#Video KYC

Text

Digital KYC: Transforming Customer Onboarding and Security in the Modern Age

In today's digital world, where speed, security, and efficiency are paramount, traditional paper-based Know Your Customer (KYC) processes are becoming increasingly outdated. Enter Digital KYC, a revolution in customer onboarding and verification that leverages technology to streamline processes, enhance security, and benefit both businesses and customers alike.

From Paperwork to Pixels: Embracing the Digital Shift

Gone are the days of cumbersome paper forms and lengthy verification procedures. Digital KYC utilizes online platforms and innovative technologies to automate and expedite the KYC process. This involves collecting and verifying customer information electronically, typically through secure online portals, mobile apps, or even video conferencing.

Benefits Abound: Why Businesses are Embracing Digital KYC

The advantages of implementing Digital KYC are numerous and far-reaching. Let's delve deeper into some key benefits:

Faster Customer Onboarding: Ditch the paperwork hassle! Digital KYC significantly reduces onboarding time, allowing customers to complete verification instantly through intuitive online interfaces. Studies by Deloitte show that digital solutions can reduce onboarding time by up to 70%, leading to higher customer satisfaction and improved conversion rates.

Enhanced Security: Gone are the days of vulnerable paper trails. Digital KYC often employs robust security features like biometric authentication (fingerprint, facial recognition, etc.) and encryption to protect sensitive customer data. This significantly reduces the risk of fraud and identity theft, safeguarding both businesses and customers.

Cost Savings: Automating manual tasks and eliminating paper-based processes leads to significant cost savings. Accenture reports that companies can save up to 70% on operational costs through digital KYC implementation. Additionally, reduced fraud losses and improved compliance add to the financial benefits.

Challenges and Solutions: Navigating the Digital Landscape

While the advantages of Digital KYC are undeniable, certain challenges need to be addressed:

Privacy Concerns: Data protection and customer consent are paramount. Businesses must ensure transparency in data collection and usage, complying with relevant privacy regulations like GDPR and CCPA.

Technological Hurdles: Seamless integration of AI, Optical Character Recognition (OCR), and other technologies is crucial. Additionally, ensuring user-friendly interfaces and accessibility across different devices is essential.

Regulatory Compliance: Staying abreast of evolving regulations and legal frameworks surrounding digital KYC is critical. Businesses must partner with technology providers who offer solutions compliant with relevant industry standards and local regulations.

Case Studies: Witnessing the Power of Digital KYC in Action

Numerous organizations have successfully implemented Digital KYC, reaping significant benefits:

DBS Bank (Singapore): Reduced onboarding time by 90% and improved customer satisfaction through a digital KYC platform integrated with AI and facial recognition.

HSBC (Hong Kong): Achieved 70% faster account opening time and a 20% reduction in fraud attempts through a digital KYC solution with biometric verification.

StanChart (India): Streamlined onboarding for small businesses by 80% using a mobile app-based KYC platform.

These examples showcase the real-world impact of Digital KYC in improving customer experience, enhancing security, and driving operational efficiency.

Conclusion: Embrace the Future, Embrace Digital KYC

Digital KYC is no longer just a trend; it's the future of customer onboarding and verification. By embracing this technology, businesses can gain a competitive edge, improve customer satisfaction, and ensure robust security. The benefits are undeniable, and the challenges are surmountable. As regulations evolve and technological advancements continue, Digital KYC's role in shaping a secure and efficient financial landscape will only become more prominent.

Are you ready to join the digital revolution?

