#Transfer Your Epf Account From previous Employer to current employer

Text

How to Use the EPFO Portal for PF Management

SLNConsultancy #SLNPFConsultancy #SLNESIConsultancy #SLNPFESIConsultancy #PFConsultancyHyderabad #PFConsultancyNearMe

The Employee Provident Fund Organisation (EPFO) portal is an essential tool for employees in India to manage their Provident Fund (PF) accounts. The portal provides various services that make it easier to track, manage, and utilize your PF savings. This article will guide you through the key features of the EPFO portal and how you can use it for effective PF management.

Accessing the EPFO Portal

To start using the EPFO portal, you need to visit EPFO's official website. Here's how you can access it:

Open your web browser and go to the official EPFO website.

Click on ‘For Employees’ under the ‘Our Services’ section on the homepage.

Select ‘Member UAN/Online Services (OCS/OTCP)’ from the list of services. This will redirect you to the Unified Member Portal.

UAN Activation and Login

Your Universal Account Number (UAN) is the key to accessing all your PF-related details. If you haven't activated your UAN yet, follow these steps:

Click on ‘Activate UAN’ on the Unified Member Portal login page.

Enter your UAN, Member ID, Aadhaar, PAN, and mobile number.

Click on ‘Get Authorization PIN’.

Enter the OTP sent to your mobile number and click on ‘Validate OTP and Activate UAN’.

Once your UAN is activated, you can log in to the portal using your UAN and password.

Checking PF Balance

One of the most common uses of the EPFO portal is to check your PF balance. Here’s how:

Login to the Unified Member Portal using your UAN and password.

On the dashboard, select the ‘View’ tab and then click on ‘Passbook’.

The portal will redirect you to the EPFO Passbook portal.

Select the relevant Member ID to view your passbook and balance details.

Downloading the PF Passbook

Your PF passbook contains a detailed record of your PF transactions. To download it:

Follow the steps mentioned in the ‘Checking PF Balance’ section to access your passbook.

Click on the ‘Download’ option at the top of the passbook to save it as a PDF.

Updating KYC Details

Keeping your KYC (Know Your Customer) details up to date is crucial for smooth transactions. To update your KYC details:

Login to the Unified Member Portal.

Navigate to the ‘Manage’ tab and click on ‘KYC’.

Select the documents you want to update (Aadhaar, PAN, Bank Details, etc.).

Enter the required details and click on ‘Save’.

Your employer will verify the details, and once approved, your KYC status will be updated.

PF Withdrawal

You can withdraw your PF amount online through the EPFO portal. Here’s how:

Login to the Unified Member Portal.

Go to the ‘Online Services’ tab and click on ‘Claim (Form-31, 19 & 10C)’.

Verify your KYC details and enter the last four digits of your bank account.

Click on ‘Proceed for Online Claim’.

Select the ‘PF Advance (Form 31)’ option for partial withdrawal or ‘Full Withdrawal’ if you’re retiring or have left the job.

Fill in the required details and submit your claim.

Tracking PF Claim Status

After submitting a withdrawal claim, you can track its status online:

Login to the Unified Member Portal.

Click on the ‘Online Services’ tab and select ‘Track Claim Status’.

The status of your claim will be displayed on the screen.

Transferring PF Account

If you change jobs, you must transfer your PF account to the new employer to maintain continuity. Here’s how:

Login to the Unified Member Portal.

Go to the ‘Online Services’ tab and click on ‘One Member – One EPF Account (Transfer Request)’.

Verify your personal details and your PF account.

Select whether your previous or current employer will attest your claim.

Submit the transfer request and track its status under the ‘Online Services’ tab.

Grievance Redressal

If you face any issues related to your PF account, you can raise a grievance through the EPFO portal:

Visit the EPFO Grievance Management System (EPFiGMS).

Click on ‘Register Grievance’ and log in using your UAN.

Fill in the grievance form with relevant details.

Submit the form and note down the registration number for future reference.

Conclusion

The EPFO portal is a powerful tool for managing your PF account efficiently. By familiarizing yourself with its features, you can easily keep track of your savings, withdraw funds, update your information, and resolve any issues that may arise. Make sure to regularly log in to your account to stay updated on your PF status and ensure your financial future is secure.

0 notes

Text

King Jerry Ltd

BACKGROUND

King Jerry is an Indian full-service airline, based in Delhi, with its hub at Indira Gandhi International Airport. The carrier commenced operations on 15 June, 2014 with its inaugural flight between Delhi and Kolkata. The airline had carried more than three million passengers by June 2016 and as of Sep 2019, has a 6.2% share of the domestic carriers. The airline serves 60 airports in India (20- International, 40- Domestic) with a fleet of 30 Boeing 737 and 22 Airbus A320 Aircrafts, operated on profitable routes with higher passenger load factors. It operates 560 flights/day.

HISTORY

Initially being a low-cost carrier, King Jerry offered only economy class seating. To keep fares low, it did not provide complimentary meals on any of its flights, though it provided a buy-on board in-flight meal program. No in-flight entertainment was available initially. It offered services, such as a pre-assigned seat, multiple cancellations and priority check-in, to its passengers who are willing to pay a higher fare. In September 2015, the company announced its tie up with SonyLIV on demand video app for providing its fliers with entertainment options at the airport and in flight.

