#Key features of Decentralized physical infrastructure network

Text

Decentralized Physical Infrastructure (DePIN) Explained

DePINs are transforming the way we build and manage infrastructure by leveraging blockchain technology. These networks ensure resilience, transparency, and security by decentralizing control and integrating blockchain-based systems.

Key components of DePINs include off-chain networks, token incentives, blockchain architecture, and physical infrastructure networks. These elements work together to facilitate secure and transparent transactions and automate agreements through smart contracts. However, DePINs face challenges like scalability, regulatory uncertainty, and environmental concerns. The DePIN Flywheel concept demonstrates how tokenization fosters network growth, creating a self-reinforcing cycle of development and innovation.

This innovative model enables seamless collaboration among various devices without relying on a central authority, thereby democratizing access to essential infrastructure resources.

DePINs operate through several key components, including off-chain networks, token incentives, blockchain architecture, and physical infrastructure networks. These elements work together to facilitate secure transactions, automate processes with smart contracts, and tokenize physical assets. This integration not only optimizes resource management but also fosters a more inclusive and participatory infrastructure ecosystem, empowering communities and individuals alike.

The future of infrastructure lies in the convergence of digital and physical elements, with DePINs leading the way. Intelisync offers tailored blockchain development solutions to help startups and small businesses embrace decentralized infrastructure. Connect with Intelisync today to explore the Learn more....

#Dapp Development Company#Decentralized Physical Infrastructure#Networks DePIN#How do DePINs work in Crypto?#How Does DePIN Make Use of Blockchain Technology#Key features of Decentralized physical infrastructure network#Major Challenges of DePIN#Off-Chain Network#Physical Infrastructure Network#Physical Resource Networks (PRNs)#Pros of DePINs#The components of Decentralised Physical Infrastructure Networks (DePINs)#Types of DEPINS#Use of Blockchain Technology#What are DePINs in Crypto?#What does DePIN mean?#What Is The DePIN Flywheel?#Intelisync Blockchain Development company

0 notes

Text

Unleashing the potential of idle infrastructure

The rapid advancements in blockchain technology have ushered in a new era of decentralized networks, with Decentralized Physical Infrastructure Networks (DePINs) standing at the forefront of this transformation. DePINs represent a groundbreaking approach to managing and utilizing physical infrastructure by leveraging the power of decentralized networks and tokenization.

The challenge: unlocking the value of idle infrastructure

In traditional infrastructure models, vast amounts of physical assets—such as storage units, computing resources, and communication networks—often remain underutilized. This idle infrastructure represents a significant opportunity cost, as it could be leveraged to generate revenue, reduce costs, and enhance overall efficiency. However, centralized control, lack of transparency, and limited incentive structures have historically hindered the effective utilization of these resources. While rapid network expansion can be appealing, it is essential to align infrastructure growth with actual user demand.

Tokenization: The key to decentralized utilization

Tokenization is the process of representing physical assets as digital tokens on a blockchain. It offers a revolutionary solution to the problem of idle infrastructure. By tokenizing infrastructure assets, these resources can be fractionalized, traded, and monetized on decentralized platforms, improving resource allocation and creating new streams of revenue.

For example, a data center with excess storage capacity can tokenize this idle space, allowing users to purchase or lease storage directly through a decentralized marketplace. This not only optimizes the use of existing infrastructure but also democratizes access to it, enabling a broader range of participants to engage in the market.

Decentralization is at the heart of DePINs, but it can be undermined if control becomes too concentrated. Reliance on large mining pools, which centralize power in a few regions, underscores the need for DePINs to promote broad participation and prevent centralization to maintain the integrity of the network.

Koii Ocean: A new paradigm in funding DePINs

Koii has introduced the Koii Ocean platform, a groundbreaking approach to crowdfunding for projects. With 90,000 nodes in its ecosystem, it addresses a critical issue in the DePIN space: overreliance on venture capital funding, which often creates misalignment between project goals and community interests. Koii empowers builders through the principles of #crowdSource, #crowdBuild, and #crowdFund.

Key features of Koii Ocean:

Direct community investment: Koii node operators can invest directly in new projects. This ensures better alignment with long-term project goals (#crowdSource).

Comprehensive support: Koii Ocean handles all aspects of the fundraising process, including KYC and compliance. This makes it easier and more efficient for projects to launch and scale (#crowdBuild).

Democratized funding: The platform opens up investment opportunities to a broader community, moving away from the traditional VC-dominated model (#crowdFund).

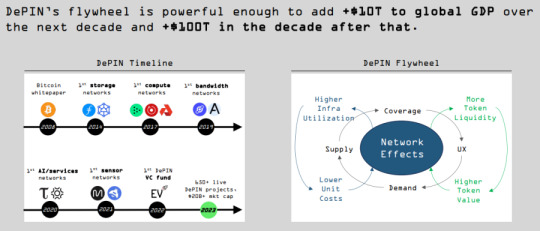

The economic flywheel and innovation incentives

The success of DePINs, including those launched through Koii Ocean, is closely tied to the economic flywheel effect. Initial token incentives drive participation, which in turn increases the network’s value and attractiveness. This creates a feedback loop that further incentivizes participation and network growth.

Koii’s approach aligns individual incentives with collective outcomes, creating a self-organizing ecosystem where participants are rewarded for contributing to the network. This decentralized model not only enhances the efficiency of resource utilization but also encourages the broader adoption of DePINs by lowering barriers to entry and increasing access to infrastructure assets.

Challenges and considerations

While DePINs and platforms like Koii Ocean offer immense potential, several challenges must be addressed:

Aligning growth with demand: DePINs must develop strategies to better forecast and match infrastructure expansion with actual user demand to avoid unsustainable growth.

Preventing centralization: true decentralization is crucial, and platforms like Koii Ocean help by broadening the investor base beyond traditional VCs.

Transparency and participant-friendly models: clear communication about KYC and participation costs helps keep everyone informed, preventing any misunderstandings and ensuring the network stays stable.

Balancing speculation and utility: DePIN projects must focus on building tangible utility to prevent volatility and ensure sustainable growth.

Conclusion

The intersection of tokenization, Crypto DePIN projects with innovative platforms like Koii Ocean represents a significant shift in how we can manage and utilize infrastructure. By unlocking the value of idle resources, enabling decentralized management, and providing new funding models, these technologies are paving the way for a new era of decentralized infrastructure.

By aligning individual incentives with collective outcomes, these new models offer powerful mechanisms for driving the growth and sustainability of decentralized networks, contributing to a more equitable and efficient global infrastructure landscape.

Join the koii node task

#koiiNetwork#web3#crypto#Blockchain#Decentralised#cryptocommunity#passive income#techinnovation#digitalfutre#internetofvalues#digitalassets#defi#earncrypto#decentralizedWeb#nextgentech

0 notes

Text

The Role of Web3 Builders in Advancing DePIN and Blockchain Technology

Introduction to Web3 Builders

In the rapidly evolving landscape of blockchain and decentralized technologies, Web3 builders are at the forefront, driving innovation and development. These pioneers are creating the next generation of internet applications that leverage blockchain, smart contracts, and decentralized networks. A critical area where Web3 builders are making significant strides is in the development of DePIN (Decentralized Physical Infrastructure Networks), which aims to revolutionize how we manage and operate physical infrastructure.

Understanding DePIN

DePIN represents a groundbreaking approach to managing physical infrastructure using blockchain technology. By decentralizing control and incorporating blockchain's transparency and security features, DePIN provides a more efficient and trustworthy method for handling physical assets and infrastructure. This includes applications in smart cities, supply chain management, energy distribution, and more.

The Impact of Web3 Builders on DePIN

Innovation in Decentralized Solutions: Web3 builders are developing innovative decentralized solutions that enhance the functionality and efficiency of DePIN. These solutions leverage blockchain's immutable ledger and smart contracts to automate processes, reduce fraud, and increase transparency.

Enhanced Security and Trust: By utilizing blockchain, Web3 builders ensure that data related to physical infrastructure is secure and tamper-proof. This is especially crucial for critical infrastructure sectors where data integrity and security are paramount.

