#UAE Non-Financing Companies

Text

Why Choose Chartered Accountants for Your Financial Needs

In Dubai's quick financial landscape, every small, medium, and large business wants to grow quickly and adapt to their changing business environment and business ethics, consequently our top-rated company, Hussain Al Shemsi Chartered Accountants, offers the best and highest quality accounting and auditing services in the UAE. Our Expert Chartered Professional Accountants provide high-quality accounting services throughout the UAE, including Accounting, Tax Accounting, Consultancy and Advisory and other professional chartered accounting services.

What are Chartered Accountants?

Chartered Accountants are professional Certified Accountants who specialize in business accounting, auditing, financial statement activities, filing corporate tax returns, and also promote business consulting and advisory services. When it comes to Dubai, Ajman, Sharjah, and other UAE locations, our Hussain Al Shemsi Chartered Accountants (HALSCA) team is the most Experienced Chartered Professional Accountants. Our team specializes in auditing, accounting, consulting, tax advisory services, industry driving reviews, and other chartered accounting services in the UAE.

The Role of Chartered Accountants

Taxation Services

HALSCA, the Expert chartered accountants in Dubai, specialize in providing the Best Taxation Services in the UAE that will guide you through difficult tax issues. With intricate knowledge of tax-effectiveness and compliance with the law while managing your financial affairs, whether you are an individual taxpayer, a corporation, or a trust, Hussain Al Shemsi Chartered Accountants provides the top taxation services in the UAE.

Auditing and Assurance

Auditing is an important function in all businesses, hence the Audit and Assurance report is required for a variety of reasons. Audit and assurance is the process of evaluating business accounts and confirming data in financial statements using a variety of documents. The audit process can assist detect corporate risks.

Financial Planning and Advisory

Efficient financial planning and advisory is crucial for long-term prosperity in Dubai's changing economic environment. In order to help individuals and organizations reach their financial objectives, chartered accountants provide strategic advising services. They provide helpful advice and recommendations based on your particular situation, ranging from investment research to budgeting.

The Advantages of Using a Chartered Accountant

Professionalism and Expertise

Dubai's chartered professional accountants are highly knowledgeable and experienced in financial management. Their commitment and professionalism guarantee that your financial affairs are managed with the highest care and attention to detail.

Compliance with Regulations

Navigating the complex regulatory environment of Dubai, UAE, can be challenging without expert guidance. Chartered accountants reduce the possibility of non-compliance and the fines that come with it by making sure your financial procedures follow local laws and regulations.

Strategic Business Guidance

Chartered accountants are trusted advisors who provide strategic insights to propel corporate growth, going beyond simple math calculations. Their experience can assist you in navigating obstacles and seizing chances whether you're growing your business or venturing into new industries.

Accuracy and Efficiency of Finance

You can anticipate increased accuracy and efficiency in your operations when chartered accountants are in charge of your financial processes. They can find chances for optimization and simplify procedures thanks to their sophisticated accounting tools and thorough attention to detail.

Conclusion

Choosing Hussain Al Shemsi Chartered Accountants (HALSCA) Reliable Chartered Professional Accountants in Dubai, UAE, is a strategic move for anyone serious about their financial health. These experts bring a level of professionalism, expertise, and strategic insight that is unmatched in the financial sector. Whether you're a small business looking to optimize your operations, a large corporation seeking efficiency improvements, or an individual in need of personal financial advice, expert chartered accountants in Dubai can provide the guidance and support you need. Their comprehensive services, from tax planning to auditing and financial advisory, ensure that your financial needs are met with precision and care. By partnering with a chartered accountant, you are investing in a secure and prosperous financial future.

#best audit firm in dubai#top accounting firm in ajman#professional chartered accountants in ajman#professional chartered accountants near me#best audit firm in uae#best accounting firm in uae

2 notes

·

View notes

Text

Could the United Arab Emirates buy Chinese J-20 fighters?

Fernando Valduga By Fernando Valduga 05/27/2024 - 08:48am Military

0

Shares

1.6k

Views

Share on Facebook

Share on Twitter

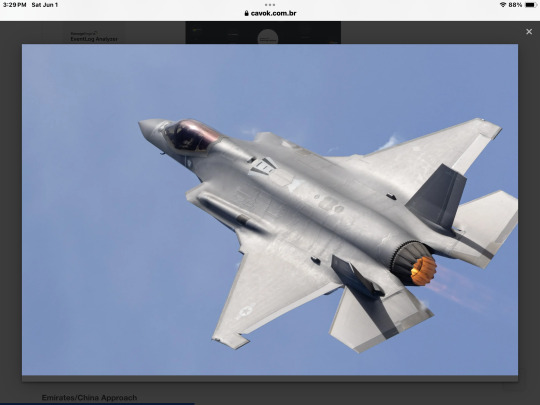

Although Israeli approval has finally been obtained for the sale of the F-35 to the United Arab Emirates, speculations are arising about a possible Chinese choice by the United Arab Emirates, despite restrictions on the export of the J-20. The head of joint operations of the UAE Armed Forces went to Beijing at the end of April to meet with the commander of the Chinese Air Force, a meeting that symbolizes a rapprochement between the two nations that could suggest a future collaboration in the field of military aviation.

The United Arab Emirates Air Force traditionally has two types of aircraft, so far they are the F-16 sold by the US and the Mirage 2000-9 from Dassault. While the 67 Mirage 2000 jets will be replaced by the 80 standard F4 Rafale of a contract signed in 2021, the issue of the succession of the F-16 remains uncertain.

F-16 Desert Falcon.

In November 2020, the Trump administration approved the sale of 50 F-35 stealth fighters to the Emirates, for an amount of 23 billion dollars. This decision comes after the signing, on August 13, 2020, of a standardization agreement between Israel and the United Arab Emirates, followed by the recognition of the Hebrew state by the latter in September. And although the media of the time rejoiced a future regional peace, the desire of the Emirates to acquire the American F-35 stealth fighter will initially compromise the normalization of relations with Israel, which is firmly opposed to the sale of the device to the Emirates, citing the policy of "qualitative military advantage" from which it benefits.

This policy, initiated by the United States in the 1960s, aims to ensure that Israel has the most advanced military means to maintain its regional superiority, so the sale was frozen by the Biden administration in 2021. Several reasons for this: Israel in the first place, but also the conditions imposed by Washington on human rights records and, finally, China, whose approach to the Emirates is viewed unfavorably by Washington. The United States is particularly concerned about the fact that China uses Huawei's 5G technology to spy on the capabilities of the F-35, while the Emirates refused to terminate the contract with the technology giant. Last but not least, the UAE are co-financing the development of the Russian Su-75 Checkmate fighter, derived from Su-57.

Despite the abundance of petrodollars, the Emirates are struggling to reach the F-35 and, in turn, have threatened to cancel the contract. Pushed into the arms of other potential military suppliers, the Emirates' option for the J-20 then seems plausible.

Emirates/China Approach

Economically, the United Arab Emirates is the largest export market of the United States in the Middle East and North Africa. More than 1,000 American companies operate in the country and many others use it as a regional headquarters to conduct business throughout the Middle East, North Africa region and parts of Asia. The fact that the Emirates are approaching China is therefore not anecdotal. As The Hill reported last year, “the fabric of America's strategic ties with the Gulf region is tearing apart,” and it seems that the situation is only getting worse. If China is the largest non-oil trading partner of the United Arab Emirates worldwide, it is in the military domain that relations are evolving the most.

In 2021, American intelligence services discovered the existence of a Chinese military facility in a port in the United Arab Emirates. The Emirates agreed to end the project at the request of the United States, but construction would have resumed at the end of 2022. The Emirates also participated in the joint exercise "Falcon Shield 2023", with its F-16 block 60 and Mirage 2000-9 aircraft, offering several opportunities for China to learn about Western equipment.

