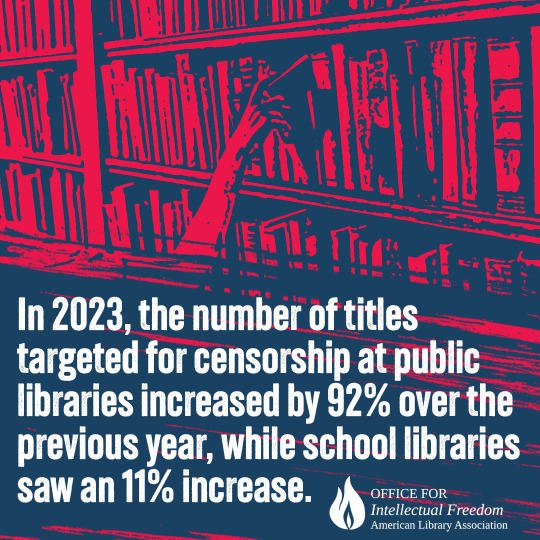

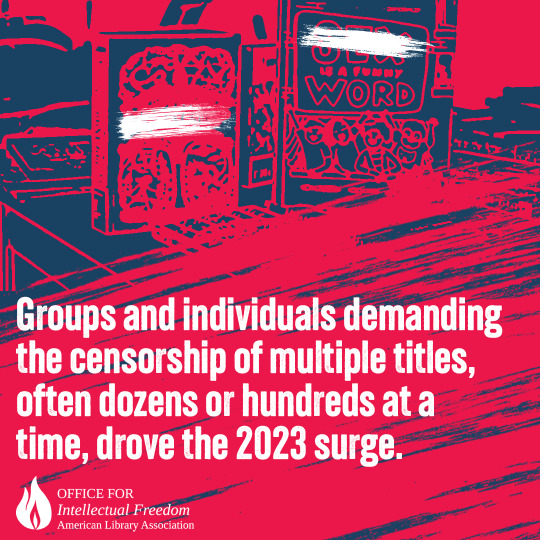

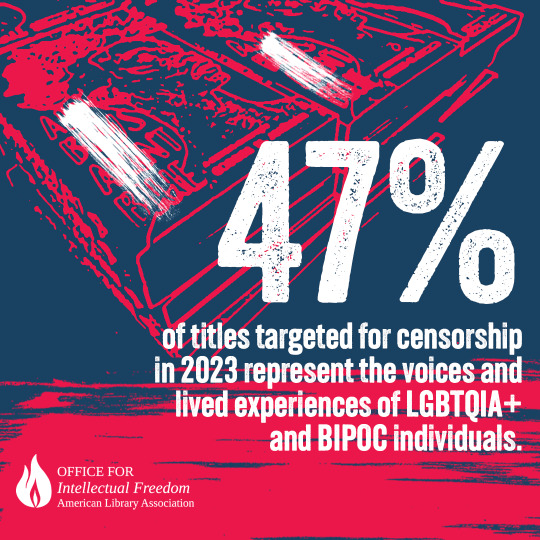

The ALA's State of America's Libraries Report for 2024 is out now.

2023 had the highest number of challenged book titles ever documented by the ALA.

You can view the full PDF of the report here. Book ban/challenge data broken down by state can be found here.

If you can, try to keep an eye on your local libraries, especially school and public libraries. If book/program challenges or attacks on library staff are happening in your area, make your voice heard -- show up at school board meetings, county commissioner meetings, town halls, etc. Counterprotest. Write messages of support on social media or in your local papers. Show support for staff in-person. Tell others about the value of libraries.

Get a library card if you haven't yet -- if you're not a regular user, chances are you might not know what all your library offers. I'm talking video games, makerspaces (3D printers, digital art software, recording equipment, VR, etc.), streaming services, meeting spaces, free demonstrations and programs (often with any necessary materials provided at no cost!), mobile WiFi hotspots, Library of Things collections, database subscriptions, genealogy resources, and so on. A lot of electronic resources like ebooks, databases, and streaming services you can access off-site as long as you have a (again: free!!!) library card. There may even be services like homebound delivery for people who can't physically come to the library.

Also try to stay up to date on pending legislation in your state -- right now there's a ton of proposed legislation that will harm libraries, but there are also bills that aim to protect libraries, librarians, teachers, and intellectual freedom. It's just as important to let your representatives know that you support pro-library/anti-censorship legislation as it is to let them know that you oppose anti-library/pro-censorship legislation.

Unfortunately, someone being a library user or seeing value in the work that libraries do does not guarantee that they will support libraries at the ballot. One of the biggest predictors for whether libraries stay funded is not the quantity or quality of the services, programs, and materials it offers, but voter support. Make sure your representatives and local politicians know your stance and that their actions toward libraries will affect your vote.

Here are some resources for staying updated:

If you're interested in library advocacy and staying up to date with the challenges libraries are facing in the U.S., check out EveryLibrary, which focuses on building voter support for libraries.

Book Riot has regular articles on censorship attempts taking place throughout the nation, which can be found here, as well as a Literary Activism Newsletter.

The American Library Association's Office for Intellectual Freedom focuses on the intellectual freedom component of the Library Bill of Rights, tracks censorship attempts throughout each year, and provides training, support, and education about intellectual freedom to library staff and the public.

The Electronic Frontier Foundation focuses on intellectual freedom in the digital world, including fighting online censorship and illegal surveillance.

I know this post is long, but please spread the word. Libraries need your support now more than ever.

161 notes

·

View notes

Note

The FAQ link sent me straight to the inbox. Do you have a Patreon? (Sorry if you've answered this before.)

Oops, that's not supposed to happen!! I'm at the shop rn but once I'm home I'll take a look at it, I recently changed my site theme so the link might have just broke 🤣

I do have a Patreon, and a Ko-Fi now too as well!! (just recently started a secondary page for Ko-Fi, I haven't finished sprucing it up yet but it's at least setup enough to function lmao) Both are setup for monthly subs, but Ko-Fi is frankly my favorite as it also allows for one-time donations, it supports community goals (which Patreon got rid of, bleh) and its fees are WAY lower, meaning more of what people send me actually gets to me!

That said, I do want to include a disclaimer for anyone finding out for the first time:

Obviously with the nature of Rekindled being fanfiction, I can't directly profit off it, so I'm limited in what I can offer in terms of tier rewards. I'm not exactly keen on running the risk of offering stuff like early access pages or sellable digital downloads of the comic itself, that sort of thing, as it could be held against me as selling Rachel's characters / story / etc. for my own profit. While Patreon overall does offer the "legal grey area" of operating as more of an optional tip jar than a commercial storefront, I would still rather mitigate the risk of legal consequences before they've happened, rather than push my luck and get screwed for it later LMAO

Aa such, most of what I post rn are backlog Twitch VODs from past streams (which includes live footage and commentary of me making "new" episodes) and time lapses of completed episodes ! Stuff that contains Rekindled goodies without it being a direct sales item ;p

Aside from balancing on legal tightropes, I've also just... learned the hard way from past experiences that I'm not the best at maintaining a robust and regular tier reward system 🫣 (thanks ADHD) If I were able to do this as my full-time job, maybe, but ultimately I prefer keeping my crowdfunding platforms simple so I can focus on making what people are really paying for - the continued production of more episodes!