FUTURE PROSPECT

The airline will be introducing its first international destination, Colombo, with flights connecting to Chennai. Company will be introducing operations in total of 5 international destinations with 12 short- haul flights. London will be the airline's first long-haul destination and will be launched after successful operation of short-haul international flight.

The airline will be expanding its fleet with 4 Boeing 787 Dream liner aircraft to operate on international routes.

CORPORATE AFFAIRS

In November 2018, it entered into talks with an Indian airline over a possible merger which ended in a no deal. According to the airline, it is a planned strategy due to the tough aviation environment in India and to focus on maintaining profitability rather than on capturing market share and increasing the destinations and fleet size. But later contradicting its statement in 2019, it bagged the fifth largest carrier in the country with an 7.9% market share following the announcement about expansion. The airline is headquartered in Delhi, India. Shantanu has served as the Managing Director of the airline since its inception.

HR BUDGET

*The total estimates for the headers with no change will remain constant for next period.

NEWS AND RUMORS

1. A passenger misbehaved with a female flight attendant. And according to the practice, she conveyed the incident to the cockpit and reported to the chief flight attendant. As the flight had already taken-off, the chief decided this to be the first thing to be looked in as they land and for now, they had the passenger flex-cuffed as directed by other pit members. But when this was reported to King Jerry, the company didn't take any actions against the passenger and instead fired the flight attendant after a heated argument. Owing to this, 5% of the female flight attendants resigned and other employees went on strike because of this irresponsibility on part of the company and not following the air rage rules.

2. One of the competitor airlines, Jet airways, is facing a shutdown. And because of this shutdown, a large pool of talented employees is available to King Jerry .These people are in search of job opportunities and are applying at various vacant positions.

3. King Jerry had a technological redesign and now owns various upgrades. One of the upgrades is replacement of traditional baggage system with latest Baggage Handling Mechanism. It has led to tremendous decrease in the requirement of ground staff. Hence the company is planning to transfer few of the excess employees for the new international routes and fire the rest.

· Post- Installation; 1 employee will be laid off for every 5 employees on International Airports whereas, 3 employees will be laid off for every 10 employees at Domestic Airports. Transferring will lead to 4.5% increase in accommodation cost and 9% increase in training cost.

4. Budget 2020 has proposed a monetary limit on the tax-exempt contribution from the employer to NPS account. According to the proposal, employer's contribution to EPF and NPS exceeding more than Rs 7.5 lakh in a financial year will be taxable in the hands of the employee.

Table 1.1 Compensation Sheet

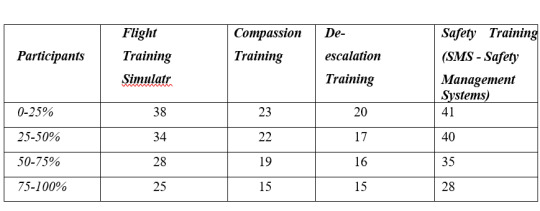

Table 1.2 Types of Trainings

Each training program has a duration of 2-3 weeks in a batch of 15 employees.

*The data is based on various previous surveys and feedback forms.

Table 1.3 Percentage increase in respective training benefits

Note: The participant percentage refers to the number of responses from participants opting for that particular training. For ex, if 25% of the responses from participants opt for flight simulator training then the increase would be 38% for those participants.

Task at hand:

1. Each participant is required to estimate the number of employees to be hired/ fired based on the news and rumors provided, thereon ascertain the total compensation of employees for Oct-Mar. (Reasons for each to be mentioned in the word document) (Refer table 1.1)

2. To strengthen its profile in the overseas market, the company is planning to train its employees. 2 options are to be selected by the company from among the 4 available training options. Determine the cost and update the budget accordingly, maximizing the benefits derived. (Reasons for each to be mentioned in the word document) (Refer table 1.2 and 1.3)

3. Special Hiring decision: There will be a vacancy for a station manager soon. The station manager is the top manager in one of the airline's airport and is responsible for all activities at the airport, from ticketing passengers to handling the fueling and turnaround of an aircraft. The station manager usually supervises one or two ticket desks, two baggage handlers and one or more aircraft servicing people. He/she works from the first flight in the morning until the last flight at night, often a 10-12 hours a day, 5 to 6 days a week, he/she must be good with the public and very passenger oriented. when anything out of ordinary happens. it falls on the station manager to make things right with the passengers. The station with the opening, currently has an all-male crew belonging to majority. The only requirement in the job advertisement is that the application has "related experience in the airline industry". You have passed the list of applicants down to three individuals. whom will you select? (State reasons in word document)

Potential Candidate 1

A middle aged, minority female who was formerly a cabin attendant for an airline that went bankrupt. She received excellent annual evolutions and won award for "Cabin Attendant of the Year". She is bright, eloquent and seems to be highly motivated. She stated that she could learn technical parts of the job quickly (supervision of baggage

handling, fueling, etc.). She is the only applicant with a college degree. One of your staff people stated "If we are going to stay ahead of minority hiring practices, now is the time to start.”

