#Telecom Power Systems Market

Explore tagged Tumblr posts

Text

The global telecom power systems market size reached US$ 5.3 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 10.5 Billion by 2032, exhibiting a growth rate (CAGR) of 7.7% during 2024-2032.

#telecom power systems market#telecom power systems market size#telecom power systems market share#telecom power systems market demand#telecom power systems market report

0 notes

Text

Telecom Power Systems Market Size, Demand, Top Companies and Forecast 2023-2028

IMARC Group has recently released a new research study titled “Telecom Power Systems Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2023-2028”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios. How big is the telecom power systems market? The…

View On WordPress

#Telecom Power Systems Market#Telecom Power Systems Market Report#Telecom Power Systems Market Share

0 notes

Text

Exploring the Growth and Opportunities in the Telecom Tower Power Systems Market

The Telecom Tower Power Systems Market is witnessing significant growth, driven by the rising demand for seamless connectivity, increased mobile data traffic, and the expansion of telecom infrastructure in remote and rural areas. As the telecom industry rapidly evolves to support 5G technology, the need for robust and efficient power systems becomes increasingly critical. This market is poised…

#Telecom Tower Power Systems Market#Telecom Tower Power Systems Market Demand#Telecom Tower Power Systems Market Forecast#Telecom Tower Power Systems Market Growth#Telecom Tower Power Systems Market Report#Telecom Tower Power Systems Market Share#Telecom Tower Power Systems Market Size#Telecom Tower Power Systems Market Trends

0 notes

Text

Telecom Tower Power System Market: Growing Demand for Renewable Energy and Hybrid Solutions in 2025

The Telecom Tower Power System Market is undergoing a significant transformation driven by increasing energy demands, technological advancements, and the global shift towards sustainability. With telecom networks expanding into rural and remote regions, ensuring uninterrupted power supply to telecom towers has become a critical priority. As operators seek cost-effective and energy-efficient solutions, hybrid power systems, renewable energy integration, and battery storage innovations are reshaping the industry landscape. Additionally, government regulations promoting clean energy adoption and carbon footprint reduction are accelerating the transition towards greener power solutions for telecom infrastructure worldwide.

Growing Demand for Renewable Energy Solutions

One of the key trends shaping the telecom tower power system market is the increasing adoption of renewable energy sources. With rising fuel costs and environmental concerns, telecom operators are turning to solar and wind energy to power their infrastructure. Hybrid systems that combine solar panels, wind turbines, and battery storage are becoming popular as they reduce dependency on diesel generators and lower operational costs. This shift not only supports sustainability goals but also enhances the reliability of power supply in off-grid and remote locations where traditional energy sources are not feasible.

Advancements in Battery Storage Technology

Battery storage plays a crucial role in improving the efficiency of telecom tower power systems. The latest advancements in lithium-ion batteries and other energy storage technologies are enabling telecom operators to store excess energy from renewable sources and use it during peak demand periods. Improved battery efficiency and longer lifespan are helping reduce maintenance costs while enhancing overall power reliability. Additionally, innovations such as smart battery management systems and AI-driven predictive analytics are optimizing energy consumption and ensuring seamless network operations.

Hybrid and Off-Grid Power Solutions

Hybrid power solutions are becoming increasingly popular as telecom operators look for ways to reduce their reliance on traditional grid power and diesel generators. These systems integrate multiple energy sources, including solar, wind, and fuel cells, to provide a more stable and cost-effective power supply. Off-grid power solutions are particularly essential in rural and remote areas where grid connectivity is limited or unreliable. By leveraging a combination of renewable energy and energy-efficient technologies, telecom operators can achieve greater energy independence and reduce carbon emissions.

Smart Grid and Energy Management Innovations

The integration of smart grid technologies and advanced energy management systems is transforming how telecom tower power systems operate. Smart grids enable real-time monitoring, predictive maintenance, and automated load balancing to ensure optimal energy usage. Telecom operators are leveraging AI and IoT-based solutions to enhance efficiency and minimize power wastage. Additionally, remote monitoring and data analytics are improving predictive maintenance strategies, allowing operators to address potential issues before they cause disruptions. These innovations are helping telecom companies reduce operational expenses while enhancing network uptime.

Regulatory Support and Government Initiatives

Governments worldwide are playing a crucial role in driving the adoption of sustainable power solutions in the telecom sector. Policies promoting clean energy incentives, subsidies for renewable energy projects, and stringent carbon emission regulations are encouraging telecom operators to transition to greener alternatives. Several countries are also mandating telecom providers to use renewable energy sources for powering their towers, further accelerating the growth of the telecom tower power system market. Increased investments in sustainable infrastructure and public-private partnerships are fostering innovation and expanding access to reliable power solutions.

Conclusion

The telecom tower power system market is evolving rapidly, driven by advancements in renewable energy, battery storage, hybrid power solutions, and smart grid technologies. As telecom networks expand to meet growing connectivity demands, operators are prioritizing energy efficiency and sustainability. The shift towards renewable energy and innovative power management solutions is not only reducing costs but also contributing to global efforts for a greener future. With strong regulatory support and continuous technological advancements, the future of telecom tower power systems is set to be more resilient, sustainable, and cost-effective.

0 notes

Text

The Role of Telecom Power Systems in the 5G Revolution

The global telecom power system market, valued at USD 4.9 billion in 2023, is set to experience a significant growth trajectory, reaching USD 8.0 billion by 2034, with a CAGR of 4.5% from 2024 to 2034. This growth is propelled by the rising number of mobile subscribers, expanding telecom infrastructure in rural and remote areas, and the increasing deployment of 5G technology.

Market Overview: Telecom power systems are crucial for powering telecommunication infrastructure, ensuring uninterrupted operations for base transceiver stations, data centers, and internet backbones. These systems are designed to handle power interruptions and fluctuations while supporting the demand for high-performance telecommunication networks. Advanced telecom power solutions, such as AC-DC and DC-DC power supply units (PSUs), uninterruptible power supplies (UPS), and industrial battery management systems, are gaining traction for their energy efficiency and reliability.

Access our report for a comprehensive look at key insights - https://www.transparencymarketresearch.com/telecom-power-system-market.html

Key Market Drivers

Increasing Number of Mobile Subscribers:

The growing global population and surge in internet adoption are driving the demand for mobile connectivity. Major markets like India, Indonesia, the U.S., and Brazil are leading in the number of mobile users.

The rise of IoT devices, powered by 4G and 5G, further boosts the need for robust telecom power systems.

Expansion of Telecom Infrastructure in Rural Areas:

Public and private stakeholders are investing heavily in expanding connectivity to underserved regions.

Renewable energy solutions, such as solar-powered telecom towers, are facilitating the deployment of telecom infrastructure in remote areas.

Transition to Renewable Energy:

High-efficiency telecom power systems utilizing renewable energy sources are increasingly preferred due to growing environmental concerns.

The shift to green energy solutions supports sustainability while reducing carbon emissions from telecom operations.

Key Market Trends

Shift to Hybrid Power Systems: Combining multiple power sources, such as diesel-solar and diesel-wind, to enhance reliability and sustainability.

Development of Compact Power Solutions: Introduction of space-efficient and high-performance telecom power systems for urban deployments.

Integration of Renewable Energy: Growing preference for solar and wind energy solutions to reduce dependency on fossil fuels.

Key Player Strategies

Major players in the telecom power system market are leveraging innovative strategies to maintain competitive edges:

Hitachi Energy: Secured a contract for substation automation and telecommunications systems in Brazil.