Sooooo with that big disclaimer / explanation aside , if you do decide to check it out, just keep in mind that both platforms are operating more like optional tip jars, with the odd piece of bonus content every now and then from what I can feasibly (and legally) provide !! I try my best to upload regularly enough for the monthly subscription to be "worth it", but that's why I also have a Ko-Fi setup now too, for people who would rather just make one time donations or don't want to deal with another monthly subscription cost (mood)

Regardless, all the money that I earn from Patreon, Ko-Fi, and Twitch goes back into Rekindled in some way or another! Whether it's helping cover costs for my drawing software or paying for new brushes / assets, or even just helping with our Internet bill so that I can keep posting LMAO I'm super grateful to those who have or are currently tucking some extra change into my pocket to help support my work and get me by, every little bit counts 🤗💖

(and ofc for those who don't have the means to support with money - reading my work, commenting on it, reblogging it, etc. is super helpful too!!! All your kind words and fun discussions and theories in the tags and fanart and everything in between are their own form of compensation, because it brings me immense amounts of joy and constantly reminds me why I do what I do 🥺💖)

31 notes

·

View notes

Text

How to Build a Seamless Payment Platform with Cash App Clone Script?

In the competitive landscape of digital finance, launching a peer-to-peer (P2P) payment app like Cash App presents a lucrative opportunity for entrepreneurs. With the rise of cashless transactions, businesses seeking to enter the fintech space can leverage a Cash App Clone Script to establish a robust and feature-rich payment solution. Bizvertex offers a scalable and cost-effective Cash App Clone Software tailored for startups and enterprises aiming to penetrate the digital payment sector.

Rapid Market Entry with White Label Cash App Clone Software

Developing a P2P payment application from scratch involves extensive research, development, and compliance measures, leading to high costs and prolonged time-to-market. A White Label Cash App Clone Software significantly reduces these challenges, allowing businesses to deploy a fully functional platform with minimal investment. By utilizing Bizvertex’s clone solution, entrepreneurs can customize the software to align with their brand identity, ensuring a seamless user experience while maintaining regulatory compliance.

Essential Features of a Cash App Clone Script

To compete in the fintech industry, a Cash App-like platform must offer key functionalities that enhance user engagement and transaction security. The Cash App Clone Script by Bizvertex includes:

Instant P2P Money Transfers – Enables users to send and receive money effortlessly.

QR Code Payments – Facilitates quick transactions via QR code scanning.

Multi-Currency Support – Allows users to transact in different fiat and digital currencies.

Bank Account Integration – Provides seamless linking with bank accounts for deposits and withdrawals.

Cryptocurrency Transactions – Supports Bitcoin and other digital assets for modern financial needs.

Robust Security Measures – Includes two-factor authentication, encryption, and fraud detection.

Bill Payments & Mobile Recharge – Enhances user convenience by integrating utility bill payments.

Custom Branding & UI/UX – Ensures a personalized experience for end-users.

Business Advantages of Choosing a Cash App Clone Software

1. Cost-Effective Development

Investing in a White Label Cash App Clone Software significantly reduces development costs compared to building a payment app from scratch. Bizvertex provides a ready-made yet customizable solution, ensuring a high return on investment (ROI) for entrepreneurs.

2. Faster Time-to-Market

Speed is crucial in the fintech industry. By opting for a Cash App Clone Script, businesses can launch their P2P payment app quickly and start acquiring users without delays.

3. Scalability & Customization

A pre-built clone solution from Bizvertex allows startups to scale as their user base grows. The software is fully customizable, enabling businesses to add unique features and branding elements.

4. Revenue Generation Opportunities

A Cash App-like platform offers multiple revenue streams, including transaction fees, subscription models, merchant partnerships, and cryptocurrency trading commissions.

Build a Profitable P2P Payment App with Bizvertex

For entrepreneurs aiming to establish a foothold in the fintech industry, Bizvertex’s Cash App Clone Software provides a reliable and efficient pathway. With advanced security features, a seamless user interface, and multi-currency support, businesses can create a successful and profitable P2P payment platform. Get started with Bizvertex today and build a fintech brand that stands out in the market.

3 notes

·

View notes

Text

Finding Resolve

We’ve all done it. We are all part of this new phenomenon, something that barely existed before this century, and only truly gained momentum in the last decade. The worst part is, most of us have forgotten exactly how much we are involved with it, because it is hard to remember what and how much these phenomena cost.

I am talking about the subscription economy, that magical place where software and streaming services are the product, and our monthly bill is usually on autopay. It ranges from SOAS (Software As A Service) providers like Adobe and Microsoft, to all the music, movies, and more that we stream into our homes, cars, and mobile devices.

And it is eating us alive.How many subscriptions do you have? Let’s start with your vehicle. Do you have satellite radio? That’s one. Do you subscribe to cloud-based software? That can be one or more. What about streaming tunes like Spotify or Apple Music? There you guy. The list is getting longer.

And then there are all the streaming TV choices, which runs from services like YouTube TV to Netflix, Paramount+, Apple TV+, Peacock, Max, Hulu, Disney…I could go on. You may have cut the cable at home, but you tethered yourself in other ways to the extent that the net effect is little different.

Then there’s the gaming community, if that’s your thing. More dinero. Maybe you fell for the premium version of an app, like Accuweather. If you’re a regular Amazon shopper, you no doubt have Prime, which costs $139 a year, plus the vitamins and supplements I receive every month from them. Like listening to books? There’s Audible. Old newspapers? There’s Newspapers.com, one of my favorite sites to do research. Cloud storage? Good Lord, I have several, for my thousands of photos and documents.

So successful has the subscription model been that paywalls have appeared everywhere online, like the New York Times, Washington Post, and Atlantic Monthly, each of whom have amazing content, a feast for my eyes and brain. Alas, I have drawn the line, because I sense it has long spun out control. And if CNN goes ahead and paywalls its app and site, I guess I won’t be reading them anymore.

Because I, like many people, have subscription fatigue. I simply cannot begin to consume all of this media. Sadly, I cannot remember all of the services to which I subscribe, and if you aren’t there yet, I bet you will be soon enough. The only way to know for sure is to carefully track your credit card statements to look for monthly billing.

That, of course, is the problem, because we willingly provided our billing data so that we do not have to do this every month. As long as that credit card is valid, those providers will keep hitting your card every month. It is only when your card is about to expire that you get a notification. And if you were not careful and instead provided a bank routing and account number, they can keep sticking their hand into your pocket as long as you have that account.

Ironically, there are new subscription management software sites and apps that supposedly make it easy to track and opt-out of all the things, but they are subscription services themselves. That’s like replacing one drug with another. You’re still on the hook.

It all starts so easily, because many of the subscription services are technically just micro payments, only $5 or $10. We see that as pocket change. Other services offer annual payment options, which provide a slight discount for paying in full in advance. But many of the once-cheap micro payments have started to get expensive, like Netflix and Spotify (I am speaking from experience). They are no longer minor indulgences.

Were these tangible products we had to buy in a store, I bet we would all be a lot more careful. The friction of having to be somewhere to even just tap your credit card would probably be enough to cause us to think. But it is simply too easy in the digital world to keep subscribing, because once we get in that loop, there is never any friction.

We are all going to have to muster a lot more resolve to win this fight, as well as start keeping meticulous records. Otherwise, these things develop lives of their own, lives that will continue hitting credit cards even after our own lives are over. I’m pretty sure none of us will be consuming anything at that point, and there’s no use paying for it.

We don’t have to wait for New Years Day to make this resolution.

Dr “I Honestly Can’t Remember All Of Them” Gerlich

Audio Blog

2 notes

·

View notes

Text

Find Your Perfect Alternative to Smokeball Legal Practice Management Software

In the bustling world of law, legal professionals are always on a quest to find the perfect legal practice management software. The law practice management software boosts productivity and helps lawyers offer exceptional client service. There are various legal practice management software in the industry. All these software offers different features, pricing, and integration capabilities. Among various billing software for lawyers, CaseFox and Smokeball are emerging as two prominent software in the industry. But because of various advanced features and functionalities, CaseFox is becoming a Smokeball alternative. In this blog, you will learn more about CaseFox and Smokeball and compare all the features of both the softwares.