Potential Candidate 2

A middle-aged majority male who was assistant station manager for five years for a large airline who wanted to relocate. He appears to be pleasant and easy going and has good recommendations from his former employer. He could step in and immediately do the job well.

Potential Candidate 3

The young ticket agent at the airport where the opening has occurred. She has been working for the airline for two years and has very good performance evolutions. She worked as a baggage handler a few times when needed but has not done some of the other jobs she would be supervising. The out- going station manager has stated, " I think, in time, she could learn how to be a good station manager. She will make some mistakes, but everybody does. The company should send a strong message to employees that promotion from within is one of our policy.

4. Come up with a separate PPT presentation with strategies that King Jerry airlines can opt for COVID. Divide your strategies into two halves

o -Sustenance and cost cutting strategies during COVID

o -Revival and growth strategies post COVID

5. The top executives of King Jerry Airlines have been publicly been exposed to be harassing airhostesses and female flight-crew in exchange of not firing them or offering promotions. Both the CEO and CMO of the company have had evidence leaked against them for abuse of authority. A case has been filed against them and investigation is being done on King Jerry's hiring ethics. As the PR team of the company, DEFEND your employees and release a statement to regain public trust as well as the trust of female employees.

Submission Date: 20/2/2021

Submission Time: 7:30 Am

In-case of any queries, Contact:

Jay Agrawal – 08197412790

Pushkal Aggarwal - 09911761505

1 note

·

View note

Text

5 Beneficial Services Offered on the EPFO Portal

The Employees' Provident Fund Organisation (EPFO) offers online services to its subscribers through its official portal. In order to avail those services, the subscribers must have a Universal Account Number (UAN) and be registered on the unified portal. EPFO is a social security organisation that encourages employees to save money for their post-retirement life.

Employee Provident Fund (EPF) members can avail the services on the EPFO platform after activating their accounts. To activate the EPF account, one needs a UAN which is given to an employee by an employer. The UAN helps employers effectively manage their PF contributions to an employee’s account. Furthermore, the various member IDs of an employee/EPF subscriber are all clubbed under one UAN in order to keep track of the old and new EPF contributions.

EPFO Portal Services for Employers

Establishments under the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952 with 20 or more employees must register with the EPFO. In order to facilitate compliance by such establishments, the EPFO has offered various online services on its platform. The list of services offered for employers on the EPFO portal includes:

List of exempted establishments

Online registration of establishments

Online ECR/Challan Submission/OCTP

EPFiGMS (Register your grievance)

For principal employers

Pradhan Mantri Rojgar Protsahan Yojana

TRRN query (up to December 2016)

TRRN query search

Establishment search

UAN dashboard

Employers can use the EPFO portal to register their establishments, generate UAN for their employees, make contributions through online payments to their employees’ accounts, file the monthly returns integrated with the contributions and charges, and so on.

EPFO Portal Services for Employees

After UAN activation, the employees can log in to the website to avail the services offered. The list of services offered for employees on the EPFO portal includes:

Member passbook

Member UAN/Online Service (OCS/OTP)

OCS/UMANG-FAQs/Eligibility

Know your claim status

EPFiGMS (Register your Grievance)

Fillable application form for COC

Pensioner's portal

One Employee - One EPF Account

Inoperative A/c helpdesk

Locate an EPFO office

Here are the 5 important and beneficial services that are offered through the EPFO portal to the employees:

View and update PF passbook: EPFO members can view and print their PF passbook on the portal. They can also update and edit their personal details online. They can get details about the monthly EPF contributions, current PF balance and Know Your Customer (KYC) status by SMS or by giving a missed call to 011-22901406.

Check EPF claim status: EPFO members can easily check their EPF claim status on the website by just entering their UAN and captcha.

PF withdrawal and transfer: By linking their UAN with their Aadhaar, employees can partially or fully withdraw their PF balance online through the EPFO portal under certain circumstances. They can also transfer their PF balance from one account to another through the EPFO portal.

e-SEWA: This service is provided to employees who are registered with the EPFO portal. Using this service, one can download the UAN card, update KYC details, view PF passbook and so on.

Inoperative accounts helpdesk: With this online helpdesk, members can track inoperative old EPF accounts. They can also transfer the balance in those accounts to the current account by furnishing their previous employment details. If a member wants to withdraw the balance from an inoperative account, he or she may only receive the interest on the initial contributions made during the first 15 years. No interest is paid post the first 15 years.

Salaried employees who are registered with the EPFO portal and have activated their UAN can carry out various online services with regards to their EPF accounts such as EPF online transfer, view and download PF passbook, link previous member IDs with the present, update the UAN card, update KYC details, auto-transfer request upon job changes, and so on.

0 notes

Text

How To Transfer Your EPF Money Online

Maya and Hari met over dinner last night to celebrate Maya’s new job. She was happy, yet equally anxious about the paperwork which comes along with it. Though she is tech savvy, she abhors paperwork. However, Hari being a HR professional calmed her down.