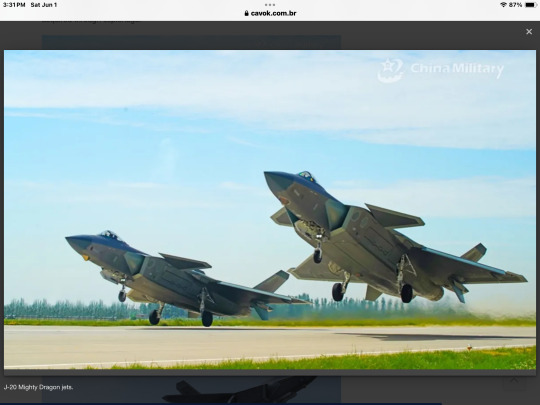

The recent meeting between General Saleh Mohammed bin Majren Al Ameri and Lieutenant General Chang Dingqiu of the Chinese Air Force illustrates this rapprochement between the two countries. Interestingly, the photos shared by the Ministry of Defense of the United Arab Emirates after the visit to China show a painting with two J-20 Mighty Dragon fighters, the real stars of this meeting.

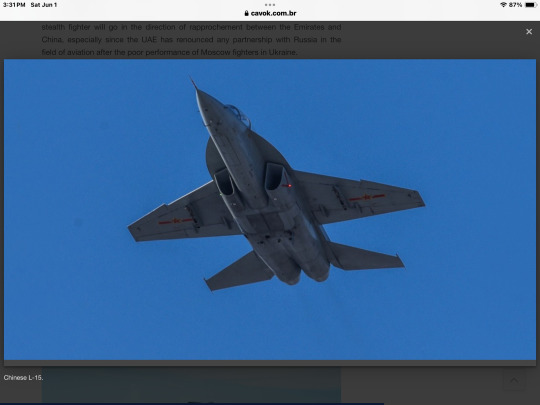

J-20: an export candidate?

The recent acquisition by the United Arab Emirates of the Chinese Hongdu L-15A Falcon jet coaches and speculations around the potential interest in the Chengdu J-20 stealth fighter will go in the direction of rapprochement between the Emirates and China, especially since the UAE has renounced any partnership with Russia in the field of aviation after the poor performance of Moscow fighters in Ukraine.

Chinese L-15.

The obstacles encountered in the acquisition of American F-35 fighters, despite the close ties between the two countries, led the Emirates to seriously consider other alternatives, including the Chinese J-20. Ironic when we know that the United States accuses China of having manufactured the J-20 using American technologies, acquired through espionage.

J-20 Mighty Dragon jets.

At the moment, it is still too early to say whether the United Arab Emirates will end up acquiring the J-20 from China, given that this type of aircraft would be difficult to integrate with other means within its military power and that China does not seem to have the ambition to export it (favoring the FC-31). In addition, negotiations with China could also be a way for the Emirates to put pressure on the United States, due to the blocked F-35 agreement. For now, the sale agreement remains viable according to Daniel Mouton, a former employee of the United States National Security Council.

J-35 jet, or FC-31, offered for export by China.

However, considering the regional crisis and other geopolitical reasons, the Arab countries represent a good market opportunity for China, which already maintains friendly relations with many of them and intends to become the main supplier of combat aircraft and drones in the Middle East. Unless the U.S. allows an increase in UAE power as a frontline army in the face of the Iranian regional threat, a threat shared by all states in the region, whether or not they recognize the State of Iran.

Source: Air & Cosmos

Tags: Military AviationChengdu J-20 'Mighty Dragon'F-35 Lightning IIUAEAF - United Arab Emirates Air Force/United Arab Emirates Air Force

Sharing

tweet

Fernando Valduga

Fernando Valduga

Aviation photographer and pilot since 1992, he has participated in several events and air operations, such as Cruzex, AirVenture, Dayton Airshow and FIDAE. He has works published in specialized aviation magazines in Brazil and abroad. He uses Canon equipment during his photographic work in the world of aviation.

Related news

HELICOPTERS

IMAGES: Italian Air Force presents special commemorative painting in helicopter HH-139B

26/05/2024 - 17:03

MILITARY

VIDEO: Swedish Gripens practice landings on highways

26/05/2024 - 13:56

AERONAUTICAL ACCIDENTS

RAF pilot dies after accident with Spitfire of World War II in England

26/05/2024 - 11:43

BRAZILIAN AIR FORCE

Trailer with drones for mapping affected areas in RS is transported by FAB

26/05/2024 - 11:19

MILITARY

VIDEO: Chinese military jets in the crosshairs of Taiwan's F-16

25/05/2024 - 23:30

MILITARY

First Ukrainian pilots complete training in F-16 fighters in the US

25/05/2024 - 17:25

6 notes

·

View notes

Text

A new report by the Global Initiative Against Transnational Organized Crime, GI-TOC, published on Monday, warns that weak rule of law, organised crime and a large “grey” economy in Western Balkan countries – and the war in Ukraine – have allowed Russian Illicit Financial Flows, IFFs, to surge through the region and interfere in key decision making processes there.

“The Balkans’ strategic geographic position, acting as a gateway between Asia and Western Europe, coupled with an ecosystem of state capture, institutional weaknesses, organised crime and a rampant shadow economy, make the region particularly susceptible to IFFs,” Vanya Petrova, author of the report, told BIRN.

“This fact has actively been exploited by major players such as Russia, China and the UAE to influence decision-making in key markets and institutions,” she added.

The Kremlin has repeatedly taken advantage of its integration into the Western financial system to exploit governance gaps through the corrosive effect of illicit finance. This danger has taken on new and potentially greater dimensions with the onset of Russia’s war in Ukraine,” she says.

Global IFFs are estimated to be worth around 1-1.6 trillion US dollars annually, accounting for 3-5 per cent of world gross domestic product, GDP. However, according to Petrova, in the Western Balkans the figure is around 6 per cent of the region’s GDP.

After Russia invaded Ukraine in February last year, many sanctions were introduced, including a freeze by G7 countries of around 315 billion US dollars’ worth of Russian reserves held in Russia’s Central Bank.

Ways used by Russian elites to avoid sanctions include “laundering money through the purchase of real estate and business assets; utilizing professionals to open bank accounts, initiate bank transactions, transfer funds and create corporate structures that directly or indirectly support them; using complex ownership structures to avoid identification; and using third-party jurisdictions and false trade information to facilitate sensitive goods shipments to Russia”.

Russians avoid sanctions via the Western Balkans “with their combination of state and media capture, simmering ethnic divisions, slow pace of EU accession and the legacy of Russian cognitive bias”.

According to the report, since 2014, Bosnia, Bulgaria and Serbia have not followed EU sanctions against Russia, while both North Macedonia and Montenegro have provided so-called citizenship for investment to Russian citizens, despite criticism from the EU.

Albania has not yet followed through with a “fiscal amnesty” programme that would allow any Albanian or foreign citizen to deposit up to €2 million in non-declared money in the banking system, but has not scrapped the idea either.

Smuggling of people, weapons and cash have facilitated illegal activity since the start of the war in Ukraine. Smuggled cash is mainly concealed in cars or hidden among legitimate products in transport trucks or shipping containers.

According to the report, soon after the war started in 2022, Ukrainian refugees took undeclared cash with them to Europe; the wife of a former Ukrainian MP was caught at a border crossing for refugees with US$28 million and €1.3 million as she tried to enter Hungary.

In another case, a former Ukraine security service general, allegedly a Russian collaborator, was detained at the Serbia-North Macedonia border with €600 000 in cash, a large sum in US dollars, and diamonds and emeralds of unknown value.

Intensified use of covert channels for illegal money transfers into Albania exists as well.

Flows are often made indistinguishable by being mixed with gains in “cash-intensive businesses, such as restaurants, bars, beauty salons, petrol stations, private parking lots and taxi companies,” where this illegal money is laundered.

The report also explains that another form of IFF is fuel fraud. This often includes the evasion of custom tariffs by declaring lesses quantities of an oil product by selling fuel from ships on the Danube to fishers. A more recent trend, the report says, is the purchase of fuel at lower prices from Hungary and reselling it in Serbia.

The EU single market has a zero VAT policy for invoices between intermediaries, which has allowed VAT fraud to bloom. Petrova says that “in December 2022, the European Public Prosecutor’s Office (EPPO) uncovered what is believed to be the biggest VAT carousel fraud ever investigated in the EU, responsible for an estimated loss to EU taxpayers of €2.2 billion, including Bulgaria and Croatia, as well as third countries such as Albania and Serbia”.

