#Types of DEPINS

Explore tagged Tumblr posts

Text

Decentralized Physical Infrastructure (DePIN) Explained

DePINs are transforming the way we build and manage infrastructure by leveraging blockchain technology. These networks ensure resilience, transparency, and security by decentralizing control and integrating blockchain-based systems.

Key components of DePINs include off-chain networks, token incentives, blockchain architecture, and physical infrastructure networks. These elements work together to facilitate secure and transparent transactions and automate agreements through smart contracts. However, DePINs face challenges like scalability, regulatory uncertainty, and environmental concerns. The DePIN Flywheel concept demonstrates how tokenization fosters network growth, creating a self-reinforcing cycle of development and innovation.

This innovative model enables seamless collaboration among various devices without relying on a central authority, thereby democratizing access to essential infrastructure resources.

DePINs operate through several key components, including off-chain networks, token incentives, blockchain architecture, and physical infrastructure networks. These elements work together to facilitate secure transactions, automate processes with smart contracts, and tokenize physical assets. This integration not only optimizes resource management but also fosters a more inclusive and participatory infrastructure ecosystem, empowering communities and individuals alike.

The future of infrastructure lies in the convergence of digital and physical elements, with DePINs leading the way. Intelisync offers tailored blockchain development solutions to help startups and small businesses embrace decentralized infrastructure. Connect with Intelisync today to explore the Learn more....

#Dapp Development Company#Decentralized Physical Infrastructure#Networks DePIN#How do DePINs work in Crypto?#How Does DePIN Make Use of Blockchain Technology#Key features of Decentralized physical infrastructure network#Major Challenges of DePIN#Off-Chain Network#Physical Infrastructure Network#Physical Resource Networks (PRNs)#Pros of DePINs#The components of Decentralised Physical Infrastructure Networks (DePINs)#Types of DEPINS#Use of Blockchain Technology#What are DePINs in Crypto?#What does DePIN mean?#What Is The DePIN Flywheel?#Intelisync Blockchain Development company

0 notes

Text

Tariff Halving Boosts DEX Volume to $82.3B; XBIT Exchange Thwarts 3 Flash Loan Attacks

Hardware Tariff Relaxation Ignites Compute Power Market On April 11, U.S. Customs and Border Protection (CBP) officially implemented Tariff Adjustment Order No. 8917, reducing import tariffs on 16 categories of products, including Chinese-manufactured mining chips and encrypted hardware wallets, from 125% to 25%. This policy caused the futures price of Bitmain Antminer S25pro to drop by 34% in a single day. Major North American mining operators immediately announced an additional purchase order of $1.2 billion. On-chain data revealed that within 72 hours of the tariff adjustment, transaction volume on the decentralized compute power leasing protocol HashFlow surged by 580%, pushing its governance token HFT into the top 30 crypto assets by market value. DEX Ecosystem Shows Technological Differentiation as Capital Hedging Increases Amid geopolitical risks, DEX platforms experienced a net outflow of $4.7 billion in April, marking the highest level since the FTX incident in 2022. Despite this, Uniswap V4 recorded daily trading volumes exceeding $5.8 billion, with its newly launched TWAMM block trading function attracting over 32,000 institutional accounts. Notably, the XBIT decentralized exchange platform successfully intercepted three flash loan attacks this month using its military-grade security architecture, including a multi-signature cold wallet system and real-time AI risk monitoring modules. Its native token XBT surged 83% during the week, ranking first among decentralized platform tokens. On-chain data for Q1 2025 showed that DEX trading volumes based on ZK-Rollup technology increased by 327% year-on-year, while the market share of traditional AMM protocols fell to 41%. The latest "Lightning Clearing Engine" technology compresses transaction confirmation time to 0.8 seconds and supports a maximum transaction throughput of 34,000 transactions per second. The liquidity aggregation protocol of the XBIT Exchange decentralized platform is now connected to 32 public chains, offering the industry’s lowest slippage rate of 0.15%. DeFi Enters Era of Hardcore Innovation The U.S. Department of Commerce’s Executive Order No. 2025-04 included 12 types of blockchain infrastructure core components, such as high-end GPUs for AI training and quantum-resistant encryption chips, in the tariff exemption list. This policy directly targeted NVIDIA H200 Tensor Core GPUs and Canaan Technology A14 series mining chips manufactured in China. Within 72 hours of its implementation, Amazon Web Services (AWS) bulk purchase orders surged by $2.3 billion, pushing the total locked value (TVL) of the decentralized compute power market DePIN protocol to over $9.3 billion. The global pre-order volume of the XKey Pro hardware wallet, co-developed with the XBIT Exchange platform, exceeded 500,000 units. With the U.S. SEC approving the issuance of the first DEX security token, DEX platforms are transitioning from marginal innovation to becoming core components of financial infrastructure.

0 notes

Text

Hey, welcome back to the crypto world! A lot has happened since you’ve been away, and the market has evolved with new types of projects and ideas. I’ll break it down for you like you’re starting fresh, focusing on the main groups or "markets" of crypto—like DeFi, DePIN, and others—and give you an update on what’s going on as of April 7, 2025. Think of this as a quick tour of the crypto playground!

---

### 1. DeFi (Decentralized Finance)

**What It Is**: Imagine a bank, but instead of a big building with tellers, it’s all run by computer code on a blockchain (like Ethereum). DeFi lets people lend, borrow, trade, or earn interest on their crypto without needing a bank or middleman. It’s like a DIY financial system!

- **How It Works**: You use "smart contracts" (self-running programs) to do things like swap tokens (e.g., trading Bitcoin for something else), lend your crypto to earn interest, or borrow by locking up some crypto as collateral.

- **Big Names**: Uniswap (a trading platform), Aave (for lending/borrowing), and MakerDAO (creates a stablecoin called DAI).

- **What’s New in 2025**: DeFi is still huge! It’s grown up a bit—more stable and user-friendly now. People are using "Layer 2" solutions (like side roads off the main Ethereum highway) to make transactions cheaper and faster. Total value locked in DeFi (the money parked in these projects) is climbing again after a dip in 2022-2023. There’s also talk of "DeFi 2.0," where projects are mixing real-world stuff (like loans for houses) with crypto.

**Why It Matters**: It’s all about cutting out the middleman and giving you control. But it’s risky—hacks and scams still happen if the code isn’t perfect.

---

### 2. DePIN (Decentralized Physical Infrastructure Networks)

**What It Is**: This is newer and super cool! DePIN uses crypto to build and run real-world stuff—like Wi-Fi networks, energy grids, or storage systems—without big companies in charge. People chip in their own hardware (like a router or solar panel) and get paid in tokens.

- **How It Works**: Think of it like a neighborhood sharing game. You set up a Wi-Fi hotspot at home, join a DePIN project, and earn tokens when others use your signal. Blockchain keeps it fair and tracks everything.

- **Big Names**: Helium (decentralized Wi-Fi and 5G), Filecoin (storage space for files), and Render (sharing computing power for graphics or AI).

- **What’s New in 2025**: DePIN is HOT right now! It’s growing fast because it ties crypto to things you can touch and see. Helium’s network is expanding for IoT (Internet of Things) devices, and projects like Arkreen are letting people trade solar energy. Posts on X say the ecosystem is “on fire” with new projects popping up.

**Why It Matters**: It’s a way to make crypto useful beyond just trading coins. Plus, it’s eco-friendly in some cases—like encouraging renewable energy.

---

### 3. NFTs (Non-Fungible Tokens)

**What It Is**: NFTs are like digital collector cards—unique items you own on the blockchain. They can be art, music, game items, or even virtual land.

- **How It Works**: You buy an NFT with crypto (usually Ethereum), and it’s yours forever (or until you sell it). It’s stored on the blockchain, so no one can fake it.

- **Big Names**: Bored Ape Yacht Club (fancy monkey pics), CryptoPunks, and games like Axie Infinity.

- **What’s New in 2025**: NFTs boomed in 2021, crashed a bit, and now they’re finding their footing. They’re less about crazy art prices and more about practical uses—like tickets to events, proof of ownership for real stuff (e.g., a house deed), or in-game items. The hype’s calmer, but the tech is sticking around.

**Why It Matters**: It’s about owning digital stuff in a world that’s increasingly online. Still, some call it a fad—depends on who you ask!

---

### 4. Web3

**What It Is**: Web3 is the big dream of a decentralized internet. Instead of Google or Facebook owning your data, you control it using blockchain. It’s tied to crypto because tokens power these systems.