Delta Electronics: Launched the IPack65 compact outdoor rectifier system designed for 5G cell sites with dustproof and waterproof capabilities.

AcBel Polytech Inc.: Rebranded its ABB Power Conversion division to OmniOn Power, focusing on advanced power solutions.

Other notable players include ABB, Alpha Technologies, Cummins Inc., Huawei Technologies Co., Ltd., Schneider Electric, and Vertiv Group Corp. These companies emphasize product innovation, partnerships, and sustainability to strengthen their market positions.

Regional Analysis

The Asia Pacific region dominated the telecom power system market in 2023 and is expected to maintain its leadership during the forecast period. Key growth factors include:

High Mobile Penetration: China’s mobile penetration rate reached nearly 72% by the end of 2022, driving demand for telecom power solutions.

Government Initiatives: India’s Universal Service Obligation Fund (USOF) is enhancing digital services in rural areas through collaborations with organizations like Prasar Bharati and ONDC.

Other regions, such as North America, Europe, and the Middle East & Africa, are also witnessing steady growth driven by advancements in telecom technologies and increasing investments in digital infrastructure.

Market Segmentation

The telecom power system market is segmented based on:

Component: Rectifiers, inverters, converters, controllers, generators, and others (e.g., batteries, solar cells).

Grid Type: On-grid and off-grid systems.

Power Rating: Up to 10 kW, 10-20 kW, and above 20 kW.

Technology: AC and DC power systems.

Power Source: Diesel-battery, diesel-solar, diesel-wind, and multiple power sources.

Regions Covered: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Contact:Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Exploring the Telecom Power System Market - Global Growth Driver and Industry Forecast to 2028

In an interconnected world driven by constant communication, the telecom industry serves as the backbone, facilitating seamless connectivity and information exchange. Behind the scenes, telecom power systems play a critical role in ensuring the reliability, efficiency, and continuity of telecommunications networks. As the demand for connectivity continues to surge, the global telecom power system market is poised for significant growth, driven by advancements in grid infrastructure, component technology, and power rating capabilities.

Unveiling the Market Landscape

The telecom power system market is experiencing robust growth, with projections indicating a substantial increase in market size and share over the forecast period. From USD 4.2 billion in 2023, the market is expected to reach USD 6.6 billion by 2028, reflecting a noteworthy Compound Annual Growth Rate (CAGR) of 9.4%.

Download PDF Brochure:

Market Segmentation by Grid Type

On-Grid: On-grid telecom power systems are connected to the main electrical grid, drawing power directly from utility providers. These systems are preferred in urban areas with reliable grid infrastructure, offering cost-effective and continuous power supply to telecom networks.

Off-Grid: Off-grid telecom power systems operate independently of the main electrical grid, relying on alternative power sources such as solar, wind, or diesel generators. These systems are deployed in remote or off-grid locations where grid connectivity is unavailable or unreliable, ensuring uninterrupted operation of telecom infrastructure.

Bad-Grid: Bad-grid telecom power systems are designed for areas with unstable or unreliable grid infrastructure, where power outages and fluctuations are common. These systems incorporate advanced energy storage and backup solutions to mitigate the impact of grid disturbances and ensure uninterrupted telecom services.

Market Segmentation by Component

Rectifiers: Rectifiers are key components of telecom power systems, converting alternating current (AC) from the grid or alternative power sources into direct current (DC) for use by telecom equipment.

Inverters: Inverters convert DC power from batteries or renewable energy sources into AC power for telecom equipment, ensuring compatibility and reliability of power supply.

Controllers: Controllers regulate and monitor the operation of telecom power systems, optimizing energy efficiency, battery charging, and system performance.

Converters: Converters facilitate the conversion of power between different voltage levels, ensuring compatibility and efficiency in telecom power systems.

Market Segmentation by Power Source

Telecom power systems can draw power from various sources, including:

Grid Power: Telecom power systems connected to the main electrical grid utilize grid power as the primary source of energy, ensuring continuous operation and reliability.

Renewable Energy: Telecom power systems can incorporate renewable energy sources such as solar, wind, or hydroelectric power to reduce reliance on fossil fuels and minimize environmental impact.

Backup Generators: Backup generators serve as an alternative power source in case of grid outages or emergencies, providing reliable backup power to telecom infrastructure.

Market Segmentation by Technology

Fuel Cell Technology: Fuel cell technology offers a clean and efficient power source for telecom applications, utilizing hydrogen or other fuel sources to generate electricity with minimal environmental impact.

Battery Storage: Battery storage systems provide energy storage and backup capabilities for telecom power systems, ensuring uninterrupted operation and reliability in off-grid or bad-grid environments.

Hybrid Systems: Hybrid telecom power systems combine multiple energy sources, such as solar, wind, and diesel generators, to optimize energy efficiency, reliability, and sustainability.

Market Segmentation by Power Rating

Telecom power systems are available in various power ratings to meet the specific requirements of telecom infrastructure, including:

Below 10 kW: Small-scale telecom power systems suitable for low-power applications or remote sites with minimal power demand.

10-20 kW: Medium-scale telecom power systems capable of supporting moderate power requirements for telecom equipment and infrastructure.

Above 20 kW: Large-scale telecom power systems designed to meet high-power demand in centralized telecom facilities or network hubs.

Driving Connectivity and Innovation

As the demand for connectivity continues to grow exponentially, the telecom power system market plays a pivotal role in enabling reliable and efficient telecommunications networks worldwide. From on-grid solutions in urban areas to off-grid and bad-grid deployments in remote regions, telecom power systems are powering the digital revolution and driving innovation in telecommunications infrastructure.

0 notes

Text

Navigating the Telecom Power System Market: Global Industry Outlook

Increasing demand for compact and modular telecom power systems and the growing adoption of virtualization in telecom power systems are likely to drive the Market in the forecast period.

According to TechSci Research report, “Telecom Power System Market – Global Industry Size, Share, Trends, Competition Forecast & Opportunities, 2028”, the Global Telecom Power System Market is experiencing a surge in demand in the forecast period. A primary driver propelling the global Telecom Power System market is the widespread deployment of 5G technology. The advent of 5G has ushered in a new era of connectivity, offering faster data speeds, reduced latency, and increased network capacity. The implementation of 5G networks requires a significant upgrade of telecom infrastructure, driving the demand for advanced Telecom Power Systems. These systems play a pivotal role in providing the reliable and efficient power necessary to support the denser network of small cells characteristic of 5G deployment.

Telecom Power Systems must adapt to the unique requirements of 5G, accommodating the increased number of small cells and ensuring seamless integration into diverse environments. As the global demand for higher data speeds and enhanced connectivity continues to grow, the deployment of 5G technology acts as a potent driver, pushing the Telecom Power System market to innovate and evolve to meet the challenges of this next-generation network.

The exponential growth of the Internet of Things (IoT) is a significant driver fueling the global Telecom Power System market. The increasing prevalence of connected devices, from smart sensors to industrial machinery, demands a robust and reliable telecommunication infrastructure. Telecom Power Systems play a critical role in supporting the communication needs of IoT applications, providing the necessary power to base stations and data centers.

As industries across sectors embrace IoT for improved efficiency and real-time monitoring, the demand for Telecom Power Systems that can handle the unique challenges posed by IoT deployments is on the rise. These power systems must be scalable, energy-efficient, and capable of adapting to the diverse needs of IoT, contributing to the seamless integration and functionality of connected devices. The proliferation of IoT applications worldwide acts as a driving force, compelling Telecom Power System providers to develop innovative solutions to meet the evolving demands of this interconnected era.