“In general, this and trade misinvoicing remains the most prominent channel through which IFFs flow in and out of the Western Balkans,” Petrova writes. Trade misinvoicing includes fake legal transactions when no real business is taking place.

The report urges Europe to further decouple its economy from Russia, a network screening and sanctioning of Russian strategic investments in the Balkans, and to “prioritize the integration of the Balkans into the rollout of the newly designed Anti-Money Laundering Authority (AMLA) and coordinating their actions with US FinCEN and the financial intelligence institutions in each EU member state”.

4 notes

·

View notes

Text

UAE Corporate Tax and Property Investments: Are Owners Accountable to File Taxes?

As the UAE ushers in its first form of taxation - the Corporate Tax 2023 - there’s been a surge in queries online. Among the many questions, the one that was asked most frequently was: Who must adhere to mandatory tax filing, and who is exempt from this financial threshold?

To put an end to these uncertainties, a beacon of clarity came from the Ministry of Finance through a decisive cabinet decision. This landmark decision delineates the regulations governing foreign corporations and non-resident property owners, be it in Dubai or anywhere else in the country.

The UAE Ministry of Finance has taken a carefully thought-out step by introducing Cabinet Decision No. 56 of 2023. This decision sets new rules for foreign companies and non-residents, making them answerable to the new Corporate Tax in the UAE. What it means is that these entities now have to pay taxes on the money they make from real estate and other property investments in the UAE.

To navigate this situation, these companies need to start working with the UAE's regulatory authorities. Given that this rule applies to properties used for business and investment within the UAE. Recent information from the Ministry of Finance says that foreign companies (or property developers in UAE) owning property in the country must pay Corporate Tax based on their income after deducting expenses.

However, there's a positive side to these tax rules. Businesses affected by this tax can subtract relevant expenses that match the rules outlined in the Corporate Tax law. This smart calculation of deductions lowers the amount of income that gets taxed, which helps ease the financial load.

For people in situations where they are foreigners living in another country or who live in the UAE. If they own a real estate property, like a building, regardless if they’ve bought it themselves or through special arrangements, they usually wouldn’t have to pay a special tax on the money they make from it. But this special tax exemption doesn't apply anymore if they do certain kinds of business activities specified in the Cabinet Decision.

In a similar way, there's another situation where real estate investment trusts and certain investment funds can make their mark. They can avoid paying Corporate Tax on income from UAE's properties if they follow specific rules and conditions.

Younis Haji Al Khoori, the undersecretary of the Ministry of Finance, whose declarations echo global wisdom, elucidates, "The Corporate Tax treatment of income derived from UAE real estate and other immovable property by foreign juridical persons is in line with international best practice," further reinforcing the tenet that income tied up with immovable property should be up for taxation within the sovereign grounds which hosts the said property.

His strong message echoes deeply. The UAE's Corporate Tax Law cleverly combines elements that follow international tax rules, carefully designed to create fairness, ensuring a balanced situation for local and foreign companies dealing with property income in the UAE.

Summary

In summary, the symphony of this paradigm shift composes a melody of equity woven through the tapestry of Corporate Tax. As the sands of Dubai bear witness, this arrangement aligns itself with global conventions, creating an environment where enterprises, irrespective of their origin, will stand on equal footing.

#residential projects in dubai#top developers in dubai#residential property for sale in dubai#shapoorji properties

2 notes

·

View notes

Text

Federal Corporate Tax in UAE – Published Official CT Legislation

After the announcement by the government regarding the benefits of Corporate Tax in UAE (CT) and the frequently asked questions (FAQs) on January 31, 2022, as well as the publication of the Public Consultation Document in April 2022, the Federal Decree-Law no. 47 of 2022 regarding the Taxation of Corporations and Businesses UAE Corporate Tax Law has been released on December 9, 2022.

The UAE Corporate Tax Law is Federal Decree-Law No. 47 of 2022, enacted on October 3, 2022, and will be in force 15 days following its public publication by the Official Gazette. The UAE Corporate Tax law applies to profits from businesses in financial years beginning on or after June 1, 2023.

This article offers brief highlights of the new rules which were made public by The Ministry of Finance (“MoF”) and the Federal Tax Authority (“FTA”). It is important to note that the rules closely match those in the Public Consultation Document.

Additional details will be deferred to Cabinet and Tax Authority Decisions. Further guidance is expected to be issued to finalize all UAE Corporate Tax Legislation in areas such as the Free Zone and Director compensation guidelines. Following the publication of Corporate Tax Legislation, the MoF has confirmed that the implementation is scheduled for June 2023.

Scope of Corporate Tax in UAE

Corporate Tax in UAE will be applied to the adjusted net profit of the worldwide accounting of the company.

The UAE Corporate Tax regime has two rates of different types:

A tax-free rate will be applied to tax-paying earnings up to a certain amount that is to be set in the Cabinet Decision (the FAQs relate to the threshold of AED 375,000)

The tax statutory standard rate is 9 percent.

The relative minimal tax burden of just 9% aims to ensure that the UAE has a competitive tax rate in the global marketplace.

The UAE Corporate Tax Law is silent in Article 3 on aspects governing the global minimum of 15% tax rate. That applies to MNEs that fall within the scope of Pillar Two, which is part of BEPS Pillar 2. OECD BEPS project and applies to multinational corporations (MNCs) that have consolidated worldwide revenues exceeding EUR 750 million (c. 3.15 billion AED) 3.15 billion) at any time in two of the preceding four years. The FAQs address the possibility of adopting within the UAE of BEPS Pillar 2.

Individuals:

Individuals also are affected by corporate taxation if they engage in business activities and are in line with general VAT rules of business activities. The Cabinet is expected to decide how to apply Corporate Tax in UAE to natural individuals. Thus, Corporate Tax in UAE does not apply to a person’s salary and other earnings earned through employment.

However, those who are earning income through an enterprise activity will be covered by Corporate Tax in UAE.

Free Zones

A clearly defined and specific policy (subject to a further Cabinet decision) is set out for companies established in UAE-free zones. These zones:

Maintain sufficient substance and

Earn qualifying income.

What exactly is a sufficient income will be defined by a Cabinet decision. The Public Consultation Document could refer to the requirement to not do business with the mainland UAE. It is stated that Free Zone businesses can choose to be taxed as a corporation at a rate of 9 percent.

The extensive UAE rules for sourcing are in force and essential for the Free zone companies seeking to comply with the substance requirements.

Withholding Tax

There is a possibility of a zero-withholding tax on specific categories in the UAE State Sourced income produced by a non-resident. In turn, foreign investors who do not conduct any activities in the UAE won’t be taxed within the UAE.

Foreign Entities

Foreign entities can be considered residents in the UAE if they are managed and controlled by the UAE. In the case of foreign companies that aren’t recognized as residents of the UAE and who possess a permanent establishment in the UAE, The Definitions of Permanent Establishment have been clarified as fixed PE as well as the term “agency PE. Further details on PEs will be subject to a Ministerial decision.

Exempt Entities

The UAE Corporate Tax Law has retained the exemption for Investment Managers of the Public Consultation Document. Specific rules apply to Partnerships as well, as Family Foundations can also use to increase tax transparency

Government entities and government-controlled entities as well as qualifying public benefit entities and qualifying investment funds will be exempt from the UAE Corporate Tax Law.

Extractive companies (upstream oil and gas companies) are exempt if they earn revenue from the extraction business.

Bank operations will be restricted to Corporate Tax in UAE (unless your institution operates in a Free Zone and is eligible for the zero-interest rate).

Implementation Date

Article 69 of the UAE Corporate Tax Law provides that the Law applies to Tax Periods that begin on or after June 1, 2023.

Companies with a fiscal year that begins on January 1 are subject to CIT beginning 1. January 2024.

Financial records & Requirement to Maintain Audited Statements

Taxpayers must prepare and maintain financial statements backed by all records and documents to support UAE Corporate Tax returns. The forms should be kept for a minimum of seven years.