Scalability and Flexibility: Web3 builders focus on creating scalable solutions that can adapt to the growing needs of industries. Whether it’s integrating new IoT devices or expanding network capabilities, these solutions are designed to be flexible and scalable.

Key Contributions of Web3 Builders to DePIN

Smart City Infrastructure: Web3 builders are instrumental in developing smart city infrastructure. By integrating IoT devices with blockchain, they enable real-time monitoring and management of urban resources such as traffic, energy, and public services, leading to more efficient and sustainable cities.

Supply Chain Transparency: In the supply chain sector, Web3 builders create systems that track goods from production to delivery using blockchain. This ensures transparency, reduces the risk of counterfeiting, and improves the efficiency of logistics operations.

Energy Management: Web3 builders are also advancing energy management systems by developing blockchain-based platforms that monitor and optimize energy consumption and distribution. This helps in integrating renewable energy sources and improving overall energy efficiency.

Healthcare Systems: By applying blockchain technology to healthcare, Web3 builders enhance patient data security and integrity. Decentralized health records ensure that patient data is only accessible to authorized individuals, improving privacy and reducing the risk of data breaches.

Future Prospects for Web3 Builders and DePIN

The future of DePIN looks promising with the continuous efforts of Web3 builders. As blockchain technology and decentralized networks evolve, we can expect even more sophisticated and efficient applications in various sectors. The collaboration between Web3 builders and industry stakeholders will be crucial in driving the adoption and success of DePIN solutions.

Web3 builders play a pivotal role in the advancement of DePIN and blockchain technology. Their innovative solutions are transforming how we manage and operate physical infrastructure, making it more secure, transparent, and efficient. As we move towards a more decentralized future, the contributions of Web3 builders will be essential in realizing the full potential of DePIN and blockchain technology.

By staying engaged with the developments led by Web3 builders, businesses and individuals can harness the benefits of these cutting-edge technologies and drive forward the next wave of digital transformation. Follow U2U Network to update the latest information about Blockchain

0 notes

Text

Decentralized Finance (DeFi) Redefining Traditional Banking

Decentralized Finance (DeFi) has emerged as a disruptive force in the financial industry, challenging the traditional banking system with its innovative approach to providing financial services. By leveraging blockchain technology and smart contracts, DeFi platforms offer users the ability to access a wide range of financial products and services without the need for intermediaries. This article explores how DeFi is redefining traditional banking and its implications for the future of finance.

The Rise of DeFi

The concept of DeFi gained traction with the launch of Ethereum in 2015, which introduced smart contracts—self-executing contracts with the terms of the agreement directly written into code. Smart contracts enabled the creation of decentralized applications (dApps) that could automate financial transactions, such as lending, borrowing, and trading, without the need for traditional financial institutions.

Since then, the DeFi ecosystem has experienced explosive growth, with a myriad of protocols and platforms offering innovative financial services. Decentralized exchanges (DEXs), lending protocols, liquidity pools, and yield farming are just a few examples of the diverse range of DeFi applications available to users.

Disintermediation of Financial Services

One of the key features of DeFi is its disintermediation of financial services. Traditional banking relies on intermediaries such as banks, brokers, and clearinghouses to facilitate transactions and manage risk. These intermediaries often come with associated costs, delays, and barriers to entry.

In contrast, DeFi platforms operate on decentralized networks, where transactions are executed directly between users through smart contracts. This removes the need for intermediaries, resulting in lower fees, faster transaction times, and increased accessibility for users around the world.

Access to Financial Services for the Unbanked

One of the most promising aspects of DeFi is its potential to provide access to financial services for the unbanked and underbanked populations. According to the World Bank, approximately 1.7 billion adults worldwide remain unbanked, lacking access to basic financial services such as savings accounts, loans, and insurance.

DeFi platforms have the ability to reach these underserved populations by leveraging blockchain technology and cryptocurrencies. Users can access financial services directly from their smartphones, without the need for a traditional bank account or physical infrastructure. This has the potential to empower individuals and communities by giving them control over their finances and access to global markets.

Challenges and Opportunities

While DeFi holds great promise, it also faces significant challenges. Security vulnerabilities, regulatory uncertainty, and scalability issues are among the primary concerns facing the DeFi ecosystem. High-profile hacks and exploits have highlighted the need for robust security measures and risk management practices.

Regulatory scrutiny is also increasing as governments and regulatory bodies seek to understand and regulate the rapidly evolving DeFi space. Balancing innovation with consumer protection and financial stability will be crucial in shaping the regulatory landscape for DeFi in the years to come.

Despite these challenges, DeFi presents numerous opportunities for innovation and growth. As the technology matures and scalability solutions are developed, DeFi has the potential to become a mainstream alternative to traditional banking, offering users greater financial sovereignty, transparency, and efficiency.

Decentralized Finance (DeFi) is revolutionizing the financial industry by redefining traditional banking and democratizing access to financial services. By leveraging blockchain technology and smart contracts, DeFi platforms offer users a wide range of financial products and services without the need for intermediaries.

While DeFi faces challenges such as security vulnerabilities and regulatory uncertainty, its potential to provide access to financial services for the unbanked and underbanked populations is immense. With continued innovation and collaboration, DeFi has the opportunity to reshape the future of finance, empowering individuals and communities around the world.

0 notes

Photo

New Post has been published on https://cryptonewsuniverse.com/from-financial-to-physical-the-next-big-thing-in-crypto-depin/

From Financial To Physical The Next Big Thing In Crypto - DePIN

From Financial To Physical. The Next Big Thing In Crypto – DePIN

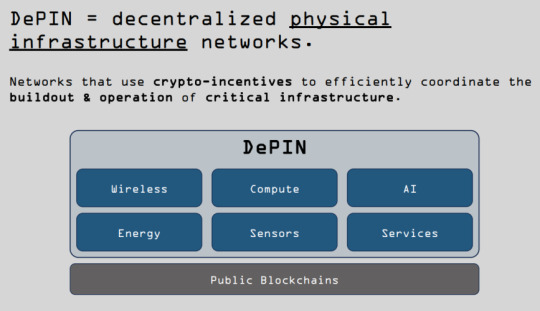

Recently, there has been significant interest in decentralized physical infrastructure, also known as DePIN, within the crypto space. People are curious about the potential of this niche and which specific projects within it are worth noting. The latest detailed study, titled State of DePIN 2023 by Messari, aims to provide insights into these questions. This summary will highlight key findings from the report and discuss their potential impact on the cryptocurrency market.

What Is DePIN?

The report commences with a concise delineation of DePIN, an acronym for decentralized physical infrastructure. It encompasses a cluster of ventures that employ cryptocurrency-based incentives to foster a range of physical infrastructure. These initiatives span from decentralized Wi-Fi systems, decentralized computing clouds, decentralized cloud storage solutions, and decentralized mobile networks to other similar endeavors. A salient feature that sets most DePIN projects apart, in addition to their crypto-based incentives, is the accessibility for individuals to contribute, provided they possess the requisite hardware.

Source: The Messari Report.pdf

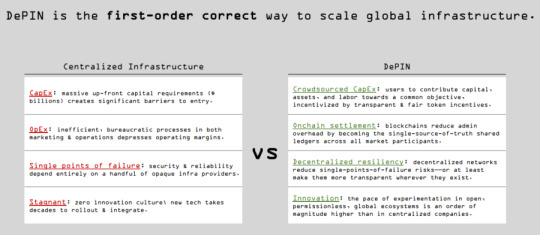

The report highlights that DePIN solutions have the advantage of being more efficient, resilient, and high-performing than their centralized counterparts. Additionally, DePIN projects can rapidly innovate and evolve due to community participation, which gives them a unique edge over centralized projects. This efficiency and resilience not only make them attractive to investors but also instill confidence in their long-term viability.

Source: The Messari Report.pdf

The authors posit that DePIN initiatives possess a self-reinforcing mechanism known as a flywheel, whereby their growth and influence fuel further adoption and expansion. As these projects gain traction and popularity among users and service providers, they become even more potent and widespread, creating a positive feedback loop. The authors project that DePIN will substantially impact the global economy, with the potential to augment GDP by a staggering $10 trillion over the next decade. This ambitious projection underscores the transformative potential of these projects.