#digital kyc#biometric remote kyc#ekyc#kyc#know your customer#biometric authentication#digital identity#identity#digital identity verification#identity verification#biometrics#technology#remote kyc#video kyc#contactless biometric#multifactor biometrics#multifactor authentication

1 note

·

View note

Text

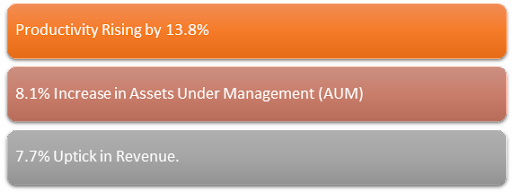

Transforming Wealth Management: The Tech-Infused Evolution

In a time when innovation is primarily driven by digital change, the wealth management sector is leading the charge. It is more important than ever to have a simple, safe, and interesting solution for personalized portfolio management, client interaction, and client onboarding. As a means of achieving efficiency and personalization, technological improvements have become the primary driver behind the transformation of the wealth management industry. These advancements have allowed wealth managers to streamline processes, automate tasks, and provide clients with real-time access to their portfolios. Additionally, technology has enabled the development of sophisticated algorithms and data analytics tools that can analyze market trends and make informed investment decisions. As a result, wealth management firms are able to offer more tailored investment strategies and deliver a higher level of service to their clients.

Statistics of the Indian wealth management industry:

Assets under management (AUM): US$429.70 billion (2023).

Market size: US$390.00 billion (2023).

Number of high-net-worth individuals (HNIs): 3.5 lakhs (2020), expected to grow to 6.11 lakhs by 2025.

Number of ultra-high-net-worth individuals (UHNIs): 13,637 (2021), expected to grow to 19,006 by 2026.

70–80% of wealth management firms in India are using video KYC for onboarding new clients.

85–90% of wealth management firms in India are using technology to automate some of their wealth management processes.

The fintech market in India is expected to grow to US$2.1 trillion by 2030.

India has the highest fintech adoption rate globally, with 87% of Indians using fintech services.

Financial technology companies are at the forefront of India's wealth management sector's digital development. By automating and streamlining wealth management procedures, fintech is able to increase efficiency, lower costs, and make investing more accessible to a larger group of individuals.

Fintech is being applied in the Indian wealth management sector in the following significant ways:

Digital onboarding: To make the process of opening a wealth management account simpler and faster for investors, fintech businesses are utilizing digital onboarding solutions. This includes minimizing the need for paperwork and in-person meetings by utilizing Video KYC and other digital verification techniques.

Investment automation: Fintech firms are creating tools to assist wealth managers in automating processes including risk management, asset allocation, and portfolio rebalancing. This can free up wealth managers to concentrate on additional value-added tasks, including giving their clients individualized financial advice.

Data analytics: Wealth managers may gain a better understanding of their customer's financial needs and risk tolerance by working with fintech businesses to leverage data analytics. The creation of more individualized and successful wealth management plans may then be accomplished with the usage of this data.

Engagement with clients: Wealth managers may keep in touch with their customers and provide them with real-time information on their investments with the aid of client engagement platforms that fintech businesses are building. Stronger client-wealth manager connections and an enhanced customer experience can result from this.

Both investors and wealth managers are benefiting from the growing usage of fintech in the wealth management sector. Lower expenses, increased convenience, and more individualized investing advice are all advantages for investors. Increased productivity and efficiency assist wealth managers by enabling them to concentrate on giving their clients greater service.

All things considered, the adoption of fintech in India's wealth management sector is a trend that is anticipated to continue in the years to come.

The Wealth Management Tapestry

The financial dreams and objectives of people are intimately woven into the wealth management sector, creating a complicated tapestry. It has historically been associated with in-person meetings, voluminous documentation, and drawn-out procedures. But a new era has arrived with the development of technology, changing how wealth management firms carry out their fundamental duties.'

It is impossible to emphasize the importance of technology in asset management. The foundation of efficiency and innovation in this industry is technology, which offers real-time data analytics that yield actionable insights and complex algorithms that customize investment plans to the particular demands of customers. Technology integration creates new opportunities for customized customer experiences in addition to streamlining operational procedures. Furthermore, technology also plays a crucial role in risk management within asset management firms. By utilizing advanced risk assessment tools and predictive modeling, technology enables firms to identify and mitigate potential risks, ensuring the safety and security of clients' investments. Additionally, technology-driven automation processes help reduce human errors and increase overall operational efficiency, allowing firms to focus more on strategic decision-making and delivering superior financial outcomes for their clients.