That will apply to every UAE entity (unless included in the Corporate Tax Group). Every entity must make separate financial statements. However, all entities will not be audited for financial information. Subsequent Cabinet Decision(s) will outline the tax-paying categories required to keep audited or certified accounts.

Small Business Tax Relief

The possibility of relief for small-sized businesses with gross or revenue less than the threshold of a specific amount is made. Qualifying businesses will be considered not to have tax-deductible income and must comply with a simplified set of requirements.

Revenues and not tax-deductible income determine the threshold. It is likely to be confirmed by an upcoming Cabinet Decision.

Deductible / Non-Deductible Expenses

The expenses incurred solely and exclusively to serve business needs (and which are not to be capitalized) can be deducted.

Deductions are not allowed for expenditures incurred to generate tax-free income. Deductibility is only permitted in the case of any price with a mixed purpose. Interest expense is deductible subject to a maximum of 30% of EBITDA.

Financial assistance rules have been implemented to prevent businesses from getting funding to pay dividends or distribute profits.

Entertainment costs are limited to 50 percent.

Non-deductible expenses include contributions to a non-qualifying Public Benefit Entity and bribes, fines, and dividends.

Importantly, amounts taken from the business by an individual who is a tax-deductible individual are not deductible.

Exempt Income & Relief

The following income categories are exempt from Corporate Tax in UAE (Article 22 of the UAE Corporate Tax Law):

Capital Gains and Dividends, and other profits distributions from a Resident

Capital Gains or Dividends, as well as other profits distributions from Qualifying shareholding in a legal entity of a foreign country with a holding time of 12 months and a minimum contribution of 5 percent, and at an absolute minimum of 9 percent CIT for the source country. From which they originate.

The income from a foreign PE is subject to the conditions & an option to use an exemption (rather than credit)

The income earned by an individual, not a country resident, comes from the operation of ships or aircraft involved in international transport.

These transactions can be subjected to a specific reduction, i.e., it is essentially an exemption from taxation:

Restructurings and intragroup transactions that qualify as qualifying entities are eligible when they hold 75 percent common ownership

Restructuring of businesses is a relief from the government with specific conditions.

Transfer Pricing

Related parties’ transactions should be carried out under the arm’s-length arms-length principle outlined in Section 34 of the UAE Corporate Tax Law. It also states that the five standard OECD transfer pricing techniques are suitable to help support the arm’s-length arms-length nature of arrangements with related parties and allow alternative methods if needed.

Article 34 states that should there be an adjustment by a tax authority from a foreign country that affects a UAE entity, the application must be submitted to the FTA to request a similar adjustment that allows the UAE firm to be exempt against double taxation. The resulting adjustments relating to domestic transactions do not require an application.

The requirements for documentation on transfer pricing are covered by Article 55. UAE businesses must follow the transfer pricing regulations and the documentation requirements set by references to the Transfer Price Guidelines.

These lead to three-tier reports, i.e., master file, local file, and country-by-country reporting. The connection to a controlled transactions disclosure form is provided (details of which are to be determined).

It is important to note that no thresholds of materiality are provided. Separate legislation will be announced shortly. Advance pricing plans will become made available via the normal clarification process currently in place.

UAE has introduced provisions requiring the payment and benefits given to persons connected to be tax-deductible in the market value. The same rules are followed in section 34 of UAE CIT Law for applying this principle.

Administration & Enforcement

The MoF is the sole authority for multilateral or bilateral agreements and the exchange of information between countries.

The FTA is responsible for the corporate tax system’s administration, collection, and application. The Tax Procedures Law sets fines and penalties.

Companies will require an FTA VAT Registration UAE.

Companies affected by Corporate Tax in UAE must submit a CT report electronically for each period of financial activity within nine months from the close of that Financial Period. (A financial period generally refers to any financial period that is 12 months long)

Free Zone companies that are which are subject to CIT at 0 percent CIT must also submit a Corporate Tax Return.

Foreign Tax Credits

Tax credits for foreign taxation are allowed for UAE corporate tax due as per the Public Consultation Document. Businesses are entitled to claim the lesser amount of corporate tax due and the sum of withholding tax that is effectively taken out. There is no carrying forward. There will be no credit for taxes paid to an individual Emirate.

Tax Grouping

Fiscal unity or Tax Group: UAE companies can create a “fiscal unity” or Tax Group to serve UAE purposes. The primary requirement for the formation of a Tax Group is to comply with an (in)direct minimum shareholding of 95 percent.

Free zone entities subject to zero percentage shareholding are not eligible to join the Tax Group. Furthermore, the parent (which may be intermediate) is required to be a UAE company.

Losses

By article 37 of the UAE Corporate Tax Law, losses can be carried forward for up 75 percent of taxable income. Losses can be transferred between members of the same group of corporations if they are 75 percent direct or indirectly owned. Losses cannot be transferred from exempt people or entities in the free zone. The loss offset is subject to the cap of 75 when it comes to businesses that roll forward losses.

Tax-deductible losses may be lost in the event of an ownership change (50 percent or more); however, the new owner is operating the same or similar business. The requirements to be considered for this have been established.

Anti-Abuse

UAE will implement an Anti-Abuse General Rule known as “GAAR”. The GAAR applies to cases where one of the principal reasons for a transaction is to gain an advantage in taxation for corporations that is not in line with the intent, intent, or purpose of UAE Corporate Tax Law.

The FTA will be able to address and adjust or counteract the transaction. The GAAR only applies to arrangements or transactions made after the UAE Corporate Tax Law is published in the UAE Official Gazette on October 10, 2022, in issue #737.

Summary

The publication of UAE Corporate Tax Law and confirmation of a rate of 9 The UAE have established a global affordable Corporate Tax rate and confirmed their intention to implement Corporate Tax in June 2023.

The information to be released in the next few months will be fleshed out and provide a greater understanding of the implementation process. Nevertheless, several key elements are already confirmed, including introducing compulsory transfer pricing rules.

2 notes

·

View notes

Text

Federal Corporate Tax in UAE – Published Official CT Legislation

In the wake of the public announcement regarding the benefits of Corporate Tax in UAE (CT) and the frequently asked questions (FAQs) on January 31, 2022, as well as the publication of the Public Consultation Document in April 2022, the Federal Decree-Law no. 47 of 2022 regarding the Taxation of Corporations and Businesses Corporate Tax Law has been released on December 9, 2022.

The UAE Corporate Tax Law is Federal Decree-Law No. 47 of 2022, issued on October 3, 2022, and becomes effective 15 days following its announcement in the Official Gazette. The Corporate Tax law applies to the profits of businesses for fiscal years that begin on or after June 1, 2023.

This article gives brief highlights of the new rules, which were it was announced by The Ministry of Finance (“MoF”) and the Federal Tax Authority (“FTA”). It is important to note that the new rules align with the Public Consultation Document.

More details are awaiting Cabinet and Tax Authority Decisions, and further guidelines are expected to be issued to finalize all Corporate Tax Legislation in areas such as the Free Zone and Director compensation guidelines. Following the publication of Corporate Tax Legislation, the MoF has confirmed that its introduction is scheduled for June 2023.

Scope of Corporate Tax in UAE

Corporate Tax in UAE applies to the adjusted net profit of the worldwide accounting of the company.

The Corporate Tax in UAE Regime has two rates of different types:

A tax-free rate applies to tax-deductible earnings up to a certain amount that is to be set in a Cabinet Decision (the FAQs relate to the threshold of AED 375,000)

The tax standard for the statutory rate is 9 percent.

Confirming the minimal tax burden of just 9% aims to ensure that the UAE has a competitive tax rate worldwide.

The Corporate Tax Law is silent in Article 3 on aspects governing the global minimum of 15% tax rate. That applies to MNEs that fall within the definition of Pillar Two, which is part of BEPS Pillar 2. OECD BEPS project and applies to multinational corporations (MNCs) that have consolidated worldwide revenues exceeding EUR 750 million (c. the equivalent of AED 3.15 billion) at any time in two of the last four years. The FAQs address the possibility of adopting within the UAE of BEPS Pillar 2.