Smokeball Overview

Smokeball is a legal practice management software that supports smart case management and legal billing. Smoke is a legal practice management software that is suitable for firms. Smokeball doesn't focus too much on solo practitioners. Smokeball offers in-built e-signature but users may have to switch to advance plans for that. The software helps in managing leads, cases, and time effectively. Smokeball offers a variety of features, but users may have to pay for leveraging these features. CaseFox Overview CaseFox is a cloud-based legal practice management software that offers various comprehensive features. This software is suitable for solo practitioners and firms. It can make the whole process of legal management efficient. From the first step of client intake to offering customer service, CaseFox can do it all. Lawyers and firms can manage their time, finance, documents, and cases with the advanced feature of CaseFox. The software allows users to track time, expenses and generate bills efficiently. With the pricing and features that CaseFox provides, it becomes a Smokeball alternative for various individuals. The best part about CaseFox is that it is a free legal billing software for solo practitioners. CaseFox doesn't charge any amount from solo practitioners in their free plan. This law practice management software offers all the features in the free plan too.

CaseFox vs Smokeball

Pricing

The pricing of law firm case management software varies according to the features and functionality. Some case management systems provide subscription-based models while others opt for one-time payment or usage-based pricing options. When evaluating the legal billing software for your firm, it is crucial to consider the pricing of the software. The pricing of the firm does not just impact the budget of the firm. But it also determines the value your firm will receive from the software. Below, we will compare the pricing of CaseFox and Smokeball. a. CaseFox Pricing CaseFox is a legal software that offers three different price plans. It has flat pricing, which means lawyers won’t have to pay an extra amount for any additional feature. For solo practitioners that don’t have many caseloads, CaseFox is a free law practice management software. It doesn't charge anything. Next, CaseFox has a pro plan that costs around $39 per user/month USD. This plan includes all the features that CaseFox has to offer. From time tracking, billing, task management, invoice generation, legal billing, and LEDES billing. CaseFox offers everything in this plan that a firm or legal professional may need. b. Smokeball Pricing Smokeball has three different pricing editions. The first one is Smokeball start, and this plan costs around $29.00 per User/Per Month. This is the most basic plan that Smokeball offers and this plan doesn't have various essential and advanced features. The next plan is Smokeball grow, and it is starting at $99.00 per User/Per Month. The last plan that it has is Smokeball Prosper starting at $149.00 per month/per user.

Multilingual Support

Multilingual is a feature that enables law lawyers and firms to connect with clients from different backgrounds. The multilingual support that law firm billing software offers allows law firms to create invoices, communicate with clients and offer service in multiple different languages. This software helps in fostering better client relationships. a. CaseFox Multilingual feature CaseFox offers multilingual support that enables lawyers and firms to generate bills and invoices in multiple languages. This feature is very effective and useful for lawyers as it enables them to reach wider audiences speaking different languages. The multilingual feature that CaseFox offers removes language barriers. This is a must-have feature and it can be beneficial for various legal professionals and law firms. b. Smokeball Multilingual Feature Smokeball is a legal billing software that offers various advanced features but unfortunately, it lacks multilingual capabilities. Smokeball supports only one language to generate bills, invoices and for client communication, too.

Customer Support

The customer support feature of legal practice management holds great importance in offering client satisfaction. Robust customer support will enable firms to offer top-notch service to their clients. Lawyers and firms can solve the issues that their clients face within a few minutes with powerful customer service. Below, we will compare the customer support that CaseFox and Smokeball offer. a. CaseFox Customer Support Customer support will play an essential role in enhancing user experience. CaseFox offers top-notch customer support to users. CaseFox is one of those case management softwares that offers robust 24*7 customer support. This means if any time clients face any glitches, technical issues or they have any sort of queries. They can take help from customer support which is available 24*7. b. Smokeball Customer Support Smokeball is a legal practice management software that offers customer support only in business hours. This means clients can report their issues and queries only during these hours. This can be the major drawback for the software, as it can hamper the daily practice of lawyers or firms. If they face any technical issues.

CaseFox VS Smokeball

Feature CaseFox Smokeball Free Account CaseFox offers a free account for a solo practitioner. Smokeball offers a free trial but it doesn't have a free account. User Interface CaseFox has a straightforward and intuitive interface. Smokeball offers user-friendly with modern designCustom Forms and Template CreationCaseFox offers custom form and templates for billing and invoicing. Smokeball doesn't have any customization for forms and templates. Customer Support 24*7 customer support by CaseFox. Smokeball offers customer service only during business hours. LEDES e-Billing CaseFox makes LEDES e-billing easy. Smokeball doesn’t have an LEDES e-billing feature.

The Bottom Line

When it comes to choosing the perfect law practice management software, it is essential to consider various factors. Such as interface, integration, billing, invoicing, task management, case management and pricing, etc. CaseFox and Smokeball both are reputable legal billing software. With the features and pricing that CaseFox offers, it becomes the perfect Smokeball alternative. CaseFox is a powerful Smokeball competitor, as it is affordable and offers more features. Assess the requirements of your firm and choose the legal billing software that suits your needs. Read the full article

#Smokeball#Legal#LegalPracticeManagementSoftware#LawPracticeManagementSoftware#AlternativetoSmokeball#SmokeballAlternative#SmokeballCompetitor#LawPracticeManagement#LegalPracticeManagement#LawManagementSoftware#LegalManagementSoftware#CaseFox#LawFirmSolution#legalsoftware#LegalTech

2 notes

·

View notes

Text

Quicken vs QuickBooks: Which One is Right for Your Business?

Are you struggling to choose the right accounting software for your business? Look no further! In this post, we'll be comparing Quicken vs QuickBooks – two of the most popular accounting software on the market. Both are powerful tools that offer features to manage your finances, but which one is right for you? Join us as we dive into what makes these two options unique and how to make an informed decision based on your business needs. Let's get started!

Comparing Quicken vs QuickBooks

When it comes to managing your business finances, Quicken and QuickBooks are two of the most popular software options available. While Quicken vs QuickBooks both programs offer similar accounting features such as tracking expenses and income, there are some key differences between them.

Quicken is designed primarily for personal finance management. It's a great option if you're self-employed or run a small business with just a few employees. With Quicken, you can track your bank accounts, credit cards, investments and more in one place.

On the other hand, QuickBooks is more ideal for businesses that require robust accounting tools like inventory management and payroll processing. It's also suitable for larger organizations with multiple users who need access to financial data simultaneously.

Another difference between these two platforms is their pricing models. Quicken offers a one-time purchase fee while QuickBooks has monthly subscription plans based on the features required by your business.

Ultimately, choosing between Quicken vs QuickBooks depends on your specific needs as well as the size and complexity of your organization. Consider factors such as budget constraints and which features are necessary for efficient financial management before making a decision.

What is Quicken?

Quicken is a personal finance management software that has been around since 1983. It was originally designed to help individuals manage their finances by tracking income and expenses, creating budgets, and generating reports. Today, Quicken offers various versions of its software that cater to different financial needs.

One version of Quicken is called Quicken Deluxe which allows users to track investments in addition to managing their personal finances. Another version is called Quicken Premier which includes features for managing rental properties as well as investment tracking.

Quicken also offers a mobile app that allows users to access their financial information on the go. Users can sync their data across devices so they always have access to up-to-date information.

Quicken is best suited for individuals or small businesses looking for an easy way to manage their personal finances without needing advanced accounting knowledge.

What is QuickBooks?

QuickBooks is a popular accounting software designed for small businesses to manage their financial transactions, invoices, bills and expenses. It was developed by Intuit and first released in 1983 as a desktop application. Since then, it has expanded its features and services to cater to the growing needs of businesses.

This software allows users to track inventory levels, create sales orders, generate reports and integrate with other applications such as payroll systems. QuickBooks also offers cloud-based versions that enable users to access their data from anywhere at any time.