Video KYC and Seamless Onboarding: Catalysts for Growth

As the wealth management industry embraces the digital age, the adoption of video KYC (Know Your Customer) and seamless onboarding processes emerges as a game-changer. These technological advancements not only simplify the onboarding journey for clients but also play a pivotal role in expanding the user base for management companies.

The Video KYC Advantage

Video KYC, a revolutionary approach to identity verification, allows wealth management firms to remotely and accurately authenticate their clients. This transformative process not only saves valuable time but also elevates the overall customer experience to unprecedented heights. The ability to fulfill KYC requirements online eliminates the need for clients to physically visit, bestowing convenience and enhanced security upon the process.

In an industry where trust is paramount, Video KYC adds an extra layer of credibility. The face-to-face interaction through secure video calls instills confidence in clients, assuring them that their sensitive information is handled with the utmost care. As a result, Video KYC not only expedites the onboarding process but also establishes a foundation of trust, crucial for long-lasting client relationships.

Seamless Onboarding: A Strategic Imperative

Seamless onboarding, facilitated by Video KYC, is a strategic imperative for wealth management companies looking to thrive in the digital era. Traditionally, client onboarding has been plagued by cumbersome paperwork and tedious procedures, often acting as a deterrent for potential clients. The marriage of Video KYC and seamless onboarding transforms this arduous process into a user-friendly, efficient journey.

Clients can now complete the required identity verification and documentation procedures from the comfort of their homes through secure video calls. This not only saves time but also enhances the overall client experience, making the onboarding process a crucial touchpoint for positive first impressions. The ease of onboarding becomes a catalyst for client retention and acquisition, as individuals are more likely to engage with a wealth management platform that respects their time and simplifies complex procedures.

Expanding the User Base

The marriage of Video KYC and seamless onboarding acts as a gateway for wealth management companies to expand their user base. In an era where individuals seek instant gratification and streamlined processes, a frictionless onboarding experience becomes a powerful differentiator. Wealth management firms that embrace these technological advancements position themselves as frontrunners in attracting a diverse clientele.

Research indicates that 60% of wealth management firms are planning to implement Video KYC in the next two years, underscoring the industry's recognition of the transformative potential of this technology.

As companies leverage Video KYC and seamless onboarding to create a more accessible and user-friendly environment, the barriers to entry for potential clients are significantly lowered. This not only broadens the reach of wealth management services but also democratizes access to financial planning and portfolio management.

Genesis and MyConCall by Novel Patterns: Crafting the Future of Wealth Management

Genesis: A Comprehensive Investment Solution

Genesis by Novel Patterns offers a holistic solution for investment management with support for multiple asset classes, multi-currency capabilities, configurable charts of accounts, dynamic fee set-up, user-defined fields, and an efficient multitab user interface.

Asset & Investment Management Platform by Novel Patterns

Revolutionising Wealth Management: MyConCall's Video KYC & Personal Discussion Integration

In the realm of wealth management, a transformative shift is underway with MyConCall's integration of video KYC and personal discussion features. Wealth management extends beyond mere financial planning; it embodies the creation of a personalized experience tailored to the distinct needs and aspirations of each client. Recognizing this paradigm, Genesis and MyConCall have embarked on a collaborative journey to pioneer a new era of customized wealth management.

The integration of video KYC enables wealth management firms to fulfill KYC requirements seamlessly online, eradicating the necessity for clients to make physical visits. This shift bestows both convenience and heightened security upon the onboarding process, aligning with the contemporary preferences of clients who seek streamlined and safeguarded interactions. The elimination of the physical presence requirement is a pivotal enhancement, epitomizing the commitment to client-centricity and reflecting the industry's dedication to embracing cutting-edge solutions for a more accessible and secure wealth management experience.

Video Engagement Platform by Novel Patterns for Video KYC & Personal Discussion Solution

Against this backdrop of technological transformation, the partnership between Genesis and MyConCall emerges as a beacon of innovation. Their collaboration seeks to redefine wealth management by combining cutting-edge technology with personalized service, addressing key pain points in the client onboarding process, portfolio management, and client engagement.