Individuals:

Individuals are affected by corporate taxation if they engage in business activities that are in line with an overall VAT concept for business activities. A Cabinet decision is anticipated regarding how to apply Corporate Tax in UAE to natural people. That means that Corporate Tax does not apply to a person’s salary and other earnings earned through employment. However, those earning income through part of a business venture would be covered by Corporate Tax in UAE.

Free Zones

A specific and defined regime (subject to a further Cabinet decision) is provided for all businesses in UAE-free zones. These zones:

Maintain sufficient substance and

Earn qualifying income.

What is a sufficient income will be defined by a Cabinet decision. According to the Public Consultation Document, this could refer to the requirement not to do Business with the mainland UAE. It is stated that Free Zone companies can choose to be taxed as a corporation at a rate of 9 percent.

A wide range of UAE rules for sourcing is in force and essential for businesses in the Free zone who want to satisfy the requirements of substance.

Withholding Tax

There will be no withholding tax on specific categories of UAE State Sourced income produced by a non-resident. In turn, foreign investors who don’t carry any businesses in the UAE, in general, will not be taxed within the UAE.

Foreign Entities

Foreign entities can be residents of the UAE if they are operated and controlled in the UAE. Foreign entities who aren’t considered to be residents in the UAE, however, may have a permanent establishment in the UAE. The Definitions of Permanent Establishment have been clarified as fixed PE and the term “agency PE. Further details on PEs will be subject to a Ministerial decision.

Exempt Entities

The UAE Corporate Tax Law retains the exemption for Investment Managers exempted from Public Consultation Documents. Rules apply to Partnerships, and Family Foundations can also use to increase tax transparency.

Government entities and government-controlled entities, as well as qualifying public benefit entities and investment funds, will be exempt from the UAE Corporate Tax Law. Extractive companies (upstream oil and gas companies) are exempt if they earn revenue from their extractive businesses.

Banking operations are affected by Corporate Tax in UAE (unless an institution falls located in a Free Zone and is eligible for the zero-interest rate).

Implementation Date

Article 69 of the UAE Corporate Tax Law provides that the Law will apply to Tax Periods that begin on or after June 1, 2023.

Businesses with a financial year that begins on January 1 are subject to CIT starting on January 1, 2024.

Financial records & Requirement to Maintain Audited Statements

Taxpayers must create and keep financial statements backed by all records and documents to support Corporate tax returns. The forms must be kept for a minimum of seven years.

This obligation will apply to every UAE entity (unless included in the Corporate Tax Group).

Every entity must create its financial statements. However, only some entities may be audited for financial information. A subsequent Cabinet Decision(s) will define the types of tax-paying individuals that must keep certified or audited accounting statements.

Small Business Tax Relief

Reliefs for small-scale businesses with revenues or gross income below the threshold of a specific amount are made. Qualifying businesses will be considered to have no tax-deductible income and must comply with a simplified set of requirements.

The threshold is determined by the revenue, not the earnings or taxable income. That is likely to be confirmed by an upcoming Cabinet Decision.

Deductible / Non-Deductible Expenses

The expenses incurred solely and exclusively for business reasons (and which are not to be capitalized) can be deducted.

Deductions are not allowed when expenses are incurred to earn tax-free income. In the case of any expenditure with a mixed purpose, removal is not permitted. Interest expense is deductible subject to a limit of 30% of EBITDA.

Financial assistance rules are in effect and prevent companies from getting funding to pay dividends or distribute profits.

Entertainment costs are set at 50 percent.

Donations not tax-deductible include those made to a non-Qualifying Public Benefit Entity and bribes, fines, and dividends.

Notably, the amounts withdrawn from the Business by any natural person who is a tax-deductible individual are not deductible.

Exempt Income & Relief

The following income categories will be exempted from Corporate Tax in UAE (Article 22 of the UAE Corporate Tax Law):

Capital Gains and Dividends, and other distributions of profits from a Resident

Capital Gains such as dividends, capital gains, and other distributions from Qualifying shareholding in a legal entity of a foreign country that is subject to a hold duration of 12 months, the minimum contribution of 5 percent, and at the minimum, subject to 9 percent CIT for the source country. From which they originate.

The income from a foreign PE is subject to certain conditions and the option to apply an exemption (rather than credit)

Earnings of an individual who is not a resident of the country come from operating ships or aircraft involved in international transport.

These transactions can be subjected to a specific reduction, i.e., effectively an exemption from taxation:

Restructurings and intragroup transactions that qualify as qualifying Entities will be eligible when they hold 75 percent common ownership.

Restructuring relief for businesses under specific conditions.

Transfer Pricing

Related party’s transactions should be carried out under the arm’s-length principle as outlined in Section 34 under the UAE Corporate Tax Law. In addition, it states that the five conventional OECD Transfer Pricing strategies are suitable to help support the arm’s length character of arrangements with related parties and allows the use of alternative methods when needed.

Article 34 provides that when a tax authority adjusts to a foreign country that affects the tax structure of a UAE entity, the application must be submitted to the FTA to request a similar adjustment that allows the UAE firm to be exempt against double taxation. Any adjustments that result from domestic transactions do not require an application.

The requirements for documentation on transfer pricing are covered in Article 55. UAE businesses will have to follow the rules for transfer pricing and the documentation requirements set by OECD Transfer Price Guidelines, which lead to three-tier reports, i.e., master file, local file, and country-by-country reporting. A reference to a controlled transaction disclosure form is provided (details of which are still to be determined).

It should be noted that no thresholds for the materiality of the product are provided. Separate legislation will be released later. Advance pricing plans will become made available via the normal clarification process currently in place.

UAE has introduced provisions requiring the payment and benefits given to persons connected to be tax-deductible in their market value. The same rules are followed in Article 34 of the UAE CIT Law.

Administration & Enforcement

The MoF is the sole authority for purposes of multilateral bilateral or multilateral agreements as well as for the exchange of information between countries.

The FTA is accountable for the corporate tax system’s administration, collection, and application. Fines and penalties are governed under a law known as the Tax Procedures Law.

Companies will require a VAT Registration UAE from the FTA.

Companies that are required to comply with UAE Corporate Tax are required to submit the Corporate Tax return online for every financial year within nine months from the date of the end of that Financial Period. (A financial period generally refers to any financial period that is 12 months long)

Free Zone companies that are subject to CIT at 0 percent CIT must also submit a CT Return.

Foreign Tax Credits

Tax credits for foreign taxation are allowed for Corporate Tax in UAE due as per the Public Consultation Document. Businesses can claim less corporate tax owing and the sum of tax withholding effectively removed. There is no way to carry forward. There will be no credit for taxes paid to the individual Emirate.

Tax Grouping

Fiscal unity or Tax Group: UAE companies can form a “fiscal unity” or Tax Group to serve UAE purposes. The main requirement for a Tax Group is to comply with the (in)direct sharing requirement, which is 95 percent. Free zone entities subject to zero percent cannot join the Tax Group. Additionally, the parent (which may be intermediate) must be a UAE company.

Losses

By article 37 of the UAE Corporate Tax Law, losses can be carried forward for up 75 percent of taxable income. Losses can be transferred between members of the same group of corporations if those entities have 75 percent direct or indirectly owned. Losses cannot be transferred from exempt individuals or entities that are free zone. Loss offsets are also subject to the cap of 75 for businesses that roll forward losses.

Tax-deductible losses may be lost in the event of an ownership change (50 percent or more) if the new owner runs the same or similar Business. The criteria to be considered for this have been established.

Anti-Abuse

UAE will adopt an Anti-Abuse General Rule, also known as “GAAR.” The GAAR applies to cases where one of the primary reasons for a transaction is to gain an income tax benefit for the corporation that is incompatible with the purpose or intent of the UAE Corporate Tax Law.

The FTA will deal with and alter or counteract the transaction. The GAAR only applies to agreements or transactions entered after the UAE Corporate Tax Law is published in the UAE Official Gazette on October 10, 2022, in issue #737.

