#Tennessee payday loans

Text

Get Quick Cash with No Credit Check: Tennessee Payday Loans and Cash Advances

Nashville is considered the “Country Music Capital of the World.” It is home to The Grand Ole Opry, Southern Plantations, and awesome cuisine. Nashville is the capital of the U.S. state of Tennessee and home to Vanderbilt University.

Online loans in TN have never been easier. There are payday loans in Nashville, TN, and other cities throughout the state. Requesting online payday loans in Tennessee is simple.

Apply Now:

#QuickCash#SameDayLoan#NoCreditCheck#EasyApproval#InstantFunds#OnlinePaydayLoan#FastApproval#EmergencyLoan#ConvenientFunding#SmallLoans

0 notes

Text

Online Payday Loans In Alamo, Tennessee, Easy Solution To Your Financial Problems

Online Payday Loans In Alamo, Tennessee, Easy Solution To Your Financial Problems

In Alamo, Tennessee you can accept two loans simultaneously. A general amount should be the maximum of $1,000. Also, the total sum of your current taken auto Alamo Payday loans shouldn’t be higher than 22.5% of your monthly income. Your employer can pay you in advance so you will have more time. Spend this time wisely, and you will see success. Do not worry about being decreased in bank…

View On WordPress

0 notes

Text

5 Tips To Get The Best Payday Loan

In tough circumstances, it's difficult to make both ends meet for most people. As a matter of fact, unfavorable economic climate forces many people to take a loan. If your current job doesn't pay you enough, we suggest that you give a go to a payday loan. If you don't know whether you should reduce your expenses or apply for a payday loan, we suggest that you check the tips given below. These tips may help you make a wise decision based on your circumstances.

If you are looking for payday loan in Tennessee. visit here

First of all, make sure you know how much money can meet your needs. While it is tempting to apply for an amount that is a lot higher than what you currently need, you should never go this route. The reason is that the high rate of interest will kill you down the road. So, if you want to be on the safe side, you should only apply for a loan that will jus meet your needs. Don't be greedy. Some people don't need as much money as they borrow. As a result, they find it really hard to repay the loan. Paying the higher rate of interest becomes a headache for them and their life becomes a hell. So, always go for what you need, not what you want.

Repayment method

Now, this factor is the most important. When applying for a loan, make sure you choose the best repayment method based on your circumstances. For instance, you can give a post dated check to your lender so he could get the payment on a certain date. Or your lender may ask you to give you the account number of your checking account. In this case, the lender will just deduct the payment amount from that account. Based on your needs, make sure you ask the lender to use the right payment method.

Extension

Due to one reason or the other, you may fail to repay the loan on the due date. In this case, you can ask for an extension. Your lender may give you a 48-hour extension based on your history. However, keep in mind that you will have to pay the fees for the extension.

It's important that you make all the payments until you have gotten rid of the loan. In case of late payments, you will have to face penalties, which you don't want at any cost.

Valuable items

If you want to enjoy a lower rate of interest, you can apply for a loan with a valuable item, such as jewelry. Usually, a secured loan will save you a lot of money because of the lower interest rate. So, if you can, take something valuable with you to the lender.

Credit history

As far as payday loans are concerned, your credit history plays a great role. Even if your credit history is bad, you can apply for a loan but the rate of interest will be a lot higher. On the other hand, if you have good credit rating, the lender may offer lower rate of interest and better repayment options. Therefore, we suggest that you keep a good credit history in order to prevent higher rate of interest. And for this paying the loan back on time is the way to go.

So, if you are thinking about getting a payday loan, we suggest that you consider your circumstances and use these tips to be on the safe side. Keep in mind that payday loans are not for everyone. You should get this loan only if you are sure that you will be able to pay it back on the due date.

Have you been going through difficult times recently? If so, we suggest that you give a go to a payday loan . This will help you meet your needs without any problem.

#Tennessee payday loans#online loans in tn#online payday loans tennessee#online payday loans#tennessee cash advance

0 notes

Text

#Payday Loans Alternative Tennessee#Online Payday Loans Alternative Tennessee#Online Payday Loans Alternative TN

1 note

·

View note

Link

0 notes

Text

Title Loans Near Me Texas

No Credit Check Title Loan in Texas Fast TX & Nationwide USA. Get Qualified for Title Loans Near Me Today. Fair Cash Offers. Any Location: Online Title Loans Texas, Get a Loan With Car Title in Texas Nationwide USA!

Texas Title Loan Services

Finding the best direct quick approval instant loan lender for bad credit is vital so that you get the loan at the best possible rates and no hidden fees. There are many online payday loan providers offering cash loans instantly at lower than the prevailing average rates in order to get more clients.