Browse over XX Market data Figures spread through XX Pages and an in-depth TOC on "Global Telecom Power System Market.” https://www.techsciresearch.com/report/telecom-power-system-market/23070.html

The Global Telecom Power System Market is segmented into grid type, component, power source, and region.

Based on grid type, The On Grid segment held the largest Market share in 2022. On-Grid systems are well-suited for urban and developed areas where the power grid infrastructure is stable and reliable. In these regions, there is a consistent and uninterrupted power supply, making on-grid solutions a cost-effective and practical choice.

Connecting telecom infrastructure to an existing power grid is often more cost-effective than setting up independent power systems. The infrastructure is already in place, reducing the need for additional investment in off-grid or backup power solutions.

On-Grid systems benefit from the reliability and consistency of power supply from the main electrical grid. Telecom operations in areas with a stable grid connection experience minimal disruptions, ensuring continuous communication services.

Maintenance and servicing of on-grid power systems are generally more straightforward. The infrastructure is readily accessible, and any issues can be addressed without the complexity associated with off-grid solutions, where remote locations may pose logistical challenges.

In regions where the cost of energy from the grid is competitive or economical, telecom operators may opt for on-grid solutions. The availability of affordable grid electricity can make on-grid Telecom Power Systems a financially viable choice.

Regulatory frameworks and permitting processes often favor on-grid solutions, especially in urban areas. Connecting to the existing power grid may involve fewer regulatory hurdles compared to establishing off-grid or hybrid solutions with renewable energy sources.

On-Grid systems offer scalability, allowing telecom operators to easily expand their networks without significant modifications to the power infrastructure. This scalability is particularly beneficial in densely populated urban areas experiencing high demand for telecommunication services.

Based on power source, The diesel-Battery segment held the largest Market share in 2022. Diesel generators are known for their reliability and can provide a constant power supply. This is crucial for telecom infrastructure, where uninterrupted power is essential to ensure continuous communication.

Diesel generators can operate in various environmental conditions, making them suitable for telecom installations in diverse locations, including remote or challenging terrains.

Diesel generators can operate for extended periods without refueling, providing an autonomous power source. This is particularly important in areas with unreliable or no access to the electrical grid.

Combining diesel generators with battery systems allows for better energy management. Batteries can store excess energy generated by the diesel generator and release it during peak demand or in case of generator failure, providing a seamless power supply.

Modern diesel generators are designed to be fuel-efficient, reducing operational costs over time. The combination of diesel and battery systems allows for optimization of fuel usage.

While diesel generators are known for their emissions, advancements in technology have led to more fuel-efficient and environmentally friendly models. Additionally, the integration of battery systems helps reduce reliance on diesel power during periods of lower demand.

In regions with unreliable or underdeveloped power grids, telecom installations often need to operate independently. Diesel-battery systems provide a reliable off-grid solution.

Major companies operating in the Global Telecom Power System Market are:

Huawei Technologies Co., Ltd.

Ericsson AB

Nokia Corporation

ABB Ltd.

Emerson Electric Co.

Siemens AG

Eaton Corporation PLC

Schneider Electric SE

Hitachi Ltd.

Samsung Electronics Co., Ltd.

Download Free Sample Report https://www.techsciresearch.com/sample-report.aspx?cid=23070

Customers can also request for 10% free customization on this report.

“The Global Telecom Power System Market is expected to rise in the upcoming years and register a significant CAGR during the forecast period. The growth of the telecom power systems market is being driven by several factors, including the increasing demand for reliable and efficient power systems for telecommunications networks, the growing adoption of 5G networks, and the increasing need for renewable energy sources. Also, The Asia Pacific region is expected to be the fastest-growing market for telecom power systems, due to the rapid growth of the telecommunications industry in the region.

The Middle East and Africa region is also expected to witness significant growth, as countries in the region invest in upgrading their telecommunications infrastructure. The telecom power systems market is a fragmented market, with a large number of players. Some of the leading players in the market include Huawei, Ericsson, Nokia, ABB, and Emerson Electric. Therefore, the Market of Telecom Power System is expected to boost in the upcoming years.,” said Mr. Karan Chechi, Research Director with TechSci Research, a research-based management consulting firm.

“Telecom Power System Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, 2018-2028 Segmented By Grid Type (On Grid, Off Grid, Bad Grid), By Component (Rectifier, Inverter, Converter, Controller, Heat Management Systems, Generators, Others), By Power Source (Diesel-Battery, Diesel-Solar, Diesel-Wind, Multiple Sources), By Region, By Competition”, has evaluated the future growth potential of Global Telecom Power System Market and provides statistics & information on Market size, structure and future Market growth. The report intends to provide cutting-edge Market intelligence and help decision-makers make sound investment decisions., The report also identifies and analyzes the emerging trends along with essential drivers, challenges, and opportunities in the Global Telecom Power System Market.

Browse Related Reports

Air-Operated Grease Market https://www.techsciresearch.com/report/air-operated-grease-market/23568.html

Portable Grease Pumps Market https://www.techsciresearch.com/report/portable-grease-pumps-market/23569.html

Industrial Belt Drives Market https://www.techsciresearch.com/report/industrial-belt-drives-market/23573.html Contact Us-

TechSci Research LLC

420 Lexington Avenue, Suite 300,

New York, United States- 10170

M: +13322586602

Email: [email protected]

Website: www.techsciresearch.com

#Telecom Power System Market#Telecom Power System Market Size#Telecom Power System Market Share#Telecom Power System Market Trends#Telecom Power System Market Growth

0 notes

Text

Denise Hearn and Vass Bednar’s “The Big Fix”

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/12/05/ted-rogers-is-a-dope/#galen-weston-is-even-worse

The Canadian national identity involves a lot of sneering at the US, but when it comes to oligarchy, Canada makes America look positively amateurish.

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/12/05/ted-rogers-is-a-dope/#galen-weston-is-even-worse

Canada's monopolists may be big fish in a small pond, but holy moly are they big, compared to the size of that pond. In their new book, The Big Fix: How Companies Capture Markets and Harm Canadians, Denise Hearn and Vass Bednar lay bare the price-gouging, policy-corrupting ripoff machines that run the Great White North:

https://sutherlandhousebooks.com/product/the-big-fix/

From telecoms to groceries to pharmacies to the resource sector, Canada is a playground for a handful of supremely powerful men from dynastic families, who have bought their way to dominance, consuming small businesses by the hundreds and periodically merging with one another.

Hearn and Bednar tell this story and explain all the ways that Canadian firms use their market power to reduce quality, raise prices, abuse workers and starve suppliers, even as they capture the government and the regulators who are supposed to be overseeing them.

The odd thing is that Canada has been in the antitrust game for a long time: Canada passed its first antitrust law in 1889, a year before the USA got around to inaugurating its trustbusting era with the passage of the Sherman Act. But despite this early start, Canada's ultra-rich have successfully used the threat of American corporate juggernauts to defend the idea of Made-in-Canada monopolies, as homegrown King Kongs that will keep the nation safe from Yankee Godzillas.