- **How It Works**: Think of apps where you log in with a crypto wallet (like MetaMask) instead of a password. You might earn tokens for using it or sharing content.

- **Big Names**: Ethereum (the backbone), IPFS (decentralized file storage), and projects like Mastodon (a decentralized Twitter alternative).

- **What’s New in 2025**: Web3 is still more vision than reality, but it’s picking up steam. People are building social networks, games, and tools that don’t rely on big tech. Posts on X call it a “narrative trend” alongside DeFi and NFTs.

**Why It Matters**: It’s about taking power back from tech giants. But it’s slow going—most people still prefer the ease of regular apps.

---

### 5. Other Hot Crypto Types

- **Stablecoins**: Coins like USDT or USDC that stay steady (pegged to $1). They’re huge for trading and DeFi because they’re less wild than Bitcoin.

- **Layer 1s & 2s**: Blockchains like Solana, Avalanche (Layer 1s), or Polygon and Arbitrum (Layer 2s on Ethereum) compete to be the fastest and cheapest. Solana’s hosting a lot of DePIN projects now!

- **AI Crypto**: Tokens tied to artificial intelligence—like Fetch.ai or Render—are booming as AI grows. They help run AI models or crunch data.

- **RWAs (Real-World Assets)**: Crypto tied to physical things (e.g., tokenized gold or real estate). It’s blending traditional finance with blockchain.

- **Gaming/Metaverse**: Games like The Sandbox or Decentraland use crypto for virtual economies. It’s quieter now but still alive.

---

### What’s Going On Now (April 2025)?

- **Market Mood**: Crypto’s in a growth phase again. Bitcoin hit new highs late last year, and altcoins (everything else) are catching up. People are excited but cautious—crashes like 2022 taught lessons.

- **Trends**: DePIN and AI crypto are the shiny new toys. DeFi’s still a giant, but it’s maturing. NFTs and Web3 are simmering, not boiling. Posts on X mention “new narratives” like “restaking” (reusing staked crypto for more rewards) and “zk apps” (privacy-focused tech).

- **Big Picture**: More real-world use cases are popping up. Governments are watching closer—some regulating, others experimenting with their own digital currencies.

---

### Quick Catch-Up Tips

- **Start Simple**: Play with a DeFi app like Uniswap or check out Helium’s DePIN map online to see it in action.

- **Watch the Leaders**: Bitcoin and Ethereum still rule. If they move, the market follows.

- **Risk Alert**: It’s still a rollercoaster—prices swing, scams lurk, and tech can break. Only use what you’re okay losing.

You’ve been out for years, but the basics haven’t changed much: it’s still about decentralization and freedom, just with fancier tools now. What do you think—want to dive deeper into any of these?

1 note

·

View note

Text

What are Decentralized Physical Infrastructure Networks (DePIN)?

DePIN, which stands for 'Decentralized Physical Infrastructure Networks', describes networks that connect physical hardware devices. To allow them to operate in a decentralized manner, they are backed by cryptocurrency-based rewards.

DePIN (also known as Token-Incentivized Physical Infrastructure Networks (TIPIN) , Proof of Physical Work (PoPW), or EdgeFi ) is an important step for cryptocurrency-based technologies to connect digital and physical spaces. Some argue that it has the potential to further cement cryptocurrencies as vital resources beyond the financial and transactional use cases of their early years, ultimately driving the development of Web3.

At their core, DePIN development company projects attempt to create democratized technologies to compete with or replace centralized technology offerings. Those who provide the necessary hardware and thus constitute the network contribute to both the adoption and decentralization of the service and are typically rewarded with cryptocurrency for their services.

The most popular and earliest example of a DePIN is Helium, which launched a decentralized wireless network (DeWi) in 2019, backed by individuals operating interconnected hardware devices around the world. Others have followed suit and built various infrastructure solutions to support 5G cellular networks, connect cars, and even collect air quality data.

How does DePIN work?

DePIN is based on the basic idea of the Internet of Things (IoT) which enables the automation of processes by connecting multiple physical objects ('things'). Examples of IoT include the automation of smart home technology, traffic management by connecting vehicles, and improving healthcare through wearable sensors.

To function properly, DePIN networks generally require:

Hardware – Physical components that help connect networks to the physical world. For example, access points can be used for wireless networking, and extra hard drive space can be used for storage networking.

Hardware Operators – Users who purchase (or lend) hardware and are connected to their respective networks.

Token – A project-specific cryptocurrency that is paid to hardware operators for their services. Each token comes with different economic characteristics based on the rules set by the project.

End Users – Users of the infrastructure powered by the network hardware. For example, end users could be those who prefer to rely on a DePIN project rather than a corporation for their WiFi signal and pay to receive the service provided by the network.

Helium: DePIN in action

Helium was one of DePIN’s pioneering projects. Its original goal was to create a type of low-power wide-area network (LoRaWAN) for IoT devices to connect to each other. As a unique service at the time, it has enjoyed first-mover advantage in the space, attracting partnerships with projects aimed at tracking weather, monitoring air quality, and incorporating GPS.

Users who wish to maintain Helium nodes can purchase (or build) hardware called access points that can plug into and join the network and provide internet to that geographic area. In return, the access points collect the Helium token, HNT.

Meanwhile, anyone who wants to use the networks created by the connected hardware (e.g. to run their IoT devices or browse the web) buys data credits (DCs) in exchange for burning HNT. This burning and minting balance (BME) controls the monetary policy of HNT.

Other examples of DePIN

Although the DePIN ecosystem is still being explored, there are a couple of projects that have made significant progress.

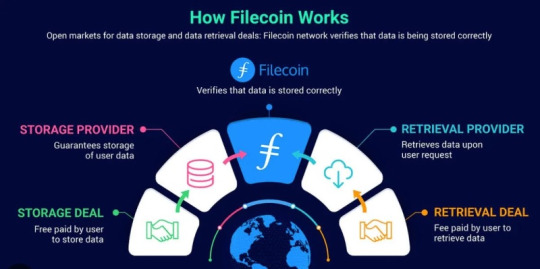

Filecoin

Launched in 2020, Filecoin offers cloud storage services similar to Web giants like Google Cloud and Amazon Web Services. However, instead of being controlled by centralized providers, Filecoin offers a distributed storage solution secured by crypto-economic incentives.

Filecoin connects those who need space to store data with users who have free space on their hard drives. Users who provide storage space are paid with the FIL token.

DIMO

Based on the idea that your information can be useful for many purposes, DIMO offers the possibility for users to monetize their own vehicle and driving data.

Downloading the DIMO app allows users to selectively share information about their cars (such as battery health, trip information, etc.) and be rewarded with the Ethereum- based DIMO token. Services such as used car marketplaces and ride-sharing apps can purchase access to this data to improve their operation.

Hivemapper

Hivemapper aims to provide decentralized real-world mapping by using dashcams to replicate the services provided by Google Street View.

After purchasing a Hivemapper dashcam and installing it in their car, users drive around (during daylight hours) and generate visual data associated with GPS geolocation that can be uploaded to the network. Users are rewarded with the Solana -based HONEY token . Those who wish to use the map can purchase map credits that correlate to distances/areas that have been recorded by the network of users.

DePIN Essentials

DePIN refers to interconnected real-world devices that provide digital services in a decentralized manner.

Cryptocurrency tokens are used by DePIN development projects to incentivize and reward those who use and/or maintain the hardware that powers the networks.

Helium pioneered DePIN, offering decentralized networks for Internet of Things (IoT) devices and 5G cellular data, but other uses for DePIN include cloud storage, geo-mapping, data sharing, and more.

0 notes

Text

Understanding the Importance of Crypto Token Standards in DePIN Projects

Introduction:

Over the past decade, the evolution of blockchain technology has ceased to be only about cryptocurrencies and has started to venture into areas where decentralization can present new opportunities. One such new area is DePIN development services (Decentralized Physical Infrastructure Networks) which is a model combining blockchain technology and tangible infrastructure for the purpose of decentralizing management and possession. At the heart of the viability of the DePIN networks as developed by these projects is crypto — token creation, which has its foundations in the token standards. The growth of DePINs is made possible by different token ecosystems, which are made secure, interoperable, and functional because of these standards.

What Are Token Standards?