Source: The Messari Report.pdf

The authors go on to list the industries in which DePIN is currently causing significant changes. These industries encompass various areas such as digital maps in the crypto sector, energy grid management, home internet services, food delivery platforms, ride-sharing services, and, surprisingly, even pet and livestock-related projects. It should be noted that these endeavors are still in their initial phases.

The authors have categorized crypto projects in the DePIN niche into six categories: compute, wireless, energy, AI, services, and sensors. According to their analysis, there are over 650 cryptos across these categories, with a combined market capitalization of over $20 billion.

Source: The Messari Report.pdf

The DePIN projects have garnered significant interest from venture capitalists, resulting in substantial capital being invested. To put it in perspective, the top ten DePIN projects alone have collectively secured a significant amount of funding. It's worth noting that many of these projects continue to attract investments even after their initial coin offerings (ICOs) and the launch of their main networks.

It is uncommon for a crypto project to secure substantial funding after its ICO. However, when this does happen, it indicates that investors have tremendous confidence in the project's potential. The DePIN niche has attracted significant post-ICO funding, with numerous projects raising substantial amounts. The top ten DePIN crypto projects in terms of funding raised include Filecoin and Helium, each securing $250 million, RNDR Network with $100 million, Fetch AI with $75 million, Livepeer with $50 million, Really with $35 million, Hivemapper with $25 million, Andrena with $25 million, Braintrust with $25 million, and DIMO with $20 million.

DePIN Blockchains

Intriguingly, most of the nearly thousand crypto projects operating within the DePIN space are opting to deploy on a select few cryptocurrency blockchains. This observation encompasses both layer one and layer two blockchains, with Solana emerging as the most favored layer one choice among DePIN projects.

The authors cite the high speed, affordability, and use of the Rust programming language as reasons for this. Among layer two solutions, Caldera and Eclipse are favored for DePIN projects. These platforms offer flexibility, enabling DePIN projects to blend Ethereum's security with Solana's performance, as seen in the case of Eclipse.

In addition to layer one blockchains that prioritize DePIN, the authors highlight some notable examples. Iotex is one such example, which was already utilized by the US military for health monitoring trials in November 2021. Peaq, on the other hand, is still in the pre-launch phase, but it has already generated significant interest and excitement within the community.

The importance of DePIN adoption cannot be overstated, as it will have a profound impact on both layer one and layer two. The success of DePIN chains and projects hinges on the demand side of the equation, which is carefully examined in the second part of the report.

Unlike many other cryptocurrencies, the authors emphasize that DePIN revenues are fueled by utility rather than speculation. They highlight that participants in DePIN projects typically need to purchase and lock or burn their associated tokens in return for access to the decentralized service or product being provided. This characteristic aligns DePIN projects with traditional crypto coins, which are utilized for various purposes, such as payment of fees and staking.

According to the authors, DePIN projects consistently yield an estimated $15 million in yearly on-chain revenue throughout the bear market. Given the large number of DePIN projects, this amount may seem insignificant. The authors, however, need to offer a clear answer to which DePIN projects are the most profitable, leaving it open to speculation.

However, it is worth mentioning that Livepeer has developed a dashboard named the Web 3 Index, which monitors the earnings of major DePIN projects. Decentralized storage and computing are generating the highest revenue.

Source: The Messari Report.pdf

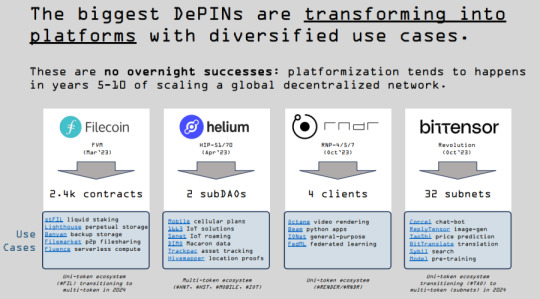

The authors highlight the evolution of DePIN projects, with many expanding their offerings to become comprehensive platforms providing a variety of decentralized products and services. They cite Filecoin, Helium, RNDR Network, and Bittensor as five notable examples of such platforms, demonstrating the diversification of DePIN projects beyond their initial scope.

DePIN Categories

Compute

In the next section, the authors divide the Compute category into its previously discussed main elements: Storage, Compute, and Retrieval. They mention that specific DePIN projects within the compute category, such as Filecoin and Akash Network, provide a “full stack experience.”

Source: The Messari Report.pdf

In terms of Storage, it's suggested that DePIN could gain widespread acceptance by utilizing decentralized data storage. While other cryptocurrency projects and protocols have primarily adopted this technology, it's promising to see increased decentralization across the crypto space. This article provides an opportunity to delve deeper into the meaning of decentralization.

The authors highlight that Compute faces the opposite issue compared to storage. While there is an abundance of decentralized data storage but insufficient demand for it, the supply of decentralized computing power is lacking. Yet, there is a surplus of demand for it.

The authors note that decentralizing Retrieval poses a significant challenge, especially in maintaining competitiveness. This is primarily due to the fact that Cloudflare, a centralized retrieval protocol, currently serves 20% of all regular websites at no cost, making it challenging to monetize alternative solutions.

Wireless

This relates to the next DePIN category the authors detailed earlier: Wireless. The growth of the total addressable market for decentralized wireless services has been exponential, and it's no surprise why. The demand for decentralized wireless services is rising as the world becomes increasingly interconnected. This category of DePIN has even earned its own name – DeWi, short for decentralized wireless – highlighting its significance in the industry.

The authors also divide this category into three parts: mobile, fixed internet, and Wi-Fi. Helium, in particular, is gaining significant attention due to its rapid expansion and popularity. As an illustration, Helium has collaborated with T-Mobile to offer affordable mobile plans across the US.

Source: The Messari Report.pdf

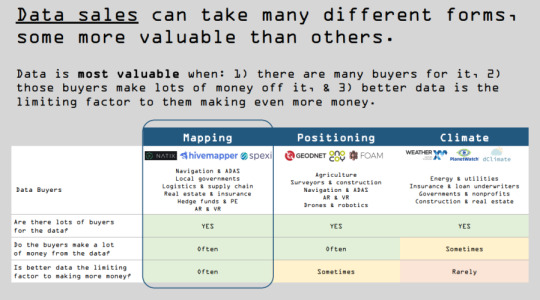

Data Sales

The authors decided to examine a new category not initially included in their list but gaining significant interest: Data sales. They point out the importance of data in a world that is becoming more digital.

That is why they are optimistic about DePIN initiatives such as Hivemapper, which motivates individuals to map their local surroundings, similar to Google Maps but without a central authority. They also highlight other specialized DePIN projects, such as one that monitors noise pollution in a community-driven manner.

This relates to another category detailed earlier: Services. According to their perspective, they classify services into two types: horizontal services, like decentralized marketplaces for freelance work, and vertical services, such as decentralized ride-sharing systems.

The conversation shifts to the emerging DePIN category of Vertical Ads, but surprisingly, they don't offer much insight into it. Notably, they fail to mention the Brave browser in this context. The situation is similar regarding energy-related DePIN initiatives, as they are also in the early stages of development.

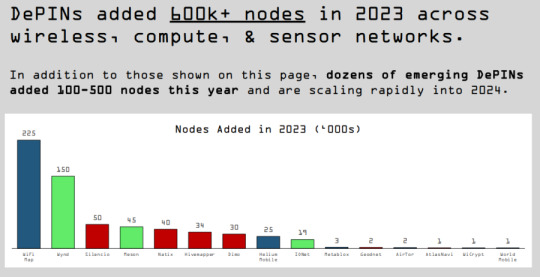

DePIN Growth, Potential

The report now shifts its attention to the supply side of the equation, specifically examining the remarkable growth and potential of DePIN nodes. The authors begin by presenting an interesting fact: The number of DePIN nodes continues to grow and has now surpassed 600,000. The graph below illustrates that the Wi-Fi map nodes are the most numerous, with more than 200,000 nodes being a part of the DePIN project.