One of the key benefits of using QuickBooks is its user-friendly interface which makes it easy for beginners to navigate through various financial tasks. The program also provides tutorials and customer support resources for those who need additional assistance.

Another great advantage of this software is that it can be customized according to specific business requirements. Users can choose from different plans based on the size of their business or opt for add-ons like payroll management or payment processing services.

QuickBooks has become a go-to solution for small businesses looking for an efficient way to handle their finances while staying organized and compliant with tax laws.

The Difference between Quicken vs QuickBooks

Quicken and QuickBooks are both financial management software options, but they serve different purposes. Quicken is a personal finance management tool that can help individuals with their budgeting, banking, and investment tracking needs. On the other hand, QuickBooks is an accounting software designed specifically for small businesses.

One of the key differences between Quicken vs QuickBooks is in their functionality. While Quicken focuses on managing personal finances, QuickBooks offers more comprehensive features such as invoicing, payroll processing, inventory management, and accounts payable/receivable. This makes it a better option for small business owners who need to manage multiple aspects of their financial transactions.

Another difference between these two accounting tools is their pricing model. Quicken typically charges a one-time fee for purchasing its software while QuickBooks follows a subscription-based model where users pay monthly or annually depending on the plan they choose.

Deciding whether to use Quicken vs QuickBooks depends largely on your individual needs as well as those of your business if you have one. If you're looking for robust accounting capabilities with features like invoicing or inventory tracking then go for QuickBooks while if you're just looking to manage personal finances then stick with Quicken

Which One is Right for Your Business?

When it comes to deciding which accounting software is right for your business, there are a few factors you should consider. One of the first things you need to determine is what specific features your business needs. For example, if your business requires inventory tracking or payroll management, QuickBooks may be the better option for you.

Another important consideration is the size of your business. Quicken may be more suitable for small businesses or sole proprietors who don't require as many advanced features as larger companies. On the other hand, QuickBooks can handle multiple users and large amounts of data, making it ideal for medium-sized and larger businesses.

The level of technical expertise required to use each software platform is also an important factor to consider. If you have limited experience with accounting software and want something user-friendly and easy-to-learn, Quicken may be a better choice. However, if you're comfortable with technology and want more advanced capabilities like custom reports or integrations with other software tools, QuickBooks might suit your needs better.

Ultimately, choosing between Quicken vs QuickBooks depends on understanding what your business requirements are in terms of functionality, size and technical aptitude. By taking these factors into account when selecting an accounting solution that best meets those criteria will help ensure success over time.

How to Choose the Right Accounting Software for Your Business

Choosing the right accounting software for your business can be overwhelming, especially with so many options available. Here are some important factors to consider when selecting the best fit for your needs:

Business Size: Consider the size of your business and whether you need a basic or advanced accounting system.

Features: Look at the features offered by each platform and determine which ones are essential for managing your finances.

User Interface: Make sure that you choose a user-friendly interface that is easy to navigate and understand.

Integration: Check if the software integrates with other tools such as payment processors, CRMs, or inventory management systems.

Support: Choose a platform that offers reliable customer support in case any issues arise.

Security: Ensure that the software has robust security measures in place to safeguard sensitive financial data from potential cyber threats.

Pricing: Determine whether there are any upfront costs, monthly fees or hidden charges associated with using the accounting software before making a final decision.

By considering these factors carefully when choosing an accounting system, you'll have greater confidence in finding one that meets all of your requirements and helps drive success for your business!

Conclusion

After comparing Quicken vs QuickBooks and analyzing the features of both accounting software, it's clear that they have significant differences.

Quicken is best suited for individuals or small business owners who need to manage their personal finances or do basic bookkeeping tasks. On the other hand, QuickBooks provides a more robust platform with advanced tools and features that cater to larger businesses.

Choosing the right accounting software depends on your individual needs and budget. Consider factors such as business size, industry type, level of financial expertise, and future growth plans when making your decision.

Whichever software you choose between Quicken vs QuickBooks will help streamline your financial management processes and improve the accuracy of your accounting records. So take time to evaluate both options carefully before deciding which one is right for your business!

3 notes

·

View notes

Text

What is Cloud Computing? Everything You Need to Know.

Cloud computing is a paradigm in computing that involves the delivery of various computing resources over the internet. It provides on-demand access to a shared pool of configurable computing resources, such as servers, storage, networks, applications, and services. Instead of relying on local servers or personal devices, users can access and utilize these resources remotely through a network of servers hosted in data centers.

Here are some key aspects and components of cloud computing:

On-demand self-service: Cloud computing allows users to provision and deploy computing resources (such as virtual machines, storage, or applications) as needed, without requiring human intervention from the service provider. This flexibility enables users to scale their resources up or down based on demand.

Broad network access: Cloud services are accessible over the network, usually through standard internet protocols. Users can access cloud applications and data from various devices, including desktop computers, laptops, tablets, and smartphones.

Resource pooling: Cloud providers pool computing resources to serve multiple users simultaneously. These resources are dynamically allocated based on demand, ensuring efficient utilization and optimization of hardware.

Rapid elasticity: Cloud computing enables users to scale their resources up or down quickly. This elasticity allows users to adapt to changing workloads and accommodate peak usage periods without requiring significant upfront investment in additional infrastructure.

Measured service: Cloud computing providers monitor and measure resource usage, enabling the billing and metering of services based on consumption. Users are charged for the actual resources utilized, such as storage, processing power, bandwidth, or active user accounts.

Service models: Cloud computing offers various service models, including:

a. Infrastructure as a Service (IaaS): Provides virtualized computing resources, such as virtual machines, storage, and networks, allowing users to deploy and manage their applications within the cloud infrastructure.

b. Platform as a Service (PaaS): Offers a platform and environment for developing, testing, and deploying applications. Users can focus on application development without worrying about the underlying infrastructure.

c. Software as a Service (SaaS): Delivers software applications over the internet on a subscription basis. Users can access and use these applications without the need for installation or management on their local devices.

Deployment models: Cloud computing can be deployed in different ways:

a. Public cloud: Computing resources are owned and operated by third-party service providers, and multiple users share these resources. Examples include Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform.

b. Private cloud: Computing resources are dedicated to a single organization and are not shared with other users. They can be managed internally by the organization or by a third-party vendor.

c. Hybrid cloud: Combines both public and private cloud deployments, allowing organizations to leverage the benefits of both. It provides flexibility in choosing where to deploy workloads and enables seamless integration between the two environments.

d. Community cloud: Computing resources are shared by multiple organizations with common interests, such as specific industries or regulatory requirements.

Cloud computing has transformed the way businesses and individuals use and access computing resources. It offers scalability, cost-efficiency, flexibility, and ease of management, allowing organizations to focus on their core competencies without the burden of maintaining complex IT infrastructures.

2 notes

·

View notes

Text

North America Dental Practice Management Software Market Historical Analysis, Opportunities, Latest Innovations, Top Players Forecast (2020-2027)

The North America dental practice management software market is expected to grow from US$ 790.9 million in 2020 to US$ 1,650.6 million by 2027; it is estimated to grow at a CAGR of 11.1% from 2020 to 2027.

North America Dental Practice Management Software Market Introduction

Recognizing the unique challenges faced by dentists, dental practice management software provides essential support. These user-friendly, frequently cloud-based platforms streamline clinical and administrative operations, offering robust tools for managing dental clinic data. Tailored templates for dental practices are a key feature, along with the ability to import and organize visual data such as tooth diagrams, X-rays, and gum assessments.