The Genesis and MyConCall alliance harnesses the power of video KYC to remotely verify the identity of clients, setting the stage for a seamless and secure onboarding process. This collaboration understands that wealth management is not a one-size-fits-all endeavor; it's about creating bespoke experiences for each client. Through personalized portfolio management and enhanced client engagement facilitated by MyConCall's unique features, the partnership aims to elevate the wealth management experience to new heights.

Genesis & MyConCall: Transforming Wealth Management

In a game-changing partnership, Genesis and MyConCall redefine wealth management through video KYC and personal discussions. This collaboration streamlines onboarding, personalizes portfolio management, and enhances client engagement.

Video KYC onboarding: Genesis and MyConCall simplify client onboarding with secure video calls, eliminating paperwork, and offering a seamless experience from home.

Personalized Portfolio Management: Cutting-edge algorithms tailor investment strategies to individual goals and risk tolerance, ensuring optimized and diversified portfolios.

Enhanced client engagement: The MyConCall platform facilitates one-on-one personal discussion sessions, fostering trust and satisfaction by addressing client concerns directly.

Robust security & compliance: Video KYC ensures secure identity verification, complies with regulatory requirements, and safeguards sensitive client information.

Geo-tagging for security: The geo-tagging feature verifies client location during video KYC, adding an extra layer of security and enabling personalized services based on geography.

Rewind-Up: A Future Defined by Innovation

In a nutshell, technology plays a revolutionary role in the wealth management business as it navigates the digital frontier. Specifically, video KYC and seamless onboarding stand out as particularly important examples. These developments serve as catalysts to increase wealth management businesses' user bases in addition to streamlining operational procedures. Genesis and MyConCall's collaboration is a prime example of the industry's dedication to innovation, ushering in a time where trust, efficiency, and customization will characterize wealth management. Those who take advantage of these technological advancements will be well-positioned to prosper in a cutthroat market and usher in a new era of wealth management characterized by accessibility, security, and client-centricity. These advancements in technology have the potential to revolutionize the way wealth management services are delivered, making them more accessible to a wider range of clients.

By leveraging technology, platforms like Genesis and MyConCall by Novel Patterns can provide personalized investment strategies and financial advice tailored to each individual's unique needs and goals. This level of customization not only enhances the client experience but also ensures that their investments are aligned with their long-term objectives, ultimately leading to greater success and satisfaction in the wealth management industry.

#cart#fintech#myconcall#novel patterns#account aggregator#bfsi#video kyc#financial accounting#genesis#wealth management

1 note

·

View note

Text

Video KYC refers to the process of verifying a customer’s identity remotely through a live video interview, eliminating the need for physical presence.

0 notes

Text

#kyc providers#kyc solution#kyc canada#kyc verification#insurance#kyc api#kyc software#fintech#kyc platform#Video KYC#Video KYC provider#KYC solutions Provider#kyc solutions

1 note

·

View note

Text

0 notes

Text

How Is the Video KYC Solution Helping the Financial Sector

KYC is the foundational step for any onboarding process. Know Your Customer is a mandatory procedure to verify a customer's identity and also prevent fraud and identity theft.

In a traditional verification system, KYC requires a tedious process of visiting the financial institution, submitting documents, and waiting for the in-person verification to be complete, which may take more than a week.

However, because of the COVID-19 pandemic, it became difficult for people to follow this method of verification. The restrictions on in-person interactions led to an alternative digital channel of verification. The convergence of technology and the existing KYC verification structure led to the introduction of video KYC.

Many organizations, especially banks and financial institutions, have shifted their onboarding process from offline to online to serve their customers without any hindrances.

On 9th January 2020, the Reserve Bank of India introduced video KYC in India and laid down the guidelines required to be followed by the banks.

Now, with a video call, the KYC details can be verified in minutes. Read on to understand how video KYC is helping the financial sector.

What Is Video KYC?