Source: The Messari Report.pdf

The authors note a rapid increase in the quantity of DePIN nodes. This growth is attributed to DePIN initiatives addressing scalability challenges related to the expansion of physical infrastructure. Consequently, DePIN offerings are becoming more affordable and of higher quality. It is worth noting that the development of this physical infrastructure is being encouraged through the distribution of crypto incentives, particularly tokens awarded to individuals contributing to such infrastructure.

The tokenomics of these tokens are integral to the supply-side equation, and the authors recognize three distinct strategies. First, supply-based tokenomics encourages growth. Second, demand-based tokenomics promotes efficiency. Lastly, a combination of supply- and demand-based tokenomics strikes a balance between development and efficiency.

The advantages and disadvantages of the three methods are outlined in the image below. The authors also observe that certain strategies have been more effective for specific DePIN projects. For example, they note that projects that require a lot of hardware benefit the most from supply-based tokenomics, as it essentially rewards contributors with a large number of tokens. On the other hand, DePIN projects that are primarily software-based can expand by offering points that may eventually be converted into tokens.

Source: The Messari Report.pdf

In assessing the value of various DePIN projects, the authors recommend focusing on both the market cap and the fully diluted valuation. Their rationale is that DePIN projects often involve significant investments from venture capitalists, which can influence price movements.

Essentially, the authors suggest that the demand for specific DePIN offerings may be tempered by the influx of tokens from initial project backers. They imply that lower-quality DePIN projects may encounter challenges and predict that many early investors will opt to sell once their portfolios have appreciated five to tenfold.

Before making any investment decisions, it's crucial to thoroughly investigate cryptocurrencies, especially those in emerging sectors like DePIN. While some experts recommend investing in blockchains that support DePIN projects to mitigate risk, this approach may not yield returns as substantial as identifying and investing in promising DePIN projects early on, with their potential for 100x growth.

Source: The Messari Report.pdf

DePIN 2024 Forecast

The section of Messari's DePIN report that garnered the most excitement is the predictions for DePIN in 2024. According to the authors, the first theme you need to watch out for is the intersection of DePIN and AI, which is expected to play a crucial role in DePIN's development. DePIN AI has the potential to surpass centralized AI in terms of capabilities and effectiveness within the next one to two years.

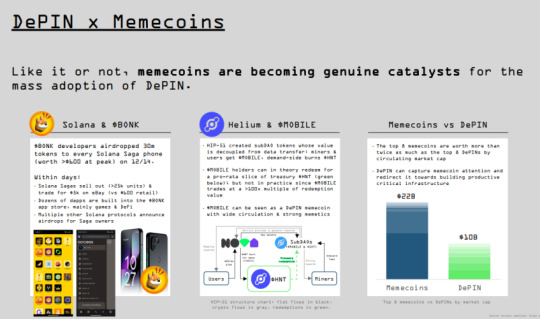

The second important topic is the intersection between DePIN and meme coins. While the idea may seem odd, the authors acknowledge this and use the Solana phone Bonk airdrop as an example to show how these two can be paired. This also hints at a future where physical infrastructure is encouraged through the use of meme coins.

The third important aspect to be mindful of is the intersection of DePIN with zero-knowledge technology. By leveraging advanced zero-knowledge technology, DePIN could carry out a form of cyber attack known as a vampire attack on Web 2, which involves taking control of users' content and activity.

The fourth theme to watch is similar to the third but focuses on the intersection between DePIN and gaming. Think of it as GameFi on steroids, where the cryptocurrency elements of gaming are integrated with cutting-edge gaming technology, such as VR headsets, to create a more immersive and interactive experience.

The fifth theme to be mindful of is the intersection between DePIN and privacy, with a particular focus on decentralized virtual private networks (VPNs) as a critical intersection area.

The authors highlight a curious trend in DePIN: The intersection between DePIN and Asia, referring to the continent, is expected to yield unexpected results. They foresee multiple top 10 DePIN projects emerging from this region, with most still in the nascent stages of development.

What It Means For Crypto

The DePIN report's findings have significant implications for the cryptocurrency market. In essence, they suggest that the most successful cryptocurrency narratives and niches during the current bull market will be those that are not financially focused. A previous article on crypto narratives supports this and is reinforced by the fact that some DePIN projects have already acknowledged this trend.

Several crypto initiatives acknowledge that applications related to finance will face increased scrutiny. In contrast, DePIN presents a significantly lower likelihood of antagonizing regulators, and its credibility is evident. The increasing presence of DePIN projects on global app stores and their partnerships with established companies and brands demonstrate that it operates within a safer realm, particularly in regulatory compliance.

Given its immense potential and the nascent stage of most DePIN projects, the DePIN niche is expected to be highly unpredictable from an investment standpoint. While some tokens may experience astronomical growth, others will likely plummet in value or become worthless. Despite the risks, the long-term outlook for DePIN indicates that it will have a lasting impact on the cryptocurrency landscape, contributing to increased adoption and mainstream acceptance.

Previously, the main factors driving cryptocurrency demand were primarily based on speculation. However, real-world adoption may occur with the rise of DePin and other non-financial sectors. This shift could make everyday individuals feel more at ease using and putting money into cryptocurrency, consequently boosting further adoption and investment. Advocates believe that the ultimate goal of cryptocurrency is to decentralize all aspects of life. If that is the desired outcome, we are on the right path.

The reaction of centralized equivalents to the decentralized alternatives of popular products and services is a topic of much speculation. Some anticipate a similar response to DeFi and other disruptors of the traditional financial system, characterized by intense regulatory opposition, mainstream media-fueled FUD, and attempts to suppress their growth. However, DePIN networks have an inherent advantage that will make them more resistant to suppression, as they are generally more decentralized than most cryptocurrencies. This resilience will demonstrate the staying power of crypto.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Editor and Chief Markethive: Deb Williams. (Australia) I thrive on progress and champion freedom of speech. I embrace "Change" with a passion, and my purpose in life is to enlighten people to accept and move forward with enthusiasm. Find me at my Markethive Profile Page | My Twitter Account | and my LinkedIn Profile.

0 notes

Text

DePIN Sector Dynamics: RNDR, IOTX, HNT, and THETA Gain Traction – A Comprehensive Analysis

The emerging sector of Decentralized Physical Infrastructure Networks (DePIN) is experiencing a spotlight on key projects, including Render Network (RNDR), IoTeX (IOTX), Helium (HNT), and Theta Network (THETA). Examining recent data from platforms like CoinGecko, CryptoBusy explores the diverse performances within this sector, shedding light on the market forces influencing these projects.

Render Network, featuring its native token RNDR, has shown a modest 2.6% rise in its trading price, currently at $3.90. Positioned at the 53rd spot on CoinGecko with a market capitalization of $1,465,205,430, Render faces a 3.60% decline over the past week, reflecting challenges within the Polygon Ecosystem.

IoTeX (IOTX), in contrast, faces a 28.40% drop in daily trading volume, signaling a potential decrease in market activity. Currently trading at $0.04142, IoTeX's performance indicates challenges within the DePIN sector, marked by an 83.75% decrease from its all-time high.

Helium's HNT token showcases a noteworthy 10.2% increase in the past day, trading at $7.63. Positioned at the 64th spot on CoinGecko with a market capitalization of $1,101,645,933, Helium's rise is accompanied by a 34.30% increase in daily trading volume, indicating growing investor interest.

0 notes

Text

Decentralized Physical Infrastructure (DePIN) Explained

What if infrastructure could be managed without central control, ensuring security and transparency? Enter Decentralized Physical Infrastructure Networks (DePINs).

DePINs are transforming the way we build and manage infrastructure by leveraging blockchain technology. These networks ensure resilience, transparency, and security by decentralizing control and integrating blockchain-based systems.

Key components of DePINs include off-chain networks, token incentives, blockchain architecture, and physical infrastructure networks. These elements work together to facilitate secure and transparent transactions and automate agreements through smart contracts. However, DePINs face challenges like scalability, regulatory uncertainty, and environmental concerns. The DePIN Flywheel concept demonstrates how tokenization fosters network growth, creating a self-reinforcing cycle of development and innovation.