Summary

With the publication of the UAE Corporate Tax Law and confirmation of a 9% tax rate and a 9% rate, UAE has established a globally competitive rate for Corporate Tax in UAE and confirmed its intention to implement Corporate Tax in June 2023.

It is expected that additional information to be released over the coming months to be fleshed out and provide more excellent knowledge of its implementation. Nevertheless, several key elements are already confirmed, including introducing compulsory transfer pricing rules.

4 notes

·

View notes

Text

Why Do Accounting Leaders Need CMA Certification? Decode the Benefits!

In today’s competitive accounting world, earning a Certified Management Accountant (CMA) certification can truly set you apart. Whether you're an experienced professional looking to level up or someone just starting their career, the CMA designation opens doors to CMA career opportunities, higher salaries, global opportunities, and leadership roles. Companies are increasingly on the lookout for finance experts who not only understand the numbers but can also think strategically and drive business decisions. This makes the CMA one of the most valuable management accountant certifications in the industry. In this guide, we’ll dive into why getting your CMA is more than just a credential—it’s a smart move for anyone serious about advancing in an accounting career.

CMA Certification: A Path to Global Recognition

One of the standout benefits of CMA certification is its global recognition. Unlike some finance certifications that are region-specific, the CMA is recognized worldwide, making it a valuable credential whether you’re working in the U.S., Europe, India, or beyond. The certification is granted by the Institute of Management Accountants (IMA), a global professional organization that has certified CMAs in over 140 countries.

In today’s interconnected world, companies are increasingly looking for finance professionals who understand global markets and can navigate the complexities of international business. The CMA credential ensures you have the necessary skills to manage accounting functions across borders and in various industries, including manufacturing, healthcare, banking, and tech.

Industries and Countries in Demand for CMAs:

United States: As one of the largest financial hubs, the U.S. has a significant demand for CMAs in both public and private sectors.

India: With its growing economy and a strong focus on finance professionals, India is rapidly becoming a top market for CMAs.

Middle East: With the rise of large multinational companies, the demand for certified professionals in finance has increased in countries like the UAE and Saudi Arabia.

Increased Earning Potential for CMAs

One of the most compelling reasons to pursue CMA certification is the financial reward. According to IMA’s Global Salary Survey, CMAs earn a significant premium over their non-certified counterparts. The report shows that CMAs in the U.S. earn, on average, 58% more in total compensation than those without the designation.

Regional Salary Data:

United States: CMAs in the U.S. earn an average base salary of $40,000.

India: In India, CMAs can expect an average CMA salary of ₹6 lakhs per annum, with experienced professionals earning upwards of ₹20 lakhs.

Europe: European CMAs often command high salaries in finance and leadership roles, ranging between €60,000 and €100,000 annually.

When you compare the earning potential of CMAs to non-certified finance professionals, the difference is clear. Over the span of a career, CMAs can earn significantly more, making the certification a wise investment.

CMA vs. CPA: Choosing the Right Certification

While both the CMA and Certified Public Accountant (CPA) designations are highly respected in the finance world, they cater to different career paths. Understanding the key differences between the two can help you make an informed decision about which certification is right for you.

Key Differences Between CPA & CMA

Focus Area:

CMA: Management accounting and strategy

CPA: Public accounting and auditing

Global Recognition:

CMA: High, across various industries

CPA: Primarily U.S.-focused

Typical Roles:

CMA: Financial analyst, CFO, Controller

CPA: Auditor, Tax Specialist

Salary:

CMA: High earning potential globally

CPA: High, especially in audit and tax

Exam Format:

CMA: 2-part exam focusing on financial management and decision-making

CPA: 4-part exam focusing on auditing, regulation, and business concepts

If you’re interested in management accounting, strategic decision-making, and global career opportunities, the CMA certification is the ideal choice. On the other hand, if you’re focused on tax, auditing, or public accounting in the U.S., the CPA may be better suited to your goals.

Career Flexibility and Growth with CMA Certification

The CMA certification is highly versatile and opens the door to various career paths across industries. CMAs are equipped with a unique skill set that combines accounting, financial analysis, and business strategy, which makes them highly valuable in senior management roles.

Career Paths for CMAs:

Chief Financial Officer (CFO): As a CFO, you’ll be responsible for managing the financial actions of a company, including budgeting, financial planning, and risk management.

Financial Analyst: In this role, you’ll provide insights and analysis on financial data to help businesses make informed decisions.

Controller: Controllers oversee the preparation of financial reports and ensure compliance with accounting principles and regulations.

Leadership and Strategic Decision-Making Skills

One of the key benefits of the CMA certification is the focus on leadership and strategic decision-making. Unlike other certifications that focus mainly on technical accounting, the CMA emphasizes the ability to analyze financial data and use it to guide business decisions. This skill set is highly valued in senior management positions, where decision-making based on financial insights is critical.

Skills Acquired Through CMA Training:

Financial Planning and Analysis: CMAs are trained to prepare detailed financial plans and forecasts that help businesses achieve their goals.

Strategic Management: Understanding how financial data impacts long-term business strategy is a key skill for CMAs.

Risk Management: CMAs are well-equipped to assess and mitigate financial risks, ensuring the long-term stability of the business.

These skills make CMAs ideal candidates for leadership roles in finance departments, giving them a clear edge over other professionals.

Job Security and Demand for CMAs During Economic Uncertainty

In an ever-changing global economy, job security is a key concern for many professionals. One of the lesser-known benefits of the CMA certification is its ability to provide stability during economic downturns. During recessions or periods of economic uncertainty, companies often look to financial experts to help them navigate cost management, budgeting, and strategic decision-making. CMAs are particularly well-suited to these tasks due to their focus on both financial and strategic management.

Examples of Demand During Economic Crises:

During the 2008 financial crisis, many companies relied heavily on management accountants to control costs and optimize financial performance.

The COVID-19 pandemic also saw a rise in demand for CMAs, as businesses sought experts to manage cash flow and reassess financial strategies.

CMA’s Role in the Age of Automation and AI

The role of a CMA is evolving with technological advancements. Automation and artificial intelligence (AI) are reshaping the finance industry, and CMAs are uniquely positioned to adapt to these changes. As businesses increasingly adopt automation for repetitive accounting tasks, the demand for professionals who can analyze data and make strategic decisions is on the rise.

Key Tech-Savvy Skills for CMAs:

Data Analytics: CMAs are trained to interpret complex financial data, providing insights that drive business strategy.

Automation: CMAs are expected to manage and implement automation tools in finance departments, ensuring that these tools are used effectively.

AI in Decision-Making: As AI becomes more integrated into financial management, CMAs will play a critical role in interpreting AI-driven insights and applying them to business strategy.

The CMA certification ensures that finance professionals are not just accounting experts, but also skilled in leveraging technology to enhance business performance.

Networking and Professional Development

Networking is a crucial component of career growth, and CMAs benefit from being part of a global professional community. The Institute of Management Accountants (IMA) provides numerous networking opportunities through conferences, seminars, and online forums, giving CMAs access to a global network of professionals.

Professional Development Opportunities:

IMA Events: IMA regularly hosts events where CMAs can meet industry leaders, attend workshops, and stay updated on the latest trends in finance.

CMA Alumni Networks: Being part of a global community of CMAs can open doors to new career opportunities and mentorship.

Networking is not just about building relationships; it’s about staying connected to industry trends and continuing professional development throughout your career.

Conclusion

The CMA certification is more than just a credential; it’s a pathway to a successful and fulfilling career in finance. From increased earning potential and global recognition to leadership opportunities and tech-savvy skills, the benefits of CMA certification are clear. If you’re looking to enhance your career and take the next step toward leadership in finance, pursuing the CMA is a wise investment in your future.

Ready to start your journey toward becoming a CMA? Explore the CMA course at Miles and take the first step in achieving your career goals today!

0 notes

Text

understanding accounts receivable vs.debt collection:key differences for uae businesses

Understanding Accounts Receivable vs. Debt Collection: Key Differences for UAE Businesses

For businesses in the UAE, managing finances efficiently is key to maintaining healthy cash flow and ensuring long-term success. Two essential components of financial management are accounts receivable and debt collection. While they both involve the recovery of funds, they are distinct processes with different implications for your business. Understanding the differences between accounts receivable and debt collection can help you manage your finances more effectively. Here’s what you need to know.