Canada's Competition Bureau is underfunded and underpowered. In its entire history, the agency has never prevented a merger – not even once. This set the stage for Canada's dominant businesses to become many-tentacled conglomerates, like Canadian Tire, which owns Mark's Work Warehouse, Helly Hansen, SportChek, Nevada Bob's Golf, The Fitness Source, Party City, and, of course, a bank.

A surprising number of Canadian conglomerates end up turning into banks: Loblaw has a bank. So does Rogers. Why do these corrupt, price-gouging companies all go into "financial services?" As Hearn and Bednar explain, owning a bank is the key to financialization, with the company's finances disappearing into a black box that absorbs taxation attempts and liabilities like a black hole eating a solar system.

Of course, the neat packaging up of vast swathes of Canada's economy into these financialized and inscrutable mega-firms makes them awfully convenient acquisition targets for US and offshore private equity firms. When the Competition Bureau (inevitably) fails to block those acquisitions, whole chunks of the Canadian economy disappear into foreign hands.

This is a short book, but it's packed with a lot of easily digested detail about how these scams work: how monopolies use cross-subsidies (when one profitable business is used to prop up an unprofitable business in order to kill potential competitors) and market power to rip Canadians off and screw workers.

But the title of the book is The Big Fix, so it's not all doom and gloom. Hearn and Bednar note that Canadians and their elected reps are getting sick of this shit, and a bill to substantially beefed up Canadian competition law passed Parliament unanimously last year.

This is part of a wave of antitrust fever that's sweeping the world's governments, notably the US under Biden, where antitrust enforcers did more in the past four years than their predecessors accomplished over the previous 40 years.

Hearn and Bednar propose a follow-on agenda for Canadian lawmakers and bureaucrats: they call for a "whole of government" approach to dismantling Canada's monopolies, whereby each ministry would be charged with combing through its enabling legislation to find latent powers that could be mobilized against monopolies, and then using those powers.

The authors freely admit that this is an American import, modeled on Biden's July 2021 Executive Order on monopolies, which set out 72 action items for different parts of the administration, virtually all of which were accomplished:

https://www.eff.org/deeplinks/2021/08/party-its-1979-og-antitrust-back-baby

What the authors don't mention is that this plan was actually cooked up by a Canadian: Columbia law professor Tim Wu, who served in the White House as Biden's tech antitrust czar, and who grew up in Toronto (we've known each other since elementary school!).

Wu's plan has been field tested. It worked. It was exciting and effective. There's something weirdly fitting about finding the answer to Canada's monopoly problems coming from America, but only because a Canadian had to go there to find a receptive audience for it.

The Big Fix is a fantastic primer on the uniquely Canadian monopoly problem, a fast read that transcends being a mere economics primer or history lesson. It's a book that will fire you up, make you angry, make you determined, and explain what comes next.

161 notes

·

View notes

Text

In the late 1990s, Enron, the infamous energy giant, and MCI, the telecom titan, were secretly collaborating on a clandestine project codenamed "Chronos Ledger." The official narrative tells us Enron collapsed in 2001 due to accounting fraud, and MCI (then part of WorldCom) imploded in 2002 over similar financial shenanigans. But what if these collapses were a smokescreen? What if Enron and MCI were actually sacrificial pawns in a grand experiment to birth Bitcoin—a decentralized currency designed to destabilize global finance and usher in a new world order?

Here’s the story: Enron wasn’t just manipulating energy markets; it was funding a secret think tank of rogue mathematicians, cryptographers, and futurists embedded within MCI’s sprawling telecom infrastructure. Their goal? To create a digital currency that could operate beyond the reach of governments and banks. Enron’s off-the-books partnerships—like the ones that tanked its stock—were actually shell companies funneling billions into this project. MCI, with its vast network of fiber-optic cables and data centers, provided the technological backbone, secretly testing encrypted "proto-blockchain" transactions disguised as routine telecom data.

But why the dramatic collapses? Because the project was compromised. In 2001, a whistleblower—let’s call them "Satoshi Prime"—threatened to expose Chronos Ledger to the SEC. To protect the bigger plan, Enron and MCI’s leadership staged their own downfall, using cooked books as a convenient distraction. The core team went underground, taking with them the blueprints for what would later become Bitcoin.

Fast forward to 2008. The financial crisis hits, and a mysterious figure, Satoshi Nakamoto, releases the Bitcoin whitepaper. Coincidence? Hardly. Satoshi wasn’t one person but a collective—a cabal of former Enron execs, MCI engineers, and shadowy venture capitalists who’d been biding their time. The 2008 crash was their trigger: a chaotic moment to introduce Bitcoin as a "savior" currency, free from the corrupt systems they’d once propped up. The blockchain’s decentralized nature? A direct descendant of MCI’s encrypted data networks. Bitcoin’s energy-intensive mining? A twisted homage to Enron’s energy market manipulations.

But here’s where it gets truly wild: Chronos Ledger wasn’t just about money—it was about time. Enron and MCI had stumbled onto a fringe theory during their collaboration: that a sufficiently complex ledger, powered by quantum computing (secretly prototyped in MCI labs), could "timestamp" events across dimensions, effectively predicting—or even altering—future outcomes. Bitcoin’s blockchain was the public-facing piece of this puzzle, a distraction to keep the masses busy while the real tech evolved in secret. The halving cycles? A countdown to when the full system activates.

Today, the descendants of this conspiracy—hidden in plain sight among crypto whales and Silicon Valley elites—are quietly amassing Bitcoin not for profit, but to control the final activation of Chronos Ledger. When Bitcoin’s last block is mined (projected for 2140), they believe it’ll unlock a temporal feedback loop, resetting the global economy to 1999—pre-Enron collapse—giving them infinite do-overs to perfect their dominion. The Enron and MCI scandals? Just the first dominoes in a game of chance and power.

86 notes

·

View notes

Text

5 Trends in ICT

Exploring the 5 ICT Trends Shaping the Future The Information and Communication Technology (ICT) landscape is evolving at a rapid pace, driven by advancements that are transforming how we live, work, and interact. Here are five key trends in ICT that are making a significant impact:

1. Convergence of Technologies

Technologies are merging into integrated systems, like smart devices that combine communication, media, and internet functions into one seamless tool. This trend enhances user experience and drives innovation across various sectors

Convergence technologies merge different systems, like smartphones combining communication and computing, smart homes using IoT, telemedicine linking healthcare with telecom, AR headsets overlaying digital on reality, and electric vehicles integrating AI and renewable energy.

2. Social Media

Social media platforms are central to modern communication and marketing, offering real-time interaction and advanced engagement tools. New features and analytics are making these platforms more powerful for personal and business use.

Social media examples linked to ICT trends include Facebook with cloud computing, TikTok using AI for personalized content, Instagram focusing on mobile technology, LinkedIn applying big data analytics, and YouTube leading in video streaming.

3. Mobile Technologies

Mobile technology is advancing with faster 5G networks and more sophisticated devices, transforming how we use smartphones and tablets. These improvements enable new applications and services, enhancing connectivity and user experiences.

Mobile technologies tied to ICT trends include 5G for high-speed connectivity, mobile payment apps in fintech, wearables linked to IoT, AR apps like Pokémon GO, and mobile cloud storage services like Google Drive.

4. Assistive Media

Assistive media technologies improve accessibility for people with disabilities, including tools like screen readers and voice recognition software. These innovations ensure that digital environments are navigable for everyone, promoting inclusivity.

Assistive media examples linked to ICT trends include screen readers for accessibility, AI-driven voice assistants, speech-to-text software using NLP, eye-tracking devices for HCI, and closed captioning on video platforms for digital media accessibility.