VKYC, or Video Know Your Customer, is the process used by financial institutions to verify information during the onboarding process. Instead of going to the banks for offline verification, the process can now be simply done through a video call.

This facility is enabled by VCIP technology and is regulated and assisted by a trained professional for a customer-friendly experience.

In the last two years, there has also been a huge shift towards cashless transactions. As a result, many e-wallet and digital payment companies now provide video KYC facilities to their customers to facilitate a smooth transaction and avoid identity theft.

Even the Securities and Exchange Board of India has allowed video KYC for mutual fund investments, encouraging the adoption of this method in the financial sector. The global video KYC market is expected to reach $1.1 billion by 2027 according to Allied Market Research.

What Is The Process Of Video KYC Verification?

Video KYC is a simple and quick way to verify customer details during the digital onboarding process.

The customer schedules a video call with the financial institution, wherein the representative verifies the government document and also confirms the address through geo-tagging.

Finally, all the identity cards are matched through the AI facial recognition tool.

After a thorough verification, the details are submitted for the final audit, according to which the KYC is verified.

What Are The Benefits Of Video KYC Process for the Financial sector?

Cost-effective: Adoption of video KYC cuts the cost allocated for the physical infrastructure required for verifying identities in an offline setup.

The company also saves money on low-value tasks, which are now replaced by automated messages and status updates.

The investment is shifted to the adoption of a new affordable and effective software supporting video KYC.

KPMG reported that video KYC can reduce the customer acquisition’s cost by 90% because it removes the need for physical labor and infrastructure.

Saves time: Ideally, a regular KYC takes up to 10–20 days to get verified, but video KYC ensures quick verification within 10–20 minutes.

There is also no requirement for the institution's representative to visit the address and do a physical verification.

A video call can be scheduled according to the needs and requirements of both the customer and the organization.

Paperless process: Video KYC solution replaces physical document submission with an electronic mode. All the identity cards, like passports, driver’s licenses, and address proofs, can be shown and submitted online.

Even the storage of such documents is done through a cloud storage system, which is easier to access and track than regular paperwork data.

It pushes the financial institutions to work towards a sustainable and efficient work environment.

Customer Satisfaction: For any company, customer satisfaction is the primary goal. The video KYC tool is designed to have a pro-customer approach.

According to a report by PwC, 82% of customers prefer the digital onboarding process over the traditional method, and 47% have a positive attitude towards banks offering service remotely.

The whole verification process is based on the consent and convenience of the customer. They can freely ask questions from the agent and ensure the video KYC process is performed securely while sitting in the comfort of their homes.

Easy onboarding process: With the growing competition in the business and finance industries, it is essential to retain and hold a strong customer base.

Video KYC is an efficient alternative to accelerate the onboarding process and provide financial products and services quickly to those concerned.

By using technology and software-dependent verification systems, the whole process becomes seamless and error-free, making it a more preferable method for this industry.

Reach potential customers: The video KYC solution solves the problem of reaching remote locations without investing in the logistics involved in sending a team for verification.

It allows people who have a camera and an internet connection to participate in the onboarding process despite their geographical limitations.

Moreover, this feature is inclusive of the multilingual factor; agents can be chosen based on the language preferred.

Prevents Scams and Identity Theft: For the financial year 2022, banks in India reported 9,102 frauds amounting to underlying damages of Rs. 60,389 crore.

A major reason for this loophole is the lack of a concrete verification system.

A video KYC would prevent identity thefts as the agent would be able to carry out the verification in compliance with the regulations and the data retrieved would remain encrypted, confidential, and stored safely in an electronic format.

There is no dependency on manual setup and is relatively error free than other formats, thus preventing any scams and fraud.

From the consumer’s perspective, this also adds to the accountability and credibility of the company

Rise of small financial institutions: For legacy businesses, it is easy to integrate and develop a new channel of verification based on their customized needs.

They are relatively less vulnerable to fluctuations in demand generated by the customers than compared to smaller financial institutions.

The video KYC process is a boon for such growing financial actors because it allows them to scale their resources allocated for verification depending on the demand of customers.