This innovative model enables seamless collaboration among various devices without relying on a central authority, thereby democratizing access to essential infrastructure resources.

DePINs operate through several key components, including off-chain networks, token incentives, blockchain architecture, and physical infrastructure networks. These elements work together to facilitate secure transactions, automate processes with smart contracts, and tokenize physical assets. This integration not only optimizes resource management but also fosters a more inclusive and participatory infrastructure ecosystem, empowering communities and individuals alike.

However, the path to widespread DePIN adoption is not without its challenges. Issues such as scalability, regulatory uncertainties, technological hurdles, and environmental impacts need to be addressed. Despite these obstacles, the potential benefits of DePINs are immense, offering a more resilient, efficient, and sustainable infrastructure future.

To harness the power of decentralized solutions for your business, reach out to Intelisync and start your blockchain journey today.

The future of infrastructure lies in the convergence of digital and physical elements, with DePINs leading the way. Intelisync offers tailored blockchain development solutions to help startups and small businesses embrace decentralized infrastructure. Connect with Intelisync today to explore the potential of Learn more....

#Dapp Development Company#Decentralized Physical Infrastructure#Networks DePIN#How do DePINs work in Crypto?#How Does DePIN Make Use of Blockchain Technology#Key features of Decentralized physical infrastructure network#Major Challenges of DePIN#Off-Chain Network#Physical Infrastructure Network#Physical Resource Networks (PRNs)#Pros of DePINs#The components of Decentralised Physical Infrastructure Networks (DePINs)#Types of DEPINS#Use of Blockchain Technology#What are DePINs in Crypto?#What does DePIN mean?#What Is The DePIN Flywheel?#Intelisync Blockchain Development company

0 notes

Text

Unlocking a New Dimension of Entertainment: The Rise of Metaverse Casino Games

Introduction:

In the ever-evolving landscape of digital innovation, the concept of the metaverse has emerged as a revolutionary force, reshaping the way we interact with technology and entertainment. Among the myriad possibilities within this expansive virtual universe, one fascinating development has been the advent of Metaverse Casino Games. In this article, we delve into the immersive world of Metaverse Casino Games, exploring the convergence of virtual reality, blockchain technology, and the metaverse to create a groundbreaking gaming experience.

Metaverse Casino Games: A Gateway to Virtual Thrills

The metaverse, often described as a collective virtual shared space, has opened up new avenues for creativity and engagement. Metaverse Casino Games leverage this virtual space to bring the thrill of traditional casinos into the digital realm. Imagine stepping into a vibrant virtual casino where players can interact with each other and experience the excitement of games like poker, blackjack, and roulette—all from the comfort of their homes.

Metaproalne: The Backbone of Metaverse Casino Games

At the core of this revolutionary gaming experience lies the concept of Metaproalne, a metaverse protocol that seamlessly integrates blockchain technology with virtual reality. This fusion creates a secure and transparent environment, ensuring fair play and real ownership of in-game assets. Metaproalne acts as the backbone, providing a decentralized infrastructure that enhances the overall gaming experience in the metaverse.

The Allure of Metaverse Products

Metaverse Casino Games are not just about gambling; they represent a broader category of metaverse products. These products encompass a range of virtual assets, from customizable avatars and in-game currencies to virtual real estate within the metaverse. The metaverse product ecosystem creates a dynamic virtual economy, allowing players to buy, sell, and trade assets, adding a layer of realism and excitement to the gaming experience.

A Glimpse into the Virtual Casino Experience

Stepping into a Metaverse Casino Game is akin to entering a futuristic, neon-lit gaming utopia. Virtual avatars stroll through a bustling casino floor, surrounded by the sounds of slot machines, cheers from poker tables, and the spin of the roulette wheel. The immersive graphics and realistic gameplay elevate the gaming experience, making it almost indistinguishable from a physical casino visit.

The Role of Blockchain in Ensuring Fair Play

One of the key advantages of Metaverse Casino Games is the integration of blockchain technology to guarantee fairness and transparency. Through the use of smart contracts, the games operate on a decentralized network, eliminating the possibility of manipulation. Players can trust that the outcomes are truly random, enhancing the credibility of the virtual casino environment.

Metaverse Casino Games and Social Interaction

Beyond the allure of winning jackpots, Metaverse Casino Games offer a social dimension that sets them apart from traditional online casinos. Players can engage with each other through their avatars, fostering a sense of community. Virtual chat features, live events, and multiplayer options create an environment where the social aspect of gaming is as integral as the games themselves.

Navigating the Metaverse Economy

As players immerse themselves in Metaverse Casino Games, they become active participants in a thriving virtual economy. Metaverse products, ranging from rare virtual assets to exclusive in-game items, can be bought and sold using blockchain-based currencies. The metaverse economy introduces a novel dimension where players can accumulate wealth and assets that hold real-world value.

Challenges and Opportunities in the Metaverse Casino Industry

While the metaverse casino industry presents exciting possibilities, it is not without challenges. Issues such as regulatory considerations, security concerns, and the need for widespread adoption pose hurdles. However, these challenges also represent opportunities for innovation and collaboration within the industry as it strives to create a safe and enjoyable virtual gaming environment.

Conclusion:

Metaverse Casino Games have ushered in a new era of entertainment, blending the thrill of traditional casinos with the limitless potential of the metaverse. Powered by Metaproalne and fueled by blockchain technology, these games offer a secure, transparent, and socially interactive gaming experience. As the metaverse continues to evolve, the convergence of virtual reality, blockchain, and metaverse products promises to reshape the landscape of online gaming, providing players with an unparalleled level of immersion and excitement. The future of entertainment has arrived, and it's unfolding within the virtual walls of the Metaverse Casino.

0 notes

Text

Solana's Secret Weapon: How it Dethroned BNB

Solana Surged Past BNB Chain, Claiming Fourth Spot in Global Market Cap Rankings Last Week.

Solana has been making waves in the cryptocurrency world, consistently surpassing Ethereum

in daily decentralized exchange (DEX) trading volume. This trend, coupled with innovations in

decentralized physical infrastructure networks (DePINs), signals a potential shift in the crypto

landscape that could have far-reaching implications.

Key Highlights:

● Solana overtook BNB chain in Market Cap this week, making them fourth place in the

overall global market cap

● Solana overtook Ethereum in DEX volume again, with $848.71 million compared to

Ethereum's $778.66 million on July 1, 2024.

● Firedancer, a new high-performance validator client, promises to boost significantly

Solana's transaction processing capabilities .

● Solana's low fees and high efficiency are driving its growing popularity.

● Innovations in DePINs, like those proposed by Koii Network, could further accelerate this

trend.

Solana's Rising Dominance

The latest data shows Solana surpassing Ethereum in daily DEX trading volume, with $848.71

million compared to Ethereum's $778.66 million on July 1, 2024. This "flipping" event is

becoming more frequent, occurring approximately every 10 days in recent months. This

increased frequency suggests a growing shift in user preference and network activity. Moreover,

Solana has received a great deal of interest from institutional investors as a potential candidate

for the launch of a future spot ETF.

Solana's appeal lies in its low transaction fees and high efficiency, making it more

capital-efficient for traders. This efficiency allows for profitable trades at lower values and

enables high-frequency trading, contributing to higher overall volumes.

#DePIN - The Decentralized Infrastructure Revolution

While Solana's growth is impressive, innovations in DePINs could further accelerate this trend

and reshape the entire blockchain landscape. The Koii Network, for example, proposes novel

solutions to enhance scalability and reliability of decentralized networks by leveraging consumer

computing capacity.

Koii introduces two key innovations:

1. SCALEs (Succinct Curated Acyclic Ledger Extensions): These efficient large archives

are event streams with dynamic audits and incentives, addressing blockchain scalability

challenges.

2. CARP (Compute Attribution and Reputation Protocol): This standardizes reputation

management to boost network security and reduce audit inefficiencies.

The above innovations have the capacity to support a wide range of decentralized applications,

from streaming services to AI-driven search engines and uncensorable social platforms. By

tapping into underutilized and idle consumer hardware resources, they aim to create a more

efficient and equitable digital economy.