1. Accounts Receivable: Managing Ongoing Business Operations

Accounts receivable (AR) refers to the money owed to a business by its customers for goods or services provided on credit. These are current obligations and typically involve invoices with payment terms agreed upon in advance, such as 30, 60, or 90 days.

Key Features of Accounts Receivable:

Regular Business Activity: AR is a normal part of day-to-day operations. Businesses extend credit to customers to facilitate ongoing transactions and relationships.

Internal Management: Most companies have an internal accounts receivable department responsible for tracking unpaid invoices, sending reminders, and following up with customers.

Soft Approach to Recovery: Since accounts receivable is a part of regular business dealings, businesses typically take a softer approach to recovery, such as sending payment reminders or offering extensions.

2. Debt Collection: Addressing Delinquent Payments

Debt collection, on the other hand, comes into play when accounts receivable become overdue or delinquent. If a customer fails to pay their invoice within the agreed-upon time frame, the debt is classified as delinquent, and more formal recovery efforts are initiated.

Key Features of Debt Collection:

Escalated Recovery Efforts: Once the account is delinquent, businesses often escalate recovery efforts, which may involve formal demands, negotiations, or even legal action.

Third-Party Involvement: Businesses may outsource debt recovery to a third-party debt collection agency or law firm like Al Qada to ensure a more formal and professional approach.

Legal Enforcement: In cases where informal recovery attempts fail, legal enforcement measures such as court action, asset seizure, or garnishment of wages may be pursued to recover the outstanding debt.

3. When to Move from Accounts Receivable to Debt Collection

It’s essential for UAE businesses to recognize when accounts receivable transitions into debt collection. Typically, this occurs after repeated reminders and a reasonable grace period without payment. At this point, it’s time to hand the case over to a professional debt recovery service like Al Qada to ensure that legal avenues are pursued for collection.

Indicators for Transitioning to Debt Collection:

Invoice Overdue for 90+ Days: If an invoice remains unpaid after three months, it is generally considered delinquent.

Unresponsive Customer: If repeated attempts to contact the customer fail or they refuse to pay, the case should be escalated to debt collection.

High Risk of Non-Payment: If the customer is facing financial difficulties or has a history of missed payments, it may be prudent to initiate debt recovery sooner.

4. Legal Implications in the UAE

In the UAE, debt recovery is governed by specific laws that regulate how businesses can pursue delinquent payments. Al Qada provides expert legal services to ensure compliance with UAE debt recovery laws, minimizing legal risks while maximizing recovery chances. Our firm can assist you in transitioning from accounts receivable management to formal debt recovery, ensuring that your business doesn’t lose valuable revenue.

5. Why Choose Al Qada for Debt Collection

While accounts receivable can be managed internally, debt collection often requires a legal and strategic approach. At Al Qada, we specialize in handling complex debt recovery cases for UAE businesses. Our services ensure that all necessary legal steps are taken to recover what is owed to you, allowing you to focus on core business operations while we manage the recovery process.

Conclusion: Understanding the Balance Between AR and Debt Collection

For UAE businesses, managing accounts receivable and knowing when to escalate to debt collection is crucial for maintaining healthy cash flow. By distinguishing between the two processes and knowing when to take formal recovery steps, you can protect your financial interests while maintaining strong business relationships.

If your business is facing overdue invoices or delinquent payments, Al Qada’s expert debt collection services can help you recover your funds efficiently and legally.

0 notes

Text

UAE and Australia conclude negotiations on a Comprehensive Economic Partnership Agreement Business Economy and Finance

The UAE-Australia CEPA seeks to boost non-oil trade through the removal or reduction of tariffs and trade barriers.

Bilateral non-oil trade between the UAE and Australia reached US$2.3 billion (AED 8.4 Billion) in H1 2024, up 10 percent compared to 2023.

HE Al Zeyoudi: “With strong economic, social, and cultural ties between our nations, Australia has long been a valued partner for the UAE. This CEPA will unlock significant opportunities for UAE businesses and provide Australian companies with a gateway to new markets across the MENA region.”

Hon. Don Farrell: “As a trading nation, we are committed to opening up new opportunities for our exporters, farmers, producers and businesses. Under this trade agreement, Australian exports are expected to increase by US$460 million per year”

Abu Dhabi, United Arab Emirates – September 17, 2024: The UAE and Australia have finalized negotiations on a landmark Comprehensive Economic Partnership Agreement (CEPA) between the two countries that will, once ratified and implemented, represent Australia’s first trade deal with a country in the MENA region. The UAE-Australia CEPA will streamline trade processes, eliminate tariffs on a wide range of goods and services, create new opportunities for investment, and encourage private-sector collaboration in priority sectors.

The negotiations built on growing economic relations between the UAE and Australia, with bilateral non-oil trade reaching US$2.3 billion in H1 2024, an increase of 10 percent from H1 2023. The UAE is Australia’s leading trade partner in the Middle East and its 20th largest partner globally. As of 2023, the two countries have also committed a combined US$14 billion to each other’s economies, with more than 300 Australian businesses operating in the UAE in sectors such as construction, financial services, agriculture and education.

Upon the conclusion of negotiations, HE Al Zeyoudi stated: “With strong economic, social, and cultural ties between our nations, Australia has long been a valued partner for the UAE. This CEPA will unlock significant opportunities for UAE businesses and provide Australian companies with a gateway to new markets across the MENA region. I look forward to collaborating with my Australian counterpart to swiftly ratify the CEPA and deliver its benefits. This milestone not only reaffirms our commitment to building strong relations with key partners, but to expanding the reach of our trading network into key regions such as Asia-Pacific.”

His Excellency Hon. Don Farrell stated: “As a trading nation, we are committed to opening up new opportunities for our exporters, farmers, producers and businesses. Under this trade agreement, Australian exports are expected to increase by US$460 million per year, but this deal means more for Australia than just numbers. A trade agreement with the UAE will facilitate investment into key sectors, which is important to achieving our ambition of becoming a renewable energy superpower.”

Foreign trade remains the cornerstone of the UAE’s economic agenda. In 2023, the UAE’s non-oil trade in goods reached an all-time high of $712 billion, a 14.3% increase on 2022 – and 36.8% more than 2021. A CEPA with Australia will be a significant addition to the UAE foreign trade network, which is helping to propel non-oil foreign trade towards its target of AED4 trillion (US$1.1 trillion) by 2031

Follow Emirates 24|7 on Google News.

Source link

via

The Novum Times

0 notes

Text

Best Structured Trade Finance Services in Dubai, UAE

Structured trade finance is an essential component of international trade, facilitating the smooth exchange of goods and services across borders. In a city like Dubai, a global hub for trade, structured trade finance services play a pivotal role in ensuring the success of businesses by providing them with the liquidity and security needed to manage complex international transactions. Fiddelis Consulting, a leading financial consulting firm in Dubai, specializes in offering structured trade finance services that are tailored to meet the needs of businesses operating in diverse industries.

Understanding Structured Trade Finance

Structured trade finance refers to a specialized form of financing used in commodity trading and other large-scale transactions. It involves complex financial instruments, such as letters of credit, guarantees, and trade receivable financing, to mitigate risks associated with international trade. For businesses engaged in importing and exporting, structured trade finance provides a lifeline by ensuring access to working capital, safeguarding against non-payment risks, and facilitating smoother trade flows. Fiddelis Consulting provides expert guidance to companies seeking these trade finance solutions, helping them navigate the intricate legal, financial, and operational aspects of cross-border trade.

Tailored Solutions by Fiddelis Consulting

As a trusted financial advisory firm in Dubai, Fiddelis Consulting offers a range of services that cater to the specific needs of businesses, from SMEs to large multinational corporations. Their structured trade finance services include supply chain finance, export credit solutions, and risk management strategies. By leveraging these services, businesses can secure financing that is aligned with the structure of their trade deals, minimize risks, and enhance profitability.

