#Upadacitinib

Text

Upadacitinib Shows Positive Endoscopic Outcomes in Crohn's Disease#Upadacitinib #Shows #Positive #Endoscopic #Outcomes #Crohns #Disease

Dr Brian Feagan

COPENHAGEN, Denmark — The reversible oral Janus kinase (JAK) inhibitor upadacitinib (Rinvoq, AbbVie) was associated with superior endoscopic outcomes at 12 weeks and 1 year compared with placebo among people with moderately to severely active Crohn’s disease.

The findings of this subanalysis come from two phase 3 induction trials (U-EXCEL and U-EXCEED) and one maintenance study…

View On WordPress

2 notes

·

View notes

Link

Opinion/decision on a Paediatric investigation plan (PIP): Rinvoq, upadacitinib, decision type: P: decision agreeing on a investigation plan, with or without partial waiver(s) and or deferral(s), therapeutic area: Dermatology, PIP number: P/0383/202 #BioTech #science

0 notes

Text

Rinboq

[Drug name] Generic name: Upadacitinib Sustained Tablets

Trade name: Ruifu

English name: Upadacitinib Sustained

[Ingredients] The main ingredient of this product is upadacitinib.

[Properties] This product is a purple (15mg specification) or red (30mg specification) oval biconvex film-coated tablet. After removing the coating, it is white to off-white to light yellow to gray-brown to light brown, and spots may appear.

[Indications] This product is suitable for adults and adolescents aged 12 years and above with refractory, moderate to severe atopic dermatitis who have poor response to other systemic treatments (such as hormones or biological agents) or are not suitable for the above treatments.

[Dosage and Administration] Treatment with upadacitinib should be initiated by and used under the guidance of a physician who has experience in the diagnosis and treatment of this product's indications. Dosage The starting dose for children aged 12 years and older and weighing ≥ 40 kg and adults up to 65 years of age is 15 mg once daily. If the response is poor, consider increasing the dose to 30 mg once daily. If the 30 mg dose does not achieve an adequate response, discontinue this product. The lowest effective dose required should be used to maintain the response. The safety and efficacy of this product has not been studied in adolescents weighing less than 40 kg. The recommended dose for adults aged 65 years and older is 15 mg once daily. Data for patients aged ≥ 75 years are limited. Recommended dose for patients with renal impairment or severe hepatic impairment Renal impairment Patients with mild or moderate renal impairment do not require dose adjustment. There are limited data on the use of upadacitinib in patients with severe renal impairment (see [Pharmacokinetics]). Upadacitinib 15 mg once daily should be used with caution in patients with severe renal impairment. Upadacitinib 30 mg once daily is not recommended in patients with severe renal impairment. Upadacitinib has not been studied in subjects with end-stage renal disease. No dose adjustment is required for patients with mild (Child-Pugh A) or moderate (Child-Pugh B) hepatic impairment (see [Pharmacokinetics]). This product should not be used in patients with severe hepatic impairment (Child-Pugh C) (see [Contraindications]). Usage This product can be taken with or without food and at any time of the day. This product should be swallowed whole and should not be broken, crushed or chewed to ensure that the full dose is administered. Combined topical treatment This product can be initiated with or without topical corticosteroids It is not recommended to start treatment with this product in patients with an absolute lymphocyte count (ALC) less than 500 cells/mm3, an absolute neutrophil count (ANC) less than 1000 cells/mm3, or a hemoglobin level less than 8 g/dL. (See [Precautions] and [Adverse Reactions]). Suspension of administration If a patient develops a serious infection, treatment with this drug should be suspended until the infection is under control.

0 notes

Text

Rheumatoid Arthritis Therapeutics Market To Reach USD 36.39 Billion By 2030

Rheumatoid Arthritis Therapeutics Market Growth & Trends

The global rheumatoid arthritis therapeutics market size is expected to reach USD 36.39 billion by 2030, expanding at a CAGR of 5.93% from 2024 to 2030, according to a new study by Grand View Research, Inc. Some of the key trends driving the market are availability of novel biologics, increase in potential clinical pipeline candidates, and rise in aging population. Thus, growing availability and awareness of safer drugs are projected to escalate rheumatoid arthritis drugs market growth.