Given the potential for transmitting infections via patients' oral fluids during dental procedures, the enforcement of social distancing was a critical measure to combat the COVID-19 pandemic. The heightened risk of coronavirus infection from direct exposure to these fluids resulted in the postponement of routine dental treatments, with a focus on essential emergency and urgent care. However, the need for accessible data and communication systems offered by practice management software became increasingly important during this time of limited physical workstation availability. Consequently, these circumstances are likely to have a favorable impact on the dental practice management software market.

Download our Sample PDF Report

@ https://www.businessmarketinsights.com/sample/TIPRE00024244

North America Dental Practice Management Software Strategic Insights

Strategic insights for the North America Dental Practice Management Software market deliver a data-driven analysis of the industry environment, encompassing current trends, major players, and regional specificities. These insights offer practical guidance, allowing readers to distinguish themselves from competitors by identifying unserved market segments or developing unique value propositions. Through the application of data analytics, these insights support industry participants in anticipating market shifts, whether they are investors, manufacturers, or other stakeholders. Maintaining a future-oriented perspective is crucial, assisting stakeholders in foreseeing market changes and strategically positioning themselves for long-term success in this evolving region. Fundamentally, effective strategic insights empower readers to make informed choices that enhance profitability and achieve their business goals within the market.

NORTH AMERICA DENTAL PRACTICE MANAGEMENT SOFTWARE MARKET SEGMENTATION

North America Dental Practice Management Software Market: By Delivery Mode

Web-Based Delivery Mode

Cloud-Based Delivery Mode

On-Premise Delivery Mode

North America Dental Practice Management Software Market: By Component

Scheduling Software

Patient Communication Software

Invoice/Billing Software

Insurance Management Software

Other Components

North America Dental Practice Management Software Market: By Country

North America

US

Canada

Mexico

North America Dental Practice Management Software Market: Companies Mentioned

Carestream Dental, LLC

Curve Dental, Inc.

Datacon Dental Systems

Epic Systems Corporation

DentiMax

Henry Schein, Inc.

Patterson Dental Supply, Inc.

Gaargle Solutions Inc.

NXGN Management, LLC

Compudent Systems Inc.

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications

#North America Dental Practice Management Software Market#North America Dental Practice Management Software Market Analysis#North America Dental Practice Management Software Market Opportunities

0 notes

Text

How to Print and Mail Cheques from QuickBooks and Other Accounting Software

Even in 2025, cheques remain essential for many businesses. From vendor payments to payroll processing, printed cheques offer control, traceability, and compliance. While digital payments dominate in many sectors, printing and mailing cheques through accounting software like QuickBooks, Xero, and Sage is still a preferred option for thousands of companies.

In this comprehensive guide, you’ll learn how to securely print and mail cheques from QuickBooks and other accounting software—automatically, efficiently, and in compliance with today’s financial regulations.

Why Businesses Still Use Printed Cheques in 2025

Despite the rise of ACH and wire transfers, printed cheques continue to play a role due to:

Vendor preferences in certain industries.

Record-keeping requirements for auditing and reconciliation.

Security controls offered by physical documents.

Cross-border transactions where electronic systems may lag.

Advantages of Automated Cheque Printing and Mailing

AdvantageDescriptionSaves TimeNo manual printing, signing, or stuffing envelopes.Improves SecurityMICR-encoded, fraud-resistant checks with audit trails.Enhances WorkflowSyncs directly with your accounting system.Reduces CostsNo need for in-house printers, supplies, or postage.Offers Mailing FlexibilitySend via USPS, FedEx, or Canada Post.

How Cheque Printing & Mailing Works from QuickBooks

Step-by-Step for QuickBooks Online Users

Connect to a Cheque Mailing Service

Use integrations like Checkeeper, Melio, or Deluxe eChecks.

Enter Bill or Payment Info

Record the vendor payment like any other transaction.

Choose “Print Later” Option

Flag the cheque for batch processing.

Log into Your Cheque Mail Service

Import the pending cheques.

Select Cheque Style and Template

Use company-branded checks with MICR encoding.

Confirm Mailing Preferences

Select envelope type, delivery method, and speed.

Process and Track

Monitor mailing status and delivery confirmations.

Using Checkeeper: A QuickBooks-Integrated Solution

Checkeeper is a popular tool for QuickBooks users due to:

Full QuickBooks Online and Desktop integration.

Unlimited check printing and cloud-based templates.

USPS mailing with delivery tracking.

Same-day processing.

Printing Cheques from QuickBooks Desktop

Install Compatible Printer with MICR Toner

Insert Blank Cheque Stock

Go to File > Print Forms > Cheques

Select Bank Account and Cheques

Preview and Print

For mailing, integrate with services like PrintBoss, which automates batching and postal fulfillment.

Mailing Cheques from Other Accounting Software

1. Xero

Integrate with Plooto or Checkeeper.

Export payment details or sync directly via API.

Set up cheque layouts and print/mail options.

2. Sage

Use Sage-integrated tools like Deluxe or Checkflo.

Enable multi-user access for approvals and print queues.

3. FreshBooks

FreshBooks doesn’t have native cheque support but works via Zapier and tools like VersaCheck or Checkeeper.

Features to Look for in Cheque Printing Software

FeatureBenefitMICR EncodingMeets bank processing standards.Cloud Sync with Accounting SoftwareEnsures accurate data flow.USPS/Canada Post SupportOffers mail tracking and delivery options.Custom TemplatesAllows brand consistency.Batch PrintingSpeeds up bulk operations.Two-Factor AuthenticationAdds security for sensitive payments.

Security and Compliance Tips

Use Secure Printers or Cloud Providers

Prevent unauthorized access with role-based controls.

Enable Multi-User Approval Workflows

Require sign-off from finance or management.

Encrypt All Transactions

Ensure data in transit and storage is secured.

Store Cheque Images and Logs

Useful for audits and dispute resolution.

Comply with NACHA & CRA Standards

Meet U.S. and Canadian cheque compliance laws.

Cost Considerations

Cost ItemTypical CostBlank Cheque Stock$25–$60 per 500 checksMICR Toner Cartridges$80–$150 eachMailing Service Fees$1.50–$3.50 per chequeSoftware Subscription$10–$50/month depending on features

Using an all-in-one provider is often more affordable than managing in-house.

Best Practices for Efficiency

Automate recurring payments like rent or contractor payroll.

Outsource high-volume payments to print-and-mail vendors.

Centralize cheque logs for internal control and audit readiness.

Add QR codes for recipients to scan and confirm deposit instructions.

Cheque Printing API Integrations

For developers and finance teams:

Lob API – Ideal for enterprise cheque workflows.

Checkeeper API – Simple integration with CRMs and billing tools.

Melio API – Focused on bill pay and expense management.

These APIs enable fully automated cheque issuance from custom applications.

Conclusion

In 2025, printing and mailing cheques from QuickBooks and other accounting software is easier, faster, and more secure than ever. Whether you're a small business paying local vendors or a large organization handling payroll, leveraging cheque automation tools saves time, reduces errors, and ensures compliance.

By selecting the right platform, integrating with your accounting software, and following best practices, you can modernize your cheque workflow while keeping the trust and flexibility that paper payments provide.

youtube

SITES WE SUPPORT

Automated Postal APIs – Wix

0 notes

Text

Benefits of Cloud-Based Service Industry Management Software for UAE Companies

In today’s fast-paced digital world, service-based companies across the UAE are embracing technological advancements to streamline their operations and improve customer satisfaction. One of the most significant innovations reshaping the service industry is cloud-based management software. From facility maintenance providers and cleaning services to IT support and consulting firms, businesses are increasingly shifting to the cloud to gain a competitive edge.

This blog explores the key benefits of adopting cloud-based service industry management software in the UAE market and why it’s becoming a game-changer for service-oriented enterprises.

1. Real-Time Access Anytime, Anywhere

With cloud-based systems, UAE companies can access their data and operations from anywhere — whether in the office, on-site with a client, or working remotely. This is especially valuable in the UAE’s dynamic business landscape where quick decision-making and flexibility are critical.