Through a remote and interactive authentication process, smaller financial institutions can also participate in this growing sector.

Conclusion:

The introduction of video KYC is a revolution in the financial sector. With a variety of forms of verification available for the consumers, this has turned out to be a seamless , speedy and beneficial process for the companies to attract potential customers and maintain efficient working with the existing.

It is a useful tool to prevent costly scams and identify fake accounts.

The video KYC is a cost effective technology that allows them to maintain a strong customer base and guarantee a satisfactory consumer experience.

Veri5Digital, India’s leading identity and digital solutions provider, provides an efficient and effective video KYC system that ensures seamlessness and customer satisfaction.

0 notes

Photo

Are you aware of the ways to update mutual funds KYC online? Learn them here with this blog. Also learn how video KYC is important for KYC update.

0 notes

Text

Video KYC solution that uses facial recognition technology and AI to verify the identity of an individual remotely. This process can be completed through a video call or by uploading a video, making it a convenient and secure way to verify identity. It can be used for various purposes such as banking, e-commerce, and online services.

0 notes

Text

Video KYC solutions for Banks and Financial services

Video-based KYC allows users to do remote KYC from any location via a video call. In contrast to conventional methods, the verifier uses a video chat to validate the papers, check their liveliness, and determine the person's location. The top video KYC service provider is Contaque.

People can complete their KYC in a number of ways for financial transactions and other similar activities. As previously stated, the Know Your Customer (KYC) process serves to verify the user's identity in accordance with RBI, PMLS by the Government of India, SEBI, IRDA, and other regulatory agencies' requirements. Best video KYC Solutions is Contaque.

The RBI recently approved adopting a Video-based Customer Identification Process (V-CIP) as a tool to achieve paperless KYC, much like one can opt to go for an offline KYC registration or an online KYC verification process. The paperless KYC for opening NPS accounts has also received permission from Pension Fund Regulator PFRDA. Video KYC has become a factor as a result of this.

Customers and potential customers seek convenience. It's time for the financial sector to take the lead since the world is moving digital and millennials and Generation Y are changing what customers expect from customer service. Utilize the best Video KYC software system to digitise your KYC verification process and create a seamless customer experience while ensuring quicker KYC completion at a lower cost and improved customer satisfaction. Contaque gives best customer experience for Video KYC.

0 notes

Text

#video kyc solution providers#video kyc platform#video kyc providers#video kyc services#KYC UK#kyc solution#kyc api#fintech#banks#finance#kyc companies#banking

1 note

·

View note

Link

vKYC is a secure solution that enables your customers to verify themselves from the comfort of their homes. It allows you to authenticate customer details in real-time through video & AI-driven face match, Liveness detection, geo-tagging, and eKYC verification of your documents. The solution adheres to all RBI guidelines issued for video – customer identification process (V-CIP)

0 notes

Text

1 note

·

View note

Link

India's top provider of video KYC solutions, video KYC solution, is committed to improving the customer experience. We provide a range of services to help detect and stop financial and identity fraud. Pixl has a sizable user base and enjoys the trust of numerous businesses. To give our customers the best service possible, we are constantly advancing our technology.

0 notes

Text

#artificial intelligence#technology#digital onboarding#customer onboarding#kyc software#banks#nbfc#digital kyc#document management#video kyc

0 notes

Text

Buy Verified Binance Account

Buy Verified Binance Account Features:

➤ Support for many of the most traded cryptocurrencies Convert. This is the easiest way to trade. Classic. It’s simple to use

➤ Futures on USES. USDA margined without expiration and leverage up to 125x. Futures on COIN – M

➤ Tokens can be leveraged up to 125 times, with or without expiry dates.

➤ Binance Earn. All-in-one Investment Solution Binance Pool.

➤ Binance is supported in more than 160 countries.

➤ Less time and lower fees

➤ Email and password login

➤ Other login information.

➤ Recovery information.

➤ A new and completely fresh account

➤ 100% verified account

➤ 24/7 customer support.

➤ 7/24 Instant Delivery.