He showed her a way out.

With technology advancing, transfer of your Employee Providend Fund balance is possible in a paperless manner. The UAN number makes it simple to track your funds even while you move from one organisation to another at any point of time.

Under the ‘One Employee, One EPF account ’ drive, the Unified Account Number (UAN) simplified the whole process.

If you already have an account and your employer has digital signatures of his/her authorised signatories on the EPFO portal, then transferring your EPF sum is very simple.

Hari completed Maya’s EPF procedure by following the 4 simple steps listed below. You, too, can follow these steps and complete the hassle-free transfer procedure:

Step 1: Check Your Eligibility

To transfer your EPF money online from one account to another, you need to first be eligible to do so. You can check your eligibility at the Online Transfer Claim Portal (OTCP) under the category “FOR EMPLOYEES” on the home-page of EPFO website – www.epfindia.gov.in .

If you are eligible for the online transfer, then register as a member on the portal. If you are already a registered member, you can directly log-in into Online Transfer Claim Application. Click on “Request for Transfer of account” to file online Transfer Claim. If not, you need to register yourself on the portal.

You need to be sure either your current employer or previous employer has digital signature. Besides, keep handy the previous and the current employers’ PF details.

Step 2: Fill in the Application Form

Once you’ve followed the above procedure, fill in the application form. This is divided into Part A, B, and C.

Part A consist of filling all your personal details such as name, mobile number, e-mail id, bank account number, and bank’s IFSC Code.

Part B pertains to details of your previous employer. You need to enter your PF account number and go to “click here to get details”. The details regarding your employer will appear. Further, the details such as joining date, date of leaving, father/ spouse’s name will appear. But, if there are any missing details such as date of birth etc., it is mandatory for you to fill in these.

Part C is about your current employee PF account. On entering your PF account number, the employer details will appear, and if some details are missing, you need to enter these.

The important point at this step is to claim attestation. You have an option to either get it attested through the previous employer or present employer. The employer gets the notification via email and on the EPF portal. Your application will be verified by the employer and will be forwarded to the EPFO.

Once your application has been completed, a preview of your form can be seen. In case you require to change any details, look for “TO change application data, click here”.

Step 3: Submit the form

At this step, a Captcha code will appear; type that into the field and click on “GET PIN” button. But before you go ahead, don’t forget to signify your assent by selecting the button, “I Agree”.

Soon, you will receive the PIN on your registered mobile number. Submitting the PIN you’ve received will complete your online application transfer process.

Step 4: Track your transfer status

A tracking ID will be generated once the application is over. With this, you can track your online application. And don’t forget to save the Printable Transfer Claim Form (Form 13) generated on your machine (desktop, laptop, tablet, phablet, smartphone or any other gadget you’re using), take a print-out, sign and send it across to the employer (current or previous) you’ve chosen to complete the claim process.

To Sum-up…

Gone are the days when you would lose your money and there was no proper format to track your EPFtransfer claim. Online transfer claim has simplified the whole process and is hassle free. It takes 30-60 days to complete the claim settlement process and for the transfer to be done. However, please note your employer can view, verify or correct, and submit your details online through this portal.

Read on for: Everything You Wanted To Know About Your EPF

Read on to know: How the EPF Withdrawal Rule May Have Impacted Your Finances

And more about EPF: Now You Would Get Loyalty-Cum-Life Benefit On Your EPF A/c

Also click here to learn: How To Manage Your Personal Finances When Laid-Off

You can also access Personalfn EPF calculator here.

This post on " How To Transfer Your EPF Money Online " appeared first on "PersonalFN"

0 notes

Text

How to Transfer PF from One Employer to Another #SLNConsultancy #SLNPFConsultancy #SLNESIConsultancy #SLNPFESIConsultancy #PFConsultancyHyderabad #PFConsultancyNearMe

Transferring your Provident Fund (PF) when you switch jobs is essential to ensure the continuity of your retirement savings. The process is straightforward, thanks to the Universal Account Number (UAN) system introduced by the Employees’ Provident Fund

Organisation (EPFO). Here’s a step-by-step guide on how to transfer your PF from one employer to another.

Step 1: Activate and Update Your UAN Your UAN, which is unique and remains the same throughout your career, plays a crucial role in the PF transfer process. Follow these steps to activate and update your UAN: Visit the UAN Member Portal: UAN Member Portal. Click on ‘Activate UAN’: Enter your UAN, Member ID, Aadhaar, PAN, and other required details. Update Your KYC Details: Ensure your KYC (Know Your Customer) details, such as Aadhaar, PAN, and bank account information, are correct and verified.

Step 2: Check Eligibility for PF Transfer Before initiating the transfer, make sure you meet the eligibility criteria: You must have an active UAN. Your previous and current employers should have digitally registered authorized signatories. Your UAN must be linked with your Aadhaar and other KYC details.

Step 3: Log in to the UAN Portal Go to the UAN Member Portal: UAN Member Portal. Log in Using Your UAN and Password.