Rheumatoid arthritis affects approximately 1% of the global population. The condition has different symptoms such as joint pain, swelling, and stiffness, which are generally accompanied by chronic pain and inability to perform daily activities. Over a prolonged period, this disorder can hamper a patient’s mobility and can lead to permanent joint damage. If left untreated, this disorder can lead to mobility impairment and risk of joint replacement.

Growing prevalence of the disease, presence of biologics & biosimilars, and well-defined regulatory guidelines are poised to provide a fillip to the market. According to the Arthritis Foundation, 64% of the population within the age group of 65 is likely to suffer from arthritis in U.S. Increasing awareness regarding disease remittance therapies and rising healthcare expenditure in developed regions are estimated to promote revenue growth.

Current treatment for rheumatoid arthritis includes generic pharmaceuticals such as NSAIDs and corticosteroids along with novel biologics such as JAK inhibitors and IL-6 antagonists, which are widely used in developed countries due to their high effectiveness. New product launches such as Infliximab and Adalimumab biosimilars are anticipated to work in favor of the market. Moreover, Eli Lilly’s Olumiant and AbbVie’s Upadacitinib are expected to cut down chances of disease remittance.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/rheumatoid-arthritis-therapeutics-market

Rheumatoid Arthritis Therapeutics Market Report Highlights

Biopharmaceuticals segment led the market and accounted for 88.73% of the global revenue in 2023. Biopharmaceuticals are large-molecule drugs that are manufactured, extracted, and synthesized from biological sources.

Prescription led the market with a market share of 89.64% in 2023. As rheumatologist consultations rise, the prescription segment is expected to remain dominant in the market for rheumatoid arthritis medications over the forecast period.

North America rheumatoid arthritis therapeutics market accounted for 52.31% share in 2023. The regional market continues to grow and evolve, driven by demographic shifts, advancements in medical research, regulatory changes, and an increasing emphasis on personalized healthcare.

The Asia Pacific rheumatoid arthritis therapeutics market is experiencing significant growth, driven by the increasing prevalence of rheumatoid arthritis, improving healthcare infrastructure, and advancements in treatment options.

Rheumatoid Arthritis Therapeutics Market Segmentation

Grand View Research has segmented global rheumatoid arthritis therapeutics market report based on molecule, sales channel, and region:

Rheumatoid Arthritis Therapeutics Molecule Outlook (Revenue, USD Million, 2018 - 2030)

Pharmaceuticals

NSAIDs

Analgesics

DMARDs

Glucocorticoids

Biopharmaceuticals

Biologics

TNF-α antagonists

T-cell inhibitors

CD20 antigen

JAK inhibitors

anti-IL6 biologics

Biosimilars

CD20 antigen

TNF-α antagonists

Rheumatoid Arthritis Therapeutics Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

Prescription

Over-the-Counter (OTC)

Regional Insights

North America rheumatoid arthritis therapeutics market accounted for 52.31% share in 2023.The regional market continues to grow and evolve, driven by demographic shifts, advancements in medical research, regulatory changes, and an increasing emphasis on personalized healthcare. The aging population across the region significantly impacts the demand for rheumatoid arthritis therapeutics. As people live longer, the prevalence of chronic conditions such as RA increases, boosting the need for effective treatment options. This demographic trend is a primary driver of sustained market growth.

Europe Rheumatoid Arthritis Therapeutics Market Trends

The Europe rheumatoid arthritis therapeutics market is substantially changing, influenced by healthcare reforms, research advancements, and patient-focused initiatives across different countries. The prevalence of rheumatoid arthritis is increasing due to an aging population and changing lifestyles, leading to a growing demand for effective & innovative treatment options across the continent.

Asia Pacific Rheumatoid Arthritis Therapeutics Market Trends

The Asia Pacific rheumatoid arthritis therapeutics market is experiencing significant growth, driven by the increasing prevalence of rheumatoid arthritis, improving healthcare infrastructure, and advancements in treatment options. The prevalence of rheumatoid arthritis is on the rise across Asia Pacific due to factors such as the aging population, changing lifestyles, and increasing awareness leading to early diagnosis. This rising prevalence has led to a growing demand for effective and affordable RA treatments, prompting healthcare providers & policymakers to focus on improving RA care & management.