Mobile accessibility allows service managers and field staff to:

Track job progress in real-time

Update schedules and dispatch technicians instantly

Generate reports and invoices on-site

2. Cost-Effective with Reduced IT Burden

Traditional on-premise software requires significant upfront investment in hardware, servers, and ongoing maintenance. In contrast, cloud-based solutions operate on a subscription model (SaaS), making them more affordable for SMEs and scalable for growing enterprises.

Benefits include:

No need for physical infrastructure

Lower setup and maintenance costs

Automatic updates and data backups

This is ideal for UAE businesses that want modern solutions without the hassle of complex IT management.

3. Enhanced Collaboration and Workflow Automation

Cloud-based platforms promote better collaboration between office staff and field teams. Integrated features like task assignments, project tracking, and customer feedback loops ensure that everyone is on the same page.

Automation tools can handle repetitive tasks such as:

Sending appointment reminders

Scheduling preventive maintenance

Generating service reports

This reduces errors, improves productivity, and frees up staff to focus on delivering high-quality service.

4. Scalability to Match Business Growth

As UAE service companies expand, their software needs evolve. Cloud-based solutions are inherently scalable, allowing businesses to add users, services, and modules as needed without major disruptions or upgrades.

Whether you’re a startup or a growing enterprise, cloud platforms can grow with you — a crucial advantage in the fast-moving service economy of cities like Dubai, Abu Dhabi, and Sharjah.

5. Data Security and Compliance

Modern cloud providers offer robust security protocols including data encryption, secure access controls, and compliance with regional and international standards. This is particularly important for UAE companies operating under strict data protection regulations.

With automatic data backups and disaster recovery features, businesses can operate with confidence knowing their sensitive information is protected.

6. Improved Customer Experience

Customer satisfaction is at the heart of every service business. Cloud-based management software enhances client communication by offering:

Online booking and appointment confirmations

Real-time service status updates

Digital invoices and service histories

Faster response times, accurate billing, and transparency contribute to higher client trust and retention.

Final Thoughts

In a highly competitive service industry, UAE companies need agile, efficient, and scalable solutions. Cloud-based Service Industries Management Software UAE offers exactly that — helping businesses cut costs, improve collaboration, and deliver better customer experiences.

Whether you're managing a team of technicians, offering professional services, or coordinating large-scale operations, the cloud empowers you to stay ahead in today’s digital landscape.

Ready to take your service business to the cloud? Invest in a solution tailored for UAE's unique market and watch your efficiency soar.

0 notes

Text

Boost Efficiency with SuiteWorks Tech Subscription Billing SuiteApp

Suite Works Tech is a leading subscription billing solutions provider in India, offering the best NetSuite Subscription Billing SuiteApp to supercharge your operations. As a top subscription billing software provider in Hyderabad, we specialize in delivering tailored solutions for businesses using NetSuite. Whether you need advanced subscription billing software for NetSuite or an innovative subscription billing solution, our expertise ensures seamless implementation and enhanced productivity. Optimize your billing processes with the best subscription billing software for NetSuite today!

#Leading Subscription Billing Software for NetSuite#Best Subscription Billing Software for NetSuite#Top Subscription Billing Software for NetSuite#Subscription Billing Software for NetSuite#Subscription Billing Suiteapp#Subscription Billing solutions provider#Subscription Billing software provider#NetSuite Subscription Billing Solution#Subscription Billing solutions provider in india#Subscription Billing solutions provider in hyderabad

0 notes

Text

RISE Nulled Script 3.7.1

Download RISE Nulled Script – The Ultimate Project Manager for Free Looking for a powerful, professional, and feature-rich project management tool without breaking the bank? RISE Nulled Script is the ultimate solution designed for startups, agencies, freelancers, and businesses of all sizes. This highly functional script offers everything you need to streamline your workflow, manage your team efficiently, and deliver projects on time—all for free. Start managing your projects like a pro with this premium software, available now at no cost. What is RISE Nulled Script? RISE is a cracked version of the premium RISE Ultimate Project Manager script from CodeCanyon. With this nulled script, you gain access to all the professional features without any restrictions or license requirements. Whether you're handling internal tasks, client projects, or managing a remote team, RISE offers a comprehensive solution tailored to meet modern project management demands. Technical Specifications Script Name: RISE Ultimate Project Manager Framework: PHP CodeIgniter Current Version: Latest updated version (Nulled) File Format: ZIP (ready to upload to your server) License: GPL (Nulled – Free to use) Database: MySQL Key Features and Benefits of RISE Nulled Script Client Management: Add and manage unlimited clients with full profile data, contacts, and communication logs. Team Collaboration: Real-time discussions, task assignments, file sharing, and progress tracking. Time Tracking: In-built timer to track hours spent on tasks and projects for accurate billing. Invoices & Payments: Generate professional invoices, send reminders, and accept payments online. Task Management: Create tasks, assign priorities, and set deadlines effortlessly. Project Milestones: Break large projects into manageable stages with clear timelines. Reports & Analytics: Get powerful insights into performance, productivity, and financials. Multi-language Support: Work with clients or teams in any language for global usability. Responsive Design: Access your dashboard from mobile, tablet, or desktop seamlessly. Why Choose RISE Nulled Script? Unlike many limited project management tools, RISE Nulled Script gives you full access to enterprise-grade functionalities. With this script, you can focus more on getting work done rather than paying monthly subscriptions or worrying about feature limitations. From solo freelancers to digital agencies, RISE adapts to your workflow while helping you stay organized and on track. Common Use Cases for RISE Nulled Script Freelancers: Track billable hours, generate invoices, and collaborate with clients. Agencies: Manage multiple clients and projects in one dashboard. Remote Teams: Stay connected, aligned, and productive from anywhere in the world. Startups: Get started with professional project management without the financial burden. How to Install RISE Script Download the full RISE Nulled Script package from our website. Unzip the archive and upload the contents to your hosting server. Create a MySQL database and note down the credentials. Run the installation wizard by navigating to your domain (e.g., yourdomain.com/install). Follow the on-screen instructions to complete setup and connect to your database. Log in to your admin panel and start managing your projects right away. Frequently Asked Questions (FAQs) Is RISE Nulled Script safe to use? Yes, we ensure that the script is thoroughly scanned and clean. However, always use trusted sources like our website to download to avoid malicious code. Can I use RISE Nulled Script for commercial projects? Absolutely. Once installed, you can manage unlimited client and commercial projects with no limitations. Is there any support for updates? As a nulled version, official updates are not available. However, we regularly provide the latest versions for download. Will this work on shared hosting? Yes, RISE Nulled Script works seamlessly on most shared hosting providers that support PHP and MySQL.

Download RISE Script Now Why pay for premium tools when you can access them for free? Download RISE today and take full control of your project management workflow. Maximize productivity, improve client communication, and stay ahead of deadlines without spending a dime. Also, explore other powerful tools like the7 NULLED for your WordPress projects. For more design freedom and stunning performance, check out Impreza NULLED—a top-rated theme trusted by professionals worldwide.

0 notes

Text

Best Bespoke CRM Development London

Customer Relationship Management (CRM) systems have become indispensable tools for businesses looking to streamline operations, enhance customer interactions, and drive growth. While off-the-shelf CRM solutions offer a range of features, they often fall short in addressing the unique needs of specific industries or businesses. This is where Bespoke CRM Development London comes into play, offering tailor-made solutions designed to align perfectly with a company’s workflows, objectives, and customer engagement strategies.