Step 4: Initiate the PF Transfer Request Go to the ‘Online Services’ Tab: Select ‘One Member – One EPF Account (Transfer Request)’. Verify Personal Information: Ensure that your personal details, including the PF account numbers of both previous and current employers, are correct. Choose the Employer to Attest the Claim: You can choose either your previous or current employer to attest the transfer request. Enter Your UAN or Previous Member ID: Fill in the required details and click on ‘Get Details’. Verify the PF Account Details: Check the details of both your previous and current PF accounts. Click on ‘Get OTP’: An OTP will be sent to your registered mobile number. Enter the OTP and submit the request.

Step 5: Submit Form 13 After submitting the online transfer request, you need to download Form 13. This form must be signed by you and submitted to your chosen employer (either previous or current) for attestation. The employer will then forward it to the EPFO.

Step 6: Track Your Transfer Status You can track the status of your PF transfer request online through the UAN Member Portal. Here’s how: Log in to the UAN Member Portal. Go to ‘Online Services’: Select ‘Track Claim Status’.

Step 7: Confirmation of Transfer Once the transfer is complete, you will receive a confirmation message on your registered mobile number. The transferred amount will reflect in your new PF account under your current employer.

Additional Tips Ensure Your KYC Details Are Up-to-date: Any discrepancies can delay the transfer process. Keep a Record of All Communications: Save emails, messages, and copies of forms submitted. Consult Your HR Department: If you face any issues or have questions, your HR department can provide assistance.

Conclusion Transferring your PF from one employer to another is a crucial step in maintaining the continuity of your retirement savings. By following these steps and ensuring that your UAN and KYC details are up-to-date, you can make the process smooth and hassle-free. Regularly tracking your transfer status and keeping your records organized will help avoid any complications.

0 notes

Text

How to get your account details at the uan activation status

Many people possess challenges using their finances. This is really a global problem. Both the created and the developing worlds are confronted with this challenge. Another part of this is the fact that people could have a chance to reside a fairly great life whilst working, but things change tremendously after retirement.

Because of this financial problems, there have been a number of programs started by both the government and diverse individuals to aid people overcome their financial crises. Particularly after pension. Some of these applications involve investment, such that you will see a real worth of money for those people at the end of their own service many years.

There are some additional plans which involve direct conserving of a area of their wage. This way, the amount of money is subtracted in parts every months as the wages are compensated. So, at the conclusion of a good number of a long time before retirement living, they may have something substantial to keep life with.

There are times where employers of labor need to change between professions as well as the previous business will not be able to cover the money or that will have challenges backlinking the company accounts that he runs. This is also one reason for the development of the new uan registration.

Unique Consideration Number (UAN) is an extremely unique account that is made to help staff have their provident consideration without problems. With this, they can very easily switch between jobs or work for different organizations at once with no problem of fund transfer and bland account issues.

Before now, the worker Provident Fund Firm is set to aid all workers manage their PF. And anytime an employee adjustments a job, he'll have to modify his/her EPF number additionally. You know that this kind of official and financial paperwork are uneasy to get carried out. It involves a lot of paperwork and it has thus already been discouraging for most people.

It is one of the though levels of changing employment, which must be done. It will always be associated with a lot of headache as the employee will need to reach the previous employer. After that, there will be a desire to move the previous fund to the current account.

This is why the particular Universal Account Number will be initiated. This is actually the new UAN. It really is designed to switch the old unique account, that can have to change and change. Because the epf balance uanremains unchanged all through life. Workers no longer have to fear concerning the hassles of fixing a job as the account doesn’t change.

When a staff member gets away from an organization as well as joins a replacement, the consideration still continues. The consideration number includes a special Twelve digits that's issued as well as assigned to a certain employee, from EPFO India. The EPFO UAN number may also serve as a name of the staff till his/her pension.

visit here to get more information about epf balance uan.

0 notes

Text

Provident Fund – Universal Account Number

Universal account number or UAN is a unique number given to every member of Employees Provident Fund. This 12 digit number links various EPF members ID. The UAN does not change in lifetime. You can change many jobs, but this number will be with you. This number does not replace PF number. Rather, it is an additional number. Every employee gets the universal account number. Currently unemployed can also get the UAN. Even a student can also get UAN upfront before joining the employment. Within six months EPFO has successfully allotted the UAN to all the current employees. Now it has given this facility to the trust PF members and unemployed PF members. I recommend that you should get your UAN number as soon as possible.

Fortunately, for the UAN you don’t need the employer. If your employer didn’t tell you the universal account number, you can get UAN online. EPFO is trying hard to establish direct connection with employee and reduce the role of employer. You must be aware of the high handedness of many employers, because of the PF key

Features of Universal Account Number

• An employee will get only one universal account number

• You will have same UAN in different jobs within the country

• Change jobs as much as you want, the EPF will follow you

• This number would be attached to your identity

• The KYC documents are used for authentication of the universal account number

• The EPFO portal issues the UAN. The Employers tell UAN to the employees

THE FOLLOWING DOCUMENTS ARE ACCEPTED AS KYC DOCUMENTS:

• Bank Account Number

• Driving License

• Election Card

• Passport

• Ration Card

• ESIC Card

How to activate EPFO UAN?