List of Key Players of Rheumatoid Arthritis Therapeutics Market

AbbVie, Inc.

Boehringer Ingelheim International GmbH

Novartis AG

Regeneron Pharmaceuticals Inc.

Pfizer, Inc.

Bristol-Myers Squibb Company

F. Hoffmann-La Roche Ltd.

UCB S.A.

Johnson & Johnson Services, Inc.

Amgen, Inc.

Lilly (Eli Lilly and Company)

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/rheumatoid-arthritis-therapeutics-market

#Rheumatoid Arthritis Therapeutics Market#Rheumatoid Arthritis Therapeutics Market Size#Rheumatoid Arthritis Therapeutics Market Share

0 notes

Text

0 notes

Link

Terapia orale indicata per il trattamento della patologia attiva da moderata a severa AbbVie, azienda biofarmaceutica globale basata sulla ricerca, annuncia che l'Agenzia italiana del farmaco (Aifa) ha approvato la rimborsabilità in Italia di upadacitinib 45 mg (dose d'induzione) e 15 e 30 mg (dosi di mantenimento) come primo Jak inibitore per il trattamento di pazienti adulti con malattia di Crohn attiva da moderata a severa che hanno avuto una risposta inadeguata, hanno perso la risposta o sono risultati intolleranti alla terapia convenzionale o a un agente biologico. "Ad oggi si stima che in Italia vivano circa 250mila persone affette da malattie infiammatorie croniche intestinali, tra cui la malattia di Crohn. Questo numero è destinato ad aumentare significativamente negli anni a venire", afferma Flavio Caprioli, medico gastroenterologo presso la Fondazione Irccs Ca' Granda Ospedale Maggiore Policlinico di Milano e professore associato di gastroenterologia presso l'Università degli Studi di Milano. Si tratta di patologie immunomediate che "hanno un impatto molto significativo sulla qualità di vita dei pazienti - sottolinea - anche per il loro esordio in età giovanile, ovvero nel pieno della vita sociale e all'inizio della vita lavorativa dell'individuo. Accogliamo con favore l'ottenimento della rimborsabilità di upadacitinib da parte di Aifa, un farmaco che si assume per via orale una volta al giorno e che, grazie a un meccanismo d'azione unico, offre una nuova opzione terapeutica per un ampio numero di pazienti, raggiungendo obiettivi potenzialmente in grado di cambiare il decorso della malattia di Crohn".La Commissione europea - ricorda una nota - aveva approvato upadacitinib ad aprile 2023 grazie ai risultati di due studi clinici di induzione, U-Exceed e U-Excel, e di uno studio di mantenimento, U-Endure.1. Gli studi clinici hanno mostrato risultati positivi nella risposta endoscopica, nel raggiungimento della remissione clinica e nella guarigione della mucosa intestinale."Upadacitinib è una terapia che si caratterizza per un meccanismo d'azione nuovo nella malattia di Crohn - evidenzia Alessandro Armuzzi, responsabile dell'Unità operativa di Malattie infiammatorie croniche intestinali dell'Irccs Istituto clinico Humanitas - Agisce bloccando l'azione di alcune sostanze coinvolte nei processi infiammatori e, oltre ad aver dimostrato di agire efficacemente sui sintomi della malattia, è in grado di ridurre le lesioni a carico del canale digerente, al punto da arrivare in molti casi a una vera e propria guarigione della mucosa, con importanti benefici per i pazienti nonché con possibili impatti anche in termini di risparmi assistenziali a lungo termine. L'ottenimento della rimborsabilità rappresenta un significativo passo in avanti nella gestione clinica della malattia di Crohn, considerando che molti pazienti, nonostante il trattamento con terapie convenzionali o biologiche, continuano ad avere una malattia in fase attiva".Questa è la sesta indicazione rimborsata dal Servizio sanitario nazionale in Italia per upadacitinib, riporta la nota. Oltre alla malattia di Crohn, in Italia upadacitinib è rimborsato per il trattamento dei pazienti adulti con colite ulcerosa, artrite reumatoide, artrite psoriasica, spondilite anchilosante e dermatite atopica. La malattia di Crohn è una patologia sistemica cronica e progressiva che si manifesta con un'infiammazione della parete gastrointestinale, che causa diarrea persistente e dolore addominale. Peggiora nel tempo in una consistente percentuale di pazienti e può portare a complicanze che richiedono cure mediche urgenti, compreso l'intervento chirurgico. Poiché i segni e i sintomi della malattia di Crohn sono imprevedibili, questo comporta un impatto significativo per le persone che ci convivono, non solo dal punto di vista fisico, ma anche emotivo ed economico. Fonte