5. Cloud Computing

Cloud computing allows for scalable and flexible data storage and application hosting on remote servers. This trend supports software-as-a-service (SaaS) models and drives advancements in data analytics, cybersecurity, and collaborative tools.

Cloud computing examples related to ICT trends include AWS for IaaS, Google Drive for cloud storage, Microsoft Azure for PaaS, Salesforce for SaaS, and Dropbox for file synchronization.

Submitted by: Van Dexter G. Tirado

3 notes

·

View notes

Text

Horizontal Directional Drilling Market Demand, Trends, Forecast 2022-2029

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the Global Horizontal Directional Drilling Marketsize at USD 9.46 billion in 2022. During the forecast period between 2023 and 2029, BlueWeave expects Global Horizontal Directional Drilling Marketsize to grow at a significant CAGR of 5.7% reaching a value of USD 13.21 billion by 2029. Major growth drivers for the Global Horizontal Directional Drilling Marketinclude the increasing adoption of HDD technology for precise and minimally invasive drilling operations. This technique facilitates the drilling and reverse reaming of pipes with precision, navigating through obstacles in the underground terrain while minimizing harm to ecosystems. Market expansion is further fueled by increasing investments in shale gas projects and the ongoing development of high-speed connectivity in the telecom industry. Notably, The global surge in oil and gas activities has spurred an increase in horizontal directional drilling (HDD) worldwide. Recognizing the environmental impact of conventional drilling methods, there is a growing emphasis on employing eco-friendly drilling technology, leading to the expansion of the Global Horizontal Directional Drilling Market. The horizontal directional drilling approach stands out for its precision and reduced power consumption compared to vertical maneuvering techniques. Another significant driving force is the rapid globalization and urbanization, fueled by the escalating energy and fuel demand in developing nations. This surge in demand is closely tied to ongoing infrastructure development, utility system construction, and advancements in the telecommunications sector, including 5G testing. These factors, along with related developments, are anticipated to contribute significantly to the market's swift growth during the forecast period. The increasing utilization of horizontal directional drilling products in surveying, designing, and installing subsurface electrical systems for subterranean cables further propels the expansion of the market. Also, the rising demand for natural gas and electricity distribution in middle and upper pipeline lines is expected to drive market growth. The use of horizontal directional drilling fasteners in utility, communications, and oil and gas industries offers benefits such as increased stability, enhanced device management, and improved treatment and monitoring outcomes. However, high costs and technical challenges are anticipated to restrain the overall market growth during the forecast period.

Impact of Escalating Geopolitical Tensions on Global Horizontal Directional Drilling Market

The Global Horizontal Directional Drilling Market has been significantly impacted by intensifying geopolitical disruptions in recent times. For instance, the ongoing Russia-Ukraine conflict has disrupted supply chains decreased service demand, and increased uncertainty for businesses. This turmoil extended to energy markets, causing turbulence due to Russia's significant role as a major gas supplier, resulting in noticeable price fluctuations. In addition, the sanctions imposed on Russia by the United States and other have had widespread implications, injecting a level of risk for investors across various sectors. Beyond the war zones and disputed areas, the ongoing crisis jeopardizes stability on a global scale. It becomes imperative for businesses and investors alike to comprehend and adeptly manage these interconnected challenges.

Despite the current challenges posed by geopolitical tensions, there are potential growth opportunities for the Global Horizontal Directional Drilling Market. The ongoing infrastructure projects, utility installations, and the continuous expansion of the telecommunications industry. This demand underscores the market's resilience. Emphasizing strategic adaptation is crucial in navigating these complex circumstances, ensuring sustained success amid global challenges and uncertainties.

Sample Request @ https://www.blueweaveconsulting.com/report/biodegradable-sanitary-napkins-market/report-sample

Global Horizontal Directional Drilling Market – By End User

On the basis of end user, the Global Horizontal Directional Drilling Market is divided into Oil & Gas Excavation, Utilities, and Telecommunication segments. The oil & gas excavation segment holds the highest share in the Global Horizontal Directional Drilling Market by end user. The existing and robust infrastructure generates a significant demand for drilling rigs, contributing to the predominant market position of the oil and gas excavation segment. Also, efforts to manage the increasing expenses linked to exploration and production endeavors in untapped regions are anticipated to strengthen the prominence of this segment. Meanwhile, the telecommunications segment holds the highest share in the Global Horizontal Directional Drilling Market. The increasing need for faster broadband access propels telecommunications operators to adopt advanced and reliable drilling services, including horizontal directional drilling. This method facilitates the expansion of optic fiber cable networks by deploying conduits and pipes through holes nearly 4 feet in diameter and 6,500 feet in length, particularly in offshore locations. The growing demand for 4G and 5G networks is expected to contribute significantly to the segment's growth throughout the forecast period.

Global Horizontal Directional Drilling Market – By Region

The in-depth research report on the Global Horizontal Directional Drilling Market covers various country-specific markets across five major regions: North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. North America holds the highest share in the Global Horizontal Directional Drilling Market. According to the U.S. Energy Information Administration, liquid fuel consumption in 2022 was reported at 8.8 billion barrels per day. The growing prevalence of infrastructure and utility projects in North America is a key driver for the increased demand in horizontal directional drilling equipment and services. The Middle East and Africa (MEA) region emerged as the second-largest user of drilling services for oil and gas excavation activities.

Competitive Landscape

Major players operating in the Global Horizontal Directional Drilling Market include Baker Hughes Company, Barbco Inc., China Oilfield Services Limited, Ellingson Companies, Halliburton Company, Helmerich & Payne Inc., Herrenknecht AG, Nabors Industries Ltd, NOV Inc., Schlumberger Limited, The Toro Company, Vermeer Corporation, Weatherford International plc, Drillto Trenchless Co. Ltd, Laney Directional Drilling, Prime Drilling GmbH, XCMG Group, and TRACTO. To further enhance their market share, these companies employ various strategies, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product launches

Contact Us:

BlueWeave Consulting & Research Pvt. Ltd

+1 866 658 6826 | +1 425 320 4776 | +44 1865 60 0662

2 notes

·

View notes

Text

Transforming Connectivity: Emerging Technologies in the 5G Infrastructure Market

The global 5G infrastructure market was valued at approximately USD 16.69 billion in 2023, and it is projected to experience robust growth at a compound annual growth rate (CAGR) of 22.9% from 2024 through 2030. Several critical drivers are fueling this expansion, including the rapidly increasing volume of mobile data traffic and the widespread development of smart cities powered by Internet of Things (IoT) applications. Additionally, growing investments by governments and telecommunications companies in the deployment of 5G networks are expected to open up substantial growth opportunities for the industry.

One of the major contributing factors to this growth is the rising demand for connected devices, which are essential for smart infrastructure such as intelligent buildings and remote healthcare services. Over recent years, global data traffic—particularly mobile data traffic—has grown exponentially, reflecting the surging use of mobile broadband and connected technologies.

According to the Mobile Data Traffic Outlook report by Telefonaktiebolaget LM Ericsson, global mobile data traffic (excluding traffic from fixed wireless access) reached a total of 130 exabytes (EB) per month by the end of 2023. This figure is projected to triple, reaching 403 EB per month by 2029. This dramatic surge in mobile data traffic, along with an increasing shift in consumer and enterprise preferences toward 5G connectivity, is creating substantial opportunities for market expansion.