You can access your UAN by visiting the UAN Member Portal Website. First you need to activate your UAN by clicking on the link called” Activate your UAN” on the portal. You should keep his/her Member ID, Mobile number and UAN ready while trying to log-in. You will receive your UAN from your employer. You need to follow the steps listed to activate your UAN.

• Visit the link: http://uanmembers.epfoservices.in/uan_reg_form.php

• Enter your mobile number, UAN and EPF account details.

• EPFO will send an authorization PIN to your mobile number, once you enter the aforesaid details.

• Submit the PIN received in your mobile and activate UAN.

• Generate your login ID and password to complete the registration process.

10 Benefits of Universal Account Number (UAN) To the Employee

• You can link all of your previous PF account at one place

• EPF Transfer has become very easy. It can be done automatically

• EPF balance from all of the account gets transferred automatically

• You can easily take loan from the PF account. The process would be online soon

• You will get monthly SMS update of PF contribution

• You can easily check and download your PF passbook any time

• Employer cannot blackmail you because of the EPF. He would not be able to withhold the PF of an employee

• If you link your Adhaar with UAN, you can withdraw PF without employer’s signature.

• You can update your personal details online

• You will get to know whether your company is depositing PF on time or not as both mobile alerts and online checking facilities are available

You need to submit the following documents to link the member ID of a new organization to UAN:

• Any KYC document.

• Bank account details including Bank Account Number, IFSC Code and Branch Name.

• Last working day of the previous company.

• UAN provided by the previous organization.

In case an employee does not have an UAN, then she/has to submit the following documents:

• Bank Account Number.

• IFSC Code.

• Branch Name.

• Last working day of the previous company.

• PF Account number of the previous organization.

How EPFO Issue Universal Account Number (UAN)?

Steps for Existing Employee

• EPFO itself has allotted the universal account number of all the contributing members.

• Employers download these universal account numbers of it employees.

• EPFO has directed the employer to tell the new universal account number to every employee.

• Further employer would upload KYC details of the employee.

• An employee can also upload his KYC. Then employer needs to verify it.

Steps for New Employee

• The employer submits the first PF contribution of new employees.

• These new members without UAN will be intimated to the employer through the OTCP (Online transfer claim portal).

• The employer has to fill the details of these new employees in the OTCP. The employer would also fill UAN of the employee, if she has any.

• If the employee doesn’t have UAN previously, then the employer can generate the new UAN for him through the portal.

• If the employee has the UAN, then the employer has to verify it from the previous employment. The new employer can view the details of previous employment through the OTCP using UAN. After verification of personal detail the employer approves existing UAN for the employee.

• In the next step employer uploads the copy of KYC documents.

Know UAN at The EPFO Portal

Initially EPFO has entrusted employers to distribute the UAN to its employee. But, for some obvious reasons, most of the employers did not disclose UAN to its employees. Therefore, despite allotting UAN to 5 crore employees, only few lakhs people registered at UAN portal. While, UAN portal gives you the direct link to your PF account.

Now, EPFO gives you the facility to know your UAN online. Once you get the UAN, Activate it online. After the activation, you must upload KYC documents. This will be very beneficial in future.

What About Old PF account?

There are more than 6 crore inoperative PF accounts. Rs 26,000 Crore is lying in these accounts. The UAN will also solve this problem. At the UAN portal you can easily link your previous PF accounts. If you KYC details matches with the old PF accounts, the linking will complete within a month.

However, if you don’t have PF account number or your old company is shut now, even in this situation you can track your old PF account and link it to the UAN. PF department has actively started to identify the inoperative accounts. It has made an online page to trace the old inoperative account. If you are in such situation, use this EPFO Inoperative Account Help Desk an do share your experience with Plan money tax.

If for any reason you are not able to link your previous account with UAN, you can use old online process of PF transfer.

Convenience of New UAN Member Portal

EPFO has also introduced a new portal for members based on UAN. You should register in this portal. The registration in this portal will give you greater convenience about all EPF matters. It is like the key in your hand.

Facilities at UAN Member Portal:

• You can check your UAN allottment status

• You don’t need to check the PF balance through SMS. You can download/print your EPF passbook anytime

• You can download/print your UAN card

• You can link all your previous PF accounts with UAN. The name should be same

• You can file PF transfer or withdrawal claim online

• You can view the status of PF claim online

• You can update your KYC

Attend HRM is an payroll software which can do all of the above and much more for you. If you haven’t downloaded Attend HRM yet, Download Now!

Lenvica supplies comprehensive Human Resource Software Solutions for complete HR Management. With years of experience specializing in development of HR software, the Lenvica software portfolio include Attendance Software, Payroll Software, Leave Management, Shift Management, Project Management solutions, developed to solve complex HR software needs of small to large organizations.