The Importance of Bespoke CRM Solutions

Standard CRM platforms like Salesforce, HubSpot, or Zoho provide a broad set of functionalities that cater to a wide audience. However, businesses with specialized processes, niche markets, or complex operational structures may find these solutions restrictive. A bespoke CRM system eliminates these limitations by offering:

- Customized Workflows: Designed to match existing business processes, reducing the need for manual adjustments. - Scalability: Adapts as the business grows, ensuring long-term viability. - Integration Capabilities: Seamlessly connects with existing software, such as ERP, marketing automation, or accounting tools. - Enhanced Security: Built with industry-specific compliance and data protection in mind.

For businesses in London, where competition is fierce across sectors like finance, legal, real estate, and retail, a bespoke CRM development London approach ensures a competitive edge by delivering a system that works precisely the way the business does.

Key Benefits of Bespoke CRM Development

1. Tailored to Business Needs Unlike generic CRM solutions, a bespoke system is built from the ground up to address specific pain points. Whether it’s automating client onboarding in a law firm or managing high-volume transactions in e-commerce, a custom CRM ensures efficiency and accuracy.

2. Improved User Adoption One of the biggest challenges with off-the-shelf CRM software is low user adoption due to complex interfaces or irrelevant features. A bespoke CRM development in London is designed with the end-user in mind, ensuring intuitive navigation and relevant functionalities that encourage consistent use.

3. Competitive Differentiation In a saturated market, businesses need tools that set them apart. A custom CRM can incorporate unique features like AI-driven customer insights, predictive analytics, or automated reporting—capabilities that standard CRMs may not offer without costly add-ons.

4. Cost-Effectiveness Over Time While the initial investment in bespoke CRM development may be higher than purchasing a pre-built solution, the long-term savings are significant. Businesses avoid recurring licensing fees, reduce dependency on third-party vendors, and eliminate the need for multiple software subscriptions.

5. Seamless Integration with Existing Systems London-based enterprises often rely on a mix of legacy and modern software. A custom CRM can be engineered to integrate smoothly with these systems, ensuring data consistency and eliminating silos.

Industries That Benefit from Bespoke CRM Development

Financial Services Banks, investment firms, and insurance providers require CRMs that handle sensitive client data securely while complying with strict regulations like GDPR and FCA guidelines. A bespoke CRM development in London can incorporate advanced encryption, audit trails, and role-based access controls.

Legal Sector Law firms need CRMs that manage case histories, client communications, and billing efficiently. Custom solutions can automate document generation, track billable hours, and ensure compliance with legal data retention policies.

Real Estate Property agencies benefit from CRMs that manage listings, client inquiries, and transaction histories. A bespoke system can integrate with property portals, automate follow-ups, and provide analytics on market trends.

Healthcare Clinics and private healthcare providers require CRMs that handle patient records, appointment scheduling, and regulatory compliance. Custom-built solutions ensure HIPAA or NHS data protection standards are met while improving patient engagement.

Retail & E-Commerce For businesses selling online or through physical stores, a bespoke CRM development London project can unify customer data from multiple touchpoints, enabling personalized marketing, loyalty programs, and inventory management.

The Bespoke CRM Development Process

Creating a custom CRM involves several stages, each critical to delivering a solution that aligns with business objectives.

1. Requirement Analysis The process begins with in-depth consultations to understand business workflows, pain points, and goals. Stakeholder interviews, process mapping, and competitor analysis help define the CRM’s scope.

2. System Design Developers create wireframes and prototypes, outlining the user interface, data architecture, and integration points. This phase ensures the CRM is both functional and user-friendly.

3. Development & Customization Using agile methodologies, the CRM is built in iterative phases, allowing for continuous feedback and adjustments. Core features like contact management, reporting dashboards, and automation tools are developed.

4. Integration & Testing The CRM is connected to existing systems (e.g., email platforms, accounting software) and rigorously tested for performance, security, and usability.

5. Deployment & Training After final approvals, the CRM is rolled out, and employees receive comprehensive training to maximize adoption.

6. Ongoing Support & Optimization Post-launch, the development team provides maintenance, updates, and enhancements to ensure the CRM evolves with the business.

Choosing the Right Bespoke CRM Development Partner in London

Selecting a competent development team is crucial for a successful CRM project. Key considerations include:

- Industry Experience: Look for developers with expertise in your sector. - Technical Proficiency: Ensure they use modern frameworks (e.g., .NET, Python, React) and follow best practices in security and scalability. - Client Testimonials & Case Studies: Review past projects to gauge reliability and quality. - Post-Launch Support: A good partner offers long-term maintenance and updates.

Future Trends in Bespoke CRM Development

As technology advances, bespoke CRM systems in London are incorporating cutting-edge innovations:

- AI & Machine Learning: Predictive analytics, chatbots, and sentiment analysis enhance customer interactions. - Blockchain: Secure, tamper-proof transaction records for industries like finance and legal. - Voice & IoT Integration: Voice-activated CRM controls and IoT data integration for smarter decision-making. - Hyper-Personalization: AI-driven insights enable highly targeted marketing and customer service.

Conclusion

Investing in Bespoke CRM Development London is a strategic decision that empowers businesses to optimize operations, enhance customer relationships, and stay ahead in competitive markets. Unlike one-size-fits-all solutions, a custom CRM is designed to fit seamlessly into existing workflows, scale with growth, and deliver measurable ROI. By partnering with an experienced development team, businesses can unlock the full potential of a CRM system tailored precisely to their needs, ensuring long-term success in an ever-evolving digital landscape. Visit more information for your website

0 notes

Text

Benefits of Hiring Outsource Bookkeeping Services for Startups

Managing business finances is critical—but it doesn’t have to be a burden. As companies focus on scaling operations and maximizing productivity, many are turning to outsource bookkeeping services as a smarter alternative to in-house accounting. Whether you're a startup, small business, or growing enterprise, outsourcing your bookkeeping can bring accuracy, efficiency, and peace of mind.

In this blog, we’ll explore what outsource bookkeeping services entail, their benefits, how they work, and why Capthical is your trusted partner for expert bookkeeping solutions.

What Are Outsource Bookkeeping Services?

Outsource bookkeeping services involve delegating your company’s financial record-keeping to an external expert or agency. These professionals handle tasks like tracking income and expenses, managing invoices, reconciling accounts, and preparing financial reports—all remotely.

Unlike hiring a full-time in-house bookkeeper, outsourcing allows you to access a team of experts at a fraction of the cost, without compromising on accuracy or compliance.

Why Businesses Choose to Outsource Bookkeeping Services

More businesses are realizing the value of outsourcing their bookkeeping. Here’s why:

1. Cost-Effective Financial Management

Hiring an in-house bookkeeper involves fixed salaries, employee benefits, training, and infrastructure. By choosing outsourced bookkeeping services, you pay only for what you need—saving significantly on overhead costs.

2. Access to Expert Bookkeepers

When you outsource, you’re not limited to local talent. You gain access to certified bookkeepers with industry-specific experience and up-to-date knowledge of tax laws, compliance regulations, and financial best practices.

3. Improved Accuracy and Reduced Errors

Financial mistakes can be costly. Professional outsource bookkeeping service providers like Capthical ensure data accuracy, timely entries, and thorough reconciliations to prevent errors and reduce the risk of penalties.

4. Scalability for Growing Businesses

As your business grows, your financial needs become more complex. Outsourcing allows you to scale your bookkeeping support as needed—without the hassle of recruiting and training additional staff.

How Outsource Bookkeeping Services Work

The process of outsourcing is seamless and straightforward. Here's what you can expect when partnering with a reliable firm like Capthical:

Initial Consultation – Discuss your current bookkeeping process and goals.

System Setup – Integration with your accounting software (like QuickBooks, Xero, or Zoho).

Data Sharing – Secure transfer of receipts, invoices, and bank statements.

Ongoing Maintenance – Regular updates, reconciliations, and report generation.

Review and Reporting – Monthly or quarterly financial reports with insights for decision-making.