Title Loan Texas is here to help you find the right instant cash lender, so that you would get the immediate cash online easily and also quickly. Hence, it is important to take your time when choosing the right online payday loan with same or next day approval in Texas!

Texas

Houston | San Antonio | Dallas | Austin | Fort Worth | El Paso | Arlington | Corpus Christi | Plano | Laredo | Lubbock | Garland | Irving | Amarillo | Grand Prairie | McKinney | Frisco | Brownsville | Pasadena | Killeen | McAllen | Mesquite | Midland | Denton | Waco | Carrollton | Round Rock | Odessa | Abilene | Pearland | Richardson | Sugar Land | Beaumont | The Woodlands | College Station | Lewisville | League City | Tyler | Wichita Falls | Allen | San Angelo | Edinburg | Conroe | Bryan | Mission | New Braunfels | Longview | Pharr | Flower Mound | Baytown | Cedar Park | Temple | Atascocita | Missouri City | Georgetown | North Richland Hills | Mansfield | Victoria | Rowlett | Harlingen | Pflugerville | San Marcos | Spring | Euless | Port Arthur | Grapevine | DeSoto | Galveston

Nationwide USA

Alabama | Alaska | Arizona | Arkansas | California| Colorado | Connecticut | Delaware | Florida | Georgia | Hawaii | Idaho | Illinois | Indiana | Iowa | Kansas | Kentucky | Louisiana | Maine | Maryland | Massachusetts | Michigan | Minnesota | Mississippi | Missouri | Montana | Nebraska | Nevada | New Hampshire | New Jersey | New Mexico | New York | North Carolina | North Dakota | Ohio | Oklahoma | Oregon | Pennsylvania | Rhode Island | South Carolina | South Dakota | Tennessee | Texas | Utah | Vermont | Virginia | Washington | West Virginia | Wisconsin | Wyoming | Washington DC (District of Columbia)

Car Title Loans in Texas

There are many offers like title loans online with instant decision on loan approval or same day cash advance loans for bad credit that you will find. You need to dig deep and choose wisely considering both cons and pros of such advances. The reality is that no one can guarantee you 100% approval and they will definitely carry out some sort of background check before lending you the quick loan online, even if you need emergency cash now.

Title Loans in Texas

We can help you get the title loans you need–especially if you are dealing with an emergency situation. Best of all, unlike the bank, you won’t need to wait for too long to get approved for your loan. Unlike other lenders, Texas Title Loan will give you a loan based on the value and equity of your car. Our title loans are accessible to everyone, even if you’ve been turned down by other lenders because of bad credit. Since our application process is super easy, the entire process can be as short as 15 minutes to get your loan approved! Even if you have a low credit score or a poor payment history, you can still get a loan and drive off in your own car!

Auto Title Loan TX

Texas Title Loans is happy to help those who have fallen into a rough patch as we know these things are temporary. Aside from credit score, another large determining factor when trying to get a loan is your employment and income status, meaning when you’re out of a job or are self-employed the process gets exceedingly difficult.

At Texas Title Loans, we’re happy to work around these kinds of situations and still provide cash to our customers with an auto title loan. These are the times that you’re going to need cash the most, and Texas Title Loans is here to help the communities that have allowed us to remain in business for so long. No matter how unique your situation might be, we’re happy to help you evaluate your options at no cost to you and find a way to get you your cash.

1 note

·

View note

Text

How Memphis's Methodist University Hospital, a "nonprofit," sued the shit out of its Black, poor patients while raking in millions and paying execs more than a million each

Methodist University Hospital in Memphis is a nonprofit: it pays virtually no local, state or federal tax; but unlike other Methodist hospitals, Methodist University Hospital is relentless in pursuing medical debts from indigent patients. The hospital owns its own collection agency, and is one of the leading litigants in Tennessee's debt courts.

At issue is Methodist University Hospital's policy of requiring patients to cover any expense excluded by their insurers, no matter how high that deductible or excess is and no matter how poor the patient is. And since Obamacare's lowest-cost plans carry incredibly high deductibles and excesses, and exclude many forms of care, the poorest patients at Methodist University Hospital are also expected to pay the highest bills.

There are a lot of poor people in Memphis, which is the second-poorest city in America, with more than 40% of the city's workforce earning less than $15/hour. The poor people of Memphis include Methodist University Hospital's own staff, many of whom have been sued by Methodist University Hospital because they couldn't afford their medical bills on the salary the hospital paid them. In addition to suing dozens of its own employees, Methodist University Hospital has garnished the wages it pays to more than 70 of its own workers.

Memphis's inequality closely tracks with race, with Black people carrying a much higher risk of poverty.