KOII: A Fork Built on Solana's Strengths

Recognizing Solana's potential, KOII, an innovative blockchain project, has forked the Solana

codebase to create its own unique ecosystem. KOII's decision was influenced by Solana's Proof

of History consensus mechanism, which provides an excellent framework for DePIN

applications. The recent growth of the Solana ecosystem further validates KOII's choice.

However, KOII isn't just a Solana clone. It has introduced several key differences that set it

apart:

1. Leveraging Consumer Hardware: KOII taps into the vast potential of consumer devices,

creating a more decentralized and accessible network.

2. Multi-Token Support: Unlike many blockchain networks, KOII allows users to pay fees in

various tokens, supporting a diverse ecosystem.

3. Shorter Epoch Time: This feature enables faster network updates and more responsive

governance.

4. Off-chain Storage Integration: KOII reduces on-chain data load by integrating with

off-chain storage solutions, enhancing scalability.

5. Flexible Smart Contracts: KOII's smart contract system offers greater flexibility, allowing

for more complex and diverse applications.

6. Minimal On-chain Data Load: By utilizing off-chain hooks, KOII minimizes the amount of

data stored directly on the blockchain, improving efficiency and reducing costs.

While Koii has been up and running for a couple years, their whitepaper is still one of the best

ways to learn more about how this fits into the broader Solana landscape. Read more here:

koii.network/whitepaper

Firedancer: Boosting Solana's Potential

Solana's rising dominance is further bolstered by the development of Firedancer, a new

high-performance validator client. Created by Jump Crypto, Firedancer aims to dramatically

increase Solana's transaction processing capabilities, potentially handling over 1 million

transactions per second.

This significant upgrade not only enhances Solana's appeal as a leading Layer 1 blockchain but

also addresses the network's need for client diversity. By providing a fourth validator client

option, Firedancer strengthens Solana's resilience against bugs, code exploits, and attacks,

positioning it to better compete with other top cryptocurrencies. The introduction of Firedancer

could be a game-changer in Solana's quest to challenge Ethereum's dominance in the DeFi

space

Future Implications

The rise of Solana and the development of new decentralized infrastructure technologies point

to a future where blockchain networks can handle greater transaction volumes (i.e., TPS) with

increased efficiency. This could lead to:

1. More competitive DEX environments, potentially driving down costs for users.

2. Increased adoption of decentralized finance (DeFi) applications due to lower barriers to

entry.

3. The emergence of new types of dApps that were previously unfeasible due to scalability

limitations.

However, it's important to note that Ethereum still maintains a significant lead in total value

locked (TVL) and overall ecosystem size. Ethereum's TVL stands at $59 billion compared to

Solana's $4.5 billion, indicating that Ethereum's dominance in the broader DeFi landscape

remains strong.

Conclusion

As Solana continues to gain ground on Ethereum in terms of DEX volume, and newtechnologies like Koii's SCALEs and CARP emerge, we may be witnessing the early stages of a

major shift in the blockchain and cryptocurrency landscape. These developments could lead to

more efficient, scalable, and user-friendly decentralized networks, potentially accelerating the

adoption of blockchain technology across various sectors.

For those interested in being part of this revolution, there are two primary ways to get involved, one of which is

1. Run a KOII Node: Contribute to the network's decentralization and earn rewards.

As the blockchain landscape evolves, Solana's rise and its influence on projects like KOII

showcase the dynamic nature of the crypto ecosystem. The flippening of BNB may just be the

beginning of Solana's journey to the top, with far-reaching implications for the future of

decentralized technologies.

However, it's crucial to remember that the crypto market is highly volatile and that Ethereum's

established ecosystem and ongoing upgrades could help it maintain its leading position. As

always, investors and users should conduct thorough research and consider the risks before

participating in any cryptocurrency-related activities.

#solana#fire dancer#scalability#proof of history#TPS#Rust#blockchain#blockchain development#defi#Depin#scale#CARP#Market cap#BNB#cryptocurrency

1 note

·

View note

Text

DePIN Projects on peaq Network

DePIN projects on peaq Network leverage decentralized physical infrastructure to create innovative solutions for real-world challenges. These projects combine IoT, blockchain, and AI to enhance efficiency, security, and scalability.

The world of technology is constantly evolving, and the Decentralized Physical Infrastructure Network (DePIN) has emerged as a game-changing concept promising to revolutionize how devices and machines communicate and collaborate. At the forefront of this transformation is the peaq Network, a Layer 1 blockchain designed specifically to support the development and deployment of DePIN projects on peaq Network. In this comprehensive article, we will delve into this network, exploring its advantages as well as the featured DePIN projects it hosts. Let's explore!

What is peaq?

peaq Network is a Layer 1 blockchain that has been specifically designed to cater to the needs of DePINs and Machine Real World Assets (RWA). The network's primary objective is to provide a robust and scalable platform for the development and deployment of DePIN applications, enabling seamless interactions between devices, machines, and the physical world.

peaq Network's key features

Here are peaq Network's key features that make it an ideal platform for DePIN projects:

High throughput: The peaq Network is capable of handling over 100,000 transactions per second (TPS) with low transaction costs, ensuring efficient and scalable operations for DePIN applications. Super Decentralized: peaq has a Nakamoto Coefficient of 90+. The highest among major Layer-0 and Layer-1 blockchains.

Cross-chain compatibility: The peaq Network integrates with the Wormhole protocol, allowing for seamless interaction with other blockchains, including Ethereum, BNB Chain, and Polkadot. This cross-chain compatibility enables DePIN projects to leverage the strengths of multiple blockchain ecosystems.

Scalability and sustainability: The peaq Network utilizes Elastic Scaling and Agile Core Time technologies to maintain high transaction volumes (100,000 transactions per second) while ensuring energy efficiency and sustainability.

Developer-friendly: The peaq Network supports both Ink! (Rust) and Ethereum Virtual Machine (EVM) smart contracts, providing developers with flexibility and choice in their development approach.

Growing ecosystem: The peaq Network has already attracted over 25 DePIN projects, including Eloop, a car-sharing platform, showcasing the platform's appeal and the growing ecosystem of DePIN applications.

Modular DePIN functions on peaq Network

The peaq Network provides pre-built functionalities for essential DePIN components. These functionalities are accessible through the peaq SDK, enabling developers to quickly build and deploy their DePIN applications.

peaq ID

peaqID is a decentralized identifier (DID) designed for machines, devices, vehicles, and robots in Web3. Based on the W3C DID standard, it enables verifiable, decentralized digital identity for these entities. peaqID serves several key functions:

Enabling machines to identify and authenticate one another

Facilitating transactions between machines

Verifying assertions made by machines

Preserving privacy and upholding sovereignty

peaq access

peaq access is a robust feature enabling sophisticated access control within the peaq network. By defining user roles, it allows developers to manage permissions for decentralized physical infrastructure networks (DePINs) and decentralized applications (dApps). This versatility empowers dApp developers to create diverse use cases within the Economy of Things, such as granting or denying car usage in a car-sharing dApp or controlling access to specific locations based on user privileges.

peaq pay

The peaq pay feature simplifies payments between machines or users and machines. When interacting with Decentralized Physical Infrastructure Networks (DePINs), users often encounter difficulties ensuring that the service will be fully completed before payment. Conversely, DePINs face the challenge of ensuring users have sufficient funds to cover the service cost. peaq pay addresses these issues through a three-step process:

Creation of a multi-sig wallet: The service user is required to deposit the amount needed for the service into a shared wallet.

Funding the multi-sig wallet: This is done by transferring funds from the sender's existing wallet on the network.

Approving transactions: After the service is successfully completed, the funds are released to the service provider, and the user is refunded any remaining balance.

peaq verify

peaq verify, a multi-tiered framework developed by peaq, aims to establish a secure and decentralized method for verifying physical machine data within Decentralized Physical Infrastructure Networks (DePINs). The framework is divided into three tiers:

Tier 1 Verification: Machine-Origin Authentication

Tier 2 Verification: Pattern Matching Validation

Tier 3 Verification: Oracle-Backed Authentication

AI-Agents

The peaq network has integrated Fetch.ai's autonomous agents, enabling the deployment of AI-Agents on the platform. This empowers peaq's entrepreneurs and developers to utilize Microagents for streamlining and automating diverse business operations within the Economy of Things.