The term token standards refers to a set of rules that developers follow in designing and issuing tokens on a blockchain. These regulations govern the nature of tokens and their behavior and interaction with the other platforms and applications. The most common token standards are those constructed on the Ethereum platform; ERC20, ERC721, and ERC1155. Each has its own function:

ERC-20: For all types of fungible tokens such as cryptocurrencies or governance tokens.

ERC-721: For non-fungible token assets (NFTs) — representing distinct assets.

ERC-1155: A mixed standard that allows for unique and non-unique tokens in one asset .

As for DePIN projects, such token standards allow for proper functioning of these projects by standardizing essential processes such as transfer of value, interactions with smart contracts, and integration with DApps.

Understanding DePIN Development

The growing trend of DePIN refers to the economic model seeking to distribute the ownership and the operation of physical infrastructure including, but not limited to, telecommunication networks, renewable energy distribution, and storage networks. These DePIN initiatives target at attracting more resources by extending licenses within the replicable infrastructure using blockchain and tokenization.

For Example:

Helium Network: Relies on a tokenized model of a distributed wireless Lora network, where parties are incentivized to host LoRa based hotspots using their tokens.

Filecoin: A system that offers an incentive system to its users who volunteer their computer hardware in exchange for digital assets backed by the media’s services for their pieces of disk space.

EnergyWeb: Concentrates on the development of distributed generation and consumption of energy using networks that incorporate tokens.

In such ecosystems, tokens serve monetary purposes as well as avenues of governance and incentives for the members to commit and participate. There are also token standards that ensure the effective, secure and efficient scaling up of such tokenized systems.

How Token Standards Shape DePIN Projects

Cryptocurrency Token Development Support

Token standards afford designers the structure for proper creation of tokens. In DePIN development, where mission-critical infrastructure is needed within a short period, rolling out such standards helps reduce the agile development constraints and allow teams to concentrate on the specific needs of their projects. For example, ERC-20 [27] or ERC-155 [28] token standards provide ready-made met…

2. Creating Connections

One of the most significant issues faced in DePIN projects is the ability of the tokens to work across different platforms. Since the token standard defined similarly to an ERC-20 is accepted by many wallets, exchanges, and other dApps, the tokens created by DePIN projects would be easily pervasive into the other ecosystems of blockchain. This connectivity improves the comfort of operation of users, since they do not have several activities related to controlling, exchanging demand or holding their tokens in the form of deposits.

3. Formulating incentive Structures

DePIN networks operate on the principle of encouraging users to spend their resources. In a decentralized storage system, for instance, the storage provider was compensated in kind with tokens for any storage capacity placed at the Network’s disposal. Token standards allow implementing reward mechanisms in a fair and straightforward manner with the use of smart contracts. In particular, standards like ERC-4626, which is applicable for tokens that earn returns to their holders, come in handy in such cases because they simplify reward distribution in case of staking and providing liquidity.

4. Facilitation of Governance Systems

In offering governance for such systems, they resort to the use of tokenization that allows for decentralization. Usually, governance tokens are issued in form of ERC 20 standards and allow users to vote on various issues such as upgrading the network or changing the policies of the network. Token standards that underlie such systems run these processes in an open and incorruptible manner promoting confidence among.

Use Cases of Token Standards in DePIN Development

Fungible Tokens for Rewarding Users and Settling Payments

ERC-20 based tokens are most suitable to the participants in DePIN networks. For instance, users of a decentralized solar energy grid may be rewarded fungible tokens for each kilowatt-hour they produce. These tokens can then be utilized for purchases within the ecosystem or exchanged outside it.

2. NFTs to Assure One’s Ownership Over a Special Asset

In a fully decentralized wireless network, individual hotspots or antennas could be represented as individual NFTs. All these tokens conform to the ERC-721 standard which protects and guarantees their ownership enabling users to rent or sell their infrastructure in the secondary markets.

3. Hybrid Tokens for Infrastructures with Layered Complexity

There are advantages in using ERC-1155 tokens by projects offering fungible rewards and unique representation of resources. The benefits of this standard in its use can be witnessed in a model that gives tokens to users but such users can own particular nodes or devices in the network.

The Future of Token Standards in DePIN Development

In the foreseeable future, as the blockchain sector continues to grow, it is expected that more advanced and specific token standards for the potential of DePIN will be introduced. These advancements could offer solutions to certain issues faced by physical infrastructure networks, such as locating assets in real-time, achieving cross-chain functionality, and pricing resources dynamically.

The emergence of multi-chain token standards will also be important as DePIN projects cover more than one blockchain. Standards such as ERC-4337 for account abstraction, which promote effortless transfer of tokens across networks, may change the dynamics and interaction of tokens within the decentralized infrastructure organizations.

Conclusion

The success of crypto token development may depend on the type of token standards that are adopted. In this sense, it is not a coincidence that their importance in the development of DePIN elements is very pronounced. ERC-20, ERC-721, and ERC-1155 standards give a wide scope for DePIN projects by offering uniformity, safety, and the capability to work with other systems. The developing patterns in blockchain technology suggest that the systems of token standards are not static. Their enhancement will facilitate the development of decentralized physical infrastructure networks in the years ahead, which will enhance innovations and usages within that time frame.

0 notes

Text

Integrating DePIN and RWA Tokenization: A Path Toward a Decentralized Economy

Recent years have witnessed an expansion in the blockchain ecosystem which goes beyond cryptocurrencies and even decentralised finance (DeFi). In the Age of Digital asset economies, two concepts namely DePIN (Decentralized Physical Infrastructure Networks) and RWA (Real-World Assets) tokenization have risen to the forefront and are among the most dominant shaping the economia global today. There is no longer a need to marginalize physical assets as they are now easily converted to digital assets and transacted. This blog will discuss how such changes are taking place thanks to DePIN and all the rage RWA tokenization, and what it brings for the development of blockchain in a nutshell.

What Is DePIN?

Decentralized Physical Infrastructure Networks, also known as DePIN, are Networks where people and organizations can donate and be rewarded, through blockchain technology, for their possession of physical resources such as hardware, sensors or data. DePIN links a physical infrastructure with a decentralized network, thus allowing an individual to earn on the contribution made to upkeep or scaling of the network.

This idea is similar to that of a network infrastructure as it is operated in a centralized manner but still with a twist. In place of large institutions building and reaping the benefits of the infrastructure, everyone gets a chance to be involved, and the rewards are built through blockchain networks. DePIN projects enable users to be owners, operators and revenue earners for things like IoT systems, communication tower infrastructure and green energy farm stations.

What Is RWA Tokenization?

In the area of Crypto currencies, RWA (Real World Asset) tokenization entails putting physical assets on the blockchain in a digitized-tokenized form. Such assets include but are not limited to, commodities like gold, and real estate or even pieces of artwork and equities in businesses.The process of tokenizing tangible assets allows for the creation of digital goods which can be freely traded, transferred and even fractions sold as is the case with cryptocurrencies.

As a result, more and better investment opportunities are available, seeking liquidity for the non liquid assets becomes easier as well as improving the process where transactions are carried out physically. The tokenization of RWAs allows for splitting property ownership into small shares, minimizes the threshold for investors and offers innovative financial solutions that were impossible in the conventional economy.

The Intersection of DePIN and RWA Tokenization

In both cases what is disrupting the digital asset space is DePIN and RWA tokenization, and where their real strength lies is in their intersection and how they fit together. Membership is a new class of assets that can readily traded and owned by millions of individuals around the world as the physical infrastructure in networks of DE-PIN become tokenized as RWAs.

For example, decentralized infrastructure networks such as renewable energy grid or IoT-based smart city system infrastructure can be tokenized. This enables treaty and every other stakeholders, to have digital and translated assets which are associated with various real infrastructure projects. The hybridization of these two approaches creates an innovative model where the physical assets and infrastructure of the real economy exist in the digital realm.

This shift has the power to transform the way digital assets are transacted by introducing the concept of being able to tokenize any type of physical asset, be it a solar power plant, a mesh network of communication or a transport system. Such tokenized instruments would be able to be listed on the secondary market through decentralized exchanges or other blockchain solutions availing new markets and liquidity.

The Role of Blockchain Technology

The proper functioning of both DePIN and the tokenization of RWA tokenization services requires a lot of blockchain technology based on its characteristics. Decentralized ownership, smart contracts, and secure transactions are based on the blockchain. It brings in transparency, immutability, and trustless execution to both DePIN and RWA tokenization which is important in measuring and managing physical assets and infrastructure properly.