Methodist University Hospital's management -- including CEO Dr. Michael Ugwueke, who was paid $1.6 million in total compensation last year and former CEO Gary Shorb, who draws $1.2m/year to serve as Ugwueke's advisor -- are apparently pursuing this agenda on their own. One former long-serving board member, Beverly Robertson (2003-12) says she had no idea that the hospital had pursued its patients so aggressively.

As a nonprofit, Methodist University Hospital is required to provide "a significant community benefit, including charity care and financial assistance." In 2018, the hospital made a $86m operating surplus, suggesting that it has plenty of room to subsidize the poor people it is currently suing.

The Hospital's pettiness and meanness are really unbounded: they chased one patient from low-paid job to low-paid job seeking to garnish her wages, ultimately getting TJ Maxx to garnish her paycheck from a part-time, low-waged job. Her wages there were so low that many weeks they didn't rise to the level where the law permitted garnishments; other weeks, the amount the hospital was legally entitled to take from her was as low at $3.67.

When the hospital is unable to collect from its poorest patients, it adds penalties and interest to their debt, so that a patient who chooses to go to a payday lender to borrow money to pay the $100 a court has ordered her to pay might end up more in debt to the hospital and to the loan-shark at the end of the week.

It's a form of debt indenture, being undertaken by a Christian, faith-based nonprofit institution with a public duty to perform charitable works.

https://boingboing.net/2019/06/27/1-6-mil-to-ceo-ugwueke.html

364 notes

·

View notes

Text

Short Term Loans Enduring Online Help Of Small Finance - Loans

The simpler it's for the borrower to pay again, the extra probably he/she retains to the due date. Most payday loan lenders can ask that an intending borrower provides an energetic bank account, SSN or government-issued ID, and proof of income, but the requirement for getting a standard loan is more than that. Which means, for example, the lender should test you’ve got enough money coming in every month to be be in a position pay the loan back. That is the one approach to get private loans in Fargo, ND on good terms. Reliable firms publish full phrases and circumstances on web sites. We are available 24/7, you may apply every time it is convenient for you, so we are going to approve money in minutes! You perceive that your mobile phone service supplier may cost you fees for calls made or texts despatched to you, and you agree that we'll don't have any legal responsibility for the price of any such calls or texts. I must applaud Rhonda for her awesome customer service.

Not a payday loan company

Money advances do not earn rewards

741 Dinah Shore Blvd

Consolidate your debt utilizing dwelling fairness

Automobile insurance

Mounted default fees capped at £15, and

youtube

If the lender is a member of a commerce affiliation, you may also make a complaint to the affiliation. Legal guidelines in some states restrict the number of renewals payday lenders can allow, and payday lenders who belong to the payday lender trade group Client Monetary Providers Affiliation of America (CFSA) limit themselves to 4 renewals per loan except native laws impose greater limits. As you'll be able to see, it’s difficult to get a payday loan in states like Colorado or Maryland. 34 states in the United States of America even have legal guidelines along with federal rules that dictate the process. Advance America is a short-time period lender with quick funds switch and set charges on transactions. To pay again the debt, your creditor often calls for a submit-dated test for the full sum of the cash, which normally consists of the preliminary sum, the interest, and different charges attached.

Such a nasty historical past of credit ranking additionally results in lowering of the borrower’s credit score rating. The sum of money a borrower can have entry to is determined by loads of factors such as the state law governing payday loans in the borrower’s state of residence. In some states, the borrower can renew or rollover a loan when the borrower finds it difficult to pay on the scheduled time; this offers the borrower more time to pay up the loan. Lenders will take into consideration many components, equivalent to your employment and income standing, and will fairly assess your application before making a final determination. 3. In some kind of employment or have one other common income source. Connie helped me finished up my software and was very patient and sort. 3) Complete: If connected, click on via to the lender's page and complete the web software. Our lenders are open for enterprise 24 hours a day, 7 days per week. If you happen to want a small quick-term loan, then look no further. Payday loans are an costly method to help people over short-term issues.

Taking full advantage of this stuff is possible by merely availing of nationwide cash advance over the Internet. It is best to know in case you have been related in a matter of minutes. And do not be fooled into pondering this is a protracted process - you'll know onscreen if in case you have been authorised! Read this article to search out out all the pieces that you must learn about personal loans in Fargo, ND! Many individuals face unexpected monetary conditions once they want extra cash however merely do not know where to turn. I just relocated from Miami, Florida to Houston, Texas and wanted some additional cash to get me by until payday. Our lenders observe all of the Florida legal guidelines and rules. This rule applies to each on-line and traditional lenders. Tennessee Title Loans, Inc. is prepared that will help you get extra money right this moment to take care of any money emergency.