Fiddelis Consulting’s team of experts has in-depth knowledge of the Middle Eastern and global trade landscapes, enabling them to provide insightful advice on trade financing strategies that align with market conditions. Their customized approach ensures that each client receives financing solutions that are both sustainable and scalable, allowing them to optimize their cash flow while minimizing operational risks.

For businesses looking to navigate the complexities of structured trade finance and secure financial stability, Fiddelis Consulting is the partner of choice in Dubai.

0 notes

Text

Comprehensive Guide to Staffing and HR Outsourcing in Dubai and the UAE

Dubai and the broader UAE have become global business hubs, attracting enterprises from various sectors including finance, technology, and tourism. One essential aspect of maintaining business growth and productivity is human resources management. Staffing agencies, HR outsourcing companies, and HR consultancy firms in the UAE have stepped in to help businesses navigate the complexities of hiring and workforce management.

HR Consultancy in the UAE

Many businesses in the UAE opt for HR consultancy UAE to gain expert advice and guidance on workforce management strategies. HR consultancies offer tailored solutions to improve productivity, retain top talent, and develop competitive compensation strategies.

Consultants work closely with businesses to:

Analyze Workforce Needs: Understanding current workforce strengths and weaknesses.

Implement HR Technologies: Streamlining operations through HR software and systems.

Develop Retention Strategies: Focusing on employee satisfaction, engagement, and retention.

HR consultancy services in the UAE help businesses optimize their human capital management, leading to increased efficiency and growth.

Outsourcing Companies in the UAE

As businesses in the UAE continue to expand, many are looking towards outsourcing companies in UAE to handle specific functions, especially in sectors like IT, customer service, and human resources. Outsourcing allows companies to reduce operational costs and focus on their core competencies.

Some common areas where businesses seek outsourcing services include:

IT Services: Software development, system maintenance, and technical support.

Customer Service: Call centers, chat support, and other customer engagement services.

Back-office Operations: Handling non-core functions such as data entry, payroll, and administrative support.

Outsourcing in the UAE has become a strategic choice for companies aiming to reduce overhead costs while ensuring high-quality service delivery.

0 notes

Text

Economic Substance Regulations (ESR) were introduced in the UAE in 2019 to ensure compliance with international tax standards. These regulations aim to prevent businesses from engaging in harmful tax practices by requiring them to prove that they have substantial economic activities within the country. For companies planning to setup a business in Dubai or already operating, understanding ESR is crucial for avoiding penalties and ensuring smooth operations.

Who Does ESR Apply To?

ESR applies to businesses engaged in specific activities, including:

Banking

Insurance

Investment fund management

Shipping

Intellectual property activities

Holding company activities

Lease-finance

Headquarters activities

Distribution and service centers

If your business falls under any of these categories, whether you operate in a free zone or on the mainland, compliance with ESR is mandatory.

Key Requirements for Compliance

Substantial Economic Presence To comply with ESR, your business must show significant economic activity in the UAE. This includes:Having a physical office in the UAE.Employing enough full-time employees.Conducting core business functions within the country. |

Directed and Managed in the UAE Key business decisions must be made within the UAE, with directors attending board meetings in the country.

Adequate Expenditure Companies need to prove they have sufficient operating expenses tied to their UAE activities.

Annual Reporting Businesses must submit an Economic Substance Report each year, detailing income, expenses, and employees related to the relevant activities.

Consequences of Non-Compliance

Failure to comply with ESR can lead to significant penalties, including fines ranging from AED 20,000 to AED 400,000. Additionally, companies may face deregistration or license suspension. Ensuring compliance is particularly important for businesses undergoing business setup in Dubai, as penalties can disrupt operations and damage reputations.

Impact on Business Setup in Dubai

ESR affects both mainland and free zone businesses in Dubai. If your business is involved in relevant activities, it’s essential to account for ESR during the setup of your Dubai business. From securing office space to hiring staff, businesses need to ensure they can meet the ESR requirements from the start.

Complying with ESR strengthens the UAE’s reputation as a transparent and responsible business hub, and businesses that adhere to the regulations can avoid legal complications while maintaining credibility in global markets.

Conclusion

or businesses in Dubai, complying with Economic Substance Regulations is crucial to avoid penalties and ensure smooth operations. Whether you’re in the process of business setup in Dubai or running an established company, understanding ESR and meeting its requirements is essential for long-term success. Seeking professional guidance can help you navigate these regulations effectively and ensure full compliance.

0 notes

Text

UAE Corporate Tax: New Businesses Must Register Within 3-Month Deadline

Dubai: Have you recently established a company in the UAE? If so, it's crucial to prioritize registering for corporate tax, even as you focus on building your business, hiring staff, and setting up your office.

New companies incorporated in the UAE are required to register for corporate tax within a 3-month window. Failure to do so could result in penalties, a setback no new business wants to face.

Despite frequent alerts from authorities, many new business owners are missing the registration deadline or submitting incomplete applications, leading to rejections, according to tax consultants.

To avoid these pitfalls, new businesses should follow these steps:

Register for Corporate Tax Within 3 Months: This is non-negotiable to avoid penalties and complications later.

Evaluate Eligibility: Assess whether your business qualifies for 'Qualifying Free Zone Person' status, the 3-year SME Relief program, and other relevant factors such as transfer pricing applicability.

Maintain Proper Accounts: Ensure accurate bookkeeping and avoid mixing non-business expenses with business finances.

Consider VAT and Other Laws: Keep in mind the applicability of VAT and other relevant legal requirements.

"Every company formed on or after June 1, 2023, in the UAE is subject to the corporate tax regime from day one"

The Federal Tax Authority (FTA) issues regular alerts on tax registration deadlines based on the incorporation date of each company. However, many founders are delaying the necessary paperwork, leading to missed deadlines for obtaining a Tax Registration Number (TRN).

"Early registration ensures that a newly formed company is prepared to meet its tax obligations from the start." This can prevent last-minute rushes and errors, which could lead to penalties and complications.

Another critical decision for new businesses is choosing the appropriate financial year. Options include the standard January to December timeline, an April to March fiscal year, or a different 12-month period.

"The financial year and tax period will depend on the company's Memorandum of Association or Articles of Association," For companies incorporated on or after June 1, 2023, the first tax period will start from the date of incorporation and must be at least 6 months but not exceed 18 months."

For example, if a company selects a January to December financial year, the first tax period would be from June 1, 2023, to December 31, 2023—spanning 7 months. Alternatively, if the fiscal year is April to March, the first tax period would be June 1, 2023, to March 31, 2024—a 10-month period.

To avoid penalties, businesses must prioritize meeting the tax registration deadlines.

0 notes

Text

Voice Logger Manufacturers Company in UAE: Enhancing Communication and Compliance

In today's rapidly evolving business environment, effective communication and compliance are more crucial than ever. Companies across the UAE are increasingly turning to advanced technologies to ensure that their communication systems are not only efficient but also secure and compliant with industry standards. One such technology that has gained significant traction is the voice logger. As a leading Voice Logger Manufacturers Company in UAE, Aria Telecom provides top-tier solutions designed to meet the diverse needs of businesses in various sectors, including finance, healthcare, customer service, and more.

Voice Logger Manufacturers Company in UAE like Aria Telecom understand the importance of accurate and reliable call recording systems. A voice logger is an essential tool that records and stores telephone conversations, enabling businesses to monitor, analyze, and retrieve calls when needed. This capability is vital for ensuring that all communication processes are transparent, accountable, and compliant with legal and regulatory requirements. As a trusted Voice Logger Manufacturers Company in UAE, Aria Telecom offers a range of voice logging solutions that are customizable to fit the unique needs of each business.

One of the primary reasons why businesses in the UAE are investing in voice logging technology is to enhance customer service. By recording customer interactions, companies can review conversations to ensure that their representatives are providing the highest level of service. This not only helps in training and quality assurance but also in resolving disputes that may arise from miscommunications. As a Voice Logger Manufacturers Company in UAE, Aria Telecom’s voice loggers are equipped with advanced features that allow for easy retrieval and analysis of recorded calls, making it easier for businesses to maintain high customer service standards.