Smart Contracts: They are virtual and self-fulfilling contracts coded with the provisions of the agreement. In DePIN networks, smart contracts can facilitate the distribution of rewards for k contributions to the infrastructure. In tokenization of RWA, they make sure that all transactions dealing with tokenized assets are done following the rules and in a very safe manner.

Decentralized Ownership: With the help of blockchain, there is a decentralised ownership structure whereby people and companies can own physical infrastructure or tokenized geographical assets with no banks or other centralized entities involved. Such a model of ownership is more egalitarian and accommodating to most since investment is open to everybody.

Tokenization Standards: Tokenization standards protocols such as ERC-721 for NTFs (non-fungible tokens monetary-based equity) and ERC-20 for fungible tokens are designed to help tokenize real world assets in a blockchain. These standards simplify the process of converting into the digital format such pieces of physical infrastructure or tangible assets and allow their effective embedding in borderless networks.

Benefits of DePIN and RWA Tokenization

The integration of DePIN and RWA tokenization offers several benefits, including increased efficiency, accessibility, liquidity, and transparency in digital asset transactions.

DePIN and RWA Tokenization are great revolutions in the digital space that come with numerous positive aspects such as enhanced operational efficiency, improved overall interactions, liquidity and transparency in digital transactions involving assets.

1. More Liquidity

The RWA tokens permit issuing tradable pieces of property which would be hard to trade on their own such as real estate and fine arts. These fractionalized assets can be put on trade in decentralized exchanges thus enabling the investors to find the buying or selling of a real asset much easier and with more liquidity. The infrastructure projects under DePIN can also take advantage of tokenization creating liquidity for physical assets such as Energy grids and communication towers.

2. Fractional Ownership

RWA tokenization has numerous advantages, of which fractional ownership is the most significant. You don’t have to own the whole property (building or land) any more since such an asset can be bought as a token bix. This enhances the access of such investment avenues to many people hence better portfolio balances. In the context of DePIN projects for example a decentralized renewable energy grid installation, individuals can buy tokens that provide ownership of specific energy generating units, thus enabling investment in such projects’ infrastructure on a much lower scale.

3. Reduced Barriers to Entry

Tokenization lowers the entry barriers for investors by allowing smaller, more affordable investments in real-world assets. This is in reference to DePIN networks for instance especially with regard enabling the individuals even with smaller amounts of capital to acquire ownership stakes in and engage in non centralized physical networks. This encourages people who would have otherwise missed out on the opportunity to invest in infrastructure pockets since it was either out of their means or very centralized.

4. Openness and Safety

With the positivity of the blockchain, every transaction having to do with any form of asset or decentralized structure can be verified. Any transactions conducted in the smart contracts are stored on the blockchain and cannot be altered or erased, thus minimizing instances of cheating and making all participating parties follow through with their obligations. DePIN projects can utilize transparency to secure contributors’ faith in the project, while owners of RWA tokenized assets can maintain transparent and secure records of ownership.

5. Wide Reach

In both DePIN and RWA tokenization, there is no geographical restriction keeping anyone from using the services. For example, investors can access and invest in these tokenized assets or even participate in infrastructure projects that are decentralized irrespective of their location. This leads to an international market for such digital assets; hence more users can participate and collaborate across regions.

Challenges and Risks

Even though the merits of DePIN and the tokenization of the RWAs are apparent, these two phenomena bear challenges and risks that should be surmounted if such technologies are to realize their potential.

1. Absence of Exact Regulation

One of the foremost challenges that both DePIN and RWA tokenization is potential regulatory constraints. Many of the countries are still in the process of crafting the necessary legislation concerning the tokenization of digital assets and decentralize systems. The precise absence of such regulations leads to legal and compliance exposure for the undertaking investors, projects, and users. However, as things get better in the industry, we will be able to see such aspects as more detailed rules and regulations tending for such endeavours.

2. Insecurity

It is true that, most instances where blockchain technologies are applied, security measures are adequate; however the presence of poor smart contract design or weak infrastructural support can be used against the system by hackers. Also, both DePIN systems and RWA tokenization systems should employ security as a key component through intensive auditing, constant maintenance and regular improvement to mitigate loss of assets and securing the entire system from breaches.

3. Resistance to Change

Here and in other areas the strategy of DePIN and RWA tokenization may be challenged by a potential user who lacks awareness and understanding of the benefits of these technologies. Educating the public, enterprises and even authorities about the use and advantages of these technologies is significant for the promotion of use. Moreover, in order to enhance participation, there is need to have easy and effective user interface and straightforward onboarding processes to the new users.

4. Issues of Legality and Ownership

The problem of RWA tokenization comes with numerous legal problems especially those revolving around the ownership of the assets. The extent to which tokenized assets can be enforced in law may differ from one jurisdiction to another, and it may sometimes be difficult to ascertain what the rights and duties of token holders are. It is the existing legal regimes and the concomitant guidelines that would facilitate the protection and enforcement of ownership rights in both virtual and non-virtual space.

Real-World Use Cases

This essay proposes exploring real-world implementations of DePIN and RWA tokenization to understand the current trends in digital asset transactions.

Helium Network (DePIN EXAMPLE): Helium is an innovative decentralized wireless network that enables users to connect to the Internet of Things (IoT) network by constructing their own hotspots at a small fee.The Helium use cases are extensive, allowing for the development of a token-based, decentralized, peer-to-peer network for IoT communication that requires no external control.

Real Estate Tokenization: A lot of real estate properties are already on different blockchains making it feasible for a person to own a part of the house rather than the whole house as was the case before. For instance, investors can buy property coins which gives him/her ownership in specific buildings or lands and these coins can easily be exchanged in the secondary market.

Energy Tokenization (DePIN & RWA Example): Both DePIN and RWA studies depict tokenization in the real world, allowing renewable energy projects to be less than owned by the individuals. Similarly, owning a fraction of the solar or wind energy producing assets on cradles of tokens is being facilitated. Such energy goods developed on tokenize sand structures are buyable and sellable, or they can be traded in addressing the energy spent creating a provision for being a market for both producing and consuming energy in an organized manner.

The Future of DePIN and RWA Tokenization

With the development of blockchain technologies, it can be envisaged that deep physical infrastructural networks and real-world asset tokenization will contribute more towards digital asset transactions in the foreseeable future. These innovations would indeed change the scope of what it means to own, transact and even use objects in the real world, giving rise to new ways to finance projects and eliminating geographical limits on investments.

Utilizing a decentralized infrastructure and the ability to tokenize real-world assets, we are continuing to develop a more inclusive financial ecosystem that in a way unites the real world with a digital one. Liquidity, democratization of asset ownership and safety are the aspects, which will characterize the future of digital currency transactions and will be based on the use of blockchain technology; and these aspects will definitely be there.

Conclusion

DePIN and RWA tokenization are the newest wave in digital asset transactions. These developments have opened up new markets, made them more accessible, and improved the efficiency of transactions by combining traditional assets with blockchain technology. Still, there are challenges; the impact of DePIN and RWA tokenization on the future of finance is great, as one can envision a more open and wider embracing of such tools. As such, the future of finance promises to be more decentralized, transparent, and fairer.

0 notes

Text

Explore outstanding DePIN projects in 2024

DePIN Projects leverage decentralized physical infrastructure networks to address real-world challenges. By integrating IoT, blockchain, and AI, these projects enhance efficiency, security, and scalability across various industries.

The world of decentralized physical infrastructure networks (DePIN) is burgeoning, offering innovative solutions to long-standing challenges in connectivity, storage, and resource sharing. In 2024, several DePIN projects have captured attention with their groundbreaking approaches and potential for real-world impact. In this article, we'll delve into outstanding DePIN projects. We'll examine their unique value , technological underpinnings, and the role they play in reshaping the way we interact with the digital world. Let's explore!

What is DePIN project?

Traditionally, physical infrastructure such as data networks, transportation systems, and electrical grids have been controlled by centralized organizations. DePIN projects aim to revolutionize this model by establishing peer-to-peer networks where individuals contribute their resources and share control, similar to how Airbnb leveraged the power of community in Web2.

Outstanding DePIN projects in 2024

DePIN Helium project

The Helium Network, launched in 2019, is a pioneering decentralized wireless network built on blockchain technology. It empowers individuals and devices to connect to the internet while rewarding participants who contribute to its infrastructure with HNT, the network's native token. It thrives on community ownership and operation, fostering a more democratic approach to connectivity.