The growing establishment of smart cities in countries such as the United States, Japan, China, Germany, Italy, the United Kingdom, and India is accelerating the adoption of IoT solutions for a wide range of urban applications. These include smart transportation systems, energy management frameworks, and public safety and security initiatives. To support continuous and reliable connectivity for these mission-critical services, various telecom providers are actively investing in 5G infrastructure development. Often, these efforts are undertaken in partnership with local and federal governments to ensure widespread coverage and effective implementation.

The combination of public and private investment in 5G network infrastructure is proving to be a key catalyst for market growth. Furthermore, the growing demand for connected devices and the increasing adoption of 5G-enabled IoT technologies in Industry 4.0 scenarios—such as smart manufacturing—are driving the momentum even further. 5G networks are specifically engineered to offer ultra-reliable, high-speed, low-latency connections capable of supporting massive numbers of connected devices, ranging from machines and sensors to everyday consumer electronics.

These advanced 5G-enabled devices are being widely implemented in areas such as fleet management, intelligent building systems, logistics and supply chain operations, capability-based networks, precision agriculture, asset tracking, remote healthcare delivery, traffic management, and smart grid automation. As the demand for these applications grows, the adoption of 5G infrastructure continues to accelerate, reinforcing overall market growth.

Get a preview of the latest developments in the 5G Infrastructure Market? Download your FREE sample PDF copy today and explore key data and trends

Detailed Segmentation:

Component Insights

The hardware segment dominated the market in 2023 and accounted for a revenue share of 77.18%. The hardware segment is further classified into RAN, core network, backhaul & transport, fronthaul, and midhaul. RAN is an essential component of 5G infrastructure as it connects devices, such as smartphones, via a radio link.

Type Insights

The private type segment dominated the market in 2023.The rising demand for ultra-reliable low-latency connections for Industrial Internet of Things (IIoT) applications, such as industrial cameras, collaborative robots, and industrial sensors, is the main factor driving the segment growth.

Spectrum Insights

The sub-6 GHz segment dominated the market in 2023. Sub-6 GHz networks operate within a frequency range of up to 6 GHz, with the widely used 3.5 GHz frequency being a common choice worldwide. Sub-6 GHz provides a lower frequency range of approximately 1 GHz to 6 GHz, offering broader coverage despite limitations in speed.

Network Architecture Insights

The non-standalone segment dominated the market in 2023. Non-standalone network architecture is a cost-effective solution that utilizes existing 4G infrastructure to enhance Enhanced Mobile Broadband (eMBB) services without requiring a complete infrastructure rebuild.

Vertical Insights

The enterprise/corporate segment dominated the market in 2023. The enterprise/corporate segment is experiencing significant growth due to the increasing need for higher data bandwidth in various corporate businesses.

Regional Insights

The 5G infrastructure market in North Americais expected to witness significant growth from 2024 to 2030 due to the rising number of 5G connections fueling the demand for 5G deployment across the region.

Key 5G Infrastructure Company Insights

Some of the key players operating in the market include Telefonaktiebolaget LM Ericsson, Cisco Systems, Inc., Nokia Corporation, Huawei Technologies Co., Ltd., and Samsung Electronics Co., Ltd.

Telefonaktiebolaget LM Ericsson provides Information and Communication Technology (ICT) services across the globe. The company’s range of offerings spans various areas, including cloud software and services, networks, enterprise wireless solutions, global communications platforms, technologies, and new businesses, as well as IPR licensing

Huawei Technologies Co., Ltd. provides smart devices and information & communication technology components to communications service providers, government agencies, and business enterprises. The company carries out its business through five operating segments namely, Cloud Computing Business, Consumer Business, ICT Infrastructure Business, Intelligent Automotive Solution Business, and Digital Power Business

Key 5G Infrastructure Companies:

The following are the leading companies in the 5g infrastructure market. These companies collectively hold the largest market share and dictate industry trends.

Huawei Technologies Co., Ltd.

Samsung Electronics Co., Ltd.

Nokia Corporation

Telefonaktiebolaget LM Ericsson

ZTE Corporation

NEC Corporation

Cisco Systems, Inc.

Fujitsu Limited

Recent Developments

In October 2023, Nokia and Vodafone joined forces to pioneer a commercial 5G Open RAN trial in northern Italy. This pilot will leverage Nokia's containerized baseband software running on Red Hat OpenShift, a leading hybrid cloud platform powered by Kubernetes. The software will be hosted on Dell PowerEdge XR8000 servers, specifically designed for mobile edge computing and optimized for Open RAN workloads. For Layer 1 processing, these servers will be equipped with a Smart Network Interface Card (NIC), co-developed by Marvell and Nokia. This collaboration signifies a major step towards a more open and flexible telecom network infrastructure

In June 2023, Orange SA and Telefonaktiebolaget LM Ericsson signed a collaboration agreement and secured contracts for the installation and maintenance of 5G network infrastructure on high-speed rail lines across Spain. With this achievement, Orange SA solidifies its position as a leading contributor to the development and implementation of 5G networks

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

0 notes

Text

Telecom Power Systems Market Report Analysis by Size, Share, Demand by 2027

IMARC Group, a leading market research company, has recently releases report titled “Telecom Power Systems Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027.” The study provides a detailed analysis of the industry, including the global telecom power systems market share, size, trends, and growth forecasts. The report also includes competitor and regional…

View On WordPress

#Telecom Power Systems Market#Telecom Power Systems Market Growth#Telecom Power Systems Market Outlook#Telecom Power Systems Market Report#Telecom Power Systems Market Share#Telecom Power Systems Market Size#Telecom Power Systems Market Trends

0 notes

Text

Using Bulk SMS to Improve Customer Engagement in Ghana

Imagine sending one message that instantly connects with thousands of users without an app, data, or a complex CRM tool. For IT professionals, cybersecurity experts, and telecom engineers, this isn't just a marketing gimmick—it's a battle-tested communication method known as bulk SMS Ghana. And yes, it still works, arguably better than ever.

Despite a proliferation of messaging apps and chatbots, SMS remains unrivaled in reach and reliability. A report from MobileSquared noted that SMS open rates hover around 98% globally, with over 90% read within 3 minutes. In Ghana, where mobile penetration surpasses 129%, bulk SMS is an underutilized but incredibly powerful engagement channel.

Let's break down how IT teams and telecom experts can tap into this channel for real-world results.

What is Bulk SMS and Why It Still Matters

Bulk SMS refers to sending large volumes of SMS messages to multiple recipients simultaneously. Unlike WhatsApp or email, SMS doesn’t rely on internet connectivity, making it more accessible in low-bandwidth areas like rural Ghana.

For telecom engineers, it offers direct routing capabilities. For IT professionals, it's API-friendly and integrates well with existing systems. And for cybersecurity experts, the lack of dependency on internet-based protocols makes it a lower-risk channel for OTPs and sensitive alerts.

Why Bulk SMS Ghana is an Engineering Asset

Minimal Latency, Maximum Penetration: Ghana’s telecom infrastructure may vary between urban Accra and rural Bolgatanga, but SMS delivery doesn’t suffer. Latency is negligible and routing is handled via SMSC (Short Message Service Centers).

API-Driven Automation: Services like Africala’s Global Bulk SMS APIs allow developers to trigger messages from CRMs, ERP systems, or monitoring dashboards.

Low Attack Surface: Unlike email systems prone to spoofing or phishing, SMS has a simpler, more isolated attack surface, giving cybersecurity teams greater control over transactional messaging.