24 Hours Reply/Contact:-

➤Gmail : [email protected]

➤Skype: usaseobiz

➤Telegram:@usaseobiz

➤WhatsApp : +1 (856) 661-7982

Why Choose Binance?

Overview Of Binance And Its Feature Highlights

Binance is one of the most popular cryptocurrency exchanges globally, operating in over 100 countries. It was founded in 2017 by changpeng zhao and has grown to be a market leader in the industry. Some of the features that make binance stand out are:

Availability of over 600 cryptocurrencies: Binance offers access to a wide range of digital assets, including the most famous coins like bitcoin, ethereum, and ripple, as well as the trending ones.

User-friendly interface: Binance is designed with a user-friendly interface, making it easy for beginners to navigate the platform and execute trades easily.

High liquidity: Binance’s high trading volumes make it one of the most liquid exchanges in the market, ensuring that traders can always find a match for their orders.

Advanced trading tools: Binance offers a range of advanced trading tools like limit orders, stop-loss orders, and margin trading for advanced traders.

Benefits Of Using Binance

Trading on binance comes with several benefits, including:

High-security measures: Binance employs state-of-the-art security measures, including two-factor authentication, cold storage, and security audits, to ensure the safety of its users’ funds.

Lower trading fees: Binance charges some of the most competitive trading fees in the industry, with a 0.1% fee for trades. Users also get lower fees when they use binance’s native coin, binance coin (bnb).

Fast trade execution: Binance’s trading engine is designed to handle a massive amount of transactions per second, ensuring fast trade execution and quick order fills.

Supports multiple languages: Binance is available in multiple languages, making it accessible to people from different regions and facilitating global adoption.

Provides educational resources: Binance offers educational resources for newcomers to the cryptocurrency space, including articles, videos, and webinars, to help them understand how the market works and how to trade successfully.

If you’re looking for a secure, user-friendly, and feature-rich cryptocurrency exchange, binance is the perfect choice for you. Join the millions of traders who trust binance and start trading today!

How To Create A Binance Account

Buy Verified Binance Account: How To Create A Binance Account

Are you interested in creating your own binance account? Binance is one of the world’s largest cryptocurrency exchanges and a popular platform for buying and selling cryptocurrencies. If you want to create a binance account, follow this step-by-step guide.

Step-By-Step Guide On Creating A Binance Account

Go to binance.com and click on the ‘register’ button located at the top right-hand corner of the screen.

Enter your email address and create a secure password.

Solve the captcha security puzzle, and then click on the ‘register’ button.

Binance will send you a verification email. Go to your email inbox and find the verification email, then click on the link provided.

Once you have followed the link, binance will prompt you to complete a kyc (know your customer) verification process, which will require you to provide personal information such as your name, address, date of birth, and identification documents such as a passport or driver’s license.

After submitting your verification, binance will check your information and approve your application if the information you provided is correct.

After approval, you can start using binance to buy and sell cryptocurrencies.

Required Information And Verification Process

Binance requires every new user to complete a kyc verification process. The verification process involves providing personal information and identification documents. The following information is required:

Full name

Address

Date of birth

Identification documents (passport, driver’s license, national id, or any government-issued id)

Your uploaded documents will typically be processed within 24-48 hours. It’s worth noting that binance may require additional documents or information to approve your account, so be prepared to provide any necessary information promptly.

Tips For Account Safety

Binance takes security seriously, and there are several steps you can take to maximize your account’s safety:

Enable 2-factor authentication (2fa) to add an additional security layer to your account.

Always use a strong, unique password and avoid reusing passwords across multiple platforms.

Avoid sharing your account login details with anyone, and don’t fall for phishing scams that ask you to provide your account information.

Use reputable anti-virus and anti-malware software on your computer and mobile devices.

Creating a binance account is a simple, yet necessary process for anyone interested in trading cryptocurrencies. By following these guidelines, you can set up your account with ease and ensure that it is secure.

How To Verify Your Binance Account

The Importance Of Verifying Your Binance Account

Verifying your binance account is crucial for a variety of reasons, including:

Ensuring the security of your account against potential hacking and fraudulent activities.