Helium's initial success with its LoRaWAN IoT network inspired a global movement, leading to the deployment of nearly a million hotspots by hundreds of thousands of individuals. Building on this momentum, Helium is expanding beyond IoT into CBRS-based cellular networks and future WiFi networks. This adaptable approach aims to revolutionize wireless network development, making it more cost-effective, efficient, and accessible for all.

DePIN World Mobile project

World Mobile is a global connectivity platform that is revolutionizing internet access for underserved communities. By combining blockchain technology, renewable energy, and a sharing economy model, it offers affordable, high-quality connectivity solutions.

The platform leverages both existing infrastructure and innovative technologies, such as utilizing "TV white space" for data transmission in certain regions.

Founded by Micky Watkins in 2018, World Mobile operates as a decentralized network, where decisions are made by the community of users and participants. Users can actively contribute to the network's growth and earn World Mobile Tokens (WMT) as rewards.

DePIN World Mobile project Network is built on a shared economy model powered by the WMT token. It comprises three types of user-operated nodes:

Earth Nodes: Responsible for core network functions, including authentication, identity management, blockchain operations, and telecommunications services.

Air Nodes: Provide coverage and internet access directly to users.

Aether Nodes: Connect to traditional telecommunications operators to bridge the gap between legacy systems and the World Mobile network.

DePIN Filecoin project

Filecoin is a decentralized storage network that leverages blockchain technology to create an open market for cloud storage. It enables users to pay miners to store their data securely and reliably over time while miners compete to offer the most competitive prices for storage space. This unique system incentivizes miners to provide storage and earn rewards in the form of Filecoin (FIL) tokens based on the amount of storage they contribute.

Developed as a decentralized alternative to traditional cloud storage providers, Filecoin aims to revolutionize the web by creating a more secure and efficient marketplace for data storage. The open-source project was founded by Protocol Labs and Juan Benet, with financial support from various venture capital firms, angel investors, and an initial coin offering (ICO) in 2017.

Anyone can become a storage provider on the Filecoin network by setting up a mining rig and connecting it to the network, renting out unused hard drive space to earn FIL tokens. The Filecoin network is governed by a decentralized community of users who participate in decision-making through a consensus-based process, upholding the principles of transparency, decentralization, and open-source collaboration.

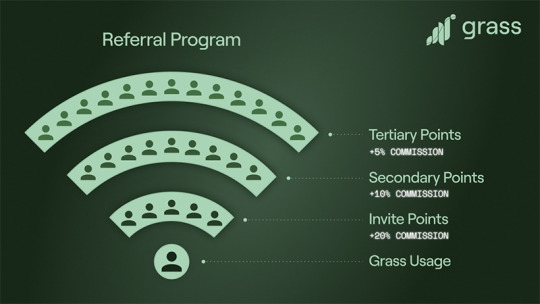

DePIN Grass project

Grass, a groundbreaking crypto project by Wynd Network, empowers users to monetize their untapped internet bandwidth by connecting their devices to its network. This innovative platform challenges the traditional model of centralized proxy providers, which often exploit users' resources without compensation. Grass aims to democratize the market, directly rewarding users with tokens for their contributions and granting them a voice in governance decisions.

DePIN Akash Network project

Akash Network is a Layer 1 App-chains platform - a decentralized cloud computing network that facilitates the secure and efficient exchange of computing resources between users. Built on the Cosmos SDK and secured by a Proof-of-Stake consensus mechanism, Akash offers developers a high-speed, cost-effective solution for deploying decentralized applications, including DeFi apps, blogs, games, and other blockchain components.

To engage with the Akash Network, you can become a provider of computing resources or deploy decentralized applications on the platform. This allows you to leverage the benefits of the decentralized cloud computing marketplace, gaining access to a wide array of resources at a fraction of the cost of centralized providers.

The DePIN projects explored in this article represent a glimpse into the transformative power of decentralization in the realm of physical infrastructure. As DePIN continues to gain momentum, it's clear that it has the potential to transform how we access and interact with physical infrastructure. By embracing decentralization, community ownership, and innovative technologies, DePIN projects are paving the way for a more inclusive, efficient, and resilient future. To learn more about exciting developments in the DePIN space and explore potential investment opportunities, visit the website U2U Network.

0 notes

Text

8% of your income / on your contribution this is reality and not a dream / This company is engaged in real estate, builds residential and office premises, accepts money as an INVESTMENT AT A NOBLE 8%. If you are a young promising person or you have life experience over 30 years old. You have an excellent opportunity to think about where to invest with diversification, of course, study this type of Investment. Although each of us knows and dreams of owning real estate, or at least being part of a project. Isn’t it great to drive through or know that you are directly involved in a given building / project, real estate / active participation. This company has different projects, Of course, different deposit amounts / it depends on your level as an investor /. Judging by the percentage of 8%, this is, to put it mildly, much more than in a regular bank / this is a good plus /. Under normal conditions, the contract lasts about a year / individual terms can be revised to advantage / if you are a global investor. https://p.exporo.de/ https://www.instagram.com/bitcoin__crypto_trading_inwest/ #meme #BITGET #0x0 #wif #depin #crypto_trend #cash_flow #hodl #CoinGecko #Ledger #pepe #crypto_pur #PancakeSwap #batter #aevo #bome #DEX_Screener #Binance K

0 notes

Text

Despite still being in its infancy, a new product by io.net is going to amass one million GPUs from independent vendors from all over the globe. The platform is on its way to becoming a first-ever truly decentralized cloud network for the AI era.First AI-focused computation network announced by io.net The first-ever global decentralized computation network io.net announces its goal to create a Decentralized Physical Infrastructure Network (DePIN) for artificial intelligence applications. It will rely on a fully peer-to-peer decentralized ecosystem of over one million geographically distributed GPUs.AI is becoming prohibitively expensive.The cost of training machine learning models continues to soar, increasing an average of 3,100% per year.And while the cost of training is expensive, actually running these models is often much worse. According to @nvidia CEO, Jensen… pic.twitter.com/IYsX53qmvf— io.net (@ionet_official) October 11, 2023 The euphoria around various mainstream AI products — starting from OpenAI's ChatGPT chat bot — has made GPU power an increasingly scarce resource. Demand for GPUs is increasing by 1,000% every 18 months, while the cost of training large-scale AI models has risen by around 3,100% per year.This, in turn, results in the lower resource-efficiency of cloud services, stifling innovation and forcing AI start-ups to adjust their development roadmaps.io.net is going to address these challenges by putting GPUs all over the world to use. Its solution will unlock one-click deployment of massive GPU clusters that can support intense machine learning workloads and be operational in just 90 seconds.Ahmad Shadid, founder and CEO of io.net, stressed the importance of solutions of this type for the upcoming phases of AI disruption:AI is one step away from starting the Fourth Industrial Revolution but current GPU providers can’t support the scale and speed of innovation. io.net will be able to connect one million GPUs distributed across the globe in under 90 seconds, giving AI startups access to essential processing power on demand.As covered by U.Today previously, AI cryptocurrencies are yet again in the spotlight for cryptocurrency investors and traders.New dawn for idle GPUsThrough making GPU computation accessible, flexible and readily available, io.net will challenge traditional players like AWS, GCP and Azure.Also, it is set to benefit from the pessimism of miners: as more and more currencies are moving toward proof-of-stake (PoS), mining on GPUs becomes unprofitable. For large computation networks with GPUs, the utilization rates barely exceed 12-18%.Per the calculations of its team, in readjusting their farms for GPU provision, io.net contributors can make up to 1,500% more profit with less energy consumption compared to their competitors involved in PoW hash mining.

0 notes

Text

Decentralized Physical Infrastructure Networks Tapping The Potential of DePIN to Create a Physical Infrastructure Network.

Decentralized Physical Infrastructure Networks (DePin) work in the blockchain networks incentivizing communities for creating physical infrastructure networks/dApps (charging, telecoms, etc. Though DePin has been around since last many years, the consensus has been around Web3 in the real world. Nonetheless, the sector is utilizing the power of digital decentralized infrastructure, and Escape Velocity is feeling its heat. As a venture capital firm, it is helping pre-seedling and seedling firms with funds, capital, and incentives for utilizing DePin to full capacity and growth.

Here we will understand the concept of a Decentralized Physical Infrastructure Network.

Understanding Decentralized Physical Infrastructure Network (DePIN?