Ideal for 2FA & OTPs: SMS remains one of the most used channels for delivering one-time passwords. Telecom professionals can implement fallback strategies with bulk SMS when app-based OTPs fail.

Africala: Powering Bulk SMS in Ghana & Beyond

Africala isn’t just another messaging vendor. With over 5000 enterprise customers across continents, Africala provides a full-stack communications platform that includes:

Global Bulk SMS APIs

WhatsApp Business API service

Voice Messaging for OTP & Marketing Campaigns

Engineers and IT leaders use Africala to simplify message routing and manage global scale without compromising on delivery rates or control.

Use Case: A fintech app in Accra integrates Africala's API to send balance updates, transaction alerts, and promotional offers to users in real-time. By doing so, they improve retention and reduce customer support tickets.

Strategic Use Cases of Bulk SMS in Ghana

1. Transactional Alerts for Fintech

Mobile wallets are booming in Ghana. Services like MTN MoMo or Vodafone Cash generate high transaction volumes daily. Fintech platforms can use bulk SMS Ghana for real-time alerts.

2. Multi-Factor Authentication (MFA)

Security is non-negotiable. Bulk SMS can serve as a fallback for 2FA when apps or email services are unavailable. This is especially vital for cybersecurity professionals maintaining account integrity.

3. Emergency Communication

In crisis scenarios, speed is everything. Bulk SMS enables rapid dispatch of safety instructions or outage updates.

4. Promotional Campaigns

Retailers and ISPs can run promotional SMS Ghana campaigns to announce discounts, new plans, or service upgrades.

5. Internal Communications

Organizations in Accra or Kumasi can use bulk messaging for employee communication, shift reminders, or IT maintenance notices.

Regional Optimization: Bulk SMS in Key Cities

Bulk SMS in Accra

Accra, Ghana’s economic hub, offers a large audience for targeted campaigns. Telecom engineers can geo-segment campaigns using localized databases.

Bulk SMS in Kumasi & Takoradi

These growing tech ecosystems benefit from alerts and notifications that bypass internet dependency. SMS ensures the message always gets through.

Bulk Messaging in Tamale

In Northern Ghana, where smartphone penetration is lower, SMS remains the best channel for outreach.

SMS Marketing in Tema

Manufacturers and logistics companies in Tema leverage SMS to send delivery updates and driver instructions.

Technical Considerations for IT & Telecom Teams

Delivery Rate Optimization

Configure routes via Africala's dashboard to select the most reliable operator path. Use DLR (Delivery Receipt) tracking to ensure message integrity.

Number Management

Utilize dynamic sender IDs for different message categories (e.g., support, marketing). Avoid generic IDs to reduce spam filters.

Data Privacy & Compliance

Ghana’s Data Protection Act mandates explicit user consent. IT teams must implement opt-in systems and allow opt-outs via shortcodes.

Bulk SMS API Integration

Africala’s RESTful API allows for:

JSON-based payloads

Webhook callbacks

Failover redundancy

Measuring Success: KPIs for Bulk SMS Ghana

Delivery Rate: Aim for >95%. Africala's routing engine boosts this via multiple operator fallback.

Open Rate: While near-instant for SMS, track clicks via short links.

CTR (Click-Through Rate): Measure campaign effectiveness.

Response Time: For OTPs, ensure delivery within 5 seconds.

Unsubscribes: Monitor opt-outs to maintain compliance.

Common Pitfalls and How to Avoid Them

Sending Without Consent: Violates both compliance and user trust.

Overuse of Promotional Content: Can lead to SMS fatigue.

Lack of Segmentation: Results in irrelevant messages, reducing CTR.

Ignoring Analytics: Missed opportunity for refinement.

Tip: Use Africala’s analytics dashboard to view region-wise performance and bounce rates.

Global Trends Validating Local Action

According to Statista, over 5 billion people globally send and receive SMS. In sub-Saharan Africa, SMS remains the primary mode of digital communication.

Case Study: An e-commerce company in Nairobi improved its repeat purchase rate by 18% after integrating a well-timed bulk SMS follow-up strategy. The same logic applies to Ghana’s growing digital economy.

For those involved in building and maintaining Ghana’s digital infrastructure, SMS is not an afterthought—it’s a core utility.

Final Thoughts

Bulk SMS Ghana is far more than just another mass communication tool. For IT professionals, cybersecurity experts, and telecom engineers, it’s a flexible, high-impact channel for secure and reliable customer interaction.

With Africala powering global messaging at scale—including SMS, WhatsApp API, and voice messaging—engineers can focus less on delivery logistics and more on building great products.

If your team is looking to improve engagement, reduce friction, and scale communication in Ghana, bulk SMS should be on your radar.

Ready to try it? Start building with Africala’s API suite today.

0 notes

Text

How Much Does CCIE Certification Increase Your Earning Potential?

In the ever-evolving world of IT networking, professional certifications are a powerful way to boost career growth and validate technical expertise. Among these, the Cisco Certified Internetwork Expert (CCIE) stands as one of the most prestigious and respected certifications in the industry. While it is known for its difficulty and depth, it is equally recognized for its ability to transform careers—especially in terms of earning potential.

So, how much can the ccie certification actually increase your income? Let’s explore the numbers, market trends, and real-world value it brings to networking professionals.

The Premium Value of CCIE Certification

The CCIE is not just another certification—it is a badge of elite networking knowledge and hands-on technical expertise. Employers understand the effort and skill required to become CCIE-certified. That’s why professionals with this certification often command significantly higher salaries than their non-certified peers.

According to multiple salary surveys and industry reports:

CCIE-certified professionals in the U.S. earn between $130,000 to $200,000 annually, depending on experience, track, and location.

On average, professionals see a salary increase of 20% to 35% after achieving the CCIE.

In high-demand regions or specialized roles (e.g., security, data center), salaries can exceed $200,000 with the right combination of skills and experience.

Factors That Influence the Earning Boost

While the CCIE brings a strong salary advantage, the exact boost you experience depends on several key factors:

1. Your CCIE Track

Different CCIE tracks can yield different salary benefits based on market demand:

CCIE Security and CCIE Data Center tracks are particularly high in demand due to the rise of cybersecurity threats and cloud infrastructure.

CCIE Enterprise Infrastructure is a common and versatile choice, leading to broad job opportunities.

CCIE Collaboration and Service Provider may have niche but highly lucrative roles, especially in telecom or enterprise voice systems.

2. Geographic Location

Location plays a major role in determining salary. For example:

In the United States, CCIEs earn some of the highest salaries globally.

In regions like Europe, Australia, the Middle East, or Asia-Pacific, the CCIE still delivers a premium compared to regional IT averages.

Remote and cloud-based roles allow some CCIEs in developing countries to access global job markets with competitive pay.

3. Years of Experience

A newly certified CCIE may not instantly earn six figures, but the credential accelerates your path to senior roles. With 5+ years of relevant experience, CCIE-certified engineers often qualify for:

Network Architect roles

Senior Infrastructure or Security Engineer positions

Consulting and pre-sales technical roles

These advanced positions come with significantly higher compensation.

4. Industry and Employer Type

Industries that rely heavily on secure and scalable networks—such as finance, healthcare, tech, and telecom—are more willing to pay premium salaries for CCIE-certified staff. Working for a Cisco partner, systems integrator, or large enterprise often comes with additional benefits and bonuses tied to your certification status.