0 notes

Text

Online vs. Offline PF Transfer: Pros and Cons

SLNConsultancy #SLNPFConsultancy #SLNESIConsultancy #SLNPFESIConsultancy #PFConsultancyHyderabad #PFConsultancyNearMe

Transferring your Provident Fund (PF) when you change jobs is a crucial task to ensure the continuity of your retirement savings. With advancements in technology, the Employees’ Provident Fund Organisation (EPFO) offers both online and offline methods for transferring PF. Each method has its advantages and disadvantages. Here’s a comprehensive comparison to help you decide which method suits you best.

Online PF Transfer

Pros

Convenience: The online process allows you to transfer your PF from the comfort of your home or office, eliminating the need to visit EPFO offices.

Speed: Online transfers are typically faster, often completing within a few weeks.

Real-Time Tracking: You can track the status of your transfer request in real-time through the EPFO portal.

Paperless Process: The online method reduces paperwork, making it an environmentally friendly option.

Reduced Errors: Online submissions reduce the chances of errors that can occur in manual paperwork, as the system validates data entries.

Cons

Technical Issues: The process can be hampered by website downtimes or technical glitches, which may delay the transfer.

KYC Requirements: Your KYC details (Aadhaar, PAN, and bank account information) must be up-to-date and verified for the online process to work smoothly.

Digital Literacy: Users need a basic level of digital literacy and access to the internet, which may not be available to everyone.

Offline PF Transfer

Pros

Personal Interaction: You have the opportunity to interact directly with EPFO officials or your employer’s HR department, which can be helpful if you need guidance.

No Digital Requirements: The offline process does not require internet access or digital literacy, making it accessible to everyone.

Flexibility in Documentation: If there are issues with your KYC documents or if they are not updated, you can still proceed with the offline process by submitting physical documents.

Cons

Time-Consuming: Offline transfers typically take longer to process, often several months, due to manual handling and paperwork.

Multiple Visits: You may need to make several visits to your employer’s office or EPFO office to submit forms and follow up on the transfer status.

Higher Chances of Errors: Manual handling of forms can lead to errors, such as incorrect data entry or lost paperwork.

Tracking Difficulties: Tracking the status of your transfer is more challenging and may require repeated follow-ups with the concerned authorities.

Detailed Steps for Each Method

Online PF Transfer

Activate UAN: Ensure your Universal Account Number (UAN) is activated and linked with your Aadhaar, PAN, and bank account.

Log in to the UAN Portal: Visit the UAN Member Portal and log in using your UAN and password.

Initiate Transfer: Go to ‘Online Services’ > ‘One Member – One EPF Account (Transfer Request)’. Verify details, choose the employer to attest the claim, and submit the request.

Submit Form 13: Download and sign Form 13, then submit it to your employer for attestation if required.

Track Status: Monitor the status of your transfer request through the UAN Member Portal.

Offline PF Transfer

Obtain Form 13: Collect Form 13 from your employer or download it from the EPFO website.

Fill and Submit Form 13: Complete the form with details of your previous and current PF accounts. Submit the signed form to your current employer.

Employer Attestation: Your current employer will attest the form and forward it to the EPFO office.

Follow Up: Regularly follow up with your employer and EPFO office to check the status of your transfer request.

Confirmation: Once the transfer is complete, confirm that the amount has been credited to your new PF account.

Conclusion

Both online and offline methods for PF transfer have their own sets of advantages and disadvantages. The online process is more convenient, faster, and environmentally friendly, but it requires up-to-date KYC details and basic digital literacy. The offline process, while more accessible to those without internet access, is time-consuming and involves more paperwork and follow-ups.

Choosing the right method depends on your specific circumstances, such as your comfort level with digital tools, the accuracy of your KYC details, and the urgency of the transfer. Regardless of the method you choose, ensuring the continuity of your PF savings is a crucial step in securing your financial future.

0 notes

Text

What Is The Contribution For Provident Fund Both By The Employer & Employee?

EPF has been one of the prestigious and most sought after investments in India. Under the provident fund scheme, an employee at a government or private organization can create wealth through your working years in a company. The amount you receive earns interest regularly. This amount can be used to fund a part of post-retirement life plans and goals.

This could be owning a home or having a dream holiday. It is known that both the employer and the employee contribute to the provident fund. But how much each of them pays remains a question in our minds. So in this article, you will find detailed information on: What is the Contribution for Provident Fund both by the Employer & Employee?

EPF Contributions By The Employer & Employee

If your company has an employee strength of more than 20. Then, You and your employer are required to contribute12% of your basic pay salary into your EPF account monthly. If you are a women employee then you need to transfer only 8% of the basic pay.

But his happens only for the first 3 years of your service. In either of the case, your employer would continue to add 12% of the basic in your account. Furthermore, an organization with less than 20 employees or an establishment being a sick one( financially), then the EPF interest rate stands to be 10℅ for both you and your employer.

Moreover, a person is free to pay above 12℅ as a contribution to the PF. This is solely the decision of the employee. Yet the employee can’t exceed the 20% mark. But the employer contribution is always 12%. This implies employees can contribute above 12% but the employer doesn’t match your contribution.