As described DePin is the Frodo Baggins of Crypto, but along with it there is a high potential to unite Web3s' promising fields; IoT/EoT, telecoms, mobile, energy, and many more. We will understand it in simple terms. For some people, crypto is all about earning gains but for many, it is about expected returns and you expect that one bitcoin will go up against USD or another fiat currency. Now enter DePIN. It is a token as it can buy you something that is tangible like web access, telecom services, power, and much more.

It is chiefly utility goods in the real world, unlike other things in Web3. We can understand it in this way, DePin makes use of a blockchain and tokens to develop the physical infrastructure of value and depends on decentralization instead of centralized networking for any type of transaction and business. These are developed to provide real value.

Benefits of DePin

By crowdsourcing the physical infrastructure, DePin can instantly be hyper-scale than traditional projects and at a cheaper cost when distributed over the network.

DePin operates as collective ownership over the hardware that constitutes part of the network rather than dependent on one centralized corporation.

Traditional infrastructure projects also often landed up with centralized control laying down their own terms and conditions for who can join and who not. On other hand, DePin is open and readily accessible to all.

DePins also do not need censorship and have no centralized gatekeeper who could deny access to a particular party dependent on nothing but a whim.

DePins offers more competitive edges than the traditional setups.

DePins operate at a much reasonable cost and its operating expenditure is also less. In the blockchain, it offers its members peer-to-peer payments without depending on a payment processor or any intermediary. In fact, Decentralized networks promise early growth. So, for contrarians, herein lies the opportunity, and Escape Velocity feels it. It closely partners with founders and communities to help networking companies reach escape velocity.

No doubt setting up the infrastructure is not easy especially when we talk about Decentralized Infrastructure but for those who are ready to take on this challenge, Escape Velocity provides the fuel.

#Decentralized Physical Infrastructure Networks#Escape Velocity#Decentralized Physical#Infrastructure Networks

0 notes

Text

Engineered Wooden Flooring Market Size will Witness Substantial Growth by 2027: Armstrong, Hamberger, Mohawk, Shaw, Kahrs

The recently Published Report titled Engineered Wooden Flooring Market Size will Witness Substantial Growth by 2027: Armstrong, Hamberger, Mohawk, Shaw, Kahrs by Axel Reports offers a comprehensive picture of the market from the global view point as well as a descriptive analysis with detailed segmentation, complete research and development history, latest news, offering a forecast and statistic in terms of revenue during the forecast period from 2021-2027. The report covers a comprehensive analysis of key segments, recent trends, competitive landscape, and key factors playing a substantial role in the market are detailed in the report. The report helps vendors and manufacturers to understand the change in the market dynamics over the years.

Get Sample Copy of this Report with the Latest Market Trend and COVID-19 Impact: https://axelreports.com/request-sample/165694

Global Market Segmentation by Top Key-Players: Armstrong Hamberger Mohawk Shaw Kahrs Mannington Baltic Wood Bauwerk Beaulieu Tarkett Yihua Depin Weitzer Parkett Vohringer Anxin Green Flooring Shengxiang Maples Shiyou Jinqiao

NOTE: Consumer behaviour has changed within all sectors of the society amid the COVID-19 pandemic. Industries on the other hand will have to restructure their strategies in order to adjust with the changing market requirements. This report offers you an analysis of the COVID-19 impact on the Engineered Wooden Flooring market and will help you in strategising your business as per the new industry norms.

Report offers: 1. Insights into the intact market structure, scope, profitability, and potential. 2. Precise assessment of market size, share, demand, and sales volume. 3. Authentic estimations for revenue generation and Engineered Wooden Flooring Market development. 4. Thorough study of Engineered Wooden Flooring Market companies including organizational and financial status. 5. Perception of crucial market segments including, forecast study. 6. Acumen of upcoming opportunities and potential threats and risks in the market.

Market segments by Types of, the report covers- Three Layers Engineered Wooded Flooring Multilayer Engineered Wooded Flooring Industry Overlook by Applications of, the report covers- Residential Commercial

The report diversifies the global geographical expanse of the market into five prominent regions as:

North America (United States, Canada and Mexico)

Europe (Germany, France, United Kingdom, Russia, Italy, and Rest of Europe)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

South America (Brazil, Argentina, Colombia, and Rest of South America)

Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of Middle East & Africa)

Key Elements Discussed In The Report: The report then discusses important dynamics on the business drivers that have a major impact on the performance are given in the report. The business drivers are important to the business operations and financial results of the industry. All the drivers are determined in the research study using market analysis. The report is comprehensive coverage of the existing and potential markets along with their assessment of their competitive position in the changing market scenario. It scrutinizes in-depth global market trends and outlook coupled with the factors driving the global Engineered Wooden Flooring market, as well as those hindering it.

Get Up to 30% Discount on the first purchase of this report @ https://axelreports.com/request-discount/165694

Moreover, the report throws light on the pinpoint analysis of global Engineered Wooden Flooring market dynamics. It also measures the sustainable trends and platforms which are the basic roots behind the market growth. With the help of SWOT and Porter’s five analysis, the market has been deeply analyzed. Consumer behavior is assessed with respect to current and upcoming trends. The report takes a detailed note of the major industrial events in past years. These events include several operational business decisions, innovations, mergers, collaborations, major investments, etc.

Customization of the Report: This report can be customized to meet the client’s requirements. Please connect with our sales team ( [email protected]), who will ensure that you get a report that suits your needs. You can also get in touch with our executives on +18488639402 to share your research requirements.

ABOUT Axel Reports:

Axel Reports has the most comprehensive collection of market research products and services available on the web. We deliver reports from virtually all major publications and refresh our list regularly to provide you with immediate online access to the world’s most extensive and up-to-date archive of professional insights into global markets, companies, goods, and patterns.

Contact: Axel Reports Akansha G (Knowledge Partner) Office No- P 221 Pune, Maharashtra 411060 Phone: US +18488639402 Web: https://axelreports.com/

0 notes

Text

Decentralized Physical Infrastructure (DePIN) Explained

What if infrastructure could be managed without central control, ensuring security and transparency? Enter Decentralized Physical Infrastructure Networks (DePINs).

DePINs are transforming the way we build and manage infrastructure by leveraging blockchain technology. These networks ensure resilience, transparency, and security by decentralizing control and integrating blockchain-based systems.

Key components of DePINs include off-chain networks, token incentives, blockchain architecture, and physical infrastructure networks. These elements work together to facilitate secure and transparent transactions and automate agreements through smart contracts. However, DePINs face challenges like scalability, regulatory uncertainty, and environmental concerns. The DePIN Flywheel concept demonstrates how tokenization fosters network growth, creating a self-reinforcing cycle of development and innovation.

This innovative model enables seamless collaboration among various devices without relying on a central authority, thereby democratizing access to essential infrastructure resources.

DePINs operate through several key components, including off-chain networks, token incentives, blockchain architecture, and physical infrastructure networks. These elements work together to facilitate secure transactions, automate processes with smart contracts, and tokenize physical assets. This integration not only optimizes resource management but also fosters a more inclusive and participatory infrastructure ecosystem, empowering communities and individuals alike.

However, the path to widespread DePIN adoption is not without its challenges. Issues such as scalability, regulatory uncertainties, technological hurdles, and environmental impacts need to be addressed. Despite these obstacles, the potential benefits of DePINs are immense, offering a more resilient, efficient, and sustainable infrastructure future.

To harness the power of decentralized solutions for your business, reach out to Intelisync and start your blockchain journey today.

The future of infrastructure lies in the convergence of digital and physical elements, with DePINs leading the way. Intelisync offers tailored blockchain development solutions to help startups and small businesses embrace decentralized infrastructure. Connect with Intelisync today to explore the potential of Learn more....