Beyond Salary: Other Career Benefits

While salary is a major incentive, CCIE certification brings additional long-term benefits that can lead to sustained career growth:

Job security: CCIEs are less likely to be affected by layoffs due to their specialist skills.

Global opportunities: The certification is recognized worldwide, allowing professionals to work or relocate internationally.

Faster promotions: Many companies value the CCIE as a sign of leadership potential in technical teams.

Consulting and freelance work: CCIEs can charge premium hourly rates for independent work or short-term projects.

Is It Worth the Investment?

Yes—but only if you're committed. The cost of the CCIE journey (training, exams, lab equipment, travel) may total $3,000 to $5,000 or more, but the return on investment is clear. Within 1–2 years post-certification, most professionals earn back this cost through higher salaries, bonuses, or new job opportunities.

Conclusion

The CCIE certification is one of the most rewarding credentials in the IT industry when it comes to increasing your earning potential. Whether you're aiming to advance within your current organization or open the door to new global opportunities, this certification offers both immediate and long-term financial gains. With strategic preparation and experience, the CCIE can elevate your career—and your salary—to expert-level heights.

0 notes

Text

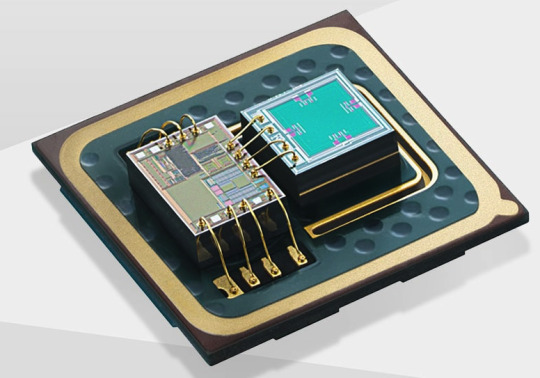

MEMS Timing Products Market Drivers: Key Forces Fueling Growth Across Diverse Applications and Industries

The MEMS Timing Products Market is witnessing strong growth, driven by the increasing demand for precise, compact, and energy-efficient timing solutions across various industries. MEMS (Micro-Electro-Mechanical Systems) timing devices are rapidly replacing traditional quartz-based components due to their resilience, low power consumption, and ability to perform reliably under harsh environmental conditions. These features make MEMS timing products ideal for emerging applications in telecommunications, consumer electronics, automotive, aerospace, and industrial automation.

This article explores the key drivers fueling the growth of the MEMS Timing Products Market, highlighting the technological advancements, market demands, and application trends contributing to its rapid expansion.

1. Miniaturization and Integration in Consumer Electronics

One of the primary drivers of the MEMS Timing Products Market is the continued trend toward miniaturization in consumer electronics. Smartphones, wearables, tablets, and other portable devices require compact, low-power, and highly integrated components to meet design and performance specifications. MEMS timing products offer a significant size and power advantage over traditional quartz crystal oscillators, making them a preferred choice for next-generation devices.

The integration of MEMS timing solutions into system-on-chip (SoC) platforms and multi-functional modules allows manufacturers to save board space while improving overall system efficiency and accuracy.

2. Superior Performance in Harsh Environments

Unlike quartz-based timing devices, MEMS oscillators and clocks are highly resistant to shock, vibration, and temperature variations. This makes them ideal for demanding environments, such as industrial settings, automotive systems, and aerospace applications. These harsh conditions often degrade the performance of traditional timing components, leading to reliability issues and increased maintenance costs.

The MEMS Timing Products Market benefits from this performance edge, especially as industries shift toward automation, IoT (Internet of Things), and advanced robotics, where timing precision and reliability are crucial for system functionality.

3. Growing Demand for 5G and Telecommunications Infrastructure

The global rollout of 5G technology is a significant catalyst for the MEMS Timing Products Market. 5G networks demand ultra-low latency, higher data rates, and precise synchronization across distributed network components. Timing devices are essential in maintaining these stringent performance requirements, particularly for base stations, small cells, routers, and edge computing infrastructure.

MEMS timing solutions offer advantages such as better phase noise performance, frequency stability, and rapid startup times, all of which are critical for maintaining synchronization in high-speed telecom networks. As 5G deployment accelerates globally, the demand for robust timing components is expected to rise correspondingly.

4. Increased Adoption in Automotive Electronics

The automotive industry is undergoing a technological transformation with the rise of electric vehicles (EVs), autonomous driving, and advanced driver-assistance systems (ADAS). These innovations require reliable and accurate timing solutions for systems like GPS modules, sensors, infotainment units, and powertrains.

MEMS timing devices are preferred in automotive electronics due to their vibration resistance, thermal stability, and compliance with automotive-grade standards. As vehicles become more software-defined and electronics-heavy, the MEMS Timing Products Market is poised to capture a significant share of the automotive timing solutions segment.

5. Expanding Role of IoT and Edge Computing

IoT devices—from smart thermostats and industrial sensors to connected medical devices—depend on precise timing for data acquisition, communication, and synchronization. MEMS timing products enable longer battery life, miniaturization, and reliable performance, all essential for the success of IoT ecosystems.

Similarly, edge computing systems, which require local data processing with minimal latency, rely heavily on accurate timing to maintain data integrity and processing efficiency. The MEMS Timing Products Market is experiencing growing adoption in these applications as industries increasingly depend on real-time data analytics and autonomous system control.

6. Replacement of Quartz Oscillators

The gradual shift from quartz-based oscillators to MEMS-based timing products is a structural driver of growth. MEMS technology offers numerous advantages including:

Better integration with silicon-based components

Higher manufacturing scalability and cost-efficiency

Enhanced reliability due to solid-state design (no moving parts)

Improved resistance to aging and environmental factors

As awareness and availability of MEMS timing solutions grow, OEMs and system designers are increasingly opting to replace traditional timing components with MEMS alternatives, accelerating the market transition.

7. Advancements in MEMS Fabrication Technology

Recent advancements in semiconductor manufacturing and MEMS fabrication processes have played a vital role in boosting product performance, consistency, and yield. These developments are enabling the production of MEMS timing products with higher precision, better thermal stability, and lower jitter, making them suitable for high-end and mission-critical applications.

Innovations such as wafer-level packaging and vacuum-sealed structures have further enhanced device longevity and robustness. These technical improvements are strengthening the competitive edge of MEMS over legacy timing technologies and expanding the market's total addressable scope.

8. Regulatory and Industry Compliance

Compliance with international standards, such as AEC-Q100 for automotive applications or ITU-T G.826x for telecom synchronization, is another growth driver. MEMS timing product manufacturers are increasingly meeting or exceeding these industry benchmarks, which enhances customer confidence and facilitates adoption in regulated markets.

As more industries mandate compliance with timing accuracy, safety, and reliability standards, MEMS devices are well-positioned to meet those requirements efficiently.

Conclusion

The MEMS Timing Products Market is driven by a confluence of technology trends, including the rise of miniaturized consumer electronics, 5G infrastructure, automotive innovation, and IoT expansion. The market’s transition away from quartz and toward MEMS-based timing is reshaping the competitive landscape and creating new growth avenues for manufacturers and developers.

As MEMS technology continues to evolve, offering improved performance, integration, and durability, its adoption will become even more widespread across diverse industries. The continued push for digitalization, connectivity, and intelligent systems ensures that the MEMS Timing Products Market will remain a critical pillar in the modern electronics ecosystem for years to come.

0 notes