Benefits of Outsource Bookkeeping Services with Capthical

At Capthical, we understand that no two businesses are alike. Our outsource bookkeeping services are tailored to your needs, ensuring:

✅ Timely Financial Reports

Stay on top of your cash flow with regular, easy-to-understand reports.

✅ Data Security

We follow industry-standard encryption and data security protocols to protect your financial information.

✅ Cloud-Based Access

Access your financial data anytime, from anywhere, via our secure cloud-based platforms.

✅ Dedicated Support Team

A personal account manager ensures all your queries are handled promptly and professionally.

Industries That Benefit from Outsourced Bookkeeping Services

Outsource bookkeeping services are versatile and beneficial across industries. At Capthical, we support clients in:

Retail and E-commerce: Track sales, returns, and inventory.

Healthcare: Manage insurance payments and medical billing.

Real Estate: Handle rent rolls, property management, and investment tracking.

IT and Software Firms: Monitor subscriptions, payroll, and R&D expenditures.

Consulting and Freelancers: Keep tabs on billable hours and client invoices.

No matter your niche, proper bookkeeping is essential—and outsourcing gives you the financial clarity to thrive.

In-House vs. Outsourced Bookkeeping Services: A Comparison

Feature

In-House Bookkeeping

Outsourced Bookkeeping Services

Cost

High (salary, benefits)

Low (pay-as-you-go)

Scalability

Limited

Highly flexible

Expertise

Depends on individual

Access to a team of experts

Time Investment

High

Low

Tech Integration

Often outdated

Latest software and automation

Clearly, outsourced bookkeeping services offer a modern, efficient, and economical alternative to traditional in-house models.

Key Features to Look for in an Outsource Bookkeeping Partner

Not all providers are the same. Here’s what you should look for when choosing your outsourced bookkeeping service:

Experience and Credentials Choose a firm with certified professionals and proven track records.

Transparent Pricing Look for no hidden fees and clearly defined service packages.

Custom Solutions Your provider should understand your business and tailor their offerings accordingly.

Technology Integration Ensure compatibility with your preferred accounting software and tools.

Capthical ticks all these boxes and more—making us the go-to choice for smart bookkeeping solutions.

The Future of Bookkeeping: Why Outsourcing is the New Normal

As automation and AI reshape the accounting landscape, outsource bookkeeping services are evolving to include data analytics, predictive insights, and strategic financial guidance. Businesses that adopt this model early gain a competitive edge by focusing more on growth and less on routine accounting.

Outsourcing is no longer a cost-saving measure alone—it’s a strategic decision for businesses that want to stay agile, lean, and informed.

Ready to Outsource Bookkeeping Services? Partner with Capthical Today!

If you're tired of spending endless hours on spreadsheets, missed entries, and monthly reconciliations, it's time to consider Capthical’s outsource bookkeeping services. Let us handle your finances while you focus on what you do best—growing your business.

👉 Explore Our Bookkeeping Services 👉 Request a Free Consultation 👉 Contact Us Now

Capthical provides accurate, timely, and secure financial services designed to simplify your accounting process. Make the smart move today and outsource your bookkeeping services to experts who care about your business success.

0 notes

Text

11 Best IPTV Reseller Platforms for Live TV Streaming

Choosing the ideal IPTV (Internet Protocol Television) reseller panel can make or break your business. A weak platform may result in unreliable service, limited features, higher operational costs, and unhappy clients. To succeed in the IPTV market, you need a panel that delivers stable HD streaming, a rich library of live channels and on-demand content, and efficient customer support that helps you manage everything smoothly.

After in-depth testing and analysis, I’ve compiled a list of the leading IPTV reseller platforms for 2025. Whether you're just starting out or looking to scale your current operation, this guide outlines all the essentials — from pricing and features to advantages and drawbacks — so you can make a smart, informed decision.

Legal Disclaimer

All content on this site is shared solely for general informational use. Although we aim to present accurate and up-to-date details, we do not warrant the completeness, reliability, or suitability of the information found here. Any decisions you make based on this content are entirely your own responsibility, and we are not accountable for any consequences, losses, or damages that may result.

This site may also contain links or references to other websites. We do not oversee or endorse the content on those external sources and are not responsible for what they publish. Please be aware that this disclaimer may be updated, so it's advisable to check it from time to time.

What Is the Role of an IPTV Reseller?

An IPTV reseller acts as a middleman, purchasing streaming services from a primary IPTV provider and reselling them under their own brand. Instead of managing servers or producing content, the reseller relies on the provider to handle the technical infrastructure — including streaming delivery, system maintenance, and software management.

This business model allows the reseller to focus on marketing, customer acquisition, and support. It’s a low-barrier way to enter the streaming industry, requiring minimal technical skills or upfront investment. As IPTV continues to grow in popularity, becoming a reseller is a practical way to build a branded presence in the online TV market.

Understanding How IPTV Reseller Panels Work

IPTV reseller panels are platforms that help streamline how retailers manage and scale their streaming services. Here's a simplified breakdown of how they function:

User-Friendly Dashboard:The panel provides a centralized, easy-to-use interface where resellers can manage client accounts, activate services, and handle renewals — no technical expertise required.

Custom Plans & Pricing: You can create your own subscription packages, define price points, and control user access. This flexibility allows you to adapt your services to different market segments.

Access to Streaming Content: Resellers tap into a full catalog of live channels, movies, and shows hosted by the main IPTV provider. You don't host or store any content — you simply resell it.

No Tech Burden: The provider maintains the backend infrastructure, ensuring stable streams, server uptime, and continuous updates. Resellers don’t need to worry about hardware or software issues.

Focus on Business Growth: Freed from technical responsibilities, you can dedicate your time to branding, customer support, and expanding your client base.

Integrated Tools for Success: Most panels include built-in tools like billing systems, analytics, and user activity tracking, helping you manage income, customer behavior, and performance.

Scalable Infrastructure: As your subscriber list grows, the platform scales with it. There's no need for additional investments in infrastructure or technical upgrades.

Full Branding & Profit Control: You're in charge of your business identity — from pricing to customer experience. You present your own brand while the provider takes care of the behind-the-scenes work.

How to Start Your IPTV Reseller Business

Interested in stepping into the IPTV market? It’s a rapidly expanding field that offers low startup costs and high income potential. Follow this straightforward five-step guide to get your business off the ground:

1. Choose a Trusted IPTV Provider Begin by researching providers known for reliable service, fast servers, and a wide selection of live and on-demand content. Your reputation will depend on their performance, so pick a solid partner.

2. Get Access to a Reseller Platform Once you’ve selected your provider, you’ll receive a management panel. This is where you’ll handle customer creation, plan assignments, and user activity — it's your operational hub.

3. Build Your Packages and Set Rates Tailor your subscription plans to your audience. Offer multiple durations (monthly, quarterly, yearly), and enhance value with extras like VPN services, 24/7 support, or loyalty rewards to attract and retain clients.

4. Create and Promote Your Brand Set up your digital storefront with a professional website and active social channels. Build trust by engaging in IPTV communities and making your brand visible across different platforms.

5. Launch and Scale Strategically Go live with your offerings and prioritize customer satisfaction. Collect feedback, refine your services, and gradually expand by adding premium features like niche content or exclusive sports channels.

With thoughtful planning and consistent effort, your IPTV reseller venture can grow into a sustainable and profitable business.

Top 10 IPTV Reseller Platforms to Explore in 2025

The IPTV landscape continues to expand rapidly in 2025, offering exciting income potential for anyone entering the digital streaming world. Choosing the right provider is crucial if you want to thrive as an IPTV reseller. Below is a revised guide to ten platforms that combine reliability, strong channel selection, and attractive margins for growing your IPTV business.

1. IPTVUSAFHD – Premium-Grade Content Access