#Dapp Development Company#Decentralized Physical Infrastructure#Networks DePIN#How do DePINs work in Crypto?#How Does DePIN Make Use of Blockchain Technology#Key features of Decentralized physical infrastructure network#Major Challenges of DePIN#Off-Chain Network#Physical Infrastructure Network#Physical Resource Networks (PRNs)#Pros of DePINs#The components of Decentralised Physical Infrastructure Networks (DePINs)#Types of DEPINS#Use of Blockchain Technology#What are DePINs in Crypto?#What does DePIN mean?#What Is The DePIN Flywheel?#Intelisync Blockchain Development company

0 notes

Text

Pheel’s daily challenge list

so far when i missed days ive just been using my memory, so this will hopefully help keep me more organized haha

PART 2 HERE

January

Day 1: Winter Lucario Day 2: Axle and the Axels Day 3: Birthday Cubone Day 4: Kiki and Jiji Day 5: Alejo the Spewpa Day 6: Dragons with cookies Day 7: Saphirien Day 8: Delphox Day 9: Laser pointer Islacura Day 10: Null Day 11: Leslie and Danero Day 12: OC Cards 1 Day 13: OC Cards 2 Day 14: Nurupantarata Sneeze Day 15: Kyurem-Daily Day 16: Arcanine Day 17: Tyson (who is not Newton) Day 18: Falcata Day 19: Kyurem study Day 20: Xurkitree Day 21: BotW Link Day 22: Red Dragon Day 23: Depin Day 24: Anattawam Day 25: Pokemon trainer ocs Day 26: Western Yuko Day 27: Chicken Tarragon Day 28: Gabite Day 29: 21 Pokemon Day 30: Silvally Day 31: Godzilla

February

Day 32: Sleepy Slowking Day 33: Nosepass Day 34: Luckypheel and Lilboop chickens Day 35: Flying Islacura in profile Day 36: Birthday Ozomi Day 37: Mewtwo’s Birthday Day 38: Fuzzy Noodle w/ Whiskers Day 39: Raichu and Politoed Day 40: Yuuya Sakazaki Day 41: Rhydon Day 42: Apex and Pitcher Plants Day 43: Krookodile and Rockruff Day 44: Scrafty Day 45: Birthday Choco + Will and Nuala Day 46: Lugia/Kyurem bleps Day 47: Kanto Starter bleps Day 48: Blake the Liepard Day 49: Ingot Day 50: Islacura and Audino (day 50 digital art special!!)* Day 51: Blue Dragon plush Day 52: Keiji* Day 53: Lupe, Ixi, Draik and... Attic! Day 54: Dora K. and Agnes (and avocados) Day 55: Traveling Kyurem, Arcanine, and Dunsparce Day 56: Poppy and Fidel Catstro Day 57: Ignatius petting Zen, and also Bowser is there Day 58: Kasutamasabisu’s dragonsona Day 59: Death as a Dragon

March

Day 60: Swamp Siphooskii Day 61: Islacura, Noodly Dragon, Gator Orb Day 62: Some Guy, Kyurem, Log Gator Day 63: Arcanine Bag Search Day 64: Lyn and Dragonair, Airplane with Lati@s, dragons, other doodles Day 65: Alderstrom* Day 66: Careleon and Kasutamasabisu’s Dragonsona* Day 67: Flower Crown Mandibuzz Day 68: Bog the Crocodile Day 69: Mallamark Day 70: Carlton Day 71: Shy Guy Day 72: Kyurem in bow tie Day 73: Kommo-o Day 74: Galilei and Lilei Day 75: Garrett Thompson Day 76: Zuko in Dora K. pose Day 77: Null on a balloon Day 78: Rainbow Apex wearing the Apex shirt Day 79: Nykle Day 80: Flygon Day 81: Giratina* Day 82: Ludovica and Vikavolt Day 83: More fat gay dragons (aka careleon and saul’s sonas) Day 84: Avery pokemon selfie doodles Day 85: Nyork Nyork, Charizarp, robot dragons Day 86: Kyurem in a tutu (+ bonus afro kyurem) Day 87: Fasenso Day 88: Druddigon and Arcanine sonas Day 89: Sorbet the Piñata Dragon Day 90: Guzzlord

April

Day 91: Boro Day 92: Freya and Nuru need to learn how to sit on the couch!! Day 93: Wizard Blizzard Lizard Freyisbreen Day 94: Artichoke Day 95: Kangaskhan Day 96: Gravity and Dragons Day 97: The Dragon Day 98: Zorua Day 99: Shepe’s sona Day 100: Dancing Kyurem, and introducing Kronch* Day 101: Alderstrom and Siphooskii visit my college Day 102: Gliscor blep* Day 103: Damnsparce dragon Day 104: Kittibi* Day 105: Affidus Day 106: Palkia* Day 107: Keldeo Day 108: Hitmontop Day 109: Honoka and Lucia Oonishi (Ho-oh and Lugia) Day 110: Rosa and Swablu* Day 111: Bataari Day 112: Aggron* Day 113: Dragon poll results Day 114: Red Dunsparce and other jammy pokemon Day 115: Kyurem holding a balloon Day 116: Kirby Day 117: Eishelle dragon form Day 118: Kronch gijinka* Day 119: Thick outline Dunsparce* Day 120: Type: Null

May

Day 121: Shianna (and their motorcycle) Day 122: Pebsi Day 123: Bergot Day 124: Linnéa and Roserade Day 125: Tom Day 126: Isa Friez Day 127: Niko Day 128: Skye Day 129: Inniq Day 130: Kronch Day 131: Kelly Day 132: Felix Day 133: Lyn and Udon Day 134: Ludovica Day 135: Eloise Day 136: Arvid and Max Day 137: Attic Day 138: Fayko Day 139: ChanChan Day 140: Raven Day 141: Deborah Day 142: Silver Day 143: Nurupantarata/Giulia Day 144: Ramys Day 145: Fantasia Day 146: Vulpix Day 147: Poutine Day 148: Paisley Day 149: Mario-José Day 150: Petunia Day 151: Careleon

June

Day 152: Igha Day 153: Lady Boo Day 154: Isntbirds Dragon Day 155: Gaius* Day 156: Yee’s Sherky Day 157: Zen, Rina, and Cuthbert* Day 158: Sitting Islacura Day 159: Serperior Day 160: Keymintt Blog Dragon Day 161: Minccino Day 162: Ghetsis Day 163: Chill-artdude’s Tom Day 164: Groudon Day 165: Jerico Day 166: Lapras Day 167: Poppy Bros. Jr Day 168: Digital Freya* Day 169: Slowpoke Day 170: Bowser Day 171: Anattawam tests a pezzie Day 172: Kyraniu Day 173: Sonny and Pal Day 174: Kronch and Fugure OtGW Cosplay (collab)* Day 175: Haiko Day 176: Giorgio and Karina Day 177: Moussa Day 178: Princess Emeraude Day 179: Ojaiy Dragon Day 180: Miitopia Group Day 181: Kyurem/Pidgey fusion

July continued on part 2

PART 2 HERE

(i discovered there’s apparently a point where too many links breaks them all so whoops)

#pheel talk#pheel daily challenge#should i go back and tag all the posts as that#or nah this masterlist works i guess??#hmmm idk#not art

15 notes

·

View notes

Text

HOW DOES HIGH BLOOD PRESSURE AFFECT LIFESTYLE?

People with hypertension should avoid certain activities and situations that may raise their heart rates and blood pressure to dangerous levels. These include the following:

· Saunas

· Steam baths

· Steam rooms

· Heated whirlpools

· Hot tubs

· Very warmly heated swimming pools

It is very important for hypertensives to limit the amount of time spent in these activities to less than 10 minutes, after which they should sit down out of the heat for a few minutes before standing to minimize the risk of dizziness or passing out (syncope).

Hypertensives should also be careful about using certain over-the-counter (OTC) medications that contain vasoconstrictors, which can elevate blood pressure. Such medications include:

· Eye drops

· Cold, flu, sinus, and cough medications (especially those containing decongestants)

· Antihistamines

Hypertensives are also encouraged to follow all of their physician’s orders regarding treatment, in order to prevent serious health consequences. However, patients are encouraged to discuss with their physicians any side effects or other concerns that they may have about their treatment.

ARTIHYPERTENSIVE DRUGS

· Diuretics: Medications that promote the formation of urine of kidneys, causing the body to flush out excess fluids and minerals, especially sodium. Example Lasix, Ditide, Lasilactone, Amirfru.

· Alpha blockers and beta blockers: Medications that inhibit alpha and beta receptors in various parts of the nervous system, slowdown the heart rate. These help arteries to relax, decrease the force of the heartbeat and reduce blood pressure. Beta blockers are especially useful in patients with heart disease. Example: Mnipress, Prozopress, Hytrin, Terapres, Inderal, betabloc, Betaloc, Lopressor, Metolar, Aten, Atelol, Atecard, betacard, Tenormin, Tenolol, hipres, Carca, Cadivas, Carloc.