The Featured DePIN projects on peaq Network

The peaq Network has already attracted a diverse range of DePIN projects, each leveraging the platform's unique capabilities to address various challenges in the physical infrastructure domain. Some of the featured DePIN peaq projects:

Eloop: Decentralized car-sharing platform

Eloop is a decentralized car-sharing platform that has been built on the peaq Network. The platform aims to revolutionize the way we access and use transportation services by leveraging blockchain technology to create a secure, transparent, and user-centric car-sharing ecosystem.

Key features of Eloop

Self-Sovereign Machine IDs: Eloop utilizes the peaq Network's Self-Sovereign Machine ID system to uniquely identify and manage the vehicles in the car-sharing network.

Autonomous Access Control: The platform integrates autonomous access control mechanisms, allowing users to securely access and use the shared vehicles without the need for centralized intermediaries.

Decentralized Payment Processing: Eloop's payment processing is decentralized, enabling seamless and secure transactions between users and vehicle owners, facilitated by the peaq Network's machine payment capabilities.

Data Transparency: The platform leverages the peaq Network's data management features to provide users with transparent and auditable records of vehicle usage, maintenance, and overall performance.

Scalability and Efficiency: Eloop's integration with the peaq Network's high-throughput and energy-efficient infrastructure ensures that the platform can handle the increasing demand for car-sharing services without compromising user experience or environmental sustainability.

MapMetrics: Web3 drive-to-earn navigation app

MapMetrics is a Web3 drive-to-earn navigation app that has migrated from the Solana blockchain to the peaq Network. The app aims to incentivize users to contribute to the development and maintenance of detailed maps by rewarding them for their driving and navigation activities.

Key features of MapMetrics

Decentralized mapping: MapMetrics leverages the peaq Network's decentralized infrastructure to crowdsource and maintain highly accurate and up-to-date maps powered by the contributions of its user base.

Drive-to-earn rewards: Users are rewarded with native tokens for their driving and navigation activities, incentivizing them to actively contribute to the development and improvement of the mapping data.

Machine-to-machine interactions: The app integrates with the peaq Network's machine payment and autonomous agent capabilities, enabling seamless interactions between vehicles and the mapping infrastructure, further enhancing the efficiency and automation of the platform.

Cross-chain compatibility: MapMetrics' migration to the peaq Network showcases the platform's cross-chain compatibility, allowing the app to leverage the strengths of multiple blockchain ecosystems and access a wider range of services and resources.

Developer-friendly environment: The peaq Network's support for both Ink! (Rust) and EVM smart contracts made it an attractive choice for the MapMetrics team, as it allowed them to utilize their existing development expertise and tools.

The decision by the MapMetrics team to migrate their application from Solana to the peaq Network highlights the platform's appeal for innovative DePIN projects.

Other featured DePIN Projects on peaq Network

In addition to Eloop and MapMetrics, the peaq Network has attracted a diverse range of other DePIN projects, each leveraging the platform's unique capabilities to address various challenges in the physical infrastructure domain. Some other featured DePIN projects on the peaq Network include:

Wingbits: Community-run antenna network to collect aircraft location data

Silencio Network: Application to measure noise pollution using smartphones

bloXmove: The company built the framework for Web3 Uber on peaq

Acurast: The company is decentralizing the cloud computing industry with mobile-first DePIN for distributed computing.

AYDO: The company is building a Web3 alternative to Big Tech smart home platforms

Farmsent: Empowering over 160,000 Asian and South American farmers through Web3 technology for greater control over their agricultural sales.

Future of DePIN project on peaq Network

peaq's technological superiority is showcased by its exceptional scalability, security, and commitment to environmental sustainability. Through innovative technologies like Elastic Scaling and Agile Core Time, the network can process over 100,000 transactions per second by 2025, ensuring it can meet the demands of a rapidly expanding ecosystem. Furthermore, peaq is also at the forefront of sustainability, employing the most eco-friendly blockchain architecture in Web3.

peaq's influence extends globally, evident in its thriving community and numerous partnerships. With more than 25 DePIN peaq projects, including the recent additions of Parasail, Particle Network, Nevermined, and Olas to the peaqosystem further underscore peaq's growing impact and commitment to cultivating a robust and interconnected community.

Looking towards the future, peaq is set to launch over 500.000 machines, vehicles, robots, and devices, solidifying its position as the world's fastest-growing DePIN ecosystem. With a steadfast focus on innovation and expansion, peaq is dedicated to building a decentralized future where physical infrastructure is optimized for efficiency, security, and accessibility.

In conclusion, the peaq Network is leading a new era of DePIN projects, leveraging scalability, sustainability, and developer-friendly features. This initiative is reshaping our interaction with the physical world by encouraging collaboration and fostering innovation. The peaq Network envisions a future where decentralized physical infrastructure plays a pivotal role in creating a smarter, greener, and more interconnected world. For those interested in exploring the potential of DePINs and their practical applications, further insights can be found on platforms like the U2U Network, which offers comprehensive resources and updates on ongoing developments in the crypto market and DePIN projects.

0 notes

Text

Unveiling the Future: Bitcoin Mining Cloud Service with Slomining in the USA

The world of cryptocurrency is continually evolving, and Bitcoin, the pioneer of digital currencies, remains at the forefront of this revolution. As more individuals seek to participate in the decentralized ecosystem, Bitcoin mining has become an attractive avenue for those looking to enter the space. Slomining, a leading provider of blockchain cloud mining services in the USA, is paving the way for enthusiasts to embark on their mining journey with ease and efficiency.

Bridging the Gap with Blockchain Cloud Mining:-

Bitcoin mining, a process integral to the creation and security of the Bitcoin network, has traditionally required substantial investments in hardware, electricity, and maintenance. Slomining recognizes the barriers this presents to many aspiring miners and has thus introduced a user-friendly and accessible solution through its blockchain cloud mining services.

Key Features of Slomining's Bitcoin Mining Cloud Service:-

Accessibility for All: Slomining's cloud mining service democratises Bitcoin mining, making it accessible to a broader audience. By removing the need for specialized hardware and extensive technical knowledge, Slomining empowers individuals to participate in the mining process regardless of their background or experience.

Efficiency and Cost-Effectiveness: Traditional mining setups demand a significant upfront investment and ongoing operational costs. Slomining's cloud mining service eliminates these barriers by offering a cost-effective alternative. Users can leverage Slomining's infrastructure, benefiting from economies of scale and efficient mining operations without the burden of maintaining physical equipment.

Cutting-Edge Technology: Slomining employs state-of-the-art technology in its mining operations. This ensures optimal hash rates, maximizing the chances of successfully mining new Bitcoin blocks. Users can take advantage of the latest advancements in hardware and software without the need for constant upgrades.

Transparent Operations: Transparency is a cornerstone of Slomining's ethos. Users have real-time visibility into their mining operations, including hash rates, earnings, and operational costs. This transparency builds trust, allowing users to monitor and understand the performance of their mining contracts.

User-Friendly Interface: Slomining's user-friendly interface simplifies the process of setting up and managing mining contracts. Whether you are a seasoned miner or a newcomer to the world of cryptocurrency, Slomining's intuitive platform ensures a seamless experience, from purchasing mining contracts to tracking earnings.

Diversified Mining Plans: Recognizing the diverse needs of its user base, Slomining offers a range of mining plans catering to different budgets and preferences. Users can choose plans based on hash power, contract duration, and other factors, allowing for a tailored mining experience.