0 notes

Text

Giant-Cell Arteritis Market to witness growth by 2034, estimates DelveInsight | RINVOQ (upadacitinib), COSENTYX (secukinumab), Mavrilimumab, TREMFYA (guselkumab), more

http://dlvr.it/T6f53F

0 notes

Text

Giant-Cell Arteritis Market to witness growth by 2034, estimates DelveInsight | RINVOQ (upadacitinib), COSENTYX (secukinumab), Mavrilimumab, TREMFYA (guselkumab), more

http://dlvr.it/T6dy89

0 notes

Text

Giant-Cell Arteritis Market to witness growth by 2034, estimates DelveInsight | RINVOQ (upadacitinib), COSENTYX (secukinumab), Mavrilimumab, TREMFYA (guselkumab), more

http://dlvr.it/T6dy84

0 notes

Text

Giant-Cell Arteritis Market to witness growth by 2034, estimates DelveInsight | RINVOQ (upadacitinib), COSENTYX (secukinumab), Mavrilimumab, TREMFYA (guselkumab), more

http://dlvr.it/T6dxYF

0 notes

Text

Giant-Cell Arteritis Market to witness growth by 2034, estimates DelveInsight | RINVOQ (upadacitinib), COSENTYX (secukinumab), Mavrilimumab, TREMFYA (guselkumab), more

http://dlvr.it/T6dxQz

0 notes

Text

Giant-Cell Arteritis Market to witness growth by 2034, estimates DelveInsight | RINVOQ (upadacitinib), COSENTYX (secukinumab), Mavrilimumab, TREMFYA (guselkumab), more

http://dlvr.it/T6dwXb

0 notes

Text

Giant-Cell Arteritis Market to witness growth by 2034, estimates DelveInsight | RINVOQ (upadacitinib), COSENTYX (secukinumab), Mavrilimumab, TREMFYA (guselkumab), more

http://dlvr.it/T6dqTW

0 notes

Text

Upadacitinib 15 mg (Rematib) | Order Now At IEB Pharma

The goal of Upadacitinib 15 mg Rematib is to affect the immune system and lessen the severity of rheumatoid arthritis symptoms.

0 notes

Text

0 notes

Text

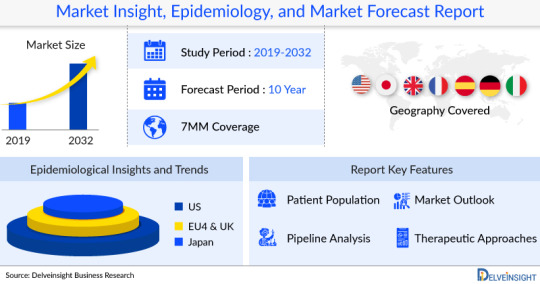

Inflammatory Bowel Disease Market expected to rise | Companies- Eli Lilly and Company, Gilead, Galapagos, Protagonist Therapeutics, Athos Therapeutics, expected to drive market

The Inflammatory Bowel Disease market growth is driven by factors like increase in the prevalence of Inflammatory Bowel Disease, investments in research and development, entry of emerging therapies during the study period 2019-2032.

The Inflammatory Bowel Disease market report also offers comprehensive insights into the Inflammatory Bowel Disease market size, share, Inflammatory Bowel Disease epidemiology, emerging therapies, market drivers and barriers, ongoing clinical trials, key collaboration in the space, market uptake by key therapies and companies actively pushing Inflammatory Bowel Disease market size growth forward.