Interest calculations On EPF Account

According to the current 2020-2021 budget, the interest rate stands to be 8.50% on your PF account. This interest rate is quite better as compared to other investment schemes. At the time of retirement or 2 months after changing the job, then you can apply to avail of the entire EPF capital. This can be availed into your bank account or EPF account of your successor company.

The interest is calculated on yearly basis. Although your contribution made is on monthly basis. At the beginning of a new financial year, the interest is calculated on past balance. This follows as opening balance (previous years) + total monthly contribution ( current year) + interest on the total( old opening balance and contribution).

Tax Benefits On PF Account

EPF provides a huge amount if you would as an employee for a period of time. Including a good interest, the EPF earnings are tax-free too. This has been amended under the section-80C. But you need to remember The amount remains to be tax-free if withdrawn only after 5 years of contribution. So if your service years are less than 5 years, then you would have to pay a tax on it.

Employer’s Contribution Sub-Division In EPF Account

But a word of caution, the 12% that your employer contributes in the EPF account doesn’t come fully to your account. Only a part of it is added to your actual EPF account. With this we should further look into sub-division of the basic EPF rate that the employer pays:

Firstly, comes in the Employee’s Provident Fund (EPF) that account to 3.67% out of the 12% that your employer pays

Next is the Employee’s Pension Scheme (EPS) which is 8.33% of the basic pay.

Employee’s Deposit Link Insurance Scheme (EDLIS) stands to .50% of the basic salary

EPF Administration charges 1%

Lastly, comes in EDLIS Administration charges which account for 0.01%

Recent Amendments On EPF Account Contribution

However, due to the COVID -19 pandemic, Employers can choose to pay only 10% of basic in their EPF account. But, the condition is only applicable for the months of May, June and July 2020. But it is their choice they can also continue to pay 12%.

Moreover, as per the employer is concerned the company can also choose anyone between 10% and 12%. A decrease in the EPF percentage contribution from either side or both would increase the in-hand pay. But the differential increase would be a taxable pay. For instance,

i. You and your employer both contribute 10% to the EPF

Let’s say that you opted to contribute 10% of the basic in your EPF account.If your employer does the same, then this would create a differential factor of 4% of the basic pay. This 4% will be awarded as take-home salary per month but it would be taxable.

b. You contribute 10% to the PF scheme whereas the employer plays 12% of the basic pay or vice-versa.

If you have a contribution of 12% to your EPF account. And your employer contributes 10% to the EPF account or vice-versa. Then a differential factor of 2% is created. This would be given as an in-hand salary. But remember this increase in-hand salary is taxable.

c. Both employer and the employee continue to contribute 12%.

This implies that there will be no change in the contribution. Hence, there is no increase in the in-hand salary. Yet, it would be better as contribution remains intact. And the interest amount earned would be higher. This interest earned would also be tax-free.

Contribution Calculation With An Example:

Let us see this calculation with an example:

Let say you have a basic pay of Rs.30,000 in your salary slip. Now let us see the division of the EPF contributions in detail:

Your contribution to EPF

If you provide12% of your basic pay it would be about 3600 Rs that you will add to your EPF account.

If you obliged to pay 10% then it would make up 3000Rs

Furthermore, if you are a female within the above-mentioned tenure of your service then it would be about 2400 Rs.

Your employer’s contribution:

Considering the employer provides 12% to you.

In accordance with the first, the employer contribution that is 3.67% would add 1101 Rs to your EPF account per month.

Then comes in the EPS cut that is 8.33% which would make 2499 Rs in total. However, For EPS the highest amount on which it is to be calculated can’t exceed 15000. Therefore, your employer can only contribute 1249.5 Rs to the EPS. Don’t worry the extra that is (2499-1249.5=)

5 Rs is then added to your EPF account.

The rest of the sub-division amount is awarded to the EPF service. You don’t receive any amount from it to your EPF

So, the total contribution to your EPF account per month comes out to be :

If your contribution is 12 % then (3600+1101+1249.5)=5950.5 Rs

If your contribution is 10 % then (3000+1101+1249.5)=5350.5 Rs

If your contribution is 8% then (2400+1101+1249.5)=4750.5 Rs

How Can You Check On The Contributions?

You can check the EPF account status and the percentage contribution. You check it by signing in to your EPFO member portal.

EPF is an employee provident fund for the salaried employee overseen by EPFO. They are widely considered as a retirement benefits scheme. It is used to be the employees to save a part of their salary. They are used by employees when they are unable to work in later stages of life. It churns a portion of your in-hand salary

Bottom Line:

EPF scheme is great for retirement funds. But after the article, you might think that the major of the contribution is yours. Also, this contribution reduces the in-hand salary that you have. But should remember EPF can be a great help to fulfill family responsibilities. And they are one of the safest and secure investments. They are definitely worth investigating. Nevertheless, the employer also pays a good amount to the EPF account of yours. And it’s well said, every penny worth’s counting.

source http://invested.in/contribution-for-provident-fund-both-by-employer-employee/

source https://investedindia.wordpress.com/2020/09/29/what-is-the-contribution-for-provident-fund-both-by-the-employer-employee/

0 notes