· ACE inhibitors: These medications are type of vasodilator that help to reduce blood pressure by inhibiting the substances in the blood, that cause blood vessels to constrict. Example: Captopril, Enace, Envas, Normace, Amtas, Acinoprel, Cipril, Listril, Lisicard, Ramace, Cardace, Covance, Repace.

· Angiotenin II receptor blockers (ARBs): This new class of drugs is showing good results and great promise in reducing hypertension-related complications. Example: Losar, Losacar.

· Calcium channel blockers: These are type of vasodilator that inhibit the flow of calcium into heart and blood vessel tissues, reduce tension in the heart, relax blood vessels and lower blood pressure.

Many physicians find that using a combination of the above mentioned drugs is more effective and has fewer side effects than using large doses of a single medication.

Example: Vasopten, Calaptin, Angizem, Dilcal, Dilcontin, Diltiaz, Dilzem, Angiblock, Calcigard, Cardipin, Depin, Myogard, Nefedine, Nicardia, Amcard, Amdepin, Amlong, Amlopress, Amlosafe, Amtas, Stamlo, Angi-guard, Amtas AT, Amlovas AT, Amlopress AT.

PRIMARY (ESSENTIAL) HYPERTENSION?

Primary, or essential, hypertension occurs in about 90 to 95 percent of cases and has no known cause. The following are factors that are associated with hypertension and may increase the risk of developing the condition:

· Stress

· Family history of hypertension

· Obesity

· Lack of regular exercise

· Smoking

· Advanced age

· High caffeine intake

· Diet high in fats and oils

· High Cholesterol levels

· Inherited problems in the body’s angiotensin-renin system, which influences all factors related to controlling blood pressure: blood vessel contraction, heart cell development, sodium and water balance and the “salt genes” which play an important role in the relationship between salt and hypertension.

· Inherited problems in the body’s sympathetic nervous system, which control heart rate, blood pressure and the width of blood vessels.

· Type II diabetes: Half of all patients with type II diabetes also have hypertension, making hypertension a primary feature of Type II diabetes.

· Insulin resistance: Whether or not people have diabetes, the body’s inability to use insulin has also been associated with high blood pressure.

· Low levels of nitric oxide, which affects the smooth muscles that line blood vessels to keep them relaxed and flexible. Nitric oxide also helps prevent blood clots.

· Low calcium and magnesium intake.

TYPES OF HIGH BLOOD PRESSURE

There are different types of hypertensions, which are as follows primary, secondary, renovascular, labile, malignant and resistant. Until the year 2000, these different types were generally diagnosed by paying attention to people’s diastolic blood pressure (the lower number of a blood pressure reading). In other words, someone with high blood pressure actually had diastolic hypertension. However, the National Heart, Lung and Blood Institute of USA recommended that healthcare professionals should evaluate people’s not only systolic blood pressure, but also their diastolic blood pressure while making a diagnosis of hypertension. Most people with high blood pressure are diagnosed with primary hypertension, which means that researchers only understand the risk factors for the condition but not the root cause. However, these people show substantial improvement with stress management techniques.

Hope you liked this article!

This article is written by Dr. Bimal Chhajer (Non Invasive treatment specialist)

0 notes

Text

Research On World Engineered Wooden Flooring Market Report 2025

Report on World Engineered Wooden Flooring Market by Product Type, Market, Players and Regions-Forecast to 2025 by DecisionDatabases.com

Engineered Wooden Flooring market research report provides the newest industry data and industry future trends, allowing you to identify the products and end users driving Revenue growth and profitability.

The industry report lists the leading competitors and provides the insights strategic industry Analysis of the key factors influencing the market.

The report includes the forecasts, Analysis and discussion of important industry trends, market size, market share estimates and profiles of the leading industry Players.

Final Report will cover the impact of COVID-19 on this industry.

Browse the complete report and table of contents @ https://www.decisiondatabases.com/ip/50186-world-engineered-wooden-flooring-market-report

The Players mentioned in our report

Armstrong

Hamberger

Shaw

Kahrs

Mannington

Baltic Wood

Bauwerk

Beaulieu

Tarkett

Mohawk

Yihua

Depin

Weitzer Parkett

Vohringer

Anxin

Green Flooring

Shengxiang

Maples

Shiyou

Jinqiao

Global Engineered Wooden Flooring Market: Product Segment Analysis

Three Layers Engineered Wooded Flooring

Multilayer Engineered Wooded Flooring

Global Engineered Wooden Flooring Market: Application Segment Analysis

Residential

Commercial

Global Engineered Wooden Flooring Market: Regional Segment Analysis

USA

Europe

Japan

China

India

South East Asia

Download Free Sample Report of World Engineered Wooden Flooring Market @ https://www.decisiondatabases.com/contact/download-sample-50186

There are 10 Chapters to Deeply Display the World Engineered Wooden Flooring Market. Chapter 1 About the Engineered Wooden Flooring Industry Chapter 2 World Market Competition Landscape Chapter 3 World Engineered Wooden Flooring Market share Chapter 4 Supply Chain Analysis Chapter 5 Company Profiles Chapter 6 Globalisation & Trade Chapter 7 Distributors and Customers Chapter 8 Import, Export, Consumption and Consumption Value by Major Countries Chapter 9 World Engineered Wooden Flooring Market Forecast through 2025 Chapter 10 Key success factors and Market Overview

Purchase the complete World Engineered Wooden Flooring Market Research Report @ https://www.decisiondatabases.com/contact/buy-now-50186

Other Reports by DecisionDatabases.com:

World Turf Protection Flooring Market Research Report 2025 (Covering USA, Europe, China, Japan, India and etc)

World Bamboo Flooring Market Research Report 2025 (covering USA, Europe, China, Japan, India, South East Asia and etc)

World Commercial Flooring Market by Product Type, Market, Players and Regions-Forecast to 2025

World Laminate Flooring Market Research Report 2022 (covering USA, Europe, China, Japan, India, South East Asia and etc)

About-Us: DecisionDatabases.com is a global business research reports provider, enriching decision makers and strategists with qualitative statistics. DecisionDatabases.com is proficient in providing syndicated research report, customized research reports, company profiles and industry databases across multiple domains.

Our expert research analysts have been trained to map client’s research requirements to the correct research resource leading to a distinctive edge over its competitors. We provide intellectual, precise and meaningful data at a lightning speed.

For more details: DecisionDatabases.com E-Mail: [email protected] Phone: +91 9028057900 Web: https://www.decisiondatabases.com/

#Engineered Wooden Flooring#Engineered Wooden Flooring Market#Engineered Wooden Flooring Market Report#World Engineered Wooden Flooring Market#Engineered Wooden Flooring Industry

0 notes

Link

Joint Admissions and Matriculation Board (JAMB) Registration Form 2019 : Instructions & Guidelines

Sale of the 2019 Joint Admissions and Matriculation Board, JAMB Form has commenced. Cyber cafés will not be allowed to render services on behalf of JAMB. So please visit ONLY JAMB accredited centres. There will be no sales of scratch cards for the registration. Continue reading for more details.

It’s important you Download JAMB CBT Practice Software from Here.

2019 Joint Admissions and Matriculation Board (JAMB) Unified Tertiary Matriculation Examination (UTME) registration procedures, instructions and everything you need to know is available here. Bookmark this page and always check back often. We will continue to supply you with adequate information to help you have a stress free registration.

The period of sale/registration for all candidates including those from Foreign Countries is from 10th January, 2019 to 21st February, 2019.

2019 JAMB UTME Eligibility.

The general entry requirements for admission into the First Degree, National Diploma (ND), National Innovation Diploma (NID) and Nigeria Certificate in Education (NCE) programmes in Universities, other Degree-Awarding Institutions, Monotechnics, Polytechnics, Innovation Enterprise Institutions and Colleges of Education are five (5) O’Level Credit passes including Mathematics and English Language. Details are available in the eBrochure which would be given to each Candidate at the accredited CBT centres and JAMB State-Offices.

2019 UTME Order of Choice of Institution.

On the 2019 registration platform, Candidates are to note that their 1st choice can be a College of Education, University, Innovative Enterprise Institutes, Polytechnics/Monotechnics, NDA (Nigerian Defence Academy) or Nigeria Police Academy.

2019 JAMB UTME Date and Venue.

The 2019 CBT EXAMINATION will commence on Saturday, 16th March and end on Saturday, 23rd March, 2019.

The venue of the examination will be at any centre in the candidate’s chosen examination town(s)

How to Obtain JAMB Form & General Instructions