Some of the key highlights from the Inflammatory Bowel Disease Market Insights Report:

Several key pharmaceutical companies, including Eli Lilly and Company, Gilead, Galapagos, Protagonist Therapeutics, Athos Therapeutics, and others, are developing novel products to improve the Inflammatory Bowel Disease treatment outlook.

The total Inflammatory Bowel Disease market size will include the market size of the potential upcoming therapies and current treatment regimens in the seven major markets.

As per DelveInsight analysis, the Inflammatory Bowel Disease market is anticipated to witness growth at a considerable CAGR

Strategise your business goals by understanding market dynamics @ Inflammatory Bowel Disease Market Landscape

Inflammatory Bowel Disease Overview

Inflammatory bowel disease (IBD) is a term that describes disorders involving long-standing (chronic) inflammation of tissues in your digestive tract. Types of IBD include: Ulcerative colitis. This condition involves inflammation and sores (ulcers) along the lining of your large intestine (colon) and rectum.

Inflammatory bowel disease (IBD) is a term that describes disorders involving long-standing (chronic) inflammation of tissues in your digestive tract. Types of IBD include:

Ulcerative colitis. This condition involves inflammation and sores (ulcers) along the lining of your large intestine (colon) and rectum.

Crohn's disease. This type of IBD is characterized by inflammation of the lining of your digestive tract, which often can involve the deeper layers of the digestive tract. Crohn's disease most commonly affects the small intestine. However, it can also affect the large intestine and uncommonly, the upper gastrointestinal tract.

Both ulcerative colitis and Crohn's disease usually are characterized by diarrhea, rectal bleeding, abdominal pain, fatigue and weight loss.

For some people, IBD is only a mild illness. For others, it's a debilitating condition that can lead to life-threatening complications.

Inflammatory Bowel Disease Symptoms

Inflammatory bowel disease symptoms vary, depending on the severity of inflammation and where it occurs. Symptoms may range from mild to severe. You are likely to have periods of active illness followed by periods of remission.

Signs and symptoms that are common to both Crohn's disease and ulcerative colitis include:

Diarrhea

Fatigue

Abdominal pain and cramping

Blood in your stool

Reduced appetite

Unintended weight loss

Do you know the treatment paradigms for different countries? Download our Inflammatory Bowel Disease Market Sample Report

Recent breakthrough in the Inflammatory Bowel Disease

FDA approves first oral treatment for moderately to severely active Crohn’s disease:

FDA has approved Rinvoq (upadacitinib) for adults with moderately to severely active Crohn’s disease who have had an inadequate response or intolerance to one or more tumor necrosis factor blockers. Rinvoq is the first approved oral product available to treat moderately to severely active Crohn’s disease.

Patients should start with 45 mg of Rinvoq once daily for 12 weeks. Following the 12-week period, the recommended maintenance dosage is 15 mg once a day. A maintenance dosage of 30 mg once daily can be considered for patients with refractory, severe, or extensive Crohn’s disease.

Inflammatory Bowel Disease Epidemiology Segmentation

DelveInsight’s Inflammatory Bowel Disease market report is prepared on the basis of epidemiology model. It offers comprehensive insights to the Inflammatory Bowel Disease historical patient pools and forecasted Inflammatory Bowel Disease patients. The report provides in-depth data of various subtypes and for the same epidemiology is segmented further. The Inflammatory Bowel Disease Market report proffers epidemiological analysis for the study period 2019-32 in the 7MM segmented into:

Inflammatory Bowel Disease Prevalence

Age-Specific Inflammatory Bowel Disease Prevalence

Gender-Specific Inflammatory Bowel Disease Prevalence

Diagnosed and Treatable Cases of Inflammatory Bowel Disease

Visit for more @ Inflammatory Bowel Disease Epidemiological Insights

Inflammatory Bowel Disease Treatment Market

The Inflammatory Bowel Disease market outlook of the report helps to build a detailed comprehension of the historic, current, and forecasted Inflammatory Bowel Disease market trends by analyzing the impact of current Inflammatory Bowel Disease therapies on the market, unmet needs, drivers and barriers, and demand for better technology.