Conclusion:-

Slomining is redefining the landscape of Bitcoin mining with its blockchain cloud mining service in the USA. By eliminating the complexities and barriers associated with traditional mining setups, Slomining opens the doors for enthusiasts to actively participate in the decentralized future of finance. As the cryptocurrency ecosystem continues to evolve, Slomining stands as a beacon, providing a gateway for individuals to contribute to the security and decentralization of the Bitcoin network. Whether you are a seasoned miner or a newcomer to the space, Slomining invites you to join the future of cryptocurrency with its efficient, transparent, and accessible Bitcoin mining cloud service.

for more info:-

Bitcoin Mining Cloud Service

Blockchain Cloud Mining in Usa

Cloud Computing Affiliate Program

Cloud Mining Affiliate Programs

0 notes

Text

The Role of Smart Contracts in Crypto Token Development

In the world of blockchain technology and cryptocurrency, smart contracts have emerged as a revolutionary concept that holds the potential to reshape industries and redefine the way transactions and agreements are executed. Within the realm of crypto token development, smart contracts play a pivotal role in creating, managing, and governing various types of tokens. In this article, we will delve into the significance of smart contracts in crypto token development and explore how they are changing the landscape of digital assets.

Understanding Smart Contracts

At its core, a smart contract is a self-executing piece of code that runs on a blockchain network. It automates the execution of predefined actions and terms when specific conditions are met. Unlike traditional contracts that rely on intermediaries, smart contracts operate in a trustless environment, ensuring transparency, security, and efficiency.

Smart Contracts and Crypto Tokens

Crypto tokens represent digital assets or units of value that are built on blockchain platforms. They can be used for a variety of purposes, from facilitating transactions and accessing specific services to representing ownership in a digital or physical asset. Smart contracts provide the underlying infrastructure for crypto tokens to function seamlessly and autonomously.

1. Token Creation and Issuance

Smart contracts enable the creation and issuance of tokens through predefined rules and parameters. For example, in the Ethereum ecosystem, the ERC-20 standard outlines a set of rules that a smart contract must follow to create fungible tokens. These rules include functions for transferring tokens, checking balances, and managing token approvals. Smart contracts ensure that tokens are created in a consistent and standardized manner, reducing the risk of errors or discrepancies.

2. Token Functionality and Automation

Smart contracts imbue tokens with advanced functionalities. For instance, utility tokens can be designed to grant access to specific features or services within a decentralized application (DApp). Through the execution of smart contracts, these tokens can automate actions such as granting access upon receiving the required number of tokens or implementing time-based restrictions.

3. Decentralized Exchanges and Peer-to-Peer Trading

Smart contracts also play a role in enabling decentralized exchanges (DEXs) and peer-to-peer trading platforms. These contracts facilitate trustless and secure trading between users without relying on a central authority. Smart contracts lock the tokens being traded until the predefined conditions, such as payment confirmation, are met. This eliminates the need for intermediaries and minimizes counterparty risks.

4. Token Governance and Voting

Smart contracts can be used to implement token governance mechanisms, allowing token holders to participate in decision-making processes related to the token's future development or the direction of the project. Token holders can cast votes on proposed changes, upgrades, or other key decisions, creating a decentralized governance structure.

Conclusion

Smart contracts have undeniably transformed the landscape of crypto token development, introducing automation, transparency, and security to digital assets. They provide a robust framework for creating, managing, and governing various types of tokens, expanding the possibilities of what can be achieved within the blockchain ecosystem. As the technology continues to evolve, we can expect smart contracts to play an even more significant role in shaping the future of finance, business, and beyond.

0 notes

Text

Choosing the Best Fluree Node Provider: A Comprehensive Comparison

As the adoption of FlureeDB and its decentralized graph database continues to grow, many developers and businesses are seeking reliable and efficient Fluree node providers to deploy and manage their nodes. A Fluree node provider offers a hosting and management service, allowing users to run their Fluree nodes on the provider's infrastructure. Selecting the best Fluree node provider is a critical decision that directly impacts the performance, security, and reliability of your node. In this article, we will conduct a comprehensive comparison of Fluree node providers, exploring the key factors to consider when making your choice.

1. Infrastructure and Performance:

One of the primary considerations when choosing a Fluree node provider is the infrastructure they offer. Evaluate the provider's hardware specifications, including CPU power, memory, storage capacity, and network bandwidth. The infrastructure should meet FlureeDB's performance requirements and provide the necessary resources for your node to run smoothly and efficiently.

2. Security Measures:

Security is a critical aspect of any Fluree node deployment. Look for providers that offer robust security measures, including firewall protection, encryption, and intrusion detection. A secure infrastructure is essential to safeguard your node and the data it handles from potential threats and unauthorized access.

3. High Availability and Redundancy:

FlureeDB operates optimally with high availability and redundancy. Choose a node provider that ensures your node remains available and operational at all times, even in the event of hardware failures. Redundancy in the form of data replication and fault tolerance is vital for minimizing downtime and maintaining continuous operations.

4. Scalability and Resource Allocation:

Consider a provider that offers scalable solutions to accommodate your node's growth over time. The ability to easily scale your node's resources, such as CPU, memory, and storage, is essential to handle increasing data demands and transaction volumes.

5. Monitoring and Management Tools:

A reliable Fluree node provider should offer robust monitoring and management tools. Monitoring tools allow you to track the performance, health, and resource utilization of your node, enabling you to identify and address any performance issues proactively.

6. Support and Customer Service:

Evaluate the provider's level of customer support and service. Look for providers that offer responsive and knowledgeable customer support, as it can make a significant difference in resolving any issues or concerns quickly.

7. Pricing and Cost-Effectiveness:

Compare the pricing models of different Fluree node providers to find a cost-effective solution that meets your budget while providing the required infrastructure and performance. Consider any additional features or services included in the pricing to determine the overall value.

8. Reputation and Reviews:

Research the reputation of the Fluree node providers you are considering. Look for reviews and feedback from other users to gauge their experiences with the provider's services. Positive reviews and a strong reputation can indicate a reliable and trustworthy provider.

9. Location and Data Sovereignty:

Consider the physical location of the provider's data centers. Depending on your requirements, you may prefer a provider with data centers in specific regions to comply with data sovereignty regulations or reduce latency for your users.

10. Experience with FlureeDB:

An ideal Fluree node provider should have experience and expertise in handling FlureeDB deployments. Look for providers that specialize in hosting and managing Fluree nodes, as they are more likely to have an in-depth understanding of the platform's requirements and nuances.

Conclusion:

Choosing the best Fluree node provider is a significant decision that can impact the performance, security, and reliability of your Fluree node. Evaluate factors such as infrastructure and performance, security measures, high availability, scalability, monitoring tools, customer support, pricing, reputation, and experience with FlureeDB.

By conducting a comprehensive comparison and considering these essential factors, you can find a Fluree node provider that aligns with your needs and ensures a seamless deployment and management experience. A reliable and efficient node provider will enable you to focus on building and running your FlureeDB applications with confidence, contributing to the success and growth of the decentralized ecosystem.

1 note

·

View note

Text

"Streamlined Operations: Optimizing Efficiency with Remote Infrastructure Management"

The remote infrastructure management market has experienced substantial growth in recent years, driven by the increasing adoption of remote work and the need for efficient management and maintenance of IT infrastructure. Remote infrastructure management (RIM) refers to the practice of monitoring, managing, and maintaining an organization's IT infrastructure and systems from a remote location. It involves tasks such as network monitoring, server management, security management, and software updates. RIM provides organizations with the flexibility to manage their IT infrastructure remotely, ensuring operational continuity and minimizing downtime.

One of the key drivers of the remote infrastructure management market is the rapid shift towards remote work and decentralized operations. With the advancements in technology and the increasing acceptance of remote work, organizations are seeking effective ways to manage their IT infrastructure and support remote employees. RIM enables IT teams to remotely monitor and manage infrastructure components, ensuring seamless connectivity, data security, and system performance. It allows organizations to address IT issues promptly, provide support to remote employees, and optimize the performance of their IT infrastructure without the need for physical presence.

Furthermore, the need for cost optimization and scalability has also fueled the growth of the remote infrastructure management market. Outsourcing IT infrastructure management to remote service providers offers cost advantages by eliminating the need for on-site infrastructure, maintenance staff, and associated expenses. Organizations can leverage the expertise and resources of remote infrastructure management providers to scale their IT operations as per their business requirements. Additionally, RIM enables organizations to focus on their core competencies and strategic initiatives, while leaving the technical aspects of IT infrastructure management to specialized service providers.