Avoiding any service disruptions or deposit/withdrawal interruptions.

Gaining higher withdrawal limits for increased flexibility in trading cryptocurrencies.

Step-By-Step Guide On Verifying Your Binance Account

Follow these easy steps to verify your binance account:

Log in to your binance account and click on the “account” tab.

Click on the “verify” button and select your country of residence.

Choose the type of identification document you possess and input the required information.

Upload a clear and legible photo of your identification document, along with a selfie of yourself holding the same document.

Wait for the verification process to complete (usually within 15 minutes).

Additional Verification Requirements For Higher Withdrawal Limits

If you want to have access to higher withdrawal limits, you will need to complete additional verification requirements. These include:

Providing proof of residential address (i.e. Utility bill, bank statement, etc. Dated within the last three months).

Submitting a video verification (in some countries).

Once you complete these steps, you will be able to enjoy higher withdrawal limits. It is important to monitor your account and continue to comply with all regulations to ensure continued access to binance’s services.

The Benefits Of Buying A Verified Binance Account

If you’re looking to engage in cryptocurrency trading, you cannot ignore the importance of having a binance account. Binance is one of the world’s largest cryptocurrency exchanges, catering to millions of customers globally. While opening a binance account is a straightforward process, the issue of verification can cause unnecessary headaches.

This is when buying a verified binance account can save you time and effort.

The Advantages Of Buying A Verified Binance Account From A Reputable Seller

Buying a verified binance account from a reputable seller can offer you numerous benefits, such as:

Immediate access to the platform: A verified binance account allows you to sign in and start trading immediately. You don’t have to wait for the verification process to complete, which can take several days.

A higher deposit and withdrawal limit: A verified account comes with a higher deposit and withdrawal limit that enables you to carry out more significant trades.

No limit on cryptocurrency withdrawals: Non-verified accounts have restrictions on cryptocurrency withdrawals. A verified account, on the other hand, comes with no such restrictions.

Enhanced account security: By buying a verified account, you can rest assured that the account is secure, backed by superior security features and software updates.

24/7 account support: Reputable sellers offering verified binance accounts provide round-the-clock account support to cater to your needs at any time of the day.

When buying a verified binance account, it is imperative to analyze and choose the right seller carefully. You should ensure that the seller you choose eliminates the risk of scams and frauds by providing clear verification policies.

The advantages of buying a verified binance account from a reputable seller are plenty. Not only does it offer you immediate access to the platform, but it also provides an enhanced security feature, higher withdrawal and deposit limits, and 24/7 account support.

With the right seller, it’s a decision that can streamline your cryptocurrency trading process.

Frequently Asked Questions Of Buy Verified Binance Account

What Is A Verified Binance Account?

A verified binance account is one that has undergone a thorough kyc process, which involves submitting personal identification documents.

Can I Buy A Verified Binance Account?

Yes, you can purchase a verified binance account from verified account sellers, but it’s important to be careful and choose a reputable seller.

Why Should I Buy A Verified Binance Account?

Buying a verified binance account allows you to avoid the lengthy and often complicated kyc process and start trading almost immediately.

Is It Safe To Buy A Verified Binance Account?

Buying a verified binance account is safe as long as you choose a reputable seller with positive reviews and a proven track record.

How Much Does A Verified Binance Account Cost?

The cost of a verified binance account varies depending on the seller and the level of verification, but it typically ranges from $100 to $500.

What Are The Risks Of Using A Purchased Binance Account?

The risks of using a purchased binance account include potential fraud, account suspension, and loss of funds. Only use reputable sellers to minimize these risks.

24 Hours Reply/Contact:-

➤Gmail : [email protected]

➤Skype: usaseobiz

➤Telegram:@usaseobiz

➤WhatsApp : +1 (856) 661-7982

#buyverifiedbainanceaccounts#bainanceaccount#oldbainanceaccount#newbainanceaccount#bainanceaccountsell

2 notes

·

View notes