The most common medications used to treat IBD are antibiotics such as metronidazole and ciprofloxacin; ASA anti-inflammatory drugs such as Asacol, Azulfidine, Colazol, Pentasa, Rowasa and Lialda; steroids, such as prednisone, prednisolone or budesonide, immunomodulators such as Imuran(azathioprine), Purinethol, and methotrexate; biologics, such as REMICADE, HUMIRA, CIMZIA, ENTYVIO, STELARA and XELJANZ, nutritional therapy can be used to induce and maintain remission in Crohn’s disease.

There are various drugs currently being studied for the treatment of IBD. The Key players are Eli Lilly and Company, Gilead, Galapagos, Protagonist Therapeutics, Athos Therapeutics, and others.

According to DelveInsight, the Inflammatory Bowel Disease market in 7MM is expected to witness a major change in the study period 2019-2032.

Inflammatory Bowel Disease Key Companies

Eli Lilly and Company

Gilead

Galapagos

Protagonist Therapeutics

Athos Therapeutics

For more information, visit Inflammatory Bowel Disease Market Analysis, Patient Pool, and Emerging Therapies

Scope of the Inflammatory Bowel Disease Market Report:

10 Years Forecast

7MM Coverage

Descriptive overview of Inflammatory Bowel Disease, causes, signs and symptoms, diagnosis, treatment

Comprehensive insight into Inflammatory Bowel Disease epidemiology in the 7MM

Inflammatory Bowel Disease marketed and emerging therapies

Inflammatory Bowel Disease companies

Inflammatory Bowel Disease market drivers and barriers

Key Questions Answered in the Inflammatory Bowel Disease Market Report 2032:

What was the Inflammatory Bowel Disease market share distribution in 2019, and how would it appear in 2032?

What is the total Inflammatory Bowel Disease market size and the market size by therapy across the 7MM for the study period (2019-32)?

What are the important findings from 7MM, and which country will have the greatest Inflammatory Bowel Disease market size from 2019-32?

During the study period (2019-2032), at what CAGR is the Inflammatory Bowel Disease market projected to expand at 7MM?

Table of Contents:

1 Inflammatory Bowel Disease Market Key Comprehensive Insights

2 Inflammatory Bowel Disease Market Report Introduction

3 Competitive Intelligence Analysis for Inflammatory Bowel Disease

4 Inflammatory Bowel Disease Market Analysis Overview at a Glance

5 Executive Summary of Inflammatory Bowel Disease

6 Inflammatory Bowel Disease Epidemiology and Market Methodology

7 Inflammatory Bowel Disease Epidemiology and Patient Population

8 Inflammatory Bowel Disease Patient Journey

9 Inflammatory Bowel Disease Treatment Algorithm, Inflammatory Bowel Disease Current Treatment, and Medical Practices

10 Key Endpoints in Inflammatory Bowel Disease Clinical Trials

11 Inflammatory Bowel Disease Marketed Therapies

12 Inflammatory Bowel Disease Emerging Therapies

13 Inflammatory Bowel Disease: 7 Major Market Analysis

14 Attribute analysis

15 Access and Reimbursement Overview of Inflammatory Bowel Disease

16 Inflammatory Bowel Disease Market Key Opinion Leaders Reviews

18 Inflammatory Bowel Disease Market Drivers

19 Inflammatory Bowel Disease Market Barriers

20 SWOT Analysis

21 Disclaimer

22 DelveInsight Capabilities

23 About DelveInsight

Related Reports:

Inflammatory Bowel Disease Epidemiology 2032

DelveInsight's "Inflammatory Bowel Disease - Epidemiology Forecast to 2032" report delivers an in-depth understanding of the disease, historical and forecasted Inflammatory Bowel Disease epidemiology in the 7MM, i.e., the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan.

About DelveInsight:

DelveInsight is a leading Life Science market research and business consulting company recognized for its off-the-shelf syndicated market research reports and customized solutions to firms in the healthcare sector.

Contact Us:

Kritika Rehani

+91-9650213330

www.delveinsight.com

#Inflammatory Bowel Disease market#Inflammatory Bowel Disease market share#Inflammatory Bowel Disease market size#Inflammatory Bowel Disease treatment market#Inflammatory Bowel Disease companies

0 notes