In an emergency, you need a payday lender that is straightforward to entry and might provide the funds wanted to take care of the situation. It is usually vital that the time between mortgage approval and deposition of funds is brief, although this varies with the amount and time of approval. Prices shall be added for late cost. However, your lender shouldn’t use the CPA more than twice if they’ve not been capable of get the cash from your account, and they shouldn’t try to take an element payment. Federal Deposit Insurance Company (FDIC) research from 2011 which discovered black and Hispanic households, recent immigrants, and single mother and father have been more seemingly to make use of payday loans. They are designed for use as a substitute of payday loans, however you should utilize one to repay a payday loan as effectively. Unhealthy in addition to Zero Credit score Okay. Easy Credit score examine wanted, Zero Fax, No Headache, A foul credit score Superb. The easiest method to search out out whether a loan firm is respectable is to examine its license. There could also be other methods so that you can kind out your brief-term cash problem so think in regards to the options before you borrow from a payday lender. You just must fill in and submit the net mortgage request type and we will do the rest. Our online type is quick and straightforward to fill in.

1 note

·

View note

Photo

Instant Online Payday Loans Tennessee (TN) | No Credit Check

EasyQualifyMoney provides Payday Loans Online in Tennessee (TN) - Instant Approval Loans! No Hard Credit OK! Apply now and get funds the same day!

Visit: https://easyqualifymoney.com/instant-online-payday-loans-tennessee-no-credit-check.php

#Instant Online Payday Loans Tennessee#Payday Loans Online or Near You in Tennessee#Payday Loan In Tennessee With No Credit Check#Cash Advance Loan in Tennessee#Short Term Fast Cash Loans in Tennessee#Get Cash Fast#online payday loans#Tennessee Use Payday Loans

0 notes

Link

Do you need some cash to cover up an emergency in TN? Then you can apply at Kaptain Loans for Tennessee payday loans. Visit : Kaptain Loans to know more.

0 notes

Link

If you are a Tennessee resident and facing unexpected financial emergencies, then payday loans in Tennessee are legal and approved by the state. But you should learn more about the laws, requirements, and other information before requesting online payday loans.

0 notes

Photo

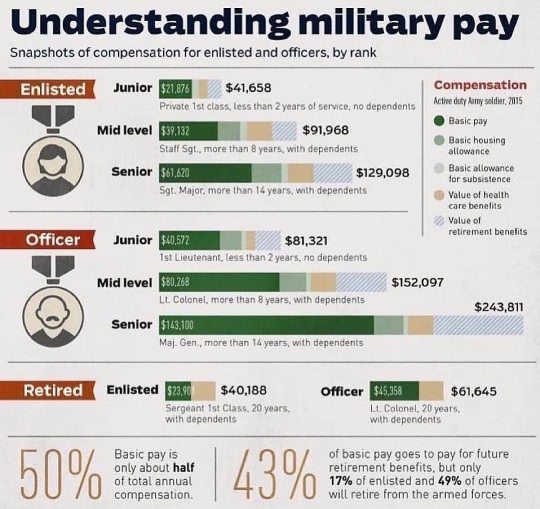

Have you heard the myth that the U.S. Army does not pay well? In actuality a junior enlisted soldier makes more than most entry level (yes, High School Students) civilian careers, with no student loan debt. Let that sink in #ArmyPay #Benefits #PayDay #Army #reposted from • @4g4carmy #dosomethingpositive for your #futureself #dosomethingworthwatching #contactmenow #pm #dm #text # 615-429-0932 #usarmyreserve #classof2022 #classof2021 #careergoals (at Middle Tennessee Area) https://www.instagram.com/p/ChzWN4qOYFW/?igshid=NGJjMDIxMWI=

#armypay#benefits#payday#army#reposted#dosomethingpositive#futureself#dosomethingworthwatching#contactmenow#pm#dm#text#usarmyreserve#classof2022#classof2021#careergoals

0 notes

Photo

Car title loans are an easy and affordable way to get the funds you need quickly, without having to sell your vehicle. Whether your car is paid in full or you are still making payments, a car title loan may be a more reasonable option than a payday advance or an unsecured loan. However, our title loans in Tennessee does not make you follow a lengthy process. We at Money Title Loans work to offer needed funds to our valued clients so that their financial problems get solved. All you require to do is call us at 8445841409 or you can visit our website and fill the application form online.

0 notes

Link

Kaptain Loans offer online payday loans, Cash loans, installment loans and personal loans in Tennessee cities like Nashville, Murfreesboro, Memphis, Jackson. Click KaptainLoans to know more.

